2

History, Background, and Goals

of the Supplemental Nutrition

Assistance Program

The U.S. Department of Agriculture (USDA) includes among its goals to increase food security and reduce hunger by increasing access to food, a healthful diet, and nutrition education for low-income Americans. Nutrition assistance programs offered by USDA include the Supplemental Nutrition Assistance Program (SNAP); the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); the National School Lunch and School Breakfast (School Meals) Programs, including summer food service; the Child and Adult Care Food Program (CACFP); Food Assistance for Disaster Relief; the Emergency Food Assistance Program; the Food Distribution Program on Indian Reservations; and food distribution programs such as the Commodity Supplemental Food Program. SNAP, formerly called the Food Stamp Program, is the nation’s largest nutrition assistance program and a key automatic stabilizer of family well-being during economic downturns. In fiscal year (FY) 2011, SNAP served more than 46 million Americans at a cost of more than $75 billion (FNS, 2012a). This chapter reviews the history of SNAP, the SNAP benefit formula and eligibility, the definition of the SNAP allotment, trends in program participation and costs, and trends in food insecurity and poverty and how they are affected by the SNAP program. The final section presents conclusions.

MILESTONES IN THE HISTORY OF THE

SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM

SNAP is administrated by USDA in cooperation with state social service agencies. The authorizing legislation states that the program is intended to

The Thrifty Food Plan (TFP) is a model-based market basket of foods that represents a nutritious diet at minimal cost and serves as the basis for establishing the maximum Supplemental Nutrition Assistance Program (SNAP) benefit. TFP market baskets stipulate the type and quantity of foods for home consumption that correspond to a nutritious and low-cost dietary pattern at the level of the maximum SNAP benefit. Revisions in the last update, in 2006, reflected recent changes in dietary guidance, as well as new information on food composition, consumption patterns, and inflation-adjusted food price changes. It should be noted, however, that some nutrient goals, such as reducing sodium and increasing vitamin E and potassium intake for certain age groups, cannot be met without substantial changes to usual dietary patterns and/or changes in current food manufacturing processes.

“alleviate hunger and malnutrition” by “permit[ing] low-income households to obtain a more nutritious diet through normal channels of trade.”1 Today this goal is accomplished through the issuance of monthly benefits in the form of Electronic Benefit Transfer (EBT) cards that can be used in retail food stores. The SNAP benefit is based on the Thrifty Food Plan (TFP), which is intended to provide a minimal-cost, healthy diet based on household size (see Box 2-1) (Carlson et al., 2007a).

Households with very little or no income receive the full TFP amount. Other households receive the TFP amount minus 30 percent of their net income because the SNAP program assumes that each household with income can contribute 30 percent of that income to the purchase of food. To the extent that 30 percent of household income is insufficient to purchase an amount of food equal to the TFP market basket, the SNAP benefit is issued in an amount that, combined with 30 percent of household income, totals the TFP amount for that household size (FNS, 2012b). For example, a household of four people with net income of $1,000 per month is expected to spend $300 per month of its net income for food. Because it needs $612 to purchase the TFP market basket, SNAP issues the household $312 in benefits.2 Eligibility for benefits is based on a gross income limit of 130 percent of the federal poverty threshold for a given household size, and net income may not exceed 100 percent of that threshold (households

____________________

1Food and Nutrition Act of 2008, Public Law 110-246, Sec. 2, pp. 1-2.

2This example does not incorporate the temporary increase in SNAP benefits under the American Recovery and Reinvestment Act of 2009 (Public Law 111-5).

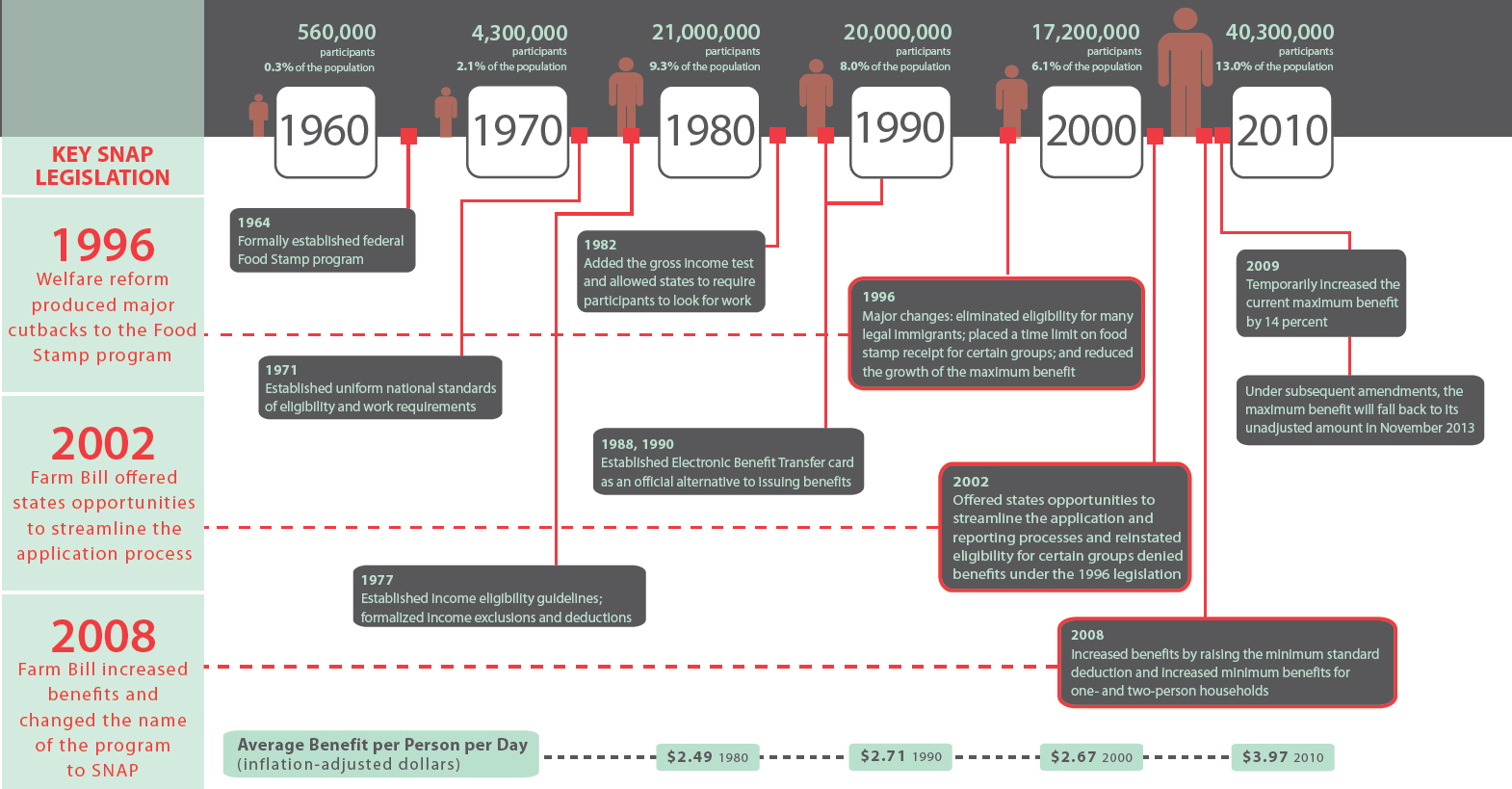

that contain an elderly or disabled person are exempt from the gross income test). The TFP, basic eligibility rules, and benefit levels are the same throughout the contiguous United States. See Figure 2-1 for a timeline of the dates of key SNAP legislation, as well as changes in participation and average benefit amounts over time.

The Early Program

SNAP was preceded by the original Food Stamp Program of 1939 and the pilot programs of the early 1960s. The 1939 program was initiated to align growing food surpluses with a concern for the needs of the poor as the country emerged from the Great Depression. The program grew out of a commodities distribution program in which commodities were purchased for a nonprofit, noncapital corporation, the Federal Surplus Relief Corporation, whose goal was to encourage domestic consumption of surplus food as a source of unemployment relief. With the new program, people on relief (public assistance) purchased orange stamps for $1 each, up to an amount approximately equal to their normal monthly food expenditure. For every orange stamp they purchased, they received a blue stamp worth 50 cents. The orange stamps could be used to buy any food, while the blue stamps were for foods USDA deemed surplus. The program operated in about half of U.S. counties and served about 4 million people a month at its peak (FNS, 2012c). The Secretary of Agriculture’s 1939 annual report3 included the following description of the program: “In times of great agricultural surpluses, which usually are accompanied by great unemployment, it will be there to do a minimum job in terms of minimum diets below which the public health would be endangered. The broader market made it possible for farmers in times of stress will help to stabilize our whole economy” (p. 719). Not surprisingly, the program was widely popular with the general public, participants, and grocers. By 1943, however, the program was terminated because of reduced availability of surpluses due to the war effort and a decline in unemployment levels (FNS, 2012d).

The Program of the 1960s and the Food Stamp Act of 1964

Nonetheless, the Food Stamp Program was not forgotten, and interest in the program continued until 1960, when it again became a reality. During his presidential campaign in West Virginia, Senator John F. Kennedy promised to start a food stamp program if elected. His first executive order on January 21, 1961 (White House, 1961), expanded food distribution programs and was followed by a February announcement that USDA would

____________________

3Food Stamp Act, HR 7940, 95th Congress (1977-1978).

initiate a series of food stamp pilot programs. Starting with eight sites, the initiative eventually expanded to 43. The success of these pilot programs led President Lyndon Johnson to request in 1964 that a permanent Food Stamp Program be enacted.4 He signed such a program into law later that year under the auspices of his “War on Poverty” (FNS, 2012d).

The original blue and orange stamps were replaced with food coupons, which participants were still expected to purchase. The so-called purchase requirement was considered essential to ensuring that the food stamp benefit would equal the cost of a healthy diet for the family’s size. State welfare agencies would determine eligibility, and households not on public assistance could apply at those offices. Any food for home consumption could be purchased except imported foods (exceptions were made for coffee, tea, and bananas). Alcohol and tobacco purchases were specifically prohibited. Counties were added to the program as they made requests and appropriations allowed. By April 1965, there were more than half a million participants, and by the time of the next major program changes, in February 1971, there were 10 million participants (FNS, 2012c).

The 1970s: National Eligibility Standards, Nationwide

Expansion, and Elimination of the Purchase Requirement

Program revisions in 1971 replaced the state-by-state rules with national eligibility standards.5 In 1974, the Food Stamp Program expanded across the nation. Before the nationwide expansion, many counties operated commodity distribution programs in lieu of the Food Stamp Program, in part because the commodities were intended to cover a family’s full food needs for a month with no cash contribution.

The next major changes to the Food Stamp Program resulted from the Food Stamp Act of 1977.6 The purchase requirement ensured that a family would receive coupons valued at what USDA determined to be the cost of a healthy diet; however, it had a depressing effect on program participation. After heated debate, the purchase requirement was eliminated, and participants were to receive only the formerly free portion of their benefit in coupons; they were expected to continue to buy a healthy diet by supplementing their coupons with cash (the 30 percent of net income rule). Following implementation in 1979, the reforms did indeed result in a greater percentage of eligible households participating in the program; during the month in which the purchase requirement was lifted, participation increased by 1.5 million over the previous month (FNS, 2012c).

____________________

4Food Stamp Act of 1964, Public Law 88-525.

5Amendments to the Food Stamp Act of 1964, Public Law 91-671.

6Public Law 88-535.

Many other significant changes were included in the 1977 law, but one change that did not make the final cut was an attempt to limit the types of foods that could be purchased, excluding those with low nutritional value. The bill did require that food stamp funds be given to the Expanded Food and Nutrition Education Program (EFNEP) operated by the USDA Extension Service, to increase its ability to educate food stamp participants in nutrition7 (see Chapter 4 for further information).

The 1980s Through Today

In the 1980s, legislators expressed concern about the size and cost of the Food Stamp Program, and subsequent legislation, among other things, limited participation by requiring households to meet a gross income test and decreasing the frequency of cost-of-living adjustments for allotments (FNS, 2012c). Legislation in 19888 increased the TFP by 3 percent in recognition of the time lag between the cost-of-living adjustments and their implementation over time. Later in that decade, the 3 percent increase was eliminated.9

As part of the 1996 Welfare Reform Act,10 a number of changes were made to the Food Stamp Program, including giving states greater administrative control, eliminating eligibility for legal noncitizen residents11 (partially restored in the Farm Security and Rural Investment Act of 2002 [Farm Bill]12), limiting eligibility for able-bodied adults without dependents, and officially adopting the EBT system for benefit delivery (Committee on Ways and Means, 2004). The EBT system went nationwide in 2002. It is designed to reduce fraud in the program and potential stigma resulting from the use of paper coupons (FNS, 2012c).

In April 2009, as part of the American Recovery and Reinvestment Act,13 a 13.6 percent increase was added to the TFP for most households (about $80 for a family of four) in an effort to help jump-start the economy and in recognition of the economic challenges faced by program participants. This increase in the TFP, which translated into a higher maximum benefit amount, is scheduled to expire on October 31, 2013.

____________________

7Food Stamp Act of 1977, Public Law 95-113, Stat. 913-1045.

8Hunger Prevention Act of 1988, Public Law 100-435, 102 Stat. 1645-1677.

9Personal Responsibility and Work Opportunity Reconciliation Act of 1996, Public Law 104-193.

10Personal Responsibility and Work Opportunity Reconciliation Act of 1996, Public Law 104-193.

11Legal immigrants must live in the country at least 5 years before receiving benefits.

12Public Law 107-171.

13Public Law 111-5, Title 1, Sec. 101.

SNAP BENEFIT FORMULA AND ELIGIBILITY

Benefit Formula

Participants’ monthly benefits, accessed using an EBT card, allow them to purchase food items for use at home, as well as seeds and plants to produce food. Consistent with its original design, SNAP is intended to supplement money a household has available for food purchases as described earlier. The purchasing power of the benefits, however, is affected by changes in food prices over the benefit period, as well as by other costs, such as those for fuel and shelter, and employment and income volatility. The cost-of-living adjustment for the TFP is discussed below. Other adjustments to reflect the cost of living are applied to the shelter deduction, the standard deduction, and the resource limit (FNS, 2012b). Box 2-2 provides a basic overview of the SNAP benefit formula.

The SNAP allotment for a household is determined by the maximum benefit guarantee, the benefit reduction rate, and net income. For purposes

BOX 2-2

SNAP Benefit Formula

Calculation of the SNAP allotment is based on the maximum monthly benefit, which in turn is based on the cost of the Thrifty Food Plan minus 30 percent of the applicant’s net income, or as:

SNAP allotment = G – 0.3 × Yn,

where G is the maximum monthly benefit, which varies by household size but is fixed across the contiguous 48 states and the District of Columbia (higher in Alaska and Hawaii), and Yn is net income. Net income, Yn, is calculated by subtracting a number of deductions from gross income, Yg, which consists of most sources of private income and some transfer income. Specifically, net income is

Yn = Yg – (0.2 × earnings) – child support – standard deduction –

dependent care deduction – excess shelter deduction –

(out-of-pocket medical costs – 35),

where earnings refer to labor market income, child support is payments made for children for whom paternity is established, the standard deduction is a deduction received by all households to cover emergency or unusual expenses, dependent care includes child and adult care expenses, the shelter deduction is for persons facing very high housing costs as a fraction of their income, and out-of-pocket medical expenses encompass those costs not reimbursed by private or public insurance for persons aged 60 and older and the disabled.

of the SNAP program, a household is defined as individuals who live together and who generally buy and consume meals together. If the individuals are related by birth, marriage, or adoption, they are counted as part of the household (except that a person aged 60 or older who is incapable of preparing his or her own meals may be treated as a separate household); if the individuals are not related and do not share meals, they can apply separately (FNS, 2012b).

The maximum benefit, for the 48 contiguous states and the District of Columbia for FY 2012, is shown in Table 2-1 (the amounts for Alaska and Hawaii are higher). As was the case in earlier versions of the program, the benefit reduction rate is fixed across the nation at 30 percent under the expectation that households should be responsible for about a third of their monthly food expenses, although with the formal deductions, the rate is effectively reduced to about 15-20 percent (Ziliak, 2008).

As depicted in Box 2-2, several expenses are deducted from household gross income to arrive at net income. SNAP allows 20 percent of labor market earnings to be deducted from gross income to account for work-related expenses such as transportation.14 Child support payments are deducted. All households receive a standard deduction intended to cover emergency and unusual household expenses; the amount of this deduction varies by household size ($147 in FY 2012 for households comprising one to three people, $155 for households of four or more people). The excess shelter deduction takes effect when households spend 50 percent or more of their income on housing after all other deductions, and is capped at $459 in FY 2012 for the contiguous United States (FNS, 2012b). The standard deduction is set at 8.31 percent of the income eligibility standard for each household size (but not to exceed 8.31 percent for a household of six). It is adjusted each fiscal year to reflect changes for the 12-month period ending the preceding June 30 using the Consumer Price Index (CPI) for All Urban Consumers for items other than food (BLS, 2012).15 The shelter deduction (see Chapter 5) is adjusted to reflect changes for the fiscal year using the CPI for All Urban Households for the previous 12-month period ending the preceding November 30.16 These income deductions are discussed further in Chapter 5. The deduction for out-of-pocket medical costs in excess of $35 is allowed only for those aged 60 and older and the disabled.

If net income is zero or negative, the household qualifies for the maximum benefit. At the other extreme, the SNAP allotment can, in theory, be zero, but USDA sets a nominal benefit floor ($16 in FY 2012 for one- to

____________________

14Food Stamp Act of 1977, Public Law 95-113.

157 C.F.R., Vol. 4, § 273.9 (d)(1).

167 C.F.R., Vol. 4, § 273.9 (d)(6)(ii).

TABLE 2-1 Maximum SNAP Benefits for the 48 Contiguous States and the District of Columbia (October 1, 2011, Through September 30, 2012)

| Number of Persons | Monthly Amount ($) |

| 1 | 200 |

| 2 | 367 |

| 3 | 526 |

| 4 | 668 |

| 5 | 793 |

| 6 | 952 |

| 7 | 1,052 |

| 8 | 1,202 |

| Each additional person | 150 |

SOURCE: FNS, 2012b.

two-person households in the 48 contiguous states and the District of Columbia [FNS, 2012e]).

About 80 percent of all benefits are used within the first 2 weeks of issuance, and more than 91 percent of all benefits are used by the 21st day (FNS, 2012f). This has led some people to suggest that benefits might be issued semimonthly to smooth use over the month (Orszag, 2012; Wilde, 2007). Among the arguments made in favor of such semimonthly delivery of benefits is that evidence suggests the caloric intake of SNAP recipients declines 10 to 15 percent at the end of the month (Shapiro, 2005), and admissions to hospitals for hypoglycemia increase significantly among food insecure diabetics (Seligman et al., 2011). This change, however, could result in increased program administration costs and possibly reduced flexibility for bulk purchases among SNAP beneficiaries. The committee is unaware of any instances in which implementation of benefits more frequently than once monthly has occurred.17

Basic Eligibility

Basic eligibility for SNAP requires passing two income tests and two asset tests. The gross income test requires that gross income be less than 130 percent of the federal poverty threshold for the household size, while the net income test requires that net income be less than 100 percent of the poverty threshold (see Table 2-2 for FY 2012 limits). The gross income test is waived for households containing persons aged 60 and older and those receiving certain disability payments, although the net income test still applies. The asset tests are a liquid asset test of $2,000 ($3,250 for persons

____________________

17See http://www.fns.usda.gov/snap/ebt/issuance-map.htm (accessed October 11, 2012).

TABLE 2-2 SNAP Income Limits for the 48 Contiguous States and the District of Columbia (October 1, 2011, Through September 30, 2012)

|

Number of Persons |

Gross Income Limit ($/month) |

Net Income Limit ($/month) |

|

1 |

1,180 |

908 |

|

2 |

1,594 |

1,226 |

|

3 |

2,008 |

1,545 |

|

4 |

2,422 |

1,863 |

|

5 |

2,836 |

2,181 |

|

6 |

3,249 |

2,500 |

|

7 |

3,633 |

2,818 |

|

8 |

4,077 |

3,136 |

|

Each additional person |

414 |

319 |

SOURCE: FNS, 2012b.

aged 60 and older or disabled); such assets include, for example, most forms of cash, checking accounts, savings, stocks, and bonds, and a vehicle value test of $4,650 (FNS, 2012b). The value of the home is excluded from the asset test (FNS, 2012b), as is the earned income tax credit. However, if the earned income tax credit is not spent for more than 12 months, any remaining amount is counted as a resource (some states have shorter windows).18 The asset limit is adjusted each fiscal year to reflect changes in the CPI for All Urban Households, rounded down to the nearest $250 increment (FNS, 2011). Most states (36) waive the value of all vehicles, and an additional 15 waive the value of the primary vehicle (FNS, 2010).

Categorical Eligibility

Most recipients of Temporary Assistance for Needy Families (TANF), Supplemental Security Income (SSI), and General Assistance are categorically eligible for SNAP and thus not subject to the above income and asset tests (FNS, 2012b). In 2010, some 24 percent of the SNAP caseload was categorically eligible for this reason, compared with 42 percent in 1996. The TANF-only share of the caseload declined from 37 percent in 1996 to 8 percent in 2010, mainly because of the decline in TANF recipients following welfare reform (Eslami et al., 2011).

Under broad-based categorical eligibility, households may become categorically eligible based on the receipt of noncash assistance from TANF or state maintenance-of-effort money. The noncash benefits range from receipt of brochures made available in certification offices to actual enrollment in

____________________

18Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010, Public Law 111-312, Sec. 728.

employment programs. Some 47 states use noncash categorical eligibility for gross income eligibility, and of these, 41 states use the broadest definition (FNS, 2010). These state options have become controversial.

DEFINITION OF THE SNAP ALLOTMENT

The Economy Food Plan and Individual Benefits

The Economy Food Plan, first established in 1961, was used to determine maximum food stamp benefits until 1975, when a U.S. Circuit Court ruled that the plan did not adequately address the needs of individuals of different sexes and ages. The court ruled that “substantially all recipients” should have access to a healthy diet and directed the Secretary of Agriculture to issue regulations that would either individualize allotments or “increase the ‘average’ allotment so that virtually all recipients are swept within it.”19

In response to the court’s guidance, in January 1976 the Secretary replaced the Economy Food Plan with the TFP at the same cost level, and the Food Stamp Act of 1977 changed the proposal to specifically support that administrative action. Today’s statute (1) specifies that the TFP is the basis of the SNAP maximum benefit, (2) defines a reference family’s age and sex composition (see next section), and (3) requires annual updates to reflect the cost of the plan. Further, the statute makes clear that the TFP is the basis of the benefit “regardless of [a household’s] actual composition.”20

The Thrifty Food Plan

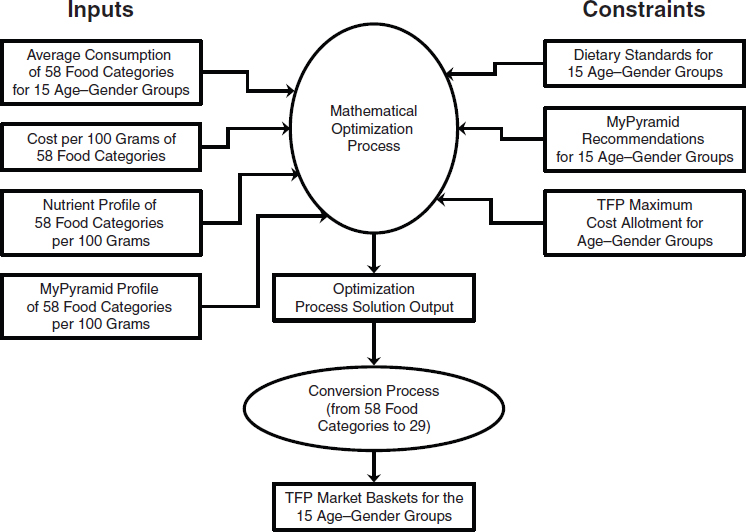

The TFP is “an assortment of foods that represents as little change from average food consumption of families with relatively low food costs as required to provide a nutritious diet, while controlling for cost.”21 As depicted in Figure 2-2, the TFP provides a market basket for each of 15 age-sex groups. For SNAP purposes, however, the plan bases maximum benefits on the market basket for a household comprising a male and female aged 19-50 and two children aged 6-8 and 9-11. This is called the “reference family,” meaning that the TFP maximum benefit is based on this four-person family composition. A 5 percent waste factor is factored in, and economies of scale are applied by household size.

____________________

19Rodway v. United States Department of Agriculture, 514 F.2d 809, 168 (U.S. App. D.C. 387, 1975).

20Food and Nutrition Act of 2008, Public Law 110-246, Sec. 4, p. 1-8.

2190th Congress, 1st session, House Agriculture Committee Report no. 95-464, pp. 186-187 (June 1977).

FIGURE 2-2 Thrifty Food Plan methodology.

SOURCE: Carlson et al., 2007a.

Other Food Plans

The TFP is the least costly of four plans developed by USDA to represent market baskets at different cost levels that conform to the most current dietary standards. The other three food plans are the Low-Cost Food Plan, the Moderate-Cost Food Plan, and the Liberal Food Plan. The Low-Cost plan represents food expenditures for the second-from-the-bottom quartile of food spending, the Moderate-Cost plan represents the second-from-the-top quartile, and the Liberal plan represents the top quartile. The plans are typically updated every 5 years, although the last update was in 2006. For a family of four, the monthly cost of the TFP in June 2011 was $612, compared with $796 for the Low-Cost plan, $995 for the Moderate-Cost plan, and $1,208 for the Liberal plan.22 The Low-Cost plan often is used by bankruptcy courts to allocate the portion of a person’s income that is necessary for food expenses. The Liberal plan is used by the Department of Defense to determine the Basic Allowance for Subsistence rates for all

____________________

22This example does not incorporate the temporary increase in SNAP benefits under the American Recovery and Reinvestment Act of 2009 (Public Law 111-5).

service members. All three of these plans are used to set state child support and foster care payments through USDA’s report Expenditures on Children by Families (Carlson et al., 2007b).

All plans meet the same caloric level for each age-gender group and are based on the 1997-2006 Dietary Reference Intakes (IOM, 1997, 1998, 2000, 2001, 2005a,b), the 2005 Dietary Guidelines for Americans (DGA) (HHS and USDA, 2005), and the 2005 MyPyramid food intake recommendations (USDA, 2005). All plans also are capped at their original levels but adjusted for inflation each year. A waste factor of 5, 10, 20, and 30 percent is calculated for the TFP and the Low-Cost, Moderate-Cost, and Liberal plans, respectively. All plans are for food consumed at home.

Cost-of-Living Adjustments

The TFP is updated monthly, but the SNAP maximum benefit is updated only annually (see Chapter 5). These updates are based on the CPI for the 29 food categories in the TFP that have a corresponding CPI or set of CPIs for each age-sex group (Carlson et al., 2007a). The maximum benefit is updated in October of each year using the previous June’s TFP cost, thereby resulting in a lag of 4 to 16 months. Between June and October 2008, for example, the cost of the TFP rose from $588 to $606, a 3.1 percent increase, for a family of four (Hanson and Andrews, 2008). An Economic Research Service (2008) report suggests two alternative adjustment methods: using 103 percent of the TFP or semiannual adjustments. A 3 percent increase in the maximum benefit in October would still result in a lag in benefits for some months, but over the course of FY 2008, for example, the benefit reduction per household would have been equivalent to $12.40 rather than $22.00 per month. The semiannual adjustment would have reduced the per household average monthly benefit reduction equivalent from $22.00 to $16.20 per month. Both methods have been used in the past only to be terminated when program cost savings were needed.

As described in Chapter 4 (Figure 4-3), the CPI for food has lagged behind the TFP cost index. This index is calculated by USDA’s Center for Nutrition Policy and Promotion (CNPP) using price data provided by the Bureau of Labor Statistics. As a result of this lag, participants’ food purchasing power may decline further to the extent that adjustments fail to account fully for the rise in the cost of the TFP.

Thrifty Food Plan: Dietary and Consumption Considerations

To determine the market baskets, the most recent TFP uses (1) the 1997-2005 Recommended Dietary Allowances, Adequate Intakes, and Acceptable Macronutrient Distribution Ranges (IOM, 1997, 1998, 2000, 2001,

2005a,b); (2) the recommendations of the 2005 DGA (HHS and USDA, 2005); and (3) the 2005 MyPyramid food intake patterns (USDA, 2005).

The DGA are federal nutrition policy and as such are the basis of nutrition guidance for all federal food assistance programs, including WIC, the School Meals programs, and CACFP. Although participants’ use of SNAP benefits is not directly tied to the DGA, the guidelines serve as the basis for educational programs for participants—SNAP-Ed and EFNEP. USDA-FNS views these educational programs as shared targeting that reinforces and builds on important nutrition messages across programs using multiple sources.23Appendix G provides a list of the 2010 DGA.

The TFP uses 58 different food groups in quantities as similar as possible to the current consumption pattern of low-income households using data from the 2001-2002 National Health and Nutrition Examination Survey (NHANES) for the reference family. USDA notes that while there is deviation from these reported purchasing patterns, the market basket for this family contains more pounds of food than the average family reports eating (Carlson et al., 2007b). Pricing is based on the 2005 A.C. Nielsen Homescan Panel (NCP, 2012).

Thrifty Food Plan: Cost Considerations

Updated TFPs should cost no more than the previous plan adjusted for inflation; in other words, the cost level of the TFP should remain constant. In its TFP publication, CNPP states that “because 2001-2002 consumption data underlie the 2006 revision of the TFP market baskets CNPP limited the cost of each group’s revised TFP market basket to equal the average real costs of its previous TFP market basket for the 2001-2002 period. This constant real-cost constraint was used to examine whether and how a person could achieve a nutritious diet based on current dietary needs” (Carlson et al., 2007a, p. 18). CNPP states further that it was able to meet the cost constraint. However, the committee found that the expectations of program participants imposed by this approach were not always realistic given constraints on access to low-priced foods, the lack of cooking skills for the “from-scratch” preparation often assumed in the TFP, the lack of variety in meals using the ingredients assumed in the plan, and other considerations.

Audits by the Office of the Inspector General

A report issued by USDA’s Office of the Inspector General found the TFP methodology to be sound. However, the following caveat was cited:

____________________

23See http://www.nal.usda.gov/fsn/Guidance/FY2013SNAP-EdPlanGuidance.pdf (accessed October 11, 2012).

“While noting the lack of a statistical basis for the food pricing data obtained through the A.C. Nielsen Homescan Reporting Service, we were unable to identify any better source for use in developing a food price database” (OIG, 2009).

Home Consumption Limitation

SNAP has always limited food purchases to food consumed at home, with the exception of accommodations for some elderly and disabled persons, the homeless, and some treatment centers. The program also limits prepared foods such that hot food may not be purchased with SNAP benefits (see the discussion of eligible foods later in this chapter).

A 2006 report of the Economic Research Service used the 2002 Consumer Expenditure Survey to estimate that low-income households spent 125 percent of the calculated cost of the TFP if food consumed both at home and away from home was considered (Blisard and Stewart, 2006). If food consumed away from home was not considered, however, low-income households spent about 86 percent of the level suggested by the TFP for food consumed at home. Using NHANES data for 2001 and 2002, USDA estimated that the TFP would need to be increased by 7 percent if just one meal a week per person were eaten away from home (Lin and Carlson, 2010). Lin and Carlson note further that “allowing for SNAP benefits to be spent on food away from home, which is generally nutritionally inferior to food at home, may help SNAP participants balance time constraints and other needs, but could also make eating healthy even more challenging” (p. 1).

Thrifty Food Plan: Economies of Scale

As noted above, the TFP is designed for a reference family of two adults and two children, and the cost is then adjusted for families of different sizes. The adjustment factors reflect economies of scale in food purchases since larger packages usually have lower costs per unit. Under typical circumstances, for example, a large family may be able to consume a gallon of milk before it spoils, but a small family may be able to consume only a quart of milk. If milk prices are lower per ounce in larger containers, the cost per person of milk consumption is lower for the large family. To account for these economies of scale, the per-person benefit for a family of four is increased by 5 percent for a family of three, by 10 percent for a family of two, and by 20 percent for a family of one. Conversely, per-person benefits are reduced by 5 percent for families with five or six members and by 10 percent for those with seven or more members.

Foods Eligible for Purchase with Benefits

The Food Stamp Act of 1964

According to the Food Stamp Act of 1964,24 eligible foods included any foods for human consumption except alcoholic beverages, tobacco, and foods identified on the package as imported meat and meat products. The House Agriculture Committee tried at the time to prohibit soft drinks, luxury foods, and luxury frozen foods, but the Senate Agriculture Committee declined, saying that the restriction would cause “insurmountable administrative problems.”25 The basic definition in the 1964 act remained essentially unchanged until 1977 with some exceptions, including the additions outlined below.

In 1970, the elderly homebound and disabled were allowed to use coupons for meals prepared and delivered to them by private nonprofit organizations or political subdivisions as long as the provider received no federal financial assistance. Meals On Wheels was specifically cited as eligible to accept coupons donated by these households on a voluntary basis. In 1973, the Agriculture and Consumer Protection Act26 eliminated the imported foods limitation; added plants and seeds as eligible foods; and allowed food coupons to be accepted by communal dining facilities for the disabled and elderly, as well as addiction treatment programs. An attempt at that time to ban non-nutritious foods was defeated on the House floor.27

The Food Stamp Act of 1977

In the debate on the 1977 Food Stamp Act, the House Agriculture Committee considered the issue of “junk foods.” There was an effort to define such foods as those “which the Secretary, after consultation not less than once annually with the President of the National Research Council of the NAS (Food and Nutrition Board) determines to have such negligible or low nutritional value or insignificant enhancement of palatability as to be inappropriate for inclusion in a healthy diet.”28 This amendment failed even though it included another provision that had passed that would have

____________________

24Public Law 88-525, Sec. 3.

2590th Congress, 1st session, House Agriculture Committee Report No. 95-464, p. 321 (June 1977).

26Public Law 93-86.

2790th Congress, 1st session, House Agriculture Committee Report No. 95-464, p. 323 (June 1977).

2890th Congress, 1st session, House Agriculture Committee Report No. 95-464, p. 333 (June 1977).

excluded ice cubes, artificial food coloring, powdered and liquid cocktail mixes, chewing gum, carbonated drinks, and cooking wines.29

The amendment’s defeat was attributed to concern about the difficulty it would cause the Secretary, the administrative burden on retailers, and the uncertain state of nutrition science. It was also recognized that eliminating the provision that such items could not be obtained with benefits meant households could purchase the items anyway within their food budgets. When program participants were required to pay for a portion of their food benefit, their cash and the benefit were returned to them in the form of coupons that could be used only to purchase foods. When households no longer had to turn their cash contribution into coupons, only the federal benefit portion continued to be received as coupons, and households could use their cash for any food or nonfood purchases. Even though hot foods ready for immediate consumption were never permitted, the House committee did officially ban such foods except in communal dining situations and in restaurants used by the elderly. “If the fast food stores cannot redeem food stamps, the Committee thought that grocery stores should not be permitted an unfair advantage.”30 The ban on hot foods was included in the 1977 law and remains in the current law. The issue of competition among outlets that sold hot foods arose when USDA disallowed Kentucky Fried Chicken™ from becoming a food stamp–approved retailer. The company sued and won in District Court, but on October 7, 1971, the Fifth Circuit Court of Appeals upheld USDA’s right to deny fast food establishments’ authorization to accept benefits.31

Current Law

The current law defines eligible foods as “(1) any food or food product for home consumption except alcoholic beverages, tobacco, and hot foods or hot food products ready for immediate consumption …, [and] (2) seeds and plants for use in gardens to produce food for the personal consumption of the eligible household.”32

Recently, the State of New York requested a waiver from the law to undertake a demonstration project restricting the purchase of sugar-sweetened beverages in New York City. The stated goal was to reduce obesity. USDA denied the request on August 19, 2011. The letter of denial raised the following concerns: New York City was too large a site for such

____________________

2990th Congress, 1st session, House Agriculture Committee No. 95-464, p. 333 (June 1977).

3090th Congress, 1st session, House Agriculture Committee No. 95-464, p. 333 (June 1977).

31Kentucky Fried Chicken of Cleveland, Inc., Plaintiff-Appellee, v. United States of America, 449 F.2d 255, No. 71-1960, U.S. appellate (1971).

32Food and Nutrition Act of 2008, Public Law 110-246, Sec. 3, pp. 1-4.

a complex proposal; retailers would face difficult operational issues; the proposal failed to address point-of-sale problems, which could cause confusion and stigma for clients and retailers; and the evaluation component of the project was inadequate (USDA, 2011).

USDA’s Food and Nutrition Service (FNS) further commented on its preference for incentive-based approaches and cited a project it is carrying out with Massachusetts that increases allotments when fruits and vegetables are purchased with SNAP benefits (USDA, 2011). FNS elaborates further on its views on its website.33 The Massachusetts pilot is the result of $20 million provided by the Food, Conservation, and Energy Act of 200834 for study of the impact of an incentive-based point-of-sale project focused on increasing the purchase of fruits and vegetables. The life of the project—Healthy Incentives Pilot—extended from November 2011 through December 2012. The pilot was located in one county and provided a credit worth 30 percent of the purchase price of targeted fruits and vegetables bought with SNAP benefits. There was a $60 monthly cap per household. Fruits and vegetables could be fresh, frozen, canned, or dried (MA DTA, 2011).

TRENDS IN PROGRAM PARTICIPATION AND COSTS

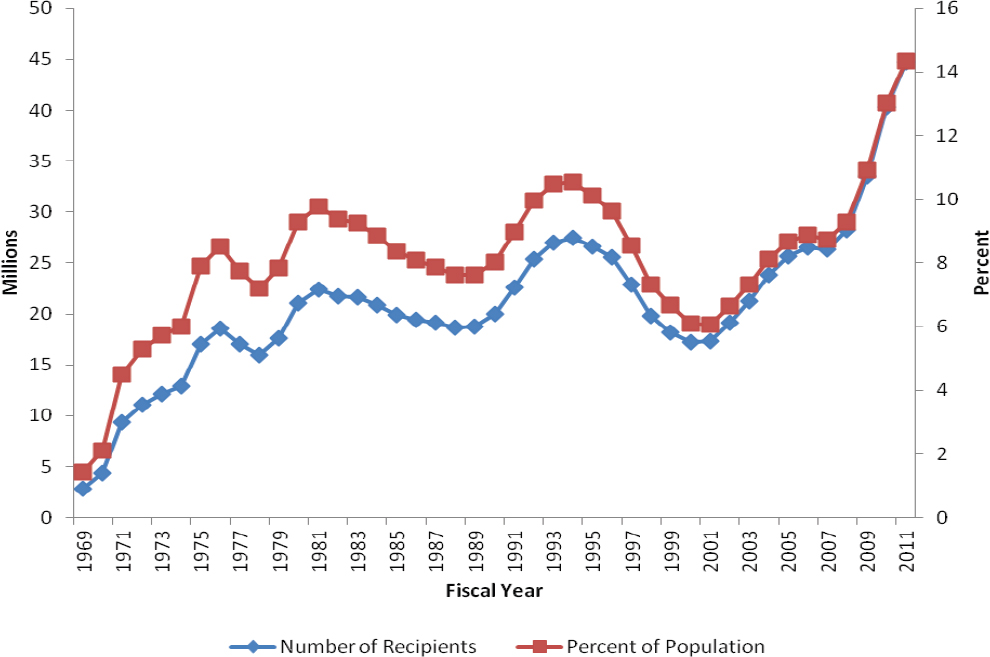

The committee’s review of the evidence revealed a number of descriptive trends in program participation, costs, and caseload composition. Figure 2-3 depicts trends in SNAP participation and total costs from 1969 to 2011. Participation is presented in millions of persons on the left axis and as a percentage of the population on the right axis. Program participation increased rapidly with the rollout in the 1970s, and trends remained fairly stable through the 1980s, although there were clear increases and declines in participation over the business cycle as the program functions as an automatic fiscal stabilizer. The last two decades have seen much greater variability in participation. Substantial increases in the early 1990s were followed by a decline of more than one-third between 1994 and 2000 in response to changes in the business cycle (Ziliak et al., 2003) and welfare policy reform (Kabbani and Wilde, 2003; Ratcliffe et al., 2008). Since then, in response to the recessions of 2001 and 2007, along with expanded outreach efforts as part of the 2002 and 2008 Farm Bills (Klerman and Danielson, 2011; Mabli and Ferrerosa, 2010), average annual participation has increased 160 percent to more than 46 million in FY 2012, or one in seven Americans.

Mabli and colleagues (2011) examined the duration of SNAP participation by individuals from 2002 to 2004. They looked at individuals rather than households because the composition of a given household frequently

____________________

33See http://www.usda.fns.gov.

34Public Law 110-234.

FIGURE 2-3 Trends in the number and fraction of the population receiving SNAP benefits, 1969-2011.

SOURCES: FNS, 2012a; U.S. Census Bureau, 2012.

changes over time. Weighted data from the 2004 cohort showed that the median duration of participation for individuals enrolled in SNAP was about 10 months. About 25 percent of participants that left the program, however, returned within 6 months, and 50 percent returned within 20 months.

Given the dramatic changes in participation in recent years, an obvious question is whether particular population subgroups (e.g., children, adults) led the trends. Table 2-3 presents changes in the age composition of the SNAP program in recent years. In a typical year over the past decade, about one-half of SNAP participants consisted of school-age children and just over 40 percent nonelderly adults; these proportions changed little even during the previous recession (Eslami et al., 2011) (elderly adults are defined as aged 60 and over for SNAP purposes).

As shown in Table 2-4, there has been a near doubling of the fraction of SNAP households receiving the maximum monthly benefit over the past decade, and takeup rates increased from 64 percent of eligible participants in 1997 to 72 percent in 2009. Eligible participants that are entitled to higher benefits are more likely to participate. In 2009, while only 72 percent of eligible households participated in the program, the participating

TABLE 2-3 Distribution of SNAP Participants by Age Category Over Time

| Fiscal Year | Number of Participants in Thousands (% of caseload) | |||

| Preschool | School Age | Nonelderly Adults | Elderly Adults | |

| 1997 | 4,046 (17.5) | 7,825 (33.8) | 9,385 (40.6) | 1,834 (7.9) |

| 2000 | 2,846 (16.7) | 5,919 (34.6) | 6,623 (38.7) | 1,702 (10.0) |

| 2003 | 3,541 (16.9) | 7,087 (33.9) | 8,514 (40.7) | 1,788 (8.5) |

| 2006 | 4,243 (16.6) | 8,361 (32.7) | 10,763 (42.1) | 2,229 (8.7) |

| 2009 | 6,317 (15.9) | 12,199 (30.7) | 18,121 (45.6) | 3,121 (7.9) |

NOTE: FY = fiscal year.

SOURCES: FNS, 1999, 2001, 2004, 2007, 2011.

TABLE 2-4 Distribution of Participants by Benefit Amount, Household Size, and Takeup Rate Over Time

| Household Characteristic | FY 1997 | FY 2000 | FY 2003 | FY 2006 | FY 2009 |

| Percent of SNAP households receiving maximum benefit | 22.7 | 20.2 | 25.9 | 32.1 | 37.4 |

| Mean household size | 2.4 | 2.3 | 2.3 | 2.3 | 2.2 |

| Percent of SNAP-eligible population receiving any benefit | 64.0 | 56.7 | 56.4 | 68.9 | 72.2 |

| Dollar value of average benefit per person per meala | 0.78 | 0.80 | 0.92 | 1.03 | 1.37 |

| Fraction of households with earnings | 24.2 | 27.2 | 28.2 | 29.7 | 29.4 |

NOTE: FY = fiscal year.

aCalculated as average monthly benefit (based on aggregate program participation data) per person, divided by 91.5 meals/month.

SOURCES: Cody and Castner, 1999; Cunnyngham, 2001; Cunnyngham and Brown, 2004; Leftin et al., 2011; Wolkwitz, 2007.

households received 91 percent of the total benefits, in dollar terms, of the amount that would have been spent if the takeup rate were 100 percent (Leftin et al., 2011).

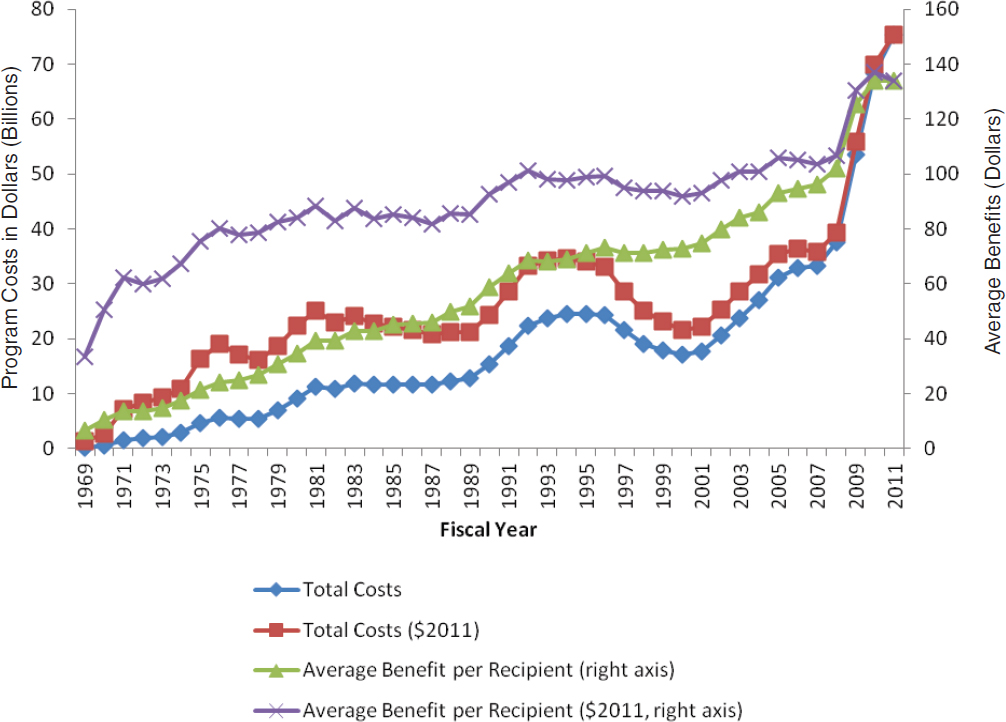

Program costs for SNAP are almost entirely in the form of benefits and are covered by the federal government, the exception being for a small portion of administrative expenses paid for by state governments. Figure 2-4 demonstrates that program outlays have increased in lockstep with participation and that the growth in inflation-adjusted spending differs little from

FIGURE 2-4 Trends in nominal and real SNAP expenditures, 1969-2011.

SOURCES: FNS, 2012a; GPO, 2012.

nominal growth.35 In the last decade, nominal spending (fixed value or price) rose 342 percent, while real spending (change in value or price over time) increased almost 250 percent, such that by FY 2011, program costs were in excess of $75 billion, making SNAP one of the largest programs in the social safety net. Although total costs have grown rapidly, inflation-adjusted per-recipient benefits changed little over the past three decades until the increases under the ARRA were instituted.36

TRENDS IN FOOD INSECURITY AND POVERTY

A central goal of SNAP is to alleviate hunger and malnutrition by increasing resources for the purchase of food for a nutritious diet. In 1995, USDA began monitoring food security (see Box 2-3) by means of the annual Food Security Supplement to the monthly Current Population Survey (CPS),

____________________

35Inflation is measured using the chain-weighted personal consumption expenditure deflator with 2011 base year.

36Public Law 111-5.

Food security is access at all times to enough food for an active healthy life. Food insecurity exists when there is inadequate or unsure access to enough food for active, healthy living. In 1995, the U.S. Department of Agriculture (USDA) began collecting data on food access, food adequacy, spending on food, and sources of food assistance for the U.S. population. Data are collected annually through a food security survey conducted by the U.S. Census Bureau, and are used as a source of information on the prevalence and severity of food insecurity in U.S. households. In the 18-item Core Food Security Module (CFSM), households are placed in one of four mutually exclusive groups: high food security, marginal food security, low food security, and very low food security. Most analyses refer to food insecurity, which combines the latter two categories.

Categories of Food Insecurity

|

USDA Classification |

Number of Affirmative Responses to the CFSM |

|

High food security |

0 |

|

Marginal food security |

1 or 2 |

|

Low food security |

3-5 |

|

Very low food security |

8 or more in households with children; |

SOURCES: http://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us.aspx (accessed April 8, 2013); Anderson, 1990; NRC, 2006.

a nationally representative survey carried out by the U.S. Census Bureau.37 In December of each year since 2001, about 50,000 households have responded to a series of 18 questions (10 if no children are present) that make up the Core Food Security Module (CFSM) in the CPS (see Appendix F for the list of questions). Each question is designed to capture some aspect of food insecurity, and some questions include the frequency with which that aspect manifests. Respondents are asked about their food security status in the last 30 days, as well as over the past 12 months, and about food spending and the use of federal and community food assistance programs. The 18-item food security scale is intended to capture self-assessed concerns/anxiety over lack of access to healthy and safe foods owing to a lack of economic resources. It is measured at the household level and thus does not identify who in the household is experiencing food insecurity.

____________________

37For discussion of the history of food insecurity measures, see NRC (2006).

A report from the National Research Council (NRC) of the National Academy of Sciences reviews the concepts and methodology for measuring food insecurity and hunger. It recommends that USDA no longer refer to the more severe forms of food insecurity as “hunger” since hunger is a physiological condition experienced at the individual level and not necessarily at the household level (NRC, 2006). In line with this recommendation, USDA has classified the most severe form of food insecurity as “very low food secure,” which it identifies if a household answers affirmatively to six or more (eight or more if children are present) questions on the CFSM. The NRC (2006) report includes the recommendation that USDA continue to measure and monitor food insecurity regularly in a household survey. It recommends further that, given that hunger is a separate concept from food insecurity, USDA undertake a program to measure hunger, which is an important potential consequence of food insecurity. The report also concludes that exclusive reliance on trends in the prevalence of food insecurity would not be an appropriate measure of the effectiveness of food assistance programs such as SNAP. For program evaluation purposes, it is important to know what effect SNAP has on food insecurity. As discussed here and in Chapter 2, however, a challenge facing evaluation of the impact of SNAP on food insecurity is the prospect of reverse causality; that is, food insecure households may self-select into SNAP. Several authors have used sophisticated econometric techniques to model the self-selection process and, after controlling for nonrandom selection, generally have found that SNAP reduces food insecurity (Gundersen and Oliveira, 2001; Kreider et al., 2012).

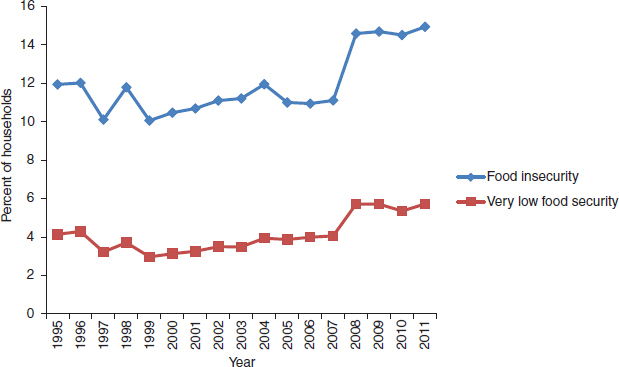

Figure 2-5 shows trends in 12-month prevalence rates of food insecurity and very low food security among U.S. households from 1995 through 2011. Prevalence rates for 1996 and 1997 were adjusted for the estimated effects of differences in data collection screening protocols used in those years. The supplements were conducted in various months in the initial years but since 2001 have been fielded in December, which implies that the 12-month recall refers to the actual year of the survey. The fraction of households experiencing food insecurity or very low food security held fairly steady until the Great Recession that began at the end of 2007. Thereafter, food insecurity increased by 31 percent and very low food security by 32 percent, although both indicators fell slightly between 2009 and 2011 as the economic recovery began to gain traction.

These trends in food insecurity must be interpreted in the context of other factors that may impact access to food for low-income households, including changes in income distribution across the low-income range, noncash assistance (e.g., participation in other assistance programs), and other basic household needs (Nord, 2007). Indeed, an apparent contradiction in Figure 2-5 is that as SNAP participation and expenditures accelerated in the latter half of the past decade, food insecurity accelerated as well. In

FIGURE 2-5 Trends in prevalence rates of food insecurity and very low food security in U.S. households, 1995-2011.

NOTE: Prevalence rates for 1996-1997 were adjusted for the estimated effects of differences in data collection and screening protocols used in those years.

SOURCE: ERS, 2012. Calculation by ERS based on Current Population Survey Food Security Supplement data.

fact, SNAP recipients are twice as likely as SNAP-eligible nonrecipients to report being food insecure (Tiehen et al., 2012). (A similar contradiction is seen in Figure 2-6, presented later in this section.)

Because participation in SNAP is not likely to be unrelated to food security status, a selection problem arises in evaluating the effect of the program on food insecurity (Currie, 2003). Studies evaluating nonrandom selection by nonexperimental statistical methods (e.g., Gundersen and Oliveira, 2001; Kreider et al., 2012; Mykerezi and Mills, 2010; Yen et al., 2008) generally have found that SNAP reduces food insecurity.

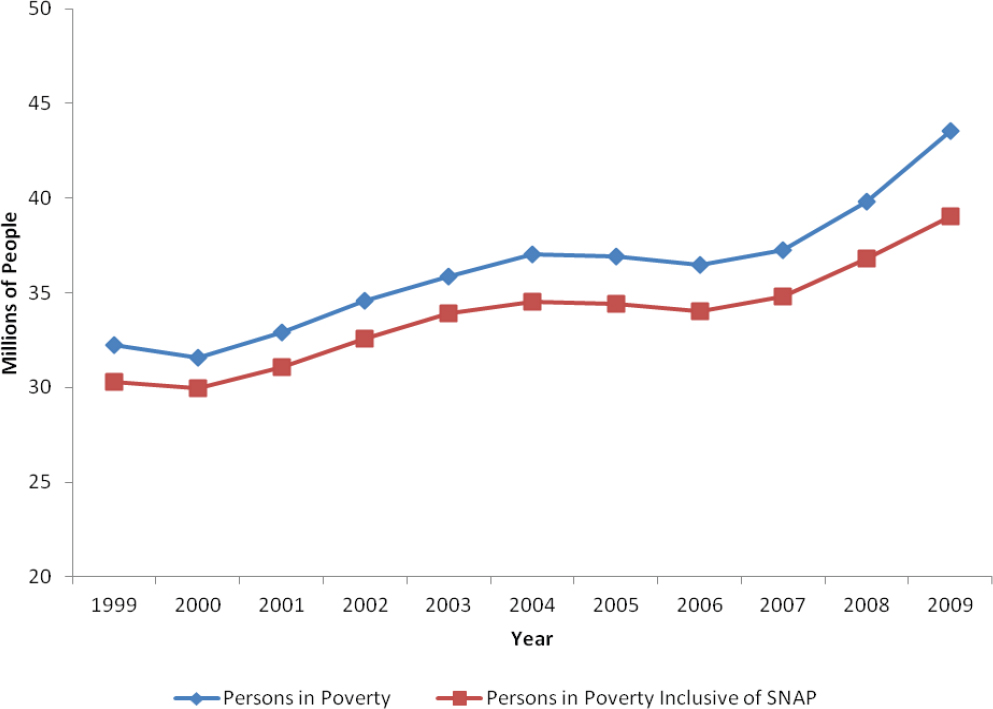

A broader metric of the effect of SNAP on the well-being of individuals and households is the antipoverty effectiveness of the program. While the provision of food assistance has a modest effect on household work effort (Hoynes and Schanzenbach, 2011), it increases household resources for the purchase of food and thus should reduce the incidence and severity of poverty by freeing up income for the purchase of other goods and services (Tiehen et al., 2012; Ziliak, 2011). Ziliak (2011) used data from the Annual Social and Economic Supplement of the CPS to estimate the number of persons lifted out of poverty by SNAP in any given year from 1999 to 2009. Figure 2-6 shows that the antipoverty effectiveness of SNAP increased over the decade, with

FIGURE 2-6 Trends in number of persons in poverty, exclusive and inclusive of SNAP benefits, 1999-2009.

SOURCE: Ziliak, 2011.

about 2 million people being lifted out of poverty each year through 2003, rapidly increasing to 4.5 million in 2009, most likely because of expanded generosity of benefits in response to the recession. Using the same CPS data as Ziliak (2011), Tiehen and colleagues (2012) found that SNAP participation had an even larger impact on reducing the depth and severity of poverty. Their estimates showed that SNAP benefits led to an average annual decline of 4.4 percent in the incidence of poverty from 2000 to 2009, while the depth and severity of poverty declined 10.3 and 13.2 percent, respectively.38

Although the basic design of SNAP (with the exception of national eligibility standards and elimination of the purchase requirement) has remained

____________________

38The incidence of poverty refers to the percentage of the population below the poverty line, while depth and severity refer to how far below the line a given poor person’s income is. The latter measures differ in the weight given to families farther below the poverty line, with the severity measure giving more weight than the depth measure to the poorest poor.

unchanged since the 1964 law was enacted, the program has undergone many substantial changes that have resulted in its expansion and retraction over the years. These changes often have brought new complexities to program administrators and applicants. The legislation governing today’s program has specific eligibility requirements and administrative procedures that make SNAP more complex than other social programs. Even as many features of the program limit its ability to be responsive to an individual household’s needs, many other features, such as income deductions, are designed to make it more responsive. Striking a balance between a more targeted and a more accessible benefit has been an ongoing tension in the program. The size and the cost of the program make it a target for budget cuts, and even relatively small adjustments have the potential to impact a significant number of Americans.

Over the years, debates have continued about whether the program should be more of a nutrition or an income maintenance program (including whether the in-kind benefit should be replaced by a cash allotment); to what extent, if any, the program should limit food choices; what responsibilities participants should be expected to have (e.g., whether they, as is now the case, should be required to seek employment if able-bodied); whether geographic distinctions should be applied in determining need and/or benefit levels; and what the program’s role should be in providing nutrition education and reaching out to eligible nonparticipants. Other debates have centered on the adequacy of the TFP, whether expecting households to devote 30 percent of their net income to the purchase of food is realistic, and how net income should be defined. For example, households are expected to pay up to 50 percent of their net income for shelter with no commensurate reduction in the amount of their remaining income that should be considered available for food purchases—they are still expected to spend 30 percent of their net income for food. These and other issues have continued to be debated since the inception of the permanent program in 1964 and are discussed in further detail in the ensuing chapters of this report.

Anderson, S. A. (1990). Core indicators of nutritional status for difficult-to-sample populations. Journal of Nutrition 120:1557-1600.

Blisard, N., and H. Stewart. 2006. How low-income households allocate their food budget relative to cost of the Thrifty Food Plan, ERR-20. Washington, DC: USDA, ERS. http://webarchives.cdlib.org/sw15d8pg7m/http://ers.usda.gov/Publications/err20 (accessed July 5, 2012).

BLS (Bureau of Labor Statistics). 2012. Consumer Price Index: All urban consumers. ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt (accessed June 4, 2012).

Carlson, A., M. Lino, W. Y. Juan, K. Hanson, and P. P. Basiotis. 2007a. Thrifty Food Plan, 2006, CNPP-19. Washington, DC: USDA, CNPP. http://www.cnpp.usda.gov/Publications/FoodPlans/MiscPubs/TFP2006Report.pdf (accessed May 31, 2012).

Carlson, A., M. Lino, and T. Fungwe. 2007b. The Low-Cost, Moderate-Cost, and Liberal Food Plans, 2007, CNPP-20. Washington, DC: USDA, CNPP. http://www.cnpp.usda.gov/publications/foodplans/miscpubs/foodplans2007adminreport.pdf (accessed July 26, 2012).

CBO (Congressional Budget Office). 2012. The Supplemental Nutrition Assistance Program—Infographic. http://www.cbo.gov/publication/43174 (accessed May 31, 2012).

Cody, S., and L. Castner. 1999. Characteristics of food stamp households: Fiscal year 1997. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.fns.usda.gov/ora/menu/Published/snap/FILES/Participation/char97.pdf (accessed May 24, 2012).

Committee on Ways and Means. 2004. Background material and data on programs within the jurisdiction of the Committee on Ways and Means (Green Book). Washington, DC: Government Printing Office. http://www.gpo.gov/fdsys/search/pagedetails.action?granuleId=&packageId=GPO-CPRT-108WPRT108-6 (accessed June 4, 2012).

Cunnyngham, K. 2001. Characteristics of food stamp households: Fiscal year 2000. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.fns.usda.gov/ora/menu/Published/snap/FILES/Participation/2000Characteristics.pdf (accessed May 24, 2012).

Cunnyngham, K., and B. Brown. 2004. Characteristics of food stamp households: Fiscal year 2003. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.fns.usda.gov/ora/menu/Published/snap/FILES/Participation/2003Characteristics.pdf (accessed May 24, 2012).

Currie, J. 2003. U.S. food and nutrition programs. In Means-tested transfer programs in the United States, edited by R. Moffitt. Chicago, IL: University of Chicago Press. Pp. 199-290. ERS (Economic Research Service). 2012. Trends in prevalence rates of food insecurity and very low food security in U.S. households, 1995-2011. http://ers.usda.gov/media/246942/trebds.xls (accessed September 17, 2012).

Eslami, E., K. Filion, and M. Strayer. 2011. Characteristics of Supplemental Nutrition Assistance Program households: Fiscal year 2010. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.fns.usda.gov/ora/menu/Published/snap/FILES/Participation/2010Characteristics.pdf (accessed May 24, 2012).

FNS (Food and Nutrition Service). 2010. Supplemental Nutrition Assistance Program: State options report. Washington, DC: USDA, FNS. http://www.fns.usda.gov/snap/rules/Memo/Support/State_Options/9-State_Options.pdf (accessed July 16, 2012).

FNS. 2011. Supplemental Nutrition Assistance Program (SNAP): Eligibility, certification, and employment and training provisions: Proposed rule. Federal Register 76(86):25414-25458. FNS. 2012a. Supplemental Nutrition Assistance Program participation and costs. http://www.fns.usda.gov/pd/SNAPsummary.htm (accessed May 24, 2012).

FNS. 2012b. Supplemental Nutrition Assistance Program: Eligibility. http://www.fns.usda.gov/snap/applicant_recipients/eligibility.htm (accessed July 16, 2012).

FNS. 2012c. A short history of SNAP. http://www.fns.usda.gov/snap/rules/Legislation/about.htm (accessed June 1, 2012).

FNS. 2012d. From food stamps to the Supplemental Nutrition Assistance Program. http://www.fns.usda.gov/snap/rules/Legislation/timeline.pdf (accessed July 17, 2012).

FNS. 2012e. FY 2012 minimum SNAP allotment. http://www.fns.usda.gov/snap/government/FY12_Minimum_Allotments.htm (accessed July 19, 2012).

FNS. 2012f. Building a healthy America: A profile of the Supplemental Nutrition Assistance Program. Alexandria, VA: USDA, FNS. http://www.fns.usda.gov/ora/MENU/published/snap/FILES/Other/BuildingHealthyAmerica.pdf (accessed May 22, 2012).

GPO (Government Printing Office). 2012. Economic report of the President: Table B-6: Chain-type quantity indexes for gross domestic product, 1963-2011. Washington, DC: GPO. http://www.gpo.gov/fdsys/pkg/ERP-2012 (accessed May 24, 2012).

Gundersen, C., and V. Oliveira. 2001. The food stamp program and food insufficiency. American Journal of Agricultural Economics 83(4):875-887.

Hanson, K., and M. Andrews. 2008. Rising food prices take a bite out of food stamp benefits, EIB-41. Washington, DC: USDA, ERS. http://www.ers.usda.gov/publications/eib-economic-information-bulletin/eib41.aspx (accessed July 5, 2012).

HHS and USDA (U.S. Department of Health and Human Services and U.S. Department of Agriculture). 2005. Dietary guidelines for Americans. 6th ed. Washington, DC: U.S. Government Printing Office. http://www.health.gov/dietaryguidelines/dga2005/document (accessed June 4, 2012).

Hoynes, H. W., and D. W. Schanzenbach. 2012. Work incentives and the Food Stamp Program. Journal of Public Economics 96(1):151-162.

IOM (Institute of Medicine). 1997. Dietary reference intakes for calcium, phosphorus, magnesium, vitamin D, and fluoride. Washington, DC: National Academy Press.

IOM. 1998. Dietary reference intakes for thiamin, riboflavin, niacin, vitamin B6, folate, vitamin B12, pantothenic acid, biotin, and choline. Washington, DC: National Academy Press.

IOM. 2000. Dietary reference intakes for vitamin C, vitamin E, selenium, and carotenoids. Washington, DC: National Academy Press.

IOM. 2001. Dietary reference intakes for vitamin A, vitamin K, arsenic, boron, chromium, copper, iodine, iron, manganese, molybdenum, nickel, silicon, vanadium, and zinc. Washington, DC: National Academy Press.

IOM. 2005a. Dietary reference intakes for energy, carbohydrate, fiber, fat, fatty acids, cholesterol, protein, and amino acids. Washington, DC: The National Academies Press.

IOM. 2005b. Dietary reference intakes for water, potassium, sodium, chloride, and sulfate. Washington, DC: The National Academies Press.

Kabbani, N., and P. E. Wilde. 2003. Short recertification periods in the U.S. Food Stamp Program. Journal of Human Resources 38(Suppl.):1112-1138.

Klerman, J. A., and C. Danielson. 2003. The transformation of the Supplemental Nutrition Assistance Program. Journal of Policy Analysis and Management 30(4):863-888.

Kreider, B., J. V. Pepper, C. Gundersen, and D. Joliffe. 2012. Identifying the effects of SNAP (food stamps) on child health outcomes when participation is endogenous and misreported. Journal of American Statistical Association 107(499):958-975.

Leftin, J., A. Gothro, and E. Eslami. 2010. Characteristics of Supplemental Nutrition Assistance Program households: Fiscal year 2009. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.fns.usda.gov/ora/menu/Published/SNAP/FILES/Participation/2009Characteristics.pdf (accessed May 29, 2012).

Leftin, J., E. Eslami, and M. Strayer. 2011. Trends in Supplemental Nutrition Assistance Program participation rates: Fiscal year 2002 to fiscal year 2009: Final report. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.mathematica-mpr.com/publications/PDFs/nutrition/trends2002-09.pdf (accessed July 5, 2012).

Lin, B. H., and A. Carlson. 2010. SNAP benefits and eating out: Wise choices required. Amber Waves, http://webarchives.cdlib.org/sw1vh5dg3r/http://www.ers.usda.gov/AmberWaves/March10/Findings/SnapBenefits.htm (accessed July 5, 2012).

MA DTA (Massachusetts Department of Transitional Assistance). 2011. It’s HIP to be healthy: The Massachusetts Healthy Incentives Pilot. Presented to the Massachusetts Food Policy Council, October 7, 2011. http://www.mass.gov/agr/boards-commissions/docs/DTA-presentation-Food-Policy-Council-10-7-11.pdf (accessed July 19, 2012).

Mabli, J., and C. Ferrerosa. 2010. Supplemental Nutrition Assistance Program caseload trends and changes in measures of unemployment, labor underutilization, and program policy from 2000 to 2008. Submitted by Mathematica Policy Research, Inc. to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://www.mathematica-mpr.com/publications/PDFs/nutrition/SNAP_caseloads.pdf (accessed July 16, 2012).

Mabli, J., S. Tondella, L. Castner, T. Godfrey, and P. Foran. 2011. Dynamics of Supplemental Nutrition Assistance Program participation in the mid-2000s. Submitted by Decision Demographics to U.S. Department of Agriculture, Food and Nutrition Service, Alexandria, VA. http://222.fns.usda.gov/ora/MENU/Published/snap/FILES/Participation/DynamicsMid2000.pdf (accessed December 14, 2012).

Mykerezi, E., and B. Mills. 2010. The impact of Food Stamp Program participation on household food insecurity. American Journal of Agricultural Economics 92(5):1379-1391.

NCP (National Consumer Panel). 2012. National Consumer Panel. https://www.ncponline.com/panel/US/EN/Login.htm (accessed July 26, 2012).

Nord, M. 2007. Characteristics of low-income households with very low food security: An analysis of the USDA GPRA Food Security Indicator, EIB 25. Washington, DC: USDA, ERS. http://www.ers.usda.gov/publications/eib-economic-information-bulletin/eib25.aspx (accessed July 5, 2012).

NRC (National Research Council). 2006. Food insecurity and hunger in the United States: An assessment of the measure. Washington, DC: The National Academies Press.

OIG (Office of the Inspector General). 2009. Supplemental Nutrition Assistance Program benefits and the Thrifty Food Plan: Audit Report 27703-1-KC. Washington, DC: USDA, OIG. http://www.recovery.gov/Accountability/inspectors/Documents/27703-1-KC%20Final%20Report%20FOIA%20%2812-8-09%29.pdf (accessed June 4, 2012).

Orszag, P. 2012. End-of-month hunger hurts students on food stamps. http://www.bloomberg.com/news/2012-04-03/end-of-month-hunger-hurts-students-on-food-stamps.html (accessed July 16, 2012).

Ratcliffe, C., S.-M. McKernan, and K. Finegold. 2008. Effects of Food Stamp and TANF policies on Food Stamp receipt. Social Service Review 82(2):291-334.

Seligman, H. K., E. A. Jacobs, A. Lopez, U. Sarkar, J. Tschann, and A. Fernandez. 2011. Food insecurity and hypoglycemia among safety net patients with diabetes. Archives of Internal Medicine 171(13):1204-1206.

Shapiro, J. M. 2005. Is there a daily discount rate? Evidence from the food stamp nutrition cycle. Journal of Public Economics 89(2-3):303-325.

Tiehen, L., D. Joliffe, and C. Gundersen. 2012. Alleviating poverty in the United State: The critical role of SNAP benefits, ERS-132. Washington, DC: USDA, ERS. http://www.ers.usda.gov/publications/err-economic-research-report/err132.aspx (accessed July 5, 2012). U.S. Census Bureau. 2012. Population estimates. http://www.census.gov/popest/data/historical/index.html (accessed May 24, 2012).

USDA (U.S. Department of Agriculture). 2005. MyPyramid food intake patterns. http://www.choosemyplate.gov/food-groups/downloads/MyPyramid_Food_Intake_Patterns.pdf (accessed June 4, 2012).

USDA. 2011. Letter from Jessica Shahin, Associate Administrator, Supplemental Nutrition Assistance Program USDA, to Elizabeth Berlin, Executive Deputy Commissioner, New York State Office of Temporary and Disability Assistance. August 19, 2011. http://www.foodpolitics.com/wp-content/uploads/SNAP-Waiver-Request-Decision.pdf (accessed June 5, 2012).