10

Fiscal Stewardship: A Budget Process for the Long Term

Herbert Stein, chair of the Council of Economic Advisers under Presidents Richard Nixon and Gerald Ford, famously said: “If something cannot go on forever, it will stop.” But there is a corollary—how it stops matters.

As detailed throughout this report, significant dividends would be realized by addressing the fiscal challenge that faces the nation before it forces precipitous and hasty actions in the face of intense economic, social, and political pressures. If started early enough, changes in social, economic, and fiscal policy commitments can be phased in gradually, giving the American public time to make adjustments in their own retirement and savings plans and their expectations about the role of government in their lives. Whether change arrives through a gradual process of timely course corrections or as a rude shock from economic forces over which the United States will have little control may depend on whether the nation can reform the way it makes budget decisions.

The best-designed budgeting process cannot make the hard choices easier. But once those choices have been made, a well-designed process can support leaders who are prepared to meet the long-term fiscal challenge. The committee has concluded that the federal government’s current budget process does little to facilitate the actions needed to address the nation’s fiscal challenge and would do little to preserve any hard-won gains achieved by those actions.

Any budget is a plan for the fiscal future, but the way the federal government currently formulates its budget is weighted toward the past. Established programs and tax expenditures favor the interests and needs of current generations in the competition for resources, at the possible expense of future

generations. The budget process needs to represent not only the interests and needs of the moment, but also those of the future. If the needs of today’s taxpayers are not properly balanced with those of tomorrow’s, future generations may suffer a loss in living standards and may have to contend with a severe economic crisis.

In this chapter the committee discusses a set of budget process reforms that would promote and sustain a new regime of more responsible budget stewardship. Specific reforms are proposed that would provide both policy makers and the public with a clear picture of the long-term implications of budget proposals, provide incentives for the President and Congress to act responsibly, and promote accountability for their actions or for their failure to act. Better process cannot provide political will, but it can reinforce the resolve of leaders who are prepared to face the long-term fiscal challenge and act as responsible stewards.

We offer what we believe are the essential elements of a reformed budget regime that focuses attention on the long-term challenge. In the next section we first provide the context with a brief discussion of the political challenge of instituting such reforms. The rest of the chapter presents the elements of a proposed new budget regime, one that would add information, set medium- and long-term fiscal goals, and enhance accountability by policy makers for meeting those goals.

THE POLITICAL CHALLENGE

Budgeting is always an exercise in hard choices. In any democracy, it is especially difficult to allocate fiscal sacrifice. The groups that benefit from specific tax and spending programs are almost always more organized than the general public that would benefit from responsible budget changes.

Tackling long-term fiscal challenges is even more daunting and politically challenging. Taking on programs that drive long-term deficits raises vexing challenges for the current generation of decision makers. Today’s voters must be convinced to make sacrifices in current consumption and promised government benefits in order to reduce the probability of a future crisis and to improve the living standards of the next and future generations.

Rather than facing the proverbial wolf at the door, taking on the nation’s long-term fiscal challenge is, as once suggested by Charles Schultze (former chair of the Council of Economic Advisers), more akin to dealing with the termites in the woodwork—a problem that is not immediately apparent but can bring the entire house down if not dealt with proactively. For example, if policy makers wait until the Social Security trust fund is insufficient to pay benefits, the federal deficit will already have grown to a level that will damage economic growth and saddle the budget with

ever-growing interest payments. The information needed to address Social Security’s unsustainability is available now, but nothing in the process requires that it be recognized and addressed now, when it could be dealt with much more easily than later.

The nature of budgeting also has changed in recent decades in ways that complicate the exercise of budgetary discipline and resolve. Before the 1960s, the lion’s share of spending was provided through discretionary appropriations. The appropriations committees, largely controlled by members with relatively safe seats, took a fiscally conservative and incremental approach to the budget, keeping spending growth from outpacing revenues. Since then, however, as the scope of government benefits grew to meet human needs, most spending came through open-ended entitlements, which are not subject to annual review or to budgetary caps. There has also been an increase in open-ended tax expenditures on the revenue side, which are also subject to neither annual review nor caps.

Leadership

Some observers believe that the political risks of tough choices are so high that only an economic crisis will compel leaders to change the nation’s fiscal course. And history suggests that political leaders rarely step forward to lead such an effort as long as there are no obvious and compelling economic or political consequences today of current policies. If the historical pattern holds, it presents a bleak prospect for meeting the current challenge, because, as the committee’s analysis shows, waiting for a crisis will cause unprecedented economic and political harm to the nation.

Other evidence is more encouraging, however. The recent history of developed nations indicates that deficit reduction and major policy reform are not politically impossible tasks for the leaders of advanced democracies. Some nations have made substantial reforms in their own pension and tax systems in the past 20 years (see Penner, 2007). One recent study of the past 40 years of fiscal history in nations of the Organisation of Economic Co-operation and Development (OECD) found that incumbent governments that institute policies to reduce deficits are rewarded with reelection (Government Accountability Office, 1994; see also Brender and Drazen, 2008). Although deficit reduction is never easy, leaders who take decisive action can then position themselves as taking measures necessary to protect the nation’s economy and finances and protect the interests of the next generation.

The United States, too, has taken some significant steps in recent years to change the course of fiscal policy. In 1983, the National Commission on Social Security Reform (known as the Greenspan Commission, after its chair) formulated convincing analyses and arguments that led to political

consensus for reforms to Social Security. The reform, which included both tax increases and reductions in benefits for retirees, did not fully solve the program’s sustainability problems but it greatly ameliorated them.

Similarly, in 1990, the nation adopted a budget agreement that constituted significant deficit reduction, to be followed by similar action in 1993; see Box 10-1. That agreement, engineered by leaders of both major parties, helped turn the federal government from then-chronic deficits to a 4-year period of budget surpluses.

These examples illustrate how leaders can confront politically charged fiscal challenges (see Light, 1995). The 1990 example provides both a positive and a cautionary message. It created budget process rules that for almost 10 years brought discipline to budget decisions. But the rules were eroded when budget surpluses seemed to make budget discipline less important. Partly as the result of the abandonment of those rules, the budget surpluses soon disappeared.

These infrequent examples of far-sighted leadership can provide guidance for how to break through long-standing gridlock to produce major

|

BOX 10-1 The 1990 Budget Agreement In 1990, the nation faced a budget crisis brought on in part by a projected deficit far in excess of the targets established by the Gramm-Rudman-Hollings Balanced Budget and Emergency Deficit Control Act of 1985 (Pub.L. 99-177). That act had established annual deficit targets and required an automatic cancellation of budget resources for many programs if the target for a given year was exceeded. The projected deficit for fiscal 1991 was so far in excess of the legislated target, and the resulting automatic cuts would have been so severe, that leaders began bipartisan negotiations to find new targets and a new approach to budget discipline as an alternative to one they considered unworkable. Under this pressure, President George H.W. Bush and Democratic congressional leaders negotiated a set of tax increases, cuts in entitlements, and limits on discretionary appropriations. These policy actions were supported by enactment of procedural reforms incorporated in the Budget Enforcement Act of 1990. The act legislated dollar caps on discretionary appropriations spending for fiscal 1991-1995 (later extended through 2002) and instituted a new pay-as-you-go (PAYGO) regime that required any new tax cuts or entitlement expansions to be offset by other benefit cuts or tax increases over the following 5 (later 10) years. The 1990 actions were updated in 1993 with another set of major cuts and tax increases, along with extensions of the budget process rules. The budget rules, constraints on discretionary programs, and PAYGO offsets were observed through much of the decade, until the emergence of budget surpluses. Ironically, of course, those surpluses were partially brought about by these earlier actions. |

fiscal reforms (see Fabrizio and Mody, 2006). One interesting lesson from this history is how leaders can take advantage of how the public views most major fiscal issues. On fiscal issues, the public is not of one mind, but at least two. A July 2009 New York Times/CBS News poll confirmed what other polls and research has consistently shown: a majority of people want the deficit to be reduced but about the same majority do not want spending cut or taxes increased. This ambivalence provides an opportunity for leaders to reframe issues to appeal to the latent public support for fiscal restraint, and a sustainable longer-term fiscal path.

The Role of Process

Political leadership is essential to fiscal reform, but the rules and institutions of the budget process can make important contributions. They determine the kinds of information available and how it is used, shape incentives for action, and establish accountability for the results of those actions (Meyers, 2009). Budget processes frame the most important decisions made by a political system in a given year: how much of the economy to devote to government through taxes and how to allocate spending of limited resources.

No one should expect any budget process to persuade legislators to endure severe political pain. But well-designed rules can nudge them in the right direction and can provide political “cover.” They can say that, contrary to their personal preferences, “The rules made me do it.”

But budget processes are produced by the same system that produced the problems they seek to address (see Anderson and Sheppard, 2010). When major budget enforcement measures were adopted in 1990, they were designed to lock in deficit reduction achieved through negotiated revenue and spending policy agreements. In other words, policy makers first made the difficult decision that deficit reduction was imperative. Then, with considerable difficulty, they negotiated an agreement to achieve it. The new rules were negotiated last, and they were designed primarily to prevent the Congress from allowing the hard-won package of deficit reductions to erode over time. A properly designed budget process can highlight the important consequences of different courses of action and can force leaders to acknowledge explicitly and take responsibility for the long-term consequences of their decisions. Far-sighted and strong budget rules can also help leaders take on both near- and long-term deficits by providing fiscal targets and restraints.

BUDGET REFORM FOR RESPONSIBLE STEWARDSHIP

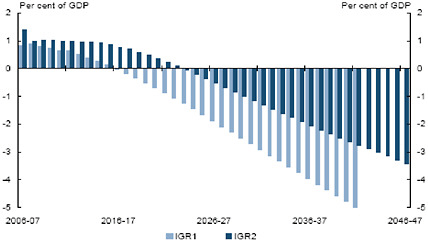

The long-term fiscal outlook depicted in this report argues for a new way to use the budget to institutionalize a long-term perspective and pro-

vide leaders with the tools needed to forestall looming fiscal crisis. Consistent with the history of budget process reform, there is reason to believe that a more forward-looking process can help to support the initiatives of those leaders who are willing to make the case for fiscal responsibility.

The committee favors reforming the budget process to make it more focused on the long term and to establish a new system of responsible budget stewardship. The current budget process is focused primarily on the short term. It uses a 5- or 10-year time frame as the primary period for the baseline, and the costs of most proposals are factored into the decision process only for that period. While existing congressional rules enforcing discretionary spending ceilings and PAYGO offsets may prevent new actions that make deficits worse, the current regime does not prompt Congress or the President to go beyond current baselines to achieve deficit reduction. It contains nothing that requires changes in major drivers of the long-term fiscal outlook—Medicare, Medicaid, Social Security, and tax policy. Moreover, the current process sets no explicit fiscal goals or targets for long-term deficits or debt. Budgetary costs are largely presented on a current cash basis, which is misleading for programs whose present commitments imply future costs that are much larger than their current cash effects on the deficit. As with most OECD nations, existing long-term sustainability analyses are not integrated into the budget process in the near term (Anderson and Sheppard, 2010). Given this orientation, it is not surprising that the process has not encouraged leaders to deal with the looming problem.

Recent actions have expanded the time horizon for budget decisions in certain areas, providing a possible model for broader reforms. The 2003 Medicare prescription drug legislation instituted a funding warning that requires the President to propose changes when the portion of general revenue financing exceeds 45 percent, although Congress has undermined the provision by eliminating the requirement for expedited congressional review. The Senate has included a “four decade” rule for new mandatory spending that requires the Congressional Budget Office (CBO) to estimate costs for the subsequent four decades, bolstered by a point of order that can be raised on the floor. Although this provision has entered into debates on occasion, it is still too soon to know whether it will provide significant institutional self-restraint.

The rest of this section discusses three major areas in which reform is needed to highlight the long-term implications of current programs and to encourage decision makers to act now to place the budget on a sustainable long-term path: information, goals and targets, and accountability.

Information on Long-Term Implications of Current Decisions

A first step for reform of the budget process would be better information about the fiscal future. Such information would provide a strong foun-

dation for other reforms. With better information, the long-term outlook and related analyses would be highlighted as part of the budget process. The President could use long-term analyses to provide an annual fall report on the fiscal state of the nation and to develop a budget for the following fiscal year. Congress could use long-term projections to develop its annual budget resolution, set enforceable medium- and long-term budget targets, and use these to guide its annual choices in appropriations and reviews of mandatory spending and tax policy.

More broadly, new and more prominent information about the long-term implications of current and proposed policies—with appropriate caveats about the uncertainties that surround any such projections—could be used by the public to assess whether a proposed budget meets the tests of fiscal prudence presented in this report, to assess the long-term implications of pending budget proposals, and to hold leaders accountable for the long-term consequences of their budget choices.

Information alone cannot be expected to change ingrained practices. However, like the slow effect of water dripping on stone, the gradual introduction of new fiscal measures and better information can, in fact, highlight and elevate the long-term dimension of major policy debates.

Better information on the long-term outlook and consequences of today’s budget choices can also help leaders reach the right choices. The seriousness of the projected long-term fiscal challenge has been no secret to policy makers. CBO, the Government Accountability Office (GAO), and the U.S. Office of Management and Budget (OMB) all prepare annual assessments of the budget outlook decades ahead.

In the past decade, a growing number of countries have independently adopted some version of long-term fiscal projections as part of their budget planning. Long-term fiscal projections provide a way to assess and discuss the sustainability of current public policies by quantifying the long-term fiscal consequences of those policies, as well as the effects of demographic and other changes on selected summary fiscal indicators. Their use is still limited to a relatively small number of industrialized countries, and it is too early to assess whether they have affected budget choices. (See Appendix G for a summary of information from 12 OECD countries on long-term fiscal projections.)

In the United States, the presentation and consideration of such information is divorced from the decision-making process: it is presented separately from and at different times than CBO’s reports on the 10-year budget outlook. Adding or enhancing information, developing new metrics, and changing how information is presented and used in developing the federal budget could increase the visibility of and accountability for the long-term consequences of budget choices.

The committee offers three proposals for more long-term information in the budget process: integrating treatment of long-term budget projections

into annual budget documents and making them prominent; expanding use of information on fiscal exposures in CBO and OMB budget reports; and increasing the use of accrual accounting.

Integration of Long-Term Budget Projections

Although OMB, CBO, and GAO all prepare long-term budget projections, these are not highly visible. OMB’s analysis appears in the Analytic Perspectives volume of the President’s budget. CBO’s long-term analysis is prepared on a different cycle than its regular budget baseline reports and update. GAO updates its reports throughout the year, but must wait for updated data from CBO and the annual Social Security and Medicare Trustees reports. All of the reports provide important information on the budget’s long-term trends, but nothing in the current annual budget process requires that this information be used in that process, so these reports are easily ignored.

As a first step, OMB and CBO could readily integrate presentation of their long-term fiscal outlooks with their near-term budgetary baselines by updating and publishing long-term projections in their initial and midyear budget reports. It would also be very valuable if the long-term impact of the President’s budget policies became a regular section of the main budget volume, with long-term projections included in that volume’s Summary Tables. In the same vein, it would be very valuable if CBO’s long-term outlook were updated every time the agency updates its budget baseline. Other countries do a better job of highlighting their long-term outlook in ways that are hard for policy makers and the public to ignore: Australia is one example; see Box 10-2.

Information on Fiscal Exposures

Some of the largest federal programs have costs that grow exponentially over the long term. Their longer-term cost projections are not disclosed in either budget authority or outlay columns in the budget. GAO has coined the term “fiscal exposures” to refer to such activities, which include federal insurance and operations and maintenance for newly acquired capital, as well as long-term spending estimates for the pension and health benefits of current employees. Some of these exposures are defined as liabilities in federal financial statements; but others, such as Social Security, Medicare, and Medicaid, are not. Yet all of them will require future expenditures that are not fully reflected in near-term or even 10-year projections that are prepared routinely by CBO and others (see Government Accountability Office, 2003). OMB’s Analytical Perspectives volume includes reporting on assets and liabilities, but it does not include the same range of commit-

ments as GAO’s analyses. CBO’s budget reports do not include estimates for such exposures.

As an initial small step toward greater awareness of the longer-term dimensions of fiscal exposures, the magnitude of such commitments could be noted in the schedules of the President’s budget. Ideally, OMB would work with agencies to implement an exposure concept, by recording the net present value of future costs for specific program activities in the budget for which such information is relevant, appropriate, and feasible. Government Accountability Office (2003) recommended that such information be recorded in a column alongside the more familiar outlays and budget authority recorded for all programs.

More broadly, both policy makers and the public would be well served if OMB and CBO were required to produce annual reports on fiscal exposures, which would serve as counterparts to GAO’s analyses. These three agencies could work together to assess methodological issues in estimating these exposures.

Accrual Accounting

The federal budget mostly relies on cash accounting to estimate the amount and timing of program costs. That accounting is generally the most appropriate measure to capture the current-year effects of federal fiscal policy on the economy and on the borrowing needs of the Treasury. However, for selected programs, cash accounting provides misleading signals to federal policy makers about the financial costs of commitments that extend far beyond the current year.

Cash understates the longer-term costs of some programs that represent long-term contracts. For these programs, costs may arise far in advance of when cash is needed to satisfy obligations: for example, federal deposit and pension benefit guarantee insurance programs often show up as earning surpluses on a cash basis in the budget, even though their underlying risks and longer-term deficits are known to actuaries and auditors. In these cases, an accrual approach should be considered using the best methods available to estimate accruing costs.

An accrual approach would record the net present value of long-term contractual commitments in the year they are made, regardless of the actual flow of cash payments. In 1990, the federal government adopted such an accrual approach to replace the cash approach for loan and loan guarantee programs—recognizing that near-term cash flows understate the magnitude and risks associated with loan guarantees and overstate the commitment implied by direct loans. Accrued net present value better captures the underlying costs to the federal Treasury over the longer term and records these costs as outlays (and therefore as part of the deficit calculation) at

the time the commitment is made. Using present value accounting to move forward the time when the cost of long-term commitments is recognized in the budget improves incentives for policy makers to take timely action if it is needed to address their costs.

The federal government similarly could adopt accrual budgeting for such commitments as federal employee pension and retiree health care costs, which are currently recognized as liabilities on the federal financial balance sheet. It would also be valuable to consider adopting accrual approaches to estimating the budgetary costs of such contingent liabilities as insurance programs. Moving to accrual for insurance would require additional research and complex modeling to capture the longer-term risks assumed by government for uncertainties, such as natural disasters and other unpredictable events.

Fiscal Goals and Targets

The committee believes that establishing a set of fiscal goals and targets is essential to gaining control of the fiscal future. Setting fiscal goals is a critical first step in institutionalizing consideration of the long-term outlook. Above all, it would force acknowledgement of the unsustainability of current policies.

In recent years, many nations have adopted fiscal targets and frameworks that helped them become fiscally responsible. In New Zealand, for example, the adoption of overall fiscal targets, in concert with market pressures, reframed policy debates; see Box 10-3. Sweden followed a similar approach. Fiscal targets had an impact not through formulaic cuts, but by providing a compelling way to frame budget debates on the basis of the long-run implications of current budget choices. In both countries, earlier fiscal and economic crises made fiscal goals important, and leaders risked criticism if their fiscal outcomes fell short.

In the United States, Congress last set overarching fiscal goals under the 1985 Gramm-Rudman-Hollings Act, which prescribed declining deficit targets for the federal budget. However, the goals were applied in a mechanical fashion that proved to be politically unsustainable, as unprecedented economic fluctuations moved the goals further away regardless of the actions taken by the policy makers. Chastened by this experience, policy makers turned to spending targets under the Budget Enforcement Act (BEA) of 1990, with a focus on holding themselves accountable for decisions they controlled, namely, the overall size of discretionary spending and new entitlements and tax cuts. Although this approach was more realistic and feasible for the United States, the BEA regime did not address the growth of spending or revenue losses for existing programs. That is, it prevented legislative acts from making things worse when in force, but contained no

|

BOX 10-3 New Zealand’s Budget Principles New Zealand, since 1994, has followed a legally enshrined set of budget principles, and the Government is legally required to assess its fiscal policies against these. The principles include: reducing public debt to prudent levels; once these have been achieved, maintaining them by ensuring that, over a reasonable period of time, operating expenses do not exceed operating revenues; sustaining a net worth that provides a buffer against adverse events; managing fiscal risks prudently; and pursuing policies that contribute to stable, predictable future tax rates. It is left to the government to interpret terms in the law such as “prudent” and “reasonable.” A government may depart from the principles if it specifies its reasons and a plan to return to the principles in a specified period of time. Every 4 years the government presents a statement of New Zealand’s “long-term fiscal position,” including a 40-year budget projection and accompanied by a “statement of responsibility, signed by the Secretary of the Treasury, attesting that his Department used its best professional judgments about the risks and outlook (Anderson and Sheppard, 2010). |

mechanism for significantly improving the long-term outlook. Subsequently, the abandonment of overarching fiscal policy goals and targets has left Congress and the President without a framework to assess the long-term consequences of current policy or new proposals. Nor does it reward them for doing so.

The setting of long-term fiscal targets could be adapted to the current budget process. As explained in Chapter 3, the committee judges that a 60 percent upper limit on the ratio of debt to the size of the economy (as measured by the gross domestic product, GDP) would be an appropriate fiscal goal for leaders to put in place over the next two decades. Formal adoption of such a goal now can help leaders develop fiscal policies to constrain the exponentially growing levels of debt implied by the nation’s current fiscal path.

A practical question is how to integrate such long-term fiscal goals into a budget process that is predominately focused on the near term. The long-term outlook is the starting point for formulating alternative fiscal policy targets that would create a more sustainable fiscal future. However, no one would suggest that the federal government should prepare a detailed budget for the next 50 or 75 years. Rather, since the federal budget is prepared annually, long-term goals should serve as a guide for the formulation of policies that would lead to a sustainable debt level over the next 10 or 20 years. In the United States, any such fiscal target would have to be renewed with each administration and each Congress.

A frequent review of the fiscal targets would allow the problem to be addressed iteratively, in politically manageable bites. The target may need to be adjusted and phased in over the near term, for instance, to avoid precipitous fiscal actions that might jeopardize the economic recovery. In such major policy areas as health care, progress will in all likelihood proceed in iterative stages. Thus, although the next budget offered by the President or approved by Congress will likely not contain sufficient specific proposals to eliminate the excess growth of health costs, it could include actions to make progress to that end and make a commitment to continue to address the problem in the long run.

In the United States, assuming that inflation remains under control, annual deficits that average around 2 percent of GDP would be consistent with maintaining a debt-to-GDP ratio of 60 percent. As discussed in preceding chapters, simply meeting a 2 percent deficit target will become more fiscally ambitious over time unless actions are taken to modify the growth paths of the major entitlement programs or to adjust tax revenues—the key drivers of the long-term outlook.

Medium- and long-term fiscal targets could be established in the annual congressional budget resolution and then used to assess both the President’s budget and the congressional policy actions. The budget resolution and accompanying committee reports would have to explicitly address the nature of the policy actions that Congress will take to achieve the debt target over the next 10 and 20 years. CBO could be required to review this section and provide its own estimate of the impact of these proposed policies on the debt target. A new congressional procedure (point of order) could be considered to reinforce the establishment of debt targets in the budget resolution.

CBO’s report also could assess the implications of these policy changes on the long-term outlook over the next 50 years. Although budget resolutions may not provide sufficient detail to generate detailed estimates over the long term, a report that provided even some assessment of the budget resolution’s impact on the long-term target would provide useful insights. Such a report could, at a minimum, assess whether the budget resolution would make the long-term outlook better or worse.

Accountability

Fiscal targets and goals are not self-enforcing. Rather, a framework is necessary to hold leaders accountable for meeting targets. As difficult as reaching agreement on targets might be, sustaining commitment over time is even more difficult.

The accountability framework the committee proposes has four elements. First, it would require the President to provide an accounting of the

long-term fiscal outlook and the administration’s plans to address it. Second, it suggests that longer-term fiscal goals should be reinforced through a budget enforcement regime that would help ensure that the goals cannot be ignored without consequences. Third, it would ensure a periodic review of the major drivers of long-term deficits on both the spending and revenue sides of the budget. Fourth, it would require that beyond the 10-year budget projection period, the long-term fiscal effects of new proposals for spending or tax cuts be fully offset. Taken together, these reforms would establish a budget regime in which the President and Congress share political accountability for presenting and enacting budgets that take greater account of the implications of today’s policies for the federal government’s long-term fiscal outlook.

Although reforms such as providing better information and setting fiscal goals can increase attention to these issues, the commitment of elected officials will be critical to bringing about definitive actions to deal with the nation’s fiscal challenge. While the panel is not endorsing specific steps, all panel members agree that stronger public accountability for the consequences of deficits both near and long term is needed.

The committee is aware that there are many other proposals for enforcing accountability for fiscal goals. For instance a balanced budget amendment to the Constitution has been prescribed by some as an inescapable restraint on political officials. Although almost all the states have such a requirement, a provision like this would not give the national government sufficient flexibility to take necessary actions to stabilize the economy, which calls for deficits at some times and surpluses at others. In addition, although balanced budget requirements seem to promise certain discipline, they have, in fact, been undermined by creative fiscal accounting in many states—a pattern that is very likely to be repeated in many ways at the national level. Moreover, for all the reasons discussed in Chapter 3, we believe that a budget’s projections for the debt provide a more appropriate indicator of its potential economic impact than whether the budget is balanced or not.

Presidential Accountability

In the U.S. system, presidents are uniquely held publicly accountable for the performance of the economy. Political scientists observe that the state of the economy is a critical factor in a president’s approval ratings and the results of subsequent elections (Lewis-Beck and Stegmaier, 2008). Consequently, presidents often initiate policies and programs to try to ensure good economic outcomes in time for their own reelection campaigns, for their party’s midterm elections, and for their legacies. Enhancing presidential ownership of the long-term fiscal challenge ultimately depends on

whether the public holds the president accountable for long-term fiscal outcomes. One way to shape those expectations is to require presidents to account for the nation’s future fiscal outcomes annually in a highly visible forum. The president could report on the long-term fiscal outlook, based on outcomes through the most recently completed fiscal year and the proposed or enacted budget for the current year. Until fiscal sustainability is assured, this report might take the form of an address in the fall to a joint session of Congress. The president’s annual statement of the nation’s fiscal outlook would be a reference point for everyone concerned with the sustainability of the federal budget. Such a fiscal accounting might come to be widely anticipated as a basis for assessing how well the president and Congress have done in delivering on the fiscal goals and targets set earlier in the year. It would also be a well-publicized starting point for development of the coming year’s budget proposals for the long run.

Reinforcing Accountability for Meeting Goals and Targets

There is considerable controversy over whether fiscal goals and targets would constitute an effective spur or constraint on policy makers. Both in the United States and other countries, experience with fiscal rules—which use a summary indicator of fiscal condition to bind political decisions by the executive or legislature—has sometimes been discouraging. In order to have a meaningful impact on fiscal decision making, policy makers should face consequences if they ignore such goals. However, designing a budget enforcement regime is always challenging since it requires constraining the subsequent choices of political officials who are free to ignore or modify their own constraints in a democratic system.

Nonetheless, the committee believes that any fiscal policy regime has to specify consequences if fiscal results fall short of targets. Although political leaders may choose to ignore fiscal goals in the future, they should nonetheless at least be held accountable in some public way for doing so. The existence of a budget enforcement regime that specifies specific sanctions for shortfalls may have an independent effect on the fiscal policy decisions of policy makers.

Reaching fiscal goals and debt targets calls for a budget process that will enable Congress to enact laws to reduce spending and increase revenues. Fortunately, the existing budget process has features that would enable Congress to do so. Specifically, the current budget reconciliation process provides the budget committees and leadership with a vehicle to require the committees to develop the broad legislation that can achieve major budgetary savings for the near and longer term. Reconciliation bills have the advantage of overcoming the fragmentation of the committee process by imposing overarching fiscal savings targets assigned to committees,

and with deadlines and consequences. Moreover, reconciliation bills have the additional advantage of being governed by special rules in the Senate that limit debate and are not subject to filibusters.

In addition, the fiscal goals articulated by the President and Congress can be reinforced as they have in the past by discretionary spending caps and PAYGO rules that constrain the Congress from adopting new spending and revenue provisions that would jeopardize its targets. PAYGO would require offsetting legislated changes to increase entitlement spending or reduce taxes that would increase the deficit or reduce the surplus with changes that would reduce spending or increase revenues. After 1990, annual caps on appropriated spending and PAYGO were successful at restraining spending increases and tax cuts for several years, making a contribution to the balanced budgets achieved for 4 years starting in 1998. These rules are currently enforced through congressional points of order. However, the underlying statutory framework that provided for fallback budget sequesters when the rules are breached was allowed to expire in 2002. A good first step would be to reinstitute these caps and PAYGO requirements in statute, along with the potential sanction of budget cuts should the rules be violated.

However, PAYGO and caps will generally not by themselves be sufficient to enforce debt targets. They do not control for the growth of spending or declines in revenue under existing programs, such as Medicare and Medicaid. Accordingly, an accountability framework must include some kind of look-back process where the fiscal targets can be compared with actual levels of deficits and debt achieved at the end of the fiscal year.

Two of many possible options for imposing accountability if results do not meet a target or goal are automatic fall-back actions and a soft constraint. Automatic cuts or revenue increases could be triggered if the president and Congress fail to achieve the fiscal target. Both the trigger and the automatic mechanism used to determine the required spending cuts or tax increases would have to be carefully designed, and Congress and the president should be able to waive the trigger during economic or national security crises. (As noted above, the 1985 Gramm-Rudman experiment of enforcing balanced budget goals with automatic cuts failed to gain support, partly because the fiscal goals were unworkable and unrealistic, covering a relatively narrow range of programs.) Automatic fall-back cuts would need to be applied to a broad range of both spending and revenues to have a strong base for savings and to promote the principle of equal sacrifice. In contrast to an automatic approach, a soft constraint would call on Congress to either take subsequent action to meet the target or to go on record that the target is unreachable. Such a mechanism relies on the power of shame to trigger action through the budget process. Although this approach does not involve the complexity of fall-back cuts, it is also a weaker constraint that can be more easily ignored.

Periodic Review of the Drivers of the Fiscal Challenge

Given the importance of Social Security, Medicare, Medicaid, and tax policy for the long-term outlook, they will require special attention to ensure accountability. Those three programs represent open-ended commitments not only to present beneficiaries and taxpayers, but also to future ones. Although some entitlement programs employ trust funds that do have limitations, in most cases those limits only become a real constraint years after the programs are known to impose a net burden on the budget.1

There are many approaches to promote periodic review of the major drivers of the fiscal challenge, three of which are frequently mentioned: sunsets, benchmarks, and triggers.

-

With sunsets, Congress would set legislated dates for specified major entitlements and tax expenditures, but excluding such programs as Social Security and federal pensions, which represent very long-term commitments. An approaching sunset would periodically provide an incentive for reexamination of a program’s costs and benefits. Although periodic reviews might increase prospects for reining in features with fast-growing costs, they do not guarantee that reforms will actually occur. Some people object to this approach because setting sunset dates increases uncertainty on the part of individuals and businesses that rely on the programs in planning the use of their own resources.

-

Another approach to ensure that policy makers periodically address the three major entitlement programs and tax expenditures would be to establish benchmarks or targets for them. If spending exceeded these targets or revenues fell short, the budget process could require the President or Congress to propose and Congress to vote on measures that would close the gaps as soon as they are identified.

-

Congress could also enact provisions that automatically trigger actions if specified benchmarks or targets for the three major entitlement programs and major tax expenditures are not met. The use of triggers is controversial among experts. Soft triggers would require Congress or the President to either explicitly ignore the limit or take some action to address it.2 Alternatively, a hard trigger would automatically implement specific spending cuts or revenue increases (Penner and Steuerle, 2007). Other nations have used various triggers or “automatic balancing mechanisms” tied to long-run projections for some or all parts of their budgets with good results (Penner and Steuerle, 2007); see Box 10-4.

The committee notes that it is difficult to design fall-back mechanisms if targets are not both appropriate and realistic. A hard trigger, for example,

|

BOX 10-4 Automatic Balancing Mechanisms in Canada, Germany, and Sweden In Canada, an automatic balancing mechanism was introduced in 1998 and mandates action if:

Financial sustainability is defined relative to the ability to maintain a specific level of contribution over a period of 75 years. Should the level of contributions exceed a figure established bylaw, the automatic balancing mechanism would affect changes in both contributions and pensions. In this situation, the contribution rate would be increased by half of the excess of the steady state subject to maximum annual increase. The remainder would be covered by a freeze of pensions payable over a 3-year period. In Sweden, an actuarial income statement and balance sheet of the non-financial, defined, pay-as-you-go, contribution scheme has been made every year since 2001. In addition, an automatic balancing mechanism can temporarily abandon the indexation of pension rights and current benefits to average wage growth if the stability of the scheme is threatened. Stability of the system is defined by a balance ratio that relates to the scheme’s assets and liabilities. A balance ratio of less than 1 means that the scheme is out of balance (i.e., liabilities exceed assets), and earned pension rights and current benefits are reduced according to the balance ratio rather than the average wage. This will continue as long as the balance ratio is less than 1. In Germany, a sustainability factor linked to the national dependency ratio that is applied to the rate of indexation of benefits was introduced in 2005. In contrast to the triggers in Canada and Sweden, it is permanently activated—and may only be deactivated by an act of parliament—until the social security pension is sustainable under a determined contribution rate. Since 2008, the German government must report every 4 years how to meet targets for replacement and contribution rates. |

must accomplish two seemingly conflicting goals: to be sufficiently punitive and unpalatable to force Congress and the President to achieve fiscal actions through the regular process; and to be sufficiently realistic and feasible to be regarded as credible if the target is not met through the regular process.

In 2008 a bipartisan coalition of budget experts embraced hard triggers for Social Security and Medicare (Brookings-Heritage Fiscal Seminar, 2008). The coalition’s proposal sets limits on growth for these programs, enforced by automatic cuts in benefits and premiums when those limits are

exceeded. A coalition of opposing experts argued that this proposal was unbalanced in its selection of what programs should be subject to fiscal discipline, exaggerated the power of numerical targets to force decisions on how to balance spending and revenues, and would fail to address the growth of tax expenditures that also jeopardize the fiscal outlook (Aaron et al., 2008). Complex design choices would have to be faced in establishing any triggers, including how the triggers are activated, the resulting actions, how triggers can be adjusted for economic downturns, and the frequency of reviewing the trigger mechanism to reflect changes in the programs and in the overall budget outlook.2 Substantial work would be needed to determine if triggers would be equally effective on the spending and revenue sides of the federal ledger. Revenue triggers, which could take the form of surtaxes or delays in indexing and other scheduled revenue-reducing provisions, would present novel design challenges, as none have yet been developed, enacted, or applied.

In the U.S. political system, it should be noted that even a hard trigger is not automatic—Congress cannot bind its own future actions, let alone those of future Congresses. The Medicare program illustrates the differential fortunes of soft and hard triggers. Premiums for Medicare Part B (doctors’ insurance) are automatically established each year to equal a fixed percentage of projected costs for the coming year, and those levels have not to date been overturned by Congress. In contrast, the triggers that require reductions of doctors’ fees under the Part B program have been routinely overturned.3

The concept of triggers itself has triggered significant debate, among committee members as well as in the broader policy community. Proponents argue that such provisions would not allow these fast-growing determinants to grow automatically: the current system places the political burden on those trying to slow growth in costs or benefits. In contrast, a hard trigger would force program advocates to act to override the triggered changes. But opponents argue that triggers could negatively affect beneficiaries. Moreover, some analysts object to the lack of accountability by elected officials that are inherent in triggers. For instance, many would argue that cuts to doctors’ fees for Medicare have substantive effects on the availability of care for the elderly that should be debated on their merits as they occur rather than being subject to triggers.

Consideration of the Long-Term Costs of New Policies

Meeting debt targets will require the President and Congress to more carefully consider the long-term cost implications of new spending and revenue proposals. To bring consideration of long-term costs into the decision-making process, policy makers need to have access to information about the

long-term cost (or savings) effects of a proposal when it is under consideration. They also have to be able to object to long-term costs they view as unwarranted through a point of order or other procedural measure. Current rules for consideration of proposed mandatory spending and tax policy changes generally limit estimates to a 10-year period, even if the proposed change has substantial implications for the budget’s long-term outlook. Yet a different rule is well within recent policy tradition: the Senate has already incorporated such a point of order in its rules, requiring policies to be deficit neutral in each decade over the next 40 years. Both the Senate and House have weak rules that attempt to restrain actions that would worsen the Social Security deficit. CBO does not currently provide quantitative estimates of costs beyond 10 years, but it does provide a qualitative judgment about whether proposals would increase or decrease the deficit over the longer term (Elmendorf, 2009).

The 1990 PAYGO requirement that mandatory spending and revenue proposals not increase future deficits was enforced not only by the rules of the House and Senate, but also by a back-up requirement that, if congressional action increased net spending over a 5- or 10-year period, covered entitlement programs would be cut to the extent needed to eliminate the increase. It may be useful to consider a comparable procedure for longer-term costs as well. Although establishing the precise order of magnitude for long-term costs may be difficult, it may be possible to create formulaic reductions in spending or increases in revenues if proposed new legislation would increase the deficit beyond the 10-year period on the basis of CBO’s qualitative assessment. Like the 1990 act, a specified formula could provide greater incentives to observe long-term fiscal neutrality in considering new legislation.

CONCLUSION

Given the serious threat posed by long-term imbalances in the nation’s projected spending and revenues, simply waiting for a crisis to force leaders to deal with the fiscal challenge would be irresponsible. Rather, the committee concludes that reforms to the budget process are needed now to help hold leaders accountable and to support responsible action. Just as in the battle to curb cigarette smoking, information, public framing, expert studies, and political entrepreneurs will all be important in elevating the priority devoted to meeting the nation’s fiscal challenge. The breadth and scope of the changes required will call for both budget process reforms to galvanize the attention of political leaders and public engagement strategies that mobilize the attention of broader publics at the grassroots level.

Nothing can force leaders to take on this challenge absent support from the public. However, once hard decisions have been made, enhanced

information, fiscal targets, incentives for prudent action, and procedures to enhance accountability could make a difference. The reforms and options outlined in this chapter could help.