CHAPTER ONE

Methane and Water in Coalbeds

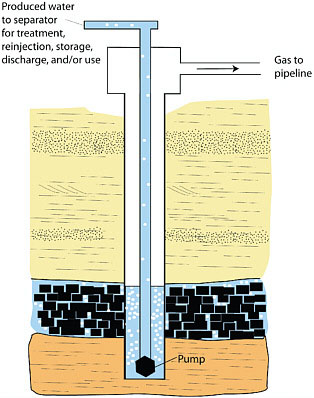

Methane production from coalbeds involves management of two important national resources: energy, in the form of natural gas, and water. In a coalbed methane (CBM) well, pumping water from the coalbeds lowers natural water pressure in the coalbed and allows the methane that had been fixed to the coal surfaces to be released and extracted (Figure 1.1). Water pumped from coalbeds as part of this process—CBM “produced water”—ranges widely in quality and quantity and is managed through some combination of treatment, storage, disposal, and/or use, subject to compliance with federal, state, and tribal regulations.

At present, significant differences exist in CBM produced water management strategies among states and between basins in the same state. These differences are due in part to differences in the composition and volume of produced water; the geology and hydrogeology of the CBM basins; federal, state, and tribal regulations; the legal categorization of water and water rights by government authorities; and costs to treat, store, and transport produced water. Produced water management is thus a challenge for regulatory agencies, CBM well operators, water treatment companies, policymakers, and the public.

Particularly in the arid western United States, water resources are scrutinized by many public and private concerns because of the need for water in such varied applications as agriculture, ranching, municipal and industrial consumption, and maintenance of natural habitats. In 12 western states1 more than 80 billion gallons of water (~245,000 acre-feet) per day were withdrawn from both surface and groundwater resources in 2005 for irrigation purposes alone (Barber, 2009). This is equivalent to completely filling about 100 domed

FIGURE 1.1 Illustration of the main features at a producing CBM well (not to scale). The black brick-like pattern represents a coal deposit lying between two sandstone units. The blue shading represents water that is present in the coal deposit. Methane gas (white dots and white shading) is adsorbed to the surfaces of the coal along cleats or fractures or is adsorbed to walls in the micropore structure of the coal matrix itself. Confinement of water in the coal by consolidated overlying and underlying sedimentary rock (sandstones in this figure) maintains the water in the coal under pressure, which in turn maintains the methane gas adsorbed to the coal. A submersible pump near the bottom of the well-bore cavity which penetrates the coal deposit pumps water from the coal. Pumping water reduces water pressure enough to allow methane to desorb from the coal surfaces and internal spaces and flow freely up the well bore. Water and methane flow through separate pipes to the surface. SOURCE: Adapted from Rice and Nuccio (2000).

professional football stadiums per day with water. While this volume of irrigation withdrawals contrasts to the approximately 42 billion gallons of CBM produced water generated in five western states in all of 2008 (see Chapter 2), water remains a vital resource and the effective, safe, and economical management of produced water from CBM wells is an important issue of consideration for government authorities, the general public, and industry.

NATIONAL CONTEXT FOR FUTURE CBM DEVELOPMENT AND PRODUCED WATER MANAGEMENT

Natural gas supplied about 24 percent of all domestic energy consumed by the United States’ residential, commercial, industrial, and electrical power generation sectors in 2008 (EIA, 2009a). That same year the nation met about 87 percent of its domestic natural gas

consumption with domestic resources, primarily methane, the main component of natural gas (EIA, 2009b). In addition to its domestic abundance, use of natural gas produces less carbon dioxide and significantly fewer criteria air pollutants2 per unit of energy produced than any other fossil fuel. Natural gas has been described as a principal transition fuel to a less carbon-intensive U.S energy portfolio.

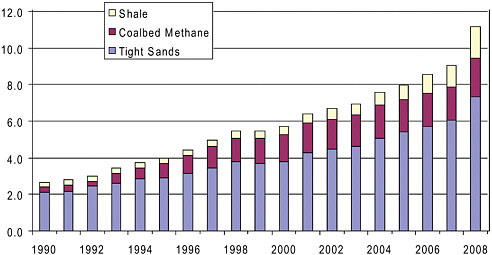

Projections suggest that unconventional natural gas may lead to an increase in the growth of the U.S. gas supply through 2030 (EIA, 2010a). CBM has become a significant part of total U.S. natural gas production over the last decade during which annual CBM production in the 48 conterminous United States increased from 1.3 trillion cubic feet (TCF) to 1.8 TCF, or just below 9.3 percent of total annual U.S. dry natural gas production (EIA, 2010b; see Figure 1.2).

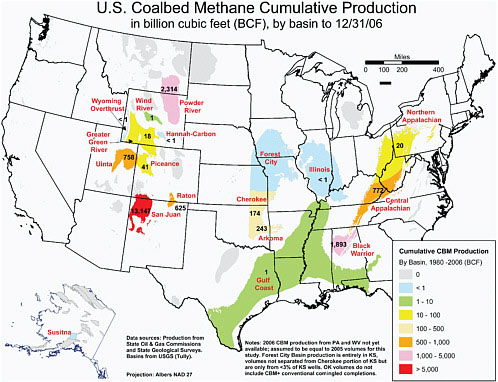

Significant recoverable amounts of CBM occur in numerous sedimentary basins of the United States from the Appalachian and Black Warrior basins in the East to the Powder River, San Juan, Raton, Greater Green, Piceance, and Uinta basins of the West. Extensive CBM resources have also been mapped in Alaska (see Figure 1.3). CBM accumulations

FIGURE 1.2 CBM has constituted a significant proportion of total unconventional U.S. gas production over the past two decades. This increase in production of methane gas from coalbeds reflects an increase in the number of CBM wells beginning in the early 1980s when development of CBM was stimulated by the Internal Revenue Service’s Section 29 tax credit. The tax credit included incentives for development of new energy sources, including tax credits for unconventional fuels production. SOURCE: Adapted from EIA (2009c).

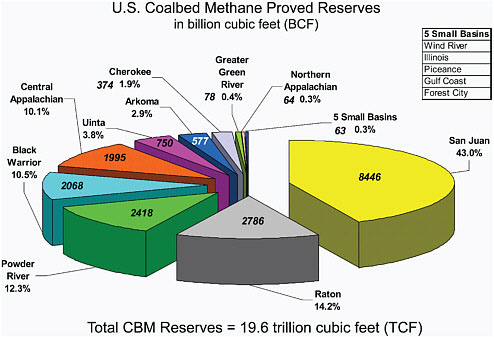

FIGURE 1.3 Sedimentary basins with CBM resources in the United States show the highest concentrations in the western United States. The Powder River, San Juan, Uinta, Piceance, and Raton basins comprise the largest currently known western U.S. recoverable resources and proved reserves (see Figure 1.4). SOURCE: EIA (2007).

vary within and among individual basins, depending on a basin’s geological evolution, the grade of coal in the basin, and the hydrogeological setting of the coal deposits in the basin (see Chapter 2 for detail). Currently, the San Juan, Raton, and Powder River basins together comprise nearly 70 percent of all proven reserves in the nation (see Figure 1.4), and production from the Rocky Mountain States has far exceeded that of all other regions in the country combined over the past 10 years. The relative youth of the CBM industry in the West coupled with future demands for domestic energy and water resources indicate a continued need for effective, safe, and economical management of produced water from CBM activities.

REPORT OVERVIEW

The Energy Policy Act of 2005 (P.L. 109-58, Section 1811; see Appendix A) recognized the importance of CBM produced water management and directed the Bureau of Land Management (BLM) to enter into an agreement with the National Research Council

FIGURE 1.4 The San Juan and Raton basins of Colorado and New Mexico and the Powder River Basin of Wyoming and Montana contain the largest proportion of proved CBM reserves. SOURCE: EIA (2007).

(NRC) to examine the effects of CBM produced water on the environment in the western states of Colorado, Montana, New Mexico, Utah, Wyoming, and North Dakota. In its request, BLM asked the NRC (1) to review existing studies by federal agencies related to CBM produced water effects and management; (2) to generate an inventory of the federal and state data resources available for CBM produced water management; (3) to identify the major positive and negative effects of CBM produced water treatment, storage, disposal, and/or use on surface water and groundwater resources; (4) to review federal and state regulations for CBM produced water management; (5) to evaluate the effectiveness of current best management practices for the minimization of potential negative impacts to water resources; and (6) to discuss the costs for CBM produced water management. In response to this request, the committee of nine volunteer experts (see Appendix B) established by the NRC has developed this report, which is intended for Congress, BLM, and other federal, state, and tribal agencies, state organizations, the general public and public groups, and industry interested in increasing the effectiveness of CBM produced water management. This report organizes the discussion in the following way:

-

The natural variables that affect produced water management, including the geological, hydrogeological, geochemical, and climatic factors specific to areas where western CBM production occurs (Chapter 2).

-

The federal and state management and regulatory framework that has developed around CBM and produced water and determines what can and cannot be done to and with the produced water once it has emerged at the wellhead (Chapter 3).

-

The range of management options, including water storage, treatment, disposal, and use, and positive and negative effects of CBM produced water that exist for the natural and constructed environments (Chapters 4 and 5).

-

The technologies and costs to treat, store, dispose of, and/or use produced water (Chapter 6).

In its consideration of these factors, the committee has understood that technologies are available to treat water to any regulatory requirement or desired end use but that treatment costs and whether or not produced water is characterized as a waste or a potential beneficial use become decisive factors in which management options are employed, particularly in the arid West. These issues, as well as the report’s conclusions and recommendations, are discussed in Chapter 7. Appendix C provides an overview of the presentations and meetings that served as some of the input to the committee’s deliberations. Appendix D contains an inventory of the available federal and state data resources. Other references specific to individual chapters are cited at the close of each chapter.

CONCLUDING REMARKS

CBM produced water management is a complex issue for public and private sectors. Water is an increasingly valuable resource in the western states and elsewhere, and the beneficial uses for CBM produced water may become a larger part of the dialogue regarding produced water management. Although the committee was asked specifically to address the issue of produced water from CBM basins in the western United States, the conclusions and recommendations of this report may have relevance to ongoing activities in other CBM basins in the nation and to produced water and water use issues, more broadly, associated with both renewable and fossil energy resource development.

REFERENCES

Barber, N.L. 2009. Summary of Estimated Water Use in the United States in 2005. Fact Sheet 2009-3098. Washington, DC: U.S. Geological Survey. Available at pubs.usgs.gov/fs/2009/3098/pdf/2009-3098.pdf (accessed March 4, 2010).

EIA (Energy Information Administration). 2007. U.S. Coalbed Methane: Past, Present, and Future. Panel 2 of 2. Washington, DC: U.S. Department of Energy. Available at www.eia.doe.gov/oil_gas/rpd/cbmusa2.pdf (accessed March 4, 2010).

EIA. 2009a. U.S. Primary Energy Consumption by Source and Sector, 2008. In Annual Energy Review (AER). Report No. DOE/EIA-0284. Washington, DC: U.S. Department of Energy. Available at www.eia.doe.gov/emeu/aer/pdf/pecss_diagram.pdf (accessed April 14, 2010).

EIA. 2009b. Natural Gas Year-in-Review 2008. Washington, DC: U.S. Department of Energy. Available at www.eia.doe. gov/pub/oil_gas/natural_gas/feature_articles/2009/ngyir2008/ngyir2008.html (accessed April 14, 2010).

EIA. 2009c. Annual Energy Outlook 2009. Washington, DC: U.S. Department of Energy. Available at www.eia.doe.gov/oiaf/archive/aeo09/index.html (accessed March 4, 2010).

EIA. 2010a. Annual Energy Outlook 2010 Early Release with Projections to 2035. Washington, DC: U.S. Department of Energy. Available at www.eia.doe.gov/oiaf/aeo/gas.html (accessed April 15, 2010).

EIA. 2010b. Coalbed Methane Proved Reserves and Production. Washington, DC: U.S. Department of Energy. Available at tonto.eia.doe.gov/dnav/ng/NG_ENR_CBM_A_EPG0_R52_BCF_A.htm (accessed April 15, 2010).

Rice, C.A., and V.F. Nuccio. 2000. Water Produced with Coalbed Methane. U.S. Geological Survey Fact Sheet FS-156-00. Washington, DC: U.S. Department of the Interior. Available at pubs.usgs.gov/fs/fs-0156-00/fs-0156-00.pdf (accessed February 23, 2010).