Purchaser Perspectives on the EHB

Health insurance purchasers at the workshop, including Ms. Jerry Malooley, speaking on behalf of the U.S. Chamber of Commerce; Mr. Michael Turpin from USI Insurance Services; and Ms. Helen Darling from the National Business Group on Health (NBGH) stressed the need for flexibility in the essential health benefits (EHB) package and expressed a strong desire to limit the comprehensiveness of the package. The more expansive the package, these panelists said, the greater the cost.

PRESENTATION BY MS. JERRY MALOOLEY, U.S. CHAMBER OF COMMERCE

While Ms. Malooley directs benefit program health policy for Indiana’s state employees, on this panel, she spoke on behalf of the U.S. Chamber of Commerce, which represents a continuum of small to large employers. Employers, she said, want to offer health benefits to their employees. Such benefits show appreciation to employees and highlight that the employer values the well-being of its employees. “This, we hope,” she said, “translates into loyalty, job performance, and less turnover.” At the same time, however, employers must consider the cost of providing these benefits alongside wages, growth, and the competitive environment. Overall, Ms. Malooley stated, employers should be permitted the flexibility to offer coverage that both meets the needs of a broad population and is cost-effective.

Ms. Malooley began by acknowledging that “we all know that for every health product on the market, someone considers it a need and wants insurance to cover it.” Consequently, any discussion of what constitutes the EHB package will be controversial. Ms. Malooley stressed, though, that decision makers should remain “objective and vigilant” when determining the package.

In September 2010, the Chamber of Commerce polled 590 small businesses1 and found that “the definition of essential benefits must not be viewed in a vacuum.” In presenting some results of that poll, Ms. Malooley asked the committee to view the EHB package as a minimum floor and to allow businesses to have the opportunity to build on those benefits, particularly considering small employer views as a result of passage of the Patient Protection and Affordable Care Act (ACA),

____________________

1 The poll included 590 small businesses with up to 199 employees. Of those who responded, 57 percent of businesses employed 5-49 employees, 19 percent employed 50-99, and 25 percent employed 100-199 (U.S. Chamber of Commerce, 2010).

- 45 percent of businesses are less likely to hire new employees; and

- Only 29 percent are confident about adding new employees and investing in their businesses (U.S. Chamber of Commerce, 2010).

Comprehensiveness vs. Affordability

To illustrate the complexity of balancing comprehensiveness and affordability, Ms. Malooley posed a question to the committee: When does one person’s need to have some new or traditionally non-covered procedure paid by insurance outweigh the majority’s need to keep premiums affordable? The desire to offer the most comprehensive benefits may not be worth the loss of affordable coverage.

The definition of the EHB, she said, is “critical” because:

- It will affect employers by establishing the floor for what plans and exchanges must offer and establishing which employer-sponsored benefits will be prohibited from restricted lifetime or annual limits. These considerations will determine the cost of plans.

- It will limit the options available to consumers. If the “floor” is an extensive, expensive benefit package, plans will become very costly and therefore fail to meet the needs of most consumers. Many employers and consumers prefer a more “bare bones plan” and the moderate price it affords. “It would be a mistake,” Ms. Malooley said, to curtail flexibility on the part of employers and consumers “by requiring all plans to cover a ‘soup to nuts’ benefit package.”

- An expansive definition will likely force small employers to stop offering coverage. “We do not want the cost of these plans to force employers to stop offering health care coverage to their employees,” Ms. Malooley stated.

It has been observed that there is a higher utilization rate for covered services (IOM, 2001). Furthermore, she continued, while utilization has positive effects on individual and population health if the covered services are beneficial and necessary for the individual’s circumstances, coverage can also have needless cost implications if unnecessary care is delivered. Thus, employers need freedom, Ms. Malooley said, to direct the content and utilization of benefits.

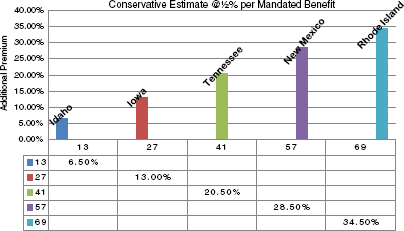

The Effect of State Mandates on Premiums

State-mandated benefits all “critically affect” the rise in premiums across the states, Ms. Malooley argued, such as those that cover marital and family counseling, contraceptives, and care by specific providers (e.g., acupuncturists, athletic trainers, massage therapists, and pastoral counselors) (CAHI, 2010). While an individual mandate may have a small impact on premiums, when these mandates accumulate, costs aggregate and “premiums really rise.” As states add additional benefit mandates, the “base” cost of a plan rises. Iowa, for instance, has 27 mandates, which she stated raises the base cost of a plan by 13 percent. Figure 3-1 illustrates how mandates can contribute to higher costs.2

This effect is significant, Ms. Malooley noted, because experience has shown that when premiums increase, more people drop or decline coverage (Chernew et al., 2005; Goldman et al., 2004). Thirty states now require fiscal analysis before the implementation of mandates (Bunce and Wieske, 2010), and at least 10 states offer a “mandate-light” program for people who feel they do not need certain mandated benefits (Bunce and Wieske, 2010).

Nothing precludes a state from requiring additional benefits beyond the EHB. “That is an issue,” she said, because the federal subsidy provided to individuals will not account for “how rich the benefit plan is and what the premiums are” for state-added benefits. Consequently, states will assume the additional cost of these state-specific mandates and make payments to individuals to defray the cost of these additional benefits in public programs.3

____________________

2 See further discussion of the full and marginal cost of state mandates in Chapter 4, Dr. Cowdry.

3 Patient Protection and Affordable Care Act of 2010 as amended. Public Law 111-148 § 1311(d)(3)(B)(ii), 111th Cong., 2d sess.

FIGURE 3-1 Insurance premiums can rise as state-mandated health benefits accumulate. SOURCE: Malooley, 2011. Adapted from data in Bunce and Wieske, 2010.

PRESENTATION BY MR. MICHAEL TURPIN, USI INSURANCE SERVICES

As a speaker knowledgeable of small and mid-sized employer needs, Mr. Turpin, Executive Vice President and National Practice Leader of Healthcare and Employee Benefits agreed with Ms. Malooley that employers want to offer health benefits as a means of attracting and retaining employees. He also emphasized that small and mid-sized employers will decrease or stop offering health benefits if the EHB package is too rich or not designed to drive market-based reforms.

Over the past five years, insured employers with fewer than 100 employees experienced annual double-digit health care cost growth.4 These increasing costs, he said, resulted from “supply-side components” including increasing physician costs, inpatient facility costs, outpatient facility costs, and prescription drug costs (Engdahl-Johnson and Mayne, 2010). The double-digit growth rates are normally “mitigated,” Mr. Turpin said, by reducing plan design and by cost-shifting to employees through higher co-pays, co-insurance, and deductibles. Towers Watson data show that between 2005 and 2010, employer costs for an individual policy rose 28 percent ($6,169 to $7,920) while employee cost sharing has increased over 40 percent ($1,642 to $2,292) (Towers Watson, 2009).

Mr. Turpin described current employer plans as “driven by access, not affordability.” Small employers have disproportionately chosen to increase cost sharing rather than to reduce access to a network of specified providers or to centers of excellence. Medical trends have not moderated as they would if network access limitation became the catalyst for outlier facilities to lower costs to be more consistent with more cost effective and equally high quality competitors. Compass Health Analytics, Inc., a private, non-profit consumer data management company, reports how approved provider MRI costs can range from $442 to $1,093 within the same PPO (preferred provider organization) network (Compass Professional Health Services, 2011).

____________________

4 Annual pooled trend and yield averages shared annually by insurers for businesses of different sizes. USI Insurance routinely requests and compares annual trend factors for insured businesses each year to gauge medical inflation and underwrite expected cost increases—independent of the insurer. Data is compiled through an analysis of USI’s own book of business, insurers, and the subset of employers who respond to a variety of surveys. Personal communication with Michael Turpin, USI Insurance, August 15, 2011.

Aligning Incentives

Many employers are concerned about an EHB package that will be “too generous,” and believe that a “basic” level of benefits would help reduce cost growth. Most of USI Insurance’s clients recognize that the current health care system is designed to treat rather than prevent chronic illness. As a result of “misaligned incentives,” plan design is the only lever employers can pull to manage their costs. Mr. Turpin acknowledged, though, that the ways in which employers usually manage plan costs (e.g., rationing plan design, increasing co-pays, and increasing deductibles) can inadvertently create barriers to care and ultimately increase long-term costs by limiting access to preventive procedures that could control an individual’s chronic illness.

Many small and mid-sized employers, Mr. Turpin said, “are gravely concerned” that the EHB will be designed to require more generous levels of benefits while “doing nothing to change the underlying cost drivers.” Without changing cost drivers, generous benefits will only contribute to higher rates of utilization and cost inflation. Employers, he noted, believe “strategy should drive structure.” The structure of the EHB should aim to improve health status and better manage chronic illness, which will also serve to “achieve affordable care.”

He cautioned that starting with a rich package would “commit the cardinal sin of letting structure drive strategy” because the benefits package would be unaffordable at the outset. In addition, he said that open-access preferred provider organizations (PPOs) and lack of care coordination through primary care providers have resulted in unsustainable medical utilization and an unrealistic expectation from employees that “access means quality.” As a result, “there is increasing openness” to the use of “medical homes” as a way to transition from a system focused on treatment to one focused on “rewarding prevention.” Employers are uncertain, however, if the EHB package will enable or preclude this transition to medical homes.

Shared Responsibility on the Part of Employers and Consumers

Small and mid-sized businesses are “uninformed” as they have little knowledge of their own employees’ health benefit claims—“most feel trapped in pooled risk arrangements.” Consequently, these employers have little incentive to engage their employees in wellness activities because their claims are pooled with higher risk employers who have “rich plans and unengaged employees.” Mr. Turpin believes legislation should be considered to require the release of paid and incurred employer claims data to help employers better understand population health information. Precedent has already been set in Texas under House Bill 2015 which requires release of data down to two covered lives5 (Mr. Turpin believes two lives is a bit extreme and that 50 covered lives would be sufficient). In addition, he said, states should encourage the development of self-insured alternatives that allow employers with more favorable claims and cost management strategies to directly benefit from their own efforts.

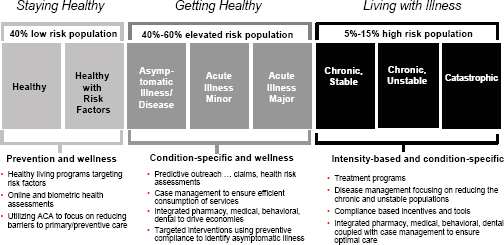

Essential health benefits can be designed, Mr. Turpin argued, “to get individuals to engage more and for employers to actively participate in engaging in the population health of their employees and trying to drive a healthier lifestyle.” Figure 3-2 shows a continuum of “consumer activation” that ranges from healthy individuals to those who are chronically and catastrophically ill. The EHB must consider that every insured person exists somewhere along this continuum and benefit design should reduce barriers to care and drive improved consumer engagement. For example, the EHB should aim to promote identification of those individuals who are asymptomatically ill. Statistically, an alarming number of catastrophic claimants are revealed to have not filed a single claim in the 12 months preceding a catastrophic medical event. Primary care, mandatory screening for key risk factors, and incentives to engage in wellness activities will activate consumers and reduce gaps in care (ICMA and CIGNA, 2008; U.S. Corporate Wellness, 2011). Mr. Turpin noted, though, that individuals must be committed to their own personal health improvement. Additionally, if “we want to reach individuals who are chronically ill and make them stable, we need to reduce barriers to care for certain common chronic illnesses prevalent in certain populations.”

____________________

5 Texas HB 2015 (June 15, 2007).

FIGURE 3-2 Insurers use a continuum of patient risk factors to guide consumer engagement efforts.

SOURCE: Turpin, 2011. Reprinted with permission by Sam Ho, committee member, and Executive Vice President and Chief Medical Officer, UnitedHealthcare.

PRESENTATION BY MS. HELEN DARLING, NATIONAL BUSINESS GROUP ON HEALTH

As president and CEO of an association of large employers, Ms. Darling began by urging the committee to focus not only on the goals of providing comprehensive coverage and promoting evidence-based, effective care, but also on the “equally important triple financial goals” of assuring people affordable coverage, protecting them from catastrophic financial losses when faced with serious illness, and helping them avoid unnecessary costs. She proceeded to describe the perspectives and concerns of large employers, including that they should be permitted and encouraged to provide flexible options to their employees, a point, she said, that is built into the ACA. It is very important, she said, that the EHB “be set up in a way that allows for flexibility and also allows for evidence to be constantly created and used in a feedback loop to what is being considered the floor.” The “minute the government” defines the package, the benefit floor will be established and will “become the pressure point in every way,” she argued.

Committee member Mr. Koller asked Ms. Darling to explain the connection between the committee’s work and the decisions made by large self-insured groups. She replied that the ACA outlines broad categories of care. Let’s take a category like rehabilitation services; what will be in the EHB should not be just anything that might be considered rehabilitation services. Thus, questions remain as to whether rehabilitation is more specifically going to be set to a maximum of 60 visits or to only visits that restore function. Self-insured employers, she said, make these kinds of decisions “all the time.” Generally, if a service is prescribed or ordered by a licensed physician, the service will be paid for unless the employer specifically sets upfront limits or if the service is considered investigational and experimental.

Using Evidence to Evaluate Effectiveness

A properly structured learning health care system6 “will enable continuous assessment of actual effects on patients and change what might be considered essential benefits, or at least the circumstances in which they would be considered essential,” Ms. Darling said. She cautioned that “it is really hard to take things away” but noted that “when there is compelling data that something is downright harmful under certain circumstances, the public actually stops doing it” (e.g., hormone replacement therapy for women, autologous bone marrow transplant for breast cancer, and clinically inappropriate use of Vioxx). An EHB package, then, should support effective, efficient care while also “weeding out” unnecessary and wasteful care. The NBGH recommends, she said, that the committee heavily weigh demonstrated evidence and a track record for clinical effectiveness as a criterion for the EHB package.

Ms. Darling referred to academic studies that have found that a third of U.S. health care dollars are wasted (Kelley, 2009) as reason to support an EHB package with demonstrated evidence of clinical effectiveness. These wasted dollars, she said, are spent on unnecessary, redundant, and ineffective care, all of which should be excluded from the EHB package. “We need a constant process of evidence generation and feedback,” she said, to manage care and benefit design in a way that ensures patients are protected from wasteful and harmful practices.

She suggested the committee recognize the tools and resources used by employers and plans for care management and benefit design. Where evidence warrants, employers and plans routinely use care and medical management tools (e.g., step therapy, limits, radiology management) to promote effective care. Step therapy encourages providers and patients to utilize proven effective drugs that are less costly or risky to patients’ health than new “blockbuster” drugs that may have less evidence. In addition, dental plans use a combination of limits— annual, frequency, age, and tooth structure—to provide low-cost dental coverage for Americans. This plan design, Ms. Darling said, has improved oral health, prevented overutilization, and minimized the cost of providing oral health care. Less than 3 percent of Americans reach their annual dental limits (NADP, 2009). Furthermore, plans use radiology management programs to ensure patients receive appropriate screenings and that patients are not subject to excessive radiation exposure or unnecessary scans. Studies have found that up to 50 percent of diagnostic imaging is redundant and may lead to unnecessary radiation exposure, particularly for children and pregnant women (AHIP, 2008; Brenner and Hall, 2007; Dehn et al., 2000).

Ms. Darling noted that “by placing high importance on proven clinical effectiveness, the IOM will ensure that patients receive the highest value, safest, and most medically appropriate health care services to meet their individual needs.” This focus on clinical effectiveness will also help plans balance comprehensiveness and affordability. Finally, it will create “synergy” between the efforts of employers and plans and the efforts of the government to promote evidence-based benefit design.

Criteria for Effectiveness

To make coverage decisions, Ms. Darling said, employers and plans often use medical necessity along with several other criteria of effectiveness, including:

- Clinical appropriateness of the service setting;

- Sufficient evidence of clinical effectiveness of the service;

- Sufficient evidence of meaningful clinical utility;

- Comparative effectiveness of the service to alternatives;

- Comparative cost and actuarial valuation of the service to alternatives;

- Demonstrated performance and quality of the providers; and

- Individual eligibility criteria (e.g., Herceptin for patients who meet genetic profile, disease state, and treatment history criteria; BMI > 40 for metabolic surgery).

____________________

6 The IOM is currently undertaking a consensus study on the learning health care system, seeking to foster “the development of a learning health care system designed to generate and apply the best evidence for the collaborative health care choices of each patient and provider; to drive the process of discovery as a natural outgrowth of patient care; and to ensure innovation, quality, safety, and value in health care” (IOM, 2010).

Ms. Darling stated that the opportunity to individually apply criteria to specific types of cases is necessary because “you cannot just have a flat benefit. You cannot just say we are going to pay for physical therapy on an unlimited basis, because then everybody would get physical therapy on an unlimited basis, and the system would give us probably two or three times what we would find beneficial.” Furthermore, personalized medical therapies are being developed that should apply to specific types of cases; these would not, she said, be considered discriminatory under the required elements for consideration. Comparative effectiveness research will “provide us with very valuable information about how to fine tune” coverage decisions.

Medical Management Practices

Ms. Darling outlined management practices used by employers to promote efficiency in benefits. Employers of all sizes, she said, are provided these resources by their health plans through their insured package of services. She advised the committee that efficiency is an important criterion to consider when designing the EHB package. Coverage, she said, can promote efficiency by requiring “best management practices” to keep benefits affordable:

- Evidence-based benefits: An evidence-based benefit model links coverage to the effectiveness of treatments. Cost sharing, provider selection, and plan payments can be used to support evidence-based care and discourage ineffective care. For example, by reducing or eliminating co-pays for maintenance drugs (e.g., for diabetes, asthma, and hypertension) with a strong evidence base for effectiveness, the employer’s plan design can encourage patient adherence to drug regimens.

- Targeted evidence-based preventive care: To improve health and reduce long-term costs, employer plans can provide incentives such as “first dollar coverage” (i.e., little or no co-payment) for evidence-based preventive care services for targeted populations. Education programs to improve employees’ awareness of preventive care are just one example.

- Emphasize primary care: Employers are often willing to pay more for primary care coordination and patient management, for example, by choosing providers who incorporate the “advanced medical home concept.”

- Meaningful cost sharing: Employers set cost sharing at levels that reduce excessive and inappropriate utilization but ensure access to needed, appropriate medical care by, for instance, varying cost sharing based on clinical necessity and therapeutic benefit. Employers have reduced cost sharing when plan participants use evidence-based care such as using decision supports and participating in disease management programs.

- Prescription drug management: Employers manage prescription drug use and pharmacy spending by establishing preferences for select generics and brand-name drugs. Step therapy, generic substitution requirements or incentives, generic education programs for plan participants and physicians, a separate deductible for prescription drugs, preauthorization for selected drugs, reduced cost sharing for mail order compared to retail purchase, mandatory mail order of maintenance medications, tiered co-payments, co-insurance rather than co-payments for medications, dose optimization, and quantity-duration protocols for certain medications are all used to manage prescription drug costs.

- Health improvement programs: Employers offer incentives such as premium discounts to plan participants who engage in health improvement programs and adopt healthier lifestyles.

- Targeted disease management programs: Employers provide targeted, evidence-based disease management programs for certain chronic and potentially high-cost conditions. Employers use incentives, rewards, and premium discounts to encourage participation.

- Retail/convenience care clinics: To add convenience and reduce inappropriate emergency room visits, employers offer access to retail clinics for common, basic medical services. Employers promote services at retail clinics through education campaigns and by lowering co-pays for retail clinic services.

- Consumer decision-support tools: Employers offer decision-support tools (both during plan selection and at point-of-care) to help plan participants make informed decisions about their health. These tools

- include customized comparison and financial modeling to help people choose among plan options; hospital and physician report cards to assess provider performance against evidence-based standards; and nurse lines, self-care guides, self-study modules, online information, health coaches, health advocates, and consumer medical information services. Some employers require that plan participants use decision-support services before nonemergency surgery.

- Pay-for-performance: Employers link plans’ provider payments to health care quality, paying more for better outcomes, greater efficiency, and better performance on prevention, chronic care management, and patient satisfaction measures. Employers also provide financial incentives to plan participants who choose better performing providers, for example, by offering a preferred tier of medical groups and hospitals with differential co-pays based on performance in quality and costs.

- High-performance networks: Employers use high-performance networks to reduce costs and improve quality by offering specialized services through facilities that meet criteria for volume and clinical outcomes, patient and family-oriented services, and evidence-based medicine.

- Health information technology (HIT): Employers require health care vendors to use interoperable HIT wherever possible or provide personal health records for plan participants.

- Transparency (cost and quality): Employers require plans and providers to publicly disclose information about the price and quality of care.

The focus on primary care prompted committee member Dr. Santa to ask Ms. Darling to comment on the degree to which the effectiveness of primary care vs. more specialty care is considered by employers as a part of benefit design. This emphasis on primary care, she said, is based on evidence comparing systems with primary care as the foundation (Starfield et al., 2005) and evidence showing that primary care encourages ongoing patient-provider relationships, which may, among other things, decrease duplicative testing. Ms. Darling said that NBGH has been working with employers and plans to “build in more reasons for starting with primary care” such as having the employee pay less for primary care visits. IBM, for example, has eliminated co-pays for primary care.

Limiting State Mandates

Ms. Darling concluded by suggesting that because state mandates are often driven “by forces that sometimes have very little to do with evidence and very little to do with cost considerations,” the committee should not consider state mandates as a criterion for the EHB package. There is a lack of awareness of the collective costs of mandates. It is important for the committee to “fully grasp the significant cost impact of overly comprehensive or open-ended coverage.”

In sum, she said, the EHB package has to be something that rules some things out; something between everything under the sun and a very narrow, limited package. Thus, she said, the committee and the U.S. Department of Health and Human Services should aim to ensure affordable but comprehensive coverage.

AHIP (America’s Health Insurance Plans). 2008. Ensuring quality through appropriate use of diagnostic imaging. Washington, DC: America’s Health Insurance Plans.

Brenner, D. J., and E. J. Hall. 2007. Computed tomography—an increasing source of radiation exposure. New England Journal of Medicine 357(22):2277-2284.

Bunce, V. C, and J. P. Wieske. 2010. Health insurance mandates in the states 2010. Alexandria, VA: The Council for Affordable Health Insurance.

CAHI (The Council for Affordable Health Insurance). 2010. Trends in state mandated benefits, 2010. Alexandria, VA: The Council for Affordable Health Insurance.

Chernew, M., D. M. Cutler, and P. S. Keenan. 2005. Increasing health insurance costs and the decline in insurance coverage. Health Services Research 40(4):1021-1039.

Compass Professional Health Services. 2011. Compass Professional Health Services: Tools and support for healthcare consumers. Dallas, TX: Compass Professional Health Services.

Dehn, T. G., B. O’Connell, R. N. Hall, and T. Moulton. 2000. Appropriateness of imaging examinations: Current state and future approaches. http://www.imagingeconomics.com/issues/articles/2000-03_02.asp (accessed April 22, 2011).

Engdahl-Johnson, J., and L. Mayne. 2010. 2010 Milliman Medical Index: 2010 healthcare costs increase $1,303 for family of four. New York, NY and Salt Lake City, UT: Milliman, Inc.

Goldman, D. P., A. A. Leibowitz, and D. A. Robalino. 2004. Employee responses to health insurance premium increases. American Journal of Managed Care 10(1):41-47.

ICMA (International City/County Management Association) and CIGNA. 2008. Creating a culture of health. Washington, DC: International City/County Management Association.

IOM (Institute of Medicine). 2001. Coverage matters: Insurance and health care. Washington, DC: National Academy Press.

_____. 2010. Project information: The learning health care system in America. http://www8.nationalacademies.org/cp/projectview.aspx?key=IOM-EO-10-06 (accessed April 20, 2011).

Kelley, R. 2009. Where can $700 billion in waste be cut annually from the U.S. healthcare system? http://img.en25.com/Web/ThomsonReuters/WASTEWHITEPAPERFINAL11_3_09.pdf (accessed August 15, 2011).

Malooley, J. 2011. Purchaser decision-making on benefit design. PowerPoint Presentation to the IOM Committee on the Determination of Essential Health Benefits by Jerry Malooley, Director, Benefit Programs Health Policy, State of Indiana, Personnel Department and Member, U.S. Chamber of Commerce, Washington, DC, January 13.

NADP (National Association of Dental Plans). 2009. 2009 dental benefits report: Premium trends. Dallas, TX: National Association of Dental Plans.

Starfield, B., L. Shi, and J. Macinko. 2005. Contribution of primary care to health systems and health. Milbank Quarterly 83(3):457-502.

Towers Watson. 2009. Towers Perrin 2010 Health Care Cost Survey. http://www.towersperrin.com/hcg/hcc/TPHCCS2010srvycharts.pdf (accessed August 11, 2011).

Turpin, M. 2011. Building affordable and sustainable essential benefits. PowerPoint Presentation to the IOM Committee on the Determination of Essential Health Benefits by Michael Turpin, Executive Vice President and National Health and Benefits Practice Leader, USI Insurance Services, Washington, DC, January 13.

U.S. Chamber of Commerce. 2010. Small businesses and Washington regulation, U.S. Chamber of Commerce, September 2010. http://www.uschamber.com/sites/default/files/press/1009pollregulation.pdf (accessed April 20, 2011).

U.S. Corporate Wellness. 2011. The ROI of employee wellness at a glance. Littleton, CO: U.S. Corporate Wellness, Inc.