1

India and China in the Global Economy

The economies of India and China have grown rapidly over the past couple of decades, and it is widely accepted that these two emerging giants will transform the global economy in numerous ways over the coming decades. Despite the importance of these countries, their strengths and weaknesses, the sources of their growth, and the missing ingredients to sustain high growth rates—are not widely known. Thus the first session of the conference, “India and China in the Global Economy”, was devoted to providing the background necessary to understand what is happening in the two economies today and how they are likely to evolve in the future.

The speakers in the session, which was moderated by STEP board member David Morgenthaler, made it clear that although the economic growth of India and China has indeed been impressive, it has also been uneven, with some economic sectors developing more rapidly than others. Understanding the two countries’ capacities for innovation demands a closer look at which areas have grown and which still lag. The speakers further agreed that it is a mistake to think of the growth of the two countries as essentially similar. Patterns of economic development in India and China are quite different, and this has an important bearing on forecasts for the two economies and, for that matter, strategies for dealing with the two countries.

THE ECONOMIC SITUATION IN INDIA

Arvind Panagariya of Columbia University opened the first session by outlining India’s departure from a history of restrictive policies on investment, licensing, and production, which were especially tight in the 1960s and 1970s. Since liberalization began in the 1980s, GDP growth has surged. Panagariya suggested that the elephant metaphor did not reflect the recent speed of India’s transformation, which has been more like a tiger. From 2003-2007, GDP growth has averaged 8.6 percent (14-15 percent in real dollar terms). Is this rate the peak of a cycle or can it be sustained?

Panagariya suggested that India’s growth would continue and increase in the coming decade if economic reforms continue and are expanded and large-scale structural changes are undertaken to support growth. Exports have doubled in three years, and software exports doubled in the last two years. The exports-to-GDP ratio is “extremely low,” he said, even though huge increases in foreign investment—over $21 billion—are comparable to that seen in China. India can adapt quickly, as evidenced by India’s telecommunications revolution. From 5 million telephone lines in 1991, India now has over 200 million lines.

India’s demography will very likely help sustain this growth. India’s population is younger than China’s and is exhibiting a rising rate of personal savings. Problems include a reliance on capital-intensive manufacturing, with labor-intensive manufacturing lagging. India still needs reforms in two areas in particular:

-

Labor market inflexibilities limit firms’ ability to respond to changing workforce needs; and

-

The power sector remains unreliable throughout the country

The Indian government is moving on transport issues, but power shortages remain a bottleneck to growth. With a heterogeneous population and

cultural variety, India does well in sectors where product differentiation is required and less well in industries that require scale.

THE ECONOMIC SITUATION IN CHINA

According to Nicholas Lardy of the Peterson Institute for International Economics, scale is a key difference between the two countries. Contrary to popular impression, China and India are not comparably sized global giants. China’s trade is six times larger than India’s. Even more striking, the increase in China’s trade level in 2007 ($433 billion, valued using MER) was greater than India’s total trade. India’s share of the global economy today is still less than half of what it was at independence in 1948. India’s economy is expanding rapidly; but its trade is still less than 1 percent of the global total, whereas China’s trade is the second or third largest. A similar disparity exists in foreign investment.

For these reasons, Lardy expressed more optimism about China’s growth than about India’s. The competitive environment in China is more favorable and intense than it is in India, where certain sectors are protected from import competition. In China, with reduced tariffs domestic firms face competition not just from foreign imports but from foreign firms operating in China. China spends three times as much on infrastructure as India.

China’s main challenge is to rebalance its growth strategy, moving toward one that relies more on domestic demand and less on exports. Currently, household consumption is only 36 percent of GDP, whereas in India that figure is 50-60 percent. For sustained economic development, India needs more manufacturing, a more liberalized trade environment, and more flexible labor markets.

The conventional wisdom is: “India does software; China does hardware. Those are their paths to expansion.” But China’s hardware exports are growing much faster than India’s software exports, which make up less than 5 percent of India’s GDP. India will need to take advantage of relatively low wage rates to build up its labor-intensive manufacturing sectors.

COMPARING THE TWO COUNTRIES

Sean Dougherty of the Organisation for Economic Co-operation and Development (OECD) Secretariat presented findings from two recent OECD surveys of China and India, highlighting sources of growth, productivity, and regulatory reforms.

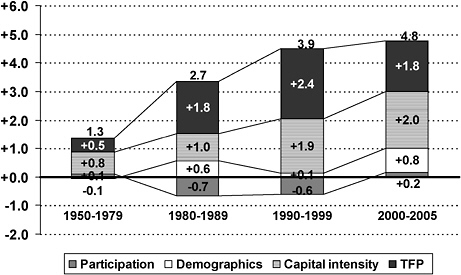

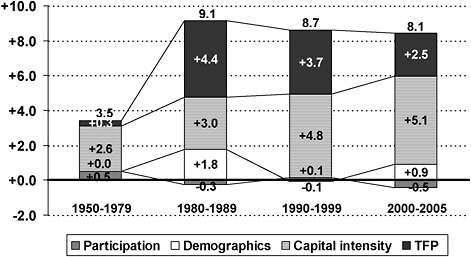

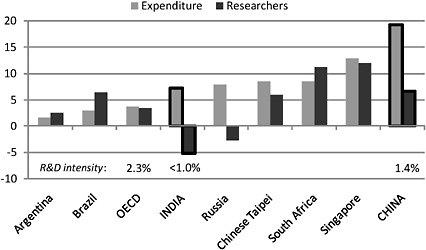

Rooted in the dramatic shifts of the 1980s, growth in both countries is sustainable, but Dougherty drew some distinctions between them. Total Factor Productivity (TFP) growth rates are important. Capital deepening—that is, an increase in capital intensity, usually measured as capital stock per labor hour, also plays a dramatic role in growth, especially in China, and is the “major explanatory factor” in the differences between the two countries’ per capita annual growth. India averaged 4.8 percent between 2000 and 2005, about half of China’s 8.1 percent annual per capita GDP growth rate (Figures 1 and 2). This difference is also seen in the R&D expenditure differences: R&D intensity in India is <1 percent; in China it is 1.4 percent (Figure 3).

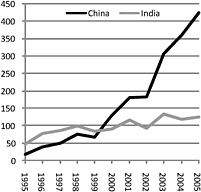

Research outputs are a better measure of performance than inputs. Although there are no good measures of scientific outputs, and there is considerable uncertainty about international comparisons, a common output measure is publications in leading peer-reviewed journals with contributions worldwide. In 10 years from 1995 to 2005 Chinese articles in high-impact scientific journals increased more than 16 times, while Indian articles merely doubled (Figure 4).

India has competitive costs and wage levels, but it needs larger-scale firms to compete successfully. Dougherty confirmed the observation that labor market restrictions in India are that country’s greatest challenge. At the state level, though, India is deregulating and making labor markets more flexible. In China, where private firms are more productive than public firms, there is a great need to extend privatization. China is restructuring rapidly and deepening regional specializations.

India’s financial markets are more developed than China’s but India has a greater need to reduce regulatory restrictions in financial product markets. Currently, India has

far more restrictions than any OECD economy. With fewer restrictions, China has managed to be more flexible in supporting new, higher risk, technological developments.

Education outcomes in India are improving, approaching China’s. In GDP growth, China’s demographic dividend will tail off in the next 10 years, while demographic rates in India will promote savings growth. Despite their problems, the future looks bright for both economies.

FIGURE 1 Sources of India’s per capita GDP growth (% annually). (Participation: the effect of the participation rate; Demographics: the effect of the share of the population of working age; Capital intensity: the effect of the level of capital per worker; TFP: total factor productivity.) SOURCE: Dougherty.

FIGURE 2 Sources of China’s per capita GDP growth (% annually). (Participation: the effect of the participation rate; Demographics: the effect of the share of the population of working age; Capital intensity: the effect of the level of capital per worker; TFP: total factor productivity.) SOURCE: Dougherty.

FIGURE 3 R&D Expenditures and Researchers (% annual change 1995-2004) SOURCE: Dougherty

FIGURE 4 Articles published in high-impact journals. SOURCE: Dougherty

DISCUSSION

Responding to a question on the state of innovation in both countries, Panagariya said that India was still “well inside” the technological frontier. Dougherty considered both economies to be inside the frontier. The growth rates shown above (Figures 1 and 2) represent a measure of innovation. By some measures, China’s R&D expenditures are high, but it is very hard to assess the real state of innovation.

To what degree do we need to look at society-wide structures and legacy issues, asked Marco di Capua, U.S. Department of Energy representative in Beijing. How does innovation change society structures themselves? One factor is intellectual property rights protection, but there are different sides to that issue. In China, a vigorous sharing of ideas is the flip side of fairly lax intellectual property protection. By that same token, some argue that intellectual property protection in the United States may have gone too far, hampering innovation.

In terms of quality of life, a questioner asked, did disregard for environmental safeguards in the early years of China’s growth allow the economy to grow unimpeded? As its leaders become attuned to environmental issues, will growth slow down? Over a third of China’s population lacks access to clean water. Yet the focus on growth will probably not change in the next three to five years, Lardy replied. With China’s per capita income at $1,600 (measured at MER), the country is unlikely anytime soon to institute the same environmental measures as OECD countries.

In response to another questioner, Panagariya cited three factors in rebutting pessimism on India’s long range prospects for developing an innovative economy:

-

India’s history of democracy over the past 60 years gives it a foundation for stability and adaptation, while China faces an uncertain political transition in the coming years.

-

India’s demographic dividend is much greater than China’s.

-

Assuming that ultimately rapid growth slows down, India’s experience of high growth is more recent, while China’s may sooner run its course.