2

Challenges to Citrus Production

ECONOMIC IMPORTANCE OF CITRUS: WORLDWIDE, UNITED STATES, FLORIDA

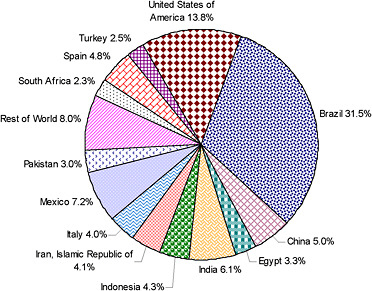

Commercial citrus fruit are produced in about 140 countries. The primary producers are Brazil, the Mediterranean Basin, the United States, and China. Citrus fruit ranks first internationally in trade value among all fruits (Norberg, 2008; UNCTAD, 2009). Sweet oranges are the major fruit grown and represent approximately 70 percent of the citrus output. According to the Food and Agriculture Organization of the United Nations (FAOSTAT, 2007), four countries account for about 60 percent of the worldwide orange production: Brazil (32 percent), United States (14 percent), India (6 percent), and Mexico (7 percent) (Figure 2-1).

Four states, Florida (68.7 percent), California (27.5 percent), Texas (2.7 percent), and Arizona (1.1 percent), produce virtually the entire US commercial citrus crop. Sweet oranges dominate Florida’s citrus production (83.6 percent) followed by grapefruit (12.6 percent) and specialty fruit consisting of mostly tangerines and tangelos. Florida produces very few lemons.

Two areas dominate the production of oranges for juice: São Paulo State, Brazil (50 percent) and Florida (35 percent) (Norberg, 2008). More than 95 percent of Florida’s orange production is processed into juice, accounting for essentially all of the US orange juice production. China is another major orange juice producer. Brazil exports about 90 percent of its juice production including a considerable amount to the United States, whereas only 10 percent of Florida’s production is exported internationally.

Important producers of sweet oranges for fresh consumption are Spain, Turkey, South Africa, and California (United States). Fresh market oranges bring much higher returns per acre than juice processing oranges. Mandarin production is concentrated in China, Japan, and other Asian countries, but high quality export fruit is produced in South Africa, Spain, and other countries of the Mediterranean Basin. Lemons are produced in Argentina, California, Italy, Spain, and other Mediterranean countries.

Florida grapefruit is grown predominately for fresh fruit but a considerable portion of the crop is processed for grapefruit juice as well. Florida is the largest US producer, commanding about two-thirds of the total. Florida produces about 30 percent of the world’s grapefruit with Mexico, Cuba, and Turkey contributing significantly to world production. Japan is the largest importer of fresh Florida grapefruit and Canada is the leading importer of Florida fresh oranges and specialty citrus fruit (USDA-APHIS, 2006; USDA-NASS, 2008, 2009).

FIGURE 2-1 Worldwide orange production, percent total production, 2005–2007.

Source: FAOSTAT, 2007.

The Florida citrus industry is estimated to have a $9.3 billion economic impact for the state. Approximately 80,000 full-time equivalent jobs (grove employees, seasonal pickers, haulers, processors, packers, and managers) are involved, earning a combined annual wage of $2.7 billion or about 1.5 percent of the state’s wage income. Most of the fruit is harvested by hand although harvesting machines have been developed and are used for harvest of about 5 percent of the processing fruit. Nearly all of the hand harvesters are transient labor, mostly from Mexico or Haiti. Citrus is a major segment of Florida’s agricultural industry, accounting for an estimated 21.1 percent of cash farm receipts in 2005 (Norberg, 2008).

HISTORY AND EVOLUTION OF THE CITRUS INDUSTRY IN FLORIDA

Cultivation of citrus is believed to have begun in Southeast Asia roughly 4,000 years ago. Trade and cultivation moved slowly west to Northern Africa, the Mediterranean, and then to southern Europe by the Middle Ages. Christopher Columbus is thought to have brought the first citrus seeds on his second voyage to the New World in 1493. The Spanish explorer, Ponce de Leon, is credited with planting the first orange trees near St. Augustine, Florida sometime between 1513 and 1565. French Count Odet Philippe first introduced grapefruit to Florida in 1806. He later planted the first grapefruit grove near Tampa in 1823 (Webber et al., 1967; Florida Citrus Mutual, 2009; UNCTAD, 2009).

Commercial farming of citrus in Florida began in the mid-1800s, motivated by favorable growing conditions in Florida and a growing demand for the attractive, healthful fruit. The fledgling industry’s growth was facilitated by improved commercial rail transportation systems along the east coast that opened the market for the fruit to northeastern United States. By the end of the Civil War, annual citrus production in Florida reached roughly one million boxes. By 1893, production was about 5 million boxes.

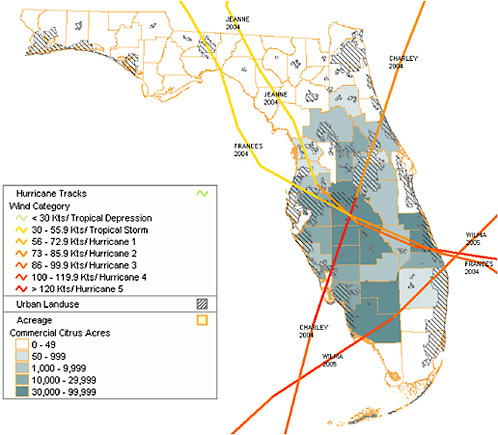

Florida’s hot and humid climate has made the success of its citrus industry possible, but periodic winter freezes and hurricanes have shaped the industry’s development. The Great Freeze of 1894–1895 proved devastating. Orchards throughout the state were ruined and most production on the Gulf Coast of other states was discontinued. A trend to move groves further south in Florida followed this freeze. This gradual movement south has continued following subsequent severe freezes mainly in the 1930s, 1960s, and 1980s, resulting in larger acreages in south Florida and disappearance of most citrus from the more northerly counties. Hurricanes have had an immediate negative effect on orange production. From August 2004 to October 2005, Florida was hit by four significant hurricanes (Figure 2-2). Based on figures from the US Department of Agriculture- National Agricultural Statistical Service (USDA-NASS) (2005), the 2003–2004 season saw a near record orange crop of about 240 million boxes of fruit. But, following the string of hurricanes, the figure for the 2004–2005 season was down to about 150 million boxes. For oranges alone, the decline in yield after the hurricanes was 38 percent (Table 2-1).

In contrast to California fruit, Florida oranges have a thinner skin, are more difficult to peel, are more subject to transit and handling damage, and are less attractive. These factors become irrelevant when the fruits are converted to juice. Processing into juice takes advantage of the characteristic “juiciness” of Florida fruit brought about by the state’s hot, humid climate. The earliest harvest of fresh market oranges begins in October, for Hamlin, Parson Brown, Ambersweet, and Navel varieties with some cosmetic packinghouse eliminations being processed for juice. The bulk of the early orange processing begins in December. Early and mid-season varieties are harvested throughout the winter and harvest of late Valencia oranges begins in early April and continues into June.

Following World War II, commercially feasible methods to process and freeze fresh fruit into concentrated juice were invented. This was a major boon to the industry, especially in Florida. Frozen juice has an extended shelf life that permits the storage of inventory to smooth out variable seasonal supply due to adverse growing conditions caused by droughts and hurricanes. The use of frozen concentrate permits blending of juice stock to provide consumers with a consistent high quality product. The convenience of a juice form also increases consumption over what it would be if only fresh fruit were available. More recently, shipping and handling methods have improved and fresh juice can be transported without producing frozen concentrate and “not from concentrate” products have become a popular product in the United States (Brown, 1995).

Brazil, specifically São Paulo State, is Florida’s key competitor in the juice market. The Brazilian coffee crisis of the 1930s led to the shift toward citrus production. The crisis was caused by a huge oversupply of coffee beans brought about by government price support programs that actually contributed to further cultivation of trees thereby exacerbating the oversupply. The worldwide Great Depression sharply reduced demand for coffee in the 1930s. Brazil entered into a period of political and economic instability that, in combination with

FIGURE 2-2 Path of hurricanes Charley (August 13, 2004), Frances (September 5, 2004), Jeanne (September 26, 2004), and Wilma (October 24, 2005).

Source: NOAA-CSC, 2009.

Table 2-1 Impact of 2004–2005 Hurricanes on Florida Citrus Crop Yield (Number of Boxes)

|

Fruit |

2003–2004 |

2004–2005 |

Percent Decline |

|

Orange |

242,000,000 |

149,600,000 |

38 |

|

Grapefruit |

40,900,000 |

12,800,000 |

69 |

|

Specialty |

8,900,000 |

7,000,000 |

19 |

|

Source: USDA-NASS, 2005. |

|||

reduced demand, led to a collapse in coffee prices paid to growers. Growers shifted to citrus and this began a period of growth for this crop. Growth in the 1960s was particularly steep as Brazil ramped up production in response to freezes in Florida that destroyed orchards and seriously affected supply. Brazil set out to be a source of alternate supply to fill the existing demand for citrus products in the United States and Europe. By the 1980s, Brazil had become the largest supplier of citrus fruit and juice.

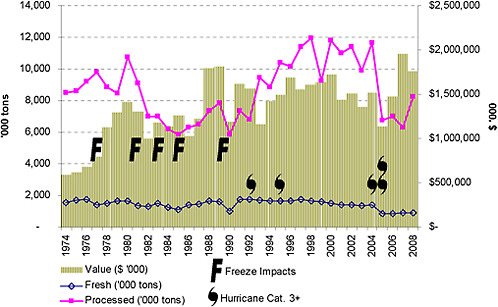

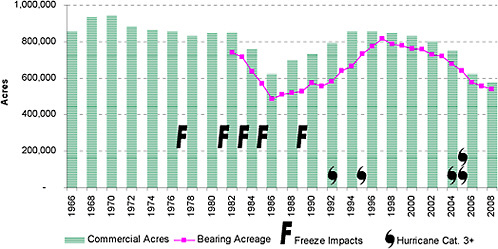

Urbanization and diseases have been critical factors in the recent history of the Florida citrus industry. According to the 2000 US census, Florida ranks seventh in the US in population growth (23.5 percent) from 1990–2000, almost double the US average of 13 percent, and corresponds to a daily population growth in Florida of 830 (US Census Bureau, 2009). The housing boom over the past few decades, now a burst bubble, led to rapid residential development in the state especially near the coast. Developers purchased grove land at premium prices, by agricultural standards, in part because acreage was plentiful and still relatively inexpensive for real estate. Developed properties are taxed at a much higher rate than agricultural lands, so public officials are disinclined to oppose the conversion of groves to residential and commercial development. Urban encroachment means that many citrus-growing areas are no longer isolated. Current levels of production and citrus acreage are sharply lower than the levels of the mid-1990s through 2004 (Figure 2-3 and 2-4). The number of juice processors has also declined sharply. There were 37 processors in Florida in 2001, but only 15 remained in 2008 (Norberg, 2009). The agricultural alternatives for most citrus land are cattle pasture or pine forests, neither of which is highly profitable, so growers have few options.

FIGURE 2-3 Florida citrus production in tons and dollar value.

Source: USDA-NASS, 2008.

FIGURE 2-4 Acreage of existing commercial and bearing citrus groves.

Source: USDA-NASS, 2009.

Plant diseases such as citrus canker have had a negative effect on citrus production and economics. The eradication program for citrus canker was responsible for the loss of 70,000 acres of groves, and the regulations on the movement of fruit from areas with the disease have greatly affected the ability of the state to market fresh fruit. Over the last 20 years, Citrus tristeza virus (CTV) caused the decline and death of most trees on sour orange rootstock, which originally constituted 25–30 percent of the acreage in Florida, but most of that acreage was replanted gradually as trees were lost.

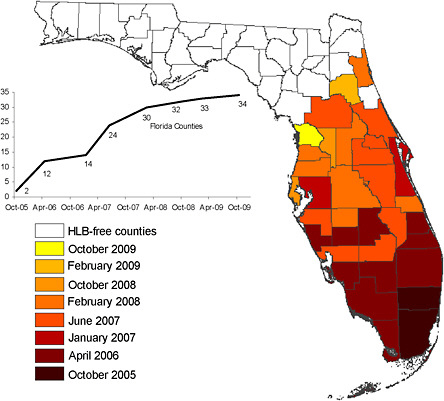

The greatest immediate threat to both the processing and fresh fruit industries in Florida is the recently arrived disease known as citrus greening or huanglongbing (HLB). Developing measures for combating HLB is the principal topic of this report. The insect vector of the HLB-associated bacterium in the Americas is the Asian citrus psyllid (ACP), which was reported in Brazil in 1942, but was not reported in North America until it was found in 1998 in Florida. Although it cannot be known whether small, unetected populations of ACP predated discovery, it is clear that ACP was widely distributed by 2000, having been reported in 31 counties in the state, so that eradication was no longer conceivable. The ACP reportedly arrived in Texas in 2001 on potted Murraya plants that originated from Florida (Mead, 2009). HLB itself was discovered in Brazil in 2004 and in the Miami area of Florida in August of 2005. The origin of HLB in Florida is unknown but may have been from budwood imported from Asia. The exclusion of pests such as ACP and the HLB bacterium clearly would have been the most effective control measure. Improving current measures for excluding pests and pathogens would likely benefit Florida citrus, but pest exclusion is a topic beyond the scope of this report. HLB is now present in all 34 Florida counties that have commercial citrus fruit production (FDACS-DPI, 2009), but is most prevalent in the southern areas of the state (Figure 2-5). The spread of HLB in

Florida is considered to have occurred too rapidly to be accounted for by ACP flights, and it is likely that long-distance spread of ACP occurred due to commerce or hobbyist activities involving backyard and ornamental citrus. HLB is widespread in Brazil and many other citrus-producing regions. HLB represents a serious threat to the citrus industry worldwide.

FIGURE 2-5 Distribution of HLB in Florida from October 2005 to October 2009.

Source: FDACS-DPI, 2009.

ECOLOGY, CLIMATE, WATER AND FLORIDA CITRUS

Landscape Factors that Contribute to Pest Outbreaks in Florida

It has been estimated that approximately 4,500 arthropod species have been introduced into the United States and of this total, approximately 1,000 insect and mites have become crop pests (Pimentel et al., 2000). Because of Florida’s geographic position in the United States, it is subject to intense pressure from invasive species. Florida’s 1,350 miles of coastline, second only to Alaska’s, provides easy access for pests that arrive by aerial movement or with humans from

tropical areas in the Caribbean, Central and South America where arthropods may reproduce continuously without a winter break. Florida’s population of 18.3 million people places it 4th among US states and with about 6 percent of the US total. This population receives shipments of agricultural produce from around the world through the state’s large airports and seaports. Despite surveillance by the US Department of Agriculture- Animal and Plant Health Inspection Service (USDA-APHIS), these ports remain major entry points for new pests that threaten Florida’s agriculture. Once in Florida, pests can be transported intra- and inter-state by movement of propagative materials, foliage or soil and become established.

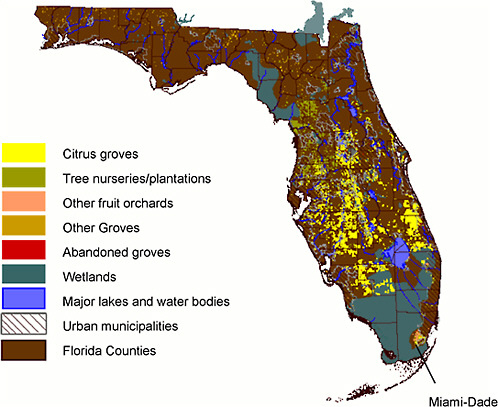

The 600,000 acres of commercial citrus in Florida currently is confined to the southern two-thirds of the peninsula exclusive of the urban Miami area and the Everglades (Figure 2-6). The highest point in Florida is only 345 ft in elevation. The flatness of Florida’s landscape facilitates planting, harvest, and transport of agricultural produce but also results in a lack of natural barriers to the movement of ACP and HLB, e.g., in storms. In the Central Ridge area, citrus is planted on deep sandy soils. Citrus in southwestern and coastal areas is planted on “flatwoods” which also have sandy soils, but are often very shallow with rooting depths of no more than 1 meter and contain some organic matter. In such areas, citrus is planted on raised, two-row beds with ditching to avoid flooding in the summer rainy season. Displacement of citrus from urbanized coastal areas has resulted in a larger proportion of the crop being at risk from frost damage.

Urban encroachment on production areas means that even if commercial citrus producers use effective management practices to control ACP in their groves, nearby residential plantings may serve as a reservoir for ACP and HLB. Abandoned orchards and those that receive minimal care serve as major sources of pests and diseases that may infest commercial orchards or nursery stock. The slowing of home building recently has resulted in groves purchased for housing being left undeveloped and becoming potential sources of ACP and HLB.

Climatic Conditions that Contribute to Pest Outbreaks in Florida

Generally speaking, Florida’s sub-tropical climate and year round vegetation in and around citrus groves allows a larger number of generations of insects to be produced and leads to more frequent application of management practices, such as insecticides, than would be found in temperate areas. This situation has potential negative consequences for farm workers and the general environment. Accordingly, Florida also has cases of insect resistance to insecticides (Omoto et al., 1995). Although resistance may originate in one particular location due to the local management practices, such resistant insects may be able to move long distances. In Florida, such long-distance movement occurs regularly because of hurricanes and summer thunderstorms. From 1851 to 2008, there were 96 category-3 to 5 hurricanes that made landfall on the eastern US coast (Texas to Maine). Thirty nine percent of these landfall events occurred in Florida (AOML, 2009).

Water Use, Groundwater Protection, and Citrus Production

Water, once a cheap and plentiful resource in Florida, is becoming a precious and valuable commodity for all sectors of Florida’s economy, including agriculture and tourism. Florida relies on groundwater pumped from permeable aquifers underground to supply drinking water to more

FIGURE 2-6 Citrus production areas in Florida.

Source: FGDL, 2007.

than 90 percent of its population (FDEP, 2009). Water consumption continues to rise and the water levels in the aquifers continue to drop, sometimes leading to geological disturbances such as sinkholes and saltwater intrusion into city wells (Hutson et al., 2004; Barnett, 2007). Much of this increased consumption is due to urban activities such as the irrigation of lawns and golf courses associated with the fast-growing housing developments throughout the state. However, farms are also large water consumers, using nearly half of Florida's public supply (Barnett, 2007). Citrus is a tropical/subtropical crop; therefore it requires substantial irrigation when grown in drier climes. Unlike other evergreen fruit trees such as avocado and mango, citrus trees continuously replace their leaves as they grow. Further, citrus trees have a relatively shallow root system as compared to deciduous fruit trees such as apple and walnut. In Florida, depending on soil type, root depths range from 18 inches in the coastal flatwoods to 11 feet in central Florida (Boman and Parsons, 1999). Studies in Australia have shown that mature citrus may require 7–8 mega liters (ML) of water per hectare while young citrus plantings may require 2–5 ML per

hectare annually (Falivene et al., 2003). Reducing irrigation by 20 percent or more resulted in significant citrus crop losses. Citrus water requirements may be less in Florida than in Australia due to Florida’s lower temperatures and higher humidity, but the requirements nevertheless are substantial.

Despite relatively high rainfall, virtually all Florida commercial citrus has microsprinkler irrigation systems installed to meet the crop water needs in the state’s soils, which are up to 95 percent sand (Reddy et al., 1992). Microsprinklers consume less water that the older overhead irrigation systems they replaced. Drip irrigation is not effective in Florida’s very sandy soils, except for young trees (Parsons and Morgan, 2004). Rainfall in Florida is confined largely to the summer season and irrigation is most needed in the dry spring. In the summer months, citrus grown in “flatwoods” groves has the opposite problem and requires good drainage to avoid flooding.

The Florida Department of Environmental Protection (FDEP) has the primary role of regulating public water systems and its responsibility for ground water is divided into two individual programs—ground water protection and ground water regulatory (FDEP, 2009). Citrus production is impacted by both programs. The FDEP requires permits to pump ground water and controls the volumes that can be pumped at any time. The water is controlled by five management districts that may impose restrictions as needed on residential, industrial, or agricultural use. For groundwater protection, the FDEP has the responsibility for monitoring fertilizer and pesticide levels in the water to make sure that they do not exceed the Environmental Protection Agency (EPA) standards. Use of agricultural products, especially pesticides, in sandy soils is particularly contentious, and is likely to become even more so now that ACP and HLB are threats to the citrus industry. Some of the management practices in place are of concern for water quality. As is stated in the University of Florida 2010 Florida Citrus Pest Management Guide, “the only soil-applied insecticide that has been shown to provide any reduction in psyllid numbers on large trees is aldicarb” (Rogers and Dewdney, 2010). Studies conducted in the 1980s in the central sands area of Wisconsin demonstrated that aldicarb can be found in wells (Rothschild et al., 1982) and follow-up studies suggested a health risk from consumption of aldicarb-contaminated groundwater (Rothschild et al., 1982). Under Florida conditions, aldicarb degrades relatively rapidly, but nevertheless has been found in some shallow water wells (Jones and Back, 1984; Forrest and Chris, 1986). Thus, aldicarb is limited to applications only in the dry season (November–April) and cannot be applied within 1000 ft of a drinking water well. Although aldicarb use under the indicated conditions is regarded as safe, it is desirable to rely on other methods and other insecticides for long-term control of ACP and HLB, to minimize risks to human health and the general environment.

Other Environmental and Landscape Management Issues

Commercial citrus production is close to being a monoculture crop. However, herbicides are applied only under the trees, leaving grasses and other plants in row middles and ditches with considerable vegetation surrounding most blocks in flatwoods groves. Crop monocultures facilitate mechanization of production and harvesting activities and allow specialization in marketing. However, monocultures generally provide less biological diversity and thus tend to be less ecologically stable than polycultures. Generalist natural enemies, primarily predators, are usually less abundant in monocultures since they have fewer alternative hosts to sustain them before the pests on which they can feed build up to damaging levels on the cash crop (Landis et

al., 2000; Bianchi et al., 2006). Thoughtful habitat management and introduction of plant diversity into a cropping system can help reduce pest populations and their damage on the cash crop by providing natural pest enemies with resources such as nectar, pollen, physical refugia and alternative hosts. There are many examples of “ecological engineering” tactics in annual crops and a few in perennial crops as well (Gurr et al., 2004). Three examples are summarized below, and described in more detail in Chapter 3..

Growers and researchers in Vietnam have noted that interplanting citrus with guava almost entirely negated infestations by citrus psyllids and, as a consequence, the citrus trees remained free of HLB (Stover et al., 2008; L. Stelinski citing unpublished report from Vietnam). Florida scientists are exploring the use of guava and the underlying biochemistry of guava’s putative capacity to limit or prevent infestations of citrus psyllids.

In New Zealand, buckwheat ground cover has been used to enhance the parasitism of a leafroller insect, a major pest of grapes. Apart from enhanced biological control, mixed plantings of crops may disrupt an insect's ability to locate or establish on a plant species (Price, 1984).

Trap cropping is the use of plant stands that are, per se or via manipulation, deployed to attract, distract, intercept, retain, and/or reduce targeted insects or the pathogens they transmit in order to reduce damage to the main crop (Shelton and Badenes-Perez, 2006). The trap crop may be treated to suppress the “trapped” insect population.

DISEASES AND PESTS THAT THREATEN CITRUS PRODUCTION

HLB (Citrus Greening): Impact, History, and Disease Spread

Impact of HLB

HLB is a destructive disease, and probably is the most serious disease of sweet orange, mandarin and grapefruit trees. It is destructive irrespective of rootstocks or whether the trees are grafted or are seedling trees. The yield of affected trees is not only reduced considerably by continuous fruit drop, dieback, and tree stunting, but also by the poor quality of fruits that remain on the trees.

HLB epidemics take several years to reach high incidence levels. The temporal progress of HLB incidence is dependent on (i) vector populations, (ii) extent of the inoculum reservoir, and (iii) age of the grove at first infection. The disease progress in the orchard can be relatively fast, reaching more than 95 percent incidence in 3 to 13 years after onset of the first symptoms (Catling and Atkinson, 1974; Aubert et al., 1984; Gottwald et al., 1991; Gatineau et al., 2006; Gottwald et al., 2007a; Gottwald et al., 2009). Severe symptoms have been observed 1 to 5 years after onset of the first symptoms, depending on the age of the tree at infection time and on the multiplicity of infection (Lin, 1963; Schwarz et al., 1973; Aubert, 1992). As the disease severity increases, the yield is reduced and makes the orchard production uneconomical in 7 to 10 years after planting (Aubert et al., 1984; Aubert, 1990; Gottwald et al., 1991; Roistacher, 1996).

It is estimated that close to 100 million trees are affected by HLB worldwide. In the northern and eastern regions of Thailand, 95 percent of trees were affected as of 1981. In the Philippines, HLB reduced the citrus acreage by 60 percent between 1961 and 1970. In Java and Sumatra, 3 million trees were destroyed from 1960 to 1970, and Bali lost 3.6 million trees from 1984 to 1987. In the southwestern oases of Saudi Arabia, HLB had killed most sweet orange and

mandarin trees by 1983. Reunion Island lost its entire citrus industry in the 1960s due to HLB. In São Paul State, Brazil, where HLB was recognized in March 2004, close to 3 million HLB-affected sweet orange trees have been removed since mid-2004 in the HLB-control program. In Florida, where HLB was reported in 2005, intensive control measures were advocated but not implemented, except for some notable private efforts. By 2008, the situation had become so serious that the very existence of citrus is endangered. South Africa suffered devastating losses due to HLB at the time when the insect vector of this disease was not yet seriously controlled with systemic insecticides. Citrus was decimated in the northern part of the country (i.e. the White River region) while in the Tzaneen region, citrus has been replaced by avocado; the Hazy View area has lost 90 percent of its citrus; and many other regions are riddled with HLB (H. Le Roux, Citrus Research International, Nelspruit, South Africa, personal communication). However, since the late 1980s, when efficient control of the African psyllid was achieved with systemic insecticides, HLB in South Africa has become much less aggressive than the HLB in Brazil, Florida or Cuba. Because the African form of HLB is heat sensitive, the disease is severe in cool, elevated areas, whereas in some dry, hot areas, the disease is mild or absent.

General reviews on HLB and its vectors have been prepared by Bové, (2006, 2009), da Graça, (1991), da Graça and Korsten, (2004), Garnier and Bové, (1993), Gottwald et al., (2007), and Halbert and Manjunath, (2004).

History of HLB

In South China, in 1919, Reinking mentioned “yellow shoot” as a citrus disease of little importance (Reinking, 1919). By 1936, the “yellow shoot disease” had become a serious problem to which Kung Hsiang Lin, a phytopathologist at the South China Agricultural University, devoted most of his activities from 1941 to the late 1950s. From his discussions with the farmers in the Chaozhou district, Guangdong province, he learned that the disease had been in the Chaozhou district since the late 19th century and that the disease in South China probably originated from that district (Lin, 1956b). Subsequently, similar diseases were reported in citrus elsewhere in the world, e.g., in the Philippines in 1921, and in South Africa in the late 1920s. However, observed symptoms were attributed to mineral deficiencies (Van der Merwe and Andersen, 1937).

K. H. Lin was the first to report in 1956 that HLB is transmissible by graft-inoculation (Lin, 1956b). Professor A. Ciccarone, an Italian phytopathologist, published a report of Lin’s work in 1957 in an Italian journal of citriculture (Ciccarone, 1957). In spite of this report, Lin’s achievements remained largely unknown in the western world. Transmission of South African greening by graft-inoculation was reported nine years later, in 1965 (McClean and Oberholzer, 1965b). Transmission of the greening agent by the African citrus psyllid vector, Trioza erytreae, was also published in 1965 (McClean and Oberholzer, 1965a). Transmission of the HLB agent by the Asian citrus psyllid vector, Diaphorina citri, was reported simultaneously in 1967 in India (Capoor et al., 1967) and in the Philippines (Martinez and Wallace, 1967).

Citrus in India has been known to suffer seriously from certain disorders resulting in low production, twig dieback, slow death, and even sudden wilting. These symptoms were attributed to “dieback”, and might have been observed by Roghoji Bhonsale (Capoor, 1963) in the 18th century, as well as by Bonavia (1888) in Assam. However, “dieback in citrus is not a specific disease” (Asana, 1958) and, over the years, many factors, including soil disorders, nutritional deficiencies, twig fungi, and viruses such as CTV, were evoked to account for it (Capoor, 1963).

Support for a connection between HLB and dieback came in 1966 from a survey on dieback in all major citrus areas of India. Researchers concluded that dieback was caused by the “virus” responsible for greening in South Africa (Fraser and Singh, 1968). Unquestionable proof for the presence of HLB in India came in 1967 when successful transmission of the disease agent with the Asian citrus psyllid was obtained (Capoor et al., 1967).

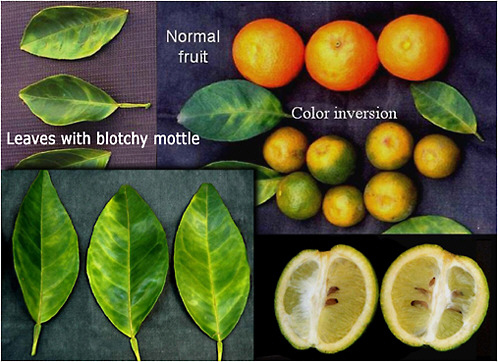

When first observed in South Africa in the late 1920s, HLB was referred to as “yellow branch” in the western Transvaal and as “greening” in the eastern Transvaal. The term “greening” prevailed and became the most common name of the disease worldwide. It refers to fruits with abnormal coloration (inverse coloration) in that they are still greenish at the stylar end, when the peduncular end has already turned orange/yellow; in normal fruits, coloration starts at the stylar end (Figure 2-9). In the Chaozhou district of southern China, where a local Chinese dialect was spoken, the disease was called huang long bing (“bing” meaning disease, “long” meaning shoot [and not “dragon”], and “huang” meaning yellow). Yellow shoot is an early, characteristic symptom of the disease and refers to the yellow color of the new flush of growth on infected trees. K. H. Lin referred to this disease as “huanglongbing” (Lin, 1956a). For these reasons, the International Organization of Citrus Virologists (IOCV) proposed in 1995 at the 13th conference of the IOCV in Fuzhou (Fujian province, China) that the official name of the disease be huanglongbing, and this proposal was accepted. Today, HLB is widely used for the African, American, and Asian forms of the disease.

Other names of the disease exist: “likubin” in Taiwan; “blotchy mottle disease” in South Africa, a very good name referring to the most characteristic leaf symptom (McClean and Schwarz, 1970); in the Philippines, the names “leaf mottling” (Salibe and Cortez, 1968) and “leaf-mottle-yellows” (Martinez and Wallace, 1968) also refer to leaf mottle, but lack the important term “blotchy”; in India, “citrus decline” or “citrus dieback” are unspecific names, as disorders other than HLB are often involved in citrus trees affected by decline or dieback; “vein-phloem degeneration” in Indonesia, draws attention on an important histological symptom.

Bacterial Agents Associated with HLB

Initially, it was thought that the HLB agent was a virus because of its graft transmissibility (Lin, 1956b). In 1967, Doi et al. in Japan, showed that “mycoplasmas” (today referred to as “phytoplasmas,” plant-infecting bacteria that lack cell walls) were associated with certain plant diseases and that those diseases could be graft transmitted. Previous to this development, mycoplasmas were known mostly as human and animal pathogens. Because of the discovery of phytoplasmas, the presumed viral etiology of many plants diseases was re-examined, including HLB.

In 1970, through the use of electron microscopy (EM), Laflèche and Bové reported the presence of bacteria-like structures in the sieve tubes of HLB affected sweet orange seedlings from Africa and Asia (Laflèche and Bové, 1970a, b). First described as mycoplasma-like or having no cell wall, the bacteria-like structures were later on shown by Saglio et al. (1971) to clearly possess a cell wall. Moll et al. (1974) in South Africa also drew attention to the similarity between the cell-wall of the HLB-associated agent and Gram-negative bacteria (i.e having a cell wall composed of an outer membrane and an inner peptidoglycan layer). The Gram-negative nature HLB-associated organism was finally demonstrated in 1984 (Garnier et al., 1984a, b). . Most HLB-affected citrus trees worldwide carry one of three recognized liberibacter species designated as Candidatus Liberibacter africanus (CLaf), Ca. Liberibacter asiaticus (CLas), or

Ca. Liberibacter americanus (CLam). However, in early 2007, a genuine plant mycoplasma, i.e., a phytoplasma, belonging to 16Sr group IX was detected in sweet orange trees in northern São Paulo State (Teixeira et al., 2008a). Another HLB-associated phytoplasma, belonging to a different group (16Sr group I) than the one detected in São Paulo State, has been identified in the Guangdong province of southern China (Chen et al., 2009).

Phytoplasmas can be easily distinguished from the walled liberibacters by EM. The symptomatic leaves from these trees in Saõ Paulo tested negative for all three liberibacter species, but were eventually found to be infected with a sieve-tube restricted phytoplasma which has 99 percent 16SrDNA sequence identity with the pigeon pea witches’ broom phytoplasma (group 16Sr IX) (Teixeira et al., 2008a). The insect vector of the HLB phytoplasma in São Paulo State has not yet been identified. Crotalaria junceae plants, grown in between citrus rows for soil improvement and showing characteristic witches’ brooms, have been found to be infected with the HLB phytoplasma (Wulff et al., unpublished). Thus, a non-citrus host is probably the source of phytoplasma inoculum on which potential insect vectors, such as leafhoppers, planthoppers or psyllids, may become infected and transmit the phytoplasma to citrus. In summary, symptoms indistinguishable from those induced by CLas infection have also been shown to be induced by specific phytoplasmas in the absence of CLas or other liberibacters.

Liberibacters and the phytoplasmas have not been available as pure (axenic) cultures. Thus, the criteria for establishing causality (Koch’s postulates) could not be fulfilled, and it could not be demonstrated that bacteria of either of these groups were indeed causal agents of HLB. In general, the three liberibacters and the two phytoplasmas should not be called ‘agents”, “causal agents”, or “pathogens” of HLB. Rigorously, they should be designated as “agents” or “bacterial agents” associated with HLB. However, there is strong circumstantial evidence that these associated agents, and in particular the liberibacters, are in fact etiological agents of HLB. The term “Candidatus” preceding a Latin binomial name indicates that the corresponding bacterium is not available in axenic culture and has only been associated with HLB by DNA sequence-based and other techniques (Murray and Schleifer, 1994).

Because axenic cultures were unavailable in the 1990s, comparisons with known bacterial 16S rDNA sequences from data bases were employed to show that the Asian and African HLB-associated organisms are indeed Gram-negative bacteria, and, more precisely, are members of a new subgroup in the alpha subdivision of the Proteobacteria. Organisms in this subdivision live in intimate association with eukaryotic cells and, in many cases, have the ability to survive and grow within an arthropod vector. The HLB-associated bacterium fits this description remarkably well because it grows in a specialized niche in its eukaryotic plant host, the phloem sieve tubes, and is transmitted by two arthropod vectors, the citrus psyllids, T. erytreae (the vector in Africa) and D. citri (the vector in Asia), in which it circulates and replicates.

Because the HLB-associated bacterium was the first representative of a new subgroup in the alpha-Proteobacteria, a new name was coined: “Liberobacter” from the Latin liber = bark and bacter = bacterium (Jagoueix et al., 1994). Liberobacter was later replaced by Liberibacter (Garnier et al., 2000a). The HLB-associated agent from Africa, CLaf, can be distinguished from the agent in Asia, CLas, on the basis of temperature sensitivity (Bové et al., 1974), as well as nucleotide sequence (Villechanoux et al., 1993), and serology (Garnier et al., 1991; Gao et al., 1993; Jagoueix et al., 1994; Garnier et al., 2000b). Sequence identification of the region between the 16S rRNA gene and the 23S rRNA gene (16S/23S intergenic region) has confirmed the notion that the African liberibacter and the Asian liberibacter represent two different liberibacter species (Jagoueix et al., 1997; Subandiyah et al., 2000).

A third liberibacter species (American HLB-associated bacterium) has been identified in São Paulo State, Brazil, shortly after HLB was detected there in 2004. Comparison of the sequences of the 16S rDNA and the 16S/23S intergenic regions of CLaf, CLas, and the American HLB-associated bacterium indicated that the latter is a new species: Ca. Liberibacter americanus (CLam) (Teixeira et al., 2005a; Teixeira et al., 2005e; Teixeira et al., 2005d; Teixeira et al., 2005b). Transmission by graft-inoculation to healthy sweet orange seedlings has been demonstrated and EM observations showed CLam to be restricted to the sieve tubes. The host(s), characteristics, distribution, and natural vectors of all three Liberibacters are shown in Table 2-2. Liberibacter associated with non-citrus hosts. The potato zebra chip (ZC) disease, so-called because chips from afflicted tubers exhibit stripes when they are fried, was first reported in Mexico in 1994. Not long after that, in 2004, the disease was reported in Texas, near Pearsall (Secor and Rivera-Varas, 2004). In recent years (2004–2006), ZC has become an economically important disease in the United States and in Mexico, with losses amounting to millions of dollars. Two reports released within months of each other, one from a group in California (Hansen et al., 2008) and the other from a group in New Zealand (Liefting et al., 2009), described the association of a liberibacter with ZC and another disease that occurs in tomato, called psyllid yellows. Two names have been proposed for this liberibacter, Ca. Liberibacter psyllaurous (Hansen et al., 2008) and Ca. Liberibacter solanacearum (Liefting et al., 2009); both are transmitted by the potato/tomato psyllid, Bactericera cockerelli. B. cockerelli is associated with diseases of solanaceous plants, tomato (Solanum lycopersicum), potato (S. tuberosum), tamarillo (S. betaceum), capsicum (Capsicum annuum), chilli (Capsicum sp.), and cape gooseberry (Physalis peruviana) in New Zealand (Liefting et al., 2009) and with the potato ZC in the United States (Lin et al., 2009). The liberibacter associated with ZC is the first liberibacter to have been described from non-citrus hosts and was found to have 95–97 percent 16S rDNA sequence identity with the HLB-associated liberibacters. The names “Ca. Liberibacter psyllaurous” and “Ca. Liberibacter solanacearum” are probably synonymous based on the currently available 16S rDNA sequences from the National Center for Biotechnology Information (NCBI), and are both included in the List of Prokaryotic names with Standing in Nomenclature (last updated on March 6, 2010). However, names included in the category Candidatus are not covered by the Rules of the Bacteriological Code (1990) (for naming new bacterial taxa) since these are only candidate species not actual species. Accordingly, a name included in the category Candidatus cannot be validly published. Therefore, the bacterium is best referred to, at present, as “Ca. Liberibacter psyllaurus/solanacearum” (CLp/s). Citrus is not a host of the potato/tomato psyllid. However, work by Garnier and Bové (1983) and Duan et al. (2008), which demonstrated CLas transmission to, and symptom production in tobacco (Nicotiana tabacum) and tomato using dodder (Cuscuta campestris, a parasitic plant), suggests that there is the possibility that the liberibacter found in potato can also be dodder-transmitted to, and can produce symptoms in, citrus (sweet orange). Once in citrus, CLp/s could be acquired and inoculated by the ACP. In other words, it is not excluded that CLp/s might behave, once it gets into citrus, as another HLB liberibacter.

TABLE 2-2 Bacterial Agents Associated with Huanglongbing

|

Agent |

Host(s) |

Characteristics |

Distribution |

Natural Vector |

References |

|

HLB Associated Liberibacters |

|||||

|

Candidatus Liberibacter africanus |

Citrus spp.; transmissible to periwinkle (Catharanthus roseus) by dodder (Cuscuta campestris) |

Sieve-tube restricted; gram-negative; heat sensitive |

Africa; Arabian Peninsula; Mauritius; Reunion Islands |

Trioza erytreae (African citrus psyllid) |

Garnier and Bové, 1983; Jagoueix et al., 1994; Garnier et al., 2000a |

|

Candidatus Liberibacter americanus |

Citrus spp.; transmissible to periwinkle by dodder |

Sieve-tube restricted; gram-negative; heat sensitive |

Brazil (São Paulo and Minas Gerais); Hunan, China (unconfirmed) |

Diaphorina citri (Asian citrus psyllid) |

Teixeira et al., 2005a, b,d,e; Lopes et al. 2009 |

|

Candidatus Liberibacter asiaticus |

Citrus spp.; transmissible to periwinkle, tobacco (Nicotiana tabacum) and tomato (Lycopersicon esculentum) by dodder |

Sieve-tube restricted; gram-negative; heat tolerant; causes disease at 32–35C |

Asia; Saudi Arabia; Florida; Brazil |

Diaphorina citri (Asian citrus psyllid) |

Bové et al., 1974; Garnier and Bové, 1983, 1993; Jagoueix et al., 1994, 1997; Garnier et al., 2000a; Duan et al., 2008 |

|

Liberibacters from Non-rutaceous Hosts |

|||||

|

Candidatus Liberibacter psyllaurous |

Solanaceous crops |

97% sequence similarity with Candidatus Liberibacter asiaticus; causes zebra chip disease in potato |

Mexico; Texas; Guatemala |

Bactericera cockerelli (potato/tomato psyllid) |

Gudmestad and Secor, 2007; Hansen et al., 2008; Lin et al., 2009 |

|

Candidatus Liberibacter solanacearum |

Tomato; Chili; Pepper; Potato; Tamarillo; Cape Gooseberry |

Likely the same as Candidatus Liberibacter psyllaurous |

New Zealand |

Bactericera cockerelli (potato/tomato psyllid)-possibly |

Liefting et al., 2009a, b |

|

Agent |

Host(s) |

Characteristics |

Distribution |

Natural Vector |

References |

|

Phytoplasma Associated with HLB |

|||||

|

Phytoplasma |

Citrus; Crotolaria juncea |

Sieve-tube restricted; wall-less; has 99% sequence identity with pigeon pea witches' broom phytoplasma (group 16Sr IX) |

Brazil (San Paulo) |

Not yet known |

Teixeira et al.., 2008c; Wulff et al.., 2009 |

|

Phytoplasma |

Citrus |

Sieve-tube restricted; wall-less; related to Candidatus Phytoplasma asteri (group 16Sr I) |

China (Guangdong) |

|

Chen et al.., 2009 |

Transmission

HLB is readily transmitted (acquired and inoculated) by budwood or by insect vectors, i.e., the African psyllid, T. erytreae (McClean and Oberholzer, 1965a) or ACP (Capoor et al., 1967; Martinez and Wallace, 1967). Low efficiency seed transmission of CLas has been reported (Zhou et al., 2008) but needs to be quantitated by further studies. Attempts at mechanical inoculation by introducing sap from infected trees into test plants proved to be unsuccessful. Graft inoculations of CLam with shoots, buds, bark from shoots or roots, and leaf patches has been successful with varying efficiency, depending on the species and the size of the tissue used (Lopes and Frare, 2008). Transmission by dodder from citrus to periwinkle, tobacco, and tomato (Lycopersicon esculentum) has been demonstrated by Garnier and Bové (1983), Garnier and Bové (1993), and Duan et al. (Duan et al., 2008), respectively.

Transmission by psyllid is considered as the primary mode of HLB spread in the field. The following section provides a brief summary of what is currently known about ACP life history and biology. More information can be found in a paper presented by Hall (2008) at the 2008 North American Plant Protection Organization (NAPPO) Workshop on Citrus Huanglongbing and the Asian Citrus Psyllid (held in Hermosillo, Sonora, Mexico) and in a review by Halbert and Manjunath (Halbert and Manjunath, 2004).

ACP description, life history, and biology

The ACP is 2.7 to 3.3 mm in length and has mottled brown wings and piercing mouthparts (stylets) which are used to ingest phloem sap from young citrus stems and leaves. Adults resting or feeding on leaves are found with their heads low and their bodies at a 45° angle with the plant surface (Figure 2-7, A and D). They are active and are capable of jumping or flying short distances when disturbed (Hall, 2008). The ACP life cycle includes an egg stage (Figure 2-7, B) and five nymphal instars (Figure 2-7, C) which take 11–15 days to complete (Chavan and Summanwar, 1993).

Oviposition and development of nymphs occur on young, tender flush leaves or shoots (Hall and Albrigo, 2007). ACP developmental times vary with temperature, with 25–28°C as the optimum temperature range for development (Liu and Tsai, 2000). Adults reach reproductive maturity 2 or 3 days after emergence, and oviposition (egg laying) begins 1 or 2 days after mating (Wenninger and Hall, 2007). Females were observed to oviposit throughout their lifetime if young leaves were present. According to reports from Husain and Nath (1927), Pruthi and Batra (1938), Tsai and Liu (2000) and Nava et al. (2007), the adult females are capable of laying 500 to 800 eggs or more over a period of two months. Studies by Skelly and Hoy (2004) indicated that oviposition by adult ACP is influenced by temperature and by relative humidity; exposure to 34° C for 5 days caused adult ACP to stop laying eggs and fewer eggs were produced when relative humidity dropped below 40 percent (Skelley and Hoy, 2004).

Maximum adult longevity ranged from 117 days at 15°C to 51 days at 30°C (Liu and Tsai, 2000); survival was observed to increase with increasing humidity (McFarland and Hoy, 2001). Very low temperatures have an adverse effect on ACP; 94 to 98 percent mortality was observed in adults that were kept at -3.3°C (Ashihara, 2004). ACP development, longevity, and reproduction also vary depending on the host species (Tsai and Liu, 2000; Fung and Chen, 2006;

FIGURE 2-7 Asian citrus psyllid (ACP) life cycle. Clockwise from top left: A) ACP adult and nymphs; B) eggs of the ACP; C) five nymphal stages of the ACP; and D) closer view of ACP mottled brown wings and 45° angle with plant surface.

Source: (A) Courtesy of M. E. Rogers, Citrus Research and Education Center, Lake Alfred, FL; (B, C, and D) Courtesy of David Hall, USDA-ARS-USHRL, Fort Pierce, FL.

Nava et al., 2007). Studies by Tsai and Liu (2000) showed that the psyllid developed faster on grapefruit than on rough lemon, sour orange, or orange jasmine (Tsai and Liu, 2000).

Wenninger et al. (2008; 2009) observed that male and female courtship behavior includes substrate-borne vibrational signals; they also found behavioral evidence that the female ACP emits a sex pheromone (Wenninger et al., 2008). Mating, which is restricted to daylight hours (Wenninger and Hall, 2007), has been found to occur multiple times with different partners (Wenninger and Hall, 2008). Oviposition and other mobile activities of the psyllid were also observed to occur only during daylight hours (Wenninger and Hall, 2007). Aubert and Hua (1990) noted that flight activity is more pronounced during warm, windless, and sunny afternoons between the hours of 4 and 6 pm. Research in Florida indicate that low numbers of adults routinely disperse from citrus within distances of 8 to 60 m (Hall, 2008) with some evidence for occasional mass migrations (Hall et al., 2008).

Population fluctuations of ACP are strongly influenced by the availability of young citrus flush, since eggs are laid only on young flush where nymphs hatch and develop. Large infestations of ACP occur during late spring through midsummer, but outbreaks can occur at any time of the year depending on warm temperatures and availability of young flush leaves (Hall, 2008). In India, Husain and Nath (1927) recorded nine ACP generations on citrus over a one year period and they speculated that two or more additional generations can occur in warmer weather with ample flush available.

ACP host plants

Halbert and Manjunath (2004) provide a list of plant species that are hosts of the ACP. The psyllids can feed on many citrus species and citrus close relatives, but the preferred hosts are Murraya paniculata (Orange jasmine, mock orange) (Aubert and Quilici, 1988) and Citrus aurantifolia (Halbert and Manjunath, 2004). However, studies done by Tsai and Liu (2000) and Tsai et al. (2002) did not show the psyllid’s preference between grapefruit and orange jasmine. Continuous shoot growth by M. paniculata plays an important role in maintaining ACP populations when citrus flush is not available (Tsai et al., 2002).

Vector-pathogen interactions

There are a number of reports on the transmission of Ca. Liberibacter spp. by ACP (Capoor et al., 1974; Huang et al., 1984; Xu et al., 1988; Hung et al., 2004; Brlansky and Rogers, 2007) that together support a horizontal (plant-to-plant), circulative-propagative transmission mechanism. Nymphs appear to acquire the pathogen during later instar stages; adults emerging from these nymphs can immediately inoculate trees with the pathogen. Studies by Xu et al. (1988) indicated that the first, second, and third instars cannot inoculate the pathogen but the fourth and the fifth instars are able to do so. Adults can acquire the pathogen with feeding times ranging from 30 minutes to 5 hours (Capoor et al., 1974; Xu et al., 1988). Since nymphs have limited mobility and spend their entire time feeding in one small area of a tree, they may be the most important stage for efficient acquisition. The adult stage with its mobility, however, is the stage which spreads the pathogen from tree to tree.

The transmission cycle of HLB includes the acquisition, retention (after a latent period), and inoculation of the pathogen by the vector. In general, pathogen transmission by the vector occurs during feeding and involves the bacteria traversing a complicated path through the vector. However, the mechanism of pathogen transmission is poorly understood for psyllid-Liberibacter interactions, and research is underway to decipher critical processes involved in this pathway. After the pathogen is acquired, it multiples in the insect, and the vector remains infected (inoculative) for life. It is reported that a latent period of up to 25 days occurs after acquisition but before the adult can inoculate the pathogen (Xu et al., 1988; Hung et al., 2004). Capoor et al. (1974), however, reported a latent period of only 8–12 days. ACP was shown to inoculate the plant during a feeding period of 5 hr (Xu et al., 1988), but results derived from modern techniques could alter this timeframe. Transmission of CLas is being investigated by electrical penetration graphs to relate psyllid feeding behavior to both acquisition and inoculation (Bonani et al., 2010). Investigations of transovarial transmission have so far given only negative results (Capoor et al., 1974; Xu et al., 1988; Hung et al., 2004), and effects of CLas on the life-span or fecundity of the psyllid have not been reported. Many early reports from Asia indicate low

transmission efficiency (ranging from 1.3 to 12 percent) by ACP (Huang et al., 1984; Xu et al., 1985; Xu et al., 1988). However, field infection rates of 50 to 70 percent have been observed in young citrus groves in China (Xu et al., 1988).

ACP distribution

The ACP distribution is discussed in another section of this chapter (see Worldwide Distribution).

Epidemiology

The ACP was first detected on Murraya in Palm Beach County, Florida in 1998 and became widespread in Florida as a result of shipment of infested orange jasmine (Halbert and Manjunath, 2004). Murraya spp. has been shown to be a host of the HLB pathogen but its role or importance in HLB epidemics is unknown. Based on observations of localized HLB secondary spread, much movement is presumed to be of short distance. However, when HLB was first diagnosed in 2005 in coastal communities in Miami-Dade County, the disease was soon found in a commercial grove some 90 to 150 km away. Gottwald et al. (2007) speculated that this could have resulted from long range dispersal of infected psyllids. In any event, the pathway of long-distance pathogen spread likely involves infected psyllids migrating from citrus to citrus as well as hitchhiking on infested ornamental plants such as Murraya , its preferred host.

The epidemiology of HLB is difficult to assess due to the fastidious nature of the presumed causal agent, its persistent/propagative mode of transmission by psyllid vectors, the long latent period needed for symptom development, as well as variability of HLB symptoms due to climate, horticultural practices and different citrus varieties. This often leads to disparate observations in estimates of disease incidence. The recent use of polymerae chain reaction (PCR) to accurately diagnose HLB infection in trees and psyllids has vastly improved this problem (Gottwald et al., 2007) by its ability to confirm infection of asymptomatic or questionable trees.

Symptomatology

Symptoms of infected field tree

In sweet orange trees, the early stages of infection can be identified by the presence of one or several characteristic “yellow shoots”. With time, the yellow shoots grow into larger yellow/pale green branches. In South Africa, trees with large yellow branches are characteristic of HLB. In later stages of the disease, the yellow branches take over the whole canopy, indicating that the tree is fully (systemically) infected. In São Paulo State, the “yellow branch” stage is less characteristic of HLB (Bové, 2009). Affected branches may show one or several of the following features: defoliation, twig dieback, presence of leaves with blotchy mottle (see below), mineral deficiency patterns (zinc in particular), or uniformly yellow, presence of affected fruits, which have a tendency to drop. Defoliation results in sparse foliage and an “open” type of growth. In Brazil, Florida, and Cuba, many young orchards, because of abundant growth flushes, became affected more severely than older orchards with fewer flushes. While many trees in these young orchards were fully affected, other trees still had some symptomless sectors with well-developed

green leaves, while the symptomatic sectors had yellowish leaves with severe zinc deficiency patterns. Such trees, with symptomless sectors and symptomatic sectors, are most characteristic of orchards being invaded by HLB. In fall and early winter, these trees have blotchy mottle leaves, which may drop in late winter and make HLB diagnosis more difficult.

In mandarin trees, HLB is characterized by yellowing of all sectors of the canopy and severe defoliation. HLB-affected Murcott tangor trees in São Paulo State have pale green/yellowish branches, undergo defoliation and show severe fruit symptoms.

Symptoms on leaves

One of the most characteristic symptoms of HLB, worldwide, is leaf “blotchy” mottle. Leaves with blotchy mottle have several shades of yellow, pale green and dark green. These shades blend into each other, and there are no sharp boundaries between the various shades of color, hence the term "blotchy" mottle (Figure 2-8). Blotchy mottle is synonymous with HLB and accompanies HLB wherever it occurs in the world. Zinc, manganese or magnesium deficiencies also produce a blotchy mottle but with a symmetrical pattern on the two sides of the leaf unlike the asymmetric pattern characteristic of HLB. The only other disease that produces similar symptoms is lime blotch/wood pocket, a genetic disorder of Tahiti or Persian limes (Timmer et al., 2000), and those symptoms occur exclusively on limes. With trees in early stages of HLB, blotchy mottle may affect large, well-developed leaves, and may be the only leaf symptom to be seen. In later stages, foliar symptoms of zinc deficiency will eventually develop, and such leaves will remain small, and with time, the whole leaf blade may ultimately turn uniformly yellow. Leaves may become thicker and leathery. Midribs and lateral veins are sometimes enlarged, swollen, and corky. In Florida, yellow midribs are prevalent on HLB-affected leaves.

FIGURE 2-8 Huanglongbing symptoms on citrus trees (left) and leaves on a branch (right).

Source: Photos courtesy of M. Irey, US Sugar Corporation, Clewiston, FL.

Blotchy mottle is most apparent on sweet orange leaves, but most other citrus species and varieties also show it, including grapefruit, pummelo, citron, rough lemon, Citrus macrophylla, Volkamer lemon, and sour orange. Leaves of lemon, Mexican lime, and Tahiti lime also show

blotchy mottle, but of a type slightly different from that of sweet orange leaves, as the patches of dark green tend to be much larger than in the case of sweet orange leaves. Blotchy mottle symptoms also vary among the mandarin varieties that are grown in different regions of the world.

Symptoms on fruit

HLB also produces characteristic symptoms on fruit, which are easily seen on sweet oranges but are also observed on mandarins, tangors, pummelos, and many other species, hybrids or varieties. In normal fruits, the orange color develops first at the stylar end, at a time when the peduncular end is still green. On HLB-affected fruit, the orange color starts first at the peduncular end, at a time when the stylar end is still green. Fruits affected by HLB also exhibit orange-stained vascular bundles, are lopsided and are smaller than normal fruit, and have aborted seeds (Figure 2-9). Juice from fruit displaying these symptoms is similar in quality to juice from immature fruit. However, trees affected with HLB are also characterized by severe drop of symptomatic fruits. Most symptomatic fruit either drops before harvest, is not picked, or is eliminated by the sizing equipment. Therefore, under current conditions, HLB severely affects yields of juice oranges but has not presented a significant quality problem for the juice.

Host Range

Non-rutaceous hosts

It has been demonstrated that the three citrus liberibacters can be transmitted to periwinkle plants by dodder (Garnier and Bové, 1983; Bonnet, unpublished). Dodder-transmission of CLas to tobacco (Garnier and Bové, 1983) and to tomato (Duan et al., 2008) has also been demonstrated, indicating that CLas can infect solanaceous plants.

Sensitive species, varieties or scion-rootstock combinations (Citrus and Citrus relatives)

The most severe symptoms are found on sweet orange, mandarin, tangelo, and grapefruit, followed by lemon, rough lemon, and sour orange. Severe fruit and leaf symptoms can be seen on pummelo (Citrus grandis), even though this species is sometimes erroneously considered more or less tolerant. Trees of small-fruited, acid lime (C. aurantifolia) are only slightly affected, but clear-cut blotchy mottle symptoms can be seen on leaves. In many countries where HLB occurs, CTV is also present and affects acid lime much more severely than does HLB. However, the lime trees are severely affected by the ACP, which is a significant pest for lime trees.

FIGURE 2-9 HLB symptoms on citrus leaves and fruit. Lopsided fruit with aborted seeds and brownish vascular bundles (lower right).

Source: Courtesy of J. M. Bové, La Brède, France.

The ornamental citrus relative, M. paniculata , shows leaf yellowing, defoliation and dieback on branches when infected with CLas or CLam in São Paulo state (Lopes et al., 2005; Lopes et al., 2006). M. paniculata was also found in Florida to be naturally infected with the CLas (Zhou et al., 2007). Leaves of Clausena lansium (Chinese wampee) infected with CLas show leaf mottle (Ding et al., 2005). Severinia buxifolia (Chinese box orange) is also a host of CLas (Hung et al., 2000).

In the Western Cape Province of South Africa, Calodendron capense, an ornamental rutaceous tree (Cape chestnut tree), showed blotchy mottle leaves, and was found to be infected with a liberibacter. The new liberibacter was characterized as subspecies "capensis" of Ca. L. africanus (Garnier et al., 2000a).

Symptomless species, varieties or scion-stock combinations

There are no citrus species, varieties or combinations that are immune to HLB; trifoliate orange (Poncirus trifoliata) is said to be tolerant, but citranges may show leaf symptoms.

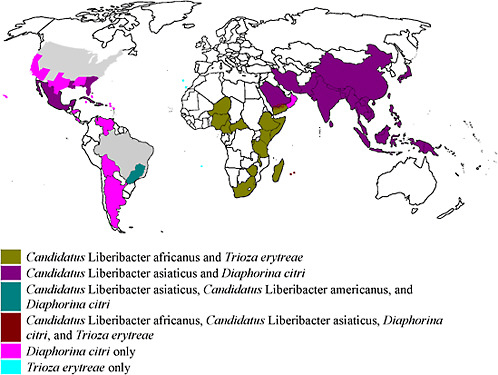

Worldwide Distribution

For many years, HLB was restricted to two large geographical regions: Africa and Asia, with the Arabian Peninsula between. At present, HLB occurs in the following regions of the world: Asia, Southeast Asia, Oceania, Africa, Madagascar, Arabian Peninsula, Reunion and Mauritius Islands, and America. The distribution of the HLB-associated liberibacters and the HLB insect vectors are given in Table 2-3 and Figure 2-10.

In all countries in Asia, Southeast Asia, and Oceania, the HLB-associated agent and the psyllid vector are temperature tolerant. Symptoms of Asian HLB occur at temperatures up to 32–35°C, if not higher. In the African countries where HLB is found, as well as in Madagascar, the disease and the African psyllid vector are only present in cool, elevated areas with temperatures below ~30°C, as the African HLB-associated liberibacter (CLaf) and the African psyllid are both temperature sensitive (Catling, 1969; Bové et al., 1974). The African psyllid is also severely affected by relative humidities below 25 percent.

In Saudi Arabia, HLB and the ACP were present in the early 1980s in the western oases along the Red Sea from Mecca down to the border with Yemen. In Yemen, HLB and the African vector occurred only on cool uplands, the HLB-associated liberibacter and its vector being both of the temperature-sensitive type. At the Saudi/Yemeni border, the two psyllid vectors were found in the same orchards, and the two HLB-associated liberibacters, CLaf and CLas, were probably present too (Bové and Garnier, 1984).

T. erytreae and ACP, as well as CLaf and CLas, were present on the two Indian Ocean islands, Reunion and Mauritius (Garnier et al., 1996). On Reunion, CLas and ACP occur from sea level up to ~500m. Above 500m, the CLaf and T. erytreae predominate. On both islands, some sweet orange trees carry both CLaf and CLas.

HLB has been present in the Americas since 2004. The countries where the disease occurs are listed in Table 2-3. In some of these countries, the disease was presumably present for several years before being reported. Ca. Liberibacter asiaticus is present in North and Central America, and both CLam and CLas occur in Brazil, with ACP as the vector.

The ACP has been present in the Rio Grande Valley of Texas (United States) since 2001 and in the Yucatan peninsula of Mexico since 2002. It quickly spread throughout Mexico, and, in June 2008, it was seen in Tijuana, at the border between Baja California, Mexico, and California, USA. By October 2008, it was detected in southern California along the United States/Mexico border. In October of 2009, ACP was detected in the Los Angeles basin and in Orange County (http://www.cdfa.ca.gov/phpps/acp/). It is present throughout the Southern United States, including Texas, Alabama, Georgia, Mississippi, and South Carolina and has been recently detected in Arizona. Table 2-3 lists regions that have the psyllid vectors but not HLB.

As of January 2009, HLB and two psyllid vectors have not been detected in the countries around the Mediterranean Basin, as well as Australia, New Zealand, and North- and South-Pacific islands, except that ACP is present on Hawaii and Maui.

Diagnosis

Diagnostic field symptoms. When HLB enters a region hitherto free of the disease, young trees show symptoms earlier, are more severely affected, and have a more rapid disease progression than adult trees. Young trees may be fully infected or still have some symptomless

Table 2-3 Geographical Distribution of Huanglongbing-associated Liberibacters and their Insect Vectors

|

Organism |

Countries Present |

References |

|

|

AFRICA |

|

|

Candidatus Liberibacter africanus and Trioza erytreae |

Burundi |

Garnier and Bové, 1996; Bové, 2006 |

|

Cameroon |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Central African Republic |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Ethiopia |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Kenya |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Malawi |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Nigeria |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Somali |

Garnier and Bové, 1996; Bové, 2006 |

|

|

South Africa |

McClean and Oberholzer, 1965a |

|

|

Swaziland |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Tanzania |

Garnier and Bové, 1996; Bové, 2006 |

|

|

Zimbabwe |

Garnier and Bové, 1996; Bové, 2006 |

|

|

ARABIAN PENINSULA |

|

|

|

Yemen |

Bové and Garnier, 1984 |

|

|

INDIAN OCEAN: |

|

|

|

Madagasca Island |

Bové, 2006 |

|

|

|

ASIA |

|

|

Candidatus Liberibacter asiaticus and Diaphorina citri |

Bangladesh |

Bové, 2006 |

|

Bhutan |

Bové, 2006 |

|

|

Cambodia |

Bové, 2006 |

|

|

China |

Bové, 2006 |

|

|

East Timor |

Bové, 2006 |

|

|

India |

Capoor et al., 1967 |

|

|

Indonesia |

Bové et al., 2000a |

|

Organism |

Countries Present |

References |

|

|

Iran |

Faghihi et al., 2009 |

|

|

Japan |

Miyakawa and Tsuno, 1989 |

|

|

Laos |

Bové, 2006 |

|

|

Malaysia |

Miyakawa and Tsuno, 1989 |

|

|

Myanmar |

Bové, 2006 |

|

|

Nepal |

Bové, 2006 |

|

|

Pakistan |

Bové et al., 2000b |

|

|

Papua New Guinea |

Bové, 2006 |

|

|

Philippines |

Martinez and Wallace, 1967 |

|

|

Sri Lanka |

Bové, 2006 |

|

|

Taiwan |

Bové, 2006 |

|

|

Thailand |

Schwarz et al., 1973 |

|

|

Vietnam |

Bové, 2006 |

|

|

ARABIAN PENINSULA |

|

|

|

Saudi Arabia |

Bové and Garnier, 1984 |

|

|

AMERICA |

|

|

|

Belize |

Citrus Growers Association pamphlet, 2009 |

|

|

Cuba |

Luis Pantoja et al., 2008 |

|

|

Dominican Republic |

Matos et al., 2009 |

|

|

Mexico |

NAPPO, 2009d |

|

|

Puerto Rico |

NAPPO, 2009c |

|

|

Florida, United States |

Halbert, 2005 |

|

|

Georgia, United States |

NAPPO, 2009a |

|

|

Louisiana, United States |

Lemon and Harless, 2008 |

|

|

South Carolina, United States |

NAPPO, 2009 |

|

Organism |

Countries Present |

References |

|

Candidatus Liberibacter asiaticus, Candidatus Liberibacter americanus, and Diaphorina citri |

Brazil |

Coletta-Filho et al., 2004; Teixeira et al., 2005a–e |

|

China (unconfirmed) |

Lou et al., 2008 |

|

|

|

INDIAN OCEAN |

|

|

Candidatus Liberibacter africanus, Candidatus Liberibacter asiaticus, Diaphorina citri, and Trioza erytreae |

Reunion Island |

Garnier et al., 1996 |

|

Mauritius Island |

Garnier et al., 1996 |

|

|

ARABIAN PENINSULA |

|

|

|

Saudi Arabia/Yemen border region |

Bové and Garnier, 1984 |

|

|

Diaphorina citri |

Argentina |

Vaccaro, 1994; Augier et al., 2006 |

|

Bahamas |

Halbert and Núñez, 2004 |

|

|

Bolivia |

Bové, 2006 |

|

|

Cayman Islands |

Halbert and Núñez, 2004 |

|

|

Costa Rica |

Villalobos et al., 2005 |

|

|

Guadeloupe |

Étienne et al., 1998 |

|

|

Honduras |

Burckhardt and Martinez, 1989 |

|

|

Oman |

Al-Zadjali et al., 2008 |

|

|

Puerto Rico |

Halbert and Núñez, 2004 |

|

|

Venezuela |

Cermeli et al., 2000 |

|

|

Virgin Islands (St. Thomas) |

Halbert and Núñez, 2004 |

|

|

Texas, United States |

French et al., 2001 |

|

Organism |

Countries Present |

References |

|

|

Hawaii and Maui, United States |

Conant et al., 2007 |

|

|

Alabama, Georgia, Louisiana, Mississippi, South Carolina, United States |

NAPPO, 2008 |

|

|

California, United States |

CDFA, 2009 |

|

|

Arizona, United States |

NAPPO, 2009b |

|

Trioza erytreae |

Portugal (Madeira Islands) |

PLANT Protection Service of Portugal, 1994–12 |

|

Spain (Canary Islands, Tenerife, La Gomera, La Palma, El Hierro) |

González Hernández, 2003 |

|

|

United Kingdom (Saint Helena) |

EPPO-CABI, 1997 |

FIGURE 2-10 World distribution of Candidatus Liberibacter spp. and their insect vectors.

Source: Based on Table 2-2.

sector(s). In general, trees are not uniformly affected. Diagnosis of HLB in the field is based on the characteristic symptoms that were discussed earlier in this section (see Symptomatology).

Biological indexing. Preferred indicator seedlings are sweet orange (such as Madam Vinous, Pineapple, Hamlin) and tangelo (Orlando, Seminole) cultivars. Inoculation can be done with budwood sticks, bark pieces, buds, and patches of blotchy mottle leaves from affected parts of the candidate tree. However, transmission is not 100 percent successful, probably because of low concentration and uneven distribution of the liberibacters, and 5 to 10 indicator seedlings should be used for each source to be indexed.

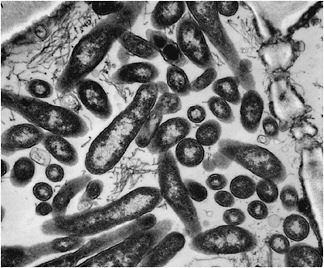

Electron microscopy. From 1970 to 1990, transmission electron microscopy (TEM) was the first and only laboratory technique for indisputable identification and confirmation of HLB and has been widely used (Garnier and Bové, 1996). The reliability and specificity of TEM is based on two properties of the HLB-associated liberibacter: (i) its exclusive location in the sieve tubes, and (ii) the presence of a cell wall (Figure 2-11). In citrus, no bacterium other than the HLB-associated liberibacters fit these criteria. However, TEM is a difficult and time-consuming technique, and it cannot distinguish between African, Asian or American liberibacters, but can

distinguish between the walled liberibacters and the wall-less HLB-phytoplasmas.

FIGURE 2-11 Electron micrograph of Candidatus Liberibacter sp. in the phloem of infected citrus tree.

Source: J. M. Bové, La Brède, France.

Serological diagnostic methods. Thirteen monoclonal antibodies (MA), specific for the African or Asian liberibacters, have been produced (Garnier et al., 1991; Gao et al., 1993). The use of these MAs for the detection of the HLB liberibacters by immunofluorescence on thin sections has shown that each MA is very specific for the strain used for immunization and, therefore, it is not advisable to use the MAs, either singly or in cocktails, for generalized

diagnosis of HLB (Garnier et al., 1991). They have, however, been used for purification of the liberibacter cells.

Molecular diagnostic methods. Today, molecular techniques, DNA hybridization and in particular PCR, are the techniques of choice for HLB diagnosis. The plant DNA required for these techniques is obtained from leaf midribs by such methods as the cetyltrimethylammonium bromide procedure of Murray and Thompson (1980). If possible, leaves with blotchy mottle symptoms should be used, as the liberibacter titer in these leaves is generally high (Teixeira et al., 2008b). The molecular diagnostic methods that have been used to detect the presence of HLB liberibacters include the following: DNA hybridization (see Villechanoux et al., 1992; Bové et al., 1993; Villechanoux et al., 1993; Planet et al., 1995; Teixeira et al., 2008b), conventional PCR (Jagoueix et al., 1996; Hocquellet et al., 1999; Teixeira et al., 2008b), nested PCR (Weisburg et al., 1991), and quantitative real-time PCR (Irey et al., 2006; Li et al., 2006; Wang et al., 2006; Li et al., 2007; Teixeira et al., 2008b).

Iodine-based starch test to assist in selecting leaves for HLB testing. Anatomical studies conducted in the 1960s found "massive accumulation" of starch in leaf samples collected from HLB-affected sweet orange trees. More recent studies have quantified starch accumulation in HLB-affected leaves at six times more than healthy leaves. Starch readily reacts with iodine, resulting in a very dark grey to black stain. Recently, a number of researchers from Vietnam and Japan have been working to adapt this starch/iodine reaction into a diagnostic tool for HLB, and they report up to 90 percent agreement between PCR analysis and starch tests with iodine. Researchers at the University of Florida Institute of Food and Agricultural Sciences (UF-IFAS) has not performed a similar correlation analysis, although studies are ongoing. An IFAS-developed version of this test, how to perform it, the required materials, its potential benefits, its limitations, and how to interpret the results has been reported (Etxeberria et al., 2007). The purpose of the test is to assist in determining which leaves, with difficult-to-interpret symptoms, should be submitted for PCR analysis. The test can be performed in the field but it does not replace PCR.

Management

Antibiotic treatments. Immediately after the discovery in 1970 that HLB is associated with a bacterium (and not a virus), tetracycline injections into the trunks of HLB-affected citrus trees were tried in South Africa, and found to significantly reduce the incidence of symptomatic fruit (Schwarz and von Vuuren, 1971; Schwarz et al., 1974; Moll and van Vuuren, 1977; Moll et al., 1980). The control procedure was, however, stopped after a few years because tetracycline is only bacteristatic and not bactericidal, requiring treatments to be repeated each year. After several trunk injections, the antibiotic induced phytotoxicity in the injected citrus trees. Tetracycline injections were used for some time in Taiwan (Su and Chang, 1974; Chiu et al., 1979) and Indonesia (Supriyanto and Whittle, 1991) without appreciable results. Wholesale use of an antibiotic in the orchard presents potential problems from development of antibiotic resistance. Experimentally, penicillin was shown to give remission of HLB symptoms, and this result supported the bacterial nature of the HLB agent (Aubert and Bové, 1980; Bové et al., 1980).

Approaches to biological control of psyllid vectors. The ACP in Florida is attacked by many generalist predators such as spiders, lacewings, syrphids, ladybugs, minute pirate bugs, along with a number of hymenopterous wasp parasitoids. However, the natural enemy reported

most effective in reducing psyllid populations were coccinellid lady beetles (Michaud, 2004), including the larval and adult stage ACP predators Olla v-nigram (Mulsant) and Harmonia axyridis. Classical biological control, defined as the introduction of natural enemies from the pest’s region of origin, has been implemented in Florida for ACP control. The tiny wasp parasitoids (so named because, unlike parasites, they always kill their hosts) Tamarixia radiata from Taiwan and Vietnam and Diaphorencyrtus aligarhensis (Shafee et al., 1975) from Taiwan were imported, reared and released against the ACP in Florida (McFarland and Hoy, 2001). Apparently, only T. radiata, a wasp that lays a single egg beneath the psyllid nympth and has shown some success against ACP in the islands of Guadaloupe (Étienne et al., 2001), has become established in the State (Michaud, 2002). However, there was little effect of T. radiata on the ACP population in Florida.