4

Hydrogen, Alternative Fuels, and Electricity

The U.S. DRIVE Partnership is focused on reducing petroleum consumption and greenhouse gas (GHG) emissions by employing three power systems: hydrogen fuel cell vehicles (HFCVs), advanced combustion engines, and plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) using electricity. Hydrogen is an energy carrier produced from a variety of energy sources, but at present it is mostly produced from natural gas. Biofuels, energy carriers for solar energy and thus renewable fuels, are produced from a variety of biological sources, including plant materials and algae. Electricity is an energy carrier that is generated from a variety of sources today, but in the United States mostly from coal and natural gas. This chapter reviews the programs relating to hydrogen that are under the U.S. DRIVE Partnership effort. (Budget information was provided by U.S. DRIVE and the U.S. Department of Energy [DOE] in response to questions from the committee.) The chapter also includes an overview of issues relating to the Partnership’s role in biofuels, natural gas, and electricity for PHEVs and BEVs.

Strategic Input Needed from Executive Steering Group

One of the challenges of the U.S. DRIVE Partnership is to have critical fuels and vehicle technologies both commercially ready so that the required fuels can be in place when vehicles with advanced technologies become available in the marketplace. The Partnership is focused on having advanced vehicle technologies with cost and performance comparable to those of conventional technologies by 2020, and so critical fuel technologies will also need to meet that time line.

The level of DOE funding in FY 2012 for the hydrogen production portion of the U.S. DRIVE Partnership will be 8.6 percent lower than the FY 2011 level, which was significantly reduced from FY 2009. Pressures to reduce expenditures are likely to have important impacts on program areas outside of U.S. DRIVE that provide important technology input. The Partnership is dependent on DOE’s Office of Fossil Energy (FE) and Office of Basic Energy Sciences (BES), as well as the Biomass Program in the Office of Energy Efficiency and Renewable Energy (EERE), for technologies relating to hydrogen generation, biofuels, and electricity, all of which affect the U.S. DRIVE Partnership strategically.

The Fuel Cell Technologies Program (FCTP) has done an admirable job of coping with these changes and the uncertainty, and it has provided coordination links with programs in other parts of DOE. However, managing the various programs under U.S. DRIVE to ensure that the required fuel technologies will be available as new vehicle technologies emerge remains a challenge, and there is a compelling need to maximize the impact of funds spent toward completing critical fuels and vehicle programs at the same time. The Partnership has diligently involved its various technical teams to gain “user” input, but these teams have not provided overall guidance across all fuel categories. Given the changes that have taken place, the continuing environment of uncertainty, and the approaching dates for planned commercial readiness, the committee believes that U.S. DRIVE should seek strategic “user” input from its Executive Steering Group (ESG) on the program direction, focus, and timing to ensure that critical fuel technologies are available when needed.

Recommendation 4-1. The DOE should seek the strategic input of the Executive Steering Group (ESG) of U.S. DRIVE. The ESG could provide advice on all DOE fuel programs potentially critical to providing the fuel technologies needed in order for advanced vehicle technologies to achieve reductions in U.S. petroleum dependence and greenhouse gas emissions, and DOE should subsequently make appropriate program revisions to address user needs to the extent possible.

Hydrogen Fuel Pathways

In the United States today, hydrogen is a major industrial gas with an annual production and consumption, mostly from centralized natural gas reforming plants, of approximately 20 million metric tons (20 billion kg) (NHA, 2010).1 A study of the transition to alternative transportation technologies (NRC, 2008, pp. 31-35) concluded that 2 million fuel-cell-powered vehicles would be the maximum practical number in 2020. Two million vehicles would increase hydrogen

__________________

1 The figure of approximately 20 million metric tons reported by the National Hydrogen Association (NHA, now called the Fuel Cell and Hydrogen Energy Association) includes hydrogen produced from merchant plants.

demand by about 2 percent2 based on today’s production, an increase that could be readily met in centralized plants by utilizing existing excess capacity or by building additional capacity. Thus, the issues during transition do not concern having enough hydrogen available overall but rather, having it available where needed at an acceptable cost and overall efficiency.

Three principal pathways appear feasible to meet the need: (1) transmission and distribution from centralized plants of gaseous hydrogen by tube trailer, (2) distribution of liquefied hydrogen by tanker, and (3) on-site generation of hydrogen at the fueling site using natural gas reforming or electrolysis of water. Hydrogen demand for transportation would thus be satisfied by combinations of centralized and on-site hydrogen production.

The “lighthouse scenario” is likely to play an important part initially in supplying needed hydrogen. In this scenario, widespread use of hydrogen fuel is encouraged in high-density cities and regions to achieve high market penetration in those areas and thus, it is hoped, a reduction in the cost of the fuel. These lighthouse areas would serve as a starting point for the development of a nationwide network. Such a system has already been proposed for Germany, and Honda is working in California on a similar approach.3 In addition, the California Fuel Cell Partnership, with support from the University of California, Davis, has been actively pursuing this approach.4 Needless to say, regulation could also play an important part in providing early hydrogen stations. A regulation being considered in California would require oil refiners to provide hydrogen stations on a schedule that meets the automotive original equipment manufacturers’ (OEMs’) projected introduction of hydrogen vehicles once the number reaches 10,000 (CARB, 2011). Considerable work remains to be done to identify pathway scenarios that fill the needs of specific market segments in the United States while minimizing cost and maximizing efficiency.

The hydrogen fuel/vehicle pathway integration effort is charged with looking across the full hydrogen supply chain from well (source) to tank for fuel cell vehicles and has been expanded to include the vehicle components, or life-cycle

__________________

2 This assumes that 5.6 kg of H2 per tank yields a 400-mile range. If each hydrogen fuel cell vehicle travels 15,000 miles per year, then each vehicle would consume 210 kg per year. A fleet of 2 million would then consume 420 million kg of H2 per year.

3 Sasha Simon, Mercedes-Benz, “The Mercedes-Benz Hydrogen Roadmap,” presentation to the NRC Committee on the Potential for Light-Duty Vehicle Technologies, 2010-2050: Costs, Barriers, Impacts and Timing, March 22, 2011, Washington, D.C.; R. Bienenfeld, Honda Motor Company, “Honda’s Environmental Technologies Overview,” presentation to the committee, June 5, 2012, Washington, D.C.

4 “Incentivizing Hydrogen Infrastructural Investment. Phase 1: An Analysis of Cash Flow Support to Incentivize Early Stage Hydrogen Investment,” June 2012, prepared by Energy Independence Now in conjunction with the California Fuel Cell Partnership Roadmap, available at http://www.einow.org/resources/reports.html, and “A California Road Map: Bringing Hydrogen Fuel Cell Vehicles to the Golden State,” California Fuel Cell Partnership, July 2012, available at http://cafcp.org/sites/files/20120720_Roadmapv(Overview)_0.pdf.

analysis. The goal of this effort is to support the U.S. DRIVE Partnership in the identification and evaluation of implementation scenarios for fuel cell technology pathways in the transportation sector, both during the transition period and in the long term, by (1) analyzing issues associated with complete hydrogen production, distribution, and dispensing pathways; (2) commenting to the Partnership on methodologies for setting targets for integrated pathways and pathway components; (3) providing observations to the Partnership on needs and gaps in the hydrogen analysis program; and (4) enhancing the communication of analysis parameters and results so as to improve consistency and transparency in all analysis activities. All of this work is considered by the committee to be important and an appropriate use of federal funds.

This effort is overseen by the fuel pathway integration technical team (FPITT), with representation from DOE, four energy companies, and the National Renewable Energy Laboratory (NREL). The expertise of this group supports analysis efforts of the Partnership on fuel cell technology pathways, coordinating fuel activities with the vehicle systems analysis effort, recommending additional pathway analyses, providing input from industry on practical considerations, and acting as an honest broker for the information generated by other technical teams.

The Partnership continues to make significant and important progress toward understanding and preparing for a transition to hydrogen fuel. During the past 2 years, a methodology for documenting and reporting assumptions and data for well-to-wheels analysis has been developed and is available.5 In addition, a methodology was developed for analyzing the optimal placement of central (large) hydrogen production facilities, and there was an evaluation of other industrial options and synergies for the use and supply of hydrogen, such as the coproduction of hydrogen from stationary fuel cells.

With guidance from a recently developed prioritized list of gaps and barriers, current efforts include an analysis of hydrogen fueling station costs during the early phase of hydrogen deployment and an update of the well-to-wheels analysis. In order to provide additional guidance to the program, a study is underway to identify specific issues that could threaten achievement of a commercially sustainable system.

The Phase 3 NRC report on the FreedomCAR and Fuel Partnership (NRC, 2010) recommended that DOE broaden the role of FPITT to include an investigation of hydrogen, biofuels utilization in advanced combustion engines, and electricity generation requirements for PHEVs and BEVs. Subsequently, the Partnership elected to maintain FPITT’s focus on hydrogen. Although the current committee recognizes that DOE maintains communications and coordination among the various fuels-related programs within DOE, the mechanism for balancing program priorities and identifying gaps among different fuel options to

__________________

5 See the NREL publication Hydrogen Pathways, Cost, Well-to-Wheels Energy Use, and Emissions for the Current Technology Status of Seven Hydrogen Production, Delivery and Distribution Scenarios, available at http://nrel.gov/docs/fy10osti/46612.pdf.

increase energy security and reduce GHG emissions is not apparent, as discussed above in the section “Strategic Input Needed from Executive Steering Group.”

Recommendation 4-2. The fuels pathways integration effort provides strategically important input across different hydrogen pathways and different technical teams to guide U.S. DRIVE Partnership decision making. In this time of budget restraints, the program of the fuel pathway integration technical team should be adequately supported in order to continue providing this important strategic input.

The hydrogen production program includes hydrogen generation from a wide range of primary energy sources, including natural gas, coal, biomass, solar, and wind. Thermal, electrolytic, photolytic, biological, and photoelectrochemical (PEC) processes are being investigated to convert these primary energy sources to hydrogen for use in fuel-cell-powered vehicles. The hydrogen production technical team (HPTT) helps guide this program toward commercially viable technologies through nonproprietary dialogue. This team includes representatives from DOE, four energy companies, and the Pacific Northwest National Laboratory (PNNL). In addition, SunCatalytix has recently been added as an associate member.

As noted in Chapter 1, a number of important programs related to the U.S. DRIVE Partnership are carried out in other parts of DOE. Work on biomass and algae production as well as work on using solar heat and wind to produce hydrogen are not part of the Partnership. The Office of Fossil Energy supports the development of technologies to produce hydrogen from coal and related carbon-sequestration technologies, and the Office of Basic Energy Sciences supports fundamental work on new materials for hydrogen storage, catalysts, and biological or molecular processes for hydrogen production, as well as work potentially affecting other areas of U.S. DRIVE.6 The Partnership has coordination links to each of these programs. Past programs of the Office of Nuclear Energy have included an investigation of high-temperature nuclear reactors for hydrogen production, but no funds are included for this approach currently.7 The hydrogen production program includes short-term and long-term approaches. In the short term, when a hydrogen pipeline system is not in place, hydrogen would be supplied from centralized plants using on-road trailers similar to (but larger than) those in commercial use today, or by small-scale generation at fueling stations using natural gas reforming or electrolysis of water. As the fleet of fuel-cell-powered cars and hydrogen demand increase, centralized

__________________

6 BES also manages the Energy Innovation Hub called the Joint Center for Artificial Photosynthesis, which is allocated $122 million over 5 years to make hydrogen from sunlight and water.

7 C. Sink, Department of Energy, “High Temperature Nuclear Reactors for Hydrogen Production,” presentation to the committee, June 4, 2012, Washington, D.C.

hydrogen generation plants with pipeline distribution would become increasingly attractive and would be expected to satisfy an increasing fraction of the total need with time.

The program includes pathways with which considerable commercial experience exists, as well as longer-term pathways, and is reviewed below.

Pathways with Commercial Experience

As already noted, the consumption of hydrogen in the United States is highest among industrial gases, and so there is extensive commercial experience in its production. DOE programs in coal gasification, biomass gasification, low-temperature electrolysis, and steam reforming of bio-derived liquid fuels benefit from this experience while seeking to achieve significant improvements in cost and performance.

A section on natural gas reforming, the commercial process most used today in centralized plants, is not included among the sections that follow for several reasons. The Partnership, through DOE studies, has already shown the feasibility of building small reformers for distributed generation at fueling sites and meeting the cost target, and opportunities to improve large-scale reforming are considered marginal. DOE now projects that reformers at fueling stations could produce hydrogen for $4 per gallon gasoline equivalent (gge) or less and thus reach the target range of $2 to $4/gge.8 Details regarding investment and operating costs are available online.9 The committee agrees with DOE that at this point other parts of the program are more appropriate for U.S. DRIVE than continuing cost-reduction efforts on this approach.

Hydrogen Production from Coal and Biomass

The production of hydrogen from coal and/or biomass will likely utilize a relatively mature technology, most appropriate for the later stages of a hydrogen transition (NRC, 2008). Reasonable estimates of the timing of these later-stage requirements suggest that hydrogen production from new large-scale coal and/or biomass facilities will not be needed before 2020. Prior to that time, central production of hydrogen appears manageable from natural gas feedstocks, which currently may offer environmental and cost advantages over coal and biomass.

Status of the Department of Energy Coal and Biomass Programs

Commercial large-scale gasification plants using coal, petroleum coke, or heavy oils have been in place for many years, and a large body of experience has

__________________

8 T. Rufael, Chevron, and S. Dillich, Department of Energy, “Hydrogen Production Technical Team (HPTT),” presentation to the committee, January 26, 2012, Washington, D.C.

accumulated concerning their cost and operation. Using biomass as a feedstock adds different physical and chemical properties to the fuel mix (see below), but does not fundamentally alter the relevance of this deep base of commercial gasifier experience.

The DOE program plan for coal speaks of “transitioning from hydrogen production for transportation applications to electric power applications,” but the technology remains relevant for central station hydrogen, either exclusively for transportation or (more likely) for the coproduction of electricity and vehicular hydrogen, and various approaches to purification of product hydrogen are being investigated. The goals of the program are “to support the goals of FE’s Office of Clean Coal in development and demonstration of advanced, near-zero emission coal-based power plants” (DOE, 2010a, p. iii). The thermochemical conversion of biomass to a syngas is supported by NREL.10

Three aspects of the programs involving coal and biomass to hydrogen reach beyond the commercial experience base with gasifiers:

- The capture and sequestration of the carbon dioxide (CO2) produced in the process;

- The integrating of operations downstream of the gasifier, especially the production of electricity and fuels; and

- A significant lowering of the capital cost.

Whatever budget resources are devoted to research and development (R&D) in high-priority process components, these resources are likely to be quite inadequate for demonstrating a near-scale facility and working out the systems integration issues that inevitably arise.

Environmental Issues

Concern for global climate change is much greater with coal than with biomass. The DOE hydrogen-from-coal activity has held the proving of the feasibility of a near-zero emissions plant as a key program goal. Achieving wide-scale deployment, however, will depend on the pace and accomplishment of the DOE’s carbon sequestration programs. Until the commercial availability and societal acceptance of full-scale carbon sequestration can be assured, there seems to be little point in demonstrating a hydrogen-from-coal plant. Unless the carbon emissions can be addressed in a satisfactory way, commercial production seems unlikely to go forward regardless of the other merits of the technology. In contrast, hydrogen from biomass could be partially carbon neutral but might raise other environmental concerns around land use.

__________________

10 See http://www.nrel.gov/biomass/proj_thermochemical_conversion.html.

In contrast with coal, a biomass production plant faces cost issues inherent in its feedstock. Whereas the coal feedstock is relatively cheap and abundant, the biomass feedstock raises a number of cost-related issues. First, the availability of feedstock limits the scale and location of biomass production plants. As a result, these are likely to face larger capital cost and transportation challenges. Second, the seasonal variability of biomass, both in its quantity and in its physical and chemical properties, will pose operating challenges. And third, storage, handling, and preparation of the feedstock to the specifications of individual gasifiers will add to cost. In addition, the type of biomass employed—for example, cellulosics, lignins, and so on—and variability of that feed will affect the gasification process.

Conclusions Regarding Hydrogen Production from Coal and Biomass

The chief issues for both the coal and biomass feedstocks center around capital cost, an observation made in the NRC (2008, p. 37) report. As that report noted: “Although coal gasification is a commercially available technology, to reach the future cost estimates … further development is needed. Standardization of plant design, gas cooler designs, process integration, oxygen plant optimization, and acid gas removal technology show potential for lowering costs. Other areas that can have an impact on future costs include new gasification reactor designs (entrained bed gasification) and improved gas separation (warm or hot gas separation) and purification technologies. These technologies need further R&D before they are commercially ready.”

Yet as long as natural gas remains as abundant, secure, and inexpensive as the current Energy Information Administration (EIA, 2012) projections indicate, a hydrogen transition appears supportable at least through 2020, and quite possibly beyond. Thus the hydrogen from coal and biomass efforts should remain focused on fundamental R&D, as noted above, and on scientific fields that might offer value in programs beyond hydrogen production, such as separation membranes, for example.

Recommendation 4-3. While a hydrogen-from-coal demonstration plant could address many of the downstream integration issues and thus provide more certainty around the probable capital costs, the committee recommends that any hydrogen-from-coal demonstration should be paced (1) to match the pace and progress of commercial-scale carbon sequestration and (2) to support a mature hydrogen fuel cell vehicle fleet in the event that natural gas becomes too costly or unavailable.

Regarding item 1 in Recommendation 4-3, the committee notes that progress in commercial-scale carbon sequestration remains highly uncertain. As a recent interagency report notes, “The lack of comprehensive climate change legislation

is the key barrier to CCS [carbon capture and sequestration] deployment. Without a carbon price and appropriate financial incentives for new technologies, there is no stable framework for investment in low-carbon technologies such as CCS” (DOE, 2010b, p. 10). Until this fundamental policy issue is resolved and the CCS process is demonstrated to be effective and safe for long-term storage of CO2, private investment in unsubsidized coal-to-hydrogen plants is likely to pose commercially unacceptable risks. Regarding item 2 in Recommendation 4-3, the opening stages of a transition to the HFCV appear supportable from natural gas feedstocks. For these reasons, continuing DOE’s basic R&D while deferring any demonstration of hydrogen from coal until conditions warrant seems appropriate.

Low-Temperature Water Electrolysis

The low-temperature (below 100°C) electrolysis of water is a mature hydrogen generation technology that has been used in military and industrial applications for decades. Electrolysis is an attractive solution to on-site hydrogen demand, as electrolyzers can be sited in nearly any location and can be scaled to meet volume requirements. Furthermore, the two primary electrolyzer technologies, alkaline and proton exchange membrane, can generate hydrogen without carbon emissions if powered by a renewable energy source. Although the membrane process has received the most attention in recent years, the alkaline process is the most commonly utilized, especially in large-scale industrial applications. The attractiveness and potential benefit to the fuel cell community stem from the fact that high-purity hydrogen can be generated by a relatively simple process and sited in geographical locations where other hydrogen generation processes are not feasible. Additionally, with respect to vehicle refueling, the hydrogen can be generated at high pressures, thereby eliminating the need for mechanical compressors.

Due to the nature of the electrolysis process, the technology can be used in small or large operations, making it ideal for lower-volume opportunities, including distributed, point-of-use applications such as home refueling or large-scale centralized production. Additional attractive aspects of the current electrolysis processes are durability and lifetime, as decades of operation without significant performance degradation and losses have been the norm. The electrochemical efficiency of the electrolysis process itself is approximately 80 percent (higher heating value [HHV]); when the entire system (balance of plant) is taken into account, efficiencies in the high 50s or low 60s can be achieved (excluding the power source efficiency contribution) (NREL, 2004, 2009, 2012).

Primary Disadvantage: Cost. The primary disadvantage of water electrolysis is cost, both operating expenditure (OPEX) and capital expenditure (CAPEX). The energy requirement to split the water alone is significant (more than 50 kWh/kg), as are the capital costs related to the hardware—for example, stack components and the balance of plant. It should be noted that the balance between OPEX

TABLE 4-1 Draft Targets (2015, 2020, and Ultimate) and Current Status for Hydrogen Production Using Water Electrolysis ($/kg H2) (Excluding Cost of Hydrogen Delivery)

| Method of Generation | Current Status | 2015 Target | 2020 Target | Ultimate Target |

| Distributed | $4.00 | $3.70 | $2.20 | $1.00-$2.00 |

| Central | $4.60 | $3.10 | $2.00 | $1.00-$2.00 |

NOTE: During the committee’s review, U.S. DRIVE representatives noted that the targets were under review for possible revision.

SOURCE: T. Rufael, Chevron, and S. Dillich, Department of Energy, “Hydrogen Production Technical Team (HPTT),” presentation to the committee, January 26, 2012, Washington, D.C.

and CAPEX is volume-dependent, as the smaller, lower-volume units are more capital-intensive, whereas the higher-volume units are more expensive to operate on a per kilogram of hydrogen basis. The current cost of producing hydrogen by the electrolysis process, central or distributed, is still significantly above the 2020 DOE targets of $2.20/kg H2 and $2.00/kg H2, respectively (see Table 4-1).11 Although the annual budget for hydrogen production (all technologies) has been reduced over the past 3 years, from approximately $28 million (FY 2008) to approximately $11 million (FY 2011), the DOE appropriately continues to support the longer-term initiatives that ultimately could reduce electrolysis stack hardware costs, advanced membranes, and new catalysts.

Generating electrolytic hydrogen without emissions is possible with a number of renewable energy sources—wind, solar, and hydroelectric power, to name a few. In order to better understand this approach, in recent years DOE has funded studies through NREL to assess hydrogen generation costs by means of a renewable wind energy electrolysis process (NREL, 2008a, 2008b). Conclusions from the cost-benefit configuration studies indicate that plant size (volume), utilization, and energy availability (wind source and strength) are critical factors in achieving the cost targets. The studies further show that under a number of conditions and assumptions, $3.00/kg H2 (gge) production costs could be achieved. The significant disadvantage of the wind electrolyzer approach is that the system must still be grid-connected for off-wind periods. The reports further highlight the impact on cost of the system architecture and engineering, including controls and software, water conditioning, the power electronics, and gas cleanup and drying. These assessments provide valuable insight into how hydrogen production rates and system utilization can impact cost, thereby providing direction to DOE about where funding would be best allocated.

As noted above, a number of sources indicate that electrolysis may be a viable hydrogen production pathway if costs and greenhouse gas emissions from electric

__________________

11 Note that the energy value of a kilogram of H2 is approximately the same as a gallon of gasoline equivalent (gge); thus, these targets can also be expressed as $/gge.

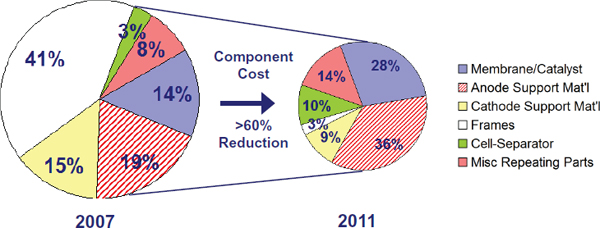

power generation can be reduced. The DOE’s response has been appropriate, proactively supporting long-term projects focused on next-generation technical solutions. As reported at the DOE Annual Merit Review meetings (2010, 2011, 2012), progress has been made in recent years. According to one effort, focusing on hardware elements has yielded significant cost-reduction advancements (see Figure 4-1). New cell materials, architecture, and ultimately advanced manufacturing methods will impact the capital on a kilogram-of-generated-hydrogen basis. Performance characteristics of the electrochemical process are predominately tied to membranes, electrodes, and catalysts, topics also currently supported. The membrane R&D is appropriately focusing on conductivity improvements and alternative polymers, while the primary electrode development effort is evaluating thin-film nanocatalyst materials (3M), similar to those developed for the fuel cell industry.

Regardless of the source of hydrogen, it is clear that for there to be the possibility of widespread HFCVs, there must be the availability of hydrogen for refueling. One possibility being pursued is that of using on-site electrolysis of water to locally produce hydrogen using wind power, which would both avoid GHGs produced (by the power plants) and reduce energy lost in the process of energy conversion at the power plant and transmission and distribution.

Appropriateness of DOE Funding. The operating and capital costs of electrolyzers as presented in Table 4-1 and Figure 4-1 must be reduced if they are to become a viable option and the hydrogen cost targets of $2 to $4/kg H2 are to be met. Research and development activities on the stack as well as on the balance of plant (predominately the power electronics) need to continue, as does integration with the energy sources. As the cost issue is related to the technology, the currently funded research topics previously discussed in the DOE portfolio of long-term projects continue to be needed. It seems appropriate that the DOE

FIGURE 4-1 Cost-reduction progress between 2007 and 2011 in membrane electrolysis stacks. SOURCE: Hamdan (2011).

programs focus on evaluation of the entire system, including the technical and cost benefits of advancements in power electronics as well as the impact of high-pressure electrolytic hydrogen generation for refueling operations.

Even though electrolysis is widely practiced commercially, its components and power electronics for refueling applications can still be improved, resulting in reductions in capital and operating cost.

Recommendation 4-4. Support should continue at the fundamental component level (e.g., catalysts, anode supports) for all types of electrolyzers as well as for associated power electronics.

High-pressure electrolytic hydrogen generation provides an avenue to significant cost savings in the dispensing of hydrogen in distributed applications at fueling stations by eliminating mechanical compression and purification subsystems. Recommendation 4-5. Technical development and systems analysis on high-pressure electrolytic hydrogen production should be supported to determine the costs, scalability, benefits, and developmental steps required to make it viable compared with conventional compression. With the goal of eliminating mechanical compression, additional work should be done on high-pressure electrolysis that can produce pressures of 84 MPa to 98 MPa (12,000 to 14,000 psi) and have sufficient capacity to do a fast tank fill (3 minutes).

Recommendation 4-6. The U.S. DRIVE Partnership should continue to support the development, testing, and analysis of (distributed) renewable electricity production methods in combination with the electrolysis of water.

Distributed Steam Reforming of Bio-Derived Liquid Fuel

Just as natural gas can be steam reformed in small refueling stations to produce hydrogen on-site, other liquid fuels can be also. If the liquid fuel is produced in a low-GHG-emissions method, which is possible from biomass, then this affords the opportunity of making low-GHG-emissions hydrogen on a distributed basis. A number of bio-derived fuels have been investigated, ranging from ethanol to heavy oils produced from biomass pyrolysis. From a technological perspective, it is straightforward to reform ethanol, but because of ethanol’s high cost the resulting hydrogen cost is not competitive with other methods of making hydrogen. Depending on future regulated costs for CO2 emissions, this pathway could become more competitive.

The DOE has investigated the reforming of other bio-derived liquids that might provide a more competitive hydrogen cost. It has supported early-phase research into both gas-phase and liquid-phase reforming of a variety of bio-derived

liquids. The major technical barriers include catalyst activity and selectivity issues along with catalyst coking issues. As a result of these efforts, some progress in yield improvements has been observed in laboratories, and a better understanding of the economics of the overall pathway is estimated. Through this work it appears that a very low bio-derived liquid cost is required to meet future hydrogen cost targets. Costs of less than $1/gal may be required for the bio-derived liquid. This may be the largest hurdle for this pathway.

The committee considers the reforming of bio-derived liquids to be an appropriate area for DOE funding, which for the past several years has been approximately $1 million per year. The funded projects are scheduled to be completed in FY 2013, and no additional funded projects are anticipated in FY 2013.

Longer-Term Pathways

The DOE is also pursuing several approaches to hydrogen production that are in their early stage of research and development, and much improvement in cost, performance, and efficiencies is needed before they are ready for commercialization. If successful, these approaches have the potential to reduce the energy requirement for hydrogen production, dependence on fossil fuels, and carbon emissions. These approaches include high-temperature water splitting, PEC processes, solar thermal conversion, and biological generation.

Emerging Hydrogen Production Technologies

Splitting water into its elements by a solar mirror system (solar thermal [ST] process) or by a PEC process involves techniques that capture solar energy to convert water directly into hydrogen. Both processes have been under investigation for decades, resulting in steady but slow progress. Both approaches are still far from being commercially viable and are faced with cost and technical challenges, yet they represent the potential to contribute to the generation of hydrogen by means of a renewable energy source.

Progress in the PEC approach has accelerated in the past decade, especially in new photoactive electrode materials that can utilize visible light and exhibit enhanced stability in an aqueous medium, such as Ti oxynitride (Maeda and Domen, 2010). Other materials that show promise include MoS2, sub-stoichiometric oxides, and selected non-oxides—for example, SiC, selected nitrides, and III-V as well as I-III-VI tandem semiconductors (GaInP2/GaAs). Nonetheless, challenges remain, including (1) low solar-to-electrochemical hydrogen efficiencies and (2) for many materials, the chemical stability, although efficiencies as high as 12 percent have been reported (NREL, 2010). Whether the PEC process has significant inherent advantages compared with combined photovoltaic and electrolysis processes remains to be determined. However, the Joint Center for Artificial Photosynthesis (JCAP) at the California Institute of Technology and the Lawrence Berkeley National Laboratory (Berkeley Lab) has been established as

an Energy Innovation Hub by DOE; JCAP could identify promising approaches for utilizing solar energy in electrochemical hydrogen production.

The second technique, the combination of high-temperature water-based redox chemistry with a thermal (solar) source—that is, the ST process—is an approach that is gaining interest because of (projected) economics. This technique has geographical limitations, but its scalability and overall simplicity make it attractive. High-temperature decomposition of water by coupling with a metal oxide redox cycle has been studied and supported by DOE for some time. The challenge has been finding materials with rapid oxidation/reduction kinetics, low thermal mass, and long-term stability and devising a continuous process that does not require large temperature swings. The DOE has been funding national laboratories, academia, and industrial partners in early-stage research for the past few years, focusing on various redox cycles and reaction and process engineering. Process modeling is progressing and will soon be validated in a 10 kWth thermal reactor currently in the design phase. The recent H2A study by TIAX on the costs associated with a number of thermochemical processes indicates that the ferrite process is the only one projected to meet the DOE cost targets of $3/gge (TIAX, 2011).

Electrolysis at an elevated temperature (a few hundred degrees) and the coupling of thermal decomposition cycles with electrolysis (e.g., electrolysis to generate hydrogen and a sulfur redox cycle for oxygen evolution) are also technically possible. They are also faced with material stability challenges and/or process complexity.

DOE support of these programs is appropriate, as they are still at the proof-of-concept phase. However, in view of the tight funding situation, continued support should be weighed against other programmatic needs, considering the viability of the approaches to meet the program goals in a reasonable time frame and the dependence on breakthrough innovation and inventions. A modest level of funding should lead to evaluation of the potential impact and likelihood of meeting program goals with these emerging technologies. Interactions with JCAP are encouraged so as to disseminate fundamental catalysis knowledge on hydrogen generation processes currently under study.

Biological Generation of Hydrogen

Biological generation (Lee et al., 2010; Hallenbeck et al., 2012) offers a possible long-range approach for effectively providing the energy input to produce hydrogen at low cost. Given the early stage of research for this method, DOE is appropriately, in the committee’s view, exploring a number of biological pathways to identify those that appear most promising.12 The results of these early

__________________

12 The committee is very much appreciative of and indebted to Professor Laurens Mets, University of Chicago, for his expert information and comments.

investigations may eventually lead to a development program. These pathways are described below.

One approach to the production of hydrogen by means of a biological process is through photosynthesis, using both of the photosystem components found in green plants. In this process, two photons absorbed by photosystem II split the water molecule, and two more, absorbed by photosystem I, transfer two electrons to transform the protons from the split water molecule into a hydrogen molecule. The process can be carried out by green algae, by cyanobacteria, or purple bacteria, which use small organic molecules rather than water as their source of hydrogen. All three use solar energy to provide the driving force for the process. Enzymes, hydrogenases in the first two cases and nitrogenase in the third, “do the work.” The hydrogenase work, being done at NREL, is currently supported by DOE at $350,000 for FY 2012. In principle, it might be possible to carry out the entire hydrogen production with only photosystem II, which would virtually double the production rate of hydrogen. However, no suitable catalyst has been found that can achieve that single-step generation, and so processes potentially available now all require both photosystems and hence a low production rate. The process is carried out in water, which need not be pure; in fact, some “contaminants” can serve as nutrients for the bacteria or algae.

An enduring problem for bioproduction of hydrogen photolytically is the sensitivity of both photosystems to molecular oxygen; O2 inactivates the processes.

If the oxygen generated by water splitting fails to escape from the reaction center, it inactivates the process. Some efforts have been carried out to try to reduce the oxygen sensitivity of the hydrogenase enzymes, the enzymes that generate the hydrogen. Replacing one of the iron atoms in the enzyme by a nickel atom does increase the oxygen tolerance, but at the cost of reducing the rate of hydrogen generation. Among the approaches being explored, perhaps the most promising currently uses ferrodoxin as the electron donor to the protons and an enzyme tolerant of oxygen for the splitting. This remains an unsolved problem. Platinum nanoparticle catalysts have also been used to enhance the activity of photosystem I, instead of an enzyme. Typical overall efficiencies today may reach 1 percent, whereas an efficiency of at least 10 percent is considered economically necessary.

Hence this goal currently seems rather far away. This work, going on at the Craig Venter Institute, has $150,000 in support from DOE for FY 2012.

Fermentation methods, particularly photofermentation, for biological production of hydrogen have been studied primarily at the National Renewable Energy Laboratory. The support level from DOE for FY 2012 is $350,000. The results appear thus far to be very inefficient and expensive. The yields are very low, but nevertheless higher, typically, than the yields from biophotolysis. One inherent disadvantage of this method is simply that it involves conversion of a high-energy-density material into hydrogen, a material with lower energy density. In effect, it is downgrading a high-energy material. It might be better to find a way to operate vehicles with glucose as fuel than to ferment the glucose to make hydrogen

intended to be a vehicle fuel. If fermentation of organic waste were to be developed into an economic, modestly efficient process, then perhaps hydrogen production by fermentation might become an attractive process. A very recent approach based on this method uses what are normally waste materials from the sugar industry—blackstrap molasses and beet molasses—as inputs for a one-stage process. This might become a viable photofermentation method for hydrogen generation (Keskin and Hallenbeck, 2012). Photofermentation has been under study at NREL, where Clostridium is being used to produce hydrogen from cellulosic materials.

Dark fermentation, an anaerobic process not involving the input of energy from light, is another related approach, one that typically uses organic waste materials as the source, with carbohydrates such as cellulose as the primary hydrogen source. The DOE is currently investigating this approach. Because the process is anaerobic, deactivation of enzymes by oxygen is not a problem with it. However, it produces a number of undesirable waste products and only a limited amount of hydrogen, and it also converts high-energy materials into what hydrogen it does generate. The yields are still low; CO2 is a major, unavoidable by-product; and the substrates are expensive at this time; thus, it does not currently appear to be one of the most attractive among the biological approaches to hydrogen generation.

Algae can produce hydrogen, and DOE is currently supporting two projects to investigate this direction. One is at the University of California, Berkeley, at a level of $150,000 for FY 2012; the other is at NREL, at $600,000 for the same period. Algae may prove effective as biogenerators of hydrogen, but one consideration may make that approach less attractive than microbial generation—namely, the greater difficulty of manipulating the genetics of algae compared with those of bacteria. Nevertheless this does seem to be a direction worth pursuing at the R&D level.13 Microbial electrolysis is an approach with some long-term potential. By attaching bacteria to an anode (anode-respiring bacteria, or ARB), the microbes can oxidize organic materials and transfer the electrons so released to that anode, thereby generating an electric current. This then electrolyzes water at the cathode to produce hydrogen. A small voltage must be added to that developed at the anode in order to decompose water molecules, but this is only an addition of about 0.13 volt, far less than the 0.82 volt required for the electrolysis. The method is capable of giving high yields, and also of using the products of dark fermentation as inputs. To make the method efficient, the applied (added) voltage must be low and the losses, too, must be kept low. Yet it must be high enough to overcome the inherent losses of the system. At the same time, the current should be maximized because that is what determines the rate of production of hydrogen. Various techniques are under investigation now to try to make microbial electrolysis a viable source of hydrogen, but the outcome is still extremely uncertain. The DOE is currently supporting this effort for FY 2012.

__________________

13 Another NRC committee has been studying sustainability issues of algal biofuel production. Its report was issued in the fall of 2012 (NRC, 2012).

In all of the approaches, researchers are exploring the possibilities that genetic modification of the appropriate microorganisms could perhaps overcome current limitations on the performance of bacterial and algal methods of hydrogen production.

One other approach under study at NREL is the production of hydrogen by pyrolysis or gasification of biological wastes. This method uses biological materials but does not involve any biological processes. The approach generates a mixture of products, one of which is hydrogen, which of course would have to be separated from the other products.

DOE funding for biological generation of hydrogen, which includes all of the above methods and excludes biomass gasification, was $1.67 million in FY 2011; the planned level for FY 2012 is $1.6 million.

HYDROGEN DELIVERY AND DISPENSING

Hydrogen delivery, storage, and dispensing account for a substantial part of both the delivered cost of hydrogen for HFCVs and the efficiency of the overall system. In a fully developed hydrogen economy, the postproduction part of the supply system for high-pressure hydrogen will probably cost as much as production and consume as much energy (NRC/NAE, 2004). Improvements continue to be made in both production and postproduction, but the relative importance of the two areas has not changed significantly. Distribution costs are of even greater concern during the transition period when the demand is low, particularly when hydrogen from centralized plants is available. In that case, distribution could easily cost more than production does.

Dispensing systems for gaseous hydrogen must be designed to prevent excessive temperature increases in the vehicle tank during pressuring and filling, particularly for the 700-bar (approximately 70 MPa, or 10,000 psi) operation. As a result, communication between the vehicle and the refueling dispenser is required so that pressure and temperature can be monitored and controlled.

This program is advised by the hydrogen delivery technical team, with membership from DOE, five energy companies, the U.S. Department of Transportation, the Argonne National Laboratory, and the Oak Ridge National Laboratory. In addition, Praxair has recently been added as an associate member. The effort is focused on three delivery pathways: transmission and distribution of gaseous hydrogen from centralized plants by tube trailer and by pipeline, and of liquefied hydrogen by tanker. The overall target is to reduce the cost of delivering and dispensing hydrogen to $1 to $2/gge. The committee believes that this is an aggressive but appropriate target, assuming that the required funding continues to be available.

In the past 2 years, there have been significant achievements in the area of hydrogen delivery and dispensing. The projected cost of transport by tube trailers has been reduced by 40 to 50 percent using a 35-MPa (350-bar), carbon-fiber-

wrapped tube trailer with a carrying capacity of 800 kg of hydrogen or a glass-fiber vessel with a capacity of 1,100 kg. In addition, there have been reductions in the installed cost of pipelines, pipeline compressors, and forecourt hydrogen storage. Further, projected hydrogen liquefaction efficiency and forecourt compressor reliability have been increased.

In 2011, researchers at FuelCell Energy, Inc., demonstrated the feasibility of employing hydrogen electrolysis to compress the gas to 7,000 psi.14 The company is currently modifying the design to achieve higher pressures. This device shows promise of replacing the single most expensive component of a hydrogen refueling station, the high-pressure compressor, while also improving efficiency. This approach should be evaluated for reaching the design pressure and should be compared with conventional compression by U.S. DRIVE, as recommended in the discussion of low-temperature electrolysis.

The Phase 3 NRC (2010) report recommended that this program be based on the activities needed to meet the 2017 cost target, and if that was not feasible, it recommended that the focus be on areas most directly impacting the 2015 decision regarding commercialization. Further, the Phase 3 report recommended that the cost target should be consistent with the program actually carried out. The DOE has been responsive by updating the technical targets and revising its cost target.

The planned budget for FY 2012 is $5.7 million, compared with an appropriation of $6 million in FY 2011. Future efforts will be focused on reducing the cost of fueling station hydrogen compression and storage as well as the delivery costs for early market applications. The committee believes that this is an appropriate use of federal funds and that a stable funding level must be maintained in order to have a reasonable chance of success in meeting the cost targets.

The emphasis for the U.S. DRIVE Partnership is on developing technologies for HFCVs and hydrogen production, BEVs and PHEVs that can connect to the electric grid, and improved internal combustion engine (ICE) systems. Biofuels used in these improved ICEs can be an important option for reducing the use of petroleum-derived fuels while also reducing the GHGs of transportation.

Within DOE, the Biomass Program has the responsibility for managing the development of biomass growth, harvesting, storage, and delivery R&D programs. The Biomass Program also manages the R&D programs for biomass conversion to biofuels and the distribution of biofuels to the market. Historically the Biomass Program interfaced with the U.S. DRIVE Partnership or its predecessors on issues

__________________

14 J. Simnick, BP, and S. Weil, Department of Energy, “Hydrogen Delivery Technical Team (DTT),” presentation to the committee, January 27, 2012, Washington, D.C. Since this presentation, pressure at more than 12,000 psi with a single stage of electrochemical compression has been demonstrated (Lipp, 2012).

of fuel distribution and on characterization and combustion of different biofuels and mixes of biofuels with conventional petroleum-derived fuels. The committee is reviewing only U.S. DRIVE activities and not the Biomass Program activities, and so its comments here are directed only toward U.S. DRIVE.

This interface between the U.S. DRIVE Partnership, which has a focus on the combustion technology, and the Biomass Program can be useful in helping the management of both programs better assess the state of development of the different vehicle/biofuel pathway approaches and understand how and when commercial deployment of large quantities of biofuels could occur. The three primary alternate vehicle/fuel pathways (HFCVs, BEVs and PHEVs that can plug into the electric grid, and biofuels for ICEs) are at different states of development and deployment, and progress in one affects the R&D emphasis and targets of the others.

Biofuels Development Strategy

The Biomass Program R&D emphasis has changed over the past several years, and this has an effect on the U.S. DRIVE tasks. Prior to 2010, R&D on making cellulosic ethanol was a strong focal point for the Biomass Program. This emphasis then gave reason for U.S. DRIVE to investigate ICE performance of various combinations of ethanol and gasoline. There was also reason to investigate distribution problems with ethanol in order to reduce costs. Starting in 2010 the Biomass Program reduced its ethanol programs and increased its programs to make biofuels, sometimes called drop-in fuels, that are thought to be indistinguishable from petroleum products. These can be produced as gasoline, jet fuel, or diesel-type finished products. Biomass sources include woody biomass and energy crops. Drop-in fuels require neither special ICE technology nor special infrastructure distribution systems.

These drop-in fuels can be made from cellulosic sources using various biochemical and thermochemical approaches. Among them are the following:

- Gasification followed by Fischer Tropsch plus finishing processing,

- Gasification followed by methanol-to-gasoline processing, and

- Pyrolysis followed by hydrotreating and hydrocracking processing.

As there are several different methods for making drop-in fuels, their development is at different states. Laboratory and bench-scale work is still required to develop catalysts and less costly process flow schemes for some options, while others are in the large-pilot-plant phase. It is not yet known if any of the processes will result in competitively priced fuels; however, studies indicate such potential if research is successful. Target dates for R&D appear similar to those for hydrogen, setting competitive cost targets in the 2017 time frame. The Biomass Program is also investigating longer-term sources, such as algae, that are in much earlier stages of development.

In the United States, about 13 billion gallons of ethanol made from corn are blended into the gasoline mix of about 135 billion gallons of gasoline, almost 10 percent by volume and 6.6 percent by energy content. Little more ethanol from corn is expected in the mix, as current legislation, the Energy Independence and Security Act (EISA) of 2007 (Public Law No. 110-140), limits the corn-based ethanol to approximately today’s volume. This act sets targets for cellulosic ethanol and other cellulosic biofuels that increase yearly until the total biofuel volume reaches 36 billion gallons of ethanol equivalent by 2022. The target volumes have not been met for the past several years. A recent NRC (2011) report on the Renewable Fuel Standard (RFS) concluded that, absent major technological innovation or policy changes, the EISA of 2007-mandated consumption of 16 billion gallons of ethanol-equivalent cellulosic biofuels is unlikely to be met in 2022.

The biofuel role for the U.S. DRIVE Partnership in this scenario is different from the Partnership role in the past, when ethanol appeared to be a larger-volume possibility and more considerations were needed for higher ethanol fuel blends and problems with distributing ethanol. There is a continuing need for future biofuels, which have been and will continue to change in type and quality, to be compatible with the evolving ICE developments. A U.S. DRIVE focus on ICE development that can handle drop-in fuels and other biofuels is warranted.

NATURAL GAS OPPORTUNITIES FOR U.S. DRIVE

The significantly increased estimates of reserves of domestic natural gas determined in the past several years, brought about by new production technologies, are having profound effects on the domestic energy markets.15 Production levels have increased over the past several years while market prices have decreased to levels not seen in over a decade. The market is already seeing increased use of natural gas to make electricity, with a corresponding reduced use of coal. The chemical industry is benefiting from the lower feedstock prices and increased availability of natural gas and the associated light hydrocarbon liquids. The economic incentive for homeowners to switch from heating their homes with heating oil derived from petroleum to natural gas is larger than ever.

In the transportation markets, natural gas has only been considered a marginal basic resource for alternate transportation fuels in the past because of limited domestic availability and the perceived need to increase imports in the form of liquids (e.g., liquefied natural gas [LNG]) just to meet demand in the traditional power, industrial, and residential markets. Imports of LNG are considered similar

__________________

15 The 2011 Potential Gas Committee (April 27, 2011, Golden, Colorado, Colorado School of Mines) estimates potential natural gas resources of 1,898 trillion cubic feet (Tcf) and proved resources of 272 Tcf. At the 2010 annual consumption of 24.1 Tcf, this represents 90 years of supply, which is up from 86 years of supply 2 years ago.

in nature to imports of petroleum crude oil, with similar negative economic and political considerations. With the additional domestic reserves and supply now estimated by the EIA in its Annual Energy Outlook (EIA, 2012), and the resultant lower prices compared to those for crude oil, natural gas is now projected to be an economic source to provide transportation fuels. This change should shift the priorities and direction of all alternate vehicle and fuel research, development, and demonstration (RD&D) programs.

The additional reserves and supply of natural gas affect alternate vehicle pathways in different ways and to different extents. These now must be taken into consideration when comparing different vehicle and fuel pathways. Some of the pathways affected are as follows:

- It is possible to use gasoline and diesel fuel derived from natural gas (e.g., gas to liquids) at costs competitive with those for fuel from crude oil.

- Other liquid fuels derived from natural gas, such as methanol, are possible at larger volumes and lower costs.

- Replacing coal with natural gas in power generation lowers the GHG emissions of the electricity used to power BEVs and PHEVS and to produce hydrogen using electrolysis.

- Transitioning to hydrogen is more straightforward, with lower projected costs and GHG emissions when more natural gas is the basic source for the hydrogen.

- It is possible to use natural gas as a direct vehicle fuel, compressed natural gas (CNG), in a light-duty vehicle (LDV) at costs competitive with those for petroleum-derived fuels.

The U.S. Compressed Natural Gas Opportunity

Compressed natural gas is used as a direct fuel in more than 10 million vehicles around the world, usually in locales with an inexpensive natural gas price compared with the price of gasoline. It generally is considered a fuel of opportunity based on low costs. With the increased domestic reserves and resultant lower domestic prices, CNG is now an attractive fuel compared to gasoline in the United States. This favorable cost relationship is projected to continue for at least several decades (EIA, 2012).

CNG can replace gasoline made from crude oil in an ICE on a gallon per gallon basis (based on British thermal units [Btu]) with about 20 percent lower GHG emissions on a life-cycle basis. No new technologies are needed for the LDV or for the infrastructure to deliver CNG to the LDV. Regarding customer needs, in vehicles specifically designed for CNG, driving distance and interior space should be roughly comparable to those provided by gasoline-fueled ICE vehicles and HFCVs. Technology improvements that can lower both the vehicle cost and the infrastructure cost are possible. The committee expects that for the

overall infrastructure, the initial investment cost per CNG vehicle could be lower than that for electric vehicles, HFCVs, and biofuel vehicles (NRC, 2013). With the existing very large natural gas pipeline system, a large part of the country could be supplied with CNG.

Although an attractive opportunity exists based on the current and midterm supply of natural gas, cost, and GHG emissions compared with those related to gasoline, the very long term role in the entire LDV fleet for the CNG vehicle is not clear. The lower GHG emissions compared with those from gasoline are beneficial but are not large enough to reach the 2050 goal of 80 percent reduction from 2005 levels without significant increases in ICE vehicle efficiency and/or reduction in vehicle miles traveled. Questions exist and are being investigated about the amount of GHGs (CO2 and methane) actually released during natural gas production. In addition, there are other general public concerns with water contamination and some production methods (hydraulic fracturing or “fracking”).

As a commodity, natural gas is subject to price variations based on supply and demand, and there is no assurance of its long-term cost advantage compared with petroleum-derived gasoline.

CNG Light-Duty Vehicle and Infrastructure R&D Needs

Several areas could benefit from further technology development primarily to lower costs for both the LDV and the fuel infrastructure. They include the following:

- The CNG storage tank in the LDV is bulky, high-pressure (about 25 MPa, or 3,600 psi), and expensive. Improvements in volumetric and gravimetric densities are needed to be comparable in many characteristics to liquid fuel tanks. The high-pressure operation makes the tanks expensive and also increases the cost of refueling at the high pressure.

- CNG refueling stations are commercially available today, but the high-pressure operation results in high costs. Home refueling could be beneficial in some markets, as many homes have natural gas. Home refueling equipment is expensive primarily because of the high-pressure operation.

Although natural gas and the CNG LDV are not part of the U.S. DRIVE effort, these R&D areas are being addressed by DOE through its Advanced Research Projects Agency-Energy (ARPA-E). The ARPA-E Methane Opportunities for Vehicular Energy (MOVE) program is a new effort to address both of the above issues. The ARPA-E has plans to fund projects at about $30 million over a 3-year period to help resolve these issues. Success in these areas is not guaranteed, but if it occurs, success in these areas combined with continued growth in natural gas reserves and production could make a compelling case for rapid growth in the CNG vehicle fleet.

Recommendation 4-7. U.S. DRIVE should include the CNG vehicle and possible improvements to its analysis efforts in order to make consistent comparisons across different pathways and to help determine whether CNG vehicles should be part of its ongoing vehicle program.

ELECTRICITY AS AN ENERGY SOURCE FOR VEHICLES

The amount of electricity required for individual plug-in vehicle16 travel depends on vehicle size, weight, and other characteristics. The Environmental Protection Agency (EPA) estimates that the midsize Nissan Leaf uses an average of 34 kWh per 100 miles and that the Transit Connect Van uses 54 kWh per 100 miles.17 Most forecasts of plug-in vehicle demand suggest that the national electric-supply-system grid will be able to support the number of electric vehicles likely to be on the road, at least to 2020. Some local supply problems could appear, possibly in Texas, for example, where a combination of grid isolation and weak incentives for new generation appear likely to cause shortages. And in some neighborhoods the clustering of plug-in vehicles might overload local circuits and transformers. But from a national perspective, the near-term grid capacity appears adequate.

Beyond that time, the energy capacity projected for the U.S. electric system also appears ample as long as the projected capacity additions are brought online (see Box 4-1). Nevertheless, three kinds of uncertainty—demand uncertainty, technology uncertainty, and policy uncertainty—will require leadership from DOE and the U.S. DRIVE Partnership to ensure the most rapid, environmentally benign market penetration and cost-effective penetration of plug-in vehicles.

Three Consequential Uncertainties

Even though the national grid appears adequate, the three uncertainties listed above remain. Their resolution will strongly influence the environmental and economic consequences of recharging plug-in vehicles as well as the pace of the acceptance of plug-in vehicles in the marketplace. Resolving the uncertainties in a favorable manner will require rapid learning and effective response on the part of DOE, the U.S. DRIVE Partnership, and state policy makers. Discussed in the sections below, the uncertainties can be briefly described as follows:

- Demand uncertainty regarding the ways that consumers will recharge these vehicles, and how (or whether) customers will use “smart-home”

__________________

16 “Plug-in vehicle” here is meant to include any vehicle relying on electric energy that is supplied externally, most likely from the national electric grid. In the terms most commonly used, this includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and extended-range electric vehicles (EREVs). Generically, since all of these vehicles are dependent to one extent or another on electricity from the grid, they are sometimes all referred to as electric vehicles (EVs).

17 See, for example, http://www.fueleconomy.gov/feg/evsbs.shtml.

BOX 4-1

The Plug-in Vehicle and the U.S. Electric Supply System

The impact of the plug-in vehicle on the grid depends on the market penetration of electric vehicles (EVs, which include both plug-in electric vehicles [PHEVs] and battery electric vehicles [BEVs]). Forecasts vary widely. For example, Deloitte Consulting projects the 2020 U.S. market share for EVs to range from 2.0 to 5.6 percent of the new-vehicle market, or between 285,000 and 840,000 vehicles per year (LaMonica, 2010). Also, Edmunds.com projects annual EV sales of 250,000 by 2017, which would put it within the Deloitte range by 2020 (Shepardson, 2012).

If it is assumed conservatively that the number of PHEVs sold increases linearly to reach 1 million per year by 2020, that would imply an EV fleet of, at most, 4 million vehicles operating in that year. If each of these vehicles recharges a 10-kWh (usable depth-of-discharge) battery twice a day, every day for a year, the total kilowatt-hours consumed in 2020 would be about 29 billion. In contrast, the Energy Information Administration estimates that the national electric grid will be able to produce 4,159 billion kWh in 2020 (EIA, 2012). Thus even a highly optimistic case for plug-in vehicle penetration suggests that the electric energy demand of plug-in vehicles will prove manageable.

To be sure, a national or even state restriction on carbon emissions severe enough to shut down large numbers of coal-fired power plants could make this forecast unachievable. But absent such an occurrence and from a national perspective, the energy demands imposed by the EV fleet appear to be manageable.

- technologies in ways that offset the grid impacts of plug-in vehicle charging;

- Technology uncertainty regarding the speed of deployment of smart-grid technologies and advanced charging systems that allow rapid charging; and

- Policy uncertainty regarding the nature and strength of rate incentives for consumers to recharge their vehicles and for the electric utility companies or others to invest in the necessary infrastructure.

These uncertainties cannot be addressed independent of one another, but rather must be resolved in their entirety. Leadership from DOE and the U.S. DRIVE Partnership will prove essential for their timely and effective resolution. Absent that leadership, the market penetration of all plug-in vehicles could be delayed and their environmental and economic benefits blunted.

Demand Uncertainty

The location and time at which the users of plug-in vehicles will choose to recharge their batteries remain quite uncertain for several reasons. First, regarding location, many grid analysts note the tendency of plug-in ownership to occur in

neighborhood clusters (May and Johnson, 2011). According to this “cul-de-sac effect,” plug-in vehicles tend to gravitate toward wealthy neighborhoods and environmentally conscious communities. The consequence can overload local circuits and transformers. Consider, for example, a Nissan Leaf recharging on a 240-volt, 15-amp circuit. This imposes a 3.3-kW load on the circuit, which is greater than the load of the average home in Berkeley, California. Similarly, a Chevy Volt recharging on a 240-volt, 30-amp circuit imposes a 6.6-kW load, about the average for homes in San Ramon, California (May and Johnson, 2011, p. 56). Since utility circuits and transformers tend to be sized to accommodate five or six homes, just a few vehicles can change the power loading of a circuit markedly. Thus, the charging issues posed by clusters of activity could challenge many early-adopter communities and utilities.

Second, regarding time, the chief concern of vehicle users is the worry about becoming stranded with a depleted battery. And so vehicle owners have an incentive to recharge their vehicles’ batteries at every opportunity: while at work, in parking garages, while parked at airports, and so forth. Thus, utility planners cannot assume that all charging will be done at night when the electric grid has off-peak power.

Third, the prospect for fast charging (see the section below) could make the plug-in vehicle much more desirable for customers to own because the charging could be completed in 15 or so minutes instead of many hours. Thus, fast charging might accelerate market penetration if it can be accommodated on the vehicle. However, this practice poses a power challenge, as distinct from an energy challenge, to the grid. Recharging a 10-kWh battery in, say, 15 minutes would require more than 40 kW of power. Larger batteries could impose a power requirement exceeding 50 kW per charge. And since the probable high cost of the early fast chargers would appear to prohibit their use in residences, fast charging would most likely be done in public places and hence while the vehicle is in daily use. Thus fast charging could exacerbate the peak-demand problem in some localities.

Finally, smart-grid technologies applied to the home could enable consumers to manage their vehicle recharging like any other appliance, and respond easily to price signals. The extent to which they adopt and use this capability and the extent to which such response might offset the local challenges posed by plug-in vehicle charging remain unknown.

Technology Uncertainty

In May 2012, eight automotive OEMs announced their adoption of a standard charging system, the Combined Charging System. The standard is a product of the Society of Automotive Engineers (SAE) and the European Automobile Manufacturers’ Association (ACEA). Operating under this standard, Combined Charging Systems would integrate the following into one vehicle connector: (1) regular

alternating current (ac) charging, (2) fast ac charging, (3) direct current (dc) charging in homes, and (4) ultrafast dc charging. Thus, a Combined Charging System could offer a single-port fast-charging system that still enables plug-in owners with vehicles designed for Level 1 or Level 2 to recharge at public stations. The companies endorsing this system include three U.S. DRIVE members: Chrysler Group LLC, Ford Motor Company, and General Motors Company. The ACEA has asserted that the Combined Charging System will become the standard for all European vehicles by 2017. However, other auto companies, notably Nissan and Mitsubishi, have protested the standard, and Tesla Motors (a U.S. DRIVE partner) has not adopted it.

The technology uncertainty concerns the rate at which the following might occur: (1) the Combined Charging System or some other widely accepted charging standard will be adopted, (2) a new generation of plug-in vehicles able to accept fast charging will appear in the marketplace, and (3) electric utility companies can upgrade transformers, substations, and distribution networks to accommodate the increased power demand.

At the same time, uncertainty exists over the pace of adoption of smart-grid technologies. On the utility side of the meter, smart-grid systems could prove more resilient to unanticipated changes in power demand brought about by fast charging. And on the customer side of the meter, smart micro-grids could manage the recharging of a plug-in vehicle in any prearranged manner. However, the rate of adoption of these technologies cannot be assured to match the rate of adoption of the vehicles.

Policy Uncertainty

The economic incentives for owners to charge their vehicles during times of low grid impact and for electric utility companies or unregulated entities to invest in charging infrastructure fall largely to the utility rate-making authorities in each state. This poses a challenge to achieving the uniformity of national (indeed, international) infrastructure required to support electric vehicle deployment. Here, DOE can exercise its national leadership capabilities to encourage a stable and productive policy environment. This, in turn, would likely reduce the other uncertainties in customer behavior, technology adoption, and infrastructure investment.

A DOE strategy that would exercise leadership from the national perspective will be essential for the prompt and efficient deployment of an electric charging infrastructure. The kind of leadership needed cannot be left to the grid interaction technical team alone. Effective leadership can help clarify the policy environment and lead to more uniform state policies for the build-out of charging infrastructure. Reducing policy uncertainty could, in turn, lower the anxiety felt by prospective plug-in vehicle owners about charging their vehicles in a cost-effective, timely, and environmentally friendly way.

Recommendation 4-8. The senior DOE leadership should consider joining with their counterparts at U.S. DRIVE to work with non-U.S. DRIVE OEMs, equipment suppliers, electric utility leadership, and state regulators to build a uniform and stable policy environment for the deployment of electric charging infrastructure.

RESPONSE TO PHASE 3 RECOMMENDATIONS

NRC Phase 3 Recommendation 4-1. The DOE should broaden the role of the fuel pathways integration technical team (FPITT) to include an investigation of the pathways to provide energy for all three approaches currently included in the Partnership. This broader role could include not only the current technical subgroups for hydrogen but also subgroups on biofuels utilization in advanced internal combustion engines and electricity generation requirements for PHEVs and BEVs, with appropriate industrial representation on each. The role of the parent FPITT would be to integrate the efforts of these subgroups and to provide an overall perspective of the issues associated with providing the required energy in a variety of scenarios that meet future personal transportation needs. [NRC, 2010, p. 118.]

The Partnership, while recognizing the importance of investigating all three approaches, has elected to maintain the FPITT’s focus on hydrogen. The current committee also believes that broader integration and coordination are needed, and it has in fact broadened its recommendation in the current report (current Recommendation 4-1).

NRC Phase 3 Recommendation 4-2. The DOE’s Fuel Cell Technologies program and the Office of Fossil Energy should continue to emphasize the importance of demonstrated CO2 disposal in enabling essential pathways for hydrogen production, especially for coal. [NRC, 2010, pp. 120-121.]

The DOE responded well to this recommendation in 2010. Although the Office of Fossil Energy and the Office of Fuel Cell Technologies continue to consider carbon when setting program priorities, the post-2010 availability of natural gas as a feedstock has diminished the urgency of demonstrating hydrogen from coal. (See Recommendation 4-3 in the current report.)

NRC Phase 3 Recommendation 4-3. The Fuel Cell Technologies program should adjust its Technology Roadmap to account for the possibility that CO2 sequestration will not enable a midterm readiness for commercial hydrogen production from coal. It should also consider the consequences to the program of apparent large increases in U.S. natural gas reserves. [NRC, 2010, p. 121.]

The DOE has indicated that it will add steam reforming of natural gas with cogeneration of steam to the roadmap for midterm readiness in response to the large increases in natural gas, but this option would produce more CO2 than coal gasification with carbon capture and sequestration. Thus, the response to the recommendation is only partial. The committee believes that other midterm options should be identified.

NRC Phase 3 Recommendation 4-4. The EERE should continue to work closely with the Office of Fossil Energy to vigorously pursue advanced chemical and biological concepts for carbon disposal as a hedge against the inability of geological storage to deliver a publicly acceptable and cost-effective solution in a timely manner. The committee also notes that some of the technologies now being investigated might offer benefits in the small-scale capture and sequestration of carbon from distributed sources. [NRC, 2010, p. 121.]

The DOE has responded to this recommendation with laboratory and pilot-scale projects to utilize CO2, including algal production.

NRC Phase 3 Recommendation 4-5. The DOE should continue to evaluate the availability of biological feedstocks for hydrogen in light of the many other claims on this resource—liquid fuels, chemical feedstocks, electricity, food, and others. [NRC, 2010, p. 121.]

The DOE Biomass Program continues to evaluate the availability of feedstocks for use in various energy and chemical pathways.

NRC Phase 3 Recommendation 4-6. The Partnership should prioritize the many biomass-to-biofuel-to-hydrogen process pathways in order to bring further focus to development in this very broad area. [NRC, 2010, p. 123.]