2

Framing the Choices

Having recognized the magnitude of the long-term fiscal challenge, how can one sort through alternatives for constructing a sustainable federal budget? A sustainable budget, as noted in Chapter 1, must align revenues and spending over a long time horizon. To guide one’s thinking about how to put today’s federal budget on a sustainable path, this chapter presents a framework for the inevitable hard choices. The right framework—although it cannot by itself resolve fundamental differences—can be a basis for informed deliberation and decision making.

CONNECTING BUDGETS AND VALUES

A budget is a plan to use part of the nation’s current and future economic resources to produce public benefits. Among other things, government spending produces goods and services whose benefits are widely shared and not easily divided—what economists call “public goods” or “collective goods” (Samuelson, 1954). National defense spending is a good example. Its benefits are shared by all and not divisible. Budgets also use taxation and spending to transfer resources from some groups to others. Examples are the use of revenues to support low-income families or to compensate wounded veterans. In political terms, the federal budget represents decisions about the use of national resources for public benefits and social objectives and decisions on how to collect the revenues to finance the planned spending. Even more broadly, a budget reflects how the proposed use of resources is expected to yield certain desirable outcomes—improvements in society and in people’s lives. The essence—and difficulty—of budgeting is to trade

off many desirable social goals against each other when resources are not unlimited. A “good” budget shows clearly whether there is a match between plans to spend and plans to pay for spending and whether the spending implied by current and proposed policies is sustainable.

In this report we insist that it is critical in assessing a budget to take the long view—to be concerned about future generations’ opportunities and well-being. Because current policies as projected are not sustainable, either spending must be reduced or revenues must increase. Budgets quantify the priority given to every public objective, from the oldest and most basic, such as national security, to newer ones, such as environmental protection. Federal government responsibilities have expanded gradually over many years. The oldest federal functions included building interstate transportation networks and securing the nation’s borders. For example, George Washington’s administration built the lighthouse at Montauk Point in New York. The newest functions include protecting endangered species, reducing greenhouse gas emissions, and expanding broadband access.

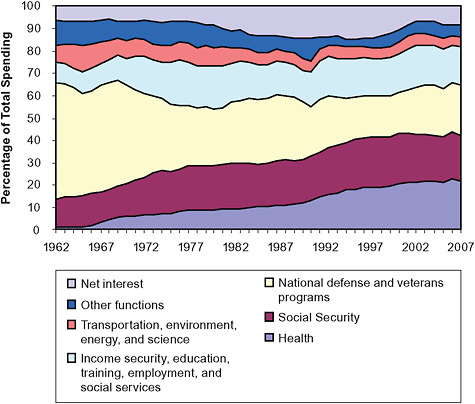

Public priorities change over time. Although federal spending as a proportion of the nation’s gross domestic product (GDP) was relatively stable from 1962 to 2008—increasing from about 19 percent to 20.5 percent—the distribution of spending by function changed dramatically. Social Security and health benefits, mainly to the poor and elderly, roughly tripled as a proportion of total spending, while the share going to defense and veterans fell from about one-half of the total to about one-fourth; see Figure 2-1.

Budget debates reflect fundamental differences: in people’s values, interests, and beliefs; about questions of budget priorities or tradeoffs concerning the best allocation of resources among public goals; and on practical questions about the best way to use resources to advance agreed-on priorities.

People hold sharply differing views of what they want or need from government, what they believe government can deliver, and what role they believe government should have in the economy and other aspects of life. In general, people favor policies that they believe will benefit themselves, their families, others like themselves, and the society as a whole—whether “benefit” is seen largely in material or in other terms.

Logically and appropriately, differences in values, interests, and beliefs about government’s role will lead people to widely different positions about what the budget should support and how. Differences in values, interests, and beliefs need to be recognized and at least partly reconciled in order to make long-range budget decisions. Fortunately, people who differ in their values and beliefs can and do often find common ground when it comes to practical solutions. In the next section we discuss the values that are most often reflected in budget debates. In the last section we consider practical concerns about how value preferences relate to budget choices.

FIGURE 2-1 Federal government spending by function, 1962-2007.

VALUES AND BUDGET DECISIONS

The list of values that are applicable to assessing budgets is potentially long (see, e.g., Yankelovich, 1994). We consider five that have been most prominent in recent budget debates: (1) equity or fairness, (2) economic growth, (3) efficiency, (4) physical security, and (5) the size of government.

Fairness

For many people, the distribution of public burdens and benefits is a principal measure of social justice (see, e.g., Penner, 2004; Rawls, 2001). Of course, people disagree sharply on what is fair and, looking at the same budget, will disagree in their assessments of its fairness.

Budgets affect the distribution of private income and wealth. At various times in the nation’s history and again in the past decade, many people have expressed concern about increases in U.S. income inequality and a lack of

progress in reducing poverty (see, e.g., Piketty and Saez, 2004; Sherman et al., 2009; Smeeding, 2005). Budgets can affect the distribution of income in two ways: directly, by specifying how revenues will be collected from one income group and distributed to another; and indirectly, by incorporating policies that affect economic opportunities. Over time, for example, budgets that provide education and other basic services to economically disadvantaged people can increase their chances for solid jobs and productive lives and thereby reduce income inequality.

People do not agree on the extent to which governments should aid or tax different groups differently or act to increase opportunities for particular groups. Most people argue that, as a matter of fairness, the government should support people who are unable to support themselves, including the indigent elderly and children of poor families; however, people differ on what degree or scope of support is appropriate.

In their attitudes toward social spending—including programs such as Social Security, Medicare, and Medicaid—Americans have tried to reconcile conflicting concepts of fairness: one based on what people need and another based on what people deserve.1 In trying to reconcile these two concepts, many people embrace a principle of “reciprocity,” which says that people should not get something for nothing, but should get something if they “play by the rules” (Yankelovich, 1994).

Another dimension of fairness concerns the distribution of public burdens and benefits across generations. It is difficult to measure how budgets redistribute costs and benefits from one generation to another. Many have argued, however, that the current federal budget—by failing to pay for current and expected obligations from current revenues—unfairly burdens future generations.2

Economic Growth

A budget should sustain and assist in expanding the nation’s economy, the ultimate base of resources that are available both for personal consumption and investment and to fund public goods and services. Yet there is no consensus—among either economists or policy makers—about the best policies to advance this goal under any given set of economic circumstances.

Budget choices can have large influence on future economic growth. In principle, well-targeted public investments that accelerate development and the application of new technologies or that increase education levels lead to economic growth and higher incomes on average (Romer, 1986). However, governments may have difficulty determining in advance which investments will stimulate growth and which will not. On the revenue side, many people favor tax reductions as a policy to stimulate private investment and growth; others argue for a tax structure that encourages savings and rewards pro-

ductive private investments; and still others would use higher revenues to reduce government deficits and increase national savings. In practice, the growth effects of different tax policies, like those of public investments, are uncertain and often in dispute.

The task of determining the differing implications for future growth of alternative revenue and spending policies raises a theoretical problem implicit in many budget debates. Some level of savings and investment (both public and private) is needed to ensure that the next generation is at least as well off as the present one. But the optimal balance of consumption and savings is unknown. A common view is that the United States needs a higher rate of savings and investment, both by governments and by private businesses and households, than has been the case in recent years.

Given how hard it is to estimate the effects of any given policy on economic growth, and therefore on the future income base for government revenues, most analysts recommend against simple or mechanical estimation (see, e.g., Kobes and Rohaly, 2002). The committee has followed this advice in its study. That is, we have neither adjusted our projections of future economic growth nor estimated future budget effects of changes in growth on the basis of changes in the mix of spending or the structure of revenues over time, even though modeling such relationships would be part of the ideal development of budget policy.

Efficiency

Although governments do not have a monopoly on inefficiency, many people believe that a good part of what government spends yields too little benefit to justify taking private resources for public purposes.3 Government leaders and managers are always looking for ways to identify and eliminate waste and to replace ineffective programs with more effective ones; however, there is no line in the federal budget for “waste, fraud, and abuse.” Instead, the task of improving government’s effectiveness requires collecting information about alternative uses of funds and the results they yield, and shifting efforts to the most effective uses.

Although evidence on the relative efficacy of alternative policies and programs can help reduce some budget disagreements, such evidence is often lacking or, at best, limited. When even experts are uncertain about the relative effectiveness of different policies or programs, the best approach to budgeting and making other policy choices is to be flexible, to continually test policies against experience, and to remain open to new information about their efficacy. Rigorously evaluating what works can contribute to more efficient use of the public’s dollars if the findings are applied to future budget choices and program reforms.

The federal government has historically used only a small fraction of

its budget to evaluate the effectiveness of its programs, although in recent years agencies have invested more effort in finding better ways to measure their performance. Thus, information about program effectiveness is slowly improving. The Government Performance and Results Act of 1993 (GPRA) provided federal agencies with the legal framework for this strategic approach, the Obama Administration’s 2010 budget calls for “establishing a comprehensive program and performance measurement system that shows how Federal programs link to agency and Government-wide goals” (U.S. Office of Management and Budget, 2009a:9).

In principle, this approach can lead to improved results. In practice, the goal of a performance-driven budget process remains elusive. The intense budget pressures of the looming deficits and debt are likely to put a premium on more efficient use of the public’s resources. Possible reforms to reinforce a performance-driven budgeting approach are discussed in Chapter 10.

Security and Risk

Ensuring physical safety, including security from external attacks and internal disorder, is perhaps the oldest and most fundamental objective of national governments. People must be safe before they can pursue other values. The value of security often focuses attention on government’s efforts to provide for national security and fight crime; but, viewed broadly, security can be a product of many policy choices, including those to provide the basic means of survival to people who cannot provide them for themselves. In the modern era, the most common view of government’s responsibility for security has expanded to include responsibility to provide a minimum level of economic security to all. Even as the budget constraints have increased, many people and policy makers seek to expand health insurance coverage or other federal programs that protect households against financial shocks or economic losses—policy changes that would increase spending but provide greater income security to many people.

Size of Government

Debates about the size of government reflect both a basic value question and a practical one. They have been shorthand for disagreements about whether or not government can be a positive instrument to promote values of equality, freedom, and security (Madrick, 2009). However, government actions can either expand or limit freedom and choice, and the relationship between government’s size and these values is quite complicated. Debates about the proper size or scope of government have also been shorthand for disagreements about government power and intrusiveness. On a practical

level, size is also a question of how much spending the society is able or willing to pay for through current taxes or by borrowing.

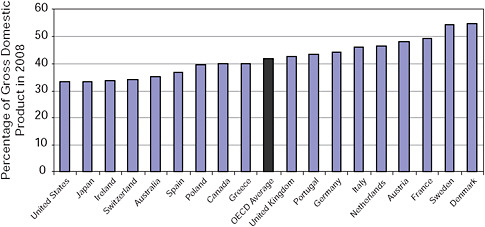

The government’s size is commonly measured by comparing the levels of federal government spending and taxes with the size of the economy, that is, as a percentage of GDP. By this measure, government (including state and local governments) is smaller in the United States than other affluent countries; see Figure 2-2. However, as discussed below, this is only a crude measure of government’s reach and influence on society and the economy. For one thing, the U.S. federal government makes more use than many other countries of special provisions in the tax code (tax expenditures) that reduce revenues and do not add to spending but do enlarge the role of government, increase deficits, and may distort private choices (Minarik, 2010); this aspect of the budget is discussed more fully in Chapter 8.

As detailed in Chapter 1, the federal government is currently spending much more than it has in the past: even if substantial and difficult reductions are made in the rate of spending growth, spending will rise. A bigger federal government will have major implications for individuals, businesses, and state and local levels of government. This development will renew and intensify old debates about the proper size and reach of the federal government.

The government can also affect individual and business behavior outside of the budget in many ways—for example, through policies that protect personal privacy or regulate the operations of financial institutions. Such laws and mandates have the effect of increasing the role of the federal government, but without increasing federal revenues and spending. Health policy illustrates how similar objectives can be pursued either through or

FIGURE 2-2 General government total tax and nontax receipts as a percentage of nominal GDP in 2008.

outside the budget: the two approaches may yield similar public benefits but with widely different effects on spending and revenues; see Box 2-1. Disagreements about which approach to take are not differences about the value of health or about providing access to better care, but about the best way to do so.

People who believe that equity or fairness gives people first claim on the money they earn (or inherit) often favor smaller government: they therefore require that a strong case be made before the government takes money, usually through taxes, for public goods and purposes. Although they may believe it is appropriate for government to help people who have no or limited capacity to take care of themselves, they may demand a high level of proof of need. People with a strong view of individual claims also often see social benefit in asking people to exercise more personal responsibility. This view leads them to argue for relatively less spending on many social programs. They also are likely to believe that high marginal tax rates discourage private investment and work effort. They stress the inefficiency

|

BOX 2-1 Health: An Example of Values and Choices For some people, health policy is about basic value choices: the extent of government’s responsibility for individuals’ physical well-being and what constitutes fairness in treating people of different means who face similar health problems. However, most health policy debates focus on more practical questions, such as:

Knowing how a person values health does not necessarily indicate that person’s stand on specific policy questions, such as whether the government should spend more or less on health care relative to other goals, or how to pay for it. If the choice is to increase spending for health, it can be done in various ways. Larger subsidies for health can be added to the budget and paid for by increased revenues or increased borrowing. Or tax subsidies can be provided to employees by allowing their employers to exclude health insurance coverage for them from their business’s income, thus lowering their tax obligations. This is the equivalent of adding subsidies on the spending side of the budget, but it has the effect of reducing income tax revenues instead. Or the government may simply mandate that employers pay for their employees’ health care, without offering a subsidy. All these options may have the same effect on health care access and health, but only the first would increase the government’s direct spending on health. |

and ineffectiveness of many spending programs. Moreover, they often argue that government programs impose a burden on the economy by increasing the cost of private investment and perhaps diverting resources to uses that do not contribute to growth. Therefore, in evaluating government spending proposals, they look for evidence that those programs produce benefits that at least exceed their direct costs (see Trenchard and Gordon, 1995).

On the other side are people who believe the government has a basic responsibility both to help individuals with limited capacities or opportunities and to foster a variety of public benefits, including building a society where more people can achieve their dreams. From this perspective, they tend to support government interventions to expand opportunity for personal economic and social achievement, as well as to shield people from events that can negate their efforts. This leads them, often, to support a larger and more robust government than those with different views. In defining a role for government social spending and regulation of private economic activity, they are more likely to emphasize flaws in the way markets function, leading perhaps to highly unequal incomes or to underproduction of public goods, such as training and basic research, needed for optimal growth. They view taxes as a worthwhile price to pay for increased collective benefits, including the opportunity to live in a just society (see Rawls, 2001).4

With regard to many federal responsibilities, people with relatively little confidence in the government’s ability to spend or invest wisely favor reducing the government’s role, as far as possible, to the basics—chiefly, defense and homeland security and environmental and public health protection when clearly justified. In contrast, people with more confidence in government’s capacity to use resources wisely often argue that there are economic justifications and unfulfilled demands for public programs that cannot be met either privately or at a community level. They often believe that government is underinvesting in certain areas—notably education, basic research, and infrastructure—that they expect to have large future payoffs that will benefit both society broadly and many individuals.

Views of the proper size of government also affect views on revenue policy. People who believe taxes are a drag on the economy’s efficiency or on individual and business incentives to work and invest generally favor low marginal tax rates and lower overall levels of taxation. Economists have tried to assess this contention. A recent analysis of many empirical studies finds no clear relationship and offers a variety of possible explanations; see Box 2-2. In contrast, people who put more emphasis on the tax system as a means to overcome some of the inequalities of wealth and unequal opportunity favor a progressive tax structure, that is, one with high marginal rates for upper-bracket incomes. They also tend to support a relatively higher overall level of taxes to finance the government programs they believe are appropriate.

|

BOX 2-2 Government Size and Economic Growth The government’s share of the economy varies widely, even among affluent nations. It has been widely assumed that if taxes are high and used to finance increased social spending, economic growth will slow. Economic theory generally posits that taxes impose a “dead weight” loss on the economy by discouraging productive effort and that the transfer of resources to poor and elderly people prevents their use for more productive purposes. The counter vailing view is that government investments in education, infrastructure, and research and development will contribute to future economic growth. Because levels of taxation and social spending vary widely from country to country, it is possible to empirically test the two views. In such a study, controlling statistically for other factors—such as the proportion of the population of working age—that might explain international variations in growth rates, Lindert (2003) found no clear relationship. In recent years, GDP grew as fast in countries with high tax-based social spending as in others. Lindert also tried to determine why countries that tax and transfer one-third of national GDP have grown no more slowly than countries that devote only one-seventh of GDP to social transfers. He concluded that the keys to this puzzle include the following:

Whatever the explanation, it appears that merely increasing the size of government through higher taxes and increased social spending does not necessarily reduce economic growth. Much depends on specific policy choices, such as the structure of the tax system and how social programs are designed. |

In most cases, the larger size of other Organisation for Economic Cooperation and Development (OECD) country governments (as a percentage of GDP) reflects more comprehensive systems of publicly financed pension and health insurance programs. The apparently smaller public sector in the United States than in almost all other affluent countries, as measured

by revenues, is consistent with its strong traditional preference for limited government. However, it also reflects a U.S. decision to support many public purposes by means of tax expenditures, which reduce revenues while extending government’s reach.

VALUES AND PRACTICAL CHOICES

The intellectual journey from values, interests, and beliefs to budget choices can be winding and complicated. For example, some policies, if used effectively, can advance multiple goals: examples are education, health care, and the development of new technologies. Education programs have contributed to economic growth while also increasing opportunities for individual advancement. Near-universal public education has added significantly to U.S. economic growth, boosted incomes, and lowered inequality (Goldin and Katz, 2008). Increased access to good health care and public health programs that lead to communitywide improvements in health can have similarly broad effects (Bloom et al., 2001). Public investment that accelerates the development of new technologies that provide a high economic return can boost growth while advancing other important public goals. For example, investments in environmental technologies that seed new industries can provide future job growth while improving energy efficiency and reducing carbon emissions, two other policy objectives. But imprudent or wasteful public investments divert resources from more productive uses; and, quite often, it is uncertain in advance whether a particular investment will be productive or wasteful.

Revenue policies can similarly be analyzed for their likely effects on growth, equity and opportunity, and other values. Such analyses need to consider both the total tax burden for each income group and the extent to which tax provisions favor certain uses of income over others. Many people believe the federal government raises revenues in ways that unnecessarily burden the economy. For example, tax provisions that favor investments in some activities over others may distort private decisions from that which would be financially optimal. If the tax code favors more spending on housing, some people will buy more housing than they would without the tax incentive, perhaps diverting capital from more productive uses. Or if the income directed to savings is taxed at the same or a higher rate than income that is consumed, savings and investment will be lower than otherwise, leading to slower growth (see Chapter 8).

The number of goals people would like to see the government pursue, or pursue more vigorously, is long and seems always to be growing: helping end poverty; improving the justice system; providing more people with better education; fostering new technologies; exploring the universe; expanding access to high-quality health care; strengthening financial regula-

tion; preparing for and responding to natural and human-caused disasters; fostering development abroad; and many more.

In many societies over recent decades, priorities have shifted from an emphasis on economic and physical security to subjective well-being, self-expression, and the quality of life. The wealth accumulated by advanced societies allows an unprecedented share of the population to grow up taking survival for granted. Using public opinion data, Yankelovich (1994) describes how affluence has changed people’s priorities, a complicated evolution as Americans have tried to take advantage of the expanded choices that affluence brought them and find a balance with their continuing need for enduring commitments, such as family and community.

People who share common values may disagree on what role government should play in advancing those values. Conversely, because broad values do not dictate specific policy choices, people who have fundamental differences may sometimes agree on specific policies or programs. Still other differences—whether framed as value choices or not—may be driven by financial or other self-interest.

Many people are not comfortable with framing much of the policy debate about budgets as a choice between big and small government. The public’s view tends to be pragmatic: Intervention in the economy is warranted when it works, otherwise not (Yankelovich, 1994). Notably, President Obama, in his inaugural address (2009), expressed this more pragmatic view: “The question we ask today is not whether our government is too big or too small, but whether it works—whether it helps families find jobs at a decent wage, care they can afford, a retirement that is dignified.” Many people look at questions of the size of government and government programs in this practical way.

The committee proposes, in the same spirit, that people now give priority to finding practical ways to put the budget on a sustainable course. This does not mean that deeply held values and beliefs need be set aside, only that everyone recognize that agreement on prompt, prudent corrective action is needed soon to avoid an outcome that could harm everyone.

NOTES

|

|

accounting is the rate that is assumed for discounting future costs and benefits (see Nordhaus, 2009:Ch. 9): the higher the assumed discount rate, the less important are the effects of today’s spending and borrowing for future generations. |

|

|

3. Government policies also can have a major influence on the efficiency with which private resources are used. A major example is discussed in Chapter 5: one goal of health care reform is to improve the use of resources in the broader health care system. However, this aspect of efficiency is not a major focus here. |

|

|

4. Opinions on whether government’s role should be bigger or smaller often vary with personal circumstances. For example, a 2009 survey measuring attitudes about risk found that those who had experienced a financial shock or had relatively few assets not only expressed more financial insecurity but were much more likely to believe that their financial well-being depended on events mostly out of their control rather than on their own actions. Not surprisingly, they also were more disposed toward collective, government-sponsored interventions to provide financial security (Allstate/National Journal Heartland Monitor, reported in Brownstein, 2009). |