THE REALITY

America’s ability to fund, and thereby accomplish, its national security goals depends heavily on the strength of the nation’s economy. The vibrancy of that economy has in turn been shown to depend heavily on advancements in science and engineering (National Research Council, 2007). Similarly, the ability of the nation’s military to prevail during future conflicts, particularly while minimizing casualties, and to fulfill its humanitarian and other missions depends heavily on continued advances in the nation’s technology base. A workforce with robust science, technology, engineering and mathematics (STEM) capabilities is critical to sustaining U.S. preeminence.

Today, however, the activities of the Department of Defense (DOD) devoted to science, technology, engineering, and mathematics are a small and diminishing part of the nation’s overall science and engineering enterprise. One consequence is that DOD cannot significantly impact the nation’s overall STEM workforce—and therefore, with a few exceptions, DOD should focus its limited resources on fulfilling its own special requirements for STEM talent.

THE DILEMMA

As a general rule, a student must decide in the 8th grade or earlier whether to preserve the option to pursue a career in STEM fields because of the hierarchical learning of mathematics (the “language” of STEM). In the traditional U.S. education course it takes about 8 more years for an individual in the 8th grade to graduate with a bachelor’s degree in science or engineering—and about 14 more to graduate with a PhD in one of those fields.

Even setting aside the shortcomings of DOD’s management of its STEM assets, the historical record of forecasting the number of scientists and engineers needed to work in national security has been abysmal at best, largely owing to inherent uncertainties in future threats and to the unpredictability of future technological advancements.

As to predicting military demands, history has proven that our best efforts cannot predict surprise events. World War I was triggered when an archduke was unexpectedly murdered and an unprepared America subsequently became entangled in conflict. U.S. involvement in World War II was sparked by the surprise attack on Pearl Harbor; in the Korean conflict, by a surprise assault across the 38th parallel; in Vietnam, by an unanticipated incident at sea; and in Afghanistan, by a surprise terrorist attack on U.S. soil. The current upheaval in the Middle East started with an altercation between a street vendor and a policeman.

Turning to technology as it applies to the military, the ability to forecast significant advancements has hardly

improved between the invention of the riding stirrup and the discovery of stealth materials and shapes. Indeed, looking back 40 years—or even 10 years—few would have predicted the technology that is available today in either the military or the civilian spheres. Further, the pace of technological progress appears to be accelerating, not stabilizing or slowing.

The relatively small fraction of U.S. citizens graduating with first degrees in a STEM field (National Science Board, 2012, p. O-7), combined with our demonstrated inability to forecast sudden increases in demand for specialized STEM workers to support national security needs, can place the nation in jeopardy.

CHANGING FACTORS INFLUENCING THE DOD STEM WORKFORCE

Two fundamental changes—ironically, both are driven by advancements in science and engineering—have further complicated the above already complex situation. The first of these is the phenomenon described by Frances Cairncross: distance is dead (Cairncross, 1997). Indeed, globalization means that for many human endeavors distance is no longer significant, whether it is offshoring software development or attacking targets in Afghanistan using robots operated from Nevada. The second fundamental change is that for the first time in history individuals or small groups of individuals acting alone can profoundly impact the lives of very large groups of people.

But the revolutionary change now being experienced in both civilian and military affairs does not stop with these two groundbreaking developments. Other lesser but still profound changes affect DOD’s need to recruit and retain high-quality scientific and engineering talent. These include:

• New technological opportunities and threats that are appearing with ever-increasing frequency (National Research Council, 2012b).

• The fact that for many technologies the most advanced work is no longer being conducted in the United States (National Research Council, 2006, 2010c; Naval Research Advisory Committee, 2010),

• The further fact that for most technologies, the most advanced work is no longer being conducted within the Department of Defense or its contractor community (Defense Science Board, 2012).

• The growing hazard to U.S. security posed by failed states (U.S. Department of Defense, 2010).

• The erosion of the concept of deterrence based on possession of superior military weapons because of so-called asymmetric threats and, potentially, further nuclear proliferation (Drell, 2007; Economist, 2012).

• Inability to control knowledge because information penetrates porous geopolitical borders literally at the speed of light (National Research Council, 2006).

• Expansion of national security demands, with the real threat of conventional conflicts in places such as Korea, the Middle East, and possibly the Arctic and with the vastly different type of conflict introduced by terrorism (Jordan et al., 2009).

CURRENT OUTLOOK

The increasing importance of STEM in maintaining a strong economy and providing national security makes it imperative that America have available a substantial, high-quality STEM workforce. However, as compared with the young people of many other countries, American youth seem less interested in pursuing careers in STEM fields. In the recent past this development has been substantially offset by attracting foreign-born individuals to America’s research universities and then making it possible for them to remain and contribute to America’s well-being and to their own quality of life. Of the current science and engineering workforce outside academia, one-quarter are foreign born (National Science Board, 2012, p. 3-48).

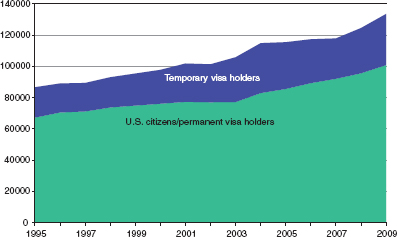

Today, more than one-half the PhD’s awarded by U.S. engineering schools go to non-U.S. citizens. Of those non-U.S. citizens who graduated with science and engineering doctorates in 2004, 38 percent had left the United States 5 years later (National Science Board, 2012, p. 3-51). The fraction of master’s degrees awarded to temporary visa holders is smaller but increasing (Figure S-1). Bachelor’s degree holders constitute half of DOD’s STEM workforce, and non-U.S. citizens have consistently earned 3 to 4 percent of U.S.-awarded bachelor’s degrees, although in certain fields, such as electrical and industrial engineering, the fraction is higher, at 9 percent (National Science Board, 2012, p. 2-22).

FIGURE S-1 Number of master’s degrees awarded in the United States, by visa status.

SOURCE: Lehming (2011).

However, the process by which the United States met its workforce needs so well in the past is in jeopardy, for several reasons:

• U.S. national immigration policy places caps on the number of high-tech (i.e., H1-B) visas allotted to for-profit organizations, and this pool of visa holders is an important source of scientists and engineers, while the coveted green card conferring permanent work status can take 6 to 10 years to obtain. In the short run, further constraints on H1-B visa entrants may make it more difficult for DOD to recruit citizens if these constraints increase competition for them from the private sector.

• Individuals who manage to overcome the barriers posed by U.S. immigration laws and remain in the United States as noncitizens after receiving their degrees are excluded from most defense-related work because of the associated requirement to hold a security clearance and the rigidity of the security clearance process (National Research Council, 2010b).

• Opportunities are increasing in many parts of the world for scientists and engineers—both U.S. citizens and noncitizens—to build productive careers in other lands because talent is in such widespread demand (Wadhwa et al., 2009).

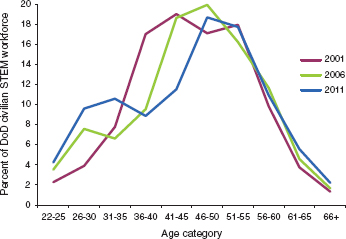

• The current DOD science and engineering workforce is an aging one (Figure S-2), with a disproportionate segment of scientists and engineers eligible to retire during the next few years (Figure S-3).

• Despite an increase in the percentage of the defense industrial base STEM workforce that is under the age of 35, the median age of such workers increased to 47 in 2010, from 45 in 2005.

• A recent survey of over 59,000 college students in various fields of study at over 300 universities assessed the desirability of potential employers. In engineering fields, the Air Force ranked 15th, followed by the Navy at 34th and the Army at 41st. In the natural sciences, the Air Force ranked 20th, followed by the Navy at 22nd and the Army at 25th. In neither of these two fields was DOD ranked in the top 100. In the field of information technology, however, DOD was ranked 20th, above the U.S Air Force at 31st, U.S. Navy at 34th, and U.S. Army at 60th (Universum, 2012).1

1 In the survey, the interpretation of which organizational components were encompassed by “DOD,” “U.S. Army,” and so forth was left to the survey respondents.

FIGURE S-2 Age distribution of Department of Defense civilian STEM workforce, selected years: 2001, 2006, and 2011.

NOTE: Figures are as of the fiscal year-end (e.g., September 30, 2011).

SOURCE: Data provided by the Defense Manpower Data Center. Tabulations by the National Research Council.

• The “defense industry,” composed of the principal DOD contractors, is moving to diversify away from defense for economic reasons (Thompson, 2011)—and because of the complexities in dealing with a powerful monopsonist (i.e., a sole) buyer.

• Because of economic circumstances, the nation is unlikely to be able to support defense expenditures at the levels of the past (Appelbaum, 2012), and DOD’s traditional predilection is not to give highest priority to funding for research (National Research Council, 2008, 2011).

• Technology today has a half-life measured in a few years, whereas major DOD development programs can take decades—making it nearly impossible under current practices to supply U.S. armed forces with the most advanced technology (National Research Council, 2010a, 2012a).

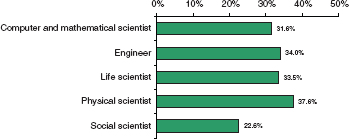

FIGURE S-3 Retirement eligibility of selected occupational groups in the DOD civilian STEM workforce.

NOTE: Percentages are as of the fiscal year-end (September 30, 2011).

SOURCE: Data provided by the Defense Manpower Data Center. Tabulations by the National Research Council.

• U.S. industry as a whole is further reducing its investment in research,2 with, for example, iconic institutions such as Bell Labs now diminishing in size and no longer U.S. owned.

• Government contractors have become increasingly risk-averse, constrained as they are by increasingly complex defense acquisition laws (Dunlap, 2011) and competing for fewer acquisition programs that have longer acquisition cycles—all of which make the work less attractive to prospective STEM hires (National Research Council, 2012a).

• The U.S. higher education system finds its predominant global position threatened by declining investments in education by state and local governments as well as by greatly increasing competition from government-funded universities and research institutions abroad.

• The United States scores average or below average among OECD countries in the proficiency of its K-12 students (OECD, 2010), and U.S. nationwide testing has shown that the average 4th grader was less than proficient in mathematics and science.3

THE CONUNDRUM

U.S. employers nearly unanimously cite the need for additional employees with specialty skills, including STEM workers, yet the nation’s overall unemployment rate remains high. Steve Jobs told the President that one of the reasons his firm had to employ 700,000 workers abroad was the ability of China to supply engineers much more rapidly than the United States, including 8,700 industrial engineers to oversee the 200,000 assembly-line workers, who were found in China in just 15 days (Duhigg and Bradsher, 2012; Wingfield, 2012). But what the United States confronts as a nation, and what DOD confronts to an even greater extent, is not an unemployment problem but a knowledge gap (i.e., a quality) problem, particularly with the potential STEM workforce.

DOD representatives state virtually unanimously that they foresee no shortage of STEM workers in the years ahead except in a few specialty fields such as cybersecurity and intelligence. However, the aerospace and defense industry has experienced difficulty in hiring systems engineers, aerospace engineers, and mechanical engineers. Pondering the projected decline in defense spending, it is not difficult to imagine a reduction in the perceived need for STEM employees by DOD and its contractors. The problem is that with the rapid pace of advancement in STEM and the uncertainty of future threats, a shortage of STEM workers, particularly those with knowledge in evolving fields, could occur at any time.

The DOD’s STEM needs, as well as those of its contractors, represent a relatively modest facet of the challenge faced by the nation’s workforce as a whole in today’s burgeoning, technologically driven economy. Total DOD civilian STEM employment is approximately 150,000, with 47 percent in engineering and 35 percent in computer and mathematical science occupations; this workforce represents only a small fraction (approximately 2 percent) of the total U.S. STEM workforce. For the private sector, although STEM jobs are a major component of the defense industrial base (approximately 3 in 10 jobs), these jobs also represent a small fraction of total U.S. STEM employment (likewise approximately 2 percent). A notable exception is aerospace engineers, a substantial proportion of whom are employed in the aerospace and defense industry.

Ironically, it is unlikely that the United States will suffer from an overall shortage of scientists and engineers. The principal reason is globalization. Today, it is a relatively straightforward matter for a U.S. commercial firm to fulfill its STEM capacity needs abroad—particularly given the large numbers of STEM workers being educated elsewhere in the world, a growing number of whom are highly qualified.

As U.S. industry’s research laboratories move abroad (National Science Board, 2012, Figures O-6 and O-7), so too do the prototype shops that design and evaluate new concepts, and so too do the production lines and eventually the maintenance facilities (in order to reap higher returns on their investment (Economist, 2011))—and so too do the continuous design modifications over the product life cycle and the ideas for subsequent innovations and generation of equipment. Further, most of tomorrow’s commercial customers will be in the developing nations,

2 The R&D investment by U.S. business declined faster than GDP in 2008-2009 and the decade ending in 2009 saw a slowing of R&D expenditures versus earlier periods. See for example, Chapter 4 in National Science Board (2012).

3 See, for example, Figures 8-1 and 8-4 in National Science Board (2012).

not in the developed countries as in the past,4 making it all the more attractive to conduct manufacturing and engineering outside the United States. A principal outcome of this scenario is that there will not be enough jobs in the United States for U.S. workers as a whole, and unemployment will remain high.

Another complication related to the security of our nation is that DOD and its contractors cannot simply export their work to overseas firms—although DOD will need to do a much better job of defining exactly which jobs truly demand U.S. citizenship as a condition of employment. The maintenance of a cadre of highly capable, dedicated, innovative, entrepreneurial U.S. scientists and engineers is thus critical to the health of the U.S. economy as well as that of DOD.

In this context, DOD’s demand for scientists and engineers is sufficiently modest that fulfilling its need for numbers should be achievable. DOD’s challenge in the foreseeable future is filling its ranks with a suitable share of the best and brightest talent—particularly given the current perception of many young graduates, in particular PhD candidates in the sciences, that working in government is less compelling, though still attractive, than careers in academic teaching and research or industry (Sauermann and Roach, 2012).

The highly regarded Science, Mathematics and Research for Transformation (SMART) Scholarship for Service Program is a DOD STEM workforce development program that addresses recruiting and retaining top talent for the department. It is a civilian scholarship-for-service program that provides full undergraduate or graduate tuition, living and book allowances, summer internships, health insurance, and other benefits in exchange for postgraduate employment at DOD; the scholarship is paid back by service on a one-year-for-one-year basis. The qualification of the students is high—the 2009 cohort of 262 students had a GPA of 3.7. This 6-year program is attractive, expandable, and well-targeted to the nation’s national security needs.

There are a number of constructive goals DOD could set to help assure that the needed cadre of highly qualified STEM workers will be available to support U.S. national security needs. These include (1) making the DOD a more attractive place for highly capable STEM employees to work; (2) creating more pathways for high-quality scientists and engineers to work in DOD; (3) enhancing early warning of new developments being achieved globally in science and engineering by increasing the involvement of DOD’s workforce in global activities in core fields; (4) managing the careers of high-quality civilian government scientists and engineers and giving them educational opportunities, as is already done for the most capable uniformed personnel; and (5) establishing and ensuring adaptable human resource development and management mechanisms that can respond to abrupt changes in STEM opportunities and needs that are fully competitive with the responsiveness found in industry.

PRINCIPAL FINDINGS

Science and technology and the DOD STEM workforce are increasingly critical to U.S. military capability. Technological surprise has proved to be decisive in past conflicts and will likely be so in the future. The ongoing globalization of STEM requires that DOD readdress its workforce policies and practices to ensure that it retains access to a significant share of the best and brightest STEM talent available. DOD is a microcosm of the larger and growing global STEM enterprise, where talent is in high demand. Access to highly qualified STEM talent should be a primary consideration in DOD workforce recruitment and retention policies, guidelines, and practices.

Finding 1: Quantity of STEM Workforce

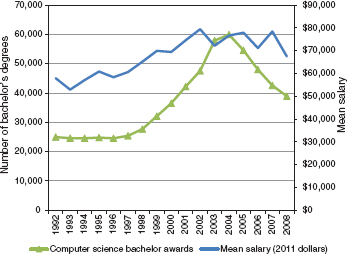

Because of the relatively small and declining size of the DOD STEM workforce there is no current or projected shortage of STEM workers for DOD and its industrial contractor base except in specialized, but important, areas— such as cybersecurity and selected intelligence fields. As a means of addressing any future shortages, experience has shown that students will respond to the demand signal of higher salaries in a STEM field5 (Figure S-4), sug-

4 Asia’s spending on defense is projected to surpass that of Europe in 2012. For more information see International Institute for Strategic Studies (2012).

5 The committee was made aware of a further instance in which students’ choice of a STEM major was made in response to the offer of higher salaries, though it was for the case of petroleum engineers, a field for which DOD has little if any need. See NRC (2012a), p. 26.

FIGURE S-4 Computer science bachelor’s degree awards and computer programmer real mean salaries, 1992-2008. SOURCE: Kuehn and Salzman (2013).

gesting a mechanism by which DOD can stimulate supply in a critical area.6 (See Observation 3-10, Observation 3-4, and Finding 2-5.)

Finding 2: Quality of STEM Workforce

The STEM issue for DOD is the quality of its workforce, not the quantity available. The DOD needs a suitable share of the most talented STEM professionals. The decisions they make within DOD are highly leveraged, impacting the efforts of very large numbers of people and enterprises both inside and outside the government. (See Finding 6-3.)

Finding 3: Changing Character of STEM Workforce

New technological advancements, often from outside the defense sector and from abroad, are appearing at an increasing rate. Adapting to this new environment requires transformational and long-term changes within the DOD management of its STEM workforce. (See Finding 6-1.)

Finding 4: Forecasting STEM Workforce Needs

Reliable forecasting of the STEM skills needed by the DOD beyond the near term is simply not possible because of the increasing rates of advancement in science and technology and the unpredictability of military needs. Flexibility, capability, and relevance in the DOD STEM workforce are the essential characteristics sought. (See Finding 6-6.)

6 Freeman (1976) established that “the supply of new entrants to engineering is highly responsive to economic conditions.”

Finding 5: Attracting and Retaining STEM Workforce

For DOD to recruit top STEM talent in competition with commercial firms, universities, and others, it must commit to improving the STEM workforce environment. The DOD must become, and be perceived as, an attractive career destination for the most capable scientists, engineers, and technicians who are in great demand in the global talent marketplace. This implies, among other things, that DOD will need to reassess its requirement for security clearances for many STEM positions along with the processes by which many of its systems are developed and procured. (See Finding 4-2 and Finding 4-3.)

Finding 6: Managing the STEM Workforce

The career development support for the DOD uniformed STEM workforce is excellent, whereas the career development support for the DOD civilian STEM workforce is far less developed. The defense-related industry lies somewhere between them. (See Finding 6-4.)

PRINCIPAL RECOMMENDATIONS

Based on the above findings, the study committee developed five principal recommendations. These are summarized in brief in the list that follows, with the suggested implementations described in the relevant chapters of the report.

The committee observes that the foreseeable STEM personnel challenge is, with the exception of a very few highly specialized disciplines, not one of meeting quantitative needs but one of providing the high-quality STEM personnel needed to fulfill the DOD mission at a high technical standard.7 Because of the leadership role that DOD STEM personnel often play in overseeing major programs and directing the efforts of large groups within the private sector as well as impacting others in government, the STEM capability and quality of the DOD leadership in its workforce are highly leveraged.

Through focused investments DOD should ensure that STEM competencies in all potentially critical, emerging topical areas are maintained at least at a basic level within the department and its industrial and university bases. This appropach will ensure that technological challenges and opportunities that arise can be met expeditiously by building on the foundation that is in place.

Recommendation 1. Recruitment and Retention of Highest-Quality STEM Workforce

The DOD workforce recruitment policies and practices should be reviewed and overhauled as necessary to ensure that DOD is fully competitive with industry (not simply the “defense industry”) in recruiting the highest-quality STEM talent. DOD should judge its recruiting competitiveness by the quality of its STEM hires, and it should continue to adjust its policies and practices until it has become fully competitive with overall industry and academia in the quality of its recruitments. (See Box S-1.) Such practices might include the following:

• More active outreach and recruitment efforts aimed at civilian hires of needed scientists and engineers that emphasize the many exciting technologies that are being developed by DOD and their potential contribution to the nation;

• New measures to expedite recruitment offers for occupations in which DOD determines that it must compete with more nimble corporate recruitment practices;

• Additional authority to expedite security clearances needed for such positions, including authority for temporary hiring into non-sensitive roles pending confirmation of security clearance; and

7 The committee considered how “quality” might be defined or what metrics might be constructed to better track the quality of the workforce. The committee decided, however, that quality measures vary from one discipline to the next, making it infeasible to provide one overarching definition. Those with hiring authority will be in the best position to consider a job candidate’s knowledge, skills, and abilities and to weigh the degree of significance of individual records of achievements and capabilities compared to those of others.

BOX S-1

Innovative Recruitment Policies and Practices at the Advanced Research Projects Agency-Energy (ARPA-E) and at the Naval Research Laboratory

The Advanced Research Projects Agency-Energy (ARPA-E) funds specific high-risk, potentially high-payoff energy research and development projects. ARPA-E has been set up to be a lean and agile organization with special hiring authority to bring on program directors and other program leadership with the ability to offer limited-term rotational assignments. Thus, individuals from all sectors are able to assume temporary positions lasting roughly 3 years. The agency empowers them to make technical and programmatic decisions for the projects they oversee.1

The Naval Research Laboratory (NRL) has recently added a direct hiring facility, the Distinguished Scholastic Achievement Appointment (DSAA), aimed at speeding the recruitment of entry-level candidates. This complements its existing direct-hire authority for persons holding advanced degrees in science and engineering. Under DSAA, managers have the opportunity to expedite hiring of candidates with an exceptional grade point average and are allowed to hire individuals based solely on their education. Candidates for certain job classifications and occupational series who possess a GPA of 3.5 or higher may be appointed without NRL having to advertise each position individually. The individual must hold a bachelor’s, master’s, or higher degree in the field of the position being filled. Managers may name/request a candidate from the list forwarded by the human resources office for one of the advertised positions.

1Based on Yehle (2011) and President’s Council of Advisors on Science and Technology (2010).

• Actions to protect or “ring-fence” science and engineering positions determined by DOD to be critical capabilities, thereby protecting the loss of such capabilities due to RIFs and hiring freezes.

Further, the DOD STEM workforce management should have as a primary objective retaining its highest-quality talent. Talented individuals include STEM professionals ranging from technicians to systems engineers to the most advanced scientists and engineers working in specialty fields. It is critical to include those at the forefront of emerging, potentially critical technical areas, and those capable of moving rapidly into these new areas. The DOD must ensure that its STEM workforce management policies, procedures, and incentives (in short, its business model) achieve that outcome. Its business model should explicitly make careers in DOD attractive to top STEM talent. Achievement of this goal will require explicit support, commitment, and action by the highest level of DOD leadership. (See Recommendation 4.3 and Recommendation 4.6.)

Recommendation 2. Open More of the STEM Workforce Pool to non-U.S. Citizens

Because DOD and its contractors need access to the most talented STEM professionals globally, DOD should reexamine the need for security clearances in selected positions in order to permit non-U.S. citizens to enter the STEM talent pool available to DOD under tailored circumstances consistent with applicable law and regulation governing military goods and services and their export and deemed export. (See Box S-2.) Further, the H1-B visa system should be modified to provide the nation and DOD with a substantially larger pool of extraordinary talent in areas of need. (See Recommendation 4.2.)

BOX S-2

Recruitment of Non-U.S. Citizens at the National Laboratories

Sandia National Laboratories has a hiring pathway by which a foreign national can become a member of its technical staff. The first stage for such an individual is to become established as a staff member (e.g., in a postdoctoral position or as a limited-term employee). In the next stage the individual is given status as in a Foreign National Interim Technical Staff member, which includes a requirement that he/she concurrently pursue U.S. citizenship. Owing to the classified nature of the lab’s work, the prospective staff member must obtain the necessary security clearances and successfully pass a comprehensive counterintelligence investigation. At this point, or upon receipt of citizenship, the individual becomes a member of the technical staff.

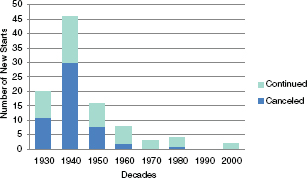

FIGURE S-5 Number of new fighter and bomber starts per decade.

SOURCE: Carlson and Chambal (2008).

Recommendation 3. Maintain Critical STEM Capabilities Through Unconventional Programs and Prototyping

To preserve design, creation, and testing team skills (which have been called on less and less as new weapons systems appear with decreased frequency—Figure S-5) and to recruit, retain, and advance a quality STEM workforce with the special talents needed by DOD and its contractors, DOD should create “skunk works”8 in the industrial base, universities, and DOD to undertake targeted, unconventional, potentially disruptive programs through prototyping for technical concept verification. These programs could subsequently be transitioned to an operating unit for implementation if successful, or terminated if not. A system that provides rotational assignments for individuals from government, the industrial base, and the private sector would be an attractive feature of these programs. This “skunk works” culture would nurture critical STEM skills within the DOD workforce as well as provide exciting, challenging, and highly attractive opportunities for the STEM workforce. (See Box S-3.) (See Recommendation 4.4.)

8 “Skunk works” refers to Lockheed Martin’s Advanced Development Program for manned and unmanned systems, which began operations in the 1940s and has since designed numerous aircraft such as the U-2, the SR-71 and the F-111.

BOX S-3

Rapid Prototyping in the Office of the Assistant Secretary of Defense for Research and Engineering

DOD established the Rapid Reaction Technology Office (RRTO) in 2006 in response to the constantly evolving threat of asymmetric warfare, including, for example, the use of improvised explosive devices (IEDs) in the Iraq and Afghanistan theater of operations. Established under the Director, Defense Research and Engineering, the office focused on developing technologies that can mature in 6 to 18 months for the purpose of countering insurgency and irregular warfare. It now has been folded into the Rapid Fielding Office within ASDR&E. The RRTO provides a diverse set of quick-response capabilities for counterterrorism while attempting to stimulate interagency coordination and cooperation. The office operates without a formal charter or governing document, and the director has much flexibility for carrying out the mission. Approximately 50 percent of the office’s projects have resulted in fielded technologies, altered concepts of operation (CONOPS), or other concrete changes, including in larger systems. Such projects included the Persistent Threat Detection System for persistent ground surveillance through a tethered aerostat with an embedded camera; the Biometric Automated Toolset for screening personnel in mobile applications; and the SKOPE intelligence cell, a joint analytic effort with the National Geospatial Intelligence Agency, the U.S. Special Operations Command, and the U.S. Strategic Command.1

_____________

1Adapted from NRC (2009).

Recommendation 4. Develop an Agile and Resilient STEM Workforce

The DOD should recruit and develop an agile and resilient STEM workforce that is attuned to the dynamism and future uncertainty of technical needs; is prepared to adapt to those needs as they arise; and is enthusiastic about working in this challenging environment. (See Box S-4.) In addition, the DOD should be prepared to educate highly capable, but not yet STEM qualified, individuals rapidly into STEM-capable professionals with master’s degrees in science and engineering in times of urgent need—as is done at the Naval Postgraduate School today. (See Box S-5.) (See Finding 5-2 and Recommendation 5-2.)

Recommendation 5. Upgrade Education and Training for the DOD Civilian STEM Workforce

The DOD should ensure that the education and training, and the re-education and re-training, opportunities for its civilian STEM workforce are both commensurate with similar opportunities afforded career military personnel and tailored to the needs of the civilian workforce. (See Box S-6.) (See Recommendation 5-2 and Finding 6-4.)

AREAS OF NEAR-TERM FOCUS

Although it is the conclusion of this committee that planning for future STEM needs should be geared to flexibility and versatility rather than forecasting, certain areas do have strong near-term interest with a potential for high impact on future DOD operations. STEM personnel will create, recognize, and exploit breakthrough discoveries, engineer prototypes and operational versions for military use, and integrate them into systems controlled by humans. The identification of those areas is based on a combination of apparent needs and high promise and is meant to illustrate implications for the STEM skills needed by DOD and the industrial base. A listing of them in alphabetical order is as follows:

BOX S-4

Agile and Adaptable Workforce Practices at NASA and at Lockheed Martin

NASA created its Engineering and Safety Center (NESC) in 2003 to provide an independent test, analysis, and assessment capability for NASA programs and projects. It operates independently of mission directorates and reports to the Office of the Chief Engineer. The NESC operates through technical discipline teams (TDTs), each led by an agency-recognized NASA tech fellow, who is an outstanding senior-level engineer or scientist with distinguished and sustained records of technical achievement. The fellows provide leadership and act as role models for NASA discipline engineering communities beyond the TDT; they are drawn not only from NASA but also from other federal agencies, industry, and universities. The TDTs are diverse teams and can provide robust, creative solutions to complex problems.

Over its nearly 70-year history, the Lockheed Martin Skunk Works® has created breakthrough technologies and landmark aircraft that continually redefine flight. Guided by the mantra “quick, quiet, and quality,” the Skunk Works requires a flexible workforce capable of quickly forming and disbanding interdisciplinary project teams. To meet this need, the Skunk Works uses a matrix organization that minimizes paperwork and delays in moving people between teams. Core engineering groups maintain skill sets and tools to support their disciplines. Program managers draw their teams from these talent pools.

BOX S-5

Rapid Retraining into Technical Fields at the Naval Postgraduate School

The Naval Postgraduate School grants master’s degrees in engineering to selected individuals who enter with liberal arts credentials. Between 2007 and 2011 over 4,000 resident students graduated from this program, of whom roughly 525 had non-technical backgrounds when they matriculated. The education is accomplished via an intense, year-round academic program that focuses on technical master’s degrees in engineering and other STEM coursework in curricula ranging from 18 to 30 months depending on the discipline and credentials of the incoming student.

BOX S-6

Graduate Study Programs for Members of the Military

The Department of Defense manages and funds postgraduate education of its military. A military authorization (i.e., a job position) can be coded with a requirement for an advanced academic degree (AAD) (PhD or master’s). Within the Air Force, for example, such a requirement provides the leverage either to get a quota at the Air Force Institute of Technology (AFIT) or find a qualified person to fill that authorization. The Air Force regulation that addresses military AADs (an example of more formal support) exists but is outdated and being revised (AFI 36-2302, dated July 11, 2001, “Professional Development [Advanced Academic Degrees and Professional Continuing Education]).” There is no equivalent Air Force regulation for civilians, with each career field managing its own postgraduate needs according to its own policies, practices, and funding levels.

- Advanced robotics and autonomous systems;

- Intelligence collection;

- Cyber warfare (defensive and offensive);

- Human identification, marking, and tracking;

- Human-machine interactions on human terms;

- Means to detect and neutralize bio-threats;

- Means to negate improvised explosive devices (IEDs);

- Military applications of biosciences (systems biology, biosensors, etc.);

- Military applications of information sciences;

- Nanotechnology (for innovative materials and other applications); and

- System design and integration.

BIBLIOGRAPHY

Appelbaum, B. 2012. The next war: A shrinking military budget may take neighbors with it. New York Times, January 6.

Cairncross, F. 1997. The Death of Distance. Boston, Mass.: Harvard Business School Press.

Carlson, G., and S. Chambal. 2008. Senior leader perspective. Developmental planning: The key to future war-fighter capabilities. Air and Space Power Journal 22(1):5-8.

Defense Science Board. 2012. Basic Research: Report of the Defense Science Board Task Force on Basic Research. Available at http://www.acq.osd.mil/dsb/reports/BasicResearch.pdf (accessed April 4, 2012).

Drell, S.D. 2007. Nuclear Weapons, Scientists, and the Post-Cold War Challenge: Selected Papers on Arms Control. Hackensack, N..J: World Scientific Publishing.

Duhigg, C., and K. Bradsher. 2012. How the U.S. lost out on iPhone work. New York Times, January 21.

Dunlap, C.J., Jr. 2011. The military industrial complex. Daedalus 140(3):12.

Economist, The. 2011. China’s economy and the WTO. The Economist, December 10.

Economist, The. 2012. Nuclear security—Threat multiplier. The Economist, May 31.

Freeman, R.B. 1976. A cobweb model of the supply and starting salary of new engineers. Industrial and Labor Relations Review 29(2):236-248.

International Institute for Strategic Studies (IISS). 2012. The Military Balance. London: IISS.

Jordan, A.A., W.J. Taylor, Jr., M.J. Meese, S.C. Nielsen, and J. Schlesinger. 2009. American National Security. Sixth Edition. Baltimore, Md.: Johns Hopkins University Press.

Kuehn, Daniel, and Harold Salzman. 2013. The labor market for new engineers. U.S. Engineers in the Global Economy. Richard Freeman and Harold Salzman (eds.). National Bureau of Economic Research, forthcoming.

Lehming, R. 2011. STEM Workforce Needs of the U.S. Department of Defense: Background Data. Presentation to the Workshop on Science, Technology, Engineering, and Mathematics (STEM) Workforce Needs for the U.S. Department of Defense and the U.S. Defense Industrial Base, Roslyn, Va., August 1.

National Research Council. 2006. Critical Technology Accessibility. Washington, D.C.: The National Academies Press.

National Research Council. 2007. Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future. Washington, D.C.: The National Academies Press.

National Research Council. 2008. Pre-Milestone A and Early Phase Systems Engineering. Washington, D.C: The National Academies Press.

National Research Council. 2009. Experimentation and Rapid Prototyping in Support of Counterterrorism. Washington, D.C.: The National Academies Press.

National Research Council. 2010a. Avoiding Technology Surprise for Tomorrow’s Warfighter—Symposium 2010. Washington, D.C.: The National Academies Press.

National Research Council. 2010b. Critical Code: Software Producibility for Defense. Washington, D.C.: The National Academies Press.

National Research Council. 2010c. S&T Strategies of Six Countries: Implications for the United States. Washington, D.C.: The National Academies Press.

National Research Council. 2011. Evaluation of U.S. Air Force Preacquisition Technology Development. Washington, D.C.: The National Academies Press.

National Research Council. 2012a. Report of a Workshop on Science, Technology, Engineering, and Mathematics (STEM) Workforce Needs for the U.S. Department of Defense and the U.S. Defense Industrial Base. Washington, D.C.: The National Academies Press.

National Research Council. 2012b. A View of Global S&T Based on Activities of the Board on Global Science and Technology. Washington, D.C.: The National Academies Press.

National Science Board. 2012. Science and Engineering Indicators 2012. Arlington Va.: National Science Foundation.

Naval Research Advisory Committee. 2010. Status and Future of the Naval R&D Establishment. Available at www.nrac.navy.mil/docs/2010_Summer_Study_Report.pdf (accessed October 17, 2011).

OECD. 2010. PISA 2009 Results: What Students Know and Can Do. Paris: Organisation for Economic Cooperation and Development.

President’s Council of Advisors on Science and Technology. 2010. Report to the President on Accelerating the Pace of Change in Energy Technologies Through an Integrated Federal Energy Policy.

Sauermann, H., and M. Roach. 2012. Science PhD career preferences: Levels, changes, and advisor encouragement. PLoS ONE 7(5):e36307.

Thompson, L. 2011. Defense Contractors Are Going to Go for the Civilian Market. Forbes 2012, April 5. Available at http://www.forbes.com/sites/lorenthompson/2011/11/08/market-conditions-pressure-defense-companies-to-diversify (accessed November 8, 2011).

Universum. 2012. America’s Ideal Employers 2102. Availiable at http://www.universumglobal.com/IDEAL-Employer-Rankings/The-National-Editions/American-Student-Survey (accessed May 31, 2012).

U.S. Department of Defense. 2010. Quadrennial Defense Review Report. Washington D.C.: Government Printing Office.

Wadhwa, V., A. Saxenian, R. Freeman, G. Gereffi, and A. Salkever. 2009. America’s Loss Is the World’s Gain: America’s New Immigrant Entrepreneurs. Kansas City, Mo.: Ewing Marion Kauffman Foundation.

Wingfield, N. 2012. Apple’s job creation data spurs an economic debate. New York Times, March 4.

Yehle, Emily. 2011. No home run yet for ARPA-E, but chief says “motivated” team’s on track. Greenwire, April 7.