8

Revenue Options

Having considered spending options in the three preceding chapters, in this chapter we consider the options for revenues. Of the committee’s four illustrative scenarios for long-term budget sustainability, three would require substantial revenues in addition to the amounts projected under our current-policy baseline. Just how additional revenue is raised is an important policy question. At higher tax rates, substantial flaws in the current tax system would be magnified. Therefore, in addition to considering options for higher levels of revenue, the committee has analyzed alternative tax regimes that promise to raise revenues more efficiently and with fewer adverse effects on economic growth. This analysis includes illustrative application of a much-simplified personal income tax structure and of a possible additional revenue source, the value-added tax (VAT), to reach higher revenue levels.1

Taxes can be raised in different ways, which distribute the burden differently across people with different levels and sources of income: these differences implicitly embody different concepts of fairness. And different tax regimes can have different overall effects on the economy: for example, most tax experts believe that the current tax code could be reformed in ways that would boost economic growth. The tax system also directly affects how the nation can respond to the increasingly competitive global economy.

The first part of this chapter provides an overview of federal revenues, currently and over time. The second part looks at flaws of the current tax system—its complexities, inequities, and generally negative effect on economic performance—and ideas for reform. The chapter also considers the

U.S. tax system in an international context, which is important to assessing how the U.S. tax regime affects the economy’s global competitiveness. It briefly discusses the important but elusive goal of achieving fairness in taxation. In the final part of the chapter, the committee analyzes two alternatives to the current tax system, considering them both as ways to fix flaws in the current system and to raise the additional revenue that would be needed under three of the committee’s four scenarios.

THE CURRENT TAX STRUCTURE

Revenue Levels and Sources

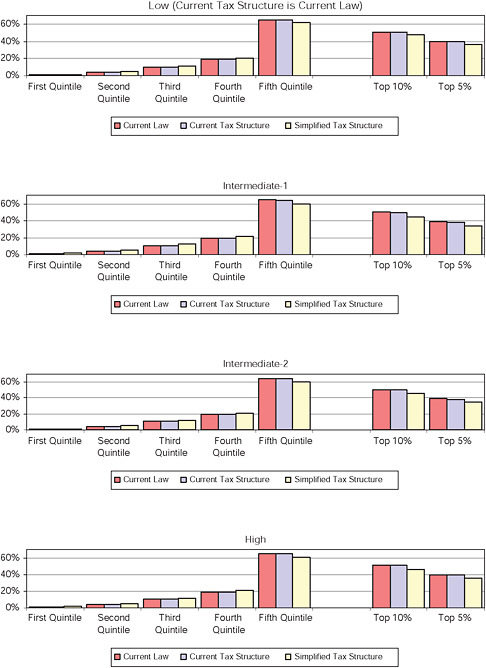

For the last half century, federal revenues have fluctuated mostly between 17 and 21 percent of the gross domestic product (GDP), even as tax legislation reduced or increased income tax rates, increased payroll tax rates, and made other changes. The business cycle has substantial effects on the federal budget; and the deep 2008-2009 recession, following major tax cuts early in this decade, has reduced revenues as a share of GDP below historical levels. However, as the economy recovers, revenues are expected to rise gradually back to 17 percent and then higher as the economy grows further. Figure 8-1 shows the recent history of federal revenues as well as the trend projected in the study’s baseline.

The largest amounts of federal revenue come from the individual income tax, the corporate income tax, and the payroll taxes that fund Social

FIGURE 8-1 Federal government revenues as a share of GDP.

NOTE: Data for 2010, 2015, and 2020 are estimates.

Security and Medicare (often referred to as social insurance taxes). These three taxes account for 93 percent of federal revenues. Federal payroll taxes rose rapidly from the 1960s to the 1980s with the expansion of Social Security and the introduction of Medicare, but as a share of GDP they have leveled off since then. While receipts from the payroll taxes were increasing, those from the corporate income tax were declining as a percentage of GDP, leaving total revenues roughly flat. The payroll taxes are earmarked to finance rising current and future health and retirement benefits; corporate income taxes are not earmarked. Therefore, the ostensibly equal exchange of corporate income tax for payroll tax receipts—the latter linked to higher health and retirement spending—arguably left the federal budget worse off for the long term.2

Complexity of the Tax Code

The individual income tax is imposed on wages and salaries, returns from savings, small business profits, and other sources of income under a graduated rate structure.3 In 2009, statutory or explicit tax rates ranged from 10 to 35 percent. A substantial share of low-income workers and families pay no income tax because, with exemptions and the usual deductions, their modest earnings are not subject to even the lowest rate. The corporate income tax imposes a rate of 35 percent on corporate profits, with small corporations paying lower rates.

Average tax rates—which are simply taxes paid divided by total income—are almost always lower than the statutory rates because they include the effects of deductions and exemptions. Yet another important type of tax rate is the “marginal” rate, which is the rate a taxpayer pays on an additional dollar of income. For example, for a person earning $60,000 who pays $6,000 in federal income tax, the average tax rate is 10 percent. But if this person is in the 25 percent federal tax bracket (and no other features of the tax code affect tax liability) then the rate on any additional income earned, the marginal rate, is 25 percent. Because marginal rates determine the after-tax returns from work, savings, and investment, they affect the willingness to undertake such activities.4

For the typical individual income taxpayer, with moderate amounts of wage income and modest deductions from an owner-occupied home, the income tax can be relatively simple. But for some taxpayers, particularly small business owners, the income tax is often quite complex. Federal tax rules spanned 70,320 pages in 2009—one measure of their complexity—three times more than in the 1970s (CCH Canadian Limited, 2009).

In part the income tax is so intricate because “income” is difficult to define and measure; partly for the same reason, the current income tax base does not reflect a consistent definition of income. Indeed, the current income

tax is probably better thought of as a hybrid of a broad-based income tax and a consumption-based tax. Some types of savings and investment (such as for education) are treated more generously than they would be under a pure income tax, while other types (such as interest on ordinary savings) are fully taxed, as they would be under a pure income tax. Some (such as savings and investment for retirement) are treated as they would be under a pure consumption tax, much more generously than under an income tax. And the rest are treated somewhere in between. These inconsistencies in taxation allow taxpayers to reduce their tax burden by shuffling assets from fully taxed to tax-favored accounts (such as for education or retirement), an activity that reduces taxes collected without significantly increasing total saving or investment.

The complexity of the tax code has steadily worsened over time in part because policy makers have increasingly used it to try to achieve social goals and to aid particular sectors of the economy through narrow reductions in tax liability. For example, the deduction for the interest on home mortgages and other housing-related deductions seek to increase home ownership, and deductions for tuition and other education-related deductions seek to make college more affordable. Such tax provisions intended to benefit specific groups of taxpayers are known as “tax expenditures.” The number of these tax expenditures (see Chapter 1) doubled from 67 in 1974 to 146 by 2004 (Government Accountability Office, 2005:4). A new study increases that count to 158, for 2008 (Minarik, 2010).

The number and range of tax expenditures lose large amounts of revenue. Tax expenditures for activities other than business account for roughly 6 percent of GDP (Burman et al., 2008a). For comparison, the individual income tax raises about 8 percent of GDP. These figures suggest that eliminating tax expenditures and broadening the tax base would allow tax rates to be cut nearly in half (Burman et al., 2008a:13). However, the elimination of tax expenditures for specific purposes might lead to demands for greater direct spending for those purposes.5

Most experts contend that if the tax code had fewer special provisions, especially those for tax expenditures and lower rates, it would be more conducive to growth and would consume less time and energy of taxpayers to comply with (or avoid).

ISSUES IN TAX REFORM

The current federal income tax is a long way from the simple and neutral system that almost all tax experts—and many taxpayers—favor. They support moving to a tax system that raises needed revenue simply, minimizes both paperwork and economic distortions, and provides a socially desired degree of progressivity. Yet policy makers have been reluctant

to do the sometimes politically risky and always unglamorous work of “cleaning up” the code by ridding it of outdated or ineffective provisions and inconsistent definitions. Experience suggests that the people who would lose financially from elimination of the targeted provisions oppose such reform and are more effectively mobilized in their opposition than the larger numbers of people who would benefit from what would be small tax reductions. Often, many taxpayers see their own tax benefits as fair treatment for special circumstances but believe other taxpayers should lose their targeted benefits.

Simplification

Achieving tax simplification would yield five main benefits for individuals, businesses, and the economy.

First, it would reduce the high administrative and compliance costs of the tax code. Americans spend about 7.6 billion hours annually filling out tax forms, keeping records, and learning tax rules (Internal Revenue Service, 2008:3). The Internal Revenue Service (Internal Revenue Service, 2008:4) estimates that the cost of complying with federal income taxes is roughly $200 billion annually.6

Second, tax simplification would improve the ability of individuals and businesses to make sound economic decisions: that is, to make decisions that work best for their own finances and for the performance of the economy, rather than to try to benefit from special provisions in the tax code. For example, the large and growing number of tax rules on pensions, savings vehicles, and investment earnings complicate, if not confuse, family financial planning.

Third, simplification would reduce the frequent and often costly errors made by both taxpayers and businesses.

Fourth, it is widely believed that simplification would address the problem that tax complexity leads to noncompliance because taxpayers are confused about what income is taxable and what tax “breaks” exist. Complexity—and its twin, ambiguity—also foster “aggressive” tax planning as both taxpayers and tax advisers try to take advantage of the code. Because complex tax rules are subject to multiple interpretations, they spur taxpayers and businesses to take risks in the hope that their tax-cutting strategies are either legal or are not uncovered by the Internal Revenue Service (IRS) (for a detailed discussion, see Edwards, 2003).

Fifth, complexity can dilute the incentives—thus, the effectiveness—of provisions that seek to advance particular societal goals. For example, it is difficult or impossible for people who invest in housing that qualifies for a tax credit to know for certain ahead of time the exact tax benefit it will yield because it depends partly on their future incomes and tax liabilities.7

Because it is difficult to estimate the tax consequences of the particular actions that such tax provisions are intended to reward, they act less as a spur to socially desirable behavior than one might expect while still resulting in loss of revenue.

There are many ideas for tax simplification. One that is frequently mentioned is to replace the income tax with a flat-rate or progressive consumption-based tax system. Revenue estimates have varied quite widely, but it appears that under revenue-neutral reform, switching to a flat consumption-based system might increase U.S. incomes over the long term by about 10 percent (Altig et al., 2001; Auerbach, 1996; Joint Committee on Taxation, 1997; Jorgenson and Yun, 2002; Kotlikoff, 1993). However, a consumption tax at a single flat rate would shift the tax burden among households significantly, which would create winners and losers among different groups of taxpayers.8

Economic Efficiency and Growth

Whatever the level of taxes in the future, GDP and incomes would be higher if the tax system were more efficient than it currently is. An efficient tax system is one that minimizes distortions that adversely affect working, saving, investing, spending, and other important economic decisions. A pure income tax would treat different forms of income in the same way, thus broadening the tax base. This would allow lower marginal tax rates without losing revenues, so that economic decisions would be less driven by their effect on taxes owed and be more likely to raise income throughout the economy.9

Neutral Treatment of Different Sources of Income

Variations in the way different categories or sources of income are taxed tend to distort wage, price, and profit signals in the economy, thereby diverting resources into lower productivity uses. This is particularly so for variations in taxing different sources of income of one type, such as business profits and capital income. For example, if one industry benefits from a special tax provision, higher after-tax returns in that industry will draw resources to it from other activities that have higher economic value. Except in the case of demonstrated market failure, only equal tax treatment of different economic activities will lead to the most efficient use of scarce resources; see Box 8-1. All of the special provisions in the current income tax code—including the favorable treatment of home ownership (even for vacation properties)—create economic costs or “deadweight losses.” These are the losses in “welfare” (economic well-being) that occur when tax rules distort economic behavior: individuals and businesses act in ways that take

|

BOX 8-1 Distortions in the Current Tax Code Provisions in the tax code that favor one source of income or another can distort private financial decisions. One example of such a distortion is that there generally is a single layer of income taxation for noncorporate business profits but two layers for corporate profits: returns to corporations’ investments are taxed at both the business level and at the individual level, in the form of dividend and capital gains taxes (see Gravelle, 2004). The tax code also creates numerous distortions for capital investment. For example, for businesses, the system of asset depreciation is distorted by the ad hoc rules that govern the time period over which investment costs are deducted and by price inflation, which lowers the depreciation deduction below replacement costs (Congressional Budget Office, 1997:39; Jorgenson and Yun, 2002:317). The tax code can distort decisions for personal savings as well. The income tax favors consumption over saving because consumption is not taxed but the returns to saving are, encouraging people to spend their earnings rather than save them. Because policy makers have long recognized the favored treatment of consumption over savings, they have enacted many special provisions for savings. The tax code has different rules for dividends, interest, tax-exempt bonds, capital gains, simplified employee pension plans, individual retirement accounts (IRAs), 401(k) retirement plans, Keogh Plans (which also allow individuals to tax-defer savings from earnings), and other retirement arrangements, life insurance, estates and inheritance, and annuities. Although in some cases these disparate rules may only subsidize the transfer of existing wealth into tax-favored accounts rather than spur new saving, they do reduce the anti-savings bias of the income tax. Yet they are so complex as to defeat most taxpayers’ (and some specialists’) understanding of them. |

advantage of the tax code rather than in ways that bring true benefits for the individual or business. That is, tax-induced distortions risk reducing the long-term benefits that arise when individuals use their incomes as they choose. They thus interfere with the wise choices of both individuals and businesses for income, consumption, savings, investment, and production.

Marginal Tax Rates

Marginal tax rates are the rates that individuals and businesses pay on an additional dollar of income, or save for any item (such as an itemized deduction) for which there is a tax preference. The economic distortions in the tax code are magnified when marginal tax rates are high or differ among otherwise similar economic options. The economic waste (“deadweight

loss”) to economic performance from the current tax code is directly related to marginal tax rates. As marginal rates rise, these efficiency losses rise more than proportionally, roughly as the square of marginal tax rates. Because of this distortion, tax reform efforts in the past, such as the bipartisan Tax Reform Act of 1986, focused on reducing marginal tax rates.

If marginal tax rates are cut, the tax base will expand as people reduce their tax avoidance and increase their productive activities (Feldstein, 1995). One series of studies has estimated that a permanent 5 percentage point reduction in marginal tax rates accounts for a 10 percent increase in capital expenditures.10

Given the adverse effects of high marginal tax rates from a growth or efficiency perspective, policy makers should want the lowest possible tax rates that raise the amount of government revenue desired. This consideration becomes particularly important for this study because the adverse effects of high rates would be magnified at the higher levels of revenue needed to achieve long-term fiscal sustainability under three of the committee’s four scenarios.11

International Context

Globalization is transforming separate but intensely competing national economies into a single world economy through rising cross-border trade and investment, migration of workers, and transfers of technology, with important implications for the tax system.

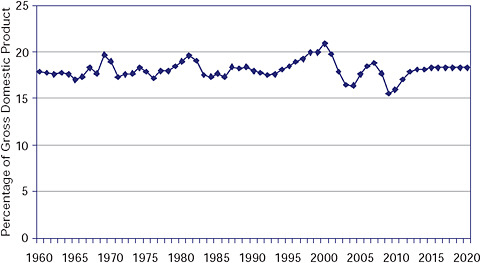

Most people are aware of globalization because of growing international trade. But the growth in trade has been dwarfed recently by the growth in international investment. Although the value of global trade has tripled since 1990, the value of global investment flows has increased 10-fold (as measured in nominal dollars between 1990 and 2006).12 These investment flows have put pressure on governments to restrain tax levels and reform tax systems with an eye to international competitiveness. The United States has a lower overall tax burden than many other advanced industrial countries. The total of federal, state, and local taxation in the United States equaled 28 percent of the economy in 2006, in comparison with an average for the countries in the Organisation of Economic Co-operation and Development (OECD) of 36 percent; see Figure 8-2. Although Japan and Korea have levels of taxation similar to the United States, most nations in Western Europe have higher tax burdens.

As OECD government budgets generally increased in size during the 1970s and 1980s, largely to finance increased services and social benefits, income and payroll taxes were the major sources of additional revenues. But in recent decades, many countries have greatly expanded their taxes on general consumption, such as VATs. In Europe, the average VAT rate rose

FIGURE 8-2 Tax revenues as a share of GDP.

over time to its current level of about 20 percent (European Commission, 2009).

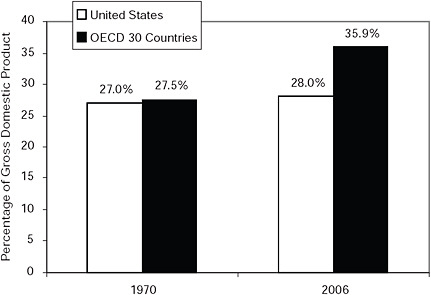

Perhaps the most striking changes in tax policies in the OECD countries have been the dramatic reductions in income tax rates since the 1980s. Following the lead of Britain and then the United States, all major industrial nations cut their statutory individual and corporate tax rates (Organisation for Economic Co-operation and Development, 2008a).13

For corporate taxes, the situation between the United States and the OECD countries is quite different. The United States now has the second highest marginal (roughly, “statutory”) corporate tax rate in the world (only Japan has higher rates); see Figure 8-3. The World Bank ranks the United States as 76th best in the world in terms of the burden of business taxes and business tax compliance costs (World Bank and PricewaterhouseCoopers, 2007:47).14

Some fiscal experts argue that international tax competition is productive because it encourages governments to reform their tax systems and reduce low-priority spending (see, e.g., Edwards and Mitchell, 2008).15 However, not all tax competition is so high-minded. Some very small countries with minimal public-sector needs have explicitly striven to attract corporate “headquarters”—which can be nothing more than mailboxes—by establishing very low corporate tax rates. In effect, the corporations and the country split the tax savings between them.

FIGURE 8-3 Top corporate tax rates in the United States and 30 OECD countries.

Whatever the underlying motivation, there is concern that unless U.S. taxation is competitive with the nation’s trading partners, businesses will shift their investment and reported profits abroad. In particular, multinational corporations, which account for a majority of U.S. merchandise exports, can shift investments to minimize tax payments and distortions (Mataloni, 2007:44; data for 2005). If U.S., foreign, and multinational corporations reduce their activity in the United States because of relatively high corporate taxes (not building new factories here, for example), one of the likely effects would be lower wages for average American workers, implicitly compensating for the higher taxes paid here.16 At the same time, tax competition to attract capital reduces tax rates on corporate income, capital gains, dividends, and high incomes in general, and thereby perhaps unintentionally constrains tax systems to be less progressive. The conflicting concerns of legitimate international tax competition and a race to the bottom on taxes on capital raise complex issues that will be important for all tax policy decisions in the coming decades.

Fairness

Every citizen and taxpayer supports tax fairness although it is quite possible that no two people agree on precisely what that is. And the literature on the subject is huge.17 Taken in the abstract, interpretations can be quite philosophical, with questions ranging from the proper ratio of the tax burden of the richest citizen to the poorest, to whether it is more morally proper to tax income or consumption.

In a practical context, the distinctions that have to be made are between making “fair” choices to collect the same amount of revenue as is collected now and making “fair” choices to distribute additional taxes (e.g., to close the budget gap described in this report). In raising an unchanged level of revenue, some people want a tax system that is more progressive, that is, that places greater burdens on those at higher incomes. Other people want less progressivity. One argument for changing the tax system but not changing its current level of progressivity is that this approach would minimize the number of “winners” and “losers” from the tax change. Also, taxpayers have made long-term commitments—borrowing money to buy homes or invest in their own businesses, for example—and increasing their taxes in the short run is unfair or, at least, painful.

When the goal is to increase the overall amount of revenue, however, fairness issues are more contentious. Furthermore, there is no clear and simple benchmark—such as maintaining the current distribution of burdens—that can be used as a starting point for public debate.

In this chapter generally, the committee models either the current tax law or a simplified alternative with tax rates chosen to replicate the level and distribution of revenues of the current law and then increases revenues by simply increasing all tax rates proportionately. Such an approach holds no particular claim to superiority and in an actual legislative process surely would be challenged from all sides. However, we find it a straightforward starting place for the kind of discussion that this report seeks to begin and support.

There are practical choices that may conflict with some conceptions of fairness. One issue, noted above, is the international competition for investment on the basis of after-tax income from investments. If international competition—whether arguably efficient or a shortsighted “race to the bottom”—forces lower taxes on incomes from capital, that would tend strongly toward the perhaps-unintended consequence of reducing the progressivity of the tax system.

Another issue is the current negative income tax burden on comparatively low-wage workers. (That is, because of “refundable” credits—discussed below—many low earners receive checks rather than paying taxes through withholding or otherwise.) In the 1960s and early 1970s, some argued for increasing the personal exemption and standard deductions to cut the tax burden for families with poverty level incomes, and, at the same time, to reduce the administrative and compliance burden on those families and the IRS by eliminating the obligation to file a return. In the mid-1970s, however, this approach was expanded with the introduction of “negative income taxes,” in the form of the Earned Income Tax Credit (EITC). The EITC eliminated the burden of the Social Security payroll tax for poor families, and provided a kind of wage supplement that did not

add to employers’ costs and so would not fuel inflation. However, it totally reversed the simplification advantage of removing low earners from the rolls; it actually made their tax returns much more complex than those for the average middle-class taxpayers. The administrative complexity grew as necessary safeguards were added against fraud. (And, there were concerns about possible under-withholding of tax for families whose wage incomes increase modestly during a year.) These issues have been compounded over the years as other tax credits have been made refundable.

If budget deficits prove to be as large as feared and significant revenue increases are enacted, it may be hard to raise enough revenue without some tax increases on the current large share of the household population that now does not pay income taxes—about 45 million—either because they receive a refund or owe no taxes, but instead actually receives negative income taxes.18 This would be a significant reversal of the recent policy trend of increasing the progressivity of the tax code.

Many other issues involving the economic efficiency, complexity, and ease of administration of the tax system may make it difficult to pursue any conception of fairness in taxation. The many objectives of tax policy, including fairness and revenue sufficiency, are necessarily to some degree in conflict, and the difficulty of resolving such conflicts is one of many reasons that tax reform is both technically complex and politically challenging.

ILLUSTRATIVE TAX OPTIONS

Three of the committee’s four scenarios for sustainability would require raising considerable additional revenue. In two of the scenarios the levels would approach or exceed the share of GDP in some other wealthy nations (see Chapter 1 for current international comparisons). If income and payroll tax rates were simply raised while retaining the current tax structure, the adverse effect on growth would likely be more severe than if a simplified tax structure were adopted; see, e.g., Congressional Budget Office (1997), Feldstein (2006), and Hubbard (1998). Table 8-1 provides an overview of the committee’s illustrative tax options, in line with the illustrative scenarios for a sustainable fiscal future outlined in Chapter 4 and detailed in Chapter 9. Possible increases in payroll taxation for Social Security and for the hospital insurance portion of Medicare, discussed in previous chapters, are also shown. The discussion below considers possible changes to federal income taxes under the current federal structure of personal and corporate income taxation or a simplified income tax structure and with the possible addition of a VAT. The two alternative tax structures are applied to reach each of the four future revenue levels and paths required by these scenarios.

TABLE 8-1 Federal Tax Structure and Revenue Levels Under the Committee’s Four Paths

|

Path |

Current Tax Structure |

Simplified Tax Structure |

|

Low Spending and Revenue: Revenues remain at 18-20% of GDP through 2050, to about 22% by 2080. |

Income taxes remain at roughly 10% of GDP. |

Income taxes remain at roughly 10% of GDP; personal income tax reformed with a broader base, lower rates, and two brackets; corporate rate cut to 25%. |

|

Payroll taxes: Medicare remains at 2.9% for both employers and employees with no limit; Social Security tax remains at 12.4% for employers and employees, up to an indexed earnings cap. |

||

|

Payroll taxes same as at left. |

||

|

Intermediate-1: Revenues rise to about 23% of GDP by 2050; edge up to about 24% by 2080. |

Current income tax cuts expire and all tax rates rise above current law. For example, for 2050, the top personal rate of 35% rises to 37.2%, and the capital gains rate of 15% rises to 15.9%. |

Similar individual income tax rates as above, but tax-bracket thresholds and standard deduction adjusted to increase revenue. For example, by 2080 the two rates are 7.4% and 18.4%, and the capital gains rate is 11%. |

|

Medicare payroll tax is doubled. Social Security payroll tax raised in steps to 13.3% in 2060; same cap. |

||

|

Payroll taxes same as at left. |

||

|

Intermediate-2: Revenues rise to about 25% of GDP by 2050 and to about 26% by 2080. |

Current tax cuts expire and income tax rates rise (more than above). For example, for 2050, the top personal rate rises to 40.9% and to 42.5% by 2080; the capital gains rate rises to 17.5% percent and to 18.2% by 2080. |

Somewhat higher individual income tax rates than immediately above; tax brackets and the standard deduction are also adjusted. For example, by 2080 the two rates are 8.7% and 21.8%, and the capital gains rate is 13.1%. |

|

Medicare tax doubled. Current Social Security tax raised in steps to 14.5% in 2075; same cap. Second-tier Social Security payroll tax added for any earnings above cap in current law; rises to 3% in 2060. |

||

|

Payroll taxes same as at left. |

||

|

High Spending and Revenue: Revenues rise to about 28% percent of GDP by 2050 and after that date to about 32%. |

Current tax cuts expire and income tax rates rise higher than above. For example, for 2050, the top personal rate is 50% and the capital gains rate is 21.4%. |

Higher individual tax rates than above; tax brackets and deductions adjusted. For example, by 2080 the two rates are 11.5% and 28.7%, and the capital gains rate is 17.2%. |

|

VAT added around 2020; rate rises to 14.6% by 2080. |

||

|

Medicare tax doubled. Current Social Security tax raised in steps to 14.7% in 2080; cap raised. Second-tier Social Security tax added for any earnings above raised cap and rises to 5.5% in 2075. |

No VAT. |

|

|

Payroll taxes same as at left. |

Current Tax Structure

One way to raise more revenue is simply to increase the statutory tax rates under the current tax structure, which now range from 10 to 35 percent. In the “high spending and revenues” scenario that approach pushes income tax rates so high that the committee has concluded that current levels of tax avoidance and negative economic effects would reach unacceptable levels. “Unacceptable” is defined differently by different experts, but the committee concluded that to avoid damaging effects on growth, the top income tax rate should not exceed 50 percent for people with the highest incomes.19 With the revenue required for the “high” scenario, that level would be reached by about 2020 under the current tax structure. At that time, we assume that policy makers would add to the current income tax a VAT similar to that in Europe. Thereafter, because we assume that personal and corporate income taxes cannot rise further, we assume for purposes of illustration that the VAT’s rate would rise to supply whatever additional revenues are needed.20

The economic burden imposed by a VAT could be minimized if it were imposed on a very broad base of all consumption. Nevertheless, in most countries, the VAT has a narrower base that excludes significant categories of consumption (such as food), for both technical and political reasons. In the 15 core countries of the European Union (EU), the average VAT tax base is about 40 percent of GDP.21 We assume that a VAT in the United States would have the same breadth as this European average.

Overall, the tax levels and structures in the United States and the EU countries are noticeably different. In 2006, the tax-to-GDP ratio in the United States was 28 percent, compared with 39.8 percent in the 15 core nations of the EU (Organisation for Economic Co-operation and Development, 2008b:96). Taxes on “general consumption” were 7.9 percent in the United States and 19.2 percent in the 15 EU countries. Thus, in a rough sense, Europe’s higher social spending and larger governments are funded by higher general consumption taxes, the VAT.

One way to view the typical European approach is as using relatively regressive VATs, with burdens falling disproportionately on lower-income people, to pay for more redistributive social spending than in the United States, such as larger child allowances and higher unemployment benefits. Following this reasoning, if the United States adopted a VAT, it might be seen as taking only half of the European social bargain.

For simplicity, we do not assume an explicit period of transition to a VAT—that is, a slow phase-in of increasing tax rates—but rather propose a VAT rate to provide the revenue needed at any given time. The committee recognizes that adding a VAT would impose disparate combined tax burdens on different age groups. For instance, middle-aged and elderly people

who have saved without the benefit of current tax subsidies, having already paid income tax on earnings when earned, would pay a VAT on those same earnings when they are spent as consumption, perhaps in retirement.22 Although the result could be unexpected double taxation of a portion of the earnings of that group, some analysts believe this would be appropriate because these groups benefit from Medicare and Social Security. (And some analysts believe that this or similar problems would inevitably accompany any major change in the tax system and can be mitigated or avoided with fine adjustments in the exemptions, rates, and other parameters of the tax law.)

Under the low scenario we rely on both the current tax structure and all the details of current tax law. The greater demands of the three other scenarios are met by proportionately increasing tax rates for: (1) the six regular tax brackets; (2) capital gains and qualified dividends; and (3) the two brackets of the alternative minimum tax (AMT).23 In other words, for the three scenarios that include spending above the revenue baseline, the current tax structure is retained, but not its detailed tax rates. Proportionately increasing tax rates is one rule-of-thumb method for an even-handed distribution of any additional tax burden, but it is by no means the only possible approach, and, like any other, it would be controversial.

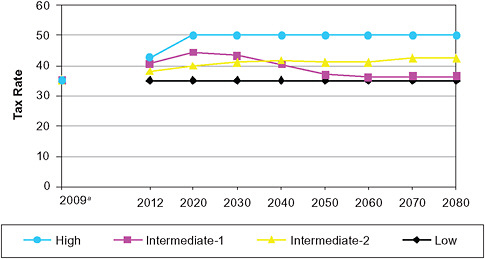

Figure 8-4 displays the top statutory rates over time for the current tax structure under the committee’s four scenarios. (Table E-1 in Appendix E

FIGURE 8-4 Current tax structure: top personal income tax rates for the committee’s four scenarios.

aUnder current law.

shows all the personal income tax rates, as well as the VAT rate.) Specifically:

-

Under the low scenario, because all personal income tax rates stay at the 2009 level, the top rate remains 35 percent.

-

The intermediate-1 scenario requires more revenue initially than the intermediate-2 scenario because it is oriented to the more immediate spending of human capital investment programs, rather than to Medicare or Social Security.

-

Because the intermediate-2 scenario is oriented more to the programs that serve the elderly, especially Medicare, its spending initially rises more slowly than spending under intermediate-1, but it rises faster than in intermediate-1 after about 2030. After about 2040, all personal income tax rates under the intermediate-2 are higher than under intermediate-1.

-

Under the high scenario, the top personal income tax rate rises to 50 percent by 2020, which the committee assumes is a practical maximum. (The other rates also rise proportionately.) In 2020 and thereafter, a VAT is added to the tax structure. With the increasing revenue needs over time in this scenario, the single rate of the VAT rises from 0.9 in 2020 to 14.6 percent in 2080.24

Simplified Tax Structure

Rather than continuing to base tax law on the current structure of the income tax, policy makers could act to reform and simplify it (see Table 8-1, above). This section considers the effects of a simplified tax structure under each of the committee’s four illustrative scenarios. The current tax structure discussed in the preceding section and the broader-based or simplified tax structure discussed here represent two “bookends,” with many possibilities in between.25

Assumptions

The committee’s illustrative version of a simplified tax would replace the current six tax brackets for individuals with two. With few deductions or credits, individual income tax rates could be lowered and still yield the same revenue because the tax base would be broader. The only deductions or credits would be the current EITC and child tax credit, both for low-income, working filers, and both refundable for those with no net income tax liability. As currently, those “taxpayers” would receive a check for the net amount of the credit. To help meet international tax competition, the corporate tax rate would be reduced from the current generally applicable 35 percent rate to 25 percent.

The two-bracket simple income tax loosely echoes the Tax Reform Act of 1986, which broadened the income tax base and reduced statutory rates. The committee’s simplified tax is a somewhat more “pure” tax reform than the 1986 act because it eliminates many more deductions, exemptions, and credits. Such a plan was recently analyzed by the Tax Policy Center of the Urban Institute and the Brookings Institution (Burman et al., 2008b).26

The committee’s simplified tax plan would be revenue neutral and approximately distributionally neutral in 2012. In other words, it would raise the same amount of money as under the current tax system, and it would generally retain the same relative burdens on various broad income groups as would occur under current tax law projected to 2012. Some analysts prefer more precisely mirroring the current-law distribution of the tax burden: for the same total revenue yield, this approach would require more tax brackets. In the committee’s scenarios that require additional revenue, the distribution of that additional revenue burden will inevitably be controversial.

For the low scenario, the committee’s illustrative simplified tax structure in 2012 would have these basic features:

-

individual tax brackets of 10 and 25 percent (“lower” and “upper” or “first” and “second” brackets, respectively);

-

application of the upper tax bracket to incomes above $73,100; and

-

a standard deduction that is almost doubled from the current level, to $17,000 for joint filers or $8,500 for others.

For all scenarios, the simplified tax structure would have these features:27

-

no itemized deductions;

-

retention of the current 15 percent rates on capital gains and qualified dividends;

-

elimination of almost all deductions and credits, except pro-savings tax features such as IRAs, 401(k) retirement plans, and Health Savings Accounts;

-

elimination of the mortgage interest deduction for own-occupied homes (see below); and

-

retention of a simplified EITC and child tax credit for low-income workers and their families.28

One tax expenditure that would be dropped is the deduction for mortgage interest on owner-occupied homes, for those who itemize deductions. Although it would be appropriate to have a mortgage interest deduction in a system in which the economic benefit of living in an owner-occupied

home, that is to say, implicit rent, is taxed, it is not appropriate in our system.

The mortgage interest tax expenditure roughly equals in cost those for pensions. Unlike those for pensions, which are generally considered pro-savings, however, the home mortgage interest deduction is generally considered pro-consumption. Critics also note that it is generally regressive because people at higher incomes tend to itemize deductions, have more mortgage interest to deduct, and are in higher tax brackets, which increases the benefit of each dollar in interest that is deducted. These critics also note that mortgage interest deductibility tends to lead to overinvestment in houses and diverts savings away from business investment that would help promote an internationally competitive economy.

As an element of a possible broader reform of health care and for fairness, for all scenarios, the simplified tax structure establishes a dollar cap on the level of insurance that employers provide as health benefits that is not subject to the income tax. As noted in previous chapters, the cost of this insurance is currently not taxable to either employers or employees, and it is not subject to either income or payroll taxation. As an open-ended subsidy, it provides an incentive for employees (especially, well-paid employees) to receive compensation in the form of “gold-plated” insurance coverage, which tends to drive up health costs. Because the value of this provision to the taxpayer increases with taxable income, it is highly regressive. It is currently the most costly tax expenditure in the system.

Capping the level of employer-paid health insurance that is excludable from personal income taxation would raise revenue and help limit this source of medical inflation. Under the committee’s simplified tax structure, the cap would be the average cost of such plans for 2009: an estimated $5,370 for single coverage and $13,226 for family coverage. The cap would rise with general price inflation, which has generally risen much less rapidly than inflation in medical prices or medical spending.29 If medical inflation continued at a high rate, the cap would raise increasing amounts of revenue over time.

The committee’s simplified tax would make no changes to the business tax base except repeal of the special manufacturing deduction added in 2004.

A major tax reform of this sort could bring difficulties and uncertainties, especially during the transition to it. However, if major tax reform is done thoughtfully, potential problems can be minimized. More importantly, potential problems would have to be weighed against the demonstrated inadequacies of the current tax system, which derive both from its structure and its high rates.

The committee offers this simplified tax structure—a major tax reform—in keeping with a basic premise of this study: that the serious and funda-

mental long-term fiscal problem facing the United States demands fundamental (and bold) long-term solutions. More specifically, if revenue levels must rise, then the current tax code’s distortions and inefficiencies will be magnified by higher rates, so that consideration of tax simplification becomes both more urgent and more necessary.

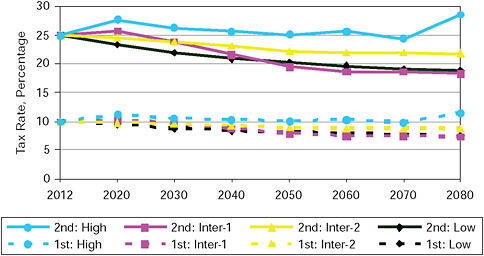

Implementation

Under the simplified tax structure, statutory rates for the personal income tax would be markedly lower, for a given revenue level, than under the current tax approach; see Figure 8-5 (see also Tables E-1 and E-2 in Appendix E). Moreover, with simplified taxation, the rates of its upper and lower brackets (i.e., the second and first brackets, respectively) generally decrease over time except under the high scenario after many years. By contrast, under the current tax structure, the top and other rates increase over time for the intermediate-2 and high scenarios.30 For the high scenario under the current tax structure, rates rise to their deemed maximum in 2020, at which time a VAT is imposed and its rate rises thereafter as needed to generate required additional revenue.

Under the simplified tax structure, personal income tax rates generally decrease over time because of the broader tax base of simplified taxation and the elimination or reduction of costly tax expenditures, including interest paid on home mortgages and, especially, employer-sponsored health insurance. With growth in real income, these tax expenditures would

FIGURE 8-5 Personal income tax rates for the first and second brackets under a simplified tax structure for the committee’s four scenarios.

otherwise be increasingly costly. The general decline in rates for personal income taxes adds to the strength of this approach in minimizing both the distortion of economic decisions and the tax system’s negative effects on work and saving incentives.

Effects of the Options on Distribution of the Tax Burden

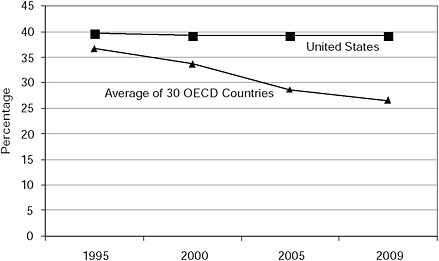

Figure 8-6 and Table 8-2 show the degree to which the combined federal tax burden is shouldered by each of five income quintiles (i.e., fifths), under the current and simplified tax structures. (The combined federal tax burden comprises the major federal taxes [see Appendix E], including the payroll taxation and VAT summarized in Table 8-1.)31 To get a clearer picture of how people with the highest incomes would fare under an alternative tax structure, data for the top quintile are supplemented by data for the top 10 percent and 5 percent of the income distribution. Also, reflecting current tax rates—not just the current structure—current law is used as a benchmark (see Appendix E for more detailed information). As described above, the combined tax burden on each group includes income taxes and payroll taxes for all scenarios and, in the high scenario under the current tax structure, the addition of a VAT.

Two indicators are used to gauge the relative burden of taxation on different income groups because they convey different insights. One indicator is the percentage shares of combined federal taxes, which are shown in Figure 8-6 for 2050 for each income group. This is a relative measure of tax burden. As a tax system becomes more progressive, higher quintiles shoulder an increasingly greater share of the total tax bill. The second indicator is the percentage change (increase or decrease) in net, after-tax income, compared with the tax baseline, for 2012, 2050, and 2080, for each group, which is shown in Table 8-2. This is a measure of how deeply the taxes will “bite.” Change in after-tax income gives another view of how a new tax policy affects each income group, one that makes particular sense when, as here, the revenue requirement is being varied.

In looking at Figure 8-6 and Table 8-2, it is important to remember that much changes over the long time span of the projections. Although the committee’s revenue illustrations are designed for approximately unchanged tax distributions at the start (2012), the relative burdens can diverge over time, for at least three reasons. First, the economy is growing. Growth in real incomes puts taxpayers into higher personal income tax brackets—particularly with the six brackets in the current tax structure—and also affects the amount of payroll tax paid.32 With only two brackets for regular income and no AMT, this “real bracket creep” generally raises proceeds of the simplified income tax far less than under the current structure.

TABLE 8-2 Percentage Change in After-Tax Income Under the Committee’s Four Scenarios in Comparison with Current Law for Selected Income Groups, in percent

Second, the needed revenue paths of the four scenarios also affect the distribution of taxation. The level and path of payroll taxation vary with the scenario, as do other details that also affect the distribution of payroll tax payments.33 And the VAT added in the high scenario under the current tax structure also has distributional effects—it is less progressive than either form of personal income taxation. In practice, there is no doubt that tax rates and other parameters of the tax system that affect tax distributions would be adjusted multiple times over the decades covered in these simulations and projections.

The third source of change in the tax distribution over time has to do with how the various personal income tax rates are adjusted in the implementations of the two tax structures. For simplicity, we have assumed that the various rates within each personal income tax bracket are adjusted proportionately to each other. Notably, capital gains rates and those on ordinary income are not only raised and lowered together, but are raised or lowered by the same proportion. All of these assumed changes potentially

contribute to changes in the distribution of tax burdens. (Appendix E provides additional data for all the years projected.)34

The committee’s modeling—like most such analysis—specifies that higher tax rates would modestly reduce taxable incomes. However, it does not model the likely reductions to GDP if tax rates rise. Again, this follows the practice in most such analyses.

Although the distributions of our scenarios’ initial tax burdens—that is, in 2012—are modeled to be approximately the same as current law would be in that year, the distribution of tax burdens can change over time if additional revenue is raised. Given the complexity of the tax system changes we analyze, it is perhaps surprising that even for many years in the future, the overall distribution of tax burdens changes only modestly across the scenarios and across tax regimes.

Looking first at the percentage share of the combined federal tax burden (Figure 8-6), for the current tax structure in 2050, in all scenarios the relative burdens stay about the same as under current law. This is in large part because the current tax structure is modeled closely on current law. The first (i.e., bottom) quintile shoulders about the same burden as current law (1.2 percent of total taxes paid), at all revenue levels. The same is true for that middle (or third) quintile, for which shares of the combined burden vary between 10.4 and 10.8 percent. The top quintile generally continues to pay 64 to 65 percent of the total burden. However, especially under the intermediate-1 scenario, those in the top 5 percent pay somewhat less: 38.1 percent, compared with 39.3 percent under current law.

With only two tax rate brackets to fine-tune the distribution in the simplified tax structure, combined federal taxation tends to move somewhat away from the current degree of tax progressivity and—partly since the implementation of simplified taxation changes only restrictedly—that divergence tends to increase over time. Table 8-2 shows that in 2050 for each scenario, the simplified tax “bites” the first and third quintiles somewhat more, and the fifth somewhat less. That is, under the current tax structure, the first and third quintiles have a bigger drop in after-tax income than under the simplified tax structure, while the reverse is true for the fifth quintile. (The same relationships appear in Figure 8-6.) These distributional effects of the tax structures tend to increase in time, as shown by the columns for 2080.35

Some details and implications of how the simplified income tax structure is modeled here may help explain the distributional differences shown. Under the current tax structure, many single-earner families in the lower quintiles get a tax break by the “head of household” filing status, which is not included in the simplified tax structure. In the simplified tax approach, real income growth makes more and more filers at the low end of the distribution subject to income taxation. The simplified tax structure also elimi-

nates itemized deductions, which currently benefit some middle-level tax filers who would, under simplified taxation, claim the standard deduction. Although the amount of the standard deduction in the simplified structure rises through time with the price level, incomes tend to increase faster, so its projected tax benefit diminishes over time, which is another cause of the distributional difference between the current and simplified tax structures.

Among high-income taxpayers, the effects of the tax treatment of income from capital gains remain significant.36 The distribution of this income source is extremely skewed: in recent years the top 0.1 percent of taxpayers has received roughly half of all capital gains. Table 8-2 shows that under both the current and simplified tax structures—but especially for the latter—the top 5 percent generally fares much better than the top 20 percent. For the implementation of both tax structures, the capital gains rate is adjusted proportionately to the rates on ordinary income, but the resulting reduction in progressivity is greater with the simplified tax structure.37

Although the simplified tax structure moves the federal tax system somewhat away from its current progressivity, it would remain highly progressive. In 2050, for instance, the first quintile would pay 1.2-1.3 and 1.5-1.7 percent of combined taxes under the current and simplified structures, respectively, for the different scenarios; for the middle quintile, taxes would be 10.4-10.8 and 11.2-12.2 percent, respectively; and for the top 5 percent the share of all taxes would vary between 38.1 and 39.4 percent for the current tax structure and between 33.7 and 36.5 percent under the simplified tax structure.38 If these distributional results were judged to differ more than is desired from the current progressivity of the tax burden, the tax liabilities could be adjusted by using somewhat more elaborate procedures than the committee used to fine-tune the tax parameters, such as the exemptions, standard deductions, numbers of tax rate brackets and their tax rates.

The committee chose a simple tax structure that started by approximately replicating the current distribution of the tax burden. This choice does not reflect the committee’s position on any particular distribution of the burden. Rather, our goal was to show ways to raise the revenues required by the spending scenarios. If policy makers and others prefer a somewhat more or less progressive system, it can be achieved with relatively minor changes in the parameters of the committee’s version of a simplified system.

Whatever the tax structure or the population group, all the committee’s scenarios except the low one reduce the after-tax incomes of taxpayers. To one degree or another, all taxpayer groups would shoulder the increased tax burden in the three scenarios that include substantial increases in federal spending.

CONCLUSIONS

This chapter’s illustrative options demonstrate some of the broad choices for modifying the federal tax system in order to collect the revenues needed in the committee’s four paths to fiscal sustainability. For the scenarios requiring higher revenues, increases in payroll taxation can be combined with increases in personal and corporate income taxation, which is feasible both to raise the needed revenue and approximately retain the current tax burdens. Our illustrations show that there is enough flexibility in the current personal income tax structure so that a VAT (a new, major tax) would need to be added only in the high spending and revenue scenario under this current tax structure. Tax policy that simplifies the current corporate and personal income taxes can achieve the highest required revenues without adding a VAT.

The illustrations show that well into the future, a simplified income tax structure (combined with higher payroll taxes) yields extra revenue by eliminating or modifying current tax expenditures. Enough extra revenue comes from such base broadening that a new tax like a VAT need not be added, even at the highest illustrated revenue level. In fact, by and large, under a simplified income tax structure, the marginal rates of personal income taxation would start low and decline over time and still provide the necessary revenue. In contrast, if the current tax structure (including tax expenditures) is retained, these rates would start higher and generally increase over time to meet the revenue requirements.

The debate over whether and how to raise revenues to pay for a given level of future spending offers an opportunity to consider alternatives to the current tax system that could be more efficient, simpler, and more conducive to economic growth. In any tax regime, high marginal tax rates tend to distort economic decisions, tend to lower growth, and—especially for personal and corporate income taxation—tend to reduce incentives for work and investment. But unavoidably difficult tradeoffs in values are implicit in the choice between the current tax structure and a simplified tax structure for personal income taxation.

After a transition, the committee’s illustrative policies, which use straightforward approaches to setting the rates, exemptions, and other parameters of the tax law, show somewhat less progressivity in combined federal tax burdens under the simplified tax structure than the current tax structure for each of the illustrative paths of revenue needs. And this difference in the distribution of tax burdens tends to increase over time, despite the similar starting points used.39

The simplified tax structure’s reduction in progressivity might be mitigated or avoided by adjustments or additions to its details—such as raising the capital gains tax rate relative to that on ordinary income, adjusting the

indexation of the standard deduction, and other changes that would have beneficial tax effects on low- and moderate-income single-earner families. Rather small changes to combined marginal tax rates—single percentage points—could change the conclusions of this distributional analysis. The simple illustrations here stop short of such fine tuning, which would surely be a part of an actual legislative process.

The current tax structure—characterized by complexity and many narrow tax expenditures—and current tax rates have resulted from past policy debates and reflect the current balance of political interests. Higher revenue levels, accompanied perhaps by bold changes to establish a simplified tax structure for the personal income tax or introduce a VAT, would require different tradeoffs and a new consensus. The options presented here suggest, in broad outlines, the kinds of changes in tax structure that may be required if a decision is made to achieve fiscal sustainability by raising revenue levels to match higher future spending, taking into account the effects of such changes on efficiency, growth, and the distribution of tax burdens

NOTES

|

|

20. For simplicity and because its revenue yield is dwarfed by that of the personal income tax, we have not explored increasing the proceeds from the corporate income tax by broadening its base—without raising the statutory rate. Although we have mentioned the corporate tax’s statutory and marginal tax rates, its average rate—influenced by exclusions from taxable income—is important too, especially in comparison with other countries. Just as the simplified tax’s broadening of the personal income-tax base can increase proceeds while lowering statutory and average rates, so can broadening the base of the corporate income tax. |

|

|

21. In 2006 the typical VAT rate for the 15 countries was 19.8 percent. For details of VAT rates, see European Commission (2009); for VAT revenues, see Organisation for Economic Co-operation and Development (2008c). |

|

|

22. However, Social Security benefits are indexed to price inflation, so these benefits would be protected from this aspect of the transition to a VAT. Similarly, the actual services paid for by Medicare and Medicaid would not diminish after a VAT, although out-of-pocket medical spending would rise. (A dollar spending cap for Medicare, Medicaid, or both [see Chapter 5] would need to take the price effect from a VAT into account.) |

|

|

23. The AMT is indexed to price inflation but, in time, real growth in incomes makes more taxpayers subject to it. The price-indexed thresholds of the tax brackets are retained in our approach, as are the current tax expenditures. |

|

|

24. In fact, it is not worthwhile to set up a VAT structure to collect at the low rate of 0.9 percent. For simplicity, these data reflect the financial pressures on the tax system structure, not short-term administrative responses. At least in the later years of the scenarios, it appears that no practical VAT with the base we have specified could replace the personal income tax: it would be in addition to it. A national sales tax might be possible, but we have not estimated this possibility in our scenarios. |

|

|

25. The simplified tax would retain the current tax’s “worldwide” treatment of cross-border income flows by continuing to tax American companies on foreign profits. |

|

|

26. The Tax Policy Center modeled both the illustrative current tax and simplified tax policies for the committee. For more information on the center’s microsimulation model and how it is applied to model the federal tax system, see, especially, Rohaly et al. (2005) and Burman et al. (2008c). Because of the need to revise and extend the model to project two very different tax approaches almost 75 years into the future, this aspect of the committee’s study used certain aspects of slightly earlier data, assumptions, and scenarios than presented in Chapter 9. (The only exceptions are that Figure 8-1 and part of Table 8-1 use the baseline data in Chapter 9.) Three differences are noteworthy. First, although both chapters rely heavily on Congressional Budget Office (CBO) projections, the revenue projections here use certain long-term assumptions, such as inflation rates, that CBO made before it made those that we use in Chapter 9. (For example, for the years after 2018, this chapter’s long-term inflation rate assumptions were those made August 2008, while those in Chapter 9 use CBO’s subsequent June 2009 assumptions.) However, the somewhat different projections used have little or no effect on the comparison here of the study’s illustrative revenue policies because these are modeled as changes from the study baseline, not as absolute levels. Second, (except for Figure 8-1) this chapter’s revenue baseline differs somewhat from the comprehensive baseline applied to Chapter 9 and described in Appendix B. However, both baselines do assume that most of the 2001 and 2003 tax cuts are permanent and extend the 2009 treatment of the AMT and the estate tax, and both baselines project future revenue collections at 18 to 22 percent of GDP during the 75-year projection period. |

|

|

The third difference of note relates to the assumed timing. Both chapters assume revenue changes start in 2012, and Chapter 9 assumes spending changes start then, too. However, the revenue needs that drive this chapter’s data were based on preliminary modeling that delayed spending reforms. Especially for the earlier years, delaying the spending reforms tended to result in higher debt service generally and, in some instances, higher noninterest spending before spending reductions took place. Consequently, this chapter’s resulting tax policies generate slightly higher revenues than needed for the scenarios of Chapter 9. This “error” is on the side of prudence. But this small difference has little or no effect on this chapter’s comparison of the eight illustrative revenue policies—since they are all affected the same way by the projected revenue needs. |

|

|

27. For each instance of a simplified tax structure, the second (or “upper”) tax bracket applies to incomes exceeding those for the first (“lower”) bracket Our illustrations vary both the personal tax rates and the thresholds for these brackets (see Appendix E). |

|

|

28. The simplified tax structure is designed to start with approximately the same relative burdens as current law projected to 2012. That is done by adjusting its parameters then, specifically, the tax bracket thresholds, the standard deduction, and the child tax credit. Over time, other parameters are also adjusted to meet revenue needs, such as the tax rates for the two brackets and the rate on capital gains and qualified dividends. Although the simplified tax is designed for approximate distributional neutrality in 2012, its tax burdens might shift over time to meet revenue needs. Because of this possibility, the study compares the later projected burdens of the current and simplified taxes against each other. |

|

|

29. The cap would be indexed using the chained consumer price index (CPI)—generally considered more accurate than older versions of the CPI (see Chapter 6). The chained CPI would also be used to index future payments in Option 1 for Social Security (discussed in Chapter 6). |

|

|

30. In the low scenario, current tax structure rates stay fixed, by the design of this scenario. |

|

|

31. Other measures of the distribution of the federal tax burden are useful as well. One is tax paid as a percentage of income, which is also the average tax rate; see Tables E-13 through E-18 in Appendix E. Also, the estimates of the future distribution of tax burdens rely heavily on projection of the income distribution, which in turn relies on CBO long-term projections. For estimation, the income breaks between the quintiles are as follows (in 2009 dollars): 20 percent, $19,429; 40 percent, $37,634; 60 percent, $65,903; and 80 percent, $112,079. That is, the top quintile comprises people with annual incomes above $112,079, and the bottom quintile comprises those with incomes below $19,429. The top 10 percent group starts at $162,348, and the top 5 percent at $227,254. |

|

|

32. The payroll tax would be affected in a variety of ways under the illustrative Social Security options of Chapter 6 (summarized in Table 8-1, above). The intermediate-2 and high scenarios not only increase the Social Security payroll tax, but they also move its relative burdens in the progressive direction. Currently, the excess of annual earnings above $106,800 is exempt from Social Security payroll taxation, but both options would impose an additional tax (at a lower rate) above the current tax cap. Moreover, the high scenario would raise the current tax cap so that additional upper-level earnings would be subject to taxation at a higher rate. Although payroll tax increases first become effective in 2012, they would be phased in very gradually, so that, for a given revenue level above “low,” the distributional differences between the current and simplified tax structure almost exclusively reflect the change in income tax structure. |

|

|

33. For details on effects of the payroll tax over time, see note 32. |

|

|

34. These results show changes in tax distributions for future projections on the basis of commonly used assumptions about the level and distribution of income, both total |

|

|

income and by source. As in the recent past, economic developments—financial booms and busts, technological innovations—will result in differences from these projections in unforeseeable ways. Still, both the distributional findings for tax structures and the various scenarios are based on the same set of economic projections. |

|

|

35. For a given scenario—such as high—the differences in the distribution of combined taxes between the current and simplified taxes very likely would reflect the different structures of the personal income tax. The differences in the distribution do not reflect the payroll tax, because the current and simplified taxes for a given scenario include the same payroll taxes (see Table 8-1). Another point refers only to the high scenario. With the current tax structure only, this scenario includes a VAT that would rise from 8.1 percent in 2050 to 14.6 percent in 2080. The rising VAT likely explains why—for the top 5 percent—the difference in after-tax income between the current and simplified tax structures is 7.5 percentage points in 2050, but narrows somewhat to 5.9 percentage points in 2080. |

|

|

36. Whatever the tax structure, increasing the gap between the marginal tax rates for capital gains and ordinary income expands the incentive to shelter income as capital gains. Such sheltering (i.e., tax avoidance) is both inequitable and inefficient. The current gap between the top statutory rate on ordinary income (35 percent) and the 15 percent rate on capital gains is 20 percentage points. Under the current tax structure for the intermediate-2 scenario in 2050, these percentage rates are 40.9 and 17.5 respectively, which increases the gap, to 23.4 percentage points. For the same scenario under a simplified tax structure, rates of 22.2 and 13.3 mean a smaller gap than at present, of 8.9 percentage points. The gap in the tax rates for ordinary income and capital gains can be reduced by taxing capital gains more heavily, but that risks curtailing investment and international competitiveness. |

|

|

37. This appears in the disaggregated findings for the top quintile—not shown here—into the 80-90, 90-95, and 95-99 percentile groups, as well as the top 1 percent and 0.l percent groups. Although, in absolute terms, those findings are very sensitive to the projected income distribution, they do show the high-end effects of tax structure, given the income projection. |

|

|

38. Historically, lower maximum tax rates have led upper-income taxpayers to exert less effort converting their taxable incomes into nontaxable forms because there is less financial incentive for them to do so. |

|

|

39. However, this comparison of relative tax burdens under three of the scenarios (not the low one) shows that taxes increase for all taxpayer groups in all years. |