Deciding What Is Essential and Evidence-Based in Two States for Public Insurance Programs

The determination of essential health benefits (EHB) will have an impact, directly or indirectly, on state-sponsored insurance programs of all sorts. Carolyn Ingram, the senior vice president of the Center for Health Care Strategies (CHCS) and formerly the director of New Mexico Medicaid and the State Children’s Health Insurance Program (SCHIP) first focused on the implications of EHB for Medicaid, Medicaid expansion programs, and offerings through the upcoming health insurance exchanges. She also drew on knowledge of transitions of low-income people migrating from a New Mexico Medicaid expansion program, called State Coverage Insurance, to employer-sponsored insurance and vice versa. Jeffery Thompson is the Chief Medical Officer of Washington State’s Department of Social and Health Services and the Health Care Authority, which operates the state’s Medicaid program, an expansion program for low income individuals not eligible for Medicaid called Basic Health Plan, and the state employee benefits program. He discussed how state-covered plans employ evidence to make coverage decisions. Leah Hole-Curry, program director of the Washington State Health Technology Assessment (HTA) Program provided further guidance on the independent review process and criteria used to evaluate new technologies for coverage in that state. This program operates within the Health Care Authority and impacts coverage for Medicaid and other state purchased health care (e.g., state employees’, retirees’, correctional inmates’, and worker’s compensation benefits).

PRESENTATION BY MS. CAROLYN INGRAM, CHCS

Ms. Ingram began by describing the differences between traditional Medicaid, the Medicaid expansion under the Patient Protection and Affordable Care Act (ACA), and the private health insurance offered in the state exchanges created by the ACA. She described the three programs depicted in Table 11-1 as “zones” through which individuals will move. A person might begin in traditional Medicaid, move into the Medicaid expansion group, and then be eligible for coverage in an exchange as their economic situation changes. This “churn” or “migration” between the different programs presents both challenges and opportunities as each program has slightly different requirements and will be impacted differently by the introduction of the EHB. Ms. Ingram expressed concern that if the packages differ in benefits, people might not “want to migrate out of the Medicaid program and into the exchange or vice versa.” As different benefits might be more of an attraction to different customers, she suggested that the committee consider the comprehensiveness of EHB compared not only to a typical employer plan but also to traditional Medicaid and existing Medicaid expansions. Based on current Medicaid experiences, as many as 50 percent of enrollees will annually move in or out of the program (Sommers and Rosenbaum, 2011).

|

|

|||

| Traditional Medicaid | Medicaid Expansion | Exchanges | |

|

|

|||

| Population | Varies (mandatory and optional) | Uninsuredupto133%FPL | Individualsabove133%FPL |

| Benefits | Mandatory and optional benefits with EPSDT requirements for children | Benchmark or equivalent that must include EHB and some traditional Medicaid services | Essential health benefits as a floor for qualified health plans |

| Delivery System | Mix of fee-for-service and managed care | Same as traditional Medicaid | Qualified health plans |

| EHB Issues | Comprehensive EHB could be more or less generous than traditional Medicaid | EHB promotes coordination with exchanges, but may be different from “benchmarks” | Fine line between comprehensiveness and affordability |

|

|

|||

| SOURCE: Ingram, 2011. | |||

Understanding the Medicaid Landscape

Ms. Ingram first clarified the difference between three state programs for lower-income individuals. Traditional Medicaid has defined mandatory1 and optional2 benefits, including EPSDT (early periodic screening, diagnosis, and treatment) requirements for children. The Medicaid expansion mandated by the ACA will be layered on top of traditional Medicaid to provide coverage for individuals up to 133 percent of the federal poverty level (FPL),3 while the exchanges will provide subsidies for individuals between 133 and 400 percent of the FPL.4 These expansions might take the form of Medicaid benchmark,5 benchmark-equivalent,5 or state basic health insurance designs;6 these expansions, plus the plans offered in the exchanges, must all include the EHB.

Under the Deficit Reduction Act of 2005,7 benchmark plans were first authorized for state Medicaid programs as a method of cost containment by allowing slimmer benefits than traditional Medicaid. These plans could offer benefits benchmarked to the benefits offered to: (1) federal employees though the federal program’s standard Blue Cross Blue Shield plan, (2) state employees in the state, or (3) enrollees in the largest commercial health maintenance organization (HMO) in the state. Additionally, other plans could be used as a benchmark provided the plan is certified “actuarially equivalent” to one of the benchmark plans (these actuarial equivalence plans require a waiver from the Secretary of the U.S. Department of Health and Human Services [HHS]). Eleven states use a benchmark plan, and several others have actuarially equivalent plans (i.e., benchmark-equivalent plans) (CMS, 2009).

Ms. Ingram stated that benchmark plans are generally less comprehensive than traditional Medicaid plans as they “tend to be more commercial in their coverage.” Benchmark plans have historically included: inpatient and outpatient hospital services; surgical and medical services; laboratory and x-ray services; well-baby and well-child care, including age appropriate immunizations; other preventive services, as designated by the Secretary; and rural health clinic and FQHC (federally qualified health center) services. But when the ACA provisions go into effect in 2014, these benchmark plans will also have to include categories of care not in typical commercial employer plans, just as the exchange plans will have to do.

Ms. Ingram noted that most states have used benchmark plans not as an overall cost containment strategy, but rather, to expand coverage to previously uncovered populations (e.g., to childless adults, parents, or expanded

____________________

1 Mandatory benefits under Medicaid include physicians’ services, laboratory and x-ray services, inpatient and outpatient hospital services, family planning services and supplies, rural health clinic services, nurse midwife services, and long-term care services (nursing facility services and home health services) (KFF, 2001).

2 Optional benefits may include prescription drugs, dental services, prosthetic devices, eyeglasses, diagnostic, screening, preventive, and rehabilitative services, personal care services, hospice care (KFF, 2001).

3 Patient Protection and Affordable Care Act of 2010 as amended. Public Law 111-148 § 2001 (a)(1)(C), 111th Cong., 2d sess.

4 § 1401(a) amending Internal Revenue Code by inserting § 36B.

5 § 2001.

6 § 1331.

7 Deficit Reduction Act of 2005. Public Law 109-171 § 6044, 109th Cong., 2d sess. (February 8, 2006).

child populations). But as states have faced budget constraints, they have reduced basic Medicaid programs and adopted benefit packages that look more like benchmark plans.

State Basic Health Plans

State basic health plans are an option for individuals between 133 and 200 percent of the federal poverty level (FPL)8 (replacing the exchange subsidy for that population9). These must be delivered through contracts with private health plans (with at least an 85 percent medical loss ratio). They must include the EHB and are subject to the premium and cost-sharing limits in the ACA. The state receives 95 percent of the subsidy that consumers otherwise would have received through the exchange.

Designing a New Mexico Medicaid Expansion Plan

New Mexico’s State Coverage Insurance (SCI), initiated in 2005, is an expansion program on top of the base Medicaid program developed to address New Mexico’s high rate of uninsured individuals and low rate of employer-sponsored coverage. The program has no pre-existing condition limitations and covers childless adults and parents up to 200 percent of the FPL, with what Ms. Ingram called “generous income disregards” that allow coverage for individuals above 200 percent of the FPL. The vision was that an individual not covered by his employer could enroll in the SCI, and then, as he received promotions and had higher earnings, he could seamlessly move onto his employer’s plan. To coordinate the SCI program with employer-sponsored care, the state Medicaid office contracted with major managed care companies in the state. Committee member Dr. Chernew later requested information about how New Mexico managed its relationships with these companies to ensure the companies were as dedicated to evidence-based care as the state agency. In response, Ms. Ingram said, “it really gets down to the contract management … you cannot design it all in the benefit package.”

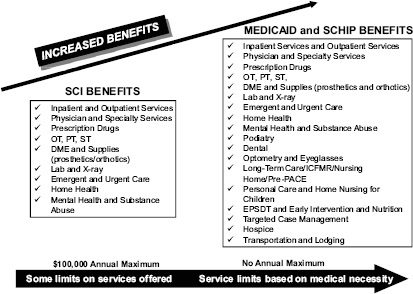

To make the SCI program affordable, the state instituted a $100,000 annual cap on coverage (New Mexico Human Services Department, 2011), but few enrollees have reached that limit. If the enrollee loses his job or gets sick, he can transition, Ms. Ingram said, to traditional Medicaid or to the New Mexico High Risk Pool, both of which have more comprehensive benefits. Figure 11-1 compares the SCI benefits with those of traditional Medicaid and indicates that SCI benefits are less comprehensive. In response to a question from committee member Dr. Sandeep Wadhwa, Ms. Ingram provided some examples of SCI benefit limits, including a 25-day inpatient limit and limits on durable medical equipment. In these instances, the state relies on the managed care companies for utilization review.

Ms. Ingram stated that under the SCI program, individuals with low incomes and disabilities get more comprehensive benefits than individuals at higher incomes. This notion is contrary to typical employer plans, where people at higher incomes are able to purchase more coverage. But for Medicaid, “when dealing with populations with disabilities at lower income levels, it makes sense to have insurance packages that are richer,” said Ms. Ingram.

When the SCI was initially unveiled, people with complex needs enrolled first. After five years, though, Ms. Ingram noted that demand and costs have leveled, though not surprisingly, pharmaceuticals and hospital care “are the biggest cost drivers.” As Ms. Ingram was redesigning the program, she conducted focus groups around the state to gain a sense of what people liked and disliked about the benefit package. Her principal finding was that SCI enrollees were “thrilled to have the coverage and did not want it to ever go away.” She also found that enrollees wanted vision and dental benefits and expressed willingness to pay higher premiums for these supplemental services.

Considerations for the Committee

In Ms. Ingram’s current role at the CHCS, she works with states to address their concerns related to the Medicaid expansion under the ACA. States have expressed to her that if the EHB include benefits not currently covered by

____________________

8 Patient Protection and Affordable Care Act of 2010 as amended. Public Law 111-148 § 1331, 111th Cong., 2d sess.

9 § 1331 (d)(3)(A).

FIGURE 11-1 New Mexico’s traditional Medicaid has a broader array of benefits than the State Covered Insurance (SCI) Program.

SOURCE: Ingram, 2011.

traditional Medicaid, then states are unclear if they will have to add these additional benefits. In response to an inquiry from committee member Mr. Schaeffer, Ms. Ingram indicated that while nothing in the ACA addresses this uncertainty, she believes states would probably have to add the EHB to ensure equity: “how could you have somebody at a higher income level getting essential benefits that are not offered in the traditional Medicaid program?" States are attempting to contain costs and continued expansion of benefits raises concerns. Ms. Ingram said, for example, that most states do not currently offer habilitation services to their traditional adult Medicaid population; if these services are mandated as an essential benefit for Medicaid programs, states will have higher Medicaid costs.

Ms. Ingram said another area of state concern is what happens when the 100 percent federal matching rate for new enrollees in the ACA-mandated Medicaid expansion ends.10 States already covering some or all of the population up to 133 percent of the FPL (e.g., New Mexico, which provides coverage under SCI) are unsure if they will get the increased (i.e., 100 percent) match for the people already enrolled or only for new enrollees. States are also concerned that this 100 percent match for Medicaid expansion programs is not sustainable.11 Thus, Ms. Ingram said, benefit decisions must consider the long-term costs for states in the absence of the federal match.

Ms. Ingram said the benefit programs described in Table 11-1 have to be designed to meet the needs of a wide variety of individuals who move through and across these programs. The definitions of EHB are going to have a long-term impact on Medicaid costs for not only the expansion population, but also for the traditional Medicaid program. A number of coordination options can minimize the impact of program churn on recipients and program

____________________

10 § 2001(y)(1)(A).

11 The 100 percent match for the Medicaid expansion will last from 2014-2016, decreasing to 95 percent in 2017, to 94 percent in 2018, to 93 percent in 2019, decreasing to 90 percent in 2020 and each year thereafter (§ 2001(y)(1)(A)-(E)).

administrators: aligning benefits and provider networks, requiring plans to offer products for Medicaid and the exchange, and offering continuous eligibility to reduce migration frequency from program to program.

PRESENTATION BY DR. JEFFERY THOMPSON, WASHINGTON STATE DEPARTMENT OF SOCIAL AND HEALTH SERVICES

The Washington State Department of Social and Health Services operates the state’s Medicaid program, state employee benefits program, and basic health plan. Dr. Thompson principally focused on how his office uses evidence to define benefits for these state-covered programs and plans and to establish the basis for medical necessity decisions.

Six years ago, Dr. Thompson and his colleagues began developing an evidence-based benefits system by meeting with interested stakeholders, including legislators, providers, and beneficiaries, to develop a definition of evidence-based benefits and a transparent hierarchy of evidence used to make benefit decisions. They defined benefits that offer access to affordable quality health care for the population served. These benefits, he said, use “the best evidence of proven value to the population,” and are codified in administrative code.12 These evidence-based medicine (EBM) rules are the result of 18 months of work with community and state legislative and gubernatorial staff, medical and hospital associations, and patient advocates. The key principles for the design process were: consistency of decisions, transparency of decisions, evidence-based, and focus on patient safety.

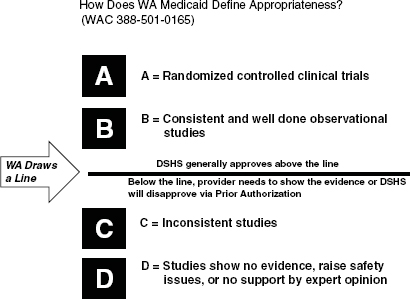

Hierarchy of Evidence in Benefit Decisions

Figure 11-2 describes the hierarchy of evidence. For example, if a service is supported by “A-level evidence based on randomized trials,” the service is likely to be added to the benefit package because, as stated by Dr. Thompson, the evidence supports that the plan “should pay for it.” Before the introduction of the evidence-based benefit design, cardiac rehabilitation was not a covered benefit. Once reviewed, however, A-level evidence showed cardiac rehabilitation helped avoid further surgery, hospitalization, and subsequent heart attacks; the benefit is now covered. Similarly, before evidence-based decisions were instituted, bariatric surgery was covered for numerous indications despite a 40 percent mortality rate at some hospitals. A review of the evidence revealed that bariatric surgery is indicated for some conditions (e.g., BMI > 35 with diabetes, and/or joint replacement), but not all patients. By limiting coverage to specific indications, the department reduced case costs by half (from $36,000 to $17,000) and improved outcomes; he reported that the state-covered plans have not had any bariatric surgery-related deaths in seven years. Dr. Thompson provided this example as a way to caution the committee: some benefits that do not have limits may have unintended consequences. However, use of evidence can balance access, quality, and costs.

The department generally approves benefits supported by A- and B-level evidence, but does not necessarily reject benefits with only C- and D-level evidence. For example, if a provider can prove that a service supported by inconsistent, C-level evidence is “less costly, less risky, and is the next step in reasonable care,” then coverage may be considered. For example, a PET scan for a cancer diagnosis may have limited or no outcome studies, but in special cases can reduce the costs and risks of a surgical procedure or is the second exam when conventional exams are inconclusive.

Additionally, the state-covered plans may be willing to cover some experimental, D-level treatments provided the treatment is approved by an internal review board, the treating physician is in the study, and the patient has provided informed consent. Certain rare conditions may never have A-level studies, Dr. Thompson said. He cited the coverage of experimental treatments for a young adult patient with generalized dystonia to highlight the upside of covering experimental therapies: while the patient’s treatment has been “quite costly,” Dr. Thompson said, “that is fine because he has been enrolled in studies where we are trying to figure out what is the appropriate therapy.”

____________________

12 Washington Administrative Code, 388-501-0165 (1994).

FIGURE 11-2 The Washington Department of Social and Health Services uses levels of evidence to choose covered benefits. SOURCE: Thompson, 2011; Washington Administrative Code, 388-501-0165 (1994).

Evidence-Based Pharmaceutical Benefit Decisions

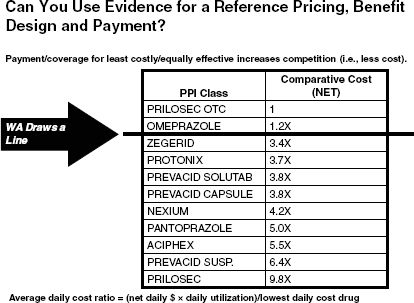

The idea of “above the line” (i.e., supported by A- and B-level evidence) and “below the line” (i.e., supported by C- and D-level evidence) benefits has also been adapted for application in pharmaceutical benefit design. Cost is an additional criterion that the department uses to weigh generics against brand name drugs. For the proton pump inhibitor (PPI) class of drugs, for instance, where there are several branded drugs available, the state-covered plans have based coverage on the least costly yet equally effective treatment. Figure 11-3 shows the drugs within this class and their comparative cost. Dr. Thompson asserted that while there is no evidence of increased effectiveness across these drugs, there is a nine-fold difference in prices. Some state employers have chosen not to cover PPIs, instead forcing beneficiaries to pay for Prilosec over-the-counter. Washington’s traditional Medicaid plan covers both generics and branded drugs in a tiered formulary and the state’s basic health plan has a $10 co-pay for drugs “above the line” (e.g., omeprazole) and a 50 percent co-pay for drugs “below the line” (e.g., Prevacid). Dr. Thompson suggested that the nation can save a great deal in health care expenditures without reducing quality by requiring that newer drugs have head-to-head comparisons rather than simply being tested against a placebo. The use of cost comparisons and evidence can also be applied to other benefits and services.

Medical Necessity Appeals

When committee member Dr. Selby asked Dr. Thompson to gauge the success of this evidence-based benefits program in making medical necessity determinations, Dr. Thompson described the state’s appeals process

FIGURE 11-3 The Washington Department of Social and Health Services considers comparative costs to a reference price when designing pharmaceutical benefits and payment. SOURCE: Thompson, 2011.

and vouched that appeals have decreased under the evidence-based model. In Washington, enrollees in the state’s entitlement programs can appeal to administrative law judges. According to Dr. Thompson, the state prevails 98 to 99 percent of the time for cases that are unrelated to durable medical equipment, principally because administrative law judges understand the evidence-based benefit system.

Challenges of an Evidence-Based Benefits System

Committee member Dr. McGlynn commented that Washington’s evidence-based benefit system is “elegantly designed” but questioned Dr. Thompson about on-the-ground challenges. In response, he stated that as a steward of the public’s money, he must control access, quality, and cost, all of which are “moving targets.” He principally does so by aiming to control pharmaceutical, hospital, and outpatient expenses because if he does not control these three domains, the system will not be “affordable to anybody.” The state communicates these opportunities and comparisons to providers via newsletters and feedback reports with great success. Furthermore, Dr. Thompson described instances in which the evidence hierarchy does not provide all of the information needed for benefit design. For example, when one randomized controlled trial (RCT) supports one treatment and another RCT supports a different treatment, the department has to compare the two, often by looking at which one is “more expensive than the other one” provided “they have equal outcomes.” Comparative effectiveness research (CER) could provide important insights into these determinations, but despite a “push toward” CER, implementing in practice “is very difficult to do,” without good systems that are transparent and non-biased. Back surgery evidence, for example,

is one instance with conflicting evidence: half the patients get better after surgery and half get worse. Weighing such conflicting evidence when designing benefits is inherently challenging.

Additionally, regardless of the level of evidence, the state-covered plans have had to “draw some lines.” Dr. Thompson stated that as technologies continually advance, the plans have had to consider “function and cost.” For example, once a patient has had bariatric surgery, he may also need a panniculectomy to remove excess skin. The coverage for this additional procedure may be weighed against whether any functional, not just cosmetic, benefit ensues.

Furthermore, he said, some plans have imposed limits on services such as occupational and physical therapy. State Basic Health beneficiaries under the Medicaid expansion, for instance, are covered for 12 visits (i.e., up to a combined maximum of 12 therapy visits per year with no more than six being for chiropractic care; visits qualify only when used as post-operative treatment following reconstructive joint surgery and must be within one year of surgery).

Additional challenges relate to the kind and quality of available evidence. For example, Dr. Thompson does not believe “placebo studies should be good enough anymore.” Additionally, even among evidence-based practice centers, there is no consensus on how to define biased research; however, he understands that the Institute of Medicine (IOM) is making recommendations to guard against biased guidelines that will better inform providers and patients (IOM, 2011). Dr. Thompson noted that making transparent decisions about the evidence is one way to account for these challenges.

PRESENTATION BY MS. LEAH HOLE-CURRY, WASHINGTON STATE HEALTH TECHNOLOGY ASSESSMENT (HTA) PROGRAM

Leah Hole-Curry began by describing the role of health care spending in Washington State’s current fiscal crisis. The state has a projected budget shortfall of $3 billion for 2011-2013. Thirty-three percent of the state’s 2010 budget was spent providing medical care to 1.5 million Washington residents compared with 20 percent of the budget in 2000 (Hole-Curry, 2011). The emergence, adoption, and widespread diffusion of new technologies, she said, contribute to excess cost growth; while these technologies are “important to celebrate,” they are also a “cause for deep concern for our nation.” Thus, HTA, which is statutorily mandated to make transparent, independent assessments related to coverage decisions, must consider cost and value in its benefit decisions.

HTA’s Review Process

Ms. Hole-Curry proceeded to describe the HTA and explain its process and criteria for reviewing technology coverage. This independent office resides within the state’s Health Care Authority. The HTA administrator selects technologies to review based on nominations from plan medical directors and members of the public. The technology assessment process takes two to eight months, including 100 days for public comment, which, while slowing the process, improves its transparency. Since 2007, $27 million in savings is attributed to HTA’s work.

Because HTA’s mission to determine if health services paid for by state government are safe and effective may be mistakenly construed as “imposing limits,” committee member Dr. Sabin asked Ms. Hole-Curry how she gains public acceptance of HTA’s work. In response, Ms. Hole-Curry described the evolution of the program: when it first began in 2006, provider groups, in particular, “fundamentally resisted” the concept by speaking out against policy decisions that would impact patient care. Since then, resistance has diminished, and provider groups more often question HTA’s specific research methods and suggest “more appropriate studies” that HTA should consider. Complaints about HTA’s role and processes do, though, continue to come from industry, manufacturer associations, and some subspecialty provider organizations.

HTA’s Review Committee

During HTA’s review process, an 11-member clinical committee holds a public hearing to review the evidence about a particular technology. The clinicians on the committee must be from the state of Washington, cannot be

associated either with a state agency or with the manufacturer of the product, and have to be actively practicing. These requirements make the clinical committee “different than other programs” because the committee is comprised of practicing providers and because its decisions are made in an open, public meeting. When committee member Mr. Schaeffer probed for details about the role of politics in shaping the decisions of this committee, Ms. Hole-Curry noted that while committee members are appointed by the head of the Washington Health Care Authority, the committee is shielded from legislative and political influence. If a legislator wishes to provide comments to the committee, for example, the legislator speaks to a member of the HTA program staff who then provides these comments to the committee during the public comment period.

The decisions rendered by the clinical committee are binding on all three of HTA’s governed programs (i.e., Medicaid, worker’s compensation, and the public employees’ program). In some unique instances, Ms. Hole-Curry said, decisions irrelevant to the program need not be implemented (e.g., the worker’s compensation program did not need to implement pediatric bariatric surgery coverage).

Evidence for Use in Policy Decisions

HTA’s clinical committee, Ms. Hole-Curry said, relies on multiple sources of data (including an evidence report provided by the vendor and public testimony) and a “very basic hierarchy of evidence” to make its coverage decisions (Box 11-1). The committee uses specified criteria to translate this data into useable findings. First, the committee considers efficacy

BOX 11-1

Criteria Used by the Washington State Health Technology

Assessment Program to Make Coverage Decisions

-

Efficacy

- How technology functions in “best environments”

- Randomized trials distinguish technology from other variables

- Meta-analysis

- How technology functions in “best environments”

-

Effectiveness

- How technology functions in “real world”

- Population level analyses

- Large, multicenter, rigorous observational cohorts (consecutive patients/objective observers)

- How technology functions in “real world”

-

Safety

- Variant of effectiveness

- Population level analyses

- Case reports/series, FDA reports

- Variant of effectiveness

-

Cost

- Direct and modeled analysis

- Administrative/billing data (charge vs. cost)

- Direct and modeled analysis

-

Context

- Mix of historic trend, utilization data, beneficiary status, expert opinion

SOURCE: Hole-Curry, 2011.

and safety to determine the degree of variation between how the technology functions in the “best environments” and the “real world.” Only after a technology has “passed” the tests of efficacy and safety does the committee consider “the cost question.” Of the 20 evaluations HTA has undertaken, the committee has considered cost for only “a few,” either because the technology has not gotten through the “first two hoops,” or because the “first two hoops answer the question and cost becomes immaterial because there is value that’s uniquely provided by the technology.” When Ms. Ginsburg asked for clarification whether the HTA has ever used cost-effectiveness in determining whether to accept or deny a new treatment, Ms. Hole-Curry cited a decision in which the clinical committee “shelved” virtual colonoscopy until evidence could demonstrate it was less expensive than equally effective alternatives. In this case, the committee found that the safety and efficacy of virtual colonoscopy was equivalent to existing covered tests, and that patient preference was approximately the same for all test options. The virtual colonoscopy, however, was more expensive and recommended every five years compared to every 10 years for existing covered tests, so the committee ruled that it would not be covered until it was deemed less expensive than equally effective alternatives.

Key Learnings

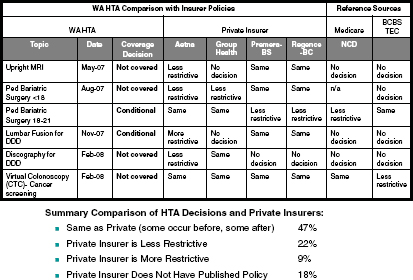

In advising the committee to avoid “hardening in our system a benefit that we know is ineffective,” Ms. Hole-Curry emphasized “our current system has both very great things and a lot of things that are not working.” She proposed four principles that the committee could consider in developing evaluation criteria: (1) aim to develop a learning system, (2) be transparent, (3) develop an evidence base but keep in mind that evidence is “not sufficient,” and (4) have demonstrable evidence of equivalence. She noted that multiple entities reach different decisions on coverage, and this has implications for a national program of EHB (Figure 11-4).

In the course of her work, Ms. Hole-Curry encounters “resistance to public examination” of benefits. She posed an alternate way of thinking about the “real fear” people have that evidence is going to be used “as a way

FIGURE 11-4 Health Technology Assessment (HTA) program coverage decisions may vary between Washington (WA) state and private insurers.

SOURCE: Hole-Curry, 2011.

to ration care”: instead of framing evaluation as taking away choices by only covering interventions with an established evidence base, frame evaluation as aiming to ensure that effective and safe care choices are preserved and interventions that are harmful or without benefit are not covered. For example, premature elective caesarean sections persist despite evidence proving this practice is harmful (Tita et al., 2009), and knee arthroscopy for osteoarthritis continues to be performed despite several high quality studies demonstrating the procedure is no more effective than sham surgery (Kirkley et al., 2008; Moseley et al., 2002).

CMS (Centers for Medicare & Medicaid Services). 2009. Report on Medicaid benchmark plans (section 1937). http://www.cms.gov/Medicaid-GenInfo/Downloads/070609benchmarkreport1937.pdf (accessed June 27, 2011).

Hole-Curry, L. 2011. Transforming health care: Using evidence in benefit decisions. PowerPoint Presentation to the IOM Committee on the Determination of Essential Health Benefits by Leah Hole-Curry, Program Director, Washington State Health Technology Assessment Program, Costa Mesa, CA, March 2.

Ingram, C. 2011. The intersection of essential health benefits and Medicaid. PowerPoint Presentation to the IOM Committee on the Determination of Essential Health Benefits by Carolyn Ingram, Senior Vice President, Center for Health Care Strategies, Costa Mesa, CA, March 2.

IOM (Institute of Medicine). 2011. Clinical practice guidelines we can trust. Washington, DC: The National Academies Press.

KFF (Kaiser Family Foundation). 2001. Medicaid “mandatory” and “optional” eligibility and benefits. Washington, DC: Kaiser Family Foundation.

Kirkley, A., T. B. Birmingham, R. B. Litchfield, J. R. Giffin, K. R. Willits, C. J. Wong, B. G. Feagan, A. Donner, S. H. Griffin, L. M. D’Ascanio, J. E. Pope, and P. J. Fowler. 2008. A randomized trial of arthroscopic surgery for osteoarthritis of the knee. New England Journal of Medicine 359(11):1097-1107.

Moseley, J. B., K. O’Malley, N. J. Petersen, T. J. Menke, B. A. Brody, D. H. Kuykendall, J. C. Hollingsworth, C. M. Ashton, and N. P. Wray. 2002. A controlled trial of arthroscopic surgery for osteoarthritis of the knee. New England Journal of Medicine 347(2):81-88.

New Mexico Human Services Department. 2011. State coverage insurance: Summary of benefits and cost sharing limits. http://www.insurenew-mexico.state.nm.us/SCISummaryofBenefits.htm (accessed April 25, 2011).

Sommers, B. D., and S. Rosenbaum. 2011. Issues in health reform: How changes in eligibility may move millions back and forth between Medicaid and insurance exchanges. Health Affairs 30(2):228-236.

Thompson, J. 2011. Health care that works: Evidence-based Medicaid. PowerPoint Presentation to the IOM Committee on the Determination of Essential Health Benefits by Jeffery Thompson, Chief Medical Officer, Washington Medicaid Program, Washington State Department of Social and Health Services, Costa Mesa, CA, March 2.

Tita, A. T., M. B. Landon, C. Y. Spong, Y. Lai, K. J. Leveno, M. W. Varner, A. H. Moawad, S. N. Caritis, P. J. Meis, R. J. Wapner, Y. Sorokin, M. Miodovnik, M. Carpenter, A. M. Peaceman, M. J. O’Sullivan, B. M. Sibai, O. Langer, J. M. Thorp, S. M. Ramin, and B. M. Mercer. 2009. Timing of elective repeat cesarean delivery at term and neonatal outcomes. New England Journal of Medicine 360(2):111-120.

This Page is Blank