10

An Economic Perspective on the Veterinary Profession

Previous chapters of this report describe the committee’s examination of trends, such as the growth of the U.S. population of companion-animal owners, the consolidation of the cattle industry, and job vacancies in the pharmaceutical industry as indicators of the demand for veterinary services. The supply of available veterinary expertise was examined from the perspective of anticipated retirements, membership in professional associations, and the numbers of student deciding to pursue (or not to pursue) advanced training, for example.

In this chapter, the economic aspects of veterinary medicine are examined as an indicator of how well the supply of veterinarians is matched by the demand for their services. From both a practical and economic perspective, the nation’s veterinary workforce is most valuable when the skills, education, and experience of veterinarians match the jobs they hold. Veterinarians who have greater investments in education would expect to be rewarded with higher earnings and anticipate fulfillment in their careers once their hard-earned skills are put to good use. The nation receives the full benefit of its investment in veterinary education through the quality of care available to animals and in improvements in public health.

One would also expect a veterinary education to yield financial returns for graduates comparable to those in other careers that have similar educational requirements and lifestyles and, indeed, with returns on other financial investments of comparable risk. Of course, financial return is just one dimension of the gains associated with education. Many people value the lifestyles and other intrinsic forms of satisfaction associated with education. And of course, many veterinarians value the opportunity to work with animals, to work outdoors, and to work in science.

From an economist’s perspective, the veterinarian position match is a twoway street. Employers will seek to take advantage of the available skills in the

workplace, moving the more educated and skilled into more demanding roles and using the less skilled when it is more economical. The nation’s public and private sectors can construct their programs for animal care and public health to take advantage of appropriate skills in each role.

Mismatches between levels of educational attainment and workforce roles diminish the value of people in all professions, including veterinary medicine. One kind of mismatch can occur, for example, if demand exceeds capacity. Employers raise salaries hoping to attract individuals with the needed skills and as a result, salaries can climb beyond what is warranted relative to the level of education and skills held by job candidates. If there are too few veterinarians (in spite of the high wages offered), the knowledge inherent in veterinary medicine cannot be used widely because there are simply too few veterinarians to serve all needs.

Another kind of mismatch occurs when capacity exceeds demand. Salaries then stay below what is appropriate for the level of education and skills of a DVM. With lagging salaries, veterinarians can be underemployed, causing some to shift to careers that do not make full use of their specific veterinary skills and education. In a sense, they are victims of an overinvestment in veterinary education, meaning that the expensive training of veterinarians will not be fully worthwhile for all who are trained. Many will find their careers unsatisfying because their jobs are not challenging, and many new graduates will have difficulty in repaying their educational loans.

A third kind of mismatch occurs when the education is not attuned to the needed occupational roles. For example, an educational program that prepares many veterinarians for traditional large-animal practice could be a disservice to its graduates, as the demand for traditional large-animal veterinarians is decreasing. A program that fails to select for and develop skills in leadership, teamwork, communication, planning, and budgeting will provide a poor preparation if veterinarians are expected to manage teams of technicians and assistants.

The remainder of this chapter examines economic characteristics of the veterinary profession for signs that these mismatches might be occurring and offers suggestions for ways to establish an economic equilibrium between supply and demand.

THE RATE OF RETURN OF A DVM DEGREE

One way to assess the nation’s workforce requirements in veterinary medicine is to consider the level of earnings relative to the investment in a veterinary education. It is then possible to forecast how many veterinarians are likely to be employed in jobs that use their skill at that level of earnings. The number of veterinarians, their earnings, and the cost of education are important for understanding the changes that occur in the profession and for judging how well the number of veterinarians matches the nation’s requirements (Getz, 2007).

Using the balance between earnings and the educational investment to assess workforce needs produces different results than other analyses of the veterinary workforce, such as a recent study of veterinary medicine in New England (Koshgarian et al., 2008). That study forecast a shortfall of 650 veterinarians in New England in 2014 and a national shortfall of 4,000. The national forecast in the study predicted 3,000 new openings a year for 8 years (2006-2014) compared to an inflow of 2,700 new DVMs a year, for an annual shortfall of 10%. The study drew on the work of the so-called KPMG study (Brown and Silverman, 1999b), which focused on trends in sectors that employ veterinarians and on the age profile of veterinarians to forecast retirements (assumed to occur at the age of 65 years), but which did not consider the level of earnings associated with a DVM degree.

Planning for future workforce requirements by looking only at the number of veterinarians without considering earnings is likely to be misleading. For example, there are many older food-animal veterinarians in New England. Looking at the average age of veterinarians might lead to the view that more DVMs are needed as replacements for retirees. If the demand for food-animal veterinarians in New England is declining as seems more likely, however, younger DVMs are likely to have switched careers, leaving an aging group of veterinarians whose salaries are stagnating, and are insufficient to attract replacements. Older veterinarians are less likely to switch careers even though earnings have leveled out. They may choose to postpone retirement to reach financial goals. As the aging group of veterinarians ultimately retire, the result is likely to be a smaller number of practicing food-animal veterinarians. A consideration of earnings leads to the conclusion that fewer food-animal veterinarians are likely to be employed in New England in the future. In other words, an aging workforce with sluggish growth in earnings does not signal an impending surge in employment opportunities. Employing veterinarians requires financial resources, of course. But substantial financial resources also are required for providing training in veterinary medicine. The expected earnings and other rewards should be balanced with the cost of the education. This discussion begins with a focus on the rate of financial return and then considers other values associated with veterinary careers.

The Influence of Education on Earnings

The educational “rate of return” relates the cost of an education to one’s future earnings. An increase in earnings that results from of having attained an education is the “financial return” on that investment. As a point of reference, the rate of return on investment in a baccalaureate compared with a high-school diploma is approximately 13-16% (Getz, 2007). Assuming a real rate of interest (after inflation) of 3%, the present value of lifetime earnings for life scientists with a baccalaureate (BS) degree is $1.0 million for men and $0.8 million for women; these reflect average rates of survival and labor-force participation of college graduates of each sex.

To understand the financial return on investment in obtaining the DVM, it is helpful to look at average earnings of DVMs who are in private practice and work exclusively with companion animals. DVMs who work exclusively with small animals in private practice without post-graduate training are the largest group of veterinarians, and their earnings strongly influence the earnings of DVMs in other roles.1 Of course, veterinarians become seasoned with experience in a particular kind of career and do not easily move among the different categories. There also are important differences in earnings among categories. However, many new DVMs can choose among the categories, and shifting is common in the first years of a career. As a consequence, earnings in the dominant group, small-animal practice, have an important influence on earnings in the others.

Figure 10-1, which is a snapshot of the average income of small-animal practice owners and associates in 2005, shows that male practice owners with more years of job experience enjoyed substantially higher earnings—a phenomenon similar to that seen in many other professions. The earnings profiles for female practice owners and for career associates of either sex, however, are relatively flat with increased experience. Those differences (which can be attributed to various factors; for example, see Box 10-1) mean that the rate of return on investment in obtaining the DVM differs significantly between men and women and between practice owners and career associates.2 The simplest method for determining the financial rate of return to a DVM is to compare the earnings of those holding a DVM with the earnings of those who are working as life scientists and engineers and have a BS as their highest degree, separately for men and women (Bell et al., 2007, Figure 2-73). The path to a DVM involves the cost of forgoing earnings as a BS life scientist and paying tuition for 4 years of education after earning a BS degree with earnings beginning in year 5. From the point of view of an individual student, tuition and the forgone earnings are the primary cost of education. Assume that is $19,000 per year for an in-state student (the 2008-2009 average) (AAVMC, 2009) and $36,000 per year for out-of-state students. From the perspective of universities and state governments, the full cost of training, including state government appropriations and revenues from other sources, is about $66,000 per student per year (AAVMC, 2009).

_____________________________

1 This analysis assumes that the average DVM is similar to the average BS holder in the life sciences in most respects other than completion of the more advanced degree.

2 A note of caution: The response rate for the American Veterinary Medical Association compensation surveys is about 25%. If DVMs who are more successful are more likely to respond, the reported rate of earnings may exceed actual averages. Nonresponse may be highest among those who choose not to join the association and who are not in veterinary practice. And response rates may differ by sex in a manner that could distort comparisons.

FIGURE 10-1 Mean incomes in small-animal practice. DATA SOURCE: Calculated from AVMA, 2007d.

Assume also that the mean starting salary of veterinarians is $71,000 and of people who have a BS in the life sciences is $35,000. The present value of lifetime earnings of male practice owners net of the present value of the tuition payments is $1.6 million. Comparing that with the earnings of life scientists who have a BS yields a rate of return of 17% on investment in obtaining a DVM, which is comparable with returns for degrees in other programs of higher education. For female practice owners, however, the present value of lifetime earnings net of tuition is $0.9 million—a 10% rate of return compared with the earnings of BS life scientists. For male career associates, the present value of lifetime earnings net of tuition is $1.2 million, for a rate of return of 11% compared with the earnings of BS life scientists. For female career associates, the present value of lifetime earnings less tuition is $0.8 million, for a rate of return of 7% (Table 10-1).

For nonresident students, tuition and fees average $36,000, and rates of return are commensurately lower, as Table 10-1 shows. With out-of-state tuition and fees, the rate of return on the investment in obtaining a DVM is below 10% for all, except for male practice owners, and particularly lower for female career associates, which is 4%.

The figures in Table 10-1 are not adjusted for the number of hours worked per week, which can make a difference in the rate of return on an educational investment. As a group, associates work fewer hours than practice owners, and female associates work fewer hours than male associates. Adjusting the figures relative to hours worked might increase the rate of return of obtaining a DVM for associates relative to practice owners (and women relative to men). However, based on hours actually worked, the total return on investment will be lower for associates and women.

BOX 10-1

Possible Reasons for Differences in the Earnings of Male and Female DVMs

A partial explanation in the salary differences between male and female DVMs may be a greater likelihood that women will work part-time. In a recent survey, about 10% of male DVMs reported working part-time compared with 20% of female DVMs. Women cite childcare and a preference for working part-time more commonly than men (Donlin, 2008). In most professions, workers who withdraw from employment and then return later suffer a decrease in earnings of about 10% for each year out of the workforce (Flyer and Rosen, 1997).

A recent analysis of DVM salaries concluded that variables such as experience, hours and weeks worked, having board certification, having held a residency position, having an equity stake in the business, living in a small or moderate community, and having been married (as a proxy for having children) account for the majority of differences between male and female DVM earnings. When these factors were considered, the difference in earnings between males and female veterinarians was reduced to about 9.0% (Goldin and Katz, 2010).

Estimating the relative importance of several possible causes of the sex differential among private-practice owners will require careful investigation (Smith, 2002). One set of hypotheses involves barriers that are more consequential for women, including access to funds—given student debt—to buy more lucrative practices, the willingness of established practice owners to sell to women, and even the possibility that clients spend differently when obtaining veterinary services from women than from men. A second set of hypotheses involves possible differences in DVMs’ preferences. Female practice owners may prefer to work fewer hours, spend more time with each client, and show less zeal for owning practices and maximizing profit. A third set of hypotheses involves possible differences between men and women in responding to surveys. Surveys that request information about income and performance may have relatively low response rates. If the women and men who respond tend to come from different parts of the distribution of outcomes, the reported differences between them will be a distortion of the actual differences. If men are less likely than women to respond because they view their income as less than their expectations, the reported differences will exaggerate the sex differential.

Other hypotheses are related to the maturity of the profession and the timing of women being allowed unbiased access to admission into veterinary colleges. Women began to exceed half the enrollment in DVM programs in the 1990s. As more women began to be admitted into DVM programs, the market for private veterinary services matured. Female graduates found an arena in which there were fewer places to establish new practices and the practices available for sale were generally expensive. Another possibility is that male associates left the profession when earnings stagnated, and this resulted in the observed sex shift in the profession (Miller, 1998). Finally, outright sex discrimination in salary is a possibility. These hypotheses, of course, are not mutually exclusive and therefore need to be considered jointly. Finding and interpreting evidence to test them will be challenging.

TABLE 10-1 Estimated Average Return for Obtaining a DVM

| Annual Costs to Obtain DVM | Average Rate of Return (percent) | |||

| Male Owner | Female Owner | Male Associate | Female Associate | |

| In-state tuition and fees, $19,161 | 17.0 | 10.0 | 11.0 | 7.0 |

| Out-of-state tuition and fees, $36,055 | 14.0 | 7.0 | 8.0 | 4.0 |

| Operating cost per student, $66,366 | 10.0 | 5.0 | 5.0 | 2.0 |

DATA SOURCE: Calculated from AVMA earnings data and AAVMC, 2009.

From the point of view of the nation as a whole, the cost of schooling is the tuition paid by the students plus the funds budgeted by the government to help to finance the veterinary medical colleges. The benefits from that investment are reflected in earnings. At $66,000 per year, the total cost per student—tuition and fees plus state and other support, means that the rate of return to a DVM that reflects the full cost of the education is lower than the return that is visible to the individual student (AAVMC, 2009). As Table 10-1 shows, for male practice owners, the return that reflects the full cost is 10%; for female practice owners and male career associates, it is 5%; and for female career associates, it is 2%. Those returns are relevant to universities and state governments as they make decisions about where to invest public funds in educational programs, as discussed later in this chapter.

Now that 77% of new DVMs (active AVMA members with 2007 DVMs) and 42% of all DVMs (active AVMA members) are female, the rate of return for women is coming to dominate that of the profession and therefore defines the typical financial return on investment in obtaining the veterinary medical doctorate. More investigation will be needed to understand why female practice owners and associates earn less than male practice owners and associates and to judge whether female practice owners are likely to experience earnings more comparable with those of male practice owners in the years ahead. There appear to be many reasons why the earnings of women differ from men (see Box 10-1).

In addition, as national chains of veterinary clinics (such as Banfield, The Pet Hospital) provide an increasing share of all veterinary care, an increasing proportion of practicing veterinarians will be associates, not practice owners. The return on investment to practicing associates will play a larger role in defining the average return to DVMs than when a higher proportion of veterinarians were practice owners.

Financial returns are only one motive for pursuing a DVM degree. Many people seek a DVM because they value the opportunity to develop and use their skills in a life science to aid animals and their owners. They may value roles in improving public health and sustaining wildlife. Because these motives are important, there is no reason to expect that the financial returns in veterinary medicine will equal those of other health professions that involve similar levels of education. Nevertheless, the financial returns play a significant role in shaping the profession. At least one study on the interests of minorities in veterinary

medicine suggests that the lower financial return of a DVM degree relative to an MD degree, and the prospects of carrying a high debt load after graduation might be among the factors that dissuade greater number of minorities from applying to veterinary school, particularly if they do not share the non-financial motivations for pursuing veterinary medicine (Kendall, 2004).

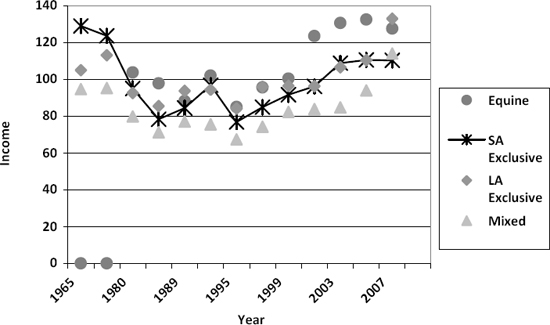

The earnings of DVMs had been on an upward trend over the last decade, recouping a decline in the 1980s and early 1990s (Getz, 1997). Figure 10-2 shows earnings for DVMs in private practice in 2006 dollars (that is, adjusted to constant 2006 dollars using the Consumer Price Index). The earnings are averages for veterinarians of all ages (and experience) employed full-time in four types of practice. All four of the practice types shown (and those not shown) experienced a substantial increase in earnings from 1995 to 2005. Equine veterinarians, who make up about 6% of practicing DVMs, showed the highest rate of increase in that time period. Veterinarians exclusively in small-animal practice, about two-thirds of the veterinarians, also showed marked increases.

The change in real earnings from 2005 to 2007, however, was essentially flat for small-animal practitioners, downward for equine practitioners, and upward for large-animal and mixed-practice veterinarians. However, salaries for both large- and mixed- animal veterinarians fell in 2009 while small-animal practitioners gained slightly (AVMA, 2011a). About 8% of AVMA members are in mixed-animal practice, which is more common in rural areas. Less than 2% of veterinarians serve large animals exclusively, and another 7% serve large animals predominantly.

FIGURE 10-2 Mean DVM income (in 2006 dollars) in private practice, 1965-2007. DATA SOURCE: AVMA annual compensation reports.

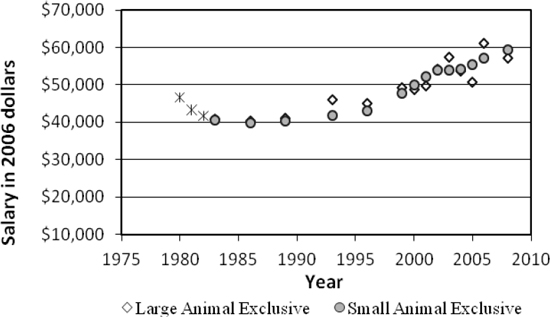

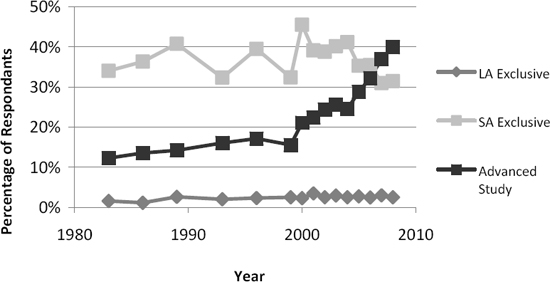

The trends in mean earnings are also reflected in starting salaries, which began to rise in the late 1990s. Figure 10-3 shows the starting salaries of all DVMs in 1980-1982 and of large- and small-animal DVMs thereafter. The salaries shown are of those who enter each type of practice with a DVM and no further training. The starting salaries of small-animal veterinarians set the pace. The starting salaries of large-animal veterinarians, which numbered fewer than 3 dozen reporting in most years, show substantial year-to-year variability. Figures 10-2 and 10-3, when considered in light of the number of new graduates entering the workforce, discussed later in this chapter, suggests that a surge in the number of new DVMs as in the 1980s led to lower earnings and that constrained growth in the number of new DVMs as in the 1990s led to higher earnings. The current trend is toward increasing numbers of graduates. The starting salaries can be better understood in the context of the flow of new graduates, as shown in Figure 10-4. Some 30-40% of new DVMs who reported their first positions begin their careers in exclusively small-animal practices. Less than 4% begin in exclusively large-animal practices. The biggest change over the last decade, however, was in the share of those who had post-DVM training, going from 16% in 1999 to 49.2% in 2011, the majority of whom pursued post-DVM internships. Advanced training in specialty fields is playing a much larger role in the career paths of DVMs, as is discussed a little later in this chapter.

The Effect of Student Debt on the Rate of Return

Education that generates a high financial return to students might justify student borrowing to pay for some of the education. Borrowing, however, involves two limits. First is the need for an income stream large enough to repay the loans, on average. When the rate of return on the added education is low, the extra income needed to repay loans may not be forthcoming. The second limit on borrowing is on wealth. Some fraction of students will suffer personal reversals, accidents, or illness or discover a mismatch in their career. If they cannot call on other wealth to repay the loans, they will be forced into personal bankruptcy or into earning permanently low incomes, with severe consequences. Students have access to loans that they may not be able to repay. The average debt of new DVMs who had loans (about 90% of all new DVMs) was $142,613 in 2011. The average starting salary was $69,789 for exclusively small-animal veterinarians, the dominant group (Shepherd and Pikel, 2011). The ratio of debt to starting salary was 2.04. At the current (2011) rate of interest on student loans (6.8%), the annual debt service for $142,613 will be in excess of $18,000 per year for a 10-year payoff. This would put the debt at about 25% of the first year of income of an associate. Financial-aid professionals use a rule of thumb that the annual debt service on student loans should not exceed 10% of earnings (University of Minnesota, 2010). By that rule, an annual income of more than $180,000 would be necessary for DVMs to sustain the average annual debt repayment of $18,000 without imposing a difficult burden on themselves. For

some fraction of students, particularly those who earn less than the average, the debt load may prove overwhelming. Although the trend toward increased student debt is common in higher education, it is a particular difficulty in veterinary medicine, in which incomes remain low relative to the cost of the education.

FIGURE 10-3 Mean starting DVM salaries (in 2006 dollars). NOTE: Response rates of annual surveys of graduating DVMs are typically greater than 90%. DATA SOURCE: AVMA Annual Surveys of Veterinary College Graduates.

FIGURE 10-4 Positions taken immediately after earning DVM, by percentage of DVM respondents. NOTE: Response rates of annual surveys of graduating DVMs are typically greater than 90%. DATA SOURCE: AVMA Annual Surveys of Veterinary College Graduates.

Comparison of Earnings in Other Health Professions

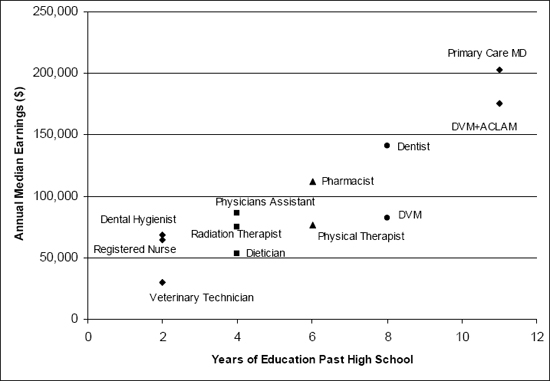

The experience in other health professions reveals how different levels of education relate to lifetime earnings. There are important roles for 2- and 4-year degree-holders, for master’s and doctoral graduates, and for those who have substantial postdoctoral training. The Bureau of Labor Statistics produces its Occupational Outlook Handbook every two years and it is the most readily available source of information on careers. The Bureau gathers data on many professions using standard methods so that information on earnings and educational requirements can be compared. That information is supplemented with the annual Occupational Employment Statistics (OES) survey. Together with the Handbook, the median earnings for health occupations reported in the OES survey gives a picture of the relationship between education and earnings in an array of health professions (see Figure 10-5).

Two-year associate degrees are inexpensive because they require less time of students and are generally offered by colleges that operate at modest cost per student. Holders of associate degrees, on the average, earn a substantial return on their investment in education as measured by the gain in earnings compared with those of typical high-school graduates. In the health professions, 2-year programs that produce registered nurses (RNs) yield very high returns. About three-fourths of new RNs enter their profession with associate degrees. In 2010, RNs had median earnings of $64,688 (BLS, 2011). Another occupation that usually begins with a 2-year degree is that of a dental hygienist. The median earning of hygienists in 2010 was $68,425.

FIGURE 10-5 Median career earnings in the health profession. NOTE: DVM = Doctor of Veterinary Medicine; ACLAM=Diplomate, American College of Laboratory Animal Medicine; MD = Medical Doctor. SOURCE: BLS, 2011 and MGMA, 2011.

Four-year BS programs involve more cost both in student time and, typically, in college funding. BS degree holders generally earn more than 2-year degree holders to justify the added expense. In the health professions, physician’s assistants (PAs) generally require at least 4 years of college, including at least 2 years before enrollment in the 2-year PA program. PAs in full-time clinical practice had median earnings of $86,403 in 2010. Dieticians must hold a BS; their median earnings were $53,248 in 2010. Radiation therapists may hold Bachelor of Arts (BA) or associate degrees or certificates; their median earnings were $75,000 in 2010 (BLS, 2011).

Master’s degree programs often involve 2 years of education after a BS. Having more expensive education generally leads to higher salaries. Physical therapists (PTs) have a master’s degree and averaged $76,315 in earnings in 2010. Pharmacists generally enter a 4-year doctor-of-pharmacy program after completing at least 2 years of college; median earnings of pharmacists in 2010 were $111,571 (BLS, 2011).

Doctoral programs generally involve 4 years of post BS education. Doctoral graduates usually earn enough to justify the higher investment in their education. Dentists, for example, had average salaries of $141,045 in 2010. Primary-care physicians generally have at least 3 years of residency training after receiving an MD or an equivalent degree. Earnings of primary-care physicians were $202,392 in 2010. Specialty physicians (not shown in figure 10-5) had median earnings of $356,885 with 14 to 17 years of post-secondary education (MGMA, 2011).

Veterinary medicine contrasts substantially with the pattern of education and earnings outlined above. Veterinary technicians may begin with 2-year associate degrees or with 4-year BS degrees, much like RNs. In 2010, veterinary technicians had median annual earnings of $29,702 (BLS, 2011). That rate is considerably less than half of the dental hygienists and RNs who had 2-year degrees. There do not appear to be BS and master’s-level occupations in veterinary medicine that are comparable with PAs and nurse practitioners.

Veterinarians with a DVM earned a median of $79,050 in 2010 (BLS, 2011). That rate is well below the earnings of pharmacists who have 2 years less education and somewhat more than half of those of dentists who, similar to the DVM, have 4 years of post BS education.

Postgraduate study, however, leads to substantial gains in veterinarians’ earnings. Some 49.2% of recent DVM graduates now pursue additional study. The average earnings of a DVM board-certified in laboratory-animal medicine was $175,034 in 2009 (AVMA, 2011a). The advanced training required for board certification yields substantially higher earnings than the DVM degree itself. In 2008, 9,305 DVMs, or about 11% of all DVMs were board-certified in at least one specialty. The DVM degree serves increasingly as preparation for more advanced study. It is difficult to forecast how the rapid increase in new DVMs who pursue advanced study may affect earnings in the decade ahead. It is possible that, as the number of board-certified DVMs increases, the market for specialty services will become saturated, depressing average earnings.

Thus, there is a mismatch between veterinary medicine and the other health professions in the cost of education versus typical earnings. The mismatch causes underemployment, turnover, career-shifting, and substantial financial burdens for graduates who have education loans. Underemployment means that professionals spend large amounts of time performing tasks that could be performed at lower expense by persons who have less education. Because of the underemployment of highly-trained professionals, earnings opportunities for those who have less training are limited; they cannot earn as much as the bottom salaries of the more highly-trained professions in veterinary medicine. Turnover means that employees move from job to job, seeking modest improvements in earnings and prospects. Career-shifting means that people move from occupations for which they had trained to occupations for which their training is less suited. Underemployment, turnover, career-shifting, and extraordinary financial burdens are all symptoms of occupations in which educational programs are not well matched to career opportunities.

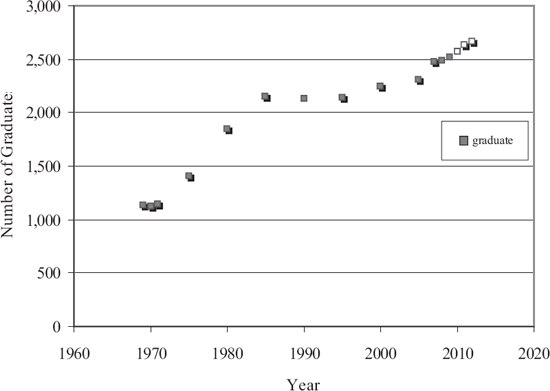

The supply of veterinarians has been growing since the late 1990s, as shown in Figure 10-6. The number of veterinary colleges expanded rapidly in the 1970s and early 1980s, and existing colleges expanded their enrollment. The surge in graduates abated in the 1990s, with the number of new DVMs at about 2,200 per year from 1985 through 1995. With the addition of a new college in California and the expansion of enrollment in other colleges, the number of graduates grew by more than 10% from 2000 to 2007, to nearly 2,500 graduates per year. On the basis of the number of students enrolled in 2010, 2,563 graduates were expected to be awarded a DVM from one of the 28 U.S. veterinary schools. The New England study mentioned earlier suggests that the number of graduates will average 2,700 by 2014 (Koshgarian et al., 2008).

Graduates of some off-shore veterinary medical colleges may, under some conditions, enter practice in the United States. Ross University in St. Kitts and St. George’s University in Grenada have articulation agreements whereby graduates of baccalaureate (4-year) colleges in the United States gain priority admission to the off-shore unaccredited DVM programs. The Ross program, for example (http://www.rossu.edu/veterinary-school/faculty/), offers dual-degree programs with five U.S. colleges. Ross requires 28 months in residence (three semesters per calendar year) in St. Kitts for seven semesters of education followed by three semesters of clinical training in one of 21 U.S. veterinary medical schools. Non-accredited foreign DVM programs generally require clinical experience in a domestic veterinary medical college for licensure in the United States. The Caribbean schools may add several hundred DVMs to the U.S. supply per year in the years ahead. AVMA has accredited nine veterinary medical colleges in Europe and Australia. Those colleges will award about 125 DVMs

per year to U.S. citizens, adding about 5% to the number of U.S. DVM graduates if all of them repatriate. Foreign graduates who achieve licensure in the United States find employment at Banfield, The Pet Hospital, and in many other areas of veterinary medicine. The overseas training programs compete with domestic veterinary programs and are growing.

The combined expansion of domestic DVM graduates and increasing foreign supply of DVMs is likely to increase the number of new DVMs who are beginning careers in the United States to over 3,000 per year within the next 10 years. Those sources of new DVMs would make up for the national shortfall in supply projected in the New England study mentioned above (Koshgarian, 2008).

The Bureau of Labor Statistics forecasts growth in employment in veterinary medicine for 2008 to 2018 (Lacey and Wright, 2010) with a 33% expansion in employment of veterinarians and 36% expansion in employment of veterinary technologists and technicians. The analysis cites expected growth in the pet population with more pet owners seeking veterinary service and the availability of increasingly sophisticated veterinary services. The analysis, however, does not take into account earnings and the likely increases in productivity as average earnings increase.

New DVM Graduates at US Colleges by Year

FIGURE 10-6 New DVM graduates by year in the United States. DATA SOURCE: AVMA with extrapolation based on current enrollments.

The role of veterinarians in addressing public health, food safety, biosecurity, animal welfare, and environmental issues will increase when public support for employment of veterinarians to address these problems expands, with compensation levels sufficient to attract and sustain appropriate talents and skills. The Bureau of Labor Statistics doesn’t mention growth in employment in these areas. When substantial employment opportunities in these areas are imminent, the veterinary colleges would want to expand the number of graduates. They are also likely to expand their research roles to widen the knowledge base of the profession in these emerging areas.

INCREASING THE RATE OF RETURN OF A VETERINARY EDUCATION

Veterinary education needs to match graduates to opportunities more effectively. The disappointingly low level of earnings of veterinarians as compared with other health professionals and the low rate of return to the DVM without advanced training are important signs that veterinary education is in need of more careful alignment with career opportunities. Also, the current veterinary workforce serves mainly companion animals. However, services related to food animals and wildlife, industry and laboratories, and public health are also important. Demand may be growing more rapidly in some sectors than in others. It will be important to adjust enrollment and veterinary education so that the preparation of graduates matches job opportunities. The challenge to the veterinary colleges is to adjust their faculty, curricula, and tuition fees in light of the changing levels of public subsidy, as discussed in Chapter 9. Several strategies might be considered:

First, holding the rate of growth in the number of graduates to a modest increase would allow the demand for veterinarians to grow more quickly than the supply and lead to an increase in average earnings, which would help to bring earnings for the DVM more into line with earnings of other health professionals.

Second, the regulatory process might be used to restructure the profession. With so many DVMs pursuing advanced training, a DVM degree is no longer the terminal degree in veterinary medicine. DVMs are now among several kinds of professionals who work with animals and public health. The growth of corporate practice, the increasing sophistication and scale of livestock production, telemedicine, and the prospect of elaborate electronic databases to track animals and outbreaks of illness may make it possible for baccalaureate and master’s degree holders who have specialized training to play important roles. The regulatory environment can adjust to changing circumstances by recognizing new roles.

Veterinary Technicians

The number of colleges offering 2-year veterinary-technician programs has grown dramatically from 69 in 1997 to 154 in 2008 (18 are 4-year programs),

and more will open (Peter Bill, Director, Veterinary Technology Program, Purdue University, 2009, personal communication). Most of the programs are in public and proprietary 2-year colleges. By 2010, students must have graduated from an AVMA-accredited veterinary-technician program if they are to take the Veterinary Technician National Examination, which is a requirement for licensure in 44 states. The 2-year colleges generally offer inexpensive programs and attract students from local areas. There are also distance-education opportunities. As noted earlier, veterinary technicians earn relatively modest salaries. It is possible that underemployed DVMs are performing functions that would be performed by veterinary technicians if the DVMs were fully employed in tasks that required their expertise.

The preceding idea suggests a comparison of the number of veterinary technicians with the number of veterinarians. According to the Occupational Outlook Handbook, 79,600 veterinary technicians in 2008 worked with 59,700 veterinarians—1.33 technicians per veterinarian (BLS, 2010). In contrast, 2.6 million registered nurses worked with 661,000 thousand physicians, a ratio of almost four to one. Exploring the relationship between doctor and technician among professions would yield a deeper understanding of differences. There were 1.23 dental hygienists per dentist and 1.58 pharmacy assistants per pharmacist in 2008. With rising incomes of veterinarians, there might be opportunities for more technicians at higher levels of earnings. Some veterinarians see technicians as competition, taking away jobs they do routinely. As veterinary incomes rise, technicians could be valuable assets who expand the practice range to underserved areas, add to the range of services offered by a practice, and increase the earnings of DVMs.

Veterinary Master’s Degree

If real earnings for DVMs were to increase, the veterinary medical profession might introduce degree programs between the veterinary technician programs (2 years) and the DVM (8 years), the analogue of nurse practitioners, physician’s assistants, and doctors of pharmacy. Such programs might entail 5 or 6 years of postsecondary education, some at the baccalaureate level and some in a professional program. Graduates of less-expensive educational programs would be well-trained professionals who are able to fill roles that are now generally filled in part by associates in veterinary practice. The specific forms and titles to be used could evolve with the programs.

The nurse practitioner profession provides an important analogue. Post-baccalaureate education of 12-36 months prepares nurses to be licensed to practice in a variety of clinical settings.3 Applicants who have 2-year degrees or baccalaureates not in nursing may be required to complete up to three semesters of

_____________________________

3 The master’s programs at the Vanderbilt School of Nursing provide examples, http://www.nursing.vanderbilt.edu/programs.html.

coursework before beginning the master’s program. Much of the master’s-level education is tracked to a specific practice arena, for example, pediatrics, midwifery, or psychiatry. The clinical experience that is part of the educational program often uses a dispersed network of sites for a wider range of experiences. Near the top of the group are certified nurse anesthetists, who complete 24-36 months of training and earned an average of $168,000 per year in 2008 (Online Nursing Degree, 2010).

It would be expected that education could be much less expensive than that for the DVM and lead to well-paid roles in clinical, agricultural, and regulatory settings. For example, as the number of livestock producers declines, the demand for veterinary services in an area—that is, the revenue that a practice can generate in an area—probably also declines. Regions that formerly supported a veterinarian can no longer do so. This is a not a sign of a shortfall in the supply of veterinarians but rather of a shortfall in employment opportunities. A limited array of veterinary services might be possible with less-expensive, less-trained personnel. Specially-trained veterinary masters might be successful in rural areas that have less demand than can support a DVM. A veterinary master’s service might be tied to a network of providers with telemedicine and coordinated records. An alternative proposal would be to create community health providers: half-time in private practice and half-time in health surveillance of livestock and wildlife. This strategy would be more expensive that using technicians, but it follows the practice used successfully in the past in national bovine tuberculosis and brucellosis programs.

Focused Veterinary Education

The selection of DVM students and the curriculum might focus on talents and skills that are likely to yield higher returns, reflecting lower cost education and higher earnings. In particular, the DVM might be more specialized, branching at some point during the 4-year program to give more emphasis to preparation for advanced study by some, for managerial roles for those pursuing roles as practice owners, and for supervisory and other roles in public health.

Specialization and Centers of Emphasis

The accreditation of the veterinary colleges (Box 10-2) has historically required each college to provide full clinical training for service to all species of domestic animals. Each college incurs the expense of a substantial animal hospital with facilities for species of little interest in a given state. Wisconsin might well prefer a higher level of support for dairy that would be possible by reducing expenditures on swine, small ruminants, and poultry. Given the declining support of state governments for veterinary training, changing the accreditation

BOX 10-2

Accreditation of Veterinary Medical Colleges

The American Veterinary Medical Association Council on Education accredits the veterinary medical colleges (AVMA, 2011d). The accreditation process sets 11 standards for the veterinary medical colleges, including curriculum and faculty. In most states, only graduates of accredited colleges and graduates of foreign programs who have satisfied requirements of the Educational Commission for Foreign Veterinary Graduates (AVMA, 2010f) or the Program for the Assessment of Veterinary Education Equivalence of the American Association of Veterinary State Boards may be licensed to practice.

rules could allow the veterinary colleges to specialize. Each may support training in the most popular areas, such as companion animals, and full training in the core disciplines that would prepare students for entry to advanced training. Each school may choose to offer advanced training in a limited number of specialties. Funding of premier programs in areas of national interest may come from regional consortia, from special tuition charges for advanced training in major areas, and from industry and government.

Because the veterinary medical profession will grow where there are employment opportunities, the veterinary medical colleges should recruit students and prepare them for tomorrow’s careers. With some degree of specialization, individual colleges can concentrate on advanced training of higher quality in subject areas that address national needs. That might also improve the financial viability of the colleges and attract new sources of financial support. Developing a “critical mass” of expertise on particular aspects of veterinary medicine could also enhance the research missions of the schools.

The role of veterinarians in promoting public health, including jobs in government (see Box 10-3), might best be pursued by a carefully organized effort to increase the employment of veterinarians and veterinary technicians through support of a Center of Emphasis (described in Chapter 9) to address specific public-health problems. Veterinary training at various levels might then be designed to produce graduates who are prepared to fill the relevant roles. The level of compensation in the public-health roles should reflect reasonable returns on investment in education at each level and would rise as earnings in private practices increase. The aggregate effect will allow each member of a team to be more productive and the whole team to provide a high level of service, perhaps at a lower cost to the public who avail of veterinary services but potentially at higher net earnings for the team of professionals.

However, training more veterinarians without expanding government public-health services will do little to improve public health. There is a compelling

case for federal agencies to support training and research in fields for which they are responsible. For example, the U.S. Department of Agriculture needs specialists and research in veterinary medicine that are important for livestock production and food safety. The Department of Homeland Security needs specialists and researchers in biohazards. The Department of Health and Human Services needs specialists and researchers in zoonotic diseases and in the problems and opportunities in the use of laboratory animals. National support for the training and research missions of the veterinary schools and colleges is essential for the intellectual future of veterinary medicine.

BOX 10-3

Addressing Vacancies in Government Service

Veterinarians in government service work primarily in the U.S. Department of Agriculture (USDA) Animal and Plant Health Inspection Service and Food Safety and Inspection Service. Those agencies have many openings for veterinarians. They offer pay below those that are generally offered to private veterinarians and often assign veterinarians to remote locations. Openings for jobs with low pay that remain unfilled are not an indication that the nation has too few veterinarians. When veterinarians command salaries commensurate with the expense of their education, USDA and other government agencies may be compelled to restructure their workforce with veterinarians in leadership and oversight roles and use 2-year and 4-year technicians and perhaps even master’s-level personnel for many front-line roles. Master practitioners would be the analogue of nurse practitioners who have 12 months to 3 years of specialty education beyond the baccalaureate and are licensed to provide a variety of services. Because federal and state governments employ a relatively small share—about 6%—of all veterinarians, government agencies must compete with the private sector in order to hire veterinarians. Nevertheless, many agencies offer salaries below those of the private sector and have many vacancies. Thus, new strategies to develop the public practice workforce are needed.