Overview:

The New Federal Role in

Innovation Clusters

Ever since Silicon Valley and Boston’s Route 128 gained global attention as fountains of dynamic new high-technology companies, state and local governments across America have tried to create innovation clusters of their own.1 To this end, several states and universities have invested in science parks, business incubators to nurture start-ups, and an array of real and virtual research collaborations with private industry.2

![]()

1 Robert Lucas has long argued that the clustering and density of talented people is a key driver of innovation and economic growth. See Robert Lucas, “On the Mechanics of Economic Development,” Journal of Monetary Economics, 22:38-39. Richard Florida has popularized the characteristics and economic advantages of innovative clusters. See, for example, Richard Florida, The Rise of the Creative Class, New York: Basic Books, 2002. For an insightful review of interface of the entrepreneur in regional growth dynamics, see Sameeksha Desai, Peter Nijkamp, and Roger R. Stough, eds., New Directions in Regional Economic Development: The Role of Entrepreneurship Theory and Methods, Practice and Policy, Northampton, MA: Edward Elgar, 2011.

2 For a review of policy initiatives around the world to develop research parks, see National Research Council, Understanding Research, Science and Technology Parks: Global Best Practices—Summary of a Symposium, Charles W. Wessner, ed., Washington, DC: The National Academies Press, 2009. For a review of selected state strategies to develop innovation clusters, see National Research Council, Growing Innovation Clusters for American Prosperity: Summary of a Symposium, Charles W. Wessner, Rapporteur, Washington, DC: The National Academies Press, 2011.

Box A

The Relevance of Innovation Clusters

Innovation clusters are regional concentrations of large and small companies that develop creative products and services, along with specialized suppliers, service providers, universities, and associated institutions. Ideally, they bring together a critical mass of skills and talent and are characterized by a high level of interaction among these entrepreneurs, researchers, and innovators.a

Prior to the second half of the 20th century, the limitations of communication and transportation technologies meant that industries most always developed in clusters. Consistent with this, U.S. manufacturing industries organically developed in clusters—for example, textiles in New England, cars in Detroit, and steel in Pittsburgh. Indeed, economists have studied industrial concentrations for over a century.b

Open global markets, rapid transportation, and high-speed communications of the 21st century should allow any company to “source anything from any place at any time.” Nonetheless, economic growth and employment continue to be strongly associated with successful clusters.c Recognizing this, regional and national governments have sought to pursue policies that actively create and nurture technology clusters within their borders.d

Muro and Katz distinguish the phenomenon of innovation or industry clusters in general from specific Regional Innovation Cluster (RIC) initiatives, which they call “formally organized efforts to promote cluster growth and competitiveness through collaborative activities among cluster participants.” Led in many cases by regional or national governments in partnership with universities and industry, these cluster initiatives often “sponsor education and training activities, encourage relationship building, or facilitate market development through joint market assessment and marketing, among many others.”e Muro and Katz note that since RIC initiatives are a relatively new phenomenon, they do not yet have a sufficient empirical record, leaving the effectiveness of these cluster building strategies to be established.

aNational Research Council, Growing Innovation Clusters for American Prosperity: Summary of a Symposium, Charles W. Wessner, Rapporteur, Washington, DC: The National Academies Press, 2011.

bSee Alfred Marshall, Principles of Economics, London: Macmillan, 1920. The first edition of Marshall’s classic textbook appeared in 1890. Marshall characterized clusters as a “concentration of specialised industries in particular localities” that he termed industrial districts.

cMichael Porter, “Clusters and the New Economics of Competition,” Harvard Business Review, November-December 1998.

dJoseph Cortright, Making Sense of Clusters: Regional Competitiveness and Economic Development, Washington, DC: The Brookings Institution, 2006. Cortright notes that “the foundation of a regional economy is a group of clusters, not a collection of unrelated firms. Firms cluster together within a region because each firm benefits from being located near other similar or related firms.” This means that economic development policy and practice can be effectively oriented toward groups of firms in a specialized region.

eSee Mark Muro and Bruce Katz, The New ‘Cluster Moment’: How Regional Innovation Clusters can Foster the Next Economy, Washington, DC: The Brookings Institution Metropolitan Policy Program, September 2010.

The federal government has traditionally played an important supportive role in the development of innovative clusters around the country. Federally funded research and military procurement have been instrumental in the emergence of clusters that have formed around major research universities.3 And through legislation, such as the Bayh-Dole Act of 1980, Congress has encouraged universities and national laboratories to commercialize federally funded research.4 Unlike many Asian and European nations, however, the United States has traditionally not adopted explicit national policies to promote development of particular industries in specific regions.

The federal role is now evolving. In recent years, support has grown in Washington to a more direct federal role in assisting and accelerating innovation clusters around the country. In part, the impetus for change has come from a National Academy of Sciences Report, Rising Above the Gathering Strom, which warned that the United States is in danger of ceding global leadership in technology and innovation to nations with more ambitious and comprehensive policies to enhance their competitiveness.5 Citing this report, Congress in 2007 passed with bipartisan support the America COMPETES Act, which included authorization—but not funding—to boost the development of innovation clusters.6 The impetus for change has also come in response to the recent economic downturn—the most severe in decades. Recognizing clusters as important catalysts for creating good paying jobs, growing new small businesses, and forming new globally competitive industries, the government has actively sought to develop federal-regional partnerships to foster their development.7

![]()

3 For an analysis of the military role in the origins of Silicon Valley and the high-tech industry in Boston, see Stuart W. Leslie, The Cold War and American Science: The Military-Industrial-Academic Complex at MIT and Stanford, New York: Columbia University Press, 1993.

4 The Bayh Dole Act of 1980 (P.L. 96-517, Patent and Trademark Act Amendments of 1980) permits the transfer of exclusive control over many government-funded inventions to universities and businesses operating with federal contracts for the purpose of further development and commercialization.

5 National Academy of Sciences, National Academy of Engineering, Institute of Medicine, Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future, Washington, DC: The National Academies Press, 2007.

6 The America COMPETES Act (P.L. 110-69), signed by President George W. Bush on August 9, 2007, directed national laboratories owned by the Department of Energy to establish Discovery Science and Engineering Innovation Institutes to co-develop applications for technology with universities and industry. On January 4, 2011, President Barak Obama signed P.L. 111-358, the America COMPETES Reauthorization Act of 2010. Section 603 of this act authorizes $100 million annually for the Commerce Department to implement a “Regional Innovation Program.”

7 National Economic Council, Council of Economic Advisers, and the Office of Science and Technology Policy, A Strategy for American Innovation: Securing Our Economic Growth and Prosperity, Washington, DC: Executive Office of the President, February 2011. Access at <http://www.whitehouse.gov/sites/default/files/uploads/InnovationStrategy.pdf>.

Consistent with this strategy, recent interagency clusters efforts, led by the Economic Development Administration, include the Jobs & Innovation Accelerator Challenge (implementing COMPETES Sec. 603) (<http://www.eda.gov/InvestmentsGrants/jobsandinnovationchallenge>); the i6 Challenge (<http://www.eda.gov/pasti6>) and the i6 Green Challenge (<http://www.eda.gov/i6>).

“Regional innovation clusters have a proven track record of getting good ideas more quickly into the marketplace. The burning question becomes, ‘How do we create more of them?’”

Keynote Address by Commerce Secretary Gary Locke,

National Academies Symposium on “Clustering for 21st Century Prosperity,”

February 25, 2010

To better understand ways in which the public sector can most effectively advance innovation clusters, the National Academies’ Board on Science, Technology, and Economic Policy (STEP) partnered with the Association of University Research Parks (AURP) to convene a symposium on ‘Clustering for 21st Century Prosperity.’ This symposium brought together senior Administration officials and economic development professionals, academics, and venture capital investors from the United States and around the world.

This report summarizes the proceedings of this symposium, and this overview highlights the key issues presented and discussed at this forum. It has been prepared by the workshop rapporteur as a factual summary of what occurred at the workshop. The planning committee’s role was limited to planning and convening the workshop. The statements made are those of the rapporteur or individual workshop participants and do not necessarily represent the views of all workshop participants, the planning committee, or the National Academies.

A. NEW INITIATIVES FOR GROWING CLUSTERS

Federal support of regional clusters has grown in recent years. The 2009 budget allocated $50 million in new funds, administered by the Commerce Department’s Economic Development Agency (EDA), to assist regional cluster initiatives.8 Also relevant is the American Recovery and Reinvestment Act of 2009, which directed the Department of Energy (DoE) to distribute $2 billion to manufacturers and component makers of lithium-ion batteries—many of them based in the Detroit area—to be used in next-generation electric vehicles.9 And

![]()

8 The fiscal 2009 budget provided $50 million in regional planning and matching grants within the Economic Development Administration to “support the creation of regional innovation clusters that leverage regions’ existing competitive strengths to boost job creation and economic growth.” See National Economic Council and Office of Science and Technology Policy, “A Strategy for American Innovation: Driving Towards Sustainable Growth and Quality Jobs,” Executive Office of the President, September 2009.

9 See symposium presentation by David Parks of the Michigan Economic Development Corporation Further, the STEP Board convened a symposium on “Building the Battery Industry for Electric Vehicles,” in July 2010 to examine the key challenges and opportunities for the Department of Energy,

the Small Business Administration, working with state agencies and the Department of Defense, has helped launch robotics clusters in Michigan, Virginia, and Hawaii.10

In addition, the Department of Energy’s Energy Regional Innovation Cluster initiative, or E-RIC, is devoted to developing technologies, designs, and systems for energy-efficient buildings.11 E-RIC attempts to align the resources of several federal agencies around regional initiatives and to collaborate more closely with state and local governments, universities, and industry.12

State and Regional Support for Cluster Initiatives

Many state and regional governments have taken a pragmatic approach to fostering innovation clusters, targeting industries such as semiconductors, batteries, flexible electronics, and robotics. New York, Ohio, Michigan, and New Mexico are among states that have invested alongside corporations and universities in R&D centers, awarded cash grants to companies building manufacturing plants, and amassed sizeable funds to provide early-stage capital to start-ups.13

Symposium participants cited numerous other examples of innovation clusters that are sprouting in regions of the United States with varying degrees of state and local government intervention as well as industry participation. These initiatives are found in places like Kansas, the Pacific Northwest, and West Virginia. “All of this is occurring on an ad hoc basis without a formal U.S. policy,” noted Ginger Lew, then of the White House National Economic Council, in her symposium remarks.14

Congress, Michigan and other states, and other federal agencies in developing a U.S. advanced battery industry.

10 See symposium presentation by Small Business Administration Administrator Karen Mills in the proceedings section of this volume.

11 For a critique of the Obama Administration’s Regional Innovation Cluster policy, see Junbo Yu and Randall Jackson, “Regional Innovation Clusters: A Critical Review,” Growth and Change, 42(2), June 2011.

12 The Department of Energy plans to pool resources with six other agencies in the $129.7 million project. Agencies participating in E-RIC are the Department of Energy, the National Institute of Standards and Technology, the Economic Development Administration, the Small Business Administration, the National Science Foundation, the Department of Education, and the Department of Labor. See <http://www.energy.gov/hubs/documents/ERIC_FOA.pdf>.

13 See presentations by Doug Parks (Michigan) and Rebecca Bagley (Ohio) in the proceedings section of this volume. For presentations on strategies deployed by New York, Pennsylvania, and South Carolina, see National Research Council, Growing Clusters for American Prosperity, op. cit. Also see Pete Engardio, “State Capitalism,” BusinessWeek, February 6, 2009.

14 See presentation by Ginger Lew, formerly of the White House National Economic Council, in the proceedings section of this volume.

B. AN ENHANCED FEDERAL ROLE?

Concerns over America’s global competitiveness and high unemployment are prompting federal policymakers to take a harder look at whether Washington can do more to bolster these regional initiatives.

Improving U.S. Competitiveness

One reason is the realization that other nations are catching up with and even surpassing the United States in key benchmarks of competitiveness in science and technology. In his symposium presentation, Marc Stanley of the National Institute of Standards and Technology (NIST) described a number of “disturbing signs” of eroding American leadership. He pointed out that after years in which spending on R&D has remained flat, at around 2.5 percent of gross domestic product, the United States now ranks behind nations such as Israel, Sweden, Finland, Japan, and South Korea in R&D intensity.15 His remarks echoed the warnings that were raised in the National Academies’ 2007 report Rising Above the Gathering Storm of an “abrupt” loss of U.S. global leadership in science, technology, and innovation and its impact on the future prosperity of the United States.16

Perhaps more importantly, other nations appear to be mastering the so-called soft infrastructure associated with successful innovation zones in the United States. In fact, Dr. Good asserted that many countries around the world “are replicating our successes better than we are.” China, Singapore, Hong Kong, Taiwan, and France are among those building modern science parks that promote synergies among businesses, governments, and university research programs in their regions.17

The growing movement among governments around the world to move away from outright subsidies to companies and poor regions and instead invest in public goods that enable industry and universities to cooperate and enable communities to compete represents “a new paradigm in regional policy,” said Mario Pezzini of the Organisation for Economic Co-operation and Development.18

![]()

15 See OECD Science, Technology and Industry Scoreboard 2011 at <http://www.oecd.org/document/10/0,3746,en_2649_33703_39493962_1_1_1_1,00.html>.

16 See National Academy of Sciences, National Academy of Engineering, Institute of Medicine, Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future, op. cit., p. 3.

17 See presentations by Alberto Duque (Portugal), Francelino Grando (Brazil), and Nicholas Brooke (Hong Kong) in the proceedings section of this volume. For a review of the growth of science parks in China, Singapore, India, Mexico, and Hungary, see National Research Council, Understanding Research, Science and Technology Parks: Global Best Practices—Summary of a Symposium, op. cit.

18 See presentation by Mario Pezzini of the Organisation for Economic Co-operation and Development in the proceedings section of this volume. See also Organisation for Economic Co-operation and Development, National Innovation Systems, Paris: Organisation for Economic Co-operation and Development, 1997, <http://www.oecd.org/dataoecd/35/56/2101733.pdf>.

Influential earlier works on global policies to promote innovation include Charles Freeman, Theory of Innovation and Interactive Learning, London: Pinter, 1987; Bengt-Åke Lundvall, ed., National

Strengthening the Structure of the U.S. Economy

The economic crisis that began in 2007 has added further impetus for the development of innovation clusters. As noted below, several senior Administration officials stated at the symposium that the collapse of financial markets and soaring unemployment in services and manufacturing has led to a focus not only on creating jobs and stimulating growth now, but also on resolving broader structural weaknesses in the U.S. economy.

Kristina Johnson, then Under Secretary of Energy, said that the enormity of the nation’s economic needs, which include energy security, building 21st century infrastructure, and creating new growth industries, require that government must find new ways to accelerate the commercialization of technologies, mobilize funds, and attain large scale. “It’s going to take trillions of dollars in investment, and it can’t be something the federal government does on its own. It has to be a collaborative, cooperative partnership,” Dr. Johnson said. “We don’t get there by technology alone and by policy alone.”19 Assistant Secretary of Commerce for Economic Development John Fernandez observed that the deep recession “in many ways may have been … a bit of a wakeup call across the board, not only for the federal government but also for the private sector and in public agencies across the country.”20

Improving Credit Markets

Some symposium participants noted that the collapse in the market for credit has made it difficult for manufacturers to build or expand capacity in order to bring new products to market. Venture and angel funding, which already had been concentrated in a few regions such as Silicon Valley, the Boston area, and metropolitan New York, dried up further in much of the rest of the country.21

In his remarks, Michael Borrus noted that traditional venture capitalists have grown more averse to supporting early-stage start-ups.22 As a result, innovative small businesses are finding it more difficult to raise the capital they need to bring promising new technologies to market. In this credit-scarce environment, he noted, small companies are finding it difficult to survive the so-called Valley

Innovation Systems: Towards a Theory of Innovation and Interactive Learning, London: Pinter, 1992; and Michael Porter, The Competitive Advantage of Nations, New York: The Free Press, 1990.

19 See the summary of the presentation by Under Secretary Kristina Johnson in the Proceedings section of this volume.

20 See the summary of the presentation by Assistant Secretary of Commerce for Economic Development John Fernandez in the Proceedings section of this volume.

21 PriceWaterhouseCoopers and the National Venture Capital Association provide a region-by-region breakdown of venture capital investment on a quarterly basis. See <https://www.pwcmoneytree.com/MTPublic/ns/nav.jsp?page=notice&iden=B>.

22 See the summary of the presentation by Michael Borrus of X/Seed Capital in the Proceedings section of this volume.

of Death, the 5 to 12 years it typically takes to turn an invention in the laboratory into a commercial product.

C. THE FEDERAL STRATEGY

Until recently, the United States has had no coordinated national effort under way to build new research parks or develop new innovation clusters. Traditionally, state and local governments and, in some cases, private foundations and other regional organizations have singularly or in combination sought to stimulate the development and growth of clusters.23 In many cases, however, state and local efforts lack critical mass in terms of funding and facilities and, in some cases, the sustained policy support needed for success.

To address this apparent gap and to adjust to the changing international competitive environment, a number of policy institutes and nongovernment organizations have in recent years released studies urging the federal government to make regional innovation clusters a core element in economic development.24 Andrew Reamer of the Brookings Institution and Jonathan Sallet of the Center for American Progress are among those who have urged federal agencies to make more effective and efficient use of resources they already deploy.25

While federal agencies, including the Small Business Administration (SBA), the Energy Department, the Department of Labor (DoL), NIST, the Department of Defense, and the National Institutes of Health have numerous programs intended

![]()

23 A number of states have promoted clusters development, taking advantage of universities to do so, since the 1980s. An example of an early document guiding state clusters development policies is “Choosing to Compete: A Statewide Strategy for Job Creation and Economic Growth,” published by the Commonwealth of Massachusetts in 1993. This report was prepared for Massachusetts Governor Weld in 1993 by a council led by Michael Porter. Reflecting support by both Democratic and Republican governors, the National Governors Association has been active in promoting and assessing state efforts over the past decade to develop innovation clusters. See Council on Competitiveness and the National Governor’s Association, Cluster-Based Strategies for Growing State Economies, Washington, DC: Council on Competitiveness, 2007.

For a review of selected state initiatives, see National Research Council, Growing Innovation Clusters for American Prosperity: Summary of a Symposium, op. cit. Clusters have not been systematically identified and mapped across all U.S. regions. To address this, the Economic Development Administration is supporting a Cluster Mapping Project, led by Michael Porter of the Harvard Business School.

24 See for example, Karen G. Mills, Elisabeth B. Reynolds, and Andrew Reamer, Clusters and Competitiveness: A New Federal Role for Stimulating Regional Economies, Washington, DC: The Brookings Institution Metropolitan Policy Program, April 2008. See also Ed Paisley and Jonathan Sallet, The Geography of Innovation: The Federal Government and the Growth of Regional Innovation Clusters, Washington, DC: Center for American Progress, 2009.

25 Andrew Reamer, “Stimulating Regional Economies,” in National Research Council, Growing Innovation Clusters for American Prosperity: Summary of a Symposium, op cit. See also Jonathan Sallet, “The Geography of Innovation: The Federal Government and the Growth of Regional Innovation Clusters” in National Research Council, Growing Innovation Clusters for American Prosperity: Summary of a Symposium, op cit.

to contribute to regional economic development, Reamer and Sallet argued in their presentations that these programs are often not coordinated with those of local development agencies, educational institutions, or nongovernment organizations that are pursuing similar aims.26 To better leverage these federal investments, a 2009 Brookings Institution report called on the federal agencies to “link, leverage, and align” their resources with regional innovation cluster initiatives.27

According to Ginger Lew, the Brookings study not only drew attention to efforts by regional governments to grow innovation clusters, but also encouraged the Obama Administration “to link, leverage, and align federal, state, and regional resources” to accelerate development of innovation clusters.

Federal Collaboration with E-RIC

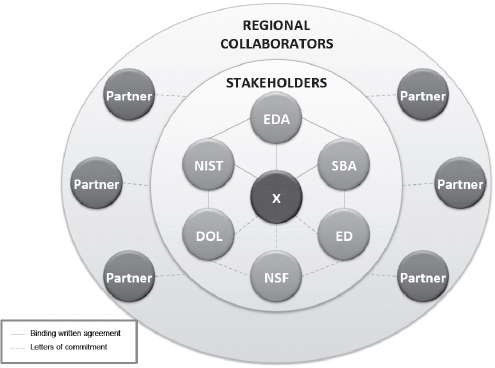

Ms. Lew suggested that the new Energy Regional Innovation Cluster effort, led by the DoE, therefore represents an important initial effort to coordinate these policy tools. In her presentation, she presented a diagram depicting how federal agencies are working together on the E-RIC. (See Figure 1.)

The lead agency in the middle, labeled “Agency X,” in this case is DoE. Six other agencies (SBA, NIST, EDA, DoL, National Science Foundation [NSF], and Department of Education [ED]) pool resources to play a supporting role. The federal agencies, meanwhile, fund and convene an array of “regional partners” also working to advance the cluster, such as colleges, workforce training programs, private companies, nongovernment organizations, and local and state development agencies.

For example, she said, the Labor Department can team with community colleges to make sure a region has enough engineers and skilled workers to meet project demand for a cluster; NIST can work with university-industry research centers to accelerate development of core technologies; the SBA can provide seed capital for start-ups; and the U.S. Department of Agriculture (USDA) supports a variety of rural cluster activities.

Getting so many federal bureaucracies to think and work together is a big challenge, Ms. Lew admitted. Practical efforts required for greater coordination are daunting and can often drain managerial energy at the federal, state, and local levels. Nonetheless, she said that she hoped to learn from the experience of the E-RICs in order to fine tune the collaboration model that can eventually be used as a template to accelerate other clusters.28

![]()

26 Ibid.

27 Karen G. Mills, Elisabeth B. Reynolds, and Andrew Reamer, Clusters and Competitiveness: A New Federal Role for Stimulating Regional Economies, op. cit.

28 The Taskforce for the Advancement of Regional Innovation Clusters (TARIC), under the auspices of the National Economic Council, is overseeing the development and implementation of interagency clusters efforts described in the symposium and those that occurred afterwards. The TARIC was chaired by Ginger Lew before her retirement in June 2011.

FIGURE 1 RIC operations.

SOURCE: Ginger Lew, Presentation at February 25, 2010, National Academies Symposium on “Clustering for 21st Century Prosperity.”

DoE Energy Hubs

In her symposium presentation, DoE Under Secretary Kristina Johnson observed that given its broad mission of meeting the nation’s energy needs, reducing carbon emissions, and now spurring economic development, the DoE must learn to leverage the efforts of other agencies and regional partners.

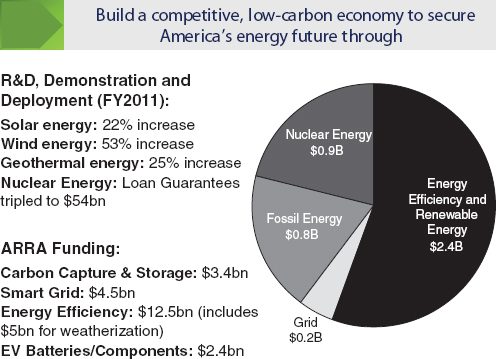

Describing DoE’s fiscal year 2011 budget of $28.4 billion, she noted that $10.4 billion will go for energy and environmental programs, with sharp funding increases for solar, wind, geothermal, and nuclear energy. The DoE is also dispersing $3.4 billion under the American Recovery and Reinvestment Act (ARRA) for projects in carbon-capture sequestration, $4.5 billion for smart grid technologies, $12 billion for energy efficiency, and $2.4 billion for production of electric-vehicle batteries and components.

To accelerate basic scientific breakthroughs, the DoE is supporting 46 “engineering frontier research centers” with $140 million allocated under the Recovery Act. In its Fiscal Year 2011 budget request, the department seeks funding to make these centers permanent.

FIGURE 2 President’s budget invests in clean energy.

SOURCE: Kristina M. Johnson, Presentation at February 25, 2010, National Academies Symposium on “Clustering for 21st Century Prosperity.”

To speed up the commercialization of clean-energy technologies, the DoE also established the Advanced Research Projects Agency for energy, known as ARPA-E, funded with $400 million from the Recovery Act. The program strives to achieve “game-changing” technology advances that could result in large-scale, commercially viable production of fuels from cellulose, sugar, and algae, for example, Dr. Johnson said.

One major DoE initiative is to establish “energy-innovation hubs,” or regional innovation clusters in solar power, energy-efficient buildings, nuclear energy, and batteries for storing energy. The first hub will focus on energy efficiency, because buildings account for 40 percent of U.S. energy consumption, 70 percent of electricity, and 55 percent of natural gas. The field also involves big industries from appliances and software to construction, which accounts for 9.5 percent of U.S. Gross Domestic Product (GDP) and employs nearly 10 million. Such agencies as the Labor Department, SBA, NIST, and NSF also have building-efficiency programs.29

![]()

29 On August 4, 2010, the Department of Energy announced the selection for a grant of the Greater Philadelphia Innovation Cluster (GPIC), led by Pennsylvania State University, to run the Energy-

Dr. Johnson also noted that DoE also is looking to provide U.S. technology start-ups the financial “staying power” to survive the Valley of Death—a term that refers to the gap in funding that frequently occurs between inventing a product and bringing it to market. One way to do this is to provide additional rounds of funding, which gives companies three to five additional years to develop prototypes.

The SBA’s New Role in Clusters

SBA Administrator Karen Mills noted that her agency is broadening its traditional role of providing advice, loan guarantees, and grants to small businesses.30 The agency is now a partner in initiatives such as the Energy Regional Innovation Cluster and is organizing new cluster efforts.

In 2009, for instance, the SBA helped launch robotics clusters in Michigan, Virginia, and Hawaii. The agency sought another $10 million in fiscal year 2011 budget for clustering activities. Among other uses, the funds are intended to help develop public-private partnerships and launch training initiatives. These partnerships can be effective, Ms. Mills noted, citing her own prior effort to establish a successful cluster in Maine among boat builders that incorporates new composite materials and processes.

Administrator Mills noted that SBA has considerable resources to help clusters. The agency has a $90 million loan portfolio, 68 field offices, and 900 Small Business Development Centers across the nation. The SBA also is affiliated with SCORE, a small-business mentoring program with 350 chapters and 14,000 counselors. The SBA has special funding to add experts at its small-business centers to assist E-RIC.

The SBA began with the Michigan robotics cluster, Ms. Mills explained, because it saw an opportunity to help struggling automotive suppliers meet the Department of Defense’s (DoD’s) need for unmanned military vehicles, such as for detecting roadside bombs. The Detroit area’s advantages include an advanced

Efficient Buildings System Design Hub. This group is partnered with national labs, universities, and private companies. See <http://energy.gov/articles/energy-efficient-building-systems-regional-innovation-cluster>. The Department of Energy is also partnering with the Economic Development Administration and other agencies on a $12 million i6 Green Challenge. This competitively awarded grant will establish or expand Proof of Concept Centers for renewable energy technologies across the United States. See <http://www.eda.gov/i6>.

30 Congress established the SBA with the Small Business Act of July 30, 1953, to “aid, counsel, assist and protect … the interests of small business concerns” and to ensure small businesses get a “fair proportion” of government contracts. The SBA guarantees small-business loans. In 1982, the Small Business Innovation Research (SBIR) program was established to administer small grants by various federal agencies to boost commercialization of innovations derived from federal R&D, among other things. For a recent assessment of SBIR, see National Research Council, An Assessment of the Small Business Innovation Research Program, Charles W. Wessner, ed., Washington, DC: The National Academies Press, 2008.

manufacturing supply base, automated tool suppliers, expertise in sensor technologies, and robotics R&D at Oakland University. Encouraging the development of regional networks, SBA helped organize a two-day meeting of DoD procurement officers and 200 Michigan businesses.

SBA also is helping organize similar cluster initiatives in Hampton Roads, Virginia (for robotics, unmanned systems, port security, sensors, modeling, and simulation) and in Hawaii (to develop unmanned vehicles to detonate unexploded ordinance.) Ms. Mills said the SBA will fund at least three more robotics clusters, and is studying five to seven more.31

Expanding the EDA Role

John Fernandez, Assistant Commerce Secretary for Economic Development noted that a key mission of the Economic Development Administration is to “prepare American regions for growth and success in the worldwide economy.”32 To promote regional innovation, now the agency’s top priority, EDA is investing $50 million of the $150 million it received under the Recovery Act to support regional clusters.

The agency also has launched the Regional Innovation Strategies Initiative, which serves as a framework for its economic development activities. EDA is realigning all of its programs to support this initiative, Mr. Fernandez said. He added that his staff is developing a rich database of innovation cluster activities across the United States and new metrics to evaluate their performance.33 EDA programs also offer technical assistance and disseminate best practices to economic development practitioners. For example, the agency offers an online, self-paced curriculum called “Know Your Region” that explains the benefits of regional planning, data on employees and companies in each county that could contribute to a cluster, and tools to formulate regional strategies.34

![]()

31 In September of 2010, SBA competitively funded 10 Innovative Economy Clusters, representing a wide range of geographic areas and industries and focusing on leading research and commercializing new products. SBA’s funding was provided to each cluster’s organizing entity to strengthen opportunities for small businesses within the cluster. See SBA News Release 10-50 at <http://archive.sba.gov/idc/groups/public/documents/sba_homepage/news_release_10-50.pdf>.

32 Congress established EDA under the Public Works and Economic Development Act of 1965 to create and retain jobs and stimulate growth in economically troubled areas. See <http://www.eda.gov/PDF/EDA%20Collateral%20Piece_With%202010%20Investment%20Policies.pdf>.

33 EDA, along with the Institute for Strategy and Competitiveness at Harvard Business School, has launched <www.clustermapping.us>, the U.S. Cluster Mapping Web site. EDA sees this Web site, which creates a national database of cluster initiatives and other economic development organizations, as “a new tool that can assist innovators and small business in creating jobs and spurring regional economic growth.” See EDA Update, “U.S. EDA Announces Registry to Connect Industry Clusters Across the Country,” October 6, 2011.

34 According to EDA, the Know Your Region research project “explores regional and local approaches to economic innovation and competitiveness across the United States” and “is intended to

Finally, EDA is expanding the scope of its public works program to include critical infrastructure needs of the 21st century, such as research parks, incubators, and better access to capital. Mr. Fernandez said the agency also is supporting proof-of-concept and workforce training centers that are custom-designed to act as catalysts for specific technology clusters and serve the needs of communities.35

NIST: Letting the Private Sector Lead

Marc Stanley, then director of the National Institute of Standards and Technology Technology Innovation Program (TIP) noted that NIST was one of the first agencies to view support for innovation clusters as part of its mission of advancing scientific research, measurement standards, and new technologies.

In 2007, NIST launched its Rapid Innovation and Competitiveness initiatives whose goals are to increase the nation’s return on its scientific investment, accelerate technological innovation, stimulate the economy, and enhance U.S. competitiveness. Mr. Stanley said that TIP, the Manufacturing Extension Partnership (MEP), and other agency programs are being deployed to help regional clusters.36

NIST’s strategy is to let private industry take the lead in terms of defining technological needs and research priorities. It first pilot program, the Nanoelectronics Research Initiative, illustrates this approach.37 This project, which will involve more than $200 million in federal funding, is a collaborative effort between industry, government, and academia to develop semiconductor

help local officials, economic development practitioners, community leaders and citizens assess local and regional assets, needs, and visions in a global context, leading to long-term regional prosperity and sustainability.” See EDA Web site at <http://www.knowyourregion.org/about>.

35 In September 2011, the winners were announced for the $37 million Jobs and Innovation Accelerator Challenge, a multiagency competition to support the advancement of 20 high-growth, regional industry clusters. Investments from three federal agencies and technical assistance from 13 additional agencies will promote development in areas such as advanced manufacturing, information technology, aerospace, and clean technology in rural and urban regions in 21 states. Projects are driven by local communities that identify the economic strengths of their areas, with funding awarded to the best proposals. Access the EDA press release at <http://www.eda.gov/NewsEvents/PressReleases/20110922_Media_Advisory.xml>.

36 The Technology Innovation Program (TIP) was established in 2007 under the America COMPETES Act, P.L. 110-69. It awards grants to fund high-risk, high-reward R&D projects addressing critical national needs. The Manufacturing Extension Partnership (MEP) is a national system of over 400 centers, field offices, and partners that encourages the creation and adoption of improved technologies and provides firms information and resources to develop new products that respond to changing market needs. Recent MEP awards support the development of regional innovation clusters in Colorado and Kentucky, among other regions. See NIST news release, “NIST Manufacturing Extension Partnership Awards $9.1 Million for 22 Projects to Enhance U.S. Manufacturers’ Global Competitiveness,” October 5, 2010.

37 The Nanoelectronics Research Initiative (NRI) is a consortium of companies in the Semiconductor Industry Association that receives support from NIST and has research partnerships with 30 universities. The goal is to demonstrate novel computing devices capable of replacing the CMOS transistor as a logic switch by 2020.

technologies that eventually will replace CMOS.38 The alliance includes corporations such as IBM, Advanced Micro Devices, Freescale, Micron Technology, and Texas Instruments, as well as 35 universities.

NIST relies heavily on industry input to define technology roadmaps for next-generation semiconductors, Mr. Stanley explained. Under the initiative, four nanotechnology research centers have been set up at different universities around the United States. The largest, an 11-university consortium called Index, is based at the State University of New York-Albany. Other centers are at the University of Texas-Austin, the University of California at Los Angeles, and Notre Dame University. NIST contributes $2.75 million annually to the centers. States and corporation contribute $20 million.

Early results are encouraging, Mr. Stanley said. The nanotechnology initiative so far has generated 13 patents and 239 publications, and supports the work of 152 graduate students and post-docs. The program also is getting federal agencies, state governments, industry, and universities to collaborate and co-fund critical research, he said, serving as “the benchmark of where we have to go” with innovation initiatives.

Box B

A Leadership Role for the Regions

What role can federal agencies play to enhance local initiatives to develop innovation clusters? Addressing this issue at the symposium, Secretary of Commerce, Gary Locke emphasized that regions must take a leadership role in this process. “The federal government can facilitate and encourage stakeholders to work together. But regions will know where their unique strengths and abilities lay,” he said, adding that the federal government can “shine a spotlight on the importance of clusters but it can’t replace a region’s knowledge of what it does best.” EDA Administrator Fernandez concurred. “We can’t legislate this stuff,” he said, “but we can support it.”

D. THE STATE AND REGIONAL GOVERNMENT ROLE

Participants at the symposium from Michigan, Ohio, and Texas described some of the most creative and determined experiments with cluster development that are taking place at the state level. Learning from the success of Silicon Valley, Boston’s Route 128, and Research Triangle, these state strategies often involve leveraging research universities as catalysts of economic development.

![]()

38 CMOS, patented by Frank Wanlass in 1967, stands for complementary metal-oxide semiconductor. CMOS is a technology for constructing integrated circuits that is used in devices such as microprocessors, static random-access memories, and image sensors.

As Mary Good remarked, universities are increasingly being expected to take on an economic development role.

As these participants also pointed out, state governments also are intervening actively to support private industry. They are going far beyond traditional incentives long used to attract large factories and corporate headquarters, such as tax breaks, free work training, and low-cost land and utilities, and are increasingly providing funding, including early-stage capital, to established companies and start-ups. They also are investing alongside universities, industry, and federal laboratories to establish major research centers devoted to core applied technologies required for a targeted cluster.

Building on Michigan’s Battery Initiative

Doug Parks, of the Michigan Economic Development Corp (MEDC), said that Michigan has been one of the boldest states in subsidizing new investment. The recession and financial crisis hit Michigan and its auto industry especially hard, he noted, spurring government efforts to diversify the industrial base.

MEDC worked with the private sector, universities, and federal agencies to launch a program to identify emerging industries where the state enjoyed strategic advantages and had a good chance of succeeding globally. From this process, MEDC selected the advanced energy-storage systems, equipment for wind and solar power, and bio-fuels industries as key emerging industries for Michigan. These sectors were seen to leverage Michigan’s strengths in manufacturing, natural resources, parts and materials suppliers, and extensive university and corporate R&D. Some 80 percent of auto-related R&D in the United States, Mr. Parks noted, takes place in the Detroit area.

MEDC developed detailed roadmaps for each cluster to facilitate cooperation among participants from government, industry, and academia. The MEDC was particularly inspired by Sweden’s “triple helix” model of tight collaboration between industry, government, and universities, Mr. Parks said.39 The state legislature funded university-based research programs called “Centers of Energy Excellence” to support each cluster. Companies and universities also contribute funds.

Michigan offers some of the nation’s most generous financial incentives for opening manufacturing facilities. It invests in start-ups through a 21st Century Jobs Fund and provides loans and grants to help larger companies commercialize manufacturing and green-energy technologies. The state also offers a variety of refundable tax credits, including special programs for manufacturing advanced batteries and solar-power equipment, companies that invest in smaller Michigan

![]()

39 Triple Helix in the study of knowledge-based innovation systems refers to interaction among universities, industry, and government. See Henry Etzowitz, The Triple Helix: University-Industry-Government Innovation in Action, London: Routledge, 2008.

companies, and companies that invest at least $350,000 for new strategic innovation relationships.

According to Mr. Parks, the most striking success has taken place in the advanced battery cluster—a new industry for the state. In addition to being essential for new electric cars, next-generation lithium-ion storage systems are in growing demand by utilities and the military. Michigan’s early efforts to build a cluster helped it win $1.3 billion in federal funds, encouraging companies such as A123, General Motors, Johnson Controls, XTreme Power, and South Korea’s LG to build lithium-ion cell or battery-pack factories in the state. These federal and state investments also are crowding in $5.2 billion in private investment. Mr. Parks estimated that Michigan’s advanced energy storage industry will create up to 40,000 new jobs over the next five years.

Lastly, Mr. Parks noted that Michigan also has been making impressive strides in attracting out-of-state manufacturers of photovoltaic cells and modules for solar energy and in helping local suppliers win military contracts.

Cluster Building in Northern Ohio

Speaking at the symposium, Rebecca Bagley said that universities, large and small businesses, and state and regional governments in the northeast Ohio region are working to diversify an economy whose manufacturing base has eroded over time. She said that economic development officials in the state are developing road maps to nurture clusters in energy storage, smart grid technology, electric transportation, and conversion of biomass and waste into energy.

NorTech—an organization funded by foundations and business associations—promotes development of the high-technology economy in a 21-county region that contains 42 percent of Ohio’s population, including the cities of Cleveland, Akron, and Youngstown. As NorTech’s CEO, Rebecca Bagley noted that her organization sets the long-term vision and strategy for the region’s efforts to build innovation clusters. It also acts as a “quarterback,” she explained, by coordinating resources and programs from a wide range of stakeholders. Partners include private companies, government agencies, and universities. Nonprofit allies include JumpStart Inc., which helps develop early-stage business, and the Manufacturing Advocacy and Growth Network (MAGNET), which helps manufacturers adopt best practice and new technologies.

The Ohio government also lends substantial support. Ohio is investing $1.6 billion over 10 years in cluster-building initiatives and has received strong voter approval for another $700 million for four more years.40

The region’s biggest effort is the Advanced Energy Initiative. Northeast Ohio has over 400 companies in the advanced-energy space, Ms. Bagley noted.

![]()

40 Ohio’s Third Frontier, a 10-year, $1.6 billion project to re-energize Ohio’s economy by investing in emerging technologies, was passed in May 2010 with 62 percent of the vote.

NorTech believes the region is strong in 10 energy areas, including bio-fuels and technologies for electric vehicles. Specific projects include an advanced-energy incubator in Warren, Ohio, a city hit especially hard by the loss of auto-related manufacturing jobs.

She added that NorTech also is focusing on flexible electronics, or electronic devices such as displays, solar cells, batteries, and sensors that bend and fold. Northeast Ohio has a strong legacy in core technologies: The University of Akron and regional companies are leaders in polymers that can be used for printable electronics, while Kent State University has been a pioneer in liquid-crystal displays.

Overall, NorTech’s strategy is to ensure that technologies invented in the region are then manufactured in the region. The region, Ms. Bagley noted, has learned from past experience when LCD technologies invented in northern Ohio did not lead to the establishment of large local industries. Instead, production of LCD displays for computers and televisions were dominated by Asian companies. To avoid a repeat of that experience, she said, NorTech’s FlexMatters program is working with established companies, universities, and regional agencies to build a flexible electronics manufacturing base in Northeast Ohio.

Betting on Research Universities in Texas

In his presentation, University of Texas (UT) at Dallas President David Daniel said that Texas is investing heavily in new research universities, which can be catalysts for clusters of new companies and knowledge industries. He said that Dallas-Fort Worth, which, despite having one of the nation’s strongest regional economies, lacks a major research university, is a leader in this effort.

Dr. Daniel noted that in June 2009, Texas set up a $50 million fund to establish faculty chairs, graduate student fellowships, and support research. Universities in Texas compete for the funds and must match them with private gifts. The state also established the National Research University Fund, a $500 million endowment to support emerging research universities. The goal, he said, is to expand this endowment to $5 billion over the next decade.

Dr. Daniel explained in his presentation that he was able to convince Texas state legislators to allocate funds by pointing out how badly the state lagged others: Texas has just 3 of the nation’s 60 most important research universities—the University of Texas at Austin, Rice, and Texas A&M. In comparison, California has 9, New York 7, and Pennsylvania 4. He also explained to Texas lawmakers how this paucity of research universities could cost the Texas economy over the long run. Although Texas has 8 percent of the U.S. population, it receives only 4.5 percent of the nation’s venture capital investment, for example. Although Dallas-Ft. Worth boasts many electronics and defense companies and is second only to Silicon Valley in technology workers, it produces little innovation because it has no research university. The Massachusetts Institute of Technology (MIT), by contrast, earned 133 patents and launched 20 companies alone in 2004. Texas

also has a large net outflow of high school graduates who pursue advanced science and technology degrees at out-of-state universities.

These arguments, Dr. Daniel said, have been persuasive. UT-Dallas has received $15 million from the state endowment and raised $17.3 million in private gifts, money it is using to aggressively recruit faculty. Master’s level student applications for next year are up 45 percent, and doctoral applications are up 70 percent. Research spending at UT Dallas, publications, and spinoffs are rising sharply, and more companies are looking to locate R&D laboratories close to campus. Such success has bolstered support in the state legislature for expanding the endowment program, Dr. Daniel said.

E. LESSONS FROM ABROAD

As many speakers noted in the symposium, innovation clusters themselves are neither new nor invented in the United States. The phenomena of “many firms relating to each other and being competitive did not happen first in Silicon Valley,” Mario Pezzini of the Organisation for Economic Co-operation and Development pointed out in his presentation, “It happened in many other places.”

When it comes to dynamic new innovation zones, however, U.S. regions such as Route 128 in Massachusetts, Silicon Valley and San Diego’s Torres Pines biotechnology park in California, and Research Triangle Park in North Carolina are viewed as the global exemplars. Seeking to replicate their success, national and regional governments around the world are making often substantial investments in science and research parks as catalysts of the development of innovation and innovative clusters that support rapid economic growth and attract a talented and educated workforce.41 According to Steve Lehrman, aide to U.S. Senator Mark Pryor (D-AR), “Now it is up to us to learn from their lessons in how to modernize our systems here in the United States.”

A “New Paradigm” in Regional Policy

This interest in regional innovation clusters has been accompanied with a new perspective on how they should be developed. Mr. Pezzini observed in his symposium remarks that in the past, regional economic strategy tended to be about compensating for economic disparities. Federal governments in Japan, southern Italy, northern Europe and other places acted like Robin Hood, taking funds from rich locales and giving them to poor ones. Many governments also provided subsidies to small business entrepreneurs.

Such central government investments tended to “produce cathedrals in the

![]()

41 For a selected review of programs to grow research parks, see National Research Council, Understanding Research, Science, and Technology Parks, Global Best Practices—Summary of a Symposium, op. cit.

desert,” said Mr. Pezzini, who early in his career had sought to oversee economic development in Italy’s Emilia-Romagna Region. These reallocation efforts not only failed to erase regional disparities but also subsidized companies that never achieved the scale or ability to differentiate their products so they could compete globally, he said.42

Now, Mr. Pezzini noted, governments around the world are relying less on subsidies to local firms and regions. Instead, governments increasingly are getting regions to identify their comparative advantages and are focusing on strengthening university research, workforce training, and small-business mentoring. These investments are viewed as infrastructure that communities can use to build innovation-driven economies. “We are dealing with a new paradigm in regional policy,” he said. Other nations also are adapting their strategies to the increasingly open, networked, and interdisciplinary global innovation process.

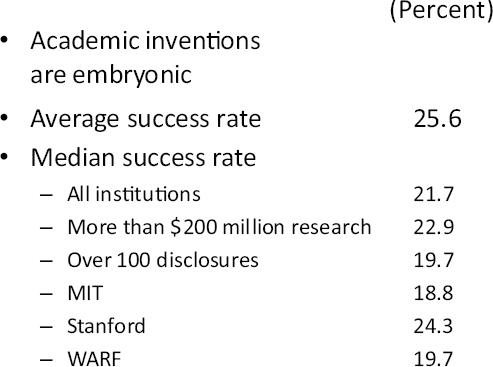

Brazil’s New Innovation Policy

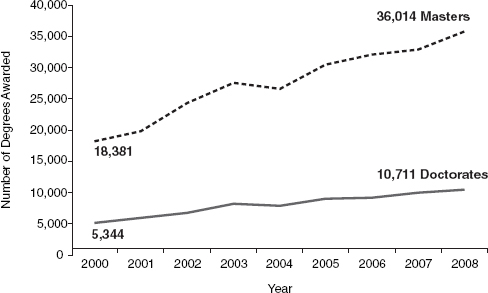

Brazil’s Secretary of Innovation, Francelino Grando, noted in his presentation that his country has made impressive progress in the past decade in improving innovation. Documenting this progress, he noted that between 2000 and 2008, the number of master’s degrees awarded annually by Brazilian universities has doubled, to more than 36,000. Awards of doctorates had also doubled to nearly 11,000. He said that there also has been explosive growth in intermediate technology training. Thanks to $550 million in government investment from 2002 through 2010, the number of technology schools has risen from 140 to 366, creating 500,000 new student positions.

Such investments in education are paying off, Dr. Grando added. There have been sharp increases in published scientific papers, small-business incubators, and technology start-ups. Private investment in R&D has swelled nearly threefold, to $24.8 billion. Brazil boasts one of the world’s top aircraft manufacturers (Embraer), and, as a leading producer of bio-fuels, is now self-sufficient in oil.

Although Brazil has spent heavily to upgrade higher education, it lacked until recently a strong national innovation policy to leverage those investments, Dr. Grando said. There also was poor communication among federal agencies and with local development organizations. To address this challenge, Dr. Grando’s Innovation Secretariat has been working to establish a system for the Ministry of Development, Industry and Foreign Trade and five other agencies to coordinate activities to advance new clusters.43

![]()

42 Mario Pezzini, Cultivating Regional Development: Main Trends and Policy Challenges in OECD Regions, Paris: Organisation for Economic Co-operation and Development, 2003.

43 These agencies are the National Development Bank, the National Institute of Intellectual Property, the Industrial Development Agency, the Export Promotion Agency, and the National Institute of Metrology, Standardization and Industrial Quality (INMETRO), which is modeled on the U.S. National Institute for Standards and Technology.

FIGURE 3 Increasing knowledge.

SOURCE: Francelino Grando, Presentation at February 25, 2010, National Academies Symposium on “Clustering for 21st Century Prosperity.”

FIGURE 4 R&D expenditure in Brazil.

SOURCE: Francelino Grando, Presentation at February 25, 2010, National Academies Symposium on “Clustering for 21st Century Prosperity.”

The federal government is backing this innovation push with money. The Ministry of Science and Technology, for example, has a $20 billion program to develop a “science and technology action plan,” Dr. Grando said. Ministry officials will lead teams responsible for nurturing clusters in industries such as information and communication technology, biotechnology, and nuclear power.

Enhancing Innovation Clusters in Brazil’s Minas Gerais State

Minas Gerais offers a glimpse of Brazil’s innovation strategy at work at the state level. With 20 million people and a territory roughly the size of France, Minas Gerais has a diversity of industries, spanning biotechnology, metals, and agriculture. Its universities have 91,000 students and spend $1.3 billion annually on R&D. There also are 282 private institutions employing 15,842 researchers.

The big challenge, though, “is how to transfer this science and technology into production, productivity, quality, competitiveness, and better employment,” explained Alberto Duque Portugal, the Minas Gerais Secretary for Science, Technology and Higher Education. The state especially wants to speed development in the poor, less densely populated north, which includes portions of the Amazon.

The state has spent some $300 million in four years to enhance the regional innovation system. It has targeted emerging clusters such as microelectronics, bio-fuels, and software. It also identified hundreds of local “poles of excellence” in traditional industries across the state to further develop. To coordinate the initiative, Minas Gerais created Sistema Mineiro de Inovação, or SIMI.

In addition to promoting science parks, incubators, and training programs, one of SIMI’s key jobs is to establish linkages between government programs, local efforts, and investors and to connect researchers and entrepreneurs across the state with each other. For instance, SIMI is trying to consolidate scattered “pools of excellence” into hubs based in one place, so that they can achieve greater scale, support bigger concentrations of public and private R&D, recruit more scientists with doctoral training, and draw more corporate investment. SIMI also is building an outreach program to bring new technologies and design help to small companies around the state, an extensive network of workforce training centers, an entrepreneurial training program, and a Web 2.0 portal connecting Minas Gerais researchers with entrepreneurs and potential investors.

Hong Kong’s Innovation Push

Hong Kong’s innovation strategy also illustrates the new paradigm for regional development described by Mario Pezzini. In the case of Hong Kong, the bid to build innovation clusters was accelerated by the Asian financial crisis in 1997. According to Nicholas Brooke of the Hong Kong Science and Technology Parks Corp., the four years of deflation that followed this crisis exposed the

territory’s overreliance on industries such as financial services, property development, tourism, and logistics.

To diversify Hong Kong’s economic base, its government has invested $1.5 billion so far to build the first two phases of a science park that houses 250 companies—80 percent of them foreign—and employs 7,000 people. When a third phase is completed, the science park expects to have 450 companies and employ 15,000, Mr. Brooke said.

The park’s strategy is to pick clusters based on existing strengths in electronics, green technology, information and communication technology, precision engineering, and biotechnology, and to capitalize on Hong Kong’s position as a world-class business environment with strong legal protections, as well as its location across the border from Shenzhen, China.

Mr. Brooke noted that the science park’s Phase III facilities will focus on new clusters, such as thin-film photovoltaic panels, environmental engineering, and energy management for buildings. The park’s laboratories, design center, and incubators focus on niche technologies within these broad areas, such as chips for wireless telecom devices, smart cards, and RFID applications, areas where Hong Kong already is strong. In all, the goal is to create in Hong Kong an important integration platform for technologies from around the world, serving markets in China and elsewhere in Asia. Many of the 250 companies in the park conduct sensitive R&D in Hong Kong and manufacture their products in China. DuPont, Philips, Freescale, Xilinx, and Nvidia are among the multinationals using this “Hong Kong-Shenzhen model.”

F. A NEW ROLE FOR NATIONAL LABORATORIES

Participants at the symposium also discussed how National Laboratories in the United States, rich reservoirs of scientific and applied technological research, have still to reach their full potential as regional economic catalysts. In the 1980s, Congress began encouraging federal laboratories, most of them established after World War II to meet national defense and energy needs, to commercialize their technology and encourage regional growth.44 Provisions of the 2005 Energy Policy Act have further sought to promote technology transfer by national laboratories.45

![]()

44 In addition to universities, the Bayh-Dole Act of 1980 made it easier for national laboratories to transfer technology. The Federal Technology Transfer Act of 1986 (P.L. 99-502) required every federal laboratory to transfer technology.

45 Title X, Sections 1001, 1002, and 1003 of the Energy Policy Act of 2005 (P.L. 109-58) contained several provisions to promote technology transfer and commercialization by federal laboratories, including establishment of a technology-transfer coordinator at the Department of Energy, a working group of laboratory directors, an energy commercialization fund, a technology infrastructure program, and a small-business assistance program.

Sandia As a Regional Growth Catalyst

Sandia National Laboratories in Albuquerque, New Mexico, was among the first national laboratories to expand its mission beyond national security and assume “a significant leadership role” in commercializing government-sponsored research, Sandia Chief Technology Officer J. Stephen Rottler explained in his presentation.

The focal point of this effort is Sandia’s 12-year-old science park.46 The park now is home to 30 high-tech companies employing 2,000 people in industries as diverse as solar energy and software to nano-materials and semiconductor manufacturing equipment. The jobs in Sandia Park pay twice as much as the average for Albuquerque. The park’s biggest success is solar-equipment manufacturer Emcore, which moved its headquarters to Albuquerque after buying a Sandia spinoff. The park is still expanding and hopes to account for 6,000 jobs in a decade.

Spin-offs, prompted by the Sandia’s Separation to Transfer Technology program, have been an important element in Sandia’s success, Dr. Rottler explained. The program allows scientists who work at Sandia National Laboratory to take leaves of absence for up to two years to join or help start up companies. If a business venture doesn’t work out, the scientists can return to their jobs. Since 1994, 138 Sandia scientists and engineers have left the laboratory in New Mexico and its California affiliate, Lawrence Livermore National Laboratory, to enter business. At least 91 companies have been started or expanded as a result.

Box C

Conflict of Interest and Technology Transfer from Federal Laboratories

The success of Sandia Science and Technology Park notwithstanding, efforts to transfer technology from national laboratories have often stalled over concerns about conflict of interest and bureaucratic red tape. In his presentation Jonathan Epstein, an aide to Sen. Jeff Bingaman (D-NM), said that conflict of interest is a genuine issue when a federal employee “is working under the taxpayer’s dollar and [is] making decisions on how taxpayer dollars are spent.”

The potential for conflict of interest is reduced when a federal laboratory has an explicit mission to work with the private sector, noted Ken Zweibel of the George Washington University Solar Institute at the symposium. Citing the case of the National Renewable Energy Laboratory (NREL) in Boulder, Colorado, whose mission is to support research by private industry, Mr. Zweibel noted that NREL scientists and laboratory facilities have helped launch most of America’s successful solar-power companies.

![]()

46 National Research Council, Industry-Laboratory Partnerships: A Review of the Sandia Science and Technology Park Initiative, Charles W. Wessner, ed., Washington, DC: National Academy Press, 1999. The review provided an early validation of the park’s concept, rationale and current plans, as well as identified potential operational and policy issues that helped to guide the growth of Sandia S&T Park.

Sandia is leveraging its core strengths in high-performance computing and simulation, nanotechnologies, micro systems, and “extreme environments” in projects aimed at developing the New Mexico economy. It is a partner in a state supercomputing project and in a small-business assistance program that is credited with creating and retaining 1,020 jobs. In California, meanwhile, Sandia is converting a portion of its Lawrence campus into i-Gate, a public-private partnership that will serve as an innovation hub for green-transportation technologies.

Kennedy Space Center’s Exploration Park

NASA is developing Exploration Park, situated adjacent to NASA’s Space Life Sciences Laboratory (SLSL) at Kennedy Space Center as an innovation cluster.

According to Robert Cabana, director of NASA’s Kennedy Space Center, Exploration Park has the potential to draw on the significant specialized talent found at the Kennedy Space Center to commercialize research out of the Center as well as to maintain and attract the knowledge base that is essential to advance NASA space missions. He noted that the Center’s 25 fully equipped laboratories are helping a broad range of new companies that are tapping the space center’s R&D.

Dr. Cabana noted that most Kennedy Space Center commercial R&D projects are funded through NASA’s Innovation Partners Program and are collaborations with companies, universities, and other national labs. Partnerships with Carnegie Mellon University, a space exploration center in Hawaii, Caterpillar, ASRC Aerospace, and the Colorado School of Mines, for example, are developing technologies and equipment to mine and develop natural resources on the moon. Other R&D partnerships are developing technologies that will enable plants to grow in space, wires made of polymers that detect and repair flaws by themselves, sensors that monitor the human body for radiation damage to DNA, and solar arrays that cleanse themselves of dust. These technologies can have significant commercial applications as well.

Exploration Park will have 5,000 researchers, technicians, and support staff. The campus will border both Kennedy Space Center’s secured campus and the University of Central Florida, which has a major engineering school. The Center’s commercial R&D efforts could get a boost from President Obama’s proposed 2011 budget, Mr. Cabana said,47 which calls for a $6 billion increase over five years.

G. UNIVERSITY-BASED CLUSTERS

Ever since Stanford University created a business park next to its campus in 1953, American universities have been regarded as global pioneers in leveraging

![]()

47 Details of the NASA budget can be found at “Fiscal Year 2011 Budget Forecast,” National Aeronautics and Space Administration, <http://www.nasa.gov/pdf/420990main_FY_201_%20Budget_Overview_1_Feb_2010.pdf>.

science and technology research as a catalyst for new industry.48 University-linked research parks such as Research Triangle Research Park in North Carolina, Cummings Research Park in Alabama, Purdue Research Park in Indiana, and others quickly followed. The trend spread globally to nations such as England, Taiwan, France, Canada, and Singapore.49 By 2007, according to a study by the Battelle Technology Partnership Practice and the Association of University Research Parks, companies housed in 134 research parks in the United States and Canada employed more than 300,000 workers and created another 350,000 jobs outside their borders.50

As several participants at the symposium noted, the role of university research parks also has evolved. Most early parks were regarded as real estate developments for corporate research labs. In subsequent decades, they became strategically planned campuses designed to foster collaboration, innovation, and commercialization of technology.51 They also integrated a variety of industries, research partners, and small-business services. These changes come as many state governors are calling on universities to assume even bigger roles as engines of innovation and regional economic development. “That is going to take a little getting used to on the part of our university people,” Dr. Good observed. “But I don’t think we will be able to get out from under that necessity.”52

America’s Fading Advantage

According to Brian Darmody, president of the Association of University Research Parks (AURP), there is growing concern that the United States is ceding its

![]()

48 AnnaLee Sexanian has argued that Stanford’s heavy involvement in fostering local technology companies was a major reason Silicon Valley surpassed the Boston area in high-tech electronics, where the Massachusetts Institute of Technology had a hands-off attitude toward start-ups. See AnnaLee Saxenian, Regional Advantage: Culture and Competition in Silicon Valley and Route 128, Cambridge: Harvard University Press, 1994.

49 National Research Council, Understanding Research Science and Technology Parks: Global Best Practices—Summary of a Symposium, op. cit.

50 Battelle Technology Partnership Practice and the Association of University Research Parks, October 2007, <http://www.aurp.net/more/FinalBattelle.pdf>.

51 Ibid.

52 Nevertheless, university technology-transfer programs still come under considerable criticism for generating too little licensing revenue and launching too few new enterprises. A report by the Marion Ewing Kauffman Foundation, for example, finds that university bureaucracies often slow the transfer of technology to private industry. These challenges come on top of other obstacles facing university researchers, including the difficulty of securing research grants for applied research and tenure and promotion policies that favor publication of scientific papers, rather than work on applied technologies or commercialization. To improve university technology transfer, the Kauffman report recommends major reforms, such as allowing university researchers to sell intellectual property directly to industry. See Robert E. Litan, Lesa Mitchell, and E. J. Reedy, Commercializing University Innovations: Alternative Approaches, Boston: National Bureau of Economic Research, Working paper JEL No. O18, M13,033, 034, 038. Last accessed on October 8, 2010 at <http://papers.ssrn.com/sol3/papers.cfm?abstract_id=976005>.

leadership in research parks to China, which now has the world’s largest research parks. Further, he noted that nations such as the United Kingdom now claim to have developed more efficient systems for transferring technology from universities.

Citing a new AURP report, he offered a set of suggestions for improving technology commercialization in the United States.53 These include a call for the Office of Management and Budget to change accounting rules to make it easier for principal investigators to commercialize federally funded research. He also recommended that the federal government expand the corporate R&D tax credit, increase funding for researchers to develop prototypes, ease U.S. export-control rules, and include entrepreneurship. “We need to embed entrepreneurship in all of our projects and policies,” Dr. Darmody said.

Challenges in University Commercialization

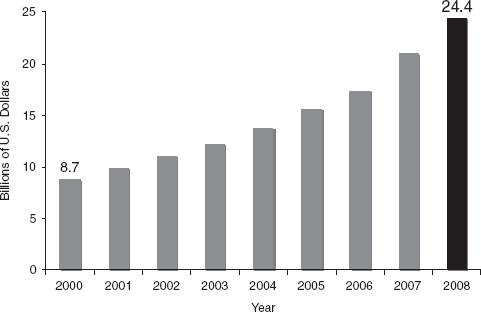

A recent study by the Association of University Technology Managers (AUTM) reveals a mixed record of university technology-transfer programs.54 In his presentation, AUTM President-elect Ashley Stevens analyzed survey data collected from member institutions since 1991. He noted that AUTM data reveal dramatic increases over the past two decades in the number of university inventions, licensing revenue, and expenditure on full-time technology-transfer specialists and patent application. The number of start-ups launched by AUTM members also has climbed steadily, from 200 in 1994 to nearly 600 in 2008.

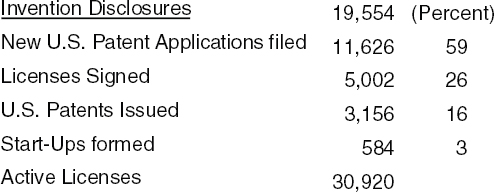

Dr. Stevens noted that when one looks at the productivity of university technology-transfer programs, however, the picture is unimpressive. Successful patent applications and the number of licenses have remained flat for the past decade. Only 59 percent of 19,554 invention disclosures by universities in 2009 resulted in U.S. patent applications, meaning that the rest never made it out of the lab, Dr. Stevens observed. Just 26 percent led to signed licenses, and only 16 percent resulted in U.S. patents issued. Just 3 percent of those inventions led to the formation of start-up companies. This weak performance is remarkably consistent across U.S. institutions, even well-endowed research universities such as Stanford and MIT, Dr. Stevens reported.

![]()

53 Brian Darmody, “The Power of Place 2.0: The Power of innovation—10 Steps for Creating Jobs, Improving Technology Commercialization and Building Communities of Innovation,” Association of University Research Parks, March 5, 2010, <http://www.matr.net/article-38349.html>.

54 See Paul M. Swamidass and Venubabu Vulasa, “Why University Inventions Rarely Produce Income? Bottlenecks in University Technology Transfer,” The Journal of Technology Transfer, 34(4), 2009. This analysis of the Association of University Technology Managers periodic Licensing Activity Surveys of 1995-2004 indicates that “the annual income generated by licensing university inventions was 1.7 percent of total research expenditure in 1995 and 2.9 percent in 2004. Some consider this and the rate of commercialization of university inventions to be too low.” The authors point out that some analysts believe that this “slow rate of commercialization of university inventions may be due to the lack of adequate trained staff and inventions processing capacity in University Offices of Technology Transfer (UOTT).”

FIGURE 5 2008 Licensing activity survey.

SOURCE: Ashley J. Stevens, Presentation at February 25, 2010, National Academies Symposium on “Clustering for 21st Century Prosperity.”

FIGURE 6 Why is this so hard?

SOURCE: Ashley J. Stevens, Presentation at February 25, 2010, National Academies Symposium on “Clustering for 21st Century Prosperity.”

Even more troubling, Dr. Stevens said, are data showing that 52 percent of the 130 technology-transfer programs studied lose money for their universities. Only 16.2 percent reported that their programs are financially self-sustaining, meaning they do not depend on the university operating budget to remain in operation.

A big reason for their struggling finances, Dr. Stevens suggested, is that universities are rarely able to reap big returns by selling stakes in successful public companies. Universities also lack sufficient staff and funds to shepherd fledgling companies through the Valley of Death until they have marketable products. One way Washington can help, he said, is by funding post-doctoral fellowships lasting several years for Ph.D. students who want to commercialize their research.

Improving the Johns Hopkins Model

Cultural attitudes at major universities have been another obstacle to commercialization, noted Johns Hopkins University technology-transfer director Aris Melissaratos in his presentation. While Johns Hopkins is among the biggest recipients of federal research dollars, 93 percent of that coming in health sciences, it has lagged in technology transfer. “In fact, it was an anathema among our faculty,” said Mr. Melissaratos, a former Westinghouse Electric executive. “At Hopkins, you were not even thought of being capable for tenure if you had even thought about starting a company.”