SCOPE OF LIFE-CYCLE ESTIMATES

Life-cycle costs (LCC) for each of the existing and proposed space-based early warning IR systems, ground- and sea-based radar systems, and defensive layers of intercept systems are defined as consisting of development, production, and sustainment costs with the last named over a 20-yr period. For the purposes of this study, LCC is divided into these three categories to allow assessing the relative costs across the mix of interceptor and sensor system options for improving missile defense.

Development costs are the cost of engineering activities needed to design and develop baseline and block upgrades of interceptor boosters, kill vehicles (KVs), early warning sensor and radar systems, and other supporting components and infrastructure, with Missile Defense Agency (MDA) annual budget requests for funds reported as research, development, test, and evaluation (RDT&E) appropriations consistent with the military services.1

Procurement costs for the manufacture of missile interceptor KVs, early warning sensor and radar systems, and associated equipment, including, as needed, the purchasing of Aegis-class ships. Construction costs are included as part of procurement and defined as those activities required to build the physical infrastructure, including power generators and maintenance facilities, that supports a given missile defense system or ship-based radar system. Procurement cost also includes the costs of integrating the applicable systems noted above

_____________

1The breakout and definition of the three categories of cost, especially as they relate to the life-cycle cost of ballistic missile interceptors are consistent with recent Congressional Budget Office (CBO) reports on missile defense.

into the existing infrastructure.2 In addition, the procurement cost of interceptors includes the production of the total quantity committed for the inventory to achieve full operational capability (FOC).

Sustainment costs are the costs of the routine efforts to operate and maintain the system over a nominal 20-yr lifetime. Depending on the expected service life of the assets, sustainment costs can include the modification, upgrades, and/or replacement costs of procuring new systems as needed.

Following development and during the sustainment phase and for the purposes of maintaining the necessary operational proficiency, readiness, and training; sustainment costs include costs for conducting engagement exercises and missile tests, which in turn include the costs of procuring test interceptors, target missiles, parts, and so on; and the sustaining engineering costs for performing the tests, assessing the missile’s performance, diagnosing potential success and root causes of failure events as part of the overall integrated system test plans toward achieving the system’s overall operational readiness and training required.3

RELATIONSHIP OF LIFE-CYCLE COST ESTIMATES TO MDA BUDGET

For the purposes of this study, LCC are separated into development, production, and sustainment costs to enable assessing relative costs across system options for improving missile defense. It should be pointed out that through the DOD FY 2011 President’s Budget (PB), submitted to Congress in February 2010, funding for MDA included funding for production (manufacturing) and sustainment operations, all under the single budget category of RDT&E. However, MDA’s most recent budget justification materials for the FY 2012 PB submitted to Congress in February 2011, separated out what were formerly RDT&E program funds into procurement, military construction (MILCON), and the operations and maintenance (O&M) program element funds.

The basis for estimates of 20-yr sustainment costs for the MDA systems and

_____________

2To account for this cost for ground-based interceptor systems similar to the ground-based missile defense (GMD) boost-phase intercept (BPI) systems, the committee applied a factor of 40 percent to account for costs of integrating the interceptor system and subsystems into the existing infrastructure. The integration activities are assumed to include assembly, installation, and integration at the ground-based interceptor launch site comparable to the silos and other infrastructure and the missile fields at Fort Greely, Alaska (FGA). This factor of 40 percent agrees with previous CBO reports on missile defense.

3Consistent with previous CBO reports, the committee assumed that the additional number of test interceptors that need to be procured is based on one test conducted every 2 years over the 20-yr lifetime of the system. The test plan is assumed to have two purposes: (1) testing out the performance of the current system baseline design of the interceptors, which includes any improvements to the booster stages as well as to the KV propulsion and IR seeker or divert systems, and (2), from an event-driven perspective, demonstrating the capability of intercepting target missiles in scenarios mirroring threats from potential adversaries.

the associated funds required will consist of both MDA RDT&E (procurement-related) budgets and the military service’s O&M and military personnel (MILPERS) funds, with specific sustainment responsibilities identified in system-unique memoranda of agreement (MOAs). As stated by LTG Patrick J. O’Reilly, USA, Director, Missile Defense Agency, operations and support (O&S) responsibilities relate to MDA’s role in material sustainment as well as procuring replacement spares and implementing P3I modifications of fielded systems. Breakout of sustainment costs includes training costs, routine maintenance costs, operational tests, and ongoing operational integration.

“Should” vs. “Will” Cost Guidance for Bounding the Range Estimates

Consistent with the Memorandum for Secretaries of the Military Departments and Directors of the Defense Agencies issued on November 3, 2010, and effective November 15, 2010, the committee made a concerted effort to incorporate the guidance on developing “should cost” targets as one of its “sound” estimating techniques.4

The committee generated 20-yr LCC range estimates for each of the committee’s recommended systems and those recently initiated by MDA systems based on first assessing the current technical and manufacturing maturity of all the systems and then generating “should cost” estimates as the lower bound (or minimum) costs based on the following:

• Scrutinizing every element of program cost,

• Assessing whether each element can be reduced by, for example, challenging the learning curves of similar systems, and

• Applying other recently implemented or proposed industry productivity improvements as part of reducing the total costs of doing business with the government, including, for example by reducing overhead rates, indirect costs, and other contractor cost-cutting measures.

The OSD policy states that the metric of success for “should cost” management is leading to annual productivity increases of a few percent from all ongoing contracted activities as program managers execute at lower cost than budgeted. OSD policy guidance believes industry can succeed in this environment because OSD and the military services will tie better system performance to higher corporate profits and because affordable programs will be less likely to face cancellation.

This is in contrast with system costs based on a program’s “will” cost, on which the committee bases its upper bound, or maximum, estimates. These esti-

_____________

4The OSD policy on this subject is based on the guidance described in the “Drive Productivity Growth Through Will Cost/Should Cost Management” article, issued by the Defense Acquisition University (DAU) Acquisition Community Connection.

mates are focused on business-as-usual costs similar to comparable programs in the past where the requested annual budget was fully obligated and expended over time. The higher “will” cost estimate is also used as the basis of the independent cost estimate (ICE) performed by the OSD Cost Assessment and Policy Evaluation (CAPE) office for establishing program budgets that support major acquisition milestone reviews. As mentioned, the committee based these maximum cost targets on analogous systems and program expenditures over comparable acquisition phases where reasonable efficiency- and productivity-enhancing efforts were undertaken. This approach to estimating a system’s “will” upper bound cost targets is consistent with and similar to the CAPE ICE estimating methods and program budget results expected for all ACAT I programs as they advance through the major milestones of the acquisition process.

Observations on System “Should Cost” Comparisons

In looking at previously stated $71 million to $85 million average unit procurement cost for the current and projected ground-based interceptor all up round, the committee wondered how that cost compared with the cost for other weapons of comparable capabilities and complexity. It extracted costs and quantities from DOD Selected Acquisition Reports (SARs) for several programs that allowed it to compare RDT&E efforts and early unit all up missile round costs.

Several of the U.S. Navy’s Trident program SARs provided interesting data. The committee believes the Trident II D-5 and GBI all up rounds are of equal complexity except for the flight tests, which are not separately identified in either RDT&E cost. Table E-1 compares the RDT&E time frame for the GMD inter-

TABLE E-1 Comparison of GMI and Trident II Missiles

| GMD Interceptor System | Trident II (D-5) Missiles | |

| RDT&E time frame | 1998 to 2009a | 1978 to 1993b |

| Interceptor AUPC (million $) | 71-84c | 54d |

| Production lot quantity | 52 | 54 |

aThe GMD program started with NMD DEM/VAL for the BPI followed by GMD block development.

bThe Trident II program includes 3 years of concept definition, 3 years of advanced development, and 10 years of full-scale development (FSD).

cMDA provided the committee with this estimate.

dThe Trident II D-5 missile AUPC cost estimates were the most recent Program Manager’s estimates to completion (ETC) for the first weapons procurement production contracts awarded after FSD to Lockheed-Martin in March 1984 for missiles and to Hughes Aircraft in July 1989 for the electronics packages as reported in “TRIDENT II (D-5) SAR,” December 31, 1990. The AUPC also includes the Program Manager’s ETC for the Kearfott Guidance contract awarded in October 1989 for guidance packages as reported in that same document.

ceptor system, its average unit procurement cost (AUPC) in FY 2010 constant dollars, and production lot quantity to those of the Trident II D-5 missiles.

The Trident II AUPC is for an all-up round for the post-boost vehicles, stellar inertial guidance, and test instrumentation for a first production lot quantity of 54 missiles built immediately after FSD. The AUPC range estimate for GBIs is based on a total quantity of 52 missiles, of which 30 interceptors have already been fielded and produced, 20 with the original Capability Enhancement I (CE-I) KV and 10 with the Capability Enhancement II (CE-II) EKV. The remaining 22 missiles are currently being funded through FY 2016.

The lower bound, or minimum AUPC estimate for producing 52 three-stage GBIs at $71 million (based on continued funding through FY 2016), is 32 percent higher than the comparable average unit cost of 54 Trident II D-5 missiles (without the warheads) at $54 million (both in constant FY 2010 dollars).

ASSESSMENT OF MDA ONGOING PROGRAM BUDGETS AND SOURCES OF DISCRETIONARY FUNDS

This section provides MDA’s current and projected future years defense plan (FYDP) annual budget ceilings and the level of ongoing budget commitments for all the programs of record. In addition, the level of discretionary funds available that could potentially be redirected to implement changes as early as FY 2012 and the out-years is provided.

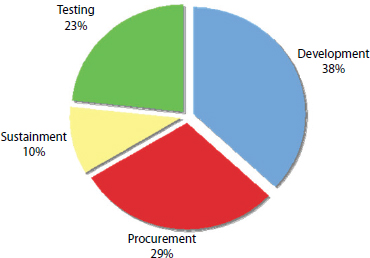

Figure E-1 provides a top-down breakout of the FY 2011 MDA budget for each of the three major system acquisition phases and costs associated with LCC. The budget for testing is separated from that for sustainment to allow comparisons with the investment budget earmarked for development for procurement acquisition phases.

Table E-2 provides further breakdown of programs considered as part of development from highest to lowest by percent of the $2.9 billion of FY 2011 funds for MDA programs of record beginning with the Aegis and ending with PTSS. Table E-2 reflects a change from the programs funded in FY 2010.

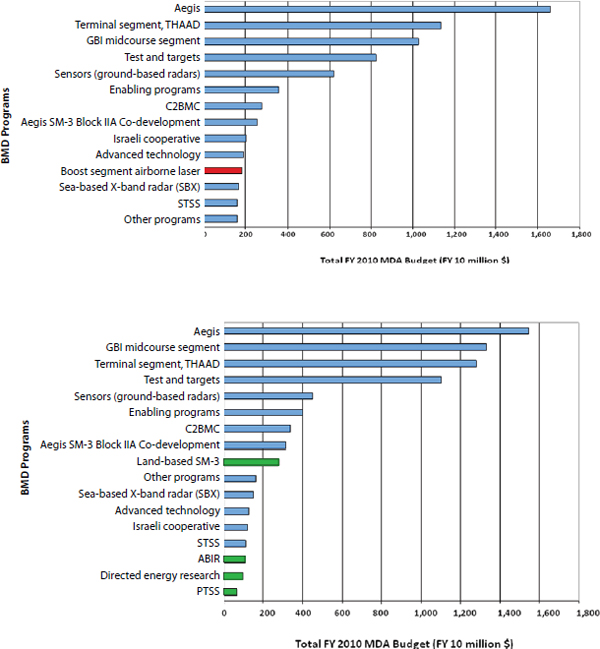

Figure E-2 displays the magnitude of the budget changes contained in the FY 2011 MDA PB submitted in February 2010. On the top bar chart, the boost segment airborne laser program has been terminated (denoted by the red bar). On the bottom bar chart, the land-based SM-3, ABIR, directed energy research, and PTSS all continue (denoted by the green bars).

Advanced Technology Programs

Of the 13 programs shown in Table E-2, at least three advanced technology programs may be considered part of what is being defined as MDA’s discretionary budget, where the investment does not appear to directly lead to a system procurement phase without first having to undergo a next-step system develop-

FIGURE E-1 MDA budget breakout by LCC phases. The total portfolio investment budget depicted in this figure does not include $431 million for RDT&E funds for Pentagon Reserve and MDA management headquarters nor does it include the MILCON budget or BRAC funds. The testing budget includes funds for Joint Warfighter exercises and war games but does not include funds for modeling and simulation, which were considered to be part of the development phase.

TABLE E-2 MDA FY 2011 Major Development Programs of Record

| Ballistic Missile Defense (BMD) Programs | Breakdown of Funding of Programs (%)a |

| Aegis | 29 |

| BMD enabling programs | 14 |

| Aegis SM-3 Block IIA codevelopment | 11 |

| Aegis ashore (SM-3 Block IIB) | 9 |

| C2BMC | 9 |

| GMD midcourse segment | 6 |

| Advanced technology | 4 |

| Airborne infrared | 4 |

| Directed energy research | 3 |

| Ground-based radars | 3 |

| Terminal segment of THAAD | 3 |

| Precision tracking and surveillance system (PTSS) | 3 |

| Other | 2 |

NOTE: C2BMC, command and control battle management center; THAAD, Terminal High-Altitude Area Defense.

aPortion of $2.9 billion FY 2010 funds for development.

FIGURE E-2 MDA program budget changes from FY 2010 to FY 2011. GBI, ground-based interceptor; STSS, space tracking and surveillance system.

ment activity proposed by MDA and funded within the FYDP or in the next 5-yr time frame. These three programs—BMD Enabling, Advanced Technology, and Directed-Energy Research—comprise 21 percent, or approximately $600 million, of the total development funds of $2.9 billion (in FY 2010 dollars).

Approximately 14 percent of the funds are for BMD Enabling programs, which are focused on developing critical processes needed to integrate standalone missile defense systems into a layered BMD system to achieve cost and operational efficiencies by improving protection performance within increased defended areas and minimizing force structure costs.

Another 4 percent of MDA’s development budget is allocated for advanced technology efforts as a hedge against future threat uncertainties focused on funding next-generation and game-changing technologies with promising operationally cost-effective capabilities and developing and demonstrating the maturity of relevant components for future BMDS architectures.

A third development program, directed energy research, consuming 3 percent of the total MDA development budget, is focused in the near term on the following:

• Using an aircraft test platform in flight, along with ground tests, to characterize high-energy laser beam propagation and the effects of atmospheric (1) propagation and (2) boundary layer and jitter with varying engagement geometries,

• Developing and experimenting with diode-pumped gas lasers, fiber lasers, and solid-state and advanced high-power laser optics,

• Investigating lethality, counter-countermeasures, beam propagation, modeling, laser beam combining, and additional innovative areas, and

• Analyzing alternatives to select out-year laser investments.

Shifting MDA Budget Trends

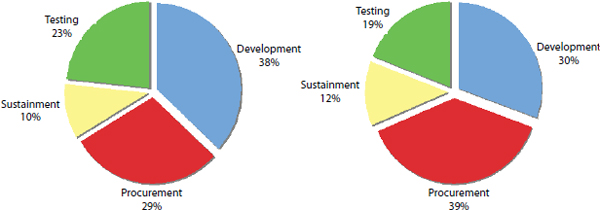

In addition to advanced technology funds being a potential source of future discretionary budget, the MDA’s continuing role in procurement of Aegis systems and material sustainment of deployed THAAD systems in FY 2012 and the out-years has shifted and reduced the percent of total MDA funds earmarked from 38 percent in FY 2011 to 30 percent (proposed) in FY 2012. As displayed in Figure E-3, FY 2012 procurement funding as a portion of the total MDA budget is 10 percent higher than in FY 2011, owing primarily to a 7.5-fold increase in the Aegis FY 2011 program budget. The FY 2012 sustainment portion of the total

FIGURE E-3 Trends in MDA investment budget portfolio (FY 2011, left pie chart; FY 2012, right pie chart).

MDA budget is 2 percent greater than the FY 2011 budget owing primarily to an increase in THAAD total sustainment funds, which now list a separate O&M budget line item for this system.

MAJOR ESTIMATING GROUND RULES AND ASSUMPTIONS

All costs in this appendix are expressed as FY 2010 dollars.5

The system LCC for each of the options considered will be displayed as “minimum” (or low) and “maximum” (or high) range estimates. For purposes of this study, the resulting LCC estimates for the minimum or the lower bound of the range estimates represent the projected “should cost” estimates6 and are computed based primarily on the data sources and cost estimating methods described later in this appendix.

Since the system options for improving U.S. missile defense range from new, advanced technology, long-range alternatives to near-term, well-proven technology alternatives, the system cost uncertainty of proposed programs and maximum, or upper bound, cost (system “will cost”) estimates must, from a budgetary perspective, include the potential for “representative” cost growth comparable to that of interceptors, early warning IR sensor systems, and ship- and ground-based radar systems. In addition, maximum cost “estimates for systems that are defined only conceptually or that depend on the development of new technologies [could grow faster than those] for well-defined programs [that are] based on proven technologies.”7 For example, as reported by CBO and assessed by the RAND Corporation, the total development and procurement cost growth

_____________

5Costs were escalated to FY 2010 dollars using inflation rates listed in the Air Force Raw Inflation Indices Base Year (FY) 2010 table by appropriation budget categories (e.g., Total Military Compensation (3500), Operations and Maintenance (3400), RDT&E (3600), MILCON (3300), Aircraft and Missile Procurement (3010/20), Other Procurement (3080), and Fuel. The inflation rates are based on OSD Raw Inflation Rates from December 11, 2009 and were issued by the Secretary of the Air Force/FMCEE as the OPR on January 8, 2010.

6The “should” cost” and the “will” cost estimates are terms commonly used by the OSD CAPE office. “Should cost” estimates are most likely generated by program offices and will include additional contingency costs to account for the inherent uncertainty in the cost-estimating methods used and for mitigating known system-specific risks (e.g., requirements creep, program budget changes, and schedule slips).

7Congressional Budget Office. 2004. Alternatives for Boost-Phase Missile Defense, Washington, D.C., July.

for missiles averaged 43.9 percent for six programs. Development cost growth was reported to 40.6 percent with procurement at 58.5 percent.8

DOD budgets for many past and current programs of record, in particular MDA and military service funds, have already been committed as part of the FY 2011 PB submitted in February 2010 and were waiting for approval in FY 2011. In addition, the PB budget justification for the majority of RDT&E and procurement program budgets contains annual projections in the FYDP through FY 2015.

For the purposes of this study and as a ground rule for estimating the cost of potential system options for improving U.S. missile defense, there is a set of system architecture baseline systems and programs of record that are operational and undergoing testing and demonstration, already fielded, or close to providing initial operational capability (IOC) before the end of the FY 2011 FYDP in FY 2015. Since the past annual funds through the approval of FY 2011 budget have already been expended or will soon be committed for these programs of record, the committee considered this portion of the LCC of the following systems as sunk cost and did not include them in their estimates.

KEY BALLISTIC MISSILE BENCHMARK DATA SOURCES

To the greatest extent possible and where the systems were technically similar to previous systems, development and production cost estimates were based on adjusting analogous costs from data from (1) historical programs of record supplied by MDA, (2) detailed breakout of funds identified in past fiscal year budget justification sheets, and (3) open source contract award prices as documented in Defense Links.

Table E-3 is a representative reference list of MDA interceptors the committee used as the key reference data for generating its LCC range estimates along with key cost details listed in tables that follow later in this section and representative sets of parametric data values collected for each.

_____________

8For most components, the cost-risk factors that CBO used were developed by the RAND Corporation and were based on published updates reported in Joseph G. Bolten, Robert S. Leonard, Mark V. Arena, Obaid Younossi, and Jerry M. Sollinger, 2008, Sources of Weapon System Cost Growth Analysis of 35 Major Defense: Acquisition Programs, MG-670-AF, Santa Monica, Calif. Total development and procurement cost growth for missiles averaged 43.9 percent for six programs. Development cost growth was reported at 40.6 percent, with the 17.5 percent of the 40.6 percent due to requirements changes, another 4.6 percent due to schedule changes, and the majority of the remainder of 15.2 percent due to cost estimating errors. The procurement cost growth average of 58.5 percent included 13.1 percent for requirements changes, 15.5 percent for schedule changes, and 5.5 percent for quantity changes with most of the remainder of 13.9 percent due to cost estimating errors.

TABLE E-3 Representative Sources of Cost Data

| Interceptor Systems | Development (NonRecurring Cost) | Production (Recurring Unit Cost) | Annual O&S Cost | MILCON Cost |

| GMD systemsa | ||||

| GBI | NMD and GBI and test details | Booster stacks (2 vs. 3 stage), booster avionics module (BAM), EKV, IA&T, long-lead parts | Total GMD system MDA, contractor and MILPERS sustainment costs and unscheduled and scheduled maintenance costs per GBI | Missile fields, utilities and mechanical/electrical buildings |

| Silos | Part of NMD total | Missile field 2 estimates, allocated on per silo cost basis | Silo ground infrastructure | |

| IFICS data terminal | Part of NMD total | FGA configuration | Yes | |

| Ground fire control | Part of NMD total | Common to FGA and MDIOC | N/A | |

| Aegisb | ||||

| BMD 3.6.1 | ||||

| SM-3 Block IA | Combined total | Yes | Per missile | N/A |

| Ship system (AWS) | Separate total | Total only including installation cost | Per AWS | N/A |

| BMD 5.1 | ||||

| SM-3 Block IB | Separate total | Yes | Per missile | N/A |

| Ship system (AWS) | Separate total | Total only including installation cost | Per AWS | N/A |

| BMD 5.1 | ||||

| SM-3 Block IIA | Separate total | N/A | TBD | N/A |

| Ship system (AWS) | Separate total | Total only including installation cost | TBD | N/A |

| THAADc | ||||

| System | Captured in RDT&E budget documents | Total procurement cost only (includes PSE, systems integration, GSE and CFE) | Beginning in FY 2011, annual O&S cost per THAAD battery split between MDA and Army O&M and MILPERS | N/A |

| Interceptors | Part of system total | Yes | budgetsd | N/A |

| TFOC | Part of system total | Yes | N/A | |

| Launchers | Part of system total | Yes | N/A | |

| Interceptor Systems | Development (NonRecurring Cost) | Production (Recurring Unit Cost) | Annual O&S Cost | MILCON Cost |

| PAC-3 | MDA and Army RDT&E and procurement budgets and latest selected acquisition report | N/A | ||

NOTE: MDIOC, Missile Defense Integrated Operations Center; NMD, National Missile Defense; EKV, exoatmospheric kill vehicle; GBI, ground-based interceptor; IA&T, assembling, integrating, and testing; GSE, general support equipment; CFE, contractor furnished equipment; PSE, particular support equipment; O&S, operation and support; TFCC, THAAD Fire Control and Communications; AWS, Aegis weapon system.

aBenchmark cost for sea-based and ground-based X-band radar covered separately.

bBenchmark cost for SPY-1 radar covered separately.

cBenchmark cost for terminal-based TPY-2 radar covered separately.

dTHAAD O&S annual costs are divided between MDA PTSS, sustaining support, government-furnished equipment (GFE) and support equipment modifications and logistics support of the interceptors, TFCC, and launchers. The Army O&S costs are comprised of POL, GFE spares, repair parts and depot maintenance and indirect support.

ESTIMATING METHODS

Overview

The best estimating methods were selected based on compilation from one of the following:

• Analogous systems with comparable performance and/or technical parametric values or

• Cost models based on factors ranging from weight and power costs to statistically derived cost estimating relationships (CERs).

Cost models with sets of CERs were preferred; they were selected based on a set of technical parameters that best depicted and aligned with the logical set of cost drivers that directly impact the magnitude of the booster and propulsion missile system costs, missile IR seekers, ground radars, airborne and space-based EO/IR/FMV sensors, space launchers, cost per kilogram trends, and so on. In addition as part of the set of estimating methods, the committee used cost models that quantified cost sensitivity—in, for example, estimating space-based interceptors vs. ground-based interceptors and differences between airborne and space-based IR sensors.

TABLE E-4 Summary of Parametric Cost Models

| System or Subsystem | Parametric Cost Models |

| Interceptor stages | Basic rocket equations |

| Propulsion subsystems | Tecolote launch vehicle cost model |

| NASA Marshall Space Flight Center (MSFC) Launch Vehicle Cost Modela | |

| IR seekers | Galorath SEER-hardware and electro-optical systems (EOS)b |

| Airborne platforms | RAND DAPCA modelc |

| Space-based platforms | Tecolote unmanned spacecraft cost model (USCM)d |

| Aerospace small satellite cost model (SSCM)e | |

| Radar | Technomics ground-based radar cost modelf |

| Electro-optical sensors | Galorath SEER-hardware and electro-optical systems (EOS)b |

| Launch service costs | American Institute of Aeronautical Engineers (AIAA) International |

| Launch Vehicle Systems Handbook, 4th editiong |

aTecolote Research, Inc. 1996. NASA MSFC, Launch Vehicle Cost Model, PRC Service, CR-0734, August 23. CERs for solid rocket motor, liquid rocket engines, solid fuel systems, and so on.

bGalorath SEER-electro-optics (EO) parametric cost model.

cRAND Corporation, DAPCA aircraft cost model.

dUSAF Unmanned Spacecraft Cost Model, eighth edition.

eAerospace Corporation, 2002, Small Satellite Cost Model (SSCM).

fTechnomics ground-based radar cost model; CERs taken from J. Horak, J. Harbor, and C. Holcomb, “Integrating Performance and Schedule Analysis with Acquisition Costing for Ground-Based Radars,” presentation to the committee, February 18, 2010.

gAIAA, 2003.

Development Costs

In general, the primary approach used in estimating the rough order of magnitude of development costs was based on an analogous method where feasible. This approach relied on parametric cost models when needed or on a cross-check to ensure the overall reasonableness of the estimates. The parametric cost estimates used for both development and production cost estimates is summarized in Table E-4.

The analogous estimates were computed using historical costs from comparable systems and escalating them to FY 2010 constant year dollars. The costs were then adjusted based on applying an aggregate set of complexity factors primarily driven by a top-down subsystem, and estimates might be lower because of the extent to which the new system could leverage the technical design, engineering, and manufacturing heritage. The heritage assessments were expressed in terms of technology readiness levels (TRLs) or manufacturing readiness levels (MRLs), widely used indexes of maturity.9

_____________

9William L. Nolte, USAF Air Force Research Laboratory (AFRL), Sensors Directorate. 2007. Hardware and Software Transition Readiness Level Calculator, Version 2.2, March 9. Available at www.acq.osd.mil/jctd/TRL/TRL%20Calc%20Ver%202_2. Accessed August 28, 2012. See also William L. Nolte, USAF AFRL, Sensors Directorate, 2002, AFRL Technology Readiness Calculator, October. Available at www.dtic.mil/ndia/2003systems/nolte2.pdf. Accessed August 28, 2012.

Production Costs

In general, the total production cost of each interceptor is calculated by estimating the first unit cost of each major component of the system and then by estimating the cost of assembling, integrating, and testing (AI&T) those components into the first interceptor off the production line. The components include the booster stage(s), avionics (electronic communications and navigation systems), the KV, and, for mobile interceptors, the launch canister. Unless there was a comparable early warning IR sensor, radar, or interceptor with known unit production cost details, the costs of the majority of the relatively new systems were based on system, subsystem, or lower level CERs from the parametric cost models listed in the above table.

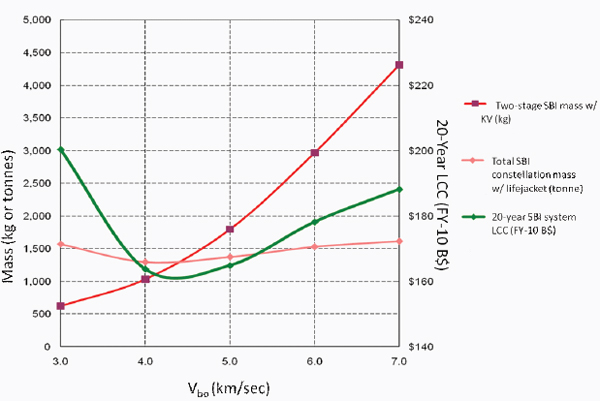

Specifically, the booster portion of the interceptor costs that were not part of the MDA programs of record were estimated using a CER based on the total impulse (thrust multiplied by burn time) of each stage of a booster and other technical parameters to calculate the cost of the first production model of the booster. Costs for the booster’s avionics and KV’s avionics, divert attitude control system (DACS), thrusters, and other hardware were estimated with the Air Force Unmanned Spacecraft Cost Model (USCM). USCM uses CERs based on the mass of various components. In addition, the space-based interceptor satellite configured with a lifejacket was estimated using USCM at the subsystem level.

“Wrap” factor percentage values were also applied for estimating the costs of IA&T for components, subsystems, or systems by adding the costs and applying a percent value to the total cost of an interceptor. Where applicable, a wrap factor percentage was also applied for estimating the cost of government systems engineering and project management (SEPM), which would add another 30 percent. The percentages and values applied in the roll-up of an interceptor (as well as other sensor system costs) are consistent with CERs most commonly used for such work.

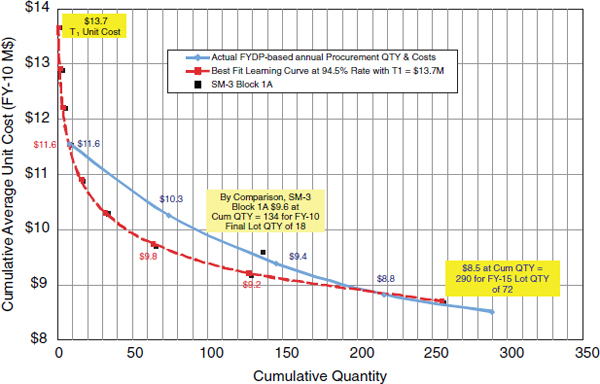

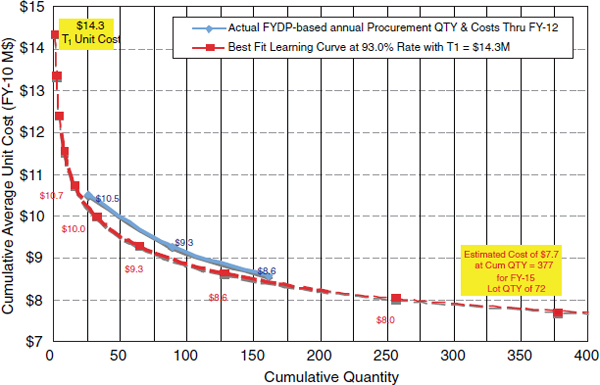

As in the 2004 CBO report, “costs for the [remaining new] interceptors that would be purchased under each option were estimated by analyzing trends in actual costs for the ground-based” interceptors that MDA has recently purchased.10 The average unit procurement costs computed for multiple interceptors reflects the impact of total manufacturing labor hours and of cost efficiencies of discounts on material quantities on the cost of the first interceptor or other system firsts. Costs would decrease as a function of the quantity produced within an assumed continuous single manufacturing run or of the inefficiencies of reopening and restarting a manufacturing line to procure more replacement interceptors. The estimate of unit production cost of additional interceptors is based on the learning curve, or cost improvement curve (CIC), or on a slope of the historical unit

_____________

10Congressional Budget Office. 2004. Alternatives for Boost-Phase Missile Defense, Washington, D.C., July.

production cost of analogous interceptors as a function of quantity produced.11 Details are provided in the next section of this appendix of the computed unit production cost for Aegis SM-3 Block IA and THAAD interceptors.

Sustainment Costs

Except for space-based interceptors (SBIs), the majority of the sustainment cost estimates are based on average annual O&S system costs provided by MDA and military services’ program offices. As needed and for completeness, the average annual O&S costs for systems already delivered and fielded were estimated by the committee and cross-checked against the total MDA portions of the RDT&E program budget justification sheets, where material sustainment-related activities were specified and the military services (i.e., Navy for Aegis and Army for Patriot) O&M system program budgets and associated military personnel (MILPERS) funds were clearly identified at the system and operating unit levels. For SBIs, the sustainment costs were based on an average on-orbit life for each SBI satellite of 7 years and included procurement replacements and launch costs to maintain full operational capability (FOC) over the 20-yr service life. The annual operating costs for ground mission control were based on previously estimated costs from the 2004 CBO report escalated to FY 2010 dollars.12

LIFE-CYCLE COST DETAILS ON MDA NEW SYSTEMS

Aegis SM-3 Block IIA and Aegis Ashore Systems

In the FY 2012 PB, MDA requested an RDT&E total budget of $2.7 billion through FY 2016 (in FY 2010 constant dollars) for the SM-3 Block IIA interceptor system and another $350 million for the Aegis Ashore program for the procurement of the first 15 Block IIA interceptors. First delivery of Block II interceptors is expected in FY 2019. Projecting forward, the committee estimated 20-yr LCC that includes the requested budget to account for the potential deployment of these latest Aegis interceptors at both ship-based locations in the Persian Gulf and land-based European or Middle East sites.

Table E-5 lists the total 20-yr LCC estimates for improved ship-based and land-based Aegis SM-3 Block IIA interceptors.

In addition to these sites with large coverage capability against Iranian IRBM/MRBM threats, a number of THAAD and/or PAC-3 batteries will also be needed for close-in defense against SRBMs near the forward perimeter of the

_____________

11The learning curve, or CIC slope, value of, for example, 95 percent, quantifies the cost reduction associated with doubling the number of interceptors being purchased and reduces the average unit cost of the lot buy of interceptors by about 5 percent.

12Congressional Budget Office. 2004. Alternatives for Boost-Phase Missile Defense, July, Washington, D.C.

TABLE E-5 Improved Aegis SM-3 Block IIA Interceptor System LCC Estimates (FY 2010 billion dollars)

| Minimum | Maximum | |

| Developmenta | 2.0 | 3.0 |

| Procurement | See above | See above |

| Force quantity buyb | Projected SM-3 Block IIA, quantity = 56 (mix of either two dedicated Aegis ships or two land-based sites) | |

| MILCON | 0.10 | 0.10 |

| 20-yr O&Sc | 3.9 | 4.4 |

| Total | 6.0 | 7.5 |

aBased on the MDA FY 2012 FYDP RDT&E PM SM-3 Block IIA codevelopment and Aegis Ashore program budgets from FY 2010 through FY 2016. The development cost also includes the delivery of 29 SM-3 Block IIA interceptors covered as part of the RDT&E interceptor co-development program budget through FY 2016 and an additional procurement budget buy of 15 SM-3 Block IIA interceptors. The average unit cost of the SM-3 Block IIA missile round was listed in FY 2014 at $24.3 million.

bThe procurement cost included in the development estimate is based on a force quantity buy of 48 operational SM-3 Block IIA missiles and an additional 8 test interceptors.

cThe SM-3 Block IIA system O&S estimates are based on continuous operational readiness of 48 SM-3 Block IIA interceptors on a mix of two dedicated Aegis ships in either the Persian Gulf or at two Middle East fixed land sites with 24 operational missiles plus test interceptors at each location, all over a 20-yr sustainment period.

defended zones. The 20-yr LCC summary estimates for these two systems are provided later in this appendix for THAAD and for Army PAC-3/MSE systems.

Aegis SM-3 Block IIB

MDA is requesting in the FY 2012 PB an RDT&E total budget of $1.6 billion through FY 2016 (in FY 2010 constant dollars) for the SM-3 Block IIB interceptor system program of record. Since the SM-3 Block IIB program beginning in FY 2011 is in an early technology development phase, MDA has awarded three contracts with potential prime contractors to define missile concepts, assess technology risk, and complete system-level trade studies in preparation for the product development phase, which is not scheduled to begin until FY 2013.

Even though previous performance interceptor funding combined with the propulsion technology content was used for the SM-3 Block IIB new program of record, it is too early in the acquisition to determine if the design baseline will focus on maturing the key component technologies to TRL values of 5 or 6 for increasing the speed of the missile (using lighter weight structures and materials to reduce inert mass) and ensuring the flexible energy management needed to effectively engage targeted ballistic missiles early in their trajectory. Other opportunities in the design trade space could include investments in advanced seeker technologies to increase KV acquisition range thus improving threat missile containment.

The engineering trade space includes alternative configurations for the booster to enable higher burnout velocities; larger diameter missiles and resulting modifications to the MK41 VLS launcher, rocket propellants, missile structures, control mechanisms, and missile communication concepts to enable communication with multiple sensors over several frequencies; and the kinetic warhead seeker and the kinetic warhead DACS. Another key aspect of the trade studies and technology development is to analyze and define a larger canister and missile threat that is compatible with the MK 41 launcher used on Aegis ships to ensure compatibility with Aegis Ashore and Afloat. This comprehensive strategy of technology investments to reduce risk, exploit technology opportunities, and engage industry early will provide the foundation for executable plans for the product development phase.

Given the current consideration of several land-based SM-3 Block IIB interceptor designs within the solution space from the original SM-3 Block IIB designs and projecting forward to a higher performance next-generation Aegis missile system (NGAMS), the committee estimated 20-yr LCC ranges to account for the technical risk and cost uncertainty in potential deployment of these latest AEGIS interceptors at land-based European sites.

Table E-6 lists the 20-yr LCC estimates for land-based SM-3 Block IIB interceptor systems for one dedicated European fixed site.

TABLE E-6 Land-Based SM-3 Block IIB System 20-Yr LCC Estimates (FY 2010 billion dollars)

| Minimum | Maximum | |

| Developmenta | 5.3 | 13.7 |

| Procurement | See above | See above |

| Force quantity buyb | Projected SM-3 Block IIB, quantity = 28 (one dedicated European land site) | |

| MILCONc | 0.10 | 0.10 |

| 20-yr O&S | 3.8 | 5.5 |

| Total | 9.2 | 19.25 |

aThe total development cost is based on total MDA FY 2012 RDT&E PB budget from FY 2011 through FY 2016 requested for the (1) land-based SM-3 Block IIB program, (2) BMD advanced technology development funds that were transferred to this program beginning in FY 2012, and (3) additional projected cost the committee estimated for extending the development phase for the lower bound, or minimum, total cost to FY 2019 and the upper bound, or maximum, total cost with the development program extended to FY 2021 and beyond.

bThe procurement cost included in the development estimate is for a total force buy quantity for defending U.S. and European allies and U.S. deployed forces from an Iranian ballistic missile attack based on a total buy quantity of 28 SM-3 Block IIB missiles: 24 operational missiles and 4 test interceptors, ground-based launchers, fire control units, and C2BMC terminals at a single dedicated European land-based site.

cThe MILCON cost is based on the MDA FY 2012 PB MILCON budget requested for the construction cost of a land-based SM-3 launch facility in the FY 2013 time frame.

Total SM-3 Block IIB interceptor system O&S estimates are based on the costs for continuous operation readiness, testing and sustainment at one land-based European site for maintaining the 24 operational missiles and remaining test assets over a 20-yr period.

ABIR Systems

Life-Cycle Cost Summary

The 20-yr LCC range estimate for the ABIR system is summarized in Table E-7.

TABLE E-7 ABIR System Total LCC Estimate (FY 2010 billion dollars)

| Minimum | Maximum | |

| Developmenta | 1.4 | 1.9 |

| Procurementb | 0.3 | 0.7 |

| Force quantity buyc | Three 24/7 CAPs of 3 + 1 spare or four mission-capable | |

| Reapers and a ground station per | CAP | |

| Total inventory of 12 vehicles for a notional annual use of up to 90 days per yr | Total inventory of 17 vehicles for a surge demand of up to 270 days per yr | |

| MILCON | 0.03 | 0.06 |

| 20-yr O&Sc | 2.6 | 2.8 |

| Total 20-yr LCC estimate | 4.2 | 5.4 |

NOTE: CAP, combat air patrol.

aThe development cost estimate of between $1.4 billion and $1.9 billion is based on the MDA total investment in the ABIR program from FY 2011 through FY 2016 of $342 million as stated in the MDA FY 2012 FYDP and projected forward for another 9 to 14 years from FY 2023 through FY 2030 to complete EMD through full operational testing and continuing until go-ahead into the production phase. (Of the $342 million in the ABIR program budget through FY 2016, $312 million is for the RDT&E development program and $30 million is MILCON budget for the construction of an ABIR facility in FY 2014.)

In addition, the development range estimates includes the cost of designing, integrating, and testing five fully configured flight test articles at a lower bound, or minimum, average unit procurement cost (AUPC) of $21.5 million for Reaper MQ-9Bs configured with an as-designed MTS-B sensor coming off the production line or at an upper bound, or maximum, AUPC of $24.5 million for a slightly modified MTS-B. The range for each ABIR system flight test article also includes an onboard processor and communications link to the C2BMC needed for satisfying and demonstrating the unique missile tracking performance required for the ABIR mission. The committee also estimated the AUPC of five sets of Reaper MQ-9 ground systems at $10 million each (in FY 2010 dollars) to be delivered along with airborne vehicles during the development phase. (Each Reaper ground system includes the procurement of hardware for the Reaper launch and recovery element for landings and takeoffs and the mission control station (MCS) for operating the vehicles once at cruise altitude and in on-station CAP orbits. The MCS includes the hardware and software interfaces to enable Reaper’s ground operators to monitor the health and status of the airborne C2BM communications downlinks and ensure the integrity and timely transmission of the airborne IR sensor missile tracking data that is being routed to the nearest C2BMC and the designated interceptor’s fire control radar.)

bFor the follow-on production phase in FY 2023 to FY 2030, the procurement cost range estimate of between $300 million and $700 million is based on an ABIR system AUPC range for the force-level quantity of between 12 and 17 airborne systems. The committee based its procurement minimum cost estimate for an ABIR sensor AUPC integrated on a Reaper MQ-9B airborne vehicle configured with a modified MTS-B sensor at a lower bound, or minimum, AUPC estimated at $21.4 million for a lower bound force size of 12 airborne systems. The committee based the procurement maximum cost estimate for the same ABIR sensor AUPC integrated on a Reaper MQ-9B airborne vehicle configured with a notional repackaged, smaller, lighter, reduced-power-version of the pod-mounted Heimdall sensor as an alternative candidate IR sensor, also integrated on a Reaper MQ-9 airborne vehicle with a minimum AUPC estimate of $37.9 million for a higher force-level quantity of 17 systems. (The modified Heimdall sensor unit cost is based on a further weight, volume, and power reduction over the envisioned modifications needed for the Global Hawk RQ-4B. Further details on the earlier use of the Heimdall sensor and the basis for the modified version of this sensor are provided in a previous section of this appendix, “Aegis SM-3 Block IIA and Aegis Ashore Systems.”) Finally, the procurement cost also includes three ground systems at $10 million each required for operating three CAPs at separate outside the continental United States (OCONUS) forward-deployed bases.

cThe 20-yr O&S cost range estimate represents the steady-state annual O&S costs on a per CAP basis for operating and sustaining the ABIR systems and the ground segment operations centers out of a forward-deployed OCONUS base across the range of a force size inventory of up to (1) 12 systems for an average annual surge of CAP operations for 90 days, estimated at an annual cost of approximately $42 million per CAP and (2) up to 17 systems for a higher annual surge of CAP operations for 270 days, estimated at an annual cost of approximately $47 million per CAP.

The basis for the forward-base locations, time to station, and other details used to compute the number of ABIR-configured Reapers to sustain a 24/7 CAP and the total force inventory quantity range of ABIR-configured Reapers needed for nominal and surge demand conditions are provided later in this section.

Previous Relevant Investments

As part of the potentially relevant (and technically relevant) proof-of-concept investment activities that preceded MDA submitting a budget for FY 2011 budget through FY 2015 for the new start ABIR program in February 2010, MDA has an on-going Airborne Sensor (ABS) program. The ABS program issued a request to industry in May 2009 for going forward with a 5-yr effort to continue “operation and sustainment of the MDA airborne sensors and platforms used to support the BMDS test program.”13 At that time, the contractor that won the award would

… be required to perform mission operations, aircraft test operations, and aircraft maintenance [on four] airborne sensor systems currently operated by

_____________

13Airborne Sensor Program (ABS) Sources Sought, FBO Daily, May 22, 2009, FBO #2734, Notice date May 20, 2009, available at http://www.fbodaily.com/archive/2009/05-May/22-May-2009/FBO01824078.htm. Accessed June 14, 2012.

MDA[:] the High Altitude Observatories (HALO I, II, and III) and the Wide-body Airborne Sensor Platform (WASP) aircraft….

The HALO I is a Gulfstream IIB aircraft with multiple sensors viewing through optical windows, used for data collection in the visible through long-wave IR (LWIR) spectral regions. Four sensor stations accommodate a mix of user-defined sensors in three gimbaled-mirror pointed platforms and one fixed-mirror pointed platform. HALO II is also a Gulfstream IIB aircraft with a cupola mounted atop the fuselage that allows for open port viewing with a multiband sensor system to collect radiometric and photo documentation data in the visible through LWIR spectral regions. HALO II also allows for window viewing by cabin sensors. HALO III is a Gulfstream IISP aircraft that serves as the airborne diagnostic target (ADT) for the Airborne Laser program. It includes a wing-mounted sensor pod, plume emulator, target board, various beacon lasers, and ADT system control and situational awareness hardware. WASP is a DC-10 aircraft modified with three pressure vessels to allow open port or closed cabin optical window sensor viewing. WASP will accommodate a prime sensor system (PSS) for data collection and guest captive-carry seeker/sensor systems. The WASP PSS is similar in design and capability to the HALO-II primary sensor.14

Furthermore, as a precursor to the ABIR program, the ABS program’s industry solicitation also stated that “as future requirements emerge, MDA may add additional aircraft, additional sensors, develop new sensor systems, and/or modify sensor/mission support systems onboard the current [MDA] aircraft…. [MDA stated that] the intended outcome of this [solicitation was] to [both] determine interest and capability in supporting the ABS program and to identify acquisition alternatives that may warrant further study and review.”15

In going forward and as part of its justification for the ABIR budget, MDA stated that in order “to address the looming threat of regional forces in large numbers, [it had] aligned [its] technology investments with [the objective of uncovering] gaps in [the] ability to (1) address large raid sizes and (2) intercept the enemy early in [its] trajectory [and] when the enemy is most vulnerable[:] assess[,] then reengage if necessary.”16

In addition, to potentially leverage the relevant airborne IR and optics technology from the ABS program, MDA had prior to February 2010 “demonstrated the ability of IR sensors carried aboard Navy Reaper unmanned aerial systems to observe ballistic missiles in-flight at long distance during the “Stellar Daggers” test in Hawaii and the Delta II launch in California. The impressive results of

_____________

14Ibid.

15Ibid.

16As reported in MDA, FY-2011 FYDP Research, Development, Test & Evaluation, President’s Budget, Exhibit R-2, RDT&E Budget Item Justification, BA 4: Advanced Component Development & Prototypes (ACD&P), PE 0604884C: Airborne Infrared (ABIR), February 2010.

these tests lead [MDA] to believe that airborne sensors can be an effective component of the Ballistic Missile Defense System as early as 2015.”17

Going forward, the MDA total investment in the ABIR program, $477.1 million (FY 2010 dollars) reflects the average annual budget, $95.4 million (FY 2010 dollars), for the technology development effort to prove the airborne sensor capabilities and allow the operational assessment and proof of capability needed to detect ballistic targets and achieve early intercepts by conducting a series of ground and flight tests through FY 2012. Specifically, MDA stated that

these demonstrations [will] incrementally prove the key functions of an airborne infrared sensor:

• Acquisition of a threat based on a cue from overhead persistent infrared satellites;

• Tracking of a threat throughout its flight;

• Generation of a two-dimensional track prediction of the threat’s flight path based on a single airborne sensor;

• Fusing multiple two-dimensional tracks into a three-dimensional track with sufficient accuracy to launch an interceptor; and

• Delivering this information through the C2BMC system to the shooter….

In FY 2010, [MDA] began assessing platform and sensor alternatives with MIT’s Lincoln Laboratory and partners at the Joint Integrated Air and Missile Defense Organization. This effort [pointed] the way to the [airborne] vehicle most suited to fill this role among a group of candidates including the currently deployed MQ-9 Reaper and the RQ-4 Global Hawk. At the same time, [MDA] [engaged the] Joint Forces Command and the COCOMs to develop a concept of operations for adding this mission to the [DOD’s] unmanned aerial systems fleet.18

The alternatives for the most likely platform and sensor combination were based on a cost-effectiveness assessment of the sensor’s performance, target auto tracking, and raid handling capacity and on the airborne systems’ secure communications data link capability to accurately transmit IR sensor data with low enough latency to enable C2BMC and BMDS interceptors to complete ballistic missile engagements.

Plans going forward include

computer-in-the-loop to hardware-in-the-loop experiments to incrementally verify and validate [the] functionality [of the airborne sensor’s effective field of regard. According to MDA, these experiments [will] culminate in Aegis intercept flight tests using primarily airborne sensors for fire control at the Pacific Missile Range Facility in Hawaii [planned for] the summer of 2012. This testing,

_____________

17Ibid.

18Ibid.

interspersed with regular campaigns in theater, [leads] to [MDA’s plans for] an operationally useful architecture as early as [FY] 2015.19

As for estimating the recurring unit costs of the airborne platform and IR sensor mix system quantities, the planned schedule reported in the FY 2011 MDA ABIR program budget of February 2010 called for the first delivery of platform and ground station in the third quarter of FY 2011, followed by four other platforms and ground stations in 1-yr increments through FY 2015. MDA planned on modifying the first and second long lead in the first and fourth quarters of FY 2011. Since the program was to start in the first quarter of FY 2011, the committee assumes these airborne IR sensors are most likely MTS-B sensors already in production or a modified version of the MTS-B sensor. For estimating purposes, two other near-term key milestones are the launch of an ABIR system for performing an airborne sensor risk reduction demonstration, set for the third quarter of FY 2012, and plans for an acquisition procurement milestone decision by the second quarter of FY 2012 to procure operational assets for fielding in FY 2015.

MDA Force-Level Quantities

For the purposes of estimating a recurring cost range for a representative unit during the procurement phase, the committee assumed a total MDA force-level quantity of at least 12 and a maximum of 17 airborne systems and the necessary three sets of ground stations that would be capable of sustaining eight mission-capable systems or primary authorized aircraft (PAA) operationally available for providing persistent 24/7 missile tracking coverage of up to three CAPs or one system per CAP. Each CAP and the two or three requisite PAA-designated systems are capable of being prepositioned and/or forward-deployed well in advance of the threat at OCONUS military bases located within a reasonable operating system range of the expected area of regard and within the effective range of the IR sensor for performing the missile tracking mission. The total force-level quantity also includes the procurement of three spares or backup inventory (BAI)-designated systems that are available as needed and colocated with each of the other PAA systems at one of the three OCONUS bases. The BAI-assigned ABIR systems are configured with the same airborne IR sensor as the PAA aircraft and are needed to maintain persistent operational coverage and used for replacing PAA-designated systems either in transit from the CAP back to the forward-deployed squadron or not operationally available until field maintenance is completed. Finally, based on a notional surge capability of three continuous CAPs on station for between 90 days and 270 days per year, the minimum and maximum range estimates of the total force-level quantity of ABIR systems is also based on procuring anywhere from one to six additional aircraft designated as attrition

_____________

19Ibid.

TABLE E-8 Projected Force-Level Quantities for ABIR Systems

| Force-Size Parameters | Reaper MQ-9 |

| Representative distance base to CAP (mi) | 621.4 |

| Cruise speed (mph) | 175 |

| Notional endurance (hr) | 32.0 |

| One-way transit to fly-out and back (hr) | 7.2 |

| Time on station (hr) | 24.8 |

| Total flight hours per sortie | 32.0 |

| Sorties per day per CAP | 1.0 |

| Number of CAP forward-operating base locations | 3 |

| Total sorties per day | 3 |

| Sorties per day per aircraft | 1 |

| Total number of PAA-designated aircraft employed | 3 |

| BAI-designated aircraft per location | 1 |

| Minimum total force size of ABIR systems (assumes no attrition) | 6 |

| Force flight hours per day (three CAPS) | 72 |

| Case 1: 90-day continuous three CAPS operation | |

|

Total annual flight hours for 90-day surge |

2,160 |

|

Average annual PAA-designated flight hours per aircraft per year |

360 |

|

Attrition rate per 100,000 flight hours |

2.0 |

|

Life-cycle flight hours (over assumed 15-yr service life) |

32,400 |

|

Number of attrition reserve for 90-day surge (over 15 yr) |

1 |

|

BAI-designated aircraft |

3 |

|

Minimum total force size (with attrition) |

10 |

| Case 2: 270-day continuous three CAPs operation | |

|

Total annual flight hours for 270-day surge |

19,440 |

|

Average annual PAA-designated flight hours per aircraft per year |

3,240 |

|

Attrition rate per 100,000 flight hours |

2.0 |

|

Life-cycle flight hours (over assumed 15-yr service life) |

291,600 |

|

Number of attrition reserve for 270-day surge (over 15 yr) |

6 |

|

BAI-designated aircraft |

3 |

|

Maximum total force size (with attrition) |

15 |

reserve inventory and needed to replace PAA systems due to operational attrition or other accidents, assuming, on average, the loss of two systems every 100,000 flight hours, where an in-flight accident occurred and/or the system was declared inoperable and too expensive to repair.

Table E-8 provides the ABIR system force-level quantity range estimates based on an average cruise speed of 175 mph at 40,000 ft and an average operational endurance of 24 flight hours per sortie.

System Acquisition Costs

Table E-9 summarizes the committee’s estimate of the ABIR System T1 recurring cost of the first of five airborne systems used during the development phase through FY 2015 for flight testing demonstrations and the projected

TABLE E-9 ABIR System AUPC Estimate During the Development Phase (FY 2010 million dollars)

| ABIR System T1 Estimate | |

| Reaper MQ-9 unit flyaway price | 15.2 |

| MTS-B sensor unit cost | 0.9 |

| Onboard mission processor and BLOS C2BMC | 0.4 |

| System AI&T (30 percent factor) | 5.0 |

| Total ABIR T1 cost | 21.5 |

cumulative average recurring unit costs for the procurement phase. The committee assumed that after FY 2015 the five flight test systems used during the development phase would end up being colocated at existing CONUS-based military test and training bases and used as test bed platforms for flight testing upgrades to an improved version of the MTS-B sensor and/or as a new, possibly more capable IR sensor for performing ballistic missile tracking missions on the Reapers acquired during the production phase.

For both the development and the procurement phase, the committee estimated the ABIR system AUPC for five flight articles and a production quantity of between 12 and 17 based on MDA’s preferred airborne platform, the Reaper MQ-9. The cost baseline for the MQ-9 unmanned aircraft vehicle is configured without mission payload hardware and includes avionics and flight controls.

For the 5-yr development phase currently funded in the FY 2011 budget through FY 2015, the committee estimated the IR sensor AUPC based on the first sensor delivered for the first Reaper to be an as-designed MTS-B sensor coming off the production line with a combination of either additional MTS-B sensors procured for the other four flight test airborne vehicles or a slightly modified version of the MTS-B designed to more closely satisfy and demonstrate the unique missile tracking performance needed for the ABIR mission. In addition, the costs for adding an onboard mission processor and C2MB communications to the Reaper MQ-9 are also included along with AI&T of each ABIR system.

For the follow-on production phase beginning after FY 2015, Table E-10 lists the ABIR AUPC range estimate for the force-level quantity of between 12 and 17 airborne systems. The committee based its range estimate of the ABIR sensor average unit cost on a modified MTS-B sensor as a lower bound for the lower bound force size of 12 airborne systems. As an upper bound recurring cost and as a potential hedging strategy for meeting the expected missile tracking requirements, the committee estimated the unit recurring cost of a notional repackaged and smaller, lighter, and reduced-power version of the pod-mounted Heimdall sensor (compared to the option MDA had considered as a candidate IR sensor for the Global Hawk RQ-4B). (The full-scale Heimdall sensor was originally designed for and is currently being used on the HALO II manned ABS testbed aircraft.) It should be noted that this upper bound, higher ABIR system recurring

TABLE E-10 ABIR System AUPC Estimate During the Production Phase (FY 2010 million dollars)

| ABIR System AUPC Estimate | ||

| Low (Quantity = 12) | High (Quantity = 17) | |

| Reaper MQ-9 unit flyaway pricea | 15.2 | 15.2 |

| Modified MTS-B sensor unit costb | 1.2 | |

| Modified Heimdall sensor unit costc | 11.8 | |

| Onboard mission processor and BLOS C2BMC | 0.1 | 0.1 |

| System AI&T (30 to 40 percent factor)d | 4.9 | 10.8 |

| Total ABIR AUPC cost | 21.4 | 37.9 |

aIn the FY 2011 through FY 2015 time frame, the Reaper MQ-9 unit fly-away price is based on the assumption that MDA will be able to procure the as-is designed green aircraft off the contractor’s manufacturing line fully configured with the flight controls, avionics, and other equipment to flight qualify the system. The price also included the communication system links for operating the unmanned vehicle through ground operators at the launch and recovery unit and the missions control station and also for transmitting the IR sensor data through MDA’s C2BMC and on to a designated interceptor’s fire control radar. After FY 2015 MDA will be procuring identically configured Reapers coming off a mature, continuous production line, where it assumed the learning or cost improvement factor is relatively flat and affords relatively small savings per system as the total quantity manufactured increases.

bThe modified MTS-B sensor is based on a more complex design than the MTS-B that provides additional IR capability to meet the mission-unique requirements for performing the missile tracking mission.

cThe modified Heimdall sensor unit cost is based on a further weight, volume, and power reduction over the envisioned modifications needed for the Global Hawk RQ-4B. ABIR system analysis alternatives performed for MDA indicated that the Heimdall sensor suite and real-time signal processors onboard the HALO II aircraft can be transplanted to fit within a configured green aircraft version of the Global Hawk RQ-4B without any other mission equipment. However, the RQ-4B airframe must be able to accommodate the weight load of the pod and the necessary onboard electronics. Given the existing RQ-4B onboard power and air cooling and further modifications needed, the total weight load on the RQ-4B of a pod-modified Heimdall sensor was estimated at between 2,000 lb and 2,800 lb, with more than 700 lb of this weight attributable to the optical sensor, the platform, and the mission equipment suite itself.

dThe factor for IA&T for the Heimdall IR sensor is higher, 40 percent, than that for the modified MTS-B sensor reflects because the recurring costs of electrical and mechanical interfaces to install this heavier sensor and still meet the platform’s center of gravity and reduced drag requirements will be higher.

cost estimate would most likely require additional development funds to cover the cost for modifying the Reaper airframe to carry the load of the larger pod-mounted IR sensor and still meet the aerodynamic performance and required high endurance of the vehicle. The upper bound estimate is also based on the higher force-level quantity of 17 systems.

The committee also estimated the average unit cost of five sets of Reaper

MQ-9 ground systems at $10 million each (FY 2010 dollars) to be delivered along with airborne vehicles during the development phase. Since this procurement relies primarily on off-the-shelf computer workstations, processors, and communication equipment, the committee estimated the cost of operating three CAPS at separate OCONUS forward-deployed bases would remain at $10 million each for the procurement of three ground systems required during the production phase. Each ground system requires the procurement of hardware for the Reaper launch and recovery element (LRE) for landings and takeoffs and for the mission control station (MCS) for operating the vehicles once at cruise altitude and for on-station CAP orbits. The MCS includes the hardware and software interfaces to enable Reapers’ ground operators to monitor the health and status of the airborne C2BMC downlinks and to ensure the integrity and timely transmission of the airborne IR sensor missile tracking data to the nearest C2BMC and the designated interceptor’s fire control radar.

System O&S Costs

Finally, Table E-11 provides a rough order-of-magnitude range estimate for the steady-state annual O&S costs on a per CAP basis for operating and sustaining the ABIR systems and the ground segment operations centers out of a forward-deployed OCONUS base for force sizes of 12 systems (for an average annual surge of CAP operations for 90 days) and 17 systems (for a higher annual surge of CAP operations for 270 days).

TABLE E-11 ABIR System Average Annual Sustainment Cost for Force Sizes of 12 and 17 for Three CAPS (FY 2010 million dollars)

| ABIR (Reaper MQ-9) Average Annual O&S Costs per CAP | ||

| 12 | 17 | |

| Unit level manning | 13.58 | 13.58 |

| Operation and consumptiona | 10.10 | 14.31 |

| Nonoperating unit maintenance | 1.07 | 1.07 |

| Sustaining support and investment | 15.03 | 15.03 |

| Indirect and other costs | 2.84 | 2.84 |

| Total average annual O&S cost per CAP | 42.63 | 46.84 |

aThe annual O&S cost per CAP for the large force size of 17 systems and the associated higher average annual flying hours per CAP case is the only O&S cost element that directly affects the magnitude of the ground operations and spare parts consumption costs at both the field and depot levels of maintenance. All the other O&S costs elements for the manning levels at the forward-deployed OCONUS squadrons are assumed to be fixed for both cases, along with the other three cost elements listed.

TABLE E-12 PTSS Total LCC Estimate (FY 2010 billion dollars)

| Minimum | Maximum | |

| Developmenta | 3.1 | 4.5 |

| Procurementb | 4.4 | 6.9 |

| Force quantity buy | 9-ball constellation + two on-orbit spares with 7 yr on-orbit life | 12-ball constellation + two on-orbit spares with 5 yr on-orbit life |

| MILCON | None required | None required |

| 20-yr O&Sc | 10.7 | 25.6 |

| Total 20-yr LCC estimatec | 18.2 | 37.0 |

aThe development cost range estimate of $3.1 to $4.5 billion includes the PTSS program budget of $1.3 billion cited in the MDA FY 2012 FYDP PB, which consists of a 1-yr concept development phase beginning in FY 2011 awarded to three contractors followed by a Phase I effort with plans for developing, launching, and operating a set of first spacecraft articles using an integrated ground control system in FY 2016. The estimate for the Phase I effort consists of the total nonrecurring development and recurring costs for designing and building the space segment bus, the optical tracking and communications payloads for two prototype satellites, and the ground segment. The PTSS prototype satellites will demonstrate early, precise, real-time tracking of ballistic missiles.

As part of the development cost and as the basis for the procurement cost of the first production satellite, the committee estimated the recurring cost of producing the first two prototype satellites at $550 million each (FY 2010 dollars) based on (1) applying PTSS weight and power budget estimates at the satellite bus and payload subsystem levels to two parametric representative space system and electro-optical cost models and (2) using each model’s cost estimating relationships calibrated to previous analogous cost expenditures and comparable parametric data details from the STSS program at the same subsystem detail for the development build of two prototype satellites. (The MDA PTSS program office provided the committee with a spreadsheet for PTSS Phase I annual budget costs and weight and power estimates for the prototype satellites as of May 2010. The two estimating tools used were the USAF Unmanned Spacecraft Cost Model (USCM) 8th edition and the Galorath SEER EOS parametric model. The cost estimating relationships of the two cost models have been calibrated against the STSS program’s recurring costs and weight and power and other parametric data values reported in the March 2010 STSS Cost Analysis Requirements Description (CARD)).

The MDA budget through FY 2016 does not include the launch vehicle (LV) and LV adapter costs or the costs for the space segment contractor’s prototype mission integrated system engineering team efforts at the space launch pad to IA&T and full functional checkout of the two prototype satellites in a stowed configuration onto the upper-stage shroud of the heavy lift launch vehicle. The committee included the launch booster, launch services, and space segment contractors’ launch IA&T and checkout costs in development cost estimate. The total launch cost during the development phase is based on launching the two prototype PTSS satellites on one Atlas V EELV-class booster capable of lifting both, each with an estimated satellite total wet mass of 1,550 kg, which includes 30 percent weight margins for the both the PTSS bus and the payload.

bThe procurement cost range estimate of $4.4 billion to $6.9 billion is based on the follow-on build of an additional 9 to 12 satellites (which includes two on-orbit spares) and an AUPC range estimate for each PTSS satellite of $452 to $572 million. The PTSS satellite AUPC range estimate for the lower bound, minimum, reference data point is based on a best case step-down in the second prototype satellite cost for the first unit cost of the production satellite designed for a 7-yr expected design life. This estimate is then projected forward for the total build quantity required to reach FOC of a 9-ball constellation based on a highly efficient cost improvement, or learning curve, of 95-98 percent. The committee based an upper bound, maximum, AUPC estimate using a worst case, or minimal, step-

down in the second prototype satellite for the first unit cost of the production article designed for a 5-yr expected design life and then projected forward for the total build quantity required to reach FOC of a 12-ball constellation based on very little or no cost improvement (a flat learning curve). As in the development phase, the launch cost range estimates are assumed to be the same for the two prototype satellites based on an EELV-class vehicle capable of lifting two production satellites per launch.

cThe 20-yr O&S cost range estimate covers the fixed costs for the ground segment infrastructure and personnel needed beginning with the first two prototype satellites on orbit and continuing forward for the production of on-orbit satellites within the constellation for the following tasks: (1) on-orbit satellite station-keeping and maintaining tracking, telemetry, and communications and (2) mission command and control (C2) needed for passing on satellite precision tracking data for augmenting the planned terrestrial sensor network.

The O&S cost range estimate also includes the cost of producing and launching the additional replacement satellites needed for sustaining the constellation size, where (1) the lower bound, or minimum, cost estimate is based on sustaining the 9-ball constellation based on satellites with an expected average on-orbit life of 7 years and (2) an upper bound, or maximum, cost estimate is based on sustaining the 12-ball constellation based on satellites with an expected average on-orbit life of 5 years.

PTSS Systems

Life-Cycle Cost Summary

A summary of the 20-yr LCC range estimate for the PTSS space and ground segment system is summarized in Table E-12. Further details on the basis of the estimates and further breakout of costs for all three phases of the life cycle are provided in this section.

Relevant Investment Costs

As of May 2010, the projected investment cost beginning in FY 2011 and continuing through FY 2016 is $1.3 billion (constant FY 2010 dollars). According to MDA, this investment and the annual budget investment of $217 million reflects a 1-yr concept development phase beginning in FY 2011 followed by a Phase I effort beginning later in FY 2011, with plans for delivery and launch of two prototype satellites by late FY 2015. The prototypes “will demonstrate early, precise, real-time tracking of ballistic missiles.20 The cost includes the estimated budget for FY 2016 of the Phase I effort to cover the costs for operating the two prototype satellites and augmenting the “planned terrestrial (surface and airborne)

_____________

20See MDA, FY-2011 FYDP Research, Development, Test & Evaluation, President’s Budget, Exhibit R-2, RDT&E Budget Item Justification, BA 4: Advanced Component Development & Prototypes (ACD&P), PE 0604883C: Precission Tracking Space System, February 2010.

sensor network … with [a demonstrated] precision tracking [capability] from space.”21

The investment costs are based on the MDA PTSS program budget estimates as of May 2010. The program budget request for FY 2012 at the time was still under development so the budget had yet to be determined. The PTSS Phase I annual program budget estimates through FY 2016 consist of all nonrecurring development and recurring cost estimates for the space segment bus, the optical tracking and communications payloads, the ground segment, the launch vehicle (LV), and LV adapter costs as well as the costs for the contractor’s prototype mission integrated system engineering team, system engineering program manager, the space segment IA&T, and the operations and testing of the prototype satellites. The roll-up of the total annual budget also included an estimate of the government program operations costs. The MDA PTSS program office provided a spreadsheet of PTSS Phase I annual budget costs and weight and power estimates of the prototype satellites. The development cost budget has been updated since May 2010 to reflect two February 2011 documents: “MDA Fiscal Year 2012 Budget Outline” and “FY 2012 Appropriations Summary,” RDT&E PTSS program element line item budget from 2011 through FY 2016.

System Acquisition Costs

For the purposes of estimating the recurring cost of prototype and an operational projected baseline constellation of nine PTSS satellites, the committee reviewed the MDA’s PTSS Phase I program budget projection and span time frame of 5 years from the start of concept definition through delivery and launch of the first two prototype satellites as the best case, or lower bound, estimate of $1,058 million (in FY 2010 dollars) through the end of FY 2015. Based on the best available analogous comparison of the STSS program’s expended average annual costs and development time frames reported in the STSS CARD document from March 201022 and the most recent STSS program percent cost growth reported by GAO,23 the committee derived an upper bound PTSS Phase I estimate of $1,354 million (also in FY 2010 dollars) based on a representative SSTS program cost growth of 28 percent over the 7 years of development span time beginning in April 2002, when MDA took over the Air Force SBIRS Low program and the

_____________

21Ibid.

22MDA. 2010. “Space Tracking and Surveillance System (STSS) Demonstration Satellites,” Cost Analysis Requirements Description (Card), March 1.

23GAO. 2010. “Report to Congressional Committees–Defense Acquisitions: Assessments of Selected Weapon Programs,” GAO-10-388SP, March.

contractor team had authority to proceed through the refurbishment and launching of the two STSS demonstrations satellites in September 2009.24

The committee was able to derive the first unit (T1) costs for the first prototype satellite based on first parsing out the Phase I space segment recurring portion of the costs from the MDA-provided Phase I annual program budgets. This was done by assuming that the Phase I portion of the nonrecurring Phase I development prototype time frame is a best case (optimistic) estimate comparable to the STSS program’s time frame of slightly less than 2 years (23 months) from the MDA contractor team’s ATP in April 2004 through prototype satellite concept design review (CDR) in March 2004.

Table E-13 provides a summary of the committee’s PTSS T1 prototype satellite unit cost and the projected cumulative average unit costs for the Phase II procurement of a constellation of nine on-orbit satellites and two spares.

MDA’s May 2010 PTSS Phase I annual program budgets submitted to the committee also included a program launch cost estimate of $145 million (in FY 2010 dollars) based on launching the two prototype PTSS satellites on an Atlas V based on a total wet mass estimate of 1,550 kg, which includes 30 percent weight margins for the bus and the two payloads.

System O&S Costs