4

Scenario Analysis

The costs and consequences of deploying PHEVs into the U.S. market were estimated by analyzing two PHEV market penetration rates, the Maximum Practical scenario and the Probable scenario. The impacts on fuel consumption and well-to-wheel CO2 emissions were then calculated using a modified version of the model developed for the 2008 Hydrogen Report (NRC, 2008). Because PHEVs will be substantially more expensive than HEVs, which are in turn more expensive than conventional vehicles, subsidies will be necessary to achieve these penetration rates, at least until vehicle costs decline sufficiently to be offset by the lower costs of driving on electricity. These subsidies are calculated for the two penetration scenarios using the expected vehicle costs from Chapter 2.

The Reference Case developed in the 2008 Hydrogen Report is used for comparing PHEVs in this report. Retaining that Reference Case for the present study allowed comparison with scenarios in the 2008 Hydrogen Report, although it precluded updating some of the numbers there such as those for oil prices, which were higher in the 2009 Annual Energy Outlook. Forecasts of energy supply and demand over such a long period are in any case highly uncertain. In particular, it is quite possible that the world production of conventional crude oil will reach a maximum during the intervening period and then go into decline, as forecast by a number of individuals and organizations.1 Other analysts predict that supplies will be ample,2 but if worldwide oil shortages cause dramatic oil price escalations during the period covered in this analysis, the world market for light-duty vehicles will change dramatically.

SCENARIO DESCRIPTIONS

In addition to the Reference Case, three other scenarios from the 2008 Hydrogen Report—hydrogen success (Case 1), advanced efficiency of conventional HEVs and nonhybrid vehicles (Case 2), and biofuels (Case 3)—are compared with the two PHEV scenarios. Portfolio cases that combine PHEVs with advanced efficiency and biofuels are also analyzed.

All scenarios describe possible futures for the U.S. light-duty vehicle fleet out to 2050 with the same total number of vehicles and vehicle-miles traveled. However, the vehicle mix over time is different for each scenario as described below.

Cases from the 2008 Hydrogen Report

Reference Case

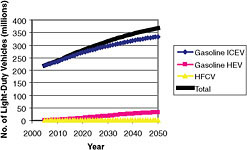

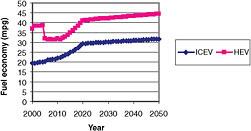

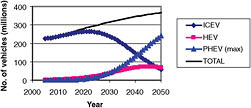

This case was based on projections out to 2030 in the high oil price scenario in the Annual Energy Outlook 2008 (EIA, 2008) for the number of vehicles and their fuel consumption, oil prices, and other factors. The committee extended the curves to 2050. As shown in Figure 4.1, conventional gasoline internal combustion engine vehicles (ICEVs) continue to dominate the light-duty sector. Gasoline HEVs gain about 10 percent fleet share by 2050. The fuel economy of these vehicles follows projections from the EIA Annual Energy Outlook 2008, meeting fuel economy standards that rise until 2020, with only modest improvements in fuel economy beyond this time. HEVs reach 44.5 mpg in 2050, while non-hybrids reach 31.7 mpg, as shown in Figure 4.2.

Hydrogen

Hydrogen fuel cell vehicles (HFCVs) are introduced beginning in 2012, reaching 10 million on the road by 2025 and 60 percent of the fleet by 2050. Initially, hydrogen is

|

1 |

For example, see U.K. Industry Taskforce on Peak Oil and Energy Security, 2008; J. Schlindler et al., 2008; R.A. Kerr, 2008; and Reuters, 2009. |

|

2 |

See the Energy Information Administration’s Annual Energy Outlook 2009, available at http://www.eia.doe.gov/oiaf/aeo/index.html, or Exxon-Mobil’s The Outlook for Energy: A View to 2030, available at http://www.exxonmobil.com/corporate/files/news_pub_2008_energyoutlook.pdf. |

FIGURE 4.1 Number of light-duty vehicles in the fleet for the Reference Case. SOURCE: NRC, 2008.

FIGURE 4.2 On-road fuel economy for vehicles in the Reference Case. SOURCE: NRC, 2008.

produced from natural gas, but over time energy sources that emit less carbon are used to produce hydrogen (biomass gasification and coal gasification with carbon capture and sequestration).

Efficiency

Improvements in engines and other vehicle technologies continue to be implemented past 2020. The fuel economy of ICEVs and HEVs is assumed to increase according to the following schedule:

-

2.7 percent per year from 2010 to 2025,

-

1.5 percent per year from 2026 to 2035, and

-

0.5 percent per year from 2036 to 2050.

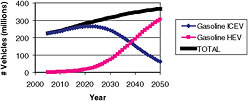

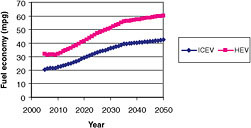

In addition, HEVs become much more important, comprising 60 percent of the fleet by 2050. The fleet mix is shown in Figure 4.3. Fuel economy for both types of vehicles approximately doubles by 2050 (Figure 4.4), when HEVs average 60 mpg and ICEVs are at 42 mpg.

FIGURE 4.3 Types and numbers of light-duty vehicles for the Efficiency Case. SOURCE: NRC, 2008.

FIGURE 4.4 Fuel economy of new light-duty vehicles for the Efficiency Case. SOURCE: NRC, 2008.

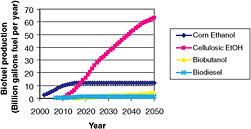

FIGURE 4.5 Biofuel supply for the Biofuels-Intensive Case. SOURCE: NRC, 2008.

Biofuels

Biofuels are introduced at a rapid rate, reaching 75 billion gallons per year in 2050 (Figure 4.5). Production of corn ethanol levels off, but cellulosic ethanol grows rapidly, reducing carbon emissions (well-to-wheels greenhouse gas [GHG] emissions for cellulosic ethanol are only 15 percent those of gasoline). Competition with food crops and indirect land use impacts on GHG emissions are not considered in this analysis.

PHEV Cases

In these two scenarios, PHEVs replace some of the vehicles in the Reference Case which is otherwise unchanged.

Maximum Practical Penetration

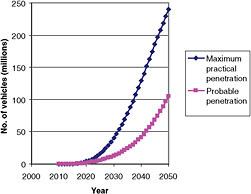

The Maximum Practical scenario uses the same annual sales rate for PHEVs as the Hydrogen Case for HFCVs except that sales are initiated in 2010, 2 years earlier.3 Auto companies are currently scheduling both PHEV-10 and PHEV-40 vehicles for introduction in that year (see Box 4.1).

This scenario assumes that manufacturers are able to rapidly increase production and that consumers find these vehicles acceptable. The Maximum Practical scenario would lead to approximately 240 million PHEVs on the road by 2050, the end of the scenario period, as shown in Figure 4.6. Such rapid penetration would require strong policy intervention because PHEVs will cost significantly more than comparable ICEVs and HEVs. At current gasoline prices, the fuel savings will not offset the higher initial cost. This policy intervention could be made in a variety of ways: mandates to vehicle manufacturers; subsidies to the purchasers

FIGURE 4.6 Penetration of PHEVs in the U.S. light-duty fleet.

|

3 |

The PHEV scenarios are described in more detail in Appendix C. |

|

BOX 4.2 Factors Affecting Deployment and Impact PHEVs will not significantly reduce oil consumption and carbon emissions until there are tens of millions of them on the nation’s roads. Whether and when this might happen is highly uncertain, in part because the following factors are still uncertain at this time:

The impact PHEVs will have for any specific growth rate also is uncertain:

Resolving such uncertainties was not possible in this study, but it will be important to consider them when planning for the future of PHEVs.

|

of PHEV (perhaps greater than the current federal tax credit of $7,500) to offset the additional costs of the vehicles; and taxes or restrictions on fuel, but these are beyond the scope of this study.4

This scenario uses the optimistic technology costs discussed in Chapter 2. If costs fail to decline to those levels, this scenario would be prohibitively expensive.

Probable Penetration

The Probable scenario represents a PHEV market penetration that the committee judges to be more likely in the absence of strong market-forcing policies to supplement the policies already in place. It also starts in 2010, but market penetration is slower than in the Maximum Practical scenario, reflecting factors described in Box 4.2. PHEVs rise to 3 percent of new light-duty vehicles entering the U.S. vehicle fleet by 2020 and to 15 percent by 2035.5 This pace would lead to 110 million PHEVs on the road by 2050, as shown in Figure 4.6.

The Probable scenario assumes the continuance of current policy incentives, which are inadequate to achieve the penetration rate in the Maximum Practical scenario. Vehicles

|

4 |

Alternatively, a sharp and prolonged rise in the price of petroleum could have the same motivational effect. However, the adverse consequences of such an event for the health of the economy could leave consumers without sufficient financial resources to purchase large numbers of PHEVs. |

|

5 |

The committee based its estimate on estimates in the America’s Energy Future (AEF) Committee report, which drew on “historical case studies of comparable technology changes” (NAS-NAE-NRC, 2009, p. 165). The AEF study estimated that PHEVs would represent 1 to 3 percent in 2020 and 7 to 15 percent in 2035. |

are more expensive in the Probable scenario because it uses the probable technology costs discussed in Chapter 2.

PHEV Portfolio Cases

Two additional cases combine PHEVs with other technologies to investigate how they may work together.

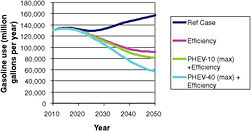

PHEV + Efficiency

This scenario is the same as the PHEV Maximum Practical Case above, except that the fuel economy of the rest of the fleet (ICEVs and HEVs) improves as in the Efficiency Case. The vehicle mix is shown in Figure 4.7. PHEVs make up 65 percent of the fleet in 2050, but 19 percent are HEVs and only 16 percent are conventional nonhybrid vehicles. This case is actually more realistic than the Maximum Practical case, because it makes little sense to invest in expensive PHEVs unless the more cost-effective efficiency measures are implemented first.

PHEV + Efficiency + Biofuels

This case adds biofuels to the PHEV + Efficiency Case above, replacing some of the gasoline used by ICEVs, HEVs, and PHEVs. The vehicle mix is the same (Figure 4.7), but the vehicles use significant amounts of biofuels instead of gasoline.

PHEV Characteristics

The PHEV-10 and PHEV-40 are the only vehicles modeled in this report. These are both midsize cars,6 as are the vehicles in the 2008 Hydrogen Report. Modeling a range of light-duty vehicles was beyond the resources of this study. Therefore, the results should be viewed as approximations. All-electric vehicles were not included in this study.

PHEVs are complicated to model because some of their energy comes from gasoline and some from the grid. The fraction of vehicle miles traveled on electricity rather than gasoline and the consumption of electricity and fuel over a drive cycle are influenced by several factors. The methodology used to calculate gasoline and electricity consumption is detailed in Appendix C. Energy consumption for all the vehicles discussed here is shown in Table 4.1.

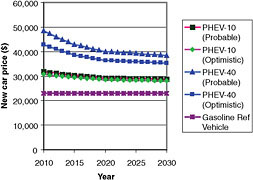

PHEV costs are as discussed in Chapter 2. The retail prices that might be expected (40 percent greater than manufacturing costs7) are shown in Table 4.2. Figure 4.8 compares these prices to those of the Reference Case vehicle. PHEV costs are significantly higher throughout the time frame of this study (2010 to 2050).

FIGURE 4.7 Number of vehicles for the Portfolio Cases, a mix of PHEVs and efficient ICEVs and HEVs, introduced at the Maximum Practical rate.

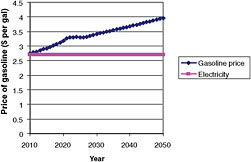

The prices of gasoline and electricity are shown in Figure 4.9. Gasoline prices rise significantly, but electricity prices do not and are here treated as constant at 8 cents per kWh for simplicity, a rate slightly lower than the national average to reflect promotional or time-of-use rates at night. A case analyzing the effect of higher electricity prices is discussed in Appendix C.

TRANSITION COSTS

Investments will be required for PHEVs to reach cost competitiveness with the Reference Case gasoline vehicle. This transition cost analysis is similar to that in the 2008 Hydrogen Report: It examines the annual cash flows to find the total investment required. Cost competitiveness is achieved in the break-even year, when the total incremental costs for all the new PHEVs bought that year is balanced by the annual fuel savings for all PHEVs on the road in comparison to the reference vehicles.8

Investment costs in this case are basically government buydowns or subsidies to cover some or all of the incremental costs in order to encourage the public to buy the vehicles. Manufacturers may at first charge less than the price needed to cover their costs when only a few vehicles are being sold, but that is unlikely to be feasible after a few years at the penetration rates envisioned here. In addition, costs would

|

6 |

The fuel economy and electric use of the modeled mid-sized PHEV cars are similar to results from Simpson (2006). The energy use is somewhat higher than projections for smaller electric vehicles such as the Volt. |

|

7 |

To make a profit, manufacturers must pass on the cost of the components they buy for their products and some fraction more. These additional costs are needed to cover their design, installation, and warranty costs, among other things. |

|

8 |

The cash flow analysis is not a discounted life-cycle cost analysis. It is an estimate of the subsidies required each year to make PHEVs appear cost-effective to the consumer and compares those to the fuel savings from all the PHEVs on the road that year. Note that PHEVs are compared to the reference vehicle, which is a nonhybrid. Consumers considering a PHEV are much more likely to compare it to an equivalent HEV, which will be significantly cheaper, get very good fuel economy, and not require daily plugging in. The committee decided to use the same Reference Case as in the 2008 Hydrogen Report to allow comparability with that study. If an HEV had been used as the reference vehicle, the incremental costs would have been lower, but so would have been the fuel savings, as shown in Figure 4.11. |

TABLE 4.1 Energy Requirements of Midsized Vehicles

|

|

PHEV-10 |

PHEV-40 |

HEV |

Conventional Non-HEV |

||

|

Control strategy, charge-depleting mode |

Blended |

Battery only |

— |

— |

||

|

Gasoline consumption, gal/100 mi |

|

|

Ref. Case. |

Efficient |

Ref. Case. |

Efficient |

|

2010 |

2.5 |

1.4 |

3.1 |

3.1 |

4.5 |

4.5 |

|

2020 |

1.9 |

1.1 |

2.4 |

2.4 |

3.4 |

3.4 |

|

2035 |

1.4 |

0.8 |

2.3 |

1.8 |

3.3 |

2.5 |

|

2050 |

1.3 |

0.7 |

2.2 |

1.7 |

3.1 |

2.4 |

|

Electricity consumption, Wh/mi |

|

|

|

|

|

|

|

2010 |

99 |

251 |

— |

— |

||

|

2020 |

76 |

193 |

|

|

|

|

|

2035 |

57 |

143 |

|

|

|

|

|

2050 |

53 |

133 |

|

|

|

|

|

NOTE: HEV and conventional non-HEV data from NRC (2008). PHEV numbers derived from Kromer and Heywood (2007). The electricity data are different from those discussed in Chapter 2 because these are more representative of a diverse fleet, and they decline over time as the vehicle becomes more efficient. Estimates of PHEV electricity consumption vary widely. Gasoline and electricity consumption for new cars, on-road, averaged over drive cycle. PHEV-10 gasoline consumption = 81 percent of efficient HEV. PHEV-40 gasoline consumption = 45 percent of efficient HEV. |

||||||

TABLE 4.2 Estimated Retail Prices of PHEVs Incremental to Retail Price of Reference Case Gasoline Car (dollars)a

|

|

PHEV-10b |

PHEV-40c |

||||

|

Optimistic |

Probable |

DOE Goald |

Optimistic |

Probable |

DOE Goale |

|

|

2010 |

7,700 |

8,800 |

|

19,800 |

25,400 |

|

|

2020 |

5,600 |

6,300 |

4,500f |

13,500 |

17,000 |

7,600g |

|

2030 |

5,100 |

5,700 |

|

12,300 |

15,500 |

|

|

OEM battery cost, $ per usable kWh |

720 |

950 |

|

720 |

1,000 |

|

|

aRetail price = 1.4 × OEM cost (see Table 2.7). An efficient ICEV would cost, at retail, about $1,000 more than the Reference Case gasoline vehicle. The retail price for an efficient HEV would be about $2,000 more than the Reference Case gasoline vehicle, as discussed in the 2008 Hydrogen Report. bBattery size (energy used) = 2.0 kWh (nameplate 4 kWh). cBattery size (energy used) = 8.0 kWh (nameplate 16 kWh). dGoal for OEM cost of battery ($500/usable kWh). eGoal for OEM cost of battery ($300/usable kWh). fCost of PHEV-10 meeting DOE goals assumes that optimistic 2030 vehicle parameters are achieved, but the battery costs $500/kWh instead of $720/kWh. For a 2 kWh battery this subtracts ($720 – $500/kWh) × 2 kWh = $440 from the OEM cost of the vehicle. Accounting for a retail price mark-up factor of 1.4, the added cost is about 1.4 × $440, or ~$600. So the retail price of the vehicle meeting the DOE battery goal is $5,100 (optimistic 2030 case) – $600 (cost reduction for lower cost battery) = $4,500. gCost of PHEV-40 meeting DOE goals assumes that optimistic 2030 vehicle parameters are achieved, but the battery costs $300/kWh instead of $720/kWh. For an 8 kWh battery this subtracts ($720 – $300/kWh) × 8 kWh = $3,360 from the OEM cost of the vehicle. Accounting for a retail price mark-up factor of 1.4, the added cost is about 1.4 × $3,360 ~ $4,700. So the retail price of the vehicle meeting the DOE battery goal is $12,300 (optimistic 2030 case) – $4,700 (cost reduction for lower cost battery) = $7,600. |

||||||

be incurred for deploying charging facilities for PHEVs.9 Unlike the analysis in the 2008 Hydrogen Report, investment costs here do not include research and development or any energy supplier costs, even though these are nonzero for PHEVs.

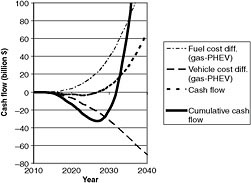

The cash flow analysis is described in Appendix C. Table 4.3 summarizes the results for the two PHEVs under the Maximum Practical penetration scenario. It also shows the results for a 30/70 mix of PHEV-40s and PHEV-10s, showing the effect of two different kinds of PHEVs in the market.

These results depend to a significant extent on the assumptions that go into the analyses. To explore these, Appendix C also includes a sensitivity analysis for the PHEV price increment, oil price, and electricity price. Break-even

|

9 |

Capital costs for in-home charging facilities are not explicitly added to the electricity cost or vehicle price in the cash flow analysis. These would likely would have a very small impact on the breakeven year or buydown cost (see Appendix C for sensitivity analysis). |

FIGURE 4.8 Retail prices for PHEVs for probable and optimistic rates of technology progress, compared to the Reference Case vehicle (conventional ICEV).

FIGURE 4.9 Price of gasoline over time and electricity price of 8 cents per kilowatt-hour. SOURCE: EIA, 2008 (gasoline price, high).

year and buydown costs are very sensitive to oil price and PHEV incremental price, as shown in Table 4.3, but much less so to electricity price. If gasoline costs twice as much as shown in Figure 4.9, with optimistic technology progress the PHEV-40 reaches breakeven in 2020 instead of 2028 and the PHEV-40 in 2025 instead of 2040. Similarly, if the even more optimistic DOE goals for battery costs are met by 2020, breakeven for the PHEV-10 is in 2020 and the PHEV-40 in 2024 (with Reference Case oil prices). These results underscore the need for battery technology breakthroughs.

Figure 4.10 illustrates the various cash flows for the PHEV-10 at the Maximum Practical penetration rate as follows:

-

The vehicle cost difference is the difference between the price of a conventional gasoline vehicle and a PHEV (see Figure 4.8), summed over all the new PHEVs sold that year. This is negative because PHEVs always cost more than conventional vehicles. It is small at first even though the cost differential is large because only a few PHEVs are sold. It continues to grow as more vehicles are sold each year.

-

The fuel cost difference is the annual difference in fuel costs for all PHEVs currently in the fleet and the same number of comparable conventional vehicles. Electricity is generally less costly than gasoline on a cents per mile basis (Figure 4.9), so this difference is positive.

-

Cash flow combines these two curves to represent the economy-wide cost per year of pursuing a PHEV introduction plan. It starts out negative because all the PHEVs sold in a year are much more expensive that the conventional vehicles they replace, but there are few PHEVs in the fleet producing fuel savings. Cash flow goes positive in 2028 (the break-even year) because the total fuel savings exceed the purchase cost differential of the PHEVs sold that year.

-

Cumulative cash flow is a year-by-year summation of the annual cash flow over time (starting in 2010). It provides a tally of the total funds that would have to be invested to make PHEVs competitive. At first, there is a negative cash flow (early PHEVs cost more than gasoline cars), but, as PHEV-10 costs come down, the negative cash flow bottoms out in 2028 at a minimum of about $33 billion, when about 24 million PHEV-10s have been produced. This minimum is the buydown investment that must be supplied to bring the PHEV-10 to cost competitiveness.

Most of the negative cash flow is due to the high price of the first few million PHEVs. This is not surprising since PHEVs initially cost a lot more than conventional vehicles. The subsidy that might be needed by automakers or buyers is the sum of the difference in costs between PHEV-10s and conventional cars, each year between vehicle introduction in 2010 and breakeven in 2028. This cumulative difference in vehicle first cost for PHEVs (as compared to a reference vehicle) is about $133 billion (averaged over the 2010-2028 buydown period, this is about $5,400 per car, or an average of $7.4 billion per year for 18 years).

Table 4.3 shows that PHEV-40s have a significantly higher transition cost than PHEV-10s because the larger battery is very expensive. The mixed cases lie between the PHEV-10 and PHEV-40 cases. Although the 30 percent of the PHEV fleet made up of PHEV-40s is costly, this is offset by the lower cost of the more numerous PHEV-10s. The break-even time is about 5 years earlier, and the buydown cost is less than for a pure PHEV-40 case.

Table 4.4 compares the transition costs for the 30/70 mix of PHEVs with the two penetration cases. Interestingly, the slower market penetration of the Probable Case gives a lower overall transition cost than the Maximum Practical Case. In the maximum practical cases, more PHEVs are bought

TABLE 4.3 PHEV Transition Times and Costs

|

Penetration Rate: |

PHEV-40 |

PHEV-40 |

PHEV-40 High Oila |

PHEV-10 |

30/70% PHEV-40/10 Mix |

|

|

Maximum Practical |

Maximum Practical |

Maximum Practical |

Maximum Practical |

Maximum Practical |

Probable |

|

|

Technical Progress: |

Optimistic |

DOE Goalb |

Optimistic |

Optimistic |

Optimistic |

Probable |

|

Break-even year c (annual cash flow = 0) |

2040 |

2024 |

2025 |

2028 |

2032 |

2034 |

|

Cumulative subsidy to break-even year (billion $)d |

408 |

24 |

41 |

33 |

94 |

47 |

|

Cumulative vehicle retail price difference until the break-even year (billion $)e |

1,639 |

82 |

174 |

51 |

363 |

— |

|

Number of PHEVs sold to break-even year (millions) |

132 |

10 |

13 |

24 |

48 |

20 |

|

aAssumes oil costs twice that in the base case, or $160/bbl in 2020, giving results similar to meeting DOE’s cost goals. bAssumes DOE technology cost goal ($300/kWh) for the PHEV-40 is met by 2020, showing the importance of technology breakthroughs as discussed in Chapter 2 and Appendix F. Reducing costs this rapidly would significantly reduce subsidies and advance the break-even year relative to the Optimistic Technical Progress cases. cYear when annual buydown subsidies equal fuel cost savings for fleet. dDoes not include infrastructure costs for home rewiring, distribution system upgrades, and public charging stations which might average over $1000 per vehicle. eCost of PHEVs minus the cost of Reference Case cars. |

||||||

FIGURE 4.10 Cash flow analysis for PHEV-10, Maximum Practical Case, Optimistic technical assumptions. The break-even year is 2028, and the buydown cost is $33 billion.

earlier, when they are more expensive, leading to higher transition costs.10 Table 4.4 also compares the transition costs of fuel cell vehicles as estimated in the 2008 Hydrogen Report.

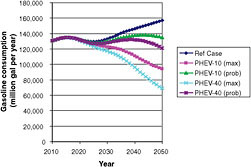

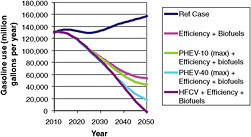

OIL CONSUMPTION

Fuel consumption was calculated for the two penetration cases with the model used in the 2008 Hydrogen Report, modified to account for PHEV characteristics and the use of two different fuels. Results are compared with the Reference Case in Figure 4.11. For the Maximum Practical Case, the PHEV-40 cuts gasoline use by 55 percent by 2050, and PHEV-10s cuts it 40 percent.11

However, much of the savings achieved with PHEVs could also be attained by HEVs, as shown in Figure 4.12, the

|

10 |

The committee used the same rate of cost reductions (Table 2.6) over time for both penetration rates. As discussed in Chapter 2, most cost reductions are likely to be from technology improvements. While economies of scale will be realized, these are likely to be modest (because Li-ion battery production is already very high) and may be offset by increases in the cost of materials with greater demand. |

|

11 |

The terms “oil” and “gasoline” are used interchangeably in this report. While not strictly accurate, reducing consumption of gasoline by one gallon will reduce demand (and imports) of oil by close to one gallon once adjustments at the refinery are accounted for. |

TABLE 4.4 Comparison of Transition Costs for PHEV and HFCV Cases

|

Penetration Rate |

30/70 PHEV-40/PHEV-10 Mix |

HFCV |

||

|

Maximum Practical |

Probable |

H2 Success |

H2 Partial Success |

|

|

Break-even yeara |

2032 |

2034 |

2023 |

2033 |

|

Cumulative cash flow difference (PHEV-gasoline reference car) to break-even year b |

$94 billion |

$47 billion |

$22 billion |

$46 billion |

|

Cumulative vehicle retail price difference (AFV-gasoline reference car) to break-even year |

$363 billion |

$179 billion |

$40 billion |

$92 billion |

|

Number of PHEVs sold to break-even year (millions) |

48 |

20 |

5.6 |

10.3 |

|

Infrastructure cost |

$48 billion |

$20 billion |

$8 billion |

$19 billion |

|

|

(In-home charger $1,000 per car) |

(In-home charger $1,000 per car) |

(H2 stations for first 5.6 million HFCVs) |

(H2 stations for first 10.3 million HFCVs) |

|

aYear when annual buydown subsidies equal fuel cost savings for fleet. bDoes not include infrastructure costs for home rewiring, distribution system upgrades, and public charging stations which might average over $1000 per vehicle. |

||||

FIGURE 4.11 Gasoline consumption for PHEV-10s and PHEV-40s introduced at Maximum Practical and Probable penetration rates shown in Figure 4.6.

FIGURE 4.12 Gasoline use for the Reference Case and the Efficiency Case and when PHEVs are included in an already highly efficient fleet, as shown in Figure 4.7.

first Portfolio Case.12 Figure 4.12 also shows the Efficiency Case from the 2008 Hydrogen Report. Gasoline use is cut by about 40 percent, mainly with advanced HEVs and no PHEVs. When PHEVs are introduced into this fleet instead of the Reference Case fleet, PHEV-10s reduce fuel consumption by an additional 7 percent and PHEV-40s by 20 percent beyond the Efficiency Case as shown by the two lower curves in Figure 4.12 for the Maximum Practical Case.

The impact on oil consumption of adding biofuels to this fleet is shown in Figure 4.13, the final Portfolio Case. Combining biofuels with advanced efficiency, including HEVs, can cut oil consumption by about 65 percent compared with the Reference Case by 2050, as shown in Figure 4.13. Adding PHEV-10s to that mix can reduce consumption by another 7 percent, while PHEV-40s could account for 23 percent. Figure 4.13 also shows the results from the 2008 Hydrogen

|

12 |

A 40-mpg HEV would use 375 gallons in 15,000 miles. As noted in Table 4.1, the equivalent PHEV-10 would use 81 percent as much fuel, or 304 gallons for the same distance, a savings of just 71 gallons. The PHEV-40, which uses just 45 percent of the fuel of the equivalent HEV will do better, saving 206 gallons. The most gasoline a PHEV-10 can save relative to a 40-mpg HEV is one quart per charge (the 10 miles driven on electricity would require that much more gasoline in the HEV). If it is driven at least 10 miles and then recharged every day, the PHEV-10 would save a total of 91 gallons per year, but many drivers will not adhere to such a regular schedule. Charging more than once a day could increase these savings, but that would probably apply to relatively few vehicles, especially in the early years, when public charging stations are rare. Results from the North American PHEV Demonstration project, involving over 100 Toyota Prius conversions to PHEVs (approximately equivalent to the PHEV-10), measured an average fuel economy of 50 mpg. With the battery pack depleted or turned off, mileage was 44 mpg (DOE/EERE, 2009), about what a conventional Prius would achieve. While a converted Prius might not fully reflect the performance of optimized PHEV, these tests show that in ordinary driving, a PHEV-10 is unlikely to provide large fuel savings. Furthermore, HEVs are expected to increase their mileage, perhaps to an average of 60 mpg by 2050, reducing the benefits of PHEVs. |

FIGURE 4.13 Gasoline use for scenarios that combine efficiency, biofuels, and either PHEVs or HFCVs.

Report when HFCVs are combined with efficiency and biofuels, which could completely eliminate gasoline consumption by the light-duty vehicle fleet by 2050.13

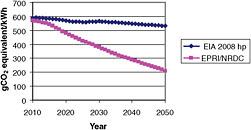

CARBON DIOXIDE EMISSIONS

PHEVs emit less CO2 because they use less gasoline than conventional vehicles, but generating the electricity that replaces the gasoline usually results in emissions. Thus, total GHG emissions from PHEVs depend on the composition of the electric grid and on the time of day for charging.14

The committee analyzed two projections for the grid:

-

A business-as-usual case, starting with the high price case from the Annual Energy Outlook (EIA, 2008) and extended to 2050 using the same growth rate for electric sector CO2 emissions;

-

A low-carbon grid projection from a joint EPRI/NRDC study (EPRI/NRDC, 2007).

The carbon emissions per kilowatt hour for both grid scenarios are shown in Figure 4.14. These projections are discussed in more detail in Appendix C.

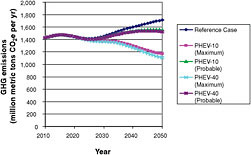

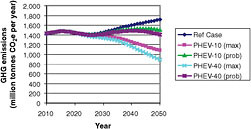

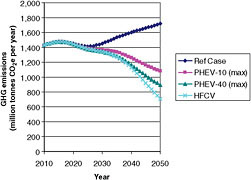

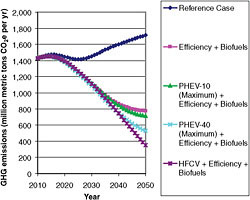

Figures 4.15 and 4.16 show CO2 emissions under the two sets of grid conditions. Emissions under the EPRI/NRDC mix are significantly lower.15 Figure 4.17 compares HFCVs to PHEVs, for the Maximum Practical Case with the low-carbon grid. HFCVs give a lower rate of GHG emissions than PHEV-10s, which still use a significant amount of gasoline. FCVs have lower emissions than PHEV-40s beyond about 2040. Low carbon emissions for both PHEVs and HFCVs

FIGURE 4.14 GHG emissions from the future electric grid. SOURCES: EPRI/NRDC estimates from EPRI/NRDC (2007), and EIA estimates from Annual Energy Outlook, 2009 (EIA, 2009a).

FIGURE 4.15 GHG emissions for PHEVs at the market penetrations shown in Figure 4.6 for the grid mix estimated by EIA. SOURCE: EIA, 2009a.

FIGURE 4.16 GHG emissions for PHEVs at the market penetrations shown in Figure 4.6 for the grid mix estimated by EPRI/ NRDC. SOURCE: EPRI/NRDC, 2007.

|

13 |

Some vehicles might still require gasoline or diesel fuel, but the use of biofuels to replace other uses of oil could more than compensate for this. |

|

14 |

This analysis did not include the additional GHG emissions from manufacturing a PHEV relative to a conventional vehicle. |

|

15 |

The reductions are only for the electricity used in the transportation sector. Total reductions from the electricity sector would be much greater than the difference between Figures 4.7 and 4.8. |

FIGURE 4.17 GHG emissions for cases combining ICEV Efficiency Case and PHEV or HFCV vehicles at the Maximum Practical penetration rate with the EPRI/NRDC grid mix.

depend on using lower carbon primary sources for electricity and hydrogen (see Appendix C).

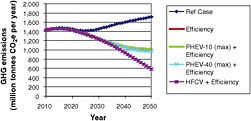

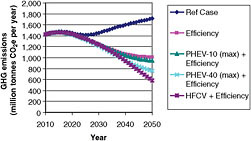

For the first Portfolio Case, Figures 4.18 and 4.19 combine PHEVs at the Maximum Practical penetration rate with the Efficiency Case for the two grid mixes. For the EIA grid mix, there is very little difference in GHG emissions between the Efficiency Case, where no PHEVs are introduced, and the PHEV-10 and PHEV-40 cases. The benefit of PHEVs appears only when a lower carbon grid (the EPRI/NRDC grid mix) is used. This highlights the importance of low-carbon electricity for gaining the potential benefits of PHEVs. The HFCV case has significantly lower GHG emissions than either of the PHEV cases for a similar level of energy supply decarbonization. That is, well-to-tank carbon emissions for supplying hydrogen can be reduced by about two-thirds by 2050 (as in the 2008 Hydrogen Report), resulting in greater CO2 reduction than when the electricity carbon emissions (g CO2/kWh) are reduced by two-thirds by 2050 (as in the EPRI/NRDC grid case). This is true because HFCVs are somewhat more efficient than PHEVs on an energy per mile basis.16

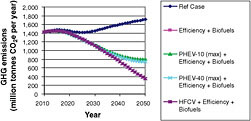

Finally, the committee estimated GHG emissions for cases that combine efficiency, biofuels, and PHEVs or HFCVs for the two grid mixes (Figures 4.20 and 4.21). Again, the importance of a low-carbon grid is apparent for the PHEVs; the GHG emissions reduction in 2050 is about 55 percent for efficiency + biofuels, 59 percent (71 percent) for efficiency + biofuels + PHEV-10s (PHEV-40s), and 80 percent for efficiency + biofuels + HFCVs. With the

FIGURE 4.18 GHG emissions for cases combining ICEV Efficiency Case and PHEV or HFCV vehicles at the Maximum Practical penetration rate with the EIA grid mix.

FIGURE 4.19 GHG emissions for cases combining the ICEV Efficiency Case and PHEV or HFCV vehicles for the EPRI/NRDC grid mix.

FIGURE 4.20 GHG emissions for scenarios combining ICEV Efficiency Case, Biofuels Case, and PHEVs or HFCVs for the EIA grid mix.

|

16 |

Furthermore, the facilities to generate hydrogen from coal or natural gas will be new and use a process that can be adapted relatively easily to carbon capture. Retrofitting an existing pulverized coal electric plant (about 50 percent of current U.S. generating capacity) with carbon capture will be very expensive. |

FIGURE 4.21 GHG emissions for scenarios combining ICEV Efficiency Case, Biofuels Case, and PHEVs or HFCVs for the EPRI/NRDC grid mix.

higher-carbon EIA grid, the GHG reduction with PHEV-10s (PHEV-40s) is about 55 percent (59 percent), about the same as for efficiency + biofuels.

SCENARIO SUMMARY

Societal Benefits of PHEVs

-

GHG and oil reductions for PHEVs are small before 2025 because of the time needed for vehicles to penetrate the market.

-

PHEV GHG benefits depend on the grid mix:

-

PHEV benefits are small compared with HEVs for the EIA grid.

-

With a low-carbon grid (EPRI/NRDC mix), introduction of PHEV-40s could significantly lower GHG emissions relative to HEVs.

-

-

Increasing conventional vehicle efficiency alone (without PHEVs) can reduce oil use by about 40 percent in 2050 compared with the Reference Case. Adding PHEV-10s at the Maximum Practical rate can reduce oil use an additional 7 percent, while PHEV-40s can reduce it an additional 23 percent.

-

Implementing efficiency plus biofuels reduces gasoline use by about 65 percent compared with the Reference Case. Adding PHEV-10s at the Maximum Practical rate can reduce oil use an additional 7 percent, while PHEV-40s can reduce it 23 percent.

-

A portfolio approach incorporating efficiency, more use of HEVs and biofuels, as well as PHEVs, yields greater reductions in oil use and GHG.

-

Long-term GHG and oil-use reductions are greater with HFCVs than PHEVs for similar levels of energy supply decarbonization (NRC Hydrogen scenario; EPRI/NRDC grid). If PHEVs are charged from the EIA grid, GHG emission reductions with PHEVs will be much less than with HFCVs.

Transition Costs

-

Transition costs and timing to breakeven are similar for HFCVs and PHEV-10s, i.e., tens of billions of dollars total, spent over a 10-20 year period. This is less than the current corn ethanol subsidy of about $10 billion per year.

-

Majority of transition cost (more than 80 percent) is for vehicle buydown. Average price subsidy needed for HFCVs and PHEV-10s over a 10-15 year transition period is similar, about $5000 to $6000 per car for PHEV-10s, and $7,000 to $9,000 per car for HFCVs.

-

Transition costs for PHEV-40s are significantly higher than for PHEV-10s, because of higher vehicle first cost. Break-even year for the PHEV-40 is 2040 in the Optimistic Technology Case, but not until 2047 for the Probable Case, unless the oil price is high or the cost of batteries can be reduced rapidly.

-

Slower Probable Case transition strategies sometimes have a lower overall transition cost than the Maximum Practical Case. This is true because the Maximum Practical Case buys large numbers of expensive early PHEVs.

-

Transition costs are sensitive to oil prices and to vehicle cost increment, which depends on battery cost assumptions, but are not very sensitive to electricity price.

-

Infrastructure costs for PHEVs might average $1000 per car for residential charging.

-

Total infrastructure capital costs to breakeven are the same order of magnitude for PHEV-10s and HFCVs, although early infrastructure logistics are less complex with PHEVs.

Overall Messages from Scenarios

-

Bringing PHEVs to cost-competitiveness will take several decades and require many billions of dollars in support. Transition costs for PHEV-40s are significantly larger than for PHEV-10s, but the reduction in gasoline consumption is greater also.

-

GHG benefits of PHEVs depend on the grid mix. With a business-as-usual EIA grid mix, the benefits of PHEVs are similar to those for efficient gasoline HEVs. With a substantially decarbonized grid, PHEVs can save 4-16 percent more GHG emissions than efficient HEVs.

-

The PHEV transition cost and timing results are sensitive to the oil price and the battery cost. But even with relatively high oil prices (AEO high oil price case $80-$120 per barrel) and achievement of aggressive battery goals (similar to the DOE goals), it will take 15-20 years and tens to hundreds of billions of dollars to bring PHEV-40s to commercial success.