COMMERCIAL APPLICATIONS OF SYNTHETIC BIOLOGY

An Overview of Venture Capital

Venture capital is financial capital invested into high-potential companies. The role of venture capital is to support the entrepreneurial talent that takes basic science and breakthrough ideas to market by building companies. This risk capital ultimately supports some of the most innovative and promising companies—those that have gone on to change existing industries or create new ones altogether (Thompson Reuters, 2011).

Venture capital is a distinct asset class. Venture capital firms, which are professional, institutional capital managers, make investments by purchasing equity in a company. The stock acquired is an illiquid investment that requires the growth of the company for the investors to ultimately reap any potential return. It is this inability of venture capitalists to rapidly enter and exit investments, or “flip” them, that aligns their goals with those of the entrepreneurs. Venture capital is intrinsically a long-term investment (Thompson Reuters, 2011).

_______________

1 Affiliation: Flagship VentureLabs, Cambridge, MA, USA.

2 Key words: venture capital, biological engineering, synthetic biology, microbiome, diesel, photosynthesis, genome engineering.

Venture capitalists invest out of a fund, a vehicle that deploys capital on behalf of third-party investors. The investors in these funds, called limited partners, are often pension funds, foundations, corporations, endowments, and wealthy individuals, among others. Given the low liquidity associated with their investment into venture capital funds, limited partners expect large returns—better than those in the stock market—from the funds in which they invest. The funds represent a commitment of capital with a fixed life, typically 10 years. The general partner, a group of partners with fiduciary responsibility for the firm with the legal form of a partnership, manages the capital in the fund. The committed capital is called by the general partner from the limited partners to make a portfolio of investments. Ultimately, when investments mature and become liquid, the profits are shared, with the majority going back to the limited partners and the rest shared by the general partner.

Funding provided by venture capitalists typically takes the form of “rounds,” where a given amount of money is invested into a company at a valuation agreed upon between the management and the investors. Prior to an investment, the equity ownership is divided among the founders, management, and others. The valuation sets a share price against which the venture capital firm buys shares. At each round, the earlier investors and management team strive to increase the valuation for the subsequent round(s) of investment. The higher the valuation of a round, the less dilution (reduction in ownership) the existing shareholders take. While each round contemplates a share price that defines a paper value for an investor’s or an employee’s shares, little actual value is created. Only at a sale event or initial public offering do investors and the management team see a tangible financial return, which can take 5-8 years, if not longer.

Venture capital firms statistically see 100 business plans, take a deep look at 10 of these proposals, and invest in one. This process involves an assessment of the management team, the proposed business, its potential to exclude competition, the market being pursued, and how well the opportunity fits with the firm’s goals.

With an investment, a partner will typically get involved with a company by taking a seat on the board of directors, where he or she works closely with the management team on company strategy and growth. The venture capital industry plays an important role in the economy. Companies supported by early venture capital account for 21 percent of the U.S. gross domestic product by revenue, and 11 percent of private-sector jobs despite the fact that fewer than 1,000 new businesses get venture capital funding any given year (National Venture Capital Association, 2009).

A Brief History of the Venture Capital Industry

Venture capital is said to have originated in 1946 with the founding of the first two firms: American Research and Development Corporation (ARDC) and

J. H. Whitney & Company (Wilson, 1985). Georges Doriot, referred to as the “father of venture capitalism,” the former dean of Harvard Business School and founder of INSEAD, founded ARDC along with Karl Compton, the former president of MIT, as well as Ralph Flanders (Ante, 2008). ARDC sought to invest in businesses run by soldiers returning from World War II. The firm is most famous for investing $70,000 in Digital Equipment Corporation in 1957—a company that when it had its initial public offering in 1968 was valued at $355 million for a return to ARDC of over 1,200-fold. Employees of ARDC went on to found leading venture funds including Greylock Partners and Flagship Ventures, among others (Kirsner, 2008).

Two major government changes allowed venture capital to emerge as a fully fledged industry. First, the Small Business Investment Act of 1958 enabled the Small Business Administration to license Small Business Investment Companies to help finance and manage small entrepreneurial businesses. Second, in 1978, the Employee Retirement Income Security Act was altered to allow corporate pension funds to invest in venture capital. These two acts together supported the framework for venture capital and facilitated substantial investment in it.

Successes of the venture capital industry in the 1970s and 1980s, with companies including Digital Equipment Corporation, Apple, and Genentech resulting, led to rapid growth of the industry. With rapid growth came diminished returns. In the early 1990s the numbers of firms and managers shrank in response to declining investment performance. At the same time, the more successful firms retrenched, starting a wave of increased returns that began in 1995 and continued through the Internet bubble in 2000 (Metrick, 2007). Once again, with grossly increased returns, the investment into the sector and the number of funds skyrocketed. Beginning in March 2000, the NASDAQ crashed, and many funds suffered from a second contraction.

After the Internet bubble, the funds raised by venture firms shrank substantially. Amounts of committed capital increased through 2005 to a level much less than in 2000, and they remained flat until the economic meltdown in 2008. During the decade from 2000 to 2010, venture capital returns also fell dramatically to the point that the median 10-year return of all U.S. funds was less than the stock market (Thomson Reuters, 2011). These events resulted in another substantial contraction in the industry. The industry is currently responding to this most recent contraction. The number of funds has decreased as the average fund size has risen. This dynamic has caused venture funds to focus on either earlier-stage investments, later-stage investments (similar to private equity), or a combination. Other funds have started focusing on flipping assets by investing before or to induce specific value-creation events. This has created a new environment where only a small number of funds are focused on the earliest stage—that which venture capital is most associated with and most successful at—with several others focused on a more transactional business. This evolution is still in process, but it has been changing the nature of companies that receive investment as well.

At the earliest stage of investments, venture capitalists have returned to investing in outstanding teams and under the assumption that they can create great companies. A number of approaches have been taken to inspire innovation and support a new era of breakthrough companies. Various firms have taken different approaches. CMEA, for example, invests in proven entrepreneurs “prenapkin” (before the idea), on the belief that they will come up with ideas. Polaris’ Dogpatch Labs has created an environment where multiple entrepreneurs share a common environment and with light money attempt to prove out their concepts. Y Combinator gives entrepreneurs an education and a small amount of money to try out their ideas. Andreessen Horowitz has similarly created an infrastructure to support the earliest stages of companies and to allow them to focus their capital on the company. “Super Angels” such as Peter Thiel have also emerged to provide important early stage funding. Several companies produced from some of these efforts have emerged as important venture-backed companies. Flagship VentureLabs has created an internal infrastructure of serial entrepreneurs to co-iterate its own innovations and use that as a basis to build companies.

Flagship VentureLabs

Flagship VentureLabs was built with a focus on increasing the efficiencies of innovation and entrepreneurship. In the broadest context, both traditional entrepreneurship and venture capital have intrinsic benefits and inefficiencies. Entrepreneurs, for example, typically perform well when capital constrained, but, by the same token, avoid asking critical questions because if an undesirable answer results, they are unemployed. Venture capital has the advantage of large sample sizes and substantial funding, but it is limited in its investments to only those which it can see, and all of its investments must fundamentally go through a common set of efforts (i.e., financial infrastructure, legal, etc.). Fundamentally, Flagship VentureLabs removes the constraints from the typical elements of traditional ecosystems; that is, by harnessing the key constituents and requirements all under one roof, with the common goal of the betterment of humankind through innovation and entrepreneurship.

The focus of Flagship VentureLabs is to develop breakthrough technologies to match large unmet needs in life sciences and sustainability through the vehicle of startup companies. New companies come from a breakthrough innovation without a set utility or from work within Flagship VentureLabs identifying the intersection between the potential for technology solution and market pull. In the former case, a team is nucleated around the technology, including the inventor, to heavily iterate the concept and pressure test it against markets, intellectual property opportunities, team-building potential, and other features with the attempt at nonrationally identifying the “sweet spot.” In certain cases, this process results in the pseudolinear formation of a company focused on commercializing the technology. In others, however, through a progressive set of explorations,

the company may end up far from its origins, potentially not including the base technology. In the latter case, the defined intersection creates a hypothesis. If the hypothesis has already been manifest by others in a company or in academia (either singularly or through a combination of efforts), a simple investment may be warranted. In the absence of such a proof point, the concept then goes through heavy conceptual iteration with the attempt to prove the hypothesis wrong, and in the combination of not being able to make it fail and the generation of significant key stakeholder support (including industry and key opinion leaders), a company will be launched. Ultimately, this approach results in taking new ideas and forming companies several years before such an opportunity is likely to be compelling. The following discusses efforts in three such technology-based companies originating from Flagship VentureLabs covering both life sciences and sustainability.

Seres Therapeutics: Rethinking Drug Development

In an effort to reduce side effects, drug development has focused its efforts on target specificity, particularly on features including affinity, low off-target effects, pharmacokinetics, pharmacodynamics, and others. The Human Genome Project and systematic understandings of the functions of kinases have helped to drive this increasing target specificity. Nonetheless, the biology of diseases is complex and multi-factorial. Focusing drugs to single actors may reduce side effects but it also limits the spectrum of efficacy. The growing recognition of the nature of disease is driving the understanding of more complex biology and the development of drugs focused on the multitude of key factors.

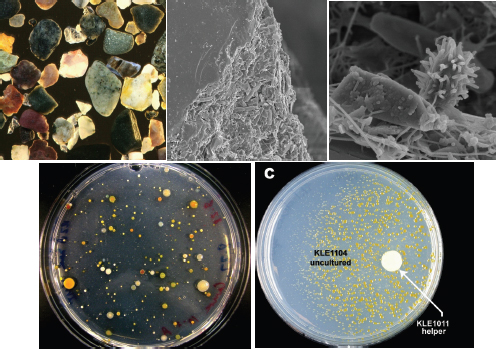

One particular example is with the human microbiome. Microorganisms have long been thought of as independently functioning pathogens. Recently, however, the commensal and mutualistic natures of various microorganisms that inhabit the body have started to be characterized (Dethlefsen, 2011). The interactions between the multitude of organisms, as well as between the organisms and the host, play an important role in normal physiology broadly (Reid et al., 2011). Accordingly, disruptions in the microbiome, whether by antibiotics, diet, infection, or other means, can alter the microbiome and induce or simply increase the likelihood of a wide range of diseases, ranging from Clostridium difficile infection and inflammatory bowel disease to obesity and diabetes (Kau et al., 2011).

The complexity of the microbiome, including not only the interrelation between a number of species and the host but also the physical formation of the communities in specific niches (Rickard et al., 2003), is important to take into account when developing therapeutics aimed at diseases where the microbiome plays an important role. Seres Therapeutics was founded specifically to develop drugs based on the complexity of the microbiome. Probiotics and single biologics affect a limited scope of disease and, thus, have limited efficacy in complex diseases such as those involving the microbiome (Shen et al., 2009). By creat-

ing synthetic microbiomes aimed at disrupting pathogenic communities, Seres provides a therapeutics means by which a normal microbiome can be restored. Understanding biology and synthetically recapitulating conditions that can recover from a disease-associated insult enables a new class of therapeutics to be designed and developed that are focused on the etiology of underlying disease.

Sustainability

Persistently high fossil fuel prices, increasing dependency on foreign fuel supplies, and insecurity relating to the sources of petroleum have created substantial market pull for alternative solutions in the $6 trillion petrochemical industry. Outside of government-mandated markets, such as ethanol of late, fuels and chemicals are fungible products driven by price and purity, as well as supply and demand. Markets therefore require products with a known utility that meet certain industrial specifications while doing so at a competitive cost point. Consumers have not shown a willingness to pay for benefits such as greenhouse gas mitigation or domestic sourcing, so products made as alternatives must do so while competing head-to-head with the incumbents using the same metrics.

Fuels have traditionally originated from biology in some form or another. Fossil fuels are thought to ultimately derive from processing of ancient biomass through a process that takes millions to hundreds of millions of years. Historically, humans have also found faster cycle time sources of energy, namely the burning of trees for heat and energy, as well as the removal of spermaceti from whales as a source of wax. All of these resources have limited renewal potential and substantial environmental impact (Tertzakian, 2009). Given the central role biology has had in fossil fuels historically, it stands to reason that biology would be well positioned to be at the forefront of the future of sustainable fuels.

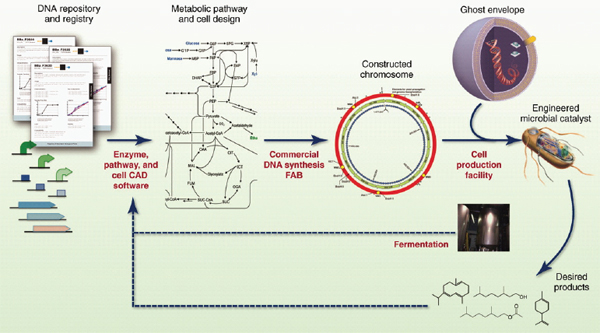

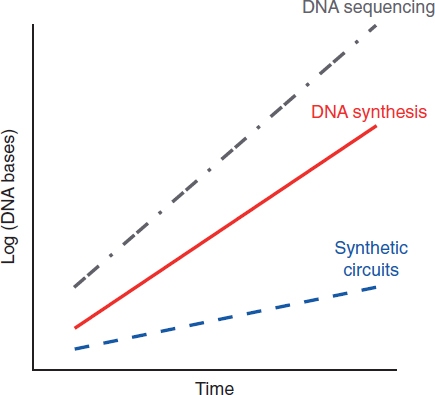

Biological engineering has evolved rapidly over the last 50-plus years. Breakthroughs in genomics research, increased genetic manipulation potential, and more complete knowledge of the inner workings of cells have set a stage for cells to be engineered to achieve desired functionalities. Moreover, the time from conception to proof of concept, and that from proof of concept to commercial viability, has reduced substantially. Historically, these periods have decreased threefold every 10 years. Given the technological potential enabled, the market needs can now drive the technological direction, thus leading toward an intersection between market pull and the potential for technology solution.

LS9: Ultraclean Renewable Diesel

In 2005, the U.S. government had built a robust market demand for ethanol by outlining a replacement timeline for methyl tert-butyl ether (MTBE), a fuel oxygenate that had been associated with groundwater contamination and potential increased cancer risks, with ethanol (U.S. Environmental Protection Agency,

2011a). Twelve billion gallons were mandated by 2012, effectively defining a market growth. This mandate was soon supplemented with the renewable fuel standard (RFS), and subsequently RFS2, ultimately requiring 36 billion gallons produced per year by 2022 (U.S. Environmental Protection Agency, 2011b). Corn ethanol was thus given ample runway to launch, and blenders were incorporating biologically based products into fuel nationwide. The intent of the MTBE replacement with ethanol, however, was replacing an oxygenate, not deeming ethanol a fuel. Nonetheless, outspoken investors were enthusiastically supportive of building the future of American renewable fuel on ethanol, asserting that it could be cheaper than and as efficient as petrochemically derived fuels (Khosla, 2006) despite the disadvantaged domestic cost structure and intrinsic lower energy density. The market was becoming well positioned for a viable alternative.

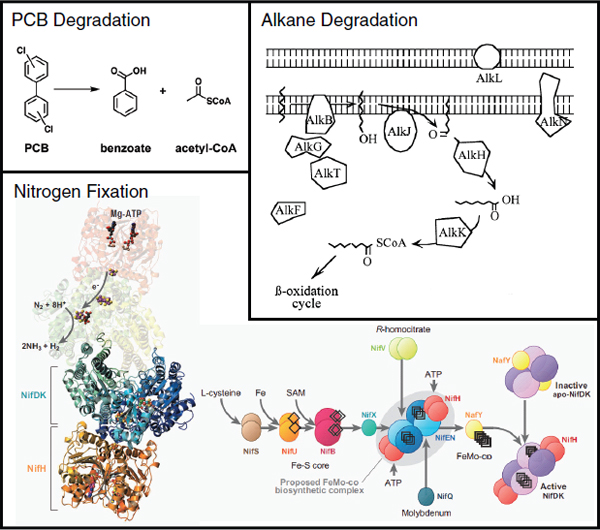

LS9 originated by asking the question, “If you could make any fuel from biology, what would you make?” The ideal fuel to be produced from biology would be diesel, given its high energy density and its use throughout the world as a primary transportation fuel. A market-acceptable biologically produced diesel must compete in a low-cost commodity market without subsidies, requiring an efficient biological pathway and process. Translating these needs into specific technological tasks required that the cell be engineerable to be feedstock agnostic (i.e., able to use any form of sugar), that the most efficient pathway of producing the product was available, that the product was to be made directly and secreted, and that it entailed both straightforward separations (a feature of the product) and no downstream processing (the final product is made by the cell).

Using the defined market constraints, various pathways to produce a straight-chain hydrocarbon were defined and evaluated. The fatty acid biosynthesis pathway not only has exceptionally high energy efficiency at over 90 percent but also produces a molecule that is chemically identical to diesel, requiring potentially fewer biological steps. Fatty acids are activated with coenzyme A (CoA) or acyl carrier protein (ACP) to make fatty acyl-CoA or fatty acyl-ACP (Zhang and Rock, 2008), which serve as the biological precursor products for fuel synthesis. These products are then modified to make a desired end product. The same pathways can be leveraged to make a series of other petrochemicals including fatty acid methyl esters, olefins, fatty alcohols, and others, in addition to alkanes (diesel) (Rude et al., 2011).

The product itself is insufficient for a commercial host and process. The identified market constraints require that the cell chassis has flexibility in feedstock, be optimized to maximize carbon flux to end product, and secrete the end product. Feedstock costs, driven by sugar prices, have risen dramatically over the past 6 years. Alternatives require the liberation of sugar from cellulosic biomass, which is done through exogenous enzymes at present. The expression of hemicellulases into the host already engineered to produce alkanes or other derivatives can enable consolidated bioprocessing, thereby reducing process costs (Magnuson et al., 1993). This is achievable, for example, with the endogenous production

of glycosyl hydrolases such as xylanase (Xsa) from Bacteroides ovatus and an endoxylanase catalytic domain (Xyn10B) from Clostridium stercorarium, which together hydrolyze hemicelluloses to xylose, which is usable in E. coli central metabolism (Adelsberger et al., 2004; Steen et al., 2010; Whitehead and Hespell, 1990). Optimizing the host requires focusing the flux of the sugar input through central metabolism to the product. Specifically, fadD and fadE knockouts block the first two steps of the ß-oxidation pathway, increasing end-product production three- to fourfold (Steen et al., 2010). Secreting the end product eliminates end-product inhibition and streamlines bioprocessing, thus increasing flux and reducing operating costs by supporting continuous operations (Berry, 2010). Expressing a leaderless version of TesA eliminates end-product inhibition, drives secretion, and notably also positively affects chain length with a natural preference for C14 fatty acids (Cho and Cronan, 1995; Jiang and Cronan, 1994; Steen et al., 2010).

Through this approach, an industrial chassis has been rationally developed to systematically meet commercial needs. By specifically including features necessary to ensure diverse feedstock utility, drop-in product synthesis, and lowest cost processing, LS9’s technology has been designed specifically to drive market pull.

Joule Unlimited: Renewable Solar Fuels

An intrinsic challenge of using a sugar-based feedstock is the price volatility associated with the commodity. Joule Unlimited was founded to develop a platform that could eliminate dependence on sugar feedstocks while still producing fuels in a way that meets market needs. A systematic exploration of sources of carbon that can be routed into central metabolism rapidly identifies photosynthesis, nature’s solution to carbon dioxide assimilation driven by solar energy, as a compelling, though insufficient, pathway. The Department of Energy’s Aquatic Species program, based on explorations of algal biofuels between 1976 and 1996, concluded that photosynthesis could support viable fuel processes, but it requires a set of key innovations to do so (Sheehan et al., 1998; Weyer et al., 2010; Zhu et al., 2008). At the outset of Joule Unlimited, the fundamental limitations of algal fuels were examined and coupled with market needs to design an entirely new and distinct approach, whose only similarity to algae was the use of photosynthesis.

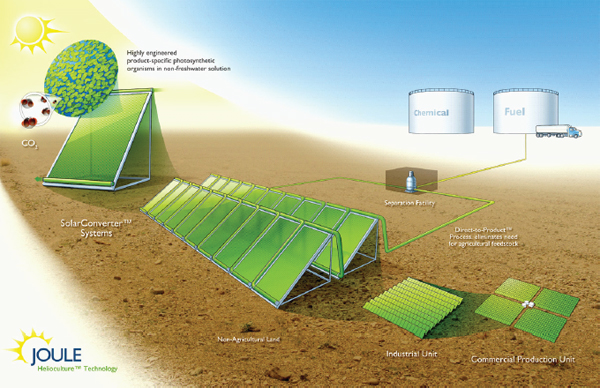

A thorough exploration of market needs identified that an ideal solution would directly produce secreted fungible fuel directly from sunlight and carbon dioxide without a dependency on arable land, freshwater, or other costly reagents, while having a cost that could meet or beat fossil fuel equivalents in the absence of subsidies and at the same time scale modularly such that smaller-scale plants could be used to validate large-scale deployments. The simultaneous technological solution to meet all of these needs demands a genetically tractable cyanobacteria engineered to not need exogenous factors and to produce secreted fuel grown in a

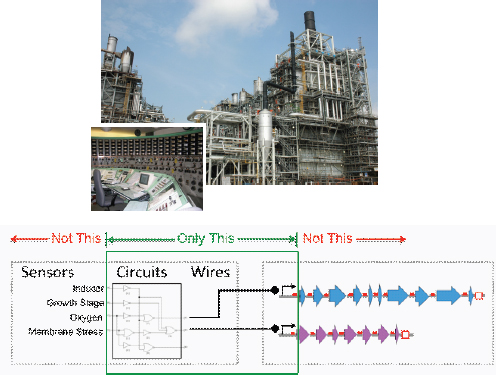

modular bioreactor leveraging the two-dimensional scaling of light and incorporating fundamental process needs including proper mixing. A schematic of the Joule Unlimited approach, Helioculture™, is provided in Figure A1-1.

Cyanobacteria had previously been engineered to express recombinant proteins, but it had not been systematically engineered on a genome scale owing primarily to a lack of engineering tools (Alvey et al., 2011). A concerted effort using E. coli engineering over 50 years serves as a roadmap of the needs for genome engineering in cyanobacteria. Using these tools coupled with a systemic genome engineering effort allows one to overcome a theoretical maximum light use and net productivity for algal biofuels of ~2,000 gallons per acre per year by enabling photoautotrophs, for the first time, to function like industrialized heterotrophs, whose phases of growth and production are separated (Berry, 2010; Robertson et al., 2011). Systematic re-regulation of central metabolism directs 95 percent of photosynthetic activity to specific product synthesis versus up to 50 percent in un-engineered organisms, allowing for productivity ~95 percent of the light-exposed time through continuous operations versus substantial down time with batch processes, minimizing maintenance energy requirements, and limiting the energy lost to photorespiration.

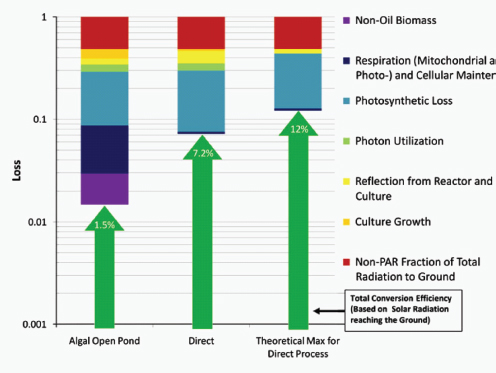

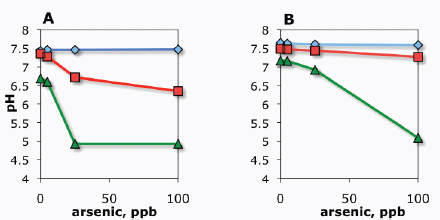

At the same time, the engineered cells are grown in a reactor system designed to be low cost and linearly scalable. Low-cost product separation, cell mixing, and proper gas transfer to the cells are all incorporated into the reactor design. Coupled together, this systems approach allows for ~12 percent theoretical maximal photonic energy conversion versus 1.5 percent for traditional algal processes (Figure A1-2), which translates to unprecedented areal productivities of 25,000 gallons of ethanol per acre per year or 15,000 gallons of diesel per acre per year.

The high productivities achieved through the Joule Unlimited approach allow for cost points as low as $20/barrel for fungible diesel. Maximizing solar energy capture, carbon dioxide fixation as a replacement for sugar use, and organism productivity creates a system that can be market competitive while providing for the environmental benefits that have been sought in fossil fuel replacements. Specifically, Joule Unlimited’s technology eliminates the need for arable land, requires no freshwater, and reduces life-cycle greenhouse gases by over 90 percent by using carbon dioxide as a feedstock. By coupling the technical needs for a total solution with a market need, Joule Unlimited has uniquely developed a process that can produce a sugar-independent diesel in a highly scalable manner, overcoming the challenges of alternative approaches.

Conclusions

Systematic changes in venture capital have altered the entrepreneurial ecosystem. Flagship VentureLabs is pioneering a new approach of technology development through companies by building technologies that specifically address the intersection between the potential for technology solution with market pull

FIGURE A1-1 Schematic of the Joule Unlimited Helioculture systems approach. Specific cyanobacteria are engineered to convert sunlight, CO2, and nonfreshwater to diesel (or other fuels and chemicals). The engineered organisms are housed within a Solar Converter, a single reactor unit designed to interconnect with others and therefore scale linearly.

FIGURE A1-2 A summation of the accumulated photon losses for algal and direct fuel processes, as well as a theoretical maximum photonic energy conversion. The losses are shown through individual contributions accumulated serially and illustrated on a logarithmic scale, beginning with the percent of photosynthetically active radiation empirically measured at the ground. Total energy conversion efficiency as a function of the losses is indicated by the green arrows.

SOURCE: Adapted from Robertson et al. (2011).

driving invention and innovation toward market needs. The resultant companies are designed by exploring cutting-edge capabilities and iterating against market needs—not just from an evolutionary standpoint, but additionally identifying the true needs of an industry across multiple facets. Synthetic biology is a new and rapidly developing tool that has particular utility in meeting broad-based and distinct market needs, particularly through its ability to create functional modules in a cell-based system. By leveraging the potential of synthetic biology with market-driven needs, Flagship VentureLabs has been able to spearhead a set of breakthrough innovations in both life sciences and sustainability. This approach now takes market potential before traditional research approaches have made for a compelling and investable technology-driven opportunity and, through heavy iteration, can bring it to bear ahead of time through broad-based collaborations with industry and academia. This approach can be broadly leveraged to develop

a series of future breakthrough technologies in a variety of important market sectors.

References

Adelsberger, H., C. Hertel, E. Glawischnig, V. V. Zverlov, and W. H. Schwarz. 2004. Enzyme system of Clostrium stercorarium for hydrolysis of arabinoxylan: Reconstitution of the in vivo system from recombinant synzmes. Microbiology 150:2257-2266.

Alvey, R. M., A. Biswas, W. M. Schluchter, and D. A. Bryant. 2011. Attachment of noncognate chromophores to CpcA of Synechocystis sp. PCC 6803 and Synechococcus sp. PCC 7002 by heterologous expression in Escherichia coli. Biochemistry 50:4890-4902.

Ante, S. E. 2008. The Birth of Venture Capital. Cambridge, MA: Harvard Business School Press.

Berry, D. A. 2010. Engineering organisms for industrial fuel production. Bioengineered Bugs 1: 303-308.

Cho, H., and J. E. Cronan, Jr. 1995. Defective export of a periplasmic enzyme disrupts regulation of fatty acid synthesis. World Journal of Biological Chemistry 270:4216-4219.

Dethlefsen, L., M. McFall-Ngai, and D. A. Relman. 2011. An ecological and evolutionary perspective on human-microbe mutualism and disease. Nature 449:811-818.

Jiang, P., and J. E. Cronan, Jr. 1994. Inhibition of fatty acid synthesis in Escherichia coli in the absence of phospholipid synthesis and release of inhibition by thioesterase action. Journal of Bacterialogy 176:2814-2821.

Kau, A. L., P. P. Ahern, N. W. Griffen, A. L. Goodman, and J. I. Gordon. 2011. Human nutrition, the gut microbiome and the immune system. Nature 474:327-336.

Khosla, V. 2006. Is ethanol controversial? Should it be? http://www.khoslaventures.com/khosla/papers.html (accessed June 8, 2011).

Kirsner, S. 2008. Venture capital’s grandfather. The Boston Globe, April 6.

Magnuson, K., S. Jackowski, C. O. Rock, and J. E. Cronan, Jr. 1993. Regulation of fatty acid biosynthesis in Escherichia coli. Microbiology Reviews 57:522-542.

Metrick, A. 2007. Venture Capital and the Finance of Innovation. New York: John Wiley & Sons.

National Venture Capital Association. 2009. Venture Impact: The Economic Importance of Venture Backed Companies to the U.S. Economy. National Venture Capital Association: Arlington, VA.

Reid, G., J. A. Younes, H. C. Van der Mei, G. B. Gloor, R. Knight, and H. J. Busscher. 2011. Micro-biota restoration: Natural and supplemented recovery of human microbial communities. Nature Reviews Microbiology 9:27-38.

Rickard, A. H., P. Gilbert, N. J. High, P. E. Kolenbrander, and P. S. Handley. 2003. Bacterial coaggregation: An integral process in the development of multi-species biofilms. Trends in Microbiology 11:94-100.

Robertson, D. E., S. Jacobson, F. Morgan, D. Berry, G. M. Church, and N. B. Afeyan. 2011. A new dawn for industrial photosynthesis: An evaluation of photosynthetic efficiencies for production of liquid fuels. Photosynthesis Research 107:269-277.

Rude, M. A., T. S. Baron, S. Brubaker, M. Alibhai, S. B. Del Cardayre, and A. Schirmer. 2011. Terminal olefin (1-alkene) biosynthesis by a novel p450 fatty acid decarboxylase from Jeotgalicoccus species. Applied and Environmental Microbiology 77:1718-1727.

Sheehan, J., T. Dunahay, J. Benemann, and P. A. Roessler. 1998. A Look Back at the U.S. Department of Energy’s Aquatic Species Program: Biodiesel from Algae. U.S. Department of Energy, Office of Fuels Development: Closeout Report TP-580-241-24190.

Shen, J., H. Z. Ran, M. H. Yin, T. Z. Zhou, and D. S. Xiao. 2009. Meta-analysis: The effect and adverse events of lactobacilli versus placebo in maintenance therapy for Crohn disease. Internal Medical Journal 39:103-109.

Steen, E. J., Y. Kang, G. Bokinsky, Z. Hu, A. Schirmer, A. McClure, S. B. del Cardayre, and J. D. Keasling. 2010. Microbial production of fatty-acid-derived fuels and chemicals from plant biomass. Nature 463:559-563.

Tertzakian, P. 2009. The End of Energy Obesity. New York: John Wiley & Sons.

Thomson Reuters. 2011. 2011 National Venture Capital Association Yearbook. New York: Thomson Reuters.

U.S. Environmental Protection Agency. 2011a. Methyl Tertiary Butyl Ether (MTBE). http://www.epa.gov/mtbe/faq.htm#concerns.

——. 2011b. Fuels and Fuel Additives. http://www.epa.gov/otaq/fuels/renewablefuels/index.htm

Weyer, K. M., D. R. Bush, A. Darzins, and B. D. Wilson. 2010. Theoretical maximum algal oil production. Bioenergy Research 3:204-213.

Whitehead, T. R., and R. B. Hespell. 1990. The genes for three xylan-degrading activities from Bacteroides ovatus are clustered in a 3.8-kilobase region. Journal of Bacteriology 172:2408-2412.

Wilson, J. W. 1985. The New Venturers: Inside the High-Stakes World of Venture Capital. Boston: Addison-Wesley.

Zhang, Y. M., and C. O. Rock. 2008. Membrane lipid homeostasis in bacteria. Nature Reviews Microbiology 6:222-233.

Zhu, X.-G., S. P. Long, and D. R. Ort. 2008. What is the maximum efficiency with which photosynthesis can convert solar energy into biomass? Current Opinion in Biotechnology 19:153-159.

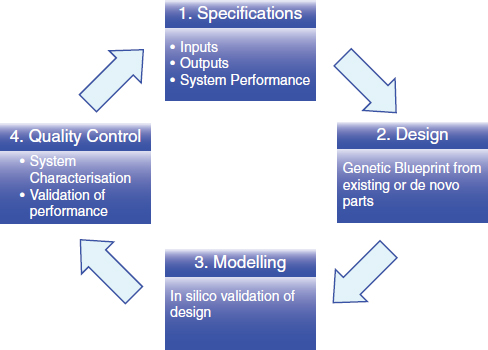

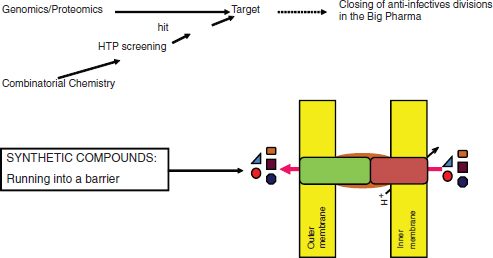

SYNTHETIC BIOLOGY: APPLICATIONS COME OF AGE3

Ahmad S. Khalil4and James J. Collins4,5

Abstract

Synthetic biology is bringing together engineers and biologists to design and build novel biomolecular components, networks and pathways, and to use these constructs to rewire and reprogram organisms. These re-engineered organisms will change our lives over the coming years, leading to cheaper drugs, ‘green’ means to fuel our cars and targeted therapies for attacking ‘superbugs’ and diseases, such as cancer. The de novo engineering of genetic circuits, biological modules and synthetic pathways is beginning to address these crucial problems and is being used in related practical applications.

_______________

3 Originally printed as Khalil, A. S., and J. J. Collins. 2010. Synthetic biology: Applications come of age. Nature Reviews Genetics 11:367-379. Reprinted with kind permission from Nature Publishing Group.

4 Howard Hughes Medical Institute, Department of Biomedical Engineering, Center for BioDynamics and Center for Advanced Biotechnology, Boston University, Boston, Massachusetts 02215, USA.

5 Wyss Institute for Biologically Inspired Engineering, Harvard University, Boston, Massachusetts 02115, USA. Correspondence to J.J.C. e-mail: jcollins@bu.edu. doi:10.1038/nrg2775.

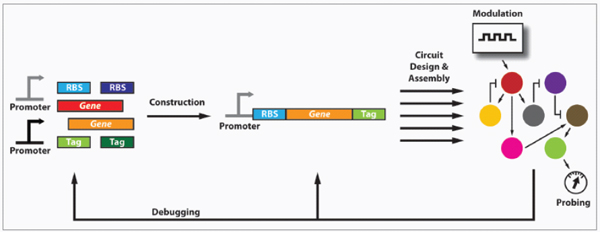

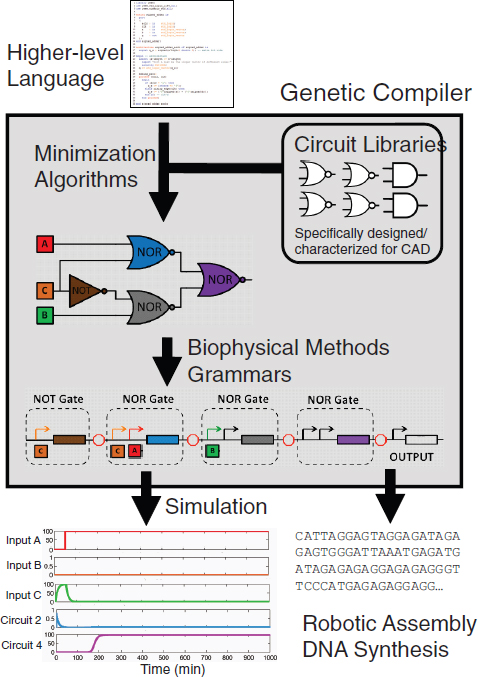

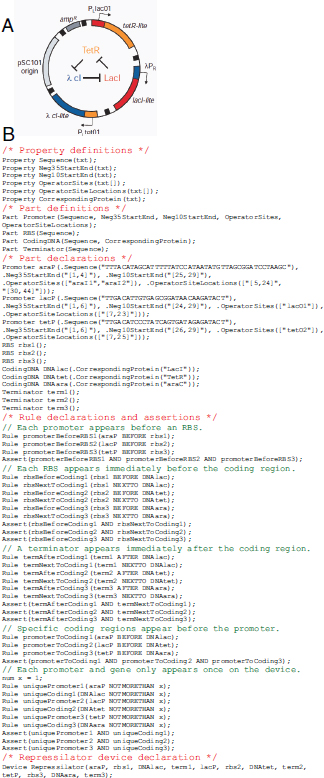

The circuit-like connectivity of biological parts and their ability to collectively process logical operations was first appreciated nearly 50 years ago (Monod and Jacob, 1961). This inspired attempts to describe biological regulation schemes with mathematical models (Glass and Kauffman, 1973; Savageau, 1974; Kauffman, 1974; Glass, 1975) and to apply electrical circuit analogies to biological pathways (McAdams and Arkin, 2000; McAdams and Shapiro, 1995). Meanwhile, breakthroughs in genomic research and genetic engineering (for example, recombinant DNA technology) were supplying the inventory and methods necessary to physically construct and assemble biomolecular parts. As a result, synthetic biology was born with the broad goal of engineering or ‘wiring’ biological circuitry — be it genetic, protein, viral, pathway or genomic — for manifesting logical forms of cellular control. Synthetic biology, equipped with the engineering-driven approaches of modularization, rationalization and modelling, has progressed rapidly and generated an ever-increasing suite of genetic devices and biological modules.

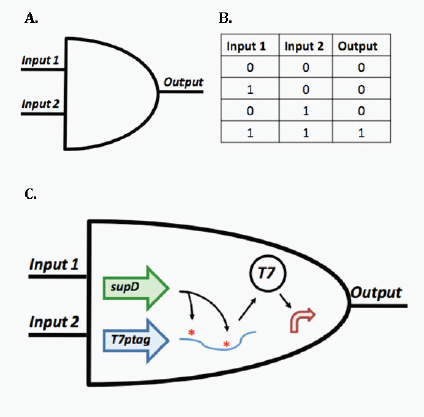

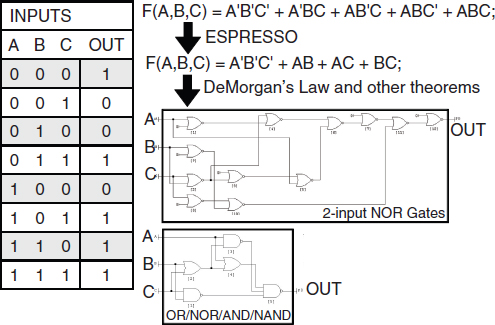

The successful design and construction of the first synthetic gene networks — the genetic toggle switch (Gardner et al., 2000) and the repressilator (Elowitz and Leibler, 2000) (Box A2-1) — showed that engineering-based methodology could indeed be used to build sophisticated, computing-like behaviour into biological systems. In these two cases, basic transcriptional regulatory elements were designed and assembled to realize the biological equivalents of electronic memory storage and timekeeping (Box A2-1). Within the framework provided by these two synthetic systems, biological circuits can be built from smaller, well-defined parts according to model blueprints. They can then be studied and tested in isolation, and their behaviour can be evaluated against model predictions of the system dynamics. This methodology has been applied to the synthetic construction of additional genetic switches (Gardner et al., 2000; Atkinson et al., 2003; Bayer and Smolke, 2005; Deans et al., 2007; Dueber et al., 2003; Friedland et al., 2009; Ham et al., 2006, 2008; Kramer and Fussenegger, 2005; Kramer et al., 2004), memory elements6 (Gardner et al., 2000; Friedland et al., 2009; Ham et al., 2006; Ajo-Franklin et al., 2005) and oscillators (Elowitz and Leibler, 2000; Atkinson et al., 2003; Fung et al., 2005; Stricker et al., 2008, Tigges et al., 2009; Danino et al., 2010), as well as to other electronics-inspired genetic devices, including pulse generators7 (Basu et al., 2004), digital logic gates8 (Anderson et al., 2007; Guet et al., 2002; Rackham and Chin, 2005; Rinaudo et al., 2007;

_______________

6 Memory elements – Devices used to store information about the current state of a system.

7 Pulse generators – Circuits or devices used to generate pulses. A biological pulse generator has been implemented in a multicellular bacterial system, in which receiver cells respond to a chemical signal with a transient burst of gene expression, the amplitude and duration of which depend on the distance from the sender cells.

8 Digital logic gates – A digital logic gate implements Boolean logic (such as AND, OR or NOT) on one or more logic inputs to produce a single logic output. Electronic logic gates are implemented using diodes and transistors and operate on input voltages or currents, whereas biological logic gates operate on cellular molecules (chemical or biological).

Stojanovic and Stefanovic, 2003; Win and Smolke, 2008), filters9 (Basu et al., 2005; Hooshangi et al., 2005; Sohka et al., 2009) and communication modules (Danino et al., 2010; Basu et al., 2005; Kobayashi et al., 2004; You et al., 2004).

Now, 10 years after the demonstration of synthetic biology’s inaugural devices (Gardner et al., 2000; Elowitz and Leibler, 2000), engineered biomolecular networks are beginning to move into the application stage and yield solutions to many complex societal problems. Although work remains to be done on elucidating biological design principles (Mukherji and van Oudenaarden, 2009), this foray into practical applications signals an exciting coming-of-age time for the field.

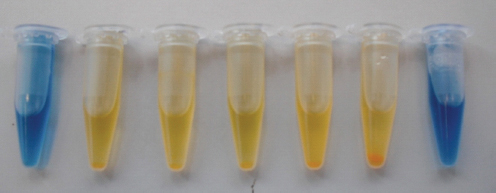

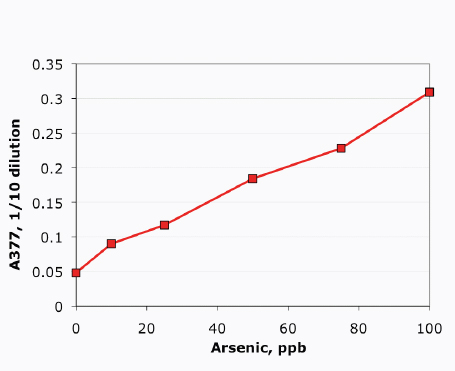

Here, we review the practical applications of synthetic biology in biosensing, therapeutics and the production of biofuels, pharmaceuticals and novel biomaterials. Many of the examples herein do not fit exclusively or neatly into only one of these three application categories; however, it is precisely this multivalent applicability that makes synthetic biology platforms so powerful and promising.

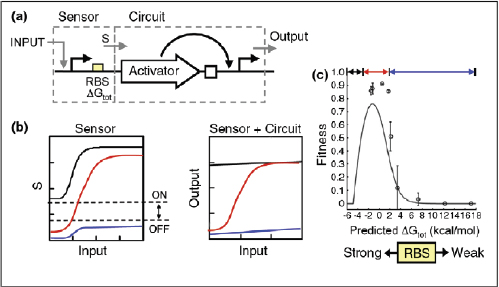

Biosensing

Cells have evolved a myriad of regulatory circuits — from transcriptional to post-translational — for sensing and responding to diverse and transient environmental signals. These circuits consist of exquisitely tailored sensitive elements that bind analytes and set signal-detection thresholds, and transducer modules that filter the signals and mobilize a cellular response (Box A2-2). The two basic sensing modules must be delicately balanced: this is achieved by programming modularity and specificity into biosensing circuits at the transcriptional, translational and post-translational levels, as described below.

Transcriptional biosensing. As the first dedicated phase of gene expression, transcription serves as one method by which cells mobilize a cellular response to an environmental perturbation. As such, the genes to be expressed, their promoters, rNA polymerase, transcription factors and other parts of the transcription machinery all serve as potential engineering components for transcriptional biosensors. Most synthetic designs have focused on the promoters and their associated transcription factors, given the abundance of known and characterized bacterial, archaeal and eukaryotic environment-responsive promoters, which include the well-known promoters of the Escherichia coli lac, tet and ara operons.

Both the sensory and transducer behaviours of a biosensor can be placed under synthetic control by directly engineering environment-responsive promoter sequences. In fact, this was the early design strategy adopted for establishing inducible expression systems (Brown et al., 1987; Deuschle et al., 1989; Hu and

_______________

9 Filters – Algorithms or devices for removing or enhancing parts or frequency components from a signal.

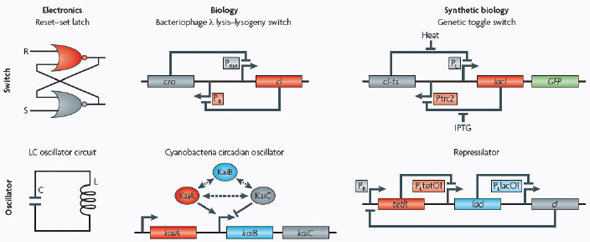

BOX A2-1

Early Synthetic Biology Designs: Switches and Oscillators

Switches and oscillators that occur in electronic systems are also seen in biology and have been engineered into synthetic biological systems.

Switches

In electronics, one of the most basic elements for storing memory is the reset–set (RS) latch based on logical NOR gates*. This device is bistable in that it possesses two stable states that can be toggled with the delivery of specified inputs. Upon removal of the input, the

circuit retains memory of its current state indefinitely. These forms of memory and state switching have important functions in biology, such as in the differentiation of cells from an initially undifferentiated state. One means by which cellular systems can achieve bistability is through genetic mutual repression. The natural PR–PRM genetic switch from bacteriophage λ, which uses this network architecture to govern the lysis–lysogeny decision, consists of two promoters that are each repressed by the gene product of the other (that is, by the Cro and CI repressor proteins). The genetic toggle switch (Gardner et al., 2000) constructed by our research group is a synthetically engineered version of this co-repressed gene regulation scheme. In one version of the genetic toggle, the PL promoter from λ phage was used to drive transcription of lacI, the product of which represses a second promoter, Ptrc2 (a lac promoter variant). Conversely, Ptrc2 drives expression of a gene (cI-ts) encoding the temperature-sensitive (ts) λ CI repressor protein, which inhibits the PL promoter. The activity of the circuit is monitored through the expression of a GFP promoter.

The system can be toggled in one direction with the exogenous addition of the chemical inducer isopropyl-β-d-thiogalactopyranoside (IPTG) or in the other direction with a transient increase in temperature. Importantly, upon removal of these exogenous signals, the system retains its current state, creating a cellular form of memory.

Oscillators

Timing mechanisms, much like memory, are fundamental to many electronic and biological systems. Electronic timekeeping can be achieved with basic oscillator circuits — such as the LC circuit (inductor L and capacitor C) — which act as resonators for producing periodic electronic signals. Biological timekeeping, which is widespread among living organisms (Dunlap, 1999), is achieved with circadian clocks and similar oscillator circuits, such as the one responsible for synchronizing the crucial processes of photosynthesis and nitrogen fixation in cyanobacteria. The circadian clock of cyanobacteria is based on, among other regulatory mechanisms, intertwined positive and negative feedback loops on the clock genes kaiA, kaiB and kaiC. Elowitz and Leibler constructed a synthetic genetic oscillator based not on clock genes but on standard transcriptional repressors (the repressilator) (Elowitz and Leibler, 2000). Here, a cyclic negative feedback loop composed of three promoter–gene pairs, in which the ‘first’ promoter in the cascade drives expression of the ‘second’ promoter’s repressor, and so on, was used to drive oscillatory output in gene expression.

——————

* NOR gate – A digital logic gate that implements logical NOR, or the negation of the OR operator. It produces a HIGH output (1) only if both inputs to the gate are LOW (0).

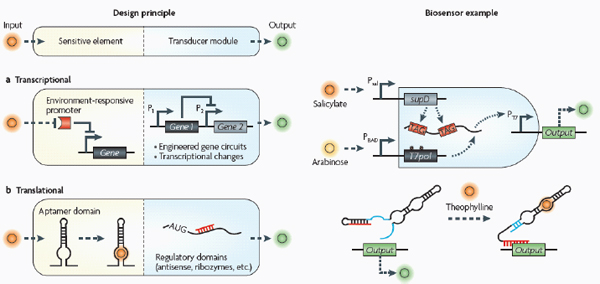

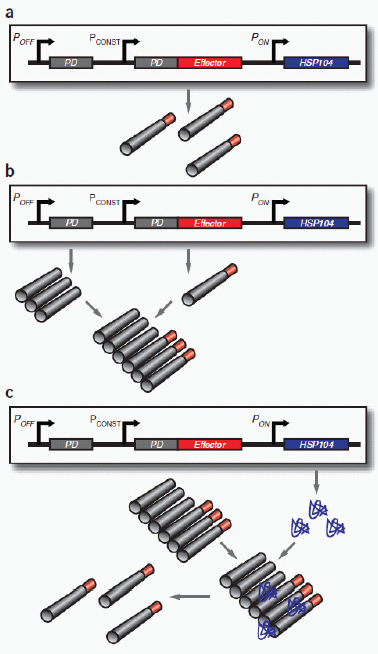

BOX A2-2

Synthetic Biosensors: Transcriptional and Translational Architectures and Examples

Biosensors consist of two basic modules (see the figure): sensitive elements for recognizing and binding analytes, and transducer modules for transmitting and reporting signals.

Transcriptional

Transcriptional biosensors (part a) are built by linking environment-responsive promoters to engineered gene circuits for programmed transcriptional changes. In the example shown, a transcriptional AND gate was designed to sense and report only the simultaneous presence of two environmental signals (for example, salicylate and arabinose) (Anderson et al., 2007). At one gate input, the researchers encoded an environment-responsive promoter (for example, PBAD) that activates transcription of a T7 RNA polymerase gene in response to a single environmental signal (for example, arabinose). The gene, however, carries internally encoded amber stop codons (red spiked circles) that function to block translation of its transcript. Activation of the second gate input is the key to unlocking translation; specifically, translation can be induced when a second promoter (for example, Psal) activates transcription of the supD amber suppressor tRNA in response to a second unique signal (for example, salicylate). In other words, only when the two environmental signals are simultaneously present can the T7 RNA polymerase be faithfully expressed and used to activate an output T7 promoter. This is an example of how sophisticated specificity can be programmed into a transducer module by creatively linking the sensory information of multiple sensitive elements. Furthermore, the design is transcriptionally modular in that different sets of environment-responsive promoters can be interfaced to the AND gate.

Translational

Translational biosensors (part b) are typically built by linking RNA aptamer domains to RNA regulatory domains. The example shown is an OFF ‘antiswitch’. Here, the small molecule theophylline is recognized and bound by the aptamer stem of the RNA biosensor. This causes a conformational change in the molecule that liberates the antisense domain from its sequestering stem loop and allows it to inhibit translation of an output reporter (Bayer and Smolke, 2005).

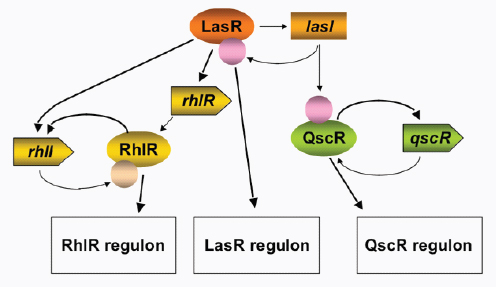

Davidson, 1987; Lutz and Bujard, 1997). By introducing, removing or modifying activator and repressor sites, a promoter’s sensitivity to a molecule can be tuned. Synthetic mammalian transactivation systems are generic versions of this strategy in which an environmentally sensitive transcription factor is fused to a mammalian transactivation domain to cause inducer-dependent changes in gene expression. Synthetic mammalian biosensors based on this scheme have been created for sensing signals such as antibiotics (Fussenegger et al., 2000; Gossen and Bujard, 1992; Weber et al., 2002), quorum-sensing molecules (Neddermann et al., 2003; Weber et al., 2003b), gases and metabolites (Malphettes et al., 2005; Mullick et al., 2006; Weber et al., 2006; Weber et al., 2004), and temperature changes (Boorsma et al., 2000; Weber et al., 2003a). Fussenegger and colleagues have even incorporated this transgene design into mammalian circuits, creating synthetic networks that are responsive to electrical signals (Weber et al., 2009).

Although the engineering of environment-responsive promoters has been valuable, additional control over modularity10 and specificity can be achieved by embedding environment-responsive promoters11 in engineered gene networks. Achieving true modularity with genetic parts is inherently difficult because of unintended interference among native and synthetic parts and therefore requires careful decoupling of functional modules. One such modular design strategy was used by Kobayashi et al. (2004) to develop whole-cell E. coli biosensors that respond to signals in a programmable fashion. In this design, a sensory module (that is, an environment-responsive promoter and associated transcription factor) was coupled to an engineered gene circuit that functions like a central processing unit. E. coli cells were programmed to respond to a deleterious endogenous input — specifically, DNA-damaging stimuli, such as ultraviolet radiation or mitomycin C. The gene circuit, which was chosen to be the toggle switch (Box A2-1), processes the incoming sensory information and flips from an ‘OFF’ to an ‘ON’ state when a signal threshold is exceeded. Because the biosensor has a decoupled, modular nature, it can be wired to any desired output, from the expression of a standard fluorescent reporter to the activation of natural phenotypes, such as biofilm formation (for example, through expression of traA) or cell suicide (for example, through expression of ccdB).

Sometimes a single signal may be too general to characterize or define an environment. For such situations, Anderson et al. (2007) devised a transcriptional AND gate that could be used to integrate multiple environmental signals into a single genetic circuit (Box A2-2), therefore programming the desired level of biosensing specificity. Genetic biosensors of this sort could be useful for communicating the state of a specific microenvironment (for example, in an industrial

_______________

10 Modularity – The capacity of a system or component to function independently of context.

11 Environment-responsive promoters – Promoters that directly transduce environmental signals (for example, heavy metal ions, hormones, chemicals or temperature) that are captured by their associated sensory transcription factors.

bioreactor) within a ‘sea’ of environmental conditions, such as temperature, metabolite levels or cell density.

Translational biosensing. RNA molecules have a diverse and important set of cellular functions (Eddy, 2001). Non-coding RNAs can splice and edit RNA, modify ribosomal RNA, catalyse biochemical reactions and regulate gene expression at the level of transcription or translation (Eddy, 2001; Doudna and Cech, 2002; Guerrier-Takada et al., 1983; Kruger et al., 1982). The regulatory subset of non-coding RNAs (Lee et al., 1993; Stougaard and Nordstrom, 1981; Wagner and Simons, 1994) is well-suited for rational design (Isaacs et al., 2006) and, in particular, for biosensing applications. Many regulatory RNA molecules are natural environmental sensors (Gelfand et al., 1999; Johansson et al., 2002; Lease and Belfort, 2000; Majdalani et al., 2002; Mandal et al., 2003; Mironov et al., 2002; Morita et al., 1999; Winkler et al., 2002; Winkler et al., 2004), and because of their ability to take on complex structures defined by their sequence, these molecules can mediate diverse modular functions across distinct sequence domains. Riboswitches (Winkler and Breaker, 2005), for instance, bind specific small-molecule ligands through aptamer12 domains and induce conformational changes in the 5′ UTR of their own mRNA, thereby regulating gene expression. Aptamer domains that are modelled after riboswitches are versatile and widely used sensitive elements for RNA-based biosensing. The choice and number of aptamer domains can provide control over specificity. Building an entire RNA-based biosensor typically requires coupling an aptamer domain (the sensitive element) with a post-transcriptional regulatory domain (the transducer module) on a modular RNA molecule scaffold.

Antisense RNAs13 (Wagner and Simons, 1994; Good, 2003) are one such class of natural regulatory RNAs that can control gene expression through posttranscriptional mechanisms. By linking a riboswitch aptamer to an antisense repressor on a single RNA molecule, Bayer and Smolke (2005) engineered transacting, ligand-responsive riboregulators14 of gene expression in Saccharomyces cerevisiae (Box A2-2). Binding of the aptamer to its ligand (for example, the small molecule theophylline) induces a conformational change in the RNA sensor that either sequesters the antisense domain in a stable stem loop (ON switch) or liberates it to inhibit translation of an output gene reporter (OFF switch). As a result of the cooperative dependence on both ligand and target mRNA, this biosensor shows binary-like switching at a threshold ligand concentration, similar

_______________

12 Aptamer – Oligonucleic acids that bind to a specific target molecule, such as a small molecule, protein or nucleic acid. Nucleic acid aptamers are typically developed through in vitro selection schemes but are also found naturally (for example, RNA aptamers in riboswitches).

13 Antisense RNAs – RNAs that bind segments of mRNA in trans to inhibit translation.

14 Riboregulators – Small regulatory RNAs that can activate or repress gene expression by binding segments of mRNA in trans. They are typically expressed in response to an environmental signalling event.

to the genetic toggle design. Importantly, this detection threshold can be adjusted by altering the RNA sequence and therefore the thermodynamic properties of the structure. In principle, the ‘antiswitch’ framework is modular; in other words, aptamers for different ligands and antisense stems targeting different downstream genes could be incorporated into the scaffold to create new sensors. In practice, developing new sensors by aptamer and antisense replacement often involves re-screening compatible secondary structures to create functioning switches. In the future, this platform could be combined with rapid, in vitro aptameric selection techniques (Cox et al., 2002; Ellington and Szostak, 1990; Hermann and Patel, 2000; Tuerk and Gold, 1990) for generating a suite of RNA biosensors that report on the levels of various mRNA species and metabolites in a cell. However, here it should also be noted that aptamers show specificity for a biased ligand space, and as a result aptamers for a target ligand cannot always be found.

Another method for transducing the sensory information captured by aptamer domains is to regulate translation through RNA self-cleavage (Winkler et al., 2004; Winkler and Breaker, 2005). RNA cleavage is catalysed by ribozymes, some of which naturally possess aptameric domains and are responsive to metabolites (Winkler et al., 2004). Yen et al. (2004) took advantage of this natural framework and encoded ligand-sensitive ribozymes in the mRNA sequences of reporter genes. In the absence of its cognate ligand, constitutive autocleavage of the reporter mRNA resulted in little or no signal. The RNA biosensor is flipped when the cognate ligand is present to inhibit the ribozyme’s activity. Similar to the ‘antiswitch’ framework (and with the same technical challenges), these engineered RNAs could potentially be used as endogenous sensors for reporting on a variety of intracellular species and metabolites.

Post-translational biosensing. Signal transduction pathways show vast diversity and complexity. Factors such as the nature of the molecular interactions, the number of interconnected proteins in a cascade and the use of spatial mechanisms dictate which signals are transmitted, whether a signal is amplified or attenuated and the dynamics of the response. Despite the multitude of factors and interacting components, signal transduction pathways are essentially hierarchical schemes based on sensitive elements and downstream transducer modules, and as such can be rationalized for engineering protein-based biosensors.

The primary sensitive element for most signal transduction pathways is the protein receptor. Whereas environment-responsive promoters and RNA aptamers are typically identified from nature or selected with high-throughput combinatorial methods, protein receptors can be designed de novo at the level of molecular interactions. For instance, Looger et al. (2003) devised a computational method for redesigning natural protein receptors to bind new target ligands. Starting with a ‘basis’ of five proteins from the E. coli periplasmic binding protein (PBP) superfamily, the researchers replaced each of the wild-type ligands with a new, non-native target ligand and then used an algorithm to combinatorially explore all

binding-pocket-residue mutations and ligand-docking configurations. This procedure was used to predict novel receptors for trinitrotoluene (TNT; a carcinogen and explosive), L-lactate (a medically-important metabolite) and serotonin (a chemical associated with psychiatric conditions). The predicted receptor designs were experimentally confirmed to be strong and specific in vitro sensors, as well as in vivo cell-based biosensors.

Protein receptors, such as the ones discussed above, are typically membrane-bound; they trigger protein signalling cascades that ultimately result in a cellular response. However, several synthetic methods can be used to transmit captured sensory information in a tunable and desirable manner. Skerker et al. (2008) rationally rewired the transmission of information through two-component systems15 by identifying rules governing the specificity of a histidine kinase to its cognate response regulator. Alternatively, engineered protein scaffolds can be designed to physically recruit pathway modulators and synthetically reshape the dynamical response behaviour of a system (Bashor et al., 2008) (Box A2-3). This constitutes a modular method for programming protein-based biosensors to have any desired response, including accelerated, delayed or ultrasensitive responses, to upstream signals.

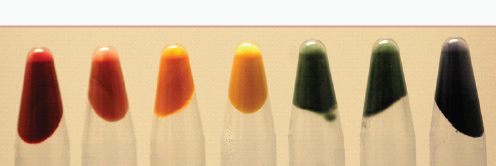

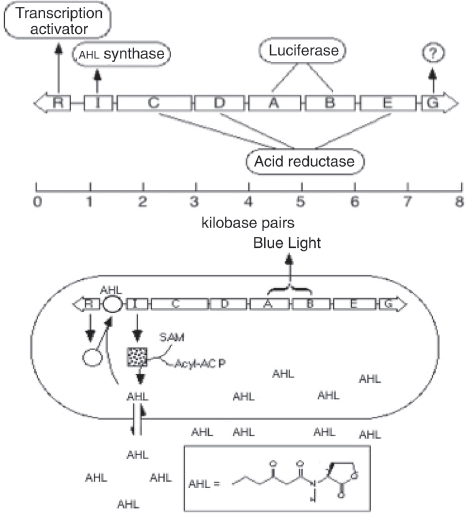

Hybrid approaches. Combining synthetic transcriptional, translational and post-translational circuits into hybrid solutions and harnessing desired characteristics from each could lead to the creation of cell-based biosensors that are as robust as those of natural organisms. Using a synthetic hybrid approach, Voigt and colleagues (Levskaya et al., 2005; Levskaya et al., 2009; Tabor et al., 2009) developed E. coli-based optical sensors. A synthetic sensor kinase was engineered to allow cells to identify and report the presence of red light. As a result, a bacterial lawn of the engineered cells could faithfully ‘print’ a projected image in the biological equivalent of photographic film. Specifically, a membrane-bound photoreceptor from cyanobacteria was fused to an E. coli intracellular histidine kinase to induce light-dependent changes in gene expression (Levskaya et al., 2005) (Box A2-3). In a clever example of its use, the bacterial optical sensor was applied in image edge detection (Tabor et al., 2009). In this case, by wiring the optical sensor to transcriptional circuits that perform cell–cell communication (the quorum-sensing16 system from Vibrio fischeri) and logical functions (Box A2-3), the researchers programmed only the cells that receive light and directly neighbour cells that do not receive light to produce a pigment, allowing

_______________

15 Two-component systems – Among the simplest types of signal transduction pathways. In bacteria, they consist of two domains: a membrane-bound histidine kinase (sensitive element) that senses a specific environmental stimulus, and a cognate response regulator (transducer domain) that triggers a cellular response.

16 Quorum sensing – A cell-to-cell communication mechanism in many species of bacteria, whereby cells measure their local density (by the accumulation of a signalling molecule) and subsequently coordinate gene expression.

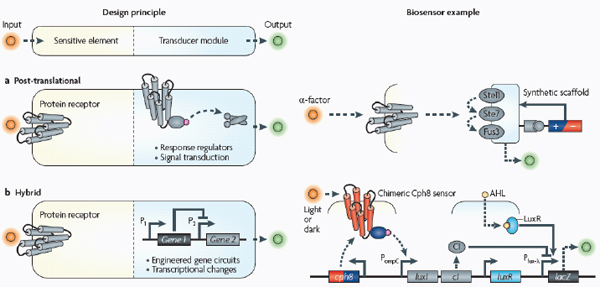

BOX A2-3

Synthetic Biosensors: Post-translational and Hybrid Architectures and Examples

A basic biosensor has two modules (see the figure): the sensitive element recognizes and binds analytes, whereas the transducer module transmits and reports signals.

Post-translational

Post-translational biosensors (part a) consist of membrane-bound protein receptors that trigger signal transduction cascades through signalling proteins, such as response regulators of two-component systems. In the example shown, a synthetic protein scaffold was engineered to physically localize the pathway components of the yeast mitogen-activated protein kinase (MAPK) pathway, which here is being triggered by the mating α-factor (Bashor et al., 2008). By recruiting pathway positive and negative modulators (±) to the scaffold, the system can be tuned to enable desired responses to upstream signals (for example, accelerated, delayed or ultrasensitive responses).

Hybrid

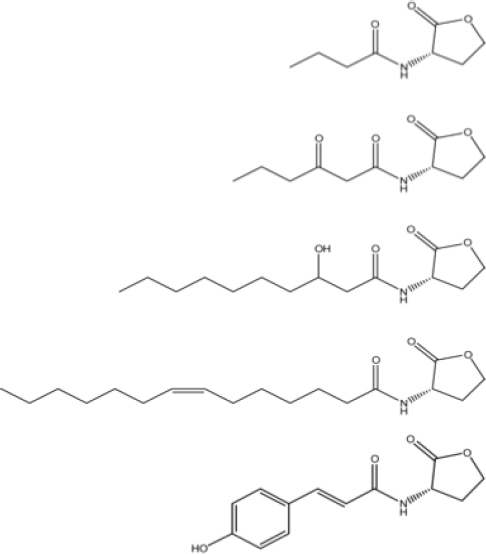

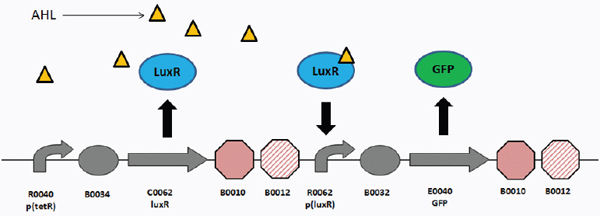

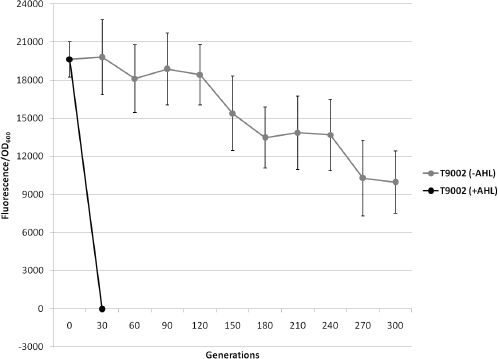

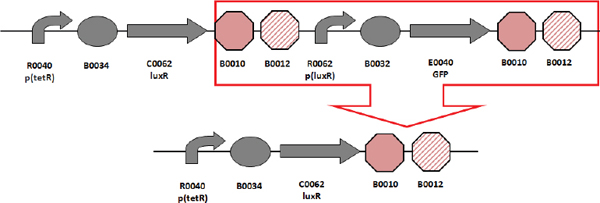

The hybrid example (part b) shows a synthetic genetic edge detection circuit (Tabor et al., 2009). The sensitive element is a light–dark sensor, Cph8, made as a chimaera of the photoreceptor domain of the cyanobacteria phytochrome Cph1 and the kinase domain of Escherichia coli EnvZ. This synthetic sensor activates an engineered gene circuit that combines cell–cell communication (genes and promoters of the Lux operon) with a logical AND gate (Plux-λ) to trace the edges of an image. Specifically, the absence of light triggers Cph8 kinase activity, which correspondingly activates the ompC promoter. Cells not receiving light will therefore produce the cell–cell communication molecule 3-oxohexanoyl-homoserine lactone (AHL; yellow circle) through expression of its biosynthetic enzyme LuxI. In addition, these cells will produce the transcriptional repressor CI (grey oval). AHL binds to the constitutively expressed transcription factor LuxR (light blue oval) to activate expression from the Plux-λ promoter, which is simultaneously and dominantly repressed by CI. The result is that only cells that receive light (and therefore do not express the transcriptional repressor CI) and are nearby to AHL-producing dark cells will activate the final gate and produce pigment through β-galactosidase activity (encoded by lacZ).

the edges of a projected image to be traced. This work demonstrates that complex behaviour can emerge from properly wiring together smaller genetic programs, and that these programs can lead to unique real-world applications.

Therapeutics

Human health is afflicted by new and old foes, including emergent drug-resistant microbes, cancer and obesity. Meanwhile, progress in medicine is faced with challenges at each stage of the therapeutic spectrum, ranging from the drying up of pharmaceutical pipelines to limited global access to viable medicines. In a relatively short amount of time, synthetic biology has made promising strides in reshaping and streamlining this spectrum (Box A2-4). Indeed, the rational and model-guided construction of biological parts is enabling new therapeutic platforms, from the identification of disease mechanisms and drug targets to the production and delivery of small molecules.

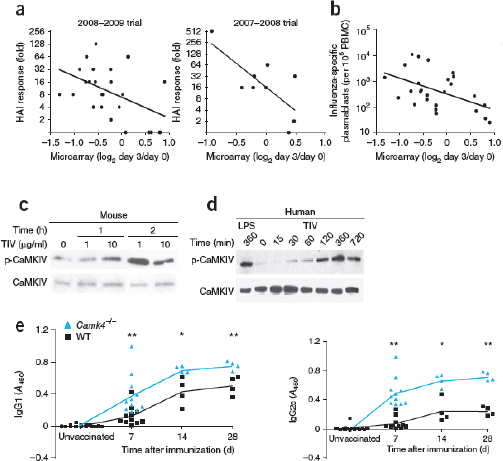

Disease mechanism. An electrical engineer is likely to prototype portions of a circuit on a ‘breadboard’ before printing it as an entire integrated circuit. This allows for the rigorous testing of submodules in an isolated, well-characterized environment. Similarly, synthetic biology provides a framework for synthetically reconstructing natural biological systems to explore how pathological behaviours may emerge. This strategy was used to give mechanistic insights into a primary immunodeficiency, agammaglobulinaemia, in which patients cannot generate mature B cells and as a result are unable to properly fight infections (Ferrari et al., 2007). The researchers developed a synthetic testbed by systematically reconstructing the various components of the human B cell antigen receptor (BCr) signalling pathway in an orthogonal environment.17 This allowed them to identify network topology features that trigger BCR signalling and assembly. A rare mutation in the immunoglobulin-β-encoding gene was identified in one patient and introduced into the synthetic system, in which it was shown to abolish assembly of the BCR on the cell surface, thereby linking this faulty pathway component with disease onset. Pathogenic viral genomes can similarly be reconstructed for studying the molecular underpinnings of infectious disease pandemics. For instance, synthetic reconstruction of the severe acquired respiratory syndrome (SARS) coronavirus (Becker et al., 2008) and the 1918 Spanish influenza virus (Tumpey et al., 2005) helped to identify genetic mutations that may have conferred human tropism and increased virulence.

Drug-target identification. Building up synthetic pathways and systems from individual parts is one way of identifying disease mechanisms and therapeutic

_______________

17 Orthogonal environment – A cellular environment or host into which genetic material is transplanted to avoid undesired native host interference or regulation. Orthogonal hosts are often organisms with sufficient evolutionary distance from the native host.

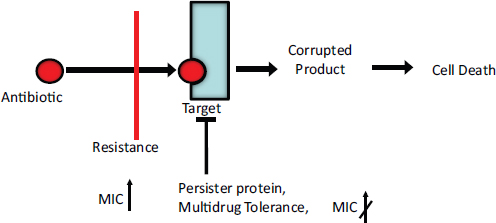

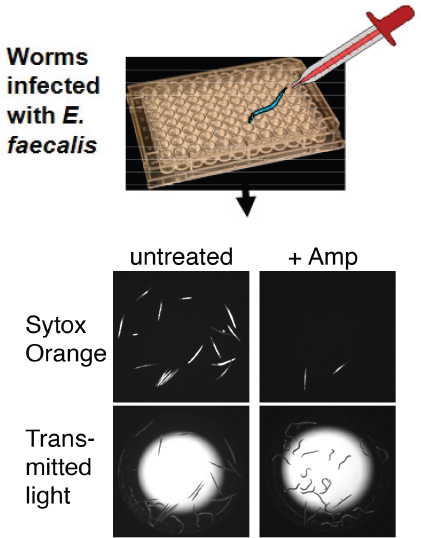

targets. Another is to deploy synthetic biology devices to systematically probe the function of individual components of a natural pathway. Our group, for instance, has engineered modular riboregulators that can be used to tune the expression of a toxic protein or any gene in a biological network (Isaacs et al., 2004). To achieve post-transcriptional control over a target gene, the mRNA sequence of the riboregulator 5′ UTR is designed to form a hairpin structure that sequesters the ribosomal binding site (RBS) and prevents ribosome access to it. Translational repression of this cis-repressed mRNA can be alleviated by an independently regulated transactivating RNA that targets the stem-loop for unfolding. Engineered riboregulators have been used to tightly regulate the expression of CcdB, a toxic bacterial protein that inhibits DNA gyrase,18 to gain a better understanding of the sequence of events leading to induced bacterial cell death (Dwyer et al., 2007). These synthetic biology studies, in conjunction with systems biology studies of quinolones (antibiotics that inhibit gyrase) (Dwyer et al., 2007), led to the discovery that all major classes of bactericidal antibiotics induce a common cellular death pathway by stimulating oxidative damage (Kohanski et al., 2007, 2008). This work provided new insights into how bacteria respond to lethal stimuli and paved the way for the development of more effective antibacterial therapies.

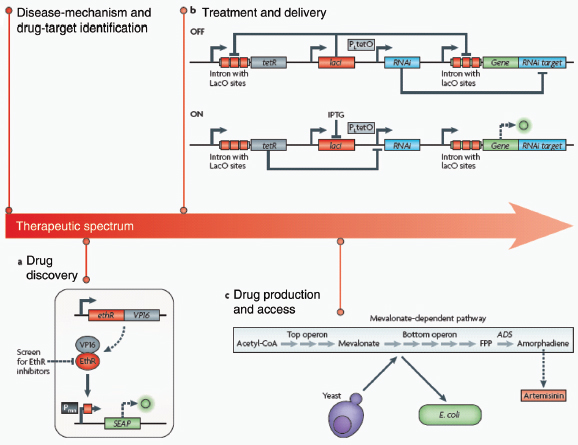

Drug discovery. After a faulty pathway component or target is identified, whole-cell screening assays can be designed using synthetic biology strategies for drug discovery. As a demonstration of this approach, Fussenegger and colleagues (Weber et al., 2008) developed a synthetic platform for screening small molecules that could potentiate a Mycobacterium tuberculosis antibiotic (Box A2-4). ethionamide, currently the last line of defence in the treatment of multidrug-resistant tuberculosis, depends on activation by the M. tuberculosis enzyme EthA for efficacy. However, due to transcriptional repression of ethA by the protein EthR, ethionamide-based therapy is often rendered ineffective. To address this problem, the researchers designed a synthetic mammalian gene circuit that featured an EthR-based transactivator of a reporter gene and used it to screen for and identify EthR inhibitors that could abrogate resistance to ethionamide. Importantly, because the system is a cell-based assay, it intrinsically enriches for inhibitors that are non-toxic and membrane-permeable to mammalian cells, which are key drug criteria as M. tuberculosis is an intracellular pathogen. This framework, in which drug discovery is applied to whole cells that have been engineered with circuits that highlight a pathogenic mechanism, could be extended to other diseases and phenotypes.

_______________

18 DNA gyrase – A type II DNA topoisomerase that catalyses the ATP-dependent supercoiling of closed-circular dsDNA by strand breakage and rejoining reactions. Control of chromosomal topological transitions is essential for DNA replication and transcription in bacteria, making gyrase an effective target for antimicrobial agents (for example, the quinolone class of antibiotics).

Drug discovery

Part a of the figure shows a synthetic mammalian gene circuit that enabled drug discovery for antituberculosis compounds (Weber et al., 2008). The antibiotic ethionamide is rendered cytotoxic to Mycobacterium tuberculosis by the enzyme EthA in infected cells. Because EthA is natively repressed by EthR, resistance to ethionamide treatment is common. In the gene circuit, a fusion of EthR and the mammalian transactivator VP16 binds a minimal promoter (Pmin) with a synthetic EthR operator site and activates expression of the reporter gene SEAP (human placental secreted alkaline phosphatase). This platform allows for the rapid screening of EthR inhibitors in mammalian cells.

Treatment and delivery

Part b shows a synthetic mammalian genetic switch for tight, tunable and reversible control of a desired gene for therapeutic or gene-delivery applications. In the OFF configuration (upper panel), expression of the gene of interest (green) is repressed at the levels of both transcription and translation. Constitutively expressed LacI repressor (red) binds to the lac operator sites in the transgene module of the gene of interest, therefore repressing its transcription. Any transcriptional leakage is repressed at the level of translation by an interfering RNA (blue), which targets the gene’s 3′ UTR. The system is switched ON (lower panel) by the addition of isopropyl-β-d-thiogalactopyranoside (IPTG), which binds LacI repressor proteins and consequently relieves both forms of repression.

Drug production and access

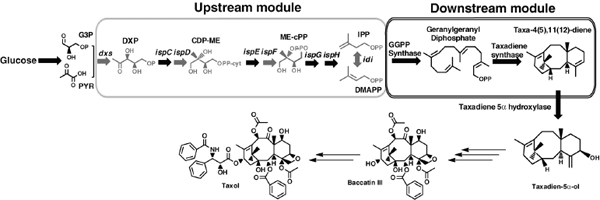

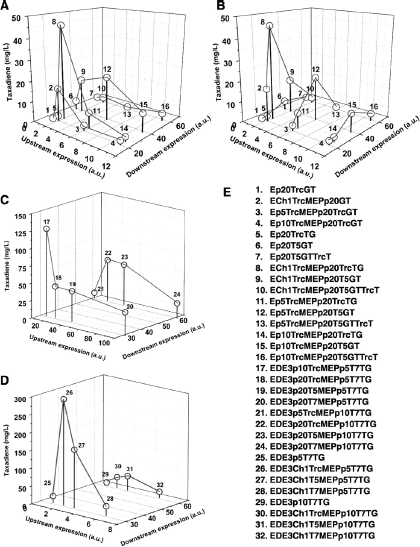

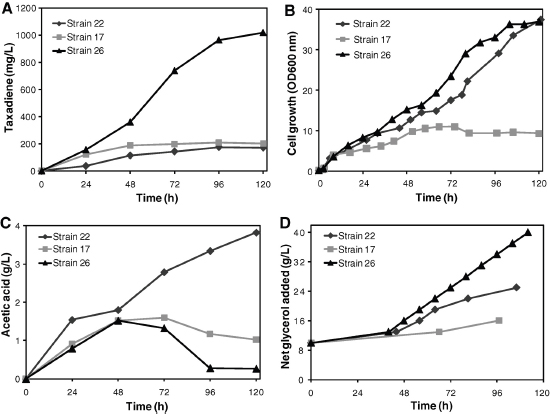

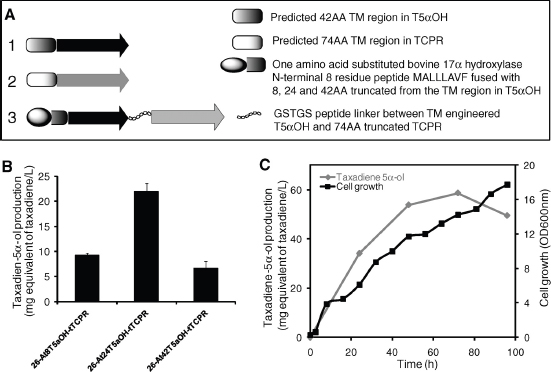

The discovery of drugs does not always translate to the people who need them the most because drug production processes can be difficult and costly. Antibiotics are industrially produced from microbes and fungi, and are therefore widespread and cheap. Conversely, many other drugs are isolated from hosts that are not as amenable to large-scale production and are therefore costly and in short supply. Such drugs include the antimalaria drug artemisinin and the anticancer drug taxol. Fortunately, global access to drugs is being enabled by hybrid synthetic biology and metabolic engineering strategies for the microbial production of rare natural products. In the case of artemisinin (part c), there exist two biosynthetic pathways for the synthesis of the universal precursors to all isoprenoids, the large and diverse family of natural products of which artemisinin is a member. The native isoprenoid pathway found in Escherichia coli (the deoxyxylulose 5-phosphate (DXP) pathway) has been difficult to optimize, so instead researchers have synthetically constructed and tested the entire Saccharomyces cerevisiae mevalonate-dependent (MEV) pathway in E. coli in a piece-wise fashion (for example, by separating the ‘top’ and ‘bottom’ operons). The researchers initially used E. coli as a simple, orthogonal host platform to construct, debug and optimize the large metabolic pathway (Martin et al., 2003). They then linked the optimized heterologous pathway to a codon-optimized form of the plant terpene synthase ADS to funnel metabolic production to the specific terpene precursor to artemisinin. This work allowed them to build a full, optimized solution that could be ultimately and seamlessly deployed back into S. cerevisiae for cost-effective synthesis and purification of industrial quantities of the immediate drug precursor of artemisinin (Ro et al., 2006). FPP, farnesyl pyrophosphate.

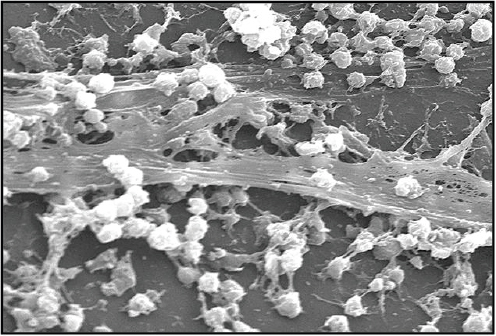

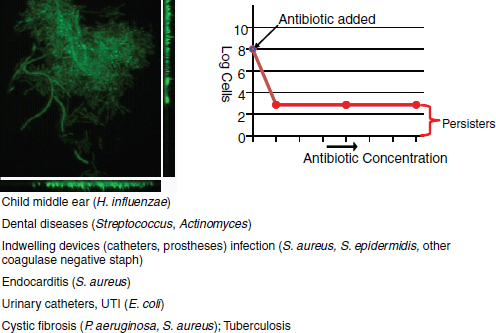

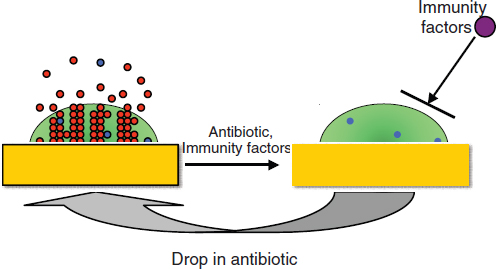

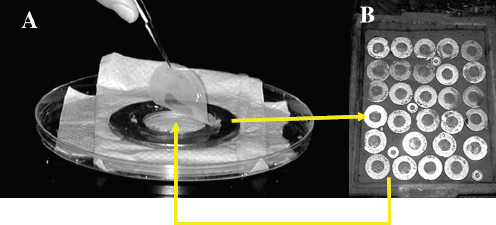

Therapeutic treatment. Synthetic biology devices have additionally been developed to serve as therapies themselves. Entire engineered viruses and organisms can be programmed to target specific pathogenic agents and pathological mechanisms. For instance, in two separate studies (Lu and Collins, 2007, 2009) researchers used engineered bacteriophages to combat antibiotic-resistant bacteria by endowing them with genetic mechanisms that target and thwart bacterial mechanisms for evading antibiotic action. The first study was prompted by the observation that biofilms,19 in which bacteria are encapsulated in an extracellular matrix, have inherent resistance to antimicrobial therapies and are sources of persistent infections. To more effectively penetrate this protective environment, T7 phage was engineered to express the biofilm matrix-degrading enzyme dispersin B (DspB) upon infection (Lu and Collins, 2007). The two-pronged attack of T7 expressing DspB and phage-induced lysis fuelling the creation and spread of DspB resulted in the removal of 99.997% of the biofilm bacterial cells. In the second study (Lu and Collins, 2009), it was suggested that inhibition of certain bacterial genetic programs could improve the effectiveness of current antibiotic therapies. In this case, bacteriophages were deliberately designed to be non-lethal so as not to elicit resistance mechanisms; instead, a non-lytic M13 phage was used to suppress the bacterial SOS DNA-damage response by overexpression of its repressor, lexA3. The engineered bacteriophage significantly enhanced killing by three major classes of antibiotics in traditional cell culture and in E. coliinfected mice, potentiated killing of antibiotic-resistant bacteria and, importantly, reduced the incidence of cells with antibiotic-induced resistance.

Synthetically engineered viruses and organisms that are able to sense and link their therapeutic activity to pathological cues may be useful in the treatment of cancer, in which current therapies often indiscriminately attack tumours and normal tissues. For instance, adenoviruses were programmed to couple their replication to the state of the p53 pathway in human cells (Ramachandra et al., 2001). Normal p53 production would result in inhibition of a crucial viral replication component, whereas a defunct p53 pathway, which is characteristic of tumour cells, would allow viral replication and cell killing. In another demonstration of translational synthetic biology applied to cancer therapy, Voigt and colleagues (Anderson et al., 2006) developed cancer-targeting bacteria and linked their ability to invade the cancer cells to specific environmental signals. Constitutive expression of the heterologous invasin (inv) gene (from Yersinia pseudotuberculosis) can induce E. coli cells to invade both normal human cell lines and cancer cell lines. So, to preferentially invade cancer cells, the researchers placed inv under the control of transcriptional operons that are activated by environmental signals specific to the tumour microenvironment. These engineered bacteria could be made to carry or synthesize cancer therapies for the treatment of tumours.

_______________

19 Biofilms – Surface-associated communities of bacterial cells encapsulated in an extracellular polymeric substances (EPS) matrix. Biofilms are an antibiotic-resistant mode of microbial life found in natural and industrial settings.

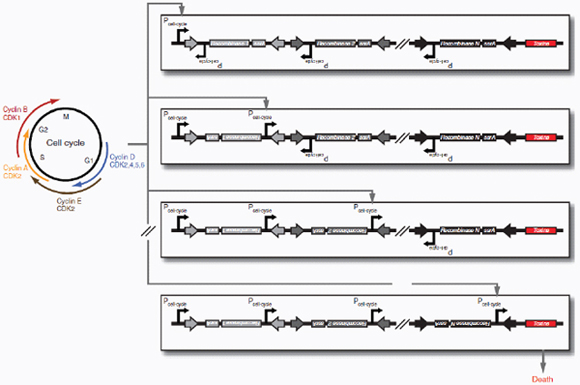

Therapeutic delivery. In addition to engineered therapeutic organisms, synthetic circuits and pathways can be used for the controlled delivery of drugs as well as for gene and metabolic therapy. In some cases, sophisticated kinetic control over drug release in the body may yield therapeutic advantages and reduce undesired side effects. Most hormones in the body are released in time-dependent pulses. Glucocorticoid secretion, for instance, has a circadian and ultradian20 pattern of release, with important transcriptional consequences for glucocorticoid-responsive cells (Stavreva et al., 2009). Faithfully mimicking these patterns in the administration of synthetic hormones to patients with glucocorticoid-responsive diseases, such as rheumatoid arthritis, may decrease known side effects and improve therapeutic response (Stavreva et al, 2009). Periodic synthesis and release of biologic drugs can be autonomously achieved with synthetic oscillator circuits (Elowitz and Leibler, 2000; Atkinson et al., 2003; Fung et al., 2005; Stricker et al., 2008; Tigges et al., 2009) or programmed time-delay circuits (Weber et al., 2007). In other cases, one may wish to place a limit on the amount of drug released by programming the synthetic system to self-destruct after a defined number of cell cycles or drug release pulses. Our group has recently developed two variants of a synthetic gene counter (Friedland et al., 2009) that could be adapted for such an application.

Gene therapy is beginning to make some promising advances in clinical areas in which traditional drug therapy is ineffective, such as in the treatment of many hereditary and metabolic diseases. Synthetic circuits offer a more controlled approach to gene therapy, such as the ability to dynamically silence, activate and tune the expression of desired genes. In one such example (Deans et al., 2007), a genetic switch was developed in mammalian cells that couples transcriptional repressor proteins and an RNAi module for tight, tunable and reversible control over the expression of desired genes (Box A2-4). This system would be particularly useful in gene-silencing applications, as it was shown to yield >99% repression of a target gene.

Additionally, the construction of non-native pathways offers a unique and versatile approach to gene therapy, such as for the treatment of metabolic disorders. Operating at the interface of synthetic biology and metabolic engineering, Liao and colleagues (Dean et al., 2009) recently introduced the glyoxylate shunt pathway21 into mammalian liver cells and mice to explore its effects on fatty acid metabolism and, more broadly, on whole-body metabolism. Remarkably, the researchers found that when transplanted into mammals, the shunt actually increased fatty acid oxidation, evidently by creating an alternative cycle. Furthermore, mice expressing the shunt showed resistance to diet-induced obesity when

_______________

20 Ultradian – Periods of cycles that are repeated throughout a 24-hour circadian day.

21 Glyoxylate shunt pathway – A two-enzyme metabolic pathway unique to bacteria and plants that is activated when sugars are not readily available. This pathway diverts the tricarboxylic acid (TCA) cycle so that fatty acids are not completely oxidized and are instead converted into carbon energy sources.

placed on a high-fat diet, with corresponding decreases in total fat mass, plasma triglycerides and cholesterol levels. This work offers a new synthetic biology model for studying metabolic networks and disorders, and for developing treatments for the increasing problem of obesity.

Finally, the discovery of drugs and effective treatments may not quickly — or ever — translate to the people who need them the most because drug production processes can be difficult and costly. As discussed below, synthetic biology is allowing rare and costly drugs to be manufactured more cost-effectively (Box A2-4).

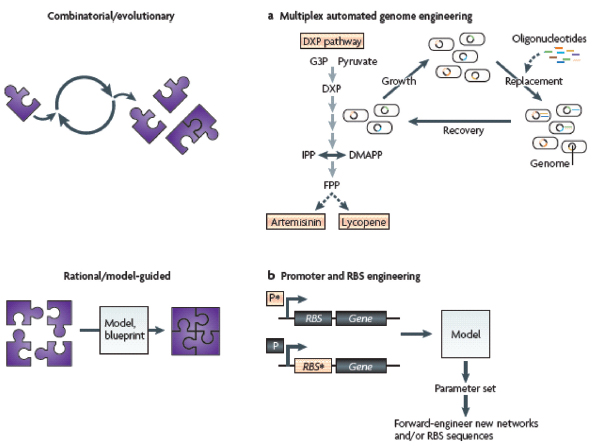

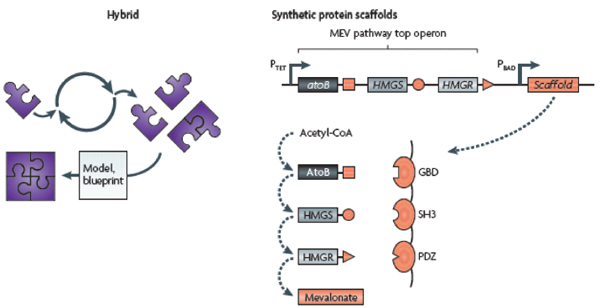

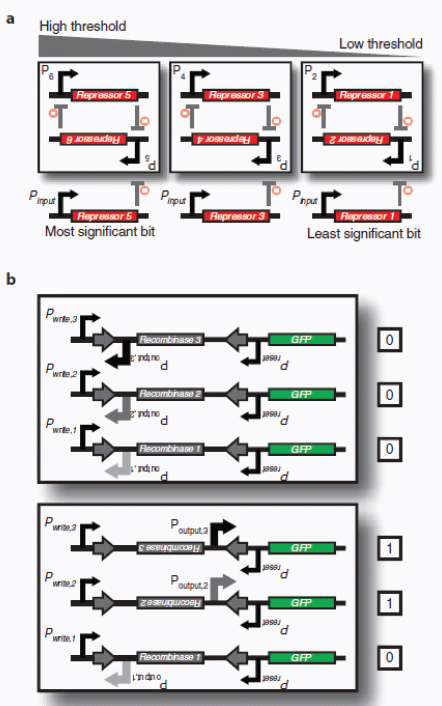

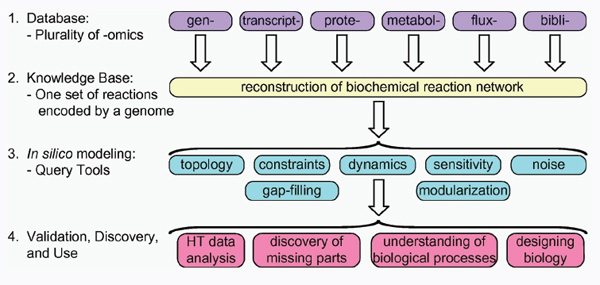

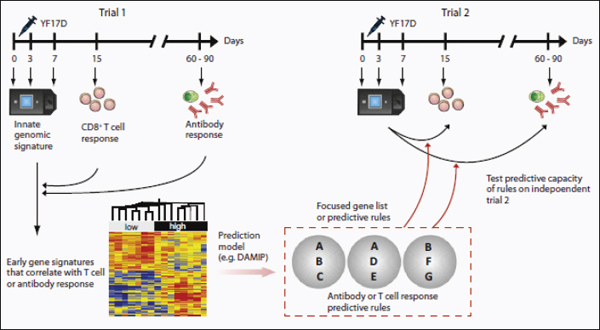

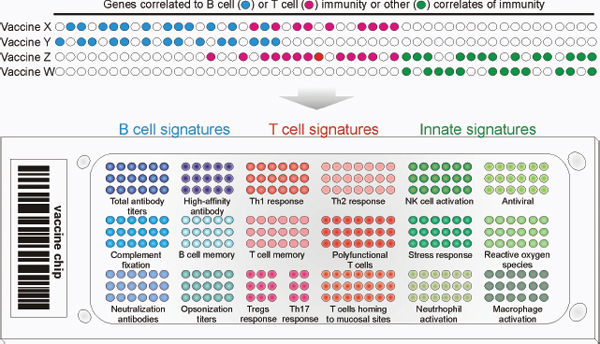

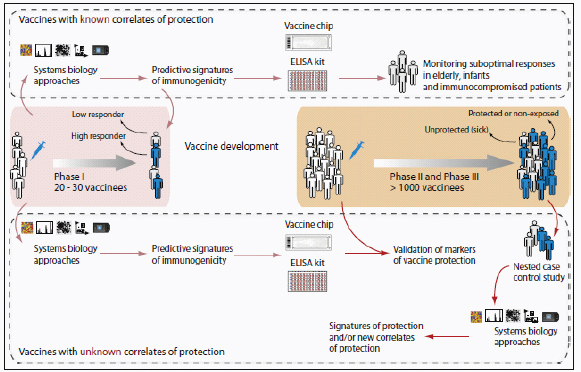

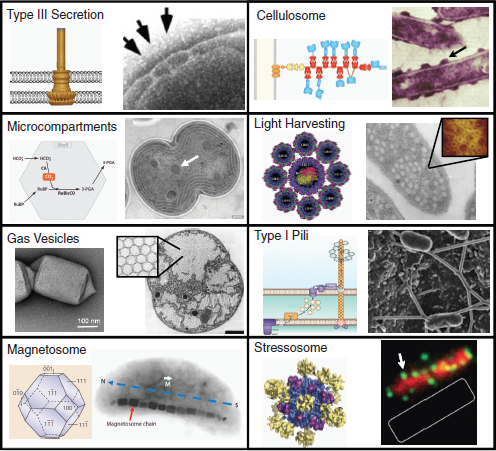

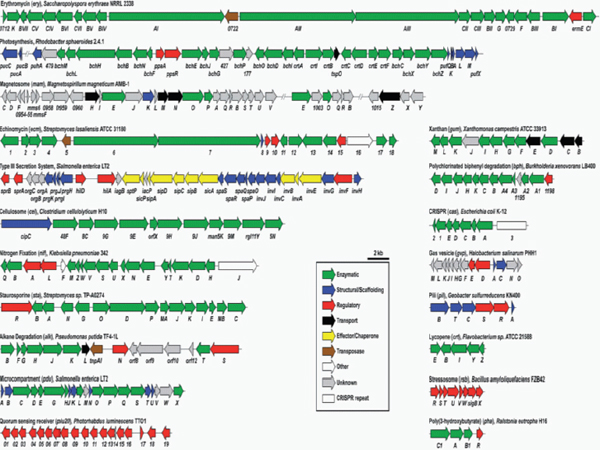

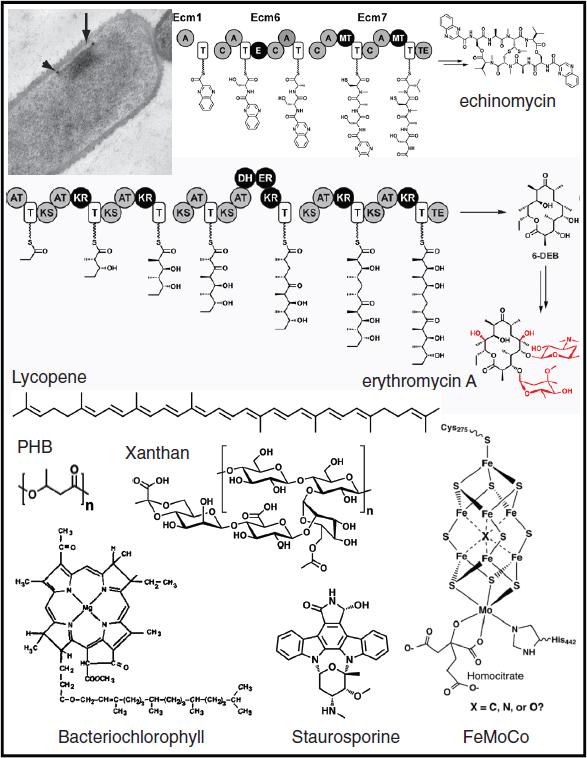

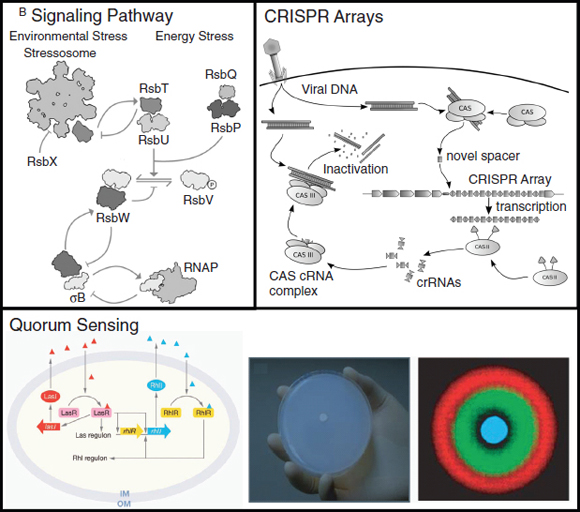

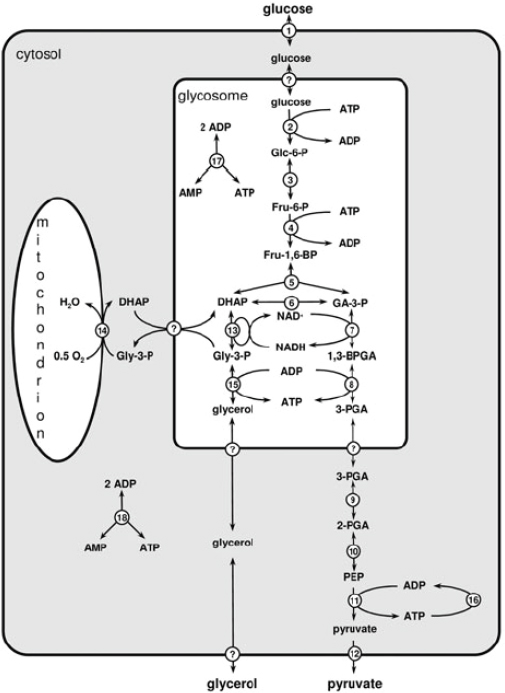

Biofuels, pharmaceuticals and biomaterials