6

Options for Social Security

Social Security is today the largest and perhaps best-known federal government program. As of the end of 2008, the program had paid $9 trillion in retirement benefits for elderly and disabled people and their dependents and survivors since its inception. About 52 million people, one of every 6 Americans, currently receive monthly Social Security benefit checks: 33 million retired workers, 2.4 million spouses, 6.4 million survivors of deceased workers, and 9.5 million disabled workers and their dependents (Social Security Administration, 2009a).

Although Social Security is currently running annual surpluses, it is projected to be in substantial deficit over the long run. In the near term, Social Security’s benefit payments will rise rapidly as the baby boomers retire, while its revenues will grow more slowly. In less than three decades the program’s reserves will be depleted; from that time forward its sources of revenues will be sufficient to pay only about three-quarters of currently scheduled benefits. However, the program’s financial course is correctable, and corrective action would contribute to making the entire federal budget sustainable.1

The Social Security part of the federal government’s overall fiscal challenge is less complex than that posed by Medicare and Medicaid, the range of potential changes to the program available to address it are much better defined, and their consequences are easier to quantify. In the last section of this chapter we present four possible sets of program changes to make Social Security fiscally sustainable, drawn from a much larger set of potential changes that have been proposed and extensively analyzed elsewhere. (See below, “Options to Restore Solvency.”) Each set—or reform option—varies

in the extent to which it will reduce the future growth of benefits or increase revenues or both, and each achieves the goal of restoring Social Security to long-term solvency without altering the program’s familiar and widely popular basic design.

The committee’s options are illustrative: many other packages of program changes (some of them frequently advanced) are obviously possible—with similar fiscal effects but differing distributional consequences. Options that would augment or alter the program’s basic structure are also possible and have been considered by others; however, the premise of the committee is that these options for structural change are neither necessary nor as politically feasible as the options we offer.

PROGRAM OVERVIEW

Since its enactment in 1935, Social Security has helped protect people against economic insecurity in old age. The basic program structure since its inception has been to assess payroll taxes on current workers and use those revenues to pay benefits to retirees.2 Virtually all workers—more than 160 million people—pay Social Security taxes. The program’s total income in 2008 was $805 billion.

In July 2009, the average monthly benefit paid to retired workers was $1,159 (about $14,000 annually), that for widows and widowers aged 60 and older was $1,118, and that for disabled workers $1,062 (Social Security Administration, 2009a).3 In the 2008 calendar year (the last year for which complete data are available), the total amount paid in benefits was $615 billion (Social Security Administration, 2009a).

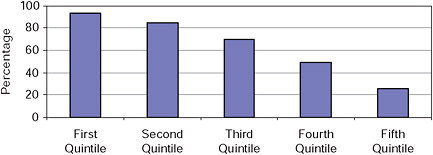

Revenues are credited to the program’s trust fund, and benefit payments are made from it. The program was initially designed with the intent that dedicated, payroll tax revenues plus the interest earned on the trust fund reserves would generally cover the payments to current retirees. The balance of revenues not used immediately to pay benefits is retained in the fund,4 where it is held in the form of special Treasury bonds. Interest earned on those reserves—which are currently in excess of $2 trillion—is also retained until used to pay benefits.

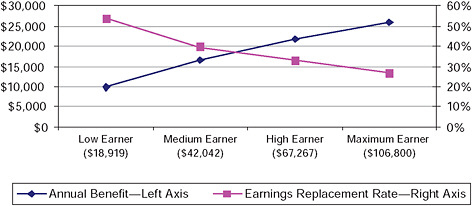

Now, and in the near future, the annual flow of dedicated tax revenues is projected to be sufficient to fully cover the annual cost of currently scheduled benefits. But starting in 2016, Social Security revenue will fall short of benefit spending by a growing amount: when that occurs, first the interest on the reserves and then the reserves themselves will have to be drawn upon. Once the latter are exhausted—now projected to be in 2037—annual Social Security tax income will be sufficient to cover only about 75 percent of the annual benefits currently “scheduled.” If nothing is done to remedy

the situation in the meanwhile, benefits would have to be reduced for all beneficiaries; those reductions would be about 25 percent from their currently scheduled levels.5

The financial outlook for Social Security has also been problematic in the past. Two circumstances have contributed to the need for periodic fiscal adjustments to maintain the program’s solvency. First, legislation has expanded Social Security coverage and increased the level of benefits. Second, the evolution of work, longer average life spans, and other demographic and economic changes have resulted in the need to reestimate how many retirees will be supported in the future by those still working.

When enacted in 1935, Social Security provided only retirement benefits: that is, the program did not cover widows or widowers, children, or disabled workers whose own work experience did not qualify them for retirement benefits. And it was only for workers in commerce and industry, about 60 percent of the workforce.6 The program (today formally known as Old Age, Survivors, and Disability Insurance or OASDI) was expanded periodically to cover additional categories of people. Benefits for surviving spouses and dependents were added early in the program’s history. Later, in the 1950s, coverage was extended to those unable to work due to total and permanent disability (and for their dependents). This part of the program, although it has grown rapidly, is much smaller than the OAS part. The overall OASDI expansion greatly increased the scale of the future commitments to retirees and their dependents and survivors as well as to disabled persons and their families. And these commitments also grew after benefits were indexed for inflation. (Monthly retirement benefits were increased by legislation 10 times before automatic cost-of-living adjustments were enacted in 1972 and then periodically modified.)7

By the late 1970s, Social Security had all of the basic features it has today. Thereafter, legislative changes focused primarily on shoring up the program’s long-run financial stability. These changes included increases in the payroll tax rate and the maximum earnings subject to the tax, future increases in the age—previously 65—at which retiring workers would be eligible for full benefits, and other minor adjustments to benefits and revenues (for details, see Apfel and Flowers, 2007).

The biggest changes that affected the program’s future finances were enacted in 1983 when it appeared that the program’s trust fund would soon be depleted and across-the-board benefit cuts were imminent. Payroll tax rates were increased. For certain higher-income beneficiaries, benefits became subject to the income tax, with those proceeds dedicated to the trust fund. Beginning that year, the annual cost-of-living adjustment was delayed from June to December. And the 1983 reforms provided for gradual increases in the age at which a person could retire with what are called full

benefits—from 65 to 67.8 The increased age for full benefits affected only people who were 45 or younger at the time, which allowed workers to plan for the change by increasing savings before retirement or by working longer (Achenbaum, 1986; Light, 1995).

The Social Security program has both a social and an insurance aspect.9 Its “social” aspect refers to its helping alleviate fear (particularly for low-income workers) of an impoverished retirement, to its compulsory character, and to its progressive benefit structure. Social Security has always replaced more of the former earnings of low-wage workers than of those at upper earning levels.

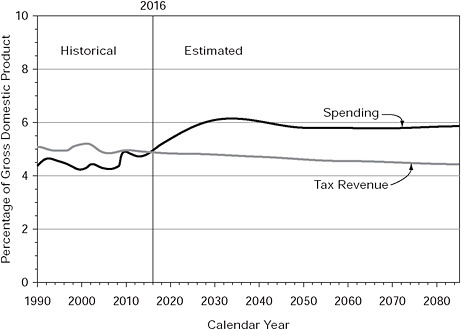

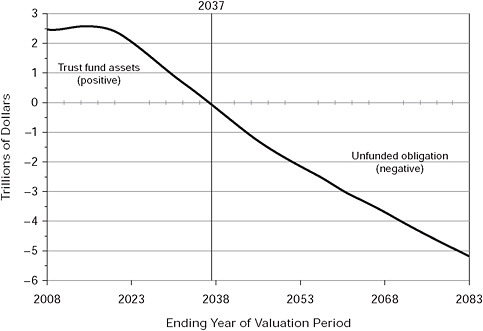

Figure 6-1 shows how, for illustrative workers with different lifetime earnings paths, lower earnings lead to lower cash benefits (left axis; line with diamonds) but higher replacement rates for those earnings (right axis, line with squares).10 Elderly retirees with the lowest income from all sources—including pensions, savings, and earnings—are most dependent on Social Security benefits; see Figure 6-2. On the basis of a 2006 survey of families and individuals 65 and older, for the lowest income quintile (with annual income of less than $11,519), Social Security benefits average 93 percent of all income. Even for the fourth quintile (total income between $28,911 and $50,064), program benefits are 50 percent of all income. Only for the top quintile (total income of at least $50,064 annually) are Social Security benefits a small (26 percent) share of all income.11

Social Security aims to alleviate economic insecurity in old age and among disabled people. As part of its “social” aspect, Social Security replaces a large proportion of preretirement wages for retirees with relatively low life-time earnings. This replacement is especially important

FIGURE 6-1 Annual Social Security benefits and earnings replacement rates, for workers who retire at age 65, scheduled for 2010.

FIGURE 6-2 Social Security benefits as a percentage of total income, for families and individuals aged 65+, by quintile of total income, 2006.

NOTE: Couples are included if at least one is aged 65 or older; see also note 11.

SOURCE: Data from the Current Population Survey (Social Security Administration, 2009b:301).

and provides a safely net for those who cannot (or are not expected to) obtain retirement income on their own through individual savings, pensions, or postretirement earnings.12 The program also provides benefits to dependents without reducing the primary earner’s benefit. For all but the highest-earning 20 percent of older Americans, Social Security is the largest single source of income (Reno and Lavery, 2009). The program, moreover, provides continuing benefits for surviving spouses and dependent children if a worker dies before retirement.

Social Security helps people reduce the risk of having inadequate resources later in life by requiring them to contribute a portion of their earnings in exchange for earned benefits they will receive when not working. Also, in retirement a spouse receives either one-half of the other spouse’s monthly benefits (if a nonworker and married to a worker) or her or his own Social Security benefits, whichever is larger.

It is important to keep in mind that currently scheduled benefits rise over time for successive cohorts of new retirees, even though replacement rates for those retiring at the full benefit age remain relatively constant.13 In order for future cohorts of retirees to have the same percentage of their covered earnings replaced by Social Security as current retirees, initial benefit levels have to rise over time with real wage growth. Wage growth is expected to continue to exceed inflation by about 1 percent a year on average because increases in per capita productivity result in increases in total compensation (i.e., earnings plus benefits). Accordingly, adjusted for inflation, Social Security benefit payments for workers who retire at age 65 would nearly double over the next 75 years (see Table C-3 in Appendix C) if no changes are made to the current benefit formula and if program revenues are adequate.

FINANCIAL PROJECTIONS

It is more than a generation since the major program and financing reforms of 1983, and many of those who were age 45 then are now retired or planning to retire. Americans are now living longer in retirement. A generally declining birthrate and changing work patterns have changed the actual and projected ratios of numbers working and paying into the program’s trust fund to those retired and collecting benefits. Within a generation, as the baby boomers retire, the number of people over the age of 65 will rise from about 13 percent of the population (in 2007) to about 20 percent (in 2040) (Census Bureau, 2009). On average, people will spend many more years in retirement—and drawing Social Security benefits—than previous generations.14 Consequently, the ratio of workers covered by Social Security to program beneficiaries is projected to decrease from its current level of 3.2 to 2.1 in 2035. Thereafter, this ratio is projected to continue to decline, but much more slowly, reaching 1.9 in 2085 (Social Security Administration, 2009d).

Social Security benefits now total 4.8 percent of GDP and they are projected to reach 6.2 percent by 2035. Over the same period, under current law (i.e., without any changes), Social Security revenues will decline from their present level of 5.8 percent to about 4.8 percent of GDP, resulting in a gap of 1.4 percent of GDP. On the basis of such straightforward projections by the Social Security actuaries and others, it is widely agreed that financial reforms are required soon to ensure that the program’s implicit promise is kept for the current generation of workers, as well as with future generations.

What will soon become a growing discrepancy between Social Security’s benefits and revenues will exhaust the trust fund and so threaten the program’s solvency as well as the payment of currently scheduled benefits; see Figures 6-3 and 6-4.15 Box 6-1 sketches how the projected depletion of the Social Security trust fund relates to other indicators of the program’s long-term financial prospects (see Social Security Administration 2009d; see also Appendix C). The program’s financial outlook presents a looming problem not just for Social Security, however; given the program’s size and pending cash flow deficits that must be somehow financed by the U.S. Treasury, it is a problem for the U.S. budget as a whole.

OPTIONS TO RESTORE SOLVENCY

Overview

The fiscal future of the Social Security program could be assured in various ways, but virtually all experts agree that reform likely will require

|

BOX 6-1 Sustaining the Social Security Trust Fund The expected date of the depletion of the Social Security trust fund is only one indicator of the seriousness of the program’s problem (see Appendix C). Another important indicator of the program’s financial soundness is its actuarial balance, based on the discounted streams of revenues and spending projected over a 75-year period. This indicator does not show the size of the trust fund at the end of the 75 years. A major Social Security reform—like that in 1983—might achieve actuarial balance during 75 years but still lead to insolvency after that time. However, a low or falling trust fund level (relative to benefits) at the end of the 75-year projection period can signal looming insolvency. Each reform option discussed in this chapter has been tested against multiple indicators. The estimates show that, under the Social Security trustees’ current economic and demographic assumptions, each of our illustrative reform options finances the program’s costs through the 75-year projection period and results in a positive or near-positive cash flow into and out of the trust fund at the end of the 75-year period. |

either a substantial increase in currently scheduled payroll tax revenues, a substantial reduction in currently scheduled lifetime benefits for future retirees, or some combination of the two. Commonly discussed changes to reduce the future growth of benefits include: raising the full-benefit retirement age and the earliest retirement age; reducing the additional benefit percentage for spouses; reducing the postretirement cost-of-living adjustment; increasing the number of years used to compute average earnings; and changing the way initial benefit levels (i.e., at retirement) are calculated so that they grow more slowly than wages for higher earners. Examples of commonly discussed revenue changes include raising additional payroll tax revenue by covering newly hired state and local government workers; increasing the maximum amount of wages subject to payroll taxes; raising the payroll tax rate; and taxing Social Security benefits similarly to private pension income. The options presented are just a few combinations of the many proposed changes within the current program framework that have been made to address the program’s projected shortfalls. For detailed descriptions and analysis, see, for example, American Academy of Actuaries (2007), Congressional Budget Office (2009b), Reno and Lavery (2009), Shelton (2008), and Social Security Advisory Board (2005); the list of the Social Security actuary is particularly comprehensive (Social Security Administration, 2009c).

Some observers also note that an increased share of general federal rev-

enues could be designated for the Social Security trust fund, or new revenue sources could be dedicated specifically to Social Security. However, since the use of such revenue sources for the program would simply make the already difficult task of achieving appropriate fiscal balance in the remainder of the federal budget even more difficult, we did not include this approach among our illustrative reform options.16

The four illustrative options discussed below entail different combinations of the broader array of possible changes outlined above—thus sustaining the program’s finances in the current, long-established framework in which payroll taxes paid by current workers support benefits for current retirees.

-

Option 1 would achieve fiscal balance for the program without any revenue increases, relying instead solely on program changes that would generally reduce the rate of growth of currently scheduled benefits for future retirees.17

-

In contrast, Option 4 would maintain currently scheduled benefits for all future beneficiaries by relying solely on increases in the payroll tax.

Between these two, the other two options combine tax increases and benefit growth reductions in different mixes:

-

Option 2 would rely two-thirds on slower growth in benefits for future retirees and one-third on future increases in payroll tax revenues.

-

Option 3 is the opposite mix: it would rely two-thirds on future increases in payroll tax revenues and one-third on slower growth in benefits for future retirees.

All four options are designed to have roughly the same overall long-term fiscal impact and to sustain the program’s solvency for the next 75 years and beyond (see Box 6-1, above). All four also would phase in benefit and tax changes over many decades, and none would introduce a major change in benefits for people who are close to retirement.

In the rest of this section we describe each option and its “ground-level” consequences for benefits and payroll taxes. Table 6-1 provides a summary comparison of the program changes in the four options (see Appendix C for more detail). Two questions guided our analysis of the options: (1) How does each option affect future benefit levels and the proportion of individual workers’ past earnings that benefits replace? and (2) How does each option tend to affect the progressivity of Social Security benefits and taxation?

TABLE 6-1 Four Illustrative Social Security Options: Overview

|

Question of Effects |

Option 1 |

Option 2 |

Option 3 |

Option 4 |

|

How is sustainable solvency achieved? |

Reductions in the growth of benefits only |

2/3 benefit-growth reductions; 1/3 payroll tax increases |

1/3 benefit-growth reductions; 2/3 payroll tax increases |

Payroll tax increases only |

|

General Reductions in the Growth (under Current Law) of Monthly and Lifetime Benefits |

||||

|

Does the option increase the future age for retirement with full benefits and for early retirement? |

Accelerate by 5 years the scheduled increase in the full-retirement age, to 67, and then increase retirement age with longevity. Similarly for early retirement. |

No |

No |

No |

|

Does the option change the preretirement calculation of monthly benefits? |

For the top 70% of wage-earners in the retirement program: reduce the rate at which overall wage increases raise monthly benefits. |

For the retirement program: a different form of the change for Option 1. |

For the retirement program: a milder form of this change. |

No |

|

Does the option change the cost-of-living adjustment to monthly benefits in retirement? |

Use a new price index that usually grows somewhat more slowly. |

No |

No |

No |

|

Increases in the Payroll Tax |

||||

|

Does the option raise the dollar cap on wages that are taxed? |

No |

No |

No |

Raise tax cap by extra 2% over current formula, starting 2012, until it applies to 90% of earnings; no benefit credit for earnings over current-law cap. |

|

Does the option change the tax rate for earnings under the (possibly raised) tax cap? |

No |

Raise tax rate for earnings under the current cap formula to 12.6% in 2012 and then in steps to 13.3% in 2060. |

Raise tax rate for earnings under the current cap formula to 12.6% in 2012, then in steps to 14.5% in 2075. |

Raise the tax rate for earnings under a raised cap formula to 12.7% in 2012 and then in steps to 14.7% in 2080. |

|

Does the option: |

|

|

|

|

|

1. Add a new tier of payroll tax? |

No |

No |

1. Yes. |

1. Yes. |

|

2. Change the tax rate for any earnings above existing tax? |

2. 2% starting 2012, to 3% in 2060. |

2. 2% starting 2012, then in steps to 5.5% in 2060. |

||

|

3. Change the benefits for any such tax paid? |

|

|

3. Benefits not increased by second-tier taxes paid. |

3. Benefits not increased by second-tier taxes paid. |

Option 1:

Benefit Changes Only

In comparison with the current program formulas, this option changes benefits for future retirees. Recognizing that longevity is increasing, Option 1 accelerates the currently scheduled increase in the age for retirement with full benefits, to 67 in 2012, instead of remaining at 66 for several more years. More specifically, the age to retire with full benefits would increase by a projected 1 month every 2 years. The age for the earliest retirement with Social Security retirement benefits would increase the same way.18

In addition to changes in retirement age, the other two provisions that affect monthly benefits under Option 1 are “progressive indexing” of the preretirement benefit-entitlement formula and a change in the cost-of-living adjustment during retirement.21 First, under the benefit formula in current law, improvements in average wages before a worker’s retirement generally increase future benefits for that worker (and all others). Under this illustrative reform option, the current indexing to average wage levels would be reduced by “progressive indexing.” For workers with the lowest 30 percent of earnings, the growth rate of benefits would be maintained. For most others, initial benefits would grow more slowly—although, on average, at least as fast as prices. Benefits would grow slowest—keeping pace only with consumer prices—only for workers with steady earnings at the current-law taxable maximum.

Second, the annual cost-of-living adjustment for retirees receiving monthly benefits would be computed from a newer price index that is generally considered more accurate, which usually provides smaller benefit increases.20 Upward cost-of-living adjustment would continue and so benefit checks would continue to be protected from price inflation during retirement.21

Benefit Effects

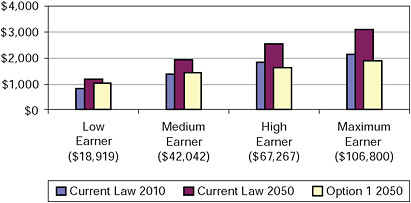

Figure 6-5 compares monthly benefit levels—adjusted for projected inflation—for new retirees in 2050 under Option 1 with those scheduled under current law for new retirees in 2010 or 2050. (Discussed below, Figure 6-6 presents another aspect of this option.) Benefits are compared for new retirees at age 65, that is, for those taking early Social Security retirement in 2010 and 2050. Because Option 1 accelerates the increase in retirement age, its age-65 benefit as illustrated in Figure 6-5 reflects benefits reduced by what is effectively even earlier retirement. Since Option 1’s age for full retirement benefits is later than current law’s—68 years and 4 months in 2050—retiring at 65 under Option 1 (in 2050) leads to a bigger reduction in monthly benefits for early retirement than retiring (in 2050) under current law, assuming payment of scheduled benefits.22 (With a different format and more detail, Tables C-3 through C-5 in Appendix C

FIGURE 6-5 Monthly Social Security benefits for workers who retire at age 65 under current law and under Option 1 (in 2009 dollars).

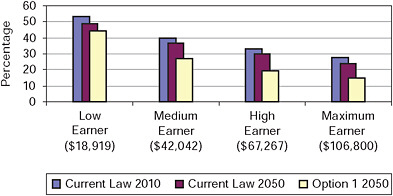

FIGURE 6-6 Social Security benefits as a percentage of past earnings for new retirees at age 65 under current law and under Option 1.

show the option’s effects on monthly benefits, the replacement of individual earnings by benefits, and on payroll taxes paid.)

Although it leads to more years of benefits, early retirement makes a big reduction in monthly benefits, under both current law and this option. For example, under current law, retiring in 2050 at 65 rather than at that year’s age for full benefits of 67 means 15.4 percent less in scheduled monthly benefits. As a result, Option 1’s increase of the retirement age for full benefits markedly contributes to lower monthly benefits. The first triplet of bars in Figure 6-5 represents monthly benefits of illustrative “low earners,” people with average lifetime earnings of $18,919 per year, in 2009 dollars.23 The three bars show that under current law, new retirees categorized as low earners are projected to receive $834 per month in 2010,

rising (by 39 percent) to $1,161 per month for the cohort of low earners who retire in 2050.

Under Option 1, benefits in 2050 for low earners would be 25 percent above the 2010 level. Real monthly benefits would grow over time for low earners, but they would grow slower than under current law. In contrast, for the “maximum earners,” people who earn at the current taxable maximum of $106,800 per year (in 2009 dollars), real benefits would decline over time. Under existing law, maximum earners are projected to receive $2,156 a month in 2010 and $3,094 in 2050; under Option 1 they would receive only about 60 percent of that amount.

Because Option 1 achieves long-term solvency of Social Security by changing only the benefit formula—with no tax increase—the benefit changes are bigger than with the other options. Through benefit changes, all future retirees would contribute to the program’s solvency, with higher earners contributing much more than other workers. Yet there would continue to be growth in real, monthly benefits—though at a reduced rate—for all but about the highest-earning third of workers.

Figure 6-6 illustrates the benefit effects of Option 1 another way, by showing not monthly benefit dollars, but to what extent a worker’s Social Security retirement benefits replace her or his preretirement earnings. For all earnings levels, these “earnings replacement rates” for individual wage earners who retire at age 65 are set to be slightly less in 2050 than in 2010 under current law.24 That is, the real benefits grow, but they grow more slowly than real wages. For example, under this option, Social Security benefits for medium earners in 2050 would replace 27 percent of prior earnings, compared with 40 percent for 2010 under current law (see Table C-4 in Appendix C).

Option 1 is designed so that in 2050 the benefits or the growth rate of benefits of all new retirees are less than those for new retirees in 2010, but they are reduced more for higher earners than for lower earners; see Figure 6-5.

Payroll Tax

Under this option there are no changes in the payroll taxes for Social Security; for illustrations of payroll taxes under this option, see discussion below.

Option 2:

Two-Thirds Benefit Growth Reductions, One-Third Payroll Tax Increases

The committee’s second option would achieve long-term actuarial balance with smaller cuts in benefit growth and an increase in the payroll tax. One of the same “building blocks” in Option 1 that reduces the growth of benefits—progressive indexing—is applied here, too, though in a different

form. A new building block for Option 2 is on the revenue side: an increase in the rate of Social Security payroll taxation. The current tax rate of 12.4 percent—half levied on employees and half on employers—would be raised in stages to 13.9 percent in 2040. Thereafter, reflecting the reduction in the growth of benefits, growth in the economy, and the retirement of the baby boom generation, the now-sufficient tax rate would decline slightly in stages to 13.3 percent in 2060.

Benefit Effects

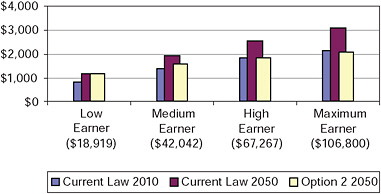

Option 2 reduces future benefits and benefit growth rates in comparison with those scheduled under current law, but it does so less than Option 1; see Figure 6-7. Medium earners who retire in 2050 would receive 13 percent more in constant dollars than they would receive in 2010 under current law. Under the current benefit formula, they would receive 39 percent more in 2050 than in 2010.

As with Option 1, people with lower earnings fare better with respect to their benefits, in comparison with current law, than higher earners. Monthly benefits for low earners are the same as in current law for all years (see Table C-3 in Appendix C). In contrast, the benefits (in constant dollars) for steady maximum earners who are new retirees would decrease slightly in 2050 in comparison with 2010. Real benefits would continue to grow—but at a reduced rate—for all but about the highest-earning one-fifth of workers.25

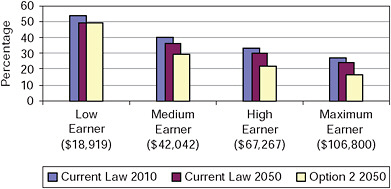

Reflecting an increase in the payroll tax that would permit higher benefit levels than in Option 1, replacement rates for Option 2 are higher than for Option 1: compare Figure 6-6 with Figure 6-8, which shows replacement rates under Option 2 in comparison with current law. By 2050, the benefits for medium earners would replace 30 percent of preretirement earnings rather than 40 percent in 2010 as under current law. Low earners would receive a higher percentage: 49 percent in 2050, in comparison with 54 percent for that group in 2010. Benefits for high earners would replace less of their prior earnings: 22 percent in 2050, compared with 33 percent in 2010.

Payroll Tax

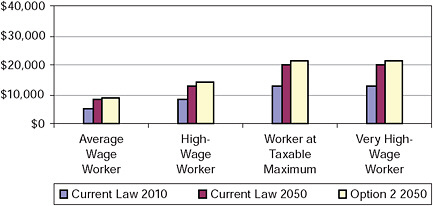

Unlike current law and Option 1, Option 2 would raise the payroll tax, but would not change its other characteristics. Figure 6-9 depicts the effects for four groups of workers in 2010 and 2050 and for the current law for 2050. (Because Option 1 doesn’t change the existing payroll tax for Social Security, there is no comparable figure for it; see, instead, the bars for the current law in Figure 6-9. See Appendix C for definitions of the wage levels of the illustrative groups.)

FIGURE 6-7 Monthly Social Security benefits for workers who retire at age 65 under current law and under Option 2 (in 2009 dollars).

FIGURE 6-8 Social Security benefits as a percentage of past earnings for new retirees at age 65 under current law and under Option 2.

FIGURE 6-9 Annual Social Security payroll tax projected for 2010 and for 2050 under current law and under Option 2 (in 2009 dollars).

Because wages are projected, on average, to continue to grow faster than prices, payroll taxes paid will increase in the future, adjusted for price inflation. The increase of the payroll tax rate under Option 2 means that workers whose wages grow at the rate of price inflation (and with earnings below the taxable maximum) would pay 9 percent more in payroll tax in 2050 than under current law.

Option 3:

One-Third Benefit Growth Reductions, Two-Thirds Payroll Tax Increases

The committee’s third option restores long-term actuarial balance by cutting benefit-growth rates less and increasing payroll taxes more than under Option 2.

Benefit growth would be slowed by a milder version of progressive indexing than is proposed in Options 1 and 2. Under Option 3 two provisions affect taxes: the current tax rate of 12.4 percent would be raised in stages to 14.5 percent in 2075, and a new, second tier of Social Security payroll taxation would be added to the existing tax. This second tier would tax earnings above the taxable maximum under current law, and—as with the existing Medicare payroll tax—there would be no cap on earnings that are subject to this new tax. The second-tier tax would be imposed at a rate of 2 percent in 2012 (employer and employee combined), and rise to 3 percent in 2060. Unlike the existing Social Security tax, collections under this added tax would not be credited toward a worker’s Social Security benefits. The second-tier tax would move the program’s financing in a progressive direction.26

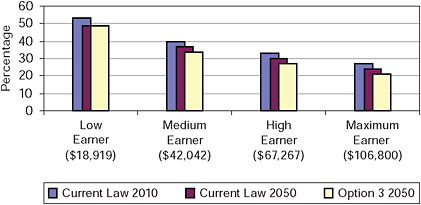

Benefit Effects

Option 3 would provide higher real benefit levels than Options 1 and 2; see Figure 6-10. In 2050, medium earners would receive an estimated $1,792 monthly under Option 3 (compared with $1,559 under Option 2, for instance). For replacement rates, the pattern under Option 3 is similar to but higher than that under Option 2; see Figure 6-11. They would decrease with earnings and would be lower in 2050 for Option 3 than under current law. For example, in 2050 the replacement rate for medium earners would be 34 percent (compared with 30 percent under Option 2).

Payroll Tax

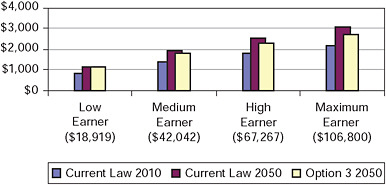

Under Option 3, all workers would pay higher taxes than under current law or Option 2; see Figure 6-12 (for details, see Appendix C). Because

FIGURE 6-10 Monthly Social Security benefits for workers who retire at age 65 under current law and under Option 3 (in 2009 dollars).

FIGURE 6-11 Social Security benefits as a percentage of past earnings for new retirees at age 65 under current law and under Option 3.

FIGURE 6-12 Annual Social Security payroll tax projected for 2010 and for 2050 under current law and under Option 3 (in 2009 dollars).

Option 3 adds a second-tier tax, very high-wage workers would pay more than those at the first-tier taxable maximum. For very high-wage workers, the total payroll tax of $25,250 in 2050 under Option 3 would be almost twice as much as they would pay in 2010 under current law.

Option 4:

Payroll Tax Increases Only

Under this option, the benefit growth rates provided under current law are maintained by introducing three changes to taxes. First, the current Social Security payroll tax would be increased by raising both that tax’s cap and its rate. Currently, about 84 percent of all earnings in the economy are subject to the payroll tax; under this option, the cap on wages subject to this tax would be raised to about 90 percent, where it has been in the past.27 Second, the current payroll tax rate would be increased—on earnings up to its new maximum—rising in stages to a combined 14.7 percent in 2080. Third, this option would add a second-tier tax on covered earnings at all levels, which would begin at 2 percent in 2012 and rise to 5.5 percent in 2060. These changes would move Social Security taxation in a progressive direction.

Benefit Effects

Under this option, there would be no change to the benefit growth rates scheduled under current law. For the benefit levels and earnings replacement rates, see the bars for the current law in the figures above.

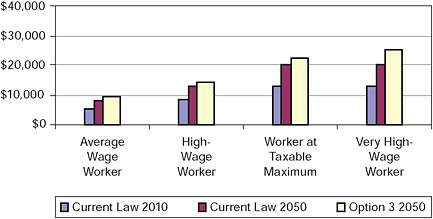

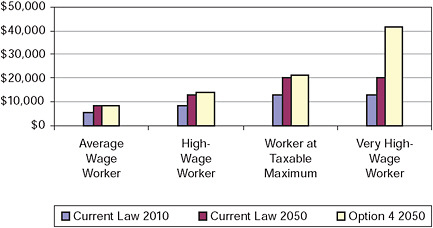

Payroll Tax

Sustaining the benefits scheduled under the current law will require substantially higher revenue from payroll taxes; see Figure 6-13. Adding a second-tier tax makes the increase much larger for those at higher earnings levels than at lower earnings levels. For example, for very high-wage workers, annual payments in 2050 would increase 109 percent, from $19,960 under current law to $41,608 under Option 4. These very high-wage workers to date have typically paid Social Security tax on just about one-half of their earnings. Contributions by those at average earning levels would increase far less, however.

CONCLUSION

Changes to make the Social Security program financially solvent are an essential element of a strategy to put the federal budget on a sustainable path. Restoring confidence in the program’s future is especially vital

FIGURE 6-13 Annual Social Security payroll tax projected for 2010 and for 2050 under current law and under Option 4 (in 2009 dollars).

now, when other sources of retirement security, such as private savings and housing equity, have been so severely diminished. If changes are enacted soon, it will be possible to close the program’s financing gap with relatively modest, incremental tax increases or restraints on the growth of benefits (or both): the longer action is delayed, the larger will be the required changes to restore long term-solvency. Future retirees will confront increasing uncertainty about what they can expect from Social Security in their old age; and low-earning workers, who rely far more than others on Social Security benefits for retirement income, will be particularly vulnerable to sudden or unexpected benefit reductions.

The four illustrative reform options outlined in this chapter would all retain Social Security’s familiar program structure, avoid sudden or unexpected increases in payroll taxes and benefit cuts, and place the program on a solid financial footing for both the standard 75-year projection period and beyond. Their differences lie primarily in the extent to which they rely on benefit reductions or tax increases to restore long-term solvency and in the particular consequences for the level of future taxes paid and benefits received over time by workers at different levels of lifetime earnings.

The macrolevel implications of these differences for the size of government—as measured by levels of spending and revenues—are straightforward and easy to describe. Option 4, which relies on higher taxes to maintain currently scheduled benefits, would eventually raise revenues by about 1.3 percent of gross domestic product (GDP); in contrast, Option 1 would not increase them at all; and Options 2 and 3 would have intermediate effects in proportion to their reliance on tax increases.

In contrast, the microlevel distributional consequences are more complicated and difficult to characterize. Some sense of them, in terms of taxes paid and for benefits received, can be seen in Figures 6-5 through 6-13, above, and they are detailed in more depth in Appendix C. Developing summary distributional measures that integrate the tax and benefit changes of each option is a complicated undertaking beyond our scope. However, we note that Social Security is now somewhat progressive in its overall consequences (Congressional Budget Office, 2006a): that is, those with higher earnings pay more in taxes in relation to lifetime benefits received than those with lower earnings, and we judge it likely that all four of our options would retain or increase the program’s current degree of progressivity.28

As we note at the outset of this chapter, other packages of frequently advanced program changes with similar overall fiscal impacts and differing distributional consequences, can be constructed, depending on one’s policy preferences. Our four illustrative options are indicative of the range of choices available to put Social Security on a solid financial footing and continue its role as a foundation for economic security in retirement for most working Americans.29

NOTES

|

|

1. Changes to sustain Social Security finances will contribute to making the entire federal budget sustainable in at least two ways. First, it is now the largest federal program and so changes have a large effect relative to the entire budget. Although Social Security is designed to be self-financing, if its spending exceeds the program’s revenues, the difference adds to the federal deficit, and, conversely, if the program spends less than it takes in, this difference reduces the federal deficit. Second, sustaining Social Security finances helps rebuild public confidence that the federal government will finance the benefits it promises and promise only benefits that it can finance. |

|

|

2. In addition to payroll taxes, which account for most Social Security revenue, small amounts come from the personal income taxes paid by upper-income individuals and families on their Social Security benefits and from interest earned on trust fund reserves. |

|

|

3. Contrary to popular understanding, the benefits received by a retiree are only loosely related to the amount that retiree paid in payroll taxes because the benefit formula is progressive and because benefits are based on the average of the retiree’s highest-earning 35 years. |

|

|

4. The retirement and the disability programs have separate trust funds and shares of the payroll tax. The former is much larger than the latter. For purposes of explication, the two separate trust funds are usually treated in the text as one. The illustrative options presented below sustain both the retirement and the disability programs. However, projections of trust fund balances combine the two. |

|

|

5. “Scheduled” benefits are those payable when the trust fund is adequate: in projections, “payable” benefits are what they would be if they had to be reduced because the trust fund was inadequate to cover scheduled benefits. Except as noted otherwise, all benefit levels mentioned are scheduled. Also, except as noted otherwise, the projections for Social Security in this chapter, Appendix C, and in the design of the committee’s illustrative |

|

|

reform options all draw on the intermediate assumptions of the 2009 Social Security Trustees’ Report (Social Security Administration, 2009d). For the long term, the less detailed projections of the Congressional Budget Office (2009f) take a generally similar path, although its projections of the gap between spending and revenue are somewhat smaller and, as a result, it projects the exhaustion of the trust fund slightly later. For consistency with the rest of the study, the baseline for the overall budget and the analysis of our paths use the Congressional Budget Office projections for Social Security. |

|

|

6. Only the briefest history of the program’s finances is presented here: for more detailed histories, see, among others, Aaron and Reischauer (1998) and Diamond and Orszag (2005). |

|

|

7. For details on these program changes, see Aaron and Reischauer (2009) and Diamond and Orszag (2005). |

|

|

8. Those who start receiving Social Security retirement benefits at an earlier age—62 is the earliest allowable—have their benefits reduced by about 8 percent a year, and those who delay retirement beyond the age at which they can receive full benefits gain about 8 percent in benefits for each year—up to age 70—they delay retirement. These adjustments were intended to equalize lifetime benefits for those who retire at different ages, based on average life expectancies. |

|

|

9. Considering the Social Security program as a whole, the program is like private insurance in that it insures against adverse events (such as the risk of an impoverished retirement), yet it is part of a social contract that includes almost all workers and their families. |

|

|

10. Except for Figure 6-2, this report shows Social Security replacement rates for individual earnings for individual workers—not for families—and does not include other sources of income in retirement. These replacement rates are percentages of individuals’ earnings creditable to Social Security. (Illustrations of earning levels are in 2009 dollars.) This definition is widely used, not just currently by the Social Security Administration, but by others (see, e.g., Congressional Budget Office, 2001:20-21). However, it differs markedly from that used in retirement planning; see Appendix C. |

|

|

11. Noncash income, such as Food Stamps or housing subsidies, are excluded, as are lump-sum pension payments and income from capital gains, such as from the sale of a house or stock. Periodic pension payments are included in the total, however. The quintile “break points” in the distribution of total money income are $11,519, $18,622, $28,911, and $50,064 per year. Percentages graphed are the mean proportion of benefits as a share of all income, within each quintile. Although the total is shown, elderly individuals tend to be more dependent on Social Security benefits than couples. |

|

|

12. Some analysts argue that the availability of Social Security and Medicare acts to reduce voluntary savings, however. |

|

|

13. “Remain relatively constant” refers to the illustrations of workers at different positions in the lifetime distribution of earnings covered by Social Security. Individual workers who retire at a given age (such as 65) in the future will generally have somewhat lower earnings replacement rates. These lower replacement rates will occur because, under current law, the retirement age for full benefits, which once was 65, will rise in 2-month increments to reach 67 after 2022. |

|

|

14. For example, the life expectancy for those turning 65 in 1990 was 15.8 years for men and 19.1 years for women; currently, it is 17.7 years for men and 20.0 years for women; and it is projected to be 20.9 years for men and 23.1 years for women in 2060. In other words, increased longevity means about one-third longer retirement for men and one-fifth longer for women in 2060 in comparison with 1990 (Social Security Administration, 2009d). |

|

|

15. The “present values” shown in Figure 6-4 use projected interest rates to discount streams of future revenue and spending to a single dollar figure, in this case for January 1, 2009. |

|

|

16. Appendix C briefly discusses the proposal to introduce individual accounts, which would make a fundamental change to the Social Security program, and other ideas have been proposed. For example, there could be more income taxation of the benefits received by people at higher income levels, or some or all of the proceeds from the federal estate tax could be devoted to Social Security. However, given the magnitude of the continuing funding gap, these two revenue sources could contribute only relatively small portions of the needed funds. From another perspective, several proposals have been made in recent years to enhance Social Security benefits for vulnerable populations, such as very old beneficiaries, workers with very low wage histories, and widows. It was beyond the scope of the committee’s charge to assess these or other enhanced benefit proposals. We note, however, that if benefits were enhanced for such vulnerable populations, corresponding reductions in benefits or tax increases would be needed to finance these changes. |

|

|

17. However, for high earners, Option 1 would reduce the inflation-adjusted level (not just the growth) of currently scheduled benefits for future retirees. |

|

|

18. Because a later retirement age provides more time for workers to become disabled and to apply for disability insurance and because it delays the age of “conversion” from disability to retirement benefits, raising the Social Security retirement age will increase spending in the disability insurance program. However, the only net effect of delayed conversions on the program’s financial position comes from differences in indexing between retirement and disability benefits for this option and two others (see Appendix C). |

|

|

19. This “progressive indexing” option is not to be confused with a somewhat similar proposal called “progressive price-indexing” that has been proposed and analyzed elsewhere. For a critical analysis of that proposal, see Appendix C and Furman (2005a). |

|

|

20. The chained Consumer Price Index would replace the older fixed-Weight Consumer Price Index. The newer index reduces the latter’s general overstatement of price inflation by roughly 0.3 percentage points per year; see a study by statisticians at the U.S. Bureau of Economic Analysis and Bureau of Labor Statistics (McCully et al., 2007:26-33) and see National Research Council (2002). |

|

|

21. However, in comparison with currently scheduled benefits, this provision would reduce monthly benefits the most for long-lived beneficiaries, who are disproportionately widows. But note that low- and middle-level workers (and their spouses) generally fare best under progressive indexing—another benefit change under Option 1. |

|

|

22. Lifetime—not just monthly—benefits are important, too, of course. For instance given the longer longevity projected for 2050, Option 1’s delayed retirement ages, relative to the unsustainable current law, produces a greater downward tendency for its lifetime than for its monthly benefits. This helps allow it to sustain program finances without a payroll-tax increase. |

|

|

23. Throughout this chapter, the illustrations of benefits, earnings replacement rates, and payroll tax paid use the Social Security Administration’s definitions of representative workers at different earnings levels. The “low,” “medium,” “high,” and “very high” illustrations are of lifetime earnings levels, scaled to reflect changes in the overall wage distribution over time. “Maximum earners” are defined differently, however, because they reflect steady earnings at each year’s taxable maximum, as does “worker at taxable maximum,” when the formula for the taxable maximum changes under some of the study’s reform options. We note, however, that the Social Security “medium” earning level has been shown to be higher than the actual average level (Mitchell and Phillips, 2006, 2009). However, because our analysis uses the various Social Security definitions of earning levels only for comparison with each other, this finding does not affect the comparisons. |

|

|

24. We present Social Security earnings replacement rates to gauge the degree to which beneficiaries—especially those without pensions or savings—can rely on Social Security benefits. |

|

|

25. This is the only instance under Option 2 for which constant-dollar benefits decrease from the 2010 to the 2050 cohorts of new retirees; for details, see Appendix C. For high earners, the real benefits in 2035 under this option would be less in 2035 than 2010; see details in Appendix C. |

|

|

26. Imposing a second-tier tax without a benefit credit thus tends to move the Social Security program away from its contributory character. |

|

|

27. Estimates of the revenue from Option 4’s tax changes (as for Option 3) rely on projected income distributions. These are included in the actuarial estimates in the current program Trustees’ Report (Social Security Administration, 2009d). The Social Security Administration’s actuaries have long had to project income distribution for the program’s revenue estimates under current law because of the tax paid on some Social Security benefits by relatively upper-income payers of the current personal income tax. |

|

|

28. By reducing or delaying benefits for future retirees relative to those scheduled under current law, Options 1, 2, and 3 would reduce the program’s contribution to income security in old age for all earnings groups; however, the reductions are proportionately larger for those with higher earnings. Option 4 would preserve the program’s currently scheduled benefit-growth rates by taxing wages more heavily in the future. Options 2, 3, and 4 would raise taxes for all earnings groups; however, the larger increases in Options 3 and 4 would be borne more by the highest earnings groups. Because payroll taxes do not apply to nonwage income, such as business profits, interest, and capital gains, options that increase payroll tax rates disproportionately affect the people who are most reliant on wage income. |

|

|

29. As of June 30, 2009, about 90 percent of the population aged 65 and over was receiving Social Security benefits, and about 94 percent of employed people and those who are self-employed were covered under the program (Social Security Administration, 2009a). |