Arkansas is seeking to reinvent itself as a knowledge-based economy. This transformation continues the state’s longstanding efforts to adapt to changing economic conditions. When the post-World War II automation of agriculture displaced much of the state’s predominantly agrarian work force, the state succeeded in attracting manufacturing industries based on Arkansas’ low wages and favorable business climate. When these industries began moving offshore in the 1970s, the state experienced a steady erosion of manufacturing jobs that continues to the present day. Arkansas began building the infrastructure for technology-based economic development in the 1980s. Recognizing the growing importance of knowledge-based industries, Arkansas’ leaders are once again taking steps to secure their future economic growth.

To review the states recent initiatives to develop a knowledge-based economy, the National Academies’ Board on Science, Technology, and Economic Policy (STEP) and University of Arkansas at Little Rock convened a conference on Building the Arkansas Innovation Economy. Held at the Clinton Presidential Library in Little Rock, the conference drew Arkansas business, political, and academic leaders along with senior U.S. government officials and national experts to highlight the accomplishments and growth of the innovation ecosystem in Arkansas, while also identifying needs, challenges, and opportunities. The participants at this conference discussed a series of proposed initiatives to strengthen Arkansas’ innovation and technology infrastructure and identified areas where federal, state, and foundation contributions could generate positive synergies.

As this report of the conference documents, Arkansas’ business, academic and government leaders recognize the economic and technological challenges confronting the state. They have studied successful economic and research programs in other states and drawn on national experts to develop strategic plans to promote economic growth and – in recent years – to enhance the state’s standing in the knowledge-based economy of the 21st century. Arkansas benefits from homegrown entrepreneurial ingenuity and pluck, its reputation as a highly pro-business state, strong transportation links, and a geographic location in the center of the North American market.

FIGURE 1 Location of Arkansas in the United States

At the same time, the state’s development continues to be hampered by weaknesses in its knowledge and skills base, the out-migration of college graduates, a dearth of venture capital, and a relatively low level of federal research funding (See Table 1). Many of the Arkansas’ economic and technology development initiatives were designed to address these areas of vulnerability.

Table 1 Innovation Indicators for Arkansas

| Category | Arkansas | U.S. Average |

| State funding for major public universities per enrolled student (2010) | $10, 825 | $9,082 |

| Engineers in the workforce (2010) | 0.53 | 1.12 |

| Life and physical scientists in the workforce (2010) | 0.3 | 0.45 |

| Federal R&D obligation per employed worker (2008) | $112 | $862 |

| Federal R&D obligations per S&E occupation holder (2008): | $4,947 | $21,594 |

| Academic S&E articles per 1000 science doctorate holders in academia (2008) | 477 | 579 |

| Patents per 1000 S&E occupation holders (2010): | 4.9 | 19.4 |

| Venture Capital deals per high tech establishments (2008): | 0.0 | 0.59 |

| High tech to all business establishments (2008) | 7.02 | 8.52 |

| Business performed R&D to private industry output (2008) | 0.52 | 2.14 |

Source: NSB Science and Engineering Indicators 2012 State Data Tool

THE INNOVATION IMPERATIVE

The twenty-first century is witness to fundamental changes in the world’s economies. Knowledge-based economic activity is recognized worldwide as the basis for sustained growth. The prosperity of individual regions is based increasingly on their relative success in attracting and retaining knowledge-based activities and assets and utilizing them for economic development. At the same time, the globalization of trade and investment as well as advances in communications and transportation has created an increasingly integrated global market. Reflecting the growing mobility of capital and labor, states and regions are increasingly vulnerable to companies, industries and jobs moving to other parts of the U.S. or to foreign countries that offer a skilled and flexible workforce, often at lower cost, and greater incentives for investment. The nation’s states and regions therefore face an imperative to foster innovation and start, grow, and retain innovative firms if they are to

sustain and augment their standard of living and ensure their long run economic well-being.1

BOX 1:

Addressing the Innovation Imperative in Arkansas

In his conference keynote, Governor Beebe of Arkansas said that among the state’s advantages are its strong work ethic and entrepreneurial spirit. He noted Arkansas’ reputation for successful businesses, beginning with Sam Walton’s Wal-Mart, and continuing with Tyson, J. B. Hunt, Stevens, Acxiom, and Alltel, which had become part of Verizon. “Those success stories were the basis for what was yesterday,” he said, “but they provide us with a roadmap for tomorrow. We’re probably not even aware of how our children and grandchildren will live 10, 15, or 20 years from now. But those who embrace technology and innovation and entrepreneurship; make the marriage between education and economic development; and learn that science is the basis for tomorrow’s economy will reap the benefits for themselves, their employees, their loved ones, and their region.”

Acknowledging that the state lags in per capita baccalaureate degrees, where it stands 49th in the nation, Governor Beebe said that he was determined to change that ranking.2 The state has initiated policies that include higher standards, higher expectations, and more advanced placement. The state has approved a lottery, with all of its available revenues targeted for college scholarships. “There will be no excuse for Arkansas to stay 49th in per capita BA degrees,” he said.

In his conference remarks, Richard Bendis, of Innovation America, outlined the key issues for building knowledge and innovation-based economies. He defined innovation as “the creation and transformation of knowledge into new products, processes and services that meet market needs.” Knowledge economies are “based on creating, evaluating and trading knowledge.” Bendis observed that the public, academic and private sectors each have essential roles in innovation. Academia must focus on the creation, integration and transfer of

______________________

1Ross De Vol, et al., Arkansas’ Position in the Knowledge-Based Economy Santa Monica: Milken Institute, September 2004, p. 1.

2 Recognizing these realities, Governor Mike Beebe’s Strategic Plan for Economic Development points out that Arkansas is “at a critical disadvantage in competing for opportunities in the 21st century economy,” and that the state had “not kept pace” with the requirements of the global knowledge-based economy. See, the Executive Summary of Governor Mike Beebe’s Strategic Plan for Economic Development, Little Rock: Arkansas Economic Development Commission, 2009.

knowledge itself. Industry must use that knowledge to create wealth in the form of commercial products, processes and services. Governments must develop policies to encourage innovation, engage in long-term vision and planning, invest in under-supported areas, and participate in public-private partnerships with industry.3

He added that technology clusters, which facilitate innovation through physical proximity and the close interaction of many actors from different sectors, serve as catalysts for innovation and the creation of start-ups. While Silicon Valley, Route 128 in Boston and Research Triangle Park in North Carolina are widely cited as examples of successful technology clusters, growing successful clusters by stimulating the development, commercialization and financing of technology-based firms is a significant challenge.4 In this regard, Bendis stressed the role of “innovation intermediaries” to coordinate local technologies, assets and resources to advance innovation in a jurisdiction.5

Bendis further observed that successful development of economic activity within a region requires a “three-legged stool.” First, the region must attract companies from other regions; second, it must retain companies that are already present; and third, it must create new companies. Creating new companies is both the most important element and the one that is most difficult to achieve. It is important because small and medium enterprises (SMEs) are a major source of innovation and new jobs.6 However, as Jeff Johnson, CEO and President of ClearPointe Technology, a managed service provider based in Little Rock, noted at the conference, “very few new firms have adequate cash to get a new business through the first year, and we were no exception."7 The result, according to Bendis, is that most start-ups with new ideas do not move to the commercialization stage – at present of 150-200 small firms that develop business plans, only about 10 draw the interest of venture capitalists, and only one is actually funded. Most small firms that need financial backing are in the proof-of-concept, start-up or seed capital phases, and typically need $500,000 to $2 million for the development of prototypes.8 This need is not being met; seed

______________________

3 See the summary of the presentation by Richard Bendis in the Proceedings chapter in this volume.

4For a review of the nature of innovation clusters and state policies to grow innovation clusters, see National Research Council, Growing Innovation Clusters for American Prosperity, Charles W. Wessner, rapporteur, Washington, D.C.: The National Academies Press, 2011.

5 See the summary of the presentation by Richard Bendis in the Proceedings chapter in this volume.

6 Small and medium enterprises generate 13 times as many patented technologies as large firms, and are an important source of innovation for large firms that often partner with SMEs. In the three years after the recession of 2001, companies of less than 20 employees created 107 percent of net new jobs while companies over 500 employees eliminated a net of -24 percent. See the summary of the presentation by Richard Bendis in the Proceedings chapter in this volume, where he cites data from the Small Business Administration.

7 See the summary of the presentation by Jeff Johnson in the Proceedings chapter in this volume.

8 See the summary of the presentation by Richard Bendis in the Proceedings chapter in this volume.

stage investments by the U.S. venture capital industry declined by 48 percent in 2011 to $919 million, or 3 percent of all venture capital investment.9 In effect, venture investment is moving downstream, away from risk, a phenomenon that is acting as a drag on start-ups in Arkansas and elsewhere.

Responding to this innovation imperative, governments around the world have implemented a variety of policies and programs designed to promote innovation-based economic growth.10 Many of these efforts emulate U.S. public-private initiatives that are widely seen as successful. Indeed, the United States has a long tradition in public-private partnerships, beginning with a 1798 government grant to Eli Whitney to produce muskets with interchangeable parts, and continuing through government support for development of the telegraph, the airplane, jet aircraft, semiconductors, computers, nuclear energy and satellites.11

As we see next, Arkansas’ recent economic and technological development efforts are a part of this long national tradition in cooperation and pragmatism in fostering economic growth and addressing common missions.

BACKGROUND: ECONOMIC DEVELOPMENT EFFORTS IN ARKANSAS, 1955-2012

For most of its history, farming and forestry dominated Arkansas’ economy. During the mid-20th century, sharecroppers and poor migrant laborers were displaced by agricultural automation. While many migrated, others stayed, making up the state’s pool of low cost surplus labor. In 1950, Arkansas’ per capita income was 56 percent of the national average, and its population was declining. In 1955, the state legislature established the Arkansas Industrial Development Commission (AIDC) with a mandate to promote industrial development. Under the leadership of its first chairman, Winthrop Rockefeller, the AIDC began to court out-of-state businesses aggressively.12 The result was

______________________

9 PWC MoneyTree Venture Capital Report, 2010.

10 For a review of innovation polices of leading nations and regions in Asia, Europe, and North America and the challenges facing the United States, see National Research Council, Rising to the Challenge, U.S. Innovation Policy for the Global Economy, C. Wessner and A., Wm., Wolff, eds., Washington, DC: National Academies Press, 2012.

11 For an abridged history of US public private partnerships and an analysis of factors characterizing successful partnerships, see National Research Council, Government Industry Partnerships for the Development of New Technologies, C. Wessner, ed., Washington, DC: National Academies Press, 2003.

12 The AIDC was formed pursuant to Act 404 of 1955, which also authorized incorporation of local industrial development corporations and issuance of local industrial development bonds. Today the AIDC operates as the Arkansas Economic Development Commission (AEDC), with a current mandate to promote economic development and develop strategies that produce better-paying jobs, support communities and support workforce training. See the summary of the presentation by Watt

an influx of manufacturers seeking low wage labor and cheap land. Between 1955 and 1960 Arkansas added over 51,000 jobs.13 In 1997, AIDC was renamed the Arkansas Economic Development Commission (AEDC) to reflect a broader emphasis on developing service and high technology industries in the state.

By the 1970s the “smokestack” industries that had located in Arkansas during the preceding decades came under international competitive pressure and began to move offshore. The percentage of manufacturing employment in the state began a long decline, from 32 percent in 1975 to 17 percent by 2005. Per capita income rose through the 1960s and 1970s, but leveled off in 1978 at about 77 percent of the national average where it has “refused to budge despite the best efforts of economic developers in the state."14 Arkansas’ unemployment rate, which stood at 5.0 percent in 1970, nearly doubled to 9.5 percent in 1975. Unemployment peaked at 9.7 percent in 1983 and remained above seven percent through the entire decade of the 1980s.15 In 1979, the AEDC released a report that warned that the state’s future economic growth was limited by a strategy that sought to recruit firms that provided labor-intensive, low skill, minimum wage jobs to Arkansans.16

During the 1980s the state took a number of steps to counteract the loss of businesses and jobs. Two new development agencies were established: The Arkansas Science & Technology Authority (ASTA) was tasked with promoting innovation, scientific research, and science, technology, engineering and mathematics (STEM) education.17 The Arkansas Development Finance Authority (ADFA) was established to provide tax-exempt bonds to finance businesses and education.18

______________________

Gregory in the Proceedings chapter in this; See also Governor Mike Beebe’s Strategic Plan for Economic Development, 2009, op. cit., p. 2.

13 Governor Mike Beebe’s Strategic Plan (2009), op. cit., p. 3.

14 Report of the Accelerate Arkansas Strategic Planning Committee, Building a Knowledge-Based Economy in Arkansas: Strategic Recommendations by Accelerate Arkansas (September 2007), pp. 16-17.

15 Governor Mike Beebe’s Strategic Plan, (2009), op. cit., p. 5.

16 AEDC, Arkansas Climbs the Ladder: A View of Economic Factors Relating to Growth of Jobs and Purchasing Power (1979).

17 Galley Support Innovations (GSI) is a California-based manufacturer of galley locks and latches for OEMs in the aerospace business that relocated to Arkansas in 2005. Hit hard by the economic downturn that began in 2008, it sought assistance from the Arkansas Science and Technology Authority’s Arkansas Manufacturing Solutions program. GSI was awarded to ASTA Technology Transfer Assistance Grants (TTAG), which enabled GSI to secure a large multi-year contract with an estimated positive financial impact of $5 million over six years. “AMS Grant Helps Local Aerospace Manufacturer Turn Business Around,” Arkansas Business (January 5, 2012).

18 (2009) op. cit., p. 6. The Arkansas Science and Technology Authority was created by statute in 1983 to “support scientific and business innovation as an economic development tool.” In 2009, it completed 31 projects involving about $8 million in grants and tax credits. It has provided grants to support the Arkansas High-Performance Computing Center at the University of Arkansas and to the

Despite difficult economic circumstances, Arkansas has spawned a significant number of world-class companies.19 Wal-Mart, which began with one retail outlet in Rogers, Arkansas, in 1962, became the nation’s largest retailer in 1991.20 J.B. Hunt, founded in 1961 in Lowell, Arkansas with five trucks and seven refrigerated trailers, became the largest US trucking company by the early 1990s. Tyson Foods, based in Springdale, Arkansas, and which originally consisted of a farmer driving a single truck to deliver chickens to Chicago, became the largest U.S. processor of poultry and the world’s second largest processor of chicken, beef and pork. Murphy Oil Corporation, based in El Dorado, Arkansas, operates onshore and offshore oil and natural gas drilling operations globally, and in 2008 ranked 134th on the Fortune 500 list.21 Other major companies with origins in the state include Riceland, Stephens Inc., Dillard’s, Alltel and Acxiom. While most of these companies are not regarded as technology-intensive firms, many of them have applied technology in their business processes with dramatic and in some cases revolutionary impact.22

______________________

Arkansas Research and Education Optical Network (ARE-ON), a communications network linking Arkansas’ four-year public universities. The authority provides financial support for technology transfer to local businesses, provides working capital for small start-up businesses (usually pursuant to royalty-based agreements), and sponsors professional development workshops for teachers and grants to individual STEM teachers for equipment and supplies. See the presentation by Watt Gregory, “Evolution of Innovation in Arkansas,” in the Proceedings chapter of this volume. See also the Arkansas Science and Technology Authority website, http://www.asta.arkansas.gov accessed January 11, 2012.

19 Giang Ho and Anthong Pennington-Cross, “Fayetteville and Hot Springs Lead the Recovery in Employment,” The Regional Economist (October 2005).

20 Wal-Mart, with one of the most sophisticated and innovative supply chains in the world, has attracted distribution centers from its major vendors to Arkansas, including Heinz, Clorox, Pfizer, General Mills, Mattel, PepsiCo, Procter & Gamble, Coca-Cola, Johnson & Johnson and Hershey’s. “Arkansas: A Natural Wonder,” Inbound Logistics (May 2009).

21 The company offers to pay college tuition and fees for all El Dorado high school students. “Murphy Oil Company,” Arkansas Business http://www.arkansasbusiness.com/company_info.asp?sym=MUR

22 Wal-Mart’s emergence as the world’s largest retailer and the world leader in supply chain logistics is attributed largely to its pioneering practice of tracking inventory by high performance computers.

22 See the summary of the presentation by Watt Gregory in the Proceedings chapter in this volume.

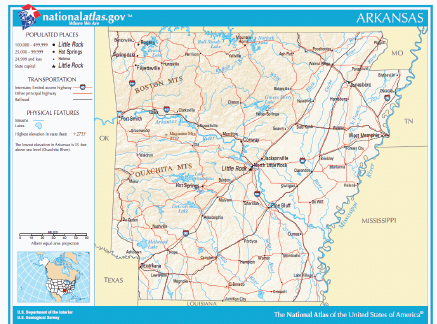

FIGURE 2 Map of the State of Arkansas

Source: U.S. Department of Interior, U.S. Geological Survey

Arkansas’ location in the center of the North American market, reinforced by a strong rail, highway and river-based transportation network, (see Figure 2) has proven a major advantage with respect to attracting and holding some traditional industries.23 Some local manufacturers have found that Arkansas’ location lowers transportation costs and thus makes them cost-competitive with products made in China.24 It is becoming evident that Arkansas enjoys geographic

______________________

23 Arkansas has over 1,000 miles of navigable waterways and port facilities on the Mississippi and Arkansas Rivers. Three carriers provide rail service including intermodal freight service. Eight interstate highways cross various parts of the state. Nucor Steel located a mini-mill in Hickman, Arkansas, which makes thin-slab steel coils for use in pipes, tubes, processors and automotive applications, citing location and transportation infrastructure as key decisional factors. Mike Parrish, a Nucor Vice President who managed the Hickman plant, said in 1996 that “What’s great about this area is it’s centrally located in the country. It’s great to advertise in this area. You’re on the [Mississippi] River. You can not only ship anywhere in the country, you can ship anywhere in the world,” “Nucor Makes Blytheville Steel Capital of the South,” Arkansas Business (December 16, 1996).

24 In 2011, the designers of five-gallon Kosmo coolers, a proprietary product, abandoned plans to have them manufactured in China, a decision based on “prohibitive” shipping costs. Instead most of the parts for the coolers will be manufactured by custom injection and blow molder River Bend Industries LLC at its factory in Fort Smith, Arkansas. River Bend worked with the designers, Arkansas entrepreneurs Tim Mika and Steve Bowman, developed a mostly US-made product (only the metal legs will be sourced from China) containing blow-molded and injection molded parts and

advantages with respect to some technology-intensive activities. Companies such as Nordex USA, LM Glasfiber and Mitsubishi Power System Americas, makers of sophisticated wind power equipment, have all cited the state’s location as a key factor in their decision to locate major manufacturing facilities there.25 These traditional advantages, however, may not prove sufficient to address the competitive challenges of the 21st century.

Competing for Industry with Incentives

For decades, state, county and municipal governments across the United States have offered various incentives to attract companies to their jurisdictions. While frequently criticized by economists as inefficient and a misallocation of public resources, jurisdictions that refrain from incentives competition risked the loss of companies, industries and jobs to other areas.26 Arkansas state, county and municipal governments have repeatedly sought to be competitive with other states and regions by using incentives to attract and retain companies. The state was one of the first in the U.S. to enact tax incentives to attract out-of-state companies.27 The Arkansas General Assembly enacted special incentives legislation tailored to the needs of Nucor Corp., a highly competitive steelmaker, for a new mill in Blytheville in the 1980s, and the company continued to receive incentives for many years thereafter as it expanded its presence in the state.28 Arkansas county and municipal

______________________

urethane from insulation. The Fort Smith location made River Bend’s coolers cost-competitive with China. To build the coolers River Bend is expanding its manufacturing capacity in Fort Smith. “River Bend Gets Kosmo Work,” Plastics News (November 7, 2011).

25 “LM Glasifiber Dedicates Little Rock Factory,” ArkansasOnline (October 28, 2008). Senior Vice President Ichiro Fukue commented that “transportation is very important for this industry. Fort Smith is the center of our market." “Arkansas Wins $100 Million Wind Turbine Nacelle Plant,” Energy Overviews (May 11, 2011). In 2010, Mitsubishi Power System Americas broke ground on a $100 million wind turbine nacelle plant in Fort Smith, Arkansas, citing the location’s transportation advantages as a key factor in the site selection. A Nordex executive commented “here in Jonesboro, we’re very near the Mississippi River for barging, there are two railways crossing Arkansas, and the highway system provides a major transportation network, so we can ship the 2.5 MW “Gamma Generation” turbines we’re building here anywhere in the country and make delivery in a matter of days.” Interview with Joe Brenner, Vice President for Production, in Wind Systems (January 2011).

26 Testimony of Arthur J. Rolnick Director of Research, Federal Reserve Bank of Minnesota, before the House Domestic Policy Subcommittee, “Congress Should End the Economic War Among the States,” October 10, 2007; Kenneth P. Thomas, Investment Incentives and the Global Competition for Capital (London and Basingstoke: Palgrave MacMillan, 2011).

27 The Enterprise Zone Act of 1983 established tax credits for creation of new jobs and sales and use tax exemptions for building materials used to construct factories. The Manufacturers’ Investment Tax Credit (later renamed InvestArk) extends manufacturers sales and use tax credits equal to seven percent of the cost of modernizing and expanding facilities. Governor Mike Beebe’s Strategic Plan (2009) p. 6.

28 See Thomas Howell, “Incentives Competition for Businesses,” In the Appendix to this report. Between 1996 and 1998, Nucor’s Blytheville project reportedly received $48.6 million in tax credits

governments have also achieved significant successes in competing for investment through use of incentive packages.29 In 2007, the General Assembly approved the creation of the $50 million Quick Action Closing Fund, designed to enable the Governor to “act quickly and decisively in highly competitive situations to finalize an agreement with a company to locate in Arkansas,” and the fund has been deployed effectively on a number of occasions.30 Arkansas continues to make extensive use of incentives – frequently combined packages of state, county and municipal benefits – to compete for investments in emerging sectors, such as wind turbines.31 Incentives have also played a role in the retention of established knowledge-based companies and jobs.32 An

______________________

and cash. “Results from Subsidies Unknown – State Has Little Idea Whether $633 Million in Breaks to Firms Spurred Investment,” Arkansas Democrat-Gazette December 12, 1999); “Choosing a Greenfield Site: Steelmakers Are Attracted Rural Areas,” Iron Age (March 1992); “Arkansas Legislators Present Their Proposal for Tax Breaks for Proposed Steel Mill,” Arkansas Democrat-Gazette (December 7, 1987).

29 Osceola, Arkansas, was shaken in 2000-01 by the loss of manufacturing plants shut down by Fruit of the Loom (textiles), Eck Adams (furniture), Siegel-Robert (auto parts) and Southwire (wire). The city began using cash generated by the municipally owned electricity distribution system to fund industrial development. In 2003, Osceola secured a new factory opened by DENSO Mfg., a Japanese maker of automotive ventilation systems, defeating other localities with a $3 million combination of incentives, which included land, site improvements, and subsidized electricity rates. Shortly thereafter, Osceola won a $1.2 billion coal fired power plant, the Plum Point Energy Station, offering a 1,000-acre site with infrastructure improvements and a 20-year estate tax abatement. Susan C. Thompson, “Factory Closing Shock Community into Opening Wallets for Economic Development,” The Regional Economist (October 2010).

30 Letter from AEDC Executive Director Maria Haley to Senator Mary Anne Salmon and Representative Tommy Lee Baker, Arkansas Legislative Council, August 22, 2011. In 2010, Caterpillar Inc. opened a $140 million, 600-job road grader factory in North Little Rock. Governor Beebe, who used $3 million from the fund to close the deal, said that “They (Caterpillar) wouldn’t be here without the Quick Action Closing Fund.” "Caterpillar Opens New Arkansas Factory, Hiring 600,” Cleveland.com (September 1, 2010).

31 In 2010, Arkansas secured an agreement with Japan’s Mitsubishi Power Systems America, Inc. for establishment of a $100 million plant to manufacture wind turbine nacelles at Fort Smith, Arkansas. The city of Fort Smith agreed to issue up to $75 million in revenue bonds for plant construction, to give Mitsubishi a free 90-acre site, to extend streets, water mains and sewers to the plant, and to give Mitsubishi a 50 percent reduction on property taxes. Sebastian County agreed to designate its entire $3.7 million allocation for federal recover zone bank to Mitsubishi. Governor Beebe contributed $3.75 million from the Quick Action Closing Fund to close the deal. “Mitsubishi Incentives Hit $83M,” Fort Smith Times Record (December 25, 2010).

32 Windstream, a rapidly-growing telecommunications network created in 2006 in Little Rock, with $5 billion in annual revenues, investigated alternative sites outside the state for its permanent headquarters, but decided in 2010 to stay in Little Rock, with CEO Jeff Gardner acknowledging that “financial incentives provided by the state and the regional placement relative to the company’s placement relative to the company’s customers in the southeast played into the decision. The incentives included a $1 million in Quick Action Closing Funds for building and training and additional benefits tied to performance. “Windstream Picks Little Rock, AR for HQ,” Business Facilities (July 13, 2010).

example is the attraction of a Hewlett-Packard Technology Center to Central Arkansas in 2009.

The Growing Importance of Knowledge-based Industries

In 1998, with the state’s manufacturing jobs eroding and college graduates out-migrating, then Governor Mike Huckabee convened the Governor’s Summit on Economic Development to consider state policies to promote economic growth, development and job creation. The Summit developed several recommendations that were implemented by the state’s General Assembly in the form of new legislation. Existing incentive programs were extended to include knowledge-based industries, capital gains tax rates were cut by 30 percent, an Arkansas Research Matching Fund was created, and a small business loan pilot program was established. The Tuition Reimbursement Tax Credit Program was established, authorizing a 30 percent tax credit for targeted companies for costs paid to employees to improve their post-secondary school education.33

In 2001, the Director of the Arkansas Department of Economic Development formed the Task Force for the Creation of Knowledge-Based Jobs, comprised of business, academic and government leaders, to develop strategies for expanding the number of knowledge-based jobs and companies in Arkansas. The task force’s report, released in September 2002, recommended that math and science be elevated to the number one educational issue in the state; that up to six research centers of excellence be established; that a variety of measures be taken to provide financial support for Arkansas-based technology start-up companies and that the state constitution be amended to permit equity investments by qualified state agencies.34

The Milken Study of Arkansas’ Competitiveness

Accelerate Arkansas, a statewide group of business leaders working on a volunteer basis to promote knowledge-based institutions, industries, workers, and partnerships, emerged from the Task Force and other state economic development initiatives. Speaking at the conference, Watt Gregory, the chair of Accelerate Arkansas, said that his organization commissioned studies about the Arkansas economy, most importantly a landmark report by the Milken Institute that represented the most comprehensive study ever undertaken of the Arkansas economy.35 The Milken study observed that a fundamental transformational

______________________

33 Governor Mike Beebe’s Strategic Plan (2009), op. cit., p. 8.

34Report of the Task Force for the Creation of Knowledge-Based Jobs (September 2002), pp. 2-3.

35 See the summary of the presentation by Watt Gregory in the Proceedings chapter in this volume.

shift was occurring in the world toward knowledge-based economic activity, reducing the relative importance of traditional assets of regional economic development—proximity to railroads, waterways and raw materials—and factors such as low labor and business costs. Regional economic prosperity, the study concluded, was increasingly based on the relative success of a location in attracting knowledge-based investments and leveraging them for economic development. The study observed that Arkansas had been “operating at the periphery of the knowledge-based economy,”—and while the state had been making progress, it was “starting far behind other states in the knowledge-based economy race."36

Using the Milken Institute’s State Technology and Science Index, the Milken study benchmarked Arkansas against other states in S&T, and ranked the state 49th, ahead of only Mississippi. Arkansas ranked 50th in categories such as competitive National Science Foundation funding and federal R&D. It was 49th in human capital and S&T workforce subsidies, and 49th for percent of the adult population with college degrees. Arkansas ranked 42nd in indices for risk capital and entrepreneurial infrastructure (leading other states in its region), and 12th in the nation for high tech industries’ annual growth rate. Arkansas also ranked 25th in the Small Business Survival Index. The study observed that “Arkansas’ strong performance in the area of net formation of high-tech establishments is very good news for the state’s economy” but warned that if factors such as the quality of primary education did not improve, “Arkansas’ competitiveness in the attraction and retention of high-tech firms will quickly erode."37

On the basis of the Milken study, members of Accelerate Arkansas concluded that the state needed to take a new approach to economic growth that was not dominated by efforts to recruit traditional manufacturing companies. In addition to the Milken study, Accelerate Arkansas studied the development plans of other states and deliberated extensively, both internally and with stakeholders throughout the state.38 Based on this analysis, they identified five “core strategies for acceleration:”

______________________

36De Vol, et al., Arkansas’ Position in the Knowledge-Based Economy: Prospects and Policy Options (2004) p. 1.

37 De Vol et al., (2004) op. cit. pp. 3-4.

38 The study of other states’ programs was based on an examination of “best in class states,” asking the question what makes some states “best” and how did they get that way? Between October 2005 and June 2006, Accelerate Arkansas’ Strategic Planning Committee consulted 95 stakeholder groups in discussions over objectives for a strategic plan and held public strategic planning fora in various parts of the state. A series of 65 strategic objectives was winnowed down to 30. Through this process, five “core strategies” were identified. Teresa McLendon (ed.) Building a Knowledge-Based Economy in Arkansas: Strategic Recommendations by Accelerate Arkansas (September 2007) pp. 33-35.

- support for job-creating research;

- development of risk capital that is available for all stages of the business cycle, particularly the funding gap;

- encouragement of entrepreneurship and new enterprise development;

- increasing Arkansas’ education level in science, technology, engineering and math;

- and support for existing industry through improved technology and competitiveness.39

Arkansas Strategic Plan

In the wake of the Milken study, Governor Mike Beebe authorized the AEDC to develop a long range statewide economic development plan. In June 2007, AEDC Executive Director Maria Haley established a five person committee to create the plan. Input was solicited in the form of interviews and surveys from economic development stakeholders, all state agencies and commissions involved in economic development, the entire federal delegation, the governor’s staff, and private businesses and foundations. The Committee drew upon the various studies and recommendations produced by Accelerate Arkansas, the Task Force for the 21st Century Economy, and the Governor’s Workforce Cabinet. The Committee identified three basic challenges facing the state:

- The state needed a transitional, systematic approach to an economy based on knowledge-based jobs.

- Economic development efforts in Arkansas were diffuse and inefficient.

- Arkansas lacked a recurring and predictable funding formula for economic development.40

Governor Beebe’s Strategic Plan concluded that the state’s economic development efforts should be concentrated under the leadership of the AEDC, a decision based on overwhelming feedback from the interviews conducted by the AEDC committee. The plan tasked AEDC with developing a “recurring and predictable funding source." The Plan set forth five objectives:

- Increase the income of Arkansans at a rate faster than the national average,

- Expand entrepreneurship that focuses on knowledge-based enterprise,

- Prepare Arkansas businesses to compete more effectively in the global

- marketplace, Develop economic development policies that meet special

______________________

39 McLendon (2007) op. cit. pp. 26-28.

40 Governor Mike Beebe’s Strategic Plan (2009).

-

needs and take advantage of existing assets in various areas of the state, and

- Increase the number of workers with post-secondary training.

Watt Gregory of Accelerate Arkansas pointed out at the conference that Governor Beebe’s Strategic Plan is closely aligned with recommendations originally developed by the Task Force for the 21st Century Economy. These were to:

- Emphasize human resource development, particularly STEM education at all levels and workforce education

- Develop mechanisms to carry innovation into the marketplace, including:

- Support for entrepreneurship

- Additional risk capital

- Increased global competitiveness in recruiting businesses and industries

- Develop cyberinfrastructure

- Support innovation by existing businesses.41

Continuing Erosion of Jobs

Arkansas has continued to experience a net loss of manufacturing jobs. The manufacturing workforce declined from 269,815 in 2001 to 199,015 in September 2011, a drop of 25.9 percent for the decade.42 In his conference keynote, Governor Beebe acknowledged that during the economic downturn that began in 2008 the state “lost jobs, more than we’ve gained—about 24,000 created, 27,000 lost,” but pointed out that of the 27,000 job losses, many required less education and resulted from movement offshore or consolidation, whereas the new jobs were better-paying and required higher levels of education and skill. He emphasized that education and economic development must be linked or neither can succeed. "[Y]ou can’t have economic development today without education, because you have to have the high-quality workforce. But

______________________

41 See the summary of the presentation by Watt Gregory in the Proceedings chapter in this volume.

42 The net decline has continued despite strong job growth in the oil and gas industry as a result of the development of major hydrocarbon deposits into the state. In 2004, Southwestern Energy successfully drilled test wells for natural gas in the Fayetteville Shale Play, a 20 by 100 mile deposit in north central Arkansas. A rush of development followed by Southwestern and other companies. A 2007 study by the University of Arkansas’ College of Business calculated that in that year, exploitation of the Play would add $1.6 billion to the state’s economy and employ 6, 000 people. Glen R. Sparks, “Community Profile: Conway, Ark. Makes Play for Economic Boom,” The Regional Economist (July 2007).

without economic development, educated people may leave for other states or countries, in some instances for work.”43

The Battelle Study

In 2007, the Arkansas General Assembly, implementing Accelerating Arkansas’ core strategy of “support jobs-creating research, approved funding to support the establishment of the Arkansas Research Alliance (ARA),44 a public-private partnership which seeks to foster university-based job-creating research. ARA sponsored a study by the Battelle Technology Partnership.45 The study identified 18 “core competencies” in the state as well as 12 “niche competencies,” winnowing those down to nine “strategic focus areas" – multidisciplinary fields of research likely to enable Arkansas to engage multiple institutions and leapfrog traditional universities with strengths in narrow academic fields.46Table 2 details the focus areas.

______________________

43 See the summary of the keynote speech by Governor Mike Beebe in the Proceedings chapter in this volume.

44 ARA funding was provided through the Arkansas Science and Technology Authority.

45 Battelle Technology Partnership Practice, “Opportunities for Advancing Job-Creating Research in Arkansas, A Strategic Assessment of Arkansas University and Government Lab Research Base,” 2009. Access the report at http://www.aralliance.org/__data/assets/pdf_file/0017/1682/JobCreating-Research-in-Arkansas.pdf The 2009 Battelle study was based on interview with 85 of the top researchers in the state and quantitative revision based journal publications and research grants of faculty members during the preceding five years.

46 See the summary of the presentation by Jerry Adams in the Proceedings chapter in this volume.

TABLE 2 Arkansas’ Nine Strategic Focus Areas

| Strategic Focus Area | Breadth of Competencies and Institutions | Opportunity for External Research Funding | Market Potential | Existing or Emerging Industry Connections |

| Enterprise Systems Computing | Emerging | Moderate | Extensive (immediate) | Extensive |

| Distributed Energy Network Systems | Emerging | Limited | Extensive (near term) | Extensive |

| Optics and Photonics | Emerging | Limited | Moderate (immediate) | Limited |

| Nano-Related Materials and Applications | Established | Significant | Extensive (long term) | Moderate |

| Sustainable Agriculture and Bioenergy Management | Established | Limited | Moderate (near term) | Moderate |

| Food Processing and Safety | Established | Moderate | Moderate (immediate) | Extensive |

| Personalized Health Research Sciences | Emerging | Moderate | Extensive (longer term) | Limited—addresses major public health issues |

| Behavioral Research for Chronic Disease | Emerging | Significant | Limited (immediate) | Limited – Addresses major public health issues |

| Management Obesity and Nutrition | Emerging | Significant | Extensive | Limited – addresses major public health issues |

SOURCE: Battelle 2007.

The Battelle study offered the ARA a “crucial roadmap” to use in recruiting talent into the state and into the core focus areas, and that the ARA would use it as its “investment roadmap going forward.”47

INITIATIVES TO PROMOTE INNOVATION IN ARKANSAS

The Arkansas Strategic Plan summarized the work of the various task forces and consulting firms that have analyzed and made recommendations on the state’s economic growth. It noted that “unfortunately, many of the recommendations contained with these early reports were never fully implemented. As a result, numerous problems identified as early as 1964 still remain today.”48 Currently, however, there are a number of state, local and federal initiatives under way to address issues of concern raised by the Milken study and other reports released over the past decade.

Innovation Clusters

The 2004 Milken study of the Arkansas economy observed that “where clusters of existing technologies expand and emerging science-based technologies form is a critical factor in determining economic winners and losers in the first half of the 21st century.” It observed that knowledge is generated, transmitted and shared more efficiently in close proximity, and economic activity based on new knowledge has a high propensity to cluster within a geographic area. The study pointed out that regional and state economic viability depends upon the ability to establish local technology clusters networked into the global business community. It concluded that clusters represent a state or region’s best defense against “being arbitraged in the global cost-minimization game” and can “mitigate input-cost disadvantages through global sourcing.”49

The Milken study analyzed various parameters supporting the formation of technology clusters and ranked Arkansas 44th among the states for technology concentration and dynamism. The study found that Arkansas lagged the national average for net annual formation of high technology establishments by 43 percent and trailed the 50-state average for proportion of the work force in high tech sectors by 64 percent. The state ranked 47th in start-ups of high tech companies. The state was strongest in high tech industries’ average yearly

______________________

47 See the summary of the presentation by Jerry Adams in the Proceedings chapter in this volume.

48 Governor Mike Beebe’s Strategic Plan for Economic Development, Little Rock: Arkansas Economic Development Commission, 2009. p. 6.

49 Clusters are increasingly acknowledged as key to growing 21st Century innovation economies. See National Research Council, Growing Innovation Clusters for American Prosperity. C. Wessner, rapporteur, Washington, DC: National Academies Press, 2011.

growth, a category in which Arkansas exceeded the national average by 25 percent.50

A number of speakers at the conference highlighted the role that a number of state and federal initiatives can play to promote technology clusters in Arkansas.

Arkansas’ Science and Technology Research Parks

In his conference presentation, Jay Chesshir of the Little Rock Chamber of Commerce noted that the state has two science parks, with a third on the way: The first is the Arkansas Research and Technology Park (ARTP), adjacent to the University of Arkansas in Fayetteville. As the state’s primary knowledge community, the Fayetteville area provides valuable fuel for the innovation and technology development activities of the ARTP. ARTP’s goal is to nurture technology-intensive companies through the formation of a community of companies, faculty and students drawing on “a set of core R&D competencies at the university.” ARTP is managed by the University of Arkansas Technology Development Foundation. It is a 501(c)(3) organization with a mandate to “validate, develop and transfer inventions made at the University to Arkansas companies and start-up ventures.”51 The ARTP features the “Enterprise Center,” a technology incubator for startups specializing in information technology and assembly manufacturing.52 He added that two affiliates had received the prestigious Frost and Sullivan Award for excellence in technology, and another affiliate won the Tibbetts Award for the most innovative small business. Recently, another affiliate won an R&D 100 award. ARTP affiliates, he said, continue to advance the frontier of product development in many specialty areas.

A second park is the Arkansas Bioscience Innovation and Commercial Center at Arkansas State University in Jonesboro, which is completing its Phase I business incubator. The development of a third S&T Park in Central Arkansas accelerated in 2010 when the Arkansas legislature authorized the establishment of research park authorities.53 A Tech Park located in Little Rock between UAMS (the University of Arkansas for Medical Sciences) and UALR (the University of Arkansas at Little Rock) is planned and part of the funding for the Technology Park will come from a voter approved increase in sales tax in Little

______________________

50 De Vol et al., (2004) op. cit., p 50.

51 ARTP, website, http://www.vark.edu/ua/artp/aboutus.html

52 Financial support for the Center is being provided through an economic infrastructure fund grant and from the Arkansas Economic Development Commission. Arkansas Small Business and Technology Development Center, “Enterprise Center to Offer Valuable Technology Incubator Resources,” press release, 2009, http://www.asbtdc.org/document/master.aspx?doc=1137

53 Arkansas Act 1045 of 2007.

Rock. The revenue is estimated at $22 million of bonding capacity, with additional private matching funds being sought. Initial engineering evaluations of possible sites are now underway.

Arkansas Biosciences Institute

In her conference remarks, Carole Cramer of the Arkansas Biosciences Institute located at Arkansas State University observed that some 200 food processing facilities are located in the state, including those of some of the world’s largest: Tyson Foods, Frito-Lay, Butterball, Wal-Mart, Riceland, Post, Nestle, and others. Wal-Mart alone, she said, “brings a cluster of people who want to sell to them.” These firms, however, while they do their manufacturing and processing in the state, do most of their R&D elsewhere. Maintaining Arkansas’ agricultural leadership, she said, will require will require building a significant in-state capacity for research and technological innovation.

To address this challenge, Arkansas State University at Jonesboro announced in 2011 the formation of a commercial innovation technology incubator at its Arkansas Biosciences Institute, to be known as the Arkansas Biosciences Institute Commercial Innovation Center (ABI-COM). ABI-COM will provide office and laboratory facilities for businesses seeking to turn innovations into products and services.54 In his conference remarks, Barry Johnson, then of the Economic Development Administration of the U.S. Department of Commerce, noted that the agency has awarded a $1.75 million public works grant to Arkansas State University at Jonesboro and helped establish the Arkansas State Biosciences institute Commercial Innovation Center.

University of Arkansas for Medical Sciences (UAMS) BioVentures

Speaking at the conference, Michael Douglas of UAMS said that the objective of his organization was “building deals for Arkansas,” and that he would offer a picture of UAMS BioVentures by touching on “the numbers, the process, best practices, state incubators, and results.” UAMS BioVentures serves a dual purpose in driving the commercialization of life sciences in Central Arkansas. First, it works within the University of Arkansas for Medical Sciences to capture the intellectual assets of the research scientists in the form of patents, them finds buyers or licensees for those patents for commercialization. This yields license agreements with industry for early stage start-up companies. Second, BioVentures operates a mixed-use wet lab life sciences incubator that provides resources to UAMS start-up companies to assist their early-stage

______________________

54 Arkansas State University, “Brian Rogers Named Director of Commercial Innovation Technology Incubator,” press release, January 5, 2011. http://asunews.astate.edu/BrianRogersNamedABICOM.htm ASU developed ABI-COM with support from a grant of $1,750,500 from the U.S. Department of Commerce Economic Development Administration. Ibid.

development into operating companies in the region. BioVentures manages the prosecution of a patent estate of about 250 patent cases, about 65 percent of which are issued or allowed. The incubator works closely with university startup companies to assist their early-stage development by providing office and laboratory space. It also provides leads to technical support and management as well as a network of seed and venture funds to bring working capital to these early companies.

Dr. Douglas said that the economic productivity of the incubators was high, with an average annual wage of $56,000. The total capital raised by the incubators in Arkansas was $247 million, and the number of jobs created was 1252. He said that a 2009 economic impact study by the Institute for Economic Advancement found that BioVentures had initiated 44 company start-up projects since its inception; generated $29.4 million in revenues (in 2008) from new products, services, and research; and created $52.4 million (in 2008) in economic output impact, with 13 percent of the total out of state. Overall, the study found that the total economic impact (1997-2008) in sales, investment, and research in the state was $184 million.

USEDA Regional Innovation Clusters (RICs)

Speaking at the conference, Barry Johnson further noted that the U.S. Economic Development Administration is planning to staff its regional offices with personnel dedicated to RICs. In 2009, USEDA made 14 investments in Arkansas to support planning and implementation efforts to encourage clusters and regionalism in the state.55 He defined RICs as “geographically bounded, active networks of similar, synergistic or complementary organizations that leverage their region’s unique competitive strengths to create jobs and broader prosperity.” Jobs within clusters pay higher average wages, and regional industries based on place-based advantages are less susceptible to off-shoring.56

In addition to the grant to Arkansas State University at Jonesboro noted above, Mr. Johnson noted that recent USEDA activities in Arkansas include over a dozen investments to support planning and implementation efforts aimed at encouraging regionalism and clusters across the state. This includes, he added, a recent USEDA Technical Assistance Grant to help establish the Center for Regional Innovation at the University of Arkansas at Little Rock.

______________________

55 An USEDA Technical Assistance Grant helped establish the Center for Regional Innovation at the University of Arkansas at Little Rock. A $1.75 million USEDA public works grant to Arkansas State University at Jonesboro helped establish the Arkansas State Bioscience Institute Commercial Innovation Center. See the summary of the presentation by Barry Johnson in the Proceedings chapter in this volume.

56 See the summary of the presentation by Barry Johnson in the Proceedings chapter in this volume.

Cyberinfrastructure

"Cyberinfrastructure” refers to the technological infrastructure that enables scientific inquiry, and includes high performance computing, data storage systems, data repositories and advanced instruments, visualization technology and people, all linked by advanced networks.57 Dr. Amy Apon, until August 2011 the Director of the Arkansas High Performance Computing Center and Professor of Computer Science at the University of Arkansas, led an effort to establish and upgrade the state’s cyberinfrastructure by securing federal and state support.58 In 2007, Dr. Apon launched an effort to bring an outside team of experts, the External Advisory Committee, to study Arkansas’ cyberinfrastructure needs, the result of which was a recommendation that the state launch the Arkansas Cyberinfrastructure Initiative.59 In May 2008, Governor Beebe funded the Initiative through the Arkansas Science and Technology Authority, and an Arkansas Cyberinfrastructure Strategic Plan was drawn up in 2008 by members of research organizations in the state.60

In her conference remarks, Dr. Apon said that underlying the cyberinfrastructure initiative is the recognition that “computing has become the most important general-purpose instrument of science.”61 Research in fields such as nanotechnology, materials science, and human biology sometimes requires millions of hours of computing time per year.62 Arkansas deployed a major new cyberinfrastructure resource in 2008, the “Star of Arkansas,” the most powerful computer in the state, capable of storing over five times the data stored

______________________

57Arkansas Cyberinfrastructure Strategic Plan (2008).p. 3.

58 In 2004, 2007 and 2010 Apon led efforts to secure Major Research Instrumentation (MRI) award from the National Science Foundation to establish a new campus research network and upgrade the power and chilling infrastructure of the university’s data center. Clemson School of Computing, “Dr. Amy Apon Joins the School of Computing as Chair of the Computer Science Division,” undated press release, http://www.clemson.edu/ces/computing/news-stories/aapon.html

59 The External Advisory Committee was partially funded by “NSF Other” funds contributed by the University of Arkansas and the Arkansas Science and Technology Authority. The Committee was chaired by Stan Anhalt, Director of the Ohio Supercomputer Center. The committee’s work was supported by an Internal Steering Committee comprised of about 30 Arkansas leaders from the education, industry and public sectors.

60 The Strategic Plan was drafted by the Arkansas Cyberinfrastructure Advisory Committee, which was similar in membership to the Internal Steering Committee.

61 Jay Buisseau, Director of the Texas Advanced Computing Center, cited by Amy Apon, in her remarks at the conference. See the summary of her remarks in the Proceedings section of this volume.

62 Dr. Amy Apon cited research underway by Professor Peter Pulay at the University of Arkansas to study the interaction of chemicals on human protein and DNA that requires four million hours of computing per year. Assistant Professor Doug Spearot is creating three-dimensional models of alloys that do not yet exist, using 20 million or more atoms, an effort which requires six million hours of computing time per year. Nanotechnology device research by Professor Laurent Ballaiche requires 70 million hours of computing time per year. See the summary of the presentation by Dr. Apon in the Proceedings chapter in this volume.

in the entire Library of Congress.63 This infrastructure now includes the research universities of Arkansas and the four-year colleges.

CHALLENGES

Despite substantial progress in the development of a knowledge-based economy, a number of speakers pointed out that Arkansas confronts key challenges in developing a cadre of educated, skilled labor, in providing adequate venture capital for start-ups, and in securing more federal research funding. Several speakers at the conference drew attention to these challenges.

Building Human Capital

Arkansas’ labor force has won frequent praise for its work ethic, and a number of major manufacturers who have chosen to locate in the state have cited the motivation of the work force as an important factor for locating there.64 However, with an increasing need for highly educated and skilled workers, Arkansas has found that it trails other states and regions in most indices for assessing skilled human capital. In 2006, the state ranked last among the 50 states in percent of adults with college degrees. A number of executives from technology-intensive companies noted at the conference that this shortage of talent in the state requires them to establish costly training programs when they

______________________

63 Purchase of the Star of Arkansas was funded in part by an $803,306 grant from NSF, with matching funds from the University of Arkansas and in partnership with Dell Corp. Stan Anhalt, Chair of the External Advisory Committee, observed that the Star of Arkansas had “the potential to improve Arkansas’ economic future through research in areas such as natural gas production, bird flu prevention, rice irrigation, nanotechnology, large-scale transportation and commerce systems, material design, sustainability, and personalized medicine. The Star of Arkansas is eight times faster than the University of Arkansas’ other supercomputer, Red Diamond, which was acquired in 2005. University of Arkansas College of Engineering. “University of Arkansas Installing Supercomputer, ’Star of Arkansas’, to be State’s Fastest,” press release, 2008, htt ://www en r en r vark edu/home/2378 h

64 Nucor Steel has located a number of facilities in Arkansas where local hires were typically “farmers or machinery workers who have been ingrained with a strong work ethic since childhood.” Dan DiMicco, President of Nucor-Yamato Steel Co., commented on his operation in the state that “We hire good people, put them in a culture that encourages them to do well, give them the tools and the opportunity to excel and then we get the heck out of their way." “Nucor Makes Blytheville Steel Capital of the South,” Arkansas Business (December 16, 1996). Mitsubishi Power Systems Americas, Inc. cited Arkansas’ “extraordinary work ethic” as a factor underlying its decision to locate a $100 million manufacturing facility for wind turbines in Fort Smith, Arkansas. The plant’s general manager said that “we looked for a part of the country where manufacturing is not some lost art." “Mitsubishi Breaks Ground on Nacelle Facility in Arkansas,” North American Windpower (October 8, 2010).

established businesses there.65 Their remarks echo a 2006-07 survey of Arkansas business leaders where 76 percent of those surveyed said that more than half of job applicants who recently graduated from high school lacked basic math and writing skills.66

The Arkansas Task Force on Higher Education Remediation, Retention and Graduation Rates was formed pursuant to legislation enacted by the General Assembly in 2007 to study the state’s education system with an eye toward increasing the percentage of citizens with bachelor’s degrees. At that time, the percent of adults in Arkansas holding bachelors’ degrees was 22.3 percent − well below the average for the 16-state Southern Regional Education Board (SREB). While Arkansas exceeded many Southern Regional Education Board (SREB) states in the number of high school graduates entering college, a greater percentage of those entering college failed to complete bachelors’ degree programs.67

Reforming of the Public Schools

Governor Beebe and other conference speakers listed the steps that the state is taking to improve PreK-12 education. Previously, only two counties in the state produced college entering populations with the percentage of students requiring remedial math lower than 25 percent. At the University of Arkansas at Pine Bluff, the percentage of entering freshmen in 2007 requiring remedial courses was 75.5 percent for English, 84.9 percent for math, and 73.6 percent for reading.68 A 2006-07 survey of Arkansas college professors on the overall

______________________

65 See, for example, the summary of the presentation by Jeff Johnson in the Proceedings chapter in this volume. Nordex USA found that when it sought to open a manufacturing plant for wind power equipment in Arkansas, it was only able to find after five months of interviews 62 of the estimated work force of 700 who possessed sufficient skills. Because of the high level of skill required, Nordex plans to build a training academy onsite. See also the summary of the presentation by Joe Brenner in the Proceedings chapter in this volume.

66 Arkansas Department of Education, Combined Research Report of Business Leaders and College Professors on Preparedness of High School Graduates (January 2007). Similarly, the human resources manager at Kagome/Creative Foods, a food processor with a facility in Mississippi County, Arkansas, said in 2010 that despite the county’s high unemployment, it was “very, very hard to find people to work,” partly a case of “too many undereducated, unemployable youth.” Susan C. Thompson, “Factory Closing Shocks Community into Opening Wallets for Economic Development,” The Regional Economist (October 2010).

67 At the time the Task Force was formed, of every 100 students then in ninth grade, 74 would graduate from high school, 64.7 would enter college, and only 16 would graduate with an associate or bachelors’ degree within 10 years. Of 37,160 students who graduated from ninth grade in 1996, only 5,817 had achieved higher degrees by 2006. The Task Force warned that “The pipeline is broken. Can a modern economy be built upon 5,817 people?” Arkansas Task Force on Higher Education Remediation, Retention and Graduation Rates, Access to Success: Increasing Arkansas’ College Graduates Promotes Economic Development (August 2008) (“Education Task Force Report.”)

68 Education Task Force Report (2008) pp. 11, 14.

academic quality of the Arkansas public high schools in preparing students for college found that over half gave the public schools grades of D (50.2 percent) or F (9.6 percent).69

A decade ago, the shortcomings in the state’s PreK-12 educational system were sufficiently severe that the Arkansas courts declared the state’s system of school funding to be “inadequate under … The Arkansas Constitution.” The Chancery Court stated that “Too many of our children are leaving school for a life of deprivation, burdening our culture with the corrosive effects of citizens who lack the education to contribute.” The court declared that under the state’s constitution, financing must be based on the amount of funding required to provide an “adequate educational system,” and ordered a cost study.70 The Arkansas Supreme Court upheld the lower court’s decision in 2002. The net result of the Lake View decision was a substantial increase in state funding for operations and facilities in elementary and secondary schools as well as overhaul of the curriculum, increased teachers’ salaries and increased requirements for accountability from school districts. By the time of the Education Task Force’s report, these reforms were beginning to have positive effects.71 As Governor Beebe noted at in his keynote speech at the conference, Arkansas is now winning accolades for levels of per-pupil funding, test scores, transparency, accountability, standards, and increase in advanced placement students.72

The Arkansas Science Technology, Engineering and Math (STEM) Coalition is a statewide partnership of leaders from the business, government, education and community sectors to develop and implement policies to improve STEM teaching and learning. In his conference presentation, Michael Gealt of the Arkansas STEM Coalition noted that his organization is concerned with all levels of education from pre-K onward, and functions both as a think tank for ideas for improving STEM education and as a lobbying organization seeking public policies to improve STEM education. Among other initiatives, the coalition has secured funding for 27 elementary school science specialists, sought state grants to STEM teachers to increase their income, established a web

______________________

69 Arkansas Department of Education, Combined Research Report of Business Leaders and College Professors on Preparedness of High School Graduates (January 2006).

70 Lake View School District No. 25 v. Huckabee No. 1992-5318 (Pulaski County Chancery Court), May 25, 2001.

71 In 2008, over half of Arkansas students scored “proficient or above” on the state’s tests for mastery of grade-level knowledge, whereas proficiency rates a decade previously were between 20 and 40 percent. In 2007, U.S. Secretary of Education Margaret Spellings cited Arkansas and Massachusetts as two states with education reform models that other states should emulate. Education Task Force Report (2008) p. 12

72 See the summary of the keynote speech by Governor Mike Beebe in the Proceedings chapter in this volume.

portal for STEM lesson plans, and advocated differential pay for STEM teachers.73

Training and Retaining University Graduates

Arkansas has 11 four-year institutions of higher learning, two of which have research as a fundamental part of their missions, the University of Arkansas, Fayetteville and the University of Arkansas for Medical Sciences.74 Major public and private commitments have been undertaken to improve the quality of these institutions, efforts that are being reflected in a succession of national research awards and individual faculty and student achievements. In addition, the University of Arkansas at Little Rock is now classified as a Research University with high research activity, and Arkansas State University at Jonesboro is classified as a Doctoral Research University. These four constitute the “Research Universities” of Arkansas.75

The fact that Arkansas currently ranks 50th in the U.S. in the percentage of adults with a college degree is not necessarily an indication of the failure of the state’s universities; the problem is one of an out-migration of graduates. The 2009 Battelle study found that Arkansas’ university system increased the number of graduates from 12,153 in 2001 to 15,262 in 2007, a growth of nearly 26 percent. Graduates in fields related to science, math and engineering grew from 3,548 in 2001 to 4,341 in 2007, an increase of 22 percent. Most significantly, the number of doctorate degrees in science, math and engineering from Arkansas doubled during the same period, from 65 doctoral degrees to 130, a growth rate nearly double the national average, suggesting that the state’s “strong growth in research funding is translating into top-level talent creation in the state.” Health and clinical sciences led the growth in doctoral degrees.76

University of Arkansas Chancellor David Gearhart recently pointed out that while the state needs to graduate college students at a higher rate, in fact between 1989 and 2006 Arkansas produced 166,000 college graduates, “nowhere near the last place nationally.” Arkansas has ended up at the bottom of the rankings because during the same period, 42 000 of those graduates left the state, with the most beneficiaries of this migration being “states with human capital economies.” As the Chancellor framed the challenge facing the state, “if

______________________

73 See the summary of the presentation by Michael A. Gealt in the Proceedings chapter in this volume.

74 More information on assets, reach, and research expertise of the University of Arkansas system can be accessed at http://www.uasys.edu/. More information on the Arkansas State University system can be accessed at http://www.asusystem.edu/.

75 For some considerations, the University of Arkansas at Pine Bluff is considered as a fifth research university because of its research on aquaculture.

76 Battelle study (2009) op. cit., p. 5

graduates are leaving to go where those businesses already are, how do you reverse the process and attract these businesses to your region?”77

Speaking at the conference Jeff Johnson, the CEO and president of ClearPointe (a managed service provider headquartered in Little Rock), described the challenges he faced in finding local IT talent to staff his Arkansas-based company. At first the company tried “growing their own” – hiring new college graduates and putting them through six months of training before placing them in company roles. This proved to work well, he said, but at a high cost for a small company, with a significant number of employees tied up in training for extended periods. Hiring talent from out of state also was difficult.

In this regard, he noted, the creation of the Engineering and Information Technology College at UALR was a “godsend.” “We started working with the college more than three years ago, serving on the advisory council.” In the past year, Mr. Johnson and others have helped the college design a curriculum that would assure companies like ClearPointe of a steady flow of qualified applicants.

Research funding in Arkansas universities has been growing rapidly, but from a comparatively weak starting point – in effect the state is still playing catch-up. The Battelle study found that in 2007 spending on university-based R&D in Arkansas totaled $240 million, an amount equal to 0.25 percent of gross state product (GSP), and that to achieve the national average of 0.36 percent of GSP, spending would have needed to be $106 million higher. The level of funding for university research in the state had grown 70 percent between 2001 and 2007, exceeding the national average growth rate of 51 percent.78 However, the rapid growth in Arkansas university research was evident across the research spectrum (see Table 3).

TABLE 3 Growth Rate in Arkansas University R&D Funding, 2001-2007

| Field | Arkansas Growth Rate (percent) | National Average | |

| Biological sciences | 133 | 55 | |

| Physics | 94 | 31 | |

| Chemistry | 205 | 44 | |

| Other engineering | 105 | 28 | |

| Other life sciences | 443 | 50.5 |

SOURCE: Battelle Study, 2009, p. 3.

______________________

77Gearhart, David. “Arkansas 180: Teaching & Research,” http://chancellor.vark.edu/13132.php.

78 Battelle Study (2009) op. cit., pp. vi-viii.

Addressing the Venture Capital Gap

A region’s ability to foster innovative start-up companies is critical to its success in the knowledge-based economy. At present Arkansas’ ability to generate start-ups is being constrained by the shortage of venture capital financing to enable new companies to reach the commercialization stage for new technologies. As Richard Bendis noted in his presentation, many small start-ups perish for lack of funding before they can commercialize their products, a primary factor underlying the so-called “Valley of Death” phenomenon. During the early stages of product development, start-ups need access to capital, such as angel or venture financing. However, most angel investments are very small and venture capital investments have moved downstream, toward established firms already generating revenues and profits. The current average venture capital investment is $8.3 million, signifying the move away from risky start-ups that typically require only a fraction of that amount.79

The Task Force for the Creation of Knowledge-Based Jobs said in its 2002 Report that “A key element that has been missing from the entrepreneurial equation in Arkansas is the lack of venture capital to keep new, knowledge-based businesses in the state.”80 Nearly a decade later, as Dr. Mary Good observed in her conference remarks, the state has two pressing needs—to improve the access to very early state capital for start-up firms, and to raise sufficient funding for innovative initiatives.81

The Milken study found that an average of about one (0.96) Arkansas firm per 10,000 businesses received venture capital from 1993 to 2002, a rate which was one-sixth the national average. Between 2002 and 2004, the number of state firms per 10,000 businesses receiving venture capital tripled, an increase that indicated that “venture capitalists were beginning to discover the state.”82 Nevertheless, Arkansas has yet to develop strong links with private equity. Venture capital investments in the state prior to 2006 usually totaled under $10 million per year, and after a spike to $40 million in that year fell off to nearly zero in 2007-2008. Even the 2006 total of $40 million, the state’s best year for venture investment represented only 0.15 percent of U.S. venture capital investments in that year.83

In his conference remarks, Jeff Johnson, said that ClearPointe’s experience as an IT start-up in Arkansas underscores the challenges confronting local high tech start-ups. The company’s only original source of capital was its receivables. Seeking financing, in 2002 the company was chosen as a presenter

______________________

79 See the summary of the presentation by Richard Bendis in the Proceedings chapter in this volume

80Report of the Task Force for the Creation of Knowledge-Based Jobs (September 2002). P. 26.

81 See the summary of remarks by Dr. Mary Good in the Proceedings chapter in this volume.

82 De Vol et al., (2004), op. cit. p. 81.

83 See the summary of the presentation by Richard Bendis in the Proceedings chapter in this volume.

at the Arkansas Venture Capital Forum, but virtually no funding was available for IT start-ups in the wake of the bursting of the dot-com bubble. The Forum gave ClearPointe access to knowledgeable people who helped it refine its business plan and monetize its needs. This attracted financing from local banks and, as Johnson recounts, “bank loans are not the best way to start a company, but we had no other options.” The company was able to operate on a “pay-as-you go” basis until it could attract some angel backing, which in turn facilitated bank loans. Jeff Johnson identified access to funding as the company’s highest hurdle to overcome.84 And, as the Arkansas Strategic Plan points out, recent structural changes in the banking industry make it more difficult to obtain the kind of debt financing that sustained ClearPointe through its early stage development.85

According to Watt Gregory, chair of the Executive Committee of Accelerate Arkansas, a number of public and private institutions in Arkansas are working to extend financial support to start-up companies in the state. The state provides funding for extremely early stage companies through AEDC’s Targeted Business Tax Incentives and the ASTA Seed Capital Fund.86 Arkansas Capital Corporation Group (ACCG) is a private, not-for profit entity comprised of several affiliated companies dedicated to financing economic development in the state. The flagship company, Arkansas Capital Corporation (ACC), provides long-term, fixed rate loans to Arkansas businesses. Diamond State Ventures, affiliated with ACCG, provides venture capital investments ranging from $250,000 to syndicated investments up to $20 million. Another ACCG member, Commerce Capital Development Company, supervises investment tax credits provided pursuant to the Arkansas Capital Development Company Act.87 Arkansas Certified Development Corporation, also an ACCG member, administers SBA 504 loans.88 A group of angel investors created an $8 million Fund for Arkansas’ Future that provides start-up funding in the $100,000 to $500,000 range.

The Arkansas Institutional Fund (AIF) is a fund-of-funds that invests in private equity and venture capital funds directing early stage capital, traditional venture capital, later stage and expansion capital and special situations capital

______________________

84 See the summary of the presentation by Jeff Johnson in the Proceedings chapter in this volume.

85 Governor Mike Beebe’s Strategic Plan (2009) op. cit., p. 45