7

Alternative Approaches to Reducing Fuel Consumption in Medium- and Heavy-Duty Vehicles

OVERVIEW

The preceding chapters this report focus primarily on the technical feasibility and cost-effectiveness of technologies aimed at improving fuel efficiency in medium- and heavy-duty vehicles. The technologies discussed represent options available for meeting a new federal fuel efficiency standard based on metrics previously discussed. However, technology alone is not the only approach that manufacturers, carriers, and operators have at their disposal to improve vehicle efficiency. Nor are fuel efficiency standards the only mechanisms available to policymakers aiming to incentivize more efficient movement of passengers and goods. The purpose of this chapter is to present alternative approaches for improving the fuel efficiency of medium- and heavy-duty-vehicle (MHDV) operations.

This chapter identifies the following set of alternative approaches and discusses their pros and cons:

|

1. Changing fuel price signals |

|

|

|

Fuel taxes Cap-and-trade: Implications for trucking |

|

2. Technology-specific mandates and subsidies |

|

|

|

Technology mandates Equipment subsidies Low-carbon fuel standards |

|

3. Alternative/complementary regulations |

|

|

|

Emissions limits Size and weight limits Mandatory speed limits |

|

4. Other complementary approaches |

|

|

|

Intelligent transportation systems Construction of exclusive truck lanes Congestion pricing Driver training Intermodal operations |

In some cases these alternative approaches can be complementary to fuel efficiency standards. In other cases these alternatives could substitute for fuel efficiency standards. For each approach a short description is provided, as well as the advantages of the approach, the disadvantages of the approach, and any potential implementation issues associated with its application. The committee recognizes that the alternative approaches included herein are complex and require a great deal more study beyond the scope of this report, particularly with respect to the potential impact on fuel efficiency improvements that each approach may have.

CHANGING FUEL PRICE SIGNALS

Fuel Taxes

The rationale for government imposition of fuel-savings standards is that trucking firms decide to implement fuel-saving technologies based on the market price of fuel, which does not include the external costs associated with climate change and fuel security. As a result, firms do not implement technologies that are socially efficient since the private return is too low. This social inefficiency can be corrected most efficiently by imposing a tax equal to the external costs. If, for example, the problem being addressed is carbon emissions, all transportation fuels should bear a tax proportional to their carbon content. If the price of fuel were higher to reflect the external costs, more fuel-saving technologies would be adopted. In addition, the higher price of fuel would lead to more fuel-efficient operations. An example is provided by the European experience. Fuel prices in Europe are significantly higher than in the United States because of higher taxes. Higher prices have not yet led to adoption in the European truck fleet of many of the more advanced technologies such as bottoming cycle and ultralight structures. However, the committee was told by one major international engine manufacturer that it decided to develop a new engine with turbocompounding for worldwide sale based on the expected payback from the higher fuel prices in Europe. The turbocompounding in this application is

expected to reduce fuel consumption by 3 to 5 percent. The European truck fleet also uses more aerodynamic fairings, relies more on driver-training for fuel-saving operations, and uses almost exclusively diesel engines, except in the lower range of Class 1. Finally, higher fuel costs would be passed on in the form of higher truck shipping rates, reducing the demand for shipping by truck and the diversion of truck shipments to other modes, particularly rail, leading to additional fuel savings.

Advantages

A tax affects the incentives associated with all of the elements in the freight transportation system. It provides incentives for technology adoption and operational efficiencies (such as reduced idling, improved driver education, etc.). These actions, in many cases, offer significant fuel savings. In addition, a tax affects the utilization of vehicles already on the road, while fuel consumption standards typically affect only new vehicles and can be implemented only slowly over time as the vehicle fleet transitions to the more fuel-efficient vehicles.

Fuel taxes would contribute toward achieving more efficient outcomes in additional ways. To the degree that demand for transportation is elastic, as discussed in Chapter 6, a fuel tax, by raising the cost of shipping, will tend to lower miles driven, thereby reducing congestion, accidents, and other driving-related negative externalities. Furthermore, increased fuel taxes would augment the highway trust fund, permitting the construction of improved transportation options, or at least offsetting the decline in revenues from reduced fuel consumption by more efficient vehicles.

Most importantly, a fuel tax economizes on the information needed by regulators. Maximizing economic efficiency requires that the marginal cost of reducing fuel consumption be the same for all vehicle manufacturers and be equal to the marginal cost of actions that vehicle operators can take to reduce fuel use. In this way, the low-cost means of reducing fuel consumption are exploited before utilizing higher-cost reduction technologies or techniques. The information needed to find the lowest-cost pattern of fuel consumption reductions places large demands on regulators when the manufacturing cost of a technology varies among manufacturers, the in-use cost varies depending on the specific use, and other measures such as driving and truck-routing procedures exist that can reduce energy consumption. A fuel tax provides incentives for private firms to take action and relies on the individual knowledge and incentives manufacturers and shippers have to reduce costs. The trucking industry is a competitive one, and the committee has found that the companies are very focused on reducing fuel costs, subject to the requirements of delivering the freight or accomplishing the particular work requirements. Furthermore, the industry is highly varied, with trucks utilized in very different tasks from long-haul freight operations to postal delivery to electric utility trucks to trash removal. Given a higher fuel price because of the tax, firms will optimize their operations to realize the greatest fuel savings while still performing the required tasks. Setting standards instead requires that regulators consider, in addition to technology options, the complexity of tasks to be accomplished, the variety of conditions under which trucks will be operated, and the changing uses over the life of the truck. A mandated fuel efficiency standard, rather than a market-based solution such as a tax, has a higher probability of counterproductive unintended consequences because of this complexity.

Finally, a fuel tax is a clear statement of the additional costs being imposed on the truck sector to accomplish societal aims, fostering transparency in the public policy process. In contrast, fuel efficiency standards can often obscure the costs to the public.

Disadvantages

Taxes involve setting a price signal and letting industry choose the most efficient means of reducing fuel consumption. In the transportation sector, setting taxes is complicated because all fuels must be appropriately priced to avoid distortions across fuel markets, for example between diesel and gasoline. The response to the tax, however, is uncertain and empirical estimates of elasticities are not precise enough to predict the resultant fuel savings. However, setting standards also involves uncertainties as to fuel savings and operational costs due to indirect effects, as discussed in Chapter 6.

In addition, a fuel tax may not provide sufficient incentive for technology development, particularly given the political difficulties associated with implementing a tax large enough to have significant incentive effects. Last, a fuel tax, while leading to immediate savings from utilization in the existing fleet, will impose costs on the fleet that were not anticipated when the investments in technology and vehicles were put in place and is likely to raise issues of equity. These issues could be accommodated by a scheduled phase-in of taxes.

Other Considerations

A variable fuel tax could be used to reduce the volatility in prices faced by trucking firms and manufacturers. For instance, a fuel tax could be implemented in a manner that would provide a price “floor” for fuel. This would reduce uncertainty and allow a clearer signal for investment in fuel-saving technologies. However, such a variable tax would create an uncertainty in the amount of dollars flowing to the highway trust fund, thus jeopardizing federal, state, and local highway construction projects. Last, a fuel tax aimed at reducing fuel consumption of heavy-duty vehicles needs to be considered in light of its impacts on the light-duty vehicle and non-road sectors.

Cap and Trade: Implications for Trucking

At the time of this writing Congress is considering enacting a “cap-and-trade” system to control the emissions of gases that contribute to climate change.1 Such a system would cap emissions at a predetermined level and issue a number of permits equal to that cap. Any controlled entity such as electric utilities or oil refineries would have to surrender a permit for each ton of CO2 emitted. The permits could be traded, so that an entity desiring to increase production and thereby emit additional tons of CO2 or other global-warming gasses could buy additional permits from a permit holder willing to sell. The market price of permits will be reflected in the cost of production and passed on to the ultimate consumer. In the trucking sector the permit price would have the same effect as a tax on fuel.

Advantages

The cap-and-trade system introduces a price on CO2 emissions, as a tax would, and provides incentives for the adoption of fuel-saving technologies as well as for the adoption of operational methods to save fuel. Applying this system over the economy as a whole it can lead to an efficient pattern of emission reduction. For example, if it is cheaper to reduce emissions from electric utilities than from another industrial plant, the electric utility will cut emissions and sell the permits it no longer needs to the industrial emitter. The industrial emitter will be willing to buy those permits as long as it is cheaper than reducing its emissions by technology or operational changes.

Once a cap is in place, regulators may have less of a need to establish fuel consumption standards for a particular covered sector. This is because any reduction in CO2 emissions coming from trucking, for example, will result in more emissions elsewhere among covered entities, so that the total emissions remain unchanged. Similar to the case with fuel taxes, this economizes on the information regulators need about technology, operating conditions, and duty cycles for trucking operations. Under a cap-and-trade system individual firms make the decisions based on their knowledge of the operations and the price of carbon emissions.

Disadvantages

By setting a cap, the ultimate emissions are known, but the cost of achieving the cap is uncertain. The cost will emerge in the market as firms consider technological and operational changes versus the cost of purchasing permits. The price will fluctuate as the demand for permits will change in response to technological developments, to changes in expectations about future economic growth and hence the demand for permits, to weather variation, and even to interest rate changes.

Introduction of a cap-and-trade system will increase governmental administrative burdens for monitoring and policing the system, supervising markets in permits and derivatives that will emerge in financial markets. Similar to the case with fuel taxes, there may be concern that the increase in fuel prices, given political limitations on how tight a cap can be legislated, will be too small to have major impacts in generating change in technology adoption.

A cap-and-trade system is designed to cap carbon or other global-warming gases, not oil consumption. While higher carbon prices will be passed on to fuel prices and reduce oil consumption, oil security concerns may require additional measures. While fuel consumption standards would reduce oil consumption, a cap-and-trade system could accommodate an additional charge within the system so as to provide the additional incentive to save oil. For example, it could be required that 1.25 tons of CO2 emissions coming from oil be traded for 1 ton of coal emissions.

TECHNOLOGY-SPECIFIC MANDATES AND SUBSIDIES

Technology Mandates

A technology mandate would be a regulation requiring operators of medium- and heavy-duty vehicles to purchase and use specified designs or models of vehicles or components. The required vehicles and equipment would be those embodying fuel-saving technologies. The regulator would establish a certification process to identify energy-efficient vehicles and components and would publish lists of complying models. The California Heavy-Duty Vehicle Greenhouse Gas Emission Reduction Regulation is the most relevant example of such a regulation.

In December 2008 the California Air Resources Board (CARB) adopted a regulation requiring certain operators of certain kinds of trucks to either use EPA SmartWay-certified tractors and trailers or to retrofit their vehicles with SmartWay-verified technologies. The SmartWay vehicles and equipment save fuel primarily through improved tractor and trailer aerodynamics and the use of low rolling resistance tires. The regulation applies to 53-ft or longer van trailers and to tractors that pull these trailers in California. Tractors that drive less than 50,000 miles per year are exempt, and tractors and trailers that operate within a 100-mile radius from a home base are exempt from the aerodynamics requirements.

Operators who choose to comply by retrofitting must equip their trailers with low rolling resistance tires and with aerodynamic fairings or other SmartWay-approved technologies. The technologies required will depend on a percentage greenhouse gas emissions reduction assigned to each device by CARB.

From 2010, when the rule goes into effect, through 2020,

CARB expects the regulation to reduce diesel fuel consumption by 750 million gallons in the state and 5 billion gallons nationwide. For comparison, diesel motor fuel purchases in California in 2007 were 3.2 billion gallons (CARB, n.d., 2009).

Advantages

Equipment mandates are seen as a simpler alternative in circumstances where a performance standard (e.g., a gallons-per-ton-mile or gallons-per-cubic-foot-mile fuel consumption standard) would be difficult to apply or enforce. From an enforcement perspective, it is often easier for regulators to confirm a manufacturer’s or user’s adoption of a technology mandate (e.g., side fairings) than to determine whether a performance metric is being achieved.

Disadvantages

Under a performance standard, the regulated party is free to adopt any combination of measures that meets the standard. Each party can be expected to adopt the most cost-effective approach for the application. Equipment mandates lack this flexibility and therefore may increase regulatory compliance costs. For example, under the California regulation, the fuel-saving benefits of required trailer fairings will vary greatly from user to user. It is most likely that some users could have obtained greater fuel savings by some alternative practice at a cost equal to or lower than the cost of the fairings. In addition, a technology mandate that is not appropriately “tuned” to the characteristics or operational aspects of a particular vehicle or class of vehicles may not achieve desired benefits due to incompatibility between the technology and vehicle use. In such cases, especially when characteristics or operations are uncertain, an emissions standard may perform better.

Equipment Subsidies

Another approach to encouraging technology adoption is to offer government subsidies. The federal government and the states have offered a variety of financial incentives to firms and individuals for purchases that reduce energy consumption. The forms of incentives include tax credits, cash grants, and credit assistance. For individuals, federal incentives for the purchase of energy-saving home improvements and for of hybrid cars are well-known examples (EPA, 2009a).

Existing programs applicable to medium- and heavy-vehicle target primarily reductions in criteria pollutants rather than GHG emissions or fuel economy, but some of these programs are also intended to promote fuel savings and the program structures could be applicable to fuel economy incentive programs. Examples include the following:

-

In California the Carl Moyer Memorial Air Quality Standards Attainment Program is a grant program that subsidizes replacement or retrofit of diesel engines in heavy trucks, locomotives, and other applications. Originally conceived to reduce emissions of criteria toxic pollutants, the program is described also as a means to reduce GHG emissions, mainly by subsidizing hybrid applications. The program has been disbursing about $14 million annually since 1998. Idling reduction retrofits are eligible for 100 percent funding, and fleet modernization (new vehicle purchases replacing older, more polluting equipment) for up to 80 percent funding. However, the subsidized equipment must exceed the emissions limits imposed on all vehicles by law, and as idling and emissions regulations have become more stringent, opportunities for truck operators to qualify for the grants have been reduced (CARB, 2008).

-

Federal grants are available under the EPA and the Clean Fuels Grant Program for hybrid deployment in trucks and urban buses (see Chapter 6).

-

A second California program is subsidizing replacement of older trucks used by drayage operators at the state’s seaports, for the purpose of reducing pollutant emissions. The program is funded at $400 million (CARB, 2008).

-

Several other states have offered financial incentive programs for installation of idle reduction devices (Leavitt, 2005).

-

American Recovery and Reinvestment Act of 2009 (P.L. 111-5) provided $300 million for federal and state programs to pay for diesel emissions reduction. A share of this will be directly available to truck operators as financial assistance for equipment replacement (e.g., through low-interest loans). The funds are administered by EPA, in part through the SmartWay Clean Diesel Finance Program (EPA, 2009b).

-

The Energy Improvement and Extension Act of 2008 (P.L. 110-343) give EPA the authority to exclude exempt idle reduction devices from the 12 percent federal excise tax on new truck purchases. EPA has certified 70 devices as eligible. The exemption is estimated to be worth $700 to $1,000 per truck to some purchasers (EPA, n.d.; Miller, 2009).

Advantages

Financial incentives may be most effective in encouraging early adoption of new technologies when the benefits are uncertain, the technology is not widely known to users, and the cost may be high because the technology is in limited production. The subsidy then transfers some of the risk from the early adopters to the public. Subsidies are also used, as the examples above illustrate, where fairness to small businesses is a concern. In the California Carl Moyers and dray-

age operator programs, part of the motivation was to avoid disproportionate harm to small businesses from stringent new regulations.

Disadvantages

Subsidies are best seen as a possible transition strategy rather than a major permanent feature of pollution control and energy-saving programs. If a significant U.S. greenhouse gas emissions reduction program is enacted, the cost burden of compliance will be ubiquitous and subsidizing these costs will be impractical except in very limited circumstances.

Low-Carbon Fuel Standard

The regulation of fuel quality and “chemistry” is not novel. The EPA currently regulates sulfur content for on-road diesel fuel, which was reduced from a limit of 500 ppm sulfur pre-2007 (40 CFR 80.29) to 15 ppm sulfur now (40 CFR 80.520). Building off the fuel standard approach, the State of California has moved forward with a low-carbon fuel standard (LCFS) that regulates the average carbon content of fuel used in the transportation sector. The LCFS has target carbon content values that will help the state meet GHG reduction goals over the next decade and beyond. As constructed in California, the LCFS is aimed at regulating fuel providers (e.g., oil refiners) and will ultimately require the introduction of larger percentages of alternative fuels in the transportation sector than would be otherwise expected. These alternative fuels include biofuels, natural gas, and electricity, to name a few. Other states and regions of the country (e.g., the northeastern states) are also considering implementing their own LCFSs.

Advantages

The primary advantage of an LCFS is that (if accounted for properly) it ensures a certain level of GHG reductions relative to a non-LCFS benchmark. A second advantage of a LCFS (if constructed in a similar fashion as the California approach) is that it regulates only a small body of entities (fuel providers) and so regulatory oversight is somewhat simplified. A third advantage is that an LCFS provides incentives for the research, development, and deployment of alternative fuels for transportation.

Disadvantages

The lower energy density of the fuel means that more gallons are used, larger fuel tanks will be required on trucks, road use taxes applied on a per-gallon basis will go up, and carbon emissions associated with transportation of the fuel will rise. Another disadvantage of an LCFS is the difficulty in assuring that life-cycle emissions (including those from upstream feedstock and fuel production) in fact lead to overall GHG reductions. New research in the biofuels area has asserted that direct and indirect land use changes associated with biomass feedstock production may, in fact, increase overall global GHG emissions if not done properly.

Implementation Issues

The greatest issue facing the implementation of an LCFS is in constructing an appropriate metric for measuring total fuel-cycle carbon emissions from fuel production. This includes not only biofuel production but also nonconventional fossil fuels, such as petroleum from tar sands or shale. Other implementation issues have to do with administrating, monitoring, and validating an LCFS measurement claim.

ALTERNATIVE AND COMPLEMENTARY REGULATIONS

Emission Standards

A carbon dioxide (CO2) emissions standard may incentivize more efficient engine operations since CO2 is directly related to the amount (and type) of fuel burned in the engine. A CO2 emissions standard could work similarly to a fuel efficiency standard. However, one of the advantages would be to allow consideration of nonfuel-saving actions that could lower CO2. For example, the introduction of alternative, low-carbon fuels could be an option for meeting the standard. Typical diesel fuel is ~86 percent carbon by mass, while natural gas is only ~75 percent carbon by mass. Therefore, two vehicles can achieve the same fuel efficiency, yet one operated on natural gas would have a lower CO2 emissions rate. Biofuels could also be addressed in this manner through accounting for carbon uptake in the feedstock used to produce the fuel, and this is discussed in more detail below.

Truck Size and Weight Mandates

Motor vehicle weights and dimensions are governed by a complex mix of federal and state regulations. The main provisions of the federal regulations are as follows:

-

Maximum gross weight of vehicle on interstate highways: 80,000 lb.

-

Maximum axle weight on interstate highways: 20,000 lb on a single axle; 34,000 lb on a tandem axle

-

Maximum weight determined by the number and spacing of axles (the “federal and state bridge formula”)

-

Width of vehicles: states must allow 102 in. on the National Network for Large Trucks (interstates plus 160,000 miles of other main roads)

-

Trailer length and numbers: states must allow single trailers at least 48 ft in length and tractors pulling two 28-ft trailers on the national network.

Federal law forbids the states to impose more restrictive

limits on roads where the federal limits apply, but a grandfather provision allows preexisting, more liberal state limits to remain in effect. States set limits on roads not covered by federal law, issue permits exempting vehicles from the limits under specified circumstances, and are responsible for enforcement. Exemptions and exceptions from nominal limits are numerous, and enforcement often is imperfect.

The regulations have been justified as serving a variety of purposes. The original state regulations (dating from the early 20th century) and the first federal regulations (dating from 1956, when the present federal aid highway program was created) served to fix design parameters for road construction. The 1983 federal preemption of state regulations more restrictive than the federal limits on the Interstates was economically motivated, to reduce the costs of interstate commerce. The most recent federal action, a 1991 law that blocked the states from allowing expanded use of longer combination vehicles (multi-trailer vehicles longer than the federally sanctioned twin-28-ft-trailer combination) was justified as a safety measure (TRB, 2002).

The regulations have important economic consequences. They influence the cost of truck transportation to shippers and the costs of highway construction and maintenance, and probably influence highway accident losses, although in complex ways. They affect international commerce (U.S. limits differ from those of Canada and Mexico, and containers shipped in international trade often are not consistent with U.S. regulations) and railroads' profitability and market share. Proposals to change the weight regulations always are controversial. Historically, liberalization usually has been opposed by the railroads, certain safety groups, some states, unionized drivers, and some carriers. Liberalization is supported by shippers, some carriers, and some states. Several detailed studies by DOT (2000), the Transportation Research Board (TRB, 1990a,b, 2002), and others (e.g., in Canada; RTAC, 1986) have examined the costs and benefits of alternative size and weight regulations.

Advantages

Historical experience and prospective studies indicate that liberalizing size and weight regulations (i.e., allowing vehicles with greater cargo volume capacity and/or greater cargo weight capacity) could significantly reduce fuel consumption in freight transportation and also reduce total shipper costs. For example, if all loaded trucks carried the maximum legal payload weight at all times, the reduction in vehicle-miles of truck travel would be inversely proportional to the increase in payload. (Percent fuel savings, however, would be less than the percent mileage reduction because the heavier trucks would consume more fuel per mile of travel. For example, fuel consumption per mile for a class 8 truck increases by roughly 5 percent for every 10,000 lb increase in weight [Greszler, 2009]).

As a hypothetical example, consider a fleet of trucks hauling coal, fully loaded, from a mine to a rail head and returning empty. If a change in the legal weight limit allowed the operator to increase each truck’s payload by 50 percent, from 50,000 to 75,000 lb, truck-miles to haul a day’s output of coal would decrease by 33 percent. However, the trucks would consume about 12 percent more fuel per mile when loaded, or 6 percent more on the round trip. The fuel savings would be 100 percent × [1 − (1.06 × 50/75)] = ~29 percent.

Similarly, an increase in the maximum legal volume capacity of trailers would allow a nearly inversely proportional decrease in truck-miles of travel in a hauling operation in which all loaded vehicles carried payloads that utilized their full volume capacity. A trucking industry study estimated that a 97,000 lb six-axle tractor-semitrailer (a vehicle that industry groups have advocated legalizing in the United States) applied in a fully weight-constrained operation will consume 15 percent less fuel per ton-mile than an 80,000 lb. tractor-semitrailer and a turnpike double (twin 48-ft trailers) in a fully volume-constrained operation will consume 28 percent less fuel per ton-mile than a single-trailer combination (Tunnell, 2008).

However, an operation in which trucks frequently operate at maximum volume capacity may gain little advantage from an increase in the weight limit, and operations that normally are weight constrained may gain no advantage from an increase in legal trailer dimensions. Also, operations in which trucks frequently travel with partial loads in order to meet delivery schedules and operations in which trucks make multiple stops to partially load or unload will not be able to fully utilize an increase in the legal maximum capacity. Consequently, in practice, a hypothetical change in size and weight limits that increased both maximum volume and weight capacity by 50 percent would yield less than a 33 percent reduction in truck-miles for the entire fleet.

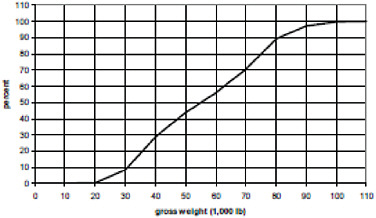

A high percentage of trucks on the road at any time are empty or are loaded to less than either their weight or volumetric capacity limit. In the 1990s less than 50 percent of VMT among all five-axle tractor-semitrailers was driven by trucks with 55,000 lb or less operating weight (see Figure 7-1).

The effect of a change in size and weight limits on fuel consumption in a particular trucking operation will depend on the characteristics of the operation and on the details of the regulatory change. Consequently the impact of a proposed change on VMT or fuel consumption is difficult to project, and past estimates have varied widely. Table 7-1 shows some illustrative projections of fuel savings.

Each of the studies noted in Table 7-1 considered induced freight traffic and diversion from rail in their estimates. The relatively small impacts estimated in the TRB studies reflect those studies’ less liberal hypothesized limit changes and their conclusion that short heavy double trailer vehicles would be attractive only in a limited range of applications.

A more recent study (Woodrooffe et al., 2009) surveyed 100 companies that operate private fleets about the potential

FIGURE 7-1 Five-axle tractor-semi vehicle-miles traveled by operating weight (cumulative percentage). SOURCE: FHWA (1997).

benefits of liberalized size and weight limits. In-depth interviews were conducted with seven companies as case studies. Two of the companies reported that because they carry low-density cargo, their trucks always reach volume capacity at a gross weight lower than the present limit. The other five companies at least occasionally load their trucks to the weight limit. These five were asked to report the percentage fuel consumption reduction they would expect if the gross weight limit were increased sufficiently to add 14,000 lb to cargo capacity. The median estimate of fuel consumption reduction was 23 percent. This prediction appears optimistic, since it could be attained only if all trucks began all their runs fully loaded to the weight limit and the heavier trucks had the same rate of fuel consumption per mile as trucks in present operations.

TABLE 7-1 Some Illustrative Projections of Fuel Consumption Savings

The impacts of past U.S. limit revisions have never been systematically monitored. In the United Kingdom the consequences of a recent change in the weight limit have been measured (McKinnon, 2005). In 2001, the U.K. weight limit was raised from 41 to 44 metric tons, allowing a 12 percent increase in maximum payload weight. Dimensional limits were not changed. Extrapolating the first two years of data on trends in truck travel and weight distributions, the study estimated that the eventual net effect would be a reduction of 170 million vehicle-kilometers/year by 2007, representing a 0.6 percent reduction in travel of freight vehicles. The percentage change in fuel consumption would be somewhat less. The estimate includes an allowance for road traffic generated by the reduced cost of truck transport. The impact has been small because a large fraction of freight vehicles do not operate at the weight limit. The characteristics of truck travel in the United Kingdom are different from those in the United States, but this example illustrates that the increase in fuel efficiency from a weight limit increase can be much less than the increase in maximum cargo capacity.

A 2002 TRB committee (TRB, 2002) reviewed the estimates of costs and benefits of revisions to size and weight limits in the past DOT, TRB, and Canadian studies. It concluded that liberalizing the regulations would reduce shippers’ freight transportation costs. Highway agencies costs for constructing and maintaining roads might increase or decrease, depending on the details of the regulatory changes and on how agencies changed their practices to accommodate the traffic changes; however, properly designed revisions to limits would yield freight cost savings exceeding any added extra infrastructure costs.

Disadvantages

The main arguments against increasing the limits have been that highway safety would be degraded, that diversion of freight from rail to truck would increase the social cost of freight transportation, and that highway agencies could not afford the cost of upgrading infrastructure to accommodate larger trucks. The 1990 TRB studies concluded that the safety impact of sensibly liberalized limits would be positive, because the dominant influence on safety would be a reduction in truck VMT. The studies found that the inherent safety differences between the old and new vehicles would be slight. The 2002 TRB study acknowledged that understanding of the factors that determine the safety performance of large trucks is incomplete and therefore called for regulatory changes to be tested through rigorously monitored large-scale pilots.

Regarding other public costs, raising limits would increase air pollutant emissions as a result of induced freight demand and diversion of freight from rail to truck. The studies’ projections imply that the change in emissions will be small in comparison with total truck emissions and its significance will diminish as truck emissions regulations become more stringent. Traffic impacts are projected to be positive on net because of the reduction in truck VMT.

Regarding highway agency costs, all the TRB studies recommended that truck fees be adjusted to cover the cost of providing infrastructure for them. The 2002 TRB committee concluded that DOT studies had overstated the probable cost of bridge repairs and replacements that would be required to accommodate larger trucks and recommended that limit revisions be accompanied by improvements in the states’ asset management programs.

All the studies predict that liberalizing limits would divert some freight from rail to truck. This diversion would not increase the social cost of freight transportation provided trucks paid fees that covered their infrastructure costs and provided that pollution, safety, and congestion effects are small or positive, as the TRB studies predicted. Regulatory changes that allowed widespread use of longer combination vehicles were projected to have a greater effect on rail traffic than changes in weight limits alone.

Implementation Issues

The regulatory changes most commonly proposed include the following:

-

Raising the federal weight limit to 97,000 lb. This would allow about a 25 percent increase in payload for weight-limited shipments on Interstates and other main roads. A bill introduced in Congress in 2009 (H.R. 1799: Safe and Efficient Transportation Act of 2009) would accomplish this.

-

Giving states the option of allowing operation of longer combination vehicles (primarily turnpike doubles, a configuration with a tractor pulling two full-sized trailers) on roads with high design standards. Several western states have from time to time advocated this change.

-

Allowing operation of a new kind of configuration, double trailers that would be longer and heavier than the twin-28-ft double now in use nationwide but shorter and more maneuverable than turnpike doubles. The DOT and TRB studies described above considered this kind of vehicle, which today is little used.

More ambitious proposals call for construction of new exclusive right-of-way for larger trucks. Four states, with the partial support of a DOT planning grant, are studying construction of truck-only lanes on segments of Interstate-70 through Ohio, Indiana, Illinois, and Missouri, together with staging areas for assembly and disassembly of longer combinations (FHWA, n.d.). Enactment of more restrictive limits also has been proposed, and a bill for this purpose (S.779, Safe Highways and Infrastructure Preservation Act) was introduced in Congress in 2009.

The 2002 TRB committee emphasized that changes in size and weight regulations made in coordination with complementary changes in highway management would offer the greatest potential for improving system performance. Specifically, the committee recommended adjusting truck fees to cover highway agency costs, improved bridge management, systematic monitoring of truck traffic, reform of enforcement methods, and vehicle safety regulations governing the performance of larger trucks.

Mandatory Speed Limits (Road-Speed Governors)

Road-speed governors have been standard features on trucks with electronic engine controls for many years. In the U.S. market at this time, it is up to the vehicle owner to decide whether or not to use the road-speed governor at all and what speed to select if the governor is used. Most large truck fleets do use road-speed governing today, with typical governed speeds in the 65 to 70 mph range. A few fleets set their governors as low as 60 mph, while many smaller fleets and owner-operators do not use the governor feature at all.

In Europe all trucks have their road-speed governors set by the factory to a specified value which is determined by law. The approach evaluated in this section would be in implementing a European-style mandatory road-speed governor regulation in the U.S. market.

Advantages

The NESCCAF/ICCT report (2009) projects a fuel savings of 0.7 percent per mph speed reduction for an aerodynamically optimized tractor/trailer combination truck on a simulated long-haul duty cycle. Other sources put the fuel savings at up to 1 percent per mph for tractor-trailers with

today’s standard aerodynamics, when cruising at 65 mph. Most studies determine the benefit of lower road speeds using 65 mph cruise as a baseline, and they do not take into account the fact that well under 100 percent of the truck’s duty cycle is spent at cruise speed. This leads to a tendency to overestimate the potential benefit.

A fleet that operates long-haul tractors in areas with little congestion can gain significant benefits. For example, a fleet that governs today at 65 mph could see a 3.5 to 5 percent benefit by lowering governed speed to 60 mph, while a fleet that runs 70 mph could see a 7 to 10 percent fuel savings by cutting speed to 60.

A universal truck road-speed-governor requirement would almost completely eliminate issues with speeding by trucks, possibly providing significant safety benefits. Only in the case of tampering would speeding be possible, and tampering would be easy to detect. Any truck running significantly over the required governed speed setting could be assumed to be tampered with.

The cost of implementing mandatory road-speed governors is very low. For new vehicles the cost would be in engineering development only, with no manufacturing cost unless features need to be added to make tampering more difficult. For existing vehicles with electronic engine controls, the retrofit cost would be limited to development cost and the cost of a service stop.

Disadvantages

A number of disadvantages must be taken into account before making decisions regarding mandatory implementation of road-speed governors:

-

If the regulation is applied to existing trucks, many of them will need changes to the rear axle ratio to match cruise engine speed to the new, lower road speed.

-

Governors will only save fuel in situations where a truck would otherwise run faster than the governed limit. Vehicles that operate in urban or congested areas will normally see little or no benefit from governing. This means that the overall fleet fuel savings will be significantly less than projections derived from open-road driving scenarios.

-

In situations where the fuel savings is significant, so is the increase in trip time. Higher trip time decreases the distance a driver can cover during a workday, meaning that more trucks would be required to move a given amount of freight. This has three undesirable effects: increased shipping costs, increased traffic congestion, and increased opportunity for accidents because of the increase in the number of trucks on the road. The lower the governed speed is set, the bigger these issues become.

-

Larger fleets today are relatively sophisticated in balancing fuel cost and trip time through their use of road-speed-governor settings. These fleets would lose the benefit of being able to determine their own trade-offs. On the other hand, most smaller fleets and owner-operators are not very sophisticated in their cost-benefit analysis, and these operators might benefit from a mandatory requirement.

-

If governed speeds are set significantly below the typical travel speeds of light vehicle traffic, the result will be a significant increase in traffic congestion and an increased risk of accidents because of increased speed differentials between trucks and light vehicles. Light-duty vehicle drivers in the United States are not accustomed to the sort of lane discipline required to achieve good traffic flow and safety in situations where large speed differentials exist. (Preventing excessive speeds by trucks could be a safety benefit.)

-

Having all trucks governed to the same speed will result in a situation where all trucks operate at nearly, but not exactly, the same speed. Inevitable tolerance differences will result in slight speed differences. Thus, when one truck passes another, it will take a long time and create a potential for rolling roadblocks that impede light-duty vehicle traffic. This disadvantage could be reduced by allowing drivers to override the governed speed for brief periods to enable faster passing. Current road-speed governors (and current European regulations) do not allow for this override feature.

-

Tampering might become a significant issue. Vehicle and engine manufacturers have gotten pretty sophisticated in their techniques for making tampering difficult, but some operators will have a significant financial and personal incentive to tamper.

-

Many long-haul truck drivers are paid by the mile. A road-speed governing regulation would amount to a direct pay cut for these drivers. For many owner-operators, implementation of a road-speed-governor requirement could make the difference between making the monthly truck payment and becoming unemployed. The incentive to run longer (illegal) driving hours would become stronger.

-

Engine and vehicle makers are developing increasingly sophisticated control features aimed at changing driver behavior in ways that save fuel. One feature used today allows drivers a slightly higher road-speed-governor setting if they follow other operating requirements aimed at saving fuel. This gives the fleet what it wants (fuel savings) and the driver what he wants (higher pay and a shorter trip time). Allowing features like this could greatly complicate a regulation.

Implementation Issues

All electronic engines today already have a road-speed-governor feature built in. The feature would need to be

modified to prevent owner or user changes to the speed-limit setting, and to prevent the feature from being turned off. These changes would be easy for vehicle and engine manufacturers to implement. Making these features sufficiently tamper-proof might prove to be a much greater challenge.

Road-speed governors on new trucks would be easy to implement in a relatively short time frame. Manufacturers will need to modify and validate their existing road-speed-governor features to meet the requirements of the new regulation. It would also be relatively easy to develop calibrations that could be retrofitted to existing vehicles with electronically controlled engines. Getting owners to bring in their vehicles for a retrofit calibration that includes a new road-speed governor might be very difficult, however. Most owners would try to put this off as long as possible, preferably for the life of the truck.

Older vehicles that have mechanical fuel systems could in theory be retrofit with road-speed-governors, but several issues would need to be overcome. First, systems would need to be developed for this market, and they would probably not be low cost. There were road-speed-governor systems for these vehicles many years ago, but they were not low cost or widely used. Second, some way to force implementation by owners would be required. These older vehicles tend to travel few miles per year, so the potential fuel savings is limited. The owners of older trucks often lack the money to pay for an upgrade. On the other hand, if older vehicles were exempt from the speed-governor regulation, this would increase the value of older vehicles and encourage these trucks to be maintained rather than scrapped. Since older trucks have much higher emissions, any incentive to prolong their life would not be desirable. Like many other good-sounding fuel-saving ideas, the unintended consequences of road-speed governing can outweigh the benefits if great care is not taken in implementation.

OTHER COMPLEMENTARY APPROACHES

Intelligent Transportation Systems

Intelligent transportation systems (ITS) encompass a broad range of wireless and wire-line communications-based information, control, and electronics technologies. When integrated into the transportation system infrastructure, and in vehicles themselves, these technologies help monitor and manage traffic flow, reduce congestion, provide alternate routes to travelers, and enhance productivity—all to improve mobility and safety. DOT has developed the National ITS Program Plan for ITS, which provides a new vision for surface transportation in the United States in the following areas:

-

Travel and transportation management

-

Travel demand management

-

Public transportation operations

-

Electronic payment

-

Commercial vehicle operations

-

Emergency management

-

Advanced vehicle control and safety system

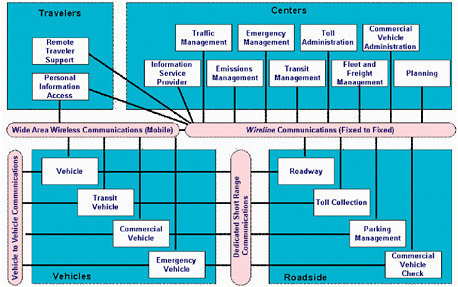

The national ITS architecture (see Figure 7-2), provides a common structure for the design of ITS. It is not a system

FIGURE 7-2 U.S. national ITS architecture. SOURCE: FHWA (2008).

design nor design concept but rather a framework around which multiple design approaches can be developed, each one specifically tailored to meet the individual needs of the user.

ITS is very broad in scope. This section limits the discussion to a sampling of the technologies that can play a significant role in reducing the fuel consumption of medium- and heavy-duty trucks. The focus is on technologies and applications in the infrastructure that help reduce the bottlenecks that truckers often experience—namely, congestion, toll booths, weigh stations, and inspection stations. In addition, Chapter 5 (under “Intelligent Vehicle Technologies”) discusses applications for reducing fuel consumption using technologies of ITS that reside primarily on the vehicle. However, several of these applications cannot operate exclusive of the infrastructure. For example, those that use real-time traffic information require technologies on the infrastructure side to sense and communicate this information to the vehicle.

As noted in Chapter 6, traffic congestion in the United States produces significant cost in terms of wasted fuel and vehicle-hours of delay. There is a general consensus among transportation planners that we cannot “build” our way out of congestion but instead need to utilize existing capacity more efficiently to improve mobility. Some ITS technologies that can contribute to utilizing capacity more efficiently are as follows:

-

Historical or real-time traffic information provided to travelers via Internet Websites during pretrip planning or via dynamic message signs or highway advisory radio while en route.

-

Adaptive traffic signal control and coordinated signal timing.

-

Ramp control such as ramp meters that use sensor data to optimize freeway travel speeds and ramp wait times.

Real-time traffic data can come from imbedded inductive loop detectors in the highway, such as the Performance Measurement System (PeMS) in California, or from traffic probe vehicles that carry special cell phones that are able to communicate the vehicle’s position and velocity in real-time to a traffic management center (TMC). The TMC integrates a variety of ITS applications to facilitate coordination of information and services within the transportation system.

Electronic toll collection (ETC) is one of the most successful ITS applications with numerous benefits, including delay reductions, improved throughput, and reduced fuel consumption. ETC systems support the collection and processing of toll plaza transactions without requiring the driver to stop and pay manually, thereby increasing operational efficiency and convenience for travelers. ETC systems operate as either integrated multistate systems such as the E-Z Pass system, or single-state or single toll authority systems such as the Oklahoma Turnpike system. In most existing charging schemes, vehicles are identified via an in-vehicle transponder or by a video image of the license plate if the vehicle does not have a transponder. For traditional ETC systems, vehicles must pass through a gate at speeds less than 5 mph to allow time for the vehicle to be recognized and the gate lifted or a light to change from red to green. With newer technologies, such as open-road tolling, toll transactions can be processed at freeway speeds, thereby reducing the need for fuel-wasting speed fluctuations and for toll booth barriers.

ITS/Commercial Vehicle Operations (CVO) applications are designed to enhance communication between motor carriers and regulatory agencies, particularly during interstate freight movement. Commercial vehicle clearance, automated roadside safety inspection, on-board safety monitoring, hazardous materials incident response, automated administrative processing, and commercial fleet management are some of the key functions that ITS can provide for commercial vehicles. The Commercial Vehicle Information System and Networks (CVISN) program, created by the Federal Motor Carrier Safety Administration, is a nation-wide framework of communication links that State agencies, motor carriers, and stakeholders can use to conduct business transactions electronically to support CVO.

An example of the use of CVISN for supporting CVO is electronic screening that includes safety screening, border clearance, weight screening, and credential checking. Communications equipment at the roadside can query trucks equipped with in-vehicle transponders as they approach a station and issue a red or green light on the transponder so drivers know whether to continue on the mainline (bypass) or report to the station for possible inspection.

In the United States there are currently two major national electronic screening programs, the North American Preclearance and Safety System (NORPASS) and PrePass. As of March 2008, NORPASS was available in 11 states and Canadian provinces and had an enrollment of more than 93,000 trucks, and PrePass was available in 28 states and had an enrollment of more than 423,000 trucks (Maccubbin et al., 2008).

Development of the Comprehensive Modal Emissions Model (CMEM) which can predict second-by-second vehicle fuel consumption based on different traffic operations is important for developing and evaluating transportation policy for reducing fuel consumption (Barth and Boriboonsomsin, 2008). CMEM is comprehensive in that it covers 30 vehicle/technology categories from the smallest light-duty vehicle to Class 8 heavy-duty diesel trucks. In their congestion research, Barth and Boriboonsomsin (2008) worked with the California Department of Transportation’s (Caltrans) Freeway Performance Measurement System. The PeMS collects real-time speed, flow, and density data from loop detectors embedded in freeways and makes the data available for transportation management, research, and commercial research.

Advantages

Evaluations of traveler information services, including real-time traffic information, show that these systems are well received by those who use them. Benefits are found in the form of improved on-time reliability, better trip planning, and reduced early and late arrivals. Studies show that drivers who use route-specific travel time information instead of area-wide traffic advisories can improve on-time performance by 5 to 13 percent (Maccubbin et al., 2008).

ITS applications for traffic control using both adaptive signal control and coordinated signal timing to smooth traffic can lead to corresponding safety improvements through reduced rear-end crashes. Studies of signal coordination in five U.S. cities and one Canadian city have shown reductions in stops from 6 to 77 percent, while 2 statewide studies have shown average improvements from 12 to 14 percent (Maccubbin et al., 2008). Reducing the number of stops reduces fuel consumption because the trip time is shorter and there are fewer energy-consuming speed fluctuations.

Ramp metering reduces the number of acceleration-deceleration cycles and smooths traffic flow. Traffic signals on freeway ramp meters alternate between red and green to control the flow of vehicles entering the freeway. A study in Minneapolis-St. Paul, MN (Maccubbin et al., 2008) showed a 21 percent crash reduction and 10 percent higher freeway volumes compared to when the ramp metering was shut down. A simulation study of two sections of freeway of that same system, each about 12 miles long, showed a 2 to 55 percent fuel savings compared to when the ramp metering was shut down. Data were collected over a three-day period, and the performance of ramp metering depended on the daily fluctuations of the demand patterns (Hourdakis and Michalopoulos, 2001).

Ninety-five percent of toll plazas in the 108 largest metropolitan areas in the United States are equipped with ETC. In Florida, ETC decreased delay by 50 percent for manual cash customers and by 55 percent for automatic coin machine customers (Maccubbin et al., 2008). On the Tappan Zee Bridge toll plaza near New York City, the ETC lane more than doubles vehicles per hour compared to the manual lanes.

Electronic screening will reduce the number of stops and starts that commercial vehicles must make for weight and safety inspections, thus reducing fuel consumption and time spent idling in lines. The Oregon Department of Transportation’s Green Light Program, a weigh-in-motion system, indicates a 36 to 67 percent reduction in pollutants—particulate matter, carbon dioxide, nitrogen oxides, carbon monoxide, and hydrocarbons—when trucks stayed at highway speed past a weigh station. Trucks that avoided deceleration to enter a station and then acceleration to exit also experienced over a 50 percent reduction in fuel consumption during this deceleration/acceleration event (see http://oregon.gov/ODOT/COMM/greenlight).

Disadvantages

Disadvantages, in terms of counterbenefits, are few if the ITS technologies described above are deployed. Maccubbin et al. (2008) rated the impact of ITS deployment in six key goal areas: safety, mobility, efficiency, productivity, energy and environment, and customer satisfaction. For all ITS deployments, he gave one of the following impact ratings was given for each goal area:

-

Substantial positive impact

-

Positive impact

-

Negligible impact

-

Mixed result

-

Negative impact

-

Not enough data

For all of the ITS technologies described above, none received a “negative impact” in any of the goal areas. Only one, ETC, received a “mixed result” in the safety goal area. In Florida the addition of open-road tolling to an existing ETC mainline toll plaza decreased crashes by an estimated 22 to 26 percent. However, an earlier experience in Florida found that driver uncertainty about toll plaza configuration and traffic speeds contributed to a 48 percent increase in crashes at plazas with traditional ETC lanes.

Although freeway ramp metering may result in higher freeway volumes, it does require an additional stop before entering the freeway if the light is red. The additional time spent accelerating from a stop to freeway speed increases fuel consumption.

Implementation Issues

A number of implementation issues arise with ITS that make it unique to other approaches:

-

Deployment of ITS is almost always regional, often covering several states, and rarely locally confined to a single city. As a result, the planning, funding, operation, and maintenance of ITS is multijurisdictional and requires cooperation at many levels of government, Federal, State and local governments.

-

Interoperability is important when planning an ITS deployment that borders similar ITS deployments in adjacent jurisdictions.

-

Advanced traveler information system deployments in rural and/or remote areas present special challenges. Often a remote location makes equipment more susceptible to vandalism. Also, available power to the equipment may not be nearby and may require installation of power lines.

-

One of the largest and most common hurdles when deploying ITS is to make the systems compatible with existing systems already deployed. This can have a

-

significant impact on ITS costs and deployment schedules.

-

Privacy issues can present particular challenges in ITS projects, as new ITS technologies can often raise concerns about intrusive, “Big Brother”-type surveillance.

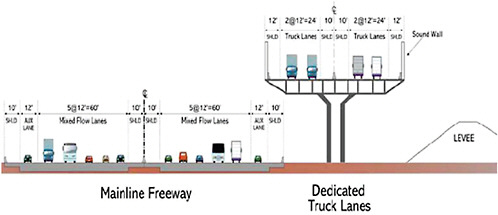

Construction of Exclusive Truck Lanes

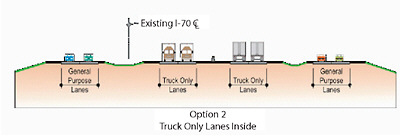

The idea of exclusive truck lanes covers several types of designs and how each type can be used to better improve efficient use of the highways, reduce traffic congestion, improve safety for all highway vehicles, and reduce the cost of moving goods. Truck-only lanes allow for the possibility for future technologies such as ITS to be used to improve all of the aforementioned items. Construction of these lanes also offers the opportunity to upgrade the current highway designs for increased weight and traffic of the future. During the Missouri Department of Transportation study of Interstate-70 between Kansas City and St Louis, the supplemental environmental impact statement team chose the truck-only lanes strategy as the preferred alternative, instead of the widen existing I-70 strategy. With that selection, the next step was to apply the strategy across the corridor as alternatives. The study team assessed several alternatives before recommending a preferred one that, at a minimum, provides two truck-only lanes on the inside and two general-purpose lanes on the outside for both eastbound and westbound travelers.

From the perspective of traffic and engineering, the truck-only lanes strategy compared more favorably than the widen existing I-70 strategy in the key areas of freight efficiency, safety, constructability, and maintenance of traffic.

The design that is the most prominent uses two lanes in each direction for truck-only traffic. These lanes are placed on the inside of the current lanes of the federal highways such as interstate highways. The design fits best in the rural and country areas, so that the width of the road right-of-way does not become a problem.

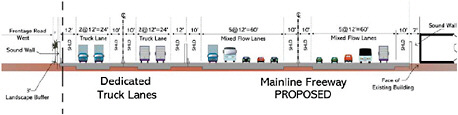

In areas where that the road right-of-way does not allow for construction of the lanes on the same level plane, another design is considered as a possibility. This design places the truck lanes over the current auto traffic lanes. There is a third design that employs underground tunnels for getting past the problem of clearance or the lack of property for the extra lanes. Several studies have been done in the United States by state transportation departments, but to date no lanes have been built for the purpose of moving only truck traffic for any long distances. Figures 7-3 to 7-5 show the various designs that have been considered.

The provision of access points to/from the truck-only lanes depends on the nature of the corridor. For corridors serving long-haul/through trips, access points can be limited to key interchanges and staging areas (if long combination vehicles [LCVs] are permitted to operate). On the other hand, in urban corridors, where most trips are a relatively short distance, more access points would be required. In this case, the cost and financial analyses should consider the tradeoffs among capital costs, usage/toll revenues, and safety. The use of tolls to offset some of the costs to build and maintain these truck-only lanes must be cost effective for the vehicle owners, or they will be bypassed by drivers.

The California State Route 60 and Interstate 710 corridor studies demonstrated the importance of providing frequent access points to increase truck traffic demands in urban truck-only toll corridors that serve primarily short-haul trips. In the State Route 60 study, the tradeoff between limiting access points and generating high demand was a major issue, especially because high demand is desired to maximize possible toll revenues. Yet adding access points increases the capital costs for the corridor.

For LCVs to be effective, staging areas are needed to make up and break up the trailer combinations. The cost of these staging areas might be borne by the owner/operator of the toll facility or by the private sector. In Oregon, staging facilities are privately owned.

Advantages

The major advantage to truck-only lanes is that freight can move faster and more efficiently along these corridors. Longer and heavier loads on highways built for the extra loads and length would make the movement of goods more efficient. In addition, it is expected that congestion should be reduced by separating truck traffic from small-vehicle traffic. With proper planning for cross-lane traffic and intersections, along with access and egress, car and truck accidents will be

FIGURE 7-3 Example of truck-only lanes. SOURCE: FHWA (2005).

FIGURE 7-4 Concept for reducing the need for additional road right-of-way. SOURCE: FHWA (2005).

reduced and possibly there will be lower insurance costs as the accident rates drop.

Last, during the construction of the truck-only lanes, there would be the ability to update and repair the present roadways at a cheaper cost than going out to maintain or repair the current lanes. This is due to being able to use the material, equipment, and workers to do both jobs.

Disadvantages

Financing for truck-only lanes will be difficult to obtain. Tolls from trucks will not pay for construction and maintenance, and public funds and additional taxes would be needed to meet the construction cost of these lanes. The social return on investment has not yet been established.

Furthermore, adequate right-of-way (ROW) is not currently available for the construction of these lanes, so additional land will need to be purchased, and the widening of the right-of-way and the clearing of land may have a negative impact on the environment.

Last, the time that it takes to construct a usable network of truck-only lanes will be several years before any benefits of a better transportation system will be realized. Due to the long time that will be needed, new technologies may not be put into place until some of the lanes are completed.

Congestion Pricing

Congestion pricing refers to variable road tolls (higher prices under congested conditions and lower prices at less congested times and locations) intended to reduce peakperiod traffic volumes to optimal levels. Congestion pricing could take different forms, such as area-wide network pricing on freeways and possibly arterials, “cordon” or area pricing in central business districts, or truck-specific congestion pricing such as the varying time-of-day gate fees implemented at the ports of Los Angeles and Long Beach.

Area-wide congestion pricing is applicable to freeways and major arterials where there is significant congestion. Cordon pricing strategies are only applicable in major urban areas with significant congestion. The limited geographic applicability of these two scenarios limits the fuel reduction potential. Area-wide congestion pricing has greater potential since it is estimated that nearly 30 percent of urban vehicle miles travelled (VMT) occurs at the level of service E (unstable flow) or F (forced or breakdown flow; TRB, 2000). Cordon pricing of metropolitan area central business districts, however, is estimated to affect only 3 percent of total VMT nationwide. Furthermore, evidence suggests that there will be little, if any, overall impact on total truck traffic (as the added costs are likely to be marginal, or the option of moving to the off-peak period is unacceptable), but

FIGURE 7-5 Elevated truck lanes. SOURCE: FHWA (2005).

rather that the benefits will occur from trucks operating under improved flow conditions and therefore using less fuel due to idling or stop-and-go operations. This will have a larger impact on smaller urban trucks since larger long-distance trucks operate mostly on uncongested highways.

Advantages

Congestion pricing could affect truck fuel consumption by:

-

Shifting trips to less congested off-peak hours;

-

Reducing congestion for trucks continuing to operate during peak periods, thereby improving their fuel economy and productivity (and offsetting the congestion pricing);

-

Reducing the overall movement of goods and related truck traffic due to higher costs; and

-

Increasing the shift in logistics patterns—for example, leading firms are establishing consolidation centers on the edges of urban areas to reduce truck activity within the congested area.

Most studies of the impact of congestion pricing have focused on all traffic, rather than distinguishing impacts on personal versus commercial vehicle traffic. A study for the U.S. Department of Energy used travel demand models in Minneapolis-St. Paul and Seattle, in conjunction with speed-fuel efficiency relationships, to evaluate the combined benefits of travel reductions and operating efficiencies from area-wide systems of managed lanes.2 The results from different scenarios ranged from a 0.1 to 2.5 percent impact on fuel consumption and greenhouse gas (GHG) emissions depending upon the scenario. Extrapolating these results to a national level based on projected 2030 congestion levels in different urbanized areas led to an overall estimated reduction in national fuel consumption ranging from 0.5 to 1.1 percent (EEA, 2008). Another national study of GHG emission reduction strategies estimated that cordon pricing could potentially reduce VMT on the order of 3 percent if applied to all metropolitan areas in the United States (Cambridge Systematics, 2009). These are rough estimates for all vehicles, however, and may not be transferable to truck traffic.

Evaluations of a cordon pricing scheme implemented in London examined effects specifically on truck traffic (Transport for London, 2006). The experience suggests that the reduction in overall vehicle-kilometers of travel has come almost exclusively from passenger vehicles rather than trucks. However, the trucks benefited from reduced queuing and, subsequently, reduced truck idling and fuel consumption. Once the scheme was introduced, excess delays were reduced by 26 percent, from 2.3 to 1.7 minutes per kilometer. For 70,000 truck-kilometers traveled and a reduction in excess idling delay of 0.6 minutes per kilometer, the scheme reduced truck idling by a total of 700 hours. With each truck-hour of idling consuming 0.8 gallons, the truck fuel consumption reduction from congestion pricing would have been 560 gallons annually (EPA, 2004). For trucks whose average fuel consumption is 40 liters per 100 km (10.4 gal/100 km), this represents a reduction in fuel consumed of about 7.7 percent.

Disadvantages

As congestion is reduced, average speed increases because speed variability declines and less time is spent at idle. Therefore, fuel consumption declines with increasing average speed—up to a point. When speeds average greater than 40 to 55 mph and approach free-flow highway speeds, fuel consumption rates increase. Congestion is likely to affect urban service and delivery movements more than long-haul freight, and therefore it is the fuel consumption characteristics of smaller trucks that are most important.

If congestion pricing is implemented only on a limited basis (e.g., only freeways), diversion of traffic to other non-tolled facilities is likely to be a significant concern because of the impacts on neighborhoods and local traffic. Increases in VMT on alternate routes could offset the fuel savings achieved from reductions in VMT and congestion on the facility itself. Therefore, congestion pricing will be most effective at reducing fuel consumption if it is implemented universally (on all major roads in an area). In addition, HOT lane implementation could potentially reduce available conventional lanes, particularly if separation lanes are needed between HOT lanes and conventional lanes. The impacts of the loss of conventional lanes on traffic flow and costs need to be evaluated in decision making regarding HOT lanes.

Implementation Issues

Congestion pricing has been experimented with in a number of areas, primarily on existing tolled facilities, but has not yet gained widespread popularity. From a technical standpoint, congestion pricing is relatively easy to implement on facilities that already are tolled. The broader-scale application of this strategy beyond existing or proposed toll highway facilities, however, is likely to require universal deployment of electronic toll collection technologies. This will require coordination by a state or regional transportation agency. The U.S. Department of Transportation (DOT) is encouraging greater experimentation in this area. In 2007, DOT awarded $853 million in funding to five metro areas for urban partnership agreements to reduce congestion, including a significant focus on tolling/strategies.

Driver Training and Behavior

Driver training requires relatively low initial investment and appears to be a highly cost-effective strategy for improving fuel efficiency and lowering operating costs and harmful emissions. One option includes training designed to educate drivers about operating practices that influence fuel consumption and improve their driving skills.

Professional drivers of heavy-duty vehicles must provide proof to insurance companies of a minimum number of training hours. There are three different types of truck driver training programs: private schools, public institutions, and training programs run by the motor carriers themselves. Most private truck driving schools and publicly funded truck driving programs provide a certificate or diploma upon graduation, which is generally recognized and accepted by some carriers as proof of acceptable training. Most larger fleets require that all new drivers go through a company training course that includes a driving course and test before they are allowed to drive for the company.

A review of tuition requirements for various commercial driver’s license (CDL) schools in the United States found that tuition can range from approximately $2,000 to $4,000 per driver. Some of these schools have already incorporated fuel-efficient driving instruction into their curricula. Drivers who have already obtained their CDL, however, would only receive targeted instruction for fuel-efficient driving at a lower tuition rate (Latty, 2009).

There are several fundamental principles and techniques each driver should know in order to minimize fuel consumption, as described below.

-

Minimize speed fluctuation. Smooth acceleration reduces inertial effects as well as wear on the engine and equipment, especially in hilly or mountainous terrain. Rapid acceleration causes undue wear on the engine, drivetrain, and tires as well as requiring more fuel to achieve the same end result. In addition, braking results in a loss of energy as vehicle momentum is converted to heat. Braking also activates the air compressor, which draws power from the engine, further increasing fuel consumption. Smooth braking saves fuel, reduces brake wear, and reduces engine load.

-

Engine braking. Use of the engine brake allows for smooth deceleration, reduces brake wear, and saves fuel.

-

Shift optimization and gear selection. One gear down may increase fuel consumption by approximately 15 percent from optimal conditions. For example, for 10 to 15-liter engines found in Class 8 trucks, a constant operation below 1,300 rpm significantly improves fuel economy, with the target range being between 1,200 and 1,500 rpm. A 20 percent difference in the time spent in top gear could improve fuel efficiency by as much as 4 percent (M. England, personal communication, 2009).

-

Idling. An average heavy diesel engine uses about one gallon of fuel per hour while idling (CARB, 2005). To reduce fuel consumption, certain types of idling can be minimized or eliminated altogether. For example, electronically controlled engines do not require significant warm-up or cool-down periods; a driver can reach 70 percent throttle as soon as oil pressure is up.3 Moreover, the cost of turning the engine off and starting it again is frequently less than the cost of idling, since excessive idling leads to increased maintenance and engine wear.

-

Tires. Tire condition and inflation are just as important on trailer tires as on tractor tires.

-

Speed. Road speed has a direct impact on aerodynamic drag. Higher speeds also cause extra wear on the engine and transmission systems.

-

Cruise control. Cruise control optimizes the electronic control system’s fuel delivery and improves fuel efficiency.

-

Clutch control. Double clutching increases clutch wear and reduces fuel efficiency. Double-clutching is not necessary on synchromesh gear boxes. Many drivers have learned to shift gears without using the clutch except to stop and start.

-

Trip planning. Total fuel usage should be considered in trip planning. Also, each full stop requires approximately one-third of a gallon to return to highway speed. Accordingly, drivers should consolidate stops for food, fuel, and so forth to increase fuel efficiency (personal communication, L. Harvey, Natural Resources Canada, 2009).

-

Block shifting/skipping gears. Fewer gear changes results in greater fuel efficiency. The quicker a driver moves up the gearbox to top gear, the more fuel that is saved. Each gear shift up improves instantaneous fuel consumption by 10 to 30 percent (personal communication, L. Harvey, Natural Resources Canada, 2009).

-

Aerodynamics. Vehicles with adjustable roof-mounted air deflectors can improve fuel efficiency. Covering trailers, whether loaded or empty, ensuring curtains are tear-free, and correctly positioning a load all help reduce aerodynamic drag and improve fuel efficiency.

-

Overfilling the fuel tank. Overfilling the fuel tank causes fuel to be lost through the breather vent when it is heated and expands, resulting in lower fuel efficiency.

-

Maintenance. Changing air and fuel filters when vacuum specifications are exceeded can improve fuel

-

efficiency. Ensuring proper wheel alignment also has a substantial impact on fuel efficiency, up to 3 to 4 percent in some cases, as well as reducing tire wear (TIAX, 2009).

Advantages

According to a staff member at Natural Resources Canada, initial case studies indicate approximately 2 to 8 percent reduction in fuel consumption and associated GHG emissions due to driver training (personal communication, L. Harvey, Natural Resources Canada, 2009; DOE, 2008). These results are consistent with values reported in the Freight Best Practice case studies. In numerous case studies, companies and drivers commonly reported an average fuel efficiency improvement of 5 percent, with actual results across all case studies reviewed ranging from 1.9 to 17 percent improvement (Freight Best Practice, 2009).