5

Options for Medicare and Medicaid

Rising health care costs are projected to increasingly dominate the federal budget, as noted in Chapter 1, and they threaten to squeeze out other public needs and priorities. This chapter presents illustrative options for limiting growth in the federal Medicare and Medicaid programs—the largest of the government’s health programs.1

THE CURRENT CONTEXT

As the committee was completing this report, the nation was debating systemwide health care reform: see Box 5-1. The proposed legislation, if enacted in a form similar to one of its most recent versions, would cover a majority of people who now lack health insurance, and it would raise revenues and increase spending without increasing the deficit over the next 10 years (Congressional Budget Office, 2009f). Although the proposed legislation includes provisions that have the potential to reduce the long-term growth of both federal and private-sector health spending, most of the provisions are to be implemented as demonstrations or experiments rather than systemwide:2 their effects are uncertain and, at best, will be modest.3 Thus, even with health reform as currently considered, the major fiscal challenge of rising health care costs has yet to be faced head-on.

The growth rate of federal health spending has been higher than the growth rate of the economy for more than three decades. At the same time, health care costs are projected to rise in the private sector, burdening households and businesses. Because the charge of this committee is the future of the federal budget, the options presented in this chapter focus on the pub-

|

BOX 5-1 2009 Health Care Reform Legislation As this report went to press, the House of Representatives had passed the Affordable Health Care for America Act, and the Senate had passed the Patient Protection and Affordable Care Act. (For details on the House bill, see Committee for a Responsible Federal Budget, 2009; Congressional Budget Office, 2009d, 2009f. For details on the Senate bill, see Congressional Budget Office, 2009i, 2009j.) In order to expand access to health care, the proposed health care bills would, among other things:

Under the two bills, 94-96 percent of the nonelderly U.S. population (who are legal residents) would have insurance coverage by 2019—an increase in the number of insured people of 31-36 million (Congressional Budget Office, 2009d, 2009j). The Congressional Budget Office (2009d, 2009i) projects that the proposed expansions in insurance coverage would increase net costs by $614-$891 billion over the next 10 years. That increase would be offset by increases in federal revenues of $264-$574 billion and a combination of spending changes that would save $427-$483 billion: the result would be a net reduction in federal deficits of $109-$132 billion. The largest savings would come from changes in the Medicare Advantage payment rates ($118-$170 billion) and reductions in annual updates to Medicare payment rates for most services in the fee-for-service sector other than physicians’ services ($186-$228 billion). One or both bills include a number of other measures designed to slow the growth of systemwide health care costs: payment reforms to discourage unnecessary hospital readmissions; pilot programs to help hospitals and physicians better manage and coordinate care (through “accountable care organizations”) and deliver more cost-efficient care (through payment “bundling”); increased payments to primary care providers and the promotion of medical homes designed to coordinate care; funding of new comparative effectiveness research and the development of new quality measures; measures to encourage greater price transparency; and measures to promote preventive services and wellness programs (Committee for a Responsible Federal Budget, 2009:5). According to an analysis that relies heavily on the Congressional Budget Office, the 10-year savings associated with these measures in the House bill are quite modest—in the neighborhood of $5 billion (Committee for a Responsible Federal Budget, 2009:5). In the second decade, the Congressional Budget Office (2009f, 2009i) expects the spending and revenue provisions of the House and Senate bills to slightly reduce federal budget deficits (relative to those projected under current law), by between zero and 0.5 percent of GDP. The effects of the spending provisions alone would be even more modest. |

lic programs (and tax expenditures) that have direct effects on the federal budget. However, public-sector health care costs cannot be considered in isolation from private-sector costs. The services paid for by Medicare and Medicaid (and other federal health programs) are similar to those delivered in the private health care system by the same providers (doctors, hospitals, imaging facilities, nursing homes, etc.). Some analysts have pointed out that changes in government programs can have considerable influence and leverage over the health system as a whole (see, e.g., Finkelstein, 2007; White, 2007:160). Medicare policy, in particular, can have such effects because virtually every health care provider is affected; and private insurers often adopt Medicare payment schedules and coverage policies, with adjustments reflecting their own market conditions. Other analysts (see, e.g., Aaron, 2007) are skeptical about the possibility of practices spreading from Medicare to the private health care sector: they argue that it is more likely that providers will try to recover from private payers whatever income they lose from Medicare. Instead, they emphasize that the health care cost growth curve must be bent downward for the entire system in order to avoid major cost shifts from the federal budget to all other payers.

The nation’s health care system is complex and multifaceted, and it includes many expensive and long-lived investments in structures, equipment, and skills. Accordingly, many reforms that promise to limit cost growth through efficiencies, better practices, and organizational changes cannot be counted on to produce significant savings in the near term. Indeed, some ideas for cost savings may even require some up-front increases in spending. Furthermore, the ultimate effects of changes in such a complex system are inevitably difficult to quantify.

Given the history and structure of the broader health care system and the uncertainties just noted, the committee believes that achieving any significant near-term savings in Medicare and Medicaid spending (relative to the baseline) with some measure of certainty will most likely require taking strong measures that directly impact their costs. Such limits could take several forms, which could be adopted singly or in various combinations. For example, provider reimbursement rates could be cut, Medicare beneficiary cost-sharing could be increased, or federal cost-sharing for Medicaid could be reduced. In a more far-reaching step, Medicare coverage could be converted to a defined contribution that could be used to purchase private insurance. Essentially, each of these steps could provide estimable amounts of budget savings to keep the total budget within prescribed limits.

However, such near-term reductions in Medicare and Medicaid spending growth would not obviate the need for systemwide changes to the nation’s health care market to relieve the underlying pressures that spur spending growth. At best, they might help generate longer-term systemwide improvements by providing incentives for administrators and payers to search for major increased efficiencies, but most likely they will contain

the cost pressure rather than prevent it. The committee does not support terminating the entitlement status of Medicare and Medicaid. Rather, the savings from such reductions are intended to be a “bridge” to savings from fundamental and systemic reform.

FOUR TRAJECTORIES

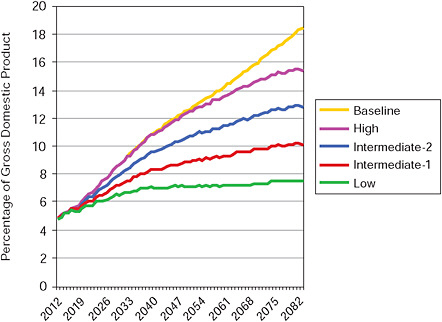

Given the uncertainty about the long-term budgetary savings that could accrue from the many possible combinations of health reforms described later in this chapter, the committee has sketched four health care spending trajectories that vary in their assumptions about the stringency of direct spending reductions in the near term, while leaving open the possibility that slower-acting redirection of incentives and improvements in information (among other things) may eventually achieve savings that will reduce or eliminate the need for direct reductions. Figure 5-1 shows the baseline and the committee’s four trajectories (see Appendix F for details). The lower the spending trajectory, the tighter the necessary limits (at least in the near term). We also discuss a range of illustrative reform approaches and options below, but uncertainties as to the effects of some of the options make it

FIGURE 5-1 Federal health spending under four sustainable budget trajectories and in the baseline.

impossible to map specific combinations of reforms onto particular long-term spending trajectories.

The lowest trajectory assumes that there will be zero percent “excess cost growth” starting in 2012, a sharp decrease from recent historical averages (see below). Zero percent excess cost growth means that per capita federal spending on health care will grow no faster than the gross domestic product (GDP) per capita.4 This low-spending trajectory makes the extremely ambitious assumption that a major slowdown occurs almost immediately and can be sustained through the entire projection period.

Spending for Medicare and Medicaid, which equaled 4.1 percent of GDP in 2008, would still increase to 6.8 percent by 2035 (3.1 percentage points below the baseline level of 9.9 percent) because of projected changes in both the number and average age of beneficiaries. By 2083, it would be at 7.5 percent of GDP, 10.9 percentage points below the study baseline. This steep, sustained slowdown of spending growth is possible only under a regime of tough cost controls in at least the near and medium term. Many analysts would consider this trajectory to be politically unrealistic. It also may be regarded as implausible to the extent that competing policy objectives of expanding access to care and improving quality are taken seriously. Nevertheless, this is the only one of the four trajectories for Medicare and Medicaid that would not require significant increases in federal revenues (as a share of GDP) above their recent historical level even when combined with stringent policy changes in other areas of federal spending.

The high health spending trajectory does far less to slow the growth of health costs.5 In fact, on this trajectory, spending is assumed to track the study baseline until 2030. However, even this trajectory assumes that the rate of excess cost growth will gradually fall to zero by 2083, leaving program spending at 15.4 percent of GDP by 2083 (3 percentage points below the baseline).

The two intermediate trajectories have federal Medicare and Medicaid spending increasing from 4.1 percent of GDP in 2008 to 7.8 percent (intermediate-1) and 8.8 percent (intermediate-2) in 2035 (2.1 and 1.1 percentage points below the baseline, respectively) and 10.2 percent (intermediate-1) and 12.8 percent (intermediate-2) in 2083 (8.1 and 5.5 percentage points below the baseline, respectively). The intermediate-1 health spending trajectory is set at the midpoint between the low and intermediate-2 trajectories, and the intermediate-2 trajectory is set at the midpoint between the intermediate-1 and high trajectories. Both intermediate trajectories are considerably more restrictive than the study baseline and would likely have to rely, to different degrees, on direct spending reductions for quite a few years. We assume that the intermediate-1, intermediate-2, and high spending trajectories would raise the Medicare payroll tax, now at 2.9 percent, to 3.6 percent in 2012 and 5.8 percent by 2025.

HEALTH SPENDING

As noted throughout this report, the health care sector of the economy is large and growing rapidly. Total health spending is projected to reach almost $2.8 trillion, or 17.9 percent of GDP, in 2011 (Centers for Medicare and Medicaid Services, 2009b). This amount represents more than a doubling of spending as a percentage of GDP over the past three decades, from 8.1 percent in 1975.6 The Congressional Budget Office (2009c) projects that if current price trends continue and with known demographic developments, these expenditures will grow to 46 percent of GDP by 2080.

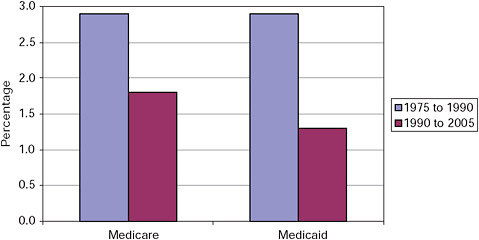

Federal outlays for Medicare and Medicaid have gone from about 1.5 percent of GDP to 4 percent over the past three decades (Congressional Budget Office, 2008b:20). Medicare and Medicaid costs per beneficiary have historically risen at about the same rate as that for private insurance (Centers for Medicare and Medicaid Services, 2009c:Table 13; Congressional Budget Office, 2007c:8). Figure 5-2 displays the historical averages for excess cost growth in Medicare and Medicaid. The rate of excess cost growth was slower in the 1990-2005 period than in the 1975-1990 one. It is difficult to determine whether this difference reflects one-time changes (such as the spread of managed care) or if the underlying trend has changed (Congressional Budget Office, 2009e:27).7

In 2008, Medicare and Medicaid accounted for about 20 percent of all federal spending (Congressional Budget Office, 2009c). According to the same analysis, nominal spending for Medicare and Medicaid will grow at an average rate of around 6 percent a year in the decade after 2009, significantly faster than the economy (which is expected to grow at an

FIGURE 5-2 Average excess cost growth in Medicare and Medicaid.

average annual nominal rate closer to 4 percent over the same period). Given the size and projected growth of Medicare and Medicaid, achieving slower spending growth for this part of the federal budget is likely to be central to any strategy to make the budget sustainable over the long term. The rapid growth of health spending has also put increasing pressure on the budgets of consumers, employers, and state and local governments: for example, premiums for health insurance offered through employers have doubled since 1999, as has the cost paid directly by workers (Kaiser Family Foundation and Health Research and Educational Trust, 2008). Choosing between health care and other priorities will become increasingly difficult even in good economic times unless the nation takes steps to improve the health system’s performance and to slow spending growth.

Reasons for Increasing Spending

The causes of the rapid growth of public and private health care spending in the United States are multifaceted and complex. Improvements in medical technology, broadly defined, are clearly important (Congressional Budget Office, 2008h). New ways of diagnosing and treating disease typically depend on expensive new equipment and devices, drugs, and the skills of increasingly specialized physicians with advanced training. Even when a medical advance reduces the cost of treating an individual patient, the benefits of the advance (such as clinical response, reduced discomfort, and shorter time for recuperation) often lead more patients to seek the new treatment, which can result in higher total health spending. Looking to the future, technological change may increasingly raise difficult decisions.

Yet it is difficult to separate the effects of technology from other contributing developments. The way the nation and its residents pay for health care has interacted with technology to fuel the growth of spending.8 Indeed, some analysts argue that the lack of cost consciousness on the part of providers and consumers is a key cause of rising health spending in both the public and private sectors (see, e.g., Committee for Economic Development, 2007). In one respect, demand is fed by health insurance, which reduces the costs paid directly by patients and thus removes a possible constraint on the use of services; health insurers generally support volume-driven high-cost medicine so long as they can cover the costs through higher premiums. There has been a significant increase in insurance coverage in the past four decades: more than 50 percent of the cost of health care in 1965, but only about 13.5 percent in 2008, was paid for directly by patients (Centers for Medicare and Medicaid Services, 2009a). The drop in direct, out-of-pocket payments occurred partly because employer contributions to health insurance premiums are exempt from taxes; this encourages more generous and expensive coverage, including coverage of relatively small, predictable

health costs. Demand for services has also grown because as incomes rise, people consume more health care services (Hall and Jones, 2007).

Another factor promoting the use of health care is the dominance of fee-for-service medicine, under which health care providers are compensated for the services they deliver. Fee-for-service medicine encourages the delivery of more services and dulls market incentives to adopt cost-saving technologies and conservative practice styles (Congressional Budget Office 2008f; Eddy, 1997). The result is an inefficient delivery system that promotes the use of medical services, discourages economizing behavior, and encourages the use of increasingly expensive and complex technology. Thus, spending in the health care system rises faster than incomes in the economy at large, and neither consumers nor providers have incentives to stop the spiral.

The ability to treat disease has expanded greatly over the past few decades, but so has the need for health care as the older population has grown rapidly. In 2000, one of six adults was age 65 or older; by 2030, the number will be one of four adults (Census Bureau, 2002; Council of Economic Advisers, 2009). An aging population uses more care, and a high proportion of that spending is financed through Medicare and Medicaid. The Congressional Budget Office (CBO) has calculated that aging by itself accounts for 37 percent of the projected growth in federal Medicare and Medicaid spending through 2035 and 21 percent through 2080 (Congressional Budget Office, 2009c). The prevalence of chronic diseases is also rising, based in part on the spread of obesity; excessive weight is associated with diabetes, heart disease, and other serious illnesses. About 34 percent of adults were obese in 2004, an increase from 23 percent in 1988 (Congressional Budget Office, 2008f). The treatment of the rising prevalence of chronic diseases also contributes to increasing health spending: the fee-for-service medical system is more likely to pay for expensive treatment of symptoms than for the maintenance of health through control of the underlying condition.

Health Spending and the Federal Budget

The federal budget is directly affected by the rising cost of health care in two major ways: Medicare and Medicaid outlays increase as the population ages and as the standard of medical practice expands to encompass the use of more, and more-advanced, interventions; and tax subsidies for health care increase as the cost of employer-sponsored insurance rises. In 2008, Medicare and federal Medicaid spending totaled approximately $671 billion (U.S. Office of Management and Budget, 2009c); see Box 5-2 for program details.

Medicare and Medicaid are entitlements, essentially guaranteeing a level of health benefits that is not bound by any spending limit (which are

|

BOX 5-2 Medicare and Medicaid In 2008, Medicare spent about $468 billion and helped pay for hospital care, doctor visits, and outpatient care, and prescription drugs for 37 million elderly over the age of 65, as well as 7 million disabled beneficiaries under age 65 (Boards of Trustees, 2009). The Medicare program has four components:

About 22 percent of Medicare beneficiaries were enrolled in Medicare Advantage plans in 2008, and the rest were enrolled in traditional Medicare. In addition, about 70 percent of Medicare enrollees had prescription drug coverage under Part D (Boards of Trustees, 2009). Medicaid covers the cost of acute and long-term care services for about 50 million low-income individuals, including children and parents in working families, children and adults with severe disabilities, and low-income Medicare beneficiaries. Although the elderly and disabled comprise only about one-third of Medicaid beneficiaries, they account for two-thirds of the program’s expenses (Council of Economic Advisers, 2009).9 The Medicaid program is financed jointly by federal and state governments, with the federal share varying according to state per capita income. On average, the federal government has paid about 57 percent of program costs (Congressional Budget Office, 2009h). The federal government spent about $201 billion on Medicaid in 2008 (U.S. Office of Management and Budget, 2009b). |

imposed on most other programs by the appropriations process). As noted in Chapter 1, if current policies remain unchanged and health spending grows as projected, outlays for Medicare and Medicaid as a share of GDP would more than double over the next quarter century, rising from 4.1 percent of GDP in 2008 to 9.9 percent in 2035, and they would continue

to increase at a somewhat slower pace thereafter (consuming about 12.6 percent of GDP by 2050).

Separate from Medicare and Medicaid, the federal government subsidizes health care through tax expenditures—large subsidies that are provided through tax provisions that support the purchase of health care in general and private health insurance in particular. The largest subsidy is the exclusion of employer contributions to health insurance premiums from employees’ taxable income, which reduced income tax collections by at least $117 billion in 2008 (Joint Committee on Taxation, 2008a).10 And as noted above, this tax subsidy, which undergirds the employment-based system of private health insurance, encourages the use of high-cost care and drives up systemwide costs (Burman, 2006; Steuerle, 2006).

The committee estimates that financing the projected growth of Medicare and Medicaid spending alone would require an increase in total federal revenues (from the recent historical average of about 18.5 percent of GDP) of about 25 percent by 2030 and about 45 percent by 2050. Without such tax increases or an explosion in borrowing, rising federal health outlays would reduce the funds available for spending on virtually all other national priorities, such as education, housing, energy, and transportation.

REFORM ISSUES

Competing Reform Objectives

Slowing the growth of federal health spending seems essential to any strategy to put the federal budget on a sustainable path, but that fiscal goal must be balanced against other health policy objectives. Indeed, one of the reasons that ever-higher levels of health spending are problematic is that the nation does not appear to be getting its money’s worth for the additional dollars being spent “at the margin.” For example, between 44,000 and 98,000 preventable deaths annually are associated with hospital care (Institute of Medicine, 2000). Conversely, by one estimate only about 55 percent of the care called for under generally accepted standards of medical practice is actually delivered (McGlynn et al., 2003). The substantial variation in per-capita health care spending across the country—with no evidence that regions with higher spending experience better health outcomes—is also often regarded as an indicator of inefficiency in the U.S. health care system (Congressional Budget Office, 2008d; Fisher et al., 2009a, 2009b).

Although federal budget savings are the primary focus of this report, health reform should also aim to improve the value that people receive for health spending. Given the evidence of waste and poor-quality care in the system, there is wide agreement that the nation needs comprehensive health reform—that is, fundamental changes in system organization and service delivery. In addition to slowing the growth of total health spending, truly

successful reform would increase the efficiency of the health system, expand access to health insurance, widen the availability of essential health services, allow choice and control by individuals over their own health insurance plans and care, encourage medical innovation, and, ultimately and perhaps most importantly, produce better health outcomes. Inevitably, those policy goals are partly in conflict, which forces policy makers to consider tradeoffs and priorities. Policies intended to reduce federal health outlays could reduce insurance coverage and the quality of care, disproportionately affecting the poorest and sickest people in the country. Measures that discourage the provision of services believed to be of limited value to a patient’s health may also squeeze out services beneficial to some patients. The challenge for reformers is to balance cost containment with other policy objectives.

Reforms of Medicare and Medicaid that shift costs to individuals (e.g., increasing the eligibility age for Medicare) or states (e.g., converting federal subsidies for Medicaid to block grants) should be distinguished from those that improve efficiency and might be emulated by private insurance companies (e.g., devising incentives that reduce hospital readmissions or improving the way Medicare pays for services). Other policies—such as a mandate on employers to pay for health coverage for their employees—may not increase federal outlays even though they require additional health spending by the private sector. Shifting responsibility for policy goals through regulation would not create an entry in the federal budget even if the effects would be equivalent to imposing a tax and expanding a federal subsidy or program. Such policies might improve the federal government’s narrowly construed fiscal position and yet worsen the health spending burden on the rest of the economy.

Uncertainty About What Works

In contrast to the policy options for Social Security (discussed in the next chapter), there is little certainty about the magnitude of budget savings that could be realized from the many possible reforms in Medicare and Medicaid. Social Security makes cash payments to a known population of beneficiaries, but health programs pay for the use of medical services for which the total cost depends on many factors—such as how many people are diagnosed with particular illnesses, the severity of those illnesses, and how those illnesses are treated according to prevailing and emerging medical practices in different parts of the country.

The savings that can be expected from Medicare and Medicaid options that make adjustments to existing payment levels or otherwise work within current institutional settings are somewhat predictable, at least over a short time span. However, the budget effects of policies that depart from current practices or that rely on significant changes in the practice of medicine or the business of health care are much more difficult to predict, particularly

over a long period of time. Options such as expanding the use of health information technology or expanded funding for research comparing the effectiveness of alternative treatments may have the potential to achieve significant reductions in health system costs, particularly over a horizon of several decades. However, existing evidence on the performance of such major changes in the delivery of health care also suggests that near-term savings would be quite modest and longer-term savings highly uncertain.

Poor incentives, inadequate information, and structural impediments to more cost-effective practice have defeated many efforts to limit costs throughout the health care system. Successful reform will require many building blocks, including changes that would transform private insurance, public programs, individual behavior, and the culture and practice of medicine. It will be an ongoing learning process, not a one-time event. Thus, the extent to which any proposal can achieve that goal is an open question. There is a great deal that is not known about the potential effects of specific policies, and policies will have to be adjusted to take advantage of successes and to learn from failures.

BROAD REFORM APPROACHES

The debate over the best general strategy for reform raises fundamental questions about the system and people’s values. Should the system rely on the competitive market and consumer choice to establish appropriate incentives for greater efficiency? Or should it rely on strong government regulation to manage health delivery, control costs directly, and protect individuals from financial risks that they should not have to bear? Without attempting to answer these questions definitively, this section presents some of the very broadest classes of alternative health care cost-control strategies. Some of these broad alternatives would change the entire health care system and could encompass Medicare and Medicaid as part of a major reform. Still others would bend the cost curve in the non-federal market and thereby help Medicare and Medicaid to achieve similar savings. Each alternative has a set of enthusiastic advocates and a set of strong-voiced opponents. The discussion begins with those options that entail the strongest government intervention in the health care system and end with the most market-driven policies.

A Single-Payer Health Insurance System

The most interventionist broad policy option would probably be a government-run single-payer health insurance system. Under this approach, the federal government would establish an insurance entity to offer health insurance and would prohibit private health insurance, except perhaps as a supplement to the publicly provided insurance. The government insurance

entity could operate in different ways. For example, it could run the entire health care system, as is the case in the United Kingdom. Alternatively, like Medicare, it could set payment rates and contract its operations to private companies (which is handled differently under traditional Medicare, as one model, and Medicare Advantage, as another). There are many other possible options.

Government would dictate the terms of coverage, and it could also become much more closely involved in deciding how medicine is practiced. Advocates (see, e.g., Krugman, 2005; Krugman and Wells, 2006) argue that government as insurer would end the worst practices ascribed to private insurers, notably including denying coverage because of individuals’ medical conditions. Because it would set prices, government could slow the growth of costs by fiat. With only one insurer, administrative costs (now driven in part by multiple paperwork requirements of different insurers) would decline. The government insurer would be free to innovate, perhaps along the lines of the arguably successful Veterans Health Administration (Longman, 2007). Furthermore, such a system would relieve businesses of the burden of managing health insurance for their employees.

Opponents (see, e.g., Committee for Economic Development, 2007; Goodman, 2005) reply that any monopoly in health care would slow or end innovation and that a government monopoly would be the worst of all. Government price setting, they say, inevitably would lead to significant misallocation of resources. The Medicare program has failed to overcome political constraints to drive innovation in the practice of medicine, and it remains largely stuck in fee-for-service medicine with only a costly flawed and partial attempt at managed care (now known as Medicare Advantage) as an alternative. In this view, a single-payer system would fail to achieve innovation for the same reason. Opponents also argue that Medicare’s administrative costs are low only because the program is underadministered, as evidenced by what they say are frequent revelations of provider fraud. Simpler paperwork systems could be created with far less intrusion. Government price setting in Medicare has not been successful in limiting total cost growth, at least in part because providers have found ways to bill for more and more expensive diagnoses and treatments to recover some of the income they lost when government cut the prices of individual services.

In answer to some of these arguments, it should be noted that single-payer systems can vary greatly in generosity and costs by, for example, varying deductibles and copayments. They can be operated with a budget cap, as in Canada, or as an open-ended system.

A “Robust Public Option”

Short of a single-payer system, a so-called “robust public option” would set up a government insurance company to compete with private

insurers. The public insurer would have authority to compel doctors, hospitals, and other providers to work for it at rates dictated by government, usually specified as Medicare rates (which are estimated to be below provider cost for at least some services and institutions). Advocates (see, e.g., Hacker, 2009) claim that such a public insurer would use its pricing power to lower the prices of private insurers by competition and would raise the standards of the insurance industry by its example, such as by offering coverage to individuals regardless of their medical condition.

Opponents (see, e.g., Cannon, 2009a; Minarik, 2009a, 2009b) counter that a government insurer’s power to dictate prices, its absence of a need to earn a profit, its lower cost of capital, and the implicit guarantee of a bailout would be sufficient to drive private firms out of the market or out of business, even if they were more efficient. With private insurers gone, the robust public option would quickly become a single-payer system, with all the problems that entails. And until private insurers were driven out of business, they would be squeezed by providers’ attempts to recover their losses in the public plan with higher charges in the private sector.

A “Non-Robust Public Option”

For want of a better term, a “non-robust public option” would create a government insurance company that competes on the proverbial “level playing field”—without the power to compel providers to work with be-low-cost compensation, without access to Treasury Department financing, and without a government guarantee. Advocates (see, e.g., Committee on Ways and Means et al., 2009) believe that such a public insurer would attract customers through ethical practices, including covering individuals without reference to health conditions. It would inject competition into the marketplace, especially in markets, such as those in less populous or rural areas, that are now dominated by a single private insurer.

Opponents (see, e.g., Cannon, 2009a; Minarik, 2009a, 2009b) reply that there already are many private insurance companies and that one more company competing on a truly level playing field would not change the competitive nature of the marketplace. Rural markets are uncompetitive in large part because of the small number of insured consumers (because of sparse populations and also because of the large percentages of uninsured individuals in those areas) and limited health care purchasing power; with a reform that extended coverage to all, those problems would solve themselves to the extent feasible. Opponents also question whether a truly level playing field is attainable: the implicit guarantee that any government enterprise would enjoy, even with a legal disclaimer (noting the recent experience of Fannie Mae and Freddie Mac, for example) would inhibit private competitors and thereby reduce the degree of competition in the marketplace. It is also possible that sicker consumers would be drawn to

a public plan and would thereby make its risk pool less viable. These factors would not exactly or completely counterbalance the possible market advantages of such a public plan, but they would make the management of the plan even more difficult and its effects more problematic.

Price Controls

At another level of intervention, government could impose price controls in health care (see, e.g., Oberlander and White, 2009; White, 2009a, 2009b). At a stroke, advocates say, this would end the unsustainable growth of health care costs and the alleged unconscionable profits and incomes in the health care industry. Evidence that health spending varies substantially across the country suggests that there are excesses that could be eliminated without effects on health care.

Opponents (see, e.g., Butler, 1998; Coulam et al., 2009) respond that the controlled prices across thousands of different health products and services would inevitably be wrong and would lead to massive resource misallocations. They point to examples of price reductions in Medicare: one result was that providers partly offset reduced prices for individual services by making more aggressive diagnoses and ordering more and different services. The variation in spending across the country arises more because of differences in the volume of services delivered than on variation in price, suggesting that price controls are not a simple way to cut spending. Finally, opponents doubt that either political and administrative processes or economic science would allow cutting only those prices that are excessive, in only the geographic areas where they are excessive, by precisely (or even nearly) the amount of the excess. Rather, the political process would gravitate toward equal across-the-board cuts, which would reduce reimbursements of both efficient and inefficient treatments and providers.

Individual, Cost-Conscious Choice of Insurance Plans

A less interventionist and more market-oriented approach would be to have individuals use a fixed-dollar contribution to choose from the available private insurance plans (see, e.g., Committee for Economic Development, 2007). A fixed-dollar contribution means that an individual saves money by choosing a less expensive plan. A similar system, known as the Federal Employees Health Benefits Plan, is available to members of Congress and all federal employees. Under it, the central market-maker (the U.S. Office of Personnel Management) sets rules for insurers and acts as a broker or “exchange” for individuals. This system prohibits consideration of preexisting conditions for enrollment (or re-enrollment). Advocates argue that such a system, if extended nationwide, would subject all private insurers to competition and give providers a reason to try to deliver quality care at the

lowest possible price. As under the regulated Federal Employees plan, insurers would not be able to select their customers and so could not profit from selecting lower-risk individuals. Instead, they would direct their energies toward attracting and satisfying customers. In sum, market forces would drive both providers and insurers to pursue efficiency and innovation.

Opponents (see, e.g., Berenson, 2005) argue that private insurers behave badly under the current system and will not change their ways, or that penny-pinching competition is not the health care that the country needs. They also doubt that competition would in fact help to reduce costs in health care, given that the “market” that now exists has not done so. Large employers and labor unions oppose this approach because they believe that the current system delivers quality health care today, and because they are advantaged by their ability to provide better health care than smaller employers with small risk pools that are unattractive to insurers.

Eliminating Group Health Insurance

An even more market-oriented approach than one like the Federal Employees Health Benefits Plan would eliminate group health insurance so that there would be only an individual insurance market (see, e.g., Cannon, 2009b). It would establish a large—perhaps income-related—tax credit for all individuals to buy health insurance and replace the current tax exclusion for employers who provide group insurance. This approach could reduce existing regulation, so that people could choose health insurance plans that do not meet current state regulations or could allow people to purchase insurance across state lines. Advocates claim that individuals would shop for cheaper health insurance and drive market prices down. Under that pressure, and especially if empowered by loosening of state regulation, insurers would offer relatively inexpensive plans stripped of mandated coverages (such as mental health) that are required by many current regulators and that increase costs. Plans would be expected to move toward high deductibles with medical savings accounts, and individuals would respond by forgoing unnecessary care.

Opponents (see, e.g., Barry et al., 2008; McDevitt et al., 2010) counter that insurers in an individual insurance market will always have an incentive to avoid bad risks and that a stronger market organizer in a competitive large-group system (like the Federal Employees plan) is essential. They also characterize the supposed competition among less regulated insurers as a “race to the bottom,” in which insurers drop coverages that are necessary for people with expensive medical conditions, thereby beginning a zero-sum competition on the basis of risk selection. Furthermore, opponents argue, the omission of such coverages may be accepted by people while they are healthy and enjoy lower premiums, but, ultimately, the absence of those coverages will cause medical expense crises when people are older or con-

tract serious illnesses. Opponents also believe that high-deductible plans do not focus on the real health cost problem, because most money is spent on expensive cases whose costs are far more than feasible deductibles; thus, individual patients have little incentive to forgo unnecessary care. In addition, opponents argue, individuals lack the technical knowledge to make complex medical decisions.

Summary of Broad Reform Approaches

Advocates of these various broad reform approaches believe that they would induce the health care industry to find ways to deliver quality care more efficiently and that those improved methods would be applied in serving Medicare and Medicaid patients as well. In some options (including use of the individual market or of individual choice as in the Federal Employees plan), individuals could have the option of keeping the cost-efficient plans that they choose over their working lives, thereby “growing into” an alternative to the Medicare program gradually over time. Through those mechanisms, the federal government would share in the savings from systemwide reform.

SPECIFIC REFORM OPTIONS

The rest of this chapter presents some of the most widely discussed specific reform options that depend (in various combinations) on market incentives and on government regulation to slow spending and improve health outcomes and the quality of care. This list of options is meant to be representative rather than exhaustive; it would be impossible to describe all of the major proposals for reforming health care and limiting federal health spending.

Although a number of these ideas have the potential to slow the growth of spending, their success is not assured. Some options require extensive further development and experimentation before they can be implemented widely, and it would likely take a long time for them to yield systemwide savings. At least in the near term (for three out of the four health spending trajectories laid out by the committee), the “strong medicine” of mandated limits on Medicare and Medicaid spending may be the only reasonably certain way (politics aside) to slow federal health spending as much and as soon as necessary. Such restrictions are hardly without problems, not the least of which is that they can be blunt instruments that could limit access or deny some necessary or beneficial care. In addition, experience with various limits to date shows that they may fail to be enforced even if they are legislated.11 Nevertheless, if political barriers can be surmounted, direct controls (imposed gradually) offer the most certain short-term route to slowing the growth of federal health spending until longer-term improve-

ments can take effect. And although it cannot be predicted, such spending constraints may spur stakeholders to seek out system improvements and efficiencies in ways that they would not otherwise. However, spending caps should not be confused with true reform. This section discusses two variants of caps on federal health spending: absolute limits on government payments to providers and capped-amount vouchers in place of open-ended entitlement. (A separate cap on the largest tax expenditure for health is also discussed below and presented as an element of a simplified tax option in Chapter 8.)

Other system reforms and improvements fall into two categories: those with relatively direct implications for slowing spending growth and those whose effects are less direct. Examples of system reforms that are focused on reducing federal spending include capping the tax exclusion for employer-sponsored coverage, reforming Medicare payment systems (through the use of bundled payments, accountable care organizations, pay-for-performance measures, improved fee-for-service pricing, and lower payments to private Medicare Advantage plans), restricting Medicare eligibility, restructuring Medicare premiums and cost-sharing requirements, and limiting malpractice awards. Examples of system reforms that are primarily concerned with care quality and health outcomes rather than cost, but which may also have indirect implications for slowing spending growth, include comparative effectiveness research, health information technology, disease management, and health promotion. These options merely illustrate some of the plausible approaches and are by no means a comprehensive list of possible reforms.

The estimated savings from most individual reform options are small in comparison with the total savings that will be needed to slow Medicare and Medicaid spending growth to a rate closer to that of GDP growth. The savings that could be achieved through a combination of options may be more or less than the sum of the savings estimates for individual options, depending on whether they reinforce or reduce each other’s effectiveness and the degree to which they overlap in achieving particular savings. It also should be kept in mind that these cost estimates were generated within the context of a financing and delivery system that is frequently characterized as fragmented and misaligned (see, e.g., Cebul et al., 2008); many of these options may very well produce different results under a reformed, better organized payment and delivery system.

Imposing Caps on Federal Health Spending

As noted above, because savings from restructuring the large and complex health care industry take time to achieve and are very difficult to estimate, achieving overall federal fiscal stability may require near-term savings through more direct and potentially more painful methods, as unattractive

as that course would be (although the pain of such caps would be mitigated to the extent that they lead to improvement in the efficacy and efficiency of the health system). It will be a challenge to set payment limits in ways that fully account for the health needs of the beneficiary population, minimize the financial hardships for low-income people, and take account of the difficulties that the elderly and low-income populations might have in navigating complex health coverage choices on their own. Congress also would have to adhere to any budget limits it sets for itself, and experiences to date have been disappointing. (See Chapter 10 for a discussion of ways to encourage greater congressional budget discipline.)

One way to impose a spending cap on Medicare is to set an absolute limit on federal payments to providers, placing pressure on them to manage their patient loads and trim nonessential services. However, establishing such caps in a fashion that would minimize dislocations would be quite difficult, and patients would ultimately bear the effects of the limitations. Alternatively, public insurance programs could be converted from defined benefits with open-ended subsidies to fixed-value vouchers, whose aggregate cost to the government could be controlled. This approach would be more transparent in transferring the risk of high-care spending from the government to patients, who would use vouchers to shop for private insurance. However, given the limited and expensive nature of coverage in the individual insurance market, reforms that make competitive group rates available to uninsured individuals would be necessary. For either approach to be successful, the traditional Medicare program would have to become fully and irrevocably accountable for its spending. (The law currently provides that shortfalls in Parts B and D of Medicare are automatically covered by general revenues, which means Medicare does not now face a binding budget constraint.) After-the-fact bailouts would have to be prevented.

For Medicaid, vouchers also could be used to help individuals pay the cost of private health insurance instead of paying directly for health services for the low-income population.12 However, the potential for significant savings would be limited because Medicaid already costs less than private insurance for comparable beneficiaries (Hadley and Holahan, 2003; Ku and Broaddus, 2008). Another way to cap Medicaid spending would be to convert federal matching payments into a block grant, eliminating the open-ended payments to states for services delivered under the program and making states fully responsible for the fiscal consequences of program management and fluctuations in caseloads. States already have experience with managing such hard budget constraints, given the annual struggles of many states to comply with balanced budget requirements—which often centrally involve Medicaid costs. Yet given the importance of Medicaid costs as a component of state budgets, it likely would be very difficult to meet still tighter targets.

In the study baseline, nominal spending for Medicare and Medicaid is

projected to grow at an annual average rate of 7.5 percent in the decade after 2012 (with nominal GDP growing at an annual average rate of 4.1 percent over that period).13 If federal spending caps were to do all the work of slowing the rate of federal health spending growth during that decade, they would have to reduce the growth rate (as a share of GDP) by an average of 1.1 percentage points per year for the most constrained spending trajectory (see Figure 5-1, above), and they would have to do so by an average of 0.8 and 0.4 percentage points per year for the two intermediate trajectories. (The high spending trajectory, as has been noted, follows the study baseline until 2030.)

It is difficult to predict how the health care industry would respond to a federal spending cap (and also how the health industry would react to state government responses to a federal cap) and what the ultimate consequences would be. The outcomes will depend in part on the extent of institutional bottlenecks to achieving efficiency (administrators who can only imperfectly control the behavior of physicians, a shortage of nurses, etc.) and whether or not the “shock” of imposing dollar constraints would be sufficient to force changes in long-standing arrangements. Similarly, wage reductions and service cuts may or may not have an effect on quality, depending on whether (for example) health professionals behave as monopolistic actors who obtain extra income through their market power and whether the services that are cut are really necessary or not. Geographic factors will also be relevant: genuine savings may be easier to achieve (all else equal) in regions of the country that are now less efficient, but fewer gains may be possible in the regions that are already relatively more efficient. Savings in Medicaid, if not achieved through efficiencies, would burden the states through their share of the cost of the program. Reductions in Medicare growth could be passed on to patients and employers in the private sector.

System Reforms with Direct Implications for Slowing Federal Health Spending Growth

Cap the Tax Exclusion for Employer-Sponsored Coverage

Health-related tax expenditures are open ended and have been growing at a rate not much slower than that of Medicare and Medicaid spending (and health costs in general). The current tax code excludes from workers’ taxable incomes the contributions made by employers to health insurance premiums, without any limit. That exclusion has fueled the growth of employer-sponsored coverage, but it has also contributed to the escalation of health care spending in ways that are inefficient and inequitable. As noted above, there is substantial evidence that the tax preference increases the volume and price of health care, although there is also considerable

uncertainty regarding the true size of this effect (Newhouse, 1996, as cited in Joint Committee on Taxation, 2008b). The value of the tax exclusion also increases with income, so that people with more income receive larger tax savings.14

Capping the value of the exclusion would increase awareness of the costs of health care by beneficiaries and is likely to promote the offering and purchase of lower-premium health coverage with more efficient networks of providers, possibly with higher deductibles and copayments. Such a cap also would increase revenues and is one element of the simplified income tax structure option described in Chapter 8. A cap could be designed in many ways, with estimated savings varying accordingly. The Commonwealth Fund, for example, estimates that a cap on the deductibility of premiums set at 110 percent of the value of the median employer-sponsored plan could generate an additional $130 billion in tax revenues over the next decade (Schoen et al., 2007). The Urban Institute has estimated that policy options capping the exclusion at the 75th percentile of premiums would generate $62 billion in tax revenues over the next 10 years if indexed by the rate of growth of medical expenses, and it would generate $224 billion if indexed by the rate of growth of GDP (Clemans-Cope et al., 2009).

Reform Medicare Payment Systems

Medicare outlays could be reduced by improving the program’s efficiency through at least five different payment system reforms (which imperfectly approximate the incentives from capitated prepayment as practiced in the private sector).

First, Medicare could restructure payments to cover more of a patient’s episode of care, such as including certain preadmission and post-discharge services in the same “bundled payment.” Providers, who would be at risk for costs in excess of the bundle amount, would have an incentive to avoid unnecessary care and might be motivated to reduce the chance of having an avoidable complication or preventable readmission. However, there is reason to be concerned that providers might be penalized for unanticipated spending that is outside of their control and that inaccurate payment rates could distort incentives to provide needed care. Evidence regarding cost savings is also mixed.15

Second, Medicare could promote “accountable care organizations” in conjunction with a cap on reimbursements. The members of such organizations, which would include hospitals, primary care and specialist physicians, and other providers, would agree to be held accountable for their performance in terms of cost and quality of care. The organization would not function as a traditional managed care plan; rather, it would be paid on a fee-for-service basis. Any savings from more efficient delivery of care

would be shared between the organization and the federal government (see Fisher et al., 2009c). Although accountable care organizations have the laudable goal of promoting more efficient and integrated care, the extent to which participating providers would actually change their behaviors is unknown.

Third, rather than continuing to pay for services without regard to their effects on patients, Medicare could incorporate measures of performance in fee-for-service payment formulas. Program expenditures would fall if the average payment rate was lowered as performance-based pricing was introduced. Implementing a pay-for-performance approach is not necessarily simple or straightforward, however, and system errors may adversely affect health care quality and access (Cannon, 2006).

Fourth, the accuracy of fee-for-service prices could be improved. Some analysts have argued that formula-based pricing for health services is likely to overpay some services relative to the market and underpay others (Ginsburg and Grossman, 2005; Hayes et al., 2007). These inaccuracies distort the provision of care, leading providers to oversupply care when reimbursement levels exceed actual costs, and undersupply care when reimbursement is lower than actual costs. Market-based reforms, such as competitive bidding methods, might improve payment accuracy and reduce program spending. Competitive bidding has been proposed to set payments for durable medical equipment and clinical laboratory services. However, there is a risk that prices might go up and services to beneficiaries might be reduced as smaller suppliers go out of business (Antos and Rivlin, 2007b).

Fifth, the payment differential between Medicare Advantage private plans and traditional Medicare could be reduced. In 2008, payment “benchmarks” for the Medicare Advantage program were, on average, 17 percent higher than projected per capita spending in traditional Medicare (Congressional Budget Office, 2008b:106). Much of this benefit accrues to private plan participants in the form of supplemental benefits or lower premiums (Congressional Budget Office, 2007d:7). The Congressional Budget Office (2008b) estimates that setting the benchmark for Medicare Advantage private plans at the same level as local per capita spending in traditional Medicare would yield approximately $157 billion in savings over the next 10 years.

Restrict Medicare Eligibility

The federal government could gradually increase the Medicare eligibility age from 65 to 67, as was done for the age of retirement with full benefits in the Social Security program. That would reduce program spending and increase revenue from payroll taxes somewhat as at least some people

delayed their retirement. The resulting Medicare savings would be modest, because the youngest elderly as a group are healthier and use less expensive medical services than those who are still older. The Congressional Budget Office (2008b) estimates that raising the Medicare eligibility age by 2 months annually starting in 2014 until the eligibility age reached 67 in 2025 would reduce Medicare spending by $85.6 billion over the next decade. It is also estimated that an additional $6.8 billion would be saved in Social Security payments in that period because some people would delay their retirement to retain employer-sponsored health benefits.

Although increasing the eligibility age might keep older workers on the job longer and raise their retirement income, it would also expose employers to higher payroll and benefit costs. Moreover, Davidoff and Johnson (2003) estimate that increasing the Medicare eligibility age to 67 would cause 9 percent of 65- and 66-year-olds (amounting to approximately 356,000 people) to become uninsured.

Restructure Medicare Cost-Sharing Requirements

Fee-for-service Medicare has a complex benefit structure, largely because of historical and political factors (Oberlander, 2003; Patashnik, 2000). There are separate deductibles for hospital and outpatient care, and copayments vary among covered services. This structure is confusing to beneficiaries and fails to provide consistent and effective financial incentives for prudent use of services. The program could be restructured with a single deductible and copayment requirement for all services, with the levels set to reduce federal outlays. The Congressional Budget Office (2008b) estimates that Medicare could save $26.4 billion over the next decade through one such restructuring.

Several changes to Medicare premiums also could generate savings. For example, raising the Medicare premium for physicians’ and other outpatient services (Part B) from the current 25 percent to 35 percent of the program’s costs would generate $217 billion in savings over the next 10 years. For the prescription drug part of the program (Part D), the Congressional Budget Office (2008b) estimates that changing it to conform to the current Part B premiums (25 percent of the program’s cost for beneficiaries with annual incomes of up to $85,000, gradually increasing to 80 percent of costs for couples with annual incomes of more than $426,000 in 2009) would increase program savings by $7.8 billion over the next decade.

An alternative to higher premiums would be to raise the payroll tax rate for Medicare. Premiums are essentially user fees that force those who directly benefit from the program to pay part of the cost, unlike payroll taxes, which shift the cost of current beneficiaries to younger generations.16 A 1 percentage point increase in the tax rate would generate $592 billion

over 10 years. If the Medicare tax rate was increased only on earnings above $150,000, the revenue gain would be $77 billion (Congressional Budget Office, 2008b).

Limit Malpractice Awards

It has been argued that legal liability fears cause providers to engage in the practice of “defensive medicine,” administering treatments that do not have worthwhile medical benefits (Kessler and McClellan, 1996). However, the effect of defensive medicine on health spending is unclear (Congressional Budget Office, 2006b), and the budgetary effects of limiting awards from medical malpractice torts may be relatively modest. The Congressional Budget Office (2008b) estimates that limiting awards from medical malpractice torts would lower federal health spending by $4.4 billion and increase federal revenue by $1.3 billion over the next 10 years. These figures may understate the potential savings if litigation fears have suppressed (in ways overlooked by conventional cost estimates) physicians’ efforts to pursue cost and quality improvements in medical care settings. Opponents of limits on tort awards argue that such limits might cause health care providers to exercise less caution and make it more difficult for victims to obtain appropriate compensation for their injuries (Congressional Budget Office, 2008b:22).

System Reforms with Indirect Implications for Slowing Federal Health Spending Growth

Systematic, comprehensive reform must also concern itself with care quality and health outcomes. A number of health reform options speak to these issues: comparative effectiveness research, health information technology, disease management, health promotion, and better primary care.

Comparative Effectiveness Research

Comparative effectiveness research assesses how well a health care technology or treatment for a specific disease works in comparison with other options. Such research can, ideally, provide a scientific basis for using treatments that provide the highest-quality care at the lowest possible price. A government role in financing and promoting the research will be unavoidable, since there are few incentives for private-sector entities to invest in comparative effectiveness research.

Randomized clinical trials can cost tens of millions of dollars (National Institutes of Health, 2007) and take years to complete. Analyzing data on medical claims or synthesizing existing studies would be less expensive than

clinical trials, but might yield less definitive results. Even when the research is completed, there is no mechanism for ensuring that providers use the information in their practices. Historically, disseminating practice guidelines has seldom had significant effects on providers’ actions, although practices might change if the health industry became more market oriented.17 A more effective but controversial approach, given the limitations and complexities of comparative effectiveness research (Gottlieb, 2009), would require Medicare to base its coverage decisions on such research. Alternatively, Medicare might increase payments to providers who adhere to guidelines derived from such research. State Medicaid programs might adopt similar policies. Currently, neither the federal nor state programs use cost-effectiveness information to make coverage and reimbursement decisions (Gold et al., 2007). The Congressional Budget Office (2008b) estimates that an increase of $1.1 billion over the next decade in federal funding for comparative effectiveness research would modestly reduce health spending, resulting in an increase in net federal spending of about $860 million. The American Recovery and Reinvestment Act of 2009 appropriated $1.1 billion for such research.

Health Information Technology

Health information technology refers to a variety of electronic tools used to manage health care information. It has the potential to save money and improve quality by reducing the need to maintain paper files, eliminating duplicative tests, encouraging more-accurate and efficient drug prescription, improving hospital patient flow, and reducing demands on hospital nursing staff. Like comparative effectiveness research, health information technology is generally recognized as a form of public good in which the private sector will underinvest. To date, information on the cost and quality effects of such technology is limited to a relatively small number of studies. It is not clear whether these findings can be broadly generalized (see Shekelle et al., 2006). The Congressional Budget Office (2008b) predicts that, by requiring all Medicare providers to adopt health information technology by 2015, the federal government could save $34 billion during the next decade.18 The American Recovery and Reinvestment Act of 2009 provided approximately $19 billion in payment incentives to encourage Medicare and Medicaid providers to adopt health information technology.

Disease Management

Disease management programs are designed to reduce avoidable complications associated with chronic disease by assisting patients in managing their conditions. Programs vary, but components include patient outreach

to encourage adherence to medication regimens, fastidious monitoring of weight or other key features, behavior modification programs, and an emphasis on preventive care. Studies have shown that disease management is associated with improved adherence to evidence-based guidelines and better disease control (Mattke et al., 2007), but the evidence on cost savings is inconclusive. Early results from a disease management trial in Medicare suggest the program is unlikely to achieve savings and may actually increase spending (McCall et al., 2007). Some people have argued that the savings potential of the Medicare demonstration project was hindered by implementation challenges (Wilson, 2007), but previous trials in Medicare also failed to produce significant savings (Bott et al., 2009).

Health Promotion

Unhealthful behaviors—including poor diet, lack of exercise, smoking, and excessive alcohol consumption—contribute both to poor health outcomes and increased health spending. Public policies aimed at smoking cessation, including cigarette taxes and workplace smoking bans, have been shown to reduce smoking rates (Carpenter, 2007; Carpenter and Cook, 2008; DeCicca and McCleod, 2008; DeCicca et al., 2008; Evans et al., 1999). Similarly, studies have shown that alcohol consumption falls in response to higher taxes and other policies, such as Sunday sales bans (Baltagi and Goel, 1990; Baltagi and Griffin, 1995; Cook and Tauchen, 1982; Dhaval and Saffer, 2007; Stehr, 2007). The effects of policies to reduce obesity are less certain.19 Small school- and community-based obesity programs have been effective at reducing body mass indices (Economos and Irish-Hauser, 2007; Gortmaker et al., 1999), and some workplace interventions have been associated with modest health improvements (Goetzel et al., 2009; Haines et al., 2007; Proper et al., 2003). If an effective clinical method of preventing obesity could be found, it would probably result in lower lifetime medical spending (Goldman et al., 2009). However, evidence is lacking as to whether such programs are cost-effective in practice (Cawley, 2007).

Better Primary Care

Better primary care could improve health-care quality and contribute to lower health-care costs by keeping people out of emergency rooms, doing a better job managing chronic diseases, and reducing reliance on medical specialists. One proposal, sometimes referred to as a patient-centered medical home, would reimburse primary-care providers at a higher rate for improvements such as facilitating better disease management, extending office hours, or adopting health information technology. A medical home

demonstration project in the North Carolina Medicaid program reported savings of 11 percent per member per month (Mercer Human Resources Consulting, 2007), and preliminary findings from a trial in the Geisinger Health System indicate that medical homes led to a 7 percent savings (Paulus et al., 2008). However, it is uncertain whether similar savings could be achieved if medical homes were widely adopted by public programs, such as Medicare. Medical homes also do not address the larger issue of the growing deficiency in the number of primary-care physicians.

Caveats Regarding Savings from Reform

A major objective of health system reform is the more efficient use of resources—but efficient use might not yield federal budget savings. Policies that increase the efficiency of health care delivery might promote the wider use of more effective but more expensive treatments, improving health outcomes without reducing spending. For example, the identification of better treatments through comparative effectiveness research might result in an increase in the number of patients treated—and, therefore, in higher costs.20 Any savings that result from comparative effectiveness research, moreover, would occur well after the research was funded because of the long lead time required to produce treatment recommendations and for the medical community to put those recommendations into practice.

In a similar vein, better health information technology may increase health spending by identifying people who need treatment but are not currently receiving it. Substantial savings through various applications of technology are possible only if medical practice becomes dramatically more efficient. Health information technology might promote such a change (albeit with attendant adjustment costs for providers), but by itself would not necessarily create such savings.

Preventive medical care (which includes things such as immunizations and screening tests) also may not be the most promising place to look for significant systemwide cost savings. Most preventive medical care improves health outcomes but increases costs (Cohen et al., 2008; Russell, 2007, 2009). Typically, preventive care must be offered to a relatively large group of people of whom only a small fraction will directly benefit through an averted illness (Cohen et al., 2008).

CONCLUSION

The difficulty of establishing a fiscally sustainable long-term growth curve for federal health spending can hardly be overstated. The reform challenge is complicated by the need to balance cost containment with other important objectives. Virtually any plan to expand access will require ad-

ditional federal spending. Similarly, reforms aimed at improving health care quality are likely to increase spending, at least in the near term. Delivery system changes—such as the expansion of health information technology and better primary care—may require considerable up-front investment, with cost savings not being realized until well in the future. Other popular ideas, including prevention and wellness initiatives, may add value to the health system but are unlikely to reduce spending.

Better payment approaches also cannot, by themselves, ensure that the resulting trends in federal health spending will be sustainable, and there is considerable uncertainty about the total budgetary savings that would accrue over the long term from the many possible combinations of health system reforms. At least in the near term, some form of health spending cap is more likely to reduce federal spending than any particular reform or combination of reforms. Although a cap would have the undesirable effect of shifting costs to nongovernment payers, it also has the potential to contribute to longer-term system improvements as fiscal constraints spur administrators and payers to seek efficiencies; given the complexities and uncertainties at issue, the response cannot be predicted. At any rate, the committee does not intend to imply that spending caps could be a long-term substitute for fundamental and systemic reform.

Health spending on its current trend is unsustainable, yet the nation has structured its health system and policy-making process as if there were few resource constraints. An essential prerequisite for change is full acceptance by the public that difficult steps need to be taken. We do not minimize the nature of the challenges that lie ahead. Reorganizing and rationalizing the ways in which health benefits and services are delivered are essential to ensure the fiscal sustainability that is vital to the nation’s future.

The four Medicare and Medicaid spending trajectories described above illustrate a range of potential reductions in the rate of growth for health spending, without specifying which combination of reform options would achieve those reductions. These illustrative options reflect an appropriate modesty about what will lower costs, especially in the near term. They also highlight the very difficult decisions of how much stringency to apply to this sector of the federal budget and national economy. The amount of federal health spending growth reduction achieved over the next several decades will determine the range of choices in other areas of the budget, on both the spending and revenue side, for putting the federal government on a fiscally sustainable course.

NOTES

|

|

2. Pilot projects are more likely than demonstrations to yield large-scale improvements because pilot projects, if they prove successful, can be implemented nationwide without congressional action. |

|

|

3. Moreover, CBO’s scoring of the Affordable Health Care for America Act (see Box 5-1) assumes that major spending provisions (such as constraints on Medicare payment rates) “are enacted and remain unchanged throughout the next two decades, which is often not the case for major legislation” (Congressional Budget Office 2009f:13). |

|

|

4. For this purpose, health care spending has to be adjusted for changes in the age and gender composition of the population. Thus, for example, even with effective discipline on costs, spending will grow faster as the population becomes older on average. |

|

|

5. See Burman (2008) for a discussion of using the value-added tax as a financing source for health care. (See Chapter 8 for a discussion of the value-added tax as a general revenue source.) |

|

|

6. The rate of growth of health spending in the United States is nearly the same as that of European countries. Between 1997 and 2003, for example, the 15 original members of the European Union (EU) experienced a 4.2 percent increase in health spending, compared with an average GDP growth of 2.4 percent. Over the same period, U.S. health spending grew 4.3 percent, while GDP grew 1.9 percent (Antos and Rivlin, 2007a). |

|

|

7. The Congressional Budget Office (2009c:27) also notes that Medicare began paying hospitals a predetermined rate for each admission under a “prospective payment system” in 1983. |

|

|

8. For example, see Smith et al. (2009) for a discussion of the interrelationship between technology and health insurance and the possibility that insurance coverage may not continue to stimulate technological change to the extent that it has in the past. |

|

|

9. Medicaid pays for cost sharing, premiums, and some treatments and services that Medicare does not cover, but it is a secondary insurer for this group. |

|

|

10. An alternative approach to calculating the cost of this tax expenditure (Joint Committee on Taxation, 2009) goes beyond conventional estimates by looking at the impact of the employer-sponsored health care exclusion on payroll taxes and assuming certain behavioral responses by taxpayers. This analysis puts income and payroll tax revenue losses in 2008 at $133 billion and $94 billion, respectively. |

|

|

11. The sustainable growth rate formula stands as an example of a budget cap that has not worked. Created by Congress to limit the growth of Medicare payments for physician services, the formula ties physician payments to economic growth. Since Medicare physician spending has been growing significantly faster than the economy, the formula consistently calls for cuts in physicians’ fees. The magnitude of these reductions has proven to be politically untenable, however, and Congress has repeatedly used its authority to override the sustainable growth rate formula. |

|

|

12. With vouchers, private plans would have a relatively fixed budget and have to manage care as efficiently as possible. The financial risk is borne by the plans: if there are insufficient funds available, beneficiaries might get less care or poorer quality care. |

|

|

13. This discussion refers to rates of growth of aggregate spending, rather than the excess cost growth measure used at the beginning of this chapter. |

|

|

14. For example, people in the lower tax brackets receive cash savings from the exclusion valued at between $600 and $3,000 per year, while people with annual incomes of more than $100,000 obtain average cash savings of between $4,000 and $5,000 (Joint Committee on Taxation, 2008b:5). |

|

|

15. The Medicare Participating Heart Bypass Center demonstration project found that bundled payment was associated with a 10 percent reduction in spending among Medicare bypass patients (Cromwell et al., 1998). However, another bundled payment trial implemented in the Medicare system found no effect on costs for patients undergoing cataract surgery (Abt Associates, 1997). |