2

What Are The Facts? Do They Merit Analysis?

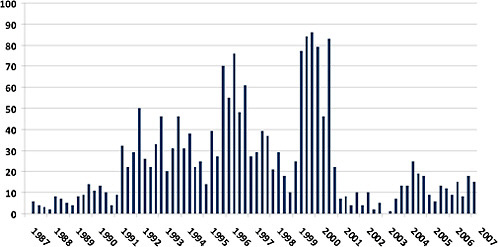

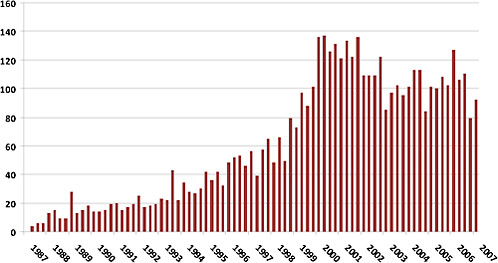

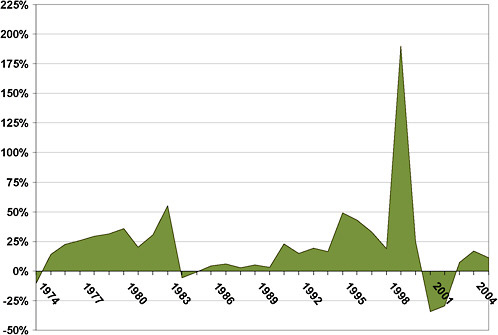

At the outset of the workshop three presenters were asked to describe what had happened to venture capital investment and investor exits over the previous decade. Josh Lerner of the Harvard Business School cited data from Venture Economics showing the bubble in venture capital fundraising between 1999 and 2002 (Figure 1), corresponding to the soaring return on venture investments in 1998-1999 (peaking at >175 percent), followed by a strikingly negative rate of return (in the neighborhood of -25 percent) in 2001. (Figure 2)

FIGURE 1 U.S. Venture Capital Fundraising (1969-2006). SOURCE: Venture Economics and Asset Alternatives.

FIGURE 2 U.S. Private Equity Returns (1974-2006). SOURCE: Venture Economics.

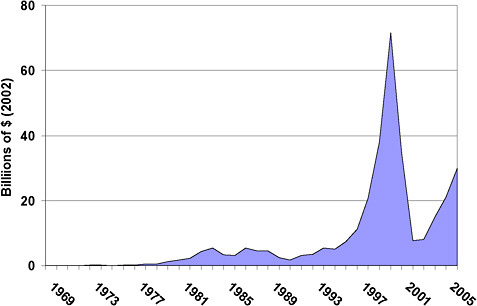

Susan Woodward, owner of Sandhill Econometrics, presented results from a proprietary set of data on approximately 20,000 venture backed firms extending back to the late 1980s—virtually the universe of such companies from the point at which they received their first round of venture funding, including those that failed and exited the market by shutting down altogether—nearly one-third of the total number of firms. Woodward’s quarterly data through early 2007 (Figure 3) show fluctuating but increasing IPO activity throughout the 1990s followed by a steep drop after the 3rd quarter of 2000, failing to recover even to the level of early 1991. Meanwhile, the number of acquisitions also grew steadily through the 1990s, peaked in 2000 and 2001 but remained quite robust through 2007. (Figure 4)

William Janeway, a partner in Warburg Pincus, presented similar data from another source showing the rise and fall in the annual number of venture backed IPOs between 1980 and 2007, and also suggesting that the median firm age at the time of going public has crept up since 2001 relative to the 1990s. (Table 1)

TABLE 1 Number of Venture-Backed IPOs and Median Age of Company at the time of IPO

|

Year |

Number of IPOs |

Med Age at IPO (yrs) |

|

1980 |

59 |

9.43 |

|

1981 |

97 |

6.05 |

|

1982 |

39 |

3.95 |

|

1983 |

196 |

4 |

|

1984 |

84 |

4.63 |

|

1985 |

76 |

3.8 |

|

1986 |

366 |

5.57 |

|

1987 |

127 |

5.35 |

|

1988 |

54 |

5.29 |

|

1989 |

65 |

6.39 |

|

1990 |

70 |

5.96 |

|

1991 |

157 |

6.66 |

|

1992 |

196 |

5.88 |

|

1993 |

221 |

6.73 |

|

1994 |

167 |

7.53 |

|

1995 |

205 |

7.47 |

|

1996 |

272 |

5.66 |

|

1997 |

138 |

6.37 |

|

1998 |

78 |

5.24 |

|

1999 |

270 |

4.31 |

|

2000 |

264 |

4.93 |

|

2001 |

41 |

6.05 |

|

2002 |

22 |

7.47 |

|

2003 |

29 |

7.83 |

|

2004 |

93 |

6.75 |

|

2005 |

56 |

6.13 |

|

2006 |

57 |

8.1 |

|

SOURCE: Venture Expert; Thomson Financial |

||

Following these presentations, there was a lively discussion of the nature of the observed changes in exit strategies. Some participants saw them as a reaction to the lowered level of investment overall in technology-based startup companies after the dot-com crash and thus as part of a regular investment cycle. Other participants emphasized the persistence of the IPO slump after the 2001 market disruption and their inability in light of other market conditions to foresee any future upturn in IPOs for technology-based entrepreneurial firms. Distinguishing cycle from trend is not the only issue. There is also the question of how volatility affects investment decisions. A deep, protracted trough can deter investments despite their having positive expected value.

In fact, there was a range of divergent views expressed at the meeting on the U.S. economy of the late 1990s and turn of the century and the role of the stock market bubble. One view considered the latter an aberration, masking the economy’s ability to continue to form new growth-oriented firms at a gradually increasing rate over time. Another view was that there was a genuine boom beneath the bubble, whose bursting halted a long term move toward entrepreneurship and initiated a new trend away from entrepreneurial founding of growth firms in the 21st century. Although few discussants embraced the latter hypothesis that the lower rate of IPOs reflected a long-term decline in the ability of the innovation system of the United States to generate growth from entrepreneurial startups, that hypothesis was not ruled out unequivocally.

Workshop chair Timothy Bresnahan, Stanford University economics professor, summarized this discussion by saying that the role of entrepreneurial growth companies and their association with expanded demand for labor in high-skill, high-wage occupations was substantial enough and the uncertainty about their future contribution was great enough to justify continuing discussion and further research, since such a secular decline would indeed be a troubling change. “Entrepreneurial firms that become established businesses have long sustained the United States’ level of aggregate economic growth and well-being,” he said. “If changes in public policy were even partly responsible for lowering the effectiveness of entrepreneurial effort and thus the incentive to undertake it, this would be a grave call for policy consideration. Nevertheless, to resolve these questions is a research task of major scope.”

Further, Bresnahan inferred from the comments of many participants that the focus of research be should be on the form of investor exit activity rather than on the annual rate of activity as the key study variable. This would help insulate the research from the large changes over this recent time period in U.S. high technology investment climate and especially from the 1999-2001 information technology boom and bust cycle.