Chapter 2

Sustaining Leadership in Innovation

The United States faces new competitive challenges in the 21st century. Globalization is diminishing what once were overwhelming American advantages as the prime location for creating, commercializing, and industrializing technology. Basic research and world-class engineering talent now are highly dispersed around the world, especially in important fields such as nanotechnology, computer science, and renewable energies. How, then, must the U.S. adapt to maintain its leadership in innovation?

IMPROVING FRAMEWORK CONDITIONS

One of America’s most fundamental strengths as a place to commercialize innovation has been its overall investment climate. For much of the post-war era, America’s boasted some of the world’s best transportation, energy, and communication infrastructure.1 In the 1980s, America’s corporate tax rates were among the lowest in the industrialized world.2 The U.S. also has had one of the world’s strongest legal systems for protecting intellectual property rights.3

______________________

1 Michael Porter observed that American communication, power transportation, and transportation infrastructure was “arguably the best in the world” after World War II, and the fact that infrastructure companies were privately owned “was a stimulus to investment and innovation.” See Michael E. Porter, The Competitive Advantage of Nations, New York: Simon and Schuster, 1990, p. 297.

2 The U.S. statutory corporate tax rate dropped from 52 percent to 35 percent in the 1980s, well below the average for OECD nations. See Congressional Budget Office, “Corporate Income Tax Rates: International Comparison,” November 2005 (http://www.cbo.gov/ftpdocs/69xx/doc6902/1128-CorporateTax.pdf). Data from M. P. Devereaux, R. Griffith, and A. Klemm, “Corporate Income Tax Reforms and International Tax Competition,” Economic Policy, vol. 35 (October 2002).

3 The United States still has the lowest rate of computer software piracy in the world, followed by Japan and Luxembourg, according to the International Data Corporation (IDC). See Business

Corporate Taxes: There are concerns that America now is at a competitive disadvantage in some of these areas.4 After the U.S. cut corporate taxes in the 1980s, other industrialized nations cut taxes even further. When state corporate taxes are taken into account, the U.S. corporate statutory rate of 39.3 percent is third highest among OECD nations, which have a median rate of 33 percent.5 What’s more, the tax codes of countries such as Germany, Singapore, Malaysia, and China favor investment in certain industries through such incentives as 10-year tax holidays. While U.S. states offer such tax breaks, the federal government does not. The U.S. is one of the few major trading nations with a tax code that does not treat investment in globally traded industrial activity any differently than non-mobile activity.6 This means “inefficiency and biases in the corporate tax code fail to promote the productivity and innovative capability of businesses in America, hampering the economy and indirectly affecting all Americans.” 7 Business advocacy groups argue that executives find the current tax burden to be an impediment to the competitiveness of their companies operating in the United States.”8

Infrastructure: Some analysts regard America’s aging infrastructure as a competitive disadvantage.9 The U.S. ranks only No. 27 in terms of infrastructure, according to the World Economic Forum, a major factor in America’s falling place in the WEF’s overall global competitiveness rankings.10 That compares to seventh place in 2000, observes the McKinsey Global Institute.11 The American Society of Civil Engineers asserts that most of America’s infrastructure is in poor shape due to delayed maintenance and lack

______________________

Software Alliance and IDC, 08 Piracy Study, May 2009, (http://portal.bsa.org/globalpiracy2008/studies/globalpiracy2008.pdf).

4 It is important to note that the Committee did not conduct a study comparing the U.S. tax system to that of other countries. The Committee did want to draw attention to the growing body of evidence that, in some cases, U.S. tax policy creates a less competitive environment.

5 Congressional Budget Office, op. cit., citing data from Devereaux, Griffith, and Klemm.

6 Robert D. Atkinson, “Effective Corporate Tax Reform in the Global Innovation Economy,” The Information Technology & Innovation Foundation, July 2009, (http://www.itif.org/files/090723_CorpTax.pdf)

7 Ibid.

8 Roth, et al, “2010 Global Manufacturing Competitiveness Survey,” Deloitte Touche Tohmatsu and U.S. Council on Competitiveness, June 2010.

9 For an analysis of the positive link between good infrastructure and innovation and development, see Tony Ridley, Lee Yee-Cheong, Calestous Juma. “Infrastructure, Innovation, and Development,” International Journal of Technology and Globalisation, Volume 2, Number 3-4/2006, Pages 268278. For an industry view, see the interview with Eric Spiegel, the president and CEO of Siemens Corporation in Harvard Business Review, “Investing in Infrastructure Means Investing in Innovation.” March 15, 2012.

10 World Economic Forum, Global Competitiveness Report, op. cit.

11 James Manyika, et al., Growth and Renewal in the United States: Retooling America’s Economic Engine, McKinsey Global Institute, February 2011, (http://www.mckinsey.com/mgi/publications/growth_and_renewal_in_the_us/pdfs/MGI_growth_and_renewal_in_the_us_full_report.pdf).

of modernization.12 The Society reports that an estimated 25 percent of America’s bridges need significant repairs, one-third of major roadways are in substandard condition, and that “America’s sewer systems spill an estimated 1.26 trillion gallons of untreated sewage every year.”13 More recently the Society called for investments in the nation’s transmission, generation, and distribution systems in order to prevent significant costs to businesses and households.14

Likewise, a bipartisan study of America’s aging transportation infrastructure concluded that it is in “bad shape.” The poor condition “compromises our productivity and ability to compete internationally,” it added. The study estimated the U.S. needs to spend $134 billion to $262 billion per year more than current plans call for until 2035 to get this infrastructure into proper condition.15

Other nations are investing aggressively to build and upgrade their transportation infrastructure. China spent $713 billion—twice as much as the U.S.—just on transportation and water infrastructure over the past five years16 and is investing an estimated $500 to 700 billion to build the world’s biggest high-speed rail network.17 In 2008, the European Investment Bank lent 58 billion Euros ($81 billion) to finance infrastructure projects, and had a target of $112 billion in 2009.

______________________

12 ASCE has assigned a C grade to bridges, C- to rail, D+ for energy, D for aviation, dams, transit, dams, and D- to drinking water. See American Society of Civil Engineers, 2009 Report Card for America’s Infrastructure, March 25, 2009, (http://www.infrastructurereportcard.org/sites/default/files/RC2009_full_report.pdf).

13 Data from U.S. federal agencies cited in Eric Kelderman, “Look Out Below! American’s Infrastructure is Crumbling,” Stateline.org, Pew Research Center, January 22, 2008, (http://pewresearch.org/pubs/699/look-out-below).

14 ASCE, Failure to Act: The Economic Impact of Current Investment Trends in Electricity Infrastructure. April, 2012.

15 See Miller Center of Public Affairs, Well Within Reach: America’s New Transportation Agenda, David R. Goode National Transportation Policy Conference. Posted on October 4, 2010 at http://www.infrastructureusa.org/well-within-reach/.

16 Cathy Yan, “Road-Building Rage to Leave U.S. in Dust,” Wall Street Journal, January 18 2011.

17 See Sean Tierney, “High-speed rail, the knowledge economy, and the next growth wave,” Journal of Transport Geography, Volume 22, May 2012, pages 285-287. Tierney notes that failure to invest in economic development “concedes considerable ground to those countries with whom we are trying to compete. Compare the $8 billion that President Obama set aside in the stimulus bill as a down payment for HSR [High Speed Rail], with the estimated $500 - $700 billion that China plans to invest for its 19,000 km HSR network.” For a review of the economic benefits of large scale transportation projects, see T.R. Lakshmanan, “The broader economic consequences of transport infrastructure investments.” Journal of Transport Geography. Volume 19(1), 2011. For a review of recent China’s investments in rail, Will Freeman, “The Big Engine That Can: China’s High-Speed Rail Project,” China Insight Economics, May 28, 2010. Problems have emerged with regard to the rapid construction of China’s rail network, its cost, the revenues it is generating, and its relevance to the needs of the general population. Recent train disasters in China have further spotlighted challenges related to the rapid growth of that nation’s high-speed rail system. See Financial Times, “China’s Rail Disaster.” July 27, 2011 and Keith B. Richburg, “Are China’s High-Speed Trains Heading Off the Rails?” Washington Post, April 23, 2011.

To address this competitive disadvantage in infrastructure, some analysts have called for a U.S. infrastructure bank that, like the EIB, could leverage private capital.18 The purpose of such a National Infrastructure Bank (NIB) would be to invest in merit-based projects of national significance that span both traditional and technological infrastructure by leveraging private capital. Phillips, Tyson and Wolf argue that “the NIB could attract private funds to co-invest in projects that pass rigorous cost-benefit tests, and that generate revenues through user fees or revenue guarantees from state and local governments. Investors could choose which projects meet their investment criteria, and, in return, share in project risks that today fall solely on taxpayers.”19

Energy Efficiency: Reliable, clean, and relatively inexpensive energy has long been an important competitive advantage for the United States. As a recent UNIDO report notes, “Energy efficiency contributes toward reducing overall company expenses, increases productivity, has effects on competitiveness and the trade balance on an economy-wide level, and, by creating a home market for energy efficient technologies, supports the development of successful technology supply industry in that field.”20 Energy efficiency also represents a major opportunity to increase energy security while also limiting carbon dioxide emissions.

An accelerated deployment of existing and emerging energy-supply and end-use technologies has the potential to yield substantial improvements to energy conservation and efficiency.21 America’s buildings, which alone use more energy than any other entire economy of the world except China, are a key area for conservation efforts.22 U.S. buildings are generally grossly inefficient; it has been widely documented that energy use in new and existing buildings can be cut by 50% or more cost-effectively. 23 Lowering the cost base for location of

______________________

18 Felix Rohatyn, The Case for an Infrastructure Bank, Wall Street Journal, September 15, 2010. In the U.S. Senate, legislation, known as the “BUILD Act, was introduced on May 15, 2011 to fund an infrastructure bank.

19 See Charles Phillips, Laura Tyson, and Robert Wolf, “The U.S. Needs an Infrastructure Bank,” Wall Street Journal, January 15, 2010.

20 Wolfgang Eichhammer and Rainer Walz, “Industrial Energy Efficiency and Competitiveness,” Vienna: United Nations Industrial Development Organization, 2011.

21 See National Academy of Sciences, et al., America’s Energy Future, Technology and Transformation, Washington, DC: The National Academies Press, 2009. The report notes that “The deployment of existing energy efficiency technologies is the nearest-term and lowest-cost option for moderating our nation’s demand for energy, especially over the next decade. The committee judges that the potential energy savings available from the accelerated deployment of existing energyefficiency technologies in the buildings, transportation, and industrial sectors could more than offset the Energy Information Administration’s projected increases in U.S. energy consumption through 2030.”

22 U.S. Green Building Council, “Buildings and Climate Change,” Accessed on November 3, 2011 at http://www.documents.dgs.ca.gov/dgs/pio/facts/LA%20workshop/climate.pdf.

23 Greg Kats, Greening Our Built World, Costs, Benefits, and Strategies, Washington, DC: Island Press, 2010.

production in the United States can be fostered by improving conservation, and the techniques learned are themselves marketable globally as innovative services.

Broadband: The U.S. is regarded as lagging in broadband infrastructure. In the U.S., 27 of every 100 households subscribe to high-speed Internet service. In Germany, broadband penetration is at 30 percent. The rate is 31 percent in France, 34 percent in South Korea, 38 percent in Denmark, and 41 percent in Sweden.24 While recognizing that a number of these countries do not have the same geographical spread as the United States, the McKinsey Global Institute nonetheless estimates that the U.S. loses $450 billion in purchasing power annually due to subpar Internet connections.25

Intellectual Property: The U.S. still has one of the best legal systems in the world to protect intellectual property rights. This has made America a leader in IP-intensive industries such as pharmaceuticals, software, and entertainment.26 NDP Consulting estimates that workers in IP-intensive industries generate more than twice the output and sales per employee than do workers in non-IP-based industries. IP-intensive industries also account for around 60 percent of U.S. exports.27

Counterfeiting and patent infringement abroad undermine the economic contribution of these industries, however. An estimated 80 percent of software used in China is pirated, IDC estimates. The piracy rate stands at 61 percent in the entire Asia-Pacific region, 65 percent in Latin America, and 66 percent in Central and Eastern Europe, compared to 21 percent in North America.28 This level of piracy has a substantial effect on U.S. companies’ revenues, and therefore their long-term capacity to innovate and compete.

SUBSTANTIALLY INCREASING R&D FUNDING

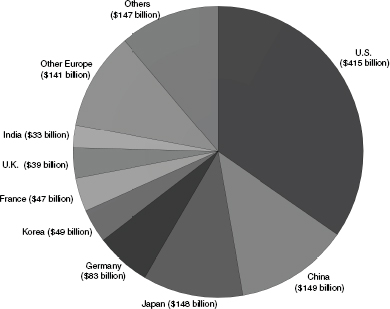

As mentioned above, the United States still enjoys a clear lead over other nations in total R&D spending. [See Figure 2.1] But as also noted earlier,

______________________

24 International Telecommunication Union and Federal Communications Commission data cited in Manyika, op. cit.

25 Ibid.

26 In many fields intellectual property protection plays only a small role in enabling firms to reap returns from their innovations. And in some fields it would appear that for the industry as a whole aggressive patenting is a negative sum game. For a survey of the economic literature, both theoretical and empirical, on the choice of intellectual property protection by firms, see Bronwyn H. Hall, Christian Helmers, Mark Rogers, and Vania Sena, “The Choice between Formal and Informal Intellectual Property: A Literature Review,” NBER Working Paper No. 17983, April 2012.

27 See Nam d. Pham, “The Impact of Innovation and the Role of Intellectual Property Rights on U.S. Productivity, Competitiveness, Jobs, Wages, and Exports,” NDP Consulting, April 2010 (http://www.theglobalipcenter.com/sites/default/files/reports/documents/IP_Jobs_Study_Exec_Summary.pdf).

28 Business Software Alliance and IDC, 08 Piracy Study, May 2009, (http://portal.bsa.org/globalpiracy2008/studies/globalpiracy2008.pdf).

FIGURE 2.1 Total global R&D spending reached $1,252 billion in 2010. SOURCE: Battelle and R&D Magazine, 2012 Global R&D Funding Forecast, December 2011.

this lead is eroding as other nations dramatically increase their investments in research—both in real terms and as a percentage of GDP.

The most dramatic gains are being made by China. R&D spending as a percentage of GDP rose from only 0.6 percent in 1996 to 1.7 percent in 2009—a period during which China’s economy grew by an astounding 12 percent a year.29 Between 2002 and 2007, the percentage of the world’s researchers living in China rose from 13.9 percent to 19.7 percent.30 Since then, China has continued to increase R&D investment by around 10 percent a year, even during the global recession. China’s long-term plans call for boosting R&D to 2.5 percent of GDP by 2020.31 The government also has set an ambitious target of

______________________

29 National Science Foundation Science and Engineering Indicators: 2010 and Ministry of Science and Technology of the People’s Republic of China, China S&T Statistics Data Book 2010, Figure 11.

30 UNESCO Science Report 2010, Paris: United Nations Educational, Scientific and Cultural Organization. Access at http://unesdoc.unesco.org/images/0018/001899/189958e.pdf.

31 China State Council, “National Medium- and Long-Term Program for Science and Technology,” op. cit.

Box 2.1

The European Union’s Growing Investments in Research and Innovation

Complementing the rising R&D expenditures of its member states, the European Union is dramatically increasing its investments in research and innovation. The new Horizon 2020 program, which succeeds the Seventh Framework Program, will invest 80 billion Euros over seven years, beginning in 2013, an increase of some 45 percent. This includes a dedicated budget of € 25 billion to strengthen the EU’s position in science; € 18 billion to strengthen Europe’s industrial leadership in innovation including greater access to capital and support for SMEs; and € 32 billion to help address global challenges such as climate change, renewable energy, and health care.32

According to the European Commissioner for Research, Innovation, and Science Máire Geoghegan-Quinn, the goal of the Horizon 2020 program is designed to transform Europe’s “world-class science base into a world-beating one.”33

producing 2 million patents of inventions, utility models, and designs annually by 2015.34

Investment in R&D has risen sharply in other nations as well. Japanese spending on research and development surged from 2.9 percent of GDP in 1995 to 3.6 percent in 2009.35 India doubled national R&D spending between 2002 and 2008, to Rupees 378 billion ($8.7 billion) annually36, and plans another 220 percent increase by 2012.37 South Korea has boosted R&D spending by an average of 10 percent annually from 1996 to 2007,38 and reportedly plans to increase the R&D-to-GDP ratio from an already-high 3.2 percent to 5 percent by 2012.39 Brazil nearly tripled R&D expenditure between 2000 and 2008, to $24.4 billion.40 Finland has boosted R&D spending from 2 percent of GDP in 1991 to

______________________

32 Access at http://ec.europa.eu/research/horizon2020/index_en.cfm?pg=h2020.

33 Neil McDonald, “Euro Commissioner visits US,” Federal Technology Watch, 10(4) January 23, 2012.

34 China State Intellectual Property Office, “National Patent Development Strategy (2011-2020).”

35 Japanese Ministry of Internal Affairs and Communications, Statistics Bureau, accessed at http://www.stat.go.jp/english/data/kagaku/index.htm. Data refer to fiscal years.

36 UNESCO, UNESCO Science Report 2010, p. 371.

37 Government of India Planning Commission, “Report of the Steering Committee on Science and Technology for Eleventh Five-Year Plan (2007-2012),” December 2006.

38 Battelle, op. cit.

39 Kim Tong-hyung, “5% of GDP Set Aside for Science Research,” Korea Times, December 12, 2009.

40 Brazil Innovation Secretary Francelino Grando, “Brazil’s New Innovation System,” National Academies symposium, Clustering for 21st Century Prosperity, Washington, DC, February 25, 2010.

3.9 percent in 2010, one of the highest levels in the world.41 In 2006, the Singapore government tripled its five-year R&D budget and set a target of pushing national spending to 3.5 percent of GDP by 2015.42

In the United States the growth in pubic R&D funding has been more uneven. Public research spending received an $18.7 billion temporary boost under the 2009 American Recovery and Re-investment Act of 2009. Congress approved significant long-term increases to non-defense R&D investment when it passed the America COMPETES Act, which pledges to double the research budget of the NSF, the DOE’s Office of Science, and NIST over seven years. However, the COMPETES Act has not yet been funded by Congress and its prospects are uncertain in the current budgetary environment.

Federal commitments to higher research spending have been flat or falling. Overall federal funding for R&D in the United States has not increased significantly since 2004, 43 and the full-year continuing resolution passed by Congress for fiscal year 2011 cut R&D spending by 3.5 percent to $144.4 billion. Under the resolution, the NIH budget was reduced by 1.1 percent, the DOE’s energy programs by 14.6 percent, the Office of Science by 1.6 percent, the NSF by 1.3 percent, and NIST by 2.5 percent.44 The Obama Administration proposed a substantial 7.3 percent increase in non-defense R&D spending for fiscal year 2011-2012. Federal support for basic and applied research, in fact, would reach its highest level in history under the proposed budget. Under the President’s plan, the NSF, NIST, and DOE would see especially large percentage increases. 45 However, fiscal challenges, precipitated by concerns about the rapid growth in the federal debt, leave the prospect of rising budgets for research and development uncertain.

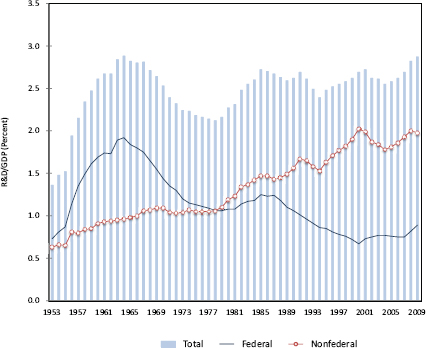

These developments come at a time when federal spending on R&D as a share of GDP has been in long-term decline.46 This decline has been masked by rising private-sector R&D spending, which has maintained total U.S. R&D spending as a percentage of GDP at a roughly constant level over the past few decades. [See Figure 2.2] The increased business R&D intensity has enabled

______________________

41 Statistics Finland, Science and Technology Statistics accessed at http://www.research.fi/en/resources/R_D_expenditure/R_D_expenditure_table and Statistics Finland, “R&D Expenditure in the Higher Education Sector Up by 11 Per Cent,” October 27, 2011.

42See Ministry of Trade and Industry, Sustaining Innovation-Driven Growth, Science and Technology, Government of Singapore, February 2006.

43 Patrick J. Clemens, “Historical Trends in Federal R&D,” in AAAS Report XXXVI: Research and Development FY 2012, Intersociety Working Group, American Association for the Advancement of Science, May 2011.

44 See analysis by American Association for the Advancement of Sciences, “R&D in the FY 2011 year-Long Continuing Resolution,” May 2, 2011.

45 AAAS Report XXXVI, op. cit.

46 Ben Bernanke, “Promoting Research and Development: The Government’s Role.” Issues in S&T, Volume XXVII (4) Summer 2011.

FIGURE 2.2 Federal funding for R&D as a share of GDP has been in long-term decline.

SOURCE: National Center for Science and Engineering Statistics, U.S. R&D Spending Suffered a Rare Decline in 2009 but Outpaced the Overall Economy, NSF 12-310 (March 2012), Figure 4.

total U.S. R&D spending to grow by 3.1 percent in constant dollars over the past 20 years.47

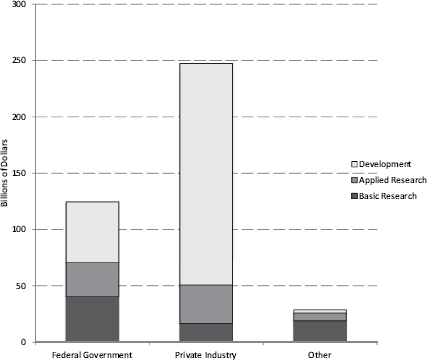

The private sector, however, spends nearly three-fourths of its R&D budget on applied R&D activities. [See Figure 2.3] The federal share, with its greater focus on basic R&D, has fallen steadily since the mid 1980s and now is about 0.7 percent of GDP —its lowest level since World War II.48

______________________

48 National Science Foundation Science and Engineering Indicators, 2010.

47 National Science Foundation, Science and Engineering Indicators: 2010, Chapter 4.

FIGURE 2.3 U.S. R&D spending by source of funding and character of expenditure, 2009.

SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Science and Engineering Indicators 2012, NSB 12-01 (January 2012), Appendix Tables 4-8, 4-9 and 4-10.

While the overall growth in total absolute R&D spending is good news, the downward trend in federal spending as a percent of GDP is less propitious for it is investments in basic research that generate the discoveries that lie behind future innovation. The burden of funding basic research is increasingly falling upon the federal government as U.S. corporations focus more of their R&D dollars on later-stage development.

The share of federal R&D that is targeted to basic research has also declined. The Department of Defense—which accounted for more than 52 percent of the federal research budget in 2011—invests around 90 percent of its R&D funds on weapons systems development, rather than on basic or applied research. [See Figure 1.4]

This does not mean the federal government can cut back on applied research. It does mean that the United States is spending a great deal less on

early stage research than the official figures might suggest. It also means that much of the U.S. R&D effort is for later-stage military purposes with limited civil applications. The R&D spending of U.S. competitors tends to be the reverse, with heavier emphasis on later-stage R&D for commercial applications. As explained below, a greater emphasis on civilian applied research will be needed in order to compete with other nations that invest more to turn new technology into products and industry, keeping in mind that many of these products eventually have military applications.

These trends in R&D spending are not, of course, entirely uniform. Not all nations are meeting their research investment targets. In 2000, for example, the European Union set a target of 3 percent of GDP by 2010 for its members. But collectively the EU remains at 1.9 percent.49 (There are notable exceptions: Germany and France are both significantly increasing their R&D budgets.50) In addition to the recent recession and financial crises, Battelle attributes the shortfall in part to high labor costs, which equal 70 percent of total R&D spending in Europe compared to 45 percent in the U.S. and 30 percent in non-Japan Asia.51 Despite strong growth since 2002, R&D spending in Brazil remains below 1 percent of GDP, although this is counterbalanced by a substantial investment in FINEP, the Brazilian Technology Agency. FINEP has a $2.5 billion budget and focuses on applied research.52

While governments have increased research funding, some are having a difficult time getting the private sector to do the same. Chinese industry accounts for just 21 percent of the nation’s R&D spending, and the vast majority of enterprises do not conduct continuous R&D.53 In Canada, business spending on R&D has remained at only around 1 percent of GDP—compared to 1.6 percent for average OECD countries54—and fell in 2010 for the third year.55 Singapore also has struggled to increase spending on innovation by private

______________________

49 Börje Johansson, Charlie Karlsson, Mikaela Backman and Pia Juusola, “The Lisbon Agenda from 2000 to 2010,” CESIS Working Paper No., 106, December 2007.

50 Chancellor Merkel’s government in Germany has proposed increasing R&D expenditures to 3 percent of GDP, up from 2.5 percent. See also remarks regarding European R&D targets by the European Commissioner for Research, Innovation, and Science Máire Geoghegan-Quinn, “Innovation for stronger regions: opportunities in FP7 Committee of the Regions” Brussels, July 14, 2011.

51 Battelle and R&D Magazine, 2011 Global R&D Funding Forecast, December 2010.

52 Xinhua, “Financing agency boosts Brazil’s innovation, productivity,” March 6, 2011.

53 See Chunlin Zhang, Douglas Zhihua Zeng, William Peter Mako, and James Seward, Promoting Enterprise-Led Innovation in China, Washington, DC: The International Bank for Reconstruction and Development/The World Bank, 2009.

54 Science, Technology, and Innovation Council, State of the Nation 2008. Ottawa: CSTI Secretariat, 2008.

55 The Daily, “Spending on Research and Development,” Statistics Canada, December 24, 2010. Access at: http://www.statcan.gc.ca/daily-quotidien/101224/dq101224a-eng.htm.

domestic companies.56 In the United States, by contrast, industry’s share of R&D funding has risen steadily and is expected to reach 64 percent in 2012.57 Industrial spending on R&D is forecast to account for all of the increase in U.S. R&D spending from 2011 to 2012.58

INSTITUTIONAL SUPPORT FOR APPLIED RESEARCH

One feature of several successful exporting nations and regions is strong public support for programs that help industries convert new technologies into manufacturing processes and products. In the United States, such collaboration on applied research typically occurs at universities that receive part of their funding from industry. Several other countries and regions have large national institutions employing thousands of scientists and engineers devoted to applied research. In such nations and regions, big public-private research institutes play a vital role in developing globally competitive industries: These institutions can effectively disseminate new technologies to a variety of domestic manufacturers. Small companies can often benefit from the lower cost through shared use of R&D personnel and equipment required to develop proofs-of-concept and to hone the manufacturing processes required for scale production.

As we see below, leading examples of institutions that support applied research include Germany’s Fraunhofer, Taiwan’s ITRI, and South Korea’s ETRI.

Germany’s Fraunhofer Gesellschaft is a network of institutes that offer some of the world’s most successful applied-research programs.59 Fraunhofer employs 4,000 Ph.D. and master’s students and has a $2.2 billion annual budget. It essentially is a contract research organization, but Germany’s federal government supplies a third of its budget. Another third is funded by the Länder, or state, governments. Private companies account for the final third. Fraunhofer operates 59 well-staffed Institutes of Applied Research across the country working closely with German manufacturers in 16 different innovation clusters. Fraunhofer Executive Director Roland Schindler described the organization as a “technology bridge,” helping industry partners develop production processes,

______________________

56 For example, see Richard W. Carney and Loh Yi Zheng, “Institutional (Dis)Incentives to Innovate: An Explanation for Singapore’s Innovation Gap,” Journal of East Asia Studies 9 (2): 291-319.

57 Battelle, op. cit.

58 Ibid.

59 For a case study of the Fraunhofer Gesellschaft, see the annex to Chapter 5 of this volume.

materials, and product designs. Fraunhofer also contributes global market research and helps promote German products abroad.60

Taiwan’s government-owned Industrial Technology Research Institute (ITRI) is one of the foremost institutes of applied industrial research in the world. Half of its $600 million annual operating budget is provided by the government and half is derived from the private sector in the form of licensing fees and payments for contract R&D. It has a staff of 5,728 personnel, of which 1,163 hold PhD’s and 3,152 Master’s degrees. ITRI functions as a technology intermediary between the domestic and international research community, on the one hand, and Taiwanese Industry, on the other hand. It is “arguably the most capable institution of its kind in the world in scanning the global technological horizon for developments of interest in Taiwanese industry, and executing the steps required to import the technology—either under license or joint development…and then absorbing and adopting the technology for Taiwanese firms to use”61. Technology is transferred to Taiwanese industry through licensing arrangements, demonstration of process technologies on internal pilot manufacturing lines, incubation of start-ups spun off from ITRI labs, and the migration of ITRI personnel to Taiwanese companies. ITRI spinoffs were the genesis of Taiwan’s semiconductor industry, a process which has been repeated in personal computers, lighting, displays, and photovoltaics62. ITRI fosters not only the start-up of companies to manufacture new products, but of complete industry chains, including design, materials, process technology development, equipment, packaging, testing, and applications.63

In South Korea, the government-funded Electronics and Telecommunications Research Institute (ETRI) plays a similar role. With

______________________

60 Presentation by Roland Schindler at the National Academies Symposium on ”Meeting Global Challenges: US-German Innovation Policy” November 11, 2010.

61 John A. Matthews and Dong-Sung Cho, Tiger Technology: The Creation of a Semiconductor Industry in East Asia, Cambridge: Cambridge University Press, 2000.

62 Sridhar Kota, “Technology Development and Manufacturing Competitiveness,” Presentation to NIST, Extreme Manufacturing workshop, January 11, 2011. Chun-yen Chang, who founded Taiwan’s first semiconductor research center at National Chiao Tung University, observed in a 2011 oral history interview that “[Y]ou can see that all the Taiwan high tech industry was originally from…the success of the semiconductor industries in Taiwan. We spun off [from the semiconductors] to LCD displays and then to the computer business. “Interview with Chun-yen Chang, Taiwanese IT Pioneers: Chun-yen Chang,” recorded February 16, 2011 (Computer History Museum, 2011), p. 11.

63 Presentation by ITRI Display Technology Center Director John Chen, Hsinchu, Taiwan (February 14, 2012).

roughly 1,700 researchers with doctoral and master’s degrees, ETRI is South Korea’s largest research institute. ETRI was central to the development of the Korean semiconductor industry, participating in the industry-government research consortia that developed Korea’s 256 megabit and 1 gigabit dynamic random access memories64. ETRI currently is number one in the world among public research organizations in terms of patents generated, with second place going to the University of California and third to MIT.65 ETRI laboratories now specialize in fields such as information technology convergence, new materials, next generation semiconductors, and new broadcast and telecom technologies.66 In the emerging field of flexible electronics, in which Korea is becoming a major player, ETRI is developing flexible memristor memory technology, utilizing graphenes, which are highly-conductive carbon nanoparticles seen as having a vast range of potential applications in electronics.67

U.S. Applied Engineering Programs

Federal applied R&D is fragmented among many agencies. A 2010 survey by MIT found that direct manufacturing R&D spending by the federal government, totaling over $700 million, is spread across four agencies. This number has risen significantly with new DARPA and DOE programs in 2011.68

The Manufacturing Extension Program of the U.S. Commerce Department, which helps small businesses apply new techniques and technologies, has a modest $125 million annual budget spread among 66 centers across the country, supported on a matching basis by the states as well as through fees.69

The National Science Foundation supports a network of more than 60 Industry/University Cooperative Research Centers specializing in fields such as advanced electronics, materials, and manufacturing, including a photovoltaic consortium involving four universities, several national laboratories, and 15 industry partners.70 NIST supports programs such as the National

______________________

64 “Taedok to Become Mecca for Venture Firms,” Chonja Sinmun (April 10, 1998).

65 “Korea’s ETRI: World Top Agency in Patents,” Korea Times (April 4, 2012).

66 Electronics and Telecommunications Research Institute, accessed at http://www.etri.se.kr/eng/.

67 “Flexible Graphene Memristors,” Printed Electronics World (December 9, 2010).

68 MIT Washington Office, Survey of Federal Manufacturing Efforts, September 2010. Access at http://web.mit.edu/dc/policy/MIT%20Survey%20of%20Federal%20Manufacturing%20Efforts.pdf.

69 For a comparative assessment of the MEP partnership, see Philip Shapira, Jan Youtie, and Luciano Kay. “Building Capabilities for Innovation in SMEs: A Cross-Country Comparison of Technology Extension Policies and Programs" International Journal of Innovation and Regional Development, 3-4 (2011): 254-272. See also Philip Shapira, “US manufacturing extension partnerships: technology policy reinvented?” Research Policy, Volume 30, Issue 6, June 2001, Pages 977–992.

70 Thomas Peterson, “The NSF Model: The Silicon Solar Consortium.” In National Research Council, The Future of Photovoltaic Manufacturing in the United States, C. Wessner, ed., Washington, DC: The National Academies Press, 2011.

Nanoelectronics Initiative71with a set of four research centers around the country72 in which 35 universities, companies such as IBM and Texas Instruments, and government agencies are striving to develop semiconductor technologies that eventually will replace CMOS as the core technology in most integrated circuits.73

National laboratories also are playing a growing role in helping industry turn technology into products. The National Renewable Energy Laboratory in Boulder, Colo., is one of the few national laboratories where commercializing technology is a top mission. Since it was founded in the 1970s, NREL has helped a number of U.S. businesses pioneer new technologies in solar power, wind energy, and bio-fuels, although its budget has fluctuated widely. Some of America’s largest applied technology programs are run by the military. The U.S. Army Tank Automotive Research, Development and Engineering Center (TARDEC), for example, collaborates extensively with private industry to apply advanced technologies in vehicles it develops.74 TARDEC’s mission, however, is to apply technologies for military needs, not commercial industries.

The U.S. government has recently launched several initiatives to boost federal support for programs aimed at translating new technology into commercial products. The DOE’s Advanced Technology Vehicle Manufacturing program, for example, provides $25 billion in direct loans to automobile and component manufacturers to fund projects aimed at improving fuel-efficiency and reducing dependence on petroleum,75 $2.4 billion of which is being used to develop advanced batteries and electrified vehicles. The Obama Administration’s 2013 Fiscal Year budget request called for $500

______________________

71 For the latest assessment of this initiative, see the President’s Council of Advisors on Science and Technology, “Report to the President And Congress on the Fourth Assessment of the National Nanotechnology Initiative,” Washington, DC: The White House, April 2012. See also Semiconductor Industry Association, “Nanoelectronics Research Initiative: A Model Government-Industry Partnership Promoting Basic Research.” Access at http://www.siaonline.org/clientuploads/One%20Pagers/Nanoelectronics_SRC_FINAL.pdf.

72 The four institutes are the South West Academy of Nanoelectronics (SWAN), headquartered at the Microelectronics Research Center at The University of Texas at Austin; The Western Institute of Nanoelectronics (WIN) in California, headquartered at the UCLA Henry Samueli School of Engineering and Applied Science; The Institute for Nanolectronics Discovery and Exploration (INDEX) in Albany, NY, headquartered at the College of Nanoscale Science and Engineering of the University at Albany; and The Midwest Institute for Nanoelectronics Discovery (MIND), led by the University of Notre Dame and includes Pennsylvania State University, Purdue University, and University of Texas-Dallas.

73 CMOS, patented by Frank Wanlass in 1967, stands for complementary metal-oxide semiconductor. CMOS is a technology for constructing integrated circuits that is used in devices such as microprocessors, static random-access memories, and image sensors.

74 See presentations by Grace Bochenek and Sonya Zanardelli of the U.S. Army Tank and Automotive Research, Development, and Engineering Center at the National Research Council conference on Building the U.S. Battery Industry for Electric-Drive Vehicles: Progress, Challenges, and Opportunities, Livonia, Michigan, July 26, 2010.

75 The Advanced Technology Vehicles Technology Loan Program was authorized under section 136 of the energy Independence and Security Act of 2007 (P. L. 110-140).

million for the DOE to aid advanced manufacturing in flexible electronics and lightweight vehicles, $200 million to DARPA for advanced manufacturing research, and increases for NSF programs relating to cyber physical systems, robotics, and advanced manufacturing.76

Another new U.S. government initiative is aimed at boosting federal assistance to development of commercial drugs. The National Institutes of Health announced Dec. 7, 2010, it would create the National Center for Advancing Translational Sciences (NCATS) by reallocating $700 million from other programs. The aim is to accelerate the pace of new drug development being brought to market by the pharmaceutical industry. 77 However, this reallocation has not taken place; instead other programs, such as Therapeutics for Rare and Neglected Diseases (TRND), have been merged and now continue under the NCATS title. Should this trend continue, it would mean that a lower program level will be available for new translational drug R&D than initially announced.

Several state governments have begun to invest in public-private applied research institutes aimed at stimulating local manufacturing industries. One of the biggest is the Albany NanoTech Complex at SUNY Albany. The complex was launched by the state government in cooperation with corporations such as IBM, Applied Materials, and Tokyo Electron. It includes one of the world’s most advanced 300 mm research fabrication plants devoted to developing prototypes of semiconductors. The complex has generated $5 billion in private investment, has 250 corporate partners, and houses 2,500 researchers, students, faculty, and staff.78 SUNY Albany’s College of Nanoscale Science and Engineering also runs a $50 million prototyping facility for micro-electromechanical systems (MEMs) and optoelectronics devices in Canandaigua, N. Y. The goal is to accelerate development of commercial devices that will be manufactured in the region.79 Other public-private programs for assisting manufacturing at the state level include the Florida Center for Advanced Aero-Propulsion and the Laboratory for Surface Science and Technology at the University of Maine and the Ohio’s Edison Technology

______________________

76 Sridhar Kota, “Opening Remarks” at the National Research Council conference on Building the U.S. Battery Industry for Electric-Drive Vehicles: Progress, Challenges, and Opportunities, Livonia, Michigan, July 26, 2010.

77 See Gardiner Harris, “Federal Research Center Will Help Develop Medicines,” New York Times, January 22, 2011.

78 Source: College of Nanoscale Science and Engineering at the University of the University of New York at Albany (SUNY-Albany). Also Pradeep Haldar “New York’s Nano Initiative,” in National Research Council, Growing Innovation Clusters for American Prosperity, C. Wessner, ed., Washington, DC: The National Academies Press, 2011.

79 College of Nanoscale Science & Engineering press release, October 23, 2010.

Centers, which includes the Northeast Ohio Manufacturing Advocacy and Growth Network (MAGNET).80

Reflecting what they see as an institutional gap in the U.S. innovation system, Germany’s Fraunhofer institutes are helping fill what they see as a gap in the U.S. innovation system by opening a number of U.S. applied technology institutes, often in collaboration with U.S. industries. Fraunhofer USA opened a non-profit state-of-the-art center to develop prototypes for laser components and systems in Plymouth, Mich., for example, and a center in Brookline, Mass., for manufacturing innovation. Other Fraunhofer centers in the U.S. focus on products such as advanced coatings, clean-energy devices, software, and molecular biotechnology applications.81

Lessons and Calls for New U.S. Institutions

The decades-old experience of organizations such as Fraunhofer, ITRI, and ETRI suggest that applied research programs run most effectively with significant, reliable, and steady financial commitment from both the government and the private sector to develop new technological options and sustain new or existing industries. Such programs also require the flexibility to adjust to new technology trends and to capture new commercial opportunities. At the same time, much of the focus of these institutions is on incremental improvements to existing industries and firms to enable them to remain globally competitive.

Some experts recommend that the federal government support new public-private intermediary institutions to accelerate industrialization of new technologies. Sridhar Kota, formerly assistant director for advanced manufacturing at the White House Office of Science and Technology Policy, has called for the U.S. to establish “Edison Institutes” modeled after those of Fraunhofer to help make maturing technologies ready for manufacturing. “We need strategic and coordinated investments to transition home-grown discoveries into home-grown products,” Dr. Kota contends.82

______________________

80 The NSF Science and Engineering Indicators for 2012 (Chapter 4) reports that $28.6 billion in 2009, or about 7% of all funding in the US. comes from sources that include academia’s own institutional funds (which support academic institution’s own R&D), other nonprofits (the majority of which fund their own R&D, but also contribute to academic research), and state and local governments (primarily for academic research).

81 Presentation by Roland Schindler at the National Academies Symposium on ”Meeting Global Challenges: US-German Innovation Policy” November 11, 2010.

82 Sridhar Kota, “Opening Remarks” at the National Research Council conference on Building the U.S. Battery Industry for Electric-Drive Vehicles: Progress, Challenges, and Opportunities, Livonia, Michigan, July 26, 2010.

In its most recent report to the President on Advanced Manufacturing, the PCAST characterizes U.S. private sector’s under-investment in important emerging technologies and in the infrastructure to support advanced manufacturing as a market failure. The report notes that individual companies cannot justify such investments because they cannot capture all the benefits for themselves. Instead, the benefits would spill over to many competitors. As a result, PCAST argues, the public sector has an important role in ensuring that new technologies are not only developed but also produced in the U.S.83

A number of government policy proposals have been offered to bolster U.S. manufacturing through support for applied research. The most recent PCAST report, for example, called for an Advanced Manufacturing Initiative spearheaded by the departments of Commerce, Defense, and Energy and coordinated by the Office of Science and Technology Policy, the National Economic Council, or the Office of the Assistant to the President for Manufacturing. Among other things, PCAST calls for federal investment of $1 billion annually for four years to support applied-research programs in potential transformational technologies, public-private partnerships to facility development of broadly applicable technologies, dissemination of new design methodologies, and shared technology infrastructure that would help U.S. manufacturers. PCAST also calls for reforms in corporate income taxes and measures to expand the skilled workforce.84 So far, however, no legislation establishing these programs has been introduced into Congress. Spence and Hlatshwayo advocate co-investment with the private sector to better align private incentives with social objectives. “It is probably a good idea to explicitly target some of the public-sector investment at technologies with the potential to expand the scope of the tradable sector and employment.”85

This call has been followed up with the recently announced National Network for Manufacturing Innovation (NNMI)— an association of precompetitive public-private consortia to conduct applied research on new technologies and design methodologies.86 According the Federal Register

______________________

83 PCAST, Report to the President on Ensuring American Leadership in Advanced Manufacturing, op. cit.

84 Ibid.

85 Michael Spence and Sandile Hlatshwayo, “The Evolving Structure of the American Economy and the Employment Challenge,” Council on Foreign Relations Working Paper, March 2011.

86 NNMI appears to be modeled in concept on Germany’s Fraunhofer-Gesellschaft, NNMI. See Chapter 5 of this report for a description of the Fraunhofer Gesellschaft. See also the presentation by Roland Schindler, Executive Director of Fraunhofer CSE, at the National Academies Symposium on Meeting Global Challenges: U.S.-German Innovation Policy, Washington, DC, November 1, 2010. Germany’s Fraunhofer system has established seven research institutes based at U.S. universities, including Michigan State University, Boston University, Massachusetts Institute of Technology, the University of Maryland, the University of Michigan, Johns Hopkins University,

notice, “The proposed Network will be composed of up to fifteen Institutes for Manufacturing Innovation (IMIs or Institutes) around the country, each serving as a hub of manufacturing excellence that will help to make United States (U.S.) manufacturing facilities and enterprises more competitive and encourage investment in the U.S. … The NNMI program will be managed collaboratively by the Department of Defense, Department of Energy, Department of Commerce’s NIST, the National Science Foundation, and other agencies. Industry, state, academic and other organizations will co-invest in the Institutes along with the NNMI program.” 87

The innovation challenge the United States faces in the 21st century was brought about by the transformation of the global economy in the last decades of the 20th century. Dramatic changes in the location of international production and in the direction of international trade flows resulted from the integration of the emerging economies into world commerce. Foreign direct investment into emerging markets transferred capital and know-how. World trade expanded more rapidly than world output, and trade in high-technology products expanded more rapidly than trade in general. This was due in large part to an increase in the growth of knowledge- and technology-intensive industries worldwide, but especially in emerging economies as they liberalized markets, increased spending on R&D and education, and adopted policies to encourage hightechnology manufacturing production and exports.88 The development of global supply chains initially increased specialization as lower value-added production was moved to lower cost locations.

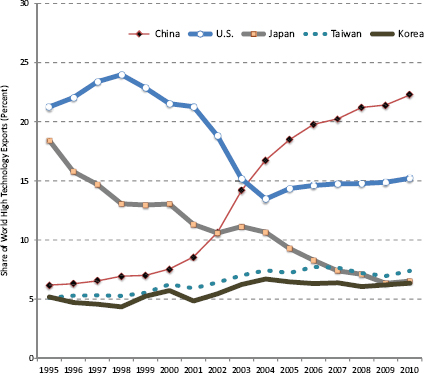

Emerging economies increasingly have moved up the value-added supply chain so that they are now competing in the same product and technology space as the United States. One measure of this increased competition is the deterioration in the U.S. trade balance in advanced-technology products that began in the late 1990s. [See Figure 2.4] The trade deficit in advanced technology products, based on data through August, will set an all-time high in 2011.

The policy objective of other nations, including emerging economies like China, and India is to move up the manufacturing value-added chain by driving innovation in their economies and increasing the technology intensity of their manufactured exports. As they do so, the United States faces increased

______________________

and the University of Delaware. These institutes provide research and development services to help translate the fruits of research at U.S. academic institutions into products for the marketplace.

87 Federal Register Notice, May 4, 2012. The President’s FY 2013 budget requests $1 billion for the NNMI program.

88 National Science Foundation, Science and Engineering Indicators 2010, chapter 6.

competition in the tradable goods manufacturing sector and increased pressure on domestic manufacturing production and employment.

To be sure, other countries are pursuing these innovation-led policies not out of any desire to cause economic disadvantage to the United States, but because it offers them the best prospects for economic growth and a high standards of living for their citizens. A recent IMF study summarized it as follows: “Technology intensive export structures generally offer better prospects for future economic growth. Trade in high-technology products tends to grow faster than average, and has larger spillover effects on skills and knowledgeintensive activities. The process of technological absorption is not passive but rather ‘capability’ driven and depends more on the national ability to harness and adapt technologies rather than on factor endowments.”89

These changes in technology and trade are massive and are occurring with great rapidity from a historical perspective. In little over a decade, for example, China has increased its share of world high-technology manufactured exports from 6 percent to 22 percent and is now the world’s largest exporter of these products. Over the same period, the U.S. share of high-technology manufactured exports fell from 21 percent to 15 percent.90 [See Figure 2.4]

China’s increase in its share of high-technology exports is reflected in statistics published by the U.S. Census Bureau on trade in advanced-technology products.91 As shown in Table 2.1, the U.S. trade deficit in advancedtechnology products in 2011 was concentrated in China. But this is more a reflection of U.S. loss of competitiveness with the Pacific Rim area in general because China primarily is an assembler of high-technology components made in nations and regions such as Japan, Taiwan, Korea, and the United States.92 China and other emerging economies, however, are continuing to move

______________________

89 The traditional factor endowments are labor and capital. See International Monetary Fund, “Changing Patterns of Global Trade,” June 15, 2011, pp. 8-9. Paul Romer much earlier stated the same idea differently. “But our knowledge of economic history, of what production looked like 100 years ago, and of current events convinces us beyond any doubt that discovery, invention, and innovation are of overwhelming importance in economic growth and that the economic goods that come from these activities are different in a fundamental way from ordinary objects.” Paul Romer, “Idea Gaps and Object Gaps in Economic Development,” Journal of Monetary Economics 32 (1993): 562.

90 National Science Foundation, Science and Engineering Indicators 2010, chapter 6. Data published by the World Bank show similar, but somewhat different results, with China’s share at 20.4 percent in 2008 and the U.S. share at 12.4 percent. World Bank, World Development Indicators at http://data.worldbank.org/indicator/TX.VAL.TECH.CD.

91 The data for advanced technology products put together by the Census Bureau is constructed from more highly disaggregated product definitions allowing for a more precise measure of U.S. trade in technology intensive products than the high technology industry-based OECD classification used in Figure 1.11. National Science Foundation, Science and Engineering Indicators 2010, pp. 6-34.

92 Robert Koopman, William Powers, Zhi Wang and Shang-Jin Wei, “Give Credit Where Credit Is Due: Tracing Value Added in Global Production Chains,” NBER Working Paper No. 16426, September 2010. See also Robert Koopman, Zhi Wang and Shang-Jin Wei, “A World Factory in Global Production Chains: Estimating Imported Value Added in Chinese Exports,” Centre for Economic Policy Research Discussion Paper No. 7430, September 2009.

FIGURE 2.4 World export shares of high-technology goods. SOURCE: National Science Foundation, National Center for Science and Engineering Statistics, Science and Engineering Indicators 2012, NSB 12-01 (January 2012), Appendix Table 6-24.

upstream in the global supply chain, increasing competition for U.S. based manufacturing.93

By shifting and reorganizing global supply chains, the globalization of the world economy has also affected the price of products, employment patterns and wages in advanced and emerging economies alike. One of the most significant changes for the United States, as documented in a recent study by Spence and Hlatshwayo, is that from 1990 to 2008, almost all incremental employment growth came from the non-tradable sector of the U.S. economy,

______________________

93 George Tassey, “Rationales and Mechanisms for Revitalizing US Manufacturing R&D Strategies,” Journal of Technology Transfer (2010) 35, pp. 283–333 and International Monetary Fund, “Changing Patterns of Global Trade,” June 15, 2011, pp. 27-29.

primarily government and health care jobs.94 There were job gains in the tradable sector in high-end services (management and consulting, computer systems design, finance and insurance) but these were offset by losses in most areas of manufacturing.95 The authors state that the manufacturing job losses were due to lower value-added positions moving offshore while higher valueadded positions remained in the United States. Looking ahead, with budget constraints at all levels of government and growing pressures to rein in the rate of growth in health care costs, major gains in future employment are unlikely to come from the non-tradable sector. The authors believe the answer lies in expanding the U.S. export sector in both high-end manufacturing and services. “To create jobs, contain inequality, and reduce the U.S. current-account deficit, the scope of the export sector will need to expand. That will mean restoring and creating U.S. competitiveness in an expanded set of activities via heightened investment in human capital, technology, and hard and soft infrastructure. The challenge is how to do it most effectively.”96

Because of the interrelationships between manufacturing and services, expanding the scope of the U.S. export sector will also necessarily expand high value-added services. As manufacturing has become more technology-intensive, the scope and nature of manufacturing has changed, increasing the demand for service occupations and service inputs at the expense of machine operators and assembly-line workers.97 “Data on occupations show that in the last decade there has been a steady increase in the share of employees in the manufacturing sector who are employed in occupations that can be considered as services-related” while at the same time in countries like the United States manufacturing has become more service intensive.98 For example, industrial products increasingly are comprised of a combination of mechanical, electrical and software components that make them more innovative, more capable and more easily updated and enhanced.99 Thus as Gregory Tassey has stated, “the fast-growing high-tech services sector must have close ties to its manufacturing base.”100

______________________

94 Michael Spence and Sandile Hlatshwayo, “The Evolving Structure of the American Economy and the Employment Challenge,” Council on Foreign Relations Working Paper, March 2011.

95 The authors state that the manufacturing job losses were due to the lower value added positions moving offshore while higher value added positions remained. Id. at 31.

96 Id. at 5.

97 OECD, OECD Science, Technology and Industry Scoreboard 2011, Paris: OECD, September 20, 2011, p. 168 and Dirk Pilat and Anita Wölfl, “Measuring the Interaction Between Manufacturing and Services,” OECD STI Working Paper, DSTI/DOC(2005)5, May 31, 2005.

98 OECD, OECD Science, Technology and Industry Scoreboard 2011, id. The OECD estimated that in 2008 services-related occupations in manufacturing in the United States were just over 50 percent of all employees in manufacturing.

99 Jim Brown, “Issue in Focus: Systems and Software Driven Innovation,” Tech-Clarity, 2011. As Janos Sztipanovits, director of Vanderbilt University’s Institute for Software Integrated Systems, stated ”More and more industrial products internal complexity is concentrating in software.” Kate Linebaugh, “GE Makes Big Bet on Software Development,” The Wall Street Journal, November 17, 2011.

TABLE 2.1 U.S. Trade in Advanced Technology Products by Country and Region in 2011

| By Country and Region (Billions of Dollars) | |||

| Country | Exports | Imports | Balance |

| China | 20.1 | 129.5 | -109.4 |

| Ireland | 2.5 | 21.6 | -19.1 |

| Mexico | 31.9 | 47.8 | -15.9 |

| Taiwan | 8.8 | 18.7 | -9.9 |

| Japan | 15.7 | 25.5 | -9.8 |

| Korea | 11.3 | 17.5 | -6.2 |

| Malaysia | 8.0 | 14.1 | -6.1 |

| Thailand | 2.9 | 7.9 | -5.0 |

| France | 10.5 | 11.2 | -0.7 |

| Germany | 13.4 | 12.7 | 0.7 |

| Singapore | 10.3 | 8.1 | 2.1 |

| U.K. | 14.0 | 10.1 | 3.9 |

| Brazil | 11.7 | 1.0 | 10.6 |

| Canada | 30.3 | 13.5 | 16.8 |

| By Region (Billions of Dollars) | |||

| Region | Exports | Imports | Balance |

| Pacific Rim | 95.7 | 219.9 | -124.2 |

| EU | 67.0 | 75.3 | -8.3 |

| Other | 124.0 | 90.8 | 33.2 |

| World | 286.7 | 386.0 | -99.3 |

SOURCE: U.S. Census Bureau, Foreign Trade, Trade in Goods with Advanced Technology Products.

Seen in this context, the innovation challenge that the United States faces is at the same time a trade competitiveness challenge and a high-tech manufacturing and services challenge. Therefore, a fundamental objective of capturing the economic value of innovation has to be increasing the output of manufacturing in the United States for high-technology, high valued-added products to grow U.S. exports and employment.101

______________________

100 Gregory Tassey, “The Manufacturing Imperative,” presentation at NAS Conference on the Manufacturing Extension Partnership, November 14, 2011. Tassey also points out that the manufacturing sector accounts for 67 percent of R&D performed by industry and 57 percent of scientists and engineers in industry are employed by manufacturing.

101 Tassey argues that “Once the premise is accepted that the only way to achieve long-term growth in jobs for a high-income economy such as the United States is through investment in technology,

The Link between Manufacturing and Innovation

Manufacturing is integral to new product development. Production lines are links in an iterative innovation chain that includes pre-competitive R&D, prototyping, product refinement, early production, and full-scale production.102 U.S. corporations still dominate a number of industries, such as personal computers and certain semiconductors, even though end products are produced offshore.103 America’s logic chip-design industry, which includes companies like Qualcomm, Nvidia, and Broadcom, relies almost entirely on silicon wafers fabricated in Asian foundries, while Apple iPods, iPhones, and iPads are assembled in China by the Taiwanese firm Hon Hai Precision Industry. In such products, the greatest economic value is in software, microprocessors, and proprietary designs, while the hardware is generally comprised of standardized parts and assembled with standard production processes.

In many high technology industries, however, design is not so easily separated from manufacturing. Production processes for advanced solar cells, lithium-ion vehicle batteries, and next-generation solid-state lighting devices are highly proprietary to the producing company and often constitute a competitive advantage. If new U.S. companies lack the domestic capability to scale up, Intel founder Andy Grove warns, “we don’t just lose jobs — we lose our hold on new technologies. Losing the ability to scale will ultimately damage our capacity to innovate.” 104

______________________

innovation, and subsequent productivity increases, the key policy issue becomes how to promote desired long-term investment in a domestic economy that must save more and consume less, while reducing budget deficits through decreased spending and increased taxes.” George Tassey, “Rationales and Mechanisms for Revitalizing US Manufacturing R&D Strategies,” Journal of Technology Transfer (2010) 35, pp. 303-304.

102 See President’s Council of Advisors on Science and Technology, “Sustaining the Nation’s Innovation Ecosystems: Information Technology Manufacturing and Competitiveness,” January 2004. (http://www.choosetocompete.org/downloads/PCAST_2004.pdf). See also President’s Council of Advisors on Science and Technology, “Report to the President on Ensuring American Leadership in Advanced Manufacturing,” June 2011.

103 A recent National Research Council study of a range of technology-intensive industries found that in many cases U.S. companies dominated market share, profits, and innovation despite a considerable shift of manufacturing and R&D work offshore. See National Research Council, Innovation in Global Industries: U.S. Firms Competing in the World, Jeffrey T. Macher and David C. Mowery, editors, Washing The National Academies Press, 2008.

104 Andy Grove, “How to Make an American Job Before it is Too Late,” Bloomberg BusinessWeek, July 1, 2010.

Box 2.2

The Case of the Display Industry

A clear example of how loss of one manufacturing industry prevents development of others is computer and TV displays. Asian producers assumed dominance of liquid-crystal displays in the 1990s as U.S. producers abandoned the industry.105

The development by U.S. companies of key technologies and materials for displays on flexible, rather than glass, substrates would seem to present a fresh opportunity for America to re-enter the potentially huge display industry. According to Ross Bringans of the Palo Alto Research Center, “flexible electronics is a very exciting direction, and there will be a lot of new technologies. We are certain that interesting business opportunities will flow out of that.” According to Dr. Bringans, these opportunities are beginning to open, particularly in Europe and East Asia.106

Two major barriers stand in the way of developing a robust U.S. based flexible electronics industry. The first is the commercial challenge of launching the industry. Bob Street of the Palo Alto Research Center has observed that Asian manufacturers such as Samsung will likely dominate this industry because the entry barriers are too high for U.S. production of displays: The ecosystem of production capacity, expertise in volume production, local equipment manufacturers, materials suppliers and technology developers reside in Asia.107 The second challenge concerns the role of the government support. In this regard, a recent study commissioned by the National Science Foundation and the Office of Naval Research of European programs to support the development and commercialization of flexible electronics technologies found that “…the relatively low prevalence of actual manufacturing and advanced systems research and development in the United States has led to an incomplete hybrid flexible electronics R&D scenario for this country….”108

______________________

105 Jeffrey Hart, “Flat Panel Displays,” in National Research Council, Innovation in Global Industries: U.S. Firms Competing in a New World, Jeffrey T. Macher and David C. Mowery, Editors, Washington, DC: The National Academies Press, 2008. For a history of the flat panel display industry, see Thomas P. Murtha, Stefanie Ann Lenway, and Jeffrey A. Hart, Managing New Industry Creation: Global Knowledge Formation and Entrepreneurship in High Technology, Palo Alto: Stanford Business Books, 2002.

106 Ross Bringans, “Challenges and Opportunities for the Flexible Electronics Industry,” Presentation at the National Academies conference on “Flexible Electronics for Security, Manufacturing, and Growth In the United States.” September 24, 2010.

107 See Bob Street, “Next Generation: The Flex Display Opportunity” in The Future of Photovoltaic Manufacturing in the United States, C. Wessner, ed., Washington, DC: The National Academies Press, 2011.

108 Ananth Dodabalpur et al., “European Research and Development in Hybrid Flexible Electronics.” Baltimore MD: WTEC, 2010.

Support for Manufacturing Overseas

Some nations aggressively support manufacturing in favored industries with a range of policy tools. They include—

• Financial Incentives: China, Singapore, Malaysia, and other nations offer 10-year tax holidays to foreign companies building factories in desired industries. The use of tax credits that eventually refund a portion of a company’s investment in plants or laboratories also is quite common. In Canada, for example, federal, provincial, and local governments offer some of the world’s most generous tax incentives for aerospace manufacturing, including investment rebates and high depreciation allowances for machinery and equipment. Nondiscretionary tax incentives for aerospace manufacturing equal $1,569 per job in Montreal and $2,617 in Winnipeg, compared to $624 in Seattle and $1,240 in Wichita.109 Canada has become a major global manufacturer of civil helicopters, flight simulators, landing gear, and gas-turbine engines.110

• Workforce Training: Some nations design the curricula of universities and polytechnics to meet the projected needs for skilled workers in desired industries. They also cover the costs of worker training for foreign investors. For example, the mission of Singapore’s Workforce Development Agency (WDA) is to “enhance the employability and competitiveness of everyone in the workforce, from the young to old workers, from the rank-and-file to professionals, managers and executives.” It realizes this mission through training and education programs as well as workshops to upgrade worker skills.111

• Leveraging Domestic Markets: A number of countries use the buying power of the government and consumer subsidies to build local demand for domestic industries. Germany’s feed-in tariffs, which are high enough to guarantee a financial return for both utilities and manufactures, largely explain why that nation has emerged as a global manufacturing leader of photovoltaic systems, for example.112 Indeed,

______________________

109 Invest in Canada Bureau, “Canada—A Strategic Choice: Canada as an Investment Destination for Aerospace” (undated).

110 Ibid.

111 Website of Singapore’s Workforce Development Agency. Access at http://app2.wda.gov.sg/web/Common/homepage.aspx.

112 A feed-in tariff is an incentive structure that sets by law a fixed guaranteed price at which power producers can sell renewable power into the electric power network. The tariff obligates regional or national electricity utilities to buy renewable electricity, such as electricity generated from solar photovoltaic panels, at above-market rates. See presentation by Bernhard Milow of the German Aerospace Center at the National Academies symposium on Meeting Global Challenges: U.S. German Innovation Policy, November 1, 2010. Also see Michael J. Ahearn. “Opportunities and Challenges Facing PV Manufacturing in the United States.” The Future of Photovoltaics

Germany’s renewable-energy sector now employs 340,000, more than the auto industry.113 To help meet its goal of having 2 million electric vehicles on the roads by 2020, the French government awards up to €5,000 to buyers of electric vehicles and plans to have state-owned companies and government agencies order 50,000 such vehicles for their fleets.114 China offers a $9,036 subsidy to buyers of electric cars and subsidizes fleet operations in 25 cities as part of its target of selling 1 million electric vehicles per year by 2020. 115 To promote domestic manufacturers of solid-state lighting, which the government hopes will be a $30 billion export industry by 2015, China is rolling out a program to help 21 major cities install 1 million street lamps using light-emitting diodes.116

• Trade Policy: Although trade barriers have fallen dramatically around the world in recent decades, some nations continue to use a variety of official and unofficial policy tools to support domestic manufacturing. It is common for countries to require foreign defense and aerospace contractors, as well as vendors of big-ticket items such as power plants and rail stock, to source some parts or to perform final assembly domestically, for example. Of major trading nations, China has the most aggressive such “import substitution” policies. The government, which has not signed World Trade Organization protocols on government procurement, essentially compels foreign makers of everything from wind turbines to high-speed trains to manufacture in China and transfer technology to domestic companies.117 Already a big exporter of solar panels, China requires at least 80 percent of equipment for its own solar power plants to be domestically produced.118 A particularly controversial policy directs state agencies to

______________________

Manufacturing in the United States; Summary of Two Symposia, C. Wessner, ed., Washington, DC: The National Academies Press, 2011.

113 Solar Progress, December 2010 Issue. Access at http://www.auses.org.au/wpcontent/uploads/2010/12/SP_DEC10.pdf.

114 David Pearson, “France Backs Battery-Charging Network for Cars,” Wall Street Journal, Oct. 1, 2009.

115 People’s Daily, “China to Sell 1 Million New-Energy Cars Annually by 2015,” Nov. 223, 2010. English translation viewable at http://english.peopledaily.com.cn/90001/90778/90860/7207607.html.

116 China Research and Intelligence, “Brief of the LED Lighting Program of 10,000 Lights in 10 Cities in China,” July 23, 2009. This article can be accessed at http://www.articlesbase.com/pressreleases-articles/brief-of-the-led-lighting-program-of-10000-lights-in-10-cities-in-china1061573.html.

117 See Jason M. Forcier, “The Battery Industry Perspective,” presented at the National Research Council conference on Building the U.S. Battery Industry for Electric-Drive Vehicles: Progress, Challenges, and Opportunities, Livonia, Michigan, July 26, 2010.

118 Keith Bradsher, “China Builds High Wall to Guard Energy Industry.” International Herald Tribune, July 13, 2009.

buy high-technology products that incorporate “indigenous innovation.”119

U.S. Support for Manufacturing

The explicit national support for domestic manufacturing in Asia and European nations such as Germany has been in sharp contrast to the United States, where support for industry has tended to be limited to defense-related manufacturing and enforcing free-trade rules. A recent report by the President’s Council of Advisors for Science and Technology (PCAST) warned that the U.S. is losing leadership in manufacturing, not only in low-tech industries that depend on low-cost foreign labor but also in high-tech products that result from U.S. innovation, inventions, and manufacturing-associated research and development.120

America’s advanced manufacturing base faces formidable competitive challenges. In some cases, according to an analysis by Erica Fuchs and Randolph Kirchain, the cost gaps between manufacturing in the U.S. and Asia are so large that they discourage innovation. It makes more economic sense for companies to import products made with mature technologies than to domestically produce advanced, better-performing products made with new technologies.121

Offshore cost advantages in high-technology products often have little to do with labor rates because manufacturing is highly automated. According to an analysis by the Manufacturing Institute, non-production expenses such as high U.S. corporate taxes, employee benefits, torts, and pollution control put American-based manufacturing at an 18 percent structural cost disadvantage compared to major trading partners and more than a 50 percent disadvantage compared to China, although rising costs elsewhere and a weaker dollar have help narrow these gaps substantially since 2006.122 Manufacturing executives

______________________

119 The State Council, People’s Republic of China, “National Medium- and Long-Term Program for Science and Technology Development, 2006-2020,” (undated).

120 President’s Council of Advisors on Science and Technology, Report to the President on Ensuring American Leadership in Advanced Manufacturing, Executive Office of the President, June 2011.

121Fuchs and Kirchain demonstrated the “dilemma” of manufacturing products with prevailing designs offshore in order to reduce as opposed to manufacturing new-technology products in the U.S. by analyzing the optoelectronic device industry. See Erica R. H. Fuchs and Rondolph Kirchain, “Design for Location? The Impact of Manufacturing Off-Shore on Technology Competitiveness in the Optoelectronics Industry,” Management Science, 56(12), pp. 2323-2349, 2010. In an analysis of optoelectronics devices, Fuchs found that U.S. manufacturing yields would have to increase.

122 Jeremy A. Leonard, “The Tide Is Turning: An Update on Structural Cost Pressures Facing U.S. Manufacturer,” The Manufacturing Institute and Manufacturers Alliance/MAPI, November 2008 (http://www.deloitte.com/assets/DcomUnitedStates/Local%20Assets/Documents/us_pip_TideIsTurning_093009.pdf). A recent Boston Consulting Group report predicts that, with respect to China, some manufacturing operations will return to the United States as wages increase in China and the U.S. dollar weakens. Harold L.

addressing NRC symposia also cited availability of workers, the lack of a domestic supply base, and inadequate access to capital for new plants or expansion as serious obstacles to keeping production in the United States.

State and federal policies and programs can help industry ameliorate these competitive gaps. Strategies for addressing these challenges include—