Panel II

The State of Battery R&D and Manufacturing in the United States

Moderator: Ralph C. Brodd Kentucky-Argonne National Battery Manufacturing R&D Center

THE BATTERY INDUSTRY PERSPECTIVE

Jason M. Forcier A123 Systems

The effort to establish a U.S. advanced battery industry “is a global fight,” said Mr. Forcier, vice-president of automotive solutions for A123 Systems. “This is not centric to the United States. This is an issue that has to be looked at globally.”

By way of introduction, A123 Systems was founded in 2001 in Boston, Mass., and has nearly 2,000 employees globally, said Mr. Forcier, A123’s senior vice-president for automotive. The company has been building lithium-ion batteries since 2003. Its initial customer was Black & Decker’s DeWalt brand of power tools, “which put us on the map,” he explained.

A123 listed in 2009 on Nasdaq with the biggest initial public offering that year. “We have had a lot of press in the past 18 months,” he noted. The company now has around 1 million square feet of manufacturing space in China, South Korea, and the U.S. Between 2009 and 2012, it will have invested some $1 billion in capacity, he said.

The core battery technology used by A123 originated in the research labs of the Massachusetts Institute of Technology, Mr. Forcier explained. The company used iron phosphate, which Mr. Forcier said was known to be one of the safest chemistries for lithium-ion batteries. The material enabled A123 to increase energy density to produce large batteries, such as those used in transportation and electrical grid storage.

The company focuses on three broad markets—transportation, power grid storage, and consumer industries. A123 supplies the biggest lithium-powered vehicle fleet, the BAE Systems hybrid bus that is marketed by Daimler. These buses have accumulated over 50 million miles, and there are 2000 of the vehicles now on the road, Mr. Forcier said. A123 also has the world’s biggest installed base of electrical grid storage systems in the world, he said. In terms of consumer products, A123 supplies batteries for products “that are applicable to our chemistry,” such as those needing long-life power and safety, he said.

A123 has one of the broadest customer pipelines in the industry, Mr. Forcier said. It sells battery cells, modules, and packs to more than 40 programs under development and 20 major customers. In addition to BAE, Daimler, and Black & Decker, customers include Procter & Gamble, Magna, General Motors, General Electric, and Delphi, he said.

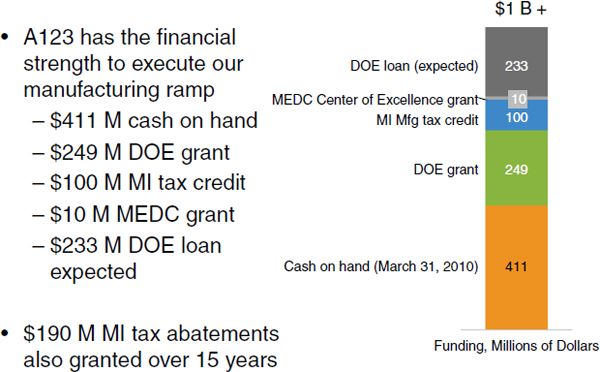

The company was “very fortunate” to raise the funds needed to invest in the industry, Mr. Forcier said. “As you hear about all these great new technologies, you really can’t go anywhere without about $1 billion in cash available,” he said. “That really is the state of the battery industry. If you’ve ever been in a lithium-ion battery plant, you know that it is a very capital-intensive business.”

A123’s cash raised most of its cash, $400 million, through its 2009 IPO, Mr. Forcier explained. A123 also received a $250 million DOE grant and a $110 million grant from Michigan. The company is in final due-diligence negotiations with the DOE for an additional $233 million loan. “So we are well-capitalized, and that is important,” Mr. Forcier said. It takes up to $200 million to $300 million to build one lithium-ion plant to supply batteries for 20,000 to 30,000 plug-in or electric vehicles.

FIGURE 2 Funding for operations.

SOURCE: Jason Forcier, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

The state of Michigan also offered generous tax abatements, Mr. Forcier noted, “although as I told several gubernatorial candidates, we don’t intend to pay taxes for another 10 years. If you looked at our quarterly results, you would see that.”

In Michigan, A123 has the largest lithium-ion plant in North America, Mr. Forcier said. It invested $230 million in the 300,000-square-foot facility in Livonia. The plant, which produced its first prismatic cells in June 2010, is capable of producing batteries for 30,000 plug-in vehicles or 1 million prismatic cells per month, he said.

A123 also is building a coating plant in Romulus, Mich. Eventually, that will be the site of a “mega campus,” where A123 intends to do “everything from powder to coatings to cell manufacturing to packs,” Mr. Forcier said.

The big strategic question now facing the battery industry is whether consumers will buy them. “A lot has been done on the creation side. The capacity is in place, and over the next two years a lot of capacity is coming on line,” Mr. Forcier said. “So really the key question is about demand.”

The price of batteries is expected to come down by 50 percent over the next five years, Mr. Forcier said. Half of that price drop will come as a result of higher production volume. Dozens of new electrification programs are underway across the world just in transportation, he explained. In 2012, “you will see a huge increase in the number of vehicles you buy having electric power trains.”

FIGURE 3 Michigan expansion.

SOURCE: Jason Forcier, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

The remaining cost cuts will come through technical advances, Mr. Forcier estimated. “All of us in the industry are working quite heavily on the next generation of chemistry, proving the technology we have, and getting more efficient with our packaging,” he said.

The battery industry is in the “most critical stage in its development,” Mr. Forcier said. Manufacturing plans are getting locked in, plants are being built, and original-equipment manufacturers are deciding to go down certain paths with their technology. “Those are long-term commitments,” he said. “So it is very, very important we achieve most of these improvements now, up front. Doing it five years from now is great, but the industry will really be locked in from a manufacturing perspective. And OEMs will be down the path in committing to certain technologies and architectures.”

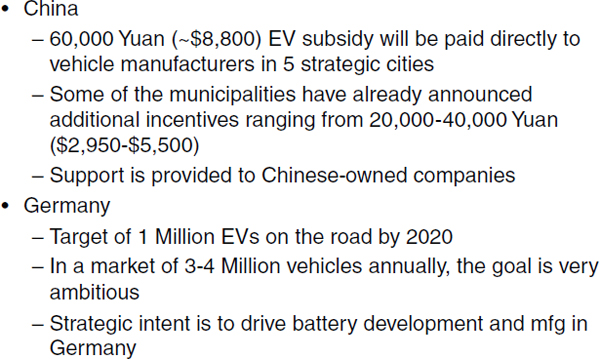

In terms of where the battery industry will be based, the competition no longer is only between states such as Michigan, Mississippi, and Alabama, Mr. Forcier said. “This is a case of the United States competing against countries,” he said. “China has a very aggressive subsidy policy. They continue to amaze me with new announcements.” China pays a direct subsidy of $8,800 per vehicle to electric vehicle manufacturers in five cities. Municipal governments have announced credits of up to an additional $5,000 per car, he explained. Shanghai waives license plate fees for electrified cars. The central government also subsidizes makers of electrified vehicles, many of which are partly owned by government entities. To get subsidies, automakers must have a firm grasp on core technologies such as batteries, the electric power train, or electronics.

China requires foreign companies to manufacture in the country if they wish to sell to the domestic market, Mr. Forcier noted. “China takes this very, very seriously,” he said. “Exporting batteries is highly unlikely. You have to build them in-country. China is making sure that happens by the way it is structuring incentives.”

Germany is using a different tack to promote the electric vehicle industry. The government announced a goal of having 1 million electric vehicles on the road by 2020, an ambitious target for a nation with around 4 million total vehicles. “German OEMs are working together quite strongly on standardizations around battery cells,” he said. Germany is “forcing and driving the industry” to localize production in Europe, he said. “Here again, if you want to do business in Europe or Germany, you will have to build in Germany,” Mr. Forcier said. “You will not be able to afford the export value-added taxes and duties that will be assigned to your product. So European business will be won and made in Europe. Asian business will be won and made in Asia.”

FIGURE 4 Global competition for electrification.

SOURCE: Jason Forcier, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

The key to growing battery sales in the United States is to create domestic demand. “We may not be the biggest auto industry in the world anymore, but the demand has to come from here in the U.S. in order to achieve energy independence and create jobs in the United States,” Mr. Forcier said. One way to do that is to electrify the big military and government vehicle fleets. “We think that is a huge opportunity to help stimulate demand in the U.S.,” he said.

The U.S. industry does not need stimulus money, rebates and incentives forever, Mr. Forcier said. “What we need are four or five years to get the costs down, to get the models in place, to get battery leasing worked out so that the cost of buying an electric vehicle gets down to the cost of buying an internal combustion engine,” he said.

Electric vehicle clearly are cheaper to operate, Mr. Forcier pointed out. “The penalty right now is the up-front cost to acquire the technology,” he said. “That is where we need support in the short term.” In four of five years, the cost equation will change as battery costs drop by half and “as companies like A123 figure out how to lease batteries and reuse them in secondary applications,” Mr. Forcier predicted.

Investments also should be made in infrastructure, he said. “But we have to be focused on infrastructure and demand at the same time.” The federal

government missed a good opportunity to address such needs through the energy bill, which is struggling to get out of Congress, Mr. Forcier said.

A recent version of the energy bill included a provision for electric cities that would have provided more incentives to buy electric vehicles, he noted. “That is the kind of legislation we need to pass,” he said. Mr. Forcier thanked the Michigan coalition in Congress and the state government for supporting such measures. “But on a federal level, it comes down to not having 60 votes,” he said.

Mr. Forcier said A123 is happy to be in Michigan and that he believes the industry has a bright future. “But we can’t ignore demand,” he said. “We’ve got the creation side covered. Demand is what we really need in order to go forward.”

Mohamed Alamgir Compact Power

The advanced-battery push and symposiums such as this one should have happened 25 years ago, quipped Mr. Alamgir, Compact Power’s research director. “Then I wouldn’t have had to go through five companies during my career in lithium battery technologies,” he said. “If you do a study on what went wrong and right in lithium-ion, you can use me as a case example. This kind of funding was not there before. It was very spotty, which is why we were in trouble.”

Compact Power was established in Colorado Springs, Colo., in 2000 to develop large vehicle batteries for LG Chem, Mr. Alamgir explained. When the company shifted to Troy, Mich., in 2005, only three employees came. “If you live in Colorado Springs, the thought of moving to Detroit is not very appealing,” he said, noting that his wife has not yet excused him for moving to Detroit. Compact Power’s parent company, South Korea’s LG Chem Ltd., explained the move by saying (a Korean proverb), “If you want to catch the tiger, you need to go to the den of the tiger,” he said. “That meant the Big Three.”

The company now employs 150 in Michigan. Most of the people Compact Power hired knew nothing of batteries at the time, Mr. Alamgir said. “They were very well-educated, so it was not very difficult for them to transition over,” he said. “To Michigan’s good fortune, many of these guys now are very well informed about battery technologies. And it is very difficult to keep them because there are very lucrative offers to move to other companies.”

Funding from the U.S. Advanced Battery Consortium and the Department of Energy “kept this company alive,” Mr. Alamgir said. The company went through “very lean times” from 2003 to 2006, he said. “When you went around to companies saying that you have an electric-vehicle and plug-in hybrid battery, they said: ‘Come back later. We have no time to address

your market now.’” He said he is grateful to the DOE and USABC “for keeping us afloat through those lean years.”

Government support has long been important to developers of lithium-ion technology, Mr. Alamgir noted. From 1985 through 1995, he had worked at EIC Laboratories in Boston. That company “survived completely” on funding from the Small Business Innovation Research program,15 he said. The bulk of Compact Power’s initial funds came from the DoE. “I have survived on government funding of the battery industry,” he said.

The company addresses “all aspects of the battery pack,” Mr. Alamgir explained. It develops battery pack concepts and designs and manufactures packs. It also develops battery-pack management systems, power and signal architectures, thermal management, charge-control algorithms, and test and validation services. It does most of its R&D in-house, but also collaborates with universities. “This is very vibrant research, and Michigan is a beneficiary,” he said.

Being part of a large corporation helps companies like Compact Power, Mr. Alamgir said.16 He noted that LG Chem’s parent, South Korea’s LG Group, is a huge global conglomerate, with $113 billion in revenue, hundreds of companies, and 160,000 employees. “This shows how deep-pocketed a company has to be to survive in this industry,” he said. “You can start a company. But I have seen with my own eyes where you can end up if you don’t have enough funding.”

He pointed out that 70 percent of LG Chem’s revenues come from petrochemicals. Lithium-ion batteries account for just 10 percent of revenues, he said, even though LG Chem is the world’s third-largest manufacturer and is widely known for that product. Mr. Alamgir noted that LG Chem’s CEO has said that when he goes to parties, people come up to him and congratulate him for his success in batteries.

Rechargeable batteries consume 40 percent of LG Chem’s R&D spending, however, compared to just 28 percent for petrochemicals. LG Chem is investing $1 billion in the battery industry over five years.

LG Chem makes lithium-ion batteries in all shapes and sizes, Mr. Alamgir explained. Its biggest business is small cylindrical and prismatic batteries for consumer devices such as mobile phones and notebook computers, supplying companies such as Dell, Nokia, Hewlett Packard, Motorola, and LG Electronics. In the automotive industry, “we are proud that we are the only company that has both Ford and GM as our customers,” he said.

______________________

15 The Small Business Innovation Research (SBIR) program is administered by the Small Business Administration in the U.S. Commerce Department. It provides early-stage financing for small technology companies.

16 Compact Power has now been split into two subsidiaries of LG Chem. LG Chem Power (Troy, MI) focuses on R&D of module and pack designs, prototype builds, sales and customer support, whereas LG Chem Michigan (Holland, MI) focuses Li ion cell manufacturing.

Vertical integration is another advantage in the battery industry, Mr. Alamgir said. LG develops most of its manufacturing processes in-house. Because Compact Power is part of a large chemical company, it has access to patented processes and chemistries that are battery-related, he said. Due to the research-intensive aspect of the business, “you have to have a lot of in-house material development and research to be viable,” he said.

The DOE and LG Chem each are contributing $151 million for Compact Power’s new manufacturing facility in Holland, Mich. President Barack Obama attended the July 15, 2010, ground-breaking ceremony, and the plant is scheduled to begin manufacturing cells in 2012. Initially, electrodes will come from South Korea and be assembled in Holland. Plans call for making electrodes in Holland as well the following year. The plant will have capacity to produce 15 million to 20 million cells, enough for 50,000 to 60,000 vehicles. It will employ around 300 people.

There is some concern in the industry that a “battery bubble” is building, Mr. Alamgir said. Some analysts project significant overcapacity in the industry. Also, some car makers are bringing battery-pack manufacturing in-house. “How does this impact the industry?” he asked.

Numerous companies already have failed in the lithium-ion industry, he noted. The casualty list includes battery maker Duracell, “which in the 1980s was the house to go to for research related to lithium batteries,” he said. “It disappeared.” After a series of takeovers in the 1980s, Duracell’s lithium-ion research operation was dismantled, he explained. Energizer also vacated the business. Other failures in lithium-ion include Polystor, Motorola ESG, Moltech, MoliCell, Electro Energy, Imara, and Firefly, he said, adding that he was part of three companies that disappeared.

Many of these battery companies got into the business at the wrong time. “This is where the government could have helped,” Mr. Alamgir said. “I’m sure that some of these guys are saying, ‘I wish I were here now.’” At the time, early battery companies could not get enough funding to survive against tough competition from Japanese and Korean companies.

One big lesson from this history is that “the government does need to support research in the future, just as the Japanese government did in the 1990s with their New Sunshine program,” Mr. Alamgir said. Even though the U.S. started the Advanced Battery Consortium, “somehow the OEMs and manufacturing companies did not pick up the slack,” he said. “Sometimes, jolts like those the stimulus funds provided will play a big role. I think companies like PolyStor or Electro Energy would have benefitted big time from such an investment.”

For the long term, however, “visionary and gutsy CEOs and CTOs of big corporations” must support the battery industry, he said. “They have to have the vision to be in this business and think of the common good of mankind, society, and countries,” Mr. Alamgir said.

At first, most of the materials for advanced batteries will have to be imported from Japan, South Korea, and China, he said. “We do not have them

here,” Mr. Alamgir said. “Even though we are working closely with new materials here, it will take two years to bring them in house.”

Mr. Alamgir recalled the he worked as an engineer at one battery company that had high-flying customers such as Research in Motion. The company was acquired by Tyco Electronics. One day a division head visited the labs and asked the staff what it did. “We explained we did R&D,” Mr. Alamgir said. “He said, ‘I don’t have any interest in dumping money into research. We have to shut this down.’” Mr. Alamgir said he later found out that the manager came from a profitable Tyco division that made electrical poles. “All you had to do is cut down a tree and make a pole,” he recalled. “He did not need research to make money”

The message is that “we need leaders who believe in the future of this industry and are committed to providing funds,” Mr. Alamgir said. “Battery research to me is a marathon race. We have a lot of sprinters in this country. We need industry leaders in marathon running like the Kenyans, Somalis, and Ethiopians who can run the race to the end.”

THE AUTOMOTIVE INDUSTRY PERSPECTIVE

Nancy Gioia Ford Motor Company

All major automakers are “dealing with the same set of issues” when it comes to electrified vehicles, said Ms. Gioia, Ford’s director for global electrification. “I agree 150 percent that we are in a marathon,” she said. “It is a marathon not only of R&D. It is a marathon of new knowledge and manufacturing. It is a marathon that will make a difference to the environment, energy security, and employment in every region around the world.”

From Ford’s perspective, “electrified transportation” means hybrids, plug-in hybrids, and full-battery electric vehicles, Ms. Gioia said. It means, “any place that we use stored electricity to directly replace oil.”

Whether the manufacturer is Ford, Nissan, General Motors, or Toyota, “each company is looking at what is needed for sustainability in the future,” Ms. Gioia said. By this, they not only mean their products and fuels, she said, but also the sustainability of their businesses.

In the near term, therefore, automakers will make continuous improvements to internal combustion engines and launch hybrids, Ms. Gioia explained. In the mid-term, from 2011 through 2020, “we will see growth in electrification,” she said. “But we also are going to see a number of other technologies continue to improve for petrol and diesel solutions.” There will be massive reductions in weight.

The importance of improving traditional technologies should not be overlooked, she suggested. “If you think about it for a sustained business, this

has the greatest impact for reduced oil consumption for the largest number of customers with the best use of capital, equipment, and depreciation,” Ms. Gioia said. These gains can be accomplished faster with existing technologies because they do not require different infrastructure. “It’s just a pragmatic reality. It’s not that we are vested in what we already have,” Ms. Gioia said. “But if you want to shift and reduce fuel consumption, making your current technologies more efficient and your vehicles lighter also enables improvements in electrification, smaller batteries, and additional efficiencies.”

The choice will not be either electric or petroleum-based technologies. “It will be a combined effort going forward,” Ms. Gioia said. “There will be fuel diversity and growth in bio-fuels. There is no silver bullet. It is not one answer. It will be a set of answers.”

Another aspect of a sustainability strategy is that a company must embed something in its fabric, Ms. Gioia said. “Electrification as a change of technology does not happen until a company embeds it in its resources, its R&D, its capital allocation, and its product development processes,” she said. “This is what we have now done at Ford with this plan. I think the companies that will continue to drive this on a global basis have it embedded in their decision-making process as one of the core foundations going forward. That also means it must be a money-producer and provide returns for our shareholders.”

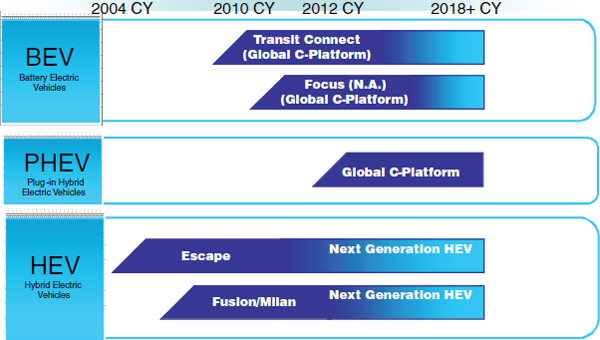

Ford is launching products across several technologies. It has the Fusion and Escape hybrids. The Ford plug-in project, which is supported by the DoE, several utility companies, and the Electric Power Research Institute,17 has been on the road since 2007, she said. In 2010, Ford launched the Transit Connect line of fuel-efficient small commercial vehicles, and it will launch Focus Electric in 2011.

Affordability is the “Achilles heel” of hybrids, which are the foundation of Ford’s electrification program, Ms. Gioia said. Ford is attacking affordability on two fronts: by working on battery technologies and by electrifying its “highest-value platforms,” she said. Some competitors have created unique platforms for hybrids, she explained.

These major platforms include the global C platform for the Ford Focus sedan. The Ford C Max and Ford S Max multi-purpose vehicles sold in Europe use the same platform, Ms. Gioia explained, as will the Transit Connect line of trucks in the future. Another major platform is the Ford CD, which is used for such midsized vehicles as the Fusion, Milan, and Mondeo. Ford can put up to 10 “top hats,” or different upper-body designs, on a single platform, she said. “We can put the technology on a variety of top hats very quickly in global, flexible manufacturing facilities,” she said.

______________________

17 The Electric Power Research Institute (EPRI) is an independent, non-profit company performing research, development and demonstration in the electricity sector.

FIGURE 5 North America—announced electrification projects.

SOURCE: Nancy Gioia, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

Electrified transportation, therefore, is not only about the battery. “It is the design, the development, the validation, the prove-out, and the manufacturing processes down the same assembly line,” Ms. Gioia said.

Ford is deploying the same electrification strategy globally. It is electrifying its products sold in Europe, Ms. Gioia said, and is looking at doing the same in Asia. “What we want is for our global volume to be electrified quickly,” she said. “But we also recognize the reality that transportation must be affordable in each region around the world. So we believe that balanced growth must provide the flexibility to react to volatile market conditions.”

Electrified cars accounted for only 1 percent of Ford’s sales in 2010, Ms. Gioia said. The goal is for that to reach 2 percent to 5 percent in 2015 and between 15 percent and 25 percent in 2025. Even then, 70 percent of Ford’s global fleet will likely be hybrids; up to 25 percent will be plug-ins, and the rest full electrics. The projections acknowledge what it will take to roll out the infrastructure and make it accessible, as well as improve battery technologies to meet customer requirements, Ms. Gioia said.

Ford is hardly alone in believing in a balanced approach. She noted analyses by JP Morgan, Credit Suisse, Boston Consulting Group, A. T. Kearney, and Roland Berger. According to projections based on a compilation of these five studies, hybrids will account for 3.1 million of the 4.3 million electrified vehicles expected to be sold in the U.S. in 2020. Five hundred thousand of those vehicles will be entirely battery-powered.

In Europe, by contrast, less than half of the projected 5.3 million electric vehicles will be hybrids. Plugs-ins will account for 1.6 million and all-battery-powered for 1.4 million of those vehicles. The results will vary tremendously by region based on factors such as fuel prices and government policy, Ms. Gioia said.

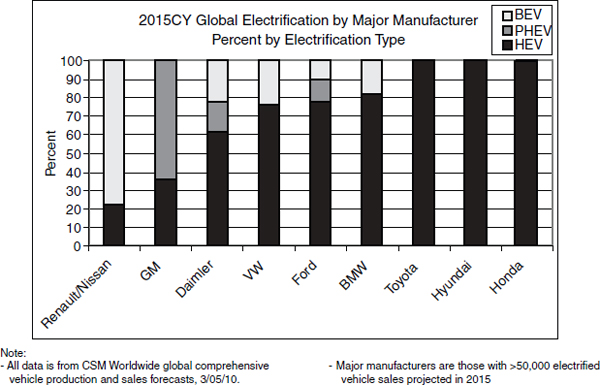

Access to intellectual property and the capabilities of the competition also can influence the results. “And there is an enormous amount of competition,” Ms. Gioia said. She noted that the projections she cited are only for major automakers that have announced goals of selling 50,000 or more electric vehicles by 2015.

The electric product mix also varies dramatically by automaker, Ms. Gioia pointed said. Toyota, Hyundai, and Honda, for example, expect all of their electric vehicles sales to come from hybrids in 2020. GM projects that more than 60 percent will come from hybrids. Renault/Nissan project that nearly 80 percent will come from all-battery electrics.

Some differences are due to the fact that some companies lacked hybrid technologies, Ms. Gioia explained. Ford and Toyota have locked up much of the intellectual property related to the parallel power-split system that allows cars to run on both the battery and internal combustion engine, she noted. To purchase or get access to that technology, manufacturers must go to Ford or Toyota. Battery electrics, therefore, are emphasized by companies whose electric vehicle-programs are not as established because less intellectual property is tied up, she said. “Another inhibitor is just time, experience, and the complexity of these systems,” she added.

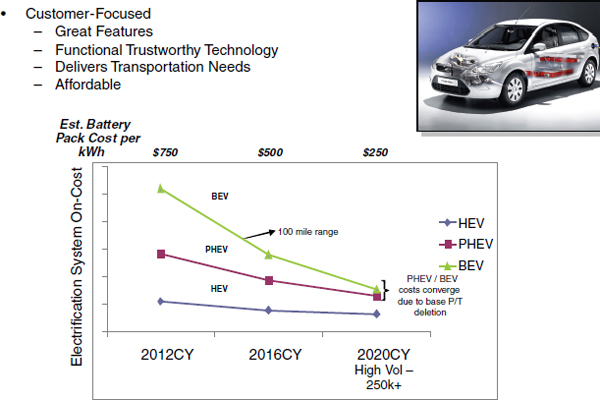

To sustain a real mass market, better batteries are of course needed, Ms. Gioia said. Automakers also must still deliver great features. The technology must be “functional and trustworthy,” meaning the cars are durable, reliable, and “something I can count on to carry my family or run my business with,” she said. An electric car “has to deliver the basic transportation needs. If I have to haul, pull, load eight people into a vehicle, it still has to do that,” she said.

The vehicle also must be affordable over time. The cost of electric battery packs should decline from an average of around $750 per kilowatt hour in 2012 to $250 in 2020, Ms. Gioia said. If the range of the battery system is held constant at about 100 miles, the cost gap between battery packs for hybrids and plug-ins are expected to nearly disappear, she said. “That is because the cost of the batteries start to equal the cost of the battery pack that you eliminate by going full-battery electric,” she said.

These factors mean consumers will have a lot of choice there will be no clear solution or timeline for rolling out of technologies, Ms. Gioia said. Ford will introduce a full line of electric vehicles. In Europe, it already has introduced

FIGURE 6 2020MY global electrification volume projections by region.

SOURCE: Nancy Gioia, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

simple start-stop systems, in which a battery starts the engine but does not power the car, that provide 3 percent to 6 percent in fuel savings. Ford also will introduce “mild hybrids” that modestly help drive the car, medium hybrids, and full hybrids, which reduce fuel by 55 percent and have all-electric drives. Ford also will launch plug-in hybrids that save 80 percent of fuel and full battery-powered cars.

Developing the supply industry is critical to the success of electric vehicles. Batteries are not the only challenge. Electrified vehicles need systems to convert alternative current to direct current, regenerative brakes, inverts, and new motors and transmissions, for example. Chargers for electric vehicles are “ridiculously expensive today” and are being developed by “what was a cottage industry,” Ms. Gioia said. “As it becomes main stream, we need main stream companies jumping into that with capital and assets to get the cost of those chargers down. So a lot has to happen to make the electrified industry progress.”

FIGURE 7 What does it take to support a sustainable mass market electric vehicle?

SOURCE: Nancy Gioia, Presentation at July 26-27, 2010 National Academies Symposium on “Building the U.S. Battery Industry for Electric Drive Vehicles: Progress, Challenges, and Opportunities.”

An example of new components is the SmartGuage18 instrument panel on new Fusion hybrids. “This is a whole new world. It’s a display, not a video game. You still want people watching the road,” Ms Gioia said. “The bottom line is that we need a new set of engineers thinking about how to communicate coaching information with customers real-time to get the most energy efficiency out of their vehicle as possible.”

Moving to the “electric state” will involve much more than the transportation and utility sectors, Ms. Gioia said. “We are going from independent systems to integrated systems,” she said. “It is a new energy ecosystem. It is a series of industries now coming together, collected in a very complex system. It is important to understand that one element of that system cannot succeed without the other.”

Each industry will require deep understanding of other industries it never had to understand before, she said. As an electrical engineer herself in the auto industry, Ms. Gioia said she “never thought about power generation and distribution down to the local transformer to say whether my car will work.”

______________________

18 SmartGuide is a liquid-crystal display panel used in the 2010 Ford Fusion hybrid and Mercury Milan hybrid that features an “EcoGuide” with animated messages about good driving habits and fuel-saving tips.

Car dealers will have to explain to customers what they must to do to their homes, for example. A plug-in vehicle doubles the energy load of a household while it is charging, she said. “Where do our customers get that information?” Ms. Goia asked. “It is a new knowledge system, and to make it work for the customer it has to work simultaneously as this transportation rolls out.”

The charging infrastructure also must be worked out. The top priorities are setting up charging systems at homes, at depots for fleets of vehicles, and at work, Ms. Gioia said. Charging at public spaces is a lower priority. She noted that at a recent session hosted by the DOE to discuss infrastructure needs, “there was fair alignment around the OEMs” about the priorities essential for meeting customer needs.

Charging infrastructure must make it easy for car owners to charge overnight. Different levels of charging systems are needed for different kinds of vehicles. Level 1, in which cars can be charged with a home electrical socket, may work fine for small, low-capacity plug-in hybrids and require investments ranging from nothing to $200, Ms. Gioia said. Level 2 systems, however, will be required for all-battery electric vehicles. These charging systems around $2,000. Level 3 systems for workplaces or public stations can cost $50,000, she said. Even assuming costs drop to $25,000 “that’s a heck of a capital investment communities have to make and then maintain,” Ms. Gioia said.

For the batteries, different cells are required for different applications. “We don’t simply install capacity for one battery and that works for all,” Ms. Gioia explained. Hybrids require more power. Plug-in hybrids need both more power and energy density. Full battery electrics require a much higher energy density.

These batteries will evolve. The current battery for the Focus full-battery electric car produces 23 kilowatt hours, adds 500 pounds to the vehicle, and is 125 liters in size. “That is whopping big to fit into a car,” Ms. Gioia said. Second-generation batteries for electric cars, which will be available two to three years after the first generation, will weigh around 400 pounds and be 100 liters. But they still will provide a range of 100 miles, she said.

Third-generation batteries, which will come in another two to three years, will weigh 250 pounds and be 75 liters big. “The goal is to make it on par with the fuel tank,” she said. “So we need two to three generations of technology before the batteries become truly replaceable in terms of weight, size, and displacement to provide the equivalent 100-mile range. If it turns out customers demand ranges of 200 miles, “that just exacerbates this challenge,” she said.

Temperature control, energy density, the number of real-world charge and discharge cycles, and cost also remain significant challenges for full electric cars, she said. “We need to go through two to three cycles of innovation and then scale up appropriately to have a customer-driven product that would be affordable,” she said.

The U.S. Advanced Battery Consortium and the battery industry as a whole generally agree much more must be done before electric vehicles are ready for

the mass market, Ms. Gioia said. This does not mean Ford won’t launch the Focus Electric in 2011, Ms. Gioia said. “Of course we are,” she said. “We also are launching Transit Connect later this year.”

“Mass market” means moving from 2 percent of car sales to 5 percent, she said. It also means, “we have affordable solutions for other than early adopters or the policy-incentivized world.” For hybrid electric cars, batteries are expected to cost $20 to $30 per kilowatt hour per cell in 2012, Ms. Gioia said. Cells for plug-ins will cost $500 to $1,000. The price range varies, due to assumptions in R&D, capital depreciation, labor, and other mark-ups, she said. Lithium-ion cells for laptop batteries are much cheaper because they are produced in mass volumes and because the transportation sector is more demanding, she said. Moreover, all components of lithium-ion batteries for cars—the cathodes, anodes, electrolytes, hardware, and separators—require improvements.

For the U.S. to be fully competitive and not remain simply an importer, “the U.S. battery industry must have world-class and leading technologies,” Ms. Gioia said. That means not just in chemistry and materials, but also in manufacturing processes and equipment, she said.

Thanks to government incentives, capacity is now being installed in the U.S. “The knowledge to build the equipment, set the details, and design the processes and equipment for the future is not being brought here yet,” Ms. Gioia said. “We need to work on that.” Manufacturing processes and equipment will deliver the needed cost reductions. “Without that, the capacity will be underutilized,” she said. Japan and South Korea are still the leaders in manufacturing technology, she said.

The U.S. also needs a fully competitive cost structure, Ms. Gioia said. Labor cost is not the big driver. “It is all of those elements and the manufacturing process capability along will scale,” she said.

“At the end of the day, there is a lot to be done,” Ms. Gioia said. “It requires a tremendous amount of system thinking, with the public and private sectors working together.”

THE UNIVERSITY/STARTUP PERSPECTIVE

Ann Marie Sastry University of Michigan and Sakti3

After Mr. Alamgir’s “chilling tour of the graveyard of battery companies, I will try to be a little more positive and uplifting,” said Dr. Sastry, who heads the Advanced Materials Systems Laboratory at the University of Michigan and is CEO of the Ann Arbor-based advanced battery developer Sakti3.

Besides climate change, another driver of electric vehicles is the growing concentration of the world’s population into megacities with 10 million inhabitants or more, Dr. Sastry said. Some cost estimates of batteries are pegged to the present state of technology, power, and energy density. “Unless we go

very strongly toward something like 500 watt hours per kilogram and 500 watts per kilogram in energy density, it is very unlikely that we will upend some of these limits and see large degrees of electrification,” she said.

Economies of scale probably won’t be achieved in electric-car batteries until production reaches 300,000 a year, Dr. Sastry predicted. At that point, the cost of a lithium-ion cell for car batteries is projected to drop from more than $500 now to around $100. She said it is important to remember that battery properties themselves will enable the car market to arrive.

One problem is that the U.S. lacks the workforce to support such an industry. Dr. Sastry cited a comment by Wanda Reder, president of the Institute of Electrical and Electronics Engineers’ Power & Energy Society. “The current graduation rate from U.S. university electric power engineering programs is not sufficient to meet our nation’s current and future needs,” Ms. Reder said.19 Studies by other organizations reach similar conclusions, Dr. Sastry said. “We’re lacking the people to do this,” she said. “The workforce education issues are profound. It’s clear that we need more scientists and engineers, and I hope everybody here in your industrial and research efforts also will put efforts back into workforce training. It’s not just a good thing to do. It’s an absolute requirement for a sustainable business.” Dr. Sastry noted that all organizations in the battery industry are facing a challenge now in finding the right workers. “So it is important to join in collaborative activities, because the technology pain is intense right now,” she said.

Research in advanced batteries had been underway for more than a decade at her lab at Michigan, Dr. Sastry noted. That research provided “the numerical underpinnings for the work we are doing now in optimizing batteries,” she said. That research also trained the scientists and engineers who now are needed in the industry, she said.

A change occurred in 2004. At the time, Dr. Sastry was doing research on nickel-metal hydride and lithium-ion batteries. For the first time, lithium-ion cells became cheaper than nickel-metal hydride. “It had nothing to with magic or any inevitable economy of scale,” she said. “It had to do with capability. Lithium ion technology was disruptive.” The technology allowed camcorders to work three hours without recharging, rather than a few minutes. “That enabled large markets, which enabled people to do manufacturing research. That improved the cost structure.”

Current projections suggest the U.S. market for electric cars will be able to reach the 300,000-unit thresh hold needed to push lithium-ion battery costs below $300 per kilowatt, Dr. Sastry said. That is the point at which many assume the market will take off. “Manufacturing technologies that do not offer

______________________

19 Amy Fischbach, “Engineering Shortage Puts Green Economy and Smart Grid at Risk,” Transmission and Distribution World, April 21, 2009 (http://blog.tdworld.com/briefingroom/2009/04/21/engineer-shortage-puts-green-economy-andsmart-grid-at-risk).

the promise of getting cost out of the product really shouldn’t be investigated,” she said. “The counterpoint to that is that we have to invest very heavily in new manufacturing technologies.”

The Advanced Materials Systems Laboratory works with many partners around the world, Dr. Sastry explained. Partners include the DoE, the National Science Foundation, LG Chem, GM Mainz Kastel, AND Technology, Oak Ridge National Laboratories, and Ford. “We are friends with everybody,” she said. “It is really important to do that, because all of the partners have a set of particular skills that are necessary to the problem.”

Because her lab is connected to a university, it has the power to convene people and make proposals that bring people together, Dr. Sastry pointed out. If companies in the industry are not one of her lab’s partners, they should join or find another group to join, she said. “The adjacent areas are very important in regularizing electric vehicles.”

The University of Michigan was one of the first to invest in research and education aimed at improving lithium-ion cells and battery packs, she said. Until recently, however, there hadn’t been a strong motive for universities and car companies to work together. “We weren’t on the cusp of commercializing the technology,” Dr. Sastry explained. As the technology improves and the industry grows, “we see greater impetus for these groups to work together.”

Dr. Sastry founded the first Energy Systems Engineering program in the U.S. It began with nine students in 2007 and had more than 200 enrolled as of Sept. 1, 2010. “We were very proud of what we accomplished in three or four years,” she said. Dr. Sastry recently handed over leadership of that program to focus on other things, she said.

The University of Michigan has joined with GM and the U.S. Advanced Battery Coalition to address all aspects of the electric power train. It conducts basic research to understand why materials fail, for example, and to develop controls algorithms. The ultimate goal is to get those controls algorithms into vehicles, Dr. Sastry said. “So if you do it right, at the vehicle scale you are using computational training that goes all the way to the atomistic and micro scale in the battery cell,” she explained. “That takes a lot of different people.”

The “technology story is important,” Dr. Sastry says, “because it tells you why all of these groups have to work together.” The physics of battery chemistries and electrochemical cycling “are not trivial,” she explained. “Even though you can write down the kinetics in a straightforward way, the reality is that it is a combination of mechanics, thermal effects, heat transfer, kinetics, and a whole host of other disciplines that are required to build simulations that allow us to say how long a battery cell will live and how well it will cycle.” These simulations also predict a cell’s capacity and the effect of temperature.

Part of what makes the undertaking difficult is “the science of how to put all those people together and execute,” Dr. Sastry said. Michigan, which has more than 70 people involved in the various institutions and national laboratories, spends a lot of time bringing the right people together, she added.

Time scales for the technology also are important, Dr. Sastry said. “People who do computational experimental work have to worry a lot about time constants and how long it takes to derive the parameters that tell us how a system is going to behave.” Such battery factors as cycle life “can really only be understood if you understand the scale at which things are breaking down or occurring inside the battery cell,” she explained.

Different expertise is needed to work on all of these problems simultaneously, Dr. Sastry said. “You want people who understand diffusion, who understand kinetics, who understand heat transfer and thermal effects, and people who understand mechanics,” she explained. “To put these equations and experiments together is not trivial.”

Her program has spent more than a decade and millions of dollars to get this far, Dr. Sastry said. The team now can “predict pretty satisfactorily” factors such as capacity, the effects of thermal cycling, and off-gassing, “but we have a long way to go,” she said. These numerical simulations influence the cost and choices of technology.

Research in manufacturing systems “that are fungible across platforms” also need support, Dr. Sastry said. “Unless the government funds approaches that can make many types of chemistries, we will fail to develop the variety of battery cells that meet the variety of needs the Army team so ably talked about.” Many interesting partnerships will follow, Dr. Sastry predicted. “Big companies will act like small innovators and vice-versa,” she said. “Universities and industry will adopt new roles.”

Regarding Sakti3, the company she helped found at the University of Michigan, Dr. Sastry noted that Henry Ford started Ford Motor from the winnings of a race. “The immutable dominance of existing big companies is not inevitable,” she said. “All of these big companies started out small. And it is something that America is particularly good at doing. And it’s something that America relies upon.”

It is very important that the U.S. government support innovations coming out of America’s national labs and universities, Dr. Sastry said. It also is important that “we grow new manufacturing approaches” to make new chemistries in a “manufacturable and cost-effective way,” she said.