The Economics and Economic Effects of Biofuel Production

The supply of biofuels depends on the availability and price of feedstocks. As discussed in Chapter 3, a sufficient quantity of cellulosic biomass could be produced in the United States to meet the Renewable Fuel Standard, as amended in the Energy Independence and Security Act (EISA) of 2007 (RFS2) mandate. However, buyers of biomass would have to offer a price that incentivizes suppliers to provide the requisite amount. For a cellulosic biomass market to be feasible, the price offered by suppliers would have to be equal to or lower than what buyers would be willing to pay and still make a profit. The first part of this chapter describes an economic analysis that estimates what the price of different types of biomass would need to be for producers to supply the bioenergy market and the cost of converting the biomass to fuel.

After this examination of the economics of producing biofuels from cellulosic biomass, the chapter turns to look at the effects of biofuel production on related sectors of the U.S. economy. The newly emergent biofuel market intersects with established markets in agriculture, forestry, and energy. The competition for feedstock created by increased production of biofuels could have substantial economic impacts on the prices of agricultural commodities, food, feedstuffs, forest products, fossil fuel energy, and land values. Therefore, the second part of this chapter examines the price effects that biofuel policy can have on competing markets.

Along with the prices of commodities, biofuel production will likely alter the availability of these products, which may change where they are produced and where they are demanded. The third part of the chapter therefore examines the effects of biofuel production in the United States on the balance of trade. Effects on the imports and exports of grains, livestock, wood products and woody biomass, and petroleum are discussed.

In addition to its interaction with commodity markets and trade, the biofuel industry also has economic effects related to federal spending. To make biofuels competitive in the energy market, the federal government supports biofuels through the RFS2 mandate and additional policy instruments discussed in Chapter 1. Tax credits and a tariff influence government revenue and expenditures. Support policies for biofuels also affect other

government programs tailored to agricultural production, conservation, and human nutrition. The fourth section of this chapter reviews the federal and state policies that are related to biofuels or affected by biofuel policies and the observed and anticipated economic effects of biofuel-support policies on other government initiatives. The rationale for public support for these policies is also examined.

Because of the costs that biofuel policies incur, alternative options have been proposed to achieve similar policy goals. The final section provides an overview of alternatives that could possibly reduce or mitigate these costs while still encouraging biofuel production. It also examines how biofuel policy may interact with federal policy to reduce carbon emissions. Both policies have or would have reduction of greenhouse-gas (GHG) emissions as an objective.

ESTIMATING THE POTENTIAL PRICE OF CELLULOSIC BIOMASS

As of 2011, a functioning market for cellulosic biomass does not exist. Therefore, the committee chose to model possible prices based on production results found in published literature. This section explains the model, along with its assumptions and results, and estimates the cost of converting biomass to liquid fuel. It was not feasible for the committee to model every possible conversion pathway and biofuel product in the duration of this study. Thus, biochemical conversion of biomass to ethanol was used as an illustration in this analysis. The first part evaluates the production costs of various potential biorefinery feedstocks, assuming constant biorefinery processing costs. The second part analyzes the costs for various biorefining technologies, assuming constant feedstock costs.

Crop Residues and Dedicated Bioenergy Crops

If a cellulosic feedstock market were in existence, the data on market outcomes would be collectable. For instance, the purchase price for feedstocks could be obtained by surveying biorefineries, and the marginal costs of producing and delivering biomass feedstocks to a biorefinery could be calculated based on observed production practices. Presumably, if the market is operating, the price the biorefinery pays would be equal to or above the marginal cost of production and delivery. However, at the time this report was written, a commercial-scale cellulosic biorefinery and feedstock supply system did not exist in the United States. As a consequence, industry values were not available to estimate or otherwise assess the biomass supplier’s marginal cost or supply curve and the biorefinery’s derived demand for biomass.

The Biofuel Breakeven model (BioBreak) was used to evaluate the costs and feasibility of a local or regional cellulosic biomass market for a variety of potential feedstocks.1 BioBreak is a simple and flexible long-run, breakeven model that represents the local or regional feedstock supply system and biofuel refining process or biorefinery. BioBreak calculates the maximum amount that a biorefinery would be willing to pay for a dry ton of biomass delivered to the biorefinery gate. This value, or willingness to pay (WTP), is a function of the price of ethanol, the conversion yield (gallons per dry ton of biomass) the

______________

1 The BioBreak model was originally developed as a research tool to estimate the biorefinery’s long-run, breakeven price for sufficient biomass feedstock to supply a commercial-scale biorefinery and the biomass supplier’s long-run, breakeven price for supplying sufficient feedstock to operate such a biorefinery at capacity. An earlier version of the model was used in the NAS-NAE-NRC report Liquid Transportation Fuels from Coal and Biomass: Technological Status, Costs, and Environmental Impacts (2009b).

biorefinery can expect with current technology, and the costs of processing the feedstock (Box 4-1).

BioBreak also calculates the minimum value that a biomass feedstock producer would be willing to accept for a dry ton of biomass delivered to the biorefinery. This value, or willingness to accept (WTA), depends on the biomass feedstock producer’s supply cost (that is, opportunity cost, production cost, and delivery cost) of supplying biomass in the long run (Box 4-2). A local or regional biofuel market for a specific feedstock will only exist or be sustained if the biofuel processor can obtain sufficient feedstock and the feedstock producers can deliver sufficient feedstock at a market price that allows both parties to break even in the long run. For the analysis, BioBreak calculated the difference or “price gap” between the supplier WTA and the processor WTP for each feedstock scenario. If the price gap is zero or negative, a biomass market is feasible (Jiang and Swinton, 2009). If the price gap is positive, a biofuel market cannot be sustained under the assumed feedstock production and conversion technology.

The BioBreak model is based on a number of assumptions. First, it assumes that the typical biomass feedstock producer minimizes costs and produces at the minimum point on the long-run average cost curve. Second, it assumes a yield distribution for biomass crops based on the expected mean yield and variation in yield within a region. Third, it assumes a transportation cost based on the average hauling distance for a circular capture region (that is, the biomass supply area) with a square road grid.2 Fourth, the model assumes that the biorefinery has a 50-million gallon annual capacity. The model is flexible and can be rescaled to consider other facility sizes. This scale is chosen because it is assumed to be the minimum scale necessary to be competitive in the ethanol market. A smaller scale will imply lower WTP. Fifth, the model assumes that each biorefinery uses a single feedstock, and this feedstock is available without causing market disruptions (for example, changes in land rental prices) within the biomass capture region. Most biorefineries will likely be built to use locally sourced material for input (Babcock et al., 2011; Miranowski et al., 2011), but to the extent that they source material from outside the capture region, the actual WTA will be higher than is estimated in the results presented in this chapter. Sixth, beyond solving for alternative oil price scenarios, the impact of energy price uncertainty on biofuel investment is not considered. If potential investors require a higher return because of future energy market uncertainty (that is, a risk premium), actual WTP will be lower and the price gap will be higher than the price gap estimates presented in this chapter. With energy market uncertainty, a price gap estimate below zero will satisfy the necessary condition for development of a feedstock market (that is, both biomass supplier and biomass processor will break even in the long run), but it may not be sufficient to induce investment.3

______________

2 Due to heterogeneity in nontransportation production costs within the capture region, BioBreak uses the average distance rather than the capture region distance. Although the transportation cost per unit of biomass will be higher at the edge of the capture region, the supplier’s minimum willingness to accept will not necessarily be strictly increasing with distance due to heterogeneity in production and opportunity costs. Even with higher transportation costs, a biomass supplier at the edge of the capture region with low production costs may be willing to supply biomass at a lower price than a biomass supplier with relatively high production costs located close to the biorefinery. BioBreak assumes that the average hauling distance within the capture region is representative of the location of the last unit of biomass purchased by the biorefinery to meet the biorefinery feedstock demand. Using the capture region distance would provide the correct estimate of the supplier’s willingness to accept if the last unit of biomass purchased by the biorefinery is located at the edge of the capture region but would overestimate the supplier’s willingness to accept in all other cases.

3 For additional information on BioBreak model assumptions and limitations, refer to Appendix K and to Miranowski and Rosburg (2010).

BOX 4-1

Calculating Willingness to Pay (WTP)

Equation (1) details the processor’s WTP, or the derived demand, for 1 dry ton of cellulosic material delivered to a biorefinery.

![]()

The market price of ethanol (or revenue per unit of output) is calculated as the energy equivalent price of gasoline, where Pgas denotes per gallon price of gasoline and EV denotes the energy equivalent factor of gasoline to ethanol. Based on weekly historical data for conventional gasoline and crude oil, the following relationship between the price of gasoline and oil is assumed: Pgas = 0.13087 + 0.023917*Poil. Beyond direct ethanol sales, the ethanol processor also receives revenues from tax credits (T), coproduct production (VCP), and octane benefits (VO) per gallon of processed ethanol. Biorefinery costs are separated into two components: investment costs (CI) and operating (CO) costs per gallon. The calculation within brackets in Equation (1) provides the net returns per gallon of ethanol above all nonfeedstock costs. To determine the processor’s maximum WTP per dry ton of feedstock, a conversion ratio is used for gallons of ethanol produced per dry ton of biomass (YE). Therefore, Equation (1) provides the maximum amount the processor can pay per dry ton of biomass delivered to the biorefinery and still break even. The values of the variables in Equation (1) are based on the following assumptions.

Price of Oil (Poil)

The processor’s breakeven price of the price of oil per barrel is a critical parameter. Based on Cushing Crude Spot Prices (EIA, 2010c), oil briefly increased to $145 per barrel in July 2008 but decreased to $30 per barrel the last week of 2008. It increased to $48 per barrel the first week of 2009 and ended 2010 at $90. Given the high volatility in crude oil spot prices, rather than simulating or specifying a single price for oil, the difference between the WTP and WTA was calculated for three oil price levels: $52, $111, and $191, which are the low, reference, and high price projections for 2022 from the EIA Annual Energy Outlook (2010a) in 2008$.

Energy Equivalent Factor (EV) and Octane Benefits (VO)

Per unit, ethanol provides a lower energy value than gasoline. The energy equivalent ratio (EV) for ethanol to gasoline was fixed at 0.667. While ethanol has a lower energy value than pure gasoline, ethanol is an octane enhancer. Blending gasoline with ethanol, even at low levels, increases the fuel’s octane value. For simplicity, the octane enhancement value (VO) was fixed at $0.10 per gallon.

Coproduct Value (VCP)

For coproduct value (VCP), the estimation is simplified by assuming that excess energy is the only coproduct from the proposed biorefinery.1 Aden et al. (2002) estimated that cellulosic ethanol production yields excess energy valued at approximately $0.14-$0.21 per gallon of ethanol, after updating to 2007 energy costs (EIA, 2008a). Without specifying the source of coproduct value, Khanna and Dhungana (2007) used an estimate of around $0.16 per gallon for cellulosic ethanol. Huang et al. (2009) found that switchgrass conversion yields the largest amount of excess electricity followed by corn stover and aspen wood. The model assumed a fixed coproduct value of $0.18 per gallon for switchgrass, Miscanthus, wheat straw, and alfalfa, while corn stover and woody biomass coproduct values were fixed at $0.16 and $0.14 per gallon.2

Conversion Ratio (YE)

The conversion ratio of ethanol from biomass (YE) is expected to vary based on feedstock type (because of variations in cellulose, hemicellulose, and lignin content), conversion process, and biorefinery efficiency. Research estimates for the conversion ratio have ranged from as low as 60 gallons per dry ton to theoretical values as high as 140 gallons dry per ton (see Appendix M, Table M-1). Eliminating theoretical values and outliers on either end, the reported range for the conversion ratio is approximately 65 to 100 gallons per dry ton. Based on the large variation within the research estimates, the model assumed a conversion ratio with a mean value of 70 gallons per dry ton as representative of current and near future technology (baseline scenario) and a mean of 80 gallons per dry ton as representative of the long-run conversion ratio in the sensitivity analysis.

Nonfeedstock Investment Costs (CI)

Investment or capital costs for a cellulosic biorefinery have been estimated to be four to five times higher than a starch-based ethanol biorefinery of similar size (Wright and Brown, 2007). The biorefinery cost estimates used in this application of the model were based on research estimates and numbers provided by Aden et al. (2002), with cost adjustments to ensure consistency with the conversion rate and storage assumptions. Given cost adjustments and updating to 2007 values, the model assumed a mean (likeliest) value of $0.94 ($0.85) per gallon for biorefinery capital investment cost in the baseline scenario.3

Operating Costs (CO)

Operating costs were separated into two components: enzyme costs and nonenzyme operating costs. Nonenzyme operating costs, including salaries, maintenance, overhead, insurance, taxes, and other conversion costs, were fixed at $0.36 per gallon. Aden et al. (2002) assumed that enzymes were purchased and set enzyme costs at $0.10 per gallon, and these enzyme cost estimates were used in the NAS-NAE-NRC (2009b) report on liquid transportation fuels from coal and biomass. Other (nonupdated) published estimates for enzymes have ranged between $0.07 and $0.25 per gallon. Discussions with industry sources indicate that enzyme costs may run between $0.40 and $1.00 per gallon given current yields and technology. The decrease in enzyme costs anticipated by Aden et al. (2002) and used in the NAS-NAE-NRC (2009b) report has not materialized. For the simulation in this report, the assumption was that the enzyme cost has a mean (likeliest) value of $0.46 ($0.50) per gallon but is skewed to allow for cost reductions in the near future.

Biofuel Production Incentives and Tax Credits (T)

To account for potential tax credits for cellulosic ethanol producers, the tax credit (T) for cellulosic ethanol producers designated by the Food, Conservation, and Energy Act of 2008 of $1.01 per gallon was considered in the sensitivity analysis and was denoted as the “producer’s tax credit.”4

______________

1The coproduction of higher value specialty chemicals may reduce production costs; however, the committee could not find any economic evaluations of such options

2The coproduct value is fixed based on the percentage of lignin, cellulose, and hemicellulose reported by Huang et al. (2009) for each feedstock type. In the studies, the only biorefinery products are ethanol and electricity. All biomass that is not converted to ethanol is burned to produce energy. Energy that is not consumed by the biorefinery is exported to the electricity grid. There are some small differences in the assumed biorefinery energy requirements. Ignoring these small differences, any biomass that is not converted to ethanol will be burned to produce electricity. Thus, the coproduct value would decrease as ethanol yield increases. There are also small differences in the composition (energy content) of the biomass feedstocks. Overall, the coproduct values are a small fraction of the overall cost to produce biofuels, so these small variations in composition and yield have only a minor effect on overall economics.

3For parameters with an assumed skewed distribution in Monte Carlo analysis, the “likeliest” value denotes the value with the highest probability density.

4The processor’s tax credit was only considered in the sensitivity analysis and not included in the baseline scenario results.

BOX 4-2

Calculating Willingness to Accept (WTA)

The biomass supplier’s WTA per unit of feedstock delivered to the biorefinery is detailed in Equation (2).

![]()

The supplier’s WTA for 1 dry ton of delivered cellulosic material is equal to the total economic costs the supplier incurs to deliver 1 unit of biomass to the biorefinery less the government incentives received (G) (for example, tax credits and production subsidies). Depending on the type of biomass feedstock, costs include establishment and seeding (CES), land and biomass opportunity costs (COpp), harvest and maintenance (CHM), stumpage fees (SF), nutrient replacement (CNR), biomass storage (CS), transportation fixed costs (DFC), and variable transportation costs calculated as the variable cost per mile (DVC) multiplied by the average hauling distance to the biorefinery (D). Establishment and seeding cost and land and biomass opportunity cost are most commonly reported on a per acre scale. Therefore, the biomass yield per acre (YB) is used to convert the per acre costs into per dry ton costs, and Equation (2) provides the minimum amount the supplier can accept for the last dry ton of biomass delivered to the biorefinery and still break even. The values of the variables in Equation (2) are based on the following assumptions.1

Nutrient Replacement (CNR)

Uncollected cellulosic material adds value to the soil through enrichment and protection against rain, wind, and radiation, thereby limiting erosion that would cause the loss of vital soil nutrients such as nitrogen, phosphorus, and potassium. Biomass suppliers will incorporate the costs of soil damage and nutrient loss from biomass collection into the minimum price they are willing to accept. After adjusting for 2007 costs, estimates for nutrient replacement costs range from $5 to $21 per dry ton. Based on the model’s baseline oil price ($111 per barrel) and research estimates, nutrient replacement was assumed to have a mean (likeliest) value of $14.20 ($15.20) per dry ton for stover, $16.20 ($17.20) per ton for switchgrass, $9 per ton for Miscanthus, and $6.20 per dry ton for wheat straw. At the high oil price ($191 per barrel), nutrient replacement costs increase by about $1.35 per dry ton. At the low oil price ($52 per barrel), nutrient replacement costs decrease by about $1.00 per dry ton.

Harvest and Maintenance Costs (CHM) and Stumpage Fees (SF)

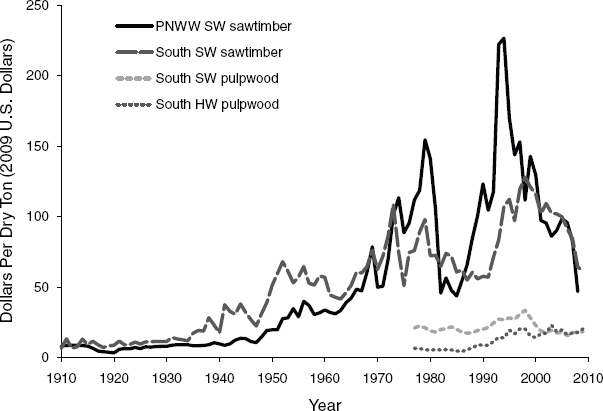

Harvest and crop maintenance cost (CHM) estimates for cellulosic material have varied based on harvest technique and feedstock. Estimates of harvest costs range from $14 to $84 per dry ton for corn stover, $16 to $58 per dry ton for switchgrass, and $19 to $54 per dry ton for Miscanthus, after adjusting for 2007 costs.2 Estimates for nonspecific biomass range between $15 and $38 per dry ton. Costs for woody biomass collection up to roadside range between $17 and $50 per dry ton. Spelter and Toth (2009) find total delivered costs (including transportation) about $58, $66, $75, and $86 per dry ton3 for woody residue in the Northeast, South, North, and West regions, respectively.4 Using the timber harvesting cost simulator outlined in Fight et al. (2006), Sohngen et al. (2010) found costs for harvest up to roadside to be about $25 per dry ton, with a high cost scenario of $34 per dry ton. Depending on the feedstock, the model assumed a mean value of $27-$46 per dry ton for harvest and maintenance with an additional stumpage fee with a mean value of $20 per dry ton for short-rotation woody crops (SRWC).

Transportation Costs (DVC, DFC, and D)

Previous research on transportation of biomass has provided two distinct types of cost estimates: (1) total transportation cost; and (2) breakdown of variable and fixed transportation costs. Research estimates for total corn stover transportation costs range between $3 per dry ton and $32 dry per ton. Total switchgrass and Miscanthus transportation costs have been estimated between $14 and $36 per dry ton, adjusted to 2007 costs.5 Woody biomass transportation costs are expected to range between $11 and $30 per dry ton. Based on the second method, distance variable cost (DVC) estimates range between $0.09 and $0.60 per dry ton per mile,

while distance fixed cost (DFC) estimates range between $4.80 and $9.80 per dry ton, depending on feedstock type. The BioBreak model used the latter method of separating fixed and variable transportation costs. One-way transportation distance (D) has been evaluated up to around 140 miles for woody biomass and between 5 and 75 miles for all other feedstocks. BioBreak calculates the average hauling distance (D) as a function of annual biorefinery biomass demand, annual biomass yield, and biomass density using the formulation by French (1960) for a circular area with a square road grid. The average hauling distance ranges between 13 and 53 miles.

Storage Costs (CS)

Due to the low density of biomass compared to traditional cash crops such as corn and soybean, biomass storage costs (CS) can vary greatly depending on the feedstock type, harvest technique, and type of storage area. Adjusted for 2007 costs, biomass storage estimates ranged between $2 and $23 per dry ton. The mean (likeliest) cost for woody biomass storage was $11.50 ($12) per dry ton, while corn stover, switchgrass, Miscanthus, wheat straw, and alfalfa storage costs were assumed to have mean (likeliest) values of $10.50 ($11) per dry ton.

Establishment and Seeding Costs (CES)

Corn stover, wheat straw, and forest residue suppliers were assumed to not incur establishment and seeding costs (CES), whereas all other feedstock suppliers would have to be compensated for their establishment and seeding costs. Costs vary by initial cost, stand length, years to maturity, and interest rate. Stand length for switchgrass ranges between 10 and 20 years with full yield maturity by the third year. Miscanthus stand length ranges from 10 to 25 years with full maturity between the second and fifth year. Interest rates used for amortization of establishment costs range between 4 and 8 percent. Amortized cost estimates for switchgrass establishment and seeding, adjusted to 2007 costs, are between $30 and $200 per acre. Miscanthus establishment and seeding cost estimates vary widely, based on the assumed level of technology and rhizome costs. Establishment costs for wood also vary by species and location. Cubbage et al. (2010) reported establishment costs of $386-$430 and $520 per acre for yellow pine and Douglas Fir, respectively (2008$). The model assumed a mean established cost value of $40 per acre per year for switchgrass, $150 per acre per year for Miscanthus, $52 per acre per year for SRWC, and a fixed $165 establishment and fertilizer cost for alfalfa.

Opportunity Costs (COpp)

To provide a complete economic model, the opportunity costs of using biomass for ethanol production were included in BioBreak. Research estimates for the opportunity cost of switchgrass and Miscanthus ranged between $70 and $318 per acre while estimates for nonspecific biomass opportunity cost ranged between $10 and $76 per acre, depending on the harvest restrictions under Conservation Reserve Program (CRP) contracts. Opportunity cost of woody biomass was estimated to range between $0 and $30 per dry ton. Depending on the region, the model assumed a mean opportunity cost of $50-$150 per acre for switchgrass and $75-$150 per acre for Miscanthus.6

Biomass Yield (YB)

Biomass yield is variable in the near and distant future due to technological advancements and environmental uncertainties. For simulation, the mean yield of corn stover was approximately 2 dry tons per acre. Switchgrass grown in the Midwest was assumed to have a distribution with a mean (likeliest) value around 4 (3.4) dry tons per acre on high-quality land and 3.1 dry tons per acre on low-quality land.7 Miscanthus grown in the Midwest was assumed to have a mean (likeliest) value of 8.6 (8) dry tons per acre on high-quality land and 7.1 (6) dry tons per acre on low-quality land.8 Switchgrass grown in the South-Central region has a higher mean yield of around 5.7 dry tons per acre. For the regions analyzed, the Appalachian region provides the best climatic conditions for switchgrass and Miscanthus with assumed mean (likeliest) yields of 6 (5) and 8.8 (8) dry tons per acre, respectively. Wheat straw, forest residues, and SRWC were assumed to be normally distributed with mean yields of 1, 0.5, and 5 dry tons per acre. First-year alfalfa yield was fixed at 1.25 dry tons per acre

(sold for hay value), while second-year yield was fixed at 4 dry tons per acre (50-percent leaf mass sold for protein value), resulting in 2 dry tons per acre of alfalfa for biomass feedstock during the second year.

Biomass Supplier Government Incentives (G)

For biomass supplier government incentives (G), the dollar for dollar matching payments provided in the Food, Conservation, and Energy Act of 2008 up to $45 per dry ton of feedstock for collection, harvest, storage and transportation is used, and it is denoted as “CHST.” The CHST payment was considered in the sensitivity analysis rather than the baseline scenario because the payment is a temporary (2-year) program and might not be considered in the supplier’s long-run analysis. Although the BioBreak model is flexible enough to account for any additional biomass supply incentives, the establishment assistance program outlined in the 2008 farm bill is not considered because implementation details were not finalized at the time the model was run.

______________

1Further detail and references for the parameters can be found in Appendix K.

2Harvest and maintenance costs were updated using USDA-NASS agricultural fuel, machinery, and labor prices from 1999-2007 (USDA-NASS, 2007a,b).

3 Based on a conversion rate of 0.59 dry tons per green tons.

4Northeast includes Pennsylvania, New Jersey, New York, Connecticut, Massachusetts, Rhode Island, Vermont, New Hampshire, and Maine. South refers to Delaware, Maryland, West Virginia, Virginia, North Carolina, South Carolina, Kentucky, Tennessee, Florida, Georgia, Alabama, Mississippi, Louisiana, Arkansas, Texas, and Oklahoma. States in the North region are Minnesota, Wisconsin, Michigan, Iowa, Missouri, Illinois, Indiana, and Ohio. West includes South Dakota, Wyoming, Colorado, New Mexico, Arizona, Utah, Montana, Idaho, Washington, Oregon, Nevada, and California.

5 Transportation costs were updated using USDA-NASS agricultural fuel prices from 1999-2007 (USDA-NASS, 2007a,b).

6 The corn stover harvest activity was developed for a corn-soybean rotation alternative and has no opportunity cost beyond the nutrient replacement cost. A continuous corn alternative, used by 10-20 percent of Corn Belt producers, was developed for corn stover harvest but not included in the BioBreak results presented in this report. The continuous corn production budgets, developed by state extension specialists, are always less profitable than corn-soybean rotation budgets with or without stover harvest. Continuous corn has an associated yield penalty or forgone profit (opportunity costs) relative to the corn-soybean rotation that occurs irrespective of stover harvest. Thus, a comparative analysis of stover harvest with a corn-soybean rotation and with continuous corn may be misinterpreted.

From the rotation calculator provided by the Iowa State University extension services with a corn price of $4 per bushel, a soybean price of $10 per bushel, and a yield penalty of 7 bushels per acre, the lost net returns to switching from a corn-soybean rotation to continuous corn equal around $62 per acre (ISUE, 2010).

7 Plot trials were evaluated at 80 percent of their estimated yield.

8This is a significantly lower assumed yield than previous research has assumed or simulated (Heaton et al., 2004; Khanna and Dhungana, 2007; Khanna, 2008; Khanna et al., 2008).

For this report, the BioBreak model was used to evaluate the cost and feasibility of seven different feedstocks: corn stover, alfalfa, switchgrass, Miscanthus, wheat straw, short-rotation woody crops, and forest residue.4 Corn stover was considered from a corn-soybean

______________

4 Although similar economic costs of biofuel were used in the NAS-NAE-NRC reports America’s Energy Future: Technology and Transformation (2009a) and Liquid Transportation Fuels from Coal and Biomass: Technological Status, Costs, and Environmental Impacts (2009b), the values differ for a number of reasons. First, the current biofuel cost estimates and biomass yield assumptions included several studies published since the earlier reports were completed. Second, the gasoline equivalent price of ethanol was revised based on improved statistical information. Third, the enzyme price assumptions used for hydrolyzing biomass in 2008 were no longer valid in 2010, and these prices were updated based on current estimates. Finally, the BioBreak model was improved with the addition of a Monte Carlo process to better reflect the distribution of observations from published studies underlying the parameters of the model.

rotation (CS).5 A 4-year corn stover-alfalfa rotation with 2 years of each crop (that is, CCAA) also was included. To account for regional variation in climate and agronomic characteristics, the WTP and WTA for switchgrass were evaluated in three regions: Midwest (MW), South-Central (SC), and Appalachia (App).6Miscanthus was also evaluated in the Midwest and Appalachian regions, while corn stover and wheat straw were assumed to be produced on cropland used for production in the Midwest and Pacific Northwest7 regions, respectively. To account for the heterogeneity in Midwest land quality, perennial grasses (switchgrass and Miscanthus) on high quality (HQ) and low quality (LQ) Midwest cropland were also considered. This is not an exhaustive list of potential feedstocks or of the potential variation in productivity across the United States, but it provides information on 13 combinations of the most widely discussed feedstocks in regions where they are likely to be produced. The 13 combinations evaluated were: corn stover (CS), stover-alfalfa, alfalfa, Midwest switchgrass (HQ), Midwest switchgrass (LQ), Appalachian switchgrass, South-Central switchgrass, Midwest Miscanthus (LQ), Midwest Miscanthus (HQ), Appalachian Miscanthus, wheat straw, short-rotation woody crops (SRWC), and forest residues.

BioBreak derives a point estimate of WTA, WTP, and the price gap for a biorefinery with a fixed capacity and a local feedstock supply area. The point estimates are based on a number of assumptions and a number of parameter inputs. Since many of these parameter inputs are uncertain, BioBreak uses Monte Carlo simulation to assess the implications of this uncertainty on the results.8 Monte Carlo simulation permits parameter variability, parameter correlation, and sensitivity testing not available in fixed parameter analysis.9 For this analysis, distributional assumptions for each parameter were based on empirical data updated to 2007 values and verified with industry information when available.10 If appropriate data were insufficient or not available, a distribution was constructed to fit available data or a range of industry values was obtained. A sensitivity analysis was then performed to determine importance. Monte Carlo simulation with parameter distributional assumptions captures the range of variability found in the estimates in the literature, which were used in this analysis. Boxes 4-1 and 4-2 summarize the equations used to calculate the biorefinery’s WTP and the biomass feedstock supplier’s WTA and the assumptions used in this committee’s analysis for the BioBreak model parameters. Appendix K provides further details about the assumptions for the feedstock supply costs. Summary tables of parameter assumptions used in the analysis are available in Appendix L, while Appendix M provides a review of the literature used to construct the parameter assumptions.

______________

5 Compared to a corn-soybean rotation, corn from continuous corn production has a yield penalty but produces more stover over the course of the rotation. If the price of stover were sufficiently high, a farmer could find it more profitable to switch to continuous corn production because the additional stover revenue would more than offset the yield penalty (that is, opportunity cost). Whether this would occur in practice is in dispute.

6 Midwest includes North Dakota, South Dakota, Nebraska, Kansas, Iowa, Illinois, and Indiana. South-Central applies to Oklahoma, Texas, Arkansas, and Louisiana. Appalachian refers to Tennessee, Kentucky, North Carolina, Virginia, West Virginia, and Pennsylvania.

7 Washington, Idaho, and Oregon.

8 For the Monte Carlo simulations, BioBreak uses Oracle’s spreadsheet-based program Crystal Ball®.

9 See NAS-NAE-NRC (2009b) for an example of BioBreak applied in a fixed parameter analysis.

10 Costs were updated using USDA-NASS agricultural prices from 1999-2007 (USDA-NASS, 2007a,b).

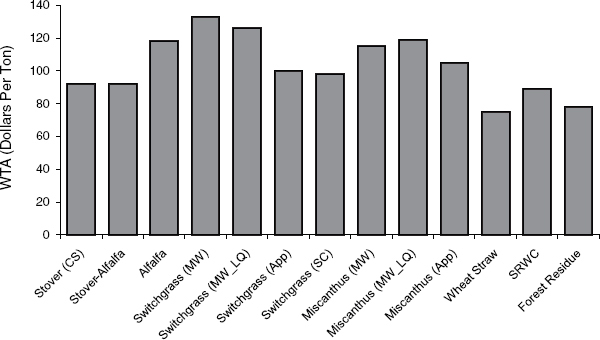

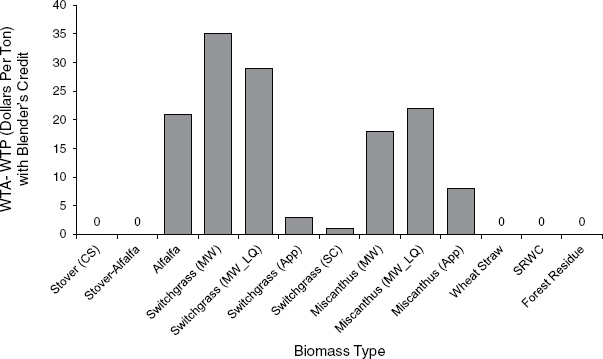

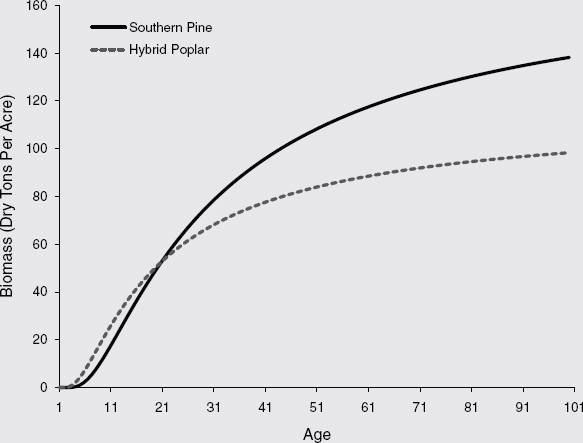

FIGURE 4-1 Biomass supplier WTA per dry ton projected by BioBreak model.

NOTE: Baseline scenario (no policy incentives, $111/barrel oil, 70 gallons per dry ton).

WTA

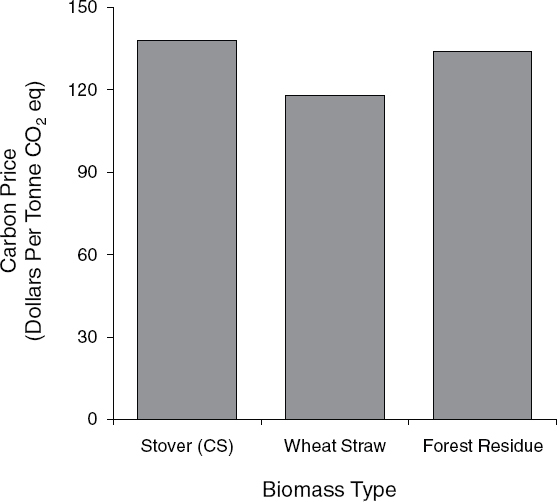

Given the parameter assumptions and an oil price of $111 per barrel, the biomass supplier’s average cost or WTA per ton of biomass delivered to the biorefinery ranges between $75 per dry ton for wheat straw in the Pacific Northwest to $133 per dry ton for switchgrass grown on high-quality land in the Midwest. Figure 4-1 provides the supply cost per dry ton for all 13 feedstock-rotation combinations in the analysis.11 Regional characteristics play a significant role. Switchgrass and Miscanthus grown on high-quality Midwest cropland have relatively high costs because of high land opportunity costs and lower yields relative to the Appalachian and South Central regions.

BioBreak derives the price gap between the biomass producer’s supply cost and the processor’s derived demand for biomass delivered to the biorefinery. Table 4-1 provides the biofuel processor’s WTP, biomass supplier’s WTA, and the price gap given the parameter assumptions and no policy incentives (for example, no blender’s tax credit or supplier payment).

This analysis ignores that RFS2, which requires that any cellulosic biofuel produced up to the mandated quantity be consumed, could influence feedstock producers and investors’ decision-making. Indeed, suppliers might be willing to invest in biofuel facilities irrespective of the economics described here if the consumption mandate of RFS2 is perceived as being rigid because the mandate provides a market for the biofuel. If the mandate is not perceived as being rigid, it will be difficult to induce private-sector investment. The complexities in the mechanisms for renewable identification numbers (RINs) for cellulosic

______________

11 The parameter draws and calculations were repeated 10,000 times resulting in 10,000 values for WTP, WTA, and the difference value (WTP-WTA) for each scenario. The value provided is the mean over the 10,000 calculations for each feedstock.

TABLE 4-1 BioBreak Simulated Mean WTP, WTA, and Difference per Dry Ton Without Policy Incentives

| WTA | WTP | WTA-WTP (per dry ton) | Price Gap in Dollars per Gallon of Ethanol | Price Gap in Dollars per Gallon of Gasoline Equivalent | |

| Stover (CS) | $92 | $25 | $67 | $0.96 | $1.43 |

| Stover-Alfalfa | $92 | $26 | $66 | $0.94 | $1.42 |

| Alfalfa | $118 | $26 | $92 | $1.31 | $1.97 |

| Switchgrass (MW) | $133 | $26 | $106 | $1.51 | $2.28 |

| Switchgrass (MW_LQ) | $126 | $27 | $99 | $1.41 | $2.13 |

| Switchgrass (App) | $100 | $26 | $74 | $1.06 | $1.59 |

| Switchgrass (SC) | $98 | $26 | $72 | $1.03 | $1.53 |

| Miscanthus (MW) | $115 | $26 | $89 | $1.27 | $1.90 |

| Miscanthus (MW_LQ) | $119 | $27 | $93 | $1.33 | $1.98 |

| Miscanthus (App) | $105 | $27 | $79 | $1.13 | $1.69 |

| Wheat Straw | $75 | $27 | $49 | $0.70 | $1.04 |

| SRWC | $89 | $24 | $65 | $0.93 | $1.39 |

| Forest Residues | $78 | $24 | $54 | $0.77 | $1.16 |

NOTE: Oil price is assumed to be $111 per barrel and conversion efficiency of biomass to fuel is assumed to be 70 gallons per dry ton.

biofuels could lead investors to conclude the cellulosic mandate is not rigid (see Chapter 6 for further discussion of RINs).

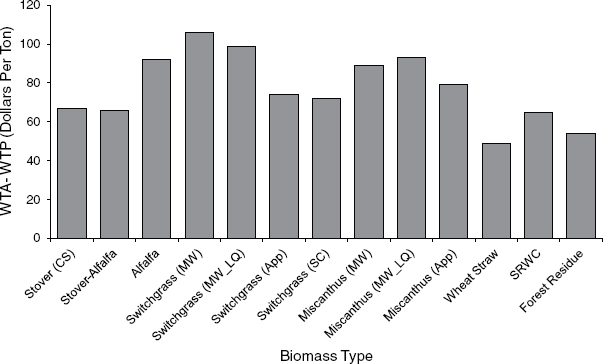

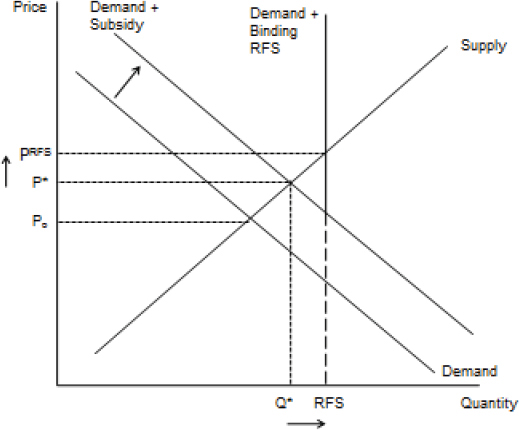

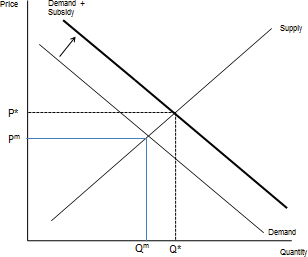

Without policy intervention, no feedstock market is feasible in economic terms in the baseline scenario. The price gap that would need to be closed to sustain a feedstock market ranges between $49 per dry ton for wheat straw to $106 per dry ton for switchgrass grown on high-quality land in the Midwest. Figure 4-2 provides a graphical depiction of the price gap for all 13 feedstock-rotation combinations (see also Box 4-3).

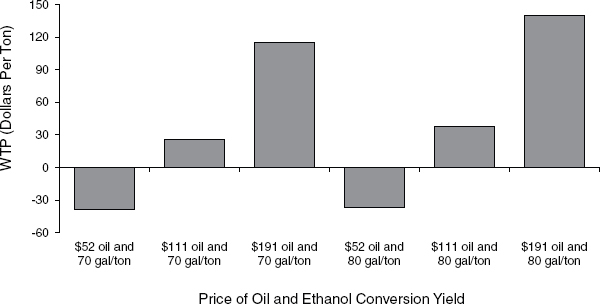

The breakeven values and resulting price gaps depicted in Figure 4-2 are sensitive to assumptions and parameters used in the analysis. One key parameter in the BioBreak model is the price of oil (see Box 4-1). The price of oil drives the processor’s derived demand for feedstock given biomass conversion cost and influences biomass supply cost through production costs. An increase (decrease) in the price of oil increases (decreases) what the processor can pay per dry ton of each feedstock and break even in the long run. At the same time, an increase (decrease) in the oil price increases (decreases) harvest and transportation costs resulting in a higher (lower) biomass supplier long-run breakeven cost. Given the assumptions, the effect on the processor’s derived demand price from an oil price change dominates the effect on the biomass supply cost. Therefore, the price gap (WTA – WTP) decreases with higher oil prices and vice versa.

The results in Table 4-1 and Figures 4-1 and 4-2 assume an oil price of $111 per barrel. At an oil price of $191 per barrel, the price gap is eliminated for several feedstocks, including stover (CS), switchgrass (App, SC), Miscanthus (App), wheat straw, SRWC, forest residue, and stover-alfalfa. Remaining feedstocks have a price gap between $5 and $23 per dry ton. Correspondingly, the price gap increases to between $110 and $168 per dry ton of biomass with an oil price of $52 per barrel. The breakeven price is also sensitive to the conversion rate of biomass to ethanol. The baseline results assume a conversion rate of 70 gallons per dry ton

FIGURE 4-2 Gap between supplier WTA and processor WTP projected by BioBreak model.

NOTE: No policy incentives (WTA – WTP, $111 per barrel oil, 70 gallons per dry ton).

of biomass for all types of feedstocks (see Box 4-1), but potential advances in the conversion process may increase this rate. An increase in the biomass conversion rate increases the biorefinery returns per unit of feedstock converted and therefore reduces the price gap. Figure 4-4 provides sensitivity results of the processor WTP for South-Central switchgrass to the price of oil and conversion rate. Sensitivity results for other feedstocks are similar.

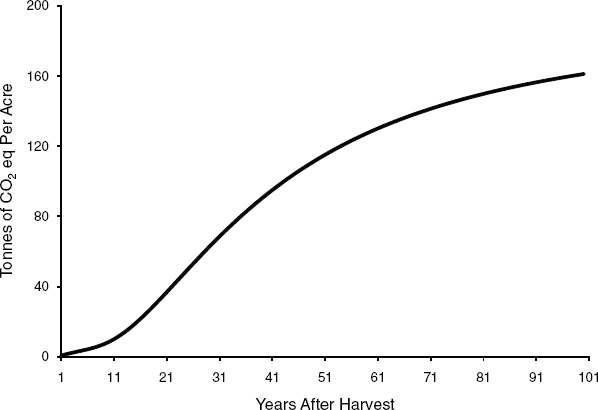

The results presented above assume no policy incentives. Any policy incentives for either the processor or supplier will decrease the price gap needed for market viability. The 2008 farm bill provides a $1.01 per gallon tax credit to cellulosic biofuel blenders. Figure 4-5 displays the price gap when the blender’s credit is included. Given the blender’s tax credit, the price gap drops significantly, resulting in viable feedstock markets for stover (CS), stover-alfalfa, wheat straw, SRWC, and forest residues (that is, WTP > WTA or WTA – WTP < 0). The remaining feedstocks have a gap between $1 and $35 per dry ton. Similarly, any policy incentive to suppliers, such as the U.S. Department of Agriculture’s (USDA’s) Biomass Crop Assistance Program in the 2008 farm bill, which provides payments for establishing bioenergy crops and collecting biomass, would further decrease the price gap and, given BioBreak’s baseline assumptions, result in viable feedstock markets for all feedstocks in the analysis (for more on the Biomass Crop Assistance Program, see Box 4-4 in section “Potential Changes Caused by Biofuel Policy”). Policy incentives for carbon emissions could also affect the price gap (as discussed later in the section “Interaction of Biofuel Policy with Possible Carbon Policies”).

One benefit of using Monte Carlo simulation to derive the breakeven values is the ability to capture the variability found in the literature for each parameter in the model. For the BioBreak application presented here, the Monte Carlo simulation was conducted using

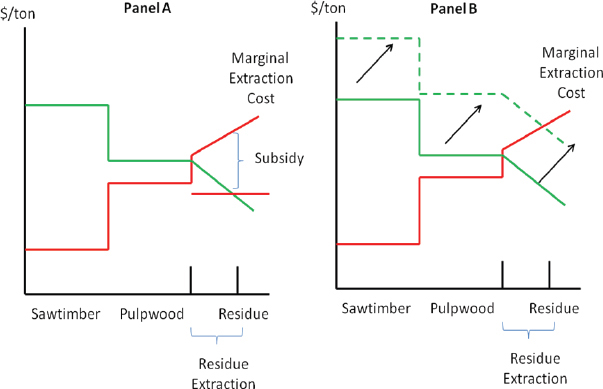

BOX 4-3

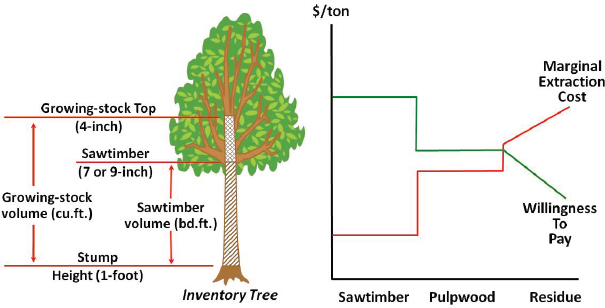

Gap in Forest Residue Demand and Supply

The market for forest residue exemplifies the gap between WTP and WTA for cellulosic feedstock. Many existing studies assume that a large proportion of wood will be available for cellulosic ethanol production through harvesting of residues. However, these studies often ignore the likely costs of extracting residues. Figure 4-3 shows that, in most cases, forest residues are not collected because the costs of extracting additional residues are likely to be high relative to the value. Figure 4-3 also shows the marketable components of a typical tree. The bole of the tree is the main marketable log from the stump at the bottom up to a diameter of 7 inches or so. This material typically is cut into lumber of some sort, depending on the form of the tree. From 7 inches or so up to around 4 inches, the main log of the tree is likely used as pulpwood. The additional stems at the top of the tree, the branches, and the leaves have traditionally been left as slash in the forest. The reason these components have been left as slash is largely economic—the cost of extracting this additional material is greater than the value of selling it. As shown in the right hand side of Figure 4-3, WTP for sawtimber is typically much higher than the marginal cost of extracting the large stems. WTP for extracting pulpwood, however, is close to, or equal to, the marginal cost of extracting the pulp component of timber, and WTP for biomass material is less than the marginal cost of extracting the additional material.

FIGURE 4-3 Components of trees and their use and value in markets.

NOTE: Sawtimber represents the largest part of the stump, up to about 9 inches in diameter. Pulpwood represents the rest of the stump up to 4 inches. The remainder is residue (often referred to as “slash”).

SOURCE: Adapted from Figure 8 in Perlack et al. (2005).

10,000 draws from the assumed distribution for each parameter. From each draw, WTA, WTP, and the price gap were calculated for each feedstock. The results presented so far have been the mean values over all 10,000 calculations. Using the distributional assumptions outlined in Appendix L, which are based on literature summarized in Appendix M, Table 4-2 provides the estimated WTA value for each feedstock at select percentiles over the 10,000 Monte Carlo simulations at an oil price of $111 per barrel. The values in Table 4-2 provide a sensitivity range for the breakeven feedstock supply cost based on the parameter variation found in the literature.

NOTE: WTA – WTP under the assumptions of $111 per barrel of oil and a biomass to fuel conversion efficiency of 70 gallons per dry ton.

TABLE 4-2 BioBreak Simulated WTA Value Without Policy Incentives by Percentile

| 10% | 25% | 40% | MEAN | 60% | 75% | 90% | |

| Stover (CS) | $81 | $87 | $91 | $92 | $95 | $97 | $101 |

| Stover-Alfalfa | $87 | $89 | $91 | $92 | $93 | $95 | $97 |

| Alfalfa | $114 | $116 | $118 | $118 | $119 | $120 | $122 |

| SG (MW) | $109 | $118 | $125 | $133 | $135 | $144 | $159 |

| SG (MW_LQ) | $115 | $121 | $124 | $126 | $128 | $132 | $136 |

| SG (App) | $87 | $93 | $97 | $100 | $102 | $107 | $115 |

| SG (SC) | $85 | $90 | $93 | $98 | $98 | $103 | $112 |

| Misc (MW) | $102 | $109 | $113 | $115 | $118 | $122 | $127 |

| Misc (MW_LQ) | $99 | $107 | $113 | $119 | $121 | $129 | $142 |

| Misc (App) | $91 | $98 | $103 | $105 | $108 | $113 | $119 |

| Wheat Straw | $65 | $70 | $73 | $75 | $77 | $80 | $86 |

| Farmed Trees | $78 | $83 | $86 | $89 | $91 | $94 | $100 |

| Forest Residue | $68 | $73 | $76 | $78 | $80 | $83 | $88 |

NOTE: Oil price is assumed to be $111 per barrel and conversion efficiency of biomass to fuel is assumed to be 70 gallons per dry ton.

Comparing Feedstock Cost Estimates of the BioBreak Model with Other Studies

The cost estimates generated by the model are highly dependent on the assumptions used and the parameters considered. The way costs are treated and the comprehensiveness of which economic costs are included in the biomass supply chain and in ethanol processing varies by study. For example, the U.S. Billion-Ton Update: Biomass Supply for a Bioenergy and Bioproducts Industry (Perlack and Stokes, 2011) relies on the University of Tennessee’s POLYSYS modeling system to estimate the marginal cost for supplying biomass to range from $40-$60 and average about $50 per dry ton of harvested biomass at the farm gate. BioBreak costs for wheat straw to the farm gate average about $40 per dry ton, corn stover about $55-$60 per dry ton, and switchgrass in the Appalachian and South Central Regions about $65 per dry ton without land opportunity costs included and $80 with land opportunity costs. Preliminary results indicate that much of the switchgrass would be produced on converted pasturelands that would have low opportunity costs. Handling, possibly drying, storing, and transporting low-density dry biomass to the biorefinery is a logistical challenge and costly (see Chapter 6).

Another study by Khanna et al. (2010) developed costs of production for corn stover, wheat straw, Miscanthus, and switchgrass for a number of potential producing states and then used these costs of production to develop biomass supply curves. Again, these were comprehensive costs at the farm gate that included land opportunity costs and were developed for the low-cost scenario assuming the availability of CRP land on which to produce switchgrass and Miscanthus. Farm-gate low-cost scenario estimates ranged from $44 to over $110 per dry ton for Miscanthus and $55 to $105 per dry ton for switchgrass. The high-cost scenarios were higher than those reported for BioBreak above. Corn stover estimates ranged from a low of $63 for no-till CS rotation to a low of $99 per dry ton for conventional till with median values of over $110 per dry ton for both CS tillage options. Again, the costs reported from the Khanna et al. (2010) did not include costs beyond the farm gate for transportation and storage.

The biomass cost estimates derived using the BioBreak model are typically higher than most similar studies because the model is inclusive of all economic costs (including opportunity costs of land) involved in producing, harvesting, storing, and delivering the last dry ton of biomass to the biofuel processing facility through the biomass supply chain.

Likewise, the biomass conversion costs account for all long-run costs in processing biomass to ethanol and include coproduct returns from a biorefinery of given capacity.

Finally, most studies assume biomass production costs are independent of crude oil prices; however, there are two factors that cause biomass production costs to increase as crude oil prices increase. First, part of the variability in crude price is due to the value of the dollar relative to other currencies. This same effect has been shown to influence crop prices (Abbott et al., 2009). Any increase in crude price caused by a devalued dollar would also increase opportunity costs for the land and fuel-based biomass production costs. It would also raise the demand for biofuels. Second, a portion of the cost of harvest, transportation, and nutrient replacement is related to the cost of fossil fuels. This concurrent increase in biomass cost would increase the apparent crude price at which biofuels would become cost competitive. The BioBreak model has attempted to incorporate these price effects on WTA.

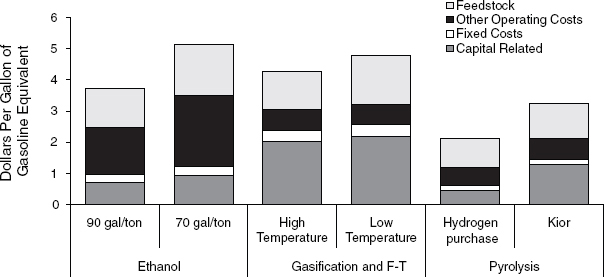

Cost of Converting Cellulosic Biomass to Liquid Fuels

As mentioned earlier, along with the cost of harvesting and transporting biomass to a biorefinery is the cost of converting it into fuel. No commercial-scale facilities currently exist for the production of liquid fuels from cellulosic biomass. The conversion cost data used in the BioBreak analysis are based on laboratory or pilot-scale performance information and estimated investment and operating cost data for an optimized nth biorefinery that uses biochemical conversion of corn stover to ethanol (Aden et al., 2002). A recent report by Anex et al. (2010) compared the cost to produce liquid biofuels biochemically and thermochemically. The report examined the costs of fermentation to produce ethanol, fast pyrolysis to produce a gasoline or diesel “drop-in” fuel, and gasification and Fischer-Tropsch (F-T) to produce a gasoline or diesel “drop-in” fuel. Because the three technologies produce fuels with different energy contents, the results are presented in terms of gallons of gasoline equivalent. RFS2 is written in terms of gallons of ethanol equivalent, so a lesser volume of “drop-in” fuels from pyrolysis or F-T based technologies are required to satisfy RFS2. (See Table 1-1 in Chapter 1.) The study was based on a consistent biorefinery size of 2,205 dry tons per day of corn stover. All capital and operating costs are referenced to 2007. Corn stover is priced at $75 per dry ton, delivered to the biorefinery on a year-round basis. The only significant products from the biorefinery are the liquid fuel and electricity or gaseous fuel generated from the unconverted biomass. A required selling price for the liquid fuel is calculated to give a 10-percent discounted cash flow rate of return on a fully equity-financed project with a 20-year life.

The cellulosic ethanol costs in the paper were based on the equipment in a 2002 study by the National Renewable Energy Laboratory (NREL) (Aden et al., 2002), updated to 2007 construction and cellulase costs. The Anex et al. study (2010) used a nominal ethanol yield of 68 gallons per dry ton of biomass, which was the maximum demonstrated yield at the time the study was conducted and is close to the yield that this committee uses in the BioBreak analysis.

The gasification and F-T economics in Anex et al. (2010) are based on an NREL report prepared by Swanson et al. (2010). Two cases were evaluated: A high-temperature (HT), entrained flow, slagging gasification system and a lower temperature, fluidized bed, non-slagging gasification system. The HT system produces more fuel per ton of biomass, but its capital cost is higher. Overall cost to produce is slightly lower for the HT case because of the higher liquid yield. Biomass gasification has been attempted by several groups at

the pilot scale. Operational difficulties have been encountered, but the gasification and F-T technology are well established for coal. Therefore, the cost data and yields for the gasification and F-T scheme can be considered reasonably reliable once the operational difficulties are overcome.

The fast pyrolysis economics are based on Wright et al. (2010). Fast pyrolysis of biomass for fuel production is a relatively new technology with little published information on yields, potential operational problems, or required equipment. The process uses equipment that is common in the petroleum refining industry, such as hydroprocessing, hydrocracking, hydrogen production, and high-temperature solids circulation similar to the fluid catalytic cracking process.

Kior, a privately funded company that is developing catalytic pyrolysis technology, submitted a Form S-1 to the U.S. Securities and Exchanges Commission (Kior, 2011) that contained additional information on capital requirements and overall yields. The technology and equipment proposed by Kior are similar to that used in the Wright et al. (2010) study, except that Kior has included a boiler and turbogenerator system to convert the off-gas and excess char into electricity. The capital costs included in Wright et al. were much lower than those reported by Kior. Although the boiler and turbogenerator represent a large capital investment, they are required to recover the energy contained in the nonliquid products as in the case of ethanol biorefineries. The Kior capital estimate is for a first-of-its-kind facility and its current usage is closer to an nth plant than a pioneer plant, but it is based on a fully developed cost estimate prepared by a major engineering company. In contrast, Wright et al.’s cost estimate is a “scoping quality” estimate for a fully developed technology. When adjusted to the same feed rate using a 0.6 scaling factor, capital cost estimated by Wright et al. was 43 percent of the capital cost estimated by Kior. Wright et al. (2010) acknowledged that some aspects of technology, such as solids removal from the pyrolysis oil, have yet to be developed and demonstrated.

The cases reported by Wright et al. (2010) and Kior (2011) were evaluated. The raw pyrolysis oil has to be hydrotreated before it can be used as a fuel. The two cases in Wright et al. (2010) differ in the source of hydrogen used to hydrotreat the pyrolysis oil. In the first case, part of the pyrolysis oil is used as feedstock to an on-site hydrogen plant to produce hydrogen. In the second case, hydrogen is purchased from an off-site plant that uses natural gas to produce the hydrogen. Producing hydrogen on site from bio-oil product lowers the liquid yield and increases the capital cost for the project. Kior’s case is similar to the hydrogen purchase case by Wright et al. (2010), with the exception of the capital costs (as discussed earlier) and yield estimates.

The pertinent information from the published studies is summarized in Table 4-3 along with a calculation of the number of biorefineries and capital investment required, the number of acres of land necessary to produce the biomass (assuming all biomass for bioenergy comes from dedicated bioenergy crops), and the annual subsidies that would be required to support the industry at various crude oil prices. Table 4-3 demonstrates that catalytic pyrolysis and fast pyrolysis are promising technologies; they can produce “drop-in” products that are compatible with the existing petroleum distribution system. However, pyrolysis still requires substantial research and development before it is economically viable without subsidies.

The three crude prices used in Table 4-3 to calculate subsidies are from the three crude price scenarios for 2022 listed in the 2010 Annual Energy Outlook (EIA, 2010a). Only the high crude price scenario eliminates the need for subsidies to support a biofuel industry. All other price scenarios require either subsidies for the biofuel industry or additional taxes on petroleum products to narrow the price gap between petroleum fuels and biofuel. Without

TABLE 4-3 Summary of Economics of Biofuel Conversion

| Ethanol | Gasification and F-T | Pyrolysis, Hydrogen Purchase | ||||

| 90 Gallons Per Dry Ton |

70 Gallons Per Dry Ton |

High Temp | Low Temp | High Yield | Kior | |

| Single Plant Capital, Million Dollars | 380 | 380 | 606 | 498 | 200 | 463 |

| Fuel Produced, Million Gallons Per Year | ||||||

| Million Gallons Per Year | 69.5 | 52.4 | 41.7 | 32.3 | 58.2 | 43.1 |

| Million Gallons of Gasoline | 46.3 | 34.9 | 41.7 | 32.3 | 58.2 | 48.9 |

| Equivalent Per Year | ||||||

| Cost to Produce | ||||||

| Nth Plant | 375 | 500 | 430 | 480 | 210 | 324 |

| Pioneer Plant | 650 | 850 | 800 | 750 | 350 | N/A |

| Number of Plants to Meet 16 billion gallons of ethanol-equivalent biofuels in 2022 | 230 | 305 | 256 | 331 | 183 | 218 |

| Capital Costs Required to Meet RFS2, Billion Dollars | 88 | 116 | 155 | 165 | 37 | 101 |

| Price Gap, Billion Dollars Per Year | ||||||

| At $52 Per Barrel | 25 | 39 | 31 | 37 | 8 | 20 |

| At $111 Per Barrel | 10 | 24 | 16 | 21 | -7 | 5 |

| At $191 Per Barrel | -10 | 3 | -4 | 1 | -28 | -16 |

| Biomass Feed Requirements | ||||||

| Million Dry Tons Per Year | 178 | 236 | 175 | 226 | 133 | 159 |

| Million Acres at 5 Tons Per Acre | 36 | 47 | 35 | 45 | 27 | 32 |

SOURCES: Aden et al. (2002); Anex et al. (2010); R. Anex (University of Wisconsin, Madison, personal communication on August 23, 2011); Swanson et al. (2010); Wright et al. (2010).

these subsidies or taxes, the biofuel industry would not expand to meet RFS2 requirements. An increase of $25 per dry ton in the price of biomass increases the annual subsidies required by $5 billion to $10 billion per year. Figure 4-6 shows a graphical breakdown of the production costs.

The capital-related costs in Figure 4-6 include the average depreciation and the assumed 10-percent return on investment for the 20-year life of the project. In the discounted cash flow analysis used to develop these costs, the capital charges are higher in the early years of the project and decline throughout the life of the project. The per-gallon, capital-related operating costs are determined by dividing this average annual effective cost of capital (depreciation plus return on investment) by the annual fuel production. The annual effective cost of capital varies from 12 to 14 percent of the total capital investment for the various projects. Another way of defining these costs is to assume they are an effective capital recovery factor for the capital investment. This range of capital recovery factors would give an effective rate of return of about 12 percent for a 20-year project.

FIGURE 4-6 Breakdown of biomass conversion costs.

The 10-percent after-tax rate of return used in these studies is probably on the low side of returns that would be required to attract capital for a new, high-risk project. The economics also assume that the project is fully equity financed. None of these projects has yet to be demonstrated commercially, implying that they are high-risk investments. High-risk investments usually require higher returns or leveraging (borrowing) of capital to reduce the risk. Either of these would increase the effective cost of capital for at least the early projects, so the total production cost numbers are probably low.

The costs in Table 4-3 and Figure 4-6 are pre-tax wholesale costs at the biorefinery gate. “Drop-in” fuels, such as those produced by pyrolysis and gasification and F-T, can use the existing petroleum infrastructure for delivery to the final consumer. Transportation and distribution costs for drop-in fuels would be similar to current petroleum products transportation costs of $0.02-$0.05 per gallon. Cellulosic ethanol would continue to be shipped by rail, barge, and truck for blending at the final distribution point with costs of $0.10-$0.50 per gallon. Construction of an ethanol pipeline system would reduce transportation costs but would require additional capital investment. Nominal pipeline construction costs typically exceed $1 million per mile (Smith, 2010).

Producing enough biomass to meet RFS2 could require 30-60 million acres of land, excluding the high yield, hydrogen-purchase pyrolysis case in Table 4-3. If all biomass for cellulosic biofuels is produced from dedicated energy crops, the amount of land needed would be at the high end of the estimate. The use of corn stover, wheat straw, other crop residues, and forest residues would reduce the amount of acres needed.

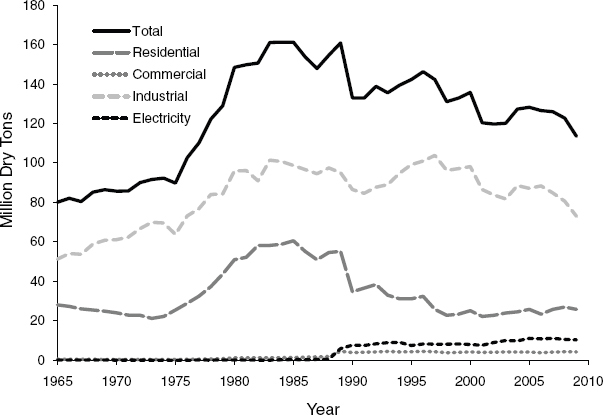

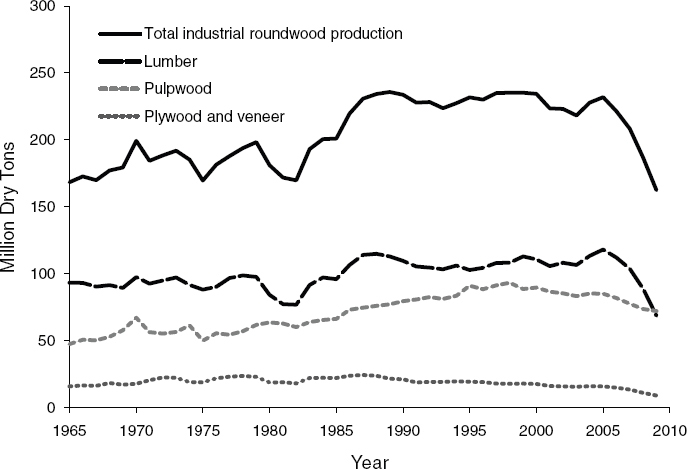

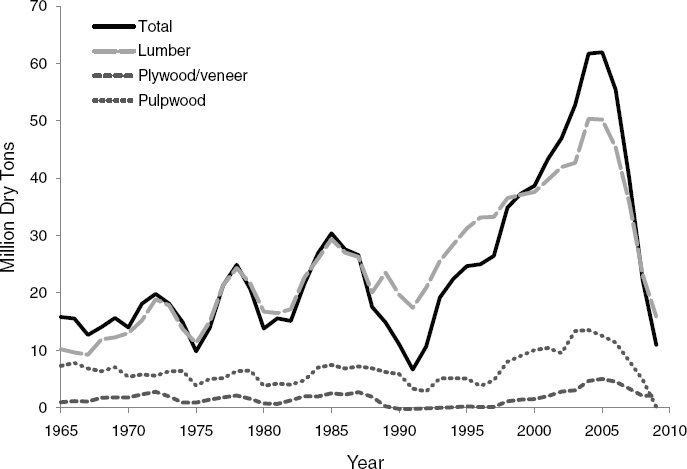

PRIMARY MARKET AND PRODUCTION EFFECTS OF U.S. BIOFUEL POLICY

Because RFS2 creates another market for crops, particularly for corn, and a possible incentive to shift land from food crops to biomass feedstocks, the mandate has repercussions for related commodity markets. The prices of grain and oilseed crops, food, animal feed, and wood products have all experienced upward pressure coinciding with the rapid expansion of the biofuel market. Coproducts from biofuel have also introduced competition in feed

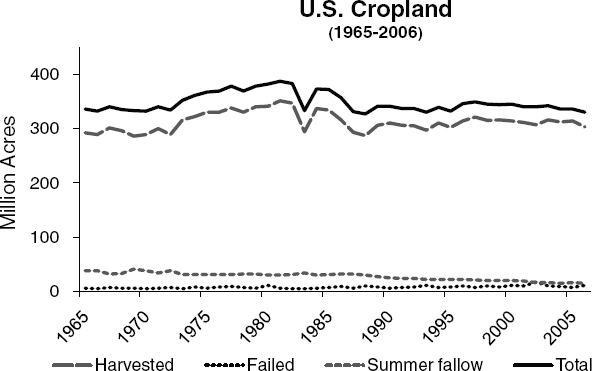

FIGURE 4-7 Allocation and use of U.S. cropland from 1965 to 2006.

DATA SOURCE: USDA-ERS (2007).

markets. Increasing biofuel in the transportation fuel market could affect domestic gasoline and diesel prices. Demand for feedstocks to meet traditional needs and those of the biofuel market increases competition for land. Although several attempts have been made to tie price and resource use effects to biofuel expansion, there is little agreement in the economic literature about the effects that can be attributed to biofuel expansion. Therefore, this section presents what has happened recently to resource prices and use relative to biofuel expansion rather than a cause-and-effect empirical analysis of biofuel expansion.

Agricultural Commodities and Resources

This section reviews the primary feedstuff and food crops, market series, and cropland resource base published by the U.S. Department of Agriculture (USDA) National Agricultural Statistics Service (NASS). Figure 4-7 provides an indication of what has happened over time to total cropland and total harvested cropland. Both series peaked in 1981 and have slowly trended downward through 2006 to about 300 million acres, with reportedly a slight increase since 2006. There has been concern over land-use change associated with the expansion of the biofuel industry. The continuous reallocation of existing cropland along with productivity growth has supported increased output even though overall cropland acres are decreasing in the United States. However, that may not be the case in other parts of the world.

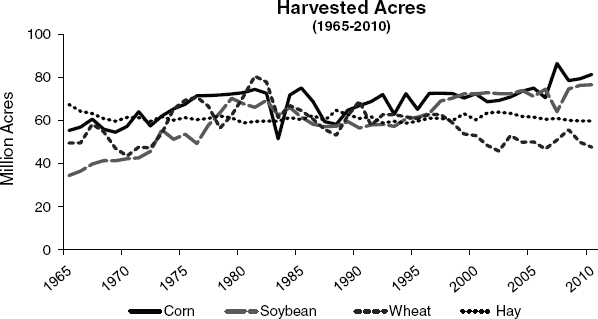

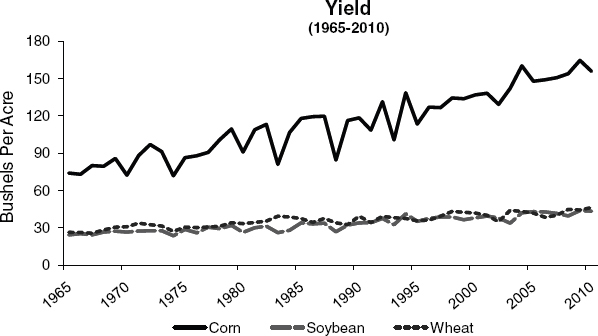

Changes in production levels follow changes in demand for and net returns to certain crops. The major field crops in terms of harvested acreage are corn, soybean, wheat, and hay (Figure 4-8). As Figure 4-8 indicates, domestic acreage for corn and soybean has been increasing, hay acreage has been relatively constant, and wheat acreage has been declining.

FIGURE 4-8 Harvested acres of corn for grain, soybean (all), wheat, and hay (all) from 1965 to 2009.

DATA SOURCE: USDA-NASS (2010).

These adjustments are in response to differences in relative commodity prices and differences in yield and productivity growth affecting net returns on these crops over time.

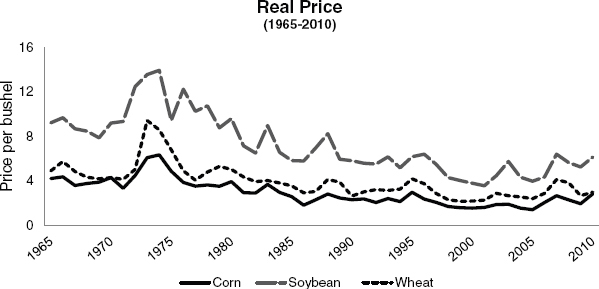

When considering agricultural commodity prices over time, media sources frequently refer to nominal prices, abstracting from the temporal impacts of inflation on prices. Although substantial nominal price shocks occurred in the mid-1970s and again in the beginning of 2006, it is important to remove inflationary impacts on prices or to convert from nominal to real prices by using an appropriate deflator as presented in Figure 4-9. Despite short-run price shocks, real commodity prices have been decreasing over the long run as a result of total factor productivity growth in the agricultural sector. Real price shocks for corn, soybean, and wheat were concurrent with higher oil real prices in the mid-1970s. Beginning in 2006, real commodity prices have tended to demonstrate increased fluctuation but modest overall increases.

Several attempts have been made to link real price changes to increased feedstock demand for biofuels, but results vary significantly between studies (see also the section “Food Prices” later in this chapter). U.S. demand for corn as an ethanol feedstock accounts for more than 40 percent of crop use (even though one-third of the grain weight is returned as a feedstuff source in dried distillers grains with solubles [DDGS]). All other things equal, corn prices will increase if there is increased corn demand for ethanol production. However, the magnitude of the price effect is not clearly established (see also “Effect of Short-term Price Spikes on Livestock Producers” in this chapter) and depends on several factors, such as biofuel expansion, drought, flooding, crop failures, exchange rate shifts, government price supports, and trade restrictions. In the short run, increased corn feedstock demand may cause a substantial corn price shock, but, in the long run, production resources will shift to increase corn supply and moderate price increases.

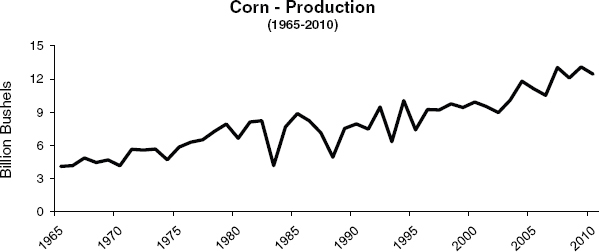

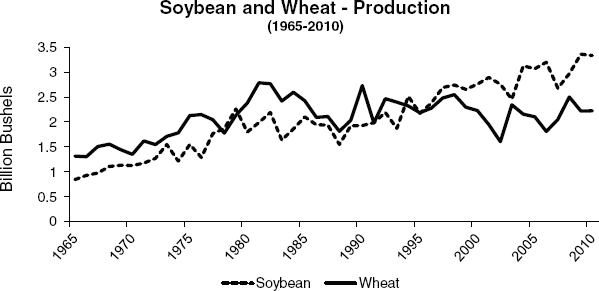

Figures 4-10 and 4-11 provide an indication of how production has shifted in the United States in the three major commodity crops from the 1965 to 2010 crop years. The production

FIGURE 4-9 Real prices for corn, soybean, and wheat from 1965 to 2010 crop year.

NOTE: 1990-1992=100.

DATA SOURCE: Price index for Producer Prices Paid Index from USDA-NASS and USDA-ERS.

FIGURE 4-10 U.S. corn-grain production from 1965 to 2010 crop year.

DATA SOURCE: USDA-NASS (2010).

of corn and soybean has been increasing significantly over time, while wheat production peaked in 1981 and has been slowly declining, although with significant annual fluctuation up to the 2010 crop year.

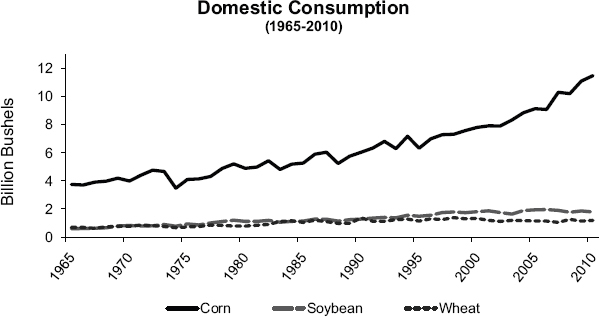

At the same time, Figure 4-12 indicates that domestic consumption of corn has increased significantly. The increase in corn production began in 1975 (well before the demand for biofuel). Thus, in addition to the demand for biofuel, the increase in domestic consumption of corn can be attributed to increases in feed and residual use (USDA-NASS, 2010). Domestic consumption of soybean, possibly affected by the demand for soybean

oil as a biodiesel feedstock, has held steady. Domestic wheat consumption has remained relatively flat in recent years.

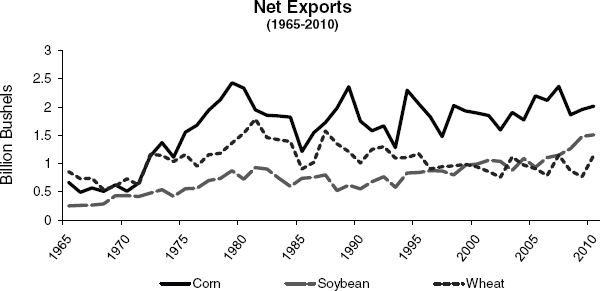

Another perspective on how biofuel production is affecting the domestic and global markets is to view patterns in U.S. net exports of corn, soybean, and wheat. It could be argued that net exports would decline, especially with increasing domestic consumption of corn, and to a lesser extent of soybean oil, for biofuel feedstock. Figure 4-13 indicates that

FIGURE 4-11 U.S. soybean and wheat (all) production from 1965 to 2010 crop year.

DATA SOURCE: USDA-NASS (2010).

FIGURE 4-12 U.S. domestic consumption of corn, soybean, and wheat from 1965 to 2010 crop year.

DATA SOURCE: USDA-NASS (2010).

FIGURE 4-13 U.S. net exports of corn, soybean, and wheat from 1965 to 2010 crop year.

NOTE: Total year exports minus total year imports.

DATA SOURCE: USDA-FAS (2010).

FIGURE 4-14 Annual yields for corn grain, soybean, and wheat from 1965 to 2010 crop year.

DATA SOURCE: USDA-NASS (2010).

net corn exports have held fairly steady, net soybean exports have actually increased, and wheat exports have declined, while yields have been steadily increasing for all three crops, as shown in Figure 4-14.

What accounts for the increase in corn and soybean production and the gradual decline in wheat production? Essentially, market forces determine the allocation of resources.

Producers select the most profitable combination of crops to produce on the cropland acres they farm. The prices, yields, seed technology, and government programs make corn and soybean more profitable than wheat. In addition, income improvement and diet adjustments in developing countries create growing demand for feed grains and oilseeds to produce animal products as well as biofuels.

In summary, the committee made the following observations on what is happening in U.S. agricultural commodity markets and resource use. First, cropland acreage has been declining slowly over time. Second, shifts in acreage for grain and oilseed crops were under way before the advent of biofuel expansion even though biofuel expansion and growing export demand have encouraged the shift in recent years.

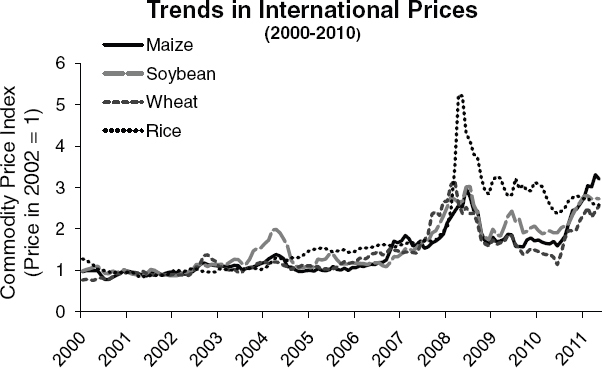

Food Prices

The diversion of land to corn production and a greater demand for corn from the biofuel industry discussed in the previous section coincided with an aberrant rise in food prices in the mid-2000s. Between 2004 and 2008, the price of the staple commodities (wheat, corn, soybean, and rice) grew an average of 102 percent (Figure 4-15) (IMF, 2010). Even though real prices had been at an all-time low in the late 1990s and early 2000s (Babcock et al., 2010), the rapid nature of the increase was disruptive to food processors and to households. The Food Consumer Price Index (CPI), calculated by USDA’s Economic Research Service, increased from 2.4 percent in 2006 to 4 percent in 2007 and grew a further 5.5 percent in 2008 (USDA-ERS, 2011b). Food banks and international development organizations expressed

FIGURE 4-15 Trends in real international prices of key cereals: 1960 to May 2008.

SOURCE: Adapted from Abbott et al. (2011).

particular concern for households that allocated a large percentage of income to food (Crompton, 2008; Lustig, 2008; Reinbold, 2008; von Braun, 2008; Wiggins and Levy, 2008).

During this commodity price spike, which peaked between 2007 and 2009, controversy ensued over the role of increased ethanol production in increased food prices. However, much of the debate used the term “food prices” in an imprecise and often contradictory manner. Specifically, some analysis of that period focused on the effect of ethanol production on raw agricultural commodity prices at either the farm level or the international market level. Other analysis focused on the effect of ethanol production on prices of processed food products at the consumer retail level. Frequently, both types of analysis were reported to the public under the label of “the effect on food prices.”

As discussed below, the nature of the U.S. food marketing system implies that changes in agricultural commodity prices and changes in retail food product prices do not correlate on a 1:1 basis. Much of the confusion in that debate, and the wide range of estimated effects of ethanol production on “food prices” during that period, was due to these uses of imprecise terminology. Consequently, the remainder of this section uses specific terminology to discuss the potential price effects of expanded biofuel production. First, the term “agricultural commodity prices” refers to the prices of raw agricultural products at the farm or international market level. Second, the term “retail food prices” refers to the prices of consumer food products at the grocery retail level.

Effects on Agricultural Commodity and Retail Food Prices: Lessons from 2007-2009

Estimates of ethanol’s influence on global agricultural commodity prices during the 2007-2009 period were as high as 70 percent (Table 4-4). Determining the extent to which biofuel production affected agricultural commodity and retail food prices is difficult because most prices at the time were also influenced by the high price of oil, greater speculation activity in commodity markets, the changing value of the dollar relative to other currencies, drought in some major production regions, export restrictions imposed by some countries, and more demand for food from the growth in population and incomes in developing countries (Trostle, 2008; Baffes and Haniotis, 2010). Some combination of these events is likely to continue to influence prices. Though the increase in the Food CPI dropped to historically low levels (1.8 percent for 2009 and 0.8 percent for 2010, the lowest rate since 1962 [USDA-ERS, 2011b]), food prices are still much higher than they were at the beginning of the decade (IMF, 2010), and food inflation in 2011 is projected to return to the historic average of between 2 and 3 percent (USDA-ERS, 2011b).

Furthermore, because of the interrelationships of agricultural commodity markets and the competition for production resources among agricultural commodities, a price change in one agricultural commodity can affect prices in other agricultural commodity markets (see “Agricultural Commodities and Resources” above). Thus, any secondary price effect needs to be taken into account in the analysis of the effects of ethanol on commodity or retail prices. Also, the magnitude of price changes at the farm, international market, or retail level resulting from increased ethanol production is determined by the complex nature of the food marketing system and the transmittal of price changes through that system. Thus, though price changes at each level of the food system are jointly determined, the size of the price changes at each level may differ.

The range of agricultural commodity price increases assigned to increased ethanol production tended to decrease with the passage of time as additional data became available and more accurate analysis could be conducted (Abbott et al., 2009; Baffes and Haniotis,

TABLE 4-4 Estimates of Effect of Biofuel Production on Agricultural Commodity Prices, 2007-2009

| Author | Coverage and Key Assumptions | Key Effects of Biofuels on Agricultural Commodity Prices |

| Banse et al. (2008) | 2001-2010; Reference scenario without mandatory biofuel blending, 5.75% mandatory blending scenario (in EU member states), 11.5% mandatory blending scenario (in EU member states) | Price change under reference scenario, 5.75% blending and 11.5% blending, respectively: Cereals: –4.5%, –1.75%, +2.5% Oilseeds: –1.5%, +2%, +8.5% Sugar: –4%, –1.5%, +5.75% |

| Baier et al. (2009) | 24 months ending June 2008; historical crop price elasticities from academic literature; bivariate regression estimates of indirect effects | Global biofuel production growth responsible for 17%, 14%, and 100% of the rises in corn, soybean, and sugar prices, respectively, and 12% of the rise in the IMF’s agricultural commodity price index. |

| Lazear (2008) | 12 months ending March 2008 | U.S. ethanol production increase accounted for 33% of the rise in corn prices. U.S. corn-grain ethanol production increased global food prices by 3%. |

| IMF (2008) | Estimated range covers the plausible values for the price elasticity of demand | Range of 25-45% for the share of the rise in corn prices attributable to ethanol production increase in the United States. |

| Collins (2008) | 2006/07-2008/09; Two scenarios considered: (1) normal and (2) restricted, with price inelastic market demand and supply | Under the normal scenario, the increase in ethanol production accounted for 30% of the rise in corn price. Under the restricted scenario, ethanol could account for 60% of the expected increase in corn prices. |

| Glauber (2008) | 12 months ending April 2008 | Increase in U.S. biofuels accounted for about 25% of the rise in corn prices; U.S. biofuel production accounted for about 10% of the rise in IMF global agricultural commodity price index. |

| Lipsky (2008) and Johnson (2008) | 2005-2007 | Increased demand for world biofuels accounts for 70% of the increase in corn prices. |

| Mitchell (2008) | 2002–mid-2008; ad hoc methodology: effect of movement in dollar and energy prices on food prices estimated, residual allocated to the effect of biofuels | 70-75% of the increase in agricultural commodities prices was due to world biofuels and the related consequences of low grain stocks, land use shifts, speculative activity, and export bans. |

| Abbott et al. (2009) | Rise in corn price from about $2 to $6 per bushel accompanying the rise in oil price from $40 in 2004 to $120 in 2008 | $1 of the $4 increase in corn price (25%) due to the fixed subsidy of $0.51 per gallon of ethanol. |

| Rosegrant (2008) | 2000-2007; Scenario with actual increased biofuel demand compared to baseline scenario where biofuel demand grows according to historical rate | Increased biofuel demand is found to have accounted for 30% of the increase in weighted average grain prices, 39% of the increase in real maize prices, 21% of the increase in rice prices, and 22% of the rise in wheat prices. |

| Fischer et al. (2009) | (1) Scenario based on the IEA’s WEO 2008 projections; (2) variation of WEO 2008 scenario with delayed 2nd generation biofuel deployment; (3) aggressive biofuel production target scenario; (4) variation of target scenario with accelerated 2nd generation deployment | Increase in prices of wheat, rice, coarse grains, protein feed, other food, and nonfood, respectively, compared to reference scenario: (1) +11%, +4%, +11%, –19%, +11%, +2% (2) +13%, +5%, +18%, –21%, +12%, +2% (3) +33%, +14%, +51%, –38%, +32%, +6% (4) +17%, +8%, +18%, –29%, +22%, +4% |

SOURCE: Timilsina and Shrestha (2010).