E

Synthesis of Business Models and Economic and Market Incentives for Vaccines and Therapeutics

The following is a white paper prepared for the February 22–24, 2010, workshop on the public health and medical countermeasure enterprise, hosted by the Institute of Medicine Forum on Medical and Public Health Preparedness for Catastrophic Events and Forum on Drug Discovery, Development, and Translation. All opinions expressed in this paper are those of the author and not necessarily of the Institute of Medicine.

By James Guyton, Hannah McClellan, and Fanni Li

Public Health and Biodefense Practice

PRTM

ABOUT THIS PAPER

Background and Charge

This paper has been developed to support an HHS Secretary-directed review of the Medical Countermeasures Enterprise (MCME) that addresses public health emergency threats including chemical, biological, radiological, and nuclear (CBRN) agents as well as pandemic influenza and other emerging infectious disease (EID). The objective is to conduct “a review of [HHS’s] entire public health countermeasures enterprise … to look at how our policies affect every step of countermeasure development and production and then ask: how can we do better?” The Secretary has charged the Office of the Assistant Secretary for Preparedness and Response (ASPR) with leading the

review, given the ASPR’s responsibility for directing and coordinating HHS’s activities relating to protecting the U.S. population from acts of terrorism and other public health and medical threats and emergencies. This white paper will be used by the ASPR and by subsequent planning committees to develop public and stakeholder workshops to examine alternative methods and models for achieving successful product development, approval, procurement, and delivery to the U.S. populations.

As part of the larger public health enterprise review, this white paper explores the following topic: Synthesis of Business Models and Economic and Market Incentives for Vaccines and Therapeutics.

Paper Objectives

The objective of this paper is to explore alternative policies, business models, and incentives that can be used to foster a more effective and sustainable medical countermeasure enterprise. Particular focus will be placed on identifying ways to further the pharmaceutical industry’s engagement in the MCME to move candidate medical countermeasures through advanced development and provide approved or licensed products for operational use. To this end, this paper will identify

-

challenges to engaging industry in the MCME and what is needed to overcome those challenges;

-

new and innovative policies, strategies, and incentives to encourage industry participation in the MCME; and

-

issues related to pursuing these new and innovative policies, strategies, and incentives.

Scope

This paper focuses primarily on policies, business models and incentives for increasing industry involvement in the MCME’s programs for medical countermeasures for CBRN threats. The paper does not focus on the Pandemic Influenza program, given the already high level of involvement of multiple large-scale commercial vaccine manufacturers in the program, although the program is considered within the context of other models that may offer some approaches that could be applied to CBRN.

Methodology

The findings in this paper have been synthesized through a review of several literature sources, including published papers, MCME agency documents, and public presentations. This literature has been supplemented by findings from interviews with numerous stakeholders from industry, academia, and government agencies represented in the MCME. A bibliography and list of interviewees are provided at the end of the paper.

This paper has benefited from multiple interactions with participants in the February 23–24, 2010, Institute of Medicine workshop on The Public Health Emergency Medical Countermeasures Enterprise: Innovative Strategies to Enhance Products from Discovery through Approval as well as members of the National Biodefense Science Board’s Markets and Sustainability Working Group.

EXECUTIVE SUMMARY

MCM Development Challenges

Developing medical countermeasures is critical to achieving the mission of protecting the U.S. population from acts of bioterrorism and other public health threats and emergencies. The MCM landscape is plagued by uncertainty in an already complex and challenging field where the development of pharmaceuticals and vaccines is inherently risky, lengthy, and costly. Successful achievement of mission goals will require close collaboration and partnership between the USG and public sector. Unfortunately, engaging experienced industry players, particularly large pharmaceutical companies, has proven challenging under the current MCME business model.

Current Approach to MCM Development

The Enterprise’s CBRN program investments to date have primarily focused on biological threats. Policy decisions on how MCM products against biological threats will be used emphasize post-event response with stockpiled MCM products. To obtain these MCMs, the MCME is seeking to develop new products (vaccines and therapeutics) for a diverse set of requirements (including special needs populations) against

thirteen Material Threat Determinations (MTDs). To fulfill this mission, the USG is partnering with MCM developers by employing a variety of incentives. Incentives include “push” mechanisms, such as grants and contracts for basic research and advanced development, as well as “pull” mechanisms, such as BioShield procurement contracts to entice MCM developers to develop MCMs through licensure or approval and produce them for procurement. To date, the incentives used to promote the MCME have succeeded in motivating significant engagement primarily by small innovator biotechnology companies.

Industry Needs

Incentives employed to date by the MCME are seen by industry to be insufficient to support robust development programs and to sustain a reliable market. As such, this approach has not created the conditions that would attract experienced industry participation. A more effective business model for MCM development could increase industry engagement by more successfully meeting the core needs of experienced pharmaceutical companies. To that end, we have identified three principal conditions that must be addressed:

-

Product Requirements: Developers need specific requirements for the MCM, including what the product should be (Target Product Profiles [TPP], including formulation, dosage, method of administration, etc.), how much will be required, and when it must be delivered.

-

Regulatory Clarity: Developers must have a clearly defined regulatory path to licensure, particularly with respect to the Animal Efficacy Rule requirements.

-

Return on Investment: Companies must realize adequate returns, financial or otherwise, to offset the opportunity costs of other potential projects.

Medical Countermeasure Business Model Framework

Top-down course corrections will likely be necessary to resolve the observable disconnect between industry needs and the current approach to MCM development to better engage private sector partners. The challenge at hand will not be solved with a short term solution, but rather through a series of policies and strategies coupled with tactical practices and incentives that will enable the current “business model” to evolve.

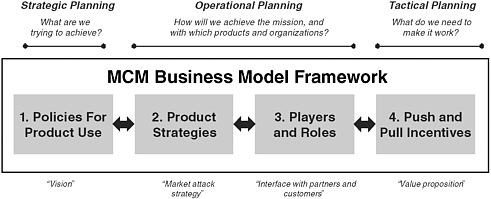

The current approach to MCM development can be summarized as a business model composed of four basic components for achieving the goals of the MCME. The business model framework includes strategic, operational, and tactical planning elements, each of which plays a pivotal role in defining, organizing, and executing MCM development. The four elements of the MCME business model include to following:

-

Policies for Product Use: Policy decisions for how MCMs are used (e.g., stockpiling, vaccination/prophylaxis that drive MCM product requirements (what, and how much).

-

Product Strategies: Development of new MCM products vs. new indications for commercial products, or indications for special populations.

-

Players and Roles: Company and customer types, roles in development, and structure of partnerships.

-

Push and Pull Incentives: Incentives provided by the government to increase industry interest in MCM development opportunities.

Incentives

Incentives are a critical component of the business model, as they provide toolkits for executing strategic and operational plans. Incentives are generally grouped into “Push” incentives that lower the costs of development and “Pull” incentives, which provide the expected revenues. Our research focused primarily on incentives that have not yet been applied to the biodefense industry. We encountered a variety of opinions as to how applicable and successful various incentives would be at promoting MCM development. Key findings from interviews and literature include the follwing:

-

No one push or pull incentive is sufficient to attract experienced companies to the MCME.

-

There is no single best combination of incentives—the right package depends on context (policy and strategy decisions, requirements, technologies, pipeline maturity, etc.).

-

Pull strategies should focus on increasing return on investment (ROI) through sustainable markets while push strategies should focus on cultivating partnerships and collaborations.

-

Minimizing disincentives (e.g., lack of sustained and sufficient funding, government contracting process, lack of regulatory clarity)

-

may be enough to “tip the scale” and would “send a signal that the MCME is committed to collaborating with industry,” potentially attracting additional private investors to MCM development.

Conclusion

Under the current policy of focusing on post-event response based on product stockpiling, opportunities to increase industry participation exist across the latter three segments of the MCME Business Model Framework. Alternative policies for product use, in turn, could have a cascade of alternative approaches. The most frequently cited opportunities for increasing the level and mix of involvement by pharmaceutical and biotechnology companies in the MCME include the following:

-

Product Strategy: The USG should increase the emphasis on promoting multiple use products, platforms, and technologies with commercial applications.

-

Players and Roles: Role assignments should focus on performer strengths, with innovator companies driving products through proof of concept (POC), and then partnering with experienced companies for late-stage development and manufacturing. USG should explore opportunities to promote collaborations, whether these are bilateral partnerships between companies or public–private partnerships.

-

Incentives: The most critical incentive the USG can provide is to create a reliable market for MCM products. Additional incentives for consideration include priority review vouchers, new types of tax incentives for research and development (R&D) costs, and the funding of capital assets (equipment, manufacturing facilities, etc.) that can be leveraged for commercial purposes.

INTRODUCTION

Medical Countermeasure Development Challenges

The development of critical countermeasures is an ongoing challenge for the MCME. Most of the threats featured in the 2007 Public Health Emergency Medical Countermeasures Enterprise (PHEMCE) Implementation Plan for CBRN threats (Table E-1 below) require development programs to achieve either approval/licensure for new MCM products or new indications for existing products.1

Table E-1 Material Threat Determinations (MTDs) and Population Threat Assessments (PTAs) Issued to Date by the Department of Homeland Security

|

DHS: Material Threat Determinations (MTDs) and Population Threat Assessments (PTAs) |

|

|

Bacilus anthracis (Anthrax) |

Marburg virus (Hemorrhagic Fever) |

|

Botulinum toxins (Botulism) |

Multi-drug resistant Bacillus anthracis (MDR Anthrax) |

|

Burkholderia mallei (Glanders) |

Radiological/Nuclear agents |

|

Burkholderia pseudomallei (Meliodosis) |

Rickettsia prowazekii (Typhus) |

|

Ebola virus (Hemorrhagic Fever) |

Variola virus (Smallpox) |

|

Franciscella tularensis (Tularemia) |

Volatile nerve agents [PTA only] |

|

Junin virus (Hemorrhagic Fever) |

Yersinia pestis (Plague) |

The MCME Environment Is Complex, Challenging, and Uncertain

Unfortunately, the MCM landscape is plagued by uncertainty in an already complex and challenging field where the development of pharmaceuticals and vaccines is inherently risky, lengthy, and costly. Development cycles can take as long as 10 to 15 years and are conservatively estimated to cost $1.2 billion for small molecules and

$1.3 billion for biologics.2 In contrast, Project BioShield’s 2004 funding is only $5.6 billion dollars over 10 years of procurement for at least 13 MTDs and 1 PTA.3 Additionally, most product candidates that enter clinical trials do not succeed, with only 13% gaining regulatory approval.4 Even if these products reach the market, 70% fail to recoup their R&D investments.5 Moreover, under the current business and incentive model has largely constrained the Enterprise to working with smaller, less experienced companies with little or no history of successfully developing, licensing, and producing products.6 Compounding these challenges is the overarching uncertainty that touches virtually every aspect of the MCM value chain, including product requirements, market size, and regulatory constraints. The “market” for CBRN MCMs has largely been determined by intermittent stockpile procurements by the U.S. government under Project BioShield. This approach makes it difficult to anticipate government procurements and thus creates market uncertainties for companies. As with any other industry, high levels of uncertainty and low expected returns lead to decreased investor interest and pose major challenges to the MCME.

MCM development also faces regulatory uncertainty due to the Animal Efficacy Rule.7 Under this guidance, efficacy is established through animal models rather than human populations for ethical reasons. To date, no novel products and only a two new indications of previously licensed products have been approved under the Animal Efficacy Rule.8 Moreover, many threats do not yet have proven animal models available.9 When models exist, they only provide a rough approximation

of the efficacy of the treatment in human populations, as countermeasures developed using the Animal Efficacy Rule will remain untested in humans until used during an emergency.10 Based on stakeholder feedback, the Animal Efficacy Rule pathway is seen as uncertain and riddled with risk by both large and small MCM developers, despite recent efforts by the FDA to provide additional guidance on the matter.11 Furthermore, several interviewees questioned whether the FDA has enough focused resources and funding to manage MCM reviews vis-à-vis other products. SMEs also questioned whether reviewers in the Center for Biologics Evaluation and Research (CBER) and the Center for Drug Evaluation and Research (CDER) have the necessary public health and national security perspective to understand the unique requirements and context of MCM products required to evaluate the trade-offs and exceptions that come into play with their development.

Engaging Experienced Industry Players Has Proven Challenging

The mission inherently requires close collaboration between the USG and private sector companies. While stakeholder opinions varied about the type of industry participation needed, the majority believed that some level of experienced pharmaceutical engagement, particularly in late stage development, was a necessity to building a successful MCM development enterprise. Because of their size, smaller companies simply do not have the breadth of skills in development chemistry, process chemistry, manufacturing, etc., that can be found in larger firms, and this is a critical gap. As one subject matter expert (SME) explained, “When you’re developing a new chemical entity and a new manufacturing platform that the Food and Drug Administration [FDA] is not familiar with, you need that experience. It’s not that the smaller guys aren’t smart enough, it’s just that it’s a game of breadth, not depth.”

Despite the need for seasoned industry expertise, the MCME has had difficulty attracting significant interest from mid- and large-size pharmaceutical firms,12 whose main barriers to entry are the high opportunity costs for potential time and money spent on CBRN MCM development activities in an industry where, according to one industry expert, “opportunity cost is everything.” Unfortunately, the market

opportunity that industry perceives for medical countermeasures is quite small, particularly for CBRN countermeasures, compared with the scale of other market segments that they address. As such, most MCM developers to date have been smaller biotech companies with fewer alternatives for development programs. As one SME explained, “While all potential partners consider funding as an incentive for participation, anticipated MCM funding is more likely to attract smaller biotech companies and academic labs.” This is largely because the opportunity costs of small biotechs for undertaking MCM development activities are much lower than that of large pharmaceutical companies.

Inconsistent funding from the USG poses additional uncertainty and risk. More specifically, in FY09, $275 million was transferred out of the SRF for advanced research and development and $137 million was transferred out for pandemic influenza preparedness. In FY10, $305 million was transferred out of the BioShield Strategic Reserve Fund (SRF) for advanced research and development while $304 million was transferred out to the National Institute of Allergy and Infectious Diseases (NIAID). 13 Current FY11 requests would transfer $476 from SRF for advanced development. Transferring funds away from the SRF leaves less pull funding available for MCM acquisition and, more importantly, sends a negative signal to current and potential industry partners regarding the government’s commitment to the MCM development mission. Congress has not articulated plans to reauthorize the SRF, creating unsettling market uncertainty for companies whose research and development programs are not expected to reach maturity until after the SRF is due to expire in FY2013.14 Ongoing uncertainties about the level of annual appropriations make it difficult for MCME agencies to effectively manage multiyear MCM research and development programs and engage industry partners in the mission. Moreover, program managers are typically unable to fully fund all projects and build pipelines of concurrent candidates.15 Because no one entity is necessarily responsible for funding end-to-end MCM development, it is important to ensure funding dollars are appropriately distributed across all stages of the product development pipeline.

Despite these challenges, most subject matter experts still believe that seasoned industry firms can play a role in MCM development,

though one representative from a leading pharmaceutical company representative noted, “If you were to search through our corporate strategy, the words ‘biodefense’ and ‘medical countermeasure’ will never appear.” Stakeholders agreed that successful MCM development depends on establishing a breadth of capabilities not typically found in most small companies. A refined MCME business model may make the CBRN MCM opportunity more appealing to experienced pharmaceutical companies.

CURRENT UNITED STATES GOVERNMENT APPROACH TO MCM DEVELOPMENT

The Enterprise’s CBRN program investments to date have primarily focused on biological threats. The approach that has been followed to date for developing MCMs against these threats can be summarized as follows:

-

Policy decisions on how MCM products against biological threats will be used emphasize post-event response with stockpiled MCM products. These policies are described in the PHEMCE Strategy and Implementation Plan of 2007.16 Such policies reinforce a perception that a successful developer would achieve only fixed, small volumes of MCM sales.

-

The MCME is largely seeking to develop new MCM products (vaccines and therapeutics) for a diverse set of requirements (including special needs populations) against 14 agents for which MTDs and PTAs have been issued, most of which are for biologic threats. 17 Coordinating funding and development for these development projects across multiple USG agencies is a complex task. Recent progress has been made toward gaining cross-agency organization in an effort to help define and manage a single “Integrated Portfolio” for USG Biodefense MCM development. 18 This approach is intended to coordinate the biodefense MCM pipelines currently managed by the Biomedical Advanced Research and Development Authority (BARDA), NIAID, Department of

-

Defense (DoD)/Chemical and Biological Defense Programs (CBDP) and Defense Advanced Research Projects Agency (DARPA) and in turn achieve a more balanced pipeline of products from research and development through advanced development to FDA approval or licensure.

-

The MCME is partnering with MCM developers to manage the entire MCM development chain from research, to development, and finally to production by employing a variety of incentives, including “push” mechanisms and “pull” mechanisms (e.g., grants, contracts, government/industry collaborations, liability protections, tax credits) and “pull” incentives (e.g., regulatory and exclusivity rewards, procurement contracts) that mitigate MCM developers’ risk.19

-

Historically, MCM advanced development by HHS depended primarily upon pull based incentives through Project BioShield. Under the Pandemic and All-Hazards Preparedness Act of 2007 (PAHPA), however, incentives that the U.S. government employs to achieve this mission now include a broader combination of “push” incentives (e.g., advanced development funding) and “pull” incentives (e.g., BioShield awards) that mitigate MCM developers’ risk20 in an attempt to help MCM development cross the perceived “valley of death”21 in late-stage development. To promote advanced development and innovation, BARDA can award contracts, grants, cooperative agreements, and utilize other transaction authorities (OTAs). BARDA is also responsible for pulling MCMs through late-stage advanced development and into production by managing the Project BioShield SRF.

INDUSTRY NEEDS FOR MCME ENGAGEMENT

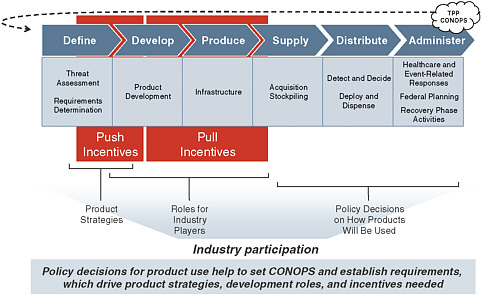

Figure E-1 illustrates several related factors that shape the level and mix of industry participation in MCM development. Policy decisions for how MCM products will be used help to set a concept of operations (CONOPS) and establish product requirements, which drive product strategies, development roles, and incentives needed. Plans for how MCMs will be supplied, distributed, and administered downstream have

significant implications for upstream development activities. These considerations may expand or contract companies’ assessments of MCM development opportunities.

FIGURE E-1 High-level overview of how policies for product use, product strategies, roles for industry players, and push and pull incentives drive industry participation throughout the MCM Development Value Chain.

Given the factors that shape industry participation in the MCME, further consideration must be given to companies’ “must-have” conditions prior to pursuing MCM development projects. A recent draft report by the National Biodefense Science Board (NBSB) Markets & Sustainability Working Group examines issues constraining or enabling industry involvement and highlights a series of recommendations for optimizing industrial support of medical countermeasure development.22 Drawing from that NBSB report, an extensive review of current literature, and the stakeholder interviews, we have identified the three principal conditions that must be met in order to attract experienced pharmaceutical companies and VC funding to the MCME:

-

Requirements: Simply stated, companies need to understand the requirements for the MCM the USG wants them to develop. Costs and risks are present at every step of the value chain, from quality control issues during R&D and manufacturing, to demand forecasting challenges, to competition from subsequent market entrants.23 These requirements should help mitigate these expenses and uncertainties by including clear clinical research requirements, expected volumes specifications, detailed price information, and intended usage scenarios,24 which drive the target product profiles (TPPs) for the countermeasures. With these requirements clearly stated, companies can then balance product requirements against their current capabilities and constraints in order to determine if an opportunity is worth pursuing.

-

Regulatory Clarity: In addition to a clear set of product requirements, MCM developers must have a clearly defined regulatory path that can be navigated to success. Companies want to know what they have to do to achieve FDA licensure or approval. As one company representative explained, “The regulatory process is the most uncertain thing there is in biodefense and creates too much risk for pharma.” The FDA provided draft guidance on this topic in January 2009 through its publication titled “Draft Guidance: Animal Models—Essential Elements to Address Efficacy Under the Animal Rule,” 25 though the exact requirements and restrictions of the regulatory path are still a topic of much debate. Some SMEs stated that the Guidance document should be repealed because it is overly restrictive. Comments have been received and are under review as the FDA works to finalize the document.

It is important to note, however, that despite the importance of bringing these products to licensure, interviewees expressed the importance of not trying to “short-cut” regulatory standards for MCMs. They noted that it makes little difference how quickly a product gets to market if the public doesn’t have confidence in its safety and refuses to accept it. Instead, interviewees voiced strong opinions that MCM developers should engage with the FDA early in

-

the process to validate plans and obtain guidance throughout the development process and submission preparation.

-

Return on Investments: A final key consideration for any MCM developer is the need to offset the opportunity cost of participating in MCM development as opposed to developing other commercial products. As public companies with a fiduciary duty to shareholders, experienced pharmaceutical manufacturers in particular must ensure the returns are worth their investments of R&D dollars and time. One SME noted that a critical difference between pharmaceutical companies and other industries that regularly contract with the USG is the fact that “Wall Street expects a much higher rate of return from pharma companies.”

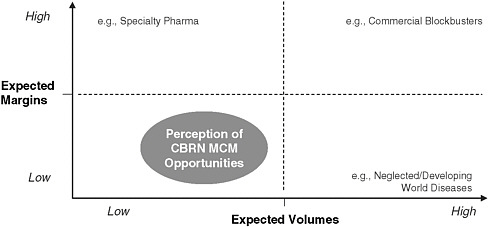

Two key factors influencing the expected return of an MCM development project are margin and volume. Figure E-2 shows the financial attractiveness of an opportunity as a function of the expected margin and market size of the product. Today’s MCME model anchors most development opportunities in the lower left quadrant, with small, periodic purchase volumes and low margins. Alternatively, competing projects tend to fall into the more fiscally attractive quadrants where they compete with MCMs on volume, margin, or both.

FIGURE E-2 CBRN MCM opportunities are perceived by industry as a low-margin, low-volume, and low-return investment.

Ideally, companies would like to be able to anticipate an expected return that is competitive against other potential projects before making an investment decision. At a minimum, however, they require some

concrete indication that MCM development is considered important and credible assurance of a long-term commitment with financial backing, policies and incentives that support a predictable market. While MCM development projects will never be risk-free investments, industry players need to be able to anticipate an attractive return, to enable an informed decision relative to other opportunities.

According to stakeholder interviews and current literature, the three critical conditions outlined above are not being met. As such, many feel it is “almost impossible” for industry to justify pursing this mission as it does not present a sound business opportunity. As one SME noted, “You have an uncertain regulatory path to approval, the government determining procurement volumes, and the government reserving the right to change its mind. That makes it all kind of scary.”

A MEDICAL COUNTERMEASURES BUSINESS MODEL FRAMEWORK FOR INDUSTRY PARTICIPATION

Resolving the observable disconnect between industry needs and today’s MCME requirements will take more than tactical additions and adjustments to the current business model. The challenge at hand will not be solved with a short term solution, but rather through a series of policies and strategies coupled with tactical practices and incentives that will enable the current business model to evolve into a system that can achieve the desired state of operations.

An effective, mission-focused MCM business model depends on top-level strategic guidance, comprehensive operational planning, and successful tactical execution. The MCM business model framework spans all three:

-

Strategic Planning: “What are we trying to achieve?”

-

Operational Planning: “How will we achieve the mission, and with which products and organizations?”

-

Tactical Planning: “What do we need to make it work?”

Framework Overview

The current approach to MCM development can be summarized as a business model composed of four basic components, each of which plays a pivotal role in defining, organizing, and executing MCM development (Figure E-3).

FIGURE E-3 MCM business model framework spans across strategic, operational, and tactical planning.

-

Policies for Product Use (or “Vision”): Policy decisions for how MCMs are used (e.g., stockpiling, vaccination/prophylaxis, or forward deployment) that drive MCM product requirements (what, and how much)

-

Product Strategies (or “Market Attack Strategy”): Development of new MCM products vs. new indications for commercial products, or indications for special populations

-

Players and Roles (or “Interface with partners and customers”—[i.e., industry]): Company and customer types, roles in development, and structure of partnerships

-

Push and Pull Incentives (or “Value creation”): Incentives provided by the government to increase industry interest in MCM development opportunities

Summary of Select Alternative Medical Development Models

This framework can be used to summarize components of alternative medical development models, including those for pandemic influenza, neglected diseases, and radiological and nuclear threats, as well as biological threats. These examples serve to highlight how policy decisions and product strategies have implications for industry roles and

incentives needed. Table E-2 provides an overview of these models based on the framework.

TABLE E-2 MCM Business Model Applied to Pandemic Influenza, Neglected Diseases, Rad/Nuc Threats, and Biological Threats

|

Examples |

1. Policies for Product Use |

2. Product Strategies |

3. Players and Roles |

4. Push and Pull Incentives |

|

Pandemic Influenza |

Broad vaccination campaign for H1N1 vaccine |

Extension of commercial vaccine for seasonal influenza |

Performers: Experienced vaccine manufacturers responsible for development, production, and licensure of their own product. |

Significant pull incentives (procurement contracts) for H1N1 Building on Experience from development contracts since 2006 |

|

|

|

|

Customers: USG, State and Local governments |

|

|

Neglected Diseases |

|

|

|

|

|

Radiological/Nuclear Threats (Rad/Nuc) |

Vendor or customer managed where feasible; Stockpiling where necessary |

New indications for commercial products (primary approach) New products for biodefense only |

Performers: Government conducting studies for Rad/Nuc indications for companies to file Customers: USG |

Simplified contract management See section 9.1: “Government develops MCM/Comp any owns IP” |

|

Biological Threats |

Stock-piling MCM’s for |

New MCMs for |

Performers: companies |

Push: NIAID grants and |

|

|

post-event response |

individual biological threats (primary approach to date) |

responsible for research as well as development and production of their products; these have primarily been innovator companies |

contracts; advanced development funding Pull: BioShield SRF procurement contracts |

|

|

|

|

Customers: USG |

|

POLICIES FOR PRODUCT USE

The first component of the MCM Business Model Framework is a set of policy decisions that drive the rest of the business model. As described in the summary of the current approach for biological threats, the policy emphasis to date has been on post-event response using stockpiled MCM products.

Alternative policy decisions would have significant implications on the usage scenarios and CONOPS for MCM products. These would likely translate into changes in the volume of MCMs required (and thereby a potentially larger addressable market) and in the target product profile of products required. For example, if the decision were made to follow a policy of pre-event prophylaxis against a certain threat, companies could expect that sales of relevant vaccines could be greater than if the products are stockpiled. 26 Similarly, a policy of forward deployment of MCMs stockpiled in-home 27 could increase expected volumes. These policies could also expand potential buyers beyond

agencies such as BARDA and the CDC to also include state and local governments, the DoD, and even individual citizens.

PRODUCT STRATEGIES

The second component of the MCM Business Model Framework provides a means for segmenting MCM products based upon development approach strategies and target populations. MCM products can be organized into four categories:

-

New Products with No/Limited Commercial Markets

-

New Products, Platforms, and Technologies for Flexible Defenses

-

New Indications for Existing Products

-

New Indications for At-Risk Populations

While each category presents a unique set of advantages and challenges, each one also plays an important role in maintaining a robust portfolio of MCM products and represents a different scope and scale of industry involvement.

New Products with No/Limited Commercial Markets

In the absence of related products that may be leveraged, CBRN MCMs must be developed and manufactured essentially for a single customer, the U.S. government, with potential for limited purchases by foreign governments. Under these circumstances, development must begin with very early stage research and progress through all of the subsequent MCM development stages. The associated time, cost, and risk introduced under these circumstances is a large disincentive to potential investors and industry collaborators. Most of the current biological MCMs fall into this category. These countermeasures address biothreats with unique biological pathways and consequences.

New Products, Platforms, and Technologies for Flexible Defenses

The MCME is interested in acquiring broad-spectrum products, platforms, and technologies that can have both commercial and biodefense applications, enabling biotechnology firms to rely more on commercial opportunities to generate adequate ROI as opposed to

depending exclusively on government procurement. 28 Additionally, as biotechnologies become more powerful and accessible, there will be an increased range and severity of potential threats, whose growth may outpace the growth of “one bug, one drug” countermeasures that can be stockpiled. 29 The White House’s Homeland Security Presidential Directive 18 and the PHEMCE Strategy and Implementation Plan of 2007 both recommended addressing this problem by developing broad spectrum countermeasures and platform technologies.30 One SME touted the value of broad spectrum products, platforms, and technologies, stating, “I want to have multiple plays because I know most products fail.” Despite widespread enthusiasm for this product strategy, broad-spectrum approaches have so far had limited success beyond new indications for some antibiotics.

New Indications for Existing Products

In some cases, it is possible to build upon the research and development of commercially available products to develop MCMs. One interviewer remarked that this is generally feasible when a potential biothreat causes symptoms or other biological reactions similar to those of diseases for which commercial drugs are already available. In such cases, it may be possible to leverage the discoveries, technologies, and other IP associated with a commercial drug to jump start the development of a new MCM. In theory, only late stage development work would be required to license the commercial drug as an MCM by showing efficacy under the animal rule, since safety will have already been proven, although additional clinical studies may be required for new dosing schedules. Additionally, the ongoing commercial market helps ensure a steady demand for the product, thereby alleviating some of the risk associated with inconsistent USG procurement and providing a more attractive case for investment by private companies. Thus this strategy carries potentially significant cost and time advantages, assuming a suitable commercial product is available.

Examples of products in this segment include some MCMs developed to address radiological and nuclear (Rad/Nuc) threats.

Because of the strong similarities between cancer activity and Rad/Nuc exposure, the oncology drug market has proven to be a powerful source of potential Rad/Nuc MCMs. Rad/Nuc MCMs have been developed by modifying commercially available oncology treatments to meet requirements for Rad/Nuc countermeasures.

New Indications for At-Risk Populations

In order to ensure the MCM portfolio provides comprehensive coverage for all individuals, a fourth segment of MCMs encompasses those products specifically tailored for “at-risk” populations among the general public, be they new indications for available products or newly developed products. According to section 2802 of the Pandemic and All-Hazards Preparedness Act (PAHPA), at-risk populations are defined as “children, pregnant women, senior citizens and other individuals who have special needs in the event of a public health emergency, as determined by the Secretary.”31 Once an MCM is licensed with a label that meets an intended CONOPS, it may need to be augmented to suit the needs and requirements of these at-risk populations. SMEs suggested that there are few development strategies 32 that are unique to MCMs for special populations and that they should simply be considered as development programs for additional indications. Incentives such as those currently in place for pediatric indications for commercial products could be pursued.

PLAYERS AND ROLES

The third component of the MCM Business Model Framework addresses operational and organizational roles for successful MCM development and procurement. The MCME encompasses a diverse set of stakeholders, including pharmaceutical and biotechnology companies, federal agencies, state, local, and tribal governments, public health organizations, and, importantly, individual citizens. Collectively, these stakeholders have a broad range of roles including defining product requirements, conducting R&D, manufacturing, procurement, and distribution. In addition to the current approach described below, there

are a number of alternative ways these players could work together to achieve the mission of bringing new MCMs to licensure. Several models for this MCM developer base are explored in section 9.1. Similarly, the MCM customer base can also vary depending on the policies and product strategies in place. Potential implications for MCM customers are discussed in section 9.2. Throughout the various models, the role of the USG in the developer base is generally one of either providing incentives directly to partners, or catalyzing interactions among industrial and academic partners. Regardless of its role on the performer side, the USG is a primary customer in each case. As expected, each alternative presents its own set of benefits and weaknesses.

MCM Developer Roles

-

Research and Development by Small Innovator Companies: Current Predominant Approach

As discussed in previous sections, the MCME’s existing incentive structure and current market challenges have primarily resulted in the USG being successful in enticing small, private sector entities to develop MCMs through licensure and produce them for USG procurement for stockpiling, distribution and potential use. Unfortunately, these small biotech ventures may lack the experience, expertise, and other general resources required to successfully complete the mission within time, cost, and quality goals, as noted in interviews with SMEs. This is particularly evident with respect to advanced development and production.

-

Research and Development by Experienced Pharmaceutical Companies

Under this model, experienced pharmaceutical companies take responsibility for the end-to-end discovery, development, scale-up and manufacturing of new MCMs. This approach could entail adapting current commercial products to fit the requirements of a bioterrorism threat or developing novel products. The USG plays a relatively hands-off role, as the bulk of the project management and execution responsibility rests with the pharmaceutical company, as they are experienced at managing the entire length of the development value chain. The strength of this approach is that it takes advantage of the most knowledgeable experience base available and maintains consistency throughout all phases of

-

development. The dominant weakness is that the opportunity cost to the industry player is tremendous and likely requires significant levels of USG incentives. Moreover, experienced pharmaceutical companies are not necessarily in the best position to execute early discovery work, as small companies tend to drive innovation.33 As one SME noted, “discovering good drug candidates is not a prerogative of big pharma.”

-

Successful examples of experienced pharmaceutical industry participation in the CBRN space do exist, as evidenced by the Pandemic Flu vaccine program. Here, experienced industry performs virtually all phases of production, and supports the annual development of new seasonal flu vaccines. It must be noted, however, that seasonal flu represents a recurring revenue stream for these industry players, as opposed to a one time production for stockpiling, highlighting the opportunity for incorporating flexible defenses in engagements with industry manufacturers.

-

Government Develops MCM/Company Owns IP

Under this model, the USG assumes responsibility for late-stage 34 development of MCM products, building on the early stage work of biotech companies. The USG plays a very active role in this model, overseeing all late stage development activities using USG resources and facilities. Strengths of this model include the fact that the government does not have to invest heavily in the high-risk, early stage research and discovery efforts, as USG involvement does not commence until products are ready for late-stage development. Additionally, the USG is able to maintain a high degree of control over the critical late stage development and regulatory activities. The model suffers from companies’ perception of risks involved in putting a successful commercial candidate back through investigational studies for an alternate indication, given the potential for adverse effects or other negative outcomes. Thus, when applied to a commercial product already on the market, some companies may be hesitant to engage when the product at hand has (or potentially could have) a lucrative commercial market application.

-

A recent example of this approach can be found in the Rad/Nuc MCM development program. Here, the USG has demonstrated it is possible to develop a pipeline of Rad/Nuc MCM candidates on a very limited budget by drawing on successful products and candidates from private companies and academic researchers. While the Rad/Nuc program does not fund programs directly, it provides inkind services to companies who are interested in furthering their product’s scope by adding biodefense indications. 35 One notable factor of these collaborations is that they do not typically require government contracts to reach licensure and are therefore not subject to Federal Acquisition Regulation (FAR), making it simpler, and “less painful,” for private companies to engage with the USG.

-

Government Owns IP/Company Develops

Another option for government and private sector collaboration is to outsource government owned MCM compounds for development by private companies, while the USG retains ownership of the IP. This model allows the government to exercise control over valuable, and potentially sensitive, intellectual property, while taking advantage of a dedicated, specialized team of scientists. A notable example of this model is seen in the DynPort Vaccine Company (DVC) and its support for the DoD’s Joint Vaccine Acquisition Program (JVAP). For example, under this contract, the U.S. Army Medical Research Institute of Infectious Disease (USAMRIID) was involved in identifying the suitable protein antigens to create the rF1V plague vaccine, and subsequent efficacy testing, while DVC manages the vaccine’s advanced development up to and including possible licensure by the FDA.36

-

Experienced Company/Innovator Company Partnership

The goal of this model is to take advantage of the unique and valuable contributions both experienced pharmaceutical and innovator companies can make toward MCM development by encouraging them to form product development partnerships. Under this strategy, experienced pharmaceutical companies support early stage development of smaller, more innovative biotechs by providing financial backing, resources, and expertise. Once the product begins

-

to mature, the large pharmaceutical partner supports or manages late stage development and manufacturing. The role of the USG in this model is to facilitate and enable the formation of such partnerships. Many SMEs surveyed maintained that, despite big pharma’s development expertise, they are not necessarily the best innovators, and “don’t do the early stage stuff well.” As such, many SMEs were supportive of this type of partnership model and saw it as a logical, valuable distribution of labor.

-

Public Private Partnership (PPP)—Product Development Partnerships or Manufacturing

A PPP is any relationship where public organizations partner with private organizations to share personnel, intellectual property, facilities, equipment, technologies, and other resources. Often no one sector has the skills or resources to address a complex public health challenge single-handedly, and commercial incentives alone may be insufficient to trigger private investment. Partnering provides an opportunity not only to deploy the right skills and resources, but also to share the risks. Under this model, the public and private sectors contribute in different, yet complementary, ways to the partnership. A public sector partner typically articulates the need, defines the vision, and makes initial commitments to mobilize the partnership. This is achieved through sustained and targeted public sector investments in technology, human capital, public health systems, or infrastructure. Private sector partners often provide expertise in applied technology development, commercialization, systems integration, human capital, and the application of market-proven business practices and systems. Examples include product development partnerships focused on effective drug and vaccine development, such as the Medicines for Malaria Venture (MMV), and Access PPPs like the Global Alliance for Vaccines and Immunization (GAVI Alliance), aimed at improving access to medicines by targeting populations.

PPPs offer a wide array of potential benefits:

Offsetting Opportunity Cost—As public companies with a fiduciary duty to shareholders, pharmaceutical firms must structure their portfolio to pursue only the most profitable projects. However, government support of PPPs may allow pharmaceutical companies to

-

support MCM projects critical to homeland security despite weak capital markets.

-

Capacity Management—This PPP approach eliminates the dependence on industry manufacturing capacity and allows pharmaceutical companies to support the MCME without interrupting or compromising commercial production in their own facilities (provided the PPP operations have dedicated facilities and resource teams). Furthermore, a PPP with flexible manufacturing capacity could provide the ability to produce a wide range of products in relatively low volumes, making it ideally suited to support the MCME.37

-

Technology and Talent Development—A PPP also provides the opportunity for pharmaceutical companies to explore and test new technologies that could benefit both biodefense and commercial projects. SMEs noted that major pharmaceutical companies are often hesitant to pursue a new technology that could improve a marketed product for fear of encountering a complication in the development, such as a clinically adverse event, that could affect the marketing of the commercial product. However, they would be more willing to explore and apply new technologies to the biodefense application (using government funding) and then use those technologies for commercial products once the technology is proven and the systems are in place. Thus the opportunity to explore new technologies for MCMs with government funding and then build upon those technologies in the commercial market could be very attractive to industry. Similarly, PPPs provide an incubator for analytical talent for the industry firm. Essentially, the PPP serves as an instrument for human capital growth—developing employees with new scientific and technical based skills that could be applied to the parent organization.

-

The majority of interviewees were supportive of creating PPPs to research, develop, and manufacture MCMs, and examples of such collaborations have shown positive results. Recent examples of PPPs at work include the Cystic Fibrosis Foundation, the Michael J. Fox Foundation for Parkinson’s Research, and the Multiple Myeloma Research Foundation. A commonly noted disadvantage of PPPs is

-

that products and technologies resulting from these agreements may face complicated disputes over intellectual property.38 Thus careful consideration and forethought must be given to ensure all parties agree on the IP ownership plan to ensure downstream IP discrepancies do not hinder a PPP’s effectiveness.

-

Outsourced Development: Virtual Pharmaceutical Company

Another alternative for the MCM development performance base is built on the notion that multiple organizations can collaborate to the point that a “virtual pharmaceutical company” is created. The goal is to form a unified network of companies capable of end-to-end execution of all aspects of the research, development, licensing, and manufacturing of an MCM. More specifically, BARDA or another participating government agency can directly manage MCM development by linking smaller biodefense discovery companies with contract manufacturing organizations (CMOs), contract research organizations (CROs), specialized facilities that test biothreat formulations and other types of intellectual property or technical resources. 39 Several industry experts remarked that the virtual pharmaceutical company model requires a manager with experience at a large pharmaceutical company who understands all development phases, particularly for processes related to late-stage development. The virtual pharmaceutical company model allows specialization and outsourcing of each segment to best available skills at lower costs to attain efficiencies. These efficiencies are especially apparent when the research segment is outsourced to the party that can most successfully complete segment’s goals.

The primary weakness of the virtual pharmaceutical company model applied to MCM development is that it is essentially constrained by the current capabilities of existing pharmaceutical, biotechnology, and support companies. In other words, this approach does little to stimulate the development of new technologies, infrastructures, and personnel not yet in existence unless additional funding is provided for such purposes.40 Similar to the public-private partnership model, intellectual property ownership can be a point of contention.

MCM Customer Roles

The customer base of the MCME is largely determined by the policies and product strategies in place. For example, the current approach of post-event response using stockpiled MCMs makes the USG (and to a lesser extent state and local governments) the sole customer for MCMs and generally limits purchases to one-time bulk acquisitions and warm base manufacturing contracts. As alternatives to the current MCM business model are considered, it is important to note that any changes to policies and product strategies will have direct implications to the size and characteristics of the MCME customer base. Depending on the policies set forth going forward, MCM customers could expand beyond the USG to include state and local governments, private citizens, international governments, and global health organizations.

While numerous scenarios are possible, pre-event prophylaxis, pre-deployment of MCMs, and international pooled procurement stand out as alternative approaches that could have significant impacts to the MCM customer base:

-

Pre-event prophylaxis could provide a much larger, more predictable demand for vaccines.

-

A pre-deployment strategy of distributing therapeutic MCMs as home supply kits would enable citizens to maintain personal stockpiles in their homes. Provided USG does not decide to purchase and distribute all MCMs, this approach would likely introduce private citizen as customers, creating an even larger customer base as each citizen would bear some responsibility to retain personal coverage rather than depending upon national reserve stockpiles.

-

Finally, the MCME may expand the customer base for US-made biodefense drugs and vaccines to allied countries to aggregate demand for MCM products. The USG has participated in the Global Health Security Initiative (GHSI), composed of health administrators from the G-7 countries and Mexico to address CBRN threats and expand access to countermeasures.41 If such a multinational pooled procurement collaboration were to occur,

|

41 |

See www.ghsi.org/. |

-

the customer base would be expanded even further to potentially include foreign governments and healthcare facilities.

PUSH & PULL INCENTIVES

The fourth component of the MCM Business Model Framework is a set of incentives for making the MCM development opportunity more appealing to experienced pharmaceutical companies. This white paper has explored multiple incentives that have been proposed or implemented in other contexts but not yet applied to the MCME. The research effort explored incentive models from a broad range of sectors, including those outside the life sciences industry. While other sectors offer relevant tools and concepts to inform incentive structure design in the MCME, no “off-the-shelf” models for MCMs were directly applicable. A summary of insights gleaned from other sectors is included in the Appendix. This section will focus on incentives deemed most relevant to the MCME mission, highlighting potential benefits and weaknesses relative to their applicability to MCM development.

The incentives presented below are grouped into “Push” incentives that lower the costs and risks of development and “Pull” incentives, which enhance the expected revenues. Most interviewees suggested that a combination of incentives could be effective in attracting companies to the MCM Enterprise and that these mechanisms could be used to augment the current MCM model. One SME summarized the issue as follows, “One thing is for sure in establishing such external incentives: one size does NOT fit all because of the varying sizes, capabilities, and capacities of companies who could address MCM development.” Combinations of push and pull incentives may be sufficient, depending on policy and strategy decisions for each MCM program, as well as where the incentives are applied along the development chain.

“Push” Incentives

Push mechanisms are intended to incite interest, action, and investment into scientific research on a particular problem by lowering the cost of research & development. Push incentives generally consist of tools for providing funding or other resources to make MCM R&D less

expensive,42 including grants, tax credits, help developing clinical trial infrastructure, and assistance during the regulatory review process. Essentially, push incentives provide assistance to participating industry partners in order to lower development cost or risk.

Currently, the USG provides several push mechanisms to engage MCM developers (e.g., grants, contracts, government/industry collaborations, liability protections, and tax credits). For example, the Pandemic and All-Hazards Preparedness Act (PAHPA) allows HHS to make advanced payments worth up to 50% of the value of a BioShield procurement contract to MCM developers before the delivery date of the product, provided that all milestones are successfully completed. 43 PAHPA also provides “limited antitrust exemption” that enables companies to participate in the joint development of an MCM. 44 MCM candidates, if approved by the FDA, could also benefit from tax credits if granted Orphan Drug Designation (ODD), 45 which is reserved for approved drugs that have a U.S. market of less than 200,000. All MCM R&D costs are also eligible for a research and experimentation (R&E) tax credit of 20% on qualified expenses.

One general criticism of push mechanisms is that money is applied without a guaranteed outcome. As such, there may be little impetus to move research into a clinically approvable product.46 This is less of a problem for an association like the Global Alliance for TB Drug Development, which actively manages all phases of the development process to ensure that research is focused on outputting an effective and safe vaccine. The most significant problem with push incentives, according to several of our SMEs, is that pharmaceutical companies want a market, not lowered development costs. While push mechanisms certainly help to incentivize industry participation, they may be inadequate by themselves, particularly for large pharmaceutical companies with higher opportunity costs.

“Pull” Incentives

Pull mechanisms seek to encourage private companies to develop MCMs by providing a reward if the desired goal is achieved. This can be done in several ways. Pull incentives can create a profitable market for the MCM, allow a regulatory or marketing reward to be applied to another more valuable product, or provide a capital asset that can be leveraged for a commercial product. Unlike push incentives, pull incentives generally pay out when the developer has reached a particular milestone, such as product approval or licensure, and in some cases, production of an FDA-approved/licensed product.

Currently, the MCME’s main pull mechanism is Project BioShield, a $5.6 billion SRF aimed at creating a market for vaccines against bioterrorism agents.47 Thus far, the funds have not succeeded in attracting large pharmaceutical companies to MCM development, but have instead engaged smaller developers with limited infrastructure or experience bringing a product to market.48

A common weakness in any pull mechanism requiring commitment of government funds is that it is very difficult for the government to confirm how much incentive a private company requires to begin an R&D program. Government subsidies can “crowd out” private capital, particularly for dual use products, that the company would otherwise use in the same R&D programs.49 Researchers have postulated that policy makers should be aware that some amounts of tax dollars are replacing private funds without a corresponding net increase in R&D activity for MCMs.50

NEW PUSH AND PULL INCENTIVES

This white paper explored various push and pull incentives from other sectors that have not yet been used in the biodefense industry. The following sections detail potential benefits, weaknesses and implementation challenges in applying these incentives to the MCME.

These sections will explore the following new push mechanisms:

-

Enhanced Tax Credits

-

Access to Intellectual Property

-

Access to Technology, Capacity, and Regulatory Services

These sections will explore the following new pull mechanisms:

-

Advanced Market Commitments (AMCs)

-

Priority Review Vouchers (PRVs)

-

Market Exclusivity Rewards and Patent Extensions

-

Prizes

-

Leverageable Capital Asset Investments

Push Incentives

Enhanced Tax Credits

Tax credits are a means of incentivizing an activity for which there is an insufficient reward or return on investment (ROI); they can also compensate the developer for creating products that serve the public good, which in this case is the development of MCMs. Tax credits can be applied in a variety of ways to incentivize MCM R&D in general, as well as encourage more activity surrounding certain aspects of the MCM development process. Below are examples of some existing tax credits:

-

Research and Experimentation Tax Credits: R&D activities are a public good that have broad social and economic gains.51 Most companies now receive an R&E tax credit of around 20% for qualified R&D expenses to incentivize R&D activity.

-

Orphan Drug Tax Credit: Currently, vaccines and therapeutics developed to treat rare diseases can get a 50% tax credit on clinical trial costs if granted Orphan Drug Designation (ODD) by the FDA. 52 Most MCMs are eligible for ODD in the United States because of their low disease prevalence. According to Dr.

-

Marlene Haffner at the 2010 IOM Conference, four MCMs have been approved for ODD since the conception of the program.53

Existing R&E and Orphan Drug tax credits are likely insufficient to incentivize adequate engagement in MCM development. New tax credit designs beyond what is currently available can be considered as well:

-

Tradable tax credits: For firms that do not have significant streams of current income (e.g., most biotech firms), tax credits will yield little or no returns. The above tax incentives could be made transferable to address this issue, and unprofitable biopharma firms could trade their credits to profitable firms. Alternatively, tax credits could also be made deferrable to a future time when the firm becomes profitable.54

-

Strategic Partnership Tax Credits: The USG can issue a tax credit for experienced pharmaceutical companies who partner with innovator biotechs to develop MCMs. This may motivate large companies to actively seek out innovator companies who are working on promising technologies.

-

Manufacturing Facilities Tax Credits: The USG can institute a new investment tax credit for the construction of new R&D and manufacturing facilities for MCM production in the United States. Tax credits for manufacturing facilities may be particularly useful for vaccine manufacturers, as manufacturers must take years to build and validate new manufacturing facilities before the vaccine can be approved, incurring significant capital expenditure and risk along the way.55

Potential Benefits

For USG: Tax credits can be used to incentivize certain industry behaviors that are beneficial for MCM development. There is evidence to suggest that tax credits are relatively efficient at incentivizing R&D activity. One study of science and technology econometrics found that one dollar in tax credits resulted in one dollar of investment in R&D.56

For Industry: Tax credits provide substantial savings to R&D expenses without the formality of contracting with the USG.

Potential Weaknesses

Creative accounting could allow only tangentially related R&D activities to receive tax credits. Careful restriction of tax credits to include only activities related to MCM development would help to curb improper accounting.57

Implementation Issues

Implementing new tax credits would require congressional action, and the US government would pay for tax credits through reduced tax revenues.

Access to Intellectual Property

The National Institutes of Health (NIH), the Centers for Disease Control and Prevention (CDC), U.S. Army Medical Research Institute for Infectious Diseases (USAMRIID), and similar agencies have a wealth of intellectual property (molecular libraries, animal models, methods, techniques, etc.) that can be of interest to researchers in the private sector. There are multiple ways to enable access to such IP in the MCM development space. One option is to form a public–private partnership where government agencies share available molecular entities for MCMs with their commercial counterpart. Another option is to maintain open source access to government patents and patent applications for certain MCMs. Much like an open source programming language, once a product becomes open source, any authorized researcher can work on the product without infringing upon patent rights. Participants frequently join open source ventures for nonmonetary incentives such as ideology, to gain reputation, or to advertise skills to potential employers. Projects like LINUX have been remarkably successful and have generated a significant amount of interest. 58 In the healthcare space, GlaxoSmithKline (GSK) recently deployed a similar model whereby

they granted access to 800 patents and patent applications for researchers working to understand neglected tropical diseases in Least Developed Countries.59

Potential Benefits

For USG: Setting up the infrastructure to disseminate government-owned IP is relatively inexpensive, and could generate interest and activity from experienced scientists. According to one SME, there is a big difference between the leading pharmaceutical companies and the scientists who work for those companies and, in his opinion, the current organization of the corporate pharmaceutical world has many scientists working on “boring” projects that “they don’t believe in.” By simply providing opportunities for experienced scientists to work on interesting problems, he believes one can harness a significant amount of valuable scientific manpower. “Innovative folks love to work on scientific enigmas. The thrill of cracking a scientific challenge provides a lot of motivation for them.” As such, pursuing an open innovation approach is one way to jump start this type of widespread collaboration and generate a lot of activity in the early stage MCM development space. Open source innovation allows the USG to capitalize on the experienced resources that make large pharmaceutical companies so successful at late stage development. As one SME noted, “If you’re not going to use big pharma, then you have to have big pharma people.”

For Private Sector Participants: SMEs remarked that increasing private sector access to intellectual property (IP) can help commercial participants lower product development costs by accelerating the discovery process.

Potential Weaknesses

Open source access to IP may push research to a wider variety of scientists, such that quality standards may not be as easy to uphold.60 Without a sponsor overseeing work, researchers may misappropriate funds, avoid work, or misstate their results. Additionally, open source methods work best for research requiring little capital or materials and a lot of labor, which may explain why Open Source methods are generally

associated with software. 61 Sharing IP may be effective in promoting early stage drug discovery, but does not incentivize industry players to undergo late stage development, which is generally expensive and time-consuming. Successful licensure of MCMs conceived through open source early stage research would likely require the support of a PPP or other commercial operation to see candidates through late stage development and into production.

Implementation Issues

Political Challenges: Open source approaches may not be favored if the USG prefers to hold certain biodefense-related IP confidential for security purposes. There are few other political challenges to creating a PPP or open source forum to share government IP, as implementation requires few tax dollars, and relies primarily on volunteers and corporate contributions.62

Incentivizing Open Source Participation: Scientists may be unwilling to partake in an enterprise for which they are afforded no credit. It would help if the existing legal framework could be supplemented or modified to support scientific micro-contributions, such as an online registry that would allow scientists to log and stamp their contributions. If the product becomes a commercial success, these inventors can receive a share of profits based upon their relative contribution.63

Access to Capacity, Technology, and Regulatory Services

The USG can directly or indirectly provide access to facilities and technical and regulatory services to facilitate the development of MCMs amongst various market players, including public, private, and not-for-profit companies. The most useful mechanism for delivering such access would be through the creation of a public private partnership wherein a dedicated, flexible operation exists to support the development of biodefense products by providing immediate access to development technology, manufacturing capacity, and experienced human capital.

Potential Benefits

For USG: The USG can benefit from the expertise of resources from across the spectrum of the drug development process. These individuals and companies will likely be more willing to engage in MCM development once capital investments, technical capabilities and other barriers to entry are removed.

For Industry: Pharmaceutical firms can benefit from capital investments, technology resources or help navigating the FDA approval process. One industry expert remarked that facilities provided through public private partnerships are also excellent incubators for new analytical talent for the company. New scientists can be placed on biodefense projects to access and learn new technologies and techniques from outside their own company.

Potential Weaknesses

The chief disadvantage of solutions and products developed using shared facilities and resources is that technologies resulting from these collaborations may face complicated disputes over intellectual property.64 Additionally, our talks with industry experts indicate that the operation may not succeed if there is too much government oversight limiting the private partners’ freedom to operate.

Implementation Issues

Soliciting Private Sector Needs: By offering access to capacity, technology, and services, the government is essentially bridging critical gaps in private sector capabilities. These gaps will differ on a case-by-case basis. As such, the participating government agency should perform exhaustive due diligence into what its private sector partners require, whether that is funding, personnel, technology resources, animal models, manufacturing capabilities, and/or regulatory insight.

Pull Incentives

The pull incentives listed below are intended to enhance expected revenues of MCMs in development.

Advance Market Commitments

Private pharmaceutical companies are oftentimes reluctant to participate in the research and development of biologic and therapeutic products that target rare and neglected diseases because the market for these products is not large and/or affluent enough to be profitable. Advance market commitments (AMCs) are pools of funding used to guarantee a market price for these products as a means of “pulling” development along. More specifically, an AMC is a guarantee by governments or other sponsors to pay developers a minimum price per dose of a medical product purchased in the market up to a specified volume. Products meeting the specifications of the AMC and purchased in the commercial market are guaranteed a co-payment from the sponsor up to a specified volume of sales. Participating companies also make binding commitments to supply the drugs or vaccines at lower, sustainable prices after the depletion of government funds made available for the initial fixed price. In 2007, the Global Alliance for Vaccines and Immunization (GAVI), which includes the Bill & Melinda Gates Foundation, along with several donor countries, created the first AMC, valued at US$1.5 billion dollars, for a multiple pneumococcal vaccine. The AMC will provide 7 to 10 years of funding, after which a long-term price will be available to consumers at near marginal cost. As of October 2009, the GAVI AMC has succeeded in attracting four offers to supply the pneumococcal vaccine from four different suppliers.65

AMCs differ significantly from advanced purchase commitments (APCs) by guaranteeing a purchase price up to a specified volume of sales, as opposed to guaranteeing a purchase volume. Under the current BioShield program for example, the USG procures MCMs by setting a future price and volume for the product, whereas an AMC prespecifies a price per dose up to a specified volume, without making a specific volume commitment up front. AMCs also contract a lower, sustainable price for the product after the funding is depleted, while traditional procurement contracts have no such provision. AMCs are not directly

applicable to federal stockpiling modality (e.g., USG only buyer), but could be very useful in pursing alternate CONOPS (e.g., pre-event programs, home stockpiling, state stockpiling) provided that individuals, families, or states are required to pay some portion for MCMs supported by USG co-payment.

Potential Benefits

For AMC Sponsors: If the AMC is successful, the sponsor of the AMC will be able to access the resulting MCMs in sufficient quantity, at an affordable price, and over the long term. Additionally, the sponsor would pay its part only for those doses actually sold in the market.

For MCM Developers: AMCs help create a predictable market where the actual MCM market is limited.

Potential Weaknesses

For AMC Sponsors: AMCs require the sponsor to create a viable market for the MCM. An AMC large enough to induce industry participation is uncertain but will likely be expensive. The GAVI AMC for a pneumococcal vaccine is $1.5 billion.

For MCM Developers: The long-term credibility of AMCs is a source of uncertainty and risk. Since R&D costs are extremely high, and if we assume R&D spans over 10 years, with another 10 years to recoup the initial investment, the perception is that this becomes a very long horizon. Pharmaceutical companies may be concerned with the government reneging on the promised offer, given that government priorities may change over the course of 20 years. This possibility is compounded by the significant likelihood that a subsequent entrant would create a clinically superior product that undermines the government commitment to the first generation product.

AMC participants also face high risk with respect to the demand for the MCM. Since an AMC does not commit volume for the MCM product, the MCM developer may face little or no demand under a pre-deployment or prophylaxis/vaccination scenario, which may undermine the viability of an AMC as a pull incentive. For example, under a pre-event scenario, if the general public is unwilling to take prophylaxis measures (i.e., an anthrax vaccine), the AMC may never get fully utilized.

Implementation Issues

Although AMCs have theoretical merit,66 they face a unique set of implementation challenges. Sponsors should consider how to set the size of the AMC and the long-term price, manage subsequent entrants into the market when the initial entrant has already capitalized on an existing AMC, and navigate through any political challenges.

Setting the Size of the AMC: Setting the AMC size is difficult as the societal value of the product must be weighed against the program costs. Furthermore, companies and the USG must negotiate a price that will both incentivize the private sector to develop the product, as well as be fiscally acceptable for the agency sponsoring the AMC. If multiple products are purchased, the perception of risk is lower, and the resulting price offered to the developer may be lower as well. 67 To give an example of the magnitude of the cost, the necessary size of an AMC to incentive R+D from large pharmaceutical companies has been estimated to be around $3 billion for a malaria vaccine—enough to equal the expected revenue of developing one commercial drug.68