Chapter 1

The Innovation Challenge

America has faced many kinds of global competiveness challenges in the post-War era. They ranged from Sputnik-era fears of being technologically eclipsed by the Soviet Bloc to waves of imports from Germany, Japan, and East Asian Tigers that shook one industry after another. Through these challenges, one factor changed little: Thanks to its robust innovation ecosystem and high levels of investments in research, America maintained its leadership in innovation as its entrepreneurs launched new products, companies, and industries, and created high-paying jobs.

While America’s innovation system has enabled the nation to weather previous competitive challenges, the nature of global competition has changed in fundamental ways. A number of economies have matured and grown their own innovation systems over the last 15-20 years; many of them actively pursue national policies aimed at rapidly capturing strategic industries and the highvalue employment they bring. This means that in today’s world, the dynamic of moving to newly created industries to sustain our prosperity is less and less sustainable as a strategic option. Efforts need to be made to retain, grow, and reinforce the industries we have as well as those we wish to develop.1

Innovation remains the wellspring of America’s economic growth.2 The challenge for the nation in the new global environment is to

______________________

1 For a detailed review of structural changes in the innovation process in 10 service as well as manufacturing industries, see National Research Council, Innovation in Global Industries: U.S. Firms Competing in a New World, Jeffrey T. Macher and David C. Mowery, Editors, Washington, DC: The National Academies Press, 2008. While many industries and some firms in nearly all industries retain leading-edge capacity in the United States, the book concludes that this is “no reason for complacency about the future outlook. Innovation deserves more emphasis in firm performance measures and more sustained support in public policy.”

2 Leading economists, including Robert Solow, Trevor Swan, Edwin Mansfield, Zvi Grillichs, and Paul Romer have calculated that technological innovations have made powerful and very substantial contributions to U.S. economic growth. See, for example, Robert M. Solow, “A Contribution to the Theory of Economic Growth,” Quarterly Journal of Economics, 1956, 70(1):65-94. In a latter article

continue to benefit from this innovation while also encouraging regional development and much higher levels of employment.3

AMERICA’S INNOVATION CHALLENGES

America is a world leader in innovation capacity, according to several rankings.4 While not as pre-eminent as in the decades following World War II, the U.S. still leads the world in research spending and patents. U.S. universities and research laboratories continue to produce technological breakthroughs and spin off dynamic start-ups. U.S. companies still create products and business models that transform entire industries.5 Concern is mounting, however, that America is not capturing enough of value of that innovation in terms of economic growth and employment.6

______________________

Solow estimated that technological progress accounted for seven-eighths of the increase in real GNP per man-hour from 1909 to 1949 in the United States. “It is possible to argue that about one-eighth of the total increase is traceable to increased capital per man hour, and the remaining seven-eighths to technical change.” Robert M. Solow, “Technical Change and the Aggregate Production Function,” The Review of Economics and Statistics, 1957, 39 (3): 312-320. Often, as Richard Nelson and others point out, this technological progress has been based on a framework of supporting national policies. See Richard Nelson, Technology, Institutions and Economic Growth, Cambridge MA: Harvard University Press, 2005. In addition, Harvard’s Dale Jorgenson documented that the pervasive use of information technologies, developed through the nation’s investments in semiconductor research and early procurement, have actually pushed upwards the nation’s long term growth trajectory. See Dale W. Jorgenson et al., Productivity: Information Technology and the American Growth Resurgence, Cambridge MA: MIT Press, 2005.

3 The Honolulu Declaration of the November 2011 APEC meeting affirmed the importance of promoting effective, non-discriminatory, and market-driven innovation policy. The agreement text notes that “Encouraging innovation – the process by which individuals and businesses generate and commercialize new ideas – is critical to the current and future prosperity of APEC economies. Our collective economic growth and competitiveness depend on all our peoples’ and economies’ capacity to innovate. Open and non-discriminatory trade and investment policies that foster competition, promote access to technology, and encourage the creation of innovations and capacity to innovate necessary for growth are critical aspects of any successful innovation strategy.”

4 The World Economic Forum ranks the United States as fifth in innovation capacity. See Center for Global Competitiveness and Performance, “The Global Competitiveness Report: 2011-2012,” World Economic Forum (http://www3.weforum.org/docs/WEF_GCR_Report_2011-12.pdf). Insead’s latest global innovation index ranks the United States seventh, down from number one in 2009. Insead, “The Global Innovation Index 2011,” (http://www.globalinnovationindex.org/gii/GII%20COMPLETE_PRINTWEB.pdf).

5 While the U.S. still leads the world in R&D spending, the growth of Chinese R&D spending has shifted the share of global R&D spending over the past ten years with China overtaking Japan in 2010. The U.S. accounted for 32.8 percent of global R&D spending in 2010, compared to 24.8 percent for Europe, 12.0 percent for China and 11.8 percent for Japan. Battelle and R&D Magazine, 2012 Global R&D Funding Forecast, December 2011.

6 See Tyler Cowen, The Great Stagnation: How America Ate All The Low-Hanging Fruit of Modern History, Got Sick, and Will (Eventually) Feel Better. New York: Dutton, 2011. Cowen argues that on the margin, innovation no longer produces as much additional GDP growth as it used to. In part, this may be an issue of not adequately measuring the contributions of modern information and communications in the national accounts. See National Research Council, Enhancing Productivity Growth in the Information Age, D. Jorgenson and C. Wessner, eds., Washington, DC: The National

Capturing the Economic Value of Innovation

This concern is based on the fact that what is innovated in America is increasingly industrialized elsewhere. Even in industries where labor cost is not a deciding factor, the high-paying production and engineering jobs that go with large-scale manufacturing often end up offshore.7 Increasingly, experts believe that this off-shoring of manufacturing is contributing to the decline in the innovative capacity of the United States.8 Gary Pisano and Willy Shih have argued, for example, that the “ability to develop very complex, sophisticated manufacturing processes is as much about innovation as dreaming up ideas.”9 And as more and more production moved offshore, other industries in the host countries increasingly benefit from the knowledge, networks and capabilities that are also relocated.

The result has been a loss of opportunity to lead in major emerging industries. The key technologies for rechargeable lithium-ion batteries and liquid-crystal displays were developed in the U.S., for example, yet were commercialized in Japan and now are almost entirely produced in Asia.10 Other materials and product technologies where the United States was the innovator, but then lost significant market share include oxide ceramics; semiconductor memory devices; semiconductor manufacturing equipment such as steppers; flat panel displays; robotics; solar cells; and advanced lighting.11

______________________

Academies Press, 2007. Jorgenson, Ho, and Stiroh have documented the step-up in total factor productivity introduced by these semiconductor-based technologies. See Dale W. Jorgenson, Mun S. Ho, and Kevin J. Stiroh, Productivity, Volume 3, Information Technology and the American Growth Resurgence, Cambridge MA: MIT Press, 2005.

7 See Gary P. Pisano and Willy C. Shih, “Restoring American Competitiveness,” Harvard Business Review, July-August 2009. For an analysis of why the U.S. is losing new high-tech manufacturing industries, also see Pete Engardio, “Can the Future be Made in America?” BusinessWeek, Sept. 21, 2009.

8 See for example, Roger Thompson, Why Manufacturing Matters, Harvard Business School, March 28, 2011. Access at http://hbswk.hbs.edu/item/6664.html. See also Stephen Ezell and Robert D. Atkinson,” The Case for a National Manufacturing Strategy.” Washington, DC: ITIF, April 2011. To some extent, the off-shoring of manufacturing may be reversing. A recent survey of manufacturing executives found that 85% of them identified low-volume, high-precision, high-mix operations, automated manufacturing and engineered products requiring technology improvements or innovation as the primary forms of manufacturing returning to the U.S. The survey was conducted by Cook Associates Executive Search, which polled nearly 3,000 manufacturing executives primarily in small- to mid-sized U.S. companies from October 13 through November 18, 2011.

9 Pisano, Gary P., and Willy C. Shih. “Does America Really Need Manufacturing?" Harvard Business Review 90(3), March 2012.

10 See Chapter 6 of this volume for case studies of the advanced battery and flexible display industries. See also Ralph Brodd, “Factors Affecting U.S. Production Decisions: Why are There No Volume Lithium-Ion Battery Manufacturers in the United States?” ATP Working Paper Series Working Paper 05–01, June 2005.

11 Gregory Tassey, “The Manufacturing Imperative,” presentation at NAS Conference on the Manufacturing Extension Partnership, November 14, 2011.

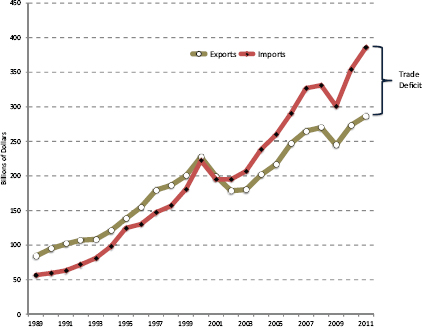

The potential for growing major new U.S. industries that can provide a sizeable return on federal investments in university research is not being realized as manufacturing moves offshore.12 One barometer of this trend is that America’s strong trade surpluses in advanced-technology products in the 1990s have swung to annual deficits and reached $99 billion in 2011.13 [See Figure 1.1]

At the same time, the United States is not paying sufficient attention to the essential pillars of the innovation ecosystem that have helped make the U.S. a global leader for so long. America’s research universities are facing severe financial constraints. The U.S. high-tech manufacturing base is eroding. The U.S. is less welcoming to highly skilled immigrants. Physical infrastructure is crumbling for lack of investment, and data communications networks are slipping below global standards. Severe budget problems are exerting intense pressure on federal and state lawmakers to cut successful programs aimed at commercializing technology and helping small business.

As this report documents, this comes at a time when many other nations are investing aggressively to upgrade their universities, woo top foreign talent, attract investment in advanced manufacturing, build next-generation transportation systems, and connect their entire populations to high-speed broadband networks.

______________________

12 Eastman Kodak, which invented OLED technology, recently sold its core technologies to South Korean and Taiwanese interests that are now releasing commercial display products. See the presentation by John Chen, “Taiwan’s Flexible Electronics Program,” at the National Research Council conference on Flexible Electronics for Security, Manufacturing, and Growth in the United States, Washington, DC, September 24, 2010. The U.S. has 9 percent of global manufacturing capacity for solar cells and modules, while Europe has 30 percent, China 27 percent, and Japan 12 percent. See Michael J. Ahearn, “Opportunities and Challenges Facing PV Manufacturing in the United States.” The Future of Photovoltaics Manufacturing in the United States; Summary of Two Symposia, C. Wessner, ed., Washington, DC: The National Academies Press, 2011. Concerning solar cells, GE recently announced that it would build the largest solar panel factory in the United States in Aurora, Colorado. Kate Linebaugh, “GE to Build Solar-Panel Plant in Colorado, Hire 355 People,” Wall Street Journal, October 13, 2011.

13 Advanced technology products defined by the U.S. Census Bureau categorize U.S. international trade into 10 major technology areas: advanced materials, aerospace, biotechnology, electronics, flexible manufacturing, information and communications, life science, optoelectronics, nuclear technology, and weapons. The United States registered trade surpluses in five of the ten categories in 2010 – aerospace, biotechnology, electronics, flexible manufacturing and weapons. But a very large deficit in information and communications offset these surpluses. U.S. Census Bureau, Foreign Trade, Country and Product Trade, Advanced Technology Products. Because the value of trade in the final product is credited to the country where the product was substantially transformed, data for products produced with components from multiple countries are imperfect. To the extent that U.S. imports of advanced technology products contain components manufactured in the United States and previously exported (microprocessors, for example) the import value will overstate the actual foreign value-added.

FIGURE 1.1 U.S. exports and imports of advanced technology products.

SOURCE: U.S. Census Bureau, Foreign Trade, Trade in Goods with Advanced Technology Products.

Coping with the Growth of New Competitors

The reshaping global environment is affecting U.S. competitiveness.14 The rest of the world has become smarter, more focused, and more financially committed to developing globally competitive national innovation systems—the networks of public policies and institutions such as businesses, universities, and national laboratories that interact to initiate, develop, modify, and commercialize new technologies.15

______________________

14 A recent survey of its alumni by the Harvard Business School supports the view that the United States faces a deepening competitiveness challenge. A large majority believed that the United States not keeping pace with other economies, especially emerging economies, as a place to locate business activities and jobs. See Michael E. Porter and Jan W. Rivkin, “Prosperity at Risk,” Harvard Business School, January 2012. Access at http://www.hbs.edu/competitiveness/pdf/hbscompsurvey.pdf.

15 Nelson and Rosenberg popularized the term National Innovation System See Richard R. Nelson and Nathan Rosenberg, “Technical Innovation and National Systems,” in National Innovation Systems: A Companion Analysis, Richard R. Nelson, ed., Oxford: Oxford University Press, 1993, pg.

As documented in this report, nations in Asia, Europe, and Latin America are boosting investments in both basic research and applied technologies in everything from nano-materials and renewable energies to life sciences. These nations also are encouraging once-cloistered universities and national laboratories to partner with industry, and wooing multinational factories and R&D centers into world-class technology parks with generous tax incentives.

China is making an especially concerted drive to bridge the innovation gap with the U.S.16 As Yang Xianwu of China’s Ministry of Science and Technology explained in a National Academies conference, “The ultimate goal is to make China sufficiently innovative to match the level of countries such as the United States.”17 As this competition intensifies, the United States has tumbled relative to other nations in several global rankings of competitiveness and innovation. For example, the U.S. dropped from No. 1 to No. 5 among 142 nations in the most recent World Economic Forum rankings of “total competitiveness.” While ranking No. 5 overall in “innovation,” the WEF ranked the U.S. 13th in higher education and training, 16th in infrastructure, 20th in technological readiness, 2nd in “goods market efficiency,” 22nd in “financial market development,” and 39th in institutions.18

______________________

4. The term “national innovation system” was coined by Christopher Freeman. See Christopher Freeman, “ Japan: A New National Innovation System,” in G.Dosi, et al, Technology and Economy Theory (London: Pinter, 1988). Charles Wessner initially presented the term “innovation ecosystem,” which highlights the complex and non-linear characteristic of innovation processes, to the PCAST. See, for example, Charles W. Wessner, “Entrepreneurship and the Innovation Ecosystem,’ in David B. Audretsch, Heike Grimm and Charles W. Wessner, Local Heroes in the Global Village: Globalization and the New Entrepreneurship Policies, New York, NY: Springer, 2005. Influential earlier works on global policies to promote innovation include Charles Freeman, Theory of Innovation and Interactive Learning, London: Pinter, 1987; Bengt-Åke Lundvall, ed., National Innovation Systems: Towards a Theory of Innovation and Interactive Learning, London: Pinter, 1992; and Michael Porter, The Competitive Advantage of Nations, New York: The Free Press, 1990. Influential earlier works on global policies to promote innovation include Charles Freeman, Theory of Innovation and Interactive Learning, London: Pinter, 1987; Bengt-Åke Lundvall, ed., National Innovation Systems: Towards a Theory of Innovation and Interactive Learning, London: Pinter, 1992; and Michael Porter, The Competitive Advantage of Nations, New York: The Free Press, 1990.

16 Chapter 5 of this report provides a detailed case study of China’s push to industrialize and develop an innovation-based economy.

17 See Yang Xianwu, “International Collaboration and Indigenous Innovation,“ in Building the 21st Century: U.S. - China Cooperation on Science, Technology, and Innovation. C. Wessner, ed., Washington, DC: The National Academies Press, 2011.

18 See World Economic Forum, The Global Competitiveness Report 2011-2012 (2011), table 5.

Strong Policy Focus on Innovation

The twenty-first century is witnessing a rapidly evolving, intensely competitive global landscape. Political and business leaders in both advanced and emerging economies see innovation-led development as central to growth. China, India, Russia, Germany, and Singapore are among the many nations that are formulating comprehensive national strategies for improving their innovation capacity.19 In many cases, this objective is being pursued with sustained high-level policy attention and substantial funding for applied research and development. Governments also are providing support for innovative small and medium-sized enterprises and are forging innovation partnerships—often based on U.S. models—to bring new products and services to market. They also are investing aggressively to create, attract and retain industries in strategic sectors.

This strong focus on innovation as the basis for economic development is a significant development. Traditional approaches to development followed the prescriptions of Neoclassical Economists who traditionally viewed factors such as capital, labor costs, and business climate as the keys to a nation’s growth. 20 Today’s focus on knowledge-based growth draws more on the ideas of New Growth economists, including Paul Romer and Robert Lucas, who have put greater emphasis on a nation’s innovation capacity.21

______________________

19 China’s 15-year comprehensive innovation strategy is described in the National Medium- and Long-Term Program for Science and Technology Development, 2006-2020, op. cit. An early outline of India’s new innovation strategy is found in National Innovation Council, Towards a More Inclusive and Innovative India, September 2010. Russia adopted a comprehensive game plan in November 2008 called The Concept of Long-Term Socio-Economic Development of the Russian Federation for the Period of up to 2020. Germany’s innovation strategy is described in Federal Ministry of Education and Research, Ideas. Innovation. Prosperity. High-Tech Strategy 2020 for Germany, Innovation Policy Framework Division, 2010, Canada’s national strategy is described in Industry Canada, Achieving Excellence: Investing in People, Knowledge and Opportunity— Canada’s Innovation Strategy, 2001. An explanation of South Korea’s long-term science, technology, and innovation strategy, Vision 2025, can be accessed at http://unpan1.un.org/intradoc/groups/public/documents/APCITY/UNPAN008040.pdf.

20 See Carl J. Dahlman, The World Under Pressure: How China and India Are Influencing the Global Economy and Environment, Palo Alto: Stanford UP, 2011. See also, Carl J. Dahlman, “The Innovation Challenge: Drivers of Growth in China and India,” in National Research Council, Innovation Strategies for the 21st Century: Report of a Symposium, Charles W. Wessner, editor, Washington, DC: The National Academies Press, 2007.

21 For a recent review of New Growth Theory, see Daron Acemoglu, “Introduction to Economic Growth,” Journal of Economic Theory, Volume 147, Issue 2, March 2012, Pages 545-550.

Box 1.1

The Complexity of Innovation

Innovation is the transformation of ideas into new products, services, or improvements in organization or process. Some innovations are incremental; others are disruptive, displacing exiting technologies while creating new markets and value networks.22 These innovations can lead to new economic opportunities, job growth, and increased competitiveness. A key characteristic of innovation is that it is highly collaborative and often multidisciplinary and multidirectional. To be effective, policies to encourage and accelerate innovation need to recognize this reality.

Innovation is often described in terms of stages: basic research, applied research, followed by development and commercialization. In the real world, this process is often not linear, leading from one stage to the next. Technological breakthroughs (such as in semiconductor research) can precede, rather than stem from, basic research. Often, research can, in parallel, address challenges that are both fundamental and applied. 23 Many products are the result of multiple R&D iterations and draw upon technical sources other than their immediate R&D progenitors; many research projects generate results that are not anticipated – sometimes the unexpected outcomes are extremely important; and innovations often result from the manufacturing process itself.

Ideas that result from the formalized exploration of knowledge do lead, in the long run, to innovations, but to expect this to be the case in the short run is misguided for both firms and governments. While innovation is not a direct consequence of R&D, it is also clear that continuous public investment has been critical in training a large number of people over many years and in creating the necessary environment to foster new technology-based businesses.

This complexity of the innovation process also highlights the role that a variety of intermediating institutions play in fostering collaboration among the many participants—including individual researchers, universities, banks, angel investors, venture capitalists, small and large companies, and governments— across the innovation ecosystem. Connections among these participants are often imperfect. In some cases, for example, a venture capitalist may not realize the true significance of a new idea, meaning that it does not receive the funding needed to develop. In other cases, an individual firm may be reluctant to incur the high costs of research and development for knowledge that will benefit others as much or more than the investor; what economists call “public goods.”

______________________

22 Clayton M Christensen and Michael Overdorf, “Meeting the Challenge of Disruptive Change" Harvard Business Review, March–April 2000.

23 Donald Stokes, Pasteur’s Quadrant, Basic Science and Technological Innovation, Washington, DC: Brookings, 1997.

These are but two common situations where the process of innovation can stall. Intermediating institutions, often with funding from both public and private sources, have often provided the way forward. The U.S. has a rich history of public-private partnerships that have provided a platform for successful cooperation.24

What sets the United States apart from most other industrial nations is that there is no overarching national innovation strategy to support, much less coordinate, disparate initiatives to build commercially oriented industries. Instead, as Charles Vest of the National Academy of Engineering has pointed out, the U.S. system consists of multiple centers of activity that are loosely organized but often highly entrepreneurial.25 Invention and product development are the result of knowledge that flows back and forth among complex, interlinked, and often ad-hoc sub-ecosystems at universities, corporations, government bodies, and national laboratories. Dr. Vest concludes that the U.S. innovation system “frankly is not really a system. It is not designed or planned very explicitly.” Nevertheless, as Dr. Vest notes, it has worked remarkably well at producing commercial products, processes, and services.26

Paradoxically, this complexity with its many opportunities for entrepreneurship may be a major strength of the U.S. innovation system. Indeed, Nobel laureate economist Elinor Ostrom has extensively documented the adaptive advantages of open, institutionally diverse systems over linearly designed systems.27

The front end of any innovation system is research and development. Since World War II, the United States has enjoyed an overwhelming advantage over the rest of the world in R&D investment. With annual R&D spending for 2012 forecast on the basis of purchasing power parity at $436 billion, the U.S. remains far ahead of the next-largest forecasted R&D investor, China, at $199 billion.28 Among corporations, 9 of the world’s 20 largest investors in R&D are American-based.29

______________________

24 For a review of best practices among recent U.S. partnership programs, see National Research Council, Government Industry Partnerships for the Development of New Technologies, C. Wessner, ed., Washington, DC: The National Academies Press, 2003.

25 See Charles Vest, “Universities and the U.S. Innovation System,” Building the 21st Century: U.S. - China Cooperation on Science, Technology, and Innovation. C. Wessner, ed., Washington, DC: The National Academies Press, 2011.

26 Charles Vest, op. cit.

27 Elinor Ostrom, Understanding Institutional Diversity, Ewing, N. J.: Princeton University Press, 2005.

28 Battelle and R&D Magazine, 2012 Global R&D Funding Forecast, December 2011.

29 Barry Jaruzelski and Kevin Dehoff, “How the Top Innovators Keep Winning,” Booz & Co., 2010 (http://www.booz.com/media/file/sb61_10408-R.pdf).

Box 1.2

Overcoming the Barriers to Innovation

As noted in Box 1.1, the process of innovation is itself a complex one involving a variety of participants across the economy. Given the complex and multifaceted nature of innovation, policies to encourage innovation need to reflect this reality.

Support for innovation first requires attention to key framework conditions including adequate investments in R&D, the security of intellectual property, a strong scientific and skills base, and a modern physical, legal, and cyber infrastructure. This includes business regulations that are simple and transparent as possible, consonant with public policy objectives such as health and environmental safety.

Support for innovation also requires our attention to common barriers that can forestall the cooperation needed to bring new ideas to the marketplace. For example, cultural barriers often separate those in industry from academia, where the focus is more on understanding basic phenomenon than on achieving concrete results.30 These barriers are often reinforced by a legacy of organizational incentives; universities have traditionally emphasized the need to publish rather than commercialize research. Cooperation can also stall when there are information asymmetries—situations where some have better (or worse) information than others in a potential transaction. For example, a venture capitalist may not realize the true significance of a researcher’s new idea, with the result that it does not receive the funding needed to develop. Indeed, the economics literature has identified a variety of contexts where the wrong incentives lead to a failure of cooperation.31

Pro-innovation policies need to strengthen the framework conditions but also address these barriers to innovation. Successful American innovation policies do just that. The Bayh-Dole Act, for example, encourages innovation by changing the incentives faced by university faculty and administrators.32

______________________

30 For an illustrative example of barriers to innovation in the food industry, see Sam Saguy, “Paradigm shifts in academia and the food industry required to meet innovation challenges.” Trends in Food Science & Technology, Volume 22, Issue 9, September 2011, pp. 467-475.

31 The analysis of incentives in economics can be divided into research on issues related to distorted motivations (including public goods problems, and common pool resource problems) and issues related to incomplete or missing information (including moral hazard and adverse selection problems.) Theoretical work in this area of economics has been richly recognized by the Central Bank of Sweden in awarding Nobel Prizes to George Akerlof, Michael Spence, Joseph E. Stiglitz, Leonid Hurwicz, Eric S. Maskin, Roger B. Myerson and Elinor Ostrom, among others.

32 For a comparative review of the effectiveness of Swedish and U.S. policies to commercialize university intellectual property see Brent Goldfarb, and Magnus Henrekson, “Bottom-up versus topdown policies towards the commercialization of university intellectual property.” Research Policy 32 (2003) 639–658. The authors note that Swedish policies “have been largely ineffective due to a

And the competitive evaluations of the Small Business Innovation Research program (SBIR) create new information for use by market participants about the technological and commercial potential of new ideas. These and other “best practices” in policy are being widely emulated around the world as policymakers in other nations seek to improve the innovative potential of their own economies.

This overwhelming advantage is starting to slip, however. While American R&D spending has risen 3.3 percent a year on average in real terms over the past decade33, for example, growth in South Korea has averaged 9.2 percent annually and China has averaged 19.4 percent, albeit from a smaller base.34 As a result, the U.S. share of global R&D spending dropped from 43.1 percent in 1998 to 37.3 percent in 2008.35 China’s share, by contrast, leapt from 3 percent to 11.4 percent over that period, both as a result of increasing R&D intensity and a rapidly industrializing economy.36

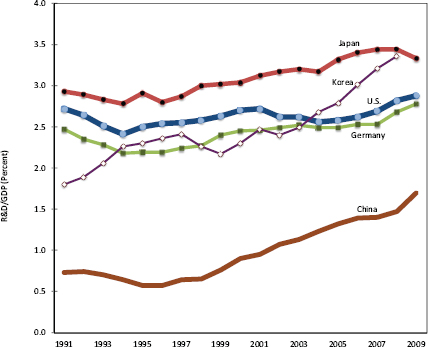

America’s edge in research intensity (R&D as a percent of GDP) also is fading. America once was the most research-intensive nation on earth. America now ranks 8th in the most recent OECD tabulation of R&D intensity by country.37 This is a disturbing trend. U.S. investment in R&D amounts to around 2.9 percent of GDP, a level that has changed little in three decades. South Korea, by contrast, has boosted R&D spending from less than 2 percent of GDP in the early 1990s to 3.4 percent. Japan’s ratio has gone from 2.8 percent to 3.3 percent and China’s R&D spending has risen from 0.7 percent of GDP to 1.7 percent. [See Figure 1.2] The Chinese Government has announced plans to boost R&D intensity to 2.5 percent by 2020.38 Overall, Asia surpassed the U.S. in 2010 in R&D spending and the gap is expected to widen.39

______________________

lack of incentives for academic researchers to become involved in the commercialization of their ideas.”

33 National Center for Science and Engineering Statistics, National Patterns of R&D Resources: 2008 Data Update, Detailed Statistical Tables, NSF 10-314 (March 2010), Table 13, R&D spending from 1998 to 2008.

34 UNESCO, Institute for Statistics Database, Table 25, gross expenditures on research and development in constant prices from 1998 to 2008.

35 Ibid.

36 Ibid.

37 OECD, OECD Science, Technology and Industry Scorecard 2011 (September 20, 2011), p. 76.

38 UNESCO, UNESCO Science Report 2010 (UNESCO Publishing: Paris, 2010), p. 389.

39 See NSF Science and Engineering Indicators, 2012. Access at http://www.nsf.gov/statistics/seind12/slides.htm. See also Battelle, op. cit. Battelle estimated U.S. R&D spending at $415.1 billion in 2010 with Asia as a whole at $429.9 billion. The Goldman Sachs Global Markets Institute also estimates that research and development in Asia as a whole will likely overtake U.S. levels in the next five years. Goldman Sachs Global Markets Institute, “The New Geography of Global Innovation,” September 2010 http://www.innovationmanagement.se/wpcontent/uploads/2010/10/The-new-geography-of-global-innovation.pdf.

TABLE 1.1 Global R&D Spending Forecast

| Region | 2010 GERD PPP(Billion U.S.) | 2010 R&D as Percent of GDP | 2011 GERD PPP(Billion U.S.) | 2011 R&D as Percent of GDP | 2012 GERD PPP(Billion U.S.) | 2012 R&D as Percent of GDP |

| Americas | 473.7 | 2.3 | 491.8 | 2.3 | 505.6 | 2.3 |

| U.S. | 415.1 | 2.8 | 427.2 | 2.8 | 436.0 | 2.8 |

| Asia | 429.9 | 1.8 | 473.5 | 1.9 | 514.4 | 1.9 |

| Japan | 148.3 | 3.4 | 152.1 | 3.4 | 157.6 | 3.4 |

| China | 149.3 | 1.5 | 174.9 | 1.6 | 198.9 | 1.6 |

| India | 32.5 | 0.8 | 38.0 | 0.8 | 41.3 | 0.8 |

| Europe | 310.5 | 1.9 | 326.7 | 1.9 | 338.1 | 2.0 |

| Rest of World | 37.8 | 1.0 | 41.4 | 1.1 | 44.5 | 1.1 |

| Total | 1,251.9 | 2.0 | 1,333.4 | 2.0 | 1402.6 | 2.0 |

SOURCE: Battelle and R&D Magazine, 2012 Global R&D Funding Forecast, December 2011.

NOTE: GERD: Gross Expenditures on R&D, PPP, Purchasing Power Parity. The Chinese government reports somewhat different estimates of 1.83% for 2011 and 1.76% for 2010. See ‘Statistical Bulletin on National Science and Technology Expenditures in 2010 and in 2011.

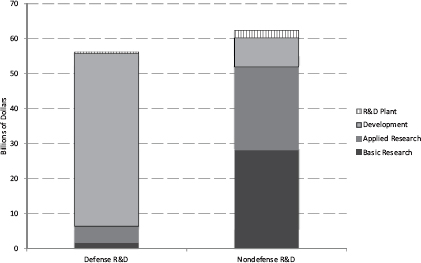

The composition of the U.S. R&D effort has evolved over the years, with the share going to military R&D increasing since the mid-1990s.40 At $72.6 billion projected for fiscal year 2013, Defense R&D expenditures will make up over half of the federal government’s total R&D expenditures of $142.2 billion.41 Within that component, as Figure 1.3 shows, much greater priority is devoted to later-stage systems development. This is significant in that the aggregate data may be overstating the actual level of basic and early stage applied R&D in the United States. Further, the majority of federal R&D is focused on specific national objectives in defense, health, space, energy and the environment. This has resulted in total federal R&D spending being concentrated in just a few industries. Seventy-five percent of federal R&D allocated to manufacturing goes to aerospace and instruments.42 Yet these two industries only account for about 10 percent of high technology value-added in

______________________

40 Patrick J. Clemins, Presentation of May 25, 2011, “R&D in the Federal Budget.” Access at http://www.aaas.org/spp/rd/presentations/aaasrd20110525.pdf.

41 Matt Hourihan, “R&D in the FY 2013 Budget,” AAAS, April 26, 2012.

42 Gregory Tassey, “The Manufacturing Imperative,” presentation at NAS Conference on the Manufacturing Extension Partnership, November 14, 2011. See also Gregory Tassey, The Economics of R&D Policy, Westport CT: Greenwood Publishing, 1997.

FIGURE 1.2 R&D expenditures as a share of gross domestic product. SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Science and Engineering Indicators 2012 (NSB 12-01), January 2012, Appendix Table 4-43.

the economy.43 This means, in Gregory Tassey’s assessment, that federal R&D spending is not optimized for economic growth of the economy as a whole.44

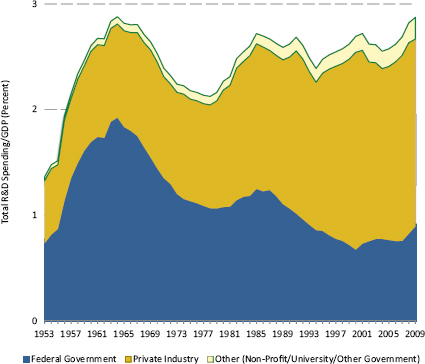

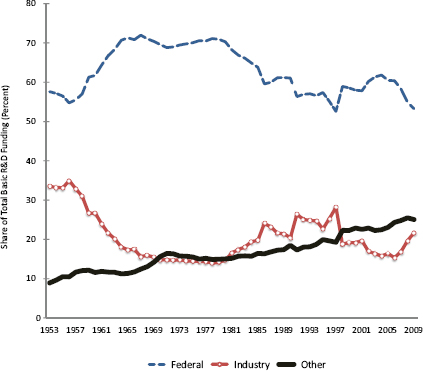

On top of these concerns, federal R&D investments—the nation’s main source of funding for basic research— have been declining as a percentage of GDP since the mid 1980s and have been trending downward since the early 1960s.45 [See Figure 1.4]

______________________

43 Id.

44 Id.

45 For an analysis of the ratio of public vs. private R&D expenditure from the postwar period to 2006, see Conceição et al. Knowledge for Inclusive Development, Westport CT: Praeger, 2002.

FIGURE 1.3 Federal Obligations for R&D by Character of Work - FY 2010. SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Federal Funds for Research and Development: Fiscal Years 2008–10 Detailed Statistical Tables, NSF 12-308 (April 2012), Tables 1, 3 and 7.

NOTE: Eighty-eight percent of Defense related R&D is in development research. FY 2010 data are preliminary.

There are growing signs that America’s position as the best place to commercialize technology is not as secure as it once was. The reasons for this are multiple and typically revolve around the role that governments around the world play to protect and nurture their domestic industries. The first has to do with markets and market access—with related government subsidies and inducements—for commercializing new technologies. A second major aspect of this relates to favorable access and terms for investment capital. The third factor is infrastructure provision and support, where some high tech industries— notably the semiconductor industry—require billions to set up new plants. A fourth reason relates to taxes and other financial incentives provided by some governments. 46 A final key factor is governmental support for high risk “big

______________________

46 Comparatively high corporate taxes and regulatory hurdles and inadequate financing have made America less competitive for capital investment An analysis by economist Jeremy A. Leonard found

bets” that require all of the above—that is a willingness to foster large-scale endeavors with a long term perspective, not just a quick payoff.

FIGURE 1.4 Total U.S. R&D spending as a percentage of GDP by funding source.

SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Science and Engineering Indicators 2012, NSB 12-01 (January 2012), Appendix Tables 4-1 and 4-7.

The wave of economic liberalization and free-trade agreements that swept the world in the late 20th century had led some analysts to conclude that

______________________

that non-production costs such as taxes put U.S. manufacturers at a nearly 18 percent cost disadvantage compared to other nations. See Jeremy A. Leonard, “The Tide Is Turning: An Update on Structural Cost Pressures Facing U.S. Manufacturer,” The Manufacturing Institute and Manufacturers Alliance/MAPI, November 2008 (http://www.deloitte.com/assets/DcomUnitedStates/Local%20Assets/Documents/us_pip_TideIsTurning_093009.pdf). For another analysis of declining U.S. competitiveness see Aleda V. Roth, et. al, “2010 Global Manufacturing Competitiveness Survey,” Deloitte Touche Tohmatsu and U.S. Council on Competitiveness, June 2010.

all major nations were converging toward free-market economic policies47 and liberal democracy.48 However, mercantilism is alive and well in the 21st century. One obvious indicator is the persistently large trade surpluses of nations that stress exports and, in some cases, seek to limit imports.

More disconcerting for U.S.-based innovation is the persistence of state capitalism overseas.49 Government support for homegrown industries, which was instrumental in the ascent of Japan and South Korea in industries such as automobiles, electronics, and steel in the 20th century, plays a heavy role in the economic strategies of nations such as China, Russia, and the Gulf States in the 21st century, notes the National Intelligence Council. 50 The council also noted that state-owned enterprises not only are far from extinction, but actually “are thriving, and in many cases seek to expand beyond their own borders.”51 State enterprises, especially those based in China, often benefit from privileged access to land, labor, capital, government purchases, and industrial subsidies.

Indeed, state enterprises have become a major means of circumventing World Trade Organization rules.52 Secretary of State Hillary Clinton noted that the world trade system needs institutions to address new challenges from some activities of state-owned enterprises.53 The OECD also has been seeking to

______________________

47 Economist John Williamson in 1989 coined the term “Washington Consensus,” referring to the seeming widespread adoption of neoliberal economic policies advocated by the International Monetary Fund, World Bank, and U.S. Treasury. See John Williamson, “What Washington Means by Policy Reform,” in John Williamson, editor, Latin American Readjustment: How Much has Happened, Washington, DC: Institute for International Economics, 1989.

48 Francis Fukuyama argued in 1992 that the evolution toward liberal democracy marked “the end of history.” See Francis Fukuyama, The End of History and the Last Man, New York: The Free Press, 1992.

49 The term state capitalism has various meanings. Recently, it has been used to describe commercial economic activity undertaken by the state-owned business enterprises that are also supported by the state. For a contemporary review of the scale and scope of modern state capitalism and the challenges it poses, see the Economist, “The Rise of State Capitalism.” January 21, 2012. The term can also refer to an economic system where the means of production are owned privately but the state plays an active role in the allocation of credit and investment to support the development of major industries. Even in the United States, the state has sometimes played a sustaining role. See, for example, the review of the role of U.S. support for the development of the aircraft industry, in John Birkler et al, “Keeping a Competitive U.S. Military Aircraft Industry aloft.” Santa Monica CA: RAND, 2011.

50 The National Intelligence Council notes that more global wealth is concentrating in emerging economies such as China, Russia, and Gulf States that “are not following the liberal model for self development but are using a different model—‘state capitalism.’” The Council describes state capitalism as a loose term used to describe a system of economic management that gives a prominent role to the state.” See National Intelligence Council, Global Trends 2025: A Transformed World, U.S. Government Printing Office, November 2008. The report can be accessed at http://www.dni.gov/nic/PDF_2025/2025_Global_Trends_Final_Report.pdf.

51 Ibid.

52 See Alan Wolff, “America’s Trade Policy Agenda and the Future of U.S. Trade Negotiations.” Testimony before the House Ways and Means Committee, February 29, 2012.

53 Hillary Rodham Clinton, “On Principles of Prosperity in the Asia Pacific, speech at Shangri-La Hotel, Hong Kong, July 25, 2011. The address can be accessed at

address this issue through guidelines for the governance of state-owned enterprises.54

Even if these government-owned enterprises are not particularly innovative, they have the potential to cause competitive harm to foreign competitors, given their scale, preferential treatment, and access to protected markets.55 Nations such as Vietnam, Malaysia, and Singapore also have large state enterprises that could evolve into global players and pose challenges to traditional trade agreements.56 Because many state enterprises are tasked with building state-of-the-art infrastructure, they are gaining experience in deploying the newest technologies for transportation, energy, telecommunications, and clean water.

China is the major source of foreign complaints about policies that distort trade and investment.57 A recent report by the U.S. International Trade Commission detailed China’s lack of enforcement of intellectual property rights, discrimination in government procurement against imported technology products or even those made by multinationals in China, and pressure on multinationals to transfer core technology to domestic Chinese companies.58

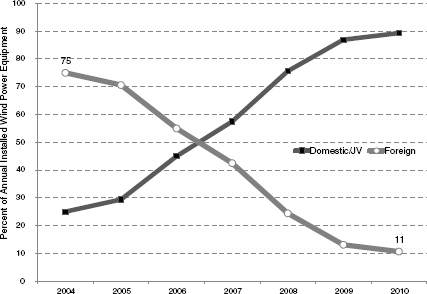

Due to government policies that favor Chinese producers and compel foreign manufacturers to transfer their technology to sell into the fast-growing domestic market for wind farms, for example, China has become one of the world’s biggest producers and exporters of wind turbines and generators. The foreign share of China’s annual new purchase of wind power equipment has fallen from 75 percent in 2004 to just 11 percent in 2010.59 [See Figure 1.5] Rapid expansion of production capacity of photovoltaic modules, fueled by $30 billion in low-cost loans from the China Development Bank, has enabled China to dominate the global market.60 The resulting flood of PV modules has driven down the cost of solar electricity, forcing U.S. manufacturers with alternate but higher priced solar power technologies, such as Solyndra, Evergreen, SpectraWatt, to file for bankruptcy.61

______________________

54 OECD, “OECD Guidelines on Corporate Governance of State Owned Enterprises,” Paris: OECD, 2005.

55 Steven Ezell, Fighting Innovation Mercantilism, Issues in Science and Technology, Winter 2011.

56 Bob Davis, “U.S. Targets State Firms in Vietnam, China in Trade Talks,” Wall Street Journal, October 25, 2011.

57 For an extensive examination of the implications of Chinese government “indigenous innovation” policies for foreign companies and trade, see Alan Wm. Wolff, “China’s Indigenous Innovation Policy,” testimony before the U.S. China Economic and Security Review Commission, Washington, DC, May 4, 2011.

58 U.S. International Trade Commission, China: Intellectual Property Infringement, Indigenous Innovation Policies, and Frameworks for Measuring the Effects on the U.S. Economy, Investigation No. 332-514, USITC Publication 4199 (amended), November 2010.

59 For a review of China’s policies to promote its renewable energy equipment sector, see Thomas Howell, William A. Noellert, Gregory Hume, and Alan Wm. Wolff,, China’s Promotion of the Renewable Electric Power Equipment Industry: Hydro, Wind, Solar, Biomass, Dewey & LeBoeuf LLP prepared for National Foreign Trade Council, March 2010.

60 Stephen Lacey, “How China Dominates Solar Power: Huge Loans from the Chinese Development Bank are Helping Chinese Solar Companies Push American Solar Firms Out of the Market,” Guardian Environment Network, guardian.co.uk, September 12, 2011.

61 Keith Bradsher, “China Benefits as U.S. Solar Industry Withers,” New York Times, September 1, 2011.

FIGURE 1.5 Foreign share of annual wind power equipment sales within China.

SOURCE: China Wind Energy Association.

NOTE: Foreign share for 2010 for companies other than Vestas, Gamesa, GE, Suzlon and Nordex were estimated based on previous years.

Government bodies also essentially require makers of lithium-ion batteries for cars to manufacture in China in order to sell into the growing domestic automobile market.62 The Chinese government also has refused to allow Chevrolet Volt plug-in hybrid passenger cars to qualify for subsidies totaling $19,300 unless General Motors transfers core technologies to a Chinese

______________________

62 See Jason M. Forcier, “The Battery Industry Perspective,” at the National Research Council conference on Building the U.S. Battery Industry for Electric-Drive Vehicles: Progress, Challenges, and Opportunities, Livonia, Michigan, July 26, 2010.

partner.63 Leveraging its large and growing market for aircraft, China is using technology transferred by U.S. and European aircraft, engine, and avionics suppliers to support its ambitious plans to build a globally competitive commercial aerospace industry.64 The government also aims to increase to 30 percent the self-sufficiency ratio of integrated circuits used in communications and digital household products and to 70 percent in products relating to national security and defense.65 China also uses its control over rare-earth metals used in electronics products to its advantage by making it difficult for foreign manufacturers to obtain the critical materials unless they build factories in China.66

The Chinese government has adopted a formal policy of favoring products incorporating “indigenous innovation” as a means of cutting dependence on imported technology and building domestic innovation capacity.67 These goals are embedded in procurement, Chinese technology standards, anti-monopoly law, and tax regulations and laws. “The indigenous innovation ‘web of policies’ is expected to make it difficult for foreign companies to compete on a level playing field in China,” according to the U.S. International Trade Commission (ITC).68

The United States lacks an effective policy to prevent the compulsory transfer of cutting-edge technology—much of it developed through federal subsidies—to build new industrial rivals in other nations. The U.S. has various policy tools to fight unfair trade practices. The President, for example, is empowered by Congress to “take all appropriate action” to oppose “unjustified, unreasonable, or discriminatory” polices or practices by foreign governments that restrict U.S. commerce.69 Although the United States Trade Representative is authorized to initiate retaliatory action by itself, in practice federal agencies react to documented petitions filed by industry. The problem with this procedure is that few U.S.-based multinationals wish to jeopardize their business in China—a critical market—by initiating a trade action.

______________________

63 Keith Bradsher, “Hybrid in a Trade Squeeze,” New York Times, September 5, 2011.

64 See Roger Cliff, Chad J. R. Ohlandt, and David Yang, Ready for Takeoff: China’s Advancing Aerospace Industry, RAND National Security Research Division for U.S.-China Economic and Security Review Commission, 2011. See also David Barboza, Christopher Drew and Steve Lohr, “GE to Share Jet Technology with China in New Joint Venture,” New York Times, January 17, 2011.

65 Chinese Ministry of Industry and Information Technology, “Outline of the 11th Five-Year Plan and Medium-and-Long-Term Plan for 2020 for Science and Technology Development in the Information Industry,” Xin Bu Ke [2006] No. 309, posted on ministry website Aug. 29, 2006. This effort, while well funded, has nonetheless encountered substantial and persistent challenges.

66 Keith Bradsher, “Chasing Rare Earths, Foreign Companies Expand in China,” New York Times, August 24, 2011.

67 See State Council of China, “National Medium- and Long-Term Program for Science and Technology Development, 2006-2020,” op. cit.

68 U.S. International Trade Commission, 2010, op. cit.

69 Section 301 (a) of the U.S. Trade Act of 1974 (P.L. 93-618).

Techno-nationalism and state-supported enterprises may not, in the end, prove successful at spawning innovation. Yet, these measures do distort investment flows that determine where U.S. inventions are converted into manufacturing industries and thus they limit the economic gains to the U.S. from research and development. If emerging economies such as India and Brazil also rely heavily on state capitalism, the threat to U.S. innovation will grow.

America no longer holds an overwhelming advantage in producing skilled talent. In 1975, the U.S. led the world in the proportion of 20- to 24-yearolds who received their first university degrees. The U.S. fell to second place as of 1990. It has since dropped to 14th.70 America’s relative decline has been especially sharp in the proportion of students earning engineering and science degrees. 71 Charles M. Vest, President of the National Academy of Engineering, highlighted in his 2011 President’s Address that just 4.5 percent of U.S. college and university students graduate in engineering fields compared to more than 21 percent in Asia and just under 12 percent in Europe.72

China and India now award more four-year engineering bachelor’s degrees than the U.S., although the quality and nature of these degrees vary.73 This is perhaps not surprising given their populations and increasing expenditures on education, but it does suggest a long-term shift in engineering capacity.74

______________________

70 McKinsey & Company, “The Economic Impact of the Achievement Gap in America’s Schools.” April 2009.

71 Joan Burrelli and Alan Rapoport, Reasons for International Changes in the Ratio of Natural Science and Engineering Degrees to the College-Age Population, InfoBrief National Science Foundation, Directorate for Social, Behavioral and Economic Sciences NAF 09-308, January 2009. See also Anthony P. Carnevale, Nicole Smith and Michelle Melton, STEM, Georgetown University Center on Education and the Workforce, October 2011. The authors point to the fact that the United States is relying on foreign-born workers to fill the gap in the STEM (science, technology, engineering and mathematics) workforce. “As a result of STEM talent shortages throughout the U.S. education and workforce pipeline, many technical industries have come to rely on immigrants to fill the gap between supply and demand for skilled scientific and technical workers.”

72 Charles M. Vest, “Engineers: The Next Generation,” President’s Address, National Academy of Engineering Annual Meeting, October 16, 2011. Vest argues that the United States has a “work force train wreck” coming in engineering. Not only does the nation not graduate enough U.S. engineers but: (1) the fastest growing segment of college graduates have been women, yet women earn less than 20 percent of U.S. engineering degrees; and (2) Asian and African Americans, who represent one-third of college-age people in the country, earn less than 13 percent of U.S. engineering degrees, and their share of the college-age population is projected to steadily increase.

73 See Vivek Wadhwa, “Chinese and Indian Entrepreneurs Are Eating America’s Lunch.” Foreign Policy, December 28, 2010.

74 Gary Gereffi, Vivek Wadhwa, Ben Rissing, and Ryan Owen, “Getting the Numbers Right: International Engineering Education in the United States, China, and India,” Journal of Engineering Education, Vol. 97, No. 1, pp. 13-25, 2008.

The Growth of Foreign Research Centers of U.S. Multinationals

Technology-intensive multinational corporations have established numerous research centers in emerging economies, largely staffed with local talent.75 The first MNC R&D centers were primarily concerned with development of technology to adapt companies’ global products to local needs and conditions76. It became apparent that in a number of countries a significant pool of R&D talent existed which was at a far lower cost than comparable workers in developed economies, and that MNCs could dramatically reduce their R&D costs and increase productivity by shifting some research functions to emerging markets77. The 9/11 attacks led to a tightening of U.S. immigration policy and a number of MNCs which relied heavily on foreign-born researchers, accelerated the move offshore to retain access to foreign talent78. More recently, MNC offshore R&D centers have been the source of some remarkable achievements, demonstrating that they are becoming integral to the R&D strategies of global technology leaders.79

______________________

75 The seminal work of Sylvia Ostry and Dick Nelson (1995)7, among many others for the last twenty years, has called for our attention of the relationship between the globalism of firms and the nationalism of governments, as well as the related interplay of cooperation and competition that characterizes high technology and knowledge-based environments. See Sylvia Ostry, Richard R. Nelson, Techno-Nationalism and Techno-Globalism: Conflict and Cooperation, Washington, DC: Brookings, 1995.

76 For example, in 2007, DuPont, a major producer of titanium dioxide for use in industrial coatings, opened a technical center in Dzershinsk, Russia to provide support for Russian manufacturers using DuPont’s titanium dioxide in their paint, paper, and plastic products. In 2008, DuPont opened an R&D center in Yaroslavl, Russia, to concentrate on the adaptation of DuPont’s new coating materials to assembly line conditions at Russia’s manufacturer’s automobile plants. “DuPont opens Tech Center in Russia,” Chemical Week (March 21, 2007); “DuPont opens High-Performance Coatings R&D Center in Russia,” Special Chem Coatings and Inks (July 28, 2008).

77 In 2010, Zinnov Management Consulting released a widely-cited study of MNC R&D centers which concluded that during the preceding three years MNC R&D centers in India alone had helped the parent organizations cut R&D costs by $40 million. “MNC R&D Centers Generate $40bn in savings: Study,” The Financial Express (July 18, 2010).

78 Semiconductor Industry Association, Maintaining America’s Competitive Edge: Government Policies Affecting Semiconductor Industry R&D and Manufacturing Activity (March 2009) pp. 2931. Most engineering PhD graduates from U.S. universities received their bachelor’s degrees in other countries. Foreign nationals make up half of the masters’ and 71 percent of the PhD candidates graduating from U.S. universities in the engineering fields relevant to the design and manufacture of integrated circuits. National Science Foundation, Division of Resource Statistics, http://www.nsf.gov/statistics/. A number of emerging economies have large pools of highlyeducated science and engineering talent, which can staff major research infrastructures. DuPont India indicated in 2011 that it planned to recruit 800 scientists, mostly PhDs, in the next two years. “DuPont India to Recruit 800 Scientists in Two Years,” India Business Insight (February 21, 2011).

79 In 2008, it was announced that for the first time in history, an entire micro[processor had been designed in India at Intel’s Design Enterprise Group in Bangalore, where a 7400-series Xeon core x86 processor was created entirely from scratch by an all-Indian design team. Praveen Vishakantaiah, President of Intel India, commented that “within six years of the inception of the India Design Centre, it has rolled out a chip from design to tape out. This is the fastest ramp up in the history of Intel.” “India Inside Intel Chips,” Financial Express (September 25, 2008). “Intel India

Illustrative of this trend is DuPont’s expanding R&D investments in India. The company, which in the early Twentieth Century pioneered the business model of systematic R&D for the purpose of generating a constant stream of new products, remains a global leader in fields such as chemistry, biotechnology, and materials science.80 At present, Uma Chowdhry, a native of India, supervises all of DuPont’s global R&D centers and the company’s significant R&D footprint in India underscores the depth and diversity of MNC R&D activity in the country.81

• DuPont has established a network of agricultural seeds research centers in India to develop high-yield hybrid crops adapted to local growing conditions.82

• In 2008, DuPont opened the DuPont Knowledge Center in Hyderabad, with 300 scientists pursuing research themes in solar energy, biotechnology, and crop science—the only DuPont engineering competence center outside the U.S. and the company’s first biotech research center outside the U.S. DuPont is expanding the scope of the centers research to include packaging, safety and protection, biofuels construction and transportation. 83

• DuPont has established a ballistics facility at the Hyderabad Knowledge Center which develops protective products such as Kevlar to meet “very specific protection needs” applicable to domestic defense procurement, the first such DuPont facility in the Asia-Pacific region.84

______________________

Team Lofts a Sixer,” The Hindu (September 21, 2008). E-Silicon, a fables producer of ASICs, established an R&D center in Bucharest, Romania, and observed that Romanian talent was particularly strong in designing analog and mixed signal devices. An E-Silicon executive commented that “there seems to be a greater skill set of these disciplines in Romania than in other locations”. “ESilicon Accelerates Expansion to Europe,” Hugin (October 28, 2008); “ESilicon to expand Romanian Chip Design Chip Operation,” EE Times Eastern Europe (November 13, 2008).

80 See Alfred Chandler, Jr., Scale and Scope: The Dynamics of Industrial Capitalism (Cambridge and London: Harvard University Press, 1990) pp. 181-193.

81 Dr. Chowdry commented that “in India we find the very best talent, entrepreneurship, and skill and language which blends well with the future of the company.” “Developing Technology to Meet Market Needs is DuPont’s Priority,” Business Line (January 19, 2008).

82 “DuPont Adds Seed Research Centers,” India Business Line (September 22, 2009).

83 “Diane Gulyas, DuPont Group VP, in “DuPont India Growing by Leaps and Bounds Despite Slowdown,” The Economic Times (April 5, 2009); “DuPont plans to Double Manpower in India, “India Business Insight (March 28, 2008). In 2010, DuPont disclosed plans to invest $100 million to expand the Knowledge Center in Hyderabad. “DuPont to Invest $100 million to step-up R&D base,” The Economic Times (October 5, 2010).

84 “DuPont Opens World-Class Ballistics Facility in City,” The Times of India (April 14, 2012) DuPont reportedly plans to seek collaboration with India’s Defense Research and Development Organization to develop new kinds of protective gear such as helmets and vests. “DuPont Bets on Helmet, Vest Maker (Who Use its Products Made Under the Kevlar Brand),” India Business Insight (April 13, 2012)

• In 2011, DuPont established an Innovation Center in Pune, India, to develop materials and technologies with applications to the automotive sector.85

China, like India, has experienced a proliferation of MNC R&D centers.86 Zinnov Management Consulting estimates that as of March 2011, multinational corporations had established over 1300 R&D centers in the country, more than double the number that existed in 2003-04. 400 of the Fortune 500 have R&D centers in China and technology leaders with Chinese R&D centers include IBM, Cisco, Eli Lilly, Microsoft, GE, Panasonic, Motorola, Toshiba, Broadcom, Nortel, DuPont, Fujitsu, Nokia, and British Telecom.87 Concerns about China’s protections of intellectual property, however, have inhibited many multinationals from conducting cutting-edge R&D in China, although they do conduct some R&D, particularly with respect to products aimed at the Chinese market.88

As corporations cut or hold flat their R&D operations in the U.S., they are rapidly expanding their offshore design and engineering centers.89 This enables corporations to draw on strong local talent and adapt to fast-growing markets. As noted above, in some cases, they are responding to foreign government pressure to transfer technology and know-how.

At the same time that new players are rising, the process of innovation itself is undergoing revolutionary change. As Henry Chesbrough has pointed out, the traditional internally focused model for innovation is becoming obsolete. To remain competitive in today’s information rich environment, companies need to leverage both “internal and external sources of ideas and take them to market through multiple paths.” 90 Indeed, companies such as Apple have prospered in an environment of open innovation, integrating new technologies, components, design expertise, and low-cost Asian manufacturing capabilities into breakthrough products.

______________________

85 “India Will Be 3rd Biggest Carmaker: Diane Gulyas,” The Economic Times (September 4, 2011).

86 See also the discussion of MNCs in China in Chapter 5 of this report.

87 Zinnov Management Consulting, MNC R&D Landscape: A China Perspective.

88 A 2009 Survey of its members by the U.S. Semiconductor Industry Association indicated that most companies surveyed would not locate their most advanced and critical R&D facilities in China despite encouragement by the government to do so. SIA, Maintaining America’s Competitive Edge (2009) op. cit. pg. 31. For a review of the limited nature and scope of research and development by U.S. affiliates in China, see Lee Branstetter and C. Fritz Foley, “Facts and Fallacies about U.S. FDI in China.” NBER Working Paper 13470, 2007.

89 See Steven D. Eppinger and Anil R. Chitkara, “The New Practice of Global Product Management,” MIT Sloan Management Review, 47(4) Summer 2006.

90 See Henry Chesbrough, Open Innovation: The New Imperative for Creating and Profiting from Technology, Boston: Harvard Business School Press, 2003.

India also has thrived in the new age of globally networked innovation, emerging as a major source of drug-discovery work and semiconductor, software, medical equipment, and auto part design.91 Companies in India also have excelled at an “inclusive” approach to innovation that addresses the needs of the low-income masses.92 Indian companies have developed innovative business models selling high-quality but ultra-low-cost goods and services ranging from cellular phone services to simple passenger cars and computers to surgical procedures aimed at the what late management thinker C. K. Prahalad described as the “bottom of the pyramid.”93 As innovation capacity grows abroad, U.S. companies will likely source more new knowledge abroad, just as companies from other countries have done in the U.S.94

Growth of Innovative Regions Around the World

Silicon Valley, greater Boston, San Diego, Austin, Seattle and other U.S. innovation zones for decades have been magnets for the world’s brightest and most visionary innovators, technology entrepreneurs, and financiers. Now these hubs face greater competition as places to commercialize new technology and launch new companies. Taipei, Shanghai, Helsinki, Tel Aviv, Hyderabad, Singapore, Sydney, and Suwon, South Korea, are among the many cities that now boast high concentrations of technology entrepreneurs and are launching important companies.95 According to a map of global innovation clusters by the

______________________

91 For example, see presentations by Swati Piramal of Nicholas Piramal, Robert Armstrong of Eli Lilly, Kenneth Herd of General Electric, and Ram Sriram of Google in National Research Council, India’s Changing Innovation system: Achievements, Challenges, and Opportunities for Cooperation, Charles W. Wessner and Sujai J. Shivakumar, editors, Washington, DC: The National Academies Press, 2007. For additional examples of R&D performed for multinationals in India, see National Research Council, The Dragon and the Elephant: Understanding the Development of Innovation Capacity in China and India—Summary of a Conference, Stephen Merrill, David Taylor, and Robert Poole, rapporteurs, Washington, DC: The National Academies Press, 2010.

92 See C. K. Prahalad, The Fortune at the Bottom of the Pyramid: Eradicating Poverty Through Profits, Wharton School Publishing, 2005. See also C.K. Prahlad and R.A. Mashelkar ’Innovation’s Holy Grail,’ Harvard Business Review, July 2010.

93 For example, see the summary of presentations by Kapil Sibal and M. P. Chugh in India’s Changing Innovation System, op. cit.

94 Proctor & Gamble, for example, has drawn on research done at India’s National Chemical Laboratory to market innovative household products worldwide. Getting fragrance onto clothes had presented a long standing challenge for detergent companies and their suppliers. The key idea of using a unique microencapsulation technology for accomplishing this was revealed in a Ph.D. thesis done at National Chemical Laboratory (NCL) in Pune (India) in the year 1998. Procter & Gamble spotted it, partnered with NCL and developed it further into polymer microcapsules for fiber use. This is a great commercial success today.

95 Chapter 7 of this report highlights policy instruments being adopted by countries and regions around the world and across the U.S. to rise to the challenges of building innovation clusters.

McKinsey Global Institute and World Economic Forum, some U.S. cities are losing ground to emerging “hot springs” of innovation in Asia and Europe.96

Other nations are getting better at replicating the features that once made American innovation hubs unique, such as access to early-stage risk capital, strong R&D linkages between universities and business, modern science parks, and entrepreneurial support networks. In Finland, where annual technology exports leapt five-fold between 1992 and 2008,97 the government agency Tekes invested €343 million ($494 million) in 2009 directly with enterprises—most of them with fewer than 500 employees—developing technologies in partnerships with universities.98 Chinese government agencies have mobilized $2.5 billion in venture capital to fund start-ups in the immense Zhangjiang science park outside Shanghai.99 Singapore, a fast-growing hub for industries such as biotechnology and digital media, is investing $275 million over five years to establish “enterprise boards” at each university, seed money for venture-capital funds, capital for start-ups, and an incubator for “disruptive innovation.”100

THE PILLARS OF U.S. INNOVATIVE STRENGTH

The U.S. innovation system remains the most dynamic in the world. It is highly decentralized, highly competitive, and highly entrepreneurial. Over the past few decades, the U.S. has been the leading source of game-changing products in fields as diverse as semiconductors, software, medicine, finance, Internet services, and mass entertainment, to name a few. Most recently, a U.S. company, Apple, has launched such revolutionary products such as the iPad and iPod, and Internet leaders such as Google, Facebook and LinkedIn have come into existence in the United States. While the U.S. government has contributed to enabling platform technologies, many of its biggest corporate successes occur

______________________

96 A McKinsey & Co. and the World Economic Forum “Innovation Heat Map,” which rates on 700 variables such as business environment, human capital, patent applications, economic value added, and industrial diversity, labeled U.S. cities such as Philadelphia, St. Louis, and Indianapolis “silent lakes” or “shrinking pools” while cities such as Shenzhen, Hyderabad, Singapore, and Cheonan, South Korea, are classified as rapidly growing “hot springs.” See Juan Alcacer and McKinsey & Co., “Mapping Innovation Clusters,” McKinsey Digital, March 19, 2009, (http://whatmatters.mckinseydigital.com/flash/innovation_clusters/). Also see Andre Andonian, Christoph Loos, and Luiz Pires, “Building an Innovation Nation,” McKinsey & Co., March 4, 2009.

97 Finnish Science and Technology Information Service data. Access at http://www.research.fi/en. This surge would, of course, include the Nokia effect.

98 Data from Tekes Annual Review 2009, (http://www.tekes.fi/en/community/Annual%20review/341/Annual%20review/1289).

99 Data from Zhangjiang High-Tech Park Web site http://www.zjpark.com/zjpark_en/zjgkjyq.aspx?ID=7.

100 National Research Foundation, “National Framework for Innovation and Enterprise,” Prime Minister’s Office, Republic of Singapore, 2008, (http://www.nrf.gov.sg/nrf/otherProgrammes.aspx?id=1206).

Box 1.3

The Postwar Rise of U.S. Pre-eminence in Science and High-technology Industry

America’s pre-eminence in both scale intensive industries and in science based and in high technology industries following the Second World War were the result of an unusual set of circumstances.101 First, significantly before World War II U.S. industry had taken the lead in a number of industries where economies of scale and scope were significant (like steel, sewing machines, and later automobiles.). The reason was that the U.S. then was by far the world’s largest “common market.” 102 With the opening of trade after WWII and the significantly lower costs of transport, even firms in small countries could take advantage of large markets and operate at scale. Second, World War II devastated the economies that had been strong competitors for technological leadership prior to the war. Prior to the war, Germany was the leader in many fields and Britain was in a few.103 The war severely damaged much of the German scientific establishment. The magnitude of U.S. postwar finance of science and new technologies helped the U.S. overtake the British. Third, after the Second World War, the U.S. pioneered in large-scale public finance of university-based scientific research as well as large-scale government support of the development of high tech industries related to defense and space.104 This is the era in which the United States took the lead in many high technology industries. Political support for these programs in the U.S. depended to a good extent on our sense of being challenged and threatened by the Soviet Union.105 By the end of the 20th Century two things had changed. One was that other countries were greatly expanding their own finance of university science. The other was that the end of the cold war eroded the political support for programs to support and grow high technology industries in the United States.

______________________

101 See Richard R. Nelson and Gavin Wright, “The Rise and Fall of American Technological Leadership: The Postwar Era in Historical Perspective,” Journal of Economic Literature 30(4), December 1992.

102 Ibid.

103 For a review of prewar German leadership in the Chemical Industry, see Ashish Arora, Ralph Landau, and Nathan Rosenberg, “Dynamics of Comparative Advantage in the Chemical Industry,” in Industrial Leadership, Studies of Seven Industries, David C. Mowery and Richard R. Nelson, eds., Cambridge: Cambridge University Press, 1999.

104 John Thelin, A History of American Higher Education, Baltimore: Johns Hopkins University Press, 2004. See also Hugh Davis Graham, Nancy A. Diamond, The Rise of American Research Universities: Elites and Challengers in the Postwar Era, Baltimore: Johns Hopkins University Press, 1997.

105 See Vernon Ruttan, Is War Necessary for Economic Growth? Military Procurement and Technological Development, Oxford: Oxford UP, 2006. See also Stuart W. Leslie, The Cold War and American Science: The Military-Industrial-Academic Complex, New York: Columbia University Press, 1993.

with little or no direct government involvement at the point of innovation application.106

America’s innovation system also is extremely complex. It is characterized by myriad varieties of interactions among government agencies, universities, private industry, financiers, and intermediary organizations.107 The system is fed by research-and-development spending that still far exceeds that of any other nation. The innovation system is supported by the world’s best university system and deepest pools of private angel and venture investment capital.

Strong Protection of Intellectual Property

Strong protection of intellectual property rights, business-friendly bankruptcy laws, a flexible labor force, and an entrepreneurial culture and legal system that favor risk-taking and tolerate failure are among the framework conditions that have kept the U.S. at the forefront of innovation. Another crucial American advantage has been its openness to foreigners. Scientists fleeing European fascism helped develop atomic energy in the U.S. and spurred its post-War ascendance in natural sciences. An influx of top talent from Taiwan, India, South Korea, China and other regions and nations who came to the U.S. to study and then settled were instrumental in U.S. pre-eminence in industries such as semiconductors, computers, software, and biotechnology. Foreign-born talent also has accounted for a disproportionate share of U.S. high-tech start-ups.108

______________________

106As Mary Meeker’s Kleiner of Perkins has observed, “private investment may have given us Facebook and Garmin, but public sector investment gave us the Internet and GPS.” As Roger Noll and Linda Cohen point out, “the foundations of the modern economy” were laid by the long-term public investments in enabling technologies such as nuclear energy, satellites, and computers. See Linda R. Cohen and Roger G. Noll, The Technology Pork Barrel, Washington, DC: Brookings Institution. 1991.

107 A good overview of the U.S. innovation system is provided in Philip Shapira and Jan Youtie, “The Innovation System and Innovation Policy in the United States,” Chap. 2 in Rainer Frietsch and Magrot Schüller, editors, Competing for Global Innovation Leadership: Innovation Systems and Policies in the USA, EU, and Asia, Fraunhofer IRB Verlag, Stuttgart, 2010.

108 AnnaLee Saxenian of the University of California at Berkeley estimated that Chinese and Indian engineers were represented on the founding teams of 24 percent of Silicon Valley technology businesses founded between 1980 and 1998. See AnnaLee Saxenian, Silicon Valley’s New Immigrant Entrepreneurs, San Francisco: Public Policy Institute of California, 1999. A follow-up study found that in one-quarter of all U.S. technology companies founded between 1995 and 2005, one-quarter had chief executive officers or chief technology officers who were foreign-born. See Vivek Wadhwa, Ben Rissing, AnnaLee Saxenian, Gary Gereffi, “Education, Entrepreneurship and Immigration: America’s New Immigrant Entrepreneurs, Part II,” Duke University Pratt School of Engineering, U.S. Berkeley School of Information, Ewing Marion Kauffman Foundation, June 11, 2007.

At the front end of America’s innovation system is basic research that is largely funded by the federal government and carried out by research universities. In contrast to many other nations, civilian research spending by the federal government is not coordinated by a single agency but instead distributed among a large number of mission agencies and departments.109 The Department of Defense accounts for a little over half of federal R&D; other funding agencies are the National Institutes of Health; the departments of Defense, Energy, and Agriculture; the National Aeronautics and Space Administration, and the National Science Foundation, which allocates research grants on a peer-review basis.