1

Overview, Conclusions, and Recommendations

The U.S. Department of the Interior’s Bureau of Land Management (BLM) is steward of the Federal Helium Reserve (see Box 1.1), the only significant depository of crude helium in the world. Helium is a critical component in many fields of scientific research, is needed in a number of important high-technology manufacturing processes, is indispensable to the U.S. space exploration program, and plays an important role in defense activities on the battle field and elsewhere. For many of these uses, there is no substitute for helium, so when shortages occur, operations must cease. Further, helium is a nonrenewable resource—it is found in only a few locations and many of the deposits in the United States are being depleted. Accordingly, the United States has an important interest in ensuring that critical users have an uninterrupted supply of helium. Indeed, this was the original reason for creating the Helium Reserve, and its proper stewardship is critical for ensuring that supply.

This report considers whether selling off the helium in the Helium Reserve in the manner prescribed by the 1996 Helium Privatization Act, discussed in detail below, has adversely affected U.S. users of helium for scientific, technical, biomedical, and national purposes. It examines the helium market and the helium industry supply chain and considers how the organizational and legislative framework impacts the ability of the Reserve to respond effectively to the dynamics of the helium market.

Chapter 1 surveys the committee’s findings and its conclusions and recommendations. Subsequent chapters discuss the findings in more detail. They include assessments of the supply chain for helium (Chapter 2), the demand side of the

|

BOX 1.1 What Is the Federal Helium Reserve? The Federal Helium Reserve, also referred to herein as the Helium Reserve or the Reserve, consists of

BLM, as operator of the Reserve, also has an interest in the partnership Cliffside Refiners LP, which owns a crude helium enrichment unit and related compression units (the “Enrichment Unit”). The Enrichment Unit, located at the Bush Dome Reservoir, is designed to produce crude helium of sufficient concentration and pressure for further refining. Pursuant to the partnership agreement, BLM is responsible for operating the Enrichment Unit. The four partners in Cliffside Refiners LP are companies that operated helium refining facilities connected to the Helium Pipeline when the partnership was founded. See Chapter 5 for a more detailed discussion of the Federal Helium Reserve. |

helium market (Chapter 3), the current and expected future sources of helium (Chapter 4), and the operation of the Federal Helium Reserve itself (Chapter 5).

INTRODUCTION

In addressing its charge, the committee was struck by the fact that although the helium market is relatively small—the amount of helium consumed domestically each year is a tiny fraction of the market for produced gases1—the helium industry is quite complex. On the demand side, helium has many different applications, some more important than others from the perspective of national interest and some impacted more directly than others by how the Reserve is managed.

The supply side of the helium market presents its own complexities. First of all, helium is a derived product (a term that will be defined shortly), which makes assessing the consequences of various options difficult. Helium is also a niche market with high barriers to entry, such that much of the supply chain is dominated by a few companies. This raises transparency and responsiveness issues when assessing the steps this committee might recommend and BLM might undertake. Finally, the existence of the Helium Reserve itself, which currently satisfies over one-half of the annual U.S. demand for helium and supplies approximately one-third of the annual global consumption, is a complicating factor. Any significant change in the amount of helium supplied from the Reserve could greatly impact its availability and pricing. All of these factors must be taken into account in assessing whether selling off the Helium Reserve in the manner prescribed by law has had any adverse effect on important users of helium in the United States.

This chapter begins with a discussion of why helium has become so important to such a disparate set of activities. It goes on to briefly describe the sources of helium and how it is extracted from natural gas, refined, and moved through the supply chain to the end users. Next, the chapter proceeds to the market issues surrounding helium and how they affect the committee’s assessments and recommendations. The important role played by the Reserve in meeting both domestic and foreign needs is then discussed, including how BLM’s operation of the Reserve affects the market. In response to the charge to the committee, included in this discussion is an assessment of the predictions of the 2000 Report (National Research Council, 2000) in light of developments in the helium market during the last decade. The chapter ends with recommendations that address some of the shortfalls in current actions and some final, concluding remarks.

DEMAND FOR HELIUM

Applications

The many uses for helium arise from its unique physical and chemical characteristics—specifically, its stable electronic configuration and low atomic mass. Among those unique characteristics are the temperatures at which helium undergoes phase transitions. Helium has the lowest melting and boiling points of any element: It liquefies at 4.2 Kelvin and 1 atmosphere and solidifies only at extremely high pressures (25 atmospheres) and low temperatures (0.95 Kelvin). These characteristics have led to many cryogenic applications for helium in science, industry, and government, and those uses make up the largest single category of applications by percentage of helium consumed.

TABLE 1.1 Helium Uses in the United States

|

Category |

Representative Application |

U.S. Share (%) |

|

Cryogenics |

|

28 |

|

|

Magnetic resonance imagining Fundamental science Industrial cryogenic processing |

|

|

Pressurize/purge |

|

26 |

|

|

Space and defense rocket purging and pressurizing |

|

|

Welding |

|

20 |

|

Controlled Atmospheres |

|

13 |

|

|

Optical fiber manufacturing Semiconductor manufacturing |

|

|

Chromatography/lifting gas/heat transfer |

|

7 |

|

|

Chromatography Weather balloons Military reconnaissance Heat transfer in next-generation nuclear reactors Party balloons |

|

|

Leak detection |

|

4 |

|

Breathing mixtures |

Commercial diving |

2 |

|

SOURCE: USGS, 2007. These data are extrapolated from data in a USGS survey conducted by BLM personnel in 2003. Current shares are not known precisely but are expected to be approximately as shown. |

||

As the second lightest element, gaseous helium is much lighter than air, causing it to be very buoyant. When combined with helium’s chemical inertness—especially when compared with the highly flammable alternative, hydrogen—its buoyancy makes helium an ideal lifting gas. Uses that depend on helium’s lifting capability include military reconnaissance, weather monitoring, and party balloons.

Other applications draw on other characteristics of helium—its relatively high thermal conductivity, low viscosity, and high ionization potential—either alone or in combination. These applications include welding, providing controlled atmospheres for manufacturing operations, and detecting leaks in equipment providing vacuum environments to science and industry. Table 1.1 summarizes the principal applications of helium and the share of use in the United States.2 A more detailed discussion of helium’s many uses is contained in Chapter 3.

Consumption

The balance between domestic and foreign consumption of helium has shifted significantly in the past 15 years. Until the mid-1990s, substantially all helium production took place in the United States. This factor, combined with high shipping costs and limited availabilities, meant that until recently, the amount of helium consumed abroad was fairly small. In 1995, for example, over 70 percent of worldwide helium consumption was in the United States (see Figures 1.1 and 1.2).

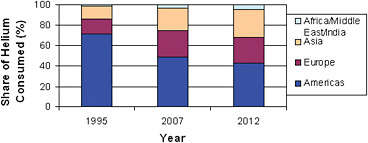

FIGURE 1.1 Helium demand, actual and forecasted, among regions of the world over time. In 1995, total volume sold was 3.750 billion cubic feet (Bcf); in 2007, total volume sold was 6.335 Bcf, and in 2012, it is expected to be 6.5 Bcf. SOURCE: Cryogas International.

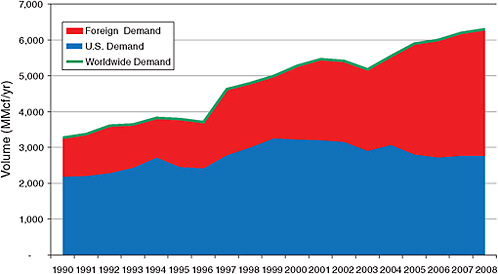

FIGURE 1.2. Consumption of refined helium in the United States (blue), in other countries (red), and worldwide (green line) for the years 1990 through 2008. SOURCE: Cryogas International.

Since that time, the demand for helium in the United States has remained fairly constant but has grown significantly elsewhere, reducing the U.S. share of total consumption. Foreign growth has been assisted by the opening of several helium-producing facilities outside the United States as well as by improved capabilities in the short-term storage and handling of refined helium. This period also saw a significant increase in industrial applications, principally in semiconductor and optical fiber fabrication facilities outside the United States, and the shifting of industrial facilities that use helium from the United States to foreign countries. By 2007, United States helium consumption had dropped to below 50 percent of worldwide demand. Despite a slight downturn in overall demand for helium associated with the global recession in 2008-2009, the committee believes, based on recent trends, that foreign demand should continue to increase relative to demand in the United States, such that U.S. relative consumption is expected to drop even further by 2012, to 43 percent.

SUPPLY OF HELIUM

Sources

Helium is the second-most-abundant element in the universe, but its diffusive properties mean that atmospheric helium leaks into space, rendering it relatively scarce on Earth.3 At only 5.2 parts per million (ppm) in air, it is not economically feasible to extract helium from the atmosphere using current technology. Rather, the principal source of helium is natural gas fields. Helium nuclei (or alpha particles) are produced in the radioactive decay of heavy elements such as uranium and thorium, located in Earth’s crust. While most of these helium atoms find their way to the surface and escape, a small fraction are trapped by the same impermeable rock strata that trap natural gas. Such natural gas usually consists primarily of methane and secondarily of ethane, propane, butane, and other hydrocarbons and various other contaminants, including H2S, CO2, and He.

Recovery of Helium

There are three different situations in which helium contained in natural gas may be economically recovered:

-

Helium may be extracted as a secondary product during the primary process of producing methane and natural gas liquids (NGLs) such as propane, ethane, butane, and benzene.

-

For natural gas fields with sufficient concentrations of helium and other nonfuel gases such as sulfur and CO2 to economically justify their extraction, the gas in those fields may be directly processed for the nonfuel constituents.

-

Helium may be extracted during the production of liquefied natural gas (LNG), which consists primarily of liquefied methane.

For the first two recovery processes, current technology requires threshold concentrations of 0.3 percent helium before separation of the helium is commercially feasible. For the third process, the helium is extracted from the tail gases, the gases that remain after the methane has been liquefied. The helium concentration in those tail gases is much higher than in the original gas, allowing the economical extraction of helium even through the original natural gas might contain as little as 0.04 percent helium.

In the first two processes, the final product—refined helium—typically is produced in two steps. First, the natural gas goes through several stages in which water, methane, and the NGLs are removed, producing a gas containing 50-70 percent helium, commonly referred to as crude helium. For extraction facilities not connected to the Helium Pipeline, the crude helium then immediately undergoes further separation and processing, generating a refined helium end product of varying purity (from 99.99 to 99.9999 percent helium). Refining the tail gases in the last of the three extraction processes presented above is similar to the processing of crude helium just described.

Crude helium extraction facilities connected to the Helium Pipeline have two options: (1) immediately transporting the crude helium to an adjoining helium refining facility, or (2) compressing it for transport through the Helium Pipeline to another refining facility connected to the Helium Pipeline or for transfer to the Bush Dome Reservoir for storage. Once stored, it can later be retrieved and further processed to produce refined helium.

Helium Supply Chain

After being refined, helium is transported to end users through a fairly complicated supply chain. In the United States, the helium typically is liquefied and delivered by refiners either to their transfill stations situated throughout the United States or to distributors of industrial gases. This transportation is handled using expensive domestic tanker trucks or bulk-liquid shipping containers standardized according to the International Organization for Standardization (ISO), each of

which holds approximately 1.0 to 1.4 million cubic feet (MMcf) of helium.4 While some of the largest helium users contract directly with a refiner for their helium purchases and deliveries, most sales to end users are through the retail division of a refiner or a distributor. The refiners and distributors then repackage the helium, either in its liquid state into dewars—evacuated, multiwalled containers designed to hold liquid helium—of varying sizes or in its gaseous state into pressurized cylinders, tube-trailers, or other modules as needed by the end users.

MARKET ISSUES

Several facets of the helium market impact the committee’s assessments and recommendations. The first is the nature of the helium sources. Helium is a derived product: Its availability principally depends on the production of other products such as methane and NGLs. This has several consequences. One is that the ability to respond to increased helium demand requires, at a minimum, additional sources of natural gas with at least threshold helium concentration. Just as important, reserves for derived products such as helium are not like primary product natural gas or oil reserves in the sense that the reserve remains in place until economic or other considerations justify recovery. Even for natural gas deposits with a relatively high percentage of helium, that helium is lost when the natural gas is extracted unless significant investments have been made in complementary helium extraction facilities.

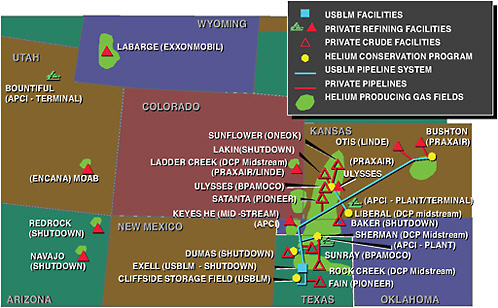

The second significant aspect of the market is the concentrated nature of the supply chain, at least through the refining stage. Because the market for helium is highly specialized, with far fewer customers and dollars generated than by markets for natural gas and crude oil, and requires specialized and expensive equipment for producing and transporting the helium, essentially all crude helium is refined and made available to the rest of the supply chain by a very limited number of companies (see Figure 1.3). The United States has 10 refining facilities owned by 8 companies. Only 6 of those facilities, owned by 4 companies, are located on the Helium Pipeline, and only these 6 facilities can process the federally owned crude helium stored in the Bush Dome Reservoir. These facilities also have access to crude helium extracted from natural gas in deposits near the Helium Pipeline—largely in the Hugoton natural gas field spanning Texas, Oklahoma, and Kansas. The helium from those fields is produced as a by-product of methane and NGLs (the first of the three helium extraction processes described in the section on recovery).

FIGURE 1.3 Map of the helium supply sources and major facilities in the United States. SOURCE: Air Products and Chemicals, Inc.

ExxonMobil owns a stand-alone crude helium extraction facility near Shute Creek, Wyoming, that has the largest helium refining capacity in the world. It processes natural gas in fields near the facility to recover non-fuel gases such as helium and CO2. The remaining three helium refining units are small facilities in the western part of the United States that produce helium under one of the first two described extraction processes.

The concentrated nature of the segment of the helium market that purchases and refines crude helium has several effects. First, and most important, there is no actual “market” for crude helium, in the sense that potential purchasers and sellers engage in publicly ascertainable bids and sales of crude helium, with the price fluctuating depending upon the relative numbers and interests of those participating. Consequently, there is no market price for crude helium. Rather, other than the public sales of federally owned helium from the Bush Dome Reservoir, discussed in the following section, all sales of crude helium involve negotiations between a fairly small number of companies engaged in refining and a similarly small number of companies producing the crude helium, and the terms, including the prices at which crude helium is sold, are not typically made public. Second, given that refining the helium must take place at one of the facilities connected

to the Helium Pipeline, the limited number of potential processors of federally owned crude helium place significant restrictions on alternatives to the current sale procedures being followed by BLM.

The final complicating facet of the helium supply chain is that because storing large amounts of helium is quite expensive, suppliers and end users generally do not stockpile it. Other than the Bush Dome Reservoir there are no significant long-term helium storage systems in the world.5 The average amount of time that helium is in the supply chain, from the time it is separated from natural gas until it is delivered to the ultimate consumer, is between 45 and 60 days, so that any significant disruption in the supply of crude helium to refiners or the processing of that helium into refined helium is felt almost immediately by end users.

FEDERAL HELIUM RESERVE

The federal government has been extensively involved in the production, storage, and use of helium for almost as long as there have been commercially extractable sources of helium. This involvement began in the early decades of the 20th century, shortly after it was discovered that gas fields in the middle of the U.S. continent contained sufficient concentrations of helium to justify separating the helium from the natural gas. In the early years, helium principally was used for its lifting capability, as a safe alternative to highly flammable hydrogen. By the mid-1920s full-scale production facilities had been built and were being operated by the federal government to support its lighter-than-air aviation programs.

Although much of the infrastructure predates the cold war, the Federal Helium Reserve as a program, including establishment of the Bush Dome Reservoir as a crude helium depository, was established in 1960 as part of the country’s cold war efforts. The Reserve was intended to provide a ready and uninterruptible supply of helium for the rapidly expanding needs of defense, the burgeoning space program, and scientific research. The federal government encouraged private companies to invest in helium extraction facilities and invested significant sums in purchasing helium. However, by 1973 it was apparent that the consumption of helium was significantly less than the amounts that could be purchased by the U.S. government. At that time over 35 Bcf had been placed on deposit in the Bush Dome Reservoir, many times the approximately 650 MMcf of helium being consumed annually at the time (Bureau of Mines, 1973). Consequently, the U.S. government quit accumulating any crude helium, and for the next 20 years, the net amounts

of crude helium placed into storage in the Bush Dome Reservoir roughly equaled the amounts withdrawn.6

The 1996 Helium Privatization Act

In an effort to resolve outstanding issues associated with the Federal Helium Reserve, Congress enacted the Helium Privatization Act of 1996 (P.L. 104-273) (hereinafter the 1996 Act). The principal directive of the 1996 Act is that all but 600 MMcf of the helium on deposit in the Federal Helium Reserve should be sold by January 1, 2015, at prices sufficient to repay the federal government in full for its initial outlays for the helium, plus interest.

The 1996 Act also created what is referred to in the helium industry as the in-kind program (50 U.S.C.S. §167d(1)). Before the 1996 Act, federal agencies were required to make their major helium purchases directly from BLM’s predecessor, the Bureau of Mines (BOM).7 Because the 1996 Act required that BLM shut down its helium refineries, it established a program by which federal agencies and their contractors that use helium must meet their helium needs by buying refined helium from a private company that, in turn, is required to purchase a like amount of crude helium from BLM. The price for helium under this program is on a cost-plus basis, whereby the private company charges the federal agency or contractor the BLM cost of crude plus the company’s costs of refining and transporting the helium, together with a profit. Importantly, purchasers of refined helium under the in-kind program are entitled to priority treatment in the event of helium shortages.8 Current regulations restrict access to the in-kind program to federal agencies or contractors with federal agencies that use more than 200 Mcf of gaseous helium

|

6 |

Part of the rationale behind the value of the Bush Dome Reservoir is that it can serve as a fly-wheel for the storage of crude helium that has been extracted but is not immediately in demand. The effectiveness of that usage is evaluated in more detail in Chapter 5, in the section “Efficiency and Conservation Benefits of the Flywheel.” While the committee supports the idea of having the reservoir available to serve as a flywheel, it has not been able to obtain any data indicating it was ever used as such. |

|

7 |

Shortly before enactment of the 1996 Act, Congress passed legislation closing BOM. In that legislation, BOM’s responsibilities with respect to the federal helium program were transferred to the BLM, which also operates under the Department of the Interior. Available at http://www.doi.gov/pfm/par/acct1995/ar1995bom.pdf. |

|

8 |

In addition to the mandatory sale provisions of 50 U.S.C. §167d(1), the subsequent subsection, 50 U.S.C. §167d(2), authorizes BLM, as agent for the Secretary of the Interior, to sell crude helium for Federal, medical, scientific, and commercial uses in such quantities and under such conditions as [the Secretary of the Interior] determines. According to BLM s representatives, no provisions have been made for the optional sale of helium under this portion of the 1996 Act. |

or more than 7510 L of liquid helium per year.9 Chapter 5 discusses the in-kind program in more detail.

NRC 2000 Report

The final section of the 1996 Act directed that the National Academy of Sciences be retained to review the 1996 Act and to assess its likely effects on the future price and supplies of refined helium. The report from that review, the 2000 Report (National Research Council, 2000),10 concluded, among other things, that the 1996 Act would not have a substantial impact on helium users. The authoring committee found that the helium market was in an extended period of stability and that no drastic increases in the price of helium or shortages of supply had occurred since the mid-1980s. It also found that because the price established by the 1996 Act for the sale of federally owned crude helium was significantly higher than the then-current prices for privately owned crude helium, and because the helium refineries on the Helium Pipeline were under long-term contracts with the natural gas companies establishing the prices they would pay for privately owned crude helium, it was highly unlikely that the refining industry would buy gas from the Helium Reserve, other than as a last resort to meet unanticipated customer demand or to satisfy obligations under the in-kind program to supply the helium needs of federal agencies.

The committee that wrote the 2000 Report made several recommendations. Among those recommendations were the following. First, it recommended that BLM commission reviews of the helium industry if drastic increases or decreases in helium capacity or use occur, but in any event every 5 to 10 years. Second, it recommended that BLM improve its methods for tracking helium capacity and use, so that adequate information would be available to assess important shifts in the industry. Third, it recommended that BLM conduct a study to determine the adequacy of the Bush Dome Reservoir as the reserves were being drawn down and to evaluate whether the quantity of helium that was to remain in the Reserve would be able to meet future federal needs if private production were to drop temporarily. Finally, the committee recommended that the Department of the Interior develop a series of research and development projects to ensure a continued supply of helium.

POST-2000 DEVELOPMENTS IN THE HELIUM MARKET

BLM implemented several of the recommendations of the 2000 Report. It engaged a Denver-based company that specializes in reservoir evaluations, NITEC LLC, to assess its operation of the Bush Dome Reservoir. Around the same time, BLM negotiated and entered into a partnership with the four companies then owning helium refining facilities on the Helium Pipeline. The partnership, Cliffside Refiners LP, had as its principal objective the design, purchase, and installation of equipment to enrich and compress the crude helium in the Bush Dome Reservoir so that the helium could meet specifications required by the refining facilities.

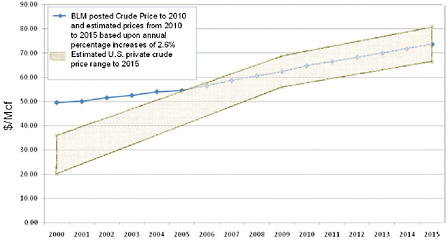

As noted in the 2000 Report, the prices charged for privately owned crude helium immediately following enactment of the 1996 Act were significantly below the prices to be charged by BLM. However, during the years following enactment of the 1996 Act, at which point the price at which BLM would be selling significant amounts of federally owned helium had been established, the prices between private parties for crude helium began to rise, either under individual contract provisions that allowed for periodic negotiations of price openers or under conditions where contract expirations required renegotiation of the contract terms. In establishing crude helium prices, the private sector, both entities connected to the Helium Pipeline and those not connected, used the BLM crude price as a benchmark, particularly during the helium shortages of 2006 to 2007. The prices at which privately owned crude helium sold have increased accordingly such that at the time of this report they were, on average, at least equal to the BLM crude price and as much as 10 percent above that level. Many if not all of the contract adjustments also include escalation terms that maintain the premium over BLM set in the adjusted price terms of the renegotiated crude contracts (see Figure 1.4).11

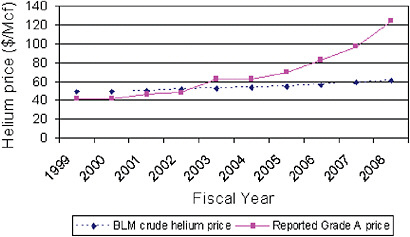

As would be expected with such increases in crude helium prices, the price reported by BLM for standard retail (or Grade A) helium has also increased, more than doubling from 2002 through 2008 (see Figure 1.5).12

In 2008, the global economy underwent a significant slowdown. One consequence was that the demand for helium, principally in the industrial markets, dropped significantly. The best estimate available to members of the committee is

|

11 |

As mentioned earlier in this section and discussed in more detail in Chapter 5, crude helium prices are not publicly available. This assessment of the relative price levels of privately and BLM-sold helium is based upon the knowledge of members of the committee. |

|

12 |

As part of its collection and reporting of data on the helium market, BLM annually reports the price of Grade A helium. According to information provided by BLM after the prepublication version of this report was released and as this report was being finalized, these reported prices are estimates, rather than a representative sampling. Further, retail prices for helium vary widely, given the range of costs associated with delivering helium to particular end users. However, the retail helium price increases reported by BLM are consistent with representative price increases obtained by committee members by sampling of scientific users of helium. |

FIGURE 1.4 Actual and projected BLM crude helium prices (blue line), with annual percentage increases from 2010 to 2015 based on an estimated Consumer Price Index shift of 2.6 percent per year. The BLM posted crude price does not include additional pipeline use and service fees that average 5 percent of the posted price. Overall trend in selling prices for privately owned crude helium (shaded areas). See text for discussion.

FIGURE 1.5 BLM crude and reported private Grade A, or standard retail, helium prices. SOURCE: USGS, 2006-2009.

that, at the time this report was written, demand for refined helium had dropped approximately 10 percent from the peak demand in 2007. However, prices for refined helium have remained substantially at the levels reached in 2007. In the judgment of the committee, the (eventual) recovery of the global economy from the 2008-2009 economic downturn is likely to result in continued growth in foreign demand for refined helium, as well as more growth of foreign supplies of crude helium.

REVIEW OF THE 2000 REPORT’S CONCLUSIONS

One of the charges to this committee is to determine the reasons for differences between the projected expectations of the 2000 Report and the actual outcomes. That charge is addressed in this section. The 2000 Report concluded as follows:

The price of helium will probably remain stable through at least 2010. The price established by the Helium Privatization Act for sales from the Federal Helium Reserve is approximately 25 percent above the current commercial price for crude helium. For this reason and because all helium refiners on the BLM pipeline have long-term take-or-pay contracts with producers of crude helium, it is highly unlikely that the refining industry will buy and use gas from the Federal Helium Reserve rather than from private stockpiles of cheaper commercial suppliers. (p. 2)

The price of both crude and refined helium did not, however, remain stable through 2010 but rose steadily in the years following the issuance of the 2000 Report, as shown in Figures 1.4 and 1.5. By 2008, private industry crude prices became approximately the same as prices established by the BLM for the crude helium in the Bush Dome Reservoir. This has led to significantly greater withdrawals by refiners on the Helium Pipeline than the 2000 Report anticipated (see Figure 1.6).

The 2000 Report made no attempt to project future demand for refined or crude helium, presumably in part because of the poor quality of data on helium uses collected by the federal government. It also did not discuss foreign demand for helium in any detail, which may have further undermined the accuracy of its predictions of stable demand. As mentioned in the preceding section, one of the main changes in the helium market since 2000 has been a surge in foreign demand for helium, combined with a decline in U.S. demand (see Figures 1.1 and 1.2).

Much of this shift in the relative growth of domestic and foreign demand appears to be linked to the slow growth or reductions in helium consumption in U.S.-based semiconductor and fiberoptic manufacturing. Both of these manufacturing-related uses of helium grew significantly since 2000 in Asia, reflecting the expansion of production of fiberoptic cable and semiconductors within the region. Asian demand is projected to grow faster than U.S. or European demand (see Figure 1.1).

Commerce Department data indicate that U.S. domestic consumption of

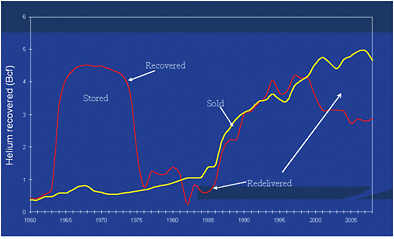

FIGURE 1.6 Crude helium recovered and removed from storage in the Bush Dome Reservoir, 1960-2008. A positive difference between the amount of helium recovered and sold in a given year constitutes an increase (by the amount of the difference) in the amount of helium stored in the Bush Dome Reservoir; a net negative difference constitutes a decrease (by the amount of the difference) in the amount of stored helium. SOURCE: U.S. Department of the Interior’s Bureau of Land Management.

helium declined during 2000-2007 at an average annual rate of 2.7 percent.13 Some of this decline reflects improved helium conservation and recycling. At the same time, U.S. exports grew at an average annual rate of 7.9 percent. Average annual growth in U.S. helium exports to Pacific Rim countries from 2000 to 2007 (6.8 percent) exceeded the growth of exports to Europe (5.1 percent).

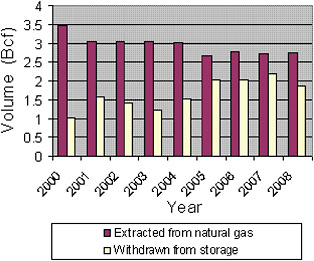

These shifts in the domestic and foreign markets result in a growing share of U.S. domestic helium being exported. The United States remains the largest single source of crude helium in the world. But the depletion of the Hugoton field, which is the principal source of crude helium for refining facilities connected to the Helium Pipeline, and the relative shifts in the prices of crude helium such that the helium sold by the BLM now costs as much as privately owned helium, mean that a growing share of U.S. “production” of crude helium has consisted of withdrawals of crude from the Bush Dome Reservoir (see Figure 1.7).

The 2000 Report’s discussion of crude helium supply focused largely on supply sources within the United States. The report argued that crude helium production from the Hugoton field would decline and production from the ExxonMobil facility in Wyoming would increase, a forecast that has proven largely accurate. The 2000 Report also mentioned the potential exploitation of crude helium associated with natural gas production in the Wyoming Riley Ridge field, and more recent forecasts

FIGURE 1.7 Crude helium production in the United States, 2000-2008, comprising helium extracted from natural gas and helium withdrawn from storage in the Bush Dome Reservoir. SOURCE: USGS, 2005a, 2009.

suggest that this source of crude helium will become significant after 2009. The 2000 Report devoted very little attention to foreign sources of crude helium beyond a brief mention of the potential production of crude helium associated with the production of LNG in Algeria.

Although foreign production of crude helium has expanded considerably beyond the levels projected in the 2000 Report, 2006 and 2007 were plagued by significant interruptions in both domestic and foreign supplies. During 2006, the unplanned shutdowns of U.S. refining facilities not linked to the Helium Pipeline, as well as a planned shutdown of the Enrichment Unit, contributed to global helium shortages and higher prices. But another important factor in the price and supply shocks of that 2-year period was the slow startup of helium production associated with new LNG production plants in Algeria and Qatar. Helium production at both locations was hampered by technical difficulties, limiting supply. Unexpected shutdowns of the helium processing plant in Russia also exacerbated supply shortages.

Conclusion. Developments in the supply and price for crude and refined helium did not follow the predictions of the 2000 Report.

It appears that some of its failure to correctly predict post-2000 developments reflected the focus of the 2000 Report on U.S. domestic supply and demand. In fact, however, the market for helium is now a global one, and the biggest demand-side shocks to this market reflected developments in foreign markets. Any future assessments of helium supply and demand must have access to better data on both U.S.

and foreign demand and supply of crude and refined helium. Moreover, the growth of foreign supply sources and the gradual decline of crude helium production in the United States from natural-gas extraction mean that foreign sources of crude helium will play a more important role in the future global market, and the performance of those supplies will affect helium price and availability for all users.

The inaccurate predictions in the 2000 Report of helium prices and supply also reflect fundamental uncertainties about both the demand and supply sides of the global market for helium, as well as the lack of publicly available data needed to project future supply and demand. Like the committee that wrote the 2000 report, this committee lacks data on characteristics and price-responsiveness of demand for helium on the part of the diverse population of industrial and scientific users, information needed to develop accurate projections of and responses to future prices. Consequently, the committee is able to provide only crude estimates of future growth in sources of supply. These uncertainties on both the demand and supply sides of the market for helium highlight an important design principle for future policy toward any federal helium program: Policies for management of this national resource must be able to accommodate shocks to the demand for and supply of crude helium.

CONCLUSIONS AND RECOMMENDATIONS FOR THE FEDERAL HELIUM PROGRAM

Having examined the global helium market, assessed the current and projected U.S. marketplace for refined helium, and assessed the role that organizational and financial factors play in meeting the goals of the federal helium program, the committee has reached some conclusions on the current situation and identified some recommendations that it believes will enable the program to respond more effectively to the helium market while also meeting national needs for this valuable national asset. More detailed discussions of the findings and rationales behind these recommendations can be found in the remaining chapters of the report.

New Policy for the Sale of Federal Helium

Both the language of the 1996 Act and its implementation by BLM pose obstacles to the optimal management of the Helium Reserve and its ability to serve U.S. national interests and the interests of U.S. taxpayers, who provided most of the resources for the construction of the Reserve and its associated infrastructure. The 1996 Act established a minimum selling price for the federally owned crude helium in the Bush Dome Reservoir. That price was arrived at by dividing the helium program’s total debt by the amount of crude helium slated for sale from 2003 to 2015. While the price is specified as the minimum price and not neces-

sarily the actual selling price, BLM has elected to sell the contents of the Bush Dome Reservoir at the minimum price, adjusting it each year by the change in the Consumer Price Index.

As was noted earlier, the BLM price initially was well above the market price for privately owned crude helium. Various factors, including significant shifts in supply and demand, caused the price of privately owned crude helium to increase steadily, reaching rough parity with the BLM price in 2007. Since that time, the price of privately owned crude helium has tracked the BLM price—in essence, BLM now is effectively setting the price for crude helium. As a result, the companies with refining facilities connected to the Bush Dome Reservoir now have access to a ready supply of crude helium at about the same price paid by other refiners not connected to the Bush Dome Reservoir. General economic considerations suggest that this effective setting of the price of crude helium by BLM’s pricing policies may retard the efforts of these and other helium refiners to aggressively pursue alternative crude helium sources, thereby negatively impacting the evolution of the helium market.

In the committee’s judgment, nothing in the 1996 Act prohibits BLM from moving toward a market-oriented pricing policy for sales of the crude helium in the Bush Dome Reservoir, as long as sales of the federally owned crude helium are priced at or above the legislated minimum. Moreover, selling the crude helium at market prices that exceed the current BLM price could enable more rapid retirement of the BLM facilities’ debt to the U.S. Treasury, a central goal of the 1996 Act, and leave more than the required 600 MMcf of crude helium on reserve in the Bush Dome Reservoir after retirement of that debt, which the committee anticipates should occur before 2015.

Several unusual characteristics of the Helium Pipeline and refinery infrastructure, however, may complicate the development of a market pricing policy for federally owned helium reserves that is both transparent and more responsive to changes in demand conditions. Any purchaser of crude helium from the Reservoir must refine the crude helium into a gas or liquid product suitable for storage, transport, and sale. Moreover, economic considerations dictate that the processing of the crude helium must take place at a refinery on the Helium Pipeline.

The six refineries on the pipeline are owned by four firms, all of which are sellers of refined helium products in global markets and three of which are shareholders in Cliffside Refiners LP.14 A market-based sales process for disposing of

the federally owned crude helium (e.g., through open auctions) almost certainly will require selling crude helium to competitors of these four firms, and any such purchaser might find it difficult to gain access to refining capacity. Market-based pricing for federally owned crude helium may not be feasible unless a policy is implemented that mandates timely access by any purchaser of crude helium to a Helium Pipeline-linked refinery.

Conclusion. The pricing mechanism used by BLM reflects the costs of the crude helium (as determined by the 1996 Act), not the value of the helium. The best data available to the committee indicate that since approximately 2007, the BLM price for crude helium has become the average price at which privately owned crude helium is being sold between private parties, and BLM, rather than market forces, is in effect, setting the price for crude helium. While recognizing the idiosyncratic nature of the helium market, the committee believes that if this situation persists, it could have several negative consequences. It could, for example,

-

Lead to inaccurate market signals, bringing about increased consumption and accelerating the depletion of the Federal Helium Reserve.

-

Retard efforts to develop alternative sources of helium.

-

Result in a net transfer of taxpayer assets to private companies.

-

Cause the sales of federally owned crude helium to subsidize exports of helium.

Conclusion. The expansion of market-based pricing of Bush Dome crude helium is hampered by the limited number of potential bidders—currently just four—whose refining facilities are connected through the federally owned Helium Pipeline to the Bush Dome Reservoir.

Recommendation 1. The Bureau of Land Management (BLM) should adopt policies that open its crude helium sales to a broader array of buyers and make the process for establishing the selling price of crude helium from the Federal Helium Reserve more transparent. Such policies are likely to require that BLM negotiate with the companies owning helium refining facilities connected to the Helium Pipeline the conditions under which unused refining capacity at those facilities will be made available to all buyers of federally owned crude helium, thereby allowing them to process the crude helium they purchase into refined helium for commercial sale.

Providing Helium for Small-Scale Science Research Communities

In addressing the principal component of its charge—namely, that it assess whether the operation of the Federal Helium Reserve in the manner prescribed by the 1996 Act has had any adverse effect on critical users in the United States—the committee notes that while rising prices and shortages have negatively impacted all users, their ability to respond varies significantly from group to group. For many of the industrial, biomedical, and larger national-security-related users, the rising costs are important but do not threaten the short-term viability of their operations. The principal exceptions to this statement are the small-scale scientific laboratories at U.S. universities and national laboratories. The committee has developed recommendations designed to address the concerns of this group of users, but the rationale for these recommendations requires some additional discussion.

The small academic laboratories typically are supported by grants from the National Science Foundation (NSF), the U.S. Department of Energy (DOE), the Defense Advanced Research Projects Agency (DARPA), and other government agencies. The grants used to support these small, helium-using laboratories usually range between $100,000 and $200,000 annually, with most in the lower end of that range. The research typically is carried out by the principal investigator (normally a faculty member at a research university), one or two graduate students, and—possibly—one or two postdoctoral fellows. Small-scale research projects at national laboratories that use helium receive slightly more funding—$250,000 to $1,500,000—that typically is awarded through the internal budgeting processes of these laboratories but is ultimately provided by the principal funding agencies mentioned above. The research is carried out much like university-based research but with technical staff—typically three or four full-time staff members rather than students—as the main workforce.

The annual consumption of liquid helium in the typical low-temperature physics research program is between 5,000 and 10,000 liters of liquid (1 liter of liquid expands to approximately 27 standard cubic feet of gas). Most of the research facilities at academic institutions are not included in the in-kind program but rather purchase their helium from local distributors. Research programs at national laboratories typically receive their liquid helium by participating in the collective purchasing procedure of the particular national laboratory with which they are affiliated. Many of these purchases take place through the in-kind program. The cost to an individual research project is the carry-through cost associated with purchasing and delivering the amount of helium consumed by that project.

Even before 2006, when liquid helium was priced at $3 to $5 per liter, liquid helium costs accounted for a substantial fraction of the grants. Since 2006, the cost of liquid helium has more than doubled and at the time of this report is between

$7 and $10 per liter. Thus, including indirect costs such as overhead charges, the annual cost of liquid helium for one of these programs is between $35,000 and $100,000, or as much as one-half of the entire operating budget of a university-based laboratory. While such increases make up a smaller percentage of the budgets for national laboratory projects, the $25,000 to $50,000 increases in annual helium costs create significant budget constraints for those projects as well. This can leave investigators in the undesirable situation of having to choose between delaying the purchase of needed equipment or forgoing research because of the inability to pay—in the case of university-based researchers—the stipends of graduate students or the salaries of postdoctoral researchers or—in the case of national laboratory-based researchers—the salaries of technical staff.15

Committee members conducted an informal poll of approximately 40 research programs at universities and national laboratories that use helium and learned of interrupted supplies of liquid helium for almost half of these programs, with some of the interruptions lasting for weeks at a time during the late summer and fall in 2006 and 2007. While these results are anecdotal, they clearly indicate that general shortages directly impact this community of users. Further, such shortages have significant adverse affects on users for small-scale scientific purposes. Because liquid helium continuously evaporates, these researchers must take small (100-200 liters) deliveries of liquid helium weekly. Shortages such as those experienced in 2006 and 2007 forced many researchers to abruptly halt their ongoing experiments, with adverse impacts. For these experiments to resume, the investigators must slowly return to operating temperatures, recalibrate their instruments, conduct background studies, and take other steps that often require weeks of extra work before they are able to resume their studies.

A small fraction of these researchers are in a less stressful situation, as their universities have campus-wide helium gas recovery and liquefaction systems to recycle the helium gas boiled off from cryostats. Access to such a system effectively cushions this group from short-term market interruptions in liquid helium supplies. Since the recovery rate of these systems typically is around 89 percent, the savings in the cost of purchasing helium can be substantial. However, the precise savings depend on the total consumption of the university and how the university accounts for the salary of the technician(s) that run(s) the liquefaction plant and for other infrastructure costs.

In summary, a small-scale laboratory or a typical project at a national labora-

tory on a fixed budget that faces increased helium costs and volatile supplies suffers major consequences—fewer funds are available to educate and train its students and postdoctoral researchers, and its research efforts are likely to be interrupted. These issues have serious long-term implications, hampering the training of future scientists and retarding the development of technologies that draw on research advances in these laboratories.

Conclusion. The majority of helium users at U.S. universities and national laboratories are funded by the federal government through grants. Many of the users, especially at universities, are not covered by the in-kind helium program, and some of them have had difficulty obtaining the helium they need during times of shortages, compromising fundamental research.

Conclusion. Because of their limited budgets, many helium users at universities and national laboratories have been adversely affected by rising retail prices for helium. If BLM implements a market-based pricing mechanism, as recommended in this report, it is anticipated the retail price for helium will increase commensurately, which will have an even greater negative impact on those helium users. These impacts could be ameliorated at least in part, however, through a programmatic and policy change that would allow small users being supported by government contracts and grants to participate in BLM’s in-kind program.

Recommendation 2. The crude helium in-kind program and its associated customer priorities should be extended by the Bureau of Land Management, in cooperation with the main federal agencies not currently participating in the in-kind program—for example, the National Science Foundation, the National Institutes of Health, and the extramural grant programs of the Department of Energy—to research being funded in whole or in part by government grants.

In the committee’s judgment, extending participation in the in-kind program could eliminate or reduce the severity of the supply and price fluctuations encountered by many users of refined helium for small academic research since 2006. Because the price of in-kind refined helium is based on the price charged by BLM for crude helium, plus costs, these small users should face significantly smaller price fluctuations than over the past few years. Furthermore, priority access to helium in times of shortages afforded to participants in the in-kind program should remove many of the supply issues encountered from time to time. 50 U.S.C.

Section 167d(2)16 appears to provide legislative authority for such an extension of the in-kind program.

In addition to recommending that these users be allowed to participate in the in-kind program, the committee believes that longer-range planning would help to reduce the amount of helium needed for these research programs. For most experimental setups, equipment such as low-loss dewars and stand-alone reliquefiers, which condense gaseous helium boiled off from liquid helium, could significantly reduce the amount of helium consumed but their costs would exceed the budgets of most of these research programs. Because the funding agencies have a vested interest in reducing the vulnerability of small-scale users to volatility in the helium market, the committee believes that policies should be developed that will help to pay for the installation and maintenance of such equipment. While costly in the short run, recycling and recovery systems will eventually save enough money to pay back the initial costs and provide future savings, in addition to conserving helium for future uses. The committee also notes that because helium usage by this group accounts for only 2 to 4 percent of overall demand, the program would not significantly impact overall helium demand. Appendix D provides a more detailed discussion of the options available for such systems.

Chapter 3 discusses, in the context of all the different helium uses, efforts that have been taken or might take place in the future to conserve helium with respect to those uses, including discussions of possible substitutes, where applicable. The committee feels that market effects associated with significantly rising helium prices should generate appropriate conservation responses and that a more general recommendation to support conservation efforts for other parts of the helium market is not called for.

Recommendation 3. Federal agencies such as the Department of Energy, the National Science Foundation, the National Aeronautics and Space Administration, and the Department of Defense, which support research using helium, should help researchers at U.S. universities and national laboratories acquire systems that recycle helium or reduce its consumption, including low-boil-off cryostats, modular liquefaction systems, and gaseous recovery systems.

Management of the Federal Helium Reserve

For the next 10 to 15 years, the Federal Helium Reserve will provide a significant portion of the helium used domestically, and the committee believes the Reserve must be managed so that it repays U.S. taxpayers their investment in the Reserve and maintains the future availability of the helium for participants in the in-kind program and other critical users of helium in the United States. The debt associated with the Reserve should be retired prior to 2015 by selling helium and methane in the Bush Dome Reservoir.17 If BLM implements a market-based pricing mechanism, as discussed in Recommendation 1, it would accelerate retirement of the debt, allowing BLM to invest in well repairs, update infrastructure, and undertake other critical steps to properly manage the Reserve to meet national needs.

One of the principal concerns of the committee—and also a concern of the committee issuing the 2000 Report—is that the 1996 Act’s stipulation that the contents of the Bush Dome Reservoir be sold on a straight-line basis undercuts efficient extraction of the crude helium in the reservoir. Appendix F discusses some general considerations for developing a production strategy for reservoirs such as the Bush Dome Reservoir. The 2000 Report noted that unsold inventories of crude helium could build up and conflict with the straight-line language of the act if this language is interpreted as mandating that equal quantities of crude helium be sold each year. At present, capacity constraints associated with the extraction facilities for the reservoir mean that the system can sell no more than 2.1 Bcf per year.

A related concern is that while BLM has engaged a private firm to assess and advise on developing a management program for the Bush Dome Reservoir, the Reservoir’s future performance remains uncertain. Chapter 5 discusses many of these issues in detail and suggests that some of these uncertainties could be reduced by acquiring and analyzing seismic data, drilling and logging additional wells, and developing a reservoir model that includes the additional data and examines the application of modern production technology, such as horizontal wells in strategic locations. Even so, uncertainty cannot be eliminated and, given the relatively advanced age of this field and reservoir, the expenses of finding the “best” forecast might not be justifiable. However, because the future performance of the Bush Dome Reservoir is so uncertain, particularly on the downside, it would be useful for BLM to consider how to deal with reservoir performance that falls well short of the base case predictions.

Conclusion. In the judgment of the committee, the extraction of crude helium from the Bush Dome Reservoir on the straight-line basis mandated by the 1996 Act, even if feasible in the later years of the reservoir’s productive life, would be economically inefficient, might preclude access to significant amounts of helium in the Bush Dome Reservoir, and is not likely to meet the needs or interests of U.S. helium users and U.S. taxpayers.

Recommendation 4. The Bureau of Land Management should develop and implement a long-term plan that incorporates appropriate technology and operating practices for delivering crude helium from the Reserve in the most cost-effective manner. More detailed recommendations on management of different aspects of the Federal Helium Reserve are set forth in Chapter 5.

Collection of Information

One of the difficulties encountered by this committee and the NRC committee that wrote the 2000 Report was the lack of timely and sufficient information to evaluate both the supply and demand sides of the helium market and the operation of the Federal Helium Reserve. Such information is needed so that those who formulate and carry out U.S. policies on helium will have the information they need to make good decisions.

Conclusion. Efficient long-term management of the federal helium program requires that BLM have adequate information about the Bush Dome Reservoir and about current and potential sources of and demand for helium worldwide. Publicly available data for many aspects of the helium market are either incomplete or nonexistent, greatly hampering management efforts. Equally important, long-term management of the program requires that BLM have the capability to assess and respond to such data.

Recommendation 5. The Bureau of Land Management (BLM) should acquire, store, and make available to any interested party the data to fill gaps in (1) the modern seismic and geophysical log data for characterization of the Bush Dome Reservoir, (2) information on the helium content of gas reservoirs throughout the world, including raw data, methodology, and economic assessment that would allow the classification of reserves contained in specific fields, and (3) trends in world demand. BLM or other agencies with the necessary expertise, such as the U.S. Geological Survey, should develop a forecast over the long term (10-15 years) of all U.S. demand for helium for scientific research and for space and military purposes.

Recommendation 6. Unless expressly prohibited from doing so, the Bureau of Land Management should publish its database on the helium concentrations in the more than 21,500 gas samples that have been measured throughout the world and provide its interpretations of gas sample analyses, especially those reflecting likely prospective fields for helium.18

Longer-Term Needs

In addition to the short- and medium-term needs discussed in Recommendations 1-6, steps should be taken to proactively respond to longer-term needs of the principal users of helium in the United States. As discussed earlier, at current drawdown rates the amount of helium in the Bush Dome Reservoir will last, at most, for 10 to 15 more years. At that point, domestic sources of helium will not satisfy the demand of helium users in the United States; instead, domestic demand will need to be met, in part, by relying upon recently developed sources in locations such as the Middle East and Russia. While the demand of some of those users might not be deemed important or necessary, that of other users—such as government agencies, including the armed forces and NASA, scientific researchers, and certain industrial sectors—is critical to the goals and national interests of the United States. Steps should be taken to ensure adequate and uninterrupted supplies of helium for their continued use.

Conclusion. Extending the Helium Pipeline into areas known to have helium, such as parts of New Mexico and Arizona, will give potential producers of helium in those areas access to the storage capacity of the Bush Dome Reservoir and the refining capabilities of those facilities connected to the Helium Pipeline. Such an extension could encourage the development of more U.S. helium resources.

Recommendation 7. The Bureau of Land Management should promptly investigate the feasibility of extending the Helium Pipeline to other fields with deposits of commercially available helium as a way of prolonging the productive life of the Federal Helium Reserve and the refining facilities connected to it.

Conclusion. Given the reliance of global demand on the continued availability of helium from the Federal Helium Reserve for the next 2 to 3 years, there is little opportunity to significantly reduce the amount of federally owned

helium sold in the short term without interrupting the market. However, as foreign supplies of helium are expected to increase in 2009, the United States has an opportunity to evaluate whether the current policy to monetize federally owned helium remains appropriate, given recent changes in the market for helium. One alternative would be to leave sufficient helium in the Bush Dome Reservoir to provide for a multiyear U.S. reserve in the event of future market disruptions.

Conclusion. Helium is a nonrenewable resource and is valuable for a number of critical activities in science, industry, and defense in the United States. Significant changes have taken place in the helium market since enactment of the Helium Privatization Act of 1996 (P.L. 104-273)).

Recommendation 8. The congressional committee or committees responsible for the federal helium program should reevaluate the policies behind the portions of the 1996 Act that call for the sale of substantially all federally owned helium on a straight-line basis. It or they should then decide whether the national interest would be better served by adopting a different sell-down schedule and retaining a portion of the remaining helium as a strategic reserve, making this reserve available to critical users in times of sustained shortages or pursuant to other predetermined priority needs.

Further, as demonstrated by the unpredicted but significant increases in foreign demand for helium since issuance of the 2000 Report, the market for helium can be highly variable. Industrial and scientific uses that are not currently foreseen might easily arise and place critical helium users in the same tight market situation, with rapidly rising prices and periodic supply shortages as were experienced in 2006 and 2007. Conversely, one or more sources of natural gas, such as shale gas, might become an additional source of helium that could somewhat relieve tight market conditions if the helium capacity associated with it is recognized and encouraged. Steps should be begun now to develop a strategy to address these important future possibilities.

Conclusion. The variability of the helium market and its importance to critical components of U.S. scientific, industrial, and national defense sectors merits the development of a more permanent and sustained method for managing this valuable resource.

Recommendation 9. The Bureau of Land Management (BLM) should form a standing committee with representation from all sectors of the helium market, including scientific and technological users, to regularly assess

whether national needs are being met, to assist BLM in improving its operation of the Federal Helium Reserve, and to respond to other recommendations in this report.

Conclusion. The strategic reserve is a finite resource and will one day be depleted. However, the helium needs of participants in the in-kind program will continue and alternative sources will have to be found for those in-kind uses that have no substitute. One possible source is helium extracted from federal lands, such as the Riley Ridge area in Wyoming. BLM could continue to serve as the operator of an in-kind program by handling Riley Ridge crude helium in a manner similar to that currently in place for indirectly using Bush Dome Reservoir crude helium reserves to satisfy the needs of in-kind users.

Recommendation 10. The Bureau of Land Management, in consultation with the Office of Science and Technology Policy and relevant congressional committees, should commission a study to determine the best method of delivering helium to the in-kind program, especially after the functional depletion of the Bush Dome Reservoir, recognizing that this will not happen until well after 2015.

Concluding Remarks

Having heard testimony from helium users and suppliers, as well as representatives of BLM, the committee was struck by the need to commence action now in order to secure a helium supply in the not-too-distant future when the prescriptions of the 1996 Act expire. The legislative framework for the operation of the federal helium program is silent as to the management of the Bush Dome Reservoir and the Helium Pipeline after 2015, when substantially all of the federally owned crude helium stored in the Bush Dome Reservoir is mandated for disposal. It is virtually certain that much more than 600 MMcf of crude helium will remain in the Bush Dome Reservoir at the end of 2015 and most current projections foresee that this target will not be achieved until 2020 at the earliest. If BLM is unable to develop a market-based approach to pricing its crude helium sales, 2016 may arrive with more than 600 MMcf in the Reservoir and incomplete retirement of the facilities’ debt. Even if it does manage to pay off its debt by 2015, given uncertainties about future prices and the capacity of the Helium Pipeline, several important questions remain to be answered: What is to be done with the remaining crude helium? How will BLM operations beyond 2015 be financed? Should the Federal Helium Reserve, either federal or private, as appropriate, continue to exist once the BLM debt to the U.S. Treasury has been retired? Before a decision is taken, any future operations in

the reserve, which would probably continue to be at Bush Dome, would need to be studied. For the study to be feasible, the refiners on the Pipeline would need to give their support.

The committee is not in a position to answer the many questions that abound about the future of the Helium Reserve because doing so would involve policy and/or legislative decisions beyond the scope of this study’s mandate. However, the critical users of helium in the United States, whose interests are the focus of this report, deserve having these questions and others like them answered.

-

If BLM can retire its debt to the nation before selling off all but 600 MMcf, should it cease recovery operations and, possibly, leave the remaining helium stored in the Bush Dome Reservoir as a strategic helium reserve for the country? Since the sales of the hydrocarbons that are extracted along with crude helium have significantly reduced the debt, it is quite possible that BLM will be able to pay down the debt early, especially if it sells at a higher market price.

-

Can the legislation requiring helium recovery in equal annual amounts be changed to reflect how reservoirs actually perform (highest withdrawal rates in the initial years and much reduced withdrawal rates in the final years)? Such a change in legislative operational requirements could reduce but not eliminate expensive efforts to increase withdrawal rates from the Bush Dome Reservoir between the time this report is written and 2014, the final year of the stored helium recovery program.

That said, the committee has come to the following conclusion on long-term U.S. needs. The limited supply of helium from subsurface resources calls for prioritizing its use and disposition to maximize national security, space, and scientific research leadership over the long term and to promote efficient development of helium resources. Ideally, this effort would be a worldwide collaboration, although it is expected that individual countries would be pursuing somewhat different goals. The committee recognizes that the United States must take action in the following areas:

-

Make U.S. helium available, to the extent possible, for important domestic needs after the functional life of the Federal Helium Reserve is over. Because this will undoubtedly mean substantial increases in price, those funding nationally significant uses of helium will have to be committed to providing the necessary funds to purchase helium.

-

Promote the discovery in North America of new and significant helium resources.

The committee concludes that without such careful and purposeful management of the Federal Helium Reserve, the Reserve is not being exploited as well as it could be for the public good. It is clear to the committee that selling substantially all of the federally owned crude helium in the Reserve in the manner prescribed by the 1996 Act has had and will continue to have an adverse effect on U.S. users of helium.19 A new approach is required, and the committee believes that the actions recommended here are the first steps in that direction. The committee also concludes that regular and careful reviews of the program by an independent body would be valuable. Moreover, the affected interests are sufficiently broad that agencies other than BLM (including research funding agencies, the White House Office of Science and Technology Policy, and congressional committees) must be involved in periodic reviews and in the establishment of a long-term strategy for U.S. helium reserves in the Bush Dome Reservoir and elsewhere. The stewardship of this valuable national asset could be much improved.