3

Cost Estimation

INTRODUCTION

As a general rule, reduced fuel consumption comes at a cost. The cost may be due to more expensive materials, increased manufacturing complexity, or a tradeoff with other vehicle attributes such as power or size. In addition to increased manufacturing costs, other costs of doing business are likely to be affected to a greater or lesser degree. These indirect costs include research and development (R&D), pensions and health care, warranties, advertising, maintaining a dealer network, and profits. The most appropriate measure of cost for the purpose of evaluating the costs and benefits of fuel economy regulations is the long-run increase in retail price paid by consumers under competitive market conditions.1 The retail price equivalent (RPE) cost of decreasing fuel consumption includes not only changes in manufacturing costs but also any induced changes in indirect costs and profit.

Most methods for estimating manufacturing costs begin by identifying specific changes in vehicle components or designs, and they then develop individual cost estimates for each affected item. Most changes result in cost increases, but some, such as the downsizing of a V6 engine to an I4, will reduce costs. Component cost estimates can come from a variety of sources, including interviews of original equipment manufacturers (OEMs) and suppliers, prices of optional equipment, and comparisons of models with and without the technology in question. Total costs are obtained by adding up the costs of changes in the individual components.

An alternative method, which has only just begun to be used for estimating fuel economy costs, is to tear down a component into the fundamental materials, labor, and capital required to make it, and then to estimate the cost of every nut and bolt and every step in the manufacturing process (Kolwich, 2009). A potential advantage of this method is that total costs can be directly related to the costs of materials, labor, and capital so that as their prices change, cost estimates can be revised. However, this method is difficult to apply to new technologies that have not yet been implemented in a mass-production vehicle, whose designs are not yet finalized and whose impact on changing related parts is not yet known.

Differences in cost estimates from different sources arise in a number of ways:

-

Assumptions about the costs of commodities, labor, and capital;

-

Judgments about the changes in other vehicle components required to implement a given technology;

-

Definitions of “manufacturing cost” and what items are included in it; and

-

Assessments of the impacts of technologies on indirect costs.

This chapter discusses the premises, concepts, and methods used in estimating the costs of fuel economy improvement, highlights areas where differences arise, and presents the committee’s judgments on the key issue of RPE markup factors.

Information on costs can be used with assumptions on payback periods, discount rates, price of fuel, and miles driven per year to provide an estimate of the cost-effectiveness of technologies. However, the statement of task given to the committee is to look at the costs and fuel consumption benefits of individual technologies. Performing cost-effectiveness analysis was not included within the committee’s task and was not done by the committee. The accurate calculation of benefits of improved fuel efficiency is a complex task that is being undertaken by the National Highway Traffic Safety Administration (NHTSA) and the U.S. Environmental Protection Agency (EPA) as part of their current joint regulatory efforts.

PREMISES

In the committee’s judgment, the concept of incremental retail price equivalent cost is most appropriate for the NHTSA’s purposes because it best represents the full, long-run economic costs of increasing fuel economy. The NHTSA has used the RPE method in its rulemakings on fuel economy, for example in the final rule for model year 2011 light-duty vehicles (DOT/NHTSA, 2009, pp. 346-352). Incremental RPE estimates are intended to represent the average additional price that consumers would pay for a fuel economy technology implemented in a typical vehicle under average economic conditions and typical manufacturing practices. These estimates are intended to represent long-run, high-volume, industry-average production costs, incorporating rates of profit and overhead expenses including warranties, transport, and retailing. Although learning and technological progress never stop, RPEs are intended to represent costs after an initial period of rapid cost reduction that results from learning by doing.2 The committee uses the term substantially learned as opposed to fully learned to convey that cost reductions due to increasing volumes may continue to occur. RPEs are not intended to replicate the market price of a specific vehicle or a specific optional feature at a specific time. The market price of a particular vehicle at a particular time depends on many factors (e.g., market trends, marketing strategies, profit opportunities, business cycles, temporary shortages or surpluses) other than the cost of manufacturing and retailing a vehicle or any given component. It is not appropriate to base a long-term policy such as fuel economy standards on short-run conditions or special circumstances.

The RPE concept, unfortunately, is not easy to apply. It raises a number of difficult questions about appropriate premises and assumptions and reliable sources of data. It frequently relies on the application of markup factors, which could vary depending on the nature of the technology and the basis for the original cost estimate. When an RPE markup factor is used, the definition of the cost to which it applies is critical. Much of the disagreement over RPE multipliers can be traced to inconsistent definition of the cost to be marked up. The following are key premises of the committee’s application of the RPE method.

-

Incremental RPE. The relevant measure of cost is the change in RPE in comparison to an equivalent vehicle without the particular fuel economy technology. More often than not, a fuel economy technology replaces an existing technology. For example, a 6-speed automatic transmission replaces a 5-speed, a compression-ignition (CI) engine replaces a spark-ignition (SI) engine, or a set of low-rolling-resistance tires replaces a set with higher rolling resistance. What matters is the change in RPE rather than the total RPE of the new technology. This requires that an estimate of the RPE of the existing technology be subtracted from that of the new technology.

-

Equivalent vehicle size and performance. Estimating the cost of decreasing fuel consumption requires one to carefully specify a basis for comparison. The committee considers that to the extent possible, fuel consumption cost comparisons should be made at equivalent acceleration performance and equivalent vehicle size. Other vehicle attributes matter as well, such as reliability, noise, and vibration. Ideally, cost and fuel economy comparisons should be made on the basis of no compromise for the consumer. Often there are differences of opinion about what design and engineering changes may be required to ensure no compromise for the consumer. This, in turn, leads to differing bills of materials to be costed out, which leads to significant differences in incremental RPE estimates.

-

Learning by doing, scale economies, and competition. When new technologies are first introduced and only one or two suppliers exist, costs are typically higher than they will be in the long run due to lack of scale economies, as-yet-unrealized learning by doing, and limited competition. These transitional costs can be important to manufacturers’ bottom lines and should be considered. However, nearly all cost estimates are developed assuming long-run, high-volume, average economic conditions. Typical assumptions include (1) high volume, (2) substantially learned component costs, and (3) competition provided by at least three global suppliers available to each manufacturer (Martec Group, Inc., 2008a, slide 3). Under these assumptions, it is not appropriate to employ traditional learning curves to predict future reductions in cost as production experience increases. However, if cost estimates are for novel technology and do not reflect learning by doing, then the application of learning curves as well as the estimation of scale economies may be appropriate. The use of such methods introduces substantial uncertainty, however, since there are no proven methods for predicting the amount of cost reduction that a new technology will achieve.

-

Normal product cycles. As a general rule, premises include normal redesign and product turnover schedules. Accelerated rates of implementation can increase costs by decreasing amortization periods and by demanding more engineering and design resources than are available. Product cycles are discussed in Chapter 7.

-

Purchased components versus in-house manufacture. Costs can be estimated at different stages in the manufacturing process. Manufacturing cost estimates gen-

-

erally do not include warranty, profit, transportation, and retailing costs, and may not include overhead or research and development. Other estimates are based on the prices that original equipment manufacturers (OEMs) would pay a Tier 1 supplier for a fully manufactured component.3 These estimates include the supplier’s overhead, profit, and R&D costs, but not costs incurred by the OEM. RPEs attempt to estimate the fully marked-up cost to the ultimate vehicle purchaser. A key issue for cost estimates based on Tier 1 supplier costs is the appropriate markup to RPE. This will depend on the degree to which the part requires engineering and design changes to be integrated into the vehicle, and other factors.

-

Allocation of overhead costs. Specific changes in vehicle technology and design may affect some of an OEM’s costs of doing business and not others. A reduction in engine friction, for example, might not affect advertising budgets or transportation costs. To date there is a very limited understanding of how to determine which costs of doing business are affected by each individual technology and how to develop technology-specific markups (e.g., Rogozhin et al., 2009). In theory, this approach has the potential to yield the most accurate results. However, in practice, unambiguous attribution of costs to specific vehicle components is difficult. For example, despite extensive reliability testing, it is not possible to predict with certainty what impact a technology or design change will have on warranty costs. Furthermore, there are significant cost components that cannot logically be allocated to any individual component. Among these are the maintenance of a dealer network and advertising. Yet, these costs must be paid. The RPE method assumes that such costs should be allocated in proportion to the component’s cost and that overall overhead costs will increase in proportion to total vehicle cost. This will not necessarily produce the most accurate estimate for each individual item but is consistent with the goal of estimating long-run average costs.

COMPONENTS OF COST

Although different studies describe and group the components of the retail price equivalent (long-run average cost) in different ways, there are four fundamental components: (1) the variable costs of manufacturing components, (2) fixed costs of manufacturing components, (3) variable costs of vehicle assembly, and (4) fixed costs of vehicle assembly and sale. The distinction between variable and fixed costs is not a sharp one, because many “fixed” costs scale to some extent with production volume. In fact, the degree to which fixed or overhead costs scale with variable costs is a key area of uncertainty.

Although many components are manufactured in-house by OEMs, it is useful to distinguish between component and vehicle assembly costs, because many manufacturers purchase 50 percent or more of a vehicle’s components from suppliers. Transaction prices and price estimates from Tier 1 and Tier 2 suppliers are a major source of information on the costs of fuel economy technologies.

Variable manufacturing costs of components include materials, labor, and direct labor burden (Table 3.1). Variable manufacturing costs are sometimes referred to as direct manufacturing costs, although when this term is used it typically includes the depreciation and amortization of manufacturing equipment. Fixed costs of component manufacturing include tooling and facilities depreciation and amortization associated with capital investments, manufacturing overhead (e.g., R&D, engineering, warranty, etc.), and profit (or return to capital). Unfortunately, terminology frequently differs from one study to another. Total manufacturing costs (variable plus fixed) are equivalent to the price that a Tier 1 supplier would charge an OEM for a finished component, ready for installation.

OEM or assembly costs include the variable costs of materials, labor, and direct labor burden for vehicle assem-

TABLE 3.1 Components of Vehicle Retail Price Equivalent (Long-Run Average Cost)

|

Component Manufacturing (Subassembly) |

|

Variable component manufacturing costs |

|

Materials |

|

Labor |

|

Direct labor burden |

|

Fixed component manufacturing costs |

|

Tooling and facilities depreciation and amortization |

|

R&D |

|

Engineering |

|

Warranty |

|

Other overhead |

|

Profit |

|

Vehicle Assembly and Marketing |

|

Variable costs |

|

Assembly materials |

|

Assembly labor |

|

Direct labor burden |

|

Fixed costs |

|

Tooling and facilities depreciation and amortization |

|

Warranty |

|

R&D |

|

Engineering |

|

Warranty |

|

Other overhead |

|

Transportation |

|

Marketing and advertising |

|

Dealer costs and profit |

|

Original equipment manufacturer profit |

bly. Fixed costs include facilities and tooling depreciation and amortization, warranty, R&D, engineering, advertising, dealer expenses and profit, transportation, and OEM return on investment (profit). The sum total of all costs, divided by the Tier 1 supplier price (or equivalent), is called the RPE markup.

The costs of inputs to the production process can vary over time. Some key components, such as electrical systems, emissions controls, and hybrid vehicle batteries, use relatively expensive metals whose prices can be volatile, significantly impacting manufacturing costs. The prices of many of these metals increased dramatically prior to the global recession beginning in 2008, but have since returned to previous levels. Most publicly available estimates of technology costs do not explicitly reflect uncertainties about future commodity prices.

FACTORS AFFECTING COSTS OVER TIME AND ACROSS MANUFACTURERS

Cost estimates for fuel economy technologies are typically presented as a single point estimate or as a range. In fact, costs will vary over time and even across manufacturers owing to technological progress, experience (learning by doing), prices of commodities, labor and capital, and the nature of the vehicles manufactured.

Economies of Scale

Scale economies describe the tendency for average manufacturing costs to decrease with increasing volume, as fixed costs are distributed over a greater number of units produced. The automobile industry is characterized by large economies of scale. Although sources differ, full scale economies are generally considered to be reached at between 100,000 and 500,000 units per year. Martec Group, Inc. (2008a), for example, asserts that production efficiencies are maximized at 250,000 to 300,000 units. Honda cited a maximum efficiency of 300,000 units in its comments to the DOT/NHTSA (2009, p. 185).

Technological Progress and Learning by Doing

Although cost estimates are generally premised on full scale economies and fully learned technologies, both the EPA and the NHTSA believe that not all Tier 1 supplier or piece cost estimates represent fully learned technology costs. In their view, learning curves should be applied for the more novel technologies not in widespread use today.4 The EPA listed 16 advanced technologies that, in its judgment, would experience future cost reductions relative to current estimates through learning by doing. Technologies such as cylinder deactivation, camless valve trains, gasoline direct injection with lean burn, turbocharging with engine downsizing, and hybrid systems from stop-start to full hybrids and plug-in hybrids were all assumed to have progress ratios of 0.8 (i.e., a doubling of cumulative production would reduce costs by 20 percent). Diesel emissions control systems were assumed to have smaller progress ratios of 0.9 (EPA, 2008a, Table 4.2-3).

If supplier cost estimates truly represent fully learned costs (at full scale economies), then there is no justification for assuming future learning by doing. The cost estimates made by Martec for the Northeast States Center for a Clean Air Future (NESCCAF), for example, were intended to reflect cost reductions by learning that would occur over the period 2009-2011. In its study for the Alliance of Automobile Manufacturers, Martec intended that its cost estimates reflect full scale economies and full learning: “Martec specified an extremely high annual volume target [500,000 units per year] specifically to drive respondents to report mature, forward costs expected in the future with the impact of learning fully reflected” (Martec Group, Inc., 2008b, p. 7). But Martec identifies two sources of learning: (1) improvement in manufacturing productivity, largely as a result of production volume; and (2) changes in system design. Martec considered the latter to be technological innovations that would change the system architecture and thus the technology itself, requiring new cost estimates. Thus, the learning considered by Martec in its estimates is based on the belief that the Tier 1 and Tier 2 suppliers would implicitly include learning effects of the first type in their high-volume cost estimates, and would exclude learning of the second type.

In its 2011 corporate average fuel economy (CAFE) rulemaking, the NHTSA recognized two types of learning by doing: “volume-based” learning and “time-based” learning. Neither is based on cumulative production, as is much of the literature on learning by doing. DOT/NHTSA (2009, p. 185) judged that a first cycle of volume-based learning would occur at a volume of 300,000 units per year and that costs would be reduced by 20 percent over low-volume estimates. A second learning threshold was set at 600,000 units per year, at which point a second cost reduction of 20 percent was taken. No further volume-based learning was assumed. The NHTSA applied this procedure to only three technologies in its 2011 rule: integrated starter generator, two-mode hybrid, and plug-in hybrid.

DOT/NHTSA (2009, p. 188) also applies time-based or year-over-year learning by doing to widely available, high-volume, mature technologies. Either time-based or volume-based learning, but not both, is applied to a particular technology. Time-based learning is applied at the rate of 3 percent per year in the second and all subsequent years of a technology’s application.

The use of learning curves poses a dilemma. On the one hand, there is no rigorous method for determining how much

and how rapidly a specific technology’s costs can be reduced by learning by doing.5 On the other hand, the phenomenon of learning by doing is widely and generally observed in the manufacturing of new technologies (e.g., Wene, 2000). This does not mean that no learning should be assumed. Rather, learning curves should be applied cautiously and should reflect average rates of learning based on empirical evidence from the motor vehicle industry. Expert judgment should be used to determine the potential for learning, depending on the nature of the technology in question.

Vehicle Type or Class

The costs of fuel economy technology also vary across vehicle classes. To a large extent this is a function of vehicle size and power. For example, an eight-cylinder engine has twice as many valves as a four-cylinder, and so the costs of valve train technologies will be higher. When technologies, such as turbocharging, increase the power output per unit of displacement and thereby enable engine downsizing at constant performance, the starting cylinder count can affect the options for downsizing. In general, an eight-cylinder engine can be replaced by a smaller six-cylinder engine of equivalent performance without additional costs for mitigating vibration. Downsizing a four-cylinder to a three-cylinder would require significant modifications to offset increased vibration, and this might even rule out reducing the cylinder count. Since most of the cost savings from downsizing accrue from reducing the number of cylinders, technologies that enable engine downsizing will be relatively more expensive for four-cylinder engines. Since different vehicle classes have different distributions of cylinder counts, the costs of certain technologies should be class-dependent. As another example, the cost of a 1 percent weight reduction by material substitution will depend on the initial mass of the vehicle.

National Research Council (2002) did not vary technology costs by vehicle class. The NHTSA’s Volpe model’s algorithm, however, operates at the level of make, model, engine, and transmission configuration. Some technology costs are scaled to the specific attributes of each vehicle. Other costs are class-dependent. In its final rule for 2011, DOT/NHTSA (2009, p. 165) specified eight passenger car classes and four light truck classes (Table 3.2). Passenger cars were divided into size classes on the basis of their footprint. Each class was divided into a standard and high-performance class on the basis of class-specific cut-points determined using expert judgment. This reflects the NHTSA’s view that in addition to size, performance is the key factor determining differences in technology applicability and cost. The classification of light trucks was based on structural and design considerations

TABLE 3.2 Vehicle Classification by the National Highway Traffic Safety Administration

|

Passenger Cars |

|

Subcompact |

|

Subcompact performance |

|

Compact |

|

Compact performance |

|

Midsize |

|

Midsize performance |

|

Large |

|

Large performance |

|

Light Trucks |

|

Minivans |

|

Small SUV/pickup/van |

|

Midsize SUV/pickup/van |

|

Large SUV/pickup/van |

(minivans) and footprint size (sport utility vehicles [SUVs], pickups, and vans).

Although classification can improve the accuracy of cost estimates, there is no perfect classification system, and there will always be some heterogeneity within a class.

METHODS OF ESTIMATING COSTS

As a generalization, there are two basic methods of cost estimation. The first and most common is to obtain estimates of the selling prices of manufactured components. The second is to tear down a technology into its most basic materials and manufacturing processes and to construct a bottom-up estimate by costing out materials, labor, and capital costs for every step. Both methods ultimately rely heavily on the expertise and the absence of bias on the cost estimator’s part.

Estimation Using Supplier Prices for Components, or “Piece Costs”

The supplier price method relies on comparing an estimate of the price that a Tier 1 component manufacturer would charge an OEM for a reference component to an estimate of the price that it would charge for an alternative that delivered reduced fuel consumption. In the past, information on the prices that manufacturers pay to Tier 1 suppliers for components has come from a variety of sources, including the following:

-

The NRC (2002) report on the CAFE standards;

-

The NESCCAF (2004) study on reducing light-duty vehicle greenhouse gas emissions;

-

The California Air Resources Board study in support of its greenhouse gas regulations;

-

The study by Energy and Environmental Analysis, Inc. (EEA, 2006) for Transport Canada;

-

Confidential data submitted by manufacturers to the NHTSA in advance of rulemakings; and

-

Confidential data shared by manufacturers in meetings with the NHTSA and the EPA in 2007.

Component cost estimates can be obtained from discussions with suppliers or OEMs, from published reports, or by comparing the prices of vehicles with and without the component in question (Duleep, 2008), bearing in mind that costs and market prices may differ significantly. The NHTSA also receives cost estimates in the form of confidential data submitted by manufacturers. Depending on how fuel economy technologies are defined, estimates for more than one component may be involved. Given a supplier price estimate, a markup factor is applied to estimate the RPE. A single markup factor is often used for all components, but different markups may be used according to the nature of the component. The key issues are, therefore, the accuracy of the supplier price estimates and the accuracy of the markup factor(s).

First at the request of NESCCAF (2004) and later at the request of the Alliance of Automobile Manufacturers, Martec Group, Inc. (2008b) estimated the variable (or manufacturing) costs of fuel economy technologies based on the bill of materials (BOM) required. The term materials as used in the Martec studies refers to manufactured components supplied by Tier 1 and Tier 2 suppliers. The direct and indirect changes in vehicle components associated with a particular technology were determined in discussions with engineering consultants and OEM engineers. The Tier 1 and Tier 2 suppliers were the primary sources of information on the costs of manufactured components required to implement the fuel economy increases (Martec Group, Inc., 2008b, p. 7).

Teardown or Bottom-Up Estimation

A change in the design and content of a vehicle induces changes in the materials of which it is made, the quantity and types of labor required to construct it, and changes in the capital equipment needed to manufacture it. Such estimates not only are time-consuming but also require analysts with a thorough knowledge of and experience with automotive manufacturing processes.

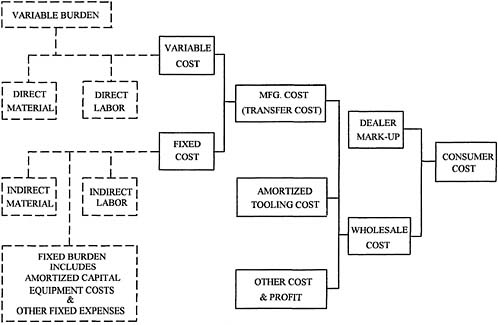

Bottom-up cost estimation methods have been used by the NHTSA for assessing the impacts of safety regulations. For example, in a study of air bag costs, an NHTSA contractor used a teardown method to identify all components of 13 existing air bag systems. This study (Ludtke and Associates, 2004) is described in Appendix F. The contractor analyzed each part or assembly and identified each manufacturing process required for fabrication, from raw material to finished product. The analysis identified parts purchased from suppliers as well as parts made in-house. Process engineers and cost estimators then carried out a process and cost analysis for each part and assembly. Two costs were developed: (1) variable costs associated with the actual manufacturing and (2) fixed or burden costs. Estimating costs to the consumer (analogous to the retail price equivalent) requires additionally estimating the OEM’s amortized costs, as well as other costs and profit. Dealers’ costs are added to the manufacturer’s cost plus profit to obtain the consumer’s cost (Figure 3.1). As the NHTSA report is careful to point out, estimating costs “is not an exact science” but rather one strongly dependent on the expertise and judgment of the estimators at every step.

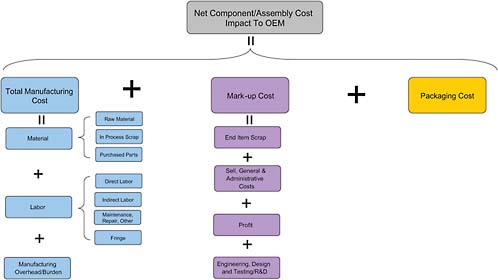

The teardown method was applied by Kolwich (2009) to estimate the incremental manufacturing cost of a downsized 1.6-liter, four-cylinder, stoichiometric direct injection, turbo-charged engine versus a 2.4-liter, four-cylinder, naturally aspirated base engine. The study did not attempt to estimate the markup from manufacturing costs to RPE. Rather, the cost estimated is equivalent to the price that a Tier 1 supplier would charge an OEM for the fully manufactured engine. Unit costs are composed of direct manufacturing costs (material + labor + fixed manufacturing costs) + “markup costs” (scrap + overhead + profit) + packaging costs (Figure 3.2).

Manufacturing costs are estimated in a series of highly detailed steps based on what is learned in disassembling the technology. Both the new and the base technologies must be torn down and costed in order to estimate the difference in cost. First, the technology to be evaluated is identified and defined. Next, candidate vehicles for teardown are identified (this limits the analysis to technologies already in production). A pre-teardown, high-level bill of materials (consisting of subsystems and components) is then created, subject to amendment, as discoveries might be made during the teardown process. At that point, the actual teardown process begins. During the teardown, all of the processes necessary for assembly are identified and recorded, and every component and the material of which it is made are identified. The data generated in the disassembly are then reviewed by a team of experts. Following the review, the components are torn down and assembly processes are identified, as is each and every piece of each component. A worksheet is then constructed for all parts, containing all cost elements. Parts with high or unexpected cost results are double-checked, and then entered into a final spreadsheet in which they are totaled and formatted.

Once manufacturing costs have been estimated, a markup reflecting all other costs of doing business is typically applied to estimate the long-run cost that consumers will have to pay. Applying this markup was outside the scope of the FEV (2009) study but was included in the Ludtke and Associates (2004) study. Estimates of the consumer’s cost of curtain air bag systems installed in five different vehicles from the Ludtke and Associates study are shown in Table 3.3. Although costs vary, it is clear that Ludtke and Associates used the same markup factors for Tier 1 manufacturers’ markups over their direct costs (24 percent), OEM markups (36 percent), and dealer markups (11 percent). These markups result in multipliers for the consumer’s cost over the Tier 1 supplier’s cost of

FIGURE 3.1 Determination of manufacturing and consumer cost. SOURCE: Ludtke and Associates (2004), p. B-10.

FIGURE 3.2 Unit cost model. SOURCE: FEV, Inc. (2009) (FEV.com), Figure 5.

TABLE 3.3 Estimated Consumer Cost (2003 dollars) for Installed Air Bag Systems and Markups

|

Item |

VW Jetta |

Toyota Camry |

Cadillac CTS |

Mercury Montereya |

Jeep Grand Cherokee |

|

Material |

$30.04 |

$27.45 |

$48.46 |

$69.88 |

$54.43 |

|

Direct labor |

$11.11 |

$20.54 |

$16.54 |

$37.62 |

$17.68 |

|

Direct labor burden |

$22.59 |

$34.40 |

$24.61 |

$55.91 |

$23.93 |

|

Tier 1 markup |

$15.40 |

$19.89 |

$21.93 |

$39.66 |

$23.21 |

|

Manufacturer markup |

$28.49 |

$36.82 |

$40.15 |

$73.11 |

$42.93 |

|

Dealer markup |

$11.84 |

$15.30 |

$16.69 |

$30.38 |

$17.84 |

|

Consumer’s cost |

$119.47 |

$154.40 |

$168.38 |

$306.55 |

$180.02 |

|

Variable cost |

$63.74 |

$82.39 |

$89.61 |

$163.41 |

$96.04 |

|

Variable manufacturing cost |

$79.14 |

$102.28 |

$111.54 |

$203.07 |

$119.25 |

|

Markup Tier 1 cost |

1.51 |

1.51 |

1.51 |

1.51 |

1.51 |

|

Markup variable manufacturing cost |

1.87 |

1.87 |

1.88 |

1.88 |

1.87 |

|

Tier 1 markup |

24.2% |

24.1% |

24.5% |

24.3% |

24.2% |

|

OEM markup |

36.0% |

36.0% |

36.0% |

36.0% |

36.0% |

|

Dealer markup |

11.0% |

11.0% |

11.0% |

11.0% |

11.0% |

|

NOTE: Original equipment manufacturer (OEM) manufacturing costs (2003$) per vehicle—head protection air bag systems (curtain-type system without a torso airbag already installed in vehicle). aCost estimates for the Mercury Monterey are substantially higher than those for the other vehicles. Ludtke and Associates (2004) do not offer an explanation for the design differences that account for the higher cost. SOURCE: Ludtke and Associates (2004). |

|||||

1.51 (1.36 × 1.11 = 1.51), and for the consumer’s cost over the direct variable costs of manufacturing (“Total Manufacturing Costs” minus “Manufacturing Overhead Burden” in the FEV [2009] study; see Figure 3.2 above) the component of 1.87 (1.24 × 1.36 × 1.11 = 1.87). The costs shown in Table 3.3 are in 2003 dollars and assume a manufacturing scale of 250,000 units per year for the air bags.

While Ludtke and Associates (2004) use a markup factor of 1.24 for direct manufacturing costs, Kolwich (2009) uses markup factors ranging from 10.3 percent to 17.7 percent, depending on the complexity of the component (Table 3.4). Note that the Kolwich rates do not include manufacturing overhead whereas the Ludtke rates do, and thus the former should be higher.

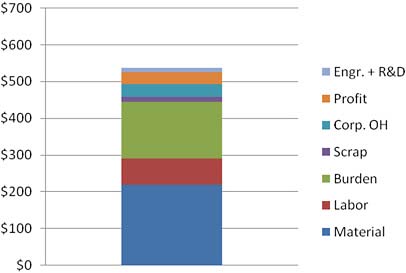

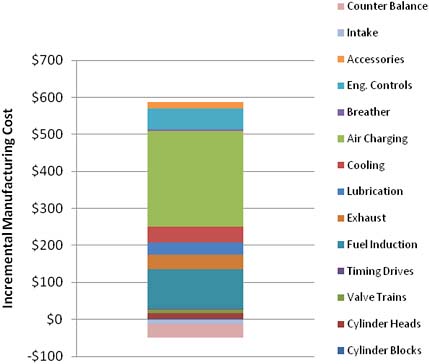

The FEV teardown study (FEV, 2009; Kolwich, 2009) allows total manufacturing costs to be broken down by engine subsystem as well as cost component. Figure 3.3 shows the incremental manufacturing costs by cost component. The largest single component of the $537.70 total is material ($218.82), followed by manufacturing burden ($154.24), labor ($72.58), corporate overhead ($33.96), profit ($33.12), engineering and R&D ($12.36), and scrap ($11.72). The total markup on manufacturing costs is just over 20 percent. Figure 3.4 shows the same total cost broken down by engine subsystem. By far the largest components are the induction air charging system ($258.89) and the fuel induction system ($107.32). Cost savings occur in counterbalance ($35.95) and intake systems ($12.73).

TABLE 3.4 Total Manufacturing Cost Markup Rates for Tier 1 and Tier 2/3 Suppliers

|

Primary Manufacturing Equipment Group |

End Item Scrap Markup (%) |

SG&A Markup (%) |

Profit Markup (%) |

ED&T Markup (%) |

Total Markup (%) |

|

Tier 2/3—large size, high complexity |

0.7 |

7.0 |

8.0 |

2.0 |

17.7 |

|

Tier 2/3—medium size, moderate complexity |

0.5 |

6.5 |

6.0 |

1.0 |

14.0 |

|

Tier 2/3—small size, low complexity |

0.3 |

6.0 |

4.0 |

0.0 |

10.3 |

|

Tier 1 complete system/subsystem supplier (system/subsystem integrator) |

0.7 |

7.0 |

8.0 |

6.0 |

21.7 |

|

Tier 1 high-complexity-component supplier |

0.7 |

7.0 |

8.0 |

4.0 |

19.7 |

|

Tier 1 moderate-complexity-component supplier |

0.5 |

6.5 |

6.0 |

2.5 |

15.5 |

|

Tier 1 low-complexity-component supplier |

0.3 |

6.0 |

4.0 |

1.0 |

11.3 |

|

SOURCE: Kolwich (2009), Table 2. |

|||||

FIGURE 3.3 Incremental cost of turbocharged, downsized, gasoline direct-injection I4 engine broken down by cost category. SOURCE: Kolwich (2009), Figure 19.

FIGURE 3.4 Incremental cost of turbocharged, downsized, gasoline direct-injection I4 engine broken down by engine subsystem. SOURCE: Kolwich (2009), Figure 19.

RETAIL PRICE EQUIVALENT MARKUP FACTORS

Markup factors relating component costs to RPE add significantly to the estimated costs of automotive technologies and are the subject of continuing controversy. The cost of making and selling light-duty vehicles is not limited to the manufacture of components and their assembly. Even for a single technological or design change, cost impacts are generally not limited to the component that is changed. Engineering expertise must be supplied to design these changes, which may or may not induce other changes in the cost of manufacturing. These integration costs can be substantial for major components, such as engines, or when, as is more often the case than not, many changes are made simultaneously. There are also indirect costs for research and development, administrative overhead, warranties, and marketing and advertising. Vehicles must be transported to dealers who have their own labor, material, and capital costs. All of these additional costs are represented by RPE markup factors.

Existing RPE Markup Factors

For the automobile industry, there is a reasonable consensus on the ratio of total costs of doing business to the cost of fully manufactured components (the price that a Tier 1 supplier would charge an OEM). This average RPE markup factor is approximately 1.5, according to the available evidence, reviewed in detail in Appendix F of this report. Part of the disagreement over the size of the RPE markup factor arises from the difference between the variable costs versus the variable plus fixed costs of a manufactured component. An appropriate RPE markup over the variable (or direct) costs of a component is approximately 2.0 (Bussmann and Whinihan, 2009). Part of the disagreement arises over the difficulty of attributing indirect and other fixed costs to a particular vehicle component.

Every fuel economy technology does not affect fixed or indirect costs in the same way. Some costs may be affected by engineering and design changes to decrease fuel consumption; others may not. This can have a very large impact on the appropriate RPE of a given fuel economy technology. Some studies use a single, average RPE markup factor (e.g., NRC, 2002; Albu, 2008; DOT/NHTSA, 2009), while others attempt to tailor the markup to the nature of the technology (Rogozhin et al., 2009; Duleep, 2008). The problem of how best to attribute indirect and fixed costs to a specific change in vehicle technology remains unresolved.

Existing estimates of the RPE markup factor are similar when interpreted consistently. Vyas et al. (2000) compared their own markup factors to estimates developed by EEA, Inc., and Chrysler. Unfortunately, differences in the definitions of categories of costs preclude precise comparisons. Vyas et al. concluded that an appropriate markup factor over the variable costs of manufacturing a motor vehicle was 2.0. The Vyas et al. (2000) report also summarized the cost methodology used by EEA, Inc., in a study for the Office of Technology Assessment (OTA, 1995). Vyas et al. (2000) concluded that the markup over variable manufacturing costs used in that study was 2.14, while the markup over outsourced parts (e.g., purchased from a Tier 1 supplier) was 1.56 (Table 3.5).

A markup factor of 1.5 was also used by the NHTSA (2009, p. 173) in its final fuel economy rule for 2011. A somewhat lower RPE markup factor of 1.4 was used by the NRC (2002) and Albu (2008), while the EPA has used a markup of 1.26 (EPA, 2008a).

The use of a markup of approximately 2 over the direct manufacturing costs of parts manufactured in-house by an

TABLE 3.5 Comparison of Markup Factors

|

Markup Factor for |

ANL |

Borroni-Bird |

EEA |

|

In-house components |

2.00 |

2.05 |

2.14 |

|

Outsourced components |

1.50 |

1.56 |

1.56 |

|

SOURCE: Vyas et al. (2000). |

|||

OEM was also supported by Bussmann (2008), who cited a 2003 study of the global automotive industry by McKinsey Global Institute that produced a markup factor of 2.08, and his own analysis of Chrysler data for 2003-2004 that produced factors of 1.96 to 1.97. Information supplied by EEA, Inc., to the committee (Duleep, 2008) implies higher markup factors: 2.22 to 2.51 for the markup over variable costs and 1.65 to 1.73 for the markup over Tier 1 supplier costs.

Average RPE factors can be inferred by costing out all the components of a vehicle, summing those costs to obtain an estimate of OEM Tier 1 costs or fully burdened in-house manufacturing costs, and then dividing the sum into the selling price of a vehicle. The committee contracted with IBIS Associates (2008) to conduct such an analysis for two high-selling model-year 2009 vehicles: the Honda Accord sedan and the Ford F-150 pickup truck. For the Honda, the RPE multipliers were 1.39 to market transaction price and 1.49 to manufacturer’s suggested retail price (MSRP). The multiplier to dealer invoice cost is 1.35, implying that dealer costs, including profit, amount to about 4 percent of manufacturing costs, not considering any dealer incentives provided by OEMs. For the Ford F-150, the RPE multipliers were 1.52 for market price and 1.54 for MSRP. The markup factor for dealer invoice is 1.43, implying that dealer costs and profit amount to about 9 percent of total manufacturing costs, not including any possible OEM incentives to dealers.

The EPA Study on RPE Factors and Indirect Cost Multipliers

Concerns with the Existing RPE Method

Objections have been raised with respect to the use of a single RPE markup factor for components manufactured by Tier 1 suppliers and sold to OEMs. The EPA has pointed out that not all technologies will affect indirect costs equally, and it has proposed to investigate technology-specific markups, by attempting to identify only those indirect costs actually affected by each technology (EPA, 2008b). In a similar vein, the importance of “integration costs” has been cited as a factor that would justify different markup factors for different technologies (Duleep, 2008).6 Because a vehicle is a system, it is almost always the case that the design of one part affects others. Manufacturers cannot simply buy a list of parts and

bolt them together to produce a vehicle that meets customers’ expectations and satisfies all regulatory requirements.7 Integrating a new engine or transmission to decrease fuel consumption will have much greater ramifications for vehicle design and is likely to generate greater integration costs than simpler components.

In a presentation to the committee, the EPA raised concerns that markup factors on piece or supplier costs tended to overestimate the costs of most fuel economy technologies: “Our first preference is to make an explicit estimate of all indirect costs rather than rely on general markup factors” (EPA, 2008b, slide 4). Nonetheless, in its assessment of the costs of greenhouse gas mitigation technologies for light-duty vehicles, the EPA staff assumed a uniform markup of 50 percent over supplier costs (i.e., a markup factor of 1.5). Still, the EPA maintains that such a markup is too large: “We believe that this indirect cost markup overstates the incremental indirect costs because it is based on studies that include cost elements—such as funding of pensions—which we believe are unlikely to change as a result of the introduction of new technology” (EPA, 2008a, p. 47).

Following up on this assertion, the EPA commissioned a study of RPE factors and indirect cost (IC) multipliers (Rogozhin et al., 2009). The IC multiplier attempts to improve on the RPE by including only those specific elements of indirect costs that are likely to be affected by vehicle modifications associated with environmental regulation. In particular, fixed depreciation costs, health care costs for retired workers, and pensions may not be affected by many vehicle modifications caused by environmental regulations.

The EPA study (Rogozhin et al., 2009) also criticizes the RPE method on the grounds that an increase in the total cost of producing a vehicle will not be fully reflected in the increased price of the vehicle due to elasticities of supply and demand. For this reason, the report argues that manufacturer profits should not be included in the RPE multiplier. The committee disagrees with this assertion for two reasons. First, as noted earlier, the global automotive industry approximates what economists term a monopolistically competitive market, that is, a market in which there is product differentiation but a high degree of competition among many firms. In a monopolistically competitive market, in the long run the full costs of production will be passed on to consumers. In the long run, monopolistically competitive market supply is perfectly elastic at the long-run average cost of production (this includes a normal rate of return on capital). Since cost estimates by convention assume long-run conditions (full scale economies and learning), long-run supply assumptions should be used to ensure consistency. The increase in RPE is a reasonable estimate of the change in welfare associated with the increased vehicle cost especially, as noted above, in the long run.

The EPA study (Rogozhin et al., 2009) estimated RPEs for the largest manufacturers for the year 2007 using publicly available data in manufacturers’ annual reports. Several assumptions were required to infer components not reported, or reported in different ways by different manufacturers. The method is similar to that used by Bussman (2008) and produced similar results. One notable difference is that the estimates shown in Table 3.6 attempt to exclude legacy health care costs, estimated at 45 percent of total health care costs, which in turn were estimated to be 3 percent of fully burdened manufacturing costs. This would lower the estimated RPEs by 1 to 2 percent relative to estimates in other reports, all else being equal. The estimated RPE multipliers were remarkably consistent across manufacturers (Table 3.6) and very comparable to the studies cited above. Estimated RPE multipliers ranged from 1.42 for Hyundai to 1.49 for Nissan, with an industry average of 1.46. Adding 1 to 2 percent for health care costs would bring the average multiplier even closer to 1.5.

Estimating Technology-Specific Markup Factors and IC Multipliers

The assertion that different technologies will induce different changes in indirect costs seems evident. The question is how to identify and measure the differences. At the present time a rigorous and robust method for estimating these differential impacts does not exist (Bussmann and Whinihan, 2009). Therefore, it is not clear that the accuracy of fuel consumption cost assessment would be increased by the use of technology-specific, as opposed to an industry-average, markup factor. The EPA (Rogozhin et al., 2009), however, has taken the first steps in attempting to analyze this problem in a way that could lead to a practical method of estimating technology-specific markup factors.

The EPA-sponsored study (Rogozhin et al., 2009) went on to estimate IC multipliers as a function of the complexity or scope of the innovation in an automaker’s products caused by the adoption of the technology. A four-class typology of innovation was used:

-

Incremental innovation describes technologies that require only minor changes to an existing product and permit the continued use of an established design. Low-rolling-resistance tires were given as an example of incremental innovation.

-

Modular innovation is that which does not change the architecture of how components of a vehicle interact but does change the core concept of the component replaced. No example was given for modular innovation.

-

Architectural innovation was defined as innovation that requires changes in the way that vehicle components are linked together but does not change the core design concepts. The dual-clutch transmission was offered as an example, in that it replaces the function of an

TABLE 3.6 Individual Manufacturer and Industry Average Retail Price Equivalent (RPE) Multipliers: 2007

|

RPE Multiplier Contributor |

Relative to Cost of Sales |

||||||||

|

Industry Average |

Daimler Chrysler |

Ford |

GM |

Honda |

Hyundai |

Nissan |

Toyota |

VW |

|

|

Vehicle Manufacturing |

|

|

|

|

|

|

|

|

|

|

Cost of sales |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

1.00 |

|

Production Overhead |

|

|

|

|

|

|

|

|

|

|

Warranty |

0.03 |

0.04 |

0.03 |

0.03 |

0.01 |

0.02 |

0.03 |

0.04 |

0.02 |

|

R&D product development |

0.05 |

0.04 |

0.02 |

0.06 |

0.07 |

0.04 |

0.06 |

0.05 |

0.06 |

|

Depreciation and amortization |

0.07 |

0.11 |

0.05 |

0.06 |

0.05 |

0.06 |

0.09 |

0.08 |

0.09 |

|

Maintenance, repair, operations cost |

0.03 |

0.03 |

0.03 |

0.03 |

0.03 |

0.03 |

0.03 |

0.03 |

0.03 |

|

Total production overhead |

0.18 |

0.22 |

0.13 |

0.17 |

0.16 |

0.15 |

0.21 |

0.19 |

0.20 |

|

Corporate Overhead |

|

|

|

|

|

|

|

|

|

|

General and administrative |

0.07 |

0.05 |

0.12 |

0.07 |

0.11 |

0.08 |

0.03 |

0.06 |

0.03 |

|

Retirement |

<0.01 |

0.01 |

0.00 |

0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

|

Health |

0.01 |

<0.01 |

<0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

|

Total corporate overhead |

0.08 |

0.06 |

0.13 |

0.08 |

0.14 |

0.09 |

0.04 |

0.07 |

0.04 |

|

Selling |

|

|

|

|

|

|

|

|

|

|

Transportation |

0.04 |

0.04 |

0.04 |

0.04 |

0.04 |

0.04 |

0.04 |

0.04 |

0.10 |

|

Marketing |

0.04 |

0.02 |

0.04 |

0.05 |

0.03 |

0.05 |

0.08 |

0.03 |

0.02 |

|

Dealers |

|

|

|

|

|

|

|

|

|

|

Dealer new vehicle net profit |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

|

Dealer new vehicle selling cost |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

0.06 |

|

Total selling and dealer contributors |

0.14 |

0.12 |

0.14 |

0.14 |

0.13 |

0.15 |

0.18 |

0.12 |

0.17 |

|

Sum of Indirect Costs |

0.40 |

0.40 |

0.39 |

0.40 |

0.44 |

0.39 |

0.43 |

0.38 |

0.41 |

|

Net income |

0.06 |

0.07 |

0.05 |

0.05 |

0.04 |

0.03 |

0.06 |

0.09 |

0.02 |

|

Other costs (not included as contributors) |

0.04 |

0.04 |

0.11 |

0.06 |

0.02 |

0.01 |

0.01 |

<0.01 |

0.05 |

|

RPE multiplier |

1.46 |

1.47 |

1.45 |

1.45 |

1.47 |

1.42 |

1.49 |

1.48 |

1.43 |

|

SOURCE: Rogozhin et al. (2009), Table 3-3. |

|||||||||

-

existing transmission but does require redesign and reintegration with other components.

-

Differential innovation involves significant changes in the core concepts of vehicle components, as well as their integration. Hybrid vehicle technology was cited as an example because it changes the functions of such key components as the engine, brakes, and battery.

An industry average was computed for each component of the RPE, omitting profit, or net income. As stated above, the committee considers this omission to be in error. The resulting components are shown in Table 3.7. Next, based on the judgment of an expert panel, short- and long-term effects on the RPE components were estimated for the four categories of technology innovation (Rogozhin et al., 2009). A value of zero for the effect of a technology innovation on an RPE component implies that the application of that technology has no impact on the cost of that particular RPE component. There will be no increase in expenditure on that RPE component as a result of the adoption of the technology. A value of 1 implies that the cost of the component will increase directly with the increased cost of the component. Values greater than 1 imply a greater-than-proportional increase. Each RPE component is multiplied by its respective short- or long-term effect, and the results are summed and

TABLE 3.7 Weighted Industry Average RPE Components Omitting Return on Capital

|

Cost Contributor |

Light Car Industry Average |

|

Production Overhead |

|

|

Warranty |

0.03 |

|

R&D (product development) |

0.05 |

|

Depreciation and amortization |

0.07 |

|

Maintenance, repair, operations cost |

0.03 |

|

Total production overhead |

0.18 |

|

Corporate Overhead |

|

|

General and administrative |

0.07 |

|

Retirement |

0.00 |

|

Health care |

0.01 |

|

Total corporate overhead |

0.08 |

|

Selling |

|

|

Transportation |

0.04 |

|

Marketing |

0.04 |

|

Dealers |

|

|

Dealer new vehicle selling cost |

0.06 |

|

Total selling and dealer costs |

0.14 |

|

Sum of Indirect Costs |

0.40 |

|

SOURCE: Rogozhin et al. (2009), Table 4-1. |

|

TABLE 3.8 Short- and Long-Term Indirect Cost Multipliers

|

|

Low Complexity |

Medium Complexity |

High Complexity |

Industry Average RPE |

|

Short term |

1.05 |

1.20 |

1.45 |

1.46 |

|

Long term |

1.02 |

1.05 |

1.26 |

1.46 |

|

SOURCE: Rogozhin et al. (2009), Table 4-5. |

||||

added to 1.0 to produce the IC multipliers. The multipliers range from 1.05 to 1.45 in the short run and 1.02 to 1.26 in the long run (Table 3.8). This implies that none of the fuel economy technologies considered, no matter how complex, could cause an increase in indirect costs as large as the industry average indirect costs, especially in the long run. This result would imply that the more that regulatory requirements increase the cost of automobile manufacturing, the lower the overall industry RPE would be.

FINDINGS

Large differences in technology cost estimates can result from differing assumptions. Carefully specifying premises and assumptions can greatly reduce these differences. These include the following:

-

Whether the total cost of a technology or its incremental cost over the technology that it will replace is estimated;

-

Whether long-run costs at large-scale production are assumed or short-run, low-volume costs are estimated;

-

Whether learning by doing is included or not;

-

Whether the cost estimate represents only direct inhouse manufacturing costs or the cost of the purchase of a component from a Tier 1 supplier;

-

Whether the RPE multiplier is based on industry average markups or is specific to the nature of the technology; and

-

What other changes in vehicle design, required to maintain vehicle quality (e.g., emissions, towing, gradability, launch acceleration, noise, vibration, harshness, manufacturability), have been included in the cost estimate.

Finding 3.1: For fully manufactured components purchased from a Tier 1 supplier, a reasonable average RPE markup factor is 1.5. For in-house direct (variable) manufacturing costs, including only labor, materials, energy, and equipment amortization, a reasonable average RPE markup factor is 2.0. In applying such markup factors, it is essential that the cost basis be appropriately defined and that the incremental cost of fuel economy technology is the basis for the markup. The factors given above are averages; markups for specific technologies in specific circumstances will vary.

Finding 3.2: RPE factors certainly do vary depending on the complexity of the task of integrating a component into a vehicle system, the extent of the required changes to other components, the novelty of the technology, and other factors. However, until empirical data derived by means of rigorous estimation methods are available, the committee prefers to use average markup factors.

Finding 3.3: Available cost estimates are based on a variety of sources: component cost estimates obtained from suppliers, discussions with experts at OEMs and suppliers, comparisons of actual transaction prices when publicly available, and comparisons of the prices of similar vehicles with and without a particular technology. There is a need for cost estimates based on a teardown of all the elements of a technology and a detailed costing of material costs, accounting for labor time and capital costs for all fabrication and assembly processes. Such studies are more costly than the current approaches listed above and are not feasible for advanced technologies whose designs are not yet finalized and/or whose system integration impacts are not yet fully understood. Nonetheless, estimates based on the more rigorous method of teardown analysis are needed to increase confidence in the accuracy of the costs of reducing fuel consumption.

Technology cost estimates are provided in the following chapters for each fuel economy technology discussed. Except as indicated, the cost estimates represent the price that an OEM would pay a supplier for a finished component. Thus, on average, the RPE multiplier of 1.5 would apply.

REFERENCES

Albu, S. 2008. ARB perspective on vehicle technology costs for reducing greenhouse gas emissions. Presentation by Assistant Chief, Mobile Source Division, California Air Resources Board, to the Committee on Technologies for Improving Light-Duty Vehicle Fuel Economy, January 24, Detroit, Mich.

Bussmann, W.V. 2008. Study of industry-average markup factors used to estimate retail price equivalents (RPE). Presentation to the Committee on Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy, January 24, Detroit, Mich.

Bussmann, W.V., and M.J. Whinihan. 2009. The estimation of impacts on retail prices of regulations: A critique of “Automobile Industry Retail Price Equivalent and Indirect Cost Multipliers.” Prepared for Alliance of Automobile Manufacturers, May 6, Southfield, Mich.

DOT/NHTSA (Department of Transportation/National Highway Traffic Safety Administration). 2009. Average fuel economy standards, passenger cars and light trucks, model year 2001: Final rule. 49 CFR Parts 523, 531, 533, 534, 536, and 537, Docket No. NHTSA-2009-0062, RIN 2127-AK29. March 23. Washington D.C.

Duleep, K.G. 2008. Analysis of technology cost and retail price. Presentation to Committee on Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy, January 25, Detroit, Mich.

EEA (Energy and Environmental Analysis, Inc.). 2006. Technologies to Reduce Greenhouse Gas Emissions from Light-Duty Vehicles. Report to Transport Canada, Ottawa, Ontario, March. Arlington, Va.

EPA (U.S. Environmental Protection Agency). 2008a. EPA Staff Technical Report: Cost and Effectiveness Estimates of Technologies Used to Reduce Light-Duty Vehicle Carbon Dioxide Emissions. EPA420-R-08-008. Washington, D.C.

EPA. 2008b. The use of markup factors to estimate indirect costs. Presentation from National Vehicle and Fuel Emissions Laboratory, Office of Transportation and Air Quality, to the Committee on Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy, National Research Council, March 31, Washington, D.C.

FEV, Inc. 2009. Light-duty technology cost analysis overview. Presentation to the Committee on the Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy, March 16, Washington, D.C.

IBIS Associates, Inc. 2008. Data Collection and Analysis: Vehicle Systems Costs. Report to the Committee on Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy, National Research Council, December, 2008, Waltham, Mass.

Kolwich, G. 2009. Light-Duty Technology Cost Analysis Pilot Study. Report FEV 07-069-103F. Prepared for the U.S. Environmental Protection Agency, Ann Arbor, Michigan, September 3. FEV, Inc., Auburn Hills, Mich.

Ludtke and Associates. 2004. Perform Cost and Weight Analysis, Head Protection Air Bag Systems, FMVSS 201. DOT HS 809 842. December. U.S. Department of Transportation, National Highway Traffic Safety Administration, Washington, D.C.

Martec Group, Inc. 2008a. Variable costs of fuel economy technologies. Presentation to the Committee on Assessment of Technologies for Improving Light-Duty Vehicle Fuel Economy, National Research Council, January 24, Detroit, Mich.

Martec Group, Inc. 2008b. Variable Costs of Fuel Economy Technologies. Report prepared for the Alliance of Automobile Manufacturers. June 1. Washington, D.C.

NESCCAF (Northeast States Center for a Clean Air Future). 2004. Reducing Greenhouse Gas Emissions from Light-Duty Motor Vehicles. Available at http://www.nesccaf.org/documents/rpt040923ghglightduty.pdf. Accessed July 6, 2009.

NRC (National Research Council). 2002. Effectiveness and Impact of Corporate Average Fuel Economy (CAFE) Standards. National Academy Press, Washington, D.C.

OTA (Office of Technology Assessment). 1995. Advanced Automotive Technology: Visions of a Super-Efficient Family Car. OTA-ETI-638. Washington, D.C.

Rogozhin, A., M. Gallaher, and W. McManus. 2009. Automobile Industry Retail Price Equivalent and Indirect Cost Multipliers. Report by RTI International to Office of Transportation and Air Quality. U.S. Environmental Protection Agency. RTI Project Number 0211577.002.004. February. Research Triangle Park, North Carolina.

Vyas, A., D. Santini, and R. Cuenca. 2000. Comparison of Indirect Cost Multipliers for Vehicle Manufacturing. Center for Transportation Research, Argonne National Laboratory. April. Argonne, Ill.

Wene, C. 2000. Experience Curves for Energy Technology Policy. International Energy Agency, Paris.