H.1 MODELING THE TRANSITION TO ALTERNATIVE FUELS AND VEHICLES USING VISION

H.1.1 The VISION Model

The VISION model was developed by Argonne National Laboratory as a means of extending the transportation sector component of the Energy Information Adminstration’s (EIA’s) National Energy Modeling System (NEMS) model to longer-term projections of U.S. energy use and greenhouse gas (GHG) emissions. The model is available to the public as a downloadable Excel file and is updated each year to incorporate recent results from NEMS and the EIA Annual Energy Outlook (AEO) report.1 VISION calculates energy use and greenhouse gas emissions for light, medium, and heavy-duty vehicles using simple algebraic energy balance equations and input assumptions about vehicle fleet mix, efficiency of vehicles, fuel characteristics, and vehicle miles traveled (VMT) out to the year 2050 and beyond. Although the calculations are conceptually simple, the model is complicated in that it incorporates a wide range of data and conversion factors to explicitly track multiple vehicle vintages, fuel types, and other trends on an annual basis. Singh et al. (2003) and Ward (2008) provide documentation and a user’s guide for the VISION model.

VISION does not include any market feedback effects over time within the model or between the transportation sector and other sectors of the economy.2 Fuel and vehicle prices are exogenous to the model and must be specified by the user. Any responses to changes in those prices would also have to be specified by the user. So, if, for example, deployment of more efficient vehicles in the VISION model reduces demand for petroleum fuels, there is no feedback to the global petroleum market and subsequent changes to gasoline and diesel fuel prices. Default values in VISION are calibrated to transportation sector results from the NEMS model, which does account for interactions between global and domestic energy markets. What VISION can assess are the effects on energy use and GHGs when there are different shares of vehicle types and fuel types over time. Vehicle shares, efficiencies, fuel volume constraints, and fuel intensities are the major inputs to the model. VISION uses the GREET 1-2011 model for assumptions about the GHG emissions rates of different fuels,3 but the analysis in this study relies on the judgment of the committee for GHG intensity rates.

VISION was used to explore the range of possible vehicle and fuel combinations that could attain the goals of this study and their associated costs. The committee modified VISION in a number of ways to add capability for the purposes of this study. The revised VISION model, referred to here as the VISION-NRC model, includes the most up-to-date assumptions from the committee about vehicle efficiencies, fuel availability, and GHG emissions of specific fuels. The sections below review the scenarios developed for the committee using VISION-National Research Council (NRC) (Section H.1.2)

_____________________________

1 See http://www.transportation.anl.gov/modeling_simulation/VISION/.

2 VISION does include a demand elasticity function to adjust VMT in response to fuel price change assumption; however, this function was not used in the present study.

3 Features of GREET1_2011 are listed at http://greet.es.anl.gov/.

and major modifications made to the original VISION model in developing VISION-NRC (Section H.1.3). For more information on the VISION model and to download the model itself, see the attached Appendix H VISION Model Spreadsheet.

H.1.2 VISION-NRC Scenarios

To explore possible paths to attain the goals, VISION-NRC was run for a range of cases. The predominant characteristic of these runs was to focus on a market dominated by a particular vehicle type and alternative fuel (i.e., battery electric vehicles (BEVs), fuel-cell vehicles). To assess the range of possibilities, the committee looked both at runs that used the midrange vehicle efficiencies for these advanced vehicles as well as runs that used the optimistic efficiencies to represent technological breakthroughs, as described in Chapter 2 and summarized in Table 2.11. From the fuels side, the committee considered both business-as-usual (BAU) production of a fuel (gasoline, hydrogen, or electricity) as well as a low-GHG fuel supply technologies, as described in Chapter 3 (low-net-GHG biofuels, H2 generation with carbon capture and storage (CCS), or a low-GHG electric grid).

Some of the key assumptions throughout all of the runs are listed below.

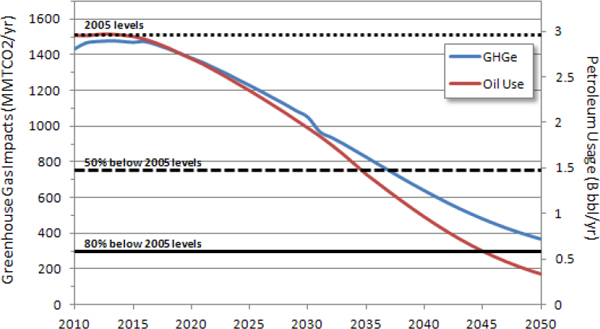

• There are two “reference cases” in the committee’s analysis. There is the BAU Case, which is basically the AEO 2011 assumptions, and then there is the Committee Reference Case, which includes, instead of the AEO assumptions, all of the committee assumptions about vehicle efficiencies, fuel carbon intensity, and effects in the future of existing regulations (see below).

• All runs of the model, except the AEO BAU Case, use the committee’s assumptions on vehicle efficiencies, GHG impact of the fuels supplied, and availability of resources. Committee estimates of vehicle fuel efficiencies can be found in Table 2.12 of Chapter 2.

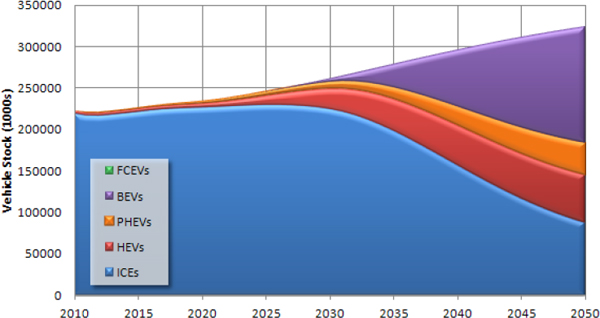

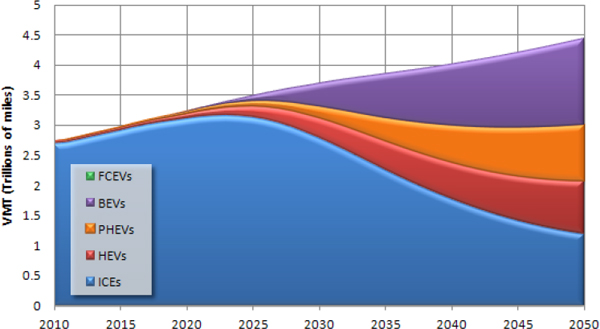

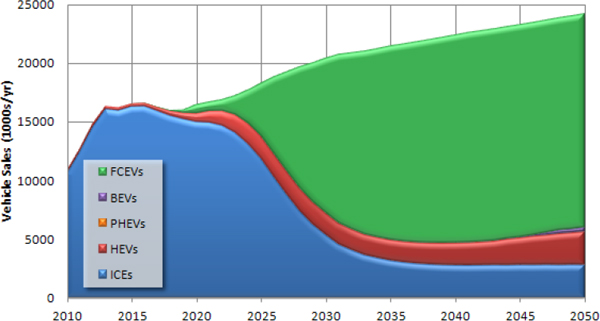

• Total new vehicle sales each year are drawn from the AEO 2011 Reference Case and do not change with the different runs, only the mix of vehicles changes; VMT per vehicle is from AEO Reference Case forecast and falls over time as vehicles age; total VMT of the fleet is the same for each run and is consistent with the AEO 2011 assumptions about total VMT over time (see Table H.1).

• Oil prices are taken from AEO 2011 and are expected to gradually increase to $125/barrel by 2035, resulting in a pre-tax gasoline price of $3.16 in that year. Gasoline prices are then extrapolated out to 2050, assuming the compound rate of growth modeled in AEO 2011 from 2030-2035. The current gasoline tax of $0.42/gallon is assumed to hold true out to 2050.

• VMT per year for battery electric vehicles (BEVs) are assumed to be two-thirds that of other vehicles, due to battery range limitations.

• The shares of new vehicles sales by type of vehicle (hybrid electric vehicle [HEV], plug-in hybrid electric vehicle [PHEV4], fuel cell electric vehicle [FCEV], etc.) are from AEO Reference Case for our BAU run; for the committee scenarios, shares are assumed to change as specified in Table H.1. In the scenarios where alternative vehicles are assumed to enter the fleet in large numbers, it is assumed that new vehicle shares never increase by more than 5 percentage points of the new vehicle stock in any given year.

• Only one PHEV, a PHEV-30, with a real world all-electric driving range of 25 miles—this yields a utility factor of 46 percent is included.

• GHGs from biofuels include both direct emissions from production and also emissions from indirect effects on land use (see Chapter 3).

_____________________________

4 BEVs and PHEVs are collectively known as plug-in vehicles (PEVs).

TABLE H.1 Assumptions Taken from AEO 2011; These Hold for All VISION Cases

| 2005 | 2030 | 2050 | |||||||

| Total LDV sales, 1000s/year | 16,766 | 18,502 | 22,219 | ||||||

| Stock of LDVs, millions | 234.6 | 282.2 | 365.2 | ||||||

| Share of cars, percent of total fleet | |||||||||

| Total VMT, trillion VMT | 2.69 | 3.76 | 5.05 | ||||||

| Average VMT a VMT/LDV | 11 455 | 13 316 | 13 822 | ||||||

a Average VMT is assumed to two-thirds of this for BEVs.

A detailed overview of the different VISION cases is provided below, with Table H.2 summarizing the differences. For more information on fuel efficiency assumptions of vehicles, see Table 2.12. For more information on the carbon rates of different fuels, see Table 3.4 in Chapter 3.

• AEO BAU Case. Uses AEO 2011 Reference Case assumptions on VMT, vehicle shares, vehicle efficiencies, fuels shares, and fuel GHG impacts. AEO forecast only is made to 2035. VMT was extrapolated to 2050 assuming a 1.5 percent growth rate from 2036 to 2050. Corporate Average Fuel Economy (CAFE) standards are only assumed to be specified through the 2016 model year, but not beyond. This case assumes a small amount of coal to liquid (CTL) fuel and gas to liquid (GTL) fuel is introduced by 2035.

• Committee Reference Case. The Committee defines its own reference case that includes all of the midrange assumptions about vehicle efficiencies, fuel availability, and GHG impact developed by the committee (summarized in Chapters 2 and 3). In addition, this case assumes that the recently finalized 2025 CAFE and GHG standards for fuel efficiency of light-duty vehicles (LDVs) will be met, and the standards will then stay at that level through 2050. The standards are interpreted to require that new vehicles in 2025 must have on-road fuel economy averaging about 41 mpg (given a fleetwide CAFE rating of 49.6 mpg). New vehicle sales shares are adjusted to meet this standard—primarily, advanced internal combustion engine vehicle (ICEV) and HEV shares are increased. After 2025, there is a very small annual improvement in average fuel consumption (~0.3 percent), which is consistent with the AEO2011 projection. This case also assumes that the federal Renewable Fuels Standard (RFS2) will be met by 2030. As a result, corn ethanol sales rise to about 10 billion gallon of gasoline equivalent (gge) per year by 2015 and stay at that level through the period. And, based on the analysis in Chapter 3, it is assumed that all cellulosic biofuels will be thermo-chemically derived drop-in fuels. The RFS2 requirements result in production of 14 billion gge per year of such biofuels by 2030, and it is assumed that they remain roughly constant after that time.

• Emphasis on ICE Vehicle Efficiency. A set of model runs that continue the focus on light duty fuel efficiency improvements through the period to 2050. Shares of advanced ICEVs and HEVs increase to just over 80 percent of new vehicles by 2050. Two runs are included that differ only in their assumptions about the fuel efficiency improvements of vehicles over time. The first assumes the midrange assumptions for fuel efficiency for all technologies (Chapter 2, Table 2.12), and the second assumes optimistic fuel efficiency for ICEs and HEVs, while maintaining midrange values for the small numbers of other types of vehicles in the fleet. It is assumed that the RFS2 requirements described above (under the Committee Reference Case) are still in place, bringing in some corn ethanol and cellulosic biofuels. These increased vehicle efficiency cases require much less liquid fuel over time, and it is assumed that the fuel backed out is gasoline.

• Emphasis on ICE Vehicle Efficiency and Biofuels. Two runs are similar to the Committee Reference Case and the emphasis on efficiency case, with the difference that more biofuels are brought into the market after 2030. The amount of biofuel brought to the market rises to the limit specified by the

committee in Chapter 3, which is 45 billion gge/year and assumes 703 million dry tons per year of cellulosic feedstock. The two runs of the model both assume this additional biofuel, largely in the form of drop-in gasoline components that displace petroleum, and the difference in the two runs is just the assumption on the fuel efficiency of vehicles. As in the case above, the first run assumes all vehicles are at the midrange efficiency. In this run, the share of petroleum-based gasoline as a liquid fuel falls to about 25 percent by 2050. The second run assumes optimistic fuel efficiency for ICEVs and HEVs. In this case, bio-based ethanol, bio-based gasoline, and a small amount of CTL and GTL, make up all liquid fuel, with almost no petroleum-based gasoline.

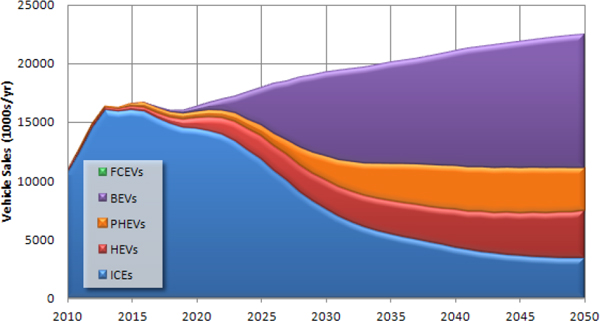

• Emphasis on fuel cell vehicles. This case also has four different runs of VISION to capture variation in both vehicle efficiency and fuel carbon content. In all of these runs, the share of fuel cell vehicles (FCVs) increases to about 25 percent of new car sales by 2030 and then to 80 percent by 2050, modeled on the maximum practical deployment scenario from Transition to Alternative Transportation Technologies: A Focus on Hydrogen (NRC, 2008). There are two runs with the midrange vehicle fuel efficiencies, each with a different assumption about the GHG impact of the hydrogen production. Finally, there are two additional runs with optimistic assumptions about the fuel efficiency of FCVs, each with the different assumptions for the GHG emissions from hydrogen production. The hydrogen produced from a mix of low-GHG-emitting sources is assumed to come from production facilities, because they might operate under a sufficiently high carbon price. The CO2 emissions are about one-fifth of those from the alternative, low-cost hydrogen fuel generation (2.6 g CO2e/gge H2 compared to 12.2 g CO2e/gge H2; see Table 3.15).

• Emphasis on electric vehicles. There are four VISION runs for this case that account for differences in assumptions about vehicle efficiency as well as the GHG emissions of the fuel. It is assumed in all runs that the share of BEVs and PHEVs increases to about 35 percent of new car sales by 2030 and 80 percent of new car sales by 2050, in line with the rates put forth in Transitions to Alternative Transportation Technologies: Plug-In Hybrid Electric Vehicles (NRC, 2010), and this case assumes relatively greater sales of PHEVs than BEVs in all years. The first two runs assume midrange vehicle efficiency, each with a different assumption about GHG emissions from the electricity grid. These forecasts for the make-up of the grid are derived from the two cases put forth in AEO 2011 (EIA, 2011). The first is the BAU Case, and the second is the GHG price economy-wide case, where a low-GHG emissions grid is achieved by a tax on carbon that is first assessed in 2013 and increases at 5 percent per year (further details of the two grid scenarios can be found in Chapter 3). The second set of runs both use the optimistic assumptions about vehicle efficiency for the BEVs and PHEVs, again, with the two differing only in their assumptions about the GHG emissions from the grid. The low-GHG emissions grid is assumed to emit 111 g CO2 per kWh of generated power by 2050, reduced to just 21 percent of the BAU grid (541 gCO2e/kWh; see Table 3.8 and discussion).

• Emphasis on natural gas vehicles. This case has a set of runs that assumes an increasing penetration of compressed natural gas (CNG) vehicles into the market. The new car sales of CNG vehicles are assumed to be 25 percent by 2030 and 80 percent by 2050, as in the case for HFCVs due to a comparable level of current technological deployment. In the first run, the committee assumed that all vehicles attain the midrange efficiencies. The second run assumes optimistic fuel efficiency for CNG vehicles and midrange for the other vehicles in the fleet. CNG fuels rise over time to fuel the vehicles, and very little liquid fuel is needed by 2050. The committee continued to assume that RFS2 must be met by 2030, so the liquid fuel that is used is primarily biofuels in both of these runs. So little liquid fuels are needed in these runs that the committee assumed no CTL and GTL comes into the market—the plants are never built. CO2 levels are about 82 percent of conventional gasoline, on an energy basis (gCO2e/MJ, see Chapter 3).

TABLE H.2 VISION Run Assumptions

| Cases | Vehicle Efficiencies | Fuel Assumptions | Shares of New Vehicles | ||||||

| AEO BAU | AEO assumptions | AEO 2011 | AEO assumptions | ||||||

| Committee Reference Case | Midrange | Committee assumptions, TCC biofuel available 13 bgge/year by 2030 | Small increase in HEVs above AEO in order to meet CAFE | ||||||

| Emphasis on ICE Vehicle Efficiency | 1. Midrange all vehicles | 1. Reference | 90% HEV share by 2050 | ||||||

| 2. Optimistic for ICEs, HEVs, midrange others | 2. Emphasis on biofuels, thermochemical conversion increases to 45 bgge/year by 2050 | ||||||||

| Emphasis on Fuel | 1. Midrange all vehicles | 1. Low cost hydrogen | 25% HFCVs in 2030 | ||||||

| Cells/Hydrogen | 2. Optimistic for FCVs | 2. Low-CO2 hydrogen | 80% HFCVs in 2050 | ||||||

| Emphasis on Electric Vehicles | 1. Midrange all | 1. AEO 2011 grid | 35% PEVs in 2030 | ||||||

| 2. Optimistic PHEV, BEV | 2. Low-CO2 grid | 80% PEVs in 2050 | |||||||

| Emphasis on Natural Gas | 1. Midrange | Committee assumptions | 25% CNGVs in 2030 | ||||||

| ICEVs | 2. Optimistic | 80% CNGVs in 2050 | |||||||

H.1.3 Major Changes to the Original Vision Model to Develop VISION-NRC

The VISION-NRC model was developed from the “VISION_2010_AEO_Base_Case” version of the VISION model, which includes EIA’s AEO 2010 projections to 2035 and GHG and upstream energy use rates from GREET 1.8d.1. The sections below review the major modifications made to this original Excel model to develop the VISION-NRC model.

H.1.3.1 Changes to the Model Input Sheet

The Model Input worksheet has been modified to store multiple scenario assumptions. Sets of inputs can be changed for each scenario by changing the value of the “CS” named variable, located in cell B5. Alternates of each scenario can be chosen by changing the values in cells I9: I12. The actual input values for each scenario are provided in the columns to the right of the main input columns, columns A through N. This is also where the scenario values themselves can be modified, though changes in one parameter can influence the implications of other parameters. For example, if fuel economy or VMT assumptions are changed, the fuel split parameters, expressed in percentages of total fuel (such as percent of ethanol as corn ethanol), would need to be modified to maintain the same absolute volume of a particular fuel type.

H.1.3.2 Updates to AEO 2011 Data

Key model inputs were updated to the revised data used in the VISION-2011 AEO BAU Case model. These are indicated in the Auto-LTs worksheet and include the following: annual auto and light truck sales, LDV stock values, and baseline new vehicle miles per gallon gasoline equivalent values.

TABLE H.3 Data for Baseline GHG Emissions to Which 2050 Levels Are Compared AEO 2007

| 2005 Metrics | Units | AEO 2007 2005, All LDVs | Source | ||||||

| Energy Use (HHV) | trillion Btu | 16,227 | AEO 2007, Table 35, Transportation Sector Energy Use by Mode | ||||||

| bgge (LHV) | 139.89 | Total Energy use converted to gallon gasoline equivalents | |||||||

| Vehicle Miles Traveled | million miles | 2,687,058 | AEO 2007, Table 50, LDV Miles Traveled by Tech. Type | ||||||

| Average mpg | mpgge | 19.21 | Calculated as total VMT / Total Energy | ||||||

| Average FCI | gCO2e/MJ | 94.73 | Calculated from fuel energy and FCI values below | ||||||

| Greenhouse gas emissions | MMTCO2e | 1,514.23 | Calculated as Total Energy × Average FCI | ||||||

| Energy Use by Fuel Type | |||||||||

| Motor Gasoline | bgge | 123.76 | AEO 2007, Table 36, Transportation Sector Energy Use by Mode | ||||||

| Ethanol | bgge | 4.77 | Includes 4.757 BGGEs, and subtracted from above | ||||||

| Compressed Natural Gas | bgge | 0.06 | Same as above | ||||||

| Liquefied Petroleum Gases | bgge | 0.04 | Same as above | ||||||

| Electricity | bgge | 0.01 | Same as above | ||||||

| Distillate Fuel Oil (diesel) | bgge | 1.99 | Same as above | ||||||

| Total | bgge | 130.61 | Same as above | ||||||

| Fuel Carbon Intensity (FCI, LHV) | |||||||||

| Motor Gasoline | gCO2e/MJ | 91.27 | NRC Fuels Committee (2010 FCI Value) | ||||||

| Ethanol | gCO2e/MJ | 44.63 | NRC Fuels Committee (2010 FCI Value) | ||||||

| Compressed Natural Gas | gCO2e/MJ | 74.88 | NRC Fuels Committee (2010 FCI Value) | ||||||

| Liquefied Petroleum Gases | gCO2e/MJ | 79.48 | GREET value from VISION model | ||||||

| Electricity | gCO2e/MJ | 165.25 | NRC Fuels Committee (2010 FCI Value) | ||||||

| Distillate Fuel Oil (diesel) | gCO2e/MJ | 90.04 | NRC Fuels Committee (2010 FCI Value) | ||||||

| Average FCI | gCO2e/MJ | 94.73 | Calculated as fuel energy-weighted average | ||||||

| Greenhouse Gas Emissions | |||||||||

| Motor Gasoline | MMTCO2e | 1,382.41 | |||||||

| Ethanol | MMTCO2e | 26.03 | |||||||

| Compressed Natural Gas | MMTCO2e | 0.51 | |||||||

| Liquefied Petroleum Gases | MMTCO2e | 0.40 | |||||||

| Electricity | MMTCO2e | 0.11 | |||||||

| Distillate Fuel Oil (diesel) | MMTCO2e | 21.89 | |||||||

| iLUC from ethanol production | MMTCO2e | 82.88 | |||||||

| Total | MMTCO2e | 1,514.23 | |||||||

| Conversion Factors | |||||||||

| Btu/gal gasoline (HHV) | 124,238 | AER 2010, Table A3 p367, 2005 value | |||||||

| Btu/gal gasoline (LHV) | 116,000 | NRC Fuels Committee | |||||||

| Btu/MJ | 947.8 | ||||||||

H.1.3.3 The New “NRC Results” Sheet

Key output values and graphs are located in a new tab, “NRC Results,” and the values for most of these graphs are contained in the columns to the right of the graphs themselves.

H.1.3.4 Calibrating the 2005 GHG Baseline

Table H.3 summarizes data used to determine the baseline GHG emissions in 2005.

H.1.3.5 Changes to the LDV Stock Sheets

The vehicle stock sheets for each vehicle type have been modified to incorporate various scenario assumptions. For example, VMT for BEVs can be adjusted downwards and redistributed to other vehicle types in the revised stock sheets (see explanation below). In addition, new correction factors have been incorporated and fuel carbon intensity values have been linked directed to the stock sheets in a new column.

H.1.3.6 Changes to the Carbon Coefficients Sheet

The Carbon Coefficients worksheet has been modified to incorporate the unique fuel carbon intensity values used in the scenarios. Calculations to capture the accounting used for indirect land use change (iLUC) emissions are also included in this worksheet.

H.1.3.7 Calculation of iLUC GHG Emissions as a Result of Increased Biofuels Production

The additional GHG emissions associated with expanding biofuels production, due to iLUC, is calculated as a function of new production capacity established in any given year:

GHGiLUC = Qnew × Ffuel

Where new production capacity, Qnew, has units of bgge/year, and the emissions factor for a particular fuel, Ffuel, has units of MMTCe /(bgge/year). For corn ethanol, FCornEthanol = 29.9 MMTCe/(bgge/year), and for thermochemical biofuels, FThermochem = 15.3 MMTCe/(bgge/year). These values are determined from committee data in the Carbon Coefficients worksheet, and then added to the total GHG emissions in the NRC Results worksheet. In years where no new production capacity is installed, no additional iLUC GHGs are emitted.

H.1.3.8 Redistribution of BEV VMT to Remainder of LDV Fleet

It is estimated that 33 percent of the BEV VMT that would have been driven are redistributed to all other LDV cars or light trucks, using Equation H.1.

![]()

Where i = vehicle type (ICE, PHEV, etc.) and n = year.

The equation applies for cars and light trucks separately. In other words, for i = ICE, the ratio of ICE cars in year n (NICE,n) to total cars (Ncars) would be multiplied to one-third of VMT from BEV cars in year n (VMTi = BEV,n).

This equation can be interpreted as an equal distribution of all “displaced” BEV car or light truck VMT (from any vintage) across all cars or all light trucks (of any vintage). Note that in VISION fuel use is determined by multiplying total VMT for any platform type (e.g., BEV cars) to the VMT-weighted fuel economy of all vehicles (of all vintages, which have distinct VMT/year) on the road. In the calculation, it is just the total VMT that increases proportional to the percent of cars or light trucks on the road.

Another way of calculating this redistribution might be to allocate proportional to the VMT of any platform type divided by all VMT by cars or light trucks. With scenarios that have newer vehicles being much higher fuel economy than older vehicles, this approach would result in lower fuel demand than distributing by the percent of total on-road vehicles. However, this approach implies BEV VMT would tend to be preferentially transferred to newer vehicles (which have higher VMT/year) compared to older vehicles (with lower VMT/year, as older vehicles are driven less). This allocation seems less realistic, considering that households purchasing a new BEV would probably not also have a new LDV of another type.

Conceivably, an algorithm could be developed to determine the degree to which VMT would tend to be transferred to vehicles of a different vintage than the on-road fleet average vintage. In theory, for example, a household purchasing a BEV may not necessarily have a second or third vehicle with a

vintage equal to the fleet average. It may be more wealthy households with second vehicles slightly newer than the fleet average. Given that BEVs will be introduced into the LDV fleet gradually over time, and that newer more efficient vehicles would mostly likely also be achieving greater market share over the same period, the effort of differentiating VMT distribution more realistically by vintage would likely result in a small change in fuel use compared to the vehicle share allocation described above.

H.2 LIGHT-DUTY ALTERNATIVE VEHICLE ENERGY TRANSITIONS MODEL: WORKING DOCUMENTATION AND USER’S GUIDE

The Light-Duty Alternative Vehicle Energy Transitions (LAVE-Trans) Model described in this section was developed by David L. Greene, Oak Ridge National Laboratory and University of Tennessee; Changzheng Liu, Oak Ridge National Laboratory; and Sangsoo Park, University of Tennessee. The committee agreed by consensus to use this model for its analysis. See the attached Appendix H LAVE-Trans Model Spreadsheet.

H.2.1 Purpose

The transition from a motor vehicle transportation system based on ICEs powered by fossil petroleum to low-GHG-emission vehicles poses an extraordinary problem for public policy. The chief benefits sought are public goods: environmental protection, energy security, and sustainability. As a consequence, market forces alone cannot be relied on to drive the transition. Securing these benefits may require replacing a conventional vehicle technology that has been “locked-in” by a century of innovation and adaptation with an enormous infrastructure of physical and human capital. The time constants for transforming the energy basis of vehicular transport are reckoned in decades rather than years. A comprehensive, rigorous, and durable policy framework is needed to guide the transition.

The LAVE-Trans model was developed to quantify the private and public benefits and costs of transitions to electric drive vehicles under a variety of future scenarios, making use of the best available information in a rigorous mathematical framework. At present, knowledge of the key factors affecting LDV energy transitions is incomplete. As a consequence, the model’s outputs should not be considered accurate predictions of how the market will evolve. Rather, the LAVE-Trans model provides a framework for integrating available knowledge with plausible assumptions and analyzing the implications for benefits, costs and public policies.

The transition to electric drive vehicles faces the following six major economic barriers that help to lock in petroleum-powered vehicles:

1. Technological limitations,

2. The need to accomplish learning by doing,

3. The need to achieve scale economies,

4. Consumers’ aversion to the risk of novel products,

5. Lack of diversity of choice, and

6. Lack of an energy supply infrastructure.

Each of the six barriers can be viewed either as a transition cost or as a positive external benefit created by adoption of the novel technology. Modern economics recognizes “network externalities,” positive external benefits that one user of a commodity can produce for another. Each of these barriers has been incorporated in the model so that the costs of overcoming them, and alternatively the external benefits of policies that break them down, can be measured, subject to the limits of current knowledge.

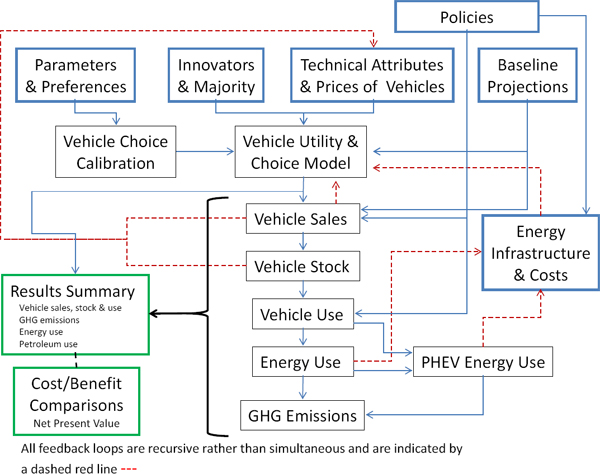

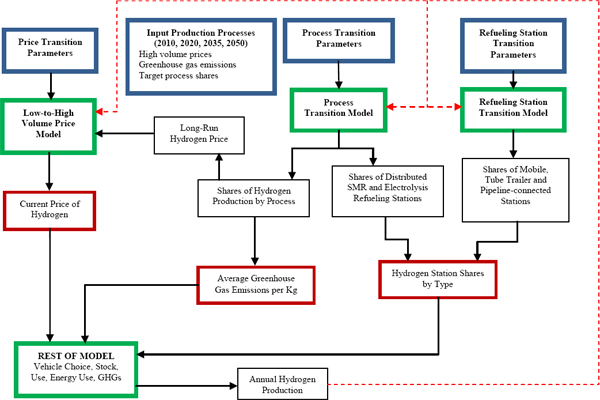

FIGURE H.1 Diagrammatic representation of the LAVE-Trans Model.

This report provides an overview of the LAVE-Trans model structure, explains how it functions, and provides instructions for operating it. Section H.2.2 provides an overview of the model structure and the components and how they are linked together. Section H.2.3 describes each component, including the key equations that control its operation. Section H.2.4 describes the inputs (parameters and data) that must be supplied to the model, and Section H.2.5 describes model outputs. Section H.2.6 is a brief users’ guide to executing a model run.

H.2.2 Model Structure

The LAVE-Trans model is an Excel spreadsheet model comprised of 25 worksheets. Figure H.1 illustrates the relationships between the major components of the model. The areas where exogenous inputs enter the model are shown as blue boxes. A relatively large amount of exogenous information is required to carry out a model run. Baseline projections of vehicle sales and energy prices are required to 2050. Technical attributes of advanced technology vehicles, including fuel consumption per kilometer, on-board energy storage, and retail price equivalent (RPE) at full scale and learning, must be specified for current and certain future years. Parameters that describe consumers’ willingness to pay for vehicles and

their attributes must also be provided. The model translates these into coefficients for the vehicle choice model. Capital, operating, and input costs of both electric, hydrogen, and natural gas infrastructure or alternative price projections must also be provided.

The model can be automatically calibrated to specified vehicle sales and vehicle use projections. At that point the Vehicle Choice model estimates the shares of ICE, HEV, PHEV, BEV, and FCV or CNG technologies for passenger cars and light trucks and for Innovator and Majority market segments. The market shares are multiplied by the passenger car and light truck sales totals in the Vehicle Sales worksheet. Sales are passed to the Vehicle Stock worksheet, which retires vehicles as they age and keeps track of the number of vehicles of each technology type by model year for every forecast year. Vehicle kilometers by age and vehicle type are calculated in the Vehicle Use worksheet. In the Energy Use worksheet, energy use is calculated for all but PHEVs by multiplying vehicle kilometers by the number of vehicles and by on-road energy consumption per kilometer. PHEV energy use, electricity and gasoline, is calculated in a separate worksheet. GHG emissions factors are applied to energy use in the GHG Emissions worksheet.

In a BAU run, the total passenger car and total light truck sales will exactly match the input projections. The technology and price assumptions of the BAU Case should match the baseline projection to which the model’s vehicle sales and vehicle use have been calibrated. Next, a Base Case, reflecting alternative technology and price assumptions can be run. In the Base Case, vehicle sales, vehicle use, energy use, and GHG emissions will change due to the new technology and price assumptions. Once a Base Case run has been made, it is transferred to the Base Case worksheet by clicking on a button in the Current Case worksheet. A policy run may then be created by specifying vehicle or fuel subsidies or taxes, exogenous investments in fuel infrastructure, or by changing assumptions about vehicle or fuel technologies. In a policy run, sales may be higher or lower than the Base Case, depending on the specific policy assumptions. The results of a policy case are stored in a Current Case worksheet, which also contains built-in graphical displays. The impacts of the Current Case relative to the Base Case are calculated in the Costs-Benefits worksheet. A standard set of tables and graphs summarizing the BAU Case, Base Case, and Current Case are stored in an Output worksheet.

There are several important feedback loops in the model. Feedbacks are recursive (with a 1-year lag) rather than simultaneous. This simplifies the solution of the model greatly but is also generally more representative of how changes can be made in the motor vehicle industry. Cumulative vehicle sales generate learning-by-doing effects that lower vehicle prices over time. Sales are accumulated in the Vehicle Sales worksheet, and learning effects are calculated there, as well. Current sales affect the availability of different makes and models, i.e., the diversity of choice available for both advanced and conventional ICE technologies. A diversity of choice metric is passed to the Vehicle Attributes worksheet. Current sales also affect next year’s vehicle prices via scale effects, also computed in the Vehicle Sales worksheet. Both learning and scale effects are passed to the Vehicle Production worksheet, where RPEs are calculated for each technology in each future year. These adjusted prices are then passed to the Vehicle Attributes worksheet.

Demand for electricity, hydrogen, and natural gas, plus exogenous assumptions about the supply of refueling/recharging infrastructure, are passed to the Fuel Input worksheet, where the quantities and costs of infrastructure are calculated. For hydrogen, these costs also depend on the model user’s assumptions about how hydrogen will be produced and delivered to vehicles in the future. These assumptions also affect the cost of hydrogen and its GHG emissions per kilogram. The availability of refueling/recharging infrastructure is passed to the Vehicle Attributes model and influences the choice among alternative technologies.

The following is a list of the model’s 25 worksheets along with a brief description of their functions:

a. Flow Chart—contains the diagram of the model structure shown in Figure H.1.

b. Scenario Assumptions—contains alternative data sets describing vehicle and fuel technologies, as well as a table in which the different data sets can be conveniently selected to construct fuel and

vehicle technology scenarios. Alternative social values for reducing petroleum use and GHG mitigation may also be selected.

c. Parameter Input—contains most of the key assumptions of the model that a user will want to change in creating a new run.

d. CO2 Cost—holds the alternative estimates of the social value of reducing carbon emissions from the U.S. government’s interagency assessment of the social costs of carbon (Interagency Working Group, 2010).

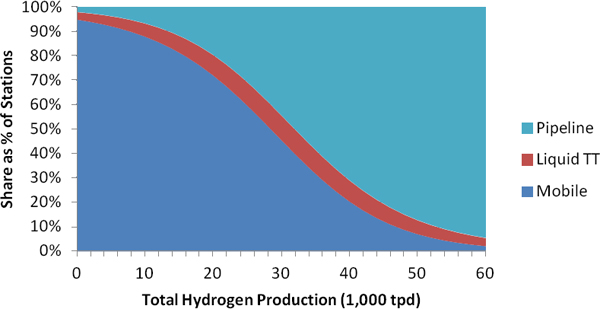

e. Hydrogen Stations—contains the multinomial logit model used to estimate a smooth transition from a user-specified initial distribution of types of hydrogen stations to a user-specified long-run configuration as a function of the total volume of hydrogen production for LDVs.

f. VISION—used storing output from the Argonne National Laboratory’s VISION model. The LAVE-Trans model can be forced to match the market shares of a VISION run. In that mode, it calculates the costs and benefits of achieving the particular VISION scenario.

g. Vehicle Attributes—contains the key vehicle attributes, by year, from 2010 to 2050. Most are derived from data contained in the Parameter Input worksheet.

h. Risk Groups—contains assumptions and calculations about innovators and majority adopters. At present these are the only two classes of consumers.

i. Choice Parameters—where the coefficients of the nested multinomial logit (NMNL) model for predicting choices among technologies are calculated.

j. Vehicle Production—where learning-by-doing, scale effects, and rates of exogenous technological progress are applied to the prices of technologies to estimate RPEs by year.

k. Vehicle Choice—the above factors come together to estimate market shares for each technology for new vehicles, as well as household’s decisions to buy or not buy a new vehicle in a given year. Consumers’ surplus is calculated here as well. Also calculated here are the cost components (i.e., cost of lack of fuel availability, cost of lack of diversity of choice, etc.) that also comprise the positive network externalities generated during the transition.

l. Vehicle Sales—the choices are applied to total vehicle sales (which will vary by time as the buy/no-buy decision changes each year) to produce estimates of sales by passenger cars and light trucks, by technology type and for innovators and majority. Also calculated in this worksheet are cumulative production, learning-by-doing, scale economies, and choice diversity.

Next come a series of large worksheets that depend on vehicle stock turnover.

m. Vehicle Stock—adds new vehicles to the existing fleet and scraps older vehicles by vintage. There are 10 tables (PC versus LT) × (five technologies).

n. Vehicle Use—multiplies kilometers per vehicle by vehicle age by the number of vehicles in the vehicle stock to estimate vehicle kilometers traveled (VKT) by vehicle type, technology type and 25 vintages. A rebound effect is built in to represent the tendency of vehicle use to increase when fuel cost per kilometer declines.

o. Energy Use—uses the vehicle efficiency estimates by vintage together with an on-road adjustment factor to estimate energy use by the same 250 categories for all years 2010 to 2050.

p. PHEV Energy—divides PHEV energy use into electricity and gasoline.

q. GHG Emissions—applies fuel specific well-to-wheel GHG factors to estimate emissions in CO2 equivalents, again for all vehicle types, technology types, vintages, and years.

r. Fuel Input—contains information about the capital, operating, and delivery costs of alternative LDV energy sources and their lifecycle GHG emissions.

s. Input USA—where the projections of U.S. vehicle sales by vehicle type and technology type are stored. In addition to vehicle projections there are U.S. VKT projections, energy price projections, value of time projections (related to income per capita) and demographic projections (e.g., numbers of households).

t. Input World—where the assumptions about the production of alternative energy vehicles outside of the United States are input. These projections are exogenous and never changed by the model.

u. Current Case—contains summaries of costs, GHG emissions, energy use, vehicle stocks, vehicle sales, and VKT for the current case running in the model. The energy efficiency of the on-road vehicle stock is calculated in this worksheet, as well as average GHG emissions rates. The Current Case can be stored in the Base Case worksheet by clicking on a button that executes a macro that copies it to that location.

v. Base Case—should reflect the same scenario assumptions about technologies and energy costs as the Current Case. The two cases will be compared in the Costs-Benefits worksheet.

w. Business as Usual Case—may be stored in the BAU worksheet; should reflect the assumptions of the vehicle sales and vehicle travel projections to which the model has been calibrated, for example, a Reference Case projection of the EIA’s AEO.

x. Costs-Benefits—Once a Current Case has been copied to the Base Case worksheet, changes to the model’s inputs and parameter assumptions create a new Current Case. Differences between the Base Case and the Current Case are calculated in the Costs-Benefits worksheet. Here one will find the infrastructure, vehicle and fuel subsidy costs, changes in consumers’ surplus, and societal benefits due to reductions in GHG emissions and petroleum use.

y. Output—contains a summary and comparison of the BAU Case, Base Case, and Current Cases, via a fixed set of tables and graphs.

H.2.3 Description of Model Components

In this section, the theory and equations of each key LAVE-Trans model component are presented and explained.

H.2.3.1 Vehicle Choice Model

Consumer demand is represented by a discrete choice, NMNL model, including a buy/no-buy choice. The buy/no-buy choice represents consumers’ decisions to buy a new motor vehicle or to use their income for something else. In each time period, each household is assumed to make a buy versus no-buy decision. This allows for a more complete estimation of consumers’ surplus effects, as well as allowing vehicle sales to increase or decrease in response to changes in policies or assumptions about technologies.

The vehicle choice model is a representative consumer model. Although it is desirable to segment the consumer market to reflect the heterogeneity of consumers’ preferences, this comes at a high price in terms of the complexity of the model and its input data requirements. In the LAVE-Trans model, the market is split into only two segments: innovators/early-adopters versus the majority. More complex market segmentation could be added in a subsequent model development effort, if warranted.

The LAVE-Trans NMNL model allows a variety of factors, Xij, including make and model diversity and fuel availability, as well as price, energy efficiency, and range to determine the utility, Ui, of each technology, i. Price is a special variable in the utility function, because its coefficient has units of utility per present value dollar. Thus, if the value of any attribute can be estimated in terms of dollars per unit of the attribute (e.g., present value dollars per MJ/km of fuel consumption), then its coefficient can be determined by multiplying the value per unit times the coefficient of price, βk (where k is an index of the technology class, or nest, to which alternative i belongs). In this way, every coefficient in Equation H.2 is a function of the sensitivity of utility to price.

![]()

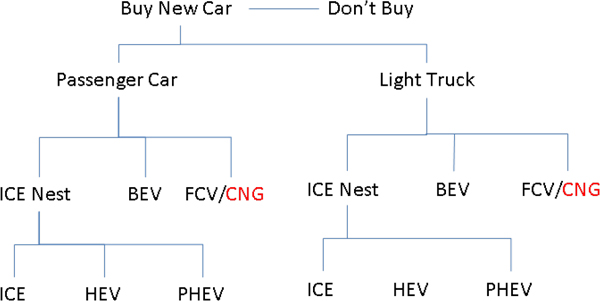

FIGURE H.2 Nesting structure of the LAVE-Trans model.

The NMNL model allows for some control over the patterns of substitution among vehicle technologies. In particular, vehicles within a given nest are closer substitutes for one another than they are for vehicles in a different nest.5 The nesting structure used in the model is shown in Figure H.2. The first level of choice is to buy or not to buy a new LDV. The second is the choice between a passenger car and a light truck. The third level is the choice between an ICE, a BEV, and an FCV. The model allows the user to substitute a CNG vehicle for the FCV, but the number of technology choices has been limited to five for the sake of simplicity. Within the ICE nest is the choice between a conventional ICE, an HEV, and a PHEV. The order of nesting does not signify a temporal sequence of choices. Rather, it orders choices from least price sensitive (buy versus no-buy) to most price sensitive (ICE, HEV, or PHEV) and attempts to group choices within a nest that are closer substitutes than choices within some other nest.

The ability to translate attributes into dollar values is useful for measuring the network externalities that arise in the transformation of the energy basis for motor vehicles. For example, increasing fuel availability by adding public recharging stations or hydrogen fueling stations will reduce fuel availability costs. This improvement in fuel availability can be translated into an indirect network externality and be given a dollar value per vehicle using the relationships in Equation H.2. Likewise, if an innovator purchases a novel technology vehicle, this generates benefits for subsequent purchasers increasing scale and learning-by-doing, bringing down the price of vehicles, and by reducing the risk perceived by the majority market segment.

Market shares depend on each alternative’s utility indexes, Uik. At the lowest level nests, the probability of choosing alternative i, given that a choice will be made from nest k, Pi|k, is given by the logit equation in which e is the base of the Naperian logarithms, and m indexes other choices in nest k.

_____________________________

5 More precisely, vehicles are more similar in their “unobserved attributes,” meaning attributes that are not included in the model. For example, the sound of an electric-drive vehicle will be different from that of an ICEV, and this may influence consumers’ choices.

The probability that a choice will be made from nest k depends on all the alternatives in nest k, as well as the utilities of all other nests at the same level. Let the measure of the utilities of all alternatives in nest k be represented by Ik, the “inclusive value” of nest j.

![]()

The probability of a choice being made from nest j is a logit function of the inclusive values of j and the other nests (indexed by k) at the same level as j.

In Equation H.5, β is the price coefficient for the choice among nests. The parameter A j reflects aspects of nest j that are common to all members of the nest. In the LAVE-Trans model, the A j parameters are generally set to zero, except at the level of choice between passenger car and light truck and buy versus no-buy. These coefficients are used to calibrate the choice model to a baseline sales forecast for passenger cars and light trucks. The procedure for calculating inclusive values can be used for any degree of nesting choices by simply passing inclusive values up to the next level.

The probability that technology i will be selected from nest j is the product of the probability of choosing nest j and the probability of choosing i, given that a choice will be made from nest j : Pij = Pi|j Pj. This relationship is repeated as one moves from the lowest nests up to the buy/no-buy decision.

The NMNL model also allows direct calculation of the change in consumers’ surplus due to changes in the prices and attributes of the choice alternatives. The change in consumers’ surplus per household between the base case and an alternative scenario can be calculated at the top of the nesting structure from the utilities of the buy and no-buy choices. The superscript 0 indicates the Base Case, and the superscript 1 indicates the Scenario Case, and β* is the price coefficient of the buy/no-buy choice.

![]()

H.2.3.2 Calibration of Choice Model Parameters

The following nine variables determine the market shares of the alternative advanced technologies:

1. Retail price equivalent (RPE),

2. Energy cost per kilometer,

3. Range (kilometers between refuel/recharge events),

4. Maintenance cost (annual),

5. Fuel availability,

6. Range limitation for BEVs,

7. Public recharging availability,

8. Risk aversion (innovator versus majority), and

9. Diversity of make and model options available.

NMNL models can be calibrated to the best available evidence on the sensitivity of consumers’ choices to vehicle prices and the value consumers attach to vehicles’ attributes, including range, fuel economy, performance, fuel availability, and diversity of choice. The procedure requires estimating the present dollar value per unit of the attribute, which can then be multiplied by the price coefficient to derive a coefficient that translates one unit of the attribute into a utility index. Each of the attributes and the method for estimating its NMNL model coefficient is considered below.

H.2.3.2.1 Diversity of Choice Among Makes and Models

Make and model diversity is represented in the vehicle choice model as the log of the ratio of the actual number of makes and models available, n, to the “full diversity” number, N, represented by the number of makes and models of the conventional technology available in the base year, ln(n /N) (for a derivation, see Greene [2001], pp. 21-22). This variable is then multiplied by a coefficient (e.g., a default value of 0.67 is used in most cases) that depends on the cumulative sales distribution across makes and models. The number of makes and models available in any given year can be determined by dividing total sales by the production volume at which full scale economies are achieved.6

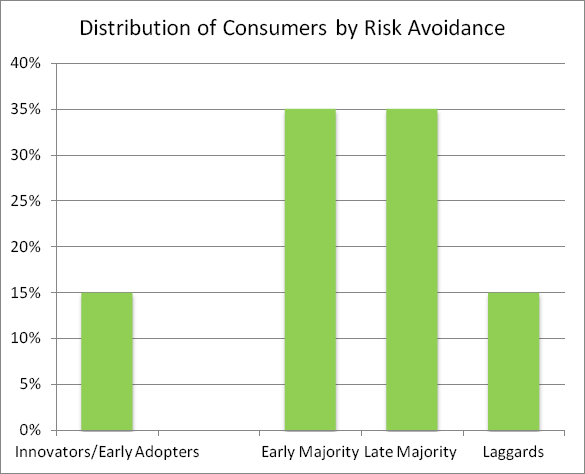

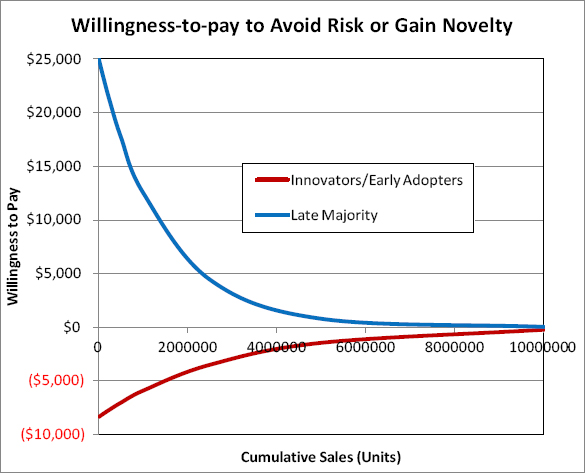

H.2.3.2.2 Consumers’ Aversion to the Risk of New Technology

Consumers’ risk aversion to new technologies (the early adopter, early majority, and late majority phenomenon) is represented in a manner analogous to learning by doing. Innovators have a preference for novel technologies (a utility premium) that decreases with cumulative sales. The majority of the market may have an aversion for novel technologies (a negative utility) that decreases with cumulative sales. These are represented by exponential “cost” functions that enter into the consumers’ utility functions. Each group is assigned a monthly quantity to either avoid (+ cost) or gain (-cost) the opportunity to purchase a vehicle with novel technology. The monthly payments are discounted to present value assuming a certain length of loan or lease (e.g., 48 months) and annual real interest rate (e.g., 7 percent). A slope coefficient for the exponential function is estimated by specifying the cumulative sales point at which the risk or novelty value of the new technology will be reduced by half. The slope coefficient, b i, is the logarithm of 0.5 divided by the specified cumulative sales. Given the estimated present value, V i, for group i and slope coefficient, b i, the risk to majority buyers and the novelty value to innovators, vij, is a function of cumulative sales of technology j, Qj.

![]()

In the current version of the model, the market is divided into only two groups: innovators and the rest of the market represented by the majority. The percent of the market in each group can be specified.

_____________________________

6 This implies that the diversity of choice for the conventional technology is total sales divided by the same full scale production volume. For example, if conventional LDV sales are 15 million in the base year and the production level for full scale economies is 100,000, then the diversity measure would be N = 150 for conventional vehicles.

FIGURE H.3 Default distribution of consumers by aversion to risk of new products.

FIGURE H.4 Default willingness-to-pay functions for innovators/early adopters and majority.

H.2.3.2.3 Value of Energy Efficiency

The value of energy efficiency is represented by the present value of future fuel savings. The way consumers value future fuel savings is a largely unresolved issue, with the econometric evidence split roughly 50/50 between undervaluing versus accurately valuing or overvaluing (Greene, 2010). If consumers consider paying more up front for future fuel savings a risky bet, behavioral economics implies that consumers will undervalue future fuel savings by one-half or more (Greene, 2011). The LAVE-Trans model allows for different specifications of consumers’ valuation of future fuel costs within the context of discounting to present value. The following variables determine the present value of future fuel costs:

E = a vehicle’s energy efficiency in MJ/km,

P = the price of energy per MJ,

M0 = the vehicle’s annual kilometers when new,

L = the vehicle’s lifetime in years,

r = the consumers’ discount rate, and

δ = the rate of decline in vehicle use with vehicle age.

The present value of fuel costs is the integral over the vehicle’s lifetime of the instantaneous fuel costs.

![]()

In Equation H.8 it is assumed that the price of fuel over the life of the vehicle is constant. While this is certainly incorrect, it is consistent with rational expectations given fuel prices that follow a random walk (Hamilton, 2009). If the discount rate is set to zero and L is set to 3, for example, this formula becomes a 3-year payback formula. The term in square brackets is discounted vehicle travel, which is useful in estimating the value of other vehicle attributes, such as range.

The variable representing energy efficiency is energy cost per kilometer. The coefficient of vehicle energy cost per kilometer ($/MJ × MJ/km) is discounted lifetime kilometers (the term in square brackets in Equation H.8 multiplied by the price coefficient.

H.2.3.2.4 Value of Maintenance Costs

Maintenance costs are assumed to be incurred annually over the life of a vehicle. The vehicle attribute is defined as annual maintenance costs in dollars. Thus, the coefficient is discounted years of vehicle life multiplied by the price coefficient. Discounted years are equal to the term in square brackets of Equation H.9. The time horizon over which maintenance costs are discounted is allowed to be different from that for fuel costs to allow flexibility in representing consumer behavior.

![]()

H.2.3.2.5 Value of Range

The value (or cost) of range is calculated as the discounted present value of time spent refueling over the life of the vehicle. The range variable is defined as the time required per refueling (in hours), t r, multiplied by the value of time (in $/hr), v, divided by kilometers per tank of fuel or kilometers per charge. Thus, it is the inverse of range that determines the value of range. Kilometers per tank is calculated by multiplying usable energy storage in gallons of gasoline equivalent, q, times the number of MJ per gallon, c, and dividing by the vehicle’s energy efficiency in MJ/km, E. The denominator of the term in the righthand-most brackets of Equation H.10, cq /E, is what is usually defined as vehicle range: kilometers per tank or per charge. The cost of increased range falls inversely with range. On-board energy storage capacity and vehicle energy efficiency may change over time, as may the value of time and the time required to refuel. It is assumed that neither a fuel tank nor a battery will be completely exhausted before it is replenished. Energy storage capacities should, therefore, be specified in terms of usable energy storage rather than total energy storage. In Equation H.10, the term in round brackets is the coefficient of range, while the term in {} brackets is the range variable. The coefficient of range is discounted lifetime kilometers multiplied by the price coefficient. The range variable is the value of time spent refueling per kilometer of vehicle travel.

Equation H.10 does not accurately represent the recharging cost for PHEVs. For PHEVs, the time required to fully recharge a battery is likely to be hours, but the driver will not stand by idly while the vehicle charges. The EV’s problem is a combination of limited range and long recharge time. In the LAVE-Trans model, Equation H.10 is used only to account for the time require to plug and unplug the vehicle. It assumed that during recharge the driver is able to use his or her time productively in other pursuits and that, therefore, the cost is zero. On the other hand, the combination of long recharge time and short range will make the plug-in vehicle unable to accommodate motorists’ desired travel on those days when the desired travel exceed the vehicle’s range. We use a different method, described in Section H.2.3.2.8, to account for those costs.

H.2.3.2.6 Value of Fuel Availability

The value of fuel availability is a key component of transition costs; it is the fuel half of the “chicken or egg” problem for alternative fuels. Despite some very good recent research (e.g., Nicholas et al., 2004; Nicholas and Ogden, 2007; Ogden and Nicholas, 2010; Melaina and Bremson, 2008), quantifying the value of fuel availability remains a challenge. The estimate used here begins with a measure of the extra time required to access fuel in a metropolitan area as a function of the ratio of the number of stations offering the alternative fuel to a reference number of gasoline stations. The fuel availability variable in the Vehicle Attributes spreadsheet is that ratio. The method is based on simulation modeling by Nicholas et al. (2004) and was used in the Department of Energy’s modeling of market transitions to hydrogen (Greene et al., 2008).

The coefficient of the fuel availability variable is the coefficient of vehicle price times discounted lifetime kilometers (the term in square brackets in Equation H.8) times a multiplier that represents the ratio of the total cost of fuel availability to the cost of access time within one’s own metropolitan area. This multiplier, which is given a default value of 3, represents the extra value of regional and national fuel availability, as well as the added fear of risk of running out of fuel. This is generally consistent with the results of Melaina’s (2009) stated preference analysis of consumers’ preferences for refueling availability, which found very roughly comparable values for availability in (1) one’s metropolitan area, (2) regionally, and (3) nationally.

The fuel availability term in the choice model combines the effects of range, R, and fuel availability, fj = nj /N0, where nj is the number of stations offering fuel for technology j and N0 is the reference number of stations (i.e., the number of gasoline refueling stations in the base year). As range increases, fuel availability decreases in importance because the number of refueling events decreases. In Equation H.11, Bf is the coefficient of the fuel availability variable (discounted lifetime kilometers multiplied by the price coefficient), w is the value of time in $/hour, C is a coefficient from the Nicholas et al. (2004) model relating the number of stations to access time, and a is the second coefficient of that model.

![]()

The term in square brackets in Equation H.11 is the extra access time required per refueling event, which is converted into a dollar value by the value of time, w. The 1/R term adjusts the coefficient B f for changes in vehicle range over time due to improved energy efficiency or energy storage.

Representing fuel availability as a ratio to a reference number of outlets is an approximation of a much more complex process. In the earliest stages of infrastructure evolution, stations are likely to be placed in clusters near concentrations of FCV owners; clustering will be a self-reinforcing process. Ogden and Nicholas (2010) estimated that in the Los Angeles, California, area, as few as 42 stations could provide one station that is within 2.6 minutes of home for clustered FCV owners. If stations were distributed by population density instead, it would require 4 to 15 times as many stations, 1.5 to 3 percent of the number of gasoline stations in the Los Angeles basin.

H.2.3.2.7 Value of Public Recharging

The value of the availability of public recharging to BEVs is a function of the present value of full availability of public recharging versus none, based on an analysis by Lin and Greene (2011a). That study derived a value of public recharging as a function of the number of days in a year an EV would not be able to satisfy typical kilometers traveled and the cost of renting a vehicle with unlimited range for those days. Let V be the present value of unlimited public recharging, f the availability of public recharging relative to the availability of gasoline stations, and β be the coefficient of vehicle price, and b be a slope coefficient. The value of public recharging is given by Equation H.12. It increases from 0 to approach V as f increases from 0 to 1.0.

![]()

This method is very approximate and should be improved. In particular, the value of public recharging should also depend on vehicle range.

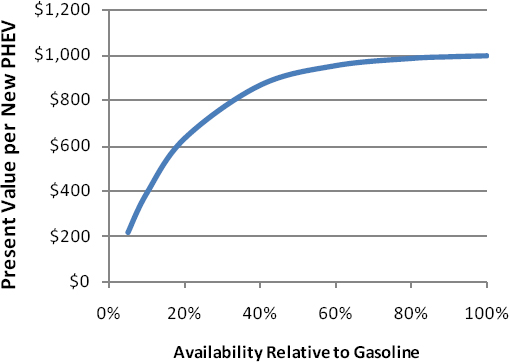

The value of public recharging to PHEVs is estimated by an equation identical in form to Equation H.12, also based on the analysis by Lin and Greene (2011a). The price coefficient, β, value, V, and slope b are specific to PHEVs, however.

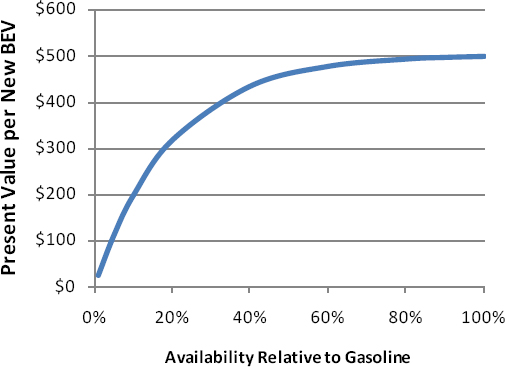

FIGURE H.5 Estimated present value of public recharging for a new battery electric vehicle.

FIGURE H.6 Estimated present value of public recharging for a new plug-in hybrid electric vehicle.

H.2.3.2.8 Value of Range Anxiety

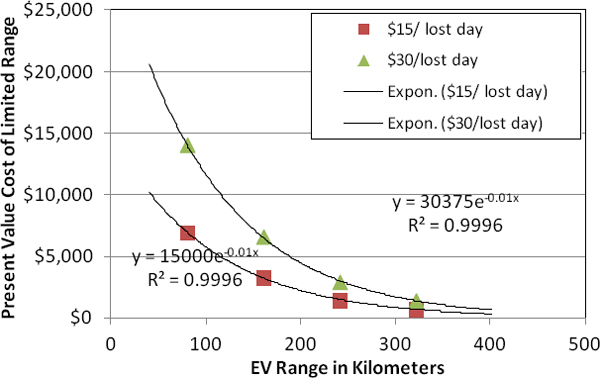

Range anxiety typically describes the fear of being stranded that the owner of a vehicle with limited range, long recharging time, and limited availability of public recharging may experience. The perceived cost of this form of range anxiety is likely to vary greatly from individual to individual and over time, as well, as drivers learn about their vehicles. In the LAVE-Trans model range anxiety is defined differently as the loss of utility due to a vehicle’s inability to be used for more than a certain number of miles per day. Range anxiety declines exponentially at a rate b from a theoretical maximum value at zero range, X, to asymptotically approach zero as range R goes to infinity. Once again, β is the coefficient of price. The values shown in Figure H.7 were taken from Lin and Greene (2011b), who calculated the number of days a vehicle with range R would be unable to accomplish the daily driving pattern of typical U.S. drivers. Lin and Greene (2011b) suggest a daily penalty of $15 to $30, which is typically less than the cost of renting a vehicle to accomplish the usual driving, because motorists have other options, especially if the household owns more than one vehicle.

![]()

FIGURE H.7 Present value cost of limited range (range anxiety) for a new BEV.

H.2.3.3 Vehicle Sales and Vehicle Production

Sales of alternative vehicles generate positive feedback for these new technologies by inducing learning by doing, scale economies, greater diversity of choice in the number of makes and models, and by reducing majority consumers’ aversion to risk. Sales by vehicle type (passenger car versus light truck) and by technology type are estimated by multiplying total sales by the shares predicted by the NMNL vehicle choice model.

Base Case sales are calibrated to exactly match exogenous total LDV sales by means of year-specific constants for the buy/no-buy choice. Similarly, the shares of passenger cars and light trucks are individually matched to the exogenous Base Case projection by calibrating a constant term for the NMNL car versus truck choice for each year. This insures that for the Base Case only, total sales as well as car and light truck sales exactly match the exogenous projection. In policy scenarios, changes in vehicle technology and new policies (e.g., vehicle or fuel taxes or subsidies) can not only change the market shares of vehicle technologies but the split between passenger cars and light trucks and total sales, as well. The calibration constants are calculated iteratively by first estimating an initial value, substituting that value into the NMNL choice model, and then recalculating a new value. Iteration is necessary because the calibration constants affect shares, which in turn determine sales, and sales affect the utility indexes for vehicles via fuel prices, learning by doing, scale economies, make and model diversity, and fuel availability. Let IC and SC be the inclusive value and Base Case market share, respectively, for passenger cars, and IT and ST are the corresponding values for light trucks. The initial estimate of the light truck constant term is the following (in which the superscript 1 indicates the first iteration).

![]()

When the calibration constant is substituted in the vehicle choice equation, it results in different market shares and, therefore, sales for cars and light trucks, which affects their prices and other attributes via the feedback mechanisms of learning, scale economies, etc. This in turn affects the inclusive values, resulting in a different estimate for the constant term via Equation H.14. The process is repeated until the constant terms are determined to at least four-digit accuracy. A similar process is used to simultaneously estimate the year-specific constant terms for the buy/no-buy choice. Typically, convergence is achieved over the 40-year forecast horizon in about 10 iterations.

Via several feedback mechanisms, vehicle sales affect future vehicle prices, numbers of makes and models from which to choose, and fuel availability. The key mechanisms affecting the prices of new technologies during the early stages of a transition are learning by doing and scale economies. Learning by doing is represented by declining costs as a function of cumulative production, Q, relative to an initial reference level, QR. The rate of learning, or progress ratio, á, represents the impact of a doubling of cumulative output on cost. Let P (Q0) represent the RPE at cumulative production Q0, then the RPE at cumulative production level Q > Q0 is given by Equation H.15.

![]()

This formulation has a significant drawback, namely that costs can decline to zero as cumulative output approaches infinity. The LAVE-Trans model limits the reduction in cost so that costs converge to the long-run RPE estimates provided by model users.

Scale economies are represented by a scale elasticity, c, which is the exponent of the ratio of production volume in a given period, q, to the ideal production volume, q *, at which full-scale economies are realized. RPE is equal to the ideal RPE, P *, times the ratio q /q * raised to the c. Values of the scale

elasticity, c, are often in the vicinity of -0.25, implying that a doubling of volume reduces costs by about 15 percent. Once q >= q *, q is set = q * so that the scale elasticity factor will never be smaller than 1.0.

![]()

Technological progress is determined by user-specified prices, energy efficiencies, and other attributes, which are key exogenous inputs to the model. The technologically achievable price at time t, P t, is defined as the RPE that could be achieved at full-scale and fully learned production. The user must specify the technologically achievable prices, energy efficiencies, and other vehicle attributes for 2010, 2015, 2020, 2030, 2040, and 2050. Technologically achievable prices and attributes for intervening years are estimated by linear interpolation. Attributes are assumed to be achieved regardless of current or cumulative sales. Prices must be driven down by learning and scale economies.

Using the above framework, the RPE of an advanced technology vehicle at any given time is the product of the technologically achievable price, Pt, times the technological progress, learning by doing, and scale economy functions.

H.2.3.4 Vehicle Stock

Vehicle stock, Scimt, is the number of vehicles of class c (passenger car, light truck) and technology type i, manufactured in model year m, in operation in calendar year t. The default survival functions for cars and light trucks are taken from NHTSA (2006). Alternatively, a three-parameter scrappage/survival function can be used to retire a fraction of the vehicle stock each year as vehicles age. Let Ri (a) be the scrappage rate function for vehicles of technology type i and age a = t – m, and Ai0, Ai1, and Ai2 be parameters of the scrappage function. The scrappage rate is the fraction of vehicles of age a – 1 in year t – 1 that are retired (scrapped) in year t. The fraction of vehicles surviving to age a is 1 -Ri(a).

![]()

The number of a-year-old (a = t – m) vehicles surviving from year t to year t + 1 is given by Equation H.19.

![]()

Vehicle stock accounts are kept for 25 ages (0-24); vehicles older than 24 years are combined into a single >25 category and scrapped at a constant rate equal to 1/Ai0.

H.2.3.5 Vehicle Use and Energy Use

Vehicle use, Vi (a), is assumed to be primarily a function of vehicle technology and vehicle age, but it also varies with energy efficiency to account for the rebound effect and varies with growth in the

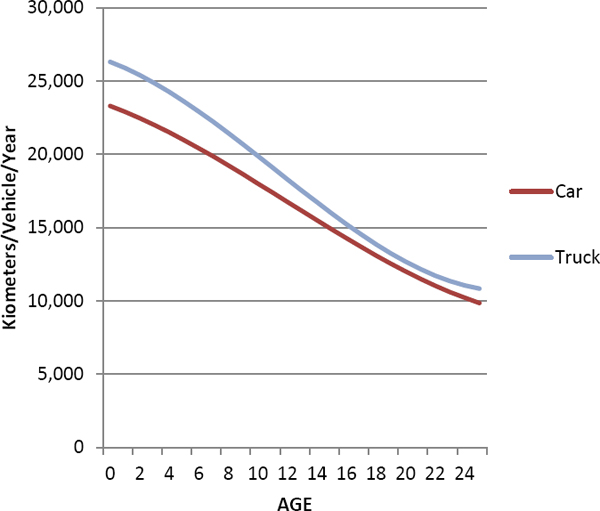

TABLE H.4 Parameters for National Highway Traffice Safety Administration Cubic Equation for Vehicle Use as a Function of Age

| C3 | C2 | C1 | C0 | ||||||

| Car | 0.36721 | -13.2195 | -232.85 | 14476.4 | |||||

| Truck | 0.68064 | -22.8448 | -238.55 | 16345.3 | |||||

vehicle stock. Vehicle use as a function of age for passenger cars and light trucks is based on NHTSA (2006), which fitted cubic polynomials to annual mileage at 1-year age intervals. Annual miles for vehicle type i (passenger car, light truck) is given by Equation H.20.

![]()

The parameter values derived by NHTSA are shown in Table H.4. Vehicle miles are converted to kilometers by multiplying by 1.609. The resulting typical curves for passenger cars and light trucks are shown in Figure H.8. The same parameters may be used for every vehicle technology, or the user may specify different annual usage rates for different vehicle technologies. However, this should be done with caution. In the current version of the model, changing usage rates could profoundly affect total vehicle travel in scenarios in which low-usage vehicles become predominant. If a lower than average usage rate is specified for BEVs, a fraction of the reduction in travel will be shifted to other vehicle technologies. When a BEV’s range and recharging limitations make it unable to perform a consumer’s typical, desired daily travel, the consumer may (1) forego the travel or take a shorter trip, (2) shift the travel to another vehicle already owned, or (3) purchase or rent an additional vehicle. The model user can specify percentages for each option. The percentage allocated to option 1 will result in a decrease in total travel.

FIGURE H.8 Annual vehicle kilometers traveled by age of vehicle.

The percentages specified for options 2 and 3 will be allocated to other vehicle types. At present, the model does not allow vehicle sales to increase to accommodate option 3. For example, suppose a model user specified that 10 percent of the vehicle miles that could not be performed by a BEV would be foregone, 60 percent would be shifted to other vehicles, and 30 percent would be accommodated by the purchase of additional vehicles. If EVs comprised 10 percent of vehicles in use and were used on average 30 percent less than other vehicle types, there would be a 1.2 percent reduction in total VMT, and 1.8 percent of the travel would be shifted to the remaining 90 percent of vehicles, increasing their rates of use by 2 percent.

H.2.3.5.1 Adjustment for Changes in the Size of the Vehicle Stock

Because the vehicle choice model includes the option to buy or not to buy a new vehicle that depends on the attractiveness of new vehicles relative to other consumer goods, total LDV sales and stock size may change from one scenario to another. If annual kilometers traveled per vehicle (by age) were constant, then vehicle travel would increase approximately in proportion to the size of the vehicle stock. In fact, because the United States now has more motor vehicles than licensed drivers, vehicle travel is relatively insensitive to increases in the number of vehicles available for use. For example, Greene (2012) found that a 10 percent increase in number of LDVs in the United States would lead to only a 2 percent increase in total VKT in the long run.7 Let the elasticity of total VKT with respect to the size of the vehicle stock be η. The effect of a change in the size of the vehicle stock in year t in scenario s, Sti, compared to the stock in year t in the base case, StB, on annual kilometers by a vehicle of age a in year t, Vats, is shown in Equation H.21.

Thus, if the vehicle stock in a given scenario increases by, say 10 percent relative to the Base Case, annual kilometers per vehicle will decrease by 7.34 percent, resulting in an increase of total vehicle kilometers by a factor of (1.1) × (0.9266) = 1.019, or about 2 percent.

H.2.3.5.2 Adjustment of VKT for Changes in Fuel Cost per Kilometer

Adjusting vehicle travel for changes in the cost of energy per mile, also known as the “rebound effect,” is accomplished in two steps. In the first step, VKT per vehicle by year and vintage is adjusted relative to the base year of 2010. Let pit be the price of energy for a vehicle of technology type i in year t, and Ecimt be the rate of energy consumption per kilometer for a vehicle of class c, technology i, model year m, in year t. Let ã be the rebound elasticity, the percent change in vehicle travel for a percent change in energy cost per kilometer. The first adjustment factor, k1, is the energy cost per mile in year t relative to the energy cost per mile in the base year, raised to the rebound elasticity.

![]()

_____________________________

7 This result pertains to models in which the sensitivity to fuel cost per mile was allowed to vary over time as a function of per capita income.

The elasticity of vehicle use with respect to fuel cost per kilometer of travel determines the percent change in travel per vehicle for a 1 percent change in fuel cost per kilometer. The default value, which may be changed by the model user, is –0.1, implying a 1 percent increase in travel for a 10 percent reduction in fuel cost per kilometer.

The second adjustment factor, k2t, is the ratio of total projected light-duty VKT from the exogenous AEO forecast, VAEO,t, relative to the model’s initial estimate of VKT for the BAU Case, V* BAU. Multiplying the model’s BAU VKT estimate by this factor insures that total VKT in the BAU Case will match the AEO projection in each forecast year.

![]()

This parameter ensures only that travel in the BAU Case matches the AEO projection. When assumptions about vehicle energy efficiency or cost or other variables are changed in a Base Case or Current Case, VKT will, in general, differ from the AEO projection. In particular, if vehicle efficiency improves and purchase prices decline, vehicle travel will increase due to the rebound effect and the increased number of vehicles on the road.

Energy use for all vehicles, Zcimt, is the product of vehicle stock, Scimt, vehicle use, Via, and vehicle fuel consumption, Ecim, divided by 1,000,000 so that the units are terajoules per year.

![]()

H.2.3.5.3 PHEV Energy Use

For PHEVs, energy use must be divided between electricity and gasoline. This is done by multiplying total energy use assuming the vehicle is operated entirely in charge-sustaining mode times the share of kilometers traveled in charge depleting mode, sd, times the relative energy consumption in charge-depleting mode compared to charge-sustaining mode, rd. The relative energy use is calculated as the ratio of the energy efficiency in charge-depleting mode divided by energy efficiency in charge-sustaining mode.

![]()

Gasoline energy use is then calculated as the product of total energy use assuming 100 percent charge depleting operation times 1 minus the share of kilometers in charge-depleting mode.

![]()

H.2.3.6 GHG Emissions

GHG emissions are calculated by multiplying time-dependent emissions coefficients, git, times the quantity of energy used, Zcimt. For PHEVs, two calculations are made, one for electricity consumption and another for gasoline consumption. Different emissions scenarios can be constructed by selecting alternative emissions coefficients for gasoline, electricity, hydrogen, and natural gas.

The GHG emissions of gasoline are computed as a weighted sum of its blend components’ GHG emissions rates. Let si be the share of fuel type i (i = conventional gasoline, corn-based ethanol, cellulosic ethanol, drop-in pyrolysis biofuel, coal-to-liquid gasoline, gas-to-liquid gasoline), and let gi be its

estimated well-to-wheel emissions rate in kilograms of CO2 per gasoline gallon equivalent energy. The GHG emissions rate of gasoline, g, is given by the following:

![]()

One of two scenarios can be selected for GHG emissions from electricity use. For the United States the GHG scenarios are based on the Reference Case and the Low Carbon Case of the GHG Price Case projections for the U.S. electricity grid of the EIA AEO 2011 extrapolated from 2035 to 2050.

Three alternative scenarios can be used for GHG emissions from hydrogen use. In all cases, emissions are assumed to be 11.44 kg CO2 per gge until hydrogen production reaches 6,000 metric tons per day (tpd; approximately enough to fuel 6 million vehicles). In a low-cost hydrogen case, no sequestration is assumed, and based on a mix of 25 percent distributed natural gas reforming, 25 percent coal gasification without CCS, 25 percent central natural gas reforming without CCS, and 25 percent biomass gasification without CCS, an emission factor of 12.2 kg/gge is used. A carbon sequestration case adds CCS to central coal and natural gas production but not distributed natural gas or central biomass, resulting in an emissions factor of 5.1 kg/gge. A low-CO2 case assumes only 10 percent distributed natural gas reforming, 40 percent central natural gas reforming with CCS, 30 percent biomass gasification without CCS, and 20 percent emission-free electricity (e.g., wind) for electrolysis, resulting in an emissions factor of 2.6 kg/gge.

H.2.4 Energy Infrastructure, Prices, and GHG Emission Rates

The costs of fuel supply infrastructure are estimated for electricity, hydrogen, and CNG. A distinction is also made between infrastructure necessary to support sales of vehicles and infrastructure added by public policy to increase fuel availability beyond the minimum necessary to support the stock of vehicles on the road. A model user may specify a fixed amount of infrastructure (or fuel supply) to be added as vehicles are sold and also the quantities and types of infrastructure deployed by subsidies or mandates.

H.2.4.1 Hydrogen

The hydrogen production and dispensing submodel estimates the number of hydrogen stations by type of station, the current price of hydrogen, and the average GHG emissions per kilogram of hydrogen used. For each hydrogen vehicle sold, it is assumed that enough fuel to operate the vehicle will be supplied and that only enough stations to provide that fuel will be constructed. The model user may require additional stations to increase fuel availability, but any additional stations will be fully subsidized (by government or industry).

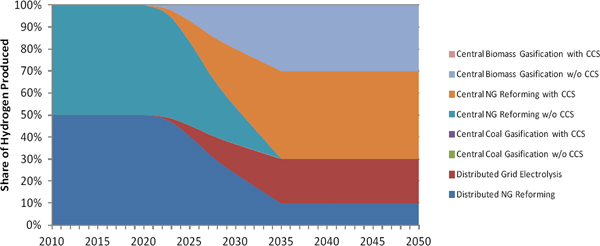

The flow of the hydrogen production and delivery model is diagrammed in Figure H.9. The input data that define a hydrogen scenario consist of (1) long-run, high-volume hydrogen production costs,8 (2) GHG emissions per gallon of gasoline equivalent energy, and (3) target production process shares, all by production process and for the years 2010, 2020, 2035, and 2050 (e.g., Table H.5).

_____________________________

8 A future version of the model will build up these estimates from data on capital, operating and feedstock requirements and costs, as well as required returns on investment.

FIGURE H.9 Flow chart of hydrogen production and delivery model.

In the LAVE-Trans model hydrogen may be produced by the following eight processes:

1. Distributed natural gas reforming,

2. Distributed grid electrolysis,

3. Central coal gasification without CCS,

4. Central coal gasification with CCS,

5. Central natural gas reforming without CCS,

6. Central natural gas reforming with CCS,

7. Central biomass gasification without CCS, and

8. Central biomass gasification with CCS.