The statement of task for this study (see Appendix A) requested that the committee address the methodologies used in the current cost estimates for a reusable booster system (RBS), including the modeling methodology used to frame the business case for an RBS. This chapter addresses the results of the committee’s review and assessment of these issues.

The basic premise behind a new RBS for future space launch of Air Force space systems is that if such a reusable launch system, including all associated infrastructure and support services can be developed, flight-certified, and operated at an “affordable” cost (meaning substantially less costly than a present Evolved Expendable Launch Vehicle [EELV]), subsequent implementation of the new space launch system would bring a large reduction in space launch costs and, therefore, overall life cycle costs (LCC). As discussed in Chapter 2, the savings associated with use of an RBS for a national security payload manifest of 8 to 10 launches per year is estimated to be up to 50 percent of the current prices being paid by the Air Force for EELV services.

If an affordable RBS can be developed, these significant cost savings can be realized. This logical conclusion is supported using the cost history for fully developed EELVs—that is, recurring cost per launch. This cost history database includes the experience with the previous family of Air Force expendable launches—Delta II, Atlas II and III, Titan IV, Delta IV and Atlas V (the last two being part of the current EELV launcher family provided by United Launch Alliance). Review of the recurring cost histories of these launchers indicates that on average about 70 percent of the recurring costs arise from the expendable vehicle hardware that is “thrown away” during each launch.1 The rest of the launch services cost consists of operations, engineering support, and management. The 70 percent hardware cost is a weighted approximation average for all expendable launch vehicles listed above. The hardware costs actually range from a low of about 55 percent (Titan IV) to a high of about 85 percent (Delta II). This strongly suggests that reuse of the first-stage flyback booster for an RBS for, say, 50 to 100 times, with a scheduled overhaul after 10 flights and engine replacement every 20 flights, could readily result in significant cost savings, maybe upwards of 50 percent as predicted by the Aerospace Corporation cost analysis.2

_____________

1 R.L. Sackheim, Overview of United States space propulsion technology and associated space transportation systems, Journal of Propulsion and Power 22(6):1315, 2006.

2 Air Force Space and Missile Systems Center (AFSMC), “Reusable Booster System Costing, SMC Developmental Planning,” presentation to the Committee for the Reusable Booster System: Review and Assessment, February 15, 2012. Approved for Public Release.

The following subsections present the results of this assessment with the baseline cost modeling approach described and an assessment of the individual models, where possible. The chapter concludes with a discussion of the overall RBS business case.

4.1 BASELINE COST MODELING APPROACH AND ASSESSMENT OVERVIEW

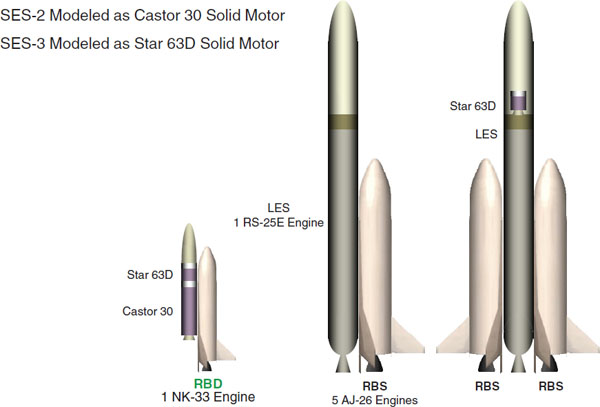

The Air Force cost modeling approach uses a mixture of models and methodologies for estimating the various RBS elements. The configurations shown in Figure 4.1 represent the baseline flight vehicle designs examined by the committee. These include the reusable booster demonstrator (RBD) to be used to demonstrate and validate various aspects of the reusable booster design and operation as well as the RBS, which includes a heavy-lift variant to support larger payloads. The costs associated with the Air Force Research Laboratory’s (AFRL’s) funding of technology development efforts, including the Pathfinder small-scale demonstrator, are not included in the baseline costing, but they are relatively small.

The committee considered a number of scenarios for RBS system development. Four of them formed the basis for the analysis:

• Scenario 1: Baseline. The EELV program is assumed to end in 2031, and RBS development occurs in a time frame that would support the entire launch manifest. RBS development includes the mid-scale RBS demonstrator and

FIGURE 4.1 RBS flight hardware elements. Major elements include the RBD, the LES, the SES, and RBS. NOTE: LES, large expendable stage; RBD, reusable booster demonstrator; RBS, reusable booster system; SES, small expendable stage. SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

assumed use of the “Americanized” version of the Russian NK-33 oxygen-rich staged combustion (ORSC) engine (i.e., a domestic AJ-26 engine). Under this baseline scenario, the time frame of the AFRL-funded hydrocarbon-fueled booster technology development does not significantly impact the booster main propulsion system.

• Scenario 2: Extended EELV. The EELV program is extended with operations until 2040, which allows completion of the AFRL-funded hydrocarbon-fueled booster technology development and development of an RD-180 replacement engine for the Atlas V. This engine would be of the thrust class of the RD-180 and would be built using technology currently under development in the AFRL Hydrocarbon Boost Technology program. This same replacement engine would be used in an RBS system. The mid-scale RBD is again assumed in the development program.

• Scenario 3: Accelerated RBS. This scenario was explored to examine implications of accelerating the end of the EELV program to 2025. This scenario uses the domestic version of the AJ-26 engine but eliminates the mid-scale RBD and proceeds directly to full-scale RBS development.

• Scenario 4: Commercial partnership. This scenario assumes a government-funded program to develop and conduct the RBD using the domestic AJ-26 engine, with the full-scale RBS developed by industry to support both Air Force and commercial spacelift needs.

Additional variations were explored within each of these four scenarios, including options to not include the heavy-lift vehicle in either the RBS development or its operations. These options were explored because the committee believes that the heavy-lift requirement places great challenges on a system that is already challenged by the technical risks discussed in Chapter 3. The requirement for a dual-reusable booster heavy-lift configuration adds significantly to the complexity of the launch system with respect to balancing structural loads, conducting safe separation, and simultaneously managing two autonomous reusable boosters in the same airspace. Given ongoing trends for smaller electronics and emerging desires and capabilities for disaggregation of large satellites, the committee believes that the heavy-lift requirement should not drive the basic conceptual design for the RBS, because this requirement may disappear in the future or be addressed with alternative space lift capabilities. Thus, the committee explored cost options that pose no heavy-lift requirement for the RBS.

An additional factor that requires consideration is the existing Air Force requirement for two independent launch capabilities to meet its assured-access-to-space goal. The scenarios described above are all based on the assumption that the current EELV launch systems would be fully retired and that the RBS satisfies the complete Air Force launch manifest. In this case, a problem identified in the RBS system could potentially jeopardize the entire Air Force launch capability. One possibility for avoiding this possibility would be to maintain the Delta IV production capability and use this launch system to satisfy the heavy-lift requirement.

The evaluations to follow principally focus on Scenarios 1 and 4. Scenario 2 allows for development of the hydrocarbon engine technology prior to proceeding with RBS development, so any decision regarding RBS development would be delayed for several years. This use of an RD-180 replacement engine would complicate the RBS vehicle design by requiring large engine throttling, as discussed in Chapter 3. Scenario 3 was also not addressed in detail as it was viewed by the committee as being too risky given the existing concerns about the rocketback return-to-launch-site (RTLS) maneuver. In the evaluations that follow, a subdesignation “-A” is used for a modification to the baseline scenario that does not include the RBS-heavy variant. In these scenarios, the implications of carrying the alternative heavy launch system were not factored into the cost analysis.

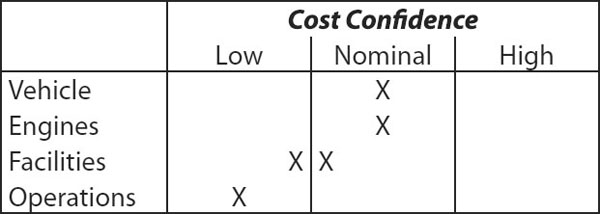

The costing analysis covers a 47-year life cycle (2014-2061), with EELV costs provided by the Air Force’s Space and Missile Systems Center (SMC) Launch and Range Systems Directorate and RBS costs estimated by the SMC’s Developmental Planning Directorate. The approaches used for the RBS cost estimates are shown in Table 4.1. The NASA/Air Force Cost Model (NAFCOM) is used for the costs of design, development, test and evaluation (DDT&E), and production and contractor proprietary approaches are used for cost estimations of the vehicle and engines. The Aerospace Corporation’s operations design model and its facilities model are used for operations and facilities.

A conservative approach was taken to the flight rate assumption. Air Force analyses are based on only eight flights per year, with one heavy-lift payload every year, and commercial markets were not considered. The mission model for the assumed flight rate is provided in Table 4.2.

TABLE 4.1 Summary of Reusable Booster System Cost Estimating Approaches

|

Cost Category |

Cost Model/Method |

|

DDT&E |

|

|

RBD (Except NK-33 Engine) |

NAFCOM |

|

RBS |

NAFCOM |

|

AJ-26 Engine Development |

Contractor estimate + OGC |

|

LES |

NAFCOM |

|

RS-25E Engine Development |

N/A—NASA developed |

|

Castor 30 (Mods for Side Mounting) |

NAFCOMa |

|

Star 63D (Mods for Side Mounting) |

NAFCOMa |

|

ΔDDDT&E (After Flight Test Program) |

NAFCOM |

|

Production |

|

|

RBS |

NAFCOM |

|

AJ-26 Engines |

Contractor estimate + OGC |

|

LES |

NAFCOM |

|

RS-25E Engines |

Contractor estimate + OGC |

|

Castor 30 |

NAFCOM |

|

Star 63D |

NAFCOM |

|

Facilities |

|

|

SLC-2W for RBD (VAFB) |

VAFB estimate + OGC |

|

SLC-3E (VAFB) |

Facilities modelb |

|

SLC-41 (CCAFS) |

Facilities modelb |

|

New Facility (CCAFS) |

Facilities modelb |

|

Operations and Sustainment |

|

|

RBD Flight Test Program |

ODMb |

|

RBS Flight Test Program |

ODMb |

|

RBS Launch Operations |

ODMb |

|

RBS Mission Integration |

Based on EELV data |

|

RBS Transportation |

Based on EELV data |

|

Range Costs |

Based on EELV data |

|

Sustainment |

Based on EELV data |

a Used first unit production cost as mod estimate

b Aerospace model

NOTE: CCAFS, Cape Canaveral Air Force Station; DDT&E, design, development, test and engineering; EELV, Evolved Expendable Launch Vehicle; NAFCOM, NASA/Air Force Cost Model; ODM, Operations Design Model; OGC, Other Government Costs; VAFB, Vandenberg Air Force Base.

SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

Other key assumptions in the cost assessment include these:

• A production learning rate of 95 percent for the RBS and large expendable stage (LES) and 98 percent for the solid motors,

• A 10-flight interval between depot maintenance (with engine replacement after every 20 flights), and

• A 5-year overlap of RBS operations with EELVs.

4.2 ASSESSMENT OF BASELINE COST MODELING

To assess the approach used for cost modeling, RBS costs have been divided into four areas: vehicle, engine, facilities, and operations. The cost estimates for each are based on different approaches, as described below. While there is a strong interrelationship among these elements, the linkages are captured only to the degree that

TABLE 4.2 Basis for Reusable Booster System Flight Rate

| Satellite Type | Orbit Requirement | EELV Used | Average Annual Rate | |

| Communications | GTO | Atlas V 531 | 0.64 | |

| Meteorological | GTO | Atlas V 501 | 0.25 | |

| SSO | Delta IV M | 0.32 | ||

| Navigation | MEO | Atlas V 401 | 1.96 | |

| Missile warning | GTO | Atlas V 411 | 0.31 | |

| SSO | Delta IV M | 2.12 | ||

| Intelligence | LEO (high inclination) | Delta IV M+(4,2) | 0.20 | |

| LEO (high inclination) | Delta IV H | 0.29 | ||

| LEO (high inclination) | Atlas V 541 | 0.20 | ||

| HEO | Atlas V 551 | 0.29 | ||

| Polar | Delta IV H | 0.29 | ||

| Polar | Atlas V 401 | 0.16 | ||

| GTO | Delta IV M+(5,4) | 0.50 | ||

| GEO | Delta IV H | 0.50 | ||

| Average annual launch rate | 8.00 | |||

NOTE: EELV, Evolved Expendable Launch Vehicle; GEO, geosynchronous Earth orbit; GTO, geosynchronous transfer orbit; HEO, high Earth orbit; LEO, low Earth orbit; MEO, medium Earth orbit; SSO, Sun-synchronous orbit.

SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

the lower-level models can identify them. All models are largely based on historical expendable vehicles and are therefore significantly handicapped by the lack of good analogous data for unmanned RBS-type reusable systems.

The vehicle estimates cover DDT&E and production costs for all flight hardware except the engines. The flight hardware includes the RBD, the RBS, and LES subsystems (less engines).

4.2.1.1 Models

The NASA/Air Force Cost Model (NAFCOM)3 was used for all vehicle estimates. NAFCOM is a parametric cost estimating model based on a database of historical NASA and Air Force launch and space systems. The committee believes that NAFCOM is an appropriate tool for this application and the maturity level of the concept, although a bottoms-up cost estimating approach would further enhance credibility of the cost estimates.

4.2.1.2 Inputs and Assumptions

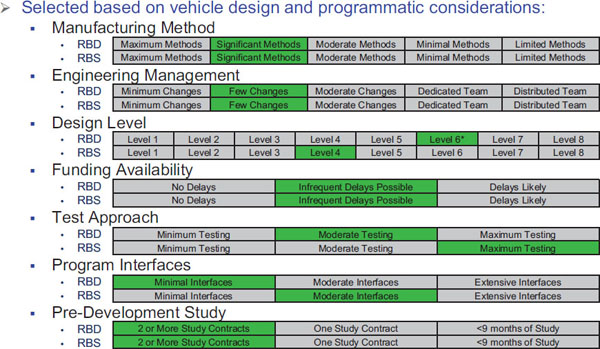

The inputs to NAFCOM include subsystem-level masses and other system characteristics. For the baseline RBS concept, the system masses are shown in Table 4.3. The other system inputs that serve as NAFCOM inputs include factors accounting for system maturity and program management approach. The cost implications of these factors are based on historical programs. Specific input factors include the following:

• Manufacturing method. This factor accounts for the identification and maturity of the manufacturing methods used in the production process and aims to address the level of use of advanced manufacturing techniques.

_____________

3 J. McAfee and G. Culver, SAIC, and M. Naderi, NASA Marshall Space Flight Center, “NAFCOM Capabilities and Results,” presentation at the 2011 Joint Army Navy NASA Air Force (JANNAF) Modeling and Simulation/Liquid Propulsion /Spacecraft Propulsion Joint Meeting, Huntsville, Al., December 5, 2011, available at http://ntrs.nasa.gov/archive/nasa/casi.ntrs.nasa.gov/20120002891_2012002403.pdf.

TABLE 4.3 Reusable Booster System Mass Breakdown to Support NASA/Air Force Cost Model Estimates

| Elements | RBD | RBS | LES | Castor 30 | Star 63D |

| Weight (lb) | Weight (lb) | Weight (lb) | Weight (lb) | Weight (lb) | |

| Structures and Mechanisms | 14,673 | 60,180 | 22,866 | 246 | 0 |

| Vehicle Structures and Mechanisms | 10,271 | 42,567 | 12,742 | - | - |

| Tank Structures and Mechanisms | 4,402 | 18,243 | 10,124 | - | - |

| Thermal Control | 0 | 0 | 949 | 37 | 9 |

| Reaction Control Subsystem | 303 | 1,143 | 118 | 74 | 44 |

| Main Propulsion System (less engines) | 1,825 | 9,423 | 3,611 | - | 0 |

| Electrical Power and Distribution | 1,697 | 3,876 | 999 | 222 | 91 |

| Command, Control, and Data Handling | 1,672 | 1,672 | 236 | 259 | 60 |

| Guidance, Navigation, and Control | 293 | 293 | 177 | 123 | 30 |

| Landing System | 1,884 | 6,002 | - | - | - |

| Rocket Engines/Motors | 3,079 | 22,221 | 8,835 | 1,503 | 370 |

| Dry Weight | 25,426a | 105,441a | 37,790a | 2,464 | 604 |

| Gross Lift Off Weight (GLOW) | 176,955 | 992,857 | 397,890 | 37,343 | 7,771 |

| Dimensions (ft) | Dimensions (ft) | Dimensions (ft) | Dimensions (ft) | Dimensions (ft) | |

| Length | 63.0 108.4 | 130.3 | 29.7 | 12.0 | |

| Wingspan | 35.0 60.1 | - | - | - | |

| Diameter | 9.5 16.1 | 15.0 | 7.7 | 7.7 | |

| Height (landing gear up) | 20.0 33.8 | - | - | - | |

| Height (landing gear down) | 23.7 40.9 | - | - | - | |

a Includes 25% dry weight margin.

NOTE: LES, large expendable stage; RBD, reusable booster demonstrator; RBS, reusable booster system.

SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

The use varies from minimum to maximum use of manufacturing techniques such as just-in-time delivery, bar coding, robotics, commercial-off-the-shelf items, and outsourcing.

• Engineering management. This factor accounts for the variation in management approaches, from streamlined activities with minor expected changes to a widely distributed team with formalized procedures and managed interfaces. At one end of the spectrum is the assumption of a minimum number of design changes, with the design team making maximum use of the highly efficient Skunk Works approach with integrated product teams, rapid prototyping, design to cost, and the like. At the opposite end of the spectrum is the assumption of a distributed design team just waiting for major technology advances and hoping they will bring frequent major requirement and design changes.

• Design level. This factor accounts for the maturity of the vehicle design and depends on what is inherited from previous projects. A high design level value indicates that the system has little inheritance from previous projects, and vice versa. Choices for the design level range from very low values, which represent the reflight of an existing vehicle, to moderate values, which represent significant modifications to an existing design, and through high values, which represent a totally new design.

• Funding availability. This factor accounts for the potential of program development delays due to funding limitations, which create inefficiencies in execution. Choices for funding availability include these: funding is assured and no delays are expected; delays are possible but infrequent; or funding is constrained and delays are likely.

• Test approach. This factor accounts for variation in the degree of testing required during system development and reflects the amount of risk being accepted and indicated by the planned test program. Choices for test approach include minimum testing, with qualification using simulation and analysis; moderate testing, with qualification at the prototype/protoflight level; or maximum use of testing with qualification at component level.

• Program interfaces. This factor accounts for the degree to which interfaces external to the development program impact launch system design and development and reflects the expected number of interfaces with multiple contractors and/or centers. Options include low or high number of major interfaces involving multiple contractors and/or centers.

• Pre-development study. This factor accounts for the depth of analysis supporting the vehicle design and reflects the level of study efforts that were conducted or are being conducted before the start of design and development. Choices for the predevelopment study level include two or more study contracts in phases A and B, with more than 9 months of study; one study contract with between 9 and 18 months of study; and less than 9 months of prephase C and D study.

Two factors not considered by the NAFCOM costing methodology are the breadth of the supplier base, particularly the implications of relying on single-source suppliers, and the degree to which the commercial market may influence future launch costs. The implications of reusable boosters for the U.S. launch industry are difficult to predict. The baseline RBS program assumes eight boosters would satisfy Air Force needs over the entire RBS life cycle. Cost models for the sustainment of these vehicles and the associated industrial support that will be required are largely absent. The potential implications for the commercial market are addressed in the next section.

The committee evaluated the NAFCOM inputs used by the Air Force in its costing analysis for the other system characteristics, which are shown in Figure 4.2. The committee agrees that these input factors are appropriate given the state of the RBS concept.

FIGURE 4.2 Additional NASA/Air Force Cost Model inputs for other characteristics. NOTE: RBD, reusable booster demonstrator; RBS, reusable booster system. SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

4.2.1.3 Results, Sensitivities, and Uncertainty Ranges

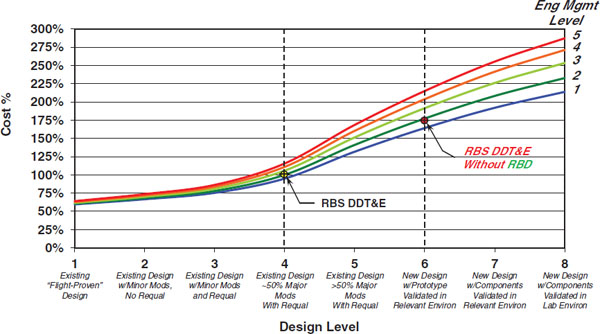

Sensitivities of vehicle cost to assumed design heritage and engineering management are shown in Figure 4.3. Clearly, DDT&E costs are significantly reduced as a result of the RBD effort, which results in a higher confidence in the RBS vehicle design as the program enters full-scale development. Potential variations in the RBS assumptions used for the NAFCOM inputs covering design heritage (design levels 1-8) and engineering management (management levels 1-5) appear to show a potential for RBS DDT&E estimates to increase by 50-100 percent, although the assumptions used for the baseline cost appear reasonable.

The engine estimates cover DDT&E and production. For the RBD, a NK-33 engine is used with Castor 30 and Star 63D solid motors in the second stage. The RBS uses five AJ-26 engines in the reusable first stage and an RS-25E engine for the expendable second stage. The reusable AJ-26 engines are assumed to be refurbished every 10 flights and replaced every 20 flights.

4.2.2.1 Models

The models and methodologies used to generate cost estimates for the engines are contractor-proprietary. These models are generally accurate when based on similar applications, although they rely on assumptions about reusability requirements, which carry some uncertainty.

FIGURE 4.3 Sensitivities to NASA/Air Force Cost Model inputs normalized to the baseline RBS design, DDT&E program. Sensitivity of cost to the design maturity (e.g., whether or not requalification of an existing design, Requal, is needed) and Engineering Management Level needed for program execution. NOTE: DDT&E, development, test, and evaluation; RBD, reusable booster demonstrator; RBS, reusable booster system. SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

4.2.2.2 Inputs and Assumptions

The specific inputs and assumptions for cost modeling of the engines were not provided to the committee because they are proprietary.

4.2.2.3 Results, Sensitivities, and Uncertainty Ranges

Engine cost estimates were provided to the committee and were included in its analyses. However, the data are considered sensitive and raw data are not included in this report.

The facility estimates cover the costs of the initial construction/modification efforts to support all RBD and RBS operations.

• Models. The Aerospace Corporation’s facility model4 was used to generate all facility estimates. This model accounts for the sharing of common items at each launch site, includes site preparation/utilities/activation costs, and also accounts for site-specific cost differences.

• Inputs and assumptions. For the RBD, modifications to the Vandenberg Air Force Base (VAFB) SLC-2W launchpad represent the only facility investment. For the RBS, one new launchpad and modifications to the SLC-41 are planned at Cape Canaveral Air Force Station (CCAFS), as well as modifications to the SLC-3E launch pad at VAFB.

• Results, sensitivities, and uncertainty ranges. Facility estimates were evaluated by the committee. These estimates appear to reasonably reflect the assumptions used, but there is some uncertainty about the impact of reusability requirements, as discussed in Chapter 3.

Operations estimates cover all labor and support required for flight operations and vehicle turnaround tasks. Costs for expendable hardware and RBS vehicle refurbishment add to operation costs but are estimated using different methodologies.

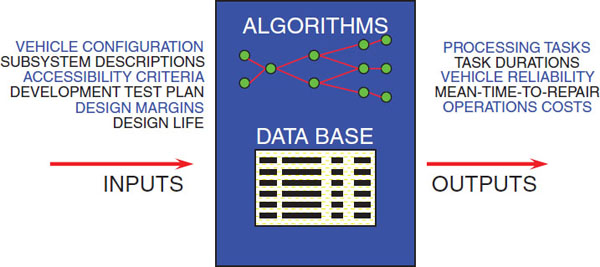

• Models. The Aerospace Corporation’s operability design model5 was used to estimate operations costs. The general approach is depicted in Figure 4.4.

• Inputs and assumptions. Estimates are based on a buildup from 188 shuttle-like tasks needed to prepare the reusable booster for its next launch. The effort needed to support each of these tasks is based on an expected level of operability improvement attributable to a design or approach difference.

• Results, sensitivities, and uncertainty ranges.Table 4.4 shows the staffing results from the Air Force analysis. In the opinion of the committee, these staffing levels seem slightly below what would be expected in that they are slightly below those existing EELV operations. In the committee’s view, it was not clear that the requirements associated with reusability, such as postflight checkout and refurbishment, were adequately reflected in the staffing analysis. The experience that will be gained from the RBD effort is likely to help in better refining these estimates. Table 4.5 shows cost estimate sensitivity to turnaround time. This sensitivity is not significant, unlike in past studies of reusable launch systems, largely because the relatively low assumed flight rate does not put great pressure on the launch vehicle processing schedule.

_____________

4 AFSMC, “Reusable Booster System Costing, SMC Developmental Planning,” 2012. Approved for Public Release.

5 AFSMC, “Reusable Booster System Costing, SMC Developmental Planning,” 2012. Approved for Public Release.

FIGURE 4.4 Aerospace Corporation’s operability design model. SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

TABLE 4.4 RBS Staffing Estimatesa

| Category | RBS Personnel Estimates | Atlas I/II | Delta II | Titan IV | ||

| CCAFS | VAFB | Common | ||||

| Vehicle processing (“Hands-On Labor”) | 43 | 43 | — | |||

| Vehicle engineering | — | — | 15 | |||

| Payload Integration | 8 | 8 | 4 | |||

| Flight Operations/Mission Operations | 7 | 7 | 5 | |||

| Flight Software Engineering | — | — | 12 | |||

| Logistics | 8 | 8 | 5 | |||

| Launch Support Equipment | 18 | 18 | 6 | |||

| Facilities Maintenance | 14 | 14 | 8 | |||

| Landing Site Ops | 22 | 22 | — | |||

| Administration | 6 | 6 | — | |||

| Total | 126 | 126 | 55 | |||

| 307 | 325b | 175b | 1,336b | |||

a Assumes all contractor workforce.

b From C.L. Whitehair, Cost of Space Launch Systems, Aerospace Corporation, June 1994.

NOTE: CCAFS, Cape Canaveral Air Force Station; VAFB, Vandenberg Air Force Base.

SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

TABLE 4.5 Cost Sensitivity to Launch Processing Time

| Launch Processing Crew-Hours | Variable Operations Cost (at 8 per year) | Fixed Operations Cost | Average Operations Cost Per Launch (at 8 per year) | Total Cost Including Production |

| 1X | 1X | 1X | 1X | 1X |

| 2X | 1.06X | 1.05X | 1.06X | 1.02X |

| 5X | 1.28X | 1.13X | 1.22X | 1.07X |

| 10X | 1.50X | 1.23X | 1.38X | 1.12X |

SOURCE: Air Force Space and Missile Systems Center, SMC Developmental Planning, “Reusable Booster System Costing,” presentation to the committee, February 15, 2012. Approved for Public Release.

4.2.5 Cost Modeling Assessment Summary

A high-level qualitative assessment of the committee’s cost confidence for the various RBS elements is summarized in Figure 4.5. Without a grassroots-type cost estimate to balance the uncertainties in a NAFCOM-based approach, it is difficult to have much confidence in the estimates. Estimates for the engines may be considered comparable to a grassroots cost estimate, since the providing organizations developed the estimates but uncertainties related to the impacts of reusability requirements somewhat reduce confidence.

These estimates appear to be based on somewhat optimistic assumptions regarding the reuse of existing infrastructure and the need for new facilities to support reusability. Labor estimates for operations appear lower than would be expected for a reusable system, as they are nearly the same as those applied for EELVs, which one would expect to have lower operability requirements since the entire launch vehicle is expendable.

4.3.1 Approach and Assumptions

For this study, the RBS business case compares the costs for the RBS system, using the Air Force cost methodology, with the projected costs for competing expendable launch vehicles, including commercial vehicles. It is noted that the very conservative launch rate (eight launches per year) can strongly impact the economic attractiveness of reusable concepts.

4.3.2 Results, Sensitivities, and Uncertainty Ranges

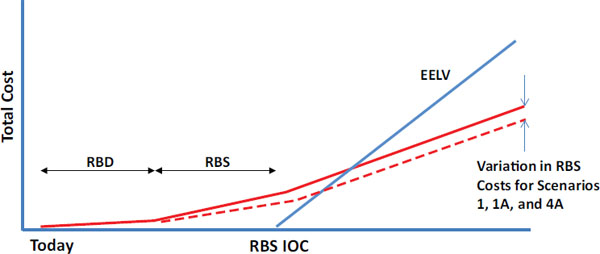

Figure 4.6 compares estimated cumulative costs for RBS under these scenarios to current cost projections for EELVs, with each scenario supporting eight flights per year. This comparison assumes RBS initial operating capability (IOC) in 2032, so that is where costs for the EELV also begin in this comparison. The costs used for the EELV are today’s costs adjusted for inflation. Scenarios 1, 1A, and 4A were considered, the red curves illustrate the resulting variations in cumulative costs, with the 4A scenario represented by the lower curve. It can be seen that removing the heavy-lift requirement for the RBS does not have a first-order impact using the existing costing approach, but the committee believes that the heavy-lift requirement will indeed introduce significant technical risks that are not captured in the cost models.

Note that the development costs for the RBD and the full-scale RBS occur in parallel with existing EELV operations (ongoing costs associated with EELV during RBS and RBS development are not shown in Figure 4.6), so that they have a claim on funding beyond that required for planned operations. Also, note that the cost break-even point for RBS is reached relatively soon after IOC independent of the scenario evaluated. Thus, once the sustained investment has been made in developing the RBS capability, the savings relative to EELV are realized fairly quickly.

FIGURE 4.5 Summary of confidence in assessments of cost.

FIGURE 4.6 Comparison of reusable booster system costs to EELV costs. NOTE: EELV, Evolved Expendable Launch Vehicle; IOC, initial operational capability; RBD, reusable booster demonstrator; RBS, reusable booster system.

These results are largely in agreement with the cost modeling presented to the committee by the Air Force and The Aerospace Corporation, although it is noted that these cost trends do not account for the Air Force requirement for two independent launch systems. If some version of the EELV was maintained to satisfy that requirement, the slope of the red curves would be steeper and the break-even costs relative to those for the EELV system would push to later dates.

There are varying degrees of uncertainty regarding the estimates for each of the RBS elements, especially with respect to the technical risk areas identified in Chapter 3. These uncertainties mean the amount of funding required to reach IOC has a reasonable likelihood of growing significantly. Also, if the costs required to support each flight increase, this would further increase the slope of the cumulative funding curve, potentially pushing the potential break-even point further out. There would be improvement in the confidence of the cost picture if RBS operability improvements could be validated and especially if costs for EELVs continue to grow beyond inflation.

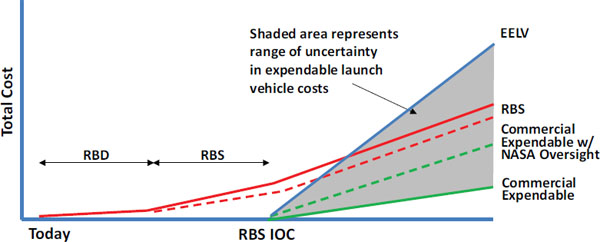

4.3.3 Impact of Commercial Activities

The greatest cost uncertainty affecting the RBS business case is from impacts of commercial activities. Advertised pricing for a SpaceX Falcon 9 EELV medium-class commercial launch is currently $54 million (in fiscal year 2010 dollars). Also, SpaceX has a contract with NASA for 12 launches to the International Space Station (ISS) for $1.6 billion, which works out to about $133 million per launch. While many ISS-unique requirements do not typically apply to unmanned payloads, this latter cost may be considered representative of a commercial effort with substantial government oversight. The expected expendable launch costs for Department of Defense missions, with anticipated levels of government oversight typical of those for meeting the mission assurance requirement, are expected to be still higher. Conversely, development of a commercial launch capability that can satisfy Air Force launch requirements may lead to true competition and lower overall costs.

Figure 4.7 compares several hypothetical cases along with the information that was shown in Figure 4.6. The green lines now represent the costs for satisfying the Air Force launch manifest with either a commercial expendable launch vehicle operating on commercial principles or the expendable launch vehicle operating with government oversight, as represented by NASA missions to the ISS. Significantly, the costs of the expendable system never cross the RBS cumulative cost curve. There are probably several reasons for this. First, the Air Force would not have paid for vehicle development in the case of the commercial vehicles, so the latter expendable vehicles would begin with a cost advantage in cases where their development costs are expected to be recapitalized across a cus

FIGURE 4.7 RBS cost compared to costs of EELVs, commercial, and other options. NOTE: EELV, Evolved Expendable Launch Vehicle; IOC, initial operational capability; RBD, reusable booster demonstrator; RBS, reusable booster system.

tomer base larger than just the Air Force. Second, this comparison is being conducted between an existing system and a conceptual RBS design, and the NAFCOM costing models provide factors to account for design immaturity. Third, NAFCOM’s supporting database was developed using information from previous government-led programs, so its cost estimates may not account for entrepreneurial approaches to developing new launch capabilities. And finally, the RBS costing methodology does not account for the cost pressures associated with a launch service provider competing in the commercial market.

The commercial lines shown in Figure 4.7 represent the lower end of the potential cost spectrum associated with satisfying Air Force launch requirements. As previously stated, satisfying Air Force mission assurance requirements may result in launch costs even higher than those realized in missions executed with NASA oversight. So in this regard, the entire range of expendable launch vehicle costs can be considered to be the range of cost uncertainty.

Given the existing uncertainties in the costing associated with expendable launch vehicles, the business case for RBS development is not as clear as portrayed in Figure 4.6 when RBS costs are compared to today’s EELV operations. Today, a number of commercial organizations are pursuing a wide variety of innovative launch vehicle concepts, and emerging commercial market forces may well challenge historical costing methodologies.

4.4 OTHER ISSUES AND COST CONSIDERATIONS

Other factors may also affect the viability of the RBS program both from the positive and negative standpoints. For example, there would ordinarily be clear benefits to the government for maintaining multiple options to meet launch needs, and the Air Force has a stated requirement for two independent launch systems for satisfying mission assurance criteria. Studies have shown cost benefits of from between 10 and 50 percent assuming a competitive market environment and continuous competition.6 Relying on a single system or launch service provider takes away the benefits of this competition. The potential advantages from competition, however, need to be tempered by the very small number of launches that the Air Force model assumes. The fixed prices associated with maintaining an industrial base for such a limited number of launches would likely more than offset any cost advantages here. Thus, maintaining two independent launch systems may significantly increase the projected costs associated with

_____________

6 R. Nash, “The case for competition in government acquisitions,” Daily Caller, June 18, 2012, available at http://dailycaller.com/2011/02/15/the-case-for-competition-in-government-acquisitions/#ixzz1yBhAuofP; G.G. Daly, H.P. Gates, and J.A. Schuttinga, “The Effect of Price Competition on Weapon System Acquisition Costs,” Paper P-1435, Institute of Defense Analysis, September 1979.

future scenarios using RBS. Conversely, development of a commercial launch capability that can satisfy Air Force launch requirements may lead to true competition and lower overall costs.

In addition, this analysis essentially accepts the feasibility and success of a reusable booster system in the time frames suggested by the Air Force projections. However, previous chapters have detailed a number of important technical areas (as, for example, with the rocketback maneuver) where considerable uncertainty exists about technology and timing. Additionally, persistently unstable funding may also delay technology development. Major delays in overcoming technological hurdles would significantly and negatively affect the cost trade-offs and breakeven points shown in previous charts. Technology maturity levels therefore would add another level of uncertainty to the balance of the cost equations between RBS and EELVs.