3

AN EVALUATION OF THE DEPARTMENT OF THE INTERIOR'S 1989 RESOURCE ASSESSMENT

As Chapter 1 described, the Department of the Interior's 1989 resource assessment caused concern among some petroleum industry representatives. The assessment projected significantly lower undiscovered resource values than two prior DOI assessments, issued in 1975 and 1981. Certainly, part of the decrease was due to discoveries made between assessments. Once an exploratory drill uncovers a petroleum field, the field moves from the “undiscovered” category to the category of “identified” resources awaiting extraction. But, more important, the estimates from the different years may have varied because of limitations of the assessment methodology.

This chapter presents the Committee on Undiscovered Oil and Gas Resources ' evaluation of the methodology used in the 1989 assessment. It begins with a brief overview of the assessment boundaries, important for understanding the assessment results. Then, it moves to a two-part evaluation of the assessment methodology: the first part covers the USGS; the second part covers the MMS. (Recall from Chapter 1 that the USGS inventoried resources for oil-producing regions onshore and in state waters, while the MMS assessed resources beneath the Outer Continental Shelf.)

ASSESSMENT BOUNDARIES

Understanding the assessment boundaries—which oil and gas resources the assessment includes and which it excludes—is crucial for policymakers who are formulating energy strategy and attempting to gain a comprehensive view of future oil and gas resources available for development. This section evaluates

three key parameters related to the assessment boundaries: the definitions of conventional and unconventional resources, the economic assumptions, and the reserve growth of existing petroleum reservoirs.

Conventional/Unconventional Boundary

One controversial aspect of the DOI's assessment is its limitation to “conventional” resources. As Chapter 1 explained, industry groups—most notably the Potential Gas Committee—do not share the DOI's delineation between conventional and unconventional resources and include in their own assessments certain resources that the DOI defined as outside of the assessment boundaries.

The DOI assessment defined conventional resources as “crude oil, natural gas, and natural gas liquids that exist in conventional reservoirs or in a fluid state amenable to extraction techniques employed in traditional development practices” (U.S. Department of the Interior, 1989). Further, the assessment specified that these resources must exist in “discrete accumulations.” The USGS, which was responsible for the onshore assessment that covered the bulk of unconventional resources, acknowledged that the boundary between conventional and unconventional resources is hazy in many situations.

The DOI's reasons for setting aside unconventional reservoirs from analysis were: (1) they are mostly discovered and their geographic and stratigraphic distributions are largely known; and (2) in-place volumes are large and recoverability is uncertain because of technical and economic factors (U.S. Department of the Interior, 1989). Further, the DOI judged that the geologic data and assessment methods available for evaluating unconventional resource occurrences were inadequate.

In the committee's opinion, the DOI's decision to exclude unconventional oil resources from its assessment is justifiable. Except for thermally stimulated heavy oil recovered primarily in California, unconventional oil deposits, like those from tar sand and oil shale, have contributed little to domestic oil production. Indeed, current and future production costs of these resources will be higher than costs of conventional resources.

On the other hand, the DOI's decision to exclude unconventional natural gas resources presents problems. Natural gas deposits in low-permeability sandstones, fractured shale, and coal beds—sources the DOI labelled “unconventional”—are making an important contribution to current production, variously estimated at about 1.5 to 2 trillion cubic feet (Tcf) per year. Much of

this volume is produced from low-permeability gas-bearing sandstones and is primarily the result of the accelerated drilling and development that occurred between 1977 and 1982, especially between 1979 and 1982 under incentives from the Natural Gas Policy Act. Production of coal-bed methane and natural gas from fractured shale have been increasing in recent years, with the former supported by increased understanding of the resource's distribution, new production technologies, and tax incentives. The recent (December, 1989) extension of coal-bed methane tax credits and the reimplementation of tax credits for tight-gas reservoirs for two years will assist further development of these resources. Production of all major forms of unconventional natural gas has been aided by extraction research funded by the Gas Research Institute and the U.S. Department of Energy.

While acknowledging some of the special characteristics of unconventional natural gas accumulations, the committee concludes that it is both feasible and appropriate to include these resources in a national resource assessment.1 Of course, the estimates of unconventional resources should be provided separately from estimates of conventional resources. Industry decisions about whether to produce unconventional resources are guided by a unique set of technical characteristics and economic incentives (in the form of tax credits). Thus, estimates of unconventional resources are most useful when they are provided separately, because future production of these resources may depend upon economic and technical conditions different from the conditions that influence the production of conventional resources.

In-Place Resources: Recoverable/Unrecoverable Boundary

As discussed in Chapter 2, the classification of resources as “recoverable” or “unrecoverable” with current technology is at best a snapshot in time. Advances in reservoir characterization, drilling, and completion continually increase the percentage of a reservoir's total petroleum supply that is recovered. Yet, the USGS/MMS assessment (like most other assessments) included no estimates of in-place resources, only estimates of resources recoverable with

|

1 |

In this chapter, the committee's conclusions and recommendations are underlined. |

current technology. Estimates of in-place resources are important in judging the potential for new recovery technology to increase the producible petroleum supply.

Because the assessment was limited to recoverable resources, on average only about one-third of discovered oil and 60 to 85 percent of discovered natural gas was incorporated in the models used to estimate undiscovered resource volumes. Excluding consideration of in-place resources in these models imposes a technological overlay too early in the assessment process. A more thorough evaluation would first estimate each play 's in-place resources and then multiply these estimates by recovery efficiencies to estimate technically recoverable resources. Using estimates of in-place resources in combination with recovery efficiencies would allow the estimates to be updated more easily to account for advances in recovery technology.

The committee recommends that in future assessments, the USGS and MMS develop methods to estimate in-place resources in each play. The agencies should base their estimates of technically recoverable resources on in-place resources, by applying recovery factors to in-place resource estimates .

Economic Boundaries

The assessment's economic boundaries hinged on the computation of a “minimum economic field size” (MEFS): the smallest field that assessors determined can be developed profitably. Calculating the MEFS requires a myriad of economic assumptions. For the 1989 assessment, the fundamental assumptions were:

-

The MEFS must yield a net average after-tax return of 8 percent on the development investment.

-

The absolute price of natural gas would not exceed 75 percent of the btu-equivalent price of crude oil.

-

The 1987 oil price was $18.00 per barrel.

-

The 1987 natural gas price was $1.80 per million cubic feet (Mcf).

-

Real oil prices would decline at an annual rate of 3 percent between 1987 and 1989 and then increase 4 percent (with a range of plus or minus 1 percent) per year beginning in 1990.

-

Real gas prices would decline 2 percent annually between 1987 and 1989 and then increase 5.5 percent (with a range of plus or minus 1 percent) per year beginning in 1990.

-

The future costs for reservoir development and transportation facilities would remain fixed at 1985-1986 levels.

With these assumptions, DOI analysts calculated the MEFS on the basis of a 1987 field discovery and a decision to develop the field beginning in that year.

The USGS and the MMS used the same assumptions in determining the MEFS. However, because onshore and offshore assessments differ in their overall approach and methodology, the USGS and MMS used different boundaries to separate the economically recoverable resources from the subeconomic resources.

USGS Economic Boundaries

In its analysis of the lower 48 states onshore and the offshore state waters, the USGS defined plays using field sizes down to 1 million barrels of crude oil or the energy-equivalent volume of natural gas (denoted as Mmboe; 1 Mmboe is equal to 6 billion cubic feet (Bcf) of gas). The 1 Mmboe volume was used to truncate the geologically assessed distribution of undiscovered fields and to provide a lower boundary for the play assessment methodology (Attanasi, 1988). In part, this truncation was a function of the minimum field size included in the national data base used as input for the assessment. For the lower 48 states onshore, the USGS found that virtually all fields of 1 Mmboe or larger were economic to develop, based on depth and field size. However, for the assessment of fields smaller than 1 Mmboe, the USGS calculated the MEFS by province or region and then determined what fraction of these small fields was economic to develop.

The calculation of the MEFS was done by discounted cash-flow analysis using assumed future oil and gas prices, inflation rates, rates of return, development costs, and timing of development (U.S. Department of the Interior, 1989). Estimates of development costs accounted for drilling depth, especially for small fields, and water depth for state waters (Attanasi, 1988).

Overall, only 1 in about 2,100 fields containing more than 1 Mmboe was found to be uneconomic to develop in the onshore lower 48 states. Fifty-two percent of 50,241 undiscovered oil fields and 47 percent of 27,014 nonassociated gas fields smaller than 1 Mmboe were considered economic to develop (Attanasi, 1988). The committee concludes that since tens of thousands of undiscovered small fields were considered economical to develop, the chosen minimum size cutoff of 1 Mmboe was too high for the overall assessment.

It is important to note that for both Alaska and state waters in the Gulf and Pacific, where development is more expensive, the USGS used a higher MEFS. For the Gulf and Pacific, the USGS assumed a minimum economically developable crude oil field size of 2 Mmboe. For Alaska, economic constraints were even greater.

For the overall assessment, in moving from technically recoverable to economically recoverable resources, applying the MEFS and the economic parameters (most notably the $18.00 per barrel crude oil price and the $1.80 per Mcf natural gas price) reduced the undiscovered resources onshore in the lower 48 states by only a small amount. Nationally, for crude oil, there was a 20 percent reduction (6.7 billion barrels) between onshore mean undiscovered recoverable resources and onshore mean undiscovered economically recoverable resources. Of that 6.7 billion barrels, however, 5.3 billion barrels were in the Alaskan region. For natural gas, there was a 26 percent reduction (65.3 Tcf) between onshore mean undiscovered recoverable resources and onshore mean undiscovered economically recoverable resources. Of that 65.3 Tcf, 56.7 Tcf were in the Alaskan region. Thus, for the onshore lower 48 states, the economic overlay produced only a small constraint to the undiscovered resource volumes.

The important implication of these results—an implication policymakers must recognize—is that higher oil prices will NOT by themselves transform large volumes of undiscovered resources from technically recoverable to economically recoverable, except in Alaska. Assuming that the DOI assessment is correct, a higher oil price may speed recovery of these resources by offering a higher profit, but it will not lead to much higher total (ultimate) recovery unless the price increases stimulate development of technological advances that expand the boundaries of technical recoverability (for example, to deeper waters).

We note, however, that the estimation of technically recoverable resources in the USGS assessment used an economic screen (for example, a minimum field size). The use of such a screen is contrary to the meaning of the term “technically recoverable” and implies that some high-cost but recoverable resources were left out of the assessment.

MMS Economic Boundaries

For its resource evaluation, the MMS divided the OCS into “planning areas.” Each planning area consisted of one or more basins. Each basin contained one or more groups of identified or postulated reservoirs that the MMS called “plays,” although these plays were actually summations of prospects

and not true, geologically defined plays.

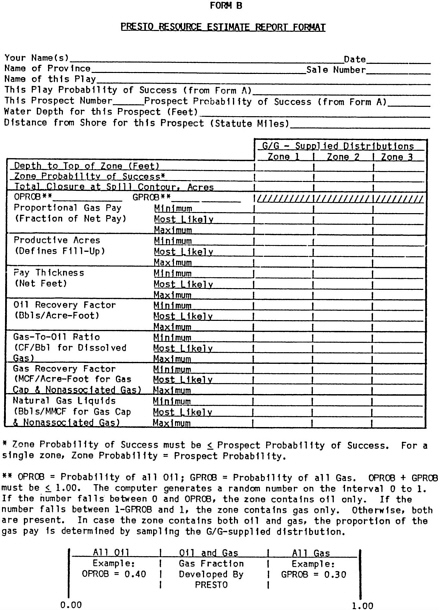

The MMS used a mathematical computer model, PRESTO (Probabilistic Resource Estimates—Offshore), to produce its final resource assessments. The PRESTO model produces a range of resource estimates with a corresponding estimate of the probability of occurrence. It simulates drilling of the modeled prospect and hydrocarbon discovery. MMS analysts derived probability distributions of resource volumes from multiple runs of the model. PRESTO determines the decision to develop, which would involve platform and production well installation, by comparing the prospect resources with a MEFS. For the 1989 assessment, the MEFS was determined outside the PRESTO model with a model called MONTCAR, a discounted cash-flow analysis program that calculates the volume of resources needed to balance various operating costs. In calculating operating costs, MONTCAR considers water depths, drilling depths, distance from shore, and other operating conditions for each prospect (Minerals Management Service, 1985). This results in a range of costs for different areas.

The MMS's calculation of the MEFS was prospect specific. It did not incorporate costs associated with production infrastructure, such as pipelines and onshore processing facilities, that might be shared between multiple discoveries. If, on a specific trial of the PRESTO model, the computed resources exceeded the MEFS, the model stored the results for developing the final range of outcomes. If the resources for that prospect were less than the MEFS, the model set the resource volumes to zero for that trial. The model also calculated minimum basin reserves (MBR) and minimum area reserves (MAR) to determine if the aggregate estimated undiscovered resources were adequate to justify required transportation and plant facilities (U.S. Department of the Interior, 1988).

The MEFS for the base-case economic scenario ($18.00 per barrel of oil and $1.80 per Mcf of gas) ranged from 3 Mmboe in the Gulf of Mexico and the Pacific, to 5 Mmboe in the Atlantic, to between 44 and 299 Mmbo in Alaska (depending on location). The maximum MEFS ranged from 190 Mmboe in the Pacific to 690 Mmboe in the Gulf of Mexico, and from 300 Mmboe in the Bering Sea of Alaska to 1,000 Mmboe in the Atlantic. MAR volumes ranged from zero in the Gulf and Pacific (that is, infrastructure is already available in these areas), to 120 Mmboe in the Atlantic, to between 77 and 810 Mmbo in Alaska (U.S. Department of the Interior, 1988). For regions with an established producing infrastructure, the MEFS and MAR had little effect on development of the undiscovered resource. In more remote or severe operating portions of producing regions, or in regions where no production has been established,

economic boundaries were present. Such boundaries were significant where costs of building infrastructure are high, as in remote, deep-water areas and other places where operating conditions are difficult. Economic boundaries were moderate for the Atlantic region but were much more significant for Alaskan waters because the cost of building infrastructure there is so high.

Inferred Reserves and Reserve Growth

Though the DOI assessment focused on petroleum from undiscovered reservoirs, it also included a separately reported estimate of inferred reserves (the postulated incremental but unknown volume estimated to be recoverable from known reservoirs). Inferred reserves are an important component of the resource base. The DOI assessment, for example, estimated that inferred oil reserves are 63 percent as large as undiscovered oil reserves, based on mean values. Therefore, the accuracy of the method used to estimate inferred reserves is an important issue.

The DOI estimates of inferred reserves were based on a statistical time series of ultimate recovery by year of field discovery that ended in 1979. This time series was compiled and published by the American Petroleum Institute (API) and the American Gas Association (AGA). It captures historical and traditional reserve growth sources, such as extensions and new pools. The time series data reflect drilling experience probably no more recent than 1977. The period since 1977 has seen a substantially increased understanding of reservoir heterogeneity, a greater understanding of the consequences of sweep efficiency in waterfloods, and the potential for strategically targeting infill drilling and recompletions. As a result, the data through 1977 on reported inferred reserves do not reflect the increased knowledge of reservoirs gained in more than ten years of drilling. At the time of the assessment, there was no way to avoid this shortcoming. However, since the assessment was completed, the Energy Information Administration (EIA) has prepared an evaluation of oil and gas reserves by year of discovery that could help document the increasing efficiency in the conversion of discovered resources to reserves (Energy Information Administration, 1990). The estimated ultimate recovery (EUR) of oil and natural gas was compiled for six dates between 1977 and 1988 by year of discovery in groups of five years each. These new data can be used, for example, to show that for Railroad Commission District 8 in Texas—a leading oil-producing district—the annual average increase in EUR for 1977-1988 was 1.5

|

BOX 3.1 The USGS'S Legislative Mandate The U.S. Geological Survey has deep roots in the monitoring of the nation's natural resources. In 1879, as the nation pushed its boundaries west, Congress, at the recommendation of the National Academy of Sciences, created the USGS to map the new territories. Congress mandated in the Organic Act of 1879 that the USGS oversee “classification of public lands and examination of the geological structure, mineral resources and products of the national domain.” In response, the new agency dispatched teams of scientists on horseback to document the west's natural resources. Since 1879, the USGS's mission to research energy resources in various parts of the nation has evolved through a patchwork of federal laws, including:

Although the USGS is responsible for developing and disseminating the geologic information needed to help formulate policy and ensure the wise development of the nation's energy resources, there is no provision in the federal statutes for a comprehensive national program to inventory oil and gas (National Research Council, 1988). |

percent for fields discovered between 1920 and 1934. This was an increase from a rate of 1.0 percent in the period 1971-1977 for those same discoveries.

The DOI should determine if the EIA's new data offer a method of updating previously inadequate recognition of reserve growth potential of known heterogeneous reservoirs. The DOI should also determine whether use of these new data are suitable for, and will continue to be available for, an improved inferred reserve assessment methodology. If these data are not appropriate or will not continue to be updated, other methods to define reserve growth potential should be developed.

DETAILED EVALUATION OF USGS ASSESSMENT METHODS

The USGS has the responsibility to assess the oil and gas resources of the onshore portions of the United States (see Box 3.1). Its jurisdiction includes the submerged lands contiguous to the coastal states to a distance of three miles from their coasts. This section evaluates the quality of the USGS assessment for these areas.

Organization and Staff

Oil and gas resource assessments carried out by the USGS are the responsibility of the Office of Energy and Marine Geology in the Geologic Division. Two branches, headquartered in Denver, provide the staff.

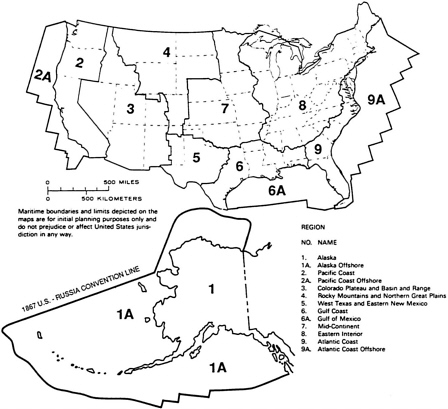

For the 1989 assessment, the USGS divided the nation into 9 regions and subdivided the regions into 80 provinces (see Figure 3.1). The provinces were assigned to 42 geologists from either the Petroleum Geology Branch or the Sedimentary Processes Branch. Following procedures set forth by an assessment coordinating committee, each geologist carried out the assessment for his or her province. Each of the 42 province geologists was responsible for preparing a report on the geology and oil and gas plays in each province. (The committee found, however, that some of these reports were not prepared and completed as open-file reports until after the assessment was finished.) Work was reviewed by the assessment coordinating committee, which made the final decisions about whether to use or modify the data provided by province geologists. The USGS reported that each of the 42 province geologists spent not more than half time on the assessment over a two-year period. The project

FIGURE 3.1 The nine regions into which the DOI divided the nation for purposes of assessing undiscovered oil and gas.

leader was the only USGS staff member who spent almost full time on the assessment.

The committee found that experienced geoscience personnel were distributed unevenly among the provinces, and that their distribution did not correlate with the importance of the provinces as producers of oil and gas or their potential for containing undiscovered resources. Current research interests of participating geologists rather than the resource assessment appeared to dictate staff allocations. This resulted in a concentration of attention on the Rocky Mountains, California, and Alaska and a comparatively low level of effort in the Gulf Coast, Midcontinent, and Illinois Basin areas. In the lower 48 states,

the Gulf of Mexico region had the highest level of undiscovered recoverable natural gas and the second-highest level of undiscovered recoverable oil, yet it received a more limited allocation of staff than other regions. For this region, at least one extremely large play was found to be exceptionally diverse in its geologic character. The possibility exists that additional resource potential was masked because of a high degree of aggregation of reservoir types within this play. This potential is one that could have been tested but was not given the necessary allocation of effort within the assessment.

Members of the assessment coordinating committee were veterans of the previous USGS assessment and each had several years of experience in assessment methodology and analysis. In addition to reviewing the work of the province geologists, this group was responsible for determining the use of the data they provided and for applying the analytical assumptions and techniques that produced the results. The assessment coordinating committee was assembled solely for this particular project; a permanent resource assessment group no longer exists in the USGS.

In contrast to the considerable level of experience in the assessment coordinating committee, the amount of experience in play analysis and resource assessment among the province geologists varied greatly. In at least one case, one of the two geologists assigned to a major province had limited experience with the geology and oil and gas production patterns within that province. In another case, an experienced geologist was assigned to a major province, but the province was large and the assessment effort could have benefitted from a greater disaggregation of plays. And, though analysts may have been experts in the general geology of the provinces for which they were responsible, many had little or no experience in resource assessment or the methodology employed. This necessitated training by the assessment coordinating committee for many of the province geologists. The committee concluded that because the play analysis procedure used for the assessment depends on expert judgment and knowledge of geologic factors affecting oil and gas accumulation, the lack of experience could be a significant factor in the accuracy of the results .

Data Base

Sources

Because no publicly accessible, comprehensive data base on United States oil and gas fields exists, the USGS used a wide variety of data sources for its assessment. As discussed in Chapter 2, several data bases, both public and private, cover one or more elements of in-place petroleum. (TORIS is one example.) However, each of these data bases is incomplete in coverage either in the total petroleum content of each reservoir in the data base or in the coverage of all discovered reservoirs.

The committee found that the USGS assessment was limited in particular by a lack of seismic data for the lower 48 states. While recognizing the enormity of the task of collecting such data, some committee members questioned whether an adequate assessment could be completed without such a data base. Without seismic data covering the lower 48 states, the USGS must depend on gathering as much geologic and related petroleum information as possible from all available sources. The data gathering task is difficult, because there are three categories of land ownership in the onshore: federal, state, and private. The number of industrial participants in onshore petroleum exploration and development is about two orders of magnitude larger than the number engaged in similar offshore activities. Onshore seismic data commonly are proprietary to the company contracting for the work or to a seismic contractor doing the work on a speculative basis. Such data often are not available to the USGS or, if they are available, are expensive. (This situation contrasts with offshore, where the federal government owns all the resources and the MMS has access to seismic data at only the cost of reproduction.) In part because of the difficulty of obtaining data, it appears that the USGS used mostly its own information, from both published and unpublished sources, for the 1989 assessment.

The committee recommends that in future assessments, the USGS make a more consistent effort to seek out both published and unpublished information from state geological surveys, state regulatory agencies, and private-sector sources. The USGS should also alert assessment users to the enormous variety of the data on which it bases its final estimates.

The province or basin reports prepared by the province geologists represent a synthesis of the data utilized in each area. The detail and degree of orientation toward petroleum assessment needs of these reports varied greatly. This reflected the variety of backgrounds and research interests of the preparers.

While the USGS plans to place all of these reports in its open-file series, only 24 were listed as complete, with an additional 16 in review or revision, at the time of this committee's review.

Association of American State Geologists' Review of USGS Data

In 1988, the Secretary of the Interior requested—in response to the natural gas industry's questions about the assessment—that the Association of American State Geologists (AASG) review the geologic information used in the assessment (Association of American State Geologists, 1988). The AASG's review was intended to be complementary to this report. The AASG solicited comments from the geologic community (including geologists from academia, state agencies, and industry) through a series of regional workshops. At each workshop, representatives of the USGS and/or the MMS presented the geologic information they used in the assessment process for the region in question. Workshop participants were asked to provide written comments on the following topics:

-

their overall impression of the adequacy of the geologic information used in defining plays and in carrying out play analysis;

-

whether they knew of any geologic information from state surveys or other sources that the USGS did not use, but that would have significantly improved the quality of the assessment; and

-

whether they noted any deficiencies or unanswered questions in areas in which they had particular expertise.

The findings from the AASG report mirrored some of this committee 's observations. While AASG reviewers noted the extensive amount of information available to the MMS, they commented on the lack of seismic data available to the USGS and on the variability in quantity and quality of other USGS data. The AASG report cited several specific examples of information that was readily available and pertinent to the analysis of a province, but was not drawn upon.

Data Auditing

Good statistical practice in resource appraisal begins with an audit of the data used in the assessment: data describing predrilling exploration, well outcomes, and the depositional environment of individual prospects. A data

audit is a framework for: (1) evaluating the data's accuracy and completeness; (2) identifying areas where the data require improvements; and (3) providing explicit measures of the data's quality to assessment users. The USGS currently lacks formal data audit procedures.

The committee recommends that the USGS design an audit to assess the quality of exploration data employed in its resource assessments. The USGS could start by instituting a formal audit of the U.S. oil and gas field data files used in the 1989 assessment. These data files include Petroleum Information Corporation's PDS oil and gas field files, NRG Associates' Significant Oil and Gas Fields of the United States files, and state geological survey and state oil and gas commission field files. Such an audit is well within the scope of the resource surveys undertaken by the USGS and would enhance the credibility of future resource assessments.

Play Analysis

This assessment was the first in which the USGS used a play-analysis approach on a national scale. The USGS identified 250 plays containing fields with more than 1 million barrels of oil or 6 billion cubic feet of natural gas (U.S. Department of the Interior, 1989). These 250 plays formed the foundation for the assessment. The definition of plays therefore is a critical component of the overall assessment process; it is the starting point for the prediction of undiscovered resource volumes.

Background

A play-based resource assessment method attempts to group into “plays” known reservoirs or fields that have common characteristics. It then predicts the remaining undiscovered petroleum accumulations within each group. Thus, play analysis provides a framework within which predictions about undiscovered resources are closely tied to knowledge about the distribution of already-discovered resources within that play.

White defined a play as “a group of geologically similar prospects having basically the same source-reservoir-trap controls of oil and gas” (White, 1980)—a definition suggesting reservoir character as a key element in play definition. Fisher and Galloway found, on the basis of analysis of all the major oil reservoirs in Texas, that “the most unifying, first-order character of play definition is the

genetic origin of the reservoir,” by which they meant the commonality of the depositional system responsible for laying down reservoir rocks (Fisher et al., 1984). Thus, reservoir origin is widely regarded as an important parameter in play definition (Tyler et al., 1984). According to this view, depositional systems affect the external and internal geometries of reservoir rocks—critical determinants, respectively, of field size and field distribution within a basin. The depositional systems, therefore, affect the overall architecture of pay and nonpay zones.

Plays must be drawn up carefully and must be as internally consistent as possible in terms of their geology and their reservoir properties. The mixing of dissimilar reservoirs in fields making up a play may lead to inaccurate statistical characterization of the play's maturity. Inaccurate statistics, in turn, may lead to an inaccurate assessment of the play's potential to contain undiscovered resources. Canadian assessors have recognized that poor play definition or mixing of plays may distort statistical analysis (Podruski et al., 1988).

Sources of Information About Plays

The USGS derived its 250 plays primarily from the Significant Oil and Gas Fields of the United States Data Base, a proprietary data base produced by NRG Associates. The version of this data base the USGS used contained about 370 “clusters,” each composed of a set of fields whose volumes of ultimately recoverable petroleum were at least 1 Mmboe. In this data base, a major reservoir is located in only one duster, but a field containing more than one reservoir may occur in more than one cluster. NRG's definition of a cluster was not necessarily designed to conform to an appropriate play definition. Nevertheless, the NRG data base provided a reasonably comprehensive national information source that the USGS could use to develop size distributions for discovered petroleum at the time of the assessment. In addition, the data base was advantageous because it was in a machine-processable format.

The USGS interpreted some clusters as plays and aggregated others to form plays. USGS geologists then provided judgments on play and accumulation attributes, including the existence of a hydrocarbon source, favorable timing of hydrocarbon migration, potential migration pathways, and the existence of potential reservoir rock facies (Crovelli et al., 1988).

The USGS's Application of Play Analysis

Although the committee regards the USGS's use of play analysis as a substantial improvement over previous methods, the committee is concerned about how accurately the USGS applied the play analysis method.

Play definition: Applying the play concept requires the identification of many factors, including depositional systems, reservoir structure, origin and migration of petroleum, and trapping style. The scales of the major components that form reservoirs (e.g., the thickness and length of a barrier bar or the areal extent of a delta lobe) are related to the field-size distribution within a basin. Lithology (in the gross sense of the major categories of carbonates versus sandstone) commonly can be a quick first check on any dichotomies in a play composed of smaller groups of reservoirs that might otherwise be assumed to be depositionally similar. Structural geological considerations may override those of depositional systems (where judged appropriate), but purely geographic groupings generally should be avoided.

The committee found that in some cases, USGS assessors created excessively large and lithologically diverse plays from clusters within the NRG data base. For example, in the Gulf Coast province, the USGS created extensive plays from vertical (and horizontal, in at least one major play) aggregations containing such a diversity of Tertiary depositional systems that the committee questioned whether they met the criteria of a play. In East Texas, the USGS combined both carbonate and sandstone clusters in the same play. The committee judged that this tendency to combine diverse aggregations in a single play seemed most significant in the Permian Basin. The mixing of dissimilar reservoirs in fields making up a play, as may have occurred in the Gulf Coast, East Texas, and Permian Basin areas, may cause either overestimated or underestimated resource volumes. Play mixing could inflate estimated resource volumes by masking declines in discovery sizes that normally occur as exploration progresses in the area encompassing the play. Play mixing could decrease resource estimates by biasing statistical computations so that the play appears mature, with many fields discovered and few remaining undiscovered fields (see the discussion below). Whether play mixing results in overstated or understated resource estimates is critically dependent on the time pattern in which the discovery wells are drilled within the mixed plays. (See the discussion of staggered mixing of plays in Adelman et al., 1983.)

To determine how play mixing might have affected the USGS's resource estimates, the committee analyzed in detail ten plays in the Permian Basin, where

we judged that the tendency to combine diverse aggregations in a single play seemed most significant and most amenable to evaluation. (Appendix C provides a detailed discussion of our analysis.) We analyzed plays containing mixed sandstone and carbonate lithologies to determine the environments of deposition of the various lithic types. We found that where plays were almost one-third sandstone or carbonate, with the balance being the other lithic type, they consisted of platform carbonate and submarine fan/canyon-fall sandstone.

Our analysis showed that partitioning the field discovery history of plays with mixed depositional systems into thirds, in the same manner as the USGS, using the same dates, yields a distribution that resembles the histogram of a play within which many fields have already been discovered, rather than a play with a greater proportion of undiscovered fields. It is likely that the mixing of dissimilar depositional systems in a play, with different characteristic size distributions for the reservoirs in each system within that play, can create a play that appears excessively mature in its discovery history.

The detailed analysis described in Appendix C suggests that the formulation of plays by aggregating clusters that include different depositional systems will underestimate the volume of undiscovered resources. Assuming the that the field-size distribution within a play bears some relationship to the depositional systems within that play, the size frequency distribution of a mixed play, being more varied, will appear more complete. This will lead to the misinterpretation that there are fewer undiscovered fields.

The committee cannot determine the degree to which the assessment is biased by the aggregation of diverse depositional systems into plays. Concerns about the makeup of plays do not extend equally to all regions and provinces assessed, and for many areas these concerns do not exist. However, we believe that such aggregations could produce important miscalculations in some circumstances. We are concerned that the USGS has performed no tests to evaluate this possibility.

The committee recommends that the USGS analyze and refine play content before the next assessment to determine the impact of play formulation on resource volumes. The USGS should also make statistical testing of play formulation a required part of the methodology for future assessments so that play mixing does not limit the reliability of the estimates.

Conceptual Plays: A further constraint on the current assessment is its general lack of treatment of “conceptual” plays: those that do not contain discoveries or reserves but that geological analysis indicates may exist (Podruski et al., 1988). Conceptual plays cannot be evaluated with the same analytical

procedure used to assess plays within existing fields; the approach to assessing these plays would be much more subjective. Results would have to be reported separately, recognizing the potential for major uncertainties related to the adequacy of source rocks, reservoir rocks, and trapping mechanisms.

Conceptual plays may be especially important for assessing natural gas supplies, because natural gas exploration is less mature than oil exploration and because future natural gas discoveries will likely be found at deeper stratigraphic intervals than oil. Information was available from industry and state sources that would have supported a conceptual gas play for Arbuckle strata in the Anadarko basin of eastern Oklahoma and western Arkansas. Recent exploration in Arbuckle rocks in that basin has turned up gas reserves in excess of 600 Bcf. A similar conceptual play for Arbuckle strata in the Anadarko basin also would have been possible. That interval in the Anadarko basin remains to be tested.

The committee determined that the USGS did not provide adequately for unknown or poorly known plays in the current assessment. This omission is a point that must be addressed in future assessments.

Quantification of Expert Judgment and Statistical Methods

Background: The Appraisal Form

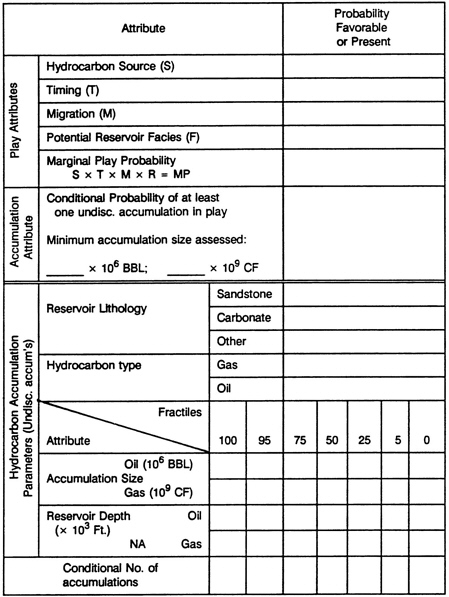

The USGS used an appraisal form to record information about each defined play (see Figure 3.2). The form included spaces for geologic risk factors, a distribution for the number of petroleum fields, separate field-size distributions for crude oil and natural gas, and gas/oil probabilities. The distributions that represent the field size and number of fields were specified in terms of an absolute maximum and minimum together with fifth, twenty-fifth, fiftieth, seventy-fifth, and ninety-fifth percentiles. These distributions were subjectively assigned by consensus, based on the discovery history and geological information for the play. Piece-wise linear cumulative distribution functions were fitted between the assigned maxima and minima, passing through the assigned percentiles. For each of these fitted distributions, a computer program calculated a mean value and a variance. Only the means and variances of the assigned distributions for each play were used for the resource appraisal.

For portions of Alaska's North Slope, where extensive seismic information is available, the USGS used a procedure based on identified individual prospects, similar to the MMS's approach for well-mapped federal offshore tracts. Because

data limitations did not allow for identification of individual prospects in other USGS provinces, plays were treated in the composite fashion described above.

Geologic Risk Factors

The play appraisal form required the assessment of separate risk factors for source, timing, migration, facies, and minimum accumulation. Each category was assigned a single value between 0 (total certainty that the attribute is absent) and 1 (total certainty that the attribute is present). The USGS treated these values as statistically independent and multiplied them together.

In the case of the hydrocarbon source attribute(s), the USGS reportedly considered organic richness, kerogen type, and thermal maturity interactively in arriving at some value between 0 and 1. However, if oil or gas in commercial amounts was present in the play, then the play attribute probability was automatically assigned a value of 1. Similar determinations apply to the assignment of the attribute probabilities for timing (T) and migration (M), with a value of 1 being assigned if accumulation had occurred. As a consequence, for all plays that had identified in-place petroleum accumulations, regardless of the amount or quality, attribute probabilities for S, T and M were assigned a value of 1. Thus, the USGS ignored geochemical data in estimating resource volumes when petroleum had already been found in the area being assessed. The committee recommends that the USGS determine the potential impact on the assessment of omitting geochemical data in assigning risk to source, timing, and migration for plays with in-place petroleum accumulations.

Most interior onshore basins have established volumes of oil and gas. Therefore, the general geochemical premise that the USGS adopted is that there is oil and/or gas present and hence there are source rocks. This premise generally permeated the entire assessment process.

Although presence or absence of oil and gas source rocks is correctly used to define whether an area is prospective for petroleum, the presence of petroleum source rocks is not a stand-alone indication that oil and gas accumulation has actually occurred in contiguous reservoir facies within the play. One must further integrate into the assessment process the interrelationships between the potential source facies and the contained reservoir facies. Most important, one must consider the degree of geothermal diagenesis that the sedimentary source and reservoir sections have experienced throughout geologic time. The USGS did not consider these basics consistently.

If a specific play is located in thermally immature sediments, then any contiguous reservoirs within that play can be prospective only for either indigenously sourced biogenic gas or for migrated oil and/or gas. The chance that indigenously sourced oil is present in thermally immature reservoirs is zero. Clearly, the chances for any oil and gas accumulation in the play will depend on migration of petroleum into the play, which in turn will depend on source rocks being located outside the play. In a like manner, if the play in question is associated with a sedimentary section that is thermally mature, then all associated contiguous reservoirs within the play may be prospective for both indigenously sourced and migrated oil and gas. Finally, for very mature strata, prospective target reservoirs should be candidates for indigenously sourced, thermally generated gas accumulation. Thus, play risk and the amount of oil and gas in place are functions of the play's thermal maturity regime. Consequently, the play's thermal maturity—immature, optimally mature, or very mature—should be clearly defined.

The committee concludes that formal consideration of thermal maturity and its inclusion in the assessment forms may substantially alter future projections of undiscovered oil and gas. The USGS should test this proposition.

Equally important as maturity consideration in play analysis is the proper definition of the organic facies characteristics associated with each play. It is insufficient to conclude that generally oil-prone organic matter and generally gas-prone organic matter will always yield the expected product. The committee recommends that in future assessments, analysts use geochemical data wherever possible to evaluate conceptual and emerging plays and established plays in which source and maturity considerations affect prospect risk. In evaluating source and maturity risks, the USGS should use its own extensive geochemical research and other recently published research.

Sizes of Undiscovered Fields in a Play

The appraisal form required that analysts input separate size distributions for undiscovered oil and undiscovered gas fields. As explained in Chapter 2, analysts created these size distributions by fitting the sizes of already discovered fields in a play to a truncated shifted Pareto (TSP) distribution. According to the USGS, analysts chose a TSP distribution in place of the more commonly used truncated, three-parameter lognormal distribution because the TSP distribution is mathematically simpler and generally yields results similar to the lognormal distribution.

To assess how the sizes of fields discovered change through time, analysts created three chronological TSP distributions for each play: one for the first third of fields discovered, one for the middle third, and one for the last third. In one Permian Basin gas play, for example, the first TSP distribution was based on the sizes of all fields discovered before 1968, the second covered fields discovered between 1968 and 1973, and the third included fields discovered between 1973 and 1983. Presumably, the parameters of the TSP distribution evolve with time. Thus, USGS analysts used the chronological TSP distributions created from known fields to extrapolate parameters for a TSP distribution for the undiscovered fields in the play (Houghton, 1988). The group responsible for evaluating the play considered the extrapolated parameters, but did not necessarily use them to define the final undiscovered field-size distribution for the appraisal form. The final undiscovered field-size distribution was based on the analysts' interpretive evaluation of the three components of the discovery record.

The committee recommends that the USGS investigate whether the manner in which the TSP distributions fit the discovery record is sensitive to the fashion in which the data are partitioned. Choice of division into two or four in place of three time segments may result in very different fitting patterns. This, in turn, would influence the subsequent judgments of geologists in their assessment of a shape for the size distribution of undiscovered deposits.

Analysts used a point estimate of the size of the largest field to calibrate the fit. This largest size depends on the number of undiscovered fields (i.e., it is an “order statistic”). Thus, the fitting procedure introduced two forms of dependence: dependence of the undiscovered size distribution's shape on the assessment of the number of undiscovered fields and a consequent probabilistic dependence between the uncertain quantities “undiscovered field size ” and “number of undiscovered fields.”

The committee judges that it is a logical contradiction to treat the uncertain quantity “undiscovered field size” as independent of “number of undiscovered fields” in subsequent calculations. Furthermore, the notion that number and size should be treated as statistically independent is contrary to reasonable models of the discovery history of a play. The undiscovered field-size distribution would be assumed the same whether there were 30 or 300 undiscovered fields in the play.

Number of Undiscovered Fields in a Play

The USGS's procedure for assigning the distribution for the number of undiscovered fields in a play is poorly described and seems unrelated to the assigned field-size distributions. While the USGS invested considerable effort into structuring the discovery history as it relates to the evolution of the field-size distribution, it apparently made no parallel effort to couple this with a parametric structuring of a corresponding distribution for the number of undiscovered fields.

For each play, the mean and variance of the assigned distribution for the total number of hydrocarbon accumulations was somehow partitioned into a separate mean and variance for the number of oil fields and for the number of gas fields. The one piece of information used for this purpose was an assigned oil/gas probability, but the formula for partitioning variance is not obvious nor is it documented. Presumably, the decision about whether an accumulation is gas or oil resulted from a binomial trial using the assigned probabilities. The committee judges that in future assessments, a better approach would be to use separately specified distributions for the number of undiscovered oil fields and the number of undiscovered gas fields in a play.

Aggregation Within a Play

The USGS characterized each play's aggregate resources with a mean and variance. Analysts obtained the mean and variance by considering the aggregate as a sum of a random number of randomly sized fields, treating the number and size as statistically independent quantities. For this calculation, evaluated above, the only inputs needed were the means and variances of the number and size distributions for the play. Similarly, only the play aggregate mean and variance were required for the higher levels of aggregation.

USGS analysts could add to the play aggregate additional resources from small fields (those containing less than 1 Mmboe). It is not clear how the USGS propagated small field uncertainty to higher aggregation levels. Overall, small fields contributed about 27 percent to the USGS's total national resource estimate.

Analysts made judgments about the chance of occurrence of the geologic conditions necessary to have formed at least one remaining significant undiscovered accumulation in the play. Analysts then proceeded quantitatively to assess accumulation sizes and numbers as probability distributions. As described previously, a truncated shifted Pareto distribution was fitted to the sizes of the

known oil and gas fields in each play to guide the analysis of field-size distributions. Geologists performed the resource calculation by means of FASPF (Fast Appraisal System for Petroleum Field Size) using an analytical method based on fitting lognormal distributions with the specified means and variances, rather than using a Monte Carlo simulation (Crovelli et al., 1988; U.S. Department of the Interior, 1989).

One problem with the USGS procedure for aggregating resources in a play was that it distilled evaluations of several analysts into one consensus result. Consensus was used to obtain both geologic risk factors and probability distributions showing the range of possible resource volumes thought to exist in the play. The USGS provided no detailed description of the protocol employed to arrive at consensus values. In addition, it reported only the consensus risk factors and resource distribution, masking the varied assessments of the participating geologists. The result is a compression of uncertainty: a failure to reflect the diversity of opinion between individual geologists in the published estimates. Consensus distributions usually concentrate on a range of values smaller than that spanned by the union of individual opinions. The history of oil and gas forecasting teaches us to be wary of point estimates equipped with narrow credible probability intervals.

The committee judges that, especially in frontier areas, the range of uncertainties in resource numbers should reflect the uncertainties exhibited in the differing opinions of geologists. We recommend that, at the very least, the range of risk factors assessed by individual geologists before a consensus is reached be available for assessment users to inspect.

Another problem with the method for aggregating resources in a play was that it treated the attributes that lead to petroleum accumulation —source, timing, migration, and reservoir—as statistically independent. Analysts used subjective judgment to determine the probabilities that these attributes were present. Assuming the attributes were independent, analysts multiplied the probabilities together to yield the marginal probability that a play contains a certain minimum petroleum volume. In most plays, however, source, timing, and migration are related geologically and therefore may be dependent. Treating the factors as independent may have yielded a lower marginal probability than if they had been treated as dependent. The precise impact of modifying this independence is poorly understood because no alternatives have been tested. However, in Alaska's North Slope province, which includes several multi-billion-barrel plays, treating accumulation attributes as independent could have significantly influenced the projection of oil and gas volumes.

The committee recommends that the USGS test the sensitivity of its undiscovered oil and gas projections to the assumption that petroleum source, timing, and migration are statistically independent.

Aggregation of Plays Within a Province

In this assessment, the USGS treated undiscovered resources in plays within a province as perfectly correlated. For example, if one play 's resources exceeded the mean of its distribution by 1.5 standard deviation units, then the USGS assumed that every play in the province exceeds the mean of its distribution by exactly 1.5 standard deviation units. Under the assumption of perfect correlation, the standard deviation of the uncertainty distribution for a province becomes equal to the sum of the standard deviations of the uncertainty distributions of the component plays. Thus, in the USGS method, only the province mean and standard deviation were needed for the higher aggregation levels.

The committee is concerned that the method the USGS used to aggregate resources within provinces is inconsistent with the method the MMS used. While the USGS method assumed complete conditional dependence among plays, the MMS method (evaluated later in this chapter] assumed complete (conditional) independence. The committee recommends that in future assessments, the USGS and MMS standardize their procedures for aggregating resources .

Regional and National Aggregates

USGS assessors estimated the standard deviation of the uncertainty distribution for regional aggregates as the exact mid-value between an assumption of perfect correlation among component provinces and an assumption of zero correlation. Thus, the degree of correlation among provinces was not region-specific. Similarly, the aggregate mean was always assumed to be the aggregate of the component means; it was not tied to distributional or correlation assumptions.

The regional aggregate is the first aggregation level for which the USGS reported uncertainty estimates in terms of percentiles. Therefore, at this level, it was necessary to describe the shape of the uncertainty distribution and not just its mean and standard deviation. This was done by assuming a lognormal distribution with matching mean and standard deviation and reporting the percentiles of the fitted lognormal distribution.

The USGS's approach to aggregation thus rested on carrying forward

standard deviations for successive aggregation levels via correlation assumptions, and on a final imposition of a lognormal distribution at the regional level. Presumably, the USGS adopted this approach to avoid conducting a simulation based on the actual size and number distributions specified at the play level. Yet, the MMS used a simulation approach that does not appear especially burdensome. Because uncertainty percentiles are not reported below the regional level, there is no need to develop distributions for aggregates below this level. Consequently a simulation approach would require that individual play aggregates be simulated only once for each simulated value of the regional aggregate.

The committee recommends that the USGS adopt a simulation approach to aggregation at the regional level. The national aggregate uncertainty distribution can easily be obtained from the regional uncertainty distributions by a simulation, because the number of regions is not large and independence between regions is a plausible hypothesis. The advantage of simulation is that all the uncertainty information contained in the original play appraisals can be carried forward. Therefore, assessors can avoid adoption of a particular parametric form for the regional uncertainty distribution. Before the USGS can implement a simulation approach, however, it must give further thought to the degree of dependence among plays within provinces and among provinces within regions. The MMS introduced dependence by using a hierarchical risking structure, but this may not be appropriate where risks are essentially zero.

Subjective Probability Assessment and Training

The use of personal probabilities in the assessment of quantities of undiscovered oil and gas is well established. Two notable examples of government agency projections of undiscovered petroleum that use subjective probability are described in “Geological Estimates of Undiscovered Recoverable Oil and Gas Resources in the United States ” (Circular 725), published by the USGS in 1975, and “Oil and Gas Resources of Canada, 1976,” published by Energy, Mines and Resources, Canada.

The recent USGS assessment method differed from that described in Circular 725 in two important ways: it adopted the petroleum play as the basic unit for analysis and it used key features of discovery process modeling as a guide to formulating subjective assessments. As discussed earlier in this chapter, each geologist subjectively appraised the size distribution of a play's undiscovered fields by choosing the parameters of a truncated, shifted Pareto distribution. The

idea that field size declines on average as exploration progresses was incorporated by displaying three, chronological TSP distributions: one representing fields discovered in the first third of the play 's history, another representing the middle third of the discoveries, and another representing the most recently discovered fields.

The most notable feature of this assessment protocol is that it employs properties of an objective first principles model of discovery as an aid in making subjective assessments without exploiting the predictive capabilities of such a model. Each assessor must use his or her judgment to appraise a descriptively complex, compound event and create distributions for the sizes and numbers of undiscovered fields. In contrast, an objective first principles model of discovery is designed to generate this distribution as a function of the discovery history without subjective intervention.

Among the issues raised by the USGS's assessment approach are:

-

Is the TSP distribution, which assessors use as a decision aid, adequate to represent the observed discovery histories for the wide spectrum of petroleum plays that the assessment covers?

-

How well trained are participating geologists in subjective probability assessment?

-

Do the results adequately represent uncertainties about field-size distributions and numbers of undiscovered fields?

Houghton studied the quality of the fit of a TSP distribution to the discovery history of a very mature play, the Minnelusa play, in the Powder River Basin and compared this fit with some alternatives (Houghton, 1988). Houghton's study appears to be the only attempt, prior to the national assessment, to validate the model on which the USGS assessment procedure is based. Given the geological diversity of the approximately 250 plays included in the national assessment, a much more aggressive effort to validate the procedure prior to its adoption was warranted. The committee questions whether the USGS's assessment procedure is robust, in the sense of providing a good fit to widely varying discovery histories, and precise, in terms of providing a good fit between predictions of future discovery patterns and existing discovery patterns.

Discussions with assessors suggest that the USGS devoted minimal effort to the organized training of participating geologists in subjective probability. In response to a question about the level of training, a senior manager replied: “Most of the geologists have probably attended a short course in subjective

probability assessment.” Because of the lack of training, it is not surprising that in interviews with participating geologists, we found many examples of failure to understand the precise meanings of fundamental probability concepts. In particular, widespread misunderstanding of the meanings of .05 and .95 fractiles, maximum possible and minimum possible values, risk, and conditional versus unconditional probabilities appeared during our interviews.

The committee found that these shortcomings of the assessment procedure are symptomatic of the USGS's failure to maintain support for research and training over the long time periods necessary to carry out a credible oil and gas assessment: Because of the absence of a permanent resource assessment group, the assessment lacked continuity in structure, a clearly defined assessment methodology that was unambiguously understood by all members of the assessment team, and enough statistical support to carry out data management, modelling, and predictive validation.

Case Study: Alaska

Alaska is perhaps the most important U.S. region for future onshore petroleum discovery. The 1989 assessment concluded that onshore Alaska and state offshore Alaskan waters house 26.9 percent of the nation 's technically recoverable undiscovered petroleum. Because of this region's significance, the accurate appraisal of its resources is critical for determining the nation's future energy strategy. Consequently, the committee analyzed the assessment more closely in Alaska than in other regions. This section presents the committee's findings related to the USGS's appraisal of Alaska's potential resources.

Overall, the committee concluded that the quality of the USGS assessment in Alaska was good compared to some other regions. In large part, the credibility of the USGS's work there was due to the staff that covered the region. The assessment team that evaluated Alaska was large compared to the teams for some other regions, and many staff members had prior resource assessment experience. Nevertheless, the committee identified some areas of the assessment process that could be improved.

Data Base

The USGS's geological data base is more complete in Alaska than in many other regions. In particular, the region covering Alaska's National Petroleum

Reserve (NPRA) has perhaps the most complete geochemical data base available. In part, this is because in Alaska, unlike in other regions where much of the well data are from industry and are proprietary, the USGS has access to data from almost all wells (except for a small number of North Slope wells for which information was withheld because of a state confidentiality period). Also, in Alaska, all the engineering and production data dating back to the beginning of production in 1957 fall under the USGS's purview. And, since the last century, the USGS has been collecting comprehensive geological data for the region.

In contrast to the geological data base, the USGS's seismic data base for Alaska is less complete. For this assessment, seismic data coverage was limited to the Arctic National Wildlife Refuge (ANWR), the NPRA, and a single, pre-common-depth-point (CDP) seismic line through Prudhoe Bay. The committee is concerned that the incomplete seismic data base, especially for the North Slope, creates an imbalance in play analysis and resource assessment in an area with one of the highest resource potentials in the onshore United States.

One way the USGS might augment its seismic data base is by increased cooperation with state government agencies and the petroleum industry. For example, it is possible that the USGS could persuade industry to allow province geologists to view proprietary seismic lines in key areas.

Play Methodology

As discussed earlier, two of the committee's concerns about the assessment relate to how the USGS defined plays and how it accounted for conceptual plays. Improper play definition can result in play mixing: the combination of dissimilar depositional systems into one category, which prejudices statistical computations and may skew the assessment toward an underestimation of resource volumes. The failure to consider conceptual plays—those without discovered petroleum but that geologic information indicates may exist—can also lead to an inordinately low resource estimate.

The committee evaluated in detail the 12 plays the USGS identified on the North Slope. From this review, the committee concluded that North Slope plays were, for the most part, well defined. Generally, prospects and discovered pools grouped into plays shared the requisite common history of petroleum generation, migration, reservoir development, and trapping conditions (Podruski et al., 1988). Nevertheless, some mixing of plays may have resulted from the inclusion of thick, stratigraphic sequences with different lithologies and origins in the same play. For example, the Barrow Arch Play includes the entire Ellesmerian sequence,

which consists of rocks ranging in age from Mississippian to Lower Cretaceous, deposited in both marine and non-marine environments and variously composed of sandstones, conglomerates, shales, and carbonates.

In contrast to the fairly consistent definition of North Slope plays, from the committee's evaluation it appears that the USGS's consideration of conceptual plays was sporadic. The USGS defined conceptual plays in some parts of Alaska, but not in others. For example, in the North Slope an “economical top of Lisburne” became a conceptual play. However, in the Cook Inlet province, no conceptual plays were included, though members of the Alaska panel were aware of conceptual plays identified and being pursued by industry.

In future assessments, the committee recommends that the USGS attempt to identify conceptual plays throughout Alaska. Because of the major potential for uncertainties in evaluating conceptual plays, however, it is essential that the volumetric contributions of conceptual and established plays be clearly separated. In regions where the USGS included conceptual plays in its resource estimates, the committee found inadequate documentation of how much of the estimates came from conceptual plays and how much from established plays.

Technically Recoverable Resources Computation

For North Slope plays, the USGS produced its estimate of the technically recoverable resource volume by applying a “recovery factor” to its estimate of the total petroleum in place. This recovery factor was uniform across all plays (32.3 percent for oil). Because the recovery factor percentage is a direct multiplier in converting oil-in-place to reserves, small variations in the percentage applied can change North Slope totals by billions of barrels. It would therefore be more appropriate to evaluate each play, or even sub-play, according to its particular characteristics. Across a region as large as the North Slope, these characteristics will vary considerably with lithology, depth of burial, tectonic setting, and applied drilling technology. For future assessments, the vast amount of production history and data now available from the Endicott, Lisburne, Prudhoe Bay, and Kuparuk fields and the greater density of infill drilling and horizontal drilling should improve the determination of recovery factors.

Economic Assumptions: Minimum Economic Field Size

To determine economically recoverable resource volumes, the USGS applied a single minimum economic field size (MEFS) of 384 Mmboe on the

North Slope for all plays in all geographic locations. The rationale behind this assumption was that 384 Mmboe is the mid-point of the area's field-size distribution, which ranged from 256 to 512 Mmboe. Assessors determined that fields at the bottom end of this range —those that contained 256 Mmboe—were not commercially developable.

After its review, the committee concluded that the 384 Mmboe cutoff may be too severe. For example, the MEFS of accumulations close to the pipeline should be substantially smaller than the MEFS of farther-removed accumulations because of the lower transportation costs. In addition, the committee concluded that the use of a single MEFS for the entire North Slope is difficult to justify. The use of a range of MEFS values more tailored to specific areas is possible without extensive additional effort. For example, the MMS, in its evaluation of federal offshore waters in the Beaufort and Chukchi Seas, used MEFS values ranging from 208 to 278 Mmboe for “satellite” fields and from 517 to 810 Mmboe for “stand-alone” fields. For future assessments, the committee recommends that the USGS study and refine the MEFS values it chooses for the North Slope. Cooperative studies between the USGS and the MMS could result in more realistic and consistent economic screening.

Uncertainty

In Alaska more than in perhaps any other region, the USGS should emphasize the uncertainty in its resource estimates. Though Alaska contains a large fraction of the nation's petroleum reserves, compared to other regions its exploration and production history is immature. Even in the generally accepted “mature” areas of Cook Inlet and Prudhoe Bay, production began relatively recently, in 1957 and 1968, respectively. The comparatively unexplored nature of many areas in Alaska magnifies the already substantial uncertainties that surround predicted resource volumes. The committee recommends that the USGS assume the responsibility of communicating this uncertainty to assessment users, making certain users do not limit their focus to mean, single number estimates, but instead consider the entire range of possibilities .

DETAILED EVALUATION OF MMS ASSESSMENT METHODS

Until the DOI established the MMS in 1982, the USGS had the responsibility to assess oil and gas volumes in federal offshore territory. Before the MMS

|

BOX 3.2 The MMS'S Legislative Mandate The MMS is a relatively new player among the federal agencies. It was established in 1982 to consolidate the administration of mineral resources in federal offshore territory. Prior to the establishment of the MMS, management of offshore resources was divided among several government branches, including the USGS, the Bureau of Land Management, and the DOI's Office of Outer Continental Shelf (OCS) Program Coordination. Unlike the USGS, the MMS has a legislative mandate to submit biennial reports to Congress that assess the undiscovered economically recoverable resources of the OCS. This mandate is specified in 1978 and 1985 amendments to the OCS Lands Act of 1953. Assessing mineral resources is only one part of the MMS's responsibilities. Its primary task is to manage the federal government 's leasing of OCS mineral resources, as authorized in the Lands Act. The MMS approves leases of offshore acres for petroleum exploration and collects royalties from companies as payment for offshore leases. |

was formed, management of Outer Continental Shelf (OCS) resources was split between several divisions within the DOI, including the USGS and the Bureau of Land Management. But as interest in producing offshore petroleum to reduce reliance on imports grew, the government decided that the authority over the OCS should be consolidated in one agency: the MMS. Thus, the MMS is charged with assessing petroleum resource volumes on the OCS (see Box 3.2). It is required to report these volumes to Congress every two years. This section evaluates the quality of the MMS's work for the 1989 assessment.

Organization and Staff

To fulfill its legislated responsibilities of performing biennial resource assessments, the MMS has subdivided the OCS into four regions: Alaska, Pacific, Gulf Coast, and Atlantic. A semi-autonomous office oversees each region. Regional offices are located in Anchorage, Alaska, Los Angeles, California, New Orleans, Louisiana, and Herndon, Virginia. In addition, the MMS has a headquarters Office of Resource Evaluation in Herndon.

Because the MMS has a legal obligation to perform offshore resource assessments biennially, and because economic resource evaluation is a continuing process for federal offshore lease sales to petroleum companies, the MMS maintains a large, exceptionally experienced professional staff in all four regional offices. (Altogether, more than 400 MMS scientists contributed to the 1989 assessment.) Experience levels are sufficient to provide sound knowledge of the various geological provinces within the regions. For example, the resource group in the Gulf of Mexico OCS region has a permanent professional staff of seven, most of whom have advanced degrees in geology or geophysics. Engineering, statistical, and mathematical specialists normally are assigned on a regional basis and are available to the province or basin groups. Many of the MMS professionals have had industry experience. Because of the obligation for biennial assessments, assessment in most areas is ongoing. Thus, there were no apparent time constraints for the 1989 assessment. Most of the work was accomplished with proper attention to detail and thorough analysis.

The experience level of the MMS staff increases the credibility of its resource assessments. The committee is concerned, however, that funding cutbacks caused by moratoria on lease sales will force the MMS to reduce personnel levels, which could have a negative effect on its ability to conduct future assessments.

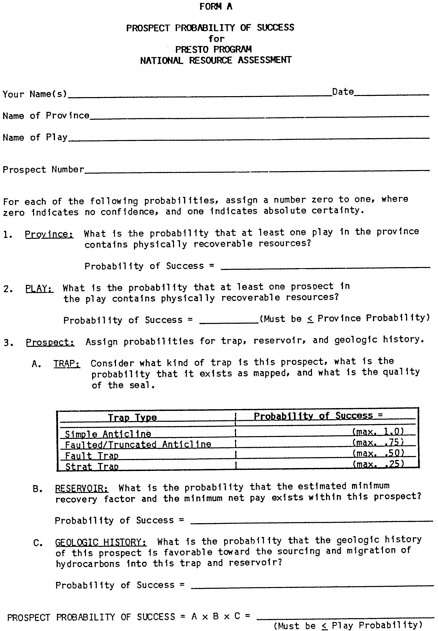

For the most part, staff training and background for the 1989 assessment were adequate to enable the staff to interpret data competently and to translate their interpretations into resource assessments with credible results. Nevertheless, there is evidence that MMS geologists shared difficulties experienced by USGS geologists in understanding the precise meaning of some important probability concepts. For example, one form (Form B) that the MMS used in Alaska asked for an appraisal of “minimum” and “maximum” values for several uncertain quantities to be assessed by geologists. At a meeting with our committee, some geologists said they interpreted the minimum value as the .05 fractile, while others thought it was a value such that there is zero probability that

the uncertain quantity will fall below it. The maximum possible value was also interpreted inconsistently. Confusion about the operational meaning of elementary probability concepts may be limited to the group of geologists we met. Nevertheless, the committee advises that in future assessments, the MMS should ensure that all participating geologists have a clear understanding of probability concepts that they must employ. Otherwise, the credibility of the assessment numbers may be questioned.

This small piece of evidence suggests that some geologists may have experienced difficulty in assessing probabilities for descriptively complex, compound events. Their assessments may not have been well calibrated with (i.e., may not have corresponded with) actual relative frequencies of such events. The MMS could conduct controlled experiments to measure how well geologists' assessments calibrate with actual events.