7

Saving and Retirement Security

This chapter addresses two broad questions related to saving and retirement security in the United States in the face of population aging: (1) How is population aging likely to affect national saving rates, levels of retirement wealth and income, and retirement security? and (2) What are some policy options for mitigating potential negative effects that population aging may have on retirement security?

Saving is a key factor shaping the economic well-being of individuals and the nation as a whole. Households need saving for many reasons, including precautionary ones (to guard against large, unexpected costs or job loss), to accumulate assets for major purchases, and to prepare for retirement. At the macroeconomic level, national saving contributes to the amount of capital available for production and hence for economic growth.

As our society ages, household saving and dissaving (spending) patterns can be expected to change in a number of ways, with a variety of consequences for national saving. For instance, as people age and move into retirement, many will begin liquidating their stock of retirement assets to generate income that pays for living expenses, health care, and retirement care, among other things. Accordingly, as the percentage of the population in retirement grows relative to the rest of the population, the cumulative effect of such disinvestment may place downward pressure on the value of equities, housing, and other assets held by the older population. If older members of the population have different risk preferences and favor different asset classes than younger people—for instance, if they are more averse to risk—then an aging population can produce a shift in aggregate taste for risk and a new sharing of risk between cohorts. Additional pres-

sure on retirement income security may come from policy changes that address the excess of current government promises to pay Social Security, Medicare, and Medicaid over the projected tax revenues available to fund those programs.

In the absence of public policy reforms or new government programs, some households will be able to take steps to mitigate the negative effects that population aging may have on their retirement security. People may elect to work longer, save more, reallocate assets to less risky investments, change retirement consumption plans, or diversify retirement-related risks through the purchase of annuities or other insurance products—for example, long-term care insurance. Yet governments, too, can promote retirement security by adopting a holistic view of retirement policy that ensures that negative impacts from prospective reform of support systems are at least partially offset by policies and programs that strengthen household saving and the workplace-based retirement system.

The committee begins by reviewing data on U.S. saving and wealth patterns and showing that current private and public saving rates by and for workers are probably inadequate to provide a level of future retirement resources similar to that of recent retirees. While such a resource shortfall will result in economic stress on households, governments, and the macroeconomy, these concerns are not insurmountable. Nevertheless, addressing them effectively will require a renewed partnership between households, employers, and the government to ensure that retirement risk burdens are distributed fairly and that future generations of workers have a secure retirement.

DEFINING RETIREMENT WEALTH AND SAVING

To provide context for the rest of the chapter, the committee begins by examining how national and household wealth in the United States, as well as saving rates and retirement adequacy, have changed over the recent past. As will be seen, personal household saving has increased of late, but these patterns are offset by the largest federal budget deficits in decades.

Measuring Household and National Wealth

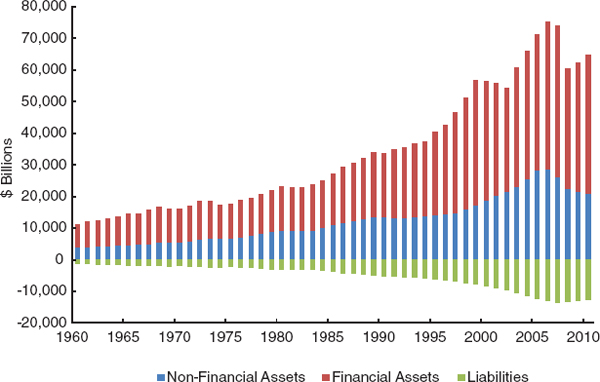

Gross national wealth (or worth) equals the total value of national assets (financial and nonfinancial) in an economy. Net national wealth, as defined in the Federal Reserve’s Flow of Funds Accounts (2011), is equal to total assets less total liabilities; this metric provides a broad-based measure of resources available to finance future consumption. Figure 7-1 shows the evolution of real (2005 dollars) net worth for the period 1960–2010, and indicates that Americans’ real net worth grew steadily over the past

FIGURE 7-1 Components of household real net worth, 1960–2010 (in 2005 dollars). SOURCE: Federal Reserve (2011).

50 years, averaging 3.5 percent annually and experiencing only 11 years of decline. Figure 7-1 suggests that growth in net wealth is correlated with the real business cycle.

National Saving Patterns

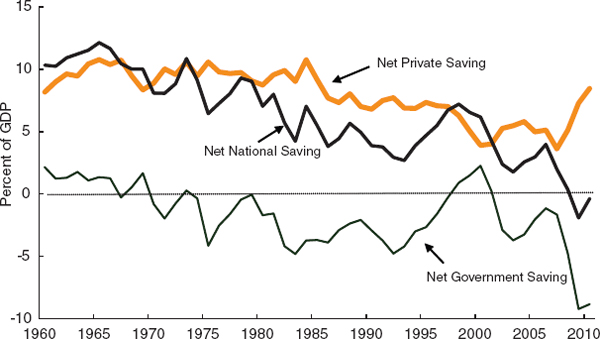

To effectively discuss saving and the impact of an aging society on saving, the committee distinguishes between private and government saving. The portion of a nation’s income not used for consumption is the sum of both kinds of saving, and it is termed national saving. In the United States, national saving and its component parts are typically measured using data from the National Income and Product Accounts (NIPA) drawn from the Bureau of Economic Analysis (BEA) (2011). Figure 7-2 shows the relationship between U.S. net private and public saving and net national saving over the past half-century. The evidence indicates that net national saving as a percent of U.S. gross domestic product (GDP) has declined in the last half-century, and this decline is attributable to declines in both private and government saving. A discussion of different saving concepts is provided in the attachment to this chapter.

The BEA defines private saving as the sum of business and personal saving, where “personal” includes not just households but also nonprofit

FIGURE 7-2 Net national saving, 1960–2010. SOURCE: Bureau of Economic Analysis.

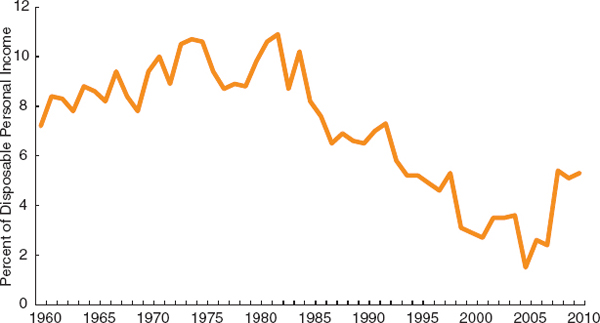

entities such as foundations, churches, and charities. Personal saving is defined as the difference between personal income and the sum of personal outlays and personal current taxes. Accordingly, the personal saving rate divides the flow of dollars saved by disposable personal income; this is the standard measure of personal saving in the United States (Guidolin and La Jeunesse, 2007). Over the last 50 years, there were three distinct periods, as depicted in Figure 7-3. The 1960–1985 period was characterized by relatively high personal saving rates, the 1985–2005 period was characterized by rapidly declining personal saving rates, and the last 5 years (2006–2011) have seen steadily increasing personal saving rates. Over the 25-year period 1961–1985, personal saving rates averaged 9.2 percent; they were never lower than 7.8 percent (1969) and peaked in 1982 for a post-Second World War high of 10.9 percent. By contrast, in the subsequent 25-year span, the average personal saving rate was only about 4.8 percent, declining in 19 of 25 years and sinking to a 70-year low of 1.5 percent in 2005.

The other main form of saving is public or government saving, measured as the difference between government revenues and expenditures. If public expenditures exceed government revenues, the public sector must borrow funds to make up the difference, which in turn may decrease funds available for private investment. At the federal level, there are few constraints on the amount of borrowing that is permitted. In contrast to the federal government, most state governments use capital budgeting rules for capital expenditures, and many have balanced budget requirements for their

FIGURE 7-3 Personal saving rate, 1960–2010. SOURCE: Bureau of Economic Analysis.

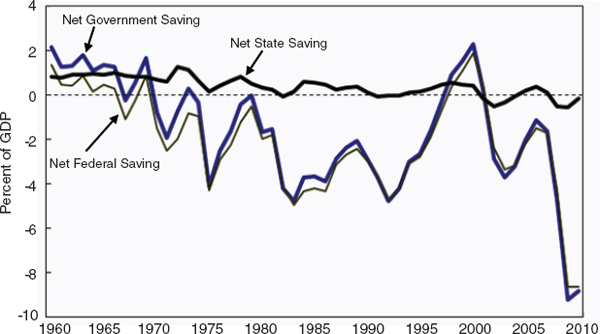

current operating budgets.1 Overall, state and local government contributions to national saving (or dissaving) tend to be relatively small relative to GDP. Figure 7-4 shows net government saving over the 1960–2010 period and demonstrates that total net government saving is strongly correlated with net federal saving. Indeed, state and local government saving rates have averaged about 0.38 percent of GDP over the past 50 years, ranging from a high of 1.25 percent in 1972 to a low of negative 0.55 percent in 2009. These figures, however, do not take into account the implicit borrowing associated with the underfunding in public pension plans (Novy-Marx and Rauh, 2010) or the underfunding of retiree health care promises. Accordingly, the states cannot be said to have contributed to net saving over the last quarter century when their off-balance-sheet shortfalls are taken into account.

The federal government has experienced rather wide swings in expenditures versus revenues over time: It ran small budget surpluses through much of the 1960s, posted small deficits through most of the 1970s, and then ran increasingly larger deficits through the 1980s and into the early 1990s. Between 1998 and 2001, the federal government ran small surpluses; it then began incurring deficits again in 2002. So while the average federal deficit was about 2.1 percent of GDP over the past half-century, federal govern-

_____________

1State balanced budget restrictions can be misleading because off-budget accounts such as defined benefit pensions and retiree health care benefits are often underfunded.

FIGURE 7-4 Net government saving, 1960–2010. SOURCE: Bureau of Economic Analysis.

ment net saving has ranged from a low of around negative 8.7 percent in 2010 to a high of about 1.9 percent in 2000. The historically large deficits of the last 3 years, in part caused by efforts to help the economy recover from the deep recession that followed the financial crisis in 2008, have unfortunately coincided with the leading edge of the retirement of the baby boom generation.

Looking ahead, these and other obligations will exert pressure on budgets at both the federal and state and local levels. Moreover, these figures do not include the enormous and persistent increases in the unfunded obligations scheduled under the Social Security and Medicare programs.2 Some researchers have estimated that total underfunding of both Social Security and Medicare under current law stands at a present value of $9.5 trillion (over a 75-year horizon); the committee recognizes, however, that there is considerable controversy about these numbers and uncertainty associated

_____________

2The term “unfunded obligations” (or “unfunded liabilities”) is used here as a means of describing the shortfall of projected revenues compared to scheduled benefit payments. The committee recognizes that, by law, there is no unfunded liability for either Social Security or Medicare Hospital Insurance: Actual law prohibits spending anything on these two programs in excess of accumulated reserves and current revenues. The reason that economists and finance experts regularly measure the shortfall or “implicit” debt of these programs is because this is a sensible way to evaluate the potential burden of “keeping the promises.” To ignore the shortfall between scheduled and payable benefits would be highly misleading.

with such estimates.3 Nevertheless, under current law, benefit projections will contribute to large and rising future federal obligations.

National Saving and an Aging Society

The recent financial crisis and recession have taken a severe toll on household wealth and national saving. Total net national saving has dropped substantially, owing to the historically large federal deficits and the accompanying large decrease in public saving. The stock of household wealth has also declined owing to the sharp decline in home prices, along with the need for millions of Americans to tap into their retirement saving owing to high unemployment.

Taking a longer-term perspective, it is difficult to predict the likely impact of population aging on national patterns of wealth accumulation. The simple economic life-cycle model predicts that people save during their working lives and draw down this wealth during retirement. For this reason, some suggest that baby boomer retirees will need to sell off their assets so as to finance consumption, which might prompt a market meltdown. On the other hand, because population aging is predictable, economic theory suggests current asset prices will adjust so that expected returns will be positive over all future time periods. Furthermore, the demand for assets by emerging economies (some of which are experiencing slower or no population aging) may help offset the sales of assets by economies with older populations (for more on such possibilities, see Chapter 8). It is also uncertain how the savings of the young and middle-aged will respond to changes brought on by an aging population. They may save at a higher rate than past generations if they anticipate reductions in public health and retirement benefits and increased longevity. On the other hand, they might save less if they plan on working longer, thus needing a relatively smaller nest egg in retirement.

It is also worth pointing out that the mix and type of saving instru-

_____________

3The $9.5 trillion is a so-called “open-group” measure, which takes into account system Trust Funds as well as scheduled future taxes and benefits. By contrast, a closed-group measure of unfunded liabilities includes projected benefits and taxes only for persons aged 15+ (in other words, those under age 15 or as yet unborn are excluded). According to this second measure, the closed-group Social Security unfunded value comes to $18.8 trillion, including the combined Trust Funds; excluding them, the unfunded amount would be $21.3 trillion (Board of Trustees, Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, 2011, p. 67). Medicare closed-group as well as open-group values are more uncertain since the system has a call on general revenues and because uncertainties about the impact of the health care reform bill make cost-savings difficult to compute (Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, 2011).

ments demanded by an aging population are likely to differ from those desired in the past (Mitchell et al., 2006). For instance, the long-term movement toward defined contribution (DC) pensions and away from defined benefit (DB) pension plans is likely to focus older individuals on new ways to manage their spending patterns and draw down their wealth throughout retirement. Guaranteed annuities represent an appealing mechanism by which older persons can protect themselves against outliving their assets, and future demand is likely to increase for products that can help make retirement income more predictable (Chai et al., 2011). Each of these is likely to challenge financial firms to design new products to provide the desired balance between protection from risk and higher expected returns. Another set of risks against which financial protection may be desired is political risk: the huge underfunded liabilities of public pension and many retiree health care plans in the United States leave those programs susceptible to reductions in scheduled benefits or other changes to reduce costs. That uncertainty may induce the young and old alike to take precautionary steps, such as by planning to work longer, saving more, and drawing down assets less quickly than they would have otherwise. While there is little hard evidence on this, early results suggest that such patterns are already evident in the wake of the financial crisis (Coronado and Dynan, in press).

An important dimension to the impact of aging on national saving is the fact that households differ greatly in terms of their standards of living. Households with low levels of human capital and low lifetime earnings will almost certainly continue to save little and to rely heavily on social programs to maintain their standard of living. It is also likely that households with higher lifetime earnings will need to be prepared to maintain an increasing share of their retirement living standards through their own means rather than through government programs. Research suggests that this may already be occurring, with households in the top quartile of earnings relying less on government social welfare programs for retirement income than previous generations of households in this quartile (Purcell, 2009a). One challenge of an aging population may be a growing number of increasingly long-lived individuals who outlive their retirement resources and will then rely heavily on the social safety net to meet late-life needs (see Table 7-1).

ARE SAVING RATES SUFFICIENT IN

VIEW OF POPULATION AGING?

This section asks whether household saving rates are adequate in view of population aging, and it identifies which subsets of people are at risk of falling behind.

TABLE 7-1 Distribution of Household Wealth from Pensions, Social Security, and Other Sources, by Wealth Decile: Early Boomers Aged 51–56 in 2004 (in 2010 dollars)

| Source | Wealth Decile | ||||||||||

| Poorest 1 |

2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | Wealthiest 10 |

Average | |

| Pension wealth | 2,445 | 11,531 | 33,412 | 59,120 | 108,255 | 139,015 | 206,486 | 280,263 | 402,127 | 595,128 | 178,007 |

| Social Security wealth | 65,819 | 125,364 | 163,678 | 213,629 | 211,623 | 237,545 | 248,236 | 261,890 | 285,379 | 289,698 | 208,096 |

| Other wealth | 6,730 | 36,034 | 81,427 | 114,054 | 180,050 | 266,219 | 345,428 | 481,462 | 700,225 | 1,544,980 | 360,822 |

| Total wealth | 74,994 | 172,929 | 278,517 | 386,802 | 499,927 | 642,779 | 800,150 | 1,023,615 | 1,387,731 | 2,429,807 | 746,924 |

| Pension wealth/total wealth (%) | 3 | 7 | 12 | 15 | 22 | 22 | 26 | 27 | 29 | 24 | 24 |

| Social Security wealth/total wealth (%) | 88 | 72 | 59 | 55 | 42 | 37 | 31 | 26 | 21 | 12 | 28 |

NOTE: Households with the top and bottom 1 percent of total wealth are excluded.

SOURCE: Derived by Olivia S. Mitchell and Yong Yu from data from the Health and Retirement Study provided in Gustman, Steinmeier, and Tabatai (2010).

Defining Adequacy

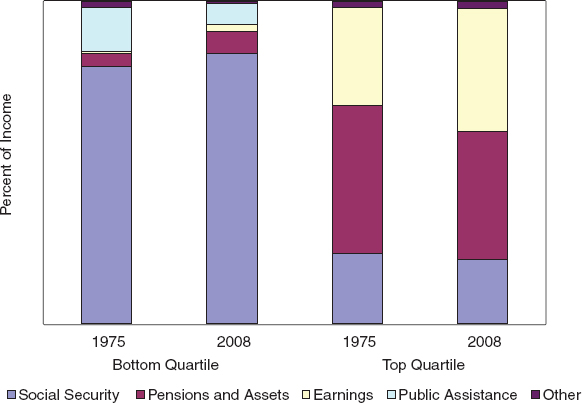

The adequacy of retirement security is usually judged using two different measures. The first focuses on a retiree’s income flow compared to his preretirement income flow and asks whether retirees’ living standards are close to what they experienced during their working life. The second measure focuses on the sufficiency of retirement resources, or the stock of assets available to smooth lifetime well-being. In either case, one must assess saving patterns, returns earned on invested assets, the number of years spent accumulating retirement assets, the period expected in retirement, and the mix of anticipated retirement income and assets. In the absence of Social Security, these two dimensions of adequacy are highly correlated because having sufficient retirement resources is crucial to generating adequate retirement income to support retirement consumption. Yet the progressivity of the current Social Security benefit structure means that some households with low lifetime earnings will require fewer of their own retirement assets to achieve adequacy. Figure 7-5 compares sources of income for the top and bottom quartile of Americans over the age of 64 for the years 1975 and 2008. The findings suggest that the bottom quartile continues to rely heavily on Social Security benefits (about 84 percent of income in 2008), whereas the top quartile has grown less reliant on Social Security payments

FIGURE 7-5 Income distribution, by source, for people aged 65+ in the top and bottom income quartiles, 1975 and 2008. SOURCE: Purcell (2009a).

(about 20 percent of income in 2008). Yet by 2008, the bottom quartile had become relatively more reliant on its own assets as a source of income, and both groups experienced an increase in reliance on labor earnings over time.

Empirical Approaches and Aggregate Findings

Analysts disagree about whether and which Americans are adequately prepared for retirement in terms of resources and retirement income. To explain this conundrum, it is important to point out that economists and financial advisers measure adequacy in different ways. One methodology uses a target saving measure to determine adequacy. This methodology defines projected retirement expenditure levels for a given household and specifies the mix of income and assets required to cover a proportion (or all) of this target spending level. Accordingly, if a household seems likely to accumulate enough assets to support this level of consumption, the household’s plan is said to be adequate; otherwise it will have a shortfall and additional saving needed may be specified to hit the target. Authors who use this approach generally conclude that a majority of Americans will face shortfalls in retirement, due to insufficient saving and early retirement (Schieber, 2004; Mitchell and Moore, 1998; McGill et al., 2010). In other words, they have not accumulated assets sufficiently rapidly to achieve the replacement rate goal. Mitchell and Moore (1998) conclude that most older households have accumulated far too little to replace preretirement income if they plan on retiring at age 62; in fact they would need to save on average 18 percent more per year (above current saving rates) to attain the desired asset level. Deferring retirement to age 65 would cut the shortfall in half.

A variant on this approach focuses on whether retirees have command over resources sufficient to replace 70–75 percent of preretirement (posttax) income. Of course this presumes that peoples’ actual preretirement consumption levels are adequate, and that having a drop in spending of one-quarter in retirement would not cause hardship. For example, Munnell and Soto (2005) use the Health and Retirement Study (HRS) to estimate how much income households receive in retirement relative to earnings before retirement. They take into account all actual and potential sources of income, including pensions, Social Security, and home equity, and conclude that replacement rates for households with employment-based pensions are 79 percent for couples and 89 percent for single-person households. Replacement rates for households without pensions are 62 percent and 63 percent, respectively.

A second approach to the adequacy question uses economic optimization models to evaluate whether people have accumulated enough to smooth their lifetime well-being. A widely cited analysis by Scholz, Seshadri, and Khitatrakun (2006) develops a life-cycle model to calculate

optimal saving decisions for HRS households, taking into account longevity risk, income shocks, medical expenses, taxes and transfers, pension and social security benefits, and changes in family composition. After deriving estimates of wealth that the households would ideally amass, they compare these outcomes with observed wealth patterns. Since peoples’ ideal wealth accumulation patterns are highly correlated with actual wealth patterns, the authors conclude that most people were doing approximately the “right thing.” While some 20 percent did appear to have saved too little, the amount of undersaving was generally small. In contrast, using a similar model but an earlier data set, Bernheim (1997) found that baby boomers had accumulated only about one-third as much financial and housing wealth as they should have.

In sum, depending on the specific study, research suggests that between one-fifth and two-thirds of the older population can be said to have undersaved for retirement. Moreover, these studies assume that Social Security and Medicare benefits will be paid as scheduled.4 Since this is improbable (see Chapter 9), the chances of shortfalls are likely even greater.

Disaggregating Adequacy Measures

Conclusions about savings adequacy might be more similar if such differences could be reconciled (Haveman et al., 2007). But in any event, all analysts agree that there is much heterogeneity in retirement wealth and consequently adequacy. One factor differentiating those who save from those who do not is financial literacy; as Lusardi and Mitchell (2011) show, the least financially literate are also least likely to plan for retirement and to actually execute successful saving plans. As noted in the preceding section, however, accumulating few liquid financial assets may be rational for low-income individuals to the extent that they expect to receive relatively generous benefits from Social Security along with means-tested (e.g., Medicaid) benefits. In other words, it may be economically sensible for the low-income population to save little even if it leaves it exposed to financial shocks.

_____________

4Mitchell and Moore (1997) found that the median HRS black and Hispanic households on the verge of retirement in 1992 had only $5,000 in financial wealth; by contrast whites had approximately 11 times more financial wealth, and more than four times as much wealth when housing is included. For all racial groupings, at the median, housing wealth comprised over half of wealth. Its importance was greatest for black and Hispanic households, where housing equity represented the vast majority of accessible wealth. Using 2001 data, Wolfe (2006) concluded that for those aged 47–64, whites had 5.5 times the net worth of nonwhites. Somewhat offsetting the lower wealth levels for nonwhites is their lower survival rates: After controlling for both race and education, Wolfe predicted that the odds of death for black men were 1.3 times those for other groups. Nevertheless, for those aged 65–90, black men were not found to have a significantly higher risk of death than other males. For additional views see Waldron (2002).

Another factor is that low-income households may be at greater risk because a larger proportion of their retirement income is used to replace necessities. One study found that replacement rates need to be as high as 94 percent for households earning $20,000 or less per year, while those earning $60,000-$90,000 have replacement rates of about 78 percent to achieve retirement adequacy (Aon Consulting, 2008). It also appears that employees with defined contribution plans were once less likely to save over their lifetimes, though those covered by defined benefit pensions can also fall short due to insufficient pension funding (McGill et al., 2010). Workers in the not-for-profit sector do appear to be saving enough to accumulate adequate retirement assets (Hammond and Richardson, 2009), particularly the longer-tenured employees.

The fact that the cost of medical care continues to outpace both earnings and overall price increases indicates that this component of retirement spending will remain substantially uncertain into the future. Many current projections indicate that retirees will need to devote an increasing fraction of retirement resources to paying for health care, as the Medicare and Medicaid systems along with employer-provided retiree health insurance face solvency pressures. If reforms in these systems result in less generous public health insurance benefits, this could reverse the long-term trend of retirees bearing a declining share of responsibility for their health-related expenses (Richardson, 2008). Even prior to the reforms, the Employee Benefit Research Institute (2009) projected that workers retiring in 2009 would need as much as $378,000 (for males; $450,000 for females) to be 90 percent sure of having enough assets to pay for out-of-pocket health care costs in retirement. If accurate, these estimates suggest many current workers are quite likely to be undersaving for a secure old age.

Handling Risk During Retirement

Whether workers and retirees have adequate retirement provision depends in large part on the risks people will face, which in turn suggests that understanding retirement risks is critical to predicting whether retirement accumulations will be adequate. Many older households are increasingly being asked to decide how much to save, where to invest, when to claim benefits, and how to effectively protect against longevity risk and potentially large macroeconomic shocks. Public policy and the markets have made some progress in helping people to better manage these risks by rolling out pension autoenrollment, autoescalation, and life-cycle default funds. Yet the typical U.S. pension contribution threshold is still too low to ensure adequate retirement wealth, and life-cycle funds can be susceptible to market volatility and systemic shocks.

Investment Portfolio Risk

One question that has interested researchers for decades is whether and how people’s risk tolerance, and hence investment and insurance demand, changes with age. Interestingly, theory and evidence are still inconclusive regarding this question; some analysts predict that equity holding will fall with age, while others find the opposite. On the whole, there is little agreement in the literature about whether an aging population will liquidate equity holdings en masse. In practice there are many different assets available to investors, with different risk attributes and correspondingly different expected returns. In general, investors require a higher rate of return on assets that have more market or aggregate risk, which is risk that cannot be avoided through portfolio diversification. For example, the expected rate of return on a diversified portfolio of stocks is higher than that on a portfolio of Treasury securities, because investors are averse to the risk that the stocks will perform poorly just when the rest of the economy is also weak. The difference between the expected return on risky stocks and Treasury bills is called the “equity risk premium.” Other risky investments, such as corporate bonds and real estate, also have expected returns in excess of Treasury rates because they expose investors to undiversifiable risks.

As the population ages, it is possible that such demographic change will affect the aggregate risk appetite of the capital market. If an older population is more risk averse than a younger one, the price of risky assets could be lower and required risk premiums commensurately higher than in the past. An increase in demand for relatively safe financial assets would create incentives for companies to shift to investing in safer real projects as well, causing shifts in the production process and in the mix of goods and services produced. An increase in risk aversion at older ages could be induced by changing economic circumstances, or it could arise from fundamental changes in preferences. Several studies, notably Bodie, Merton, and Samuelson (1992) and Jagannathan and Kocherlakota (1996), have suggested that older households should be less tolerant of investment risk because they cannot offset adverse shocks to the value of their asset holdings by increasing their labor supply. The typical advice of financial advisers to reduce exposure to investment risk with age is consistent with that reasoning. Yet more recent analyses have suggested that the link between age and the tolerance for investment risk—and its relation to labor income—may be more complicated. Benzoni, Collin-Dufresne, and Goldstein (2007) argue that because labor income is a significant source of long-run market risk for young people, they are expected to be more averse to investment risk than middle-aged households, whose lifetime labor income is less uncertain. This study predicts a hump-shaped pattern of risky asset holding over the life cycle, which in aggregate would imply greater risk tolerance when a

larger portion of the population is middle-aged. A life-cycle perspective that includes housing, such as that developed by Bakshi and Chen (1994), also suggests that the demand for financial assets may increase as people age and their demand for housing diminishes.5 It is more difficult to evaluate whether aging causes fundamental changes in preferences toward risk, and there has been relatively little work done by economists on that question.6

Morbidity Risks

An aging society will also have an increasing likelihood of morbidity risks, as a growing percentage of the population is at an age where the incidence of multiple diseases, disorders, and medical conditions increases substantially (Chapter 4). Who will bear the risk burden for financing a population with this growing number of morbidities? Some have argued for a universal-coverage national health care insurance program with mandatory participation that would result in young healthy people bearing a larger share of risk burden of paying for older people’s health care costs. Even under present law, as people age, they tend to become more dependent on government health care programs, so an aging population will likely generate increasing pressure on the Medicare and Medicaid systems, leading to the potential of ever-increasing shifts of elderly health-related risk burdens onto the working age population in an attempt to maintain system solvency. And to the extent that Social Security and Medicare provide a floor of protection to the elderly, financial market shocks that impact older people’s ability to pay for their own needs will also likely shift an increasing share of these burdens onto the labor force. Financing the costs of this shift in elderly health-related risk burdens can be facilitated through new taxes on and transfers from the labor force, but ex ante it is virtually impossible to quantify what these political risks will be and how they will be allocated.

_____________

5It is also important to recognize that risk tolerance is not spread evenly among individuals or households within age groups. Much of the total wealth of older people is held by those with very high wealth. However, the pattern of risk tolerance among the very wealthy is not clear from previous research. Older studies (e.g., Riley and Chow, 1992; Morin and Suarez, 1983) conclude that risk aversion declines with age. More recent studies (Wang and Hanna, 1997; Paravisini, Rappoport, and Ravine, 2010) find that wealthier investors are more risk averse. And, any number of studies (e.g., Hariharana, Chapman, and Domian, 2000; Hanna and Lindamood, 2004; Lybbert and Just, 2007; Kapteyn and Teppa, 2011) question the quality/usefulness of existing measures of risk tolerance and note problems associated with empirical tests of the relationship between wealth and risk aversion.

6There have been studies of the impact of changes in family status such as widowhood or divorce, where there is usually a large negative impact on income and assets. And there is separate research on the health/wealth trajectory with age. As far as the committee knows, there is no thorough and overarching analysis of how the riskiness of household assets changes with age for the elderly.

Social Security and Medicare Solvency Risk

When forecasting the contribution rate needed to achieve retirement security, most academic studies and financial planning simulation models assume that Social Security and Medicare scheduled benefits will continue to be paid. Yet this is by no means assured in view of the projected insolvency of these systems given current payroll tax and benefit formulas (Board of Trustees, Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, 2011). Payroll tax collections for Social Security benefits have been insufficient to cover annual cost from 2010; after Trust Fund assets are exhausted, payroll tax revenue will be sufficient to pay only about 75 percent of scheduled benefits beginning around 2036.

Older Americans’ ability to rely on the Medicare system is also in doubt. Medicare’s health insurance (HI) expenditures have exceeded HI Trust Fund income annually since 2008 and are projected to continue doing so until the HI Trust Fund is exhausted, in 2024. While household premium and general tax revenue income are reset each year to match expected costs, the projected cost growth of Medicare Parts B and D will require households and government to devote ever increasing shares of their budgets to financing these benefits.

Policy makers have not agreed on the feasible set of public policy solutions for restoring the solvency of these systems. Possible reforms include increasing payroll taxes by changing either the tax rate or tax base (or a combination of both), cutting the level or growth of benefits, raising the minimum age for normal and early benefit eligibility, expansion of means testing, or some combination of these. Because Social Security and Medicare currently provide a great deal of purchasing power for a substantial percentage of the population (SSA, 2010b), such profound uncertainty makes it difficult to judge future retiree adequacy with any confidence. The risk of inadequacy is substantial for the bottom quartile of workers, who rely most heavily on Social Security and Medicare, and threatens to reverse the decades-long trend of declining elderly poverty rates (see Box 7-1). Yet system reforms will likely impact the retirement security of all cohorts, and offsetting reforms to other programs such as the employment-based retirement system will be needed to ensure that older Americans can maintain a reasonable standard of living during retirement.

One might ask why poverty rates among the elderly are not higher if many people save inadequately for retirement. This report notes that retirement adequacy is usually measured either by (1) focusing on a retiree’s income flow compared to pre-retirement income, and asking whether the retiree’s living standard is close to that experienced during the working life, or (2) focusing on the sufficiency of retirement resources, or the stock of assets available to smooth lifetime wellbeing. This is different from most

BOX 7-1

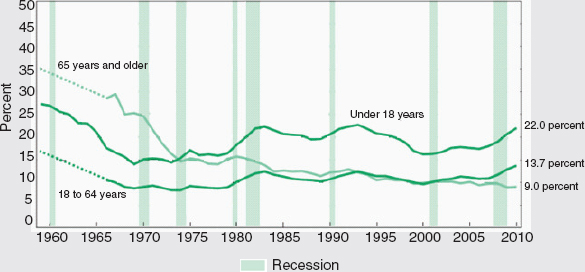

Poverty Among the Elderly

Inadequate retirement saving and poor risk management increase the likelihood that a person will spend at least a portion of retired life in poverty. Using the U.S. government’s official poverty line, poverty rates among the elderly have declined long-term (Wentworth and Pattison, 2002). Another study focused on more recent changes (Issa and Zedlewski, 2011, p. 5):

The Great Recession, which began in December 2007, reduced incomes and increased poverty for younger Americans. Between 2007 and 2009, the poverty rate for those younger than 65 increased from 18.0 to 20.7 percent. For adults age 65 or older, however, poverty rates fell from 9.7 to 8.9 percent, and the share living in low-income families fell from 36.1 to 33.7 percent [see Figure 7-1-1]. Old-age poverty declined primarily because Social Security’s cost-of-living adjustment formula increased benefits by 5.8 percent in January 2009 (following a temporary surge in prices in mid-2008), while the price level fell slightly in 2009. This benefit increase significantly boosted incomes for low-income older adults, who rely primarily on Social Security. Poverty and near-poverty rates for adults age 75 or older declined more than for adults younger than 75 because Social Security makes up a larger share of their incomes. The incidence of near poverty fell slightly between 2007 and 2009–0.2 percentage points—among adults age 65 to 74. Their poverty rate fell more sharply, from 8.8 to 8.1 percent.

Still another study (Short, 2011) computed new poverty numbers using a broader definition of income, and it finds poverty among the 65+ group to be 15.9 percent, versus 15.6 percent for those aged 10–64. The new measure differs from the official poverty line as follows (p. 8): “The official poverty measure does not take account of

concepts/measurements of poverty. It is quite conceivable that many people could save too little yet not be in poverty. One of the goals of the follow-on study to this report will be to quantify inadequacy according to different definitions and measurements and thereby obtain a better understanding of the relationship between poverty and retirement saving.

Workplace Retirement Income Plan Risk

Americans’ retirement saving adequacy is strongly influenced by whether people participate in a workplace retirement income program. In the United States, pensions are usually of the DB or DC variety, though a plan may also be structured as a hybrid with both DB and DC characteristics. Employers who sponsor a DB plan typically offer coverage to most employees and require participation in the plan.7 Private sector employers

_____________

7It should be noted that while a DB plan generally offers broad coverage, workers may lose any rights to pension benefits if they leave the organization that sponsors the plan. In other words, there is individual risk in DB plans associated with worker mobility.

taxes or of in-kind benefits aimed at improving the economic situation of the poor.” So the usual view that poverty is lower among the elderly than among the nonelderly is sensitive to the definitions used (e.g., the inclusion or exclusion of Medicare premiums).

FIGURE 7-1-1 Poverty rates among three age groups, 1959–2010. SOURCE: U.S. Census Bureau, Current Population Survey 1960 to 2011, Annual Social and Economic Supplements.

are also responsible for maintaining minimum funding levels that reduce the risk that plan assets will fall short of promised payments. By contrast, DC plans typically have voluntary participation, and they allow employee elective contributions and choice over the investment of their retirement assets.

As discussed in Chapter 5, prior generations of American workers who had workplace coverage typically had a primary DB and may have had a supplemental DC plan. Beginning in the early 1980s, however, plan type became more sector-specific, with the majority of private-sector and federal government workers covered by a primary DC plan, while most state and local public sector workers continued to have a primary DB plan. Both types of plans are under considerable stress today. In DB plans, underfunding is widespread, partly because public pensions are generally not subject to federal minimum funding requirements. Moreover, though corporate DB plans have funding requirements, there is in fact widespread underfunding in this sector as well. In DC plans, low contribution rates (which result in inadequate retirement assets) are more prevalent in the for-profit sector’s 401(k)-type DC plans than in the not-for-profit sector’s DC-type plans.

Followers of workplace-based pensions have noted some positive, but also some negative, trends of late. In any year, about half the private sector workforce has been covered by employer pensions for three decades (Employee Benefit Research Institute, 2011a and 2011b), in spite of numerous legislative attempts to enhance coverage. Low-wage workers who change jobs often or work in small firms often lack the option to save in DC plans, giving rise to government proposals to expand coverage (Iwry, 2004). Nevertheless, several policy reforms have increased employer adoption of auto-enrollment and default provisions that boost DC plan participation and contributions. Employers who offer retirement plan contribution and investment defaults generally see higher pension saving rates (only partly offset by reductions in voluntary nonpension saving; Card and Ransom, 2011). As noted above, DB plans are suffering from the market downturn and persistent underfunding.8 Regulatory burdens are widely believed to have restricted the growth and deepening of the employer-sponsored pension marketplace (Perun and Steuerle, 2006). In light of the budget stringencies discussed above, it would seem difficult to enhance tax inducements to boost pension saving. Nonetheless, if workplace retirement plans are to play a continued key role in helping the working-age population prepare for retirement, it will be critical for employers to adopt and support well-designed retirement plans that encourage workers to save adequately in diversified portfolios, which can maximize the likelihood of providing a secure retirement.

Housing Wealth Risk

In many nations, people have often considered housing as a safe asset, and U.S. baby boomers are no exception; they have relied more on housing equity for retirement security than previous generations (Lusardi and Mitchell, 2007a). Unfortunately, the bursting of the housing price bubble and ongoing housing market slump have eroded the large pool of retirement wealth that had been held in the form of home equity. Both the illiquidity of housing assets and the volatility of house prices can also affect the adequacy of retirement resources when retirees plan to lean heavily on housing wealth as a source of consumption. Real net household nonfinancial wealth experienced an approximately 26 percent decline since its peak in 2006. Such an extraordinary loss of wealth affects current and future retirees’ ability

_____________

8DB plans are significantly subsidized currently by underpriced insurance premiums, and they are likely to face premium increases (as proposed in the President’s 2012 budget), which may discourage employers from offering DB plans in the future. The government reinsurance entity, the Pension Benefit Guaranty Corporation, is itself rather seriously underfunded (see Pension Benefit Guaranty Corporation, 2011).

to rely on housing wealth to finance retirement consumption. In addition, many households enter retirement still holding a mortgage (Webb, 2009); this subjects them to additional pressure to generate adequate retirement assets to cover mortgage payments, and it also increases the illiquidity of housing for purposes of releasing equity.9 Younger households, however, have benefited from the increased affordability of housing, and their prospects for accumulating equity in new homes purchased may be better than in recent years, when prices were inflated.

EXPLANATIONS FOR SAVING INADEQUACY

Analysts have offered a variety of explanations for why many people fail to save enough for retirement. One economic argument is that public policy has engendered moral hazard, so that many may look to government programs—Social Security, Medicare, and, in some cases, Medicaid—to take care of them after they retire (Gruber, 2009). Especially for lifetime low-income workers, support provided by such government programs can represent a significant percentage of income before retirement and also make it possible to mostly maintain the same lifestyle postretirement. Because Social Security is often presented as a publicly managed DB retirement program financed by lifetime worker contributions, many wrongly assume that there is no need for them to devote anything more to retirement saving. So while Social Security was initially conceived of as an insurance program (Scheiber and Shoven, 1999), survey evidence now suggests that many expect Social Security to provide everyone with a reasonable standard of living in retirement (Greenwald et al., 2010).10

Moreover, public policy in certain areas may have counteracted retirement policy. For example, when lifetime lower-income and middle-income households do save, they can find themselves subject to means-testing of Social Security payments (through the tax on benefits). Moreover, they may also be rendered ineligible for assistance through the Medicaid program as

_____________

9While the post-2008 decline in house prices has left many households with much lower housing equity than they expected to have, it is not clear whether this will translate into a major long-term macroeconomic effect. The committee does not believe there is evidence that housing’s contribution to personal assets or consumption is changing because of the aging of the U.S. population. It recognizes that some have speculated that the value of housing will decline because of demographic-related shifts in household composition, but there is no clear evidence to allow forecasts of such a diminution of value.

10It is also possible that some Americans save little in the expectation that their children will take care of them. Many baby boomers have heavily invested in their children’s education, and they may now be looking for that investment to pay off. Currently, much of the care received by the frail elderly population is informal, usually provided by adult daughters (Johnson, Toohey, and Wiener, 2007). Whether this will continue in the future, given the trend toward smaller and more split families, is unclear.

it encourages lower-income retirees to spend down what few assets they may have in order to qualify for benefits. Minimum-distribution requirements in DC plans limit retirees’ tax deferrals and also discourage holding assets for late-life needs or deferred annuitization; these also can penalize “super saver” retirees.

Another potential factor contributing to low saving rates is financial illiteracy. That is, those who fail to understand basic economic and financial concepts may lack adequate tools for determining how—and how much—to save, as well as how to draw down assets in retirement. Studies have found that many Americans are financially illiterate, with a large percentage of households unfamiliar with the basic economic concepts necessary for making decisions about investing and saving. The problem is seen to be particularly acute among those who are most economically vulnerable, such as minorities, women, and those with the least education (Lusardi and Mitchell, 2007c and 2009). Not surprisingly, those who are least financially literate are also the least likely to be well-prepared financially for retirement (Lusardi and Mitchell, 2007b). More specifically, financially literate Americans are more likely to plan for their retirements, and planners are better prepared for retirements—with significantly higher wealth levels—than nonplanners (Lusardi and Mitchell, 2007a).

A related possibility is that people may underestimate their chances of living a long time in retirement, which might make them unlikely to save much for the latter portion of their lifetimes. But this idea is contested by Hurd and McGarry (1995), who conclude on the basis of subjective survival probabilities reported in the Health and Retirement Study that these probabilities correspond well with life table values and risk factors. In other words, it seems unlikely that overly pessimistic survival expectations are driving saving shortfalls.

CORRECTING RETIREMENT SAVING AND WEALTH SHORTFALLS

In view of the serious potential for retirement inadequacy, the committee explores next possible solutions to the problem. In particular, it focuses on what governments and employers might be able to do to help workers achieve retirement security, and what new financial products and services might help meet these deficiencies. Several approaches might be useful in correcting retirement saving and wealth inadequacies.

Boosting Saving

It is possible that more workers would save for retirement if there were universal access to employment-based retirement saving programs. Some have favored automatic enrollment of all workers, thus increas-

ing program participation (Choi et al., 2002). Yet default saving rates in automatic-enrollment defined contribution plans tend to be set relatively low to encourage the low-paid to contribute. Others have proposed universal access to auto-enrollment 401(k)s or IRAs for employees of small firms, low-income workers, and workers who change jobs often, thus allowing more employees to take advantage of these programs (Iwry, 2004). Yet there is little agreement about how much more low-income households should save for retirement, because many already have difficulty financing subsistence consumption.

A different way to reduce the need for retirement income is to develop policies that encourage longer working lives and later retirement. For instance, raising the Social Security full retirement age and Medicare eligibility age would likely induce many individuals to extend their working lives, giving them additional years to make contributions to private retirement saving accounts as well as to the Social Security system. This could have the added benefit of reducing the number of years that they would need to be supported in retirement, though it might increase hardship on some and might also boost applications to the Disability Insurance program.11

Finally, making people more productive and likely to work—particularly in their later working lives—might help them get and hold better-paying jobs and thus increase the amounts they amass in retirement saving. Working in the other direction, if people respond to shortfalls by working longer, they might not have to save as much. In any event, encouraging later-life skill-building and training could make older adults more likely to get and hold better-paying jobs. An additional approach would be to encourage employers to invest more into wellness programs for workers, thus making it more likely that their workers will be able to work longer and live better in retirement as well as better understand and control health care costs.

Increasing Access to Retirement Assets

More diversification of the ways in which Americans provide for their retirement might also enhance retirement saving adequacy. One method already available is to allow older persons to take out reverse mortgages on

_____________

11Venti and Wise (2001, p. 27) argue that “the bulk of the dispersion in wealth at retirement results from the choice of some families to save while other similarly situated families choose to spend. For the most part, controlling for lifetime earnings, persons with little saving on the eve of retirement have simply chosen to save less and spend more over their lifetimes. It is particularly striking that some households with very low lifetime resources accumulate a great deal of wealth, and some households with very high lifetime resources accumulate little wealth … these saving disparities cannot be accounted for by adverse financial events, such as poor health, or by inheritances.”

their homes (Mitchell et al., 2006). Reverse mortgages in many cases offer a reasonable way for people to access the equity in their homes while continuing to live there for the rest of their lives. Nevertheless, these mortgages are widely seen as expensive, and the decline in home values may make tapping into this asset less feasible for some retirees. Developing policies and regulations that improve the pricing and transparency of reverse mortgages could improve older Americans’ retirement security.

Protecting Against Longevity Risk

As noted previously, an aging population may result in changes in the demand for various types of financial products. For example, there could be a shift from demand for life insurance toward demand for annuities. More generally, pressures to reform Social Security and the long-term shift in private retirement schemes from DB to DC plans of various sorts, as well as increased reliance on individual saving, imply that the financial risks associated with retirement income—asset returns and the stability and liquidity of assets—will increasingly be borne by individuals rather than public or private pension schemes. Such trends are widely expected to create significant demand for major innovations in financial instruments and markets geared to meet these varied needs. While longer lives are generally considered beneficial, they can lead to a “winner’s curse” by increasing longevity risk—the chance of living so long that all retirement assets are depleted to support consumption. To protect against longevity risk, most financial advisers recommend converting a portion of retirement assets into annuities, which continue to pay as long as the insured party lives. While annuities play a critical role in theoretical models of retirement protection (Chai et al., 2011), in practice relatively few Americans buy them (Mitchell, Piggott, and Takayama, 2011). Public policy could make features and pricing of annuity products more transparent so that buyers could better understand them; this might enhance older Americans’ confidence in annuities as protection against longevity risk. Evidence also suggests that workers with access to annuities through their workplace retirement plan are more likely to annuitize a portion of their retirement wealth at some point during retirement (Brown, Poterba, and Richardson, in press; Yakoboski, 2010). Public policies that encourage employers to offer annuities in their retirement plans would likely lead to more widespread adoption of annuities as one source of retirement income.

Some commentators have suggested that strong bequest motives might inhibit annuity purchase because people want to be sure that their heirs receive at least some of their retirement benefits in the event of an unexpected death. This concern would be valid if no current annuity products offered a

“certainty period” as a provision in the annuity contract.12 However, most annuity providers offer this provision in their product lines. Research by Brown, Poterba, and Richardson (in press) shows strong take-up of certainty periods by retirees who are starting a stream of annuity income. This evidence suggests that public policy should encourage annuity providers to offer products that include the option to purchase competitively priced certainty periods. Because long-lived individuals are also likely to have as many or more years of living with various diseases and disorders, it will be important to develop health-related products and services that provide for age-appropriate diversification of health care cost risk over the increasing length of older Americans’ lifetimes. Better long-term care insurance products will be valuable here, including ways to provide for extended stays in retirement and nursing homes. Increasing availability and access to deferred annuity products that better meet retirement and estate planning needs would also enhance adequacy by providing better diversification of retirement risk burdens.

These broad issues pertinent to the level, stability, and liquidity of asset returns reflect various underlying specifics, many of which are expected to draw focused attention from the forces of financial innovation in coming decades. The most significant are likely to be longevity risk, duration risk, inflation risk, house price risk, health care cost risk, and of course the risk that markets for any or all of these risks may lose liquidity for short or even extended periods. The events of the recent financial crisis demonstrate graphically the potential for such disruptions to have major and potentially lasting impact on retirement income security for large segments of the population.

As yet, only scattered product or market developments have directly addressed aspects of this broad array of risks. A recent example is rapid growth in variable annuity products, which permit investors to pursue a broad range of asset accumulation strategies, followed by annutization into a stable return stream. As large numbers of Americans approach and move into the traditional retirement ages, the committee expects to see the emergence of other products that address security of retirement income and management of longevity risks. This trend is likely to include more decumulation rather than accumulation products and development of markets to better price longevity risk and the duration risk associated with it. Considerable academic study in recent years, and by at least one private company, has focused on design of products and markets for management of longevity risk. Such products and markets offer the potential for greater flexibility

_____________

12A certainty period guarantees that the annuity will make payment for a minimum number of years.

for an individual asset holder or financial institution to take greater risk or lay risk off, depending on preferences and market conditions at any time.

Flexibility will be especially important for individuals as they take a greater share of these risks over their life spans. Some will wish to absorb more return or liquidity risk in the early stages of their life cycle in order to achieve higher long-term returns and shift to more certain, annuity-like return streams at later stages in their retirement. Provision of such flexibility to progressively larger portions of the population will require major developments in products, but especially in creating deep and robust markets for trading and managing the underlying risks. Because there appear to be many opportunities for new products in this area, policy makers might consider whether steps are needed to encourage new products and markets or to reduce disincentives.

Many studies have stressed the complexity and variability of behavior and demands in these areas from different segments of the population. For example, asset management practices vary widely by income and wealth level: The wealthiest accumulate assets in retirement, middle-income families decumulate financial assets in this stage, and lower segments of the distribution exhaust assets and depend on Social Security for retirement income. Several studies have noted the widening of income and wealth distributions in the United States and other developed countries, trends that are expected to continue and exacerbate the variability of retirement income approaches and needs across the wealth distribution in the future. These pressures may be felt especially at lower income levels, and hence on public pension schemes. More generally, trends in income and wealth distribution can be expected to heavily influence the mix of public and private mechanisms for both health care costs and general retirement income and so affect the patterns of demand for products and markets in which these risks can be managed.

A growing body of research shows the importance of financial literacy in Americans’ ability to make effective decisions about retirement adequacy (Mitchell and Lusardi, 2011) (Box 7-2). Public policies that encourage employers to offer financial education, advice, and life planning (for all stages of a household’s life) will enhance retirement security by reducing the errors associated with lack of financial literacy.

Most important, it will be critical to reform Social Security and Medicare so that future generations have confidence that these programs continue to be the foundation of our retirement system. Without reforms, the current financing shortfalls guarantee that the programs will be unable to continue helping Americans pay for their retirements, and since many Americans—including many of those who will be retiring in the next several decades—are relying on those programs for most or all of their retirement needs, their solvency is crucial to ensuring the adequacy of Americans’ re-

tirement provision. These government programs are particularly important for the longest-lived individuals as they are the most likely to outlast their personal retirement preparations.

IMPLICATIONS

This chapter has taken the perspective that already retired cohorts of retirees had the “wind at their backs,” in that Social Security, Medicare, and generous corporate pensions enhanced their retirement security considerably. Moreover, the housing market provided excellent prospects for saving via their homes, and the stock market performed rather well until about 2000. The prospects confronting baby boomers are quite different: They face strong headwinds with regard to public program solvency, depressed housing market values, and lower and more variable capital market returns. And at the same time, longevity continues to rise, requiring either much more saving or longer working lives, or both.

Perhaps because of such changes, workers today are more pessimistic than at any time in the preceding two decades (Employee Benefit Research Institute, 2011b). And there remain important groups that face greater retirement insecurity than was true in the past. The lifetime poor are especially vulnerable; since they rely mainly on safety net programs, a humane goal might be to protect them from poverty as well as possible via government and charitable transfers. The more difficult question is how the middle class will fare in retirement. Some may be able to work longer and save more if encouraged to do so, and if they did, this could take some pressure off entitlement programs. Understanding this diversity in risk and saving profiles is key to the development of a better-integrated national retirement policy.

Moreover, population aging is likely to put increased pressure on household, employer, and government budgets, and in particular on the retirement savings component. The nation’s fiscal imbalance is not driven only by aging, but aging and the financial crisis both have exacerbated these imbalances. In the absence of policy reforms and changes in household behavior, it is unlikely that Americans will do as well in retirement as they have in the past. Retirement insecurity and saving inadequacy are likely to increase rather than recede. To the extent that this inadequacy is due to people’s financial illiteracy, early retirement, and reliance mainly on Social Security and Medicare, the problem of inadequate retirement saving is likely to worsen as the population ages.

Household savings adequacy will also depend on the cost of health care, which may prove to be even larger than out-of-pocket expenses if defined to include other costs related to poor health, such as moving expenses and the like (Poterba, Venti, and Wise, 2010). If population aging increases

BOX 7-2

The Impact of Financial Literacy on Retirement Adequacy and Retirement Confidence

Prior research has concluded that financially literate individuals are more likely to plan for retirement, and in turn, to save effectively to that end. Yet a recent nationally representative study of young Americans found that a disturbingly high fraction of people aged 23–28 were unable to answer three simple questions about simple interest, inflation, and risk diversification (Lusardi, Mitchell, and Curto, 2010). The specific wording of the questions was as follows:

(1) Interest rate. Suppose you had $100 in a savings account and the interest rate was 2 percent per year. After 5 years, how much do you think you would have in the account if you left the money to grow: more than $102, exactly $102, or less than $102? {Do not know; refuse to answer}

(2) Inflation. Imagine that the interest rate on your savings account was 1 percent per year and inflation was 2 percent per year. After 1 year, would you be able to buy more than, exactly the same as, or less than today with the money in this account?

(3) Risk diversification. Do you think that the following statement is true or false? “Buying a single company stock usually provides a safer return than a stock mutual fund.”

Strikingly, one-fifth of the population could not provide a correct answer to the simple interest question; almost half did not understand inflation; and more than half did not understand risk diversification. Moreover, men were substantially better informed than women, and whites were more knowledgeable than blacks or Hispanics (Table 7-2-1).

Low financial literacy will affect workers’ and retirees’ confidence in the retirement savings decisions they make and their ability to adjust to and recover from macroeco

the incidence of individuals requiring long-term care (or nursing home) services, then these costs are another factor that will place tremendous strain on the resources of both aged Americans and their children.

Overall adequacy of retirement resources in this nation depends on the so-called three-legged stool: household provision, pensions, and sustainable Social Security and Medicare programs. Americans rely on all three systems to provide a well-diversified and adequate retirement portfolio generating sufficient assets to provide retirement security. Some argue that our prospects are bleak, given the current weakness of the job market, the ongoing volatility of capital markets, the underfunding of the workplace pension system, and the prospect of insolvency for Social Security and Medicare. Yet if government, employers, and private households are to successfully handle population aging, we must renew and strengthen the partnership to build retirement resources.

nomic shocks. For example, the Employee Benefit Research Institute (EBRI) 2011 Retirement Confidence Survey (RCS) found that workers are more pessimistic than at any time in the two decades the RCS has been conducted, but that retirees are not more pessimistic. The EBRI main report (p. 13) states: “The percentage of retirees who are very confident that they had done a good job of preparing for retirement fell from 39 percent in 2007 to 26 percent in 2008; it has remained steady since that time (31 percent in 2011).”

TABLE 7-2-1 Patterns of Responses to Financial Literacy Questions

| Panel A: Distribution of Responses to Financial Literacy Questions (%) | |||

| Correct | Incorrect | Don't Know | |

| Interest rate | 79.3 | 14.7 | 5.9 |

| Inflation | 54.0 | 30.4 | 15.4 |

| Risk diversification | 46.7 | 15.8 | 37.4 |

| Panel B: Differences in Mean (%) by Respondent Characteristics | |||

| Interest Rate | Inflation | Risk Diversification | |

| Sex | |||

| Male v. female | 4.9 | 10.9 | 11.6 |

| Race | |||

| White v. black | 3.4 | 18.7 | 12.3 |

| White v. Hispanic | 6.8 | 16.0 | 8.5 |

NOTE: All data in Panel B are significant at the 99 percent level.

SOURCE: Derived from Lusardi, Mitchell, and Curto (2010).

In short, U.S. population aging will result in a larger percentage of the population being of retirement age, as well as rising numbers of the oldest old. Nonetheless, these stresses are not insurmountable. These trends will require a number of new approaches to make sure that retirement savings are adequate for as large a percentage of the population as possible. In particular, public policies that encourage the development of new types of financial market products are needed to shift and pool risk more effectively than is done with current instruments.

Several other options exist for enhancing Americans’ retirement security, including raising retirement ages, improving insurance protection and long-term care, fixing Social Security and Medicare, and instituting a number of private-market solutions: more saving, better financial literacy, reverse mortgages, and better long-term care and annuity products. It is also important to remember that uncertainty breeds fear and paralysis

and makes it difficult for people to make decisions. The current situation threatens to reach the point where people are so fearful that they become paralyzed. Thus, doing nothing is not an option. Solutions do exist, and they must be implemented soon.

ATTACHMENT 7-1

MEASUREMENT ISSUES: NATIONAL INCOME AND

PRODUCT ACCOUNTS SAVING AND INVESTMENT

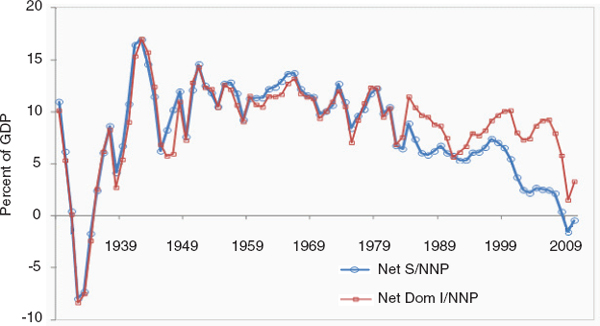

In practice, there are many ways to measure saving and investment, a few of which are illustrated briefly here. These use national accounts measures, which are equal to income or output less depreciation, rather than balance sheet saving, which is the change in real net worth.

A conventional measure uses the standard BEA definition of saving and investment. This includes private and government saving as well as domestic and foreign investment, where domestic investment includes structures, equipment, change in inventories, and software. As the denominator, the committee uses net national product (NNP), which is the relevant measure of net income. This measure is called the conventional net saving rate and is shown in Figure 7-A-1 as “net S/NNP.”

The National Income and Product Accounts (NIPA) personal saving rate (the fraction of personal income that is not consumed) has been criticized on a number of grounds, including the fact that it excludes capital gains (realized and unrealized). It does, however, include taxes on realized capital gains. NIPA does not include capital gains because the latter reflect a revaluation of the nation’s existing capital stock and do not provide resources for financing investment that adds to the capital stock. However, many economists view capital gains as indicative of increases in the expected value of future output from existing enterprises. From that perspective, capital gains represent an increase in the stock of productive capital and should be included in savings measures.

A similar tension exists in the measurement of savings through pension funds. Employer contributions to pension funds as well as pension fund interest and dividend income do count as part of personal income and contribute to measured personal saving, but increases in the market value of assets held by pension funds, for example, are not counted. Proponents of this treatment argue that while an individual household can tap its wealth by selling assets to finance consumption or accumulate other assets, the sale of an existing asset merely transfers ownership; it does not generate new economic output. However, if asset appreciation represents a real increase in the value of productive resources available to society, excluding those gains understates the effective saving rate.

In any event, since the NIPA saving rate definition excludes capital

FIGURE 7-A-1 Net saving and investment using BEA definitions, 1929–2010. SOURCE: Bureau of Economic Analysis (2011).

gains (as well as unrealized capital losses), it is likely to substantially overstate household asset accumulation in periods of rising asset values and may understate them in times of downward asset shocks. This mismeasurement problem is of particular concern for measuring the well-being of the aged in the United States, since over time more households have accumulated retirement assets in 401(k) accounts and IRAs. In other words, because those capital gains, when realized, will help cover expenses, they do represent a form of saving not currently captured by the NIPA definition. For this reason, some economists have argued that the NIPA definition does not accurately capture the true personal saving rate, so other factors should be taken into account.

Figure 7-A-1 also includes a different savings rate (net Dom I/NNP) using domestic investment for reference purposes. Standard national accounts treatment of investment is very narrow, most critically omitting most intangible investments as well as consumer durables. The conceptual definition of “investment” is that it is a use of output that increases consumption (broadly construed) in the future. Thus one can define “broad investment” as including all education, consumer durables, defense, research and development (R&D), transportation, and health expenditures of consumers and governments. There are different reasons for each, but the key is that they do not contribute to current enjoyment of goods and services (ice cream and concerts) but will enhance future enjoyment. Some do so directly by increasing productivity (as with education or R&D), while others are more

indirect (such as military spending). Health is a complicated topic primarily because we do not have a good measure of depreciation.

Note as well that the calculations do not include a full set of accounts. This would require capitalizing each of the investments, estimating the depreciation rate, and then imputing income on the basis of an assumed rate of return. Note that R&D is scheduled to be included in the core national accounts in the next few years, and there are satellite accounts for education and health. National defense is a controversial topic, and in some of the earliest national accounts it was sometimes subtracted from both output and expenditure. Note also that this calculation excludes nonmarket income and output, which would be particularly important for health, where the benefits are largely nonmarket.