Concepts of Medical Care Economic Burden and Risk

As stated in Chapter 1, the 1995 National Research Council (NRC) report Measuring Poverty: A New Approach recommended separating the measure of economic (nonmedical) poverty from assessing the adequacy of resources to meet medical care needs. The recommended approach was to determine the poverty status of a family based on whether its after-tax income, plus its near-cash in-kind benefits minus work-related expenses, child support payments, and out-of-pocket payments for medical care expenses (including insurance premium payments), was less than the family’s needed level of spending for food, clothing, shelter, utilities, and a little more. This approach makes possible a Supplemental Poverty Measure (SPM) that can show explicitly how many more people are considered poor because their resources are inadequate to meet essential needs based on disposable income after taking into account spending on medical care expenses. The traditional official U.S. poverty measure cannot make this determination because it uses before-tax money income as the definition of family and individual resources.

As directed by the U.S. Office of Management and Budget, the Census Bureau added questions about out-of-pocket spending on insurance premiums and medical expenses to its Current Population Survey Annual Social and Economic Supplement (CPS ASEC) in 2010 to enable inclusion of medical care expenses and premiums in SPM estimates.1 The results

____________________________________

1 These questions gave estimates that compared favorably with estimates of out-of-pocket medical care costs in the Medical Expenditure Panel Survey (see Czajka, in Part III of this volume).

for 2010 were published by the Census Bureau in November 2011 (Short, 2011). Using the traditional measure, the poverty rate for 2010 was 15.2 percent. Using the new SPM, the poverty rate was 16.0 percent. The biggest change was among the elderly, for whom the poverty rate was 9.0 percent under the old poverty measure and 15.9 percent under the SPM (Short, 2011:6). This is not surprising given that the elderly as a group have the most need for medical care, pay premiums for Medicare (and often private insurance), and often have high out-of-pocket expenses for copays, deductibles, and noncovered services.

The Census Bureau went further to provide sensitivity analyses of the effects of including and excluding particular factors from the new SPM. These analyses indicated that the effect of subtracting out-of-pocket expenses for medical care and insurance premiums from net income after taxes, in-kind transfers, child support payments, and work-related expenses was to increase the poverty rate by 3.3 percentage points in 2010—from 12.7 percent to 16 percent poor. This represents an increase of about 10 million people who were counted as poor by the SPM because of their medical care expenses—during 2010 (Short, 2011:9).

These 10 million people who were pushed into poverty—as well as people who would have been poor even if they did not have any medical care expenses but were further impoverished by their out-of-pocket medical care expenses—represent the proportion of the population who experienced the economic burden of medical care expenses in their families’ inability to meet their nonmedical needs. Over time, the SPM will be able to track changes in the extent to which individuals and families with modest or low incomes are impoverished as a result of spending on health insurance premiums and other medical care expenses that are high relative to their incomes. However, although the Census Bureau has the data available, its current reporting does not assess the extent to which families or individuals who are poor without considering medical care expenses are pulled deeper into poverty (well below the threshold) as a result of health insurance premiums and medical care expenses, nor does its reporting assess the extent to which families or individuals with higher incomes pay large percentages for medical care.

With the enactment of the Affordable Care Act (ACA) in 2010, national policy set a goal of making health insurance and medical care affordable by providing income-related premium subsidies and tax credits and establishing national standards for health insurance to ensure access with financial protection for essential medical care services. The ACA establishes four tiers of health insurance coverage that will be available through new health insurance exchanges, operated at the state level. The tiers set the minimum amount of coverage most people must have to meet the requirements of being insured beginning in 2014. They also serve as benchmarks for premium and cost-sharing subsidies provided to lower and

middle-income people who buy their own insurance in exchanges (Kaiser Family Foundation, 2011b). All qualified plans are required to insure a range of medical care services, including physicians, prescription medications, laboratory and diagnostic tests, and hospital care.

People purchasing coverage through the exchange will be able to choose among four different levels of cost-sharing, with all plans required to include an out-of-pocket maximum after which the insurance plan would cover costs in full. These levels of coverage are specified using the concept of an “actuarial value”:

- 1st tier (bronze) actuarial value: 60 percent, meaning on average a person would pay 40 percent of the costs of medical care and the health plan would cover 60 percent.

- 2nd tier (silver) actuarial value: 70 percent.

- 3rd tier (gold) actuarial value: 80 percent.

- 4th tier (platinum) actuarial value: 90 percent.

To satisfy the requirement to have insurance, people will be required to have insurance at least at the bronze level. For families with incomes of 400 percent of poverty or higher, plans in all tiers would have an out-of-pocket maximum of $5,950 per person or $11,900 per family.

Income-related premium assistance will be available for plans at the silver level with additional income-related cost-sharing subsidies for individuals and families with incomes below 400 percent of poverty. The ACA’s income-related premium and benefit provisions are relatively more protective the nearer household income is to poverty, recognizing that such households have limited income resources to pay for either premiums or out-of-pocket expenses for medical care. As illustrated in Table 2-1, the additional cost-sharing subsidies will result in a higher actuarial value than silver for those with incomes below 200 percent of the official poverty thresholds, including lower out-of-pocket maximums. Those buying coverage on their own and not eligible for the Medicaid expansion (up to 133 percent of poverty) will be eligible for a federal subsidy to help pay for the cost of premiums.2

_______________________

2 For a summary of the Affordable Care Act provisions related to health insurance and estimates for different levels of coverage, see Kaiser Family Foundation (2011a) at http://healthreform.kff.org/scan/2011/august/national-health-council-analysis-examines-potential-cost-of-essential-health-benefits-package.aspx. Also see Congressional Research Service reports: Medicaid and Children’s Health Insurance Program Provisions in PPACA (2010a); Medicare Provisions in the Patient Protection and Affordable Care Act (PPACA) (2010b); and Private Health Insurance Provisions in the Patient Protection and Affordable Care Act (PPACA) (2010c). For more information on actuarial values, see http://www.kff.org/healthreform/upload/8177.pdf.

TABLE 2-1 Premium Tax Credits and Cost-Sharing Protections Under the Affordable Care Act

| Federal Poverty Level (2011) | Income | Premium Contribution as a Share of Income | Out-of-Pocket Limits | Actuarial Value: Silver Plan |

| <133% | S: <$14,484 | 2% (or Medicaid) | 94% | |

| F: <$29,726 | ||||

| 133-149% | S: $16,335 | 3.0-4.0% | S: $1,983 | 94% |

| F: $33,525 | F: $3,967 | |||

| 150-199% | S: $21,780 | 4.0-6.3% | 87% | |

| F: $44,700 | ||||

| 200-249% | S: $27,225 | 6.3-8.05% | 73% | |

| F: $55,875 | S: $2,975 | |||

| 250-299% | S: $32,670 | 8.05-9.5% | F: $5,950 | 70% |

| F: $67,050 | ||||

| 300-399% | S: $43,560 | 9.5% | S: $3,967 | 70% |

| F: $89,400 | F: $7,933 | |||

| ≥400% | S: >$43,560 | — | S: $5,950 | — |

| F: >$89,400 | F: $11,900 | |||

Four levels of cost sharing:

- 1st tier (bronze) actuarial value: 60%

- 2nd tier (silver) actuarial value: 70%

- 3rd tier (gold) actuarial value: 80%

- 4th tier (platinum) actuarial value: 90%

Catastrophic policy with essential benefits package available to young adults and people whose premiums are 8%+ of income.

NOTES: Actuarial values are the average percentage of medical costs covered by a health plan. Premium and cost-sharing credits related to silver plan. F = family; S = single person.

For additional details, see The Commonwealth Fund Health Reform Resource Center: What’s in the Affordable Care Act? Available: http://www.cmwf.org/Health-Reform/Health-Reform-Resource.aspx.

SOURCE: Collins et al. (2012).

By expanding coverage to those who are currently uninsured and by setting standards for health insurance benefits, the ACA seeks to limit not only the economic burden of medical care expenses, but also the risk that individuals or families will forgo needed medical care because of the cost or be at financial risk if they should become sick or injured during the year.

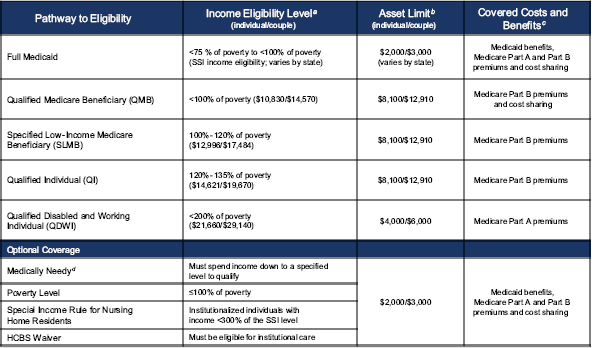

Note that the ACA provisions and poverty thresholds for tax credits for premiums and enhanced benefits apply to people under age 65. Current policies are quite different for those aged 65 and older or disabled and eligible for Medicare. As illustrated in Figures 2-1 and 2-2, for people eligible for Medicare, the threshold for eligibility for full Medicaid coverage ranges, at state option, from 75 to 100 percent of poverty for those who are aged, blind, or disabled. For those with incomes at or near poverty,

FIGURE 2-1 Medicaid and Medicare savings programs eligibility pathways and benefits for medicare beneficiaries, 2010.

NOTES: HCBS = home and community based services; SSI = Supplemental Security Income.

aApplicants are allowed a $20 disregard from any income before their income is measured against the poverty levels.

bStates have flexibility to modify asset limits; some have no asset limits. Asset limits for QMB, SLMB, QI, and QDWI include $1,500 per person for burial expenses.

cCost-sharing is covered up to the amount Medicaid pays, at states’discretion.

dMedicaid benefits may be more limited than for SSI eligibility.

SOURCE: Kaiser Family Foundation (2010), Figure 5.1. Available: http://www.kff.org/Medicare/8103.cfm.

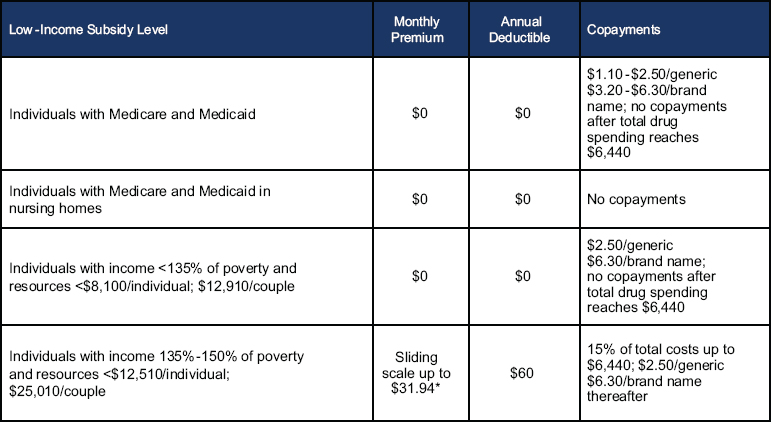

FIGURE 2-2 Medicare Part D prescription drug benefit subsidies for low-income beneficiaries, 2010.

NOTES: The 2010 poverty level is $10,800/individual and $14,600/couple. Resources include $1,500/individual and $3,000/couple for funeral or burial expenses. *$31.94 is the national monthly Part D base beneficiary premium for 2010.

SOURCE: Kaiser Family Foundation (2010), Figure 3.4. Available: http://www.kff.org/Medicare/8103.cfm.

there are various thresholds for further help with premiums or cost-sharing related to Medicare Part A (hospital) or Part B (doctor and other provider) benefits. A different set of poverty-related thresholds applies for prescription drug premiums and cost-sharing through Part D (see Figure 2-2). As a result, current national and state policies are, in effect, assessing medical care economic burden and potential risk differently for the elderly than for the under age 65 population.

This chapter describes the conceptual difference between medical care economic burden and risk, discusses why the panel thinks both measures are needed to inform national and state policy and to assess trends, and indicates why it is important to keep the two measurement efforts conceptually distinct. In our discussion of the economic burden of medical care expenses, the panel endorses the 1995 NRC recommendations regarding the approach to incorporating medical care expenses into supplemental poverty measures. Specifically, the 1995 panel recommended that a family’s actual level of spending on medical care—premium payments and out-of-pocket medical care expenses—not be included in the definition of resources available to meet the family’s nonmedical needs. The 1995 panel recommended that the adequacy of the family’s resources to meet its medical care needs be reflected in separate measures.

As discussed below, our panel proposes building on the 1995 panel’s approach to assessing burden, so as to enable policy makers to assess trends over time, by providing a retrospective assessment of how the burden of medically related expenses is changing across the income spectrum and for different population groups and different geographic areas of the country. Recommendations are provided that expand on the current SPM and recent guidance from the Interagency Technical Working Group (ITWG) (2010).

The chapter concludes with a discussion of why a measure of medical care economic risk, in addition to metrics that assess medical care economic burden, would add value and how the two approaches to assessing affordability and the impact of policy changes could support each other. Chapter 4 further develops the concept of medical care economic risk, discusses how risk measures could be useful for policy, and proposes approaches for assessing medical care economic risk.

CONCEPTUAL OVERVIEW

Health insurance and medical care in the United States are expensive. The most recent estimates indicate that the average annual premium for a family health insurance policy reached $15,073, a figure based on employer-sponsored group insurance, rising three times faster than wages since the start of the decade (a 168 percent increase in premiums compared

with a 50 percent increase in wages).3 For low- and even middle-income individuals and families, health insurance costs have become increasingly unaffordable unless employers pay a substantial share of premiums or the household is eligible for assistance through public programs. People who seek individual insurance face higher premium costs even apart from the lack of employer subsidy.

Although expensive, health insurance is essential to ensure affordability of medical care with financial protection. Given the high costs of medical care, financial risks are very high if a family member or individual is sick or injured and the family or individual is uninsured. Indeed, the purpose of health insurance is to pool risks over the population and over lifetimes so as to protect individuals and families from being unable to afford essential care when faced with a medical event, such as pregnancy, cancer, a heart attack, or a bone fracture, or when faced with ongoing costs due to chronic disease, such as diabetes or congestive heart failure. Particularly for those with annual incomes below or near the federal poverty level ($22,350 for a family of four in 2011) or with modest incomes within two to three times of the poverty level ($45,000 to $67,000 for a family of four in 2011), the costs of a significant health event without health insurance would be likely to result in the family’s going into debt, forgoing essential care, or being unable to meet other basic family needs.

Having health insurance, however, is not a guarantee that needed medical care will be affordable for a family. Today, not only are employers requiring families to share more in the rising cost of premiums, but also the policies they provide have larger deductibles and coinsurance rates that make medical care less affordable. Policies sold on the individual market and in the small-group market also often have limits on the amount that insurance will pay for specific benefits or overall—leaving individuals and families fully exposed to all costs above these limits.4 A catastrophic health event with limited benefits or limited coverage (for example, maximum annual caps on what the plan will pay or specific limits on benefits) can expose a family to the economic risk of poverty or bankruptcy even though the family has insurance. Such households could be considered “underinsured”—remaining at high financial risk although insured all year (Schoen et al., 2011; Short and Banthin, 1995). At the same time, being without

____________________________________

3 Kaiser Family Foundation and Health Research and Educational Trust, Employer Health Benefit Survey, 2011 Annual Survey, September 27, 2011, and related chartpack. Available: http://ehbs.kff.org/pdf/2011/EHBS%202011%20Chartpack.pdf.

4 Note that limits may be of less concern in the future as a result of the ACA insurance market reforms. Starting in 2010, the ACA prohibits lifetime limits and begins to restrict the use of an nual limits, which will be prohibited in 2014. For phased-in thresholds, see Commonwealth Fund Health Reform Research Center, detail at http://www.cmwf.org/Health-Reform/Health-Reform-Resource.aspx#IntTool&cat={8A4BB2D4-0219-47D1-9CEB-1CB899A97E37}&page=2.

health insurance coverage altogether clearly exposes families to the risk of not being able to afford their medical care.

To assess both the economic burden and the risks of medical care costs, the 1995 panel recommended two kinds of measures. It first recommended that the poverty measure (now the SPM) adjust income for taxes, tax credits, near-cash transfers, child support payments, work-related expenses, and premiums and other medical care expenses paid out-of-pocket, to look at what income would be necessary to cover basic costs of living excluding medical care. When the other income adjustments are made first and the subtraction of medical care expenses is then performed and the effects shown separately, as the Census Bureau has done for the SPM, then this becomes an estimate of burden, or how many more people are poor when their medical care expenses, including premiums paid out-of-pocket, are taken into account. The 1995 panel also envisioned a measure of medical care economic risk that would assess the family’s ability to financially access available medical care needed to maintain health or for the treatment of a health crisis. The economic risk of not being able to afford one’s needed medical care is reflected in either a high probability of not receiving the needed care or of not being able to meet other family needs.

Conceptually, burden and risk of medical care expenses offer two perspectives to assess the extent to which individuals and families have affordable health insurance that is adequate to ensure access to medical care with financial protection against out-of-pocket medical care expenditures including premiums. Throughout this report, we refer to burden and risk as distinct concepts and discuss why both metrics are needed and how the two can inform each other.

- Burden is a retrospective measure that examines actual out-of-pocket spending for health insurance and for medical care relative to a family’s available income resources.

- Risk is a prospective measure that assesses the likelihood that a family’s future out-of-pocket medical care expenditures would be high or unaffordable relative to the family’s income resources. As discussed further below and in more detail in Chapter 4, the risk concept requires knowledge of whether the household has insurance as well as information about the insurance benefits and cost-sharing. It also requires knowledge of characteristics, such as health status, that predict future needed care.

Both concepts of the burden and risk of medical care expenses are based on defining what constitutes a family’s resources available for medical care spending. Both concepts also require specifying how the family’s medical care should be compared to their resources. One question is whether the

comparison to define affordability should be absolute (based on a difference) or relative (based on a percentage of available resources).

This chapter first looks at burden in the context of the SPM, which takes medical care spending into account, then considers relative measures of burden, and, finally, discusses the value added of developing a new measure of medical care economic risk.

MEDICAL CARE ECONOMIC BURDEN

Medical care economic burden measures what individuals and families spend out-of-pocket for health insurance and medical care. Using poverty as an absolute threshold is one approach to assessing the affordability of medically related economic burden. Starting in March 2010, the Census Bureau added questions to its annual household survey about medical out-of-pocket expenses for insurance premiums and medical care services to use in constructing a new SPM.

SPM Treatment of Medical Care

The SPM threshold concept for families’ basic needs includes food, clothing, shelter, utilities, and a little more, but not medical care premiums or other out-of-pocket expenses. Its definition of available resources for nonmedical expenses is based on the economic concept of family income: the maximum amount of consumption that the family could achieve from current income (see Chapter 3 for a discussion of resource definitions). Unlike the official poverty measure’s definition of resources that focuses on pretax income received in cash, the SPM’s measure of resources is an aftertax measure of income that includes the transfer income the family received in-kind that could be used to meet its nonmedical needs. For example, the market value of benefits from the Supplemental Nutrition Assistance Program (formerly the Food Stamp Program), the Special Supplemental Nutrition Program for Women, Infants, and Children, and free or reduced-price school meals is included as a source of income available to meet the family’s food needs. The market value of other government programs that provide noncash benefits to help meet the family’s other nonmedical needs (shelter and utilities) is also included in the SPM resource measure. To reflect the reality that work-related expenses will be incurred by working families and will not be available for spending on nonmedical needs (food, clothing, shelter, and utilities), the SPM measure subtracts the amount of work-related expenses, including the amount of child care paid by the family (the market value of the child care up to a maximum minus any subsidy received by the family). It also subtracts child support payments for children in another household. Finally, and most importantly for the work of this panel,

the SPM measure of resources subtracts the family’s out-of-pocket medical expenses (both premium amounts and the family’s direct payments for any medical care utilized by the family) incurred during the year.

Defining Resources for Medical Care Economic Burden

Although the SPM’s definition of available resources reflects what could be spent on nonmedical needs, it is not appropriate for directly examining a family’s ability to meet its past year’s medical expenses. That is because the family’s past year’s medical spending is subtracted from its resources, and the family’s medical needs are not accounted for in the SPM thresholds. A measure appropriate for this purpose would define resources available for the family’s medical spending by taking its SPM measure of resources and then adding back its out-of-pocket medical spending but subtracting its nonmedical needs (that is, the SPM poverty threshold for the family).

The result of these calculations for families that do not have sufficient resources to meet their nonmedical needs would be a negative value. For these families, the amount of available resources for medical spending should be set to zero. A further complication will occur for families that receive in-kind transfers. It is possible (although not likely) that the market value of in-kind transfers may exceed the family’s needs for nonmedical spending. Although the family will not be poor by the SPM measure, the value of these in-kind transfers is not fungible and consequently is not available to pay for the family’s medical spending. The appropriate modification to account for this potential problem would be to start with the SPM definition of resources, then subtract both the family’s medical spending and market value of in-kind transfers and then subtract the positive difference between the family’s needs and the market value of the in-kind transfers it received.

It should be noted that the SPM definition of available resources and the proposed definition of resources for measuring medical care economic burden are based on a family’s income and consequently do not account for the fact that the family’s assets may be available to defray its out-of-pocket medical costs. Chapter 3 discusses the potential role of assets and how a consideration of easily liquidated financial assets could be incorporated into resources to assess the financial risk of being unable to meet health care needs or being driven into poverty.

It should also be noted that the SPM definition of a family, which is proposed for measuring medical care economic burden as well, begins with but extends beyond the traditional Census Bureau definition that is used for the official poverty measure. The traditional family definition includes two or more people in a household, one of whom must be the householder or reference person, who are related by blood, marriage, or adoption. Related

subfamilies (for example, a single parent and child who are related to the householder) are considered part of the family. Unrelated individuals in a household, such as roommates and boarders, are treated as single-person families, as are members of a subfamily in the household, none of whose members is related to the householder (for example, a boarder who has a family member living with him or her). Foster children and other unrelated children under age 15 are not included in any family for poverty measurement because no income data are available for them.

The SPM definition starts with the traditional definition and adds the following household members to the family: cohabitors and their children and any other unrelated children who are cared for by the family, such as foster children. This definition is broadly similar to the consumer unit definition that is used to develop the SPM poverty thresholds (Short, 2011:19). Although the SPM family definition does not necessarily correspond to the definition used for various kinds of health insurance coverage, employing the same family definition for measuring medical care burden as for the SPM is important for comparability.

Illustrative Effects of Medical Care Costs on Poverty

The Census Bureau is now publishing the number and characteristics of the poor using the SPM, along with tables that show the net impact of each adjustment to the SPM estimates if all other adjustments were in effect. As shown in Table 2-2, subtracting medical care expenses from net after-tax and transfer income significantly increased the SPM poverty rate in 2010 along with the number of people considered poor with income too low to afford basic necessities.

Compared with the SPM adjusted for taxes, near-cash transfers, child support payments, and work-related expenses but not for spending on medical care or health insurance, the adjustment for medical care out-of-pocket costs increases the poverty rate for all age groups. At the same time, adjusting for taxes, transfers, child support payments, work-related expenses, and medical out-of-pocket costs results in an SPM that increases the percentage of the elderly who are considered poor and lowers poverty rates among children compared with official poverty rates.

The adjustment does not, however, take into account people with net incomes above the poverty threshold who have medical expenses that are high relative to their income and who may well be forgoing medical care, going into medical debt, or unable to meet other daily living expenses. Nor does it count the uninsured with incomes above poverty who are at risk if they become sick of seeing their net income fall below the poverty threshold.

TABLE 2-2 Medical Out-of-Pocket Expenses and the Census Supplemental Poverty Measure

| 2010 | Poor in Millions | Percentage Poor | |||||

| All | <18 | 18-64 | 65 or older | ||||

| Poverty rate without adjustment for taxes, transfers, or medical care | 46.6 | 15.2% | 22.5% | 13.7% | 9.0% | ||

| Supplemental Poverty: adjusted for taxes and transfers but not medical care | 38.9 | 12.7% | 15.4% | 12.4% | 8.6% | ||

| Supplemental Poverty with adjustment for medical expenses (premiums and care) | 49.1 | 16.0% | 18.2% | 15.2% | 15.9% | ||

SOURCE: Short (2011).

AFFORDABILITY: ABSOLUTE OR RELATIVE CONCEPT?

The measurement of medical care economic burden discussed above is framed in the context of an absolute measure of affordability related to poverty, but there can also be relative measures of affordability that apply to families along the entire income spectrum.

Affordability is in fact a difficult concept to define and consequently to operationalize. There is consensus in the literature that affordability needs to be considered in relation to a family’s resources. For example, a $5,000 medical procedure might be affordable to a high-income individual earning more than $100,000 a year but unaffordable to someone making the minimum wage and already struggling to pay rent and cover food and transportation costs. Considering income, there are two separate measures of affordability that one could adopt:

- An absolute measure: having sufficient available resources to meet the cost of one’s medical needs after meeting the cost of nonmedical needs and necessities. The research SPM is one example of such an absolute measure. Another example is the work by Gruber and Perry that assesses consumer expenditures for necessities at varying poverty-related income levels for the amount of “discretionary” income that remains after paying for other necessities (Gruber and Perry, 2011).

- A proportional or relative measure: not having to spend a high percentage of available income on one’s medical needs. Relative measures of affordability require defining thresholds for what is affordable and what is not. Examples of the use of this type of mea-

sure are the work of Banthin, Cunningham, and Bernard (2008), Schoen et al. (2011), and Short and Banthin (1995), who examine medical expenditures as a percentage of income.

Thresholds for such a relative measure could also vary relative to income. For example, the Children’s Health Insurance Program sets a maximum of 5 percent of income for out-of-pocket medical care expenses for families with incomes below 200 percent of poverty to reflect incomes that are already stretched to meet basic nonmedical needs. The goal is to avoid driving such families into poverty from medical care expenses. Relative thresholds could be higher for families with incomes in the middle of the income distribution and could exclude from consideration those with high incomes.

Similarly, as illustrated in Table 2-1, the ACA varies thresholds for “affordability” for premiums or protection for medical care expenses depending on income relative to poverty. For incomes below 133 percent of poverty, the law provides for full Medicaid coverage without premiums and with nominal cost-sharing. At higher income levels, the law establishes different thresholds for premium tax credits. Above 400 percent of poverty, the law in essence assumes that families will be able to afford premiums and out-of-pocket expenses given the new standards for insurance that will prevail starting in 2014—namely, bronze or better with an essential benefit package.

Comparing the two types of approaches to affordability, the panel concludes that the absolute measure is more appropriate in the context of poverty analysis because it directly incorporates other needs of the family into the measure. Consider a family that does not have sufficient resources to meet its nonmedical needs. Yet its medical needs might only represent 1 percent of its available resources. Although this is a “small” percentage of available resources, medical care is unlikely to be affordable because a family living in poverty by definition does not have sufficient resources to meet its other basic needs. Alternatively, consider a high-income family whose medical care needs represent 15 percent of its available resources, yet, if the family purchased all of their medical needs, it would still have substantial resources remaining to meet its nonmedical needs.

Although both measures rely on being able to develop measures of available resources and the medical needs of a family, the advantage of the absolute measure is that it does not require an independent determination of which thresholds to use to define affordability. In the absolute measure, the nonmedical needs of the family and its available resources define affordability, whereas the proportional measure would require a consensus on what is a “high” percentage of available resources.

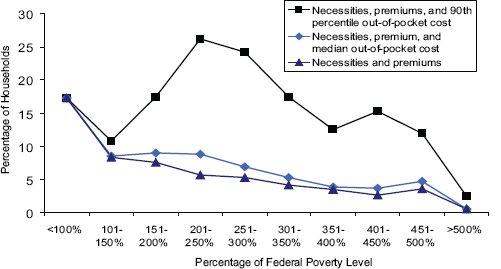

The ACA in effect adopts both absolute and relative standards for affordability as families with incomes above the official poverty threshold are often living on incomes with little room for spending beyond daily living costs and relatively low payments for health insurance. For the population under age 65, the ACA expands eligibility for Medicaid with full premium support and nominal cost-sharing to individuals and families with incomes up to 133 percent of poverty (including single and childless adults) in an effort to reduce both the burden and the risk of medical costs driving the near-poor into poverty or competing with other necessities for those already poor (see Figure 2-3). Above 133 percent of poverty, the ACA sets income-related thresholds for premiums and insurance benefits that ask families to pay more as a share of income as incomes increase. The premium tax credit provisions seek to hold premiums to under 5 percent of income for incomes below 150 percent of poverty and to 6 percent to a maximum of 9.5 percent of income for incomes ranging from 200 to 400 percent of poverty. The ACA also substantially lowers out-of-pocket limits and provides enhanced actuarial value (lower cost-sharing) for those with incomes below 200 percent of poverty to guard against families being unable to afford essential medical care although insured.

In Gruber and Perry’s analysis (2011) of the potential of these provisions to make health insurance and health care affordable, they conclude that the provisions appear relatively well targeted, based on current expen-

FIGURE 2-3 Percentage of households that may not have room in budget for health care costs, after full ACA implementation.

SOURCE: Gruber and Perry (2011).

ditures for other necessities. An estimated 90 percent or more of households with incomes up to 400 percent of poverty will be able to afford the costs of necessities, premiums, and average out-of-pocket costs for medical care based on current consumption patterns. However, their analysis indicates that, in the 200 to 300 percent of poverty range, those with health care needs that put them in the top 10 percent of the spending distribution could face unaffordable costs.

As the ACA insurance provisions are implemented, it will be important to have a measure of the economic burden of medical care costs (premiums and out-of-pocket spending) that assesses whether the reforms lower the burden for those with incomes near or below poverty and moderate the risk of expenditures that are high relative to incomes in the targeted poverty ranges. It will also be important to assess whether the source of high economic burdens comes from required premium payments, indicating that premium subsidies are inadequate, or from out-of-pocket medical care expenses, pointing to potential gaps in insurance benefit design. Such assessments are possible with data collected by the Census Bureau for purposes of the SPM.

The new law also relies on states to set up insurance exchanges, provide choices of plans that will be eligible for premium tax credits, and expand Medicaid. States vary in their enthusiasm and commitment to implement the legislation. Based on Medicaid’s historic experiences, states also vary in how easy or difficult they make it to enroll. Thus, the extent to which new provisions for premium assistance and limits on out-of-pocket exposure for medical care succeed in lowering burden and risks for poor, low-income, and middle-income families may vary substantially across states.

Currently available data enable a cross-sectional perspective on medical care economic burden using essentially a 1-year time horizon for income and medical-related expenses. To the extent that individuals or families incur expenses in 1 year that result in debt they are paying off over time, measures related to current-year spending will capture at best the amount paid off in the current year and any new medical expenses. The measures will be unable to assess whether some households incur high expenses year after year. Because of this limit it would be useful to continue to build on the Supplemental Poverty Measure to assess and track how medical care economic burden changes over time.

RECOMMENDATIONS FOR MEASURING MEDICAL CARE ECONOMIC BURDEN

Providing Additional Information in Census Bureau SPM Reports

In the context of new national medical care policy that makes a commitment to affordability with explicit standards and thresholds, the im-

portant roles that states will play going forward, and policy differences by age, the panel recommends three actions for consideration in future Census Bureau publications to show the extent of medical care economic burden in relation to the SPM. All three recommendations assume continuation of the current treatment of medical care out-of-pocket expenses in the SPM resource definition—that is, subtracting medical spending from net income adjusted for taxes, in-kind transfers, child support payments, and work-related expenses.

Recommendation 2-1: The panel recommends that the U.S. Census Bureau refine its Supplemental Poverty Measure (SPM) reports and tables to include the estimated effects of medical care economic burden on poverty by component, showing the effects of premiums separately from other out-of-pocket expenses. It further recommends that the SPM reports and tables include the estimated effects of medical care economic burden by region or state, recognizing that aggregation over time or by groups of states may be necessary to obtain reliable estimates.

By this recommendation the panel supports not only showing the effects on SPM poverty estimates of the composite measure of out-of-pocket medical care spending, as is currently done, but also showing separately the effects of spending on out-of-pocket premiums and medical care costs to assess the impact of each on the SPM estimates. The panel also urges that Census Bureau SPM reports provide not only national estimates, but also estimates at the state or regional level to assess how medical care economic burden varies geographically. If state samples are not sufficient for single-year estimates, the Census Bureau should consider combining years or combining estimates for specific geographic areas that include several states, or both.

Reporting such data annually will provide an absolute measure of the number of people who become poor as a result of medical costs, the extent to which it is premiums or other spending on medical care or both that move people into poverty, and the extent to which medical care economic burden varies depending on where individuals and families live. This information will be important to efforts to track changes as Medicaid expansions and other insurance reforms unfold. It will also provide information during recessions regarding whether insurance reforms are able to protect families when their incomes fall.

Recommendation 2-2: The panel recommends that the U.S. Census Bureau examine medical care economic burden in its Supplemental Poverty Measure (SPM) reports and tables by providing estimates of the number of people who move from higher to lower multiples of the

SPM poverty thresholds—including thresholds above and below the poverty level—because of their health insurance premiums and other out-of-pocket medical care costs.

By dividing the population into poverty-related groups up to 400 percent of poverty, the Census Bureau could use estimates of spending on premiums and medical care to assess whether such expenses are moving families into or nearer to poverty or are moving already-poor families into deeper poverty. For example, after accounting for medical care expenses, how many households move from above 200 percent of poverty to below 150 percent or below 100 percent of poverty? How many already-poor families (considering their disposable income before subtracting medical care costs) are moved below 75 percent or 50 percent of poverty?5

Recommendation 2-3: The panel recommends that the U.S. Census Bureau report findings on medical care economic burden in its Supplemental Poverty Measure reports and tables separately for the populations under age 65 and ages 65 and older.

Very different health insurance coverage policies currently apply for those reaching age 65 and eligible for Medicare compared with the population under 65. Because of this difference, it would be useful to report all measures of economic burden and risk separately for the populations under age 65 and ages 65 and older. Another reason to show estimates separately for the two age groups concerns differences in asset holdings. There is substantial evidence (see Table 2-3) that people under age 65 with incomes at or below 300 percent of poverty have few resources (including assets) to draw on in the event of a health episode that leads to medical care costs that are high relative to their incomes (see Banthin and Bernard, in Part III of this volume). The elderly tend to have greater assets than those under age 65, although, as illustrated in Table 2-3, for those near poverty (income below 200 percent of poverty), assets, including the net value of homes, are often meager to last a lifetime. Half of the elderly in the near-poverty range have less than $77,300 in total assets. Banthin and Bernard (Table A-2, in Part III of this volume) provide a full distribution. (See Chapter 3 for a discussion of the potential role of assets in measuring medical care economic risk.)

________________________

5 The Census Bureau in November 2011 prepared a special tabulation for the New York Times that is a limited example of what the panel has in mind. See http://www.census.gov/hhes/povmeas/methodology/supplemental/research/SpecialTabulation.pdf.

TABLE 2-3 Median Total Net Assets Among Nonelderly and Elderly Households by Poverty Group, 2008

| Under Age 65 | Age 65 and Older | |

| All incomes: Median Net Assets | $20,151 | $146,334 |

| Poor (<100% poverty) | ||

| Percentage poor | 13.8% | 10.3% |

| Median net assets | $0 | $20,686 |

| Low Income (100-199% poverty) | ||

| Percentage low income | 17.4% | 26.1% |

| Median net assets | $2,341 | $77,301 |

| Middle Income (200-399% poverty) | ||

| Percentage middle income | 31.5% | 29.0% |

| Median net assets | $15,518 | $136,472 |

| High Income (400% poverty) | ||

| Percentage high income | 37.3% | 35.7% |

| Median net assets | $133,838 | $355,370 |

SOURCE: Analysis of MEPS 2008. Poverty uses CPS definition of family. Assets include the net value of financial and nonfinancial assets, including real estate. Banthin and Bernard (2012) (in Part III of this volume).

Should the Census Bureau Consider Adjusting Medical Care Spending for Underspending by the Uninsured?

Measuring the actual economic burden of medical care, as is done in the expanded SPM reports recommended here, will underestimate the impact on uninsured people who may spend less than judged medically necessary, given their health care needs, because they cannot afford medical care.6 The ITWG suggested that the Census Bureau investigate the “pros and cons” for the SPM resource definition of making an upward adjustment to medical care spending for the uninsured, based on what they might have spent if insured, considering their age and health status (Interagency Technical Working Group, 2010). Such an adjustment would point out that the uninsured are at risk even if they did not incur medical care expenses.

The panel agrees with the need to include the uninsured in any assessment of people who are at risk for going without needed health care

_________________________

6 In speaking about spending for medical care received by uninsured people, we mean incurring medical expenses without regard to whether the bills are paid or not. To the extent that the uninsured are unable to pay or incur medical debt and unpaid bills, the current questions added to the CPS ASEC may actually undercount medical care economic burden because the survey asks about actual out-of-pocket expenses for medical care. Efforts to assess prospective risk would look at the risk of incurring medical expenses regardless of whether the expenses are paid.

because of costs or who are potentially at financial risk if they should have an illness or injury and be unable to postpone care. Indeed, research studies regularly find that the uninsured with low incomes spend a high share of their income on health care although they also report going without recommended care because they cannot afford it. That said, the panel thinks that modeling risk prospectively should be separate from metrics that measure actual spending retrospectively. Projecting medical economic risk should take into account insurance coverage, health status, and income to predict the population at risk of potentially unaffordable costs (see Chapter 4).

The strong advantage of the SPM and annual counts of poverty rates is that all of the estimates are based on what happened as reported in household surveys—rather than estimates of what might have happened. To the extent that policies succeed in enrolling the uninsured into plans that provide affordable insurance with low or no premiums for those who are below or near poverty, with insurance choices that enhance access with protection against out-of-pocket medical care bills, the economic burden approach currently used by the Census Bureau should find a reduction in the number of people who are impoverished by out-of-pocket medical care costs as well as a drop in the number of uninsured. Similarly, for those with insurance, if policy reforms result in benefit standards that improve protection and new premium subsidies that lower premium costs, the medical economic burden approach that the Census Bureau is currently using should indicate a reduction in the number of insured families with low incomes that have high out-of-pocket medical care costs for medical care. If, however, policy reforms fail to limit premiums or out-of-pocket costs relative to income, the current medical burden approach of the SPM would indicate either no improvement or more people impoverished due to medical spending. To inform policy, it will be important for the Census Bureau’s SPM data to reflect trends in actual spending—not hypothetical spending. Therefore, there should be no adjustment for underutilization of medical care by the uninsured in the SPM estimates of medical care economic burden.

Recommendation 2-4: The panel recommends that the U.S. Census Bureau continue to use a definition of resources for the Supplemental Poverty Measure and estimates of medical care economic burden that incorporates estimates of actual out-of-pocket spending on health insurance premiums and other out-of-pocket expenses for medical care. The Census Bureau should not model potential spending for people lacking health insurance coverage.

Contrary to the Interagency Technical Working Group’s suggestion that the Census Bureau explore an adjustment for potential underuse of medical care for the uninsured, we recommend that the Census Bureau continue

to use actual spending in its SPM estimates. Assessment of potential risk should be done using separate measures of medical care economic risk that take into account such characteristics as age, health status, whether or not the family or individual has insurance, and insurance benefit designs. It will be important to keep metrics that assess burden anchored in retrospective costs—what actually happened—and distinct from measures of risk that predict medical spending prospectively to assess the population at economic risk as a result of being uninsured or inadequately insured.

MEDICAL CARE ECONOMIC RISK

At the same time, we agree with the 1995 panel recommendations that it is important to also develop a new measure of medical care economic risk that prospectively assesses financial risk to low- or middle-income families who are either uninsured or inadequately insured given their incomes and health status. The latest data from the Census Bureau indicate that about 50 million people, 16.3 percent of the noninstitutionalized population, were uninsured in 2010 (Short, 2011).7 If individuals live in families that do not have sufficient income to meet their nonmedical needs and thereby qualify as poor, it should follow that all of the uninsured who are poor will not be able to “afford” their needed medical care without facing a bigger deficit with regard to their nonmedical needs. In other words, any uninsured family or person considered poor based on income, not counting medical care spending, is at risk because the SPM poverty thresholds, by design, do not include an allowance for medical care needs and instead subtract out-of-pocket medical care spending from resources. (It is also arguable that the official poverty thresholds, first developed from 1955 data for 1963 and updated for inflation since that time, do not include an adequate allowance for today’s levels of medical care.) The SPM estimates only disposable income needed for housing, food, and other nonmedical necessities. Although the poor are at the greatest risk of being uninsured (31.4 percent were uninsured in 2010—almost twice the average rate in the population), the poor constitute only 29.1 percent of the uninsured population.8 The majority of uninsured individuals (62.8 percent) live in families whose incomes are more than 125 percent of the poverty threshold. But how many of these individuals could “afford” to have their health care needs addressed? How many are forgoing care or going into debt to pay for

___________________________

7 The statistics cited were taken from the Census Bureau website and Census Table Creator: http://www.census.gov/hhes/www/cpstables/032011/health/toc.htm. In the P60 reports, the Census Bureau only reports the relationship between income and insurance coverage, not poverty status.

8 The definition of poverty used in these statistics is the current official poverty definition, not the SPM definition reflecting the 1995 panel’s recommendations.

care or are at risk for very high costs relative to their incomes in the event of a significant health event?

The same questions apply to those with public or private insurance with policies that would provide inadequate protection in the event of a major health event, either because of very high cost-sharing, limits on the total amount the insurance will pay, or gaps in essential benefits. A measure of medical care economic risk is needed to assess the exposure to, or potential for, incurring expenses in the future.

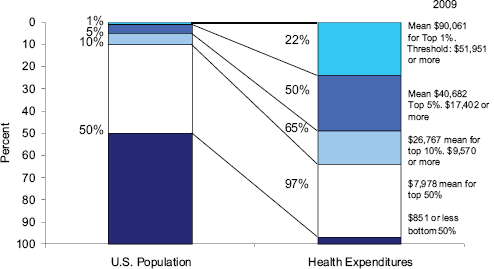

This is especially true because of the skewed nature of medical care costs. Each year the sickest 10 percent of the population accounts for about two-thirds of all spending, and the sickest 5 percent accounts for about half of total spending. At the same time, the healthiest half of the population accounts for just 3 percent of total spending (see Figure 2-4). The spending levels for each of the groups, not surprisingly, are very different: among the sickest 1 percent in 2009, each person spent more than $50,000, with an average of $90,000. In contrast, the healthiest half of the population spent $850 or less in 2009. Analysis over time indicates that a significant share of the sickest people remain “sick” in the following year—about 40 percent of the top 10 percent are in this group the following year. However, there is also substantial movement, as any major health event results in a shift in spending levels (Cohen and Yu, 2012).

FIGURE 2-4 Health care costs concentrated in sick few—sickest 10 percent account for 65 percent of expenses.

NOTE: The means are for the respective percentiles up to that value. Thresholds indicate dividing points between groups.

SOURCE: Analysis of MEPS, S. Cohen, Agency for Healthcare Research and Quality, for NAS Panel Report, April 13, 2012.

To the extent that insurance benefits are well designed, coverage would facilitate and pay for access to essential, effective care when in need and also encourage preventive care and ongoing care for chronic disease to avoid deterioration in health status and still higher health care costs. With information about health, age, work status, and other predictors of health care needs and information about insurance status and type, a measure of medical care economic risk would be able to predict the likelihood that different population groups would incur high out-of-pocket medical expenses, assuming they received care based on their health needs. Conceptually, such a measure would capture the extent to which the uninsured are using far less medical care than expected given their age and health status (underutilization) and also whether insurance policies are leaving low- or middle-income patients and their families at risk of economic costs that would be high relative to their incomes if they became sick—whether or not actual spending occurred (see Meier and Wolfe, in Part III of this volume).

In combination with measures that track medical care economic burden, such a measure of medical care economic risk would add value over time by identifying the source of risk. For example, as stated earlier in the chapter, once fully implemented, the ACA insurance provisions will offer the uninsured and low-income households a choice of plans with different actuarial values (labeled bronze, silver, gold, and platinum). Because these benefit designs may be relatively standardized, it would be possible to include an additional question in such surveys as the CPS ASEC and the Medical Expenditure Panel Survey regarding plan choice level, or at some point in the future merging this information with enrollment files, especially for those who receive premium assistance.9 Using a combination of retrospective data on past spending patterns, it would be possible to project risk in advance of enrollment changes (see Chapter 4 on modeling medical care economic risk and Chapter 5 on potential data sources for development and implementation of a model).

Such modeling is analogous to what actuaries do when estimating next year’s premium rate for a specific population with a specific insurance benefit choice. Such premium projections include patient out-of-pocket costs as well as payments covered by the insurance plan. There are several issues in developing such a prospective measure of medical care economic risk for purposes of assessing the potential that medical care expenses could impoverish a family or lead to forgone care as a result of costs. These include having sufficient information on (1) predictors of health risks (such as jobs, chronic conditions, age and sex, past history of health problems),

______________________________

9 We note that the Department of Health and Human Services is already taking steps to include on a regular basis or to test some of the information that will be required to measure medical care economic risk; see http://aspe.hhs.gov/hsp/12/surveyenhancements/ib.shtml.

(2) resources, and (3) the type of insurance to estimate financial exposure. With such information, as a companion to the SPM and consistent with the measure of medical care economic burden, a measure of medical care economic risk could be calculated for families (and unrelated individuals), as defined in the SPM.10

As with metrics to assess burden, a measure of medical care economic risk could be used either in conjunction with an absolute standard, such as a poverty measure, or with a relative standard, with thresholds that vary by poverty-income groups. A difference in approaches is that a measure of medical care economic risk would not necessarily have to take premiums into account, as premiums could be treated as regular recurring expenses.

Ideally, a measure of medical care economic risk would also provide information on the gains in welfare from having insurance that ensures access to essential care and that protects against economic risk when sick, at a premium cost that is affordable relative to income. For example, it could capture the extent to which patterns of care shift away from admissions to the hospital for potentially preventable complications of chronic disease or indicators of receipt of care, such as preventive dental care and early detection and treatment of cancer, that can improve quality of life and potentially avoid premature death.

______________________________

10 The SPM expands the family concept used in the official poverty measure to include same-sex spouses, unmarried partners, foster children, and other unrelated children. The expanded family is designed to match or at least better approximate the family unit used in the Consumer Expenditure Survey, which is the data source for the SPM poverty thresholds (Provencher, 2011).