4

Capital Markets and Investment

The availability of seed, angel, and venture capital is a key factor in the creation and growth of businesses involved in the development of innovative technologies. In the United States and other developed countries, early stage investors in particular have played an important role in nurturing firms that have new and innovative products and services to offer. As companies grow, debt capital becomes more important, especially for investment in research and development. Thus, in assessing the potential for the development of innovative capacity in China and India, it is important to take into account the condition of capital markets in those countries. David Morgenthaler led a discussion of this topic by a panel that included Martin Kenney of the faculty of the University of California at Davis, Oded Shenkar of Ohio State University, Lee Ting of W.R. Hambrecht and Lenovo Group Ltd., and Sandra Lawson of Goldman Sachs.

VENTURE CAPITAL IN CHINA AND INDIA

Venture capital (VC) industries in India and China are quite immature and were led initially by international development agencies and government agencies, observed Martin Kenney. The first significant interest in indigenous technology-based firms came in the dot-com boom in the late 1990s. China took off rapidly, with excellent NASDAQ public offerings and acquisitions by established firms beginning in 2003. India has seen successful U.S. stock market exits for private equity. India also has the advantage of a vibrant stock market. China has experienced many more venture capital investments than India, focused on the domestic market. Venture capital in India has both global and domestic market investments.

TABLE 1 Total Venture Capital Investment ($ Billions) in Five Key Global Nations/Regions, 2002-2006.

|

Year |

China |

India |

Israel |

Silicon Valley |

Boston |

|

2002 |

0.4 |

0.2 |

1.3 |

7.6 |

3 |

|

2003 |

2.4 |

|

1 |

6.8 |

3.1 |

|

2004 |

0.6 |

0.3 |

1.4 |

8.3 |

2.9 |

|

2005 |

1.2 |

|

1.3 |

8.5 |

3.1 |

|

2006 |

1.9 |

0.5 |

1.4 |

9 |

3.1 |

|

SOURCE: Adapted from Global Venture Capital Insights Report (2007) Ernst & Young |

|||||

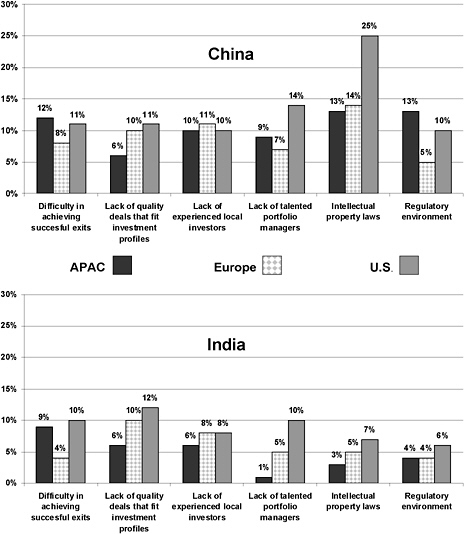

A look at regional VC investments (Table 1) reveals the predicted concentrations--in Beijing and Shanghai in China and in Bangalore, Mumbai, and Chennai in India. One in three Indian VC firms had significant U.S. VC involvement. Many elite Silicon Valley VC firms are operating in China, such as Sequoia Capital International Funds. American venture capitalists are growing more comfortable with doing business in both countries and are learning the differences in their intellectual property systems. India’s IP system poses fewer impediments (Figure 5).

Multinational VC firms are playing an important role in both countries although generally not on the frontier of technology, where U.S. VC firms are dominant. Exceptions are firms such as Softbank, 3i, and Jafco. Corporate VC funds, especially Intel Capital and Nokia, are also active. In China VC investments are generally larger, more mature, and geared mostly to supplying needs in the domestic market. In India, they are concentrated in

services and more oriented to the global market. It is possible that Indian venture capital could be more significant for global technology firms in five years, according to Kenney.

THE LINK BETWEEN EDUCATION AND CAPITAL MARKETS

Oded Shenkar explored the linkage between education and capital markets in China. Mattel Corporation’s recent admission that U.S.-based design work, not China-based manufacturing, was to blame for their faulty toys was telling. How long will it be before Chinese manufacturers take on the design process themselves? The answer has huge financial implications, as design determines a large share of the value captured in exports.

China overtook the world in volume of IT exports but the largest share of those exports still belongs to foreign enterprises working in China. In 2005, MNCs were responsible for 58 percent of China’s exports. The standard critique of Chinese innovation is that it has a long history of inventions but has not maintained flexibility for adapting its formulas. This critique dates back at least to de Tocqueville in the early 1800s.

Shenkar listed several challenges to successful innovation in China. The strategy of acquiring innovation, illustrated by the Lenovo acquisition of the personal computer division of IBM, has clear benefits for the mid-term. The strategy of attracting Chinese graduates back from abroad is also very likely to pay off. But government spending per student in China has not risen, and this points to difficulty in fostering indigenous innovation. Most Chinese universities are not on par with high-quality universities internationally; learning in China still depends mainly on repetition and memorization. There are weaknesses in both educational theory and practice in China.

Another challenge to foreign companies below the top rung in China is the vulnerability of their intellectual property to exploitation by Chinese competitors. Even in a knowledge economy, Shenkar concluded, it is possible to grow and profit by imitating without innovation.

CHINA’S VENTURE CAPITAL MARKETS

Lee Ting, a U.S.-based private equity investor who is also an official of the Lenovo Group, offered a practitioner’s perspective on China’s private equity markets. Ten years ago, he observed, U.S. private equity firms were not active in China; now we find all the large VC firms with a presence and investments in China.

What are the similarities and differences between the U.S. and China situations? In both, a private equity firm searches for companies with high value positions in a large market. Differences include the additional complexities in China, including a legal structure requiring a greater reliance on legal services, greater regulatory risk, and personal trust issues. How do you trust local management with venture money? An ability to identify the right person for a transaction is extremely important in China. The China market is still evolving. It lacks transparency, which China’s regulatory agencies are working to improve. And the market suffers from the liquidity problems of an inefficient market. Still, the prospect is for more opportunities to invest, more successful exits for investors, and hence more multinational VC involvement.

DEBT MARKETS

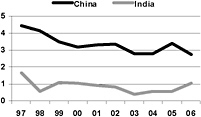

Sandra Lawson of Goldman Sachs echoed Kenney’s points on the long-term picture, but observed that while China outpaces India in foreign direct investment (FDI), India’s foreign investment upturn is likely to continue (Figure 6).

FIGURE 6 Foreign direct investment as a yearly percentage of GDP. SOURCE: Lawson

Across Asia, debt markets play a limited role in economic growth. They are small and dominated by governmental or quasigovernmental debt. A more robust corporate debt market is essential for economic growth and is the backbone for R&D investment. It enables companies and lenders to take more risk. At this point, however, the corporate debt market has little liquidity.

In both countries there are problems with respect to supply, demand, and marketplace infrastructure. In India, for example, there is little transparency. Companies disclose debts only to a few investors. Markets in mutual funds and pension funds are exceedingly weak. A good deal of investment could go there, but investors are restricted on where they can invest. For the most part investment is channeled to government debt. Investors have little ability to price risk, and they face unwelcome tax and accounting rules. Thus, debt markets represent a chicken-and-egg situation. It is a supply issue but also a problem of market infrastructure. If the infrastructure problem is addressed, both demand and supply will accelerate. India’s Knowledge Commission is creating awareness of what is needed to grow innovation there, but the choices are politically difficult.

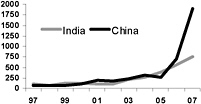

In Lawson’s opinion, both China and India have strong prospects for growth of debt markets (Figure 7). In the slightly longer term by 2016, China’s domestic debt market could grow to the size of today’s U.S. market for Treasuries.

FIGURE 7 Domestic support underpins equity markets, as of September 2007 (USD Billions). SOURCE: Lawson

There is a need for larger investors to get things moving in that direction. Building a debt market now can fuel the growth of medium-size corporations over the long term.

Asked about the significance of the money flows associated with China’s real estate boom, the panel said that the boom underscores the need for leaders to create a greater range of investment opportunities. Rising real estate prices do not create value per se and the bursting of the real estate bubble can have disastrous consequences for the economy as a whole. But real estate transactions do help grow a middle class, which in turn has broader positive effects. A growing mortgage market helps spread growth by creating demand for furnishings and related products.