How Competitiveness Can Be Achieved: Fostering Economic Growth and Productivity

Ralph Landau

We hear much about the lack of competitiveness of the United States, but seldom is this concept defined, except in terms of international trade balances and market share.1 It is obvious that this country could improve its trade balance if we reduced the wages and living standards of the American working population to those in Mexico, China, or Brazil, but this would not make America more competitive. What we should mean by competitiveness, and thus the principal goal of our economic policy, is the ability to sustain, in a global economy, a socially acceptable rate of growth in the real standard of living of the population with a politically acceptable fair distribution, while efficiently providing employment for those who can and wish to work, and doing so without reducing the growth potential in the standard of living of future generations. This last condition constrains borrowing from abroad, or incurring excessive future tax or spending obligations, to pay for the present generation's higher living standard. As discussed below, such criteria for competitiveness have historically been best realized in industrialized countries by a healthy annual increase in labor force productivity in which the United States has been the leader for most of the past century, and still is in absolute level.

If the U.S. economy could be isolated so that international trade balances were not significant and domestic capital needs were met by domestic savings, these growth criteria for the economy would still apply, but policy could be adjusted more easily to reflect domestic political preferences, such as in targeting interest and inflation rates. Now, with trade in goods and services constituting almost 20 percent of gross national product (GNP), that is, the sum of exports

and imports, and the country importing approximately $110 billion of capital in 1989,2 the previous freedom to set policy is no longer possible. The country must be able to pay for its essential imports (of goods, services, and capital) by exports, and thus international competitiveness and growth in domestic living standards cannot be separated from each other. It is important to examine briefly the changes in the international economy since the Second World War, to understand both this growing economic interdependence among nations and the resulting changes in economists' views of appropriate policy options.

During the first 20-25 years after the war, the United States enjoyed an essentially unlimited economic horizon. Propelled by the head start this situation permitted, real U.S. gross domestic product— GDP—(which differs slightly from GNP by omitting net factor incomes from abroad), tripled since 1950 and income per capita almost doubled; meanwhile real GDP of the world, aided by the United States to recover from the war, quadrupled. The United States relied on domestic savings to meet its domestic capital needs, exported capital to the recovering countries, and used macroeconomic policy to adjust demand to cyclical changes. Supply could—and did—take care of itself through the vigorous activities of the private sector.

World trade in this period grew sevenfold and enhanced this remarkable economic growth. Indeed, systematic empirical research indicates that a closed economy is ultimately a low growth economy (Grossman and Helpman, 1990). There are compensating advantages to greater participation in the world economy, such as the opportunity for nations to specialize in areas particularly advantageous to them, even though other nations have caught up and become strong competitors. Trade permits achievement of economies of scale in strong industries, and raises the level of consumer welfare by providing a greater diversity of goods and services of higher quality. Trade provides greater opportunities for exploiting research successes made in one country in other countries, first by trade and then by local manufacture. These advantages can likely become even larger as the rest of the world becomes more prosperous and provides additional markets for our goods, services, and investments.

Nevertheless, it is clear that the arena of U.S. firms and entrepreneurs has irrevocably changed. International capital and technology flows have become global and in many cases virtually instantaneous. Therefore, domestic freedom to control national destinies, formerly taken for granted, is increasingly constrained by the disciplines of the international capital markets, as well as by the trade in goods and services. On the other hand, fiscal and monetary policies, as well as

those dealing with trade, legal, tax, financial, and other matters, vary widely among countries.

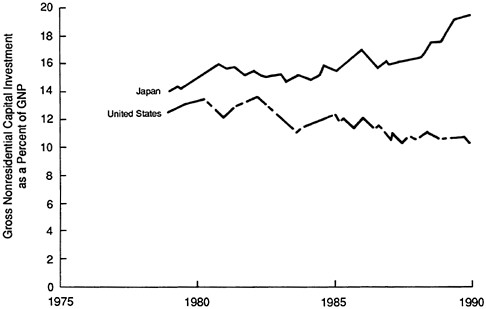

At the same time, the world continues to develop extraordinary new technologies that promise to substantially raise global living standards. The age of the computer has just started, but it has already penetrated widely (Figure 1). Telecommunications via satellite and fiber optics are binding the world together at an ever-increasing rate. Robotics provide the means to eliminate hazardous and boringly repetitious tasks. The biotechnology revolution has hardly begun, but already its potential to affect human health and improve productivity in farm and factory is immense. Superconductivity is certain to play a major role in the twenty-first century; new materials are penetrating realms as diverse as medicine and aerospace; new catalysts and pharmaceuticals are improving the efficiency of industry and the human body. Many of these developments are American. To be a scientist or technologist today is to be at the frontier of human explorations

FIGURE 1 The impact of technology on economic development: new processes, products, and services. Source: The Technological Dimensions of International Competitiveness. Prepared by the Committee on Technology Issues that Impact International Competiveness, National Academy of Engineering, Washington, D.C., 1988, p. 14.

and aspirations, but we must be cognizant of the economic and social limitations on such exciting prospects. What in this should or does make us worry?

From 1870 to 1984, the country's average real growth rate in GDP, was about 3.4 percent per year; from 1948 until recently it exceeded this level. This growth was accomplished mainly by a growth rate of about 2 percent per year in real income per person in the United States and the rest by average growth rate in population. Standards of living nearly doubled between generations. The United States surpassed the United Kingdom, the one-time leading industrial power, whose per capita real income grew at only 1 percent per year. Today, the United Kingdom is not even the leading member of the Common Market. On the other hand, starting with the Meiji restoration of 1868, Japan has recently exceeded even the high American growth rate. With an annual real GDP growth rate of more than 6.9 percent from 1952 to 1987, it has become the second largest economy in the world.

Such dramatic reversals underscore the power of compounding over long periods of time. Differences of a few tenths of a percentage point, which may not appear very significant in the short term, are an enormous economic and social achievement when viewed in the long run. For example, an increase of only 2.5 percent in the annual growth rate (which means raising the growth rate of GDP by less than 0.1 percentage point per year) will double the standard of living per capita in less than 30 years (a generation) with a constant population. Thus, it is of concern that since 1979 the U.S. real annual GDP growth rate has averaged only about 2.75 percent, with substantial year-to-year fluctuations, and with an almost static per capita real income, despite a more than seven-year economic recovery. Will the United States follow the fate of the United Kingdom, while Japan and the Far East, or post-1992 Europe (aided by the appearance of new markets in Eastern Europe) eventually outdistance it? Or can it maintain a prominent stance of economic, and strategic leadership, which its unique position of being both an economic and a military superpower demands of it? The answer to this question is not at all clear, and this alone is a reason for worrying.

Both economic evidence and historical experience suggest that sustained economic growth does not come from only doing more of what we already do, although in a global economy we must capitalize on existing technologies more fully and more rapidly than ever. For 100 years, our economy grew because we made the capital investments necessary to exploit great discoveries such as machine tools, the electric motor, petroleum exploration and refining, and semiconductors, to

name but a few. Our poorer recent growth performance cannot be attributed to a dearth of new investment opportunities now. To achieve more rapid economic growth, the promise of the new technologies must also be realized, but it cannot be accomplished without taking into account the historical realities under which new technology is applied.

THE ROLE OF TECHNOLOGICAL CHANGE IN GROWTH

The United States could have achieved its growth in per capita real income (1) by using more resources, or (2) by getting more output from each unit of resources (increasing the productivity). How much of the long-term rise in per capita incomes is attributable to each? The surprising answers emerging in the 1950s indicated that long-term economic growth (since the Civil War) had not come from simply using more and more resources, that is, capital and labor, but rather, overwhelmingly (85 percent) from using resources more efficiently. Many attached the label ''technical change'' to that entire residual portion of the growth in output which cannot be attributed to the measured, weighted growth in inputs and thus equated it to the growth in productivity. Certainly, however, many social, educational, and organizational factors, as well as economies of scale and resource allocation, also affect productivity. Stanford's Moses Abramovitz (1956), who published some early studies of this nature, called it "a measure of our ignorance."

Out of this work came the detailed growth accounting studies of the 1960s and 1970s, based on the neoclassical growth theory of Robert Solow (1957) at the Massachusetts Institute of Technology. This theory holds that in a perfectly competitive economy, in the long-run steady state, the rate of growth is independent of the saving (or equivalently the investment) rate; in other words, growth is independent of the proportion of output that is reinvested. These studies, led by Edward Denison of the Brookings Institution, Zvi Griliches and Dale Jorgenson of Harvard University, and John Kendrick of George Washington University, sought to reduce the residual by identifying some of its components and measuring the inputs more accurately.

In all these studies, the strangest aspect was that the actual sizable growth rates in the industrial countries constituted a remarkable economic phenomenon: a tribute to the dynamic performance of capitalist economies, especially significant in view of the collapse of the socialist economies in the 1980s and the reevaluation of Soviet growth rates to an essentially stagnant or declining level. And yet, because the technology, the residual, was assumed in this theory as exogenous,

not a product of traditional economic activity, it appeared that a large part of this remarkable accomplishment was unknowable, generated somewhere outside of the economy!

Economists responded to this challenge by studying the American economy from various perspectives. Some of the group mentioned above tried to relate technological change to economic forces, and thus sought in effect by various approximations to endogenize or integrate the measured phenomena into the rest of the economy. The residual was thus a summary, at the aggregate or macroeconomic level, of forces occurring at the micro level of firms and individuals, and was therefore really a part of the economy. However, the unexplained part remained disturbingly large and variable, and there were many assumptions and intuitive elements involved.

Another version of this approach addressed the measurement issues, on the assumption that if the economic variables such as scale economies and the quality and quantity of inputs were properly measured, the residual could be greatly shrunk. Obviously, as better data and methodologies became available in more recent years, this work, described in the recent book by Jorgenson and Landau, Technology and Capital Formation (1989), did shrink the residual, but it did not go away. Some of this may have been due to still unrecorded measurements such as the acquisition of human capital, to various social and political factors, and also, as we have shown in our detailed study of the chemical process industries (Landau, 1989a, 1990b; Rosenberg and Landau, 1989), to less-than-capacity utilization at times, which has had a very negative influence on productivity. Certainly no methodology of this kind is free of assumptions either, although there are fewer of them.

Nevertheless, by either approach, a significant residual remains and has difficult-to-explain large fluctuations at intervals. Furthermore, the extrapolation by these methods from the infinite variety of microeconomic activities of firms to the macro economy over time was either a rather bold leap of faith, or else the models developed were too simplistic to reveal the functioning of the "black box" of technical change at the firm level, and so left obscure just what could or should be done to increase growth rates, which, after all, is the point.

In fact, a major assumption of present-day neoclassical macroeconomists about the microeconomic world, is the textbook assertion that business firms are homogeneous maximizing agents, whose history, internal structure, and characteristics are not examined, or at least are not central to the analysis. Such a static view holds that eliminating inefficiencies and gaining economies of scale are the keys to success.

This treatment is a requirement for their growth analysis at the macroeconomic level but, in so doing, they virtually throw away the essential elements of the problem of technology commercialization. They also disregard how firms can be managed for greater competitiveness in the international marketplace—a far more powerful growth mechanism than the static efficiency model, because it continually introduces new products, processes, and services to disrupt any supposed steady state. If the economics textbooks are right, why is the business and general literature so full of accounts and advice of how different firms and industries are succeeding or failing in the international and domestic markets? And, with all their imperfections, the capital markets recognize their varying results. This is the puzzle that conventional growth theory cannot solve.

Within the past few years, new international phenomena have begun to draw the attention of economists as a means of widening their understanding of the growth process. In the past two decades, some fascinating divergences in growth rates have occurred outside the socialist bloc, such as the swift rise of the Asian "dragons," the economic decline of some South American and African countries, and, above all, the extraordinary recovery of Japan from wartime devastation. In addition, there was an almost universal slowdown in growth in the 1970s, with some recovery in the 1980s. Meanwhile, advances in economic theory were taking place. Kenneth Arrow of Stanford as early as 1962 had already pointed the way toward a better understanding of this issue. If the predicament of exogenous technical change was to be escaped, and the possibility of sustained and fluctuating growth per capita (as actually occurred) was to be retained, there has to be some form of nonconvexity in the production process, aided by endogenous technical change. From such international observations, development economics and growth theory seemed to begin to merge.

This line of work has recently been led by Robert Lucas (1988) and Paul Romer (1986; 1987a,b; 1989a,b; 1990) of the University of Chicago, but it has received varying amounts of support in papers and statements delivered at Robert Solow's sixty-fifth birthday symposium in April 1989 at the Massachusetts Institute of Technology. This support came from Joseph Stiglitz and Robert Hall of Stanford University, Frank Hahn of Cambridge University, and Avinash Dixit of Princeton University. In addition, Richard Nelson (1981, 1982) of Columbia University has produced a new evolutionary theory of growth that has many similarities to the new work of Lucas and Romer. Gene Grossman and Elhanan Helpman (1990) of Tel Aviv are also supportive of these new directions in growth and trade theory. This new work in growth theory reignited interest in increasing returns to scale as

one of the forces driving growth, especially for less developed economies, and introduced complex general equilibrium models into growth research. But economies of scale are also important for industrial countries, particularly for industries in which American firms are strong, such as aircraft, chemicals, machinery, and motor vehicles (Lipsey, 1990). The residual disappears but is replaced by the postulate of externalities, or spillovers—that is, the influence of investments of all kinds on one another. These models also include imperfect competition as the only form that can allow a role for patents and privately financed R&D, as actually occurs. This work brings back into growth theory some of the key concepts first disclosed by Evsey Domar of the Massachusetts Institute of Technology and Roy Harrod of Oxford University (Eatwell et al., 1987) even before Solow's publications, although of course in a far more sophisticated manner.

Our practical observations of the economy would support such a concept. In our studies of the petroleum and chemical industries, we describe how the invention of the assembly line by Henry Ford led to the development of modern petroleum refining aided by the rise of the chemical engineering discipline, which in turn led to the great expansion of the chemical and petrochemical industries, first in the United States, and then abroad. The penetration of the computer has had comparable if not even greater effects. Jeffrey Bernstein of Carleton University and M. Ishaq Nadiri of New York University measured such spillover effects for the high-tech industries and found them to be substantial in almost every case for R&D capital (Bernstein and Nadiri, 1988). They also measured rates of return on both physical and R&D capital, and showed that the latter are higher. However, it is very hard to incorporate the detailed micro view into these models, and much remains to be done.

From the recent work in growth theory, we therefore perceive two important modifications in Solow's neoclassical growth theory, which affect both economic research and its policy implications: (1) it applies to long-run steady-state equilibrium of the economy and not necessarily for the more immediate challenges in periods of less than perhaps 25 or 50 years because the economy in such periods is in a dynamic transition disequilibrium stage; and (2) technology in a mature economy like the United States is largely endogenous.

Other deficiencies of the neoclassical theory, in our view, lie in the omission of public, environmental, and R&D capital stocks, the growing openness of the economy and trade, premature technological obsolescence from external shocks, the different vintages of capital stock, which are not perfectly substitutable for one another, and the not necessarily constant returns to scale in production. Markets are not

always perfectly competitive as the neoclassical theory postulates; rather the competition is more often Schumpeterian (innovative, entrepreneurial), and this is a much more powerful force for growth than standard classical price competition. Firms have found, particularly in an era of international competition, that price wars are unattractive, and seek to focus, where possible, on those forms of competition for which there are greater potential profits, that is, the development of new products and processes. There are, of course, many commodity markets that are price-competitive. However, particularly in those manufacturing industries shown in Table 1, managerial energies seek to differentiate themselves by product distinctions, better and lower-cost technologies and operating procedures for their production, and more successful financing strategies. These are research-intensive industries that collectively perform 95 percent of all the industrial R&D in the United States, industries in which there is continual introduction of new products and rapid technological change. Robert Hall of Stanford University, in a timely National Bureau of Economic Research reprint (1092) has studied pricing versus marginal cost in a number of American industries. He shows that American firms often sell at prices well

TABLE 1 The Major R&D Investment Industries, 1989 Estimates (More than $1 Billion)

above marginal cost, and this fact requires interpretation in terms of theories of oligopoly and product differentiation. He concludes by saying that the evidence against pure competition is reasonably convincing.

Our recent detailed study of the American chemical process industry bears out Hall's conclusion and illustrates the richness of these motivations, and the highly successful resulting growth on a world scale, which have given this industry a consistent postwar positive balance of payments. It is one of two such major manufacturing industries (the other being aerospace). Not all industries have been equally successful, as our research shows, and this exemplifies the problem of dealing with growth at the aggregate or macro level only.

Because of such theoretical limitations, comprehension of changing trends in growth from decade to decade requires comparative empirical studies among nations over shorter periods of time, as a guide to national policies.

GROWTH IN THE UNITED STATES VERSUS JAPAN

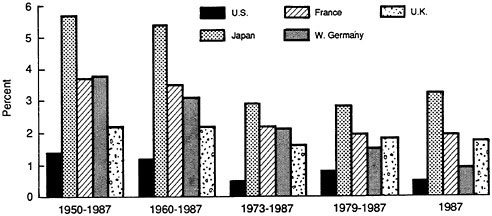

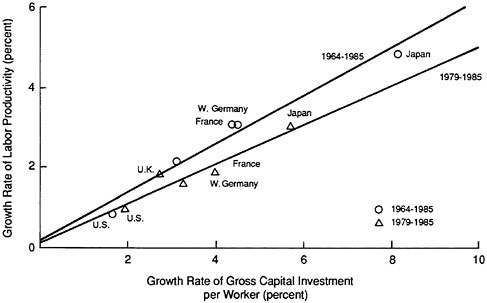

First, let us examine the relative performance of the United States and Japan, where the contrasts are the most revealing. Since the mid-1960s, productivity growth in the United States has greatly diminished from previous levels. For the period 1964-1973, the labor productivity growth of the U.S. economy was 1.6 percent per year; but from 1973 to 1978, it fell to-0.2 percent, and in 1979-1986 revived to only 0.6 percent. The Japanese labor productivity growth rates for the same periods were 8.4, 2.9, and 2.8 percent per year, respectively. In much of the later part of this period, the growth of total output in the United States was brought about almost entirely by increases in supply of capital and labor, especially (in the 1970s) the latter, as the baby boom peaked. Although explanations for the collapse in American productivity vary, it seems clear from our recent studies that one of the major reasons is that the comparative performance of the U.S. and Japanese labor productivity growth rates over this period has been heavily influenced by the much higher (often twice as high) rate of Japanese capital investment in a number of their industrial sectors, made possible by the very high Japanese savings rates. This is a significant departure from the neoclassical growth model which, as stated above, treats growth as independent of the investment rate. As a result of the low interest rates available in Japan, the discount rate for research and development and other technology-intensive efforts was also low, encouraging long time horizons, as further described below. This helped fuel the rapid adoption by most Japanese industries of

the latest available technologies from abroad. Many U.S. industries were not incorporating new technology with the same urgency.

Other reasons uncovered by our work include the two oil shocks of the 1970s (which had a worldwide negative impact on growth rates); the sharp inflation of the 1970s, which gave false signals to managements about market opportunities; the entrance of the baby boomers and other new and less skilled workers; the excess capacity in many industries; and so on. Because this flood of labor market entrants was comparatively cheap, managements favored labor over capital. The ratio of capital to labor in the United States had grown by 3 percent between 1948 and 1973, but then it slowed to less than 2 percent. Growth in Japan's ratio was higher.

The post-1973 decline in growth was not limited to the United States and Japan, but was widespread and variable among many other countries. Now, despite the lower energy costs, most countries have not recovered all the way from the pre-1973 conditions, for a variety of individual reasons, including the time lags needed to adjust to the seismic economic changes of the last two decades, as we discuss later. In studying these many events, we have found that physical capital formation has contributed far more significantly to longer-term economic growth than earlier estimates had suggested. And the residual of technological change, while not wholly explicable by our methodology, constitutes less than 30 percent, rather than the earlier estimates of 85 percent. Of course, like others in the past, we assumed the major inputs to be independent of one another; as we shall see, this assumption needs modification. There are still many measurement issues and methodologies to be resolved, but the direction now seems well supported. The important point of these findings is not their exact magnitude, but that there are several primary identifiable ways to improve growth rates over the medium term of 20 to 30 years: physical capital investment, improvement in labor quality, and R&D and technology.

THE JORGENSON ANALYSIS OF THE SOURCES OF ECONOMIC GROWTH

In the accompanying table (Table 2) we present an analysis of the sources of U.S. economic growth, still employing the neoclassical framework, but improving the methodology for measurement and allocation of inputs. The output of the U.S. economy at the aggregate level is defined in terms of value added for the domestic economy. The growth of output is decomposed into the contributions of capital and labor inputs and growth in productivity. Growth rates for the

TABLE 2 Aggregate Output, Inputs, and Productivity: Rates of Growth, 1947-1985

|

Variable |

1947-1985 |

1947-1953 |

1953-1957 |

1957-1960 |

1960-1966 |

1966-1969 |

1969-1973 |

1973-1979 |

1979-1985 |

|

Value-added |

0.0328 |

0.0529 |

0.0214 |

0.0238 |

0.0472 |

0.0360 |

0.0306 |

0.0212 |

0.0222 |

|

Capital input |

0.0388 |

0.0554 |

0.0401 |

0.0229 |

0.0367 |

0.0437 |

0.0421 |

0.0392 |

0.0262 |

|

Labor input |

0.0181 |

0.0251 |

0.0037 |

0.0124 |

0.0248 |

0.0226 |

0.0128 |

0.0219 |

0.0146 |

|

Contribution of capital input |

0.0145 |

0.0215 |

0.0149 |

0.0083 |

0.0142 |

0.0167 |

0.0149 |

0.0140 |

0.0098 |

|

Contribution of labor input |

0.0112 |

0.0153 |

0.0022 |

0.0077 |

0.0151 |

0.0140 |

0.0082 |

0.0139 |

0.0089 |

|

Rate of productivity growth |

0.0071 |

0.0160 |

0.0043 |

0.0078 |

0.0179 |

0.0053 |

0.0074 |

-.0067 |

0.0034 |

|

Contribution of capital quality |

0.0058 |

0.0126 |

0.0069 |

0.0016 |

0.0053 |

0.0058 |

0.0054 |

0.0045 |

0.0022 |

|

Contribution of capital stock |

0.0088 |

0.0090 |

0.0080 |

0.0067 |

0.0089 |

0.0108 |

0.0095 |

0.0095 |

0.0077 |

|

Contribution of labor quality |

0.0039 |

0.0060 |

0.0038 |

0.0084 |

0.0041 |

0.0030 |

0.0018 |

0.0024 |

0.0026 |

|

Contribution of hours worked |

0.0073 |

0.0093 |

-.0016 |

-.0007 |

0.0110 |

0.0110 |

0.0065 |

0.0114 |

0.0063 |

|

Rates of sectoral productivity growth |

0.0088 |

0.0142 |

0.0083 |

0.0112 |

0.0190 |

0.0060 |

0.0097 |

-.0012 |

0.0029 |

|

Reallocation of value added |

-.0019 |

0.0007 |

-.0044 |

-.0021 |

-.0021 |

-.0007 |

-.0023 |

-.0053 |

0.0006 |

|

Reallocation of capital input |

0.0005 |

0.0003 |

0.0013 |

0.0005 |

0.0009 |

0.0001 |

0.0006 |

-.0001 |

0.0009 |

|

Reallocation of labor input |

-.0003 |

0.0009 |

-.0009 |

-.0019 |

0.0001 |

-.0002 |

-.0005 |

-.0000 |

-.0010 |

|

SOURCE: Jorgenson and Fraumeni (1990). |

|||||||||

period 1947-1985 are given for output and the two inputs in the first column of Table 2. Value added grows at the rate of 3.28 percent per year, while capital grows at 3.88 percent and labor input grows at 1.81 percent.

The contributions of capital and labor inputs to the growth of output are obtained by weighting the growth rates of these inputs by their shares in value added. This produces the familiar allocation of growth to its sources. Capital input is the most important source of U.S. economic growth by a substantial margin, accounting for 44.2 percent of growth during the period. Labor input accounts for 34.1 percent of growth. Productivity growth accounts for only 21.6 percent of U.S. economic growth during the postwar period.

The findings summarized in Table 2 are not limited to the period as a whole. In the first panel of the table we compare the growth of output with the contributions of capital and labor inputs and productivity growth for eight subperiods—1947-1953, 1953-1957, 1957-1960, 1960-1966, 1966-1969, 1969-1973, 1973-1979, and 1979-1985. The end points of the periods identified in the table, except for the last period, are years in which a cyclical peak occurred. The growth rate presented for each subperiod is the average annual growth rate between peaks. The contributions of capital and labor inputs are the predominant sources of U.S. economic growth for the period as a whole and all eight subperiods.

We have found that the contribution of capital input is the most significant source of output growth for the period 1947-1985 as a whole. The contribution of capital input is also the most important source of growth for seven of the eight subperiods, while productivity growth is the most important source for the subperiod 1960-1966. The contribution of capital input exceeds the contribution of productivity growth for seven of the eight subperiods, while the contribution of labor input exceeds productivity growth in the last four of the eight subperiods.

In 1985 the level of output of the U.S. economy stood at more than three times the level of output in 1947. Our overall conclusion is that the driving force behind the expansion of the U.S. economy between 1947 and 1985 has been the growth in labor and capital inputs. Growth in capital input is the most important source of growth in output, growth in labor input is the next most important source, and productivity growth is least important (but far from trivial). This perspective focuses attention on the mobilization of capital and labor resources rather than emphasizing advances in productivity, as is sometimes done by those who primarily favor increased R&D efforts.

The findings we have summarized are consistent with a substantial body of research. For example, these findings coincide with those of L. R. Christensen (Wisconsin) and Jorgenson (1969, 1970, 1973) for the United States for the period 1929-1969. Angus Maddison (1987) (Groningen) gives similar results for six industrialized countries, including the United States, for the period 1913-1984. Assar Lindbeck (1983) (Stockholm) generally concurs. However, these findings contrast sharply with those of Abramovitz, Kendrick, and Solow, who emphasize productivity as the predominant growth source. At this point it is useful to describe the steps required to go from these earlier findings to the results we have summarized.

The first step is to decompose the contributions of capital and labor inputs into the separate contributions of capital and labor quality and the contributions of capital stock and hours worked. Capital stock and hours worked are a natural focus for input measurement, since capital input would be proportional to capital stock if capital inputs were homogeneous, while labor input would be proportional to hours worked if labor inputs were homogeneous. In fact, capital and labor inputs are enormously heterogeneous, so that measurement of these inputs requires detailed data on the components of each input. The growth rate of each input is a weighted average of the growth rates of its components. Weights are given by the shares of the components in the value of the input.

The development of measures of labor input reflecting heterogeneity is one of the many pathbreaking contributions by Denison to the analysis of sources of economic growth. The results presented in Table 2 are based on the work of Jorgenson, Frank M. Gollop (Boston College), and Barbara M. Fraumeni (Northeastern University) (1987). They have disaggregated labor input among 1,600 categories at the aggregate level, cross-classified by age, sex, education, class of employment, and occupation. These data on labor input have incorporated all the annual detail on employment, weeks, hours worked, and labor compensation published by the Bureau of the Census in the decennial "Census of Population" and the "Current Population Survey."

Our measures of capital input involve weighting of components of capital input by rental prices. Assets are cross-classified by age of the asset, class of asset, and legal form of organization. Different ages are weighted in accordance with profiles of relative efficiency constructed by Charles R. Hulten (University of Maryland) and Frank Wykoff (Pomona College) (Hulten and Wykoff, 1981; Hulten et al., 1989; Wykoff, 1989). An average of 3,535 components of capital input are distinguished at the aggregate level. Similarly, the data on

capital input have incorporated all the available detail on investment in capital goods by class of asset and on property compensation by legal form of organization from the U.S. national income and product accounts.

The growth rates of capital and labor quality are defined as the differences between growth rates on input measures that take account of heterogeneity and measures that ignore heterogeneity. Increases in capital quality reflect the substitution of more highly productive capital goods for those that are less productive. This substitution process requires investment in tangible assets or nonhuman capital. Similarly, growth in labor quality results from the substitution of more effective for less effective workers. This process of substitution requires massive investments in human capital.

In the Abramovitz-Kendrick-Solow approach, the contributions of growth in capital and labor quality are ignored, since inputs are treated as homogeneous. The omission of growth in labor quality destroys the link between investment in human capital and economic growth, while the omission of growth in capital quality leads to drastic underestimation of the impact of investment in nonhuman capital on economic growth. The results we have presented which involve two different effects, one of measurement and the other of composition or aggregation, reveal that the assumption of homogeneous capital and labor inputs is highly misleading.

We find that growth in the quality of capital stock accounts for two-fifths of the growth of capital input during the period 1947-1985. This quantitative relationship also characterizes the eight subperiods. For the period as a whole we find that the growth of hours worked exceeds the growth of labor quality. However, the growth in hours worked actually falls below the growth in the quality of hours worked for the period 1953-1960. For the period 1960-1985 the contribution of hours worked accounts for almost two-thirds of the contribution of labor input. The relative proportions of growth in hours worked and labor quality are far from uniform.

There is a further complication in understanding the causes of growth, however; quantitative measures of productivity do not fully describe the performance of any economy. Quality of products and services is also of great importance, as the Japanese have notably shown us, but is very difficult to measure (David, 1990). Another measure of productivity growth that is not incorporated into conventional measurements is functionality. The semiconductor industry today sells a million-transistor circuit completely interconnected for the same price that it sold a single transistor some 30 years ago. Thus, the functionality has increased conservatively a millionfold. By next year, a small box

containing the new Intel microprocessor (860), costing perhaps $10,000 will have about two-thirds of the performance of a Cray-1 Supercomputer, costing many millions of dollars. But because of such steady cost reductions, and therefore pricing, the value of production in dollar terms understates the quality improvement, and productivity improvement is understated. The same is true in other industries, such as chemicals.

RECENT NEW RESEARCH IN GROWTH ECONOMICS OF INDUSTRIAL COUNTRIES

The current revival of interest in growth economics has been further aided by the award of the 1987 Nobel prize in economics to Robert Solow, who has recently expressed his own reconsideration of the role of capital formation in long-term growth. He has stated that he feared one implication of his theory, that the long-term steady-state rate of growth is independent of the savings rate (or equivalently the investment rate), might have been carried too far with regard to the short and medium term in much of the subsequent economic literature and in government policies—resulting in a downplaying of the importance of capital. ''You can't take an old plant and teach it new tricks,'' he said. Indeed, our experience demonstrates that much of the capital spent by companies to maintain their physical facilities incorporates new technology, so that calculations based only on net capital additions underestimate the driving force of technology in the growth process. Old plants have old technology.

There has been a significant shift in composition of investment from longer-lived to shorter-lived assets, such as computers, which depreciate more rapidly (often in three years). Gross investment data are not affected by such compositional shifts. The substitution of more highly productive capital goods, embodying the new technology, for those that are less productive, improves the quality of capital. The productivity of the economy would thus rise even if net investment were zero. Capital's contribution to growth, taking these quality improvements into account, is accordingly much greater than is generally recognized.

It is therefore incorrect to focus primarily on increasing R&D efforts, important though these are, because the physical capital required to realize the R&D results is usually greater than the cost of the R&D involved, depending on the industry (the proportion of R&D expenditures in manufacturing is rising and now approaches 70 percent of physical capital expenditures; part of the reason for this is the

declining rate of growth in physical capital investment.) The U.S. economy is not operating everywhere at the technological frontier, and some industries are, in fact, far behind other nations. Even under neoclassical assumptions, additional investment can produce a longer-term increase in productivity growth if an economy is not at the frontier. What is true for a country is also true for an industry or firm. Once a technological lead is exploited by early market penetration, later entrants, even if possessing better technology, often cannot overcome the first entrant's economies of scale and learning curve improvement. Thus it may take 20 to 30 years of steady investment before existing or potentially important technologies can be fully exploited by American companies, but meanwhile GDP may double, as happened in Japan from 1960 to 1980.

One of the disadvantages of the neoclassical model of technology, capital, and labor is that it focuses attention only on the relative proportions in which these three inputs are used. It does not emphasize the importance of variation in their common rate of growth. There is no question that relative proportions matter. The experience of the centrally planned economies has clearly demonstrated that massive increases in physical capital that are not accompanied by improvements in the technology and the quality of the labor force lead to rapidly diminishing returns, just as the neoclassical model would suggest. But because it treats improvements in the technology and labor quality as being unaffected by public and private decisions, the neoclassical model fails to emphasize that, as we have found, these three inputs are intertwined pieces of the same process—a three-legged stool of physical, intangible, and human capital. The latter expression is shorthand for training and education of the work force, but obviously, it does not mean that everyone should be educated to the postgraduate level! Selectivity is an essential element of this leg of the stool, and more is not necessarily better. Intangible capital is not just R&D but also includes design engineering, experimental production, worker training, market development, sustained losses in initial operation and market penetration, legal precautions, and insurance.

In this sense, directly and through its stimulus to and interaction with the other factors of production, technological change has been and is central to U.S. economic growth. In the past, the successful entrepreneurial exploitation of new technologies in the private sector to create new and improved products, processes, and businesses has been a distinctive American characteristic and comparative advantage. In a world of dynamic and ever-changing national comparative advantages, it is important to build on our strengths. We can no longer depend on differences in resource endowments (as Saudi Arabia

depends on oil), but must rely on endogenous leads or lags among firms and industries of the industrial nations.

These considerations now explain the results of recent studies by our colleagues at Stanford, who have applied some of the advanced tools available today to the comparative study of growth among a number of the industrialized economies. By so doing, some of the previously mentioned constraints of the Solow model can be relaxed. What were their principal findings?

1. Using modern time series methodologies, Steven Durlauf (1989) has examined business cycles and long-term growth in a number of major industrial countries. He has found little evidence of convergence in these economies. Further, by developing a general equilibrium model of demand and supply complementarities, he has shown that appropriate stabilization policies are not meaningfully distinct from a high growth policy. High investments in one industry can induce high investments in other industries, leading in turn to higher growth rates, which then permit still more investment while increasing present consumption at an acceptable rate. But as The Economist (23 September 1989) pointed out in its editorial commentary on these results, they also suggest that the lack of investment not only causes a loss of productive capacity in its own right, but also hurts the value of investments already made. This feedback loop of negative externality well comports with our own industrial experiences, and often leads to excess capacity in one industry, and our measured low productivity therein, as happened in chemicals. Our detailed study of the chemical process industries and other high-tech industries demonstrates that industry level measurements are not only feasible, but are also meaningful and correspond to the actual events. These studies thus lead to the conclusion that stable government policies (fiscal, monetary, trade, and tax) favoring high investment rates may be essential for higher levels of economic well-being in the short as well as the long run.

In fact, this seems to have been the German and Japanese secret of their remarkable economic progress from total ruin at the end of World War II. The well-known German economist Kurt Richebacher, in the May 1990 issue of his newsletter on "Currencies and Credit Markets," summarizes this important point as follows: "Restraint in government spending, wages and consumption has paved the way for rising profits and surging capital spending, those being the drastically improved structural features of Continental Europe. While the Anglo-Saxon countries trumpeted and preached supply-side rhetoric, it was only Continental Europe that put these policies into practice."

Growth paths are distinct for each country, and there are multiple, more or less optimal equilibrium paths, which depend on the ability of any country's system to manage its own affairs. This means that history matters—growth is path dependent. Our study of the rise of the chemical engineering discipline in the United States, in association with the petroleum and chemical industries illustrates this dependence, which led to American primacy in an industry (chemicals) that had for long been dominated by Germany. Other industries have very different historical paths. For example, aerospace is heavily dependent on government for research funding and purchases of military equipment. Convergence of growth paths between countries or industries is not an inevitable process, and in many of the less developed countries, it is rare to find convergence in growth rates with the more industrialized countries. Lucas, Romer, and Stiglitz have emphasized that conventional economic growth theory has paid insufficient attention to explaining adequately such differences in economic growth paths among countries. Some countries can grow better through learning by doing than others, for example, and this is aided by the educational level.

2. Michael Boskin and Lawrence Lau (1990) found from studies of the performance of five industrialized nations that technological change is capital augmenting, and the benefits of technological progress are higher when more capital investment is deployed per worker. What they attribute to technological progress includes what others, as mentioned above, may attribute to improvement in the qualities of the inputs. They estimate that capital and technological change combined contribute about 75 percent of the U.S. growth of output. Thus, capital formation and technological change are complementary to each other. This is what we described earlier as the intertwining of the inputs to growth. Their methodology captures the second order or interactive effects not derivable from studies of a single country, which would generally yield first-order or additive effects only. Increased physical capital investment per worker, they show, can raise the rate of productivity gains and enhance competitiveness. Raising the level of output (and income) by increased capital investment per worker is a worthwhile goal in itself, but the prospect of raising the rate of productivity growth thereby, which the newer theories and research imply, is even more exciting and is a far more powerful force for increasing standards of living.

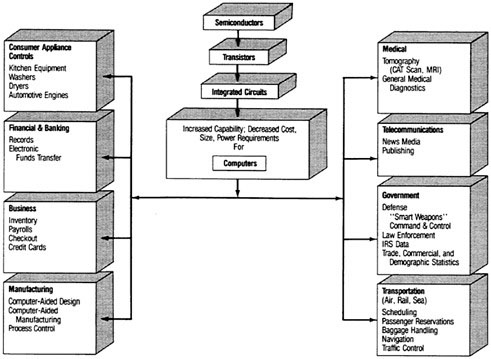

The United States has invested proportionally less in gross nonresidential physical capital investment than the other major industrial countries for 25 years, even though the level of its gross capital investment has not varied a great deal over the years. Furthermore,

with capital augmenting technological change, a steady state may not exist even under neoclassical conditions; the limits to growth are expandable. The first public disclosure of these results by Boskin (whose work at Stanford was finished by Lau) in April 1990 at the National Academy of Engineering symposium "Technology and Economics" (see Boskin and Lau, this volume) was made in a speech also describing the Bush administration's economic priority as the achievement of the highest possible sustainable growth rate, and referred to capital formation and technology as important elements.

We show some of our own related findings in Figure 2, which, taken together with the work of Durlauf, and Boskin and Lau, as well as the research described earlier, can no longer permit any doubt that Solow is right—physical capital investment does have a significantly greater effect on productivity growth in such periods of time as a quarter of a century (or perhaps longer) than the neoclassical long-term growth theory would predict. Boskin and Lau find high augmentation rates for capital in the five countries and a low elasticity of output with respect to augmented capital. These findings are consistent with those of Figure 2 if one converts the horizontal axis from the rate of growth of physical capital to augmented capital per worker. Therefore, the factors affecting the availability and cost of capital in

FIGURE 2 National productivity versus the capital-labor ratio. (Average annual percentage growth rates).

each country become critical for attaining higher sustained economic growth. It is an explanation for the difficulty the less developed countries have in exploiting generally available technology to accelerate their growth, and converging on the industrialized countries.

3. John Shoven's and Douglas Bernheim's (1989) work discloses that risk premiums matter to firms seeking investment, and these in turn depend on the "climate" set by governments and a nation's institutions. Some key climatic factors are (a) macroeconomic policies, (b) volatility and unpredictability of policy, (c) legal systems and institutions, (d) savings behavior, (e) educational systems, (f) science and technology policies, and (g) financial institutions.

In macroeconomic policy, differences in tax regimes and nominal interest rates between the United States and Japan are accompanied by different risks. Japanese companies appear to have a lower cost of capital (1/2 to 1/3 of the United States) across a wide range of investments, as recently confirmed by a major study of the Federal Reserve Bank of New York (McCauley and Zimmer, 1989). The results conform reasonably well to the relative industrial hurdle rates for the two countries. Better able to bear the risks involved, other nations invest for the longer term—and are increasingly forging ahead of the United States in key industries like electronics, machine tools, steel, autos, and the like. Moreover, as Ken-Ichi Imai (1989) of Hitotsubashi University has shown, Japan has a much better feedback loop than the United States between firms, government, and financial institutions, perhaps in part due to the number of engineers and technical experts in key policy roles, and the general lack of adversarial relations between business and government. Japanese firms are also able to establish wide networks of contractors and subcontractors, and some risks appear to be spread across the whole economy. In the United States, however, antitrust policy has, until recently, prevented such networks, and still limits cooperation to achieve results with potentially large social returns.

4. Good macroeconomic stabilization policy is a major boon to economic growth, report Ronald McKinnon and David Robinson (1989), as illustrated by the Japanese success in simultaneously reducing volatility after the oil shocks of the 1970s and maintaining rapid growth. The American policy of continual but uncertain dollar devaluation in the 1970s and 1980s is linked to higher inflation coupled with higher and more volatile nominal interest rates in the United States. These higher nominal interest rates reduce the value of tax depreciation allowances, raising the cost of capital, and increase the amount of borrowing necessary for financing the purchase of relatively longer-lived assets. Thus, the expectations of greater uncertainties have further

shortened the time horizons of American firms. In Japan, saving and capital investment were and are strongly favored, and productivity growth was very high, with low inflation. Policies favoring stabilization and capital formation support higher levels of economic well-being in the long as well as the short run. Durlauf's results by a quite different methodology lead to the same conclusion. The rapidity of technical change is obliterating the distinctions between short and long run.

THE LEGAL CLIMATE

Space permits only a brief mention of another important climate for growth—that of the legal system. It is a fact that the American legal system is unique among industrial nations in size, function, and complexity. With over 700,000 lawyers vs less than one-tenth as many in Japan (not all that different from the European countries), the contrast is stark, as are the effects. As Peter Huber (1989) said in a September 1989 conference sponsored by the Program on Technology and Economic Growth in Stanford's Center for Economic Policy Research, "Alone in the world so far, U.S. courts have abandoned the negligence standard for product liability; they ask juries to pass judgment instead on the adequacy of product design and manufacture... under a standard of strict liability for product defects; however, the people themselves, and their good care, good training, and good faith, are irrelevant. The new inquest concerns the product itself and its alleged defects. Today's U.S. tort system places technology itself in the dock." Huber cites many other changes in court decisions which are not happy ones for the innovator or for American competitiveness, such as excessive strictness on safety warnings; use of improved later designs to impeach the earlier designs if an accident or injury resulted therefrom; great latitude in filing of suits long after the machine or product was designed and used; and the rise of punitive damage awards. It is possible to identify various U.S. industries that have slowed down or reduced their commercialization of products because of liability uncertainties—general aviation, contraceptives, medical equipment, new drugs, vaccines, sporting goods, pesticides, etc.

Huber's conclusion says: "In the end, the search must be for rules that allow society to say yes to new and better products [and processes], with the same conviction and force that an open-ended liability system can say no to old and inferior ones. In many areas of policy, the answers given depend largely on the questions asked. For several decades, U.S. policymakers in the courts and elsewhere have asked:

What is unduly risky? And how can risk be deterred? But an equally important pair of questions is: What is acceptably safe? And how can safety be embraced?" The answers are not yet clear, and this uncertainty contributes significantly to the problems of competitiveness and growth.

PHYSICAL CAPITAL FORMATION

Our own and a number of other cross-sectional growth studies (such as by Philip Turner [1988] of the Organization for Economic Cooperation and Development, and John Helliwell and Alan Chung [1990] of British Columbia, Lawrence Summers [1990] of Harvard University, William Baumol and colleagues [1989] of New York University) over the last 25 years or so, establish beyond a reasonable doubt that there is a close correspondence between capital investment per worker and growth rates. There has been substantial disagreement between economists, however, about the direction of causation. In one sense, it does not really matter; the correlation itself indicates that neither demand nor supply of goods and services can be neglected. Indeed, it is well agreed that long-term growth takes place in the microeconomy—the true supply-side economics. Stabilization of demand by macroeconomic control of fiscal and monetary policy is traditionally used for short-term cyclical effects. Evidently, then, over some decades, as Solow and others have pointed out, an investment boom for the United States would be very beneficial to the long-run welfare of the American people. Short and long run really coincide, as Durlauf says.

In the most realistic sense, however, one should not expect that supply can be turned on and off as rapidly as macroeconomic policy (often a matter only of months in the latter). The gestation period for physical investment is 3-5 years; for R&D, perhaps 5-10; and for education and worker training, up to one generation. Diffusion of technology may take several years or even as long as the seventeen year life of a patent. Thus, if the close match of capital per worker and productivity is to persist, policies for long-term investment are, as summarized above, required on a concerted basis for many years. The business cycle and growth must be viewed from one overall perspective. These considerations are entirely consistent with the observations made by Barry Bosworth (1989) of the Brookings Institution, who estimates real rates of return as averaging about 8 percent for physical capital, 10 percent for education (with which our findings on the value of one year additional schooling concur), and perhaps in excess of 15 percent for research and development. (This is consistent

with findings by Bernstein and Nadiri [1988] as well as Edwin Mansfield [1986] of the University of Pennsylvania. Furthermore, these researchers measured a much greater social return for R&D). For this reason, Bosworth likewise recommends increased capital formation of all kinds.

It would, therefore, be naive to assume an instantaneous match between supply and demand. Thus, causation is really irrelevant in practice, even though George Hatsopoulos of the Boston Federal Reserve and Thermo Electron Corporation, Summers, and Krugman (1988) believe it runs from investment per worker to growth. They just have to go together, and good policy must see to that. Now that the increasingly open nature of the world economy seems irreversible, there are increasing restraints upon a country's ability to manage demand stimulation by macroeconomic policy. The world capital markets impose their discipline on national governments. Demand management will increasingly seem to be synonymous with a stable pro-growth, pro-investment policy.

The basic conclusion from this and other recent research is that the role of physical capital matters very much indeed for the growth process, as does the proper and stable management of macroeconomic policy by government and the effective direction of many individual firms in the private sector. The United States has not been doing well in this area, the results demonstrate. High cost of capital, greater expectations of uncertainty, inadequate savings and investment, increasing reliance on foreign capital in an open world capital market, a tax system that is biased against saving and investment, short term horizons by managements and governments—these are all indicia of what Charles Schultze of the Brookings Institution calls the "termites" gnawing at the growth of the American standard of living. The Brookings volume on American Living Standards, Winter 1988-89, gives many details and analyses of our present position, as does a special section of The Economist of 24 September 1988. Perhaps the American people have the right to opt for more consumption now, and less investment for future consumption, but they should at least be made aware of the consequences of such a choice.

Despite the substantial consensus on these perceptions reached at a large Washington conference on "Saving—The Challenge for the U.S. Economy," organized by the American Council for Capital Formation in October 1989, and the general agreement by many political figures, there appears to be no political consensus at this time to establish a set of policies that would favor high investment and savings rates and be of greater predictability. These policies would propose stabilization of monetary and fiscal policy, so that investor expectations of inflation and uncertainty can change, and yield up to a 3

percent reduction in real interest rates. The tax code could be improved by correcting distortions and biases against savings and investment, particularly the latter. And investment is best in a low inflation environment.

R&D AND EDUCATION

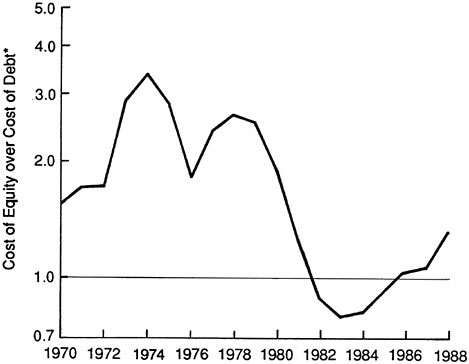

What of the other two legs of the stool of growth? Intangible capital is equity capital, the most expensive kind, because it is generally not financed by borrowing. There are various estimates of the cost of equity capital, derived from stock market and tax considerations, but it is clear that it is substantially higher than long-term interest rates, as shown in Figure 3. The higher cost of equity (in the later 1980s about two and a half to three times as high as the real long-term after-tax cost of debt and more than twice the Japanese real after tax cost of equity, as disclosed by Hatsopoulos at the April NAE symposium; see Hatsopoulos, this volume) defines the rate at which

FIGURE 3 Nominal cost of equity. *Interest rate on 10-year Treasury notes. Source: Hatsopoulos, George. 1989. Paper presented at American Council on Capital Formation conference "Saving—The Challenge for the U.S. Economy," 11-13 October.

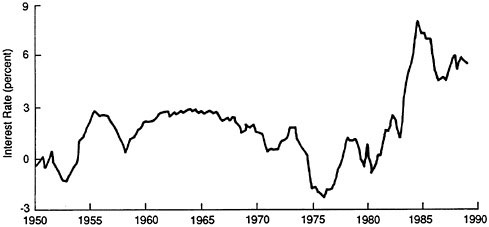

future benefits from technology are discounted. (Of course, the marginal cost of capital will vary from company to company and may deviate significantly from the national average.) This fact, combined with the high real interest rates prevalent in the United States (required to ration the low domestic savings rate and attract foreign capital), as shown in Figure 4, has tended to steadily reduce investments by U.S. firms, and impairs the ability of American companies to compete on a long-term basis with the Japanese and Germans, among others. These countries have essentially the same overall average level of technology as the United States, although the level in individual industries may differ, so that the slope of the lower curve in Figure 2 indicates the importance of capital investment (interacting with technology) for growth. The data of Figure 2 generally conform to the findings of Boskin and Lau.

As to R&D expenditure trends, it seems as a result of the foregoing considerations, that from a level of 12.7 percent annual growth from 1976 to 1985, the present rate of increase has declined to about 6 percent in nominal terms. In real terms, it is a fall from 6.6 percent to 1.8 percent. In 1989 this has been the third time in four years that R&D investment has expanded more slowly than the economy itself. The United States must increase its R&D expenditures in both the public and private sectors if it is to maintain a high growth strategy.

The subject of educational deficiencies in the United States is too well known to warrant detailed discussion, but is included in the following section on microeconomic considerations. The striking effect of labor quality has already been shown.

FIGURE 4 Long-term real interest rates. Source: Neal Soss, First Boston Corporation.

MICROECONOMIC CONSIDERATIONS

There were many other research results reported at the Stanford Conference, where the foregoing papers were presented. Within an appropriate climate set by government, business firms are responsible and accountable for implementing the national goals for growth and competitiveness, and they are not the maximizing agents of macroeconomic analysis, as mentioned above. The following is a brief summary of what the speakers disclosed about how firms can improve their performance.

-

Conduct of research, particularly in basic science, is not America's most pressing problem. The problem rather is in the subsequent exploitation of the new products that emerge from research, especially in engineering, which is what leads to economic benefits. The Japanese have shown that, drawing on the generally available scientific base developed in all countries (particularly in the United States), they can advance their economic growth tremendously by engineering and commercialization techniques of their own creation. Different firms have very different internal capabilities (perhaps partly as a result of their own separate histories and the path dependencies that go along with those histories) and they also have access to very different bodies of technological knowledge, some of which are proprietary. More can certainly be done by firms to increase their access to richer bodies of data and knowledge.

-

Technology can be found in many places outside a particular firm, and there are many methods available to tap this, such as licensing, joint ventures, consortia, and contracting with universities. In-house research needs to explore avenues not available elsewhere, and this is what lies behind the many European consortia such as Esprit, Europa, and Jessi. The Japanese have proved to be masters of this process, the United States less so.

-

Innovation has often been thought of only in its technological terms, and not in economic terms. Thus, we commonly think of innovation in terms of entirely new products or components—transistors, television, computers, and petrochemicals—and much less in terms of the perhaps equally important subsequent cost reductions or performance improvements. This type of technical innovation has long been a traditional American strength. Indeed new products that are in no way major innovations in the sense of constituting drastic departures from the past are often highly profitable when they are correctly commercialized.

-

In the very important but often overlooked area of incremen-

-

tal innovation, some U.S. industries and firms have not yet mastered the skills necessary for shorter product cycles and rapid cost reductions (what Ralph Gomory [1989, 1990], formerly of IBM, contrasted with ''ladder'' or breakthrough innovation). He labels the one at least as important a factor in competitiveness of firms as the other. Industries and firms indeed vary widely, and some have managed the necessary transitions very well. By contrast, the Japanese have a less flexible research system but a much greater ability to design for manufacturing and short cycle times.

-

Engineering skills, therefore, need to be developed that conform more effectively to the requirements of the competitive process as described above: speed of adjustment to changes in market demand, shortening of product cycles, and greater attention to quality improvement and reliability. Manufacturing engineering education in the United States has not developed the overall systems design approach of the chemical engineering profession. That profession, in its linkage between the specific performance of individual pieces of equipment and their function in the overall plant embodying them, is a metaphor for the linkage of macroeconomics to its microfoundations, a linkage that is lacking in the bulk of current economic modeling. Most important, greater interrelations (feedback loops) must be established between users and suppliers, R&D marketing and manufacturing, and between physical products, software, and services.

-

Managements need to become much more skilled in using technology for greater competitiveness in a global marketplace. A longer-term view is essential, but this is tempered by the prevailing macroeconomic climate in the United States that urgently needs to be addressed. Firms will be understandably reluctant to spend money for innovative activity unless they have some reasonable degree of confidence that they can draw adequate financial benefits from the findings of R&D.

-

By moving into other countries (transplantation), including especially the United States, to gain global market share, the Japanese may well acquire some of the American skills in entrepreneurial R&D and innovation, although their efforts to adapt to other cultures have not always been successful. There is a general movement by firms in the major industrial centers to spread into the other major markets, not only to be nearer their customers, but also to hedge their exposure to the variability of national policies. Yet it is still largely true that design, engineering, and proprietary knowledge are concentrated in the home country. Even where an industry has been consistently successful, as in chemicals, it has still been unable, because of the problems of the American business climate, to capitalize fully

-

on its strengths by moving abroad as aggressively as its European competitors who are now buying up American chemical companies. Such foreign acquisitions of other American high-technology firms are occurring with increasing frequency and publicity.

-

The secondary educational system of the United States is inferior to that of the Japanese, but its university system is more effective and links more efficiently with industry. U.S. government science and technology policy has been constructive in this regard, although much money is spent on large projects that have no clear link to commercial products and services. Furthermore, Japanese companies spend a greater percentage of their GNP on civilian R&D than does the United States.

-

The American governmental system is less well equipped to deal with long-range strategy or to address difficult decisions than that of the Japanese, absent a crisis. In turn, many firms have similar difficulties, and the high cost of capital in addition to the methods of financial analysis combine to focus attention on short-run investments, of which takeovers and leveraged buyouts are symptoms. The Japanese "patient money" approach is the antithesis of this American situation. It is because of this imperative of the American innovation process that the viewpoint of the chief executive officer of a firm often seems so perverse and incomprehensible to the technical and research staff, and conversely. Yet, it is a prime reason why so many firms have lawyers and MBAs for chief executive officers, unlike the Japanese where technologists predominate. Indeed, as compared with the situation at the end of World War II, the cream of American college graduates no longer opts strongly for careers in science and engineering. The literate elite gravitate more to the law, the numerate to finance and business. This is not surprising; the financial incentives are much greater in these professions. If managements are to be serious about competing in the world of the 1990s, they must raise the rewards for young people to go into science and engineering, such as manufacturing engineering. It may also be beneficial to offer better subsidies to encourage students to go into advanced engineering training. The Massachusetts Institute of Technology has pioneered in this respect through its funding of its internationally known School of Chemical Engineering Practice, and its Leaders for Manufacturing program. More efforts of this nature can prove to be very important to the economy. The federal government could assist by proposing grants to young people who complete four years of college majoring in science or engineering and further grants for completing a Ph.D. in such fields.

-

The financial system of the United States is a major contribu-

-

tor to a higher cost of capital, because managements of large publicly held companies that own very little of their company's stock are fiduciaries for institutional investors who now constitute about half (and in many cases much more) of the owners. Accordingly, managers become increasingly risk averse and short term minded, the higher the cost of capital, because the separated owners have no real way to measure performance except on a carefully monitored financial performance basis. Furthermore, these institutional investors are themselves managed by fiduciaries for money contributed by large numbers of workers to their pension funds, and similar as well as additional constraints apply to them. Management of fiduciaries by fiduciaries—a system totally in contrast to the much closer interrelationship between owners and managers in Japan and Germany, and in the better privately held or owner-managed companies in the United States. The successful managerial capitalism of the first half of this century has been replaced by a very different form in both substance and style. Stiglitz has recently studied the disturbing effects of the capital markets on productivity growth, with somewhat similar conclusions to those contained in this paper (Greenwald et al., 1990). The 20-page insert on capitalism in The Economist of 5 May 1990 deals with this issue also.

Of course, financial institutions respond to clear evidence that a firm's management is effective by awarding it a higher price-earnings multiple than the market average, which lowers its cost of equity capital. If on the other hand, their conclusion is the reverse, the temptation for takeovers, leveraged buyouts, mergers, and acquisitions becomes great when aided by a tax system that favors debt over equity. Managements often fail to inform their investors adequately about their actions, but most are only too well aware of the financial constraints.

WHAT SHOULD BE THE NATIONAL GOAL

Our most important finding, as described above, has been that investment in human and nonhuman capital accounts for the largest part of U.S. economic growth during the postwar period. The slowdown since 1973 has resulted in a full percentage point lower growth rate relative to the preceding postwar average. The need for new pro-investment policies of all three kinds is best illustrated by consideration of the importance of accelerated growth in real income per worker for the proper funding of the Social Security System. Alicia Munnell (1989) of the Boston Federal Reserve, in analyzing a Brookings study (by Aaron et al. [1988]), pointed out that the intermediate projection

of the Social Security Trustees suggests that the net real wage per worker in 2020 will be from 199 to 211 percent of today's level. Thirty years is not long term. How, then, is this going to materialize in view of the fact that real wages per worker have barely improved since the early 1970s? Since demographic projections show a significant decline in the working population (it will fall to around 1 percent per year in the later 1990s from a peak in the 1970s of about 2.5 percent), it is evident that a doubling of the real net wage can occur only by a massive increase in the rate of all kinds of capital investment per worker—physical, intangible, and human. Furthermore, we must be able to pay the costs of the large amount of capital we have been importing from abroad.

This means raising the noninflationary annual growth rate (real GDP) from its current level to perhaps 3.5 percent. As we noted above, this is required for the compounding effect to produce a doubling of real living standards in a generation. Even though increasing capital investment can only gradually raise productivity, because of the enormous stock of existing capital, it can nevertheless be launched within roughly a decade, if the new capital investment is efficiently concentrated in the leading-edge industries that perform most of the R&D and thus affect most strongly the overall productivity of the economy. That this criterion is essential can be seen from the failures of the socialist countries to reap productivity benefits from their very high capital investments, which the market economies have managed more effectively. Summers has made some rough calculations that suggest that this improvement could be perhaps 0.5 percentage points a year (Boskin, 1988). The 1990 Economic Report of the President makes similar calculations, and points out that this signifies a major long-term improvement in living standards, as we have also stated at the beginning. However, it is important not to repeat the errors of the 1970s, when so much capital was funneled into relatively unproductive real estate and other investments.

HOW GROWTH RATES CAN BE INCREASED TO MEET THE NATIONAL GOAL

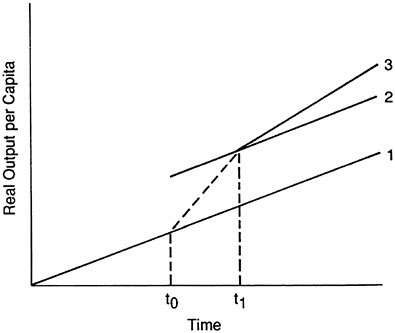

Thus, taking these considerations into account, Boskin has described the relation between Solow's general framework and the more recent results as follows. Under Solow, the fundamental variables that increase the rate of real per capita growth of a country in the long term are the rate of technical change and the increase in quality of the labor force. Increasing just the capital-to-labor ratio by this theory will lead only to a temporary increase in the rate of growth (moving

from growth path 1 to growth path 2 in Figure 5), but to higher living standards—a desirable goal in itself. As mentioned, such an increase in physical capital formation occurred during the 1960-1979 period in Japan. These large growth rates proved difficult to sustain for most of the 1980s, but permanent advantages for many industries and for the population have been created.

Measurements of productivity growth alone are not, however, a complete expression of the role of technology in economic growth. As mentioned above, in the original formulations, and in much of the work that followed, the inputs of labor, capital, and productivity were deemed essentially independent of each other. The contrary findings of Boskin and Lau can perhaps be more easily interpreted from our actual experience in the innovative process. R&D and creative design are seldom performed all by themselves—but rather only when they are expected to be employed in new or improved facilities or in superior operating modes. So technological change is not only embodied in physical capital investment, it is itself capital—intangible capital—and also a powerful inducement to it, since the availability

FIGURE 5 Alternative growth paths: Technical change and capital formation. t0: proinvestment policy leads to higher capital formation and transition to higher level of income. t1: economy resumes long-run growth rate or through interaction of investment and technical change, moves to more rapid growth path. SOURCE: Boskin (1986, p. 37).