6

Policies for Reducing GHG Emissions from and

Petroleum Use by Light-Duty Vehicles

To reach the twin goals addressed in this study, significant changes in policy will be needed to induce a move toward vehicle-fuel systems whose petroleum demand and greenhouse gas (GHG) emissions are very different from those of today. The modeling and results from Chapter 5 suggest a range of possible policy and technology pathways by which these goals might be met. This chapter reviews policy options, including those analyzed in Chapter 5 (for example, vehicle fuel economy and GHG standards and renewable fuel standards), that may offer promise. Each policy is described and assessed based on evidence about its use, effectiveness, and any shortcomings. Policy suggestions based on these assessments are provided in Chapter 7.

The policies needed to reach the goals for reductions in petroleum use and GHG emissions will have to differ dramatically from those of the past and could incur a high up-front cost. However, as the modeling results in Chapter 5 illustrate, these costs may be more than recouped in later years.

Policies are needed that can promote major changes in direction in the extensive private investments associated with vehicle manufacturing, fuel production and related infrastructure—changes that in turn will affect the market decisions made by consumers and businesses which ultimately shape such investments. The extent to which the resulting transition to a low-petroleum light-duty vehicle (LDV) system with low net GHG emissions will require displacing the incumbent internal combustion, liquid fueled vehicle technology is not known. However, major changes clearly will be needed in the use of natural resources and in the impacts of GHG emissions associated with supplying LDV fuels. Given the inherent uncertainties, an adaptive policy framework is needed that will be responsive to markets, technologies, and progress toward achieving the goals.

6.1 POLICIES INFLUENCING AUTOMOTIVE ENERGY USE AND GREENHOUSE GAS EMISSIONS

Several arenas of policy are relevant as means of influencing automotive energy use and GHG emissions: land-use, transportation, energy, environmental protection, and technology. These arenas are interrelated and the relationships are sometimes implicit. Failure to recognize the interrelationships between policy arenas could result in poor coordination or even contradictions among policy signals. Some of the relationships have been made explicit as policy makers have realized, for example, the interactions between land-use planning and transportation planning. The challenge of achieving deep reductions in petroleum use and GHG emissions requires an even greater degree of coordination among the policy arenas influencing the LDV sector.

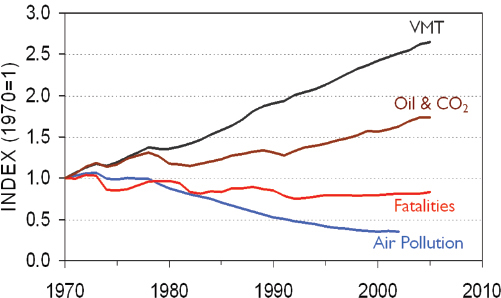

Figure 6.1 shows on a normalized scale the total nationwide levels of several key LDV-related impacts that have been a subject of public policy. From 1970 through 2005, light-duty vehicle miles traveled (VMT) increased by 160 percent. Over the same period, gains in fuel efficiency held LDV petroleum demand and CO2 emissions to a 74 percent increase. Modest absolute declines were achieved for traffic fatalities. The greatest improvement was seen in vehicle conventional air pollution, which achieved an absolute reduction of 65 percent by 2005 relative to its 1970 level.

Land-use policies are perhaps the deepest foundation of the automotive system, helping, along with geography, to shape transportation patterns through the ages. U.S. land-use governance remains highly localized, and many levels of administration are involved in the planning, permitting, and

FIGURE 6.1 Trends in impacts of U.S. light-duty vehicles.

SOURCE: DOT, DOE, and EPA statistics.

zoning of land use. Higher levels of government traditionally show substantial deference to local prerogatives.

Academic understanding of the links between land use and transportation has translated only slowly into policies that might restrain travel demand growth tied to land use. Researchers have identified five land-use features, the “five Ds,” influencing demand for automobile travel: population density, land-use diversity, neighborhood design, major destination accessibility, and transit stop distance from departure and arrival points of transit stops (TRB 2009, p. 52).

Although only recently considered in the context of transportation-related petroleum demand and GHG emissions, programs that support or constrain the expansion of croplands and managed forests used for sourcing biofuel feedstocks or for carbon sequestration through afforestation and grassland restoration are another important aspect of land-use policy. Determining the optimal use of land with respect to climate protection raises issues that may require rethinking of such policies (Righelato and Spracklen, 2007; Wise et al., 2009; Zhang et al., 2008).

Transportation policies center on the provision and operation of the infrastructure needed for mobility. For the automobile, they have focused on building, maintaining, and supporting roadways. In urban areas, transportation policy also supports mass transit, as well as sidewalks and bike paths, and so affects the availability and affordability of alternatives to auto travel. There is a clear emphasis in the U.S. Department of Transportation’s (DOT’s) official mission statement on ensuring speed of conveyance as well as safety and efficiency. With the automobile being by far the dominant mode of transportation for most Americans, facilitating auto travel has been a major part of DOT’s mission. Much of the necessary investment for highways and major roads is accomplished through a federal-state partnership approach, while most local roads are handled by municipalities with varying degrees of state involvement.

A key financial reason for the success of automobiles is that the vehicles themselves are purchased by individual consumers, who also pay for operating costs, notably fuel. That leaves to government the provision and maintenance of infrastructure. This contrasts with public transit modes, which require a public or public-private partnership to acquire and operate the vehicles and their supporting infrastructure. Consumers ultimately pay for all aspects of any transport system, with taxes or other user fees supporting the publicly provided elements.

U.S. energy policies have roots in natural resource policy. Most pertinent to the auto sector are policies that have facilitated the development of petroleum resources over the years and those related to ensuring access to overseas supplies and securing them vis-à-vis geopolitical considerations. On the domestic front, policies supporting the economic development of oil and gas resources confronted environmental considerations and the need to balance competing players’ demands for use of lands and offshore locations. Thus, the U.S. Department of the Interior long has been involved in petroleum-related activity. The Energy Research and Development Administration was created in 1974, and its successor, the U.S. Department of Energy (DOE) was formed in 1977, following the 1970s petroleum crisis.

In recognition of the importance of petroleum for military operations and as a critical resource for the entire economy, efforts to secure and expand the supply of petroleum have long been and continue to be a key part of U.S. energy policy.

The 1973-1974 energy crisis prompted the development of policies to encourage energy conservation and promote alternatives to petroleum. The LDV fleet became a key target, and vehicle efficiency standards known as the Corporate Average Fuel Economy, or CAFE, standards, were enacted as part of the Energy Policy and Conservation Act of 1975 (P.L. 94-163). A “gas-guzzler” tax followed in 1978 with passage of the Energy Tax Act (ETA; P.L. 95-618).

The 1970s also saw the development of policies to support alternatives to petroleum ranging from synthetic fossil fuels to biofuels. The ETA also introduced an excise tax exemption for gasohol,1 which subsequently was extended and transformed into a tax credit for ethanol, the volumetric ethanol excise tax credit (VEETC), which until recently stood at $0.45 per gallon of ethanol. A tariff was imposed on imported ethanol to foster domestic biofuel production. Both the tax credit and the tariff expired at the end of 2011.

The CAFE credits program for alternative fuel vehicles (AFVs) was created by the Alternative Motor Fuels Act of 1988 (P.L. 100-94). It provided credit incentives for the manufacture of vehicles that used alcohol or natural gas fuels, either exclusively or as an alternative to gasoline or diesel fuel. This program induced automakers to sell a large number of dual-fuel vehicles capable of running on E85. However, for a variety of reasons including limited availability of E85 retail outlets, the program has not fostered significant use of alternative fuels (DOT-DOE-EPA, 2002). The Energy Policy Act of 1992 (EPAct; P.L. 102-486) established an expanded set of incentives and programs to promote alternative fuels and AFVs. They include mandates for AFV use in the federal fleet and certain state and utility fleets, and authorization for federal support of voluntary AFV deployment programs, which were subsequently implemented by DOE through the Clean Cities program.

Among the most recent developments in U.S. energy policy with respect to the LDV sector is the Renewable Fuel Standard (RFS) instituted as part of the 2005 EPAct (P.L. 109-58). The RFS put in place for the first time a nationwide mandate for use of a fuel other than petroleum. The 2005 EPAct also included expanded incentives for the production and commercialization of a range of AFV technologies. It included tax incentives for AFVs and infrastructure for alternative fuels that are not drop-in fuels. Incentives were provided on a graduated scale to encourage the production of different AFVs (DOE-EERE, 2011a; TIAP, 2012). Metrics related to technical fuel efficiency were used to determine the level of incentives. The incentives were limited to the first 60,000 qualifying vehicles produced by any one automaker.

Tax credits initially were for hybrid-electric, battery-electric, and fuel-cell electric vehicles and for qualified diesel and natural gas LDVs. Numerous modifications have occurred over the years and Congress allowed the tax credits for hybrid electric vehicles, and diesel and natural gas vehicles to expire at the end of 2010. Tax credits for battery-electric motorcycles, three-wheeled electric vehicles, and low-speed neighborhood-electric vehicles expired at the end of 2011, as did a credit for converting conventional gasoline and diesel vehicles to plug-in hybrid or all-electric propulsion systems.

Currently, under the American Recovery and Reinvestment Tax Act and the Emergency Economic Stabilization Act of 2008, the United States uses a program that extends a federal tax credit of up to $7,500 to buyers of qualified plugin hybrid and battery-electric LDVs. The credit is applicable in the year of the vehicle’s purchase. Subsequent legislation limits the credit to the first 200,000 eligible vehicles from each qualified automaker. When that threshold is reached, the tax credit for subsequent vehicles sold is reduced in stages, disappearing completely after six calendar quarters.2 Fuel-cell electric vehicles remain eligible for a federal tax credit of $4,000-$8,000, depending on their fuel economy ratings, but it is scheduled to expire in 2014.

In December 2007, the Energy Independence and Security Act (EISA; P.L. 110-140) expanded the RFS to target 35 billion gallons of ethanol-equivalent biofuels plus 1 billion gallons of biomass-based diesel by 2022, with life-cycle GHG emissions stipulations designed to foster cellulosic and other advanced biofuels. The same legislation raised the combined light-duty fleet CAFE standard to a 35 mpg level by 2020 while authorizing other structural reforms in the standards. The EISA also established a loan guarantee program for construction of manufacturing facilities for advanced-vehicle batteries and battery systems and requires a phase-out of the dual-fuel vehicle CAFE credit program by 2020.

Because automobiles and their supporting infrastructure impact the environment in numerous ways, many aspects of environmental policy come into play. However, it is control of the direct emissions from motor vehicles that is most relevant.

The history of Los Angeles smog, the pioneering work of Arie Haagen-Smit in linking smog to tailpipe pollution, and the subsequent development of emissions regulations first in California and then federally with the broad authority established by the Clean Air Act (CAA 1970) all are elements of one of the iconic stories of U.S. environmental policy (Mondt, 2000; CARB, 2011). At the beginning of this process in the 1960s, air pollution science was in its infancy and controls were rudimentary. As development continued, progressively tighter standards were set for restricting tailpipe emissions, prescribing fuel formulations, and limiting fuel evaporation from vehicles and fuel pumps.

The most stringent regulations for combustion-based vehicles, such as California’s partial zero emission vehicle

_______________________

1A fuel consisting of a blend of gasoline and ethanol.

2This tax credit is described in greater detail at http://www.fueleconomy.gov/feg/taxevb.shtml, accessed February 6, 2012.

standard, cut emissions per vehicle-mile by over two orders of magnitude, reducing an LDV’s direct conventional air pollution impacts to nearly negligible levels. Quantitatively, the CAA policies addressing emissions have been by far the most effective areas of policy, resulting in a substantial absolute reduction of conventional pollution from LDVs even in the face of rising VMT (see Figure 6.1).

The CAA’s overarching requirement for healthy air, embodied in the National Ambient Air Quality Standards (NAAQS), is what ultimately anchors the policy. The law obligates the U.S. Environmental Protection Agency (EPA) to pursue fact-based assessments of air pollutants’ impacts on public health and welfare and to promulgate NAAQS solely on that basis. Economic considerations can enter in only when EPA develops the regulations that determine how the NAAQS will be met.

The Supreme Court (2007) interpreted the CAA’s definition of air pollutants to include greenhouse gases and said that they could be subject to regulation if found to endanger public health or welfare. The EPA subsequently made such an “endangerment” finding (2009), setting in motion a regulatory process that started with GHG emissions standards for motor vehicles and is being extended to other sources.

A large number of policy measures have the potential to influence technical innovation in LDVs and fuels. The federal department involved most actively in directly promoting new automotive technology has been the DOE. Its role primarily has been one of funding basic science and engineering research related to vehicles and fuels and pursuing demonstration and deployment programs that might foster market adoption of the technologies developed. Many National Research Council (NRC) studies reviewed this research, development, demonstration, and deployment approach while suggesting refinements and highlighting the challenges and obstacles involved. Examples of such energy technology policy programs include the Advanced Battery Consortium, the Partnership for a New Generation of Vehicles, the hydrogen-oriented FreedomCAR program, and the present US Drive program that emphasizes electric vehicles and plug-in hybrids. From the 1970s forward, parallel efforts have been aimed at developing renewable fuels.

6.1.6 Decision Making Through the Matrix of Policy Arenas

Based on methods of technology assessment and economic analysis as discussed below in this chapter, policy measures are established through a matrix of policy arenas such as those outlined above. The preceding overview of the different arenas of public policy that influence the LDV sector—transportation, land use, environmental protection, energy, and technology—underscores the complexity of the challenge from a practical policy-making perspective. A national decision to reach goals such as those given in this committee’s statement of task will likely need to involve all of these different policy arenas and the associated diversity of congressional committees, federal agencies, and stakeholder interests, along with an analogous range of interests at state and local levels of government. Reaching a national decision to achieve the goals will be a complicated undertaking that requires an adaptive policy framework as discussed below in this chapter.

6.2 WAYS TO INFLUENCE PETROLEUM USE AND GHG EMISSIONS EFFECTS IN THE LDV SECTOR

Policies that affect petroleum use, GHG emissions, or both ultimately exert their influence through a few key parameters:

- Vehicle energy intensity—typically, the energy required to move the average vehicle of the on-road LDV fleet 1 mile;

- Petroleum share of the energy used to power LDV fleets (when energy security and dependence on petroleum is the issue) or net GHG emissions balance of the fuel system (when climate disruption is the issue); the latter is often described as the average well-to-wheels GHG emissions of the energy used to power the vehicle fleet;3 and

- Volume of travel—typically, the VMT by the on-road LDV fleet.

It sometimes is argued that system efficiency constitutes an independent fourth parameter, but that is not the case. Policies that affect system efficiency influence GHG emissions or petroleum use only through one or more of the three parameters listed above.4

A common analytic framework for transportation energy and climate-change analysis involves factoring emissions based on the three key parameters, which interact multiplicatively. Addressing all three (vehicle energy intensity, petroleum share of energy use in LDVs, and travel activity) is important because a policy that focuses only on a single parameter is likely to require it to be pushed to extraordinary lengths.5

Whether the policies target one or more of the parameters, they operate by influencing market actors whose decisions determine the values of the parameters, which in turn determine LDV petroleum use and GHG emissions. Policies that

_______________________

3For advantages and disadvantages of the use of well-to-wheels approaches to regulating GHG emissions related to fuels, see below.

4However, in view of the interest in policies promoting system efficiency, they are discussed below in this chapter.

5For example, the average on-road fleet fuel economy would have to exceed 180 mpg if vehicle energy intensity were the only parameter targeted for reducing LDV petroleum use; see footnote 2 in Chapter 2.

target one parameter may influence others. A well-known example is the difference in impact on vehicle GHG emissions and energy use produced by motor fuel taxes versus efficiency standards. Motor fuel taxes stimulate demand for more fuel-efficient vehicles. They also raise the variable cost of driving, which in turn reduces VMT. In contrast, fuel economy standards require the sale of more fuel-efficient vehicles, reducing the cost of driving, thereby increasing VMT. CAFE is effective at pushing new technology into the fleet but is unlikely to affect the size of vehicles that consumers purchase (at least with the current footprint-based system). Taxes discourage people from driving more and encourage consumers to purchase smaller vehicles. The benefits of CAFE and taxes are largely independent of one another. Both policies have been found to reduce LDV fuel use overall, but the amount by which each policy reduces total LDV petroleum use or GHG emissions differs.

Finally, the cost of reducing emissions by changing any single parameter is likely to rise as the magnitude of required change increases or the time over which the required change is to be accomplished decreases.

Policies such as carbon pricing that affect more than a single parameter are generally considered by economists to be most cost-effective.

Vehicle energy intensity, petroleum share of the fuel market, and travel demand each is an outcome of market decisions. Thus, the market actors whose decisions affect each of the parameters (and whose decisions on one parameter can affect their decisions on another) have to be examined in assessing policy options.

In general, the ultimate actor is the consumer—the owner or other end user of LDVs who purchases vehicles and fuel and, through tax dollars, user fees, and bundled transactions, also pays for roads and other parts of the transportation infrastructure. Through factors including their choices of where to live, work, and shop, consumers determine the urban-regional forms and broader built environment that automotive transportation shapes and serves.

The markets that influence LDV petroleum use and GHG emissions involve cash flow from consumers or other end users to the suppliers of transportation-related products and services, most notably, the automobile industry and the motor fuels industry.6 In most cases, policies designed to influence decisions about motor vehicle purchase and use are directed at these entities rather than at the consumer.7 For example, motor vehicle fuel economy standards are imposed on vehicle manufacturers, not vehicle purchasers. The penalties for not meeting such standards are directly imposed on these firms and, along with the costs of meeting the standards, may be wholly or in part passed onto consumers. It is therefore left to vehicle manufacturers and fuel producers not only to develop and produce the products required to meet the regulations to which they are subject but also to generate the economic signals that induce the purchase of their products in the required quantities by consumers.

6.3 POLICIES AIMED AT REDUCING VEHICLE ENERGY INTENSITY

The ultimate aim of policies to reduce vehicle energy intensity is to lower the average actual on-road fuel consumption of the total LDV fleet. There are two broad approaches available for achieving this. The first is to reduce the average fuel consumption of the typical new vehicle, in all size classes, largely through incorporating technologies that reduce fuel consumption. The second is reduce or eliminate the heaviest and thus least efficient vehicles in the LDV fleet by encouraging the purchase and use of lighter vehicles, which can lead to reduced performance or utility (e.g., reduced load-carrying ability or acceleration). Individual policies can emphasize one of these two approaches, can encourage one while discouraging the other, or can be neutral.

6.3.1 Vehicle Energy Efficiency and GHG Emissions Standards

Several countries have enacted standards that mandate the level of energy efficiency or the level of CO2 emissions that the average newly produced vehicle must achieve by a certain date. Anderson et al. (2011), Eads (2011), and An et al. (2007) describe the vehicle efficiency and GHG emissions standards programs that are in place or under development around the world. The CAFE standards have been in effect the longest, have been studied extensively, and are most pertinent to the committee’s task.

The initial CAFE standards were enacted as part of the 1975 Energy Policy and Conservation Act (see Figure 2.1 for historical and projected LDV vehicle fuel economy). Although the U.S. standards are considered to be regulatory rather than economic, they are enforced through economic penalties. Manufacturers whose annual factory sales of vehicles do not meet the CAFE standards for each of their fleets (domestic and imported cars and domestic and imported trucks) must pay a civil penalty.8 For the 2011 model year,

_______________________

6Although the complex interactions and transactions that determine the provision of transportation infrastructure, associated land-use patterns, and related services are difficult to characterize as a distinct “market,” they also involve a set of actors whose decisions can be viewed through an economic lens.

7There are exceptions. As is discussed below, “feebates”—subsidies for more fuel-efficient vehicles and taxes on less fuel-efficient ones—cause resources to flow directly between the government and consumers. The same thing is true of direct tax credits.

8“Factory sales” are sales by the manufacturer to the dealer. Therefore, the number of vehicles of a certain model year actually reaching the con-

the penalty was $5.50 for each tenth of a mile per gallon that the manufacturer’s average fuel economy fell short of the standard, multiplied by the total volume of vehicles in the affected fleet (EPA, 2009). As of July 2011, NHTSA had collected a total of $795 million in civil penalties over the life of the CAFE program (NHTSA, 2011).

6.3.2.1 The Lag Between the Fuel Economy of New Vehicles and That of the On-Road Fleet

There is a significant difference between the fuel economy of the average new vehicle and that of the average on-road vehicle. The average LDV’s lifetime has been increasing and, according to R.L. Polk, is now about 10.8 years (R.L. Polk and Company, 2011). Vehicles are driven less as they age, and so it takes about 15 years for the age- and travel-weighted average fuel economy of the on-road fleet to reach 90 percent of the average level of new vehicles in a given year, based on the most recently published vehicle survivability statistics (NHTSA, 2006). The CAFE standards apply only to the new-car fleet, and rarely has an effort been made to impact the pace of fleet turnover.9

6.3.2.2 Recent Changes in the U.S. CAFE Standards

In 2007, new legislation set a fuel economy target of 35 mpg (2.9 gal/100 mi) for the combined LDV fleet of cars and trucks, to be achieved by model year 2020.10 The legislation authorized NHTSA to set standards on the basis of vehicle attributes. The agency settled on vehicle “footprint,” defined as the track width times the wheelbase, as a basis for all LDV standards, building on the similar approach adopted in the 2006 CAFE reform rule for light trucks. Therefore, CAFE standards now vary with the size mix of an automaker’s fleet (Box 6.1). Pursuant to the Obama Administration’s agreement with automakers and other parties to develop a single national program for CAFE standards in coordination with federal and California LDV GHG emissions standards, a more ambitious target date was set, requiring that a 35.5 mpg CAFE-equivalent (counting non-fuel-economy-related GHG emissions) new fleet average be met by model year 2016 (EPA and NHTSA, 2010). This target implies an annual rate of improvement in average new LDV fleet fuel economy of 5 percent.

In November 2011, NHTSA and EPA jointly published a Notice of Proposed Rulemaking to further strengthen CAFE standards and GHG emissions standards for LDVs for the model year (MY) 2017-MY2025 period. The agencies proposed an increase in the standards to a MY2025 target of 54.5 mpg, with GHG emissions reductions (CO2 equivalent) corresponding to a fleet average of 163 g/mi (EPA and NHTSA, 2011). In fuel economy terms, the agencies project LDV fleet average compliance levels of 40.9 mpg (2.4 gal/100 mi) in 2021 and 49.6 mpg (2.0 gal/100 mi) in 2025. The agreement would provide CAFE credits for the production of vehicles employing certain advanced technologies. The initial 5-year phase, for MY2017-MY2021, provides for a slower rate of increase for light trucks, averaging 2.9 percent per year, compared to a 4.1 percent increase in passenger car standards for the same period. The program also provides for a comprehensive mid-term evaluation prior to finalization of the MY2022-MY2025 standards. Although subject to revision under the mid-term review, the rates of increase proposed for the second phase of the program, covering MY2022-MY2025, are 4.7 percent per year for light trucks and 4.2 percent per year for passenger cars. The projected average annual rate of fuel economy increase for the recently finalized and currently proposed CAFE regulations is 3.6 percent per year over the 2010-2025 period, rising from an achieved MY2010 compliance level of 29.3 mpg (NHTSA, 2012)

BOX 6.1

The “Footprint” Approach

According to the “footprint” formula now used in computing CAFE, in model year 2016 a compact car such as the Honda Fit, with a model footprint of 40 square feet, would have a fuel economy target of 41.4 mpg (2.42 gal/100 mi), while a full size car, such as the Chrysler 300, with a model footprint of 53 square feet, would have a fuel economy target of 32.8 mpg (3.05 gal/100 mi). A large pickup truck such as the Chevrolet Silverado, with a model footprint of 67 square feet, would have a fuel economy target of 24.7 mpg (4.05 gal/100 mi).

_______________________

SOURCE: Davis et al. (2011), Table 4-19.

These two rulemakings reflect a significant change in the way CAFE standards are developed and issued. Previously, the task had been solely the responsibility of NHTSA, in consultation with other agencies such as the EPA. The standards applied only to the fuel economy of new vehicles. However, NHTSA and the EPA issued the final MY2010-MY2016 standards jointly, and the MY2017-MY2025 standards are being developed and proposed by both agencies in order to address the fuel economy of vehicles and the GHGs they emit.

NHTSA’s authority for issuing fuel economy standards remains the 1975 Energy Policy and Conservation Act,

_______________________

sumer differs somewhat from that model year’s factory sales. Manufacturers can carry forward or backward excess CAFE credits for 3 model years in order to offset any shortfalls to a given fleet. Manufacturers cannot transfer credits between fleets or between manufacturers. Penalties are assessed for a given model year and fleet if any shortfall in CAFE during that model year is not offset by these credits (NHTSA, 2012).

9The most notable exception was the “Cash for Clunkers” program adopted by the Obama Administration in 2009. This is discussed in more detail below.

10This legislation was the Energy Independence and Security Act.

as amended by the 2007 EISA. EPA’s authority for GHG emissions standards is the CAA. The factors NHTSA may consider in developing fuel economy standards are not precisely the same as the factors that EPA may use in developing GHG emissions standards, and so the promulgation of a rule covering both fuel economy and GHG emissions requires a considerable amount of interagency coordination to ensure a consistent set of requirements. An additional level of coordination is involved because the state of California, subject to EPA waiver of the CAA preemption provision, has authority to set its own motor vehicle emissions standards. California has agreed to harmonize its standards with the EPA and NHTSA under the single national program terms.

6.3.3 Subsidies for More Fuel-Efficient Vehicles and Fees on Less Fuel-Efficient Vehicles

Another policy for encouraging the production and sale of vehicles that are more fuel-efficient and/or emit less CO2 is to use subsidies, taxes, or both, based on fuel use, CO2 emissions, or a combination. In the United States, a gas guzzler tax was established by the Energy Tax Act of 1978. Phased in over 1981-1985, this program now involves a graduated level of taxation on passenger cars having a fuel economy below 22.5 mpg (regulatory level, as used for CAFE standards).11 The gas guzzler tax is proportional to the increase in fuel consumption rate above that of a 22.5 mpg car and the current maximum is $7,700 on cars rated at less than 12.5 mpg. The gas guzzler tax does not apply to light trucks and for at least the past two decades has applied to only a small fraction of vehicles, typically high-performance sports and luxury cars. In its early years, the gas guzzler tax was effective in helping to motivate fuel economy improvements in the least efficient cars in the fleet (Khazzoom, 1994; DeCicco and Gordon, 1995). Japan, many countries in Western Europe, and a few others have had graduated vehicle taxation schedules based on fuel consumption, engine displacement, or some other metric defined for tax purposes. Some of these programs have been recast in recent years to be based on vehicle CO2 emissions rate.

When subsidies for efficient vehicles are added to a vehicle taxation program, it becomes what is referred to as a “feebate” program. Such a program was under discussion as part of the response to the 1973 energy crisis (Difiglio, 1976), but only the gas guzzler tax portion was implemented. Over the years, feebate programs were proposed in a number of states but were never enacted. In 1991, the Canadian Province of Ontario enacted a tax for fuel conservation that levied modest graduated taxes on inefficient vehicles and provided subsidies for a subset of efficient vehicles.

In recent years, France has pursued a feebate-type program, known as the “bonus-malus” system, applied at the time of purchase of a vehicle (Bastard, 2010). The amount charged (“malus”) or rebated (“bonus”) depends on the vehicle’s CO2 type approval test emissions figure.12 Originally, the amounts ranged from a bonus payment of €1,000 for cars rated under 100 g/km to a fee of €2,600 for cars rated above 250 g/km. A bonus payment of €5,000 applied for vehicles with a CO2 emissions value below 60 g/km. The incentive provided by these bonus-malus values has been estimated to be broadly equivalent to €150/metric ton of CO2 (Bastard, 2010).

According to Bastard (2010), “the system demonstrated high effectiveness: in 2008, CO2 emissions from new vehicles in France fell by 9 g/km compared to 2007, falling from 149 g/km to 140 g/km, most of the decrease resulting from the bonus-malus system.” The decrease resulted from three separate impacts: (1) a downsizing in the segment mix, (2) a downsizing in power, and (3) a move to diesel in certain segments. The measure was intended to be revenue neutral, but has turned out to have a net cost for the French state, as the shift in the market to smaller vehicles was higher than anticipated. Bastard estimates that the net budgetary cost was approximately €200 million in 2008 and €500 million in 2009.13

6.3.4 Motor Fuel Taxes as an Incentive to Purchase More Fuel-Efficient Vehicles

A third type of policy to incentivize the purchase of more fuel-efficient vehicles is motor fuel taxes. Nearly every country levies taxes on motor fuel, but the level of tax varies widely. Table 6.1 shows the variance in motor fuel taxes for several major developed countries, in 1990 and in 2010.

Fuel prices impact both vehicle purchase decisions with respect to fuel economy and how much vehicles are driven. The sum of these impacts is measured by the elasticity of demand for fuel—defined as the percentage change in fuel purchased divided by the percentage change in fuel price. This elasticity has been estimated by many studies, which generally differentiate between short-term (2 years or less) and long-term (more than 2 years) elasticity. Short-term elasticity generally is interpreted as reflecting changes in VMT. Long-term elasticity is interpreted as reflecting changes in the fuel economy of vehicles purchased and the long-term VMT changes generated by changes in where people live and work.

In January 2008 the Congressional Budget Office (CBO) reviewed the literature on fuel price elasticity and concluded:

Estimates of the long-run elasticity of demand for gasoline indicate that a sustained increase of 10 percent in price eventually would reduce gasoline consumption by about 4 percent. That effect is as much as seven times larger than the

_______________________

11See http://www.epa.gov/fueleconomy/guzzler/index.htm for a gas guzzler tax program overview and lists of vehicles subject to the tax.

12This is similar to the “as tested” CAFE standard.

13Bastard (2010), p. 25. The tax and subsidy values have been adjusted in an effort to make the system more nearly revenue-neutral.

TABLE 6.1 Gasoline and Diesel Prices, Tax, and Percent Tax in 1990 and 2010

| France | Germany | Japan | United Kingdom | United States | ||||||

| 1990 | 2010 | 1990 | 2010 | 1990 | 2010 | 1990 | 2010 | 1990 | 2010 | |

| Gasoline | ||||||||||

| Total price | $5.60 | $6.72 | $4.09 | $6.86 | $4.87 | $5.93 | $4.35 | $6.81 | $2.08 | $2.71 |

| Tax | $3.97 | $4.16 | $2.56 | $4.30 | $2.29 | $2.75 | $2.63 | $4.37 | $0.56 | $0.50 |

| Percent tax | 70.9% | 61.9% | 62.7% | 62.7% | 47.1% | 46.3% | 60.4% | 64.2% | 26.7% | 18.2% |

| Diesel | ||||||||||

| Total price | $2.66 | $5.59 | $4.06 | $5.94 | $2.61 | $5.04 | $3.05 | $6.95 | $1.48 | $2.94 |

| Tax | $1.67 | $3.01 | $2.30 | $3.25 | n/a | $1.66 | $1.80 | $4.39 | $0.41 | $0.53 |

| Percent tax | 62.8% | 53.8% | 56.6% | 54.7% | n/a | 32.9% | 59.0% | 63.1% | 27.9% | 17.9% |

SOURCE: Data from Davis et al. (2011), Figures 10.2 and 10.3.

estimated short-run response, but it would not be fully realized unless prices remained high long enough for the entire stock of passenger vehicles to be replaced by new vehicles purchased under the effect of higher gasoline prices—or about 15 years … consumers also might adjust to higher gasoline prices by moving or by changing jobs to reduce their commutes—actions they might take if the savings in transportation costs were sufficiently compelling. Those long-term effects would be in addition to consumption savings from short-run behavioral adjustments attributable to higher fuel prices. CBO (2008)

A 2009 study titled Moving Cooler: An Analysis of Transportation Strategies for Reducing Greenhouse Gas Emissions (Collaborative Strategies Group, 2009) modeled how much lower LDV fleet GHG emissions would be in 2050 (relative to 2005) if fuel prices or carbon taxes were used to boost U.S. motor fuel prices to West European levels. The elasticities used in the analysis were comparable to those cited in the 2008 CBO study. The reduction as a result of the improved fuel economy portion of the fuel price impact was 19 percent. The reduction as a result of the VMT impact portion was 8 percent (Collaborative Strategies Group, 2009 pp. B-15 and D-11).

Fuel taxes can also differ by fuel type, thereby influencing the choice of engine used to power a vehicle. In Europe, most vehicle models are available in both gasoline and diesel versions. The diesel versions cost more but deliver better fuel economy. France, in particular, taxes diesel at a much lower rate than gasoline—in 2010, the tax on diesel was $3.01/gal whereas the tax on gasoline was $4.16/gal. That differential has been credited with being an important factor in causing a rise in the diesel share of new automobiles in France from 2 percent in 1973 to 74 percent in 2007.

Fuel economy improvements reduce motor fuel tax revenues, all else equal, because under current law the amount of tax per gallon of fuel is constant. Inflation also erodes the real value of fuel tax revenues. Finally, substitution of hydrogen or electric vehicles for conventional vehicles would further diminish tax revenues unless those fuels were brought within the purview of the tax law. One solution would be to tax all forms of energy used by vehicles and index the motor fuel tax to inflation and also to the average energy efficiency of all vehicles on the road. For example, if total vehicle miles of travel per unit of energy increased by 3 percent from one year to the next, the tax in the following year would be increased by 3 percent. Such an indexed highway user fee on energy would maintain a constant tax rate per vehicle mile of travel while encouraging car buyers to purchase energy-efficient vehicles.

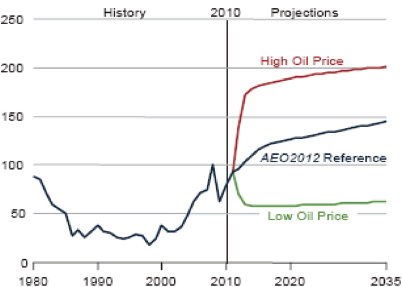

6.3.5 A Price Floor Target for Motor Fuels

A major impediment to investment in new alternative technologies, even when petroleum prices are high, is uncertainty about the future price path. Investors and consumers are less likely to invest in fuel-efficient technologies that require substantial up-front costs when they are uncertain about the payoffs from those investments. Prices of crude oil have been volatile in the past (Figure 6.2). In the late 1970s and early 1980s, the private and public sectors invested heavily in alternative fuels and AFVs, but many of the alternatives became uneconomic when prices of crude oil fell in the mid-1980s and remained low until the early 1990s.

One policy to stabilize the prices of petroleum-based fuels at a level that will help ensure a transition to more energy efficiency is through the use of a tax or surcharge on the price of oil that is applied only when oil prices fall below a specified target price. This surcharge would then be inversely related to the price of oil. For example, if the target price of oil with existing taxes is $90/bbl, and the price falls to $85/bbl over a specified period, the surtax would be $5/bbl, ensuring that the market price remains at $90/bbl. If the market price fell below $85/bbl, the surtax would increase, and if the market price rose above $90, then the surtax would be zero. The setting of the target price would be a policy choice made by Congress and the President and implemented in ways similar to other taxes on oil sales with the goal of stabilizing prices of petroleum-based fuels above a minimum price.

FIGURE 6.2 Actual average annual world oil prices from 1980 to 2010 and projected annual world oil prices from 2010 to 2035 under three different scenarios (in 2010 dollars per barrel). SOURCE: Annual Energy Outlook 2012 (EIA, 2012).

Such a price floor or fuel price stabilization policy could be implemented on crude-oil sales in the United States as suggested above, or it could apply only to imported crude oil (Hubbard and Navarro, 2010). Borenstein (2008) shows how the concept of the oil price floor could be tied only to gasoline or other specific fuels that are derived from crude oil.

Revenues from any such surcharge would vary over time. They could be earmarked for use in current and proposed subsidies for alternative vehicles and AFVs, or used more broadly for tax or deficit reduction.

6.3.6 Policies to Change the Size and Weight Composition of the LDV Fleet

The average on-road fuel economy of the LDV fleet can also be changed by altering the fleet’s composition. One example of the impact that such a change can have is the decline in U.S. on-road fleet average fuel economy due to the increase of trucks in the fleet mix between MY1980 and MY2004.14 Policies could be designed to encourage or discourage such a shift.

An example of a policy change that discourages a shift in fleet mix is the 2007 legislation updating the CAFE program. Before then, CAFE standards were set for and had to be met by each of four fleets (U.S. cars, imported cars, U.S. trucks, and imported trucks) of each manufacturer selling vehicles in the United States. This approach permitted manufacturers to “downsize” or “upsize” their fleets as part of their CAFE fulfillment strategy and helped lead to the proliferation of trucks and SUVs in the fleet mix. The reform rule of 2006 restructured light-duty truck standards, basing them on a vehicle attribute, for which NHTSA selected footprint as discussed above. The EISA 2007 legislation authorized similar restructuring for all LDVs, and footprint-based standards have subsequently been promulgated for passenger cars and light trucks. Although the exact effect depends on the shape of the curve that maps vehicle footprint to regulatory targets for fuel economy, a general intent of this structure is that similarly sized vehicles would be required to achieve a similar increase in fuel economy. The regulatory curves are flattened at the extremes, to avoid standards that are too stringent for the smallest vehicles or standards that are too weak for the largest vehicles.

Designing and estimating the effects of such standards involve complex evaluations of many factors that influence vehicle design and engineering, customers’ preferences, and automakers’ product strategies. The analysis given in the EPA and NHTSA rulemaking studies concludes that the adopted footprint-based standards appropriately balance the many considerations that the agencies were required to weigh and does not provide any motivation for automakers to change their fleet mixes for CAFE purposes. Some have argued, though, that the chosen footprint curves inhibit downsizing as a cost-effective compliance strategy and may create an incentive to upsize the LDV fleet in a way that reduces fuel savings and GHG emissions reductions attributable to the standards (Whitefoot and Skerlos, 2012).

Other policies, such as the “Cash for Clunkers” program undertaken in 2009, have been designed to encourage consumers to dispose of lower-efficiency vehicles (which were then rendered inoperable) and replace them with higher-efficiency new vehicles, providing a stimulus to new-car sales. While the program was operating, it encouraged the purchase of fuel-efficient vehicles (Yacobucci and Canis, 2010). Because the program was temporary, most observers believe that it operated primarily to shift vehicle purchases in time rather than achieve any long-term impact on fleet composition. In a report published in October 2009, Edmunds.com estimated that of the nearly 690,000 new vehicles sold during the period the program was operating, only 125,000 of the sales were incremental (Edmunds.com, 2009).

6.3.7 Assessment of Vehicle Fuel Economy Improvement Strategies

The various policies described above each have demonstrated a potential to reduce the LDV fleet’s average fuel consumption. It is generally agreed that the U.S. CAFE standards have been effective in stimulating the production and sale of more fuel-efficient vehicles (NRC, 2002). According to the EPA, the composite average LDV new-vehicle fuel economy (laboratory rated at 55 percent city driving and 45 percent highway driving) increased from 15.3 mpg (6.5 gal/100 mi) in MY1975 to 28.6 mpg (3.5 gal/100 mi) in MY2011, the latest year for which data have been published (EPA, 2010). Most of this increase occurred between

_______________________

14In 1980, “trucks” accounted for 16.5 percent of LDV production; by 2004 the truck share had reached 52.0 percent (EPA, 2010, Table 1, p. 7).

MY1978 and MY1988. The political acceptability and track record of the CAFE program have established it as a leading option among policies for meeting LDV petroleum use and GHG reduction goals. However, as discussed elsewhere in this chapter, a strict CAFE standard alone is not sufficient for meeting ambitious petroleum and GHG reduction goals because it fails to address issues of consumer motivation, travel demand, and other factors that shape the on-road fuel consumption of the LDV fleet.

Although there is less experience with their use, subsidies and taxes based on projected vehicle fuel consumption and imposed at the time of vehicle acquisition (feebates) could supplement (or, in principle, even substitute for) CAFE standards. So also could higher fuel taxes. Both types of policies have been shown to be effective in encouraging the purchase (or lease) of more fuel-efficient vehicles. However, the reluctance in the United States to raise taxes of any kind, consumers’ undervaluation of fuel economy, and the level to which taxes would have to be raised to achieve results comparable to those seen with fuel economy standards, especially if supplemented by feebates, make their use problematic.

6.4 POLICIES TO REDUCE PETROLEUM USE IN OR GHG EMISSIONS IMPACTS OF FUEL

The second major factor influencing the LDV sector is petroleum’s share of fuel use or the overall GHG emissions impact of supplying and using the fuel. Although numerous policies intended to reduce petroleum use by LDVs have been pursued over the years (e.g., the Energy Security Act of 1992 [96 P.L. 294], the Alternative Motor Fuels Act of 1988 [100 P.L. 494), the EPAct of 1992 and 2005 [109 P.L. 58], and the EISA of 2007 [110 P.L. 140] (DOE-EERE, 2011b), to date they have had little impact on the overwhelming dominance of petroleum-derived gasoline and diesel fuel. Nevertheless, many policy makers still show considerable interest in pursuing similar strategies for encouraging or mandating the use of biofuels, natural gas, hydrogen, electricity, or other non-petroleum fuels to power LDVs. Regulations, subsidies, various forms of tax incentives, and loan guarantees are now being used both in the United States and other countries to encourage the use of non-petroleum-based fuels and fuels that are expected to emit fewer GHGs. Fuel taxes and price floors on petroleum-based fuels also would discourage petroleum use.

Although the goals of reducing petroleum use and GHG emissions commonly are treated together (as in the case of the statement of task for this study; see Appendix A), the scientific, economic, and technical issues associated with these two goals are not identical. Each goal has its distinctive challenges associated with the design of fuels policies. Implementing any such policies requires appropriate metrics and the ability to track and measure effects throughout the fuel supply, distribution, and end-use systems that the policies seek to influence.

Measuring and tracking petroleum reduction require that the feedstocks used for producing fuel be quantified and reported. Given a legal definition of what qualifies as “non-petroleum” (e.g., as specified by AMFA [1988] and subsequent energy legislation), determination of the extent of petroleum reduction is conceptually straightforward. However, determining various fuels’ net GHG emissions impacts is difficult, for several reasons:

- At least some of the GHG emissions or CO2 uptake occurs upstream from the use of any fuel. For example, battery electric vehicles do not have tailpipe emissions, but the production of electricity to fuel the batteries may emit GHGs.

- The quantification of net CO2 uptake, sequestration, and related emissions is uncertain in some cases. For example, the storage of carbon in soil by perennial bioenergy feedstocks depends on prior land condition and is difficult to estimate with high certainty.

- A significant portion of the GHG emissions impacts of all alternative fuels occurs outside the LDV sector. For example, the GHG emissions from electricity generation for powering battery electric vehicles or for producing hydrogen to power hydrogen fuel-cell vehicles occur in the power generation or hydrogen production sector. Therefore, the GHG emissions must be tracked in multiple sectors beyond the LDV sector.

- Biofuel-induced land-use changes and nitrous oxide flux from nitrogen fertilization could affect the net GHG emissions effects. Yet, the quantification of those net GHG emissions effects could be difficult.

6.4.1 Tax Incentives for Fuels and Their Infrastructure

During the energy crisis in the 1970s, policies were developed to support alternatives to petroleum ranging from synthetic fossil fuels to biofuels. The Energy Tax Act of 1978 (P.L. 95-618) introduced an excise tax exemption for gasohol. The exemption subsequently was extended and transformed into a tax credit for ethanol called the VEETC, a $0.45/gal tax credit. Congress also approved a tariff on imported ethanol to foster domestic biofuel production. Both the VTEEC and the tariff expired at the end of 2011.

The EPAct of 2005 also established a tax credit of up to $30,000 for the cost of fueling equipment for alternative fuels including hydrogen, natural gas, propane, electricity, E85, and diesel fuel blends containing at least 20 percent biodiesel.15 Residential fueling equipment was eligible for a credit of up to $1,000. The tax credits for hydrogen run through 2014; they expired at the end of 2011 for all other fueling equipment (DOE-EERE, 2011a).

_______________________

15California and a number of other states have policies for subsidizing a variety of alternative fuel vehicles (AFVs) and related infrastructure.

6.4.2 Fuel-Related Regulations

Traditional fuel regulations, as authorized under the original language of the CAA’s Section 211, addressed fuel composition and its physical and chemical properties. These fuel-performance standards were based in principle on measurable fuel properties. Fuel suppliers could certify their products through laboratory testing or analytic methods based on physiochemical characteristics. Regulators could readily verify that standards were met by directly sampling fuel products, although this was rarely done. Because fuel additives and formulation requirements may not be finally incorporated into a consumer fuel until they are blended in at a distribution terminal, tanker truck, or even a fuel pump, the regulated entity may vary in fuel standards (40 CFR 80.2, Definitions).16 The point of regulation is the point of finished fuel product distribution, which is where most fuel properties are determined.

Compliance with the complex model for gasoline emissions was a departure from this standard. There are a large number of fuel parameter combinations that could meet the requirements for compliance, and compliance was referenced to the base fuel of each individual fuel supplier. Compliance was determined before the fuel left the production facility. Once the fuel was distributed and comingled with other fuels that complied at production, it was no longer possible to determine compliance at the final point of distribution.

As energy policy considerations came into play, regulations were designed to stipulate the use of certain fuels derived from specified non-petroleum feedstocks. Thus, fuel regulations developed for energy policy take the form of a legal requirement to supply a certain amount of a fuel manufactured from particular resources. Others take the form of a requirement to supply a minimum percentage of a group of fuels derived from desired sources or to supply a mix of fuels that on average meet requirements for being derived from desired sources. Such is the case for the amended Renewable Fuel Standard (RFS2) in the EISA. An approach generalized to require a mix of unspecified fuels that meet specified average net GHG emissions over their life cycle is known as a Low-Carbon Fuel Standard (LCFS), and such a standard has been established in California.

6.4.3 Renewable Fuel Standard17

RFS2 was intended to move the United States “toward greater energy independence and security” and to “increase the production of clean renewable fuels” (110 P.L. 140). RFS2 is actually a collection of mandates for fuel providers to supply categories of renewable fuels defined by their feedstock type and life-cycle GHG emissions (Box 6.2). The volume mandate for the “renewable fuel” category has been met by corn-grain ethanol and is expected to be met up to 2022 (NRC, 2011). Production capacity is available for meeting the volume mandate for biomass-based diesel. However, commercial production of cellulosic biofuels has fallen far short of the volume for that category mandated by EISA. Indeed no compliance-tracking renewable identification numbers (RINs) had been generated for cellulosic biofuels as of April 2012 (EPA, 2012a).18

EISA gives EPA the right to waive or defer enforcement of RFS2 under a variety of circumstances. For example, RFS2 can be waived if sufficient biofuels are not likely to be produced for blending or if its enforcement has been deemed to cause economic dislocation (NRC, 2011). For example, the governors of nine states, 26 members of the U.S. Senate, and 156 members of the U.S. House of Representatives petitioned EPA to grant the RFS waiver, citing the effects of the 2012 drought on U.S. food and feed prices as the reason for potential economic dislocation. The EPA has been exercising its discretion to reduce the level of cellulosic biofuels required in RFS2. Specifically, the EPA reduced the mandate for cellulosic biofuels by 93 percent in 2010 (from 100 million to 6.5 million gallons), by 97 percent in 2011 (from 250 million to 6.6 million gallons), and by 98 percent for 2012 (from 500 million to 10.5 million gallons) (EPA, 2012b). When there is a waiver, blenders are permitted to buy RINs from EPA instead of actually purchasing cellulosic biofuels. There also is a clause that allows blenders to buy RINs from EPA even if cellulosic biofuels are available but substantially more expensive than petroleum-based fuels (Thompson et al., 2010; NRC, 2011). Although the intent was to protect consumers from high prices relative to gasoline, the clause effectively eliminates a guaranteed demand for cellulosic biofuels. The potential waiver and clause regarding the purchase of RINs reduce the incentive for the major fuel producers to develop and deploy technology for producing cellulosic biofuels, particularly when large financial investments and risks are involved. But without the waiver, blenders are required to purchase fuel that is not being made; their only option is to buy RINs. The cost of cellulosic fuels has not come down as some had hoped. The combination of high cost, the potential waiver, and the clause described above have undermined the effectiveness of RFS2 in driving an increase in cellulosic biofuels.

_______________________

16Code of Federal Regulations, Title 40, Part 80, “Regulation of Fuels and Fuel Additives,” Definitions section; available at www.gpoaccess.gov/cfr/index.html.

17This description is taken from EPA’s website.

18“The Renewable Identification Number (RIN) system was developed by the EPA to ensure compliance with RFS2 mandates. A RIN is a 38-character numeric code that corresponds to a volume of renewable fuel produced in or imported to the United States. RINs are generated by the producer or importer of the renewable fuel. RINs must remain with the renewable fuel as the renewable fuel moves through the distribution system and as ownership changes. Once the renewable fuel is blended into motor vehicle fuel, the RIN is no longer required to remain with the renewable fuel. Instead, the RIN may be separated from the renewable fuel and then can be used for compliance, held for future compliance, or traded” (McPhail et al., 2011, p. 5).

BOX 6.2

Life-Cycle Assessment for

Greenhouse Gas Emissions

Life-cycle assessment (LCA) is a tool available for the accounting of net greenhouse gas (GHG) emissions effects of different fuel pathways. However, the use of LCA to determine policy compliance is a marked departure from traditional approaches to fuels regulation, which prior to the RFS had always been based on physiochemical fuel properties. Standards based on a fuel’s physiochemical properties are enforceable through measurement or measurement-based analytic methods that allow verifiable assurance of fuel providers’ compliance. However, fuel property standards are not adequate for regulating the GHG emissions associated with both production and use of a fuel. Fuel property standards cannot account for upstream emissions associated with any fuel. Therefore, LCA is used to assess the GHG emissions impacts of fuels. However, GHG emissions occur in multiple sectors in geographically dispersed locations and over multiple periods of time. For example, for biofuels, CO2 uptake by biomass and sequestration in soil or GHG emissions from indirect land-use changes occur remotely from locations of fuel use in the transportation sector. Thus, accounting for life-cycle emissions is more complicated and uncertain than it is for direct emissions (NRC, 2011).

Some members of the committee believe that a problem with using LCA in policy regulation is a misplaced burden of proof (DeCicco, 2012) because some of the CO2 sequestration and emissions occur outside the LDV sector and are not under the control of fuel producers, fuel retailers, or fuel users. Others believe that it is appropriate to hold fuel providers responsible for the upstream emissions of their products. The parties that are responsible for the direct and indirect emissions from all the different parts of the biofuel supply chain have not been clearly established. If the United States is to limit the GHG emissions impacts of LDVs and their associated fuel supply systems (as opposed to their direct tailpipe emissions only), then policies are needed to address the GHG emissions from other sectors upstream from fuel use. Although GHG emissions from the transportation sector could be reduced in the United States by RFS2, the policy may not contribute to reducing global GHG emissions.

RFS2 requires EPA to determine whether the four types of renewable fuel meet their respective GHG thresholds. Although the intent was to ensure that biofuels have lower GHG emissions impacts compared to petroleum-based fuels, whether the policy will actually contribute to a reduction in GHG emissions is uncertain. The NRC report Renewable Fuel Standard: Potential Economic and Environmental Effects of U.S. Biofuel Policy concluded that “RFS2 may be an ineffective policy for reducing GHG emissions because the effect of biofuels on GHG emissions depends on how the biofuels are produced and what land-use or land-cover changes occur in the process” (NRC, 2011; p. 2-4). The same physical fuel can have widely different life-cycle GHG emissions depending on numerous factors, including the feedstock used (e.g., corn stover or switchgrass), the management practices used to produce the feedstock (e.g., nitrogen fertilization during biomass growth), the energy source used in the biorefinery (e.g., coal or renewable electricity), and whether any indirect land-use changes were incurred as a result of feedstock production. For example, the use of crop or forest residues for feedstock is less likely to cause indirect land-use changes than is the use of planted crops. Moreover, indirect land-use changes as a result of bioenergy feedstock production and the associated GHG impacts are difficult to ascertain.

6.4.4 Possible Alternative to RFS2

Because GHG sources and sinks are dispersed across sectors (agricultural, forestry, and industrial) and international borders, some committee members believe that policies that target them at the location where they occur are likely to be much more effective than RFS2 in reducing GHG emissions impacts. RFS2 includes a GHG accounting system that can account for upstream emissions. This system requires an elaborate tracking mechanism and a combination of real-world measurement and estimation of GHG emissions at each source and sink along the supply chain to verify overall claimed benefits from the production and transport of the biomass through conversion and distribution of the final products.

6.4.5 California’s Low Carbon Fuel Standard

A regulatory effort to encourage the use of alternative fuels, with the specific intent of lowering GHG emissions, is California’s LCFS. On January 18, 2007, California’s then-governor issued Executive Order S-1-07 that called for a reduction of at least 10 percent in the carbon intensity of California’s transportation fuels by 2020. The California Air Resources Board developed regulations to implement the order, approving them in April 2009. After delays due to litigation the regulations were promulgated on June 4, 2012, under an April 2012 court order permitting the promulgation to occur pending the results of an appeal that was still underway at the time of this writing.

The LCFS uses life-cycle assessment (LCA) rather than direct measurement of fuel properties to determine compliance. It applies to essentially all transportation fuel used in the state. Regulated parties are defined broadly as fuel producers and importers and some owners of alternative fuels or alternative fuel sources. The regulation defines a

carbon intensity (CI)19 metric based on LCA. Fuel suppliers are required to progressively lower the average CI of the fuel they supply. The targeted GHG-emission reduction is 10 percent in 2020 compared to the average baseline of transportation fuels in 2010. The LCFS assigns a CI to different types of biofuel (e.g., corn-grain ethanol produced via different pathways with different types of energy input gets different scores) and a CI for land-use change and other indirect GHG effects. However, the actual GHG effects from land-use change and other indirect effects could span a wide range (Mullins et al., 2010; Plevin et al., 2010). Given the large uncertainties, the extent to which LCFS actually contributes to reducing net GHG emissions is unclear. One committee member considers that the uncertainties in LCA are such that one cannot have confidence in the efficacy of an LCFS or other policies using LCA to ensure reductions of GHG emissions from fuels. As is the case with RFS2, fuel providers are held accountable for upstream GHG emissions and GHG emissions from indirect effects. They do not control these effects but can mitigate them by their choice of the source of their fuel supply.20

LCFS allows fuel providers to petition for individualized CI score. LCFS proponents view such provisions as beneficial for fostering innovation in low-emission fuel production. For example, some ethanol producers could sequester their CO2 emissions, account for them, and seek credit for these reductions under the LCFS. Similarly, oil companies practicing enhanced oil recovery could seek credits for the portion of the injected CO2 that remains in the water phase of the oil well and the portion that is dissolved in the unrecovered oil.

6.5 POLICIES TO IMPACT VEHICLE MILES TRAVELED

Since 1970, increases in U.S. LDV vehicle miles traveled have more than offset improvements in LDV on-road fleet fuel economy (see Figure 6.1). As a result, LDV petroleum use and CO2 emissions have increased over the period. With VMT being such a driver of increased petroleum use and CO2 emissions, it is natural that attention has been devoted to finding ways of reducing its rate of growth—or even its absolute total. This section reviews the principal policies that have been examined and what is known about their likely impact.

6.5.1 Historical and Projected Future Growth in LDV VMT

Between 1970 and 2005, VMT in the U.S. LDV fleet grew by an average annual rate of 2.8 percent. This rate of growth is not expected to continue. Indeed, the average annual rate of VMT growth from LDVs projected by the Energy Information Administration’s (EIA) Annual Energy Outlook (EIA, 2011) for the period 2010 to 2035 is only about 60 percent of the average rate experienced between 1970 and 2007, the peak year prior to the recent economic recession.

But VMT is still projected to grow. Indeed, if the 1.49 percent annual growth rate of VMT over the last 5 years of EIA’s projection period is assumed to be realized as well during the 2035-2050 period, VMT in 2050 will be 5.0 trillion—an 85 percent increase relative to its 2010 level.21

6.5.2 Reducing the Rate of Growth of VMT by Increasing Urban Residential Density

The relationships among household location, workplace location, trip-making activity, and LDV travel have been subjects of research and policy debate for many years. These relationships have been difficult to establish for many reasons, including the problem of controlling for variables such as self-selection bias as households locate in places that best suit their travel needs, preferences, and capabilities. However, there is general agreement that higher urban density is associated with less driving. The important issues are (1) the magnitude of this relationship and (2) the extent to which VMT might be altered by changes in urban density.

An NRC study analyzed in great detail the impact of compact development (another term for increased urban density) on motorized travel, energy use, and CO2 emissions. The principal findings of the 2009 study can be summarized as follows:

- Developing more compactly, that is, at higher residential and employment densities, is likely to reduce VMT.

- Doubling residential density across an individual metropolitan area might lower household VMT by about 5 to 12 percent, and perhaps by as much as 25 percent, if coupled with higher employment concentrations, significant public transit improvements, mixed uses, and other supportive demand management measures22 (NRC, 2009, pp. 2-6).

The 2009 analysis suggests that reductions in national VMT resulting from compact, mixed-use development

_______________________

19Carbon intensity as defined in the LCFS is equivalent to life-cycle greenhouse gas emissions.

20In 2012, California was enjoined from enforcing the Low Carbon Fuel Standard because of a December 29, 2011, decision by the Federal Eastern District Court of California in the case of Rocky Mountain Farmers Union vs. Goldstene. The state is appealing the decision to the Ninth Circuit Court of Appeals, which lifted the lower court’s injunction on April 23 and thereby allowed the state to proceed with LCFS implementation pending appeal (CARB, 2012).

21This is the number used in the business-as-usual and reference cases and in most of the policy simulations in this report.

22The 2009 committee commented on its second conclusion as follows: “Doubling residential density alone without also increasing other variables, such as the amount of mixed uses and the quality and accessibility of transit, will not bring about a significant change in travel” (NRC, 2009, p. 89).

might range from less than 1 percent to 11 percent. The high estimate would require 75 percent of new development to be built at double the density of existing development, a significant departure from the declining densities recorded in most urban areas over the past 30 years. The study emphasizes that increasing densities and mixing land uses may be more achievable in some metropolitan areas than others. Metropolitan areas differ a great deal in their geographic characteristics, land area, historical growth patterns, economic conditions, and local zoning and land-use controls. Policies that affect land use are local in the United States and in some areas in the past have led to decreasing density as urban areas have expanded. In others, strong regional authority with a commitment to more compact land use has increased density through land-use policy.

The present committee concluded that the likely changes in VMT as a result of changes in residential density would be small in the aggregate.

6.5.3 Reducing the Rate of Growth of VMT Through the Use of Pricing Strategies

Many strategies in addition to those encouraging increased residential density have been suggested as having the potential to reduce the rate of growth of VMT. The 2009 Moving Cooler study (Collaborative Strategies Group, LLC. 2009) mentioned above examined a number of pricing strategies, including congestion pricing, intercity tolls, pay as you drive (PAYD) insurance, a VMT tax, and a gas or carbon tax. Each of these pricing measures produced a reduction of 1 percent or greater in 2050 urban VMT under all levels of policy intensity studied—extended current practice, aggressive implementation, and maximum implementation. Indeed, the VMT impact of a fee per mile traveled at maximum implementation was estimated to reduce 2050 urban VMT by about 8 percent.23

6.5.4 Reducing the Rate of Growth of VMT Through Other Policies

Moving Cooler (Collaborative Strategies Group, LLC. 2009) also examined a range of additional policies deemed to have the potential to reduce the future rate of VMT growth. As in the case with pricing strategies, each of these other policies was evaluated at three levels of implementation. Three of the non-pricing strategies were estimated to have a 1 percent or greater impact on 2050 urban VMT with expanded current practice; four had a 1 percent or greater impact with practice more aggressive than current practice; and five had an impact of 1 percent or greater with maximum implementation. Although some of these strategies may be additive, many are not. Also, some strategies (such as the transit strategies, pedestrian strategies, and certain of the employer-based commute strategies) may already be reflected in the density-based VMT impacts reported earlier in this chapter. Indeed, the 25 percent reduction in VMT cited in NRC (2009) as a possible upper bound due to higher density was generated by a combination of VMT-related policies, not merely increased density.

6.5.5 Summary of the Impact of Policies to Reduce the Rate of Growth of VMT

Policies designed to reduce the rate of growth of VMT are likely to have limited impact compared with policies targeting vehicle efficiency and new energy sources. Even the extreme reorganization of national economic activity needed to produce the higher level of urban density examined in NRC (2009) would yield only an 11 percent reduction in VMT. And it should be remembered that the various VMT-related policies are not additive. Nevertheless, this limited VMT impact should not lead to the inference that such policies might not be valuable for other reasons.

6.5.6 Policies to Improve the Efficiency of Operation of the LDV Transport Network

As noted above, there has been considerable recent interest in the extent to which policies designed to improve the operating efficiency of the LDV transport network might also serve to reduce GHG emissions or petroleum use. Examples of such policies are eco-driving programs; ramp metering; variable message signs; active traffic, integrated corridor, incident, road weather, and signal control management; traveler information; and vehicle infrastructure integration. Many of these policies focus on reducing congestion to help even out vehicle speeds and reduce time spent stopped in traffic. Others provide drivers with the knowledge and information needed to learn to drive their existing vehicles using less fuel.

There is no dispute that drivers can, if they are careful and attentive, significantly improve the fuel economy they experience on the road. There also is no dispute that congested conditions waste fuel as well as drivers’ time. The question is how widespread the use of eco-driving or the implementation of technologies that have a potential to reduce congestion (e.g., vehicle-to-vehicle communications, also known as telematics) become and how great the aggregate impact of such policies and technologies might be at the national level.

The challenge in developing such estimates is somewhat similar to the challenge of estimating the impact of increased urban density on VMT growth. In both cases, examples showing major potential, and sometimes actual, improvements in specific local situations can be cited. But how generalizable are these local results either to other localities

_______________________

23“Maximum implementation” is a $0.12/mi fee, representing the increment needed to represent Western European motor fuel tax levels. It was derived based on an additional tax of approximately $4/gal on an approximate average on-road 33 mpg.

or, more importantly, to the national level? And are there factors that can be expected to offset these improvements to some degree over time?

Little research has been done to address these issues. Indeed, the only estimate of the possible national impact over time that the committee is aware of appears in the Moving Cooler report discussed above.

That report counts as “benefits” only the fuel savings and associated GHG emissions reductions resulting from the various measures to improve the operational efficiency of the road transport network.24 It subtracts from these benefits an amount that reflects the VMT increase projected to result from reduced congestion.25Moving Cooler also takes into account the rate and extent of deployment of these strategies (Collaborative Strategies Group, 2009). Even at maximum deployment, the only strategy that reduces GHG emissions and fuel consumption by more than 0.5 percent as of 2050 is ecodriving, which yields a 4 percent reduction in GHG in that year.26

Moving Cooler acknowledges that these estimates are rather rough and might be greater if deployment of the strategies occurs sooner, of development is more widespread, or if the strategies themselves are more effective than they now appear to be. Clearly, there is much need for additional research on this topic.

6.6 POLICIES IMPACTING THE INNOVATION PROCESS

Identification, development, and commercialization of technologies that yield vehicles that are more efficient than current vehicles, AFVs, fuels from non-petroleum resources, fuel production systems with reduced GHG emissions, and, in some cases, even the means of reducing the rate of VMT growth often stem from research undertaken years before the technologies appear in the market. This section examines the different stages of the innovation process to address the questions about the role of government in this process.

There is no universally agreed-upon taxonomy for the stages of the innovation process, but one common framework divides the process into four stages (NSF, 2007):

- Research, or “systematic study directed toward fuller knowledge or understanding.” Research may be basic or applied. Basic research is directed toward the “fundamental aspects of phenomena and of observable facts without specific applications toward processes or products in mind.” Applied research is directed toward “determining the means by which a recognized and specific need may be met” (NSF, 2007; p. 1).

- Development, which takes the knowledge produced in research and systematically applies it toward the production of useful materials, devices, and systems or methods to meet specific requirements, often culminating in prototypes.

- Demonstration, which tests the feasibility of the developed technology at an appropriate scale to identify all significant impediments to commercial success.

- Deployment, in which the technology becomes widely used.

The need for government intervention is most widely accepted for the first two of these four stages: research and development (R&D). R&D builds the nation’s intellectual capability to address energy problems. Even in the presence of strong intellectual property protection, private businesses generally cannot capture all of the benefits generated by their R&D investments, especially any investments that they might make in basic research. Because of this “spillover effect,” private investment in R&D falls short of the socially optimal amount, thereby justifying public support.