Panel VI-B

Federal and Michigan Programs to Support the Battery Industry

Moderator: Sujai Shivakumar The National Academies

THE DEPARTMENT OF COMMERCE AND THE ROLE OF THE MANUFACTURING EXTENSION PARTNERSHIP

David C. Stieren Manufacturing Extension Partnership

The Manufacturing Extension Partnership “has a programmatic focus and a base of resources that I think is very relevant to addressing challenges as the battery industry for vehicles develops in this country,” said Mr. Stieren, who oversees technology deployment through the program’s nationwide network of 66 centers and 460 service centers.

The MEP is a “federal-state-private partnership” managed at the National Institute of Standards and Technology in the Department of Commerce, Mr. Stieren explained. NIST has programs that work on research, performance characterization, and measurement methods for battery technologies. NIST also administers the Technology Innovation Program, which awards grants in the battery sector, he noted.

The MEP “basically exists to provide assistance to the nation’s manufacturers,” Mr. Stieren said. “We provide services and access to public and private resources targeting enhanced growth, improvement in productivity, and enhanced capacity.”

The program was created in the late 1980s, when NIST changed its name from the National Bureau of Standards. “We work with companies that want to be proactive, want to expand, and want to establish their niche in the marketplace,” he said. “We also are a program that emphasizes the services we provide to manufacturers.” The programs are measured in terms of the economic impact to clients the MEP serves, he said.

Services are delivered through MEP’s network of 60 centers, which are found in each state and have 1,600 staff. The MEP also operates 440 field applications, Mr. Stieren noted. The staff are “boots on the street interacting with manufacturers on a daily basis to provide business and technical assistance,” he said. Because client bases tend to differ, not all centers offer the same services, he explained. The MEP also contracts with 2,300 service providers. “If a center doesn’t have the capability for a specific need, they can go into our network to look for the capability or contract with third-party service providers,” he said.

Most companies that manufacture products in the U.S. are within a two-hour drive of either an MEP center or assistance service location, Mr. Stieren said. “We really have a fantastic reach to the nation’s manufacturing base,” he said. Each year, the MEP interacts with some 31,000 companies. “That is a high number and a good number, but there are plenty of opportunities for us,” he said. Currently, the program works with less than 10 percent of America’s 340,000 manufacturers. “We’re always looking to increase those numbers,” he said.

Partnerships are the real strength of MEP programs, Mr. Stieren emphasized. “One of the things our network is really good at is helping companies get access to resources and capabilities they may not know about or have the wherewithal to gain on their own,” he said. MEP advisors work to connect companies to state and federal resources.

MEP advisors also help companies gain access to needed technologies, Mr. Stieren said. The MEP can connect them to technology at national, universities, and even private labs, he said. It also works with the Labor Department and other partners on workforce-training issues.

The MEP has many kinds of partnerships. At the federal level, the MEP works with agencies such as the Energy, Defense, and Labor departments, the Small Business Administration, and the Environmental Protection Agency, Mr. Stieren explained.

Each MEP center also partners with state agencies. “Our centers operate as not-for-profits and in some cases as components of state agencies or university affiliates,” he explained. The MEP’s approach to partnership “depends on the specific state and the specific need we are trying to address,” he said. Each of the MEP’s 60 centers have cooperative agreements, with states providing matching funds. The MEP also works with many state science and technology institutes, Mr. Stieren added.

The program looks across a state to understand all of the technology-based economic activity. It also frequently partners with state economic development organizations “so that we can better align what our centers are doing and the services we are offering across our system on a national basis with the needs and interests of specific states,” he said.

There also are partnerships with trade associations. “This is a good way for us to get a feel on a broad basis for where industry sectors are going so that we can direct the focus of our centers and services,” Mr. Stieren said.

The MEP’s economic impact has been impressive, Mr. Stieren said. In 2009, its programs helped generate $9.1 billion in new and retained sales and $1.7 billion in new investment by clients. They also led to $1.4 billion in cost savings and created or helped retain nearly 53,000 jobs. He said these data were obtained through an independent, third-party survey of more than 7,000 companies that completed projects in 2008. “This is just a snapshot of the types of impacts we have across this program,” he said. These results were achieved with $330 million in state and federal funding and fees charged to clients in industry. “These are pretty impressive impact numbers for that kind of investment,” he said.

For the U.S. battery industry, the MEP conducted around 120 projects with companies around the country between 2005 and 2009, Mr. Stieren said. The projects involved 47 different companies in 26 states. Roughly one-third of those companies had 50 employees or fewer. About half had more than 100 employees, meaning they are “pretty established in manufacturing,” he said. “This is pretty indicative of the type of clients were serve in the MEP,” he said.

The challenges addressed by MEP programs “were across the board,” he said. They include Six Sigma quality, marketing, road-mapping, lean manufacturing, energy efficiency, export market access, supply-chain management, and product development, he said. These battery projects are credited with helping generate $69 million in sales, $35 million in cost savings, $32 million in investment, and 1,041 new or retained jobs. In 2009 alone, the MEP worked with 12 different battery projects credited with generating $8.6 million in sales.

A new MEP strategy for aiding manufacturers has implications for the battery industry. In its first 20 years or so, “MEP was very focused on product efficiencies and continuous improvement of helping U.S. manufacturing companies compete,” he said. “MEP now also is very focused on growth.”

The MEP commissioned a survey asking client companies what they saw as their three most strategic challenges over the coming three years. The survey found that “continuous improvement” was seen as manufacturers’ biggest challenge, cited by more than 70 percent of respondents. Finding growth opportunities and product innovation also were cited heavily. The MEP tells companies “that if they interact with us they can continue to improve their bottom line and reach their goal of cutting costs by 20 percent,” Mr. Stieren said. “They also can look for opportunities to grow. It is not something set in stone. It is a target.”

The program’s five key focus areas still include continuous improvement, which Mr. Stieren described as “a given” because “you have to be lean, have quality in place, and address that on a continuous basis.” Other top priorities are technology acceleration, supplier development, sustainability, and workforce issues.

The MEP advises companies on how to turn their technologies into processes, products, and services needed to bridge the Valley of Death, Mr. Stieren explained. “Our approach is to make the connection between companies

and their needs to the sources of technology that are out there,” he said. “That can mean federal, university, and private laboratories. Very frequently, small technology-based start-ups just don’t have the access and wherewithal to continue to evolve their technology along the maturation path and get access to the technologies they need to scale up.”

The MEP’s supply-chain work also is becoming more important. Around 68 percent of U.S. manufacturers operate as part of a supply chain, Mr. Stieren noted. “This is interesting, because it means that most of our manufacturers’ products go to other manufacturers, not necessarily to an end consumer,” he said. “So for a national program targeting assistance for manufacturers, it is important that we understand what operation within a supply chain means.”

The MEP strategy works with suppliers to help them understand their niche in the supply chain, he said. The MEP also works with OEMs and federal agencies “so that there is a top-down and bottom-up approach to help the overall manufacturing supply chain, not just a company within it,” Mr. Stieren said.

One way Mr. Stieren said the MEP may provide value to the battery industry is by linking it up to good companies that may be in other manufacturing sectors but that are now looking for business. “We have seen this in our partnerships with a lot of other industries,” he said. In Michigan, the MEP is helping companies assess their capabilities and diversify their market. “We have access to a lot of companies that may be relevant to the supply base for the battery and electric-vehicle industries as they develop,” Mr. Stieren said.

Supplier-scouting is another MEP activity that may help the battery industry. The MEP works with OEMs and federal agencies with very specific needs to find companies with the right technical capability or production capacity to supply them, Mr. Stieren explained. “Through our national network, we basically go out and find the companies that meet their needs,” he said.

The MEP is working with federal agencies and manufacturers of wind-power generation equipment, nuclear equipment, and military products, for example. The MEP is “doing some pretty interesting things” with the DOE connected to Buy America goals of projects funded by the Recovery Act, he said. “Really what this is all about is leveraging the knowledge that resides across our MEP system to pre-qualify manufacturers and deliver capable suppliers to those OEMs.”

The MEP is a proven manufacturing-assistance program, “and we have a great reach and direct connection to U.S. manufacturers,” Mr. Stieren said. “We think there is really significant potential to leverage our national network and our existing partnerships, including those at the state level, to further develop the U.S. battery industry for electrified vehicles.”

MICHIGAN INVESTMENTS IN BATTERIES AND ELECTRIC VEHICLES

Eric Shreffler Michigan Economic Development Corporation

Michigan’s aggressive push into batteries began with a thorough study of its economy launched three years ago, explained Eric Shreffler, who leads the MEDC’s advanced energy storage program. “As many of you know, Michigan has been experiencing very difficult times,” he said. It realized that it must diversify its economy beyond auto manufacturing.

State economic development officials “looked at growing industries, industries that needed a little boost to get over the hump, and best practices around the globe,” Mr. Shreffler explained. In particular, they were intrigued by the Swedish “triple helix” strategy for developing industrial clusters with public-private partnerships that connect government funding, investment from private industry, and research programs at universities and national laboratories,38 he said. It also looked at nurturing clusters with key anchor companies in an industry “that can set the stage for growth of the supply chain and customer base.”

The MEDC formed teams for specific clusters related to renewable energy. Mr. Shreffler headed the advanced energy storage team. Other teams focus on materials, bio-energy, solar photo-voltaic cells and panels, water technology, and wind. “All of us are looking at crafting strategies to develop those sectors,” he said. In the battery sector, for example, Mr. Shreffler’s team saw a need for new investment incentives and legislation.

Advanced batteries seemed logical because the market is projected to reach $20 billion in annual revenue in 2020. The industry also fit Michigan’s strength in auto manufacturing. Although the state is more dependent on that sector than any other, Mr. Shreffler said “that doesn’t necessarily mean we should diversify completely away from that. There is an opportunity to diversify within the automotive industry. The move for vehicle electrification has basically crossed the tipping point. This is a real thing. It will become part of the portfolio of the OEMs.”

Batteries are strategically important because they will be “the new power train” of future automobiles, Mr. Shreffler said. “Michigan did not want to stand by and cede leadership in power-train development to other states and countries.”

______________________

38 Triple Helix in the study of knowledge-based innovation systems refers to interaction among universities, industry, and government. The Triple Helix concept has been championed by Henry Etzowitz. See Triple Helix: A New Model of Innovation, Stockholm: SNS Press, 2005 (in Swedish) The Triple Helix: University-Industry-Government Innovation in Action, New York: Routledge, 2008

Part of Michigan’s strategy was “to seed the marketplace and send a signal we are serious about developing this ecosystem here in this state,” Mr. Shreffler explained. “We wanted to be the first in North America to really push that message through.” As a first step, the state offered strong incentives to lure anchor companies in the sector.

Michigan was fortunate to establish its incentive program before passage of the Recovery Act made billions of federal dollars available for the advanced battery industry. “We did not know at the time we were doing this that there was going to be a Recovery Act,” Mr. Shreffler said. “But we felt pretty confident there were going to be significant investments at the federal level in advanced battery technology. So we wanted to make sure that as we were designing incentives that companies could leverage our incentives as cost-sharing for those to-be-determined federal opportunities.” Some federal tax credits were available that could dovetail with Michigan’s, such as those for consumers purchasing vehicles.

Once the battery companies came, the state worked with them to diversify beyond transportation and into other complementary markets that could use their battery products, Mr. Shreffler said. The state also focused on the entire supply chain for batteries.

The MEDC began by targeting “the heart of the value chain” for batteries—the cell and battery-pack factories and vehicle electrification programs of major auto makers. “We wanted to solidify and cement as much of that here in Michigan as possible,” Mr. Shreffler said. The MEDC saw a need for “very aggressive incentives.”

Centers of Energy Excellence39 are a key part of this strategy. This program “was developed to allow the MEDC for the first time to provide direct grant money to for-profit companies,” he said. These companies would be leveraging outside federal financing and partnering with universities or federal labs to commercialize technology. The first six grants worth $43 million were made in 2008, with $13 million going to Sakti3 to develop solid-state batteries and to A123 Systems to establish a pilot assembly facility. The other $30 million went to bio-energy projects.

The other major action was the Michigan Advanced Battery Tax Credits (MABC) program,40 “the first such program in the nation and a very aggressive approach,” Mr. Shreffler said. The initial legislation provided for $335 million. It was boosted to $1.02 billion. “What happened is that after we made the announcement, the quality of opportunity and interest from significant, global,

______________________

39 Michigan’s Centers of Energy Excellence Program was established under Senate Bill 1380, Public Act 175. In the program’s first phase, the Michigan Strategic Fund Board awarded $43 million in grants in 2008. For-profit companies receiving grants must secure matching federal funds and financial backing. Public Act 144 of 2009 allowed a second phase of the COEE program.

40 Michigan’s Advanced Battery Tax Credits initiative was created through an amendment to the Michigan Business Tax Act, Public Act 36 of 2007, to allow the Michigan Economic Development Authority to tax credits for battery pack engineering and assembly, vehicle engineering, advanced battery technology development, and battery cell manufacturing.

leading battery companies was such that we were able to go back to the legislature and show them this was not a build-it-and-hope-they-will-come” gamble, he said. The MEDC showed “if the state offered these incentives, these companies will come and establish a presence in Michigan,” Mr. Shreffler said. “I think I can count on one hand the number of ‘no’ votes across both chambers every time we went back and discussed the opportunity with the legislature.”

The credits cover four main areas. Of the total, $255 million went to battery pack manufacturers, who receive tax credits for every pack they assemble in Michigan. “The larger the battery, they more the credit, and the more you do the more you get,” Mr. Shreffler explained. Another $135 million went to vehicle engineering and $30 million to advanced battery technology projects. Most of these credits went to auto manufacturers. All recipients “are global companies that could utilize R&D and engineering resources around the globe,” he explained. “We wanted them to really establish their engineering and development work for advanced vehicle batteries here in Michigan.” The tax credits helped offset some of the costs.

The rest of the credits, worth $600 million, went to battery cell manufacturers. Michigan refunds half of the capital investment up to $100 million for a fully-integrated battery cell manufacturing facility. That means everything from the coating processes to assembly, “raw materials in one end, cells out the other,” Mr. Shreffler said.

The fact that the credits are “performance-based” helps assure legislators, he said. The credits are spread out over four years, and manufacturers can start receiving the credits in 2012 after they have built a facility and hired people. “If you don’t do that, you don’t get the credit,” Mr. Shreffler explained. “That return on investment by deferring the payout is what ultimately made the legislature feel comfortable that this was the thing to do, combined with the fact that we had considerable opportunities at the federal level as well as with the Recovery Act.”

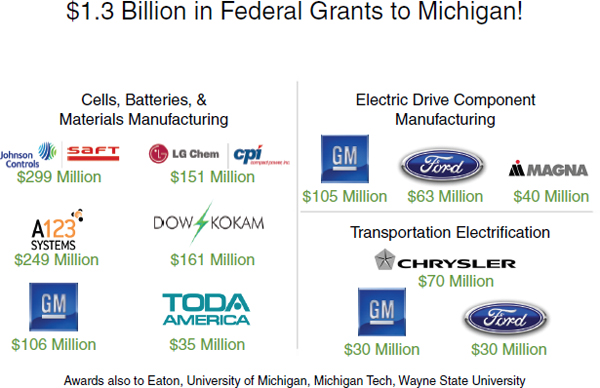

Credits of $100 million each went to six cell-manufacturing plants, those of Johnson Controls-Saft, LG Chem/Compact Power, A123, Dow-Kokam, Fortu Powercell, and Xtreme Power. Credits for pack manufacturing went to GM, Ford, Johnson Controls-Saft, and Dow-Kokam. Battery and vehicle engineering credits went to GM, Ford, and Chrysler. The $1.3 billion in grants through the Recovery Act mainly went to these same companies.

The credits and grants were so popular that from Aug. 5, 2008, “our attraction efforts were just basically answering our telephone,” Mr. Shreffler recalled. “So many companies now saw that the center of gravity in North America for this development and manufacturing was going to be taking place in Michigan. They really wanted to come and be part of that.”

Since November 2008, investments worth $5.7 billion have been announced in Michigan. There are 16 different projects, “and our pipeline continues to be very full,” Mr. Shreffler said. “I suspect in the fall we will be rolling out additional announcements that will be supporting this industry.” Michigan battery supply-chain investments now stretch from the Detroit area to Lake

FIGURE 16 Michigan’s energy storage industry: supply chain investments.

SOURCE: Eric Shreffler, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

FIGURE 17 Michigan’s energy storage industry: federal grants.

SOURCE: Eric Shreffler, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

Michigan. They includes a cathode materials plant by Toda America, battery testing facilities by AVL and A&D Technology, electric motor components by Magna, energy-storage solutions by Xtreme Power, and electric drive-train testing by Eaton.

Many small Michigan companies now also belong to this supply chain. “There are a number of suppliers in this state actively getting contracts and engaged in this industry that we’re not even aware of,” Mr. Shreffler said. “We have to go to conferences in Florida and California to meet with them and find out they are doing this.” Going forward, the MEDC team will start focusing on “understanding the full depth and breadth of what is happening with all of the companies here,” he said. It also will try to “build out this eco-system with Michigan-based companies.”

The energy storage drive is important for a number of reasons, Mr. Shreffler said. It is establishing a domestic source for high-energy, high-power batteries needed by the U.S. transportation industry and Department of Defense. Having the center of gravity in the U.S. also spurs new economic expansion and development opportunities from transportation-focused companies and “creates a foundation for building out a sustainable ecosystem over time,” he said. It also provides further opportunities for collaboration between private industry and Michigan universities.

Now the MEDC is developing the next steps to advance the battery industry. Mr. Shreffler recalled attending a board meeting where incentives were being discussed. An executive asked: “Now that you have taken care of batteries, what are you going to do next?” In reality, “we are really viewing this is as just the beginning,” Mr. Shreffler said. “The hard work is yet to come. The easy part was working with great companies to establish opportunities here.”

One focus is to look at “dual-use” opportunities for companies in the battery industry. The military is a major potential market for Michigan manufacturers. Energy storage for the grid is another major focus. “All of this is to the end of trying to help our cell manufacturers have long-term sustainability and begin to rapidly drive down the cost curve so that the battery technology is accessible to where it is needed,” Mr. Shreffler said.

The MEDC will continue to reassess its “economic tool kit” because the industry is in a new phase, he said. What’s more, two-thirds of Michigan’s legislature is set to turn over and a new governor will be elected. The MEDC will work to educate new officials on what has been done, what needs to be done, and what further tools are needed, he said. It also will continue to advocate for strong policy at the federal level to make sure the industry keeps moving forward. “It all is about execution,” Mr. Shreffler said. “We have to execute as an economic development agency. Our cell manufacturers and suppliers must execute to build out their capacity. The federal government has to execute on not abandoning the path that we’ve gone down.”

One next step is to strengthen what the MEDC calls “the alliance.” The goal is to align state initiatives, especially in batteries and advanced materials, with the priorities of federal agencies such as the Energy and Defense departments

and the national laboratories. “We look at this as an opportunity for Michigan companies to plug into federal opportunities they may have not had before,” Mr. Shreffler said. That could retain jobs in the state and advance common research and commercialization to “help drive this dual-use holy grail we have been talking about,” he said.

The state already has entered into a number of cooperative agreements. Michigan, Oak Ridge National Laboratories, and TARDEC have pooled resources for a $27 million development project over three years to commercialize advanced-storage and light-weight material research in DOE labs and adapt it for military use, for example. By demonstrating the approach is successful, “we hope this could be an opportunity for more solid and expanded funding going forward,” he said. “It is our charge to really make this a relevant opportunity for all stakeholders involved at the state and federal level to develop dual-use technologies.”

While “you will not find our team posing in front of a banner saying ‘Mission Accomplished,’” the MEDC has attained some of its early goals, Mr. Shreffler said. It has indentified opportunities, developed a strategy and “unique attraction tools,” successfully competed for Recovery Act funds, and begun attracting the advanced battery supply chain, he noted. Now the MEDC is focusing on building out the supply chain, assisting on regulatory and policy issues, and using the alliance to build collaboration among government, universities, and industry, he said. The MEDC also aims to keep exposing companies to complementary markets and pursuing new federal funding opportunities.