Estimates of Eligible Students Using the American Community Survey

In developing an approach to direct estimation,1 the panel’s first task was to determine how data collected in the American Community Survey (ACS) can be used to reflect the eligibility criteria of the school meals programs. This task has several different aspects: (1) how to use ACS variables to identify public school students, (2) how to define an economic unit’s income for purposes of evaluating a student’s eligibility for school meals, (3) how to group individuals in households to define a student’s economic unit for school meals eligibility, and (4) how to account for categorical eligibility using ACS variables. This appendix addresses issues associated with using the ACS to estimate the eligibility of students who live in households, the bulk of all public school students. As described in Chapter 3, the panel decided not to use the ACS to estimate the eligibility of students who live in group quarters. Instead estimates for these students will be provided by school districts. Another issue, discussed in Chapter 3, is how to use school-year eligibility guidelines with the calendar year ACS estimates.

____________

1 By “direct” we mean an estimator that—when one is deriving estimates for a domain— uses data only from that domain, where a domain is defined by geographic area, population group, and time period. Although an American Community Survey (ACS) 5-year period estimate is, arguably, indirect by this definition, we consider it to be direct for present purposes.

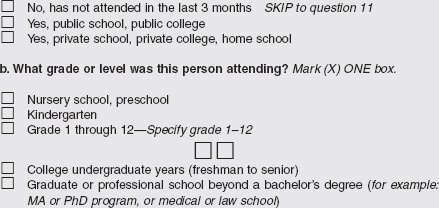

IDENTIFYING PUBLIC SCHOOL STUDENTS

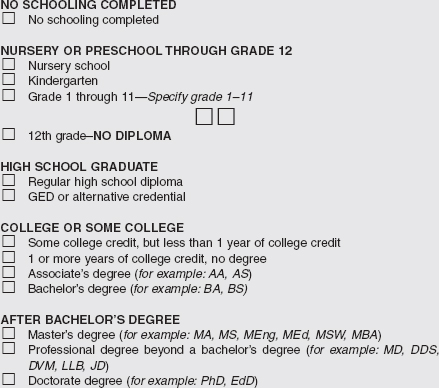

The ACS collects information about school attendance: whether the student has been attending school within the last 3 months, whether the school is public or private, and the grade attended. The ACS also collects information about each person’s age. Hence for a given geographic area, it is possible to obtain estimates for students who live in that area, attend public school, and are in approximately the appropriate grade range. In defining public school students, the panel adapted the definitions used by the Census Bureau to support the research efforts of the National Center for Education Statistics (NCES). Namely, a “student” is a person with the following responses2 to the ACS questions shown in Boxes B-1, B-2, and B-33:

- yes, attended public school or public college at some time during the past 3 months,

- highest degree or level of school completed reported as “No schooling” or “Nursery or preschool through 12 grades,” and

- age reported to be less than 20 years old.4

According to the Eligibility Manual for School Meals, U.S. Department of Agriculture/Food and Nutrition Service (2011:40)

households must report current income on a free and reduced price application. Current income means income received by the household for the current month, the amount projected for the first month for which the application is filled out, or for the month prior to application. If this income is higher or lower than usual and does not fairly represent the

____________

2 ACS data for all individuals in a household are typically provided by one person in the household.

3 Because the ACS identifies students based on their having attended school during the last 3 months rather than based on current attendance, there is a possibility that students in split families with joint custody may be living in a different household at the time of the ACS interview than they were when attending school. To the extent that children live with different parents at different times, this might cause ACS estimates to make use of the wrong household’s income.

4 NCES’s definition of public school student is as described above except that NCES applies the test in the second bullet—high school diploma or GED not reported—only to students aged 18 or 19. Hence the NCES definition includes individuals aged 0-17 who reported that they have received a high school degree and also that they attended a public school in the last 3 months. The panel’s definition excludes these individuals. According to the ACS Public Use Microdata Sample (PUMS) files for 2008, there were 245,609 students below age 18 with high school degrees or about .5% of the total number of students in 2008.

BOX B-1

ACS Questions on Schooling

10 a. At any time IN THE LAST 3 MONTHS, has this person attended school or college? Include only nursery or preschool, kindergarten, elementary school, home school, and schooling which leads to a high school diploma or a college degree.

SOURCE: See http://www.census.gov/acs/www/Downloads/questionnaires/2009/Quest09/pdf.

household’s actual circumstances, the household may, in conjunction with LEA officials, project its annual rate of income based on the guidelines given on special situations.

In the same document, FNS provides the more detailed definition of income shown in Box B-4.

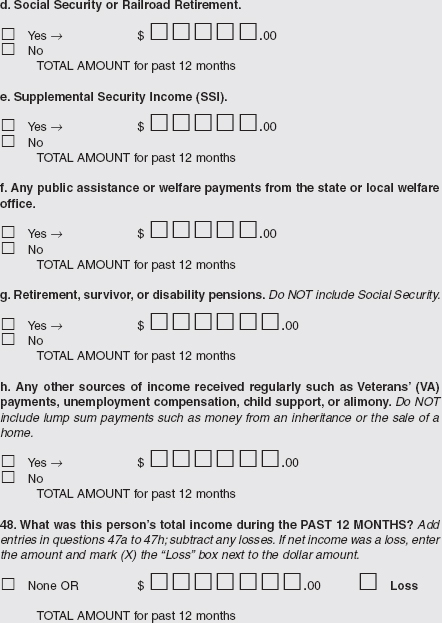

The ACS collects data on the gross money income for household members aged 15 and older, so an economic unit’s income can be compared with 130 percent and 185 percent of the applicable poverty guideline to determine the economic unit’s income eligibility status. In particular, the ACS collects the income categories shown in Box B-5 for each person 15 years of age and older.

The school meals and ACS income definitions appear to be very close, both specifically mentioning most of the same sources of income. There are a few minor differences. For example: strike benefits and workers compensation are not specifically mentioned in ACS questions, although they could be included under “any other sources of income”; railroad retirement is not specifically mentioned in the school meals definition,

BOX B-2

ACS Questions on Achievement

11. What is the highest degree or level of school this person has COMPLETED? Mark (X) ONE box. If currently enrolled, mark the previous grade or highest degree received.

SOURCE: See http://www.census.gov/acs/www/downloads/questionnaires/2009/Quest09.pdf.

but is most likely reported under “retirement income”; annuities are not specifically mentioned in ACS questions, although they are likely to be included under “retirement, survivor, or disability pensions”; investment income is not specifically mentioned in ACS questions, although it could be included under income question items “interest, dividends, etc.” or “any other sources of income”; any other money that may be available to pay for children’s meals and regular contributions from persons not living in house-

4. What is this person’s age and what is this person’s date of birth? Please report babies as age 0 when the child is less than 1 year old. Print numbers in boxes.

![]()

SOURCE: See http://www.census.gov/acs/www/Downloads/questionnaires/2009/Quest09/pdf.

hold are not specifically mentioned in ACS questions, although they could be included under “any other sources of income”; and cash withdrawn from savings is not specifically mentioned in ACS questions and is not traditionally considered to be “income.”

The panel concluded that the ACS and school meals definitions of income are sufficiently close that the ACS income definition is suitable for estimating income eligibility for the school meals programs. Nonetheless, it is important to understand the time periods to which ACS income data pertain.

The income data collected during an ACS calendar year reflect income received over 2 calendar years. For each person aged 15 and older, the ACS asks the amount of income received in the last 12 months. Consequently, an interview in January 2008 obtains income data for January 2007 through December 2007, while an interview in December 2008 obtains income for December 2007 through November 2008. The Census Bureau adjusts the income responses using a Consumer Price Index (CPI) price adjustment to reflect differences in consumer prices between the 12-month period covered by the income questions and the calendar year of the interviews.5 The resulting annual income measure appears to be com-

____________

5 The following is the Census Bureau’s description of its adjustments to income:

Adjusting Income for Inflation—Income components were reported for the 12 months preceding the interview month. Monthly Consumer Price Indices (CPI) factors were used to inflation-adjust these components to a reference calendar year (January through December). For exam ple, a household interviewed in March 2008 reports their income for March 2007 through February 2008. Their income is adjusted to the 2008 reference calendar year by multiplying their reported income by 2008 average annual CPI (January-December 2008) and then dividing by the average CPI for March 2007-February 2008. In order to inflate income amounts from previous years, the

BOX B-4

Income as Defined by FNS “Eligibility Manual for School Meals”

Income is any money received on a recurring basis, including gross earned income, unless specifically excluded by statute. Gross earned income means all money earned before such deductions as income taxes, employee’s social security taxes, insurance premiums, and bonds. Income includes but is not limited to:

• Earnings from work

— Wages, salaries, tips, commissions

— Net income from self-employed business and farms

— Strike benefits, unemployment compensation, and workers compensation

• Welfare/child support/alimony

— Public assistance payments/welfare payments (TANF, General Assistance, General Relief, etc.)

— Alimony or child support payments

• Retirement/disability payments

— Pensions, retirement income, veteran’s benefits

— Social security

— Supplemental security income

— Disability benefits

• Any other income

— Net rental income, annuities, net royalties

— Interest; dividend income

— Cash withdrawn from savings; income from estates, trusts, and/or investments

— Regular contributions from persons not living in the household

— Any other money that may be available to pay for the child(ren)’s meals.

SOURCE: U.S. Department of Agriculture/Food and Nutrition Service (2011b:39).

parable to the Current Population Survey measure (income for the prior calendar year) that is used to determine official poverty rates ( Czajka

dollar values on individual records are inflated to the latest year’s dollar values by multiplying by a factor equal to the average annual CPI-U-RS factor for the current year, divided by the average annual CPI-U-RS factor for the earlier/earliest year.

See http://www.census.gov/acs/www/Downloads/2008/usedata/2008%20ACS%20Subject%20Definitions.pdf; http://www.census.gov/hhes/www/poverty/altpovest03/cpi_u_cpi_u_rs.html; and http://www.bls.gov/cpi/cpirsdc.htm.

and Denmead, 2008). However, because the incomes collected in the ACS reflect an average of incomes received over a 2-year period, estimates from the ACS will not be as responsive to changes in economic conditions as estimates from surveys whose time frame covers a single calendar year, such as the Current Population Survey. The panel was charged with using the ACS to measure eligibility for school meals for schools, groups of schools, and school districts. For small geographic areas the only available estimates will be from the 5-year ACS. Combining the data from multiple ACS years will further smooth the income data. Consequently, when economic conditions are deteriorating, any ACS estimate will likely understate eligibility, while in periods of recovery, any ACS estimate will likely overstate eligibility. This will be more even pronounced for the 3-year and 5-year ACS estimates than for the 1-year ACS estimates.

In the school meals programs, the income information currently used to determine eligibility is reported on applications submitted to school districts. The prototype form provided on the FNS website6 gives the following instructions: “For each household member, list each type of income received for the month. You must tell us how often the money is received—weekly, every other week, twice a month, or monthly. For earnings, be sure to list the gross income, not the take-home pay. Gross income is the amount earned before taxes and other deductions.” While FNS guidelines provide flexibility in reporting of income, the data received tend to represent monthly (or more frequent), rather than annual income.7 Using annual income from the ACS to determine eligibility averages over monthly income fluctuations is likely to indicate as ineligible some students who would be eligible for free or reduced-price meals based on monthly income values (U.S. Census Bureau, 1998). The cumulative nature of eligibility for the school meals programs contributes to the understatement of eligibility if annual income is used. Once a student has been determined to be eligible in a month, the eligibility determination remains in force for the rest of the school year and for the first month of the following school year, when another eligibility determination is made. Further, if its financial situation changes a household can apply for benefits at any time. The issue of monthly versus annual income is an important one and is addressed in Appendix G.

____________

6 The prototype application form is available at http://www.fns.usda.gov/cnd/FRP/frp.process.htm.

7 Even though FNS Headquarters has no data on this, one knowledgeable person in the agency stated that “having reviewed roughly 2,500 applications in each of the past 5 years, I would say that for the most part, households are providing income data on a weekly basis, biweekly basis, or bimonthly basis. There are some school districts that require the house holds to provide monthly household income data on the applications. Very few applications provide annual data (farming households in the Midwest, etc.).”

BOX B-5

ACS Questions About Income

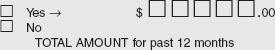

47. INCOME IN THE PAST 12 MONTHS

Mark (X) the “Yes” box for each type of income this person received, and give your best estimate of the TOTAL AMOUNT during the PAST 12 MONTHS. (NOTE: The “past 12 months” is the period from today’s date one year ago up through today.)

Mark (X) the “No” box to show types of income NOT received.

If net income was a loss, mark the “Loss” box to the right of the dollar amount.

For income received jointly, report the appropriate share for each person, or if that’s not possible, report the whole amount for only one person and mark the “No” box for the other person.

Household composition for the purpose of making an eligibility determination for free and reduced priced benefits is based on economic units. An economic unit is a group of related or unrelated individuals who are not residents of an institution or boarding house but who are living as one economic unit, and who share housing and/or significant income and expenses of its members. Generally, individuals residing in the same house are an economic unit. However, more than one economic unit may reside together in the same house. Separate economic units in the same house are characterized by prorating expenses and economic independence from each other.8

A broader—and apparently inconsistent—definition of the economic unit comes from FNS guidance9 to local school meals programs regarding the development of their application materials. Item #11 of the generic “Letter to Households” says: “Who should I include as members of my household?” The answer is: “You must include all people living in your household, related or not (such as grandparents, other relatives, or friends). You must include yourself and all children living with you.” Applicants are later instructed to list all household members and each type of income for each household member. This definition of the economic unit does not explicitly raise the possibility of multiple units living within the household and is consistent with the Census Bureau’s definition of households—all persons living in the same residence.

While the application instructions do not mention “economic units,” knowledgeable individuals who attended panel meetings noted that if applicants for the school meals programs believe there are multiple economic units in their household, they can make that argument with local school meals officials.10 Some panel members wondered whether such beliefs might be reflected on the submitted applications, with some families not including the income of persons who live in the same housing unit but whom they consider not to be part of their household. If an excluded person has more income than the decrement to the poverty guideline, excluding that person from the economic unit increases the

____________

8Eligibility Manual for School Meals, U.S. Department of Agriculture/Food and Nutrition Service (2011:37).

9 See http://www.fns.usda.gov/cnd/frp/2010_application.doc.

10 Taeuber and colleagues (2004) report on a match study of 2001 American Community Survey/Supplemental Survey (ACS/SS01) respondents and others in their households to individual administrative Supplemental Nutrition Assistance Program (SNAP) records from the state of Maryland. Eight percent of the difference between the ACS estimate and state data was due to multiple SNAP assistance units residing in the same ACS household. This is evidence that an ACS household sometimes contains multiple economic units according to SNAP definitions.

likelihood that the economic unit will be determined eligible for free or reduced-price meals. The difference between the two FNS definitions of household led to considerable discussion among panel members. Should the panel attempt to evaluate eligibility based on an “economic unit,” as defined in the Eligibility Manual for School Meals, U.S. Department of Agriculture/Food and Nutrition Service (2011:37) or should we use the broader household definition embedded in the application instructions? The panel concluded that we should do our best to evaluate eligibility based on an economic unit.

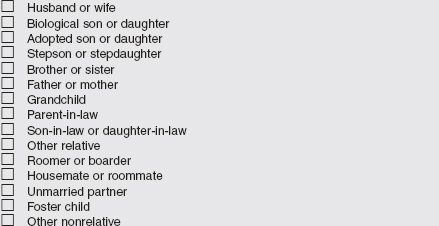

For purposes of determining which persons in the household are sharing resources and which are economically independent of other household members, the most relevant information available from the ACS consists of the answers to the questions: “How many people are living or staying at this address?” and “How is each person related to Person 1?”11Box B-6 presents the ACS question on relationship and its possible responses. Possible responses for related individuals include husband or wife, biological son or daughter, adopted son or daughter, stepson or stepdaughter, brother or sister, father or mother, grandchild, parent-in-law, son-in-law or daughter-in law, and other relative. Possible responses for unrelated individuals include roomer or boarder, housemate or roommate, unmarried partner, foster child, and other nonrelative. The Census Bureau defines all related individuals as a family, and all persons who live in the housing unit as a household.12 “Person 1” is typically referred to as the “householder.”

The ACS does not collect information on sharing of resources and expenses that can be used to distinguish separate economic units within a household. While being related to the householder does not necessarily imply a sharing of economic resources, the panel chose to make this inference as a first step. Consequently, all persons who were related to the householder (members of the family) were assumed to be members of the same economic unit. The remaining question for the panel was whether to assign unrelated individuals, particularly unmarried partners of the householder and unrelated children, to this economic unit or to other economic units within the household.

____________

11 ACS instructions define “Person 1” to be the person living or staying in the house or apartment in whose name the house or apartment is owned, being bought, or rented. If there is no such person, the person filling out the form is instructed to start with the name of any adult living or staying in the house or apartment.

12 The panel uses the Census Bureau’s definitions of family and household because we are using ACS data. However, the Census Bureau’s definitions are not uniformly adopted. For example, according to the Code of Federal Regulations for Agriculture, 7 CFR 245.2: “245.2(b) Family means a group of related or nonrelated individuals, who are not residents of an institution or boarding house, but who are living as an economic unit”; and “245.2(d) Household means family as defined in 245.2(b).”

BOX B-6

ACS Question About Relationship to Respondent

2. How is this person related to Person 1? Mark (X) ONE box.

SOURCE: See http:/www.census.gov/acs/www/Downloads/questionnaires/2009/Quest09.pdf.

The Healthy, Hunger-Free Kids Act of 2010 defines foster children whose care and placement are the responsibility of an agency that administers a State Plan or whom a court has placed with a caretaker household to be categorically eligible for school meals. Accordingly, the panel counted all foster children as eligible for free meals in the school meals programs and did not count them among the members of the foster household.13

The panel also chose to include an individual reported as an “unmarried partner” as a member of the economic unit consisting of individuals related to the householder.14 Although an individual declared to be the

____________

13 Excluding foster children from a household when determining eligibility was consis tent with guidelines in place at the time the panel developed its specifications. Under U.S. Department of Agriculture/Food and Nutrition Service (2011b) foster children are to be counted as part of the household when determining eligibility for other household children.

14 Counting of unmarried partners as part of the nuclear family was recommended by the National Research Council (1995) and was implemented in the Supplemental Poverty Measures developed as a result of that report.

householder’s partner would not be related by blood or marriage to the other members of the primary family, the panel believed that such an individual would be sharing resources with the family and decided to designate the family plus unmarried partner as the “core family.” It should be noted that not all unmarried partners in the household would be identified by the ACS question, only an individual who is an unmarried partner of the householder. An example is the situation in which the house holder’s daughter and grandchild and the daughter’s unmarried partner live in the same house with the daughter’s parents. The daughter’s partner would be identified as an “other nonrelative” and would not be included in the core family.

Further complications arise from the lack of information on how unrelated individuals, particularly children, are related to others in the household. For example, if the household includes an unmarried partner and a child who is classified as an “other nonrelative,” should the child be assumed to be the child of the unmarried partner and consequently also included in the economic unit of the householder? If there are no other unrelated adults in the household, it is probably reasonable to conclude that both the unmarried partner and the child should be included in the core family. However, if other unrelated adults are present in the household, might one of them be the child’s parent?

Because there is no perfect solution to the identification of economic units, the panel decided to examine the sensitivity of eligibility estimates to alternative assignment strategies. To this end, we prepared a number of tabulations from the 2008 ACS Public Use Microdata Sample (PUMS) files. The tables presented below illustrate characteristics of the student population and the differences in eligibility estimates that arise from different definitions of economic unit.

According to Table B-1, most of the students in the United States (97.9 percent) live in households (not group quarters) and are related to the householder. Only about 1.5 percent of students are not related to the householder and are not foster children. Foster children make up only .3 percent of the student population, as do students living in group quarters.

Table B-2 shows estimates of eligibility for school meals for related children in the United States based on the addition of various types of “unrelated people” to the economic unit that includes the core family. The table shows only estimates for related students to illustrate the impact of various definitions of the primary economic unit on eligibility for the same group of students.

For related children, the definition of the economic unit does not have a substantial impact on eligibility, although eligibility for free meals tends to decrease slightly as more individuals are included in the economic unit.

| Related Students* | Unrelated Students | Foster Students | Group Quarters Students | |

| Percentage | 97.9 | 1.5 | .3 | .3 |

| *Excludes foster and group quarters students. SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data. |

||||

TABLE B-2 Percentage of Related Students Income-Eligible for School Meals by Economic Unit

| Category | Family (%) | Family Plus Partner (%) | Family, Partner, Other Nonrelatives (%) |

Family and All but Boarders (%) | Household (%) |

| Free | 24.0 | 22.9 | 22.8 | 22.6 | 22.6 |

| Reduced Price | 11.7 | 11.7 | 11.7 | 11.7 | 11.7 |

| Full Price | 64.4 | 65.5 | 65.6 | 65.7 | 65.8 |

NOTE: Excludes unrelated, foster, and group quarters children. Also excludes unmarried partners who are students.

SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data.

The percentage eligible for free meals decreases by 1.4 percentage points as the size of the economic unit increases from family to household. There is essentially no change in the percentage eligible for reduced-price meals.

Tables B-3 and B-4 illustrate characteristics of unrelated students. Table B-3 shows the relationships to the householder reported for unrelated students in the United States on the ACS. More than 83 percent of unrelated students are reported as “other nonrelatives.” Table B-4 describes the living arrangements of unrelated students (who are not unmarried partners) in the United States. About 70 percent (20.7 percent + 49.5 percent) of unrelated children live in households with no unrelated adults,15 except perhaps for an unmarried partner. On the other hand, 26.2 percent live in households with unrelated adults and no unmarried partner, while only 3.7 percent live in a household with both an unmarried partner and other unrelated adults.

This analysis led the panel to conduct a sensitivity analysis to examine the effect of the definition of economic unit using five alternative constructions of economic unit within a household. Because foster children

____________

15 For purposes of these tabulations, an adult is an individual of at least age 20.

TABLE B-3 Relationships Reported for Students Who Are Not Related to the Householder

| No. of Unrelated Students* |

Unmarried Partner (%) |

Roomer or Boarder (%) |

Roommate or Housemate (%) |

Other Nonrelative (%) |

|

| United States | 725,669 | 5.2 | 7.4 | 4.1 | 83.4 |

*Excludes foster and group quarters students.

SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data.

TABLE B-4 Household Composition of Unrelated Students Who Are Not Unmarried Partners

| No. of Unrelated Students* |

No Unmarried Partner, No Unrelated Adult (%) |

With Unmarried Partner, No Other Unrelated Adult (%) |

No Unmarried Partner, with Unrelated Adult (%) |

With Unmarried Partner, with Unrelated Adult (%) |

|

| United States | 687,743 | 20.7 | 49.5 | 26.2 | 3.7 |

NOTE: An “adult” is a person aged 20 and older.

*Excludes foster and group quarters students.

SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data.

are considered separate economic units of size one, they were removed from the rest of the household prior to the analysis.16 The five definitions described in Table B-5 and Box B-7 reflect different ways of splitting household members into three types of economic units: the primary economic unit that includes the core family, a secondary economic unit consisting of unrelated individuals, and/or assignment of unrelated individuals to economic units of size one. Table B-5 shows how the five economic unit definitions—denoted by EU1, EU2, …, EU5—impact unrelated students in the household.

Under the first two definitions, EU1 and EU2, the primary economic unit consists only of the core family. Under EU3 and EU4, the primary economic unit consists of the core family plus any unrelated children in households that have no unrelated adults and only the core family in

____________

16 As noted previously, this was consistent with guidelines in place at the time the panel developed specifications. According to the U.S. Department of Agriculture/Food and Nutrition Service (2011b), foster children are to be counted as part of the household when determining eligibility for other household children.

| No Unmarried Partner, No Unrelated Adult (%) |

With Unmarried Partner, No Other Unrelated Adult (%) |

No Unmarried Partner, with Unrelated Adult (%) |

With Unmarried Partner, with Unrelated Adult (%) |

|

| Percentage of Unrelated Students | 20.7 | 49.5 | 26.2 | 3.7 |

| EU1 | One | One | One | One |

| EU2 | Secondary | Secondary | Secondary | Secondary |

| EU3 | Primary | Primary | One | One |

| EU4 | Primary | Primary | Secondary | Secondary |

| EU5 | Primary | Primary | Primary | Primary |

NOTES: Excludes foster and group quarters students. Primary means these students are part of the primary economic unit that includes the core family; one means each student is an economic unit of size one; secondary means these students are part of an independent secondary economic unit of unrelated individuals in the household; and an adult is a person aged 20 and older.

SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data.

households that have other unrelated adults. Under EU5, the primary economic unit consists of all household members (except foster children). EU2 and EU4 consist of a single secondary economic unit made up of all unrelated household members (except foster children). With EU1 and EU3, all unrelated individuals who are not part of the primary economic unit are assumed to be economic units of size one; if they are children, these individuals are assumed to be eligible for free meals. In some households, the only unrelated individuals are children. In EU2, these unrelated children form a separate secondary economic unit, while in EU4 they become part of the primary economic unit.

The definitions EU1 and EU2 represent extreme assumptions about economic sharing among individuals who are unrelated to the householder. EU1 assumes that unrelated persons are economically independent of the householder’s economic unit and of each other, while EU2 assumes that all unrelated individuals are independent of the householder’s economic unit but should be considered as one separate independent secondary economic unit. Compared with EU1, EU2 can be expected to lead to lower estimates of eligibility for free and reduced-price meals as the income of unrelated adults is counted in determining the eligibility of unrelated children.

The next two definitions provide a more sophisticated assignment of unrelated children. As previously noted, the presence of an unmarried

BOX B-7

Definition of Economic Units for Sensitivity Analysis

Foster children are removed from a household before the definitions of economic units described below are applied. Instead foster children are considered separate economic units of size one.

EU1: The “core” family (defined as all related individuals plus an unmarried partner of the householder) is one economic unit. All other unrelated individuals are separate economic units of size one. Since the unrelated students tend to have little income, they are all assigned—for simplicity—as eligible for free meals.

EU2: The core family is one economic unit. All other unrelated individuals in a household are considered to be a separate economic unit.

Note that for EU1 and EU2, no unrelated persons, except for unmarried partners, are added to the economic unit of the core family (family plus unmarried partner). EU1 and EU2 reflect different ways of treating the unrelated individuals.

EU3: If there are no unrelated adults (except an unmarried partner of the householder) any unrelated students (plus any other unrelated children who are not students) are combined with the core family as one economic unit. (For these households, the economic unit is the household.) If there are unrelated adults (roomers/boarders, roommates/housemates, or other nonrelatives), each unrelated individual (except an unmarried partner) is considered to be a separate economic unit of size one. Since students tend to have little income, they are all assigned—for simplicity—as eligible for free meals.

EU4: If there are no unrelated adults (except an unmarried partner), any unrelated students (plus any other unrelated children who are not students) are combined with the core family as one economic unit. (For these households, the economic unit is the household.) If there are unrelated adults (in addition to an unmarried partner), all unrelated individuals (except an unmarried partner) are combined into a separate economic unit.

EU3 and EU4 expand the economic unit that is based on the core family by adding any unrelated children if no other unrelated adults besides an unmarried partner are present. Thus, 70 percent of the unrelated students become part of the economic unit of the core family. This approach appears to be consistent with Food and Nutrition Service’s (FNS) definitions that ask applicants to “include all children living with you.” EU3 and EU4 reflect different ways of treating the unrelated children that live in households with other unrelated adults. EU3 makes all such children eligible for free meals, and EU4 makes them part of a separate economic unit that includes all unrelated individuals.

EU5: The economic unit is the household.

EU5 is at one extreme: all people who live in the housing unit are included in the economic unit.

SOURCE: Prepared by the panel.

partner without any other unrelated adults is a likely indicator that any unrelated children belong to the unmarried partner and consequently should be assigned to the primary economic unit with the unmarried partner. Likewise, if no unrelated adults are present in the household but unrelated children (other than foster children) are, the panel believed that it would be reasonable to assume that these children are economically dependent on the householder and should be included in the primary economic unit. The only difference between EU3 and EU4 is the assignment of unrelated children when there are unrelated adults other than an unmarried partner in the household. EU3 places all such unrelated children in separate economic units of size one, while EU4 places all unrelated individuals in such households in a separate secondary economic unit independent of the householder’s economic unit. EU5 considers all residents of the household, both related and unrelated, as a single economic unit.

Table B-6 displays national estimates of eligibility obtained under the five alternative definitions of economic unit for all unrelated children (excluding foster children), related children, and all students including foster children. This table does not include students living in group quarters.

While the alternative economic unit definitions have a substantial impact on the eligibility distribution for unrelated children (excluding foster children), the impact on the eligibility status of the total population of students is quite small. The fraction of students eligible for free or reduced-price meals decreases just slightly at every step from EU1 to EU5. In particular, in moving from EU4 to EU5, the percentage eligible for free or reduced-price meals declines by approximately .5 percentage points. Based on these findings, the panel concluded that any judgment we would make about how to define an economic unit would likely have only a small impact at the national level.

Income eligibility is not the sole means by which individual students can qualify for free school meals. If a household participates in the Supplemental Nutrition Assistance Program (SNAP, formerly the Food Stamp Program), Temporary Assistance for Needy Families (TANF), or the Food Distribution Program on Indian Reservations (FDPIR), a student in that household is categorically eligible for free meals. In the estimates discussed to this point, eligibility is determined based solely on income. This section examines how categorical eligibility increases the estimated rate of eligibility for free and reduced-price meals for school children. Students are categorically eligible for free meals if someone in the family

| Percentage of Students Eligible by Category and Relationship | ||||||

| Number of Students by Relationship | Category | EU1 (%) | EU2 (%) | EU3 (%) | EU4 (%) | EU5 (%) |

| Unrelated 687,743 |

Free Reduced price Full price |

100.0 0.0 0.0 |

85.2 5.7 9.1 |

42.6 8.9 48.5 |

24.7 12.5 62.8 |

18.4 12.9 68.7 |

| Related 47,714,172 |

Free Reduced price Full price |

22.9 11.7 65.4 |

22.9 11.7 65.4 |

22.9 11.7 65.4 |

22.9 11.7 65.4 |

22.6 11.7 65.7 |

| Related, Unrelated, and Foster 48,568,936 |

Free Reduced price Full price |

24.2 11.5 64.3 |

24.0 11.6 64.4 |

23.4 11.6 65.0 |

23.2 11.7 65.1 |

22.8 11.7 65.6 |

NOTE: Group quarters students not included.

SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data.

participates in certain means-tested public assistance programs targeting the low-income population. Specifically, students are categorically eligible for free meals if their families receive assistance from SNAP, TANF, or FDPIR. A student also is categorically eligible if a family member is enrolled in a Head Start or Even Start Program (based on meeting that program’s low-income criteria) or the student is (1) a homeless child as determined by the school district’s homeless liaison or by the director of a homeless shelter, (2) a migrant child as determined by the state or local Migrant Education Program coordinator, or (3) a runaway child who is receiving assistance from a program under the Runaway and Homeless Youth Act and is identified by the local education liaison.17 These definitions include students who live in households and students who may not live in typical housing units (migrant, runaway, and homeless children).

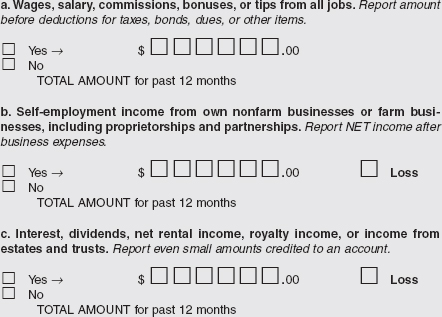

For children in households, the ACS collects information about the receipt of SNAP benefits and the receipt of public assistance income. For SNAP, the respondent reports whether any person in the household receives benefits. Public assistance income data are collected as item 47f in the income questions completed for each person in the household aged 15 and older. Specifically, the respondent is asked to report “the amount of

____________

17Eligibility Manual for School Meals, U.S. Department of Agriculture/Food and Nutrition Service (2011:48).

any public assistance or welfare payments from the state or local welfare office.” Although such an amount might include cash assistance from TANF, which confers eligibility, it might also include payments from programs that do not confer eligibility. The ACS questions about benefit receipt are shown in Box B-8.

While the ACS cannot be used to identify all types of categorical eligibility, it can be used to identify the ones that affect the greatest number of children: SNAP and TANF. One challenge in using the ACS data on benefit receipt to measure categorical eligibility, however, is reporting error that tends to understate benefit receipt.18 A match study of ACS with administrative data from Maryland’s Client Automated Resource and Eligibility System, the administrative record system for the state of Maryland, showed that many ACS respondents do not report the benefits that they actually receive.19

ACS data can be used to identify (at least some) students who are categorically eligible for school meals because someone in the household receives SNAP benefits, or if someone in the economic unit receives public assistance income. While the latter might include income from programs that do not provide categorical eligibility (hence over-counting eligibility), TANF, too, suffers from underreporting of benefits on the ACS.20 Meyer, Mok, and Sullivan (2009) showed that in 2004, the most recent year for which they had data, administrative TANF dollar amounts

____________

18 Czajka and Denmead (2008:170) report, “As a rule surveys underreport numbers of participants in means tested programs, so in comparing estimates of participation across surveys, more is generally better.” Of the surveys they examined, the Survey of Income and Program Participation (SIPP) has the highest number, 31.4 million people (or 11.2 percent of the population), in families receiving welfare or food stamps at any time during 2002. The ACS is second with 24.5 million people or 8.8 percent of the population.

19 Taeuber and colleagues (2004) report that the published (weighted) ACS/SS01 esti mate for number of households receiving SNAP benefits was 87,429 in 2000/2001, while state records showed a total of 157,857 households receiving SNAP benefits. This study matched ACS respondents and others in their household with individual administrative SNAP records from Maryland. A careful study of the discrepancy showed that 68 percent was due to underreporting of SNAP benefits on ACS from individuals who were receiving such benefits, 6 percent was due to individuals living in group quarters (not covered by ACS at the time), 8 percent was due to multiple SNAP assistance units residing in the same household, and 15 percent was due to households reporting SNAP benefits when they were not on SNAP rolls in Maryland. An earlier study by Taeuber, Staveley, and Larson (2003) showed that the underreporting was greater for households that did not have children than for households with children.

20 Lynch and colleagues (2007) matched individual ACS and TANF records for the state of Maryland. Of the 95 households in the match, 43 said “yes” to receiving public assistance and 52 said “no.” This study established that 42 of the 52 households that said “no” were actually on TANF according to Maryland and failed to report those benefits on the ACS. One reason for underreporting of TANF benefits for children is that the ACS does not collect income data for children under age 15.

BOX B-8

ACS Questions Related to Categorical Eligibility

12. IN THE PAST 12 MONTHS, did anyone in this household receive Food Stamps or a Food Stamp benefit card?

![]()

47.f. Any public assistance or welfare payments from the state or local welfare office.

SOURCE: See http://www.census.gov/acs/www/Downloads/questionnaires/2009/Quest09.pdf.

exceeded ACS reports of receipt of public assistance by 15.6 percent of total TANF receipts even though the ACS estimate includes income from other sources of public assistance.

The panel compared ACS estimates of eligibility using definitions EU4 and EU5, to evaluate the contribution of SNAP benefits and public assistance income to the percentages of children eligible for school meals. For both EU4 and EU5,Table B-7 shows eligibility percentages under four different alternatives: (1) income eligibility only, (2) income eligibility plus categorical eligibility for free meals based on receipt of SNAP benefits by anyone in the household, (3) income eligibility plus categorical eligibility for free meals based on receipt of public assistance income by anyone in the household, and (4) income eligibility plus categorical eligibility for free meals based on receipt of SNAP benefits or public assistance income by anyone in the household.

Consideration of SNAP benefits increases the percentage eligible for free meals by more than 5 percentage points under both EU4 and EU5, and accounting for both SNAP benefits and public assistance income increases the percentage eligible for free meals by about 6 percentage points. Based on our review of the eligibility rules and these findings, the panel concludes that the ACS data on SNAP benefits and public assistance income should be used in deriving estimates of eligibility because

| Percentage of Students Eligible by Category | ||||

| Category | Income Eligibility Only |

Income Eligibility Plus Categorical Eligibility Based on SNAP Benefits |

Income Eligibility Plus Categorical Eligibility Based on Public Assistance Income |

Income Eligibility Plus Categorical Eligibility Based on SNAP Benefits or Public Assistance Income |

| EU4 | ||||

| Free | 23.2 | 28.4 | 24.8 | 29.1 |

| Reduced price | 11.7 | 9.3 | 11.1 | 9.2 |

| Full price | 65.1 | 62.2 | 64.1 | 61.8 |

| EU5 | ||||

| Free | 22.8 | 28.2 | 24.5 | 28.8 |

| Reduced price | 11.7 | 9.3 | 11.0 | 9.1 |

| Full price | 65.6 | 62.5 | 64.5 | 62.1 |

NOTES: Includes related, unrelated, and foster children; excludes group quarters children.

SNAP = Supplemental Nutrition Assistance Program (formerly the Food Stamp Program).

SOURCE: Prepared by the panel using 2008 ACS Public Use Microdata Sample (PUMS) data.

these variables appear to identify students who are not eligible based on ACS income alone. Although considering children in households receiving SNAP benefits and public assistance income to be eligible for free meals resulted in levels of free eligibility closer to national estimates from administrative data, the panel’s primary remaining concern with this approach is that documented underreporting of SNAP benefits and public assistance income in the ACS is likely to result in an understatement of eligibility. The issue of underreporting of SNAP benefits and public assistance income in ACS is an important one and is addressed further in Appendix G.

MULTIPLE ECONOMIC UNITS AMONG RELATED INDIVIDUALS

To the extent that subfamilies (that are related to the householder) might have been considered separate economic units when they applied for school meals, pooling all related individuals into an economic unit could result in subfamily member children being less likely to be considered income eligible for school meals. The Census Bureau uses rela-

tionship data to define subfamilies in its ACS PUMS files.21 The panel conducted a sensitivity analysis on the impact of subfamilies on eligibility for school meals. For households with subfamilies, a subfamily with children was considered a separate economic unit (although if the household was reported as participating in SNAP, the child was still considered to be categorically eligible). At the national level, the percentage eligible for free meals increased by 1.6 percentage points, all coming from the full-price category. The challenge is that in this analysis all subfamilies were considered to be separate economic units. It is more likely that only some subfamilies are actually independent economic units, and the ACS provides no information on when individuals share resources.

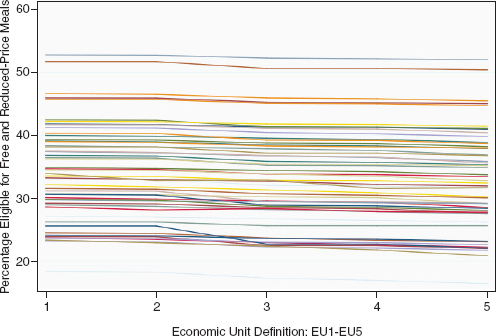

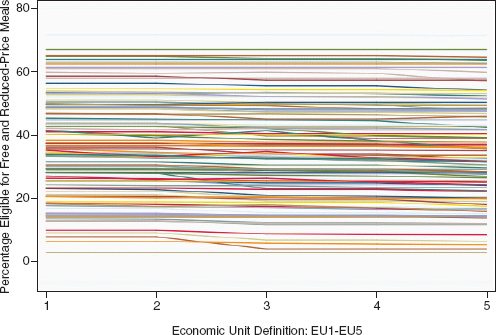

The panel noted that at a more local level, it might be possible for the choice of approach to have a greater impact, especially in areas where the proportion of students unrelated to the householder is higher than the national proportion. Accordingly, this section examines findings at two different geographic levels—the state and the school district. The 2008 PUMS data were used for all calculations. We examined the 115 school districts whose attendance boundaries align with the boundaries of one or more Public Use Microdata Areas (PUMAs).22

Impact of Alternative Definitions of the Economic Unit

Figures B-1 and B-2 plot the percentage of students eligible for free and reduced-price meals by the five alternative definitions of the economic unit for states and school districts, respectively. Each state or school district is represented by a connected line whose height at each of the five definitions (on the horizontal axis) represents the percentage of students eligible for free or reduced-price meals under that definition. A perfectly horizontal line represents the case in which the economic unit definition

____________

21 According to ACS PUMS definitions, “A subfamily is a married couple (husband and wife) interviewed as members of the same household with or without never-married chil dren under 18 years of age, or one parent with one or more never married children under 18 years old. A subfamily does not maintain its own household, but lives in a household where the householder or householder’s spouse is a relative.” Subfamilies are defined during the processing of data. Not all analysts believe that the methods used by the Census Bureau are the best possible, but they provided a target of opportunity for this analysis. See Ruggles and Brower (2003) and Schroeder (2010).

22 The panel was restricted to considering state and selected school districts because of the geographic information available on the public use ACS PUMS file. Hence this is not a complete analysis of the local impact on eligibility of economic unit definition.

FIGURE B-1 Impact of alternative economic unit definitions by state.

SOURCE: Prepared by the panel.

FIGURE B-2 Impact of alternative economic unit definitions by school district.

SOURCE: Prepared by the panel.

has no effect on the percentage eligible. While the lines are not perfectly horizontal, they do indicate that for these more local levels the economic unit definition has little effect on the percentage of students eligible for free or reduced-price meals.

The Impact of Allowing More Than One Economic Unit in the Household

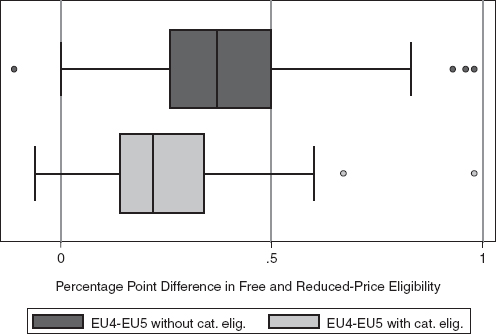

The difference between the fourth and fifth definition of the economic unit reflects the assumption of allowing the household (less foster children) to reflect the presence of a second economic unit among unrelated individuals: EU5 defines the economic unit as the whole household, while EU4 allows for the possibility of two economic units (the family and unrelated individuals). Typically one would expect that allowing for multiple units would increase the number of students eligible for free or reduced-price meals. This effect was found when ACS estimates were analyzed at the national level, and we repeated the calculations at the state level and for the 115 school districts whose boundaries aligned with PUMAs. Figure B-3 provides box plots for the distribution of the differ-

FIGURE B-3 Impact of alternative economic unit definitions on state-level eligibility (EU4-EU5) without and with categorical eligibility.

SOURCE: Prepared by the panel.

ence between the EU4 and EU5 free and reduced-price eligibility rates at the state level, both with and without accounting for categorical eligibility.

Figure B-3 shows that the difference is not always positive. In one state allowing for multiple economic units within the household lowered the eligibility rate. In all other instances, however, allowing for multiple economic units in the household increased the eligibility rate, but not by large amounts. The median increase was less than .4 percentage points without accounting for categorical eligibility and was even smaller after accounting for categorical eligibility. The increase was always less than 1 percentage point.

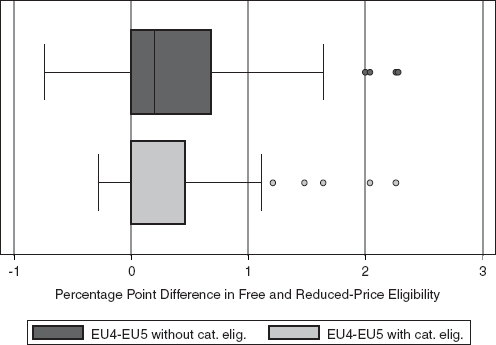

Figure B-4 displays the difference between EU4 and EU5 eligibility rates with and without categorical eligibility at the school district level. Again the difference is not always positive. However, allowing for multiple economic units tends to increase eligibility for free and reduced-price meals. These increases tend to be small, although in a few districts, they are more than 2 percentage points. Accounting for categorical eligibility reduces the difference in eligibility rates between EU4 and EU5.

The sensitivity analysis of multiple economic units among related individuals (the subfamily analysis) revealed that at the state level on

FIGURE B-4 Impact of alternative economic unit definitions on district-level eligibility (EU4-EU5) without and with categorical eligibility.

SOURCE: Prepared by the panel.

average the percentage of public school students eligible for free meals increased by 1.6 percentage points if all census-identified subfamilies are counted as separate economic units. At the school district level, the percentage eligible for free meals increases an average of 1.5 percentage points.23 The ACS provides no information about what proportion of subfamilies are actually living as independent economic units within their households, and as a result, the above increases overstate the impact of accounting for subfamilies.

These comparisons reassured the panel that using EU4 as the definition of an economic unit for determining eligibility provides a balanced approach, and by itself would not make a large difference in eligibility. This approach avoids the assumption that there is only one economic unit in a household, which is important because evidence shows that a household can have multiple economic units. However, the approach provides for at most one economic unit among unrelated individuals and does not provide for multiple economic units among related individuals. While these situations are likely to be rare, they would tend to increase eligibility (if it were possible to account for them accurately).

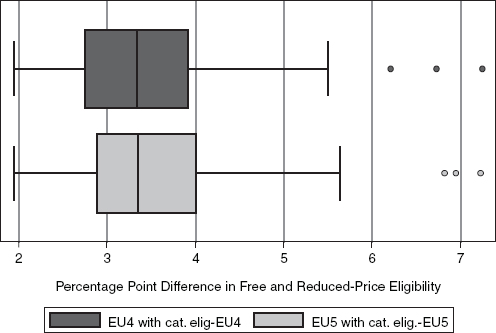

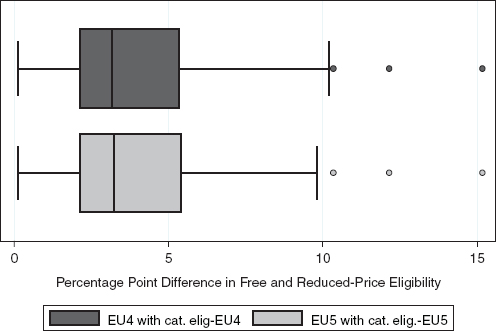

STATE AND DISTRICT ANALYSIS OF CATEGORICAL ELIGIBILITY

This section examines how accounting for categorical eligibility can increase the estimated rate of eligibility for free and reduced-price meals at the state and school district levels. For both the EU4 and EU5 definitions of an economic unit, Figures B-5 and B-6 depict the box plots for the distribution of differences between eligibility rates with and without accounting for categorical eligibility at the state and school district levels, respectively

While the impact of accounting for categorical eligibility is always positive, the impact is large for some states and school districts. The median impact at the state level is about 3.2 percentage points and for school districts is slightly higher at almost 4 percentage points. As expected, the variation in impacts is much higher at the school district level.

____________

23 In at least one example, eligibility went down because the student was in a subfamily, but the head of household had public assistance income that had qualified the student for categorical eligibility under EU4 or EU5.

FIGURE B-5 Impact of categorical eligibility at the state level with EU4 and EU5 (EUX with categorical eligibility-EUX).

SOURCE: Prepared by the panel.

FIGURE B-6 Impact of accounting for categorical eligibility at the district level with EU4 and EU5 (EUX with categorical eligibility-EUX).

SOURCE: Prepared by the panel.

The panel concluded that the definition of an economic unit should allow for multiple units within a household, as provided in the Eligibility Manual for School Meals.24 This judgment eliminated EU5 as our preferred definition. We further concluded that ACS variables pertaining to SNAP participation and the receipt of public assistance income should be used to account for categorical eligibility for free meals. We also concluded that if a household has no unrelated adult besides an unmarried partner, a reasonable assumption is to assign unrelated children to the primary economic unit. This judgment eliminated EU1 and EU2 as our preferred definition, leaving only EU3 and EU4. The only difference between these two measures is the treatment of unrelated children when unrelated adults other than an unmarried partner are present in the household. To assume that none of these adults is economically related to the children (EU3) did not seem to be a reasonable assumption. Consequently, the panel concluded that of the alternative definitions examined, EU4 should be adopted for determining eligibility for school meals. The panel realizes that this assignment rule is subject to potential errors. One type of error will occur when an unmarried partner and other unrelated adults are both present. EU4 will assign the unrelated children to the other unrelated adults to form a secondary economic unit when they may really be children of the unmarried partner and should be assigned to the primary family. A second type of error is the aggregation of all unrelated adults and children into a single secondary economic unit when more than one secondary unit should be formed. A third type of error is considering all related individuals in a household as members of the same economic unit. It is possible, for example, that in some households, a family may live as a separate economic unit in the same household as one set of parents.

____________

24 U.S. Department of Agriculture/Food and Nutrition Service (2011:37).