5

Compression-Ignition Diesel Engines

INTRODUCTION

Light-duty compression-ignition (CI) engines operating on diesel fuels have the highest thermodynamic cycle efficiency of all light-duty engine types. The CI diesel thermodynamic cycle efficiency advantage over the more common SI gasoline engine stems from three major factors: the CI’s use of lean mixtures, its lack of throttling of the intake charge, and its higher compression ratios. In a CI diesel engine-equipped vehicle, there is an additional benefit of reduced volumetric fuel consumption (e.g., gal/100 miles) because diesel fuel provides more energy per gallon than gasoline, as is discussed later in this chapter.

Lean mixtures, whose expansions are thermodynamically more efficient because of their higher ratio of specific heats, are enabled by the CI diesel combustion process. In this process, diesel fuel, which has chemical and physical properties such that it self-ignites readily, is injected into the cylinder late in the compression stroke. Ignition occurs following atomization of the fuel jet into small droplets that vaporize and mix, creating pockets of heterogeneous combustible mixtures. These heterogeneous mixtures burn with localized diffusion flames even though the overall fuel-to-air ratio may be too lean to support turbulent flame propagation such as occurs in an SI gasoline engine. This ability to successfully burn overall lean mixtures allows CI diesel engine power output to be controlled through limiting the amount of fuel injected without resorting to throttling the amount of air inducted. This attribute leads to the second major factor enabling the higher efficiency of CI diesel engines, namely the absence of throttling during the intake process, which otherwise leads to negative pumping work. SI gasoline engines must be throttled to control their power output while still keeping the fuel-air ratio at the stoichiometric ratio necessary for proper functioning of their three-way exhaust catalyst. Finally, the diesel combustion process needs higher compression ratios to ensure ignition of the heterogeneous mixture without a spark. The higher CI diesel compression ratios (e.g., 16-18 versus 9-11 for SI gasoline) improve thermodynamic expansion efficiency, although some of the theoretical gain is lost due to increased ring-to-bore wall friction from the associated higher cylinder pressures.

Fuel economy technologies considered in the NRC’s (2002) earlier report on fuel economy did not include diesel-powered CI engines because the costs and emission control systems to meet upcoming nitrogen oxides (NOx) and particulate emission standards were not developed at that time. The motivation for including light-duty CI engine technology in this report stems from two factors. Light-duty CI engine vehicles are now in widespread use in Europe because a high fuel tax on diesel and gasoline fuel allowed diesel retail prices to be substantially lower than gasoline prices. This differential is disappearing in some countries but still persists in others. European buyers have accepted initial higher CI vehicle purchase prices in return for their lower fuel consumption as well as excellent performance and driving dynamics resulting from their high torque. CI diesel vehicles constitute around 50 percent of the new light-duty vehicle market in Europe (DieselNet, 2008). However, in the 2007 U.S. light-duty market, CI diesel vehicles accounted for only about 1.7 percent of the new light-duty vehicles sales (EIA, 2009a). Recent demonstrations of diesel combustion and exhaust aftertreatment systems have shown the capability to meet U.S. 2010 Tier 2, Bin 5 and LEV II emissions regulations for light-duty vehicles. As a result of the emissions control capability achieved by original equipment manufacturers (OEMs) with their internal development projects, at the 2008 Detroit auto show 12 vehicle manufacturers announced the introduction of 13 new CI diesel powered vehicles for the 50-state 2009 U.S. market (Diesel Forum, 2008). However, due to the large fuel price increases of early 2008 and the resulting reduction in vehicle sales of larger vehicles, many OEMs canceled CI vehicle introductions announced for 2009. Nonetheless, four OEMs have offered 12 2009 CI vehicle models.

TECHNOLOGIES AFFECTING FUEL CONSUMPTION

The fuel consumption of engine systems is driven by two major elements, the base engine (i.e., combustion subsystem, friction, accessories, etc.) and the exhaust aftertreatment subsystem. As a result, the fuel consumption of an engine system depends on both the base engine and the aftertreatment. Technologies affecting engine system fuel consumption through changes to the base engine and to the aftertreatment system are discussed below.

Base Engine Fuel Efficiency Technologies

The strategies being pursued to improve base engine efficiency are the following:

-

Downsizing the engine while maintaining equal power,

-

Improving thermodynamic cycle efficiency (e.g., improved combustion),

-

Reducing engine friction (e.g., reduced piston skirt friction), and

-

Reducing accessory loads (e.g., electric water pump, reduced fuel pump loads by avoiding fuel recirculation, modulated oil pump).

Note that all these strategies apply as well to SI engines, although the gains may have different magnitudes due to process differences between CI and SI engines.

Downsizing the Engine

The most significant of these strategies is engine downsizing, which consists of using a smaller displacement engine for a given vehicle mass while still maintaining the same power to give equal vehicle performance.1 This approach requires higher cylinder pressures (i.e., higher engine brake mean effective pressure [BMEP], which is equivalent to torque) at any given point on the vehicle drive cycle, which reduces engine brake specific fuel consumption (BSFC). To downsize an engine while still maintaining the same vehicle performance, the torque and hence BMEP of the downsized engine must be raised at all speeds including the maximum-power speed. One of the key enablers to raising the BMEP is increasing the intake boost provided by the turbocharger system. The emerging approach to increase intake boost is two-stage turbocharging (Figure 5.1). Increased boosting is also used for downsizing SI engines.

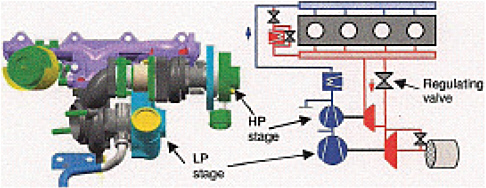

Most current light-duty CI diesel engines use a single-stage, variable-geometry turbocharger (VGT). Two-stage turbocharger (turbo) systems are being actively developed for two reasons. First, they are a key enabler for engine downsizing. Second, they enable increased exhaust gas recirculation (EGR) rates. Cooled EGR is the principal method to reduce engine-out NOx emissions, as discussed later. With a two-stage turbo system, two separate turbos are combined with additional flow-control valves. The first-stage turbo is usually sized smaller than the normal single-stage VGT used currently, and the second-stage turbo is usually sized larger than the current single-stage VGT. Electronic flow control valves triggered by the engine controller are used to direct exhaust flows to the small turbo and/or to the large one. At lower engine speeds only the smaller turbo is used and a relatively high inlet pressure is generated, even for the low inlet air flow characteristic of operation at high EGR rates.

At higher engine speeds, when the air flow rates have increased and the smaller turbo does not have sufficient flow capacity, air flow rates are sufficient to generate high intake pressures when the exhaust flow is directed through the larger turbo. Therefore, with the use of a two-stage turbo system, the problem of insufficient inlet boost pressure at low speeds with high EGR flow rates is solved without losing engine power at high speeds. The ability of two-stage turbo systems to generate higher boost pressures at low engine speeds is the key characteristic of two-stage systems that makes them enablers for engine downsizing. By providing higher intake boost, two-stage systems provide more air in the cylinder, thus allowing increased BMEP and torque to compensate for the smaller engine displacement. Naturally, two-stage turbo systems are more expensive than single-stage systems.

To utilize the increased charge mass in the cylinder resulting from the higher boost, more fuel must be injected per unit of engine displacement. The resulting increased power output per unit of engine displacement then compensates for the downsized engine displacement. Increasing the fuel flow is generally accomplished by increasing the maximum injection pressure, which enables higher injection-pressures at all loads. To support the increased cylinder pressures, the engine structure, sealing (e.g., head gasket), and lubrication (e.g., connecting rod bearings must support higher cylinder pressures with the same bearing areas) must be improved. Cylinder pressures also increase piston/ring friction, and an additional challenge is to keep the increase to a minimum. These changes require careful engineering but increase engine cost only slightly.

Improving Thermodynamic-Cycle Efficiency by Optimizing Combustion and Emissions for Maximum Efficiency

The combustion process and its phasing relative to piston motion are important determinants of thermodynamic-cycle

FIGURE 5.1 Schematic of two-stage turbocharger system. HP, high pressure; LP, low pressure. SOURCE: Joergl et al. (2008). Reprinted with permission from SAE Paper 2008-01-0071, Copyright 2008 SAE International.

efficiency. However, the combustion process also plays the key role in the engine-out emissions. As a result, optimizing combustion to minimize FC and emissions simultaneously requires careful analysis of the interactions between fuel spray dynamics, in-cylinder fluid motions resulting from the interactions of the intake flow with the piston bowl shape (i.e., combustion chamber), gas temperature history, and chemical reactions of the fuel. As fuel composition evolves from entirely petroleum based to a mixture of petroleum and bio-sourced components in the next decade to reduce petroleum dependence and increase sustainability, it is critical that understanding of combustion be increased. It is believed that advanced combustion research with tools such as three-dimensional computational fluid dynamic computer codes, including spray and combustion as well as coordinated experiments in highly instrumented engines with optical access for advanced laser-based tools, will improve understanding of combustion in the longer term. This improved understanding is critical to reducing exhaust emissions without compromising engine efficiency and along with new technologies discussed later should enable reductions in FC.

Reducing Engine Friction

Friction sources in engines are journal bearing friction, valve-train friction, and piston assembly friction. In the past 10 to 15 years, all significant sliding interfaces in valve trains have been replaced by rolling interfaces, which minimize friction. Connecting rod, camshaft, and main bearing friction is hydrodynamic, thus coming primarily from lubricating oil shear processes. This friction has been reduced by the use of lower viscosity lubricants. Therefore, the largest remaining friction sources in both CI and SI engines is that due to the piston assembly. Friction from this assembly comes from both piston skirt-to-wall interactions as well as piston ring-to-wall interactions. Both skirt and ring friction can be decreased by improved cylinder-bore roundness, which depends on both cylinder block design and associated thermal distortions as well as bore distortion due to mechanical loading by the preloaded cylinder head attachment bolts. Rounder bores under hot and loaded conditions allow lower ring tension, which in turn decrease ring-to-wall friction. Coatings to reduce ring friction are also being developed, although it is not yet clear whether such coatings can be both friction reducing and sufficiently durable. Piston skirt friction can be reduced by improved skirt surface coatings. Most current pistons have proprietary skirt coatings, but new materials are continuously being studied to further reduce skirt-to-wall friction.

Reducing Accessory Loads

Engine loads to drive accessories include those for coolant pump, oil pump, alternator, air-conditioning compressor, power-steering pump, etc. Electric-motor-driven coolant pumps are being considered because they can be turned off or run slowly during engine warm-up and at other conditions when coolant flow can be reduced without engine damage, thus reducing fuel use to drive the electrical alternator. Two-mode mechanical water pumps are also being developed that require less power to drive at part-load engine conditions but still provide more coolant flow at high-load conditions. Oil pumps, like coolant pumps, are sized for maximum engine power conditions and are hence oversized for part-load, low-speed conditions. Two-mode oil pumps are being developed and becoming available.

Exhaust Emissions Control of CI Diesel Engines

The most critical aspect of increasing the use of CI diesel engines in the United States to take advantage of their excellent efficiency is the development and production of technologies that can enable these engines to meet the 2010 and post-2010 exhaust emissions standards. As noted above, CI diesel engines without emission controls have very low

FC characteristics. So the challenge for CI engines is to reduce emissions into compliance without losing the excellent fundamental CI low FC. This challenge is in contrast to the case of the SI gasoline engines, for which reducing FC is the major issue. As noted earlier, in the 2009 model year 13 new CI diesel vehicles were announced for introduction to the U.S. market (Diesel Forum, 2008). These vehicles have been developed to meet the 2010 emissions standards, and so whatever efficiency deterioration has occurred as a result of applying the combustion and exhaust aftertreatment technologies necessary to meet the standards is reflected by the fuel economy of these vehicles. Data from the 2009 VW Jetta indicated that the fuel consumption reduction between the diesel and gasoline versions of the Jetta expected from earlier (e.g., 2006) models has been retained, in spite of the significantly reduced emissions, although this result may not hold true for all the new diesel models. As a result, the overall choice between investing in SI gasoline engine technologies to reduce the SI gasoline fleet FC on the one hand and replacing some SI gasoline engines with CI diesel engines on the other hand will rest on the total cost for emissions-compliant CI diesel engines and their remaining FC advantage after emissions control measures are implemented. In addition to the specific FC tradeoffs between SI and CI FC, business decisions on whether to tool up CI engines also depend heavily on the availability of investment capital in an industry undergoing drastic financial problems as well as expectations of the willingness of buyers to invest in CI engines, with which they are largely unfamiliar or have out-of-date perceptions.

Combustion System Technologies

The direction for CI diesel combustion system technology development has been toward more premixed combustion and away from traditional CI diesel engine diffusion-type combustion. Diffusion-type combustion tends to generate both high NOx and high particulate matter (PM) engine-out emissions because diffusion flames tend to stabilize at a nearly stoichiometric local mixture ratio that is characterized by high temperatures and resultant high NOx formation. Surrounding this local stoichiometric diffusion flame are rich local fuel mixtures whose thermal and mixture environment also cause high PM formation. Higher levels of dilution by means of large amounts of EGR as well as earlier injection and longer ignition delays reduce both average and local temperatures as well as allowing more mixing time, thus making the local fuel-air ratios much leaner. This combination of lower temperatures and locally leaner mixtures minimizes the extent of diffusion flame occurrence and thereby reduces both NOx and PM emissions. The combustion strategies that utilize this approach have been given many different names in the literature, including PCI (premixed compression ignition) (Iwabuchi et al., 1999), PCCI (premixed-charge compression ignition) (Kanda et al., 2005), LTC (low-temperature combustion) (Pickett and Siebers, 2004), and others. All these partially homogeneous charge strategies drive the combustion process in the direction of HCCI (homogeneous-charge compression ignition) (Ryan and Callahan, 1996). The term HCCI in its purest form refers to virtually homogeneous rather than partially homogeneous charge.

To utilize these premixed forms of combustion, a number of measures are used to reduce temperatures and improve mixing of the charge. The simplest and most effective measure is increased EGR, as noted above. In addition to increased EGR, lowering compression ratio also reduces mixture temperatures and, as a bonus, allows increasing engine power without exceeding cylinder-pressure design limits. Lower compression ratios make developing acceptable cold-start performance more challenging in spite of improved glow plugs and glow plug controls.

Technologies being developed to support this move in combustion technology toward premixed low-temperature combustion are cylinder-pressure-based closed-loop control; piezo-actuated higher-pressure fuel injectors; two-stage turbocharger systems; and combinations of high- and low-pressure EGR systems.

Cylinder-Pressure-Based Closed-Loop Combustion Control Technologies

Cylinder-pressure-based closed-loop combustion control technologies enable operating the engine closer to the low-temperature limit without encountering misfire or excessive hydrocarbon and carbon monoxide (HC/CO) emissions. This technology is especially important in the North American market, where the variation of North American diesel fuel ignition quality (i.e., cetane number) is greater than in Europe. This large cetane number variability makes combustion control more difficult especially for more dilute, lower-temperature combustion strategies. The FC impact of cylinder-pressure-based closed-loop combustion control is 0 to 5 percent. However, since certification fuels are well controlled, the efficiency impact would not be observed on the drive cycle for vehicle emissions certification, but only in customer use when poor ignition quality fuels are encountered in the marketplace.

Piezo-Triggered Common-Rail Fuel Injectors

Piezo-actuated common-rail fuel injectors are being developed aggressively by the global diesel fuel-injection system suppliers (e.g., Bosch, Continental, Delphi, and Denso). These injectors open faster and more repeatably than do solenoid-actuated injectors, thereby enabling more injections per combustion event. The latest generations of these injectors designed on direct-acting principles entered low-volume production for the 2009 model year in European passenger cars. Multiple injections per combustion cycle allow lower combustion noise (i.e., diesel knock) and more

precise control of mixing and local temperatures than is possible with a single injection per cycle. This additional level of control is useful to maximize the benefits of premixed low-temperature combustion. In addition to combustion control, multiple-injection capability is used to enable postcombustion injections, which have been used as part of the engine control strategy used to trigger and sustain regeneration of particulate filters.

EGR Issues

Using increased EGR levels to reduce mixture temperatures to suppress formation of NOx and PM creates two major difficulties in addition to the points mentioned above. First, the levels of EGR at idle and part-load conditions typical of urban and extra-urban driving can reach 60 to 70 percent. This means that with normal high-pressure EGR, only 30 to 40 percent of the engine air flow is going through the turbocharger with the remainder recirculated back through the engine. As a result, the turbine generates less torque and the ability of the turbocharger to boost intake pressure is severely hampered. Low inlet pressures lead to lower cylinder charge masses, causing richer mixtures and thus increasing PM formation as well as making it more difficult for post-combustion oxidation of both PM and HC/CO due to lower oxygen availability.

The second difficulty associated with very high EGR levels is that EGR cooling requirements increase. EGR cooling is extremely important because EGR enters the EGR cooler at exhaust temperatures. Mixing this hot EGR with intake air, which is already heated through compression in the turbo-charger compressor, leads to hot inlet mixtures. Hot inlet mixtures negate some of the potential of lowering NOx and PM formation through lower mixture temperatures. Therefore, high EGR levels require larger and more effective EGR coolers. Not only do these larger coolers present packaging difficulties in already crowded engine compartments, but they also are subject to fouling through condensation of heavy hydro carbons and water vapor present in the EGR stream, which form deposits inside the EGR cooler decreasing their cooling efficiency (Styles et al., 2008).

High- and Low-Pressure EGR Systems

In most CI diesel engines, EGR is supplied to the intake manifold directly from the exhaust manifold before the turbo. This approach provides high-pressure, high-temperature exhaust gas to the intake manifold. Thus this type of system is called an HP (for high-pressure) system. The HP approach is simple in principle because the exhaust manifold pressure is normally slightly higher than the intake manifold pressure. Thus EGR can be passed directly from the exhaust manifold into the intake manifold at a rate controlled by both the EGR flow control valve and the pressure difference between the exhaust and intake manifolds. This approach was inexpensive and effective in the early days of CI engine emissions control. However, as emission standards tightened, more EGR was needed, resulting in the hot intake mixture problem noted above. Partly to avoid the hot-EGR and EGR cooler fouling problems, low-pressure (LP) EGR systems have been developed (Keller et al., 2008).

In low-pressure systems, exhaust gas is taken from the exhaust system downstream of the particulate filter. As a result, particulates and heavy hydrocarbons have been removed. In addition, these exhaust gases are much cooler since energy has been removed by expanding the gases down to atmospheric pressure through the turbocharger turbine and by heat transfer in the exhaust piping leading to the particulate filter. As a result, these cooler, cleaner low-pressure exhaust gases now have to be pumped back up the intake boost pressure by passing them through the turbocharger compressor and subsequently through the charge cooler. EGR systems combining both high-pressure and low-pressure circuits have been developed and put into production on light-duty vehicles (e.g., the 2009 VW Jetta) (Hadler et al., 2008).

Variable Valve Timing

Some suggestions have been put forth that variable valve timing (VVT) mechanisms may provide opportunities for improved usage of EGR as well as other emissions control functionality (Bression et al., 2008) for CI engines. However, the current consensus from advanced development groups at OEMs and consulting firms is that VVT for CI diesels provides little or no benefit and therefore is not cost effective.

Exhaust Aftertreatment Technologies

HC/CO Control

The control of HC/CO has traditionally been relatively easy for CI engines due to the relatively low levels of these constituents emitted from conventional CI diesel combustion, in spite of relatively low exhaust temperatures. However, that situation has changed as the CI diesel combustion process has been modified to reduce combustion-gas temperatures, which reduces exhaust temperatures even further. As the combustion temperatures have been reduced, HC/CO emissions have risen. The diesel oxidation catalyst (DOC) was introduced around 1996 to reduce hydrocarbon emissions and in turn to reduce the soluble organic fraction of the dilute particulate matter. As a result of the reduced exhaust temperatures noted above, the DOC is being moved closer and closer to the turbocharger outlet to increase the temperature of the catalyst to increase its conversion efficiency. This packaging trend need not significantly increase costs but such minimal cost increases are only possible when other vehicle changes provide the opportunity to modify the engine compartment packaging to allow space for close-coupling

the DOC. In addition, oxidation catalyst coatings are being added to diesel particulate filters (DPFs) and NOx storage catalysts for additional HC/CO control.

Particulate Control

Particulate filter control of emissions from CI diesel engines is presently in use by vehicle manufacturers in Europe and the United States. These particulate filters are quite effective, filtering out 90 to 99 percent of the particulates from the exhaust stream, making CI diesel engines more attractive from an environmental impact point of view. Obviously, particulates accumulate in the filters and impose additional back pressure on the engine’s exhaust system, thus increasing pumping work done by the engine. This increase in pumping work increases fuel consumption. In addition, there is a second fuel economy decrement caused by the additional fuel required to regenerate the filter by oxidizing retained particulates. The low exhaust temperatures encountered in light-duty automotive applications of these filters are insufficient to passively oxidize the accumulated particulates. As a result, temperatures must be increased by injecting fuel (most frequently in the engine cylinder after combustion is over) to be oxidized, raising the temperature of the cylinder gases. These hot gases then pass from the cylinder out into the exhaust system and then downstream to the particulate filter to oxidize the particulates retained in the filter. To achieve sufficiently rapid regeneration for practical use in light-duty vehicles (e.g., in around 10 to 15 minutes), exhaust gases must be raised to 625 to 675°C.

Engine control algorithms for filter regeneration not only must sense when the filters need to be regenerated and bring about the regeneration without overheating the filter, but also these algorithms must contend with other events like the driver turning off the vehicle while regeneration is underway, thus leaving an incompletely regenerated filter. When the vehicle is then restarted, the control algorithms must appropriately manage either completion of the regeneration or start of a new filling and regeneration cycle. These algorithms have become quite sophisticated, with the result that particulate filter systems are quite reliable and durable.

NOx Control

There are two approaches to aftertreatment of NOx emissions: NOx storage and reduction catalysts (NSC), which are also called lean NOx traps (LNT) (Myoshi et al., 1995), and selective catalytic reduction devices.

NOx Storage Catalysts

NOx storage catalysts utilize a typical monolith substrate that has both barium and/or potassium as well as precious metal (e.g., platinum) coatings. These coatings adsorb NOx from the exhaust gas stream to form nitrates, thus storing the NOx in the catalyst. As NOx is adsorbed from the exhaust, adsorption sites on the surface of the coating fill up. Once all the coating sites have adsorbed NOx, the NSC is no longer effective at adsorbing additional NOx, which then passes right through the NSC. Therefore, at some point before the catalyst is filled, the NSC must be regenerated to purge the adsorbed NOx and free the sites to adsorb the next wave of NOx. By supplying the NSC with a rich exhaust stream containing CO and hydrogen, the CO and H2 molecules desorb the NOx from the catalyst surface and reduce the NOx to N2, H2O, and CO2. Therefore, like the particulate filter, the NSC operates in a cyclic fashion, first filling with NOx from the lean diesel exhaust (i.e., an oxidizing atmosphere) and then being purged of NOx in a rich exhaust (i.e., a reducing atmosphere) that, with the help of precious metals also part of the catalyst surface coating, reduces the NOx back to N2.

Accordingly, application of an NSC to any engine that has a lean exhaust stream like diesel engines requires that periodically (every 30 to 60 seconds depending on the size of the catalyst and the operating condition of the engine) the engine system must create a rich exhaust stream for 10 to 15 seconds to clear the catalyst surface of NOx, thus preparing it to adsorb the next wave of NOx. One approach to creating the required rich exhaust stream in the engine cylinder is by throttling the engine to reduce airflow, thus enriching the mixture in the cylinder. Although gasoline engines operate quite happily with rich mixtures, operating a CI diesel engine with a rich mixture without forming excessive particulate and hydrocarbon emissions is quite challenging. If the combustion process is carried out at sufficiently low temperatures, particulate formation is minimized, but both hydrocarbon emissions and FC increase significantly during this brief rich operation.

An additional difficulty with NSCs is that the catalyst coatings preferentially adsorb sulfur compounds from the exhaust. These sulfur compounds originate mostly from the sulfur in the fuel. This sulfur takes up the adsorbing surface sites on the catalyst, leaving no sites to adsorb NOx. This sulfur adsorption, termed sulfur poisoning, is problematic even with today’s low-sulfur (<15 ppm) diesel fuel. Some of the sulfur in the exhaust gases may also come from the engine lubricating oil. Thus the NSC must also be periodically regenerated to clear out the adsorbed sulfur. Sulfur forms a much stronger bond with the catalyst surface than does NOx and as a result, sulfur regeneration requires not only a rich exhaust stream but also higher temperatures like ~650°C rather than the typical 200 to 300°C temperatures adequate for NOx regeneration. While the sulfur regeneration does not need to be done nearly as frequently as NOx regeneration, sulfur regeneration also causes a FC penalty.

The current NOx aged conversion capability of NSCs is around 70 percent. Early attempts to develop NSCs had difficulty achieving even 50 percent aged conversion efficiency in spite of ~80 percent for a fresh NSC. Extensive development on catalyst test benches indicated that exces-

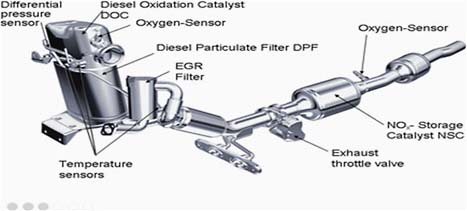

sive temperatures, particularly during sulfur regeneration, caused the observed deterioration in conversion efficiency. Recently, two factors have enabled improvements. First, newer catalyst formulations have been developed to allow sulfur regeneration at somewhat lower temperatures. Second, empirical models of catalyst behavior have been developed and incorporated into the engine controller. The combined effect of these two developments has enabled increasing aged conversion efficiency to ~70 percent. In the summer of 2008, VW released the 2009 Jetta TDI for the U.S. market which utilizes an NSC and meets Tier 2, Bin 5, as well as LEV II emissions standards, enabling VW to sell the vehicle in all 50 states and Canada. A schematic of the aftertreatment system used on this vehicle is shown in Figure 5.2.

Selective Catalytic Reduction

Selective catalytic reduction (SCR) was originally developed for stationary power plants but is now being applied to heavy-duty truck CI engines in Europe (Müller et al., 2003) and in the United States in 2010. SCR was also introduced in the United States in 2009 on some Mercedes, BMW, and VW vehicles. This system, called BlueTec, was jointly developed by all three manufacturers. SCR works by having ammonia in the exhaust stream in front of a copper-zeolite or iron-zeolite SCR catalyst. The ammonia gets stored on the catalyst surface where it is available to react with the NOx over the catalyst converting the NOx into N2 and water. To provide ammonia to the exhaust stream, a liquid urea-water mixture is injected into the exhaust sufficiently upstream of the SCR catalyst unit and before a mixer, to allow time for vaporization and mixing of the urea and creation of ammonia from the urea, which is an industrial chemical used primarily as a fertilizer. In the fertilizer application, urea is relatively inexpensive, but for use with an SCR system, it must be considerably more pure and as a result is more expensive. SCR systems tend to have NOx conversion efficiencies of 85 to 93 percent or more without the increased engine-out hydrocarbon emissions and FC resulting from NSC regenerations. As a result, vehicles using SCR have better FC characteristics at equivalent emission levels than those using NSC systems.

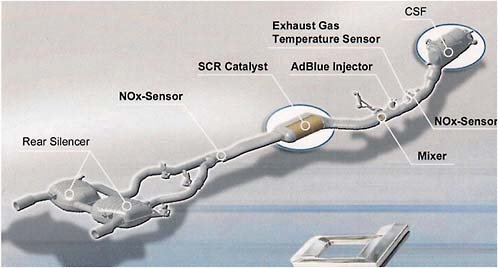

When urea is used to provide the ammonia, the urea-water mixture that is injected into the exhaust stream must be carried on board the vehicle. The amount of urea that needs to be supplied to the SCR catalyst depends on the level of NOx in the exhaust and therefore depends on driving conditions, but for light-duty vehicles it is a small fraction of the fuel flow. Initial discussions regarding the possibility of using an SCR-urea approach to NOx aftertreatment for the U.S. market were met with concern on the part of the EPA that there was considerable risk that drivers would not keep their urea tanks filled thus rendering the system ineffective. However, together with EPA oversight, vehicle manufacturers have developed systems to monitor the supply of urea in the urea tank, which will not allow the engine to restart more than a small number of times (e.g., 20) when the urea supply starts running out, following appropriate warnings to the driver. As a result of such safeguards, the EPA has approved the certification of the 2009 vehicles using the SCR-urea approach to NOx aftertreatment. One example of an SCR-urea-based exhaust aftertreatment system is illustrated in Figure 5.3.

Combined NSC and SCR Systems

Another strategy that has been proposed is to use a system in which the NSC is followed by SCR without external urea addition. It is well known that under some operating conditions with the appropriate washcoat formulation, NSCs can convert NOx to ammonia, which is undesirable for an NSC-only system and hence must be cleaned up before exiting the exhaust system. However, by following the NSC with SCR without urea injection, which is generally called passive SCR, SCR will capture and store the ammonia generated by the NSC and use it to reduce NOx. Since the amount of am-

FIGURE 5.2 Exhaust aftertreatment system on the 2009 VW Jetta using NOx storage and reduction catalyst technology for control of NOx. SOURCE: Courtesy of Volkswagen AG.

FIGURE 5.3 Schematic of a BMW exhaust aftertreatment system with selective catalytic reduction (SCR) for NOx control using urea (called AdBlue) addition. The catalyzed soot filter (CSF) is close-coupled to the engine. SOURCE: Mattes et al. (2008). Reprinted with permission.

monia generated by the NSC is not large, the passive SCR unit will have low conversion efficiencies but can be a useful supplement to the NSC system. This approach has been used by Mercedes in its Blue-Tec I system used in Europe.

Choosing Between NSC and SCR Systems

There are both cost and functionality differences between NSC and SCR systems which would influence which choice an OEM might make for NOx aftertreatment with CI engines. NSC systems use much more PGM (platinum group metals) than do SCR systems. (The SCR unit itself uses no PGM.) As a result, NSC system costs increase faster with increasing engine displacement than do SCR systems. Thus, from a cost point of view, NSC systems would be chosen for smaller displacement engines for which the current 70 percent NOx conversion efficiency of the NSC is sufficient to reduce engine-out NOx levels to below the Bin 5 emissions standards. As engine displacement is increased and engine-out NOx emissions increase, there is an engine displacement above which the 70 percent conversion efficiency of NSCs is insufficient and the higher (approximately 85 to 93 percent) conversion efficiency of SCR is required. If PGM commodity prices are sufficiently low, NSC systems costs for larger displacement I4 engines (e.g., 2.5 to 2.8 L) might be lower than those for SCR systems for those same engines, but NOx conversion efficiencies might not be high enough to meet the standards. Thus, the engine displacement above which an OEM would choose SCR rather than the NSC is not simply a cost-based decision.

FUEL CONSUMPTION REDUCTION POTENTIAL

CI Fuel Consumption Reduction Advantage

In a study for the EPA (EPA, 2008), Ricardo, Inc., carried out full system simulation (FSS) to assess the FC and CO2 impact of many of the technologies expected to enable reduced FC by 2020. FSS calculations were made for the 2007 model-year light-duty vehicle fleet for a set of vehicles representing five vehicle classes. Combinations of technologies deemed to be complementary were applied to baseline vehicles considered to be representative of each class. For the selected combinations of power train and vehicle technologies, final drive ratios were varied to find the ratios that enabled performance equivalent to the baseline vehicles based on a comprehensive set of performance measures while minimizing FC. CI diesel power trains were evaluated among the combinations of technologies considered. Results for the CI diesel power train CO2 emissions and FC versus the baseline vehicles for three of the five vehicle classes are summarized in Table 5.1. CI power trains were not applied to the other two vehicle classes, but the results for the three classes for which CI engines were evaluated are considered representative of all classes.

As indicated in Table 5.1, for the three vehicle classes considered, the average reduction in CO2 emissions was about 23 percent and the corresponding average reduction in FC was 33 percent when the baseline 2007 model year SI power trains were replaced with CI power trains utilizing DCT6, EACC, HEA, and EPS. The 2009 VW Jetta was introduced with a 6-speed DSG (VW’s name for DCT6) transmission.

TABLE 5.1 Estimated CO2 and Fuel Consumption Reductions for Three EPA Vehicle Classes, as Determined from Full System Simulation (FSS)

|

Vehicle |

Technology Package |

Major Features |

SI to CI Downsize Ratio |

Combined CO2 Emissions g/mi. |

Combined Fuel Consumption gal/100 mi. |

Combined CO2 Reduction |

Combined Fuel Consumption Reduction |

|

Full-size car |

Baseline |

3.5-L V6 gasoline SI, AT5 |

|

356 |

4.051 |

Baseline |

Baseline |

|

5 |

2.8-L I4 diesel, DCT6, EACC, HEA, EPS |

80% |

273 |

2.707 |

23.3% |

33.2% |

|

|

Small MPV |

Baseline |

2.4-L I4 gasoline SI, DCP, EPS, AT4 |

|

316 |

3.596 |

Baseline |

Baseline |

|

5 |

1.9-L I4 diesel, DCT6, EACC, HEA, EPS |

79% |

247 |

2.449 |

21.8% |

31.9% |

|

|

Truck |

Baseline |

5.4-L V8, gasoline SI, CCP, AT4 |

|

517 |

5.883 |

Baseline |

Baseline |

|

5 |

4.8-L V8 diesel, DCT6, EACC, HEA, EPS |

89% |

391 |

3.877 |

24.4% |

34.1% |

|

|

|

Average CI diesel versus gasoline |

|

|

|

23.2% |

33.0% |

|

|

NOTE: See Chapters 2 and 8 for more information on FSS. To determine the FC reductions, the CO2 emissions results taken from EPA (2008) were converted to volumetric FC using conversion factors from EPA (2005). AT5, lockup 5-speed automatic transmission; AT4, lockup 4-speed automatic transmission; CCP, coordinated cam phasing; DCP, dual (independent) cam phasing; DCT6, dual-clutch 6-speed automated manual transmission; EACC, electric accessories (water pump, oil pump, fans); EPS, electric power steering; HEA, high-efficiency alternator. SOURCE: Based on EPA (2008). |

|||||||

Note also that CI engines were downsized in displacement by an average of about 83 percent from the SI engines they replaced. Tables 7.13, 7.15, and 7.18 from EPA (2008) for small MPVs, full-size cars, and trucks, respectively, indicate that these CI engine-powered vehicles with DCT6 transmissions provided equivalent performance to the vehicles with larger-displacement original SI engines and transmissions.

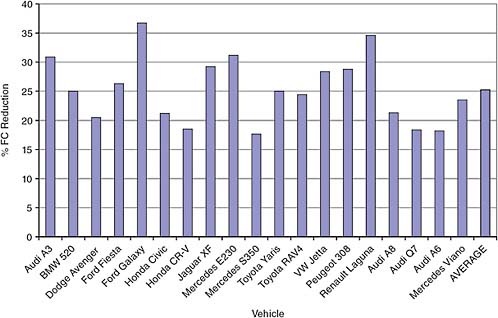

The 2007 model-year baseline vehicles were equipped with 4- and 5-speed automatic transmissions. As noted above, the 33 percent FC reduction indicated in Table 5.1 reflected DCT6 transmissions and more efficient engine accessories as well as the engine change. To estimate the separate effect of replacing SI engines and transmissions by CI engines with equivalent transmission technology and without advanced accessories, a European database of 2009 vehicles was analyzed. Using vehicles that are offered with 5- and 6-speed transmissions for both SI and CI engines, an estimate was derived of the reduction in FC from replacing SI engines with CI engines at equivalent vehicle performance without the effect of simultaneously converting from 4- and 5-speed automatics to DCT6 transmissions. The data used for this estimate are plotted in Figure 5.4 and shown in tabular form in Table 5.A.1 in the annex at the end of this chapter.

Figure 5.4 indicates that the average FC reduction for this vehicle subset was about 25 percent. Therefore, the FC reductions achievable from engine replacement alone without a simultaneous transmission change to DCT6 (and EACC with HEA) would be about 25 percent.

Fuel Volumetric Energy Effect

It should be noted that part of the volumetric FC benefit of CI diesel engines stems from the differences in volumetric energy content between gasoline and diesel fuels. The energy content of a gallon of diesel fuel is about 11 percent higher than that of gasoline. While this factor can be an advantage for drivers if diesel fuel is selling at gasoline prices or lower, the carbon dioxide emissions advantage for the diesel would be less than would be indicated by the volumetric FC advantage of the CI diesel engine. As indicated in Table 5.1, the CO2 reduction advantage for CI engines is about 10 percent less than their FC reduction advantage.

Fuels for CI Engines

The performance and emissions of diesel engines are also influenced by the fuel characteristics and fuel quality. Although fuel is not a focus of this report, several relevant characteristics for performance and emissions are important in connection with their influence on engine performance,

FIGURE 5.4 Percent reduction of fuel consumption (FC) on the NEDC driving cycle for a subset of 2009 European vehicle platforms offered with both SI and CI engines. The subset was selected from a larger set of 2009 vehicle platforms offered with both SI and CI engines by including only those platforms for which 0-62 mph (0-100 km/mile) times were within 5 percent, which was considered to be equivalent performance. The data used to construct this figure are shown in Table 5.A.1 in the annex at the end of this chapter.

efficiency, and emissions. These characteristics are cetane number (a measure of fuel self-ignition in the CI cycle—important in cycle efficiency, but also in low-temperature operation), density/heating value (a measure of volumetric energy content), lubricity (important for fuel system wear and durability), and sulfur level (important for proper operation of the engine exhaust aftertreatment system).

In the U.S. market, there is only one diesel fuel suited for on-road transportation; its characteristics are specified by the ASTM Standard D975. Most state regulations require the enforcement of these specifications. In the EU, where light-duty CI diesel passenger cars are widespread and about half the new cars are powered by diesel engines, the diesel fuel is specified by the EN590 standard. There are significant differences between the EU and the ASTM standards. The EU fuel has much higher cetane (e.g., 52 versus 40-48), the fuel density is limited to a minimum to assure adequate energy density (no limit exists in the ASTM standard), and the lubricity is better. In terms of fuel sulfur, European fuel has similar levels to U.S. fuels, for which sulfur level is regulated by the 2006 EPA standards to 15 ppm or less.

In the near future, most diesel passenger cars in the United States will be imports from Europe. Their engines have been adapted for use of U.S. diesel fuel, and the manufacturers do not expect to encounter performance and emission issues connected with the fuel, as long as fuel specifications are enforced and quality is adequate. Cylinder-pressure-based closed-loop control, as discussed earlier and utilized in one of the new 2009 CI diesel vehicles, can adjust for market variability in the cetane number of the fuel and provide compensation over the entire operating engine map. The lower lubricity of the U.S. diesel fuel requires protective coatings for the high-pressure pump in the fuel injection system. As noted earlier, the ultralow level of sulfur in the fuel regulated to less than 15 ppm is a necessary enabler for the efficient and durable operation of the exhaust aftertreatment system. Nonetheless, all OEMs marketing CI diesel vehicles in the North American (NA) market have concerns over the seasonal and regional variability of diesel fuel as well as the enforcement of fuel quality.

At present, the ASTM D975 fuel standard allows up to 5 percent biodiesel blend stock in the fuel provided the blend stock meets the characteristics of the ASTM standard. The European OEMs exporting diesel vehicles to the United States have stated that their engines are robust to this fuel blend and that performance and emissions are not affected as long as the blend is at or under 5 percent. For the European market, the manufacturers may allow up to 7 percent FAME (fatty acid methyl ester), plus up to an additional 3 percent hydrogenated biofuel. The difference in the proportion allowed by the European OEMs for the U.S. market versus for the European market is due to their concern over the qual-

ity and stability of American blend stock and the variety of feedstocks, including soy, recycled used oils, fats, etc.

Efficiency Improvements from Transmissions

The transmission technology utilized in the FSS results shown in Table 5.1 was a dual-clutch 6-speed (automated manual) transmission (DCT), which is a very efficient design concept. Transmissions used for CI diesels must be designed to handle their larger torque, which may reduce their efficiencies slightly due to larger gears, bearings, and seals. DCTs are already in production for smaller displacement CI engines (e.g., 2009 VW Jetta). The most challenging aspect of designing DCTs with the higher torque capacities needed for larger displacement CI engines is providing adequate cooling for their wet clutches (i.e., oil-cooled clutches). Dual-mass flywheels, which reduce drive train vibration, thus reducing heat-generating clutch slippage, will be used. Nonetheless, it is not presently known when such DCT units will be available with 500-650 N-m torque capacities for larger CI engines.

Expected transmission-based CI vehicle efficiency improvements beyond those already comprehended by the use of the DCT6 transmissions are estimated at 1 to 2 percent for downspeeding the engine by increasing the number of discrete speed ratios beyond six. The increased number of ratios allows keeping the average engine speed lower while still maintaining equal performance, which is why this approach is called “downspeeding.” Another 2 to 3 percent is expected from reduced transmission internal losses.

Overall Fuel Consumption Reduction Potential

The FC reduction potential via replacement of SI gasoline power trains by base-level CI power trains is illustrated by Table 5.1 (i.e., ~33 percent) for CI engines with advanced transmissions (plus EACC, HEA, and EPS) and by Figure 5.4 for engine replacement alone (i.e., ~25 percent). Additional technical improvements, as noted earlier, from downsizing, thermodynamic improvements, friction reduction, and engine accessory improvements, are being developed and will be implemented. CI engines with these technologies implemented are termed advanced-level CI engines. Transmission improvements are also possible.

Based on interactions with OEMs, consulting companies, review of the technical literature, and the judgment of the committee, estimates of the overall FC reduction potential from these advanced-level technology areas are presented in Table 5.2. For the ranges shown, the 10 percent for engine technologies alone and 13 percent for vehicles applies to larger vehicles with automatic transmissions. For smaller vehicles with manual transmissions and engine displacements less than 1.5 L, cost constraints are likely to reduce the extent of downsizing and the potential would be about 6 percent for engine alone and 7 percent for vehicle due to elimination of not only the gain from automatic transmission efficiency

TABLE 5.2 Estimated Fuel Consumption Reduction Potential for Advanced-Level CI Power Trains Compared to Base-Level CI Power Trains

improvement (−2 percent) but also some of the gains from downsizing (−3 percent) and downspeeding (−1 percent).

TECHNOLOGY READINESS/SEQUENCING

In 2003, J.D. Power estimated the CI light-duty market share would reach 16 percent by 2015 (Peckham, 2003). However, the fuel price run-up of 2007-2008 caused a significant negative price differential between diesel and gasoline fuel (i.e., diesel fuel more expensive than gasoline) due to a global shortage of distillate/diesel fuel. This negative price differential has probably interfered with the growth of CI diesel vehicle sales. Even with the large fuel price reduction resulting from the economic slowdown of 2008 to 2009, the negative price differential has gone away slowly. Table 5.3 provides a brief summary of the average U.S. gasoline-to-diesel price differential evolution between May 2008 and June 2009. From Table 5.3 it can be seen that the negative price differential decreased substantially (from 54 cents/gal, or 15 percent, to 11 cents/gal, or 5.2 percent) between May 2008 and May 2009. Between May 2009 and June 2009, gasoline prices increased more than diesel (~45 cents/gal versus 17 cents/gal) causing a shift to a positive price differential. Whether this positive price differential remains when global economic activity returns to normal levels can only be guessed. The current positive price differential in combination with the new national fuel economy standards announced May 19, 2009, may strengthen interest in CI diesel vehicles, but it remains to be seen if the predicted U.S. CI diesel market share of 16 percent will be reached by 2015.

Application of CI technology into the NA market to reduce fuel consumption involves two steps. The first step is the introduction of vehicles with optional base-level CI power trains. The second step is the improvement of these CI power trains to advanced-level ones by implementation of the advanced technologies whose potential gains are indicated in Table 5.2.

The first step is underway now, as noted earlier in this chapter, as demonstrated by the introduction of a large number of vehicles for the 2009 model year. However, these vehicles primarily use versions of CI already in production for the European market. The decisions that put these introductions into product plans occurred several years earlier when it became clear first that there was encouraging development of technology enabling compliance with the 2010 Tier 2, Bin 5 and LEV II emissions standards for modified versions of these existing engines, and second that market conditions were supportive of such introductions due to increasing concern with the rise in both the price of fuel and in greenhouse gas (GHG) emissions. Had these conditions continued, it seems likely that additional vehicles beyond those announced for 2009 would have been introduced in model years 2010 and 2011. However, as noted earlier, as the petroleum price rose and fell during 2008, the unfavorable differential between gasoline and diesel fuel grew and then decreased, leaving potential CI vehicle buyers uncertain about future fuel prices. As a result, the pace of introduction of vehicle platforms with CI power trains for the NA market based on engines already in production is likely to decrease due to reduced market demand because of the fuel-price differential history as well as lower fuel prices in general. In addition, the global economic slowdown and the associated reduced tooling capital availability caused by the global auto industry’s economic problems will also have a major impact on decisions about tooling new CI power trains for those OEMs that do not already have appropriately sized CI engines in production. Appropriately sized engines would be those with displacements suitable for the classes of vehicles whose fuel consumption reduction would have the largest impact on OEMs’ specific fleet CAFE values.

Therefore, the second step, introduction into the market of CI technologies that could reduce light-duty fuel consumption beyond that shown in Table 5.1, will likely follow two paths. The first path is the introduction of the advanced-level technologies listed in Table 5.2 into post-2009 vehicles that were newly introduced in the 2009 model year. It is expected that this will occur in vehicles for model-years 2011-2014. This estimate is based on several factors. First, it is known that these technology areas are currently under development based on meetings with several OEMs. Second, European OEMs that are introducing CI-powered vehicles in the North American market in 2009 will also be preparing for Euro 6 emissions regulations that will take effect in 2014. Since Euro 6 NOx requirements are less stringent than Tier 2, Bin 5 and LEV II emissions technologies to be used for Euro 6 will have already been developed to meet the U.S. requirements. As a result, it is expected that European OEM engineering resources in the 2009-2011 time frame will be partly applied

TABLE 5.3 Comparison of U.S. Average Gasoline and Diesel Fuel Prices Between May 2008 and June 2009

|

Date |

Gasoline Cost ($/gal) |

Diesel Cost ($/gal) |

Gasoline to Diesel Cost Difference (cents) |

Diesel to Gasoline Cost Difference (percent) |

|

May 9, 2008 |

3.613 |

4.149 |

−54 |

−14.8 |

|

May 9, 2009 |

2.078 |

2.185 |

−11 |

−5.15 |

|

June 1, 2009 |

2.524 |

2.352 |

+17 |

+7.3 |

|

SOURCE: EIA (2009b). |

||||

to realizing some of the efficiency gains summarized in Table 5.2. For the OEMs active in the European market, this timeline is compatible with tax incentives expected in 2011 for early introduction of vehicles meeting Euro 6 as well as with the next European fleet CO2 reduction target in 2012.

The second path for introduction of the advanced-level technologies summarized in Table 5.2 is their introduction simultaneously with new CI power trains in the period 2014-2020. These advanced-level versions will be required for market competitiveness for these new vehicles since the OEMs introducing CI vehicles between 2009 and 2011 will probably have already implemented advanced-level technology features. For example, BMW has already introduced an engine with two-stage turbocharging, one of the key features of the advanced-technology level. However, the pace of introduction of these vehicles with newly tooled CI engines will follow the new market conditions based on the economic recovery of global economies and the related automobile markets.

In addition, California Air Resources Board (CARB) LEV III standards are expected for 2013. The LEV III emissions levels currently under discussion would be very challenging. So OEMs will be developing technologies to enable their diesel products to meet LEV III and associated regulations. Studies at European OEMs with development vehicles using emissions control technologies developed to meet Tier 2, Bin 5 standards indicate that these technologies need additional development to achieve proposed LEV III requirements. As a result, it is expected that there will be some fuel consumption increase in order to meet the new standards.

In summary, the following technology sequencing is envisioned:

-

For OEMs with existing CI engines, vehicles introduced in 2009 will be joined by additional models from 2011 to 2014, with base-level or advanced-level technology features depending on each OEM’s particular marketing strategy.

-

During the period 2015-2020, it is expected that development efforts for these OEMs will be focused on further reduction of power train cost and fuel consumption to achieve the upper limits of the ranges shown in Table 5.2.

For OEMs without existing CI engines with displacements in the range that would have the biggest impact on improving their CAFE values (e.g., V6 engines with displacements around 3.5 L for SUV and pickup trucks), new engines may be developed and put into production if three conditions are met. First, overall light-duty markets in the 2010-2012 period must improve sufficiently from those of 2009 to generate improved corporate financial health and required tooling capital. Second, a favorable customer perception of CI power trains must evolve based on the 2009-2012 CI vehicles already in the market. These new engines would probably be introduced in both base-level and advanced-level technology versions in order to both be technologically competitive with advanced-level technology products already in the market and to achieve market volumes necessary to justify the tooling investment. Third, fuel prices must increase from late 2009 levels but without significant negative price differential between gasoline and diesel in order to provide potential customers with sufficient incentive to offset the additional prices that must be charged for CI engines.

TECHNOLOGY COST ESTIMATES

There are a number of complexities in making cost estimations for CI engines to replace SI engines. The first of these involves selecting the appropriate displacement for the CI engine. This is important because CI engine costs depend significantly on their displacement for two primary reasons. First, the configuration and cost of their exhaust aftertreatment systems depend on engine displacement since component substrate (e.g., oxidation catalyst, particulate filter) volume is proportional to engine displacement and precious metal washcoat weights applied to the substrates are proportional to substrate volume. In addition to washcoat factors, NSC (NOx storage catalyst) and urea-SCR-based NOx reduction systems have different relationship multipliers to engine displacement. This is because urea-SCR-based systems use much less PGM compared to NSC-based systems, thus decreasing the rate at which costs increase with displacement.

Second, the degree of downsizing employed for the CI engine determines the cost and complexity of the air system for the engine. Maximum downsizing corresponding to advanced-level CI engines requires two-stage turbo systems, which cost about twice those of base-level single-stage turbo systems.

The cost of the engine structure and mechanical parts of CI engines depends less on displacement since smaller engines have all the same parts as larger displacement ones. These parts all require the same casting, fabrication, and machining processes and differ primarily in the amount of raw materials used, which has a relatively small influence on total cost. In the present work, no displacement-based adjustment was made to the cost estimates for the basic engine structure and parts.

Engine Sizing Methodology

The engine sizing methodology developed for this work is based on current and future product development directions. Two CI engine configurations have been considered, namely, base-level engines and advanced-level engines, as discussed above in the subsection titled “Overall Fuel Consumption Reduction Potential.” Performance of a given vehicle depends primarily on the combined effect of the torque curve of the engine, the transmission characteristics (e.g., speed

ratio range and internal efficiency), and final drive ratio. For base-level CI engines, a maximum specific torque density of 160 N-m/L is assumed. This level is achievable with single-stage turbo systems and, for example, is the level achieved by the Tier 2, Bin 5-compliant 2009 VW Jetta. The CI engines considered in the Ricardo, Inc., FSS analysis (EPA, 2008) from which the fuel consumption reduction values in Table 5.1 were determined had base-level technology features with single-stage turbo systems.

For advanced-level CI engines, a specific maximum torque density of 200 N-m/L is assumed. This level allows downsizing from base-level CI engines, thereby enabling additional fuel consumption reductions. The Tier 2 Bin 5 compliant 2009 BMW 335d with two-stage turbocharging achieves over 192 N-m/L and the Mercedes OM651 recently introduced in Europe achieves 233 N-m/L, and so the 200 N-m/L assumed for the advanced-level technology CI engine is considered realistic.

Based on the results from the full system simulation vehicle simulations carried out by Ricardo, Inc., for the EPA (EPA, 2008) (see Table 5.1) for 2007 model-year midsize MPV, full-size car, and truck-class vehicles, base-level CI engines displacing about 83 percent of the SI engines they replaced achieved equivalent vehicle performance when combined with advanced DCT6s (6-speed dual-clutch transmissions). It is therefore assumed that base-level CI engine displacement is about 83 percent of that of the 2007 model-year SI engine being replaced. Similarly, advanced-level CI engines having displacements about 80 percent of those of base-level CI engines can maintain equivalent vehicle performance. This is because the maximum torque of a base-level CI engine of displacement δ would be about 160 × δ N-m. Since the base-level maximum specific torque of 160 N-m/L is 80 percent of the 200 N-m/L for the advanced-level CI engine, the appropriately sized advanced-level CI engine would have 80 percent of the displacement of the base-level engine (i.e., 80 percent × δ). Then peak specific torque of the advanced-level CI sized at 80 percent would be equal to that of the base-level (i.e., 200 × (80 percent × δ) ≈ 160 × δ). With equal maximum torque, the advanced-level CI engine would enable equivalent vehicle performance.

Cost Estimation Methodology

The cost estimations from the sources considered in the present work (Martec Group, Inc., 2008; EPA, 2008, 2009; Duleep, 2008/2009) are then compared with those used by the NHTSA in its final rulemaking for 2011 (DOT/NHTSA, 2009). The Martec study used a BOM (bill of materials) approach based on technology packages consisting of combinations of components that fit together technically and made sense from a marketing point of view. BOM is also discussed in Chapter 3. This assessment was made by OEMs and suppliers with which Martec met. Martec then developed component-by-component costs and described the resultant BOM and cost sets in extensive detail. The resultant BOMs included not just the CI engine hardware added or SI hardware subtracted but also additional components that, in the judgments of the OEMs and suppliers, were necessary to make fully functional vehicles meeting both emissions standards and customer expectations. Martec reviewed the resultant cost tables with both the OEMs and the sup pliers to reach consensus. It is often said by OEMs that cost numbers provided by suppliers are lower than what OEMs actually have to pay, while suppliers counter that the costs that OEMs say they have to pay include more content than that quoted by the supplier. It is hoped, therefore, that the approach used by Martec to reach consensus avoided this potential confusion and provided more correct estimates. Finally, the Martec study was carried out in 2007-2008—more recently than the years (2002-2006) on which the EPA (2009) estimates were based or the period covered (2005-2008) in Duleep (2008/2009) estimates.

To avoid the rather subjective issue of cost reductions over the production life of components, Martec developed cost estimates assuming very large production volumes so that all volume-related learning could be considered already reflected by its cost estimates. For some existing components, like common rail injection systems, global production volumes are already high enough to exceed the Martec volume threshold, and cost estimates for these items would automatically include cost reductions from high-volume learning. On the other hand, it is not expected that the CI diesel engines used for the NA market alone will exceed that volume threshold before 2020. However, since many of these engines will also be produced for the European Union (EU) market, whether by EU OEMs or by U.S. domestic OEMs that produce such engines for their EU products, the combined EU, U.S., and Canadian volumes may reach the 500,000-unit threshold. Thus the volume thresholds required to realize high-volume earnings will consist of combined EU and NA volumes for a number of the engines in the CI diesel fleet. It is expected that volumes will reach the 500,000-unit threshold primarily for the engines sold in the highest volumes in the EU (e.g., ~1.6 L). Thus for some of the smaller engine displacements likely to have low volumes in the U.S. market (e.g., <1.5 L) as well as for larger engines (e.g., 4.0-4.5 L) used in vehicles not marketed at high volume in the EU (e.g., large SUVs and pickups), the 500,000-unit volume target may not be reached by 2020 and costs will remain somewhat higher. To that extent, some of the Martec CI cost increment estimates could be too low.

The cost estimates developed in the present work were derived primarily from the Martec study (Martec Group, Inc., 2008). This choice was made for the reasons stated above. In addition, the Martec report included detailed specification of the exhaust aftertreatment system configuration, sizing, and PGM washcoat loadings. This type of information was not included in EPA (2008, 2009) studies or in Duleep (2008/2009). In addition, the Martec report described the

commodity cost basis used, thus allowing modification of those costs in the present work to reflect recent decreases in commodity pricing for PGMs.

Base-Level Engine Technology Cost Estimates

Incremental CI diesel engine cost estimates developed in the present study for replacing 2007 model-year SI gasoline engines with equivalent performance CI diesels are summarized in Tables 5.4, 5.5, and 5.6. Appendix G contains the same information for full-size body-on-frame pickup trucks.

Emissions Systems Cost Estimates

Since the exhaust emissions systems are a significant fraction of the cost for CI diesel power trains, the brief entries in Tables 5.4 and 5.5 are described in more detail in Table 5.6. Note that the entries in Tables 5.4 and 5.5 reflect choices made for NOx aftertreatment technologies. For the midsize sedan, it was assumed that the 70 percent aged conversion efficiency currently achievable with NSC-based systems would be sufficient for emissions compliance through the year 2020. Using the spreadsheet from which the cost estimates shown in Table 5.6 were obtained, it was also determined that for a 2.0-L CI engine for a midsize sedan, the NSC system is a lower cost approach ($688) than is a urea-SCR-based system ($837). As a result, Table 5.6 contains no cost estimates for the SCR-urea system for the midsize sedan. This choice could be changed depending on success in meeting LEV III requirements with NSC-based systems and changes in PGM commodity prices. However, for the heavier SUV, SCR-urea with its capability for 85 to 93 percent conversion efficiency will be required for emissions compliance. As a result, there are no entries in Table 5.6 for NCS NOx aftertreatment for the SUV since it is assumed that SCR technology will be used.

Commodity prices were quite volatile between 2004 and 2008 (Martec Group, Inc., 2008), making product planning for CI diesel vehicles quite challenging. To illustrate the impact of PGM (platinum group metals consisting of platinum, palladium, and rhodium) commodity price volatility, Table 5.6 includes estimates for the precious metal wash coats used in the catalysts in separate rows labeled PGM loading. In addition, two columns are shown for each of the two reference vehicles. Columns two and four correspond to the PGM prices in November 2007 used in the Martec study (Martec Group, Inc., 2008). The estimates in columns three and five illustrate emissions systems costs based on PGM prices from April 2009 computed in the present study. These latter costs were used for the aftertreatment system cost estimates in Tables 5.4 and 5.5 because they are considered more representative of the post 2009 period. Obviously, this price situation must be monitored, since it is unlikely to remain at April 2009 levels until 2020. For the sedan with an advanced-level downsized 1.6-L engine, emissions system cost between November 2007 and April 2009 dropped 30 percent. Note that the catalyst volumes for the cost computation for the downsized 1.6-L engine were not reduced from the 2.0-L sizes since the 1.6-L engine must produce the same power

TABLE 5.4 Committee’s Estimates of Incremental Cost of CI Diesel Engine over a Baseline SI Gasoline Engine for Replacing SI 2.4-L MPFI DOHC Four-Valve Engines in Midsize Sedans (e.g., Malibu, Accord) with Base-Level 2.0-L I4 CI Engines

|

50-State-Saleable ULEV II 2.0-L DOHC CI Diesel Engine Baseline: SI Gasoline 2.4- L MPFI DOHC 4V I4 |

Estimated Cost vs. Baseline ($) |

|

Common rail 1,800 bar piezo-actuated fuel system with four injectors (@$75), high-pressure pump ($250), fuel rail, regulator, and fuel storage upgrades plus high-energy driver upgrades to the engine control module. Credit for SI content deleted ($32) |

675 |

|

Variable-geometry turbocharger (VGT) ($250) with electronic controls, aluminum air-air charge air cooler, and plumbing ($125) |

375 |

|

Upgrades to electrical system: starter motor, alternator, battery, and the 1-kW supplemental electrical cabin heater standard in Europe ($59) |

125 |

|

Cam, crank, connecting rod, bearing, and piston upgrades, oil lines ($50) plus NVH countermeasures to engine ($40) and vehicle ($71) |

161 |

|

HP/LP EGR system to suppress NOx at light and heavy loads; includes hot side and cold side electronic rotary diesel EGR valves plus EGR cooler and all plumbing |

215 |

|

Emissions control system including the following functionality: diesel oxidation catalyst (DOC), catalyzed diesel particulate filter (CDPF), NOx storage catalyst (NSC), EGR catalyst, passive SCR. Stoichiometric MPFI emissions and evaporative systems credit ($245). See Table 5.6 for a detailed breakdown of the emissions control system components leading to the total shown here. |

688 |

|

On-board diagnostics (OBD) and sensing including an electronic throttle control ($25), four temperature sensors (@$13), wide-range air-fuel ratio sensor ($30), two pressure-sensing glow plugs (@17), two conventional glow plugs (@$3), and Delta-P sensor for DPF ($25). Credit for two switching O2 sensors (@$9). |

154 |

|

Total variable cost with credits for SI parts removed. Excludes any necessary transmission, chassis, or driveline upgrades. |

2,393 |

|

NOTE: The credit for downsizing from V6 to I4 included in the Martec Group, Inc. (2008) study was not used in the committee’s estimates since baseline 2007 midsize sedan SI gasoline engines were not V6 but 2.4-L I4 engines. Cost estimates for aftertreatment systems reflect April 2009 prices for platinum group metals. |

|

TABLE 5.5 Committee’s Estimates of Incremental Cost of CI Diesel Engine over a Baseline SI Gasoline Engine for Cost Estimations to Replace SI MPFI DOHC Four-Valve 4.0- to 4.2-L Six-Cylinder Engine in a Midsize Body-on-Frame SUV (e.g., Explorer, Durango) with a 3.5-L V6 DOHC CI Engine

|

50-State-Saleable ULEV II 3.5-L V6 DOHC CI Diesel Engine Baseline: SI Gasoline DOHC 4V 4.0-4.2-L Six Cylinder |

Estimated Cost vs. Baseline ($) |

|

Common rail 1,800 bar piezo-actuated fuel system with six injectors (@$75), high-pressure pump ($270), fuel rail, regulator and fuel storage upgrades plus high-energy driver upgrades to the engine control module. Credit for MPFI content deleted ($48). |

911 |

|

Variable-geometry turbocharger (VGT) ($350) with electronic controls, water-air charge air cooler, circulation pump, thermostat/valve and plumbing ($135) |

485 |

|

Upgrades to electrical system: starter motor, alternator, battery, and the 1.5-kW supplemental electrical cabin heater standard in Europe ($99) |

167 |

|

Cam, crank, connecting rod, bearing, and piston upgrades, oil lines ($62) plus NVH countermeasures to engine ($47) and vehicle ($85) |

194 |

|

HP/LP EGR system to suppress NOx at light and heavy loads; includes hot side and cold side electronic rotary diesel EGR valves plus EGR cooler and all plumbing |

226 |

|

Emissions control system including the following functionality: DOC, CDPF, selective catalytic reduction (SCR), urea dosing system ($363). Stoichiometric MPFI emissions and evaporative systems credit ($343). See Table 5.6 for a detailed breakdown of the emissions control system components leading to the total shown here. |

964 |

|

On-board diagnostics (OBD) and sensing including four temperature sensors (@$13), wide-range air-fuel ratio sensor ($30), NOx sensor ($85), two pressure-sensing glow plugs (@17), four glow plugs (@$3), and Delta-P sensor for DPF ($25). Credit for four switching O2 sensors (@$9) |

227 |

|

Total variable cost with credits for SI parts removed. Excludes any necessary transmission, chassis, or driveline upgrades. |

3,174 |

|

NOTE: The credit for downsizing from V8 to V6 included in Martec Group, Inc. (2008) was not used here because the baseline 2007 SI engine was a V6, not the V8 assumed in Martec Group, Inc. (2008). Aftertreatment system cost estimates reflect April 2009 prices for platinum group metals. |

|

TABLE 5.6 Cost Estimates for Exhaust Emissions Aftertreatment Technologies Capable of Enabling Tier 2, Bin 5 Compliance

output as the 2.0-L engine, requiring that exhaust gas flow rates remain virtually unchanged. For the SUV, a smaller 10 percent emissions system cost drop was observed due to the lower PGM usage with SCR-urea aftertreatment for out-of-engine NOx control for the SUV. With SCR-urea systems, only the SCR device contains no PGM. As can be observed from examination of the entries in Table 5.6, DOC1, DOC2, and the coated DPF (called CDPF) all utilize PGM washcoats. As noted earlier, the spreadsheet used to generate the aftertreatment cost estimates shown in Table 5.6 is available for recomputing the aftertreatment system cost estimates should PGM commodity prices change significantly.

Finally, there is a technology choice involved in DPF systems. The four substrate options currently available for particulate filters are silicon carbide (Si-C), conventional cordierite, advanced cordierite, and acicular mullite. Conventional cordierite is used for most nonparticulate filter substrates (e.g., DOC and NSC catalysts), whereas Si-C has been the predominant choice for light-duty DPF usage in Europe. Conventional cordierite is less expensive and lower in mass than Si-C. On the other hand, Si-C has much higher thermal conductivity and strength, which are very favorable properties for withstanding regeneration without local hot spots causing thermal stress cracking and ultimate failure of the filter. As a result of these property differences, Si-C filters are typically filled (i.e., loaded) with about twice the amount of particulate (e.g., 8-9 g/L) during vehicle operation before regeneration is carried out, whereas conventional cordierite filters must be regenerated after about half that loading (e.g., 4-5 g/L) of particulate.

There are two results from this difference. First, conventional cordierite-based filter systems tend to require more frequent regenerations with associated FC increases. Second, since during regeneration fuel is injected into the engine cylinder during the expansion stroke with the piston part way down the cylinder to raise the temperature of the gases by partial oxidation of this regeneration fuel in the cylinder and completion of oxidation of that fuel in the oxidation catalyst, some fuel from the high-pressure spray reaches the cylinder wall and some of that fuel escapes past the piston rings down into the crankcase, where it dilutes the lubricating oil with fuel. This dilution requires more frequent oil changes to protect engine durability. Since frequency of oil changes is a marketing attribute, the choice of substrate has multiple implications, namely cost, durability, mass, and oil-change interval.

Advanced cordierite is emerging as a compromise between the properties of Si-C and conventional cordierite ( Tilgner et al., 2008). Therefore, for the purpose of this report, it has been assumed that new DPF applications will utilize advanced cordierite (as was assumed for the estimates in the Martec [2008] report) and that existing Si-C applications will be converted to advanced cordierite for the next design and development cycle. Thus the cost estimates shown in Table 5.7 are based on the use of advanced cordierite for DPF monoliths.