Two speakers at the workshop described recent efforts to establish levels of criticality for materials and determine where particular elements fall within these levels. Both observed that the supply of and demand for critical materials are constantly changing, which complicates assessments of criticality. But supply and demand can be projected into the future to create scenarios of material availability. Such projections can identify opportunities for the chemical sciences to increase supply (through better extraction or recycling technologies, for example) or decrease demand (through the development of replacement materials and new technologies).

A FRAMEWORK FOR ASSESSING CRITICALITY

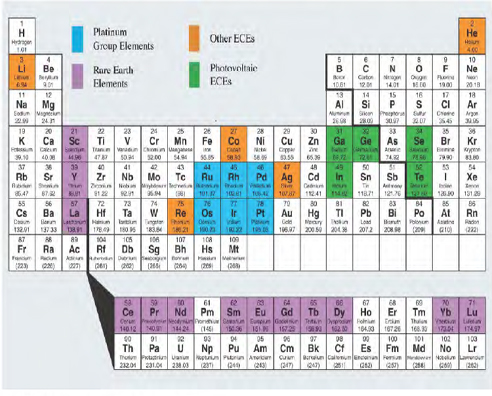

Though rare earths have drawn the most attention from the media, the concerns surrounding critical elements are much broader, said Roderick Eggert, one of the three members of the organizing committee. The phrase that some people have used to describe the situation is “the periodic table is under siege.” Just a few decades ago, most of the products used in a household or business relied on 20 to 30 elements. Today, as Steven Duclos, Chief Scientist and Manager for Material Sustainability of General Electric Global Research, has said, GE uses at least 70 of the first 83 elements of the periodic table in its products or in the processes used to make these products (Duclos, 2010). “Mineral-based materials are becoming increasingly complex,” said Eggert.

This growing complexity could lead to an explosion in demand for some elements now used in small quantities. For example, gallium, indium, and tellurium are important in emerging photovoltaic technologies. Other elements from throughout the periodic table are critical for various energy technologies (Figure 2-1).

Elements of Criticality

Criticality in element availability has three dimensions, said Eggert.

The first is importance in use. In some cases, the primary concern is physical availability. Will it be possible to get a small amount of an essential element that provides a critical or desired property to a material? In other cases, cost is the essential factor. With photovoltaic thin films, for example, the cost of the gallium, indium, or tellurium is a substantial part of the total cost of the delivered photovoltaic material. The cost of these elements therefore could determine the extent to which thin films are deployed on a large scale. Finally, importance in use relates to the ease or difficulty of substituting another material that can provide the desired properties of a scarce material.

The second dimension is supply risk. Fragile supply chains raise key questions. Will supplies be able to keep up with demand? Will supplies be secure? What are the implications for input costs to products and processes? The threat, said Eggert, is that mineral availability could constrain the development and diffusion of emerging technologies.

The third dimension is time. What is critical today may not be critical tomorrow, and vice versa, said Eggert. The ability to respond to a perceived shortage or supply restriction depends critically on the time period available for response. Adjustments that are possible in the short term—one to a few years—may be constrained by existing production capacity, the nature of capacity, the location of capacity, and existing technologies on either the supply side or demand side. Over the long term—a decade or more—much more significant adjustments are possible. “But these adjustments require investments—time, effort, money—today, with payoffs in the future,” said Eggert.

FIGURE 2-1 Possible energy-critical elements (ECEs).

SOURCE: Dr. Robert Jaffe, APS and MRS (2011).

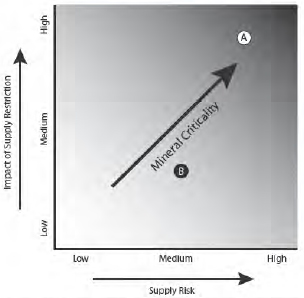

Eggert recently chaired the National Research Council (NRC) Committee on Critical Mineral Impacts on the U.S. Economy, which released the report Minerals, Critical Minerals, and the U.S. Economy (NRC, 2008). That report used a two-dimensional diagram to represent supply risk along the horizontal axis and impact of supply restrictions along the vertical axis (Figure 2-2). Thus, an element farther from the origin (such as A in the diagram) would be more critical than an element closer to the origin (B).

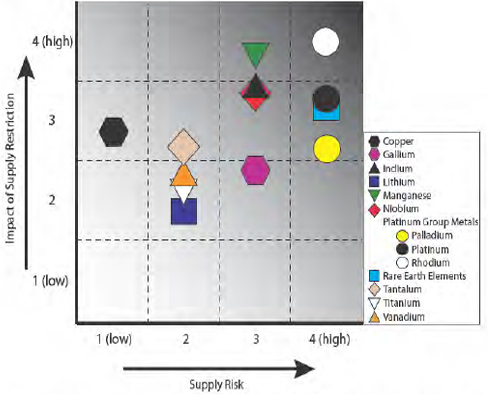

Using this framework, the committee conducted a preliminary analysis of 11 critical elements and element families (Figure 2-3). The platinum-group elements, the rare earths, manganese, indium, and niobium were most critical in this analysis. An important point to draw from this analysis is that criticality is a matter of degree, not an either-or characteristic. "There is a tendency to say, What is the list of critical elements? But it's not the list [that is important] but where a particular element falls within a range of high or low criticality." said Eggert.

FIGURE 2-2 Mineral criticality depends on both supply risks and the impact of supply restrictions.

SOURCE: NRC (2008).

FIGURE 2-3 Within a framework of supply risk and impact of supply restrictions, some elements are more critical than others.

SOURCE: NRC (2008).

Additional Observations

Based on this analysis, Eggert made four additional observations.

First, criticality is in the eye of the beholder. For a Toyota Prius, rare earth elements are critical in a variety of applications, such as permanent magnets in motors throughout the vehicle (Figure 2-4). Other rare earth elements are important in different types of glasses, in the flat-panel display, in the catalytic converter, in the batteries, and elsewhere.

In photovoltaic devices, copper, indium, gallium, selenium, cadmium, tellurium, and other elements can all be critical.

The U.S. military has defined a list of critical elements for national security that includes gallium, lithium, niobium, rare earths, rhenium, and tantalum (Parthemore. 2011).

On the international front, the Japanese government, in partnership with Japanese industry, has stockpiled cobalt, chromium, manganese, molybdenum, nickel, tungsten, and vanadium. It is also considering stockpiling gallium, indium, niobium, platinum, rare earths, strontium, and tantalum.

Thus, different groups have different definitions of critical materials.

Second, each element has its own story, said Eggert. For some elements, production is concentrated in a small number of mines, companies, or countries. All three situations pose risks. Concentration within a country may pose geopolitical risks, as in the case of China. A mine may have technical problems associated with production. A small number of companies with market power may act in an opportunistic way to the disadvantage of users. As an example of a production risk, Europe considers beryllium to be a critical element because its supply originates from only one beryllium mine and it is in the United States.

FIGURE 2-4 New hybrid vehicles incorporate many critical elements.

SOURCE: Courtesy of Science News (2011) (photo: Owaki/Kulla/Corbis, adapted by Janel Kiley).

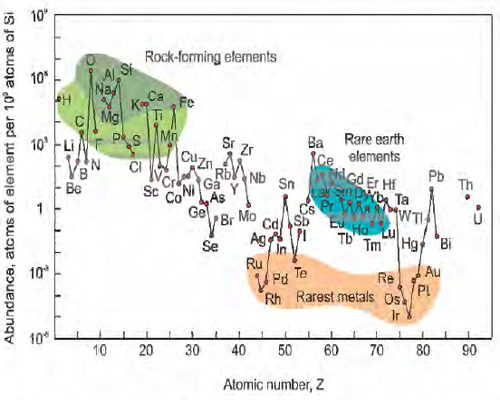

For other elements, geological scarcity is a more important factor. Elements occur in different concentrations in the Earth's crust (Figure 2-5). For example, rare earths are not as rare as other elements geologically. Some elements are reasonably abundant on average but tend only rarely to be concentrated to a sufficient degree that they become commercially viable to extract (e.g., germanium, rubidium, strontium, and niobium).

FIGURE 2-5 The abundance of elements in the Earth's crust tends to decline with increasing atomic number, but not uniformly.

SOURCE: Adapted from Haxel et al. (2002. Fig. 4).

Also, an element may be produced only as a byproduct of another element. For example, indium is produced almost exclusively as a byproduct of zinc processing, tellurium is produced almost exclusively as a byproduct of copper refining, and gallium is produced almost exclusively as a byproduct of the processing of bauxite into alumina and ultimately into aluminum. In these cases, the supply of the byproduct may be unresponsive to increases in the price of the byproduct. Thus, if the price of indium increases, the availability of indium may not go up because its availability is determined largely by zinc economics. By the same token, supply may be very responsive to a fall in the price of the main product. If copper production falls because prices tumble, the availability of tellurium could drop.

Finally, environmental and social concerns may produce long lead times and high production costs for some elements.

Eggert's third observation was that markets respond to both supply and demand signals but with time lags. For example, exploration for rare earth elements is booming, with hundreds of exploration projects currently examining rare earth mineralization in deposits around the world. Maybe only three of four of these deposits may become rare earth mines, Eggert said, but markets are responding. Even for elements produced today as byproducts, sufficient demand could lead to the development of mines only for that material.

Markets also respond to supply side signals, such as new extraction technologies, manufacturing efficiencies, and recycling to relax supply constraints. Stockpiles, diversified supplies, sharing arrangements with other users, and strategic relationships with suppliers all can affect supply and demand.

Over the longer term, substitutes can be found for elements. In some cases, an element can be replaced with one less subject to supply risk, though these opportunities are relatively rare, according to Eggert. A more common substitution involves replacing one type of material with another, such as incandescent lighting with first fluorescent lighting and then light-emitting diodes (LEDs).

Eggert's fourth and final observation was that government has an essential role to play. First, government needs to push for undistorted international trade. For some elements, such as the rare earths, trade restrictions could influence availability, the reliability of supply, and cost, and government policy can ease or eliminate these restrictions.

Also, the process of regulatory approval for domestic resource development needs to be improved. "I am not jumping on the bandwagon arguing against regulation generally but rather speaking to the efficiency of regulation," Eggert said. "We have a problem as a society with the process of regulatory approval for all types of major projects. Not that there is not a role for public input into regulatory decision making—there is—but I think we could do it a little more efficiently, not just in mining but throughout the economy."

Government also can facilitate the collection and dissemination of information and analysis. Information is necessary for informed and intelligent decision making, both in the private sector and in the public sector, and government can help provide this information for critical elements.

Finally, government can facilitate research and development, especially at the precompetitive stage. In this early stage of research and development, the benefits are diffuse,

uncertain, and far in the future, making them difficult for a private actor to capture. In such cases, government action is justified because of spillover benefits that go beyond private benefits.

The Role of the Chemical Sciences

Eggert concluded his presentation by discussing the role of the chemical sciences in critical resources. The chemical sciences are of course essential for research and innovation, he said. On the demand side, they can enable element-for-element substitution as well as broader system substitutions. The chemical sciences also can relax supply constraints through improvements in extraction and recovery.

In terms of manufacturing, the chemical sciences can improve manufacturing efficiency in response to increased scarcity or availability concerns. For example, when flat-panel displays experienced dramatic growth in production and drove up indium prices a decade ago, the chemical sciences improved the incorporation of indium into the indium tin oxides in the displays from approximately 25 to 30 percent to 70 to 80 percent of the indium purchased.

Finally, the chemical sciences play important roles in recycling, which is essentially another form of extractive metallurgy.

THE DOE CRITICAL MATERIALS STRATEGY

As new energy technologies are developed and widely implemented, the demand for critical elements could soar. To prepare for such a future, the Department of Energy (DOE) recently issued its first Critical Materials Strategy (DOE, 2010). Diana Bauer described the main conclusions of the analysis and briefly discussed an update of the study under way at the time of the workshop.

The analysis looked at four clean-energy technologies: energy-efficient lighting, wind turbines, electric vehicles, and photovoltaics. It examined the full supply chain for the critical elements used in these technologies, including extraction, processing, manufacturing, and recycling. It also looked at materials availability and policies in both materials-producing countries and materials-consuming countries as well as in countries like China that have characteristics of both. The supply of critical materials is complicated by factors like co-production, where the production of one element depends on the production of another, the availability of substitutes, and the geographically uneven distribution of ores from which the elements can be economically recovered.

Another complexity in the picture is the abundance of rare earths are not uniform and it is often not possible to substitute one rare earth for another. Looking at the various deposits and the various rare earth elements, the different deposits have different relative proportions of all the different elements. Current practices could potentially could be overproducing some of them, while underproducing others.

For example, cerium is somewhat abundant relative to the other rare earths, whereas dysprosium, which is needed for magnets, may not be as rare as terbium, but it is significantly more rare than neodymium, which is another component of magnets. This aspect of production is important to consider, as mines may not be producing rare earth elements in the proportions that are required for the actual technologies being developed.

Also, even though more than 95 percent of today’s rare earth supply comes from China, new mines are opening in other countries, further complicating the supply picture (DOE, 2010).

Matching Supply to Demand

The DOE analysis looked at 2010 production for a variety of elements and considered potential additions to supply by 2015. Some of the supply additions were from recycling, while others were from new production.

It then estimated the demand for critical elements by the four technologies considered in the study under conditions of high and low market penetration and high and low material intensity. Energy technologies can use critical elements to different extents depending on the specific technology used and supply factors. Nonenergy technologies also create a demand for these materials, which needs to be factored into the analysis. And intellectual property can be a factor, Bauer noted, when a company holds a patent on a key technology, for example.

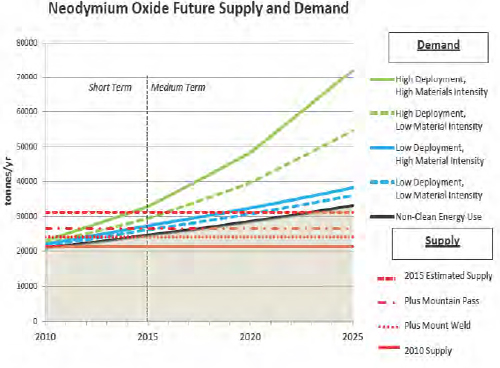

The result of the analysis was a series of charts projecting supply and demand through 2025 (Figure 2-6). The charts show demand under four different scenarios along with the current and future supply as new mines begin production. “These graphs are not predictions,” Bauer emphasized. “We are just trying to show how the different factors interrelate.” For example, if research and development were directed toward lowering material intensity, how much would demand have to drop to reach the available supply? Or if a company were considering opening a new mine, what impact will the new production have on global demand and price?

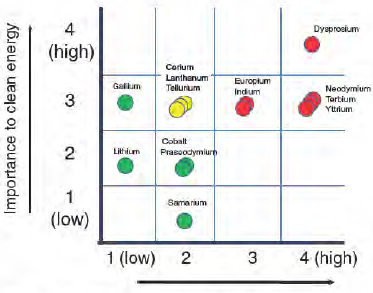

Using the graphs of supply and demand, the DOE analysts assessed criticality using the same approach developed by the NRC committee that looked at critical elements (Figure 2-7). According to this framework, the most critical element was dysprosium, with neodymium, terbium, yttrium, europium, and indium also judged as “critical.”

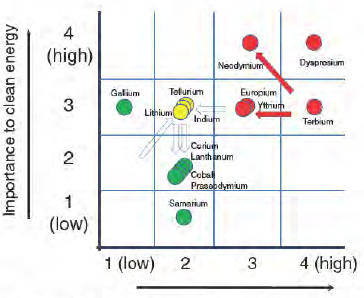

The study then looked at the change in criticality over the short to medium term, which is defined as 5 to 15 years (Figure 2-8). For example, lithium moved from not critical to near critical as projected demand rose during this period, whereas cerium and lanthanum made the opposite transition because of increased supply.

FIGURE 2-6 The demand for neodymium oxide could exceed supply by the year 2015 if new energy technologies undergo high deployment with high materials intensity.

SOURCE: DOE (2010. Fig. 7.2, p. 77).

FIGURE 2-7 Five rare earths and indium fall into the critical category in the short term.

SOURCE: DOE (2010. Fig. ES-1. p. 8).

Program and Policy Directions

Bauer listed a number of program and policy directions presented in the Critical Materials Strategy, including research and development, information gathering, permitting and financial assistance for domestic production and processing, stockpiling, recycling, education, and diplomacy. Not all of these areas are within DOE's core competencies, she noted, but some are.

FIGURE 2-8 Between the near and medium terms, several elements change criticality categories.

SOURCE: Adapted from DOE (2010. Fig. ES-2, p. 8).

In particular, DOE's Office of Science. Office of Energy Efficiency and Renewable Energy, and Advanced Research Projects Agency-Energy (ARPA-E) are investing in a variety

of promising technologies. Examples include alternatives to motors and generators that do not include rare earths, and magnet formulations that have higher performance with less rare earth content using nanotechnology approaches. DOE also has been sponsoring critical materials workshops and international meetings to help build a global as well as a national research community.

At the time of the workshop, DOE was working on an integrated research plan to be released by the end of 2011. As part of these efforts, the department planned to strengthen its information-gathering capacity and analyze additional technologies, such as the fluid-cracking catalysts used in petroleum refining. DOE will continue to work closely with international partners, interagency colleagues, Congress, and public stakeholders to incorporate outside perspectives into its planning, Bauer noted. Also, a new interagency working group led by the White House Office of Science and Technology Policy has been formed to address critical and strategic mineral supply chains, she said.

In response to a question about the role of prices in changing the availability of critical elements, Eggert agreed that price is important but also pointed to other factors. For example, supplies of the platinum-group elements may be more constrained than supplies of rare earth elements. For the past several decades, much of the rare earths used worldwide have come from two mines—the Mountain Pass Mine in California and the Bayan Obo Mine in China. The dramatically higher prices for rare earths over the past year may not have an immediate impact but over the longer term could lead to more geographically diversified mines.

Dennis Chamot of NRC pointed to the potential for relatively inexpensive materials to replace more expensive ones. For example, composites are replacing more and more steel in automobiles. Similarly, biological systems generally cannot afford to use scarce elements in processes such as photosynthesis, so organic chemistry may suggest ways to replace exotic elements.

In response to a question about supply constraints, Eggert said, “We’re really not in danger of running out of anything. Human demand relative to what’s available in the Earth’s crust is relatively small even for the rare elements, and that at least for our lifetimes and probably the lifetimes of our children and grandchildren there are significant opportunities to expand the availability of things like rare earths if we choose to devote effort to those activities.”

He also pointed out that the geographic allocation of a resource can be very important. For some critical elements, China plays an important role. At present, China is exercising its market power, which creates, in effect, a two-tiered pricing system, where prices in China to Chinese users of these elements are lower than to users in the rest of the world. However, this is less an issue of geology and more a result of existing production capacity, according to Eggert.

Thiel asked Eggert which elements are most worrisome to him in terms of price and availability. “The simple answer is gallium, indium, and tellurium for photovoltaics,” Eggert replied. “That may be biased because my institution is right across the street from the National Renewable Energy Lab, and we’ve had lots of discussions on these issues. But those elements are relatively rare in a chemical sense in the Earth’s crust, they don’t tend to be concentrated significantly above average crustal abundance in very many locations, and they are currently all produced as byproducts.”

In response to a question about recycling, Bauer noted that the potential varies by technology. For example, wind turbines from 30 years ago will not contain any neodymium, so they cannot serve as a source of that material. But fluorescent lights offer more potential because they have a shorter lifespan, a collection infrastructure is in place, and they contain heavy rare earth elements that will not be produced in much greater amounts from the mines slated to come on line. “That is a good niche type of recycling application to do first,” she said.

Bauer also was asked whether actual shortages of critical elements can currently be documented, and she responded that price pass-throughs have been documented in some industries. “Part of the challenge is that a lot of companies don’t want to share publicly their lack of ability to get material because that makes them vulnerable within the market to price increases or other disruptions,” she said.

Finally, Bauer was asked whether DOE has seen evidence of black markets in critical elements, and she noted that the rare earth situation is special. Because China has export quotas on rare earths, producers in China have incentives to develop black-market channels, “and there is definitely evidence that that has happened and is happening.”

This page intentionally left blank.