Prepared by:

Kathleen Dalton, Ph.D.

RTI International

Contents

1 Committee Changes Included in the Payment Simulations

2.1.1 New BLS-Constructed Indexes

2.1.2 Mapping BLS Areas to CBSA Markets

2.1.3 Adjusted Average Relative Wages vs. a Fixed-Weight Index

2.2 Addition of Benefits Index

2.3 Redefined GPCI Payment Areas

2.5 County Indicators for Health Professional Shortage Areas

2.6.3 Payment Impact Computations

3.2 Part B Physician and Other Practitioner Estimates

List of Exhibits

A-1 Recommended Changes in Index Construction Incorporated into Payment Simulations

A-2 Labor Markets in Source Data and Final Index Construction

A-4 Effects of Adjusting for Independent Area Variation in Benefits

A-5 County Assignments by Region, Type of Payment Locality, and CBSA Market

A-6 County Smoothing Adjustments, by Type of Index

A-7 Commuter-based smoothing adjustments by Rural—Urban Continuum Code

A-10 Distribution of estimated proportion of county population in primary care shortage areas

A-12 Budget Neutrality Factors Imposed on IOM Committee Indexes

A-13 Distribution of payment impact across all IPPS hospitals

A-14 Estimated Change in IPPS Payments, Isolated by Type of IOM Committee Recommendation

A-15 Impact of IOM Committee Recommendations on IPPS Payment, by USDA Rural- Urban Continuum Code

A-17 Impact of IOM Committee Recommendations on IPPS Payment, by Hospital Reclassification Status

A-18 Impact of IOM Committee Recommendations on IPPS Payment, by Special Rural Status

A-19 Impact of IOM Committee Recommendations on IPPS Payment, by Teaching and DSH Status

A-20 Impact of IOM Committee Recommendations on IPPS Payment, by Bed Size

A-21 Distribution of physician payment impact across all counties

A-22 Change in Aggregate Geographic Adjustment Factor, by Type of IOM Committee Recommendation

A-23 County Analysis of the Isolated Payment Effects from Redefining the GPCI Payment Areas

A-24 Physician Payment Impact of IOM Committee Recommendations, by USDA Rural- Urban Continuum Code

A-28 Physician Payment Impact of IOM Committee Recommendations, by Rural County Population Density

1 COMMITTEE CHANGES INCLUDED IN THE PAYMENT SIMULATIONS

Recommendations from the committee’s Phase I report that have been incorporated into payment simulations are presented in Exhibit A-1 below, grouped as changes in source data, changes in labor markets used for payment areas, and changes in exceptions or adjustments. Not all recommendations could be simulated accurately. For example, the recommendation for new data on geographic variation in commercial rents (a component of the practice expense [PE] geographic practice cost index [GPCI]) could not be included in the simulations because we do not have the recommended data and could not identify a reasonable proxy. The recom-

EXHIBIT A-1 Recommended Changes in Index Construction Incorporated into Payment Simulations

| Type of Recommendation | Regarding the Geographic Practice Cost Indexes | Regarding the Hospital Wage Index |

| Changes in Data [Year 1 Recommendations 2-2 and 3-3] (Note: recommendations 5-4 and 5-7 were incorporated by CMS into 2012 rates and therefore did not need to be simulated) |

• Use health care worker wages instead of all-employer wages • Use BLS-constructed indexes from public and nonpublic data for all occupations reported for physician offices surveys • Incorporate separate benefits index (from cost reports) |

• Replace hospital reported average wages with BLS-based index health care worker wages for hospital occupations • Incorporate separate benefits index (from cost reports) |

| Changes In Payment Areas (Market Definitions) [Year 1 Recommendations 2-1 and 4-1] |

• Replace the 89 payment localities (88 excluding territories not included in this analysis) with CBSA-based markets for metropolitan counties and single rest-of-state areas for nonmetropolitan counties • Apply county-based smoothing based on commuting patterns across markets |

• Apply county-based smoothing based on commuting patterns across markets (practice expense and physician work GPCIs only) |

| Changes In Exceptions and Adjustments [Year 1 Recommendation 4-2] |

• Apply county-based smoothing based on commuting patterns across markets (practice expense and physician work GPCIs only) • Eliminate frontier floors (selective replacement with other types of payment adjustments where needed) |

• Eliminate frontier floors and work GPCI floors from the index • Eliminate rural floors for metropolitan areas • Eliminate geographic reclassifications (all) |

NOTES: BLS = Bureau of Labor Statistics; CMS = Centers for Medicare & Medicaid Services; GPCI = geographic practice cost index.

mendation to incorporate geographic variation in health care worker benefits into the Bureau of Labor Statistics (BLS)-based index also cannot be implemented as envisioned without more detailed data collection; in this case, however, market-level variation in hospital worker benefits is available through Medicare cost reports, and is used as reasonable proxy.

2 TECHNICAL APPROACH

2.1 Use of BLS Data

2.1.1 New BLS-Constructed Indexes

BLS base wage indexes for the hospital wage index (HWI) and the nonphysician wage component of the PE-GPCI were computed by BLS staff at RTI’s request, in order to make use of data in small markets that were suppressed from the public use files due to privacy rules. Note that this is different from current policy, in which the Centers for Medicare & Medicaid Services (CMS) computes the GPCIs directly from wages in published data.

• Both GPCI and HWI used wages reported across all health care employers, defined as North American Industry Classification System (NAICS) code 62. Indexes were constructed from the mean wage statistic. Note that this is different from current policy, in which CMS uses the published median wage statistic.1

• BLS computed index values using fixed employment weights for physician offices (NAICS code 621100) in the nonphysician wage component of the PE-GPCI, and for general hospitals (NAICS code 622100) in the hospital index.

• For both indexes, weights for all occupations that were reported in their respective NAICS group were used in the computations.

• Missing values for any given occupation within any given BLS area were handled by renormalizing the weights for nonmissing occupations within the affected market such that the nonmissing weights for that market would sum to 1.00. Note that this is different from current policy, where CMS replaces missing data with the national median wage.

2.1.2 Mapping BLS Areas to CBSA Markets

In most parts of the country, the BLS survey data are analyzed by geographic areas that correspond to metropolitan core-based statistical areas (CBSAs) plus multiple nonmetropolitan areas within each state composed of nonmetropolitan counties grouped at the recommendations of that state. The exception is in New England, where BLS data are analyzed by New England City and Town Areas (NECTAs). Unlike CBSAs, which are composed of whole counties, NECTAs can cross multiple counties.2 This causes problems in mapping BLS data to individual counties, both for CMS when it computes current GPCIs and for the IOM’s recommended indexes. For consistency with current CMS practice, RTI used a mapping provided to us by the CMS contractor for physician payments (Acumen LLC) to assign BLS wage values to individual counties.

______________

1 Mean wages were used after it was noted that the median wages by market were more frequently suppressed in the publicly available data series; if the indexes are computed by BLS from nonpublic data, however, then median wages would be preferable in order to avoid distortion from occasional extreme values that might reflect data reporting errors.

2 See http://www.census.gov/geo/www/2010census/gtc/gtc_cbsa.html for further definitions and discussion.

Twenty-nine counties are affected by this problem; 15 map to two NECTAs, seven map to anywhere from three to nine NECTAs, and seven map to 10 or more NECTAs. Where this occurs, an employment-weighted average of the relative wages for all NECTAs associated with a given county was computed and assigned to that county. Counties were then remapped to their payment locality, and the relative wage for the locality was computed as an RVU-weighted average of county relative wages. We note, however, that RTI’s averaging may not be identical to the averages computed for CMS, and that some of the payment differences we have identified in New England areas may be due to this. It is worth emphasizing this is an area where further review might be helpful; the averaging method is a convenient, but not necessarily optimal, way to handle the problem.

Exhibit A-2 provides the number of geographic areas used for index construction in the original BLS data and the number for the final recomputed indexes for this report. GPCIs and simulations of physician payments included data from Puerto Rico but did not include data from other territories. The recomputed HWI and simulations of hospital payments did not include data from Puerto Rico, because the Inpatient Prospective Payment System (IPPS) base rates and wage index are handled somewhat differently in this territory as compared to the 50 states.

2.1.3 Adjusted Average Relative Wages vs. a Fixed-Weight Index

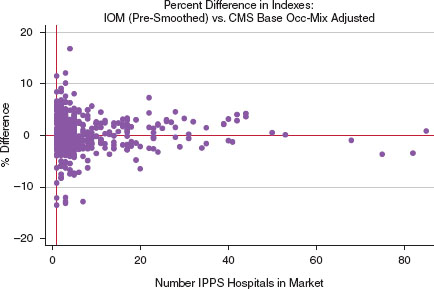

The most significant data change recommended by the Institute of Medicine (IOM) is the move in the HWI from a relative average hourly wage to a fixed-weight index. Addition of the benefits index to the BLS-based wage index (see Section 2.2, below) makes the BLS data more comparable to the IPPS average hourly wage data, but major differences remain due to (a) substituting BLS’s average wages from all health care employers for wages paid by IPPS hospitals, and (b) substituting a fixed-weight construction with a national average hospital occupation mix as weights, for average hourly wages reflecting each individual hospital’s occupation mix with only a partial adjustment to standardize for national average mix of nursing personnel. RTI found that the percent differences between the CMS occupation-mix adjusted hospital index and benefits-adjusted BLS-based index are relatively small in large markets where several hospitals contribute to the CMS hospital index, but the differences become quite large (whether

EXHIBIT A-2 Labor Markets in Source Data and Final Index Construction

| BLS-Based Wage Areas | IOM Proposed GPCI Labor Markets | IOM and CMS HWI Labor Markets | |

| Non metropolitan | 60 | 48 | 48 |

| Metropolitan, CBSA-based | 368 | 384 | 384 |

| Metropolitan, NECTA-based | 29 | 0 | 0 |

| Subtotal Excluding Territories | 457 | 432 | 432 |

| Puerto Rico, Metropolitan* | 8 | 8 | 0 |

| Puerto Rico, Nonmetropolitan* | 1 | 1 | 0 |

| Total | 466 | 441 | 432 |

NOTES: BLS = Bureau of Labor Statistics; CBSA = core-based statistical area; CMS = Centers for Medicare & Medicaid Services; GPCI = geographic practice cost index; HWI = hospital wage index; IOM = Institute of Medicine; NECTA = New England City and Town Area.

*Payment areas in Puerto Rico are included in the HWI but are adjusted separately due to special exceptions in the computation of the standardized rates for this area. All HWI analyses for the IOM Committee exclude these areas. Payment areas in other territories are excluded from both HWI and GPCI analyses.

SOURCES: RTI Analysis of CMS Wage Index Files; Communication from Acumen LLC, received November 6, 2011.

NOTE: Both indexes adjusted for budget neutrality.

SOURCE: RTI simulations.

positive or negative) as the number of hospitals contributing to the CMS hospital index declines. This is easily illustrated in a scatter plot of the percent difference against the number of IPPS hospitals per market (Exhibit A-3).

The shape of this plot suggests strongly that hospital wages could be a reasonable proxy for health care wages but only in markets where there is an adequate sample of hospitals; where there are too few hospitals, the IPPS average hourly wage, even after the partial occupation mix adjustment, is too heavily influenced by the hiring patterns of the specific hospitals in that market. The smaller the market, the less accurate the IPPS hospital index is as a measure of local variation of the exogenous price of health care labor. This is a particularly important finding in light of CMS’s use of the IPPS hospital index as geographic price adjusters for other institutional settings, and one that lends strong support to the BLS data recommendation.

2.2 Addition of Benefits Index

For lack of better data at this time, the source for the independent benefits index applied to both the HWI and the work and practice expense GPCIs is the IPPS hospital cost report wage survey.3 Data from 2009, 2010, and 2011 were combined to provide additional stability to the index. Compensation-related benefits (including payroll taxes, insurance, and pension costs)

______________

3 Worksheet S-3 Parts 2 and 3, as edited and adjusted for inflation by CMS, and published in the wage index public use files. File can be found at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/FY-2012-IPPS-Final-Rule-Home-Page.html.

are identified separately on these surveys, and can be used to compute an aggregate market- level average benefit cost per paid hour. This series was then converted to a national index by dividing the market-level hourly benefits figures by the national average hourly benefits figure. Budget neutrality between the base wage and benefits indexes was implemented by normalizing each to a payment-weighted average of 1.00. For each market, the two index values were then combined using the national weights for the ratio of benefits (exclusive of paid time off) to base wages, as published in the IPPS market basket and the MCI, respectively.

Exhibit A-4 shows the effects of adjusting base BLS wages for independent variation in benefits. It summarizes the distribution and regional mean values for the base wage index, the benefits index, and the resulting total compensation index, as computed for the revised HWI and for the new CBSA-based practice expense GPCI.

Accounting for variation in benefits tends to raise index values in high-wage markets and lower them in low-wage markets, widening the gap slightly between the lowest and highest index values. Puerto Rico is the only area where addition of the benefits resulted in a substantial reduction in the PE-GPCI, although a review of the data indicated that this could be due to

EXHIBIT A-4 Effects of Adjusting for Independent Area Variation in Benefits

| Hospital Wage Index | Practice Expense GPCI | |||||

| budget-Neutral BLS-Based Hospital Wage Index | Budget-Neutral Benefits Index | Resulting Budget-Neutral Compensation Index | BLS-Based Wage Component Index (IOM Version) | Budget-Neutral Benefits Index | Resulting Budget-Neutral Compensation Index | |

| N (Markets) | 431 | 431 | 431 | 441 | 441 | 441 |

| Mean (Unweighted) | 0.955 | 0.963 | 0.959 | 0.944 | 0.954 | 0.946 |

| Standard Deviation | .11025 | .2222 | .1231 | .1180 | .2411 | .1340 |

| Index Values | ||||||

| Minimum | 0.746 | 0.550 | 0.728 | 0.462 | 0.227 | 0.430 |

| 5th percentile | 0.821 | 0.696 | 0.809 | 0.815 | 0.676 | 0.793 |

| 25th percentile | 0.876 | 0.814 | 0.875 | 0.877 | 0.811 | 0.872 |

| 50th percentile | 0.931 | 0.933 | 0.931 | 0.940 | 0.933 | 0.932 |

| 75th percentile | 1.007 | 1.049 | 1.021 | 1.007 | 1.050 | 1.018 |

| 95th percentile | 1.160 | 1.392 | 1.177 | 1.152 | 1.382 | 1.156 |

| Maximum | 1.487 | 1.973 | 1.591 | 1.373 | 1.984 | 1.501 |

| Average Values, by Region and Rural/Urban Status | ||||||

| Northeast-metro, | 1.107 | 1.149 | 1.121 | 1.109 | 1.188 | 1.127 |

| -Nonmetro. | 0.921 | 0.955 | 0.932 | 0.92 | 0.959 | 0.929 |

| Midwest-metro. | 0.975 | 0.997 | 0.985 | 0.982 | 0.996 | 0.986 |

| -Nonmetro. | 0.87 | 0.911 | 0.883 | 0.867 | 0.916 | 0.879 |

| South-metro. | 0.962 | 0.846 | 0.942 | 0.956 | 0.853 | 0.936 |

| -Nonmetro. | 0.865 | 0.759 | 0.847 | 0.848 | 0.767 | 0.832 |

| West-metro. | 1.134 | 1.176 | 1.148 | 1.088 | 1.181 | 1.109 |

| -Nonmetro. | 0.98 | 1.026 | 0.994 | 0.947 | 1.019 | 0.963 |

| Puerto Rico-metro. | — | — | — | 0.567 | 0.339 | 0.521 |

| -Nonmetro. | — | — | — | 0.873 | 0.858 | 0.871 |

NOTES: BLS = Bureau of Labor Statistics; GPCI = geographic practice cost index; IOM = Institute of Medicine.

SOURCES: RTI Simulations; Wage Index Public Use Files published for FY 2010 through FY 2012.

underreporting of benefits on the Medicare Hospital Cost Report. Nevertheless there are still significant regional differences in relative benefit levels, indicating that it is important to incorporate benefits into wage index.

2.3 Redefined GPCI Payment Areas

Payment areas for the GPCIs were reconfigured as CBSA markets by reaggregating county-level data to CBSA and statewide nonmetropolitan areas, using total county relative value unit (RVU) to weight each county index within the revised market (see Section 2.5.2). Redefining the payment areas into separate metropolitan and nonmetropolitan markets has a systematically negative effect in the index values for nearly all rural counties, but it also has a surprisingly large impact in many metropolitan areas. This is due to the fact that for the 34 current payment localities that are not statewide, the division into urban and rest-of-state areas does not always conform to metropolitan and nonmetropolitan CBSA designations, and consequently the effect of regrouping counties based on CBSA metropolitan areas is less predictable. Among metropolitan counties, converting to CBSA markets reduces the GPCIs for roughly half and increases them for roughly half. In contrast, converting to CBSA markets reduces the GPCIs for 99 percent of nonmetropolitan counties. Exhibit A-5 provides additional detail on the county- level impact of redefining the GPCI payment areas, broken down by region and by the type of current payment locality.

2.4 Smoothing

The approach recommended by the committee for commuter-based smoothing adjustments is described in detail in the Phase I report, where it was illustrated using the 2000 “long form” census data that is used by CMS to implement the “Section 505” outmigration adjustments. For these simulations, the IOM obtained special tabulations of data from the most recent 5-year summary “Journey to Work” section of the American Community Survey (ACS).4

Commuter-pattern based smoothing is predicated on the assumption that economic integration across CBSAs or other county-based markets can represent inaccuracies in the labor markets as defined. This is seen most clearly when the wage indexes of adjoining markets are substantially different and employers compete for workers across the county-drawn boundaries. To reduce the number of arbitrary “cliffs” in the wage index—where index values differ sharply at market boundaries but economic integration (as demonstrated by the commuting) is evident at the geographic edges of these markets, the committee recommended computing county- level adjustments based on commuter-weighted averages of the index values in neighboring markets. Where workers commute in or out of counties that are part of the same labor market, no change in the index occurs; where workers commute in or out of markets with relatively little difference in their wage indexes, only small changes result. Where workers commute in or out of markets with large differences (the “cliffs"), large changes occur. Chapter 3 of the IOM’s Phase I report provides detailed examples of how these adjustments are calculated for the HWI.

______________

4 Discussion of this survey can be found in Chapter 5 of the first report, Geographic Adjustment in Medicare Payment: Phase I: Improving Accuracy (Washington, DC: The National Academies Press). Unlike the 2000 census “long form” data, the ACS data are from community samples. Complete national county-level data are available only from the 5-year summary files due to sample size issues. Special tabulations were provided to the IOM that were run for the county commuting patterns of all health care workers.

EXHIBIT A-5 County Assignments by Region, Type of Payment Locality, and CBSA Market

| Statewide Payment Localities | Non-Statewide Payment Localities | All Payment Localities | ||||||

|---|---|---|---|---|---|---|---|---|

| Urban | Rest-of-State | |||||||

| Region and Type of CBSA-Based Market | Number of Counties | Percent Total RVUs | Number of Counties | Percent Total RVUs | Number of Counties | Percent Total RVUs | Number of Counties | Percent Total RVUs |

| Northeast | ||||||||

| Metropolitan | 17 | 5.6% | 34 | 31.4% | 72 | 19.5% | 123 | 18.6 |

| markets | ||||||||

| State nonmetro. | 20 | 0.9% | 4 | 0.2% | 70 | 3.0% | 94 | 1.4% |

| counties | ||||||||

| Midwest | ||||||||

| Metropolitan | 185 | 25.6% | 24 | 18.4% | 76 | 8.2% | 285 | 17.6% |

| markets | ||||||||

| State nonmetro. | 477 | 5.5% | 3 | 0.04% | 197 | 3.4% | 677 | 3.0% |

| counties | ||||||||

| South | ||||||||

| Metropolitan | 240 | 33.5% | 48 | 32.3% | 270 | 43.5% | 558 | 36.1% |

| markets | ||||||||

| State nonmetro. | 480 | 11.7% | 1 | 0.1% | 390 | 6.0% | 871 | 5.9% |

| counties | ||||||||

| West | ||||||||

| Metropolitan | 75 | 15.1% | 15 | 17.7% | 50 | 15.0% | 140 | 15.8% |

| markets | ||||||||

| State nonmetro. | 331 | 3.0% | 0 | 68 | 1.3% | 399 | 1.4% | |

| counties | ||||||||

| Puerto Rico | ||||||||

| Metropolitan | 68 | 1.0% | 0 | 0 | 0 | 0 | 68 | 0.3% |

| markets | ||||||||

| State nonmetro. | 10 | <0.05% | 0 | 0 | 0 | 0 | I0 | <0.05% |

| counties | ||||||||

| National | ||||||||

| Metropolitan | 585 | 79.3% | 121 | 99.7% | 468 | 86.2% | 1,174 | 88.3% |

| markets | ||||||||

| State nonmetro. | 1,318 | 20.7% | 8 | 0.3% | 725 | 13.8% | 2.051 | 11.7% |

| counties | ||||||||

| All Counties | 1,804 | 100.0% | 129 | 100.0% | 1,193 | 100.0% | 3,225 | 100.0% |

NOTES: CBSA = core-based statistical area; RVU = relative value unit.

SOURCE: RTI Analysis of CMS GPCI County Data File for 2012.

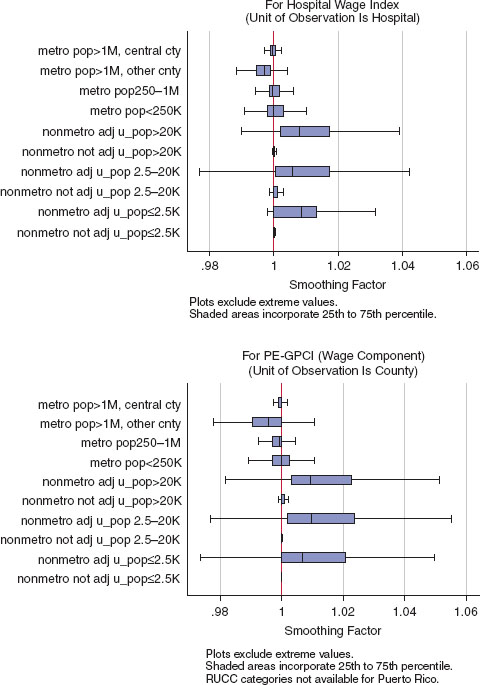

For the simulations in the year 2 report, smoothing adjustments have been computed for the revised HWI, for the CBSA wage component of the practice expense GPCI and work GPCI, and for the payment locality-based GPCIs. Exhibit A-6 shows the distribution of smoothing factors applied to the new HWI and the CBSA GPCIs. For most counties, smoothing adjustments are very small.

RTI found find that smoothing behaves exactly as was expected: commuters tend to move from lower-wage areas to higher-wage areas (making positive adjustments more common

EXHIBIT A-6 County Smoothing Adjustments, by Type of Index

| For GPCIs | |||||

| For Hospital Wage Index | PE, Wage Component | PE, Service Component | Physician 25% Work PE | ||

| Number of Counties Affected | 1,573 | 3.220 | 3,220 | 3,220 | |

| Value of Smoothing Factors | |||||

| Mean | 1.0050 | 1.0055 | 1.0028 | 1.0009 | |

| Standard Deviation | 0.0133 | 0.01710 | 0.0099 | 0.0037 | |

| Minimum | 0.9720 | 0.8983 | 0.9280 | 0.9682 | |

| 1 st Percentile | 0.9860 | 0.9770 | 0.9801 | 0.9908 | |

| 10th Percentile | 0.9960 | 0.9960 | 0.9977 | 0.9990 | |

| 50th Percentile | 1 | 1 | 1 | 1 | |

| 90th Percentile | 1.0190 | 1.0233 | 1.0129 | 1.0045 | |

| 99th Percentile | 1.0670 | 1.0747 | 1.0382 | 1.0128 | |

| Maximum | 1.1240 | 1.1984 | 1.1393 | 1.0563 | |

NOTES: Smoothing adjustments computed for CBSA markets. GPCI = geographic practice cost index; PE = practice expense.

SOURCES: RTI simulations; American Community Survey 5-Year Journey-to-Work data.

than negative ones), commuting across market boundaries is more common in counties that are adjacent to other markets, and the largest smoothing adjustments are computed for rural counties adjacent to metropolitan areas. Exhibit A-7 confirms this in a graph of the average smoothing factors by USDA Rural—Urban Continuum Code.

The committee considers the smoothing adjustment to be a type of refinement to the labor markets, one that reduces inaccuracies caused by the inherent limitation of representing economic markets by fixed political boundaries. The IOM committee’s version of smoothing adjustment is similar in many ways to the outmigration adjustment that CMS now computes for hospitals that are not reclassified, but the CMS adjustments are only positive; commuting patterns from a higher to a lower-index market are not included in the computations. Exhibit A-8 compares the size of commuter-based smoothing adjustments to the size of CMS’ outmigration adjustments as well as reclassifications.

2.5 County Indicators for Health Professional Shortage Areas

2.5.1 Background

The Health Resource Services Administration (HRSA) identifies Health Professional Shortage Areas geographically (by census tract) and by specific institution (Federally Qualified Health Centers or other safety net providers).5 HRSA also maps these designated areas or populations to counties, and provides a three-level county shortage area indicator that is published annually in the Area Resource File (ARF). In the ARF variable, counties are identified only as “not a shortage county,” a “full shortage county,” and a “partial shortage county.” Many counties are identified as “partial,” particularly in metropolitan areas, and “partial” status gives no indication

______________

EXHIBIT A-7 Commuter-based smoothing adjustments by Rural—Urban Continuum Code.

NOTES: Smoothing adjustments computed for CBSA markets. Adjustments have been made budget-neutral to offset the effect of a larger number of positive than negative adjustments.

SOURCE: RTI simulations; American Community Survey 5-Year Journey-to-Work data.

| IOM Committee Proposed Smoothing Adjustments | Current Section 505 Outmigration Adjustments | Current Reclassification Adjustments | |

| N (Hospitals with Non-Zero Adjustment) | 3,142 | 270 | 913* |

| Positive adjustments | 1,533 | 270 | 913 |

| Negative adjustment | 1,609 | N/A | N/A |

| Proportional Adjustment to Index | |||

| Mean | 1.003 | 1.018 | 1.065 |

| Standard Deviation | 0.0110 | 0.01922 | 0.0614 |

| Minimum | 0.972 | 1.0001 | 1.0001 |

| 5th Percentile | 0.994 | 1.0005 | 1.002 |

| 25th Percentile | 0.999 | 1.003 | 1.016 |

| 50th Percentile | 0.99996 | 1.011 | 1.048 |

| 75th Percentile | 1.004 | 1.029 | 1.095 |

| 99th Percentile | 1.024 | 1.053 | 1.186 |

| Maximum | 1.124 | 1.095 | 1.365 |

NOTES: CBSA = core-based statistical area; IOM = Institute of Medicine.

*Additional hospitals were identified in the 2012 payment impact file as having reclassified wage index values that were lower than the non-reclassified values for their geographic labor market, which could be due to anomalies in the timing of provider requests. We have only counted reclassified hospitals where the post-reclassified index is higher than the geographic index. Smoothing adjustments are computed for CBSA markets.

SOURCES: RTI simulations; 2012 IOPPS Impact File; American Community Survey 5-Year Journey-to-Work data.

whether the portion of a county’s population that is located in shortage areas is 5 percent or 95 percent.

HRSA also provides data to CMS that identifies primary care shortage areas by ZIP code, using the data from the geographic shortage areas (i.e., census tracts).6 There are more than 7,000 ZIP codes identified by CMS as eligible for the primary care bonus area. Bonuses are paid based on the location of services delivered, rather than residence of the beneficiary.

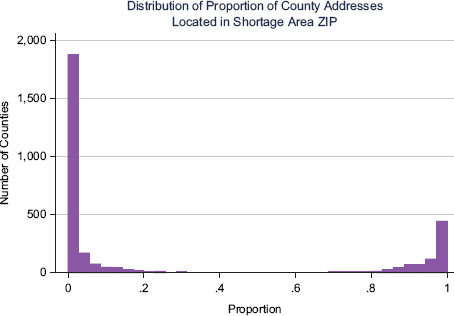

Because the committee felt that the ARF indicator does not provide a strong enough basis to evaluate the impact of the committee’s recommendations on actual shortage area populations, RTI developed a revised county indicator based on the estimated portion of a county’s population that lives within the ZIP codes identified as eligible for the primary care shortage area bonus payments.7 Eligible ZIP codes were mapped to counties using a purchased file that tracks the portions of ZIP codes that overlap county boundaries, and that also provides a weight to use in developing a proxy measure for how much of any one county’s population is covered by the eligible ZIP codes.

______________

6 The source file for ZIP codes is publicly available at http://www.cms.hhs.gov/Medicare/Medicare-Fee-for-Service-Payment/HPSAPSAPhysicianBonuses/index.html?redirect=/hpsapsaphysicianbonuses.

7 The source file for mapping ZIP codes to counties was purchased from CD Light, LLC, and downloaded from http://www.zipinfo.com/index.htm.

2.5.2 Computation

ZIP codes do not lend themselves easily to being mapped back to individual counties, since roughly one in five overlaps county boundaries. The file purchased by RTI has a record for every ZIP code-county pair as of January 1, 2012. The file does not have population estimates or land area for each record, but it does publish the number of addresses associated with each record, which can be adjusted for use as a proxy for population weights. Adjustments are made to back out address counts for specialized ZIP codes including those for the military and ZIP codes that are used for individual office buildings or large corporations; addresses were not counted for these two types of codes. This reduces, though cannot eliminate, overcounting from business addresses being added to residential. The number of addresses will always be larger than the number of residents, but if the overstatement is proportionally similar across all counties then the distribution of the adjusted address count would still be an unbiased estimate of the distribution of the population. Since this assumption is unlikely, we tested the correlation of the adjusted address counts aggregated to the county level with total county population and also with total Medicare Part B fee-for-service enrollees, by rural and regional location.8 As shown in Exhibit A-9, the results indicate that with the exception of nonmetropolitan counties in the Northeast, the address statistic correlates very well with population, indicating that this approach to redefining counties by level of primary care shortage areas is acceptable for purposes of assessing the impact of the IOM committee’s recommended changes on populations living in shortage areas.

For each county we then computed the proportion of total population (as estimated by the adjusted address counts) located in bonus-eligible ZIP codes to the total for that county. The distribution of this statistic across counties is extremely bimodal (Exhibit A-10).

Given the shape of this distribution, we constructed a five-level categorical variable assigned to each county using cut points at 0 percent, greater than 0 and up to or equal to 20 percent, greater than 20 percent and up to or equal to 80 percent, greater than 80 percent and up to but not including 100 percent, and 100 percent. Exhibit A-11 identifies the number of metropolitan and nonmetropolitan counties in each of these five categories, as well as the share of Part B fee-for-service enrollees and Part B RVUs billed by primary care providers.

2.6 Payment Simulations

2.6.1 Hospital Computations

Hospital payment estimates were made at the IPPS provider level, taking into account all current payment factors as identified in the most recent IPPS Impact Files and payment tables and published for IPPS final rules for FY 2012.9 Source documents needed to do this include the following:

• CMS IPPS Impact Files for FY 2012, for data on providers’ geographic market; number of transfer-adjusted discharges; transfer-adjusted case-mix index (CMI); indirect medical

______________

8 We used fee-for-service enrollees because these are the beneficiaries that would be affected by any change in the geographic adjusters. Because Medicare managed care enrollment varies sharply by location, this statistic does not necessarily correlate with related population statistics.

9 All files can be found at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/FY-2012-IPPS-Final-Rule-Home-Page.html.

| Pearson Correlation Coefficients | ||||

| Metropolitan Counties | Nonmetropolitan Counties | |||

| Census Region | Adjusted Address Count to Total Population | Adjusted Address Count to Part B Fee-for-Service Beneficiaries | Adjusted Address Count to Total Population | Adjusted Address Count to Part B Fee-for-Service Beneficiaries |

| Northeast | 0.917 | 0.848 | 0.537 | 0.516 |

| Midwest | 0.992 | 0.987 | 0.899 | 0.890 |

| South | 0.973 | 0.954 | 0.831 | 0.821 |

| West | 0.995 | 0.990 | 0.956 | 0.914 |

| All Regions | 0.978 | 0.957 | 0.823 | 0.823 |

SOURCES: RTI analysis of CMS primary care bonus ZIP codes (2012); CMS Part B enrollee file (2010); HRSA Area Resource File (2010).

education (IME) and disproportionate share (DSH) adjusters; outlier payments as percent of total; applicable cost-of-living adjuster (COLA); Section 505 outmigration adjustments; and final post-reclassification wage index. Data for Indian Health Service providers and providers in Puerto Rico and other territories are excluded from the computations.

Payments for rural hospitals subject to the “lower of” hospital-specific rates or IPPS rates. Sole community hospitals (SCHs) and Medicare-dependent hospitals (MDHs) were treated as traditional IPPS providers.

| Metropolitan | Nonmetropolitan | |||||

| HPSA County Status (by Estimated Share of County Population In CMS Primary Care Bonus Areas) | Number of Counties | Share of Part B Fee-for-Servlce Enrollees | Share of Primary Care RVUsa | Number of Counties | Share of Part B Fee-f or-Service Enrollees | Share of Primary Care RVUsa |

| Non HPSA: 0% | 558 | 0.365 | 0.384 | 658 | 0.089 | 0.063 |

| Partial: ≤20% | 415 | 0.369 | 0.437 | 650 | 0.096 | 0.075 |

| Partial: 20%-80% | 51 | 0.011 | 0.008 | 89 | 0.010 | 0.005 |

| Partial: 80%–<100% | 119 | 0.012 | 0.005 | 430 | 0.032 | 0.013 |

| Full HPSA: 100% | 31 | 0.004 | 0.003 | 224 | 0.012 | 0.006 |

| All Counties | 1,174 | 0.761 | 0.836 | 2,051 | 0.239 | 0.164 |

NOTES: CMS = Centers for Medicare & Medicaid Services; HPSA = Health Professional Shortage Area; RVU = relative value unit.

aDefined as Part B RVUs billed in 2010 by physicians self-identified as family practitioners, internists, pediatricians or geriatricians, nurse practitioners, nurse midwives, and physician assistants.

SOURCES: RTI analysis of CMS primary care bonus ZIP codes (2012); CMS Part B enrollee file (2010); HRSA Area Resource File (2010).

• CMS Table 1A and 1B for FY 2012, to identify the standardized operating and capital payment amounts.

• CMS Wage Index Public Use Files, to identify pre- and post-occupation-mix-adjusted index values, pre- and post-reclassification index files; application of frontier floors; and application of Section 505 outmigration adjustments.

Smoothing adjustment factors were computed only after the revised BLS-based indexes were computed. This is because the size of the smoothing factor is a function of the proportion of health care workers commuting out of each county and the HWI of the county to which the worker is commuting, as described in Section 2.4. Smoothing adjustments were then also applied at the county level (i.e., to all IPPS hospitals in the applicable county), creating slight differences in HWIs within a given market.

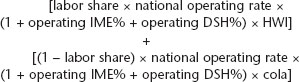

Payments under the various index options were estimated as follows:

• All applicable CMS and BLS-based index values were merged into the provider-level file based on their labor market code (combined “CBSA X state” or “rest-of-state”.

• All providers were assigned the standardized IPPS payment rate per discharge from CMS Tables 1A and 1B using the full update rather the reduced update. (A very small number of providers that do not submit quality data for the Hospital Compare web site are penalized by being given reduced standardized rates. They can be identified in the CMS Provider Specific Files [PSFs], but there are not enough of them to make a difference to these simulations.)

• Consistent with current policy, the labor-related share was set to 0.688 for providers located in labor markets with index values of 1.00 or higher, and it was set to 0.620 for providers located in labor markets with index values below 1.00.

• The provider’s diagnosis-related group (DRG) payment rate is the sum of its operating rate and its capital rate.

Whichever wage index is being tested, the provider’s operating rate is computed as

Whichever wage index is being tested, the provider’s capital rate is computed as:

![]()

Note that there is no labor related share for capital costs in the IPPS formula; instead, CMS computes the capital cost geographic adjustment factor (capital GAF) by raising the HWI to the power of 0.6847.10

• For each provider, an estimate of aggregate DRG payments excluding outliers is computed by multiplying the sum of the operating and capital rates times the transfer-adjusted discharge count and the transfer-adjusted case-mix index.11

(operating rate + capital rate) x transadj discharges x transadj CMI

An estimate of aggregate DRG payments including outlier payments can be derived making use of the Impact File’s published statistic of outlier payments as a percent of total prospective payment system (PPS) payments. The computation is

[(operating rate + capital rate) x transadj discharges x transadj CMI] (1 - outlier%)

Payments for any IPPS provider can be estimated in this manner, for any wage index that is being modeled. Separate smoothing factor calculations must be made, however, for each difference index that is modeled. Also see Section 2.7, below, for a discussion of how budget neutrality computations affect each of the indexes prior to final payment estimation.

______________

10 The exponent 0.6847 is the coefficient derived from a regression of the natural log of average total costs per discharge on the natural log of the wage index using 1988 data, estimated at the time that capital PPS payment was first implemented. The computed capital GAF can be found in the wage index public use files each year. The coefficient represents a statistical estimate of the labor-related share of total (i.e., operating plus capital) costs per Medicare discharge.

11 "Transfer-adjusted” means that the total number of Medicare discharges has been adjusted to account for cases with short-stay transfers to another hospital, or for certain Medicare severity diagnosis-related groups (MS-DRGs), postacute provider. Short-stay transfers are defined as transfers occurring before the geometric mean length of stay for the patient’s assigned MS-DRG, less 1 day. For cases qualifying as a short-stay transfer, DRG payments are reduced proportionally based on the number of actual days. The “transfer adjustment” used in this formula is computed by CMS based on the specific reductions to the payments for the cases qualifying as transfers.

2.6.2 Physician Computations

Estimates for the effects on physician and other practitioner payments were made at the county level, using all of the component county indexes and RVU data provided as published for the final rules for CY 2012.12 Each year CMS publishes a GPCI County Data File, containing component index values at the county level as well as total RVUs billed from each county. Much of the information in this file does not originate as county-level data (for example, the source data for both indexes computed from BLS data is CBSA based and the malpractice data is state based), but CMS maps the information back to the county level and provides the appropriate type of RVUs that allow us to compute RVU-weighted averages for different geographic aggregates, including the current CMS payment localities and CBSA markets. Source data used from this file for payment computations include

• three component indexes used to construct the PE-GPCI (nonphysician wages, purchased services, rent);

• the physician work index, equal to one-quarter of the index computed on BLS data for the XX proxy professions;

○ the malpractice index;

○ physician work, malpractice, and PE-RVUs; and

○ county payment locality assignment.

RTI merged CBSA codes, and the IOM committee revised nonphysician wage index and the independent benefits index into this file. County-level PE-GPCIs were computed using CMS as well as recommended IOM committee data, using the following formula as published in the final rules:

![]()

(Note that 9.968 percent of the PE-GPCI is left unadjusted for geographic variation.) PE-GPCIs were computed for the CMS data as published with frontier floors, for the CMS data without the frontier floors, for the recommended IOM committee wage data without benefits, and for the recommended IOM committee wage data with benefits but no smoothing. Additional physician work GPCIs were also computed using CMS data but excluding the current Alaska floor of 1.50, for a work GPCI that was not adjusted to one-quarter of the proxy professional index, and for a “0 percent” work GPCI (allowing us to compute payments under no physician work adjustment).

The resulting PE-GPCI, work GPCI, and malpractice GPCI were each then aggregated from county level to (a) CMS payment localities and (b) CBSA markets, using RVU-weighted averages. Although not used directly to compute payments, an aggregate average GPCI referred to as the geographic adjustment factor, or GAF, was computed for each variation on the data and for each payment area, based on the national average mix of RVUs, as follows:

______________

12 Found at http://www.cms.hhs.gov/Medicare/Medicare-Fee-for-Service-Payment/PhysicianFeeSched/PFS-Federal-Regulation-Notices-Items/CMS1253669.html.

![]()

The GAF is used by CMS and policy analysts for convenience, as a shorthand way to express overall payment differences. Since no two payment areas (or counties) have exactly the same distribution of RVUs, however, the GAF provides only an approximation of actual geographic payment adjustments.

Smoothing adjustment factors were computed only after the first round of GPCI computations were made, at both the payment locality and CBSA market level. This is because the size of the smoothing factor is a function of the proportion of health care workers commuting out of each county and the area GPCI of the county to which the worker is commuting, as described in Section 2.3. Smoothing adjustments were then also applied at the county level, creating slight differences in GPCIs within a given market.

For each county, regardless of which GPCI is used or which payment area is used, aggregate physician payments are computed by multiplying each of the three types of RVUs by their respective GPCIs (after application of smoothing factors, if applicable), summing the three products, and multiplying this sum by the current conversion factor (CF). The computation is

![]()

Payments for any county can be estimated in this manner, using any GPCI and any level of county aggregation for payment areas. Separate smoothing factor calculations must be made for each different index that is modeled. Also see Section 2.7, below, for a discussion of how budget neutrality computations affect each of the component indexes prior to final payment estimation.

2.6.3 Payment Impact Computations

For both HWI and GPCI simulations, payment impact was computed for three intermediate levels and for the net impact of all IOM committee recommendations combined. The three intermediate levels correspond to the three types of recommendations as outlined in Exhibit A-1. Payment impact is expressed as the difference between payments computed under one or more IOM committee recommendation(s) and payments computed without the recommendation(s), expressed as a percent relative to payments without the recommendation(s). Computations are as follows:

For hospital impact:

• Difference due to data changes isolates the effect of the move from the CMS hospital data to the BLS data as adjusted for benefits. Payments are computed using the benefits- adjusted BLS-based hospital index only, without market smoothing, and then compared to payments computed using CMS’s occupation-mix-adjusted index, without frontiers, reclassification, or outmigration adjustment.

• Difference due to market changes isolates the effect of commuter-based smoothing adjustments only, as this is the only market-based change among the recommendations for the HWI. Payments are computed using the benefits-adjusted BLS-based hospital index after smoothing and then compared to payments computed using the benefits-adjusted BLS-based hospital index before smoothing.

• Difference due to the elimination of policy adjustments isolates the effect of eliminating reclassifications, Lugar counties, rural floors, frontier state floors, and outmigration adjustments.13 None of these adjustments is included in the IOM committee recommendations, consequently the only way to isolate their impact is to simulate CMS payments in the absence of the adjustments (using a budget-neutrality—adjusted version of CMS’s occupation-mix—adjusted wage index) and compare these to CMS payments under current policy.

For physician payment impact:

• Difference due to data changes isolates the effect of the move from publicly available BLS data to internally computed indexes, moving from wages reported by physician office employers to wages reported by all health care employers, and adding the independent benefits index. Payments are computed using the IOM committee’s recommended benefits-adjusted BLS-based physician office wage index only (without market smoothing) and retaining the 88 payment localities, and then compared to payments computed using the CMS GPCIs without the frontier floors (also computed over the 88 payment areas).

• Differences due to market changes isolate the effect of the using CBSA markets rather than the 88 payment localities. Payments are computed using all of the IOM committee recommendations including the market change, and then payments are compared to payments computed using all of the IOM committee recommendations except the market change (that is, using an index that reflects the IOM committee data aggregated to the level of the 88 payment localities).

• Difference due to elimination of policy adjustments isolates the effect of removing the frontier floors from the PE-GPCI and the 1.50 floor from the physician work GPCI in Alaska. Payments are computed using CMS GPCIs and CMS payment areas but without floors, and compared to payments computed according to current CMS policy.

2.7 Budget Neutrality

The HWI and the physician geographic price indexes are required by statute to be budget- neutral, in the sense that the aggregate amount of payments after applying geographic adjustments must be the same as aggregate payments without any adjustment. A few special exceptions to the adjustments—including the frontier state floors and the outmigration adjustments for certain hospitals—have been explicitly exempted from this requirement. For purposes of these simulations, all of the indexes constructed to incorporate IOM committee recommendations have been made budget-neutral with respect to aggregate payments under current CMS policy, which includes any additional payments created by these special exempted exceptions.

Budget neutrality is a condition that is imposed on most special provisions of the PPS and the physician/practitioner payment system. Budget neutrality imposed on geographic price adjusters can be implemented with an across-the-board adjustment to the indexes themselves,

______________

13 While outmigration adjustments can be thought of as a CMS version of the commuter-based smoothing, they are implemented only for hospitals that are not reclassified, and therefore are hard to separate from reclassifications (they are also implemented only as a positive adjustment, and therefore more of a policy adjustment than a market refinement). For this reason, we have grouped outmigration adjustments with other policy adjustments in the analyses.

EXHIBIT A-12 Budget Neutrality Factors Imposed on IOM Committee Indexes

| Hospital Wage Index | |

| IOM committee proposed index made neutral to CMS final post-reclassification | 1.0175011 |

| GPCI Components, If Using Current Payment Localities for CMS and IOM Committee Indexes | |

| IOM committee PE smoothed wage component, made neutral to CMS wage component IOM committee PE smoothed service component, made neutral to CMS service component IOM committee smoothed work GPCI, made neutral to CMS work GPCI |

1.004498 0.999000 0.999600 |

| GPCI Components, If Using Current CBSA Markets for IOM Committee Index Only | |

| IOM committee PE smoothed wage component, made neutral to CMS wage component IOM committee PE smoothed service component, made neutral to CMS service component IOM committee smoothed work GPCI, made neutral to CMS work GPCI |

1.004240 0.998920 0.999600 |

NOTES: CBSA = core-based statistical area; CMS = Centers for Medicare & Medicaid Services; GPCI = geographic practice cost index; IOM = Institute of Medicine; PE = practice expense.

SOURCE: RTI Simulations.

or it can be implemented at the end of the rate-setting process by altering the underlying national standardized rate or conversion factor. In keeping with CMS’s current approach, we have imposed budget neutrality to current CMS payments using across-the-board adjustments to the index values.

For the GPCIs, budget neutrality factors are computed by estimating aggregate payments under both the IOM committee recommendations and under CMS policy and dividing the IOM committee estimate by the CMS estimate. All index values constructed from IOM committee recommendations are then divided by this factor to achieve a budget-neutral index, and IOM committee payments are then reestimated using this adjusted index. This is computationally equivalent to saying that final payment-weighted averages of the two indexes being compared will be 1.00.

Adjusting the HWI for budget neutrality requires several more steps to account for (a) the labor related share that is applicable to operating costs and (b) a separate wage index adjustment that is applicable to capital costs. Specifically, the wage index is applied to either 62 or 68.8 percent of the operating rate, but it is applied to a variable proportion of the capital rate because it is based on an exponential function (as described in Section 2.6.1). For operating costs, the neutrality factor would have to be adjusted as follows:

![]()

The neutrality adjustment for combined operating and capital payments is only approximately equal to this adjusted neutrality factor. While it is possible to compute separate HWI operating and capital neutrality factors, for ease of computation RTI simply iterated (starting at a value between 62 and 68.8 percent of the computed payment ratio) and recomputed payments until arriving at a value that resulted in equivalency between the two sets of payments.

Because there are several steps in the payment computations, and because RTI simulated payment impacts for subsets of the recommendations as well as for all of them combined,

multiple neutrality factors had to be computed.14 The final neutrality adjustment factors for the HWI and each of the three GPCIs are presented in Exhibit A-12.

The HWI neutrality factor is larger than the GPCI neutrality factors because of the shift from hospital to BLS data. By construction, the employment-weighted average of the BLS-based index is always 1.00—or put another way, the index is normalized to a value 1.00 based on employment. In contrast, the CMS HWI is normalized to a value of 1.00 based on hospital hours paid (although CMS budget neutrality factors ultimately adjust this to a value of 1.00 based on payment dollars). The HWI neutrality adjustment effectively renormalizes the BLS-based index to a value of 1.00 based on payment dollars.

3 PAYMENT IMPACT EXHIBITS

Exhibits A-13 through A-30 are offered to provide additional detail on the payment simulation results. They are divided into Section 3.1 (related to impact on IPPS hospital payments) and Section 3.2 (related to impact on physician payments). They are presented without commentary, but are offered to supplement the analyses provided in Chapter 2 of the main report.

3.1 IPPS Hospital Estimates

3.2 Part B Physician and Other Practitioner Estimates

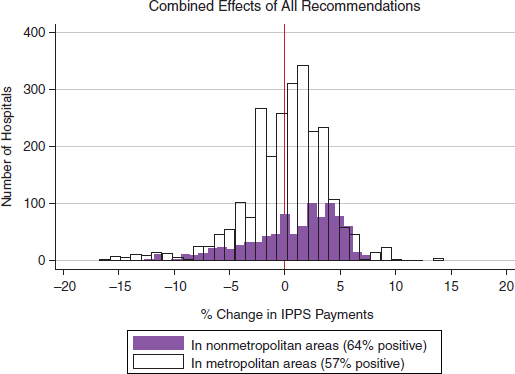

EXHIBIT A-13 Distribution of payment impact across all IPPS hospitals.

SOURCE: RTI simulations.

______________

14For example, before adding the independent benefits index to the base wage indexes, it was necessary to impose a budget neutrality adjustment on both such that the payment-weighted average of both would equal 1.00.

EXHIBIT A-14 Estimated Change in IPPS Payments, Isolated by Type of IOM Committee Recommendation

| Percent Difference In Estimated IPPS Payments (IOM Committee Relative to Current Policy) | ||||

| Data (isolated effect of move to BLS-based wages) | Market (isolated effect of smoothing) | Policy (isolated effect of eliminating adjustments, reclassifications and floors) | All (combined effects of all IOM committee recommendations-payments under final IOM committee recommended HWI compared to payments under current CMS policy) | |

| Compares payments under benefits-adjusted BLS-based index with no other adjustments to payments under CMS’s occupation-mix—adjusted index | Compares payments under benefits-adjusted BLS-based index after smoothing to payments under benefits-adjusted BLS-based Index before smoothing | Compares payments under CMS final post-reclassified index to payments under CMS’s occupation-mix—adjusted index | ||

| Distribution Across Hospitals | ||||

| Minimum | -13.5% | -1.8% | -15.0% | -16.7% |

| 5th percentile | -3.7% | -0.5% | -1.8% | -6.8% |

| 25th percentile | -1.6% | -0.1% | -1.5% | -1.9% |

| 50th percentile | 0.5% | -0.1% | -1.4% | 0.7% |

| 75th percentile | 2.4% | 0.1% | 0.4% | 3.0% |

| 95th percentile | 4.5% | 1.4% | 8.2% | 5.4% |

| Maximum | 16.8% | 7.7% | 21.9% | 14.3% |

| Average by Region and Metropolitan Status | ||||

| Northeast-metro, | -0.9% | 0.05% | -1.9% | -2.7% |

| -Nonmetro. | 1.8% | 0.4% | -2.5% | -0.3% |

| Midwest-metro. | 0.5% | -0.1% | 0.9% | 1.4% |

| -Nonmetro. | 1.9% | 0.3% | -2.6% | -0.5% |

| South-metro. | 0.8% | -0.1% | 1.1% | 1.9% |

| -Nonmetro. | -0.9% | 0.4% | -2.6% | 0.2% |

| West-metro. | -2.5% | 0.01% | 0.5% | -2.1% |

| -Nonmetro. | 2.0% | 0.1% | -2.3% | -3.1% |

NOTES: BLS = Bureau of Labor Statistics; CMS = Centers for Medicare & Medicaid Services; HWI = hospital wage index; IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System.

SOURCE: RTI Simulations.

| Difference Under IOM Committee Recommendations | |||||

| In Frontier States | In Other States | ||||

| County Rural—Urban Continuum Code | Payments Under Current Policy (Billions) | Number of Hospitals | % Difference | Number of Hospitals | % Difference |

| Metropolitan, population >1 million, central | $56.4 | 14 | -0.9% | 1236 | -0.2% |

| Metropolitan, population >1 million, other | $2.7 | 0 | – | 162 | 1.4% |

| Metropolitan, population 250K-1 million | $24.5 | 4 | 1.3% | 636 | 0.1% |

| Metropolitan, population <250K | $14.5 | 24 | -5.8% | 400 | 0.9% |

| Non-metro, urbanized pop >20K, adjacent | $4.3 | 1 | -6.1% | 267 | -0.7% |

| Non-metro, urbanized pop >20K, not adjacent | $2.6 | 11 | -9.7% | 118 | -1.4% |

| Non-metro, urbanized pop 2.5-20K, adjacent | $2.2 | 5 | -7.3% | 293 | 0.9% |

| Non-metro, urbanized pop 2.5-20K, not adj. | $1.7 | 12 | -9.7% | 180 | 1.1% |

| Non-metro, urbanized pop <2.5K, adjacent | $0.1 | 0 | – | 24 | 2.7% |

| Non-metro, urbanized pop <2.5K, not adjacent | $0.1 | 1 | -11.5% | 30 | 3.9% |

NOTES: IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System; USDA = U.S. Department of Agriculture.

SOURCE: RTI Simulations.

| Difference Under IOM Committee Recommendations | |||||

| in Metropolitan Areas | In Nonmetropolitan Areas | ||||

| Location | IPPS Payments Under Current Policy ($ Billions) | Number of Hospitals | % Difference | Number of Hospitals | % Difference |

| New England | $6.6 | 120 | -9.4% | 23 | -1.6% |

| Middle Atlantic | $16.9 | 320 | -0.6% | 69 | 1.0% |

| East North Central | $18.1 | 401 | 2.6% | 120 | 2.5% |

| West North Central | $7.4 | 169 | 1.1 % | 99 | -5.1% |

| South Atlantic | $22.2 | 421 | 3.2% | 170 | 0.9% |

| East South Central | $7.8 | 153 | 5.2% | 170 | 2.6% |

| West South Central | $11.6 | 366 | 1.8% | 183 | -2.5% |

| Mountain | $5.1 | 159 | -1.6% | 66 | -4.5% |

| Pacific | $13.4 | 380 | -3.0% | 29 | -3.8% |

NOTES: IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System.

SOURCE: RTI Simulations.

| Difference Under IOM Committee Recommendations | |||||

| In Frontier States | In Other States | ||||

| Hospital Reclassification or Adjustment Status | IPPS Payments Under Current Policy ($ Billions) | Number of Hospitals | % Difference | Number of Hospitals | % Difference |

| Reclassifications (MGCRB) | $19.5 | 2 | 4.1% | 606 | -1.8% |

| "Lugar" Hospitals | $0.5 | 0 | — | 53 | -1.4% |

| Section 505 Outmigration Adjustments | $4.6 | 2 | -11.796 | 268 | -0.5% |

| Frontier Floors | $O.O | 46 | -7.4% | N/A | — |

| Metropolitan Area Rural Floors | $9.6 | N/A | — | 261 | -3.1% |

| No Exceptions | $73.2 | 22 | -0.5% | 2158 | 1.0% |

NOTES: IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System; MGCRB = Medicare Geographic Classification Review Board.

SOURCE: RTI Simulations.

EXHIBIT A-18 Impact of IOM Committee Recommendations on IPPS Payment, by Special Rural Status

| Difference Under IOM Committee Recommendations | |||||

| In Frontier States | In Other States | ||||

| Hospital Status | Payments Under Current Policy ($ Billions) | Number of Hospitals | % Difference | Number of Hospitals | % Difference |

| Sole Community Hospital (All) | $5.9 | 32 | -6.0% | 410 | -0.3% |

| Medicare-Dependent Hospitals (All) | $1.6 | 0 | — | 211 | 2.0% |

| Rural Referral Centers (Those Not SCH or MDH) | $.5 | 2 | -8.0% | 174 | -1.1% |

| All Other (Rural) | $1.7 | 4 | -10.4% | 219 | 1.3% |

| All Other (Nonrural) | $94.5 | 34 | -3.3% | 2332 | 0.1% |

NOTES: IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System; MDH = Medicare-dependent hospital; SCH = sole community hospital.

SOURCE: RTI Simulations.

EXHIBIT A-19 Impact of IOM Committee Recommendations on IPPS Payment, by Teaching and DSH Status

| Difference Under IOM Committee Recommendations | |||||

| In Frontier States | In Other States | ||||

| Hospital Status | IPPS Payments Under Current Policy ($ Billions) | Number of Hospitals | % Difference | Number of Hospitals | % Difference |

| Teaching Only | $19.3 | 14 | -4.1% | 402 | 0.3% |

| Teaching and Disproportionate Share | $44.2 | 5 | -4.2% | 615 | 0.0% |

| Disproportionate Share Only | $35.2 | 25 | -4.8% | 1,767 | -0.1% |

| All Other (Nonteaching, Non-DSH) | $10.2 | 28 | -3.5% | 562 | 0.4% |

NOTES: DSH = disproportionate share hospital; IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System.

SOURCE: RTI Simulations.

EXHIBIT A-20 Impact of IOM Committee Recommendations on IPPS Payment, by Bed Size

| Difference Under IOM Committee Recommendations | |||||

| In Frontier States | In Other States | ||||

| Payments Under Current Policy ($ Billions) | IPPS Payments Under Current Policy ($ Billions) | Number of Hospitals | % Difference | Number of Hospitals | % Difference |

| ≤50 beds | $2.3 | 21 | -5.8% | 654 | 0.6% |

| 51-100 beds | $3.3 | 17 | -7.2% | 614 | 0.7% |

| 101-300 beds | $42.4 | 25 | -4.4% | 1,419 | -0.1% |

| 301-500 beds | $30.6 | 6 | -4.9% | 444 | 0.8% |

| >500 beds | $27.4 | 3 | 0.1% | 201 | 0.5% |

| Not availablea | $0.03 | — | — | 14 | -0.3% |

NOTES: IOM = Institute of Medicine; IPPS = Inpatient Prospective Payment System.

aNew hospitals; number of beds listed as “1” and data on bed days available are missing in 2012 impact file.

SOURCE: RTI Simulations; Final IPPS Payment Impact Files for FY 2012.

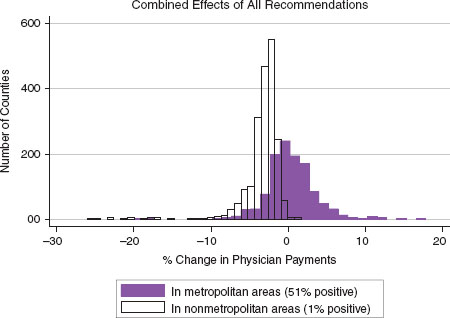

EXHIBIT A-21 Distribution of physician payment impact across all counties.

| Percent Difference in Payments | |||||

| Data (isolated effect of adjusted BLS data) | Market (isolated effect of moving to CBSA markets) | Policy (isolated effect of removing index floors) | |||

| Compares payments using adjusted BLS data but keeping payment localities, to payments under CMS GPCIs but excluding frontier and Alaska floors | Compares payments using all IOM committee recommended changes including CBSA markets, compared to payments using all IOM committee recommended changes except the CBSA markets | Compares payments under current CMS policy, including frontier and Alaska floors, compared to payments under CMS GPCIs but excluding all index floors | All (combined effects of all IOM committee recommendations—payments under final IOM committee recommended GPCIs compared to payments under current CMS policy) | ||

| Distribution Across Counties | |||||

| Minimum | -3.5% | -10.5% | -26.2% | -26.1% | |

| 5th percentile | -0.8% | -4.5% | -4.1% | -6.0% | |

| 25th percentile | -0.4% | -2.8% | 0.0% | -3.4% | |

| 50th percentile | 0.0% | -2.0% | 0.0% | -2.2% | |

| 75th percentile | 0.3% | -0.4% | 0.0% | -0.7% | |

| 95th percentile | 1.0% | 2.5% | 0.0% | 3.3% | |

| Maximum | 6.8% | 12.0% | 0.0% | 17.9% | |

| Average by Region and Metropolitan Status | |||||

| Northeast-metro. | 0.4% | 0.5% | 0% | 0.9% | |

| -Nonmetro. | 0.3% | -2.0% | 0.0% | -1.7% | |

| Midwest-metro. | 0.3% | 0.2% | -0.1% | 0.3% | |

| -Nonmetro. | 0.6% | -2.9% | -0.2% | -3.1% | |

| South-metro. | -0.2% | 0.4% | 0.0% | 0.2% | |

| -Nonmetro. | -0.4% | -2.7% | 0.0% | -3.1% | |

| West-metro. | 0.2% | 0.2% | -0.2% | 0.3% | |

| -Nonmetro. | 0.7% | -2.3% | -0.8% | -3.0% | |

| Puerto Rico-metro. | -1.6% | -0.2% | 0.0% | -1.6% | |

| -Nonmetro. | -0.2% | -0.6% | 0.0% | -0.8% | |

NOTES: BLS = Bureau of Labor Statistics; CBSA = core-based statistical area; CMS = Centers for Medicare & Medicaid Services; GPCI = geographic practice cost index; IOM = Institute of Medicine.

EXHIBIT A-23 County Analysis of the Isolated Payment Effects from Redefining the GPCI Payment Areas

| All IOM Committee Recommendations Including Market Redefinition | All IOM Committee Recommendations Including Market Redefinition | IOM Committee Recommendations Excluding Market Redefinition | |

| —compared to— | —compared to— | —compared to— | |

| IOM Recommendations Excluding Market Redefinition | CMS GPCis Without Index Floors | CMS GPCIs Without Index Floors | |

| All Counties | |||

| Number of counties w/pmt reduction | 2,464 | 2,467 | 1,658 |

| Percent counties w/reduction | 79% | 79% | 53% |

| Percent national RVUs | 51% | 54% | 50% |

| Median % reduction | -2.3% | -2.4% | -0.4% |

| Aggregate average % reduction | -1.5% | -1.6% | -0.4% |

| Number of counties w/pmt increase | 654 | 651 | 1,460 |

| Percent counties w/increase | 21% | 21% | 47% |

| Percent national RVUs | 49% | 46% | 50% |

| Median % increase | +1.5% | +1.8% | +0.3% |

| Aggregate average % increase | +1.6% | +2.1% | +0.6% |

| Metropolitan Counties Only | |||

| Number of counties w/pmt reduction | 515 | 547 | 510 |

| Percent metro, counties w/reduction | 44% | 48% | 44% |

| Percent national RVUs | 45% | 48% | 48% |

| Median % reduction | -1.2% | -1.3% | -0.3% |

| Aggregate average % reduction | -1.2% | -1.3% | -0.4% |

| Number of counties w/pmt increase | 636 | 604 | 641 |

| Percent metro, counties w/increase | 66% | 52% | 56% |

| Percent national RVUs | 55% | 52% | 52% |

| Median % increase | +1.6% | +2.0% | +0.5% |

| Aggregate average % increase | +1.6% | +2.1% | +0.6% |

| Nonmetropolitan Counties Only | |||

| Number of counties w/pmt reduction | 1.949 | 1,920 | 1,148 |

| Percent counties w/reduction | 99% | 98% | 58% |

| Percent national RVUs | 99.9% | 99% | 63% |

| Median % reduction | -2.5% | -2.6% | -0.4% |

| Aggregate average % reduction | -2.7% | -0.2% | -0.4% |

| Number of counties w/pmt increase | 18 | 48 | 819 |

| Percent counties w/increase | 1% | 2% | 42% |

| Percent national RVUs | 0.01% | 1% | 37% |

| Median % increase | +0.2% | +0.6% | +0.2% |

| Aggregate average % increase | +0.8% | +0.5% | +0.3% |

NOTES: CMS = Centers for Medicare & Medicaid Services; GPCI = geographic practice cost index; IOM = Institute of Medicine; pmt = payment; RVU = relative value unit.

| In Frontier States and Alaska | In All Other States | ||||

| Rural—Urban Continuum Code | Total Part B Practitioner Payments ($ Billions) | Proportion Billed RVUs | % Change in Payments | Proportion Billed RVUs | % Change in Payments |

| metro, pop>1M, CBSA central countiesa | $38.9 | 0.005 | 2.0% | 0.492 | 1.0% |

| metro, pop>1M, CBSA other countiesa | $2.3 | — | — | 0.031 | 3.0% |

| metro, pop 250K-1M | $16.3 | 0.001 | -2.0% | 0.221 | 0.0% |

| metro, pop <250K | $9.1 | 0.006 | -4.0% | 0.120 | -1.0% |

| adjacent nonmetro, urban pop >20K | $3.2 | 0.0002 | -5.0% | 0.045 | -3.0% |

| not adjacent nonmetro, urban pop >20K | $1.7 | 0.001 | -6.0% | 0.022 | -3.0% |

| adjacent nonmetro, urban pop 2.5-20K | $1-9 | 0.0004 | -6.0% | 0.026 | -3.0% |

| not adjacent nonmetro, urban pop 2.5-20K | $1.4 | 0.001 | -7.0% | 0.019 | -4.0% |

| adjacent nonmetro, urban pop <2.5K | $0.1 | 0.0001 | -6.0% | 0.002 | -2.0% |

| not adjacent nonmetro, urban pop <2.SK | $0.2 | 0.0002 | -6.0% | 0.002 | -3.0% |

| Puerto Rico (not coded) | $0.2 | — | — | 0.003 | -2.0% |

| All counties | $75.4 | 0.016 | -2.0% | 0.984 | 0.0% |

NOTES: CBSA = core-based statistical area; IOM = Institute of Medicine; RVU = relative value unit; USDA = U.S. Department of Agriculture.

aDesignation as “central” and “other” derived from CBSA indicators for metropolitan counties, as published in Area Resource File 2009.

SOURCE: RTI simulations.

| In Frontier States and Alaska | In All Other States | ||||

| County Shortage Indicator, as Defined by Estimated Population in Bonus Areas | Total Part B Practitioner Payments ($ Billions) | Proportion Billed RVUs | % Change in Payments | Proportion Billed RVUs | % Change in Payments |

| In Metropolitan Counties | |||||

| Non-HPSA (0%) | $31.4 | 0.001 | -5.0% | 0.410 | 1.0% |

| Partial HPSA (<20%) | $34.7 | 0.012 | -1.0% | 0.448 | 0.0% |

| Partial HPSA (20% to 80%) | $0.5 | 0.00001 | -6.0% | 0.007 | -1.0% |

| Partial HPSA (80% to <100%) | $0.2 | 0.0003 | -5.0% | 0.002 | -1.0% |

| Full HPSA (100%) | $0.1 | 0.002 | -1.0% | ||

| In Nonmetropolitan Counties | |||||

| Non-HPSA (0%) | $3.3 | 0.001 | -6.0% | 0.045 | -3.0% |

| Partial HPSA (<20%) | $4.0 | 0.002 | -6.0% | 0.055 | -3.0% |

| Partial HPSA (20% to 80%) | $0.3 | 0.00003 | -4.0% | 0.004 | -3.0% |

| Partial HPSA (80% to <100%) | $0.5 | 0.0003 | -6.0% | 0.007 | -3.0% |

| Full HPSA (100%) | $0.3 | 0.0004 | -6.0% | 0.004 | -4.0% |

| In All Counties | $75.3 | 0.016 | -2.0% | 0.984 | 0.0% |

NOTES: HPSA = Health Professional Shortage Area; IOM = Institute of Medicine; RVU = relative value unit.

SOURCES: RTI simulations; CMS ZIP primary care bonus area file (2012).

| In Frontier States and Alaska | In All Other States | ||||

| Counties Arrayed by Median Household Income | Total Part B Practitioner Payments ($ Billions) | Proportion Billed RVUs | % Change in Payments | Proportion Billed RVUs | % Change in Payments |

| Lowest quartile | $2.9 | 0.000 | -7.8% | 0.041 | -2.4% |

| 25tti to 50th percentile | $8.7 | 0.000 | -6.5% | 0.121 | -1.7% |

| 50th to 75th percentile | $19.9 | 0.004 | -5.4% | 0.268 | -0.5% |

| Top quartile | $43.9 | 0.011 | -1.0% | 0.555 | 0.7% |

| All counties | $75.4 | 0.016 | -2.4% | 0.984 | 0.0% |

NOTES: IOM = Institute of Medicine; RVU = relative value unit.

SOURCES: RTI simulations; HRSA Area Resource File (2009).

| In Frontier States and Alaska | In All Other States | ||||

| From Counties Arrayed by Percent Non-White Population | Total Part B Practitioner Payments ($ Billions) | Proportion Billed RVUs | % Change in Payments | Proportion Billed RVUs | % Change in Payments |

| Lowest quartile | $2.0 | 0.001 | -5.4% | 0.027 | -2.1% |

| 25tti to 50th percentile | $7.7 | 0.005 | -5.6% | 0.102 | -0.7% |

| 50th to 75th percentile | $29.0 | 0.005 | -3.7% | 0.381 | 0.3% |

| Top quartile | $36.6 | 0.005 | 1.7% | 0.473 | 0.0% |

| Total | $75.3 | 0.016 | -2.5% | 0.984 | 0.0% |

aComputed as (1 — %white non-Hispanic).

NOTES: IOM = Institute of Medicine; RVU = relative value unit.

SOURCES: RTI simulations; HRSA Area Resource File (2009).

| In Frontier States and Alaska | In All Other States | ||||

| Counties by Rural/Urban Status and Grouped by Persons per Square Mile | Total Part B Practitioner Payments ($ Billions) | Proportion Billed RVUs | % Change in Payments | Proportion Billed RVUs | % Change in Payments |

| Frontier Counties (≤6 persons/sq. mi.) | $0.2 | 0.0011 | -5.6% | 0.002 | -4.0% |

| Other rural, below 50th percentile | $1.4 | 0.002 | -5.6% | 0.018 | -3.0% |

| Other rural, above 50th percentile | $6.7 | 0.0006 | -7.3% | 0.094 | -3.0% |

| For comparison: all urban | $67.0 | 0.013 | -1.4% | 0.870 | 0.0% |

| All counties | $75.3 | 0.016 | -2.4% | 0.984 | 0.0% |

NOTES: IOM = Institute of Medicine; RVU = relative value unit.

SOURCES: RTI simulations; HRSA Area Resource File (2009).

| In Frontier States and Alaska | In All Other States | ||||

| From Counties Arrayed by Primary Care Practitioner RVUs as Percent Total RVUs | Total Part B Practitioner Payments ($ Billions) | Proportion Billed RVUs | % Change in Payments | Proportion Billed RVUs | % Change in Payments |

| Lowest quartile | $47.5 | 0.007 | -3.8% | 0.618 | 0.2% |

| 25th to 50th percentile | $23.9 | 0.008 | -0.5% | 0.311 | 0.0% |

| 50th to 75th percentile | $3.2 | 0.0008 | -6.8% | 0.044 | -1.3% |

| Top quartile | $0.7 | 0.0003 | -6.6% | 0.010 | -2.1% |

| All counties | $75.3 | 0.016 | 0.0% | 0.984 | 0.0% |

NOTES: Primary Care practitioners include all those self-identified identified as internists, geriatricians, family practitioners and pediatricians, plus RVUs billed nurse practitioners and physician assistants. IOM = Institute of Medicine; RVU = relative value unit.

SOURCES: RTI simulations; 2010 RVU file provided to RTI by Acumen, LLC.

| Percent Difference in Part B Payments by Level of Physician Work Adjustmenta | |||||

| Counties Grouped by Estimated Share of Their Population That Is Located in CMS Bonus Payment ZIP Codes | Current Policy: 25% of Work GPCI | 0% of Work GPCI | 100% of Work GPCI | Proportion Part B Enrolleesb | Proportion Primary Care RVUsc |

| Metropolitan Counties | |||||

| 0% | 0.7% | 0.3% | 1.8% | 0.365 | 0.384 |

| ≤20% | 0.1% | 0.0% | 0.5% | 0.369 | 0.437 |

| 20% to 80% | -0.8% | -0.3% | -2.2% | 0.011 | 0.008 |

| 80% to <100% | -1.3% | -0.4% | -4.0% | 0.012 | 0.005 |

| 100% | -1.4% | 0.0% | -5.6% | 0.004 | 0.003 |

| Subtotal | 0.4% | 0.1% | 1.1% | 0.761 | 0.836 |

| Nonmetropolitan Counties | |||||

| 0% | -2.8% | -1.0% | -8.1% | 0.089 | 0.063 |

| ≤20% | -3.0% | -1.1% | -8.6% | 0.096 | 0.075 |

| 20% to 80% | -2.5% | -1.2% | -6.3% | 0.010 | 0.005 |

| 80% to <100% | -3.0% | -1.2% | -8.6% | 0.032 | 0.013 |

| 100% | -3.7% | -2.0% | -9.0% | 0.012 | 0.006 |

| Subtotal | -2.9% | -1.1% | -8.4% | 0.239 | 0.164 |

| All Counties | 0.0% | 0.0% | 0.0% | 1.000 | 1.000 |

NOTES: CMS = Centers for Medicare & Medicaid Services; GPCI = geographic practice cost index; IOM = Institute of Medicine; RVU = relative value unit.

aFor each choice of percent physician work adjustment, value is defined as difference between payments estimated with GPCIs computed using all of the IOM committee’s recommendations, relative to payments estimated under current CMS policy including all floors.

bShare of Medicare beneficiaries enrolled in Part B fee-for-service program, from calendar 2009 (most recent county data available for download as of January 2012).

cShare of national total Part B RVUS billed in 2010 by physicians identified as internists, geriatricians, family practitioners and pediatricians, plus RVUs billed nurse practitioners and physician assistants.

SOURCES: RTI simulations; 2010 RVU file provided to RTI by Acumen, LLC.