This chapter discusses the fuel production and use associated with striving to meet the overall study goals of a 50 percent reduction in petroleum use by 2030 and an 80 percent reduction in petroleum use and in greenhouse gas (GHG) emissions from the light-duty vehicle (LDV) fleet by 2050 compared to the corresponding values in 2005. It addresses the primary sources of energy for making alternative fuels, the costs of alternative fuels, and the investment needs and the net GHG emissions of the fuels delivered to the LDV fleet over time. Alternative fuels are transportation fuels that are not derived from petroleum, and they include ethanol, electricity (used in plug-in electric vehicles [PEVs] such as plug-in hybrid electric vehicles [PHEVs] or battery electric vehicles [BEVs]), hydrogen, compressed or liquid natural gas, and gasoline and diesel derived from coal, natural gas, or biomass. Petroleum-based fuels are liquid fuels derived from crude oil or unconventional oils.

The chapter opens with a summary discussion of the study goals, fuel pathways, trends in the fuels market, fuel costs, investment costs, and GHG emissions for an LDV in 2030 using each fuel, and it includes a summary table for each of the last three categories, as well as some cross-cutting findings. More detailed discussions of each fuel follow the summary discussion, with a section devoted to each fuel. Also discussed are carbon capture and storage, and resource needs and limitations.

3.1.1 The Scope of Change Required

The study goals are aggressive and require significant improvements to the vehicle and the fuel system to meet the desired goals. The number of LDVs and the vehicle miles traveled (VMT) are expected to nearly double from 2005 to 2050, adding challenges to meeting the goals.1 To reach the goals with twice as many LDVs on the road in 2050 means that each LDV would consume on average only 10 percent of the petroleum consumed compared to 2005 and emit only 10 percent of the net GHG emissions. Gasoline and diesel made from petroleum would be nearly eliminated from the fuel mix to reach the petroleum reduction goal. The 80 percent net GHG emissions reduction goals can be met by various combinations of lower fuel consumption rate (inverse of fuel economy) and lower fuel net GHG emission (Table 3.1). The higher the reductions in LDV fuel consumption rate, the lower the reductions in fuel net GHG emissions would need to be to reach the GHG reduction goal. As discussed in Chapter 2, LDV fleet economy improvements of 3 to 5 times may be technically feasible by 2050, meaning that the average net GHG emissions of the fuel used in the entire LDV

TABLE 3.1 LDV Fuel Economy Improvement and Fuel GHG Impact Combinations Needed to Reach an 80 Percent Reduction in Net GHG Emissions Compared to 2005 Assuming a Doubling in Vehicle Miles Traveled (VMT)

| LDV Fuel Economy Increase versus 2005 | LDV Fuel Consumption Rate Relative to 2005 (percent)a | Requisite Reduction in Net Fuel System GHG Impact versus 2005 (percent)b |

| 2× | 50 | 80 |

| 3× | 33 | 70 |

| 4× | 25 | 60 |

| 5× | 20 | 50 |

| 6× | 17 | 40 |

aThe vehicle fuel consumption rate (e.g., gal/100 mi) corresponding to a given increase in fuel economy (e.g., miles per gallon) relative to the base year level. For example, a quadrupling (4×) of fuel economy simply means that the fuel consumption rate is 25 percent of the base level.

bThe net reduction of system-wide GHG emissions from fuel supply sectors needed to meet an LDV sector-wide 80 percent GHG reduction goal for a given fuel economy gain when assuming a fixed doubling of VMT, that is, without accounting for induced effects such as VMT rebound due to higher fuel economy.

_______________________

1The EIA Annual Energy Outlook 2011 (EIA, 2011a) is the basis for these projections.

fleet would have to be reduced by 50 to 70 percent per gallon of gasoline equivalent (gge) by that time.

Finding: Meeting the study goals requires a massive restructuring of the fuel mix used for transportation. Petroleum-based fuels must be largely eliminated from the fuel mix. Other alternative fuels must be introduced such that the average GHG emissions from a gallon equivalent of fuel are only about 40 percent of today’s level.

Many different alternative fuel pathways have been proposed, and this study selected seven different fuel pathways to analyze: conventional petroleum-based gasoline, biofuels (including ethanol and “drop-in”2 biofuels), electricity, hydrogen, compressed natural gas (CNG), gas to liquids (GTL), and coal to liquids (CTL). These were selected because of their potential to reduce petroleum use, to be produced in large quantities from domestic resources, and to be technically and commercially ready for deployment within the study period. Most fuels selected have lower net GHG emissions than petroleum-based fuels. Other alternative-fuel pathways were discussed but not included for detailed analysis because they did not meet the first three criteria. For example, methanol is discussed in Appendix G.8 but was not included for detailed analysis because of environmental and health concerns that inhibit fuel distribution and retail companies from broadly offering methanol as a fuel.

The fuel costs, net GHG emissions, investment needs, and resource requirements were analyzed on a consistent basis for the different fuels to facilitate comparisons among fuels. Future technology and cost improvements for the selected fuels are considered and compared on a consistent basis, even though the extent of improvement for different fuels is likely to vary.

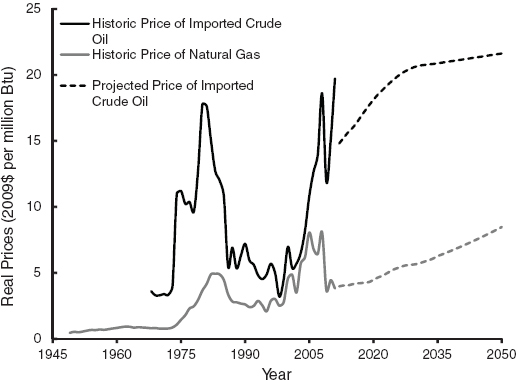

3.1.3 Developing Trends in the Fuels Market

Several developments in the energy markets over the past few years will have large impacts on long-term LDV fuel-use patterns. First, the fuel economy of the LDV fleet will increase rapidly over the next decade because of higher Corporate Average Fuel Economy (CAFE) standards effective through 2016 and proposed through 2025. The CAFE standards increase requirements from 23.5 mpg in 2010 to 34.1 mpg in 2016 to 49.7 mpg in 2025. Alternative fuels and new LDV technologies would compete with future gasoline or diesel LDVs that use much less petroleum and have lower net GHG emissions. From a consumer viewpoint, the decreasing volume of gasoline needed to travel a mile reduces the economic motivation to switch from gasoline to an alternative fuel.

Second, biofuel production is expected to increase as a result of the Renewable Fuel Standard 2 (RFS2) passed as part of the 2007 Energy Independence and Security Act (EISA). This legislation mandated the consumption of 35 billion gallons of ethanol-equivalent3 biofuel and 1 billion gallons of biodiesel (about 24.3 billion gge/yr based on energy content) by 2022. The detailed requirements of RFS2 are discussed in Appendix G.1. Based on the 2010 gasoline use of 136 billion gge/yr (8.88 million bbl/d), this mandate increases biofuel use from 9.9 percent (0.87 million bbl/d) to 18 percent (1.59 million bbl/d) of the gasoline mix by volume (EIA, 2011b). Although the mandated volume for cellulosic biofuel is not expected to be met by 2022, any additional biofuel volume in the conventional gasoline mix reduces the need for gasoline from petroleum and the volume of other alternative fuels needed to reach the study goals. See Section 3.2, “Biofuels,” in this chapter for a detailed discussion.

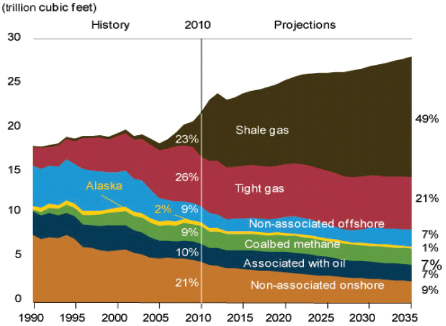

Third, the volume of economic natural gas from shale deposits within the United States has been increasing rapidly. In its June 18, 2009, report the Potential Gas Committee upgraded by 39 percent the estimated U.S. potential natural gas reserves (defined as being potentially economically extractable by the use of available technology at current economic conditions) compared with its previous biannual estimate (Potential Gas Committee, 2009). Based on the new estimates, the probable natural gas reserves would provide about 86 years of consumption if the consumption rate stays at the current level. In 2011, the Potential Gas Committee increased its estimates such that 90 years of probable reserves exist based on 2010 consumption. Many previous studies on alternative fuels did not include natural gas as a possible source for LDV fuel because of limited domestic supply, and the likely price increase in electricity and residential heating costs associated with high natural gas use in the transportation market. With increasing domestic production, natural gas now is a viable option for providing transportation fuels through multiple pathways including electricity, hydrogen, GTL, and CNG. See Section 3.5, “Natural Gas,” in this chapter and Appendix G.7 for a detailed discussion.

3.1.4 Study Methods Used in the Analysis

This study considers conventional and alternative fuels for the 2010-2050 period, and this committee undertook a number of tasks to generate possible fuel scenarios and data for use in the modeling efforts described in Chapter 5. The primary sources for the data are different for each fuel and are explained in the sections that provide details on each fuel below in this chapter. The committee made efforts to standardize input data and definitions between the primary

_______________________

2Drop-in fuel refers to nonpetroleum fuel that is compatible with existing infrastructure for petroleum-based fuels and with LDV ICEs.

3A gallon of ethanol has about 77,000 Btu, compared with 116,000 Btu in 1 gallon of gasoline equivalent.

information sources. The tasks the committee performed include:

- Assessed the current state of the technology readiness for each fuel using information gathered from presentations made to this committee and published literature.

- Estimated future improvements to these technologies that could be broadly deployed in the study period.4

- Estimated the range of costs based on future technology for each fuel delivered to the LDV at a fueling station in a similar way for each fuel. The reference price basis in the Energy Information Administration’s (EIA’s) Annual Energy Outlook 2011 (EIA, 2011a) is used for all primary fuel prices. Investment costs are expressed in 2009 dollars.

- Estimated the initial investment costs needed to build the infrastructure for each fuel pathway.5

- Estimated the net GHG emissions per gallon of gasoline-equivalent for each fuel based on the methods selected for producing the fuel. An upstream GHG component, a conversion component, and a combustion component were included in the estimate of net GHG emissions.

3.1.5 Costs of Alternative Fuels

The costs of alternative fuels through 2035 are estimated based on the energy raw material prices in the reference case of the Annual Energy Outlook 2011 (AEO; EIA, 2011a), and the basis and assumptions for the estimates are explained in the individual fuel sections. Fuel prices beyond 2035 were estimated by the committee. Table 3.2 summarizes the expected alternative fuel costs for 2030 on a $/gge or $/kWh basis for some of the fuel pathways and shows the consumer’s annual fuel costs for a new vehicle of that type based on 2030 estimated vehicle mileage.

While the values in Table 3.2 are useful guideposts for this analysis, there are a few factors to keep in mind. First, the fuel costs shown in Table 3.2 are untaxed—current or future taxes are not included and could alter the actual annual cost that consumers pay. Second, the per-gallon of gasoline-equivalent fuel cost estimates in 2030 are a snapshot in time and will likely change as technology develops and world energy prices change. Third, the untaxed fuel-purchase costs to consumers each year appear similar for most fuels except for CNG and the BEV, which are significantly lower than others. Given the small separation for the other options in 2030, untaxed fuel costs are not expected to be a significant driving force for consumers to switch from gasoline to alternate vehicle technologies in this timeframe. Untaxed fuel cost differences of only several hundred dollars per year will not cover the additional vehicle costs described in Chapter 2.6

TABLE 3.2 2030 Annual Fuel Cost per LDV, Untaxed Unless Noted

| Fuel | Fuel Cost ($/gge or kWh) | Annual Consumer Use (gge or kWh) | Annual Consumer Fuel Cost ($/yr) | ||||||

| Gasoline (taxed) | 3.64/gge | 325 gge% | 1,183 | ||||||

| Biofuel (drop in) | 3.39/gge | 325 gge% | 1,102 | ||||||

| Gasoline (untaxed) | 3.16/gge | 325 gge% | 1,027 | ||||||

| PHEV10a | 3.16/gge | 260 gge% | 913 | ||||||

| 0.141/kWh | 650 kWh | ||||||||

| CTL with CCS | 2.75/gge | 325 gge% | 894 | ||||||

| GTL | 2.75/gge | 325 gge% | 894 | ||||||

| PHEV40b | 3.16/gge | 130 gge% | 752 | ||||||

| 0.175/kWh | 1,950 kWh | ||||||||

| Hydrogen—CCS case | 4.10/gge | 165 gge% | 676 | ||||||

| Natural gas—CNG | 1.80/gge | 325 gge% | 585 | ||||||

| BEV | 0.143/kWh | 3,250 kWh | 465 | ||||||

NOTE: All fuel costs are based on the 2011 AEO (EIA, 2011a) for 2030. The assumed fuel economies are representative of on-road LDV averages for 2030 described in the scenarios in Chapter 5. The following assumptions were made: 13,000 mi/yr traveled and 40 mpgge for liquid and CNG vehicles, 80 mpgge for hydrogen and 4.0 mi/kWh for electric vehicles. PHEV10 gets 20 percent of miles on electric, PHEV40 gets 60 percent. All costs are untaxed unless noted. Electricity cost includes the retail price plus amortization of the cost of a home charger.

aPHEV10 is a plug-in hybrid vehicle designed to travel about 10 miles primarily on battery power only before switching to charge-sustaining operation.

bPHEV 40 is a plug-in hybrid vehicle designed to travel about 40 miles primarily on battery power only before switching to charge-sustaining operation.

Finding: As the LDV fleet fuel economy improves over time, the annual fuel cost for an LDV owner decreases. With high fleet fuel economy, the differences in annual fuel cost between alternative fuels and petroleum-based gasoline decreases and the annual costs become similar to one another. Therefore, over time fuel-cost savings will become less important in driving the switch from petroleum-based fuels to other fuels.

3.1.6 Investment Costs for Alternative Fuels

The investment costs to build the fuel infrastructure are sizable for all of the alternative fuel and vehicle pathways. In fact, these costs remain among the most important barriers

_______________________

4Some future technologies that might be developed during the study period are not included for detailed analysis because future efficiencies and costs are not well understood. Examples of this include photoelectrochemical hydrogen production and biofuels from algae.

5Investment costs are explained in Appendix G.2, “Infrastructure Initial Investment Cost.”

6As pointed out in Chapters 4 and 5, consumers tend to value about 3 years worth of fuel savings when making decisions on initial vehicle purchases. Using the numbers in Table 3.2, 3 years of untaxed hydrogen saves only $1,501 compared with taxed gasoline during 2030. The cost saved is not enough to cover the higher cost of a fuel cell electric vehicle (FCEV).

to rapid and widespread adoption of alternatives. Table 3.3 shows the investment costs on a $/gge per day basis and on a $/LDV basis. This calculation includes only the investment in building a new form of infrastructure needed to make and deliver the fuel to the customer. It does not include investment to expand an already large and functioning infrastructure associated with producing more of the basic resource. For instance, for hydrogen made from natural gas, the investment cost includes the cost of converting natural gas to hydrogen, pipelines to deliver the hydrogen, and the full cost of a hydrogen station, but it does not include investments to produce natural gas or deliver it to a plant. A complete list of which costs are included or excluded is shown in Appendix G.2 “Infrastructure Initial Investment Cost.” Details for these investment costs are found in the individual fuel sections below in this chapter.

The investment cost for a new petroleum refinery is included in Table 3.3 for perspective. However, with increasing fuel economy for the LDV fleet, no new refinery capacity will be needed during the study period. So in effect the initial investment cost for gasoline is near zero. The alternative-fuel-producing industry, in 2030, must make a $1,000 to $3,000 investment for each new alternative-fuel LDV, whereas almost none is needed for new petroleum gasoline LDVs. This cost differential is a major barrier to large-scale deployment of alternative fuels.

The scale, pace, and modularity of the infrastructure investments vary for the different vehicles and fuels. These differences are noted in the right-most column of Table 3.3. Two basic categories are used to describe the infrastructure requirements: centralized and distributed. Centralized infrastructure investments are those that are borne by a select number of decision makers. For example, the infrastructure for CTL, GTL, or gasoline requires large-scale plants (which cost billions of dollars each) that individual companies would pay for. Biofuels require large-scale investments for biorefineries. Hydrogen requires hydrogen production plants plus smaller-scale distributed investments by retailers to install new storage tanks and fuel pumps. The investment costs for BEVs and PHEVs in Table 3.3 include only the costs for home, workplace, and public chargers. The centralized infrastructure for CNG has already been built, and so the incremental CNG infrastructure costs include home fueling systems (paid for by car owners), or new filling stations (paid for by retailers). Thus, the infrastructure requirements vary from a few very large, multibillion-dollar investments (e.g., for biorefineries) made by a few decision makers in industry, to millions of small multithousand-dollar investments made by millions of decision makers such as consumers, ratepayers, and retailers.

Finding: The investment cost for a new fuel infrastructure using electricity, biofuels, or hydrogen is in the range of $2,000 to $3,000 per LDV. This is a significant barrier to large-scale deployment when compared with an infrastructure cost for using petroleum of only about $530 per LDV.

3.1.7 GHG Emissions from the Production and Use of Alternative Fuels

Operational and infrastructure costs (as noted in Tables 3.2 and 3.3) are critical factors to consider for deployment. However, the net GHG emissions for the different vehicle and fuel options need to be examined to determine how the goal of 80 percent GHG reduction could be met. The estimates of annual GHG emissions in 2030 for different vehicle and fuel options are shown in Table 3.4.

Each vehicle and fuel option has a range of net annual GHG emissions because GHG emissions depend

TABLE 3.3 2030 Fuel Infrastructure Initial Investment Costs per Vehicle

| Alternative Fuel | 2030 Investment Cost | LDV Fuel Use per Day | Infrastructure Investment Cost ($/vehicle) | Cost Burden | |||||

| Electricity BEV | $330/kWh per day | 8.9 kWh | 2,930 | Distributed (car owners, ratepayers) | |||||

| Electricity (PHEV40) | $530/kWh per day | 5.4 kWh | 2,880 | Distributed (car owners, ratepayers) | |||||

| Biofuel (thermochemical) | $3,100/gge per day | 0.89 gge | 2,760 | Centralized (industry) | |||||

| CTL (with CCS) | $2,500/gge per day | 0.89 gge | 2,220 | Centralized (industry) | |||||

| Hydrogen (with CCS) | $3,890/gge per day | 0.45 gge | 1,750 | Centralized (industry) and distributed (retailers) | |||||

| GTL | $1,900/gge per day | 0.89 gge | 1,690 | Centralized (industry) | |||||

| Natural gas—CNG | $910/gge per day | 0.89 gge | 810 | Distributed (retailers and car owners) | |||||

| Electricity (PHEV10) | $370/kWh per day | 1.75 kWh | 650 | Distributed (car owners, ratepayers) | |||||

| Gasoline (new refinery—if needed) | $595/gge per day | 0.89 gge | 530 | Centralized (industry) | |||||

NOTE: Basis: 13,000 mi/yr and 40 mpgge for liquid and natural gas vehicles, 80 mpgge for hydrogen, and 4.0 mi/kWh for electric vehicles. PHEV10 gets 20 percent of miles on electric; PHEV40 gets 60 percent. Investment costs are explained in the individual fuel sections.

TABLE 3.4 Estimates of 2030 Annual Net GHG Emissions per Light-Duty Vehicle Used in the Modeling in Later Chapters

| Fuel | Net GHG Emissions (kg CO2e) | Annual Use | Annual GHGs Emissions per LDV (kg CO2e) | ||||||

| CTL with CCS | 12.29/gge | 325 gge | 4,000 | ||||||

| GTL | 11.47/gge | 325 gge | 3,730 | ||||||

| Gasoline | 11.17/gge | 325 gge | 3,630 | ||||||

| PHEV10 | 0.590/kWh | 650 kWh | 380 3,290 | ||||||

| 11.17/gge | 260 gge | 2,910 | |||||||

| Natural gas | 9.20/gge | 325 gge | 2,990 | ||||||

| PHEV40 | 0.590/kWh | 1,950 kWh | 1,146 2,600 | ||||||

| 11.1/gge | 130 gge | 1,454 | |||||||

| Hydrogen—low cost | 12.2/gge | 165 gge | 2,010 | ||||||

| BEV—reference grid | 0.590/kWh | 3,250 kWh | 1,920 | ||||||

| Biofuel—with ILUCa | 5.0/gge | 325 gge | 1,620 | ||||||

| BEV—low-GHG grid | 0.317/kWh | 3,250 kWh | 1,030 | ||||||

| Biofuel—without ILUC | 3.2/gge | 325 gge | 1,040 | ||||||

| Hydrogen—with CCS | 5.1/gge | 165 gge | 840 | ||||||

| Hydrogen—low-GHG case | 2.6/gge | 165 gge | 430 | ||||||

| Biofuel—with ILUC,CCS | –9.0/gge | 325 gge | –2925 | ||||||

aIndirect land-use changes (ILUC) can have large impacts on net GHG emissions but can vary considerably.

Basis: 13,000 mi/yr and 40 mpgge for liquid and NGVs, 80 mpgge for hydrogen and 4.0 miles/kWh for electric vehicles. PHEV10 gets 20 percent of miles on electric; PHEV40 gets 60 percent. GHG estimates are explained in the individual fuel sections.

on how the fuels are produced. The range of net GHG emissions for biofuels is large because the net GHG emissions depend on many factors, including the type of feedstock used,7 the management practices used to grow biomass (e.g., overuse of nitrogen fertilizer could increase N2O flux), any land-use changes associated with feedstock production,8 and the use of carbon capture and storage (CCS) with biofuel production. The range of differences for a BEV is determined by the average GHG emissions of the grid and over time may be quite different than shown in Table 3.4. Hydrogen has a large range of possible GHGs determined by the several different choices of production method.

The net GHG emissions from the three typical alternative fuels—biofuels, hydrogen, and electricity—can be either high or low depending on technology choices, carbon costs, regulations, and other factors. Choices driven by technology, economics, and policy determine the GHG emissions for future alternative fuels.

Finding: The GHG emissions from producing biofuels, electricity, and hydrogen can vary depending on the basic resource type and conversion methods used. Making these fuels with methods involving very low GHG emissions increases the technical and cost hurdles, especially during the introductory period. Actions to encourage the use of these more challenging methods should be timed to coincide with large-scale deployment and not be a burden during the introductory period for the fuel. Needed policy actions for each fuel pathway are listed in Appendix G.3.

Biofuel is a generic term that refers to any liquid fuel produced from a biomass source. A number of different biofuel products (e.g., biobutanol and drop-in biofuels9) derived from different feedstocks (e.g., lignocellulosic10 biomass and algae) have been proposed, but only corn-grain ethanol and biodiesel were produced in commercially relevant quantities in the United States as of the drafting of this report. Ethanol and biodiesel have been of interest because they can be easily synthesized using well-known processes from commercially available agricultural products (such as corn and soybeans in the United States, sugar cane in Brazil, and other oil seeds elsewhere). However, neither ethanol nor biodiesel is fully fungible with the current infrastructure and LDV fleet designed for petroleum-based fuels.

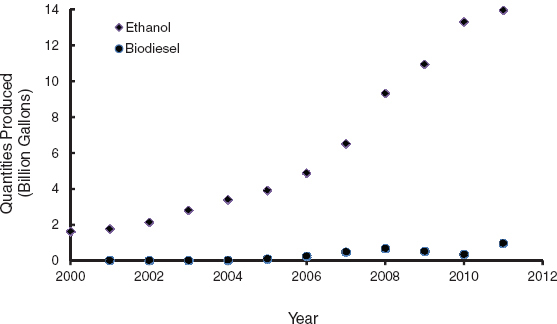

Ethanol and biodiesel are usually shipped separately and blended into the fuel at the final distribution point. Ethanol can be blended into gasoline in various proportions but has only about two-thirds of the volumetric energy content of petroleum-based gasoline. As of 2011, ethanol supplied almost 10 percent by volume of the U.S. gasoline demand (Figure 3.1). Biodiesel, produced via the transesterification of various vegetable oils or animal fats, supplied less than 1 percent of U.S. transportation fuel demand in 2011 (see Figure 3.1). U.S. biodiesel production capacity was about 2.7 billion gal/yr in 2010 (NBB, 2010), but actual production is significantly lower. Biomass can also be used to synthesize drop-in fuels, that is, synthetic hydrocarbons that would be fully fungible with existing infrastructure and vehicles.

The EISA included an amendment to the Renewable Fuel Standard in the Energy Policy Act (EPAct) of 2005. RFS2 mandated an increase of over 200 percent in the use of biofuels between 2009 and 2022. (See Box 1.1 in Chapter 1.) Biofuels, including corn-grain ethanol and biodiesel, currently require government subsidies or mandates to compete economically with petroleum-based fuels. Increases in ethanol consumption can also be limited by the “blend wall”

_______________________

7Corn-grain ethanol is likely to have different net GHG emissions than cellulosic biofuel.

8Uncertainties in GHG emissions from land-use changes are a key contributor to the wide range of estimates for net GHG emissions from biofuels. Some biofuel feedstock such as corn stover would not contribute much to GHG emissions from land-use changes.

9Biofuels that are compatible with existing infrastructure and internal combustion engine vehicles (ICEVs) for petroleum-based fuels.

10Plant biomass composed primarily of cellulose, hemicellulose, and lignin.

FIGURE 3.1 Amount of fuel ethanol produced in the United States.

SOURCE: Data from EIA (2012b,c).

(NRC, 2011). In 2010, the U.S. Environmental Protection Agency (EPA) approved the use of E15 in internal combustion engine vehicles (ICEVs) of model year 2001 or newer in response to a waiver request by Growth Energy and 54 ethanol manufacturers. Although EPA approved the use of E15 in 2010, its sale just began in July 2012 (Wald, 2012). In April 2012, EPA approved 20 companies for the manufacture of E15 (EPA, 2012a).11 Without an approved method for eliminating misfueling of older cars,12 increased ethanol use is likely to be constrained in the near term. In addition, auto manufacturers do not recommend using E15 in any vehicles that were initially designed to use E10 because of concerns that E15 might damage older engines (McAllister, 2012).

Flex-fuel vehicles (FFVs) can use higher concentrations of ethanol (up to 85 percent), and many auto manufacturers produce flex-fuel vehicles because of the CAFE credit13 they receive (DOE-EERE, 2012c). However, the number of E85 fueling stations is limited (about 2,500 stations across the United States) and varies by state (DOE-EERE, 2012a). The price of E85 has always been higher than petroleum-based gasoline on an equivalent energy content basis.

Although the use of corn-grain ethanol can reduce petroleum imports, its effects on GHG emissions are ambiguous. Life-cycle assessments by various authors have estimated a 0 to 20 percent reduction in GHG emissions from corn-grain ethanol, relative to gasoline (Farrell et al., 2006; Hill et al., 2006; Hertel et al., 2010; Mullins et al., 2010).

The EISA requires the use of additional advanced and cellulosic biofuels that will reduce petroleum imports, lower CO2e emissions, and be produced predominantly from lignocellulosic biomass. (See Appendix G.1 for definitions of biofuels in EISA.) To qualify as an advanced biofuel, a biofuel would have to reduce life-cycle GHG emissions by at least 50 percent compared with petroleum-based fuels.14 To qualify as a cellulosic biofuel, a biofuel would have to be produced from cellulose, hemicellulose, or lignin and reduce life-cycle GHG emissions by at least 60 percent compared with petroleum-based fuels. Although RFS2 specified lifecycle GHG reduction thresholds for each type of fuel and EPA makes regulatory determinations accordingly, the actual life-cycle GHG emissions of biofuels could span a wide range (NRC, 2011). Biofuels facilities that began construction after 2007 would have to be individually certified for both biomass source and production pathway to qualify for renewable identification numbers (RINs).15

The U.S. government and private investors have invested billions of dollars to develop cellulosic biofuels (see Tables

_______________________

11When the U.S. Environmental Protection Agency (EPA) approves a new fuel or fuel component, EPA only evaluates the fuel’s impact on the emission control system and its ability to meet the evaporative and tailpipe emission standards. EPA does not evaluate the impact of the new fuel on any other aspect of vehicle performance, including degradation of vehicle components and performance that are not associated with the emission control system.

12The Renewable Fuels Association submitted a Model E15 Misfueling Mitigation Plan to EPA for review and approval on March 2012. The plan includes fuel labeling to inform customers, a product transfer documentation requirement, and outreach to public and stakeholders. However, those measures will not eliminate the possibility of accidental misfueling.

13CAFE credits were used to incentivize vehicle manufacturers to sell large numbers of vehicles that run on natural gas or alcohol fuels. See Chapter 6 for details.

14In its Renewable Fuel Standard Program (RFS2) Regulatory Impact Analysis (EPA, 2010b), EPA determined the life-cycle GHG emissions to be 19,200 g CO2e/million Btu for petroleum-based gasoline and 17,998 g CO2e/million Btu for petroleum-based diesel.

15The Renewable Identification Number (RIN) system was created by EPA to facilitate tracking of compliance with RFS. A RIN is a 38-character numeric code that corresponds to a volume of renewable fuel produced in or imported into the United States.

2.3 and 2.4 in NRC, 2011); however, no commercially viable processes are operational as of the drafting of this report. Initial research focused on cellulosic ethanol; however, the difficulties associated with integrating ethanol into the existing fuel distribution system and the inability to increase ethanol yields to the desired levels have resulted in a shift in research emphasis away from the biochemical conversion processes to the thermochemical or hybrid conversion processes. Conversion processes of lignocellulosic biomass to fuels are discussed below in this chapter.

The production potential of cellulosic biofuels is determined by the ability to grow and harvest biomass and the conversion efficiency of the processes for converting the biomass into a liquid fuel. Many studies have been published, and they show that the currently demonstrated conversion potential is about 46-64 gge/ton of dry biomass feedstock (as summarized in NRC, 2011). This represents an energy-conversion efficiency to liquid fuel of 25 to 50 percent based on the ratio of the lower heating value of the fuel product to that of the biomass feedstock. Much of the balance of the biomass-energy content is used to produce electricity and to power the conversion processes.

Multiple potential sources of lignocellulosic biomass can be used to produce biofuels. They include crop residues such as corn stover and wheat straw, fast-growing perennial grasses such as switchgrass and Miscanthus, whole trees and wood waste, municipal solid waste, and algae. Each potential source has a production limit. The consumptive water use and other environmental effects of producing biomass for fuels are discussed in detail in Renewable Fuel Standard: Potential Economic and Environmental Effects of U.S. Biofuel Policy (NRC, 2011).

Several studies have been published on the estimated amount of biomass that can be sustainably produced in the United States (NAS-NAE-NRC, 2009b; DOE, 2011; NRC, 2011, and references cited therein). All of the studies focused on meeting particular production goals and none of them projected biomass availability beyond 2030; they are discussed in Appendix G.4. The studies had different target production dates ranging from 2020 to 2030. The most recent study (DOE, 2011) projected that 767 million tons of additional biomass (above that currently consumed) could be available in 2030 at a farm gate price of less than $60/ton. This estimate was based on an annual yield growth of 1 percent and would require a shift of 22 million acres of cropland (or 5 percent of 2011 cropland) and 41 million acres of pastureland (or 7 percent of 2011 pastureland) into energy crop production. That amount was assumed to be available in 2050 in this report.

Finding: Sufficient biomass could be produced in 2050, when converted with current biofuel technology and consumed in vehicles with improved efficiencies consistent with those developed by the committee in Chapter 2 (about a factor-of-four reduction in fuel consumption per mile by 2050), that the goal of an 80 percent reduction in annual petroleum use could be met.16

Several technologies can be used to process biomass into liquid transportation fuels for the existing LDV fleet. Converting corn starch to ethanol and converting vegetable and animal fats to biodiesel or renewable (green) diesel are well-established commercial technologies. As of 2012, the collective capacity of corn-grain ethanol and biodiesel refineries in the United States is sufficient to essentially meet the 2022 RFS2 consumption mandates for conventional biofuels and biomass-based diesel.

There are a number of potential processes for converting cellulosic biomass into liquid transportation fuels. Demonstration facilities have been built for some of the various technologies. Much of the focus on cellulosic biofuel has switched away from ethanol to producing a biofuel that is a drop-in fuel.

Three main pathways are being developed to produce cellulosic biofuels: biochemical, thermochemical, and a hybrid of thermochemical and biochemical pathways. The pathways are discussed in detail in the report Liquid Transportation Fuels from Coal and Biomass: Technological Status, Costs, and Environmental Impacts (NAS-NAE-NRC, 2009b). Briefly, biochemical processes use biological agents at relatively low temperatures and pressures to convert the cellulosic material to biofuels—primarily ethanol and higher alcohols.

Thermochemical conversion uses heat, pressure, and chemicals to break the chemical bonds of the biomass and transform the biomass into many different products. Three main pathways are being considered for thermochemical conversion: gasification followed by Fischer-Tropsch (FT) catalytic processing to make naphtha and diesel, gasification followed by conversion of the syngas into methanol and subsequent conversion into gasoline via the methanol-to-gasoline (MTG) process, and pyrolysis (either high-temperature or lower-temperature hydropyrolysis) followed by hydroprocessing of the pyrolysis oil to produce gasoline and diesel. Other thermochemical pathways are also under development. Thermochemical and biochemical processes can be combined—for example, gasification of the biomass followed by fermentation of the syngas to produce ethanol or other alcohols.

_______________________

16See Chapter 5 modeling results for further detail.

The economics of biofuel production have been discussed in a number of studies. Both NAS-NAE-NRC (2009b) and NRC (2011) compared recent information to develop comparative economics. The report Renewable Fuel Standard: Potential Economic and Environmental Effects of U.S. Biofuel Policy (NRC, 2011) and the references cited therein form the bases for the discussion of economics in this chapter.

Conversion of cellulosic biomass to drop-in biofuels is a relatively new and evolving suite of technologies. Predicting the future developments that can lower the cost of biofuel production is difficult. The cost of production is primarily a function of the cost of biomass, the yield of biofuels, and the capital investment required to build the biofuel conversion facility. Current conversion efficiencies are 46-64 gge/ton of dry biomass (which gives an average value of 55 gge per dry ton with a range of ±9 gge per dry ton).

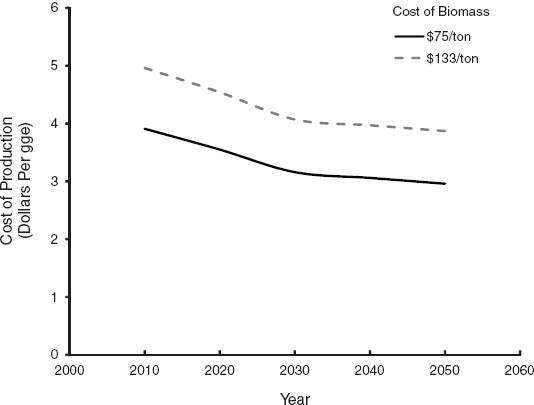

Current capital costs to build a cellulosic biorefinery vary between 10 and 15 $/gge per year for all of the technologies discussed above. Thus, a biorefinery that would produce 36 million gge/yr consumes about 2,000 dry tons of biomass per day. The biorefinery would cost between $360 million and $540 million to build. An average capital cost would be 12.5 ± 2.5 $/gge per year. Because biorefining is a developing and evolving technology, it is reasonable to assume that yields will increase and that the capital costs will decrease as the technology matures. Yields will increase because of improvements in the catalysts used and in the process configurations. The capital costs are expected to decline primarily because of economies of scale and improvements in the process configurations. Biorefineries that are bigger and more efficient than the first-mover facilities will be built as engineering and construction techniques are refined over time. The analysis is this chapter assumes that yields will increase from a baseline of 55 gge per dry ton in 2012 at a rate of 0.5 percent per year to a yield of 64 gge per dry ton by 2028. The capital costs are assumed to decrease by 1 percent per year through 2050 for an overall reduction in capital cost of 31 percent compared to the present cost. The capital costs given in this report are for fully engineered facilities for a relatively new technology. Others (Wright et al., 2010) have estimated a 60 percent decrease in capital costs as the technology evolves. Figure 3.2 shows the current and future costs to produce cellulosic biofuels based on these assumptions and the assumption that bioenergy feedstock is $75 or $133 per dry ton. Current estimates are for a biomass cost of $75 per ton, but a sensitivity to a higher cost is also included (see Figure 3.2).

Table 3.5 is a summary of projections of cellulosic biofuels that could be available, in addition to the 2012 ethanol and biodiesel production of 14 to 15 billion gal/yr, using different investment rates for new plant capacity. This committee estimated that about 45 billion gge of biofuel would be required to meet the target of 80 percent reduction in petroleum use for the LDV fleet in 2050 and would require about 703 million dry tons per year of biomass feedstock. A uniform annual construction rate of about $10 billion per year can easily produce the projected biofuel needs in 2050. The fuel availabilities are based on the projections discussed

FIGURE 3.2 Sensitivity of biofuel cost to biomass cost.

TABLE 3.5 Estimates of Future Biofuel Availability

| Annual Plant Investment Rate (billion dollars per year) | |||||||||

| 1 | 4 | 7.2 | 10.4 | ||||||

| Biofuel production (billion gge per year) by | |||||||||

| 2022 | 0.9 | 3.7 | 6.7 | 9.7 | |||||

| 2030 | 1.8 | 7.4 | 13.3 | 19.2 | |||||

| 2050 | 4.3 | 17.3 | 31.2 | 45.0 | |||||

| Biomass required in 2050 (million dry tons per year) | 68 | 270 | 488 | 703 | |||||

| Estimated land-use change (million acres) | 5.5 | 22.2 | 40.1 | 57.8 | |||||

| Total investment to 2050 (billion dollars) | 38 | 152 | 275 | 396 | |||||

| Average number of biorefineries built per year | 2.7 | 10.8 | 19.5 | 28.2 | |||||

above. Land requirements are scaled from the U.S. Billion-Ton Update previously discussed (DOE, 2011).

Worldwide expenditures on exploration and production of petroleum are high (Milhench and Kurahone, 2011). For example, ExxonMobil alone invested over $32 billion globally in capital and exploration projects in 2010. The November 7, 2011, issue of the Oil and Gas Journal (2011) reported that the National Oil Companies of the Middle East and North Africa planned to invest a total of $140 billion in oil and natural gas projects in 2012, with even more investments to follow in coming years.

If the biofuels industry grows as projected, many U.S. petroleum refineries will close or be converted to biorefineries. Conversion of a petroleum refinery to a biorefinery will be significantly less costly and labor-intensive than the construction of a “grass-roots” biorefinery.

In all future years, the amount of biofuels that can be produced will most likely be limited not by biomass availability, but rather by the availability of capital to build the biorefineries. However, a potential investor will not start construction without secure contracts for biomass supply and a guaranteed market for the product.17

A large number of biomass conversion facilities would have to be built along with specialized harvesting equipment and a truck fleet to transport the biomass from the fields to the conversion facilities. Economic studies have shown that the conversion facilities need to be near where the crops are grown. Therefore, additional product pipelines would be needed to transport the biofuels from the conversion facilities to the existing petroleum product distribution system. Although drop-in biofuels can use the existing petroleum-product distribution system, feeder lines will most likely be required between the biorefineries and the major petroleum pipelines. However, adding feeder lines will require a relatively small incremental investment.

3.2.7 Regional or Local Effects

Biomass can be grown only in certain parts of the country, and so the conversion facilities will also be located nearby. If drop-in fuels are produced, then the fuels can be shipped via the existing system of petroleum-product pipelines. This system efficiently transports large volumes of petroleum products. Initially, the biofuel refineries will be sited near the locations where the lowest-cost biomass is grown or harvested. Many of these locations are in the Southeast and Midwest United States. The major petroleum pipelines between the Gulf Coast and the Northeast and North Central United States bisect these regions. Tie-ins to these pipeline systems would be relatively short.

The chemical properties of drop-in cellulosic biofuels will be similar to those of existing, petroleum-based LDV fuels, with no additional fuel-related safety hazards. Truck traffic in rural areas is expected to increase, which could increase traffic accidents in these areas.

The primary barrier to displacing petroleum with biofuels is economic. At present, biofuels are more expensive to produce than petroleum-based fuels. The corn-grain ethanol industry had many years of government subsidies and is currently supported by the RFS2 consumption mandate. Subsidies or mandates are projected to be required to support cellulosic biofuel unless the price of oil is close to $190/bbl or conversion costs decline as projected.

As discussed above and in detail in other reports (NAS-NAE-NRC, 2009b; NRC, 2011), ethanol involves definite infrastructure issues. Pure ethanol cannot be used in conventional ICEs because of cold-start problems. It has to be blended with petroleum-based gasoline. The highest content allowed in the United States is 85 percent ethanol by volume (E85). Although E85 could contain up to 85 percent ethanol, its ethanol content typically averages only 75 percent or even less in the winter.

As of 2012, the fuel industry was close to reaching the maximum amount of ethanol that can be consumed by blending into E10. Total U.S. gasoline consumption in 2010 was just over 138 billion gallons. Blending all of this as E10 would consume only 13.8 billion gallons of ethanol, which is

_______________________

17Factors that can affect actual supply of biomass for fuels are discussed in the report Renewable Fuel Standard: Potential Economic and Environmental Effects of U.S. Biofuel Policy (NRC, 2011).

less than the 15 billion gallons of conventional ethanol mandated by RFS2. Fewer than 0.1 billion gallons of E85 were sold in 2009. As the fuel economy of vehicles improves and gasoline sales decline, even less gasoline will be available to be blended with the volume of ethanol mandated. Drop-in biofuels do not have this limitation.

3.2.10 GHG Reduction Potential

There is ongoing debate regarding the GHG emissions from the production of biofuels, including the time profile of the emissions. The uncertainties and variability associated with the GHG reduction potential of biofuels are discussed in detail in NRC (2011). The values for GHG emissions used in this study were a modified version of those developed by EPA for the RFS2 final regulations. The difference was the treatment of emissions attributable to indirect land-use change (ILUC). The EPA analysis distributes the GHG emissions from ILUC over a 30-year period. For the analysis in this report, all emissions contributed by ILUC were attributed to the first year’s operation of the biofuel conversion facility rather than spread over 30 years. This alternate ILUC treatment and its impact on annual biofuel GHG emissions are discussed in detail in Appendix G.5. These predicted GHG emissions do not include the use of CCS in the production facility to reduce overall well-to-wheels GHG emissions. Applying CCS to a biofuel production facility can potentially provide slightly negative well-to-wheels GHG emissions (NAS-NAE-NRC, 2009a).

3.3 ELECTRICITY AS A FUEL FOR LIGHT-DUTY VEHICLES

In the United States, electricity is widely available, plentiful, and relatively inexpensive. It already is used as fuel for some LDVs available on the general market, including PHEVs (e.g., the Chevrolet Volt) and BEVs (e.g., the Nissan Leaf). Further, electric-power vehicles are in wide use in commercial applications such as in warehouses and factories.

Table 3.6 shows the 2010 capability of the U.S. electricity system (EIA, 2011a). The capacity factor measures the ability of a power source to produce power and reflects both availability to produce power and whether or not the plant is dispatched. Capacity factor is estimated as the annual electricity production for each source divided by the power production it would have achieved when operating at its net summer capacity 24 hours per day for the entire year. Power dispatch is affected by the price of the source relative to other competing sources because lower-priced sources are dispatched preferentially.

TABLE 3.6 Capability of the U.S. Electricity System in 2010

| Source | Net Summer Capacity (GW) | Electricity Production (thousand GWh) | Capacity Factor | ||||||

| Coal | 318.1 | 1,879.9 | 0.67 | ||||||

| Oil and natural gas steam | 113.5 | 123.9 | 0.13 | ||||||

| Natural gas combined cycle | 198.2 | 733.8 | 0.42 | ||||||

| Diesel/conventional combustion turbine | 138.6 | 51.0. | 0.11 | ||||||

| Nuclear | 101.1 | 802.9 | 0.90 | ||||||

| Pumped storage | 21.8. | –0.2 | –0.001 | ||||||

| Renewables | 123.0 | 371.6 | 0.35 | ||||||

| Total | 1,014.4 | 3,962.8 | 0.45 | ||||||

The average U.S. retail price for electricity is about $0.10/kWh with substantial variation across the country because of the time of use, local generation mix, and various incentives or taxes. In general, electricity produced by hydro power costs the least, followed closely by coal, nuclear, and natural gas. Electricity generation from natural gas is expanding rapidly for the following reasons:

- The cost of natural gas generation strongly depends on the cost of fuel. Currently the cost of natural gas is low ($2.5 to $3.5/million Btu) and could remain low for a decade or more.

- CO2 emissions per unit of power generated by natural gas are about half of the CO2 emissions per unit of power generated by coal.

- Emissions of sulfur oxides (SOx), nitrogen oxides (NOx) and other toxic air pollutants from natural gas are much lower than the emissions from coal.

Gas turbines are well suited to provide backup power for intermittent renewable energy generation sources, such as wind and solar, because they can be ramped up relatively quickly. Because of this characteristic, the share of electricity generation from natural gas tends to increase as renewable energy increases. The generation of electricity produces GHG emissions, mainly CO2. In 2010, total GHG emissions from electric power as reported in the AEO 2011 were 2.3 billion metric tons CO2e (EIA, 2011a). There are additional emissions further upstream in the process, for example, in mining coal, producing natural gas, transporting fuels to the power plant, and building solar panels, wind turbines, and power plants. These upstream emissions can be added to the combustion emissions to estimate the total life-cycle emission of any process, including electricity generation. Life-cycle emissions are considered in this report’s analyses of GHG emissions.

The capability (and demand) for electricity generation in the United States is expected to grow slowly from the present to 2050. For the purposes of this study, two cases in the

AEO 2011 (EIA, 2011a) were examined: the 2011 reference case and the GHG price case (hereafter referred to as the low-GHG case). The low-GHG case is based on a steadily escalating carbon tax beginning at $25/metric ton of CO2e in 2013 and escalating at 5 percent per year, reaching $152/metric ton in 2050. The National Energy Modeling System (NEMS) is used by EIA to produce the AEO projections up to 2035. Therefore, the reference and low-GHG cases had to be extrapolated to 2050. For the low-GHG case, the total GHG emissions, power output, and cost data were extrapolated to 2050 using the years 2031 to 2035 to better capture the accelerating effects of the carbon tax increase in shifting the mix of generation sources. For the reference case, data from the period 2020 to 2035 were used because the mix of generation sources does not change much.

The low-GHG case shows that the annual GHG emissions in 2050 are reduced from the reference-case emissions by more than the desired 80 percent; however, this result does not account for the life-cycle emission effects in the electricity-generating sector because in the AEO analyses some of the emissions are attributed to other sectors. To compare fuels used in transportation on a consistent basis, the additional upstream generation of GHG emissions for combusted fuels will have to be included to account for the life-cycle emissions for non-combusted fuels, for example, renewables and nuclear.

For coal and natural gas, the upstream emission factors in the Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation Model (GREET model; Argonne National Laboratory) were used to calculate the total lifecycle emissions.

The AEO 2011 estimated GHG emissions from coal combustion to be 0.9552 kg CO2e/kWh.18 For coal, the upstream emissions embedded in the GREET model are 3.74 kg CO2e/GJ. Using a conversion factor of 1.055 GJ per million Btu and assuming a heat rate of 10,000 Btu/kWh for the conversion of coal to electricity, the upstream emissions are 0.04 kg CO2e/kWh. Accounting for transmission line losses of 7 percent, the correction from both upstream and transmission line losses is an additional 0.042 kg CO2e/kWh, making the total emissions for coal-fired electricity 1.0 kg CO2e/kWh.

The existing value for natural gas combustion emissions in the AEO model is 0.433 kg CO2e/kWh.19 The upstream GHG emissions for natural gas in the GREET model are 13.4 kg CO2e/GJ. The heat rate used in AEO 2011 for converting natural gas to electricity is 8,160 Btu/kWh. Using this as a conversion factor, the upstream emissions of natural gas are 0.115 kg CO2e/kWh. Correcting for transmission line losses of 7 percent makes the total correction 0.123 kg CO2e/kWh, and the total GHG emissions for natural gas are 0.556 kg CO2e/kWh.

There are no GHG emissions assumed in the AEO cases for nuclear and renewable electricity. The life-cycle emissions for nuclear and renewable energy sources were assumed to be 0.02 kg CO2e/kWh, based on the values used in the NRC report America’s Energy Future. Technology and Transformation (NAS-NAE-NRC, 2009a). Table 3.7 summarizes the results for GHG emissions from fuels.

In addition to extending beyond the AEO’s 2035 projections, the current study had to verify that the low-GHG case still gives the desired result of about an 80 percent reduction in GHG emissions by 2050 after all emissions in the life cycle are accounted for. The fraction of electricity generated by each fuel was estimated by extrapolating the 2035 AEO results to 2050. Because the changes in the fuel mix were accelerating in the latter period of the EIA case, 2031-2035, the rate in that period was used as a reasonable basis from which to extrapolate. The result is shown in Table 3.8, which indicates that the GHG emissions are still reduced by more than 80 percent in 2050.

TABLE 3.7 2010 Electricity-Generation GHG Emissions by Source

| Source | Combustion Emissions (kg CO2e/kWh) | Upstream Emissions (kg CO2e/kWh) | Life-Cycle Emissions (kg CO2e/kWh) | ||||||

| Coal | 0.9552 | 0.042 | 1.0 | ||||||

| Natural gas | 0.433 | 0.123 | 0.556 | ||||||

| Nuclear | 0 | 0.02 | 0.02 | ||||||

| Hydro | 0 | ||||||||

| Renewables | 0 | 0.02 | 0.02 | ||||||

SOURCE: EIA (2011a).

TABLE 3.8 Key Parameters of the AEO Base Case and Low-GHG Case

| Parameter | 2010 | 2020 | 2035 | 2050 | |||||

| AEO base-case cost ($/kWh) | 9.6 | 8.8 | 9.2 | 9.4 | |||||

| AEO low-GHG case cost ($/kWh) | 9.6 | 11.2 | 12.7 | 14.8 | |||||

| Carbon tax ($/metric ton CO2e) | 0 | 35 | 73 | 152 | |||||

| AEO base-case output (billions kWh) | 3,963 | 4,158 | 4,633 | 5,140 | |||||

| AEO low-GHG case output (billions kWh) | 3,963 | 3,823 | 3,976 | 4,190 | |||||

| AEO base-case GHG emissions (kg CO2e/kWh) | 0.586 | 0.535 | 0.545 | 0.541 | |||||

| AEO low-case GHG emissions (kg CO2e/kWh) | 0.586 | 0.412 | 0.256 | 0.111 | |||||

_______________________

3.3.3 Grid Impact of Plug-in Electric Vehicles

Neither of the AEO grid models account for the additional load if a large number of electric-powered vehicles are added. To assess the importance of this effect, the energy demand in 2020, 2035, and 2050 was estimated (Table 3.9).

The electricity generation projection in the low-GHG case is the comparison standard because the grid capacity is lower than that in the reference case. The result of this comparison shows that the additional load from PEVs in 2020 and 2035 is a small fraction of the projected total electricity usage and probably well within the uncertainty in the projections. Between 2035 and 2050, the power demand for PEVs is assumed to rise quickly. By 2050, it is assumed to reach 7 percent of the projected power usage and has a growth rate of about 0.5 percent per year. This load increase is well within the historic growth of the grid, which has been as high as 7 percent per year in the mid-1980s, and even the growth rate of 1 to 2 percent per year that has been true over the past 10 years in the United States. However, the low-GHG case projects load growth of less than 0.1 percent a year in the absence of BEV demand. Further, adding plants to the grid is a time-consuming process, and construction of a new plant can take a few years to a decade or more. Therefore, if the low-GHG case is an accurate projection of electricity usage, additional capacity has to be planned, permitted, funded, and constructed at a more rapid pace than projected for the next 20 years as large numbers of PEVs come into service (Table 3.10). If these additional plants cannot be brought online quickly enough, then the growth of PEV use may be restrained or the low GHG emissions may not be achieved as older plants with higher emissions may be required to be kept in service. New plant demand can be reduced to the degree that load shifting to off peak can be used. The amount of this reduction is not well defined.

There are also temporal and local effects on power demand from PEV charging. If owners charge their PEVs during times that the grid is highly used (e.g., during peak load periods), there could be problems with supplying enough electricity. For instance, if most PEVs are returned to their home base late in the afternoon with depleted batteries and are plugged in to charge, this load will be superimposed on the grid at a time when the daily load is already highest. This is especially true in the summer and winter seasons because of air conditioning and heating demands. It also may be desirable to move the load off peak to reduce GHG emissions because when peak loads are high, the oldest and likely dirtiest sources of power will be forced into service. They would not be used when power demands are well below the peak. Based on the estimates above, the peak loading issue until 2035 is unlikely to be a problem overall. But as the LDV charging load on the grid grows, the peak loading becomes of greater concern. However, studies have shown that practical, effective means are available to move the load to alternate charging times (e.g., late at night when other loads are low). One method that utilities are considering using to change consumer behavior is time-of-use (TOU) pricing, which would charge consumers lower rates during off-peak hours (generally between 11 p.m. and 5 a.m.). However, studies show that more comprehensive, integrated, and intrusive load management approaches based on the wide use of smart grid technology can be even more effective than incentives such as TOU pricing in reducing the peak load.

TABLE 3.9 Electric Vehicle Energy Demand Compared to Low-GHG Case

| 2030 | 2035 | 2050 | |||||||

| AEO low-GHG output (billion kWh) | 3,823 | 3,976 | 4,190 | ||||||

| Electric vehicle energy demand (billion kWh) | 3.4 | 72 | 286 | ||||||

| Electric vehicle energy demand (percent of output) | 0.1 | 1.8 | 6.8 | ||||||

NOTE: The demand for electric vehicles was estimated assuming 13,000 miles as the base. The number of miles driven for each vehicle was taken from Elgowainy et al. (2009). The assumed number and mix of vehicles used to estimate the charging load are shown in Table 3.10. The number of vehicles, number of miles, and fraction of the fleet are not predictions by the committee, but were selected to be conservative (high) to illustrate the impact of the charging demand on the grid. For all vehicles the energy consumption is 0.286 kWh/mi.

TABLE 3.10 Assumed Number of Electric Vehicles in Fleet

| 2020 | 2035 | 2050 | |||||||

| Total electric vehicles | 2 million | 30 million | 100 million | ||||||

| Fraction PHEV10 | 0.4 | 0.1 | 0 | ||||||

| Fraction PHEV40 | 0.4 | 0.5 | 0.3 | ||||||

| Fraction BEVs | 0.2 | 0.4 | 0.7 | ||||||

NOTE: BEV, battery electric vehicle; PHEV, plug-in hybrid electric vehicle.

The present power grid has an estimated capability to handle a large fraction of the nationwide LDV fleet simply by taking advantage of the excess capacity in off-peak hours at night (PNNL, 2007). However, that estimate represents a nationwide average, and excess capacity varies throughout the country. For example, while Texas could provide energy for 73 percent of its LDV fleet, the California and Nevada area only could recharge 15 percent of its local fleet with off-peak power. This rate could be problematic given the large number of vehicles present in this region. With larger penetration of PEVs over the coming decade (about 25 percent), it has been suggested that there will be significant strain in regions such as California if the grid does not adapt (Guo et al., 2010).

The local distribution grids of each utility could also be affected by a significant deployment of PEVs (or even by a small number of PEVs if they are concentrated in a small area served by a small number of local transformers). The most likely upgrade required by the addition of PEVs is the replacement of transformers. A study by the Elec-

tric Power Research Institute and the Natural Resources Defense Council (EPRI and NRDC, 2007) and discussions by the committee with Pacific Gas and Electric Company (Takemasa, 2011) and previous discussions with Southern California Edison (Cromie and Graham, 2009) indicate that the local grid effects are manageable and within the utilities’ normal cost of doing business. See Appendix G, Section G.2, for more discussion and an estimate of the investment cost.

There are four potential major sources of investment costs beyond the cost of the electricity itself:

- Charging stations to transfer energy from the electric distribution system to the PEVs;

- Necessary upgrades to the transmission and distribution system uniquely associated with charging PEVs;

- Additional generation capacity needed to provide fuel for large numbers of PEVs; and

- Conversion of the electric power system to realize approximately 80 percent lower annual GHG emissions.

These investment costs are estimated in Appendix G.6. The results are summarized in the following sections.

3.3.4.1 Charging Station Costs

Three types of charging stations are available. Level 1 charging stations use normal 110 V circuits and provide AC power to the vehicle. They are relatively low power and require typical charging times of over 20 hours for a 24 kWh battery. Level 2 charging stations provide AC power via a 240 V circuit (typically used today for electric clothes dryers and electric stoves). Because energy flow goes as the square of the voltage, level 2 charging stations will cut the charging time by a factor of about four. So for today’s batteries, the charging time will decrease to a few hours. Level 3 charging stations convert AC line voltage and provide high-voltage DC to the vehicle. DC stations are not suitable for home use, and DC will likely be provided at charging stations analogous to gas stations. Level 3 charging stations now can charge a typical battery of an electric vehicle to 80 percent of capacity—the recommended maximum level to avoid damage and hence reduction in battery life—in 15 to 30 minutes. Preliminary data available to date suggests there will be very limited use of DC fast chargers and that the price of charging will be significantly higher than charging at home using a level 1 or level 2 charging station.

The bulk of the charging station investment cost will be borne by the electric-vehicle owner. Longer electric-only driving distances require larger batteries and more powerful charging stations, and so the investment cost is a function of the type of electric vehicle. Appendix G.6 estimates these costs per vehicle for a wide range of electric-vehicle types, assumes appropriate charging station mixes for both home and commercial installations, and includes the reference and low-GHG grid cases to 2050. Current costs for charging stations per vehicle range from about $800 for a PHEV10 to about $4,200 for a BEV. By 2050 the investment costs per vehicle will have dropped from about $450 for a PHEV10 to about $1,950 for a BEV. Appendix G.6 also converts these costs to $/gge per day for comparison with other fuels. These costs do not include a cost for a parking space for access to charging. The parking space for access to charging is a significant additional barrier as the EIA Residential Energy Consumption Survey (2009) reported that 52 percent of households cannot park a car within 20 feet of an electrical outlet.

3.3.4.2 Costs of Additions and Changes to the Transmission and Distribution System

The upgrade costs for high-voltage transmission are included in the next two sections. The investment costs for the distribution system are considered to be relatively small and manageable by the local utilities. They likely will be included in the price of the electricity. Therefore, no additional capital costs are included.

3.3.4.3 Cost of Additional Generation Needed for Large Numbers of PEVs

The additional energy demand from 100 million PEVs in 2050 is estimated to be about 286 billion kWh. Meeting that additional demand by new plants will require the addition of the equivalent of about 90 1,000-MWe plants at a cost of about $360 billion for new generating capacity and a total of over $400 billion, including the associated high-voltage transmission system additions.

3.3.4.4 Cost of Conversion of the Power System to 80 Percent Lower Annual GHG Emissions

Beyond the addition of new capacity to provide fuel for PEVs, a large additional investment would be required to reduce the annual GHG emissions from the entire U.S. power system by about 80 percent by 2050. This investment cost is estimated to be about $1 trillion. This cost is required to decarbonize the power sector and is not attributable solely to the LDV sector.

3.3.5 Regional and Local Effects

Regional and local effects for electricity-fueled LDVs influence the method of rolling out the charging infrastructure and changes in distribution system. They also affect the attractiveness of electricity as a fuel because of the

pricing and GHG emissions of the local grid and because of dominant local use of vehicles versus electric-vehicle characteristics.

The rollout of a robust charging infrastructure is coupled to robust sales and use of PEVs, especially BEVs as opposed to PHEVs, because PHEVs can make use of liquid fuel if electricity charging is unavailable. Automobile manufacturers offering BEVs and PHEVs reported to the committee that they have found most sales to date occurring in urban areas with high income levels and a high proportion of people who are more environmentally minded (Diamond, 2010). Thus, the logical basis for expansion of the use of PEVs and the associated charging infrastructure is to proceed in urban areas in which vehicle and charging infrastructure builds rapidly and achieves the needed critical density. As time goes on, these centers are likely to expand and connect along major transportation corridors to provide power to the large number of BEVs needed to substantially reduce petroleum use and GHG emissions. Government support should follow this natural growth pattern and concentrate initial resources in limited areas rather than supporting a broad use of BEVs and expanded charging networks at many locations. Once the process is successful in one “center,” the support there can be phased out and moved to another fertile area (Electrification Coalition, 2009).

Although the U.S. power grid is interconnected, the flow of electricity from all sources to all loads is not perfect. In effect, the country is divided up into a number of regional networks that, while strongly connected internally, have weaker ties to one another. As a result, there are significant regional and even state-to-state differences in pricing and GHG emissions. Electricity as a fuel costs less than gasoline, but customers in areas with higher electricity prices realize smaller fuel-cost savings. Some regional networks with relatively low electricity prices may emit significantly more GHG emissions than others with higher electricity prices (Anair and Mahmassani, 2012). GHG emissions may also be a function of available margin and peak loading on the local grid. Even if the base-load power generation has low GHG emissions, the older and dirtier power sources will be dispatched as the load rises. Thus, the GHG emission characteristics of the local grid might also affect the attractiveness of PEVs to buyers with strong environmental concerns.

The dominant use of the vehicle interacts with the characteristics of the PEVs, and this is likely to vary regionally. BEVs are used primarily as short-commute passenger vehicles and in fleets as vehicles for light hauling, or for relatively short-distance services. Those uses match the BEV’s battery capability and charging time requirements and suggest that BEVs initially, and perhaps permanently, will be concentrated in urban locations. BEVs will not be in wide use in rural areas with longer drives and more widely separated charging locations.

The electrical safety considerations in providing electricity to the vehicle are generally well in hand. For both residential and business charging, the voltages and power levels are well within the state of practice, and safety provisions are well understood and codified. One of the costs associated with charging station installation is that it must meet the requirements of the national and local electrical codes, which means that it will most likely have to be installed by a licensed electrician and inspected and permitted by the appropriate governmental agency. For DC fast chargers used as public chargers, very high power connections between the charger and the vehicle must be made, and additional care is warranted. There are standards in use now for DC charging stations that fall under the formal jurisdiction and requirements of the national, state, and local electrical codes.

There do not appear to be technical barriers in the electrical system upstream of the vehicle. There are, however, several potential financial and societal barriers:

- The investment cost for the charging infrastructure is borne largely by the vehicle owners.

- The capital cost for the full implementation of the needed changes to achieve a low-GHG-emitting electrical power system is large.

- Coordinating the needed investments and infrastructure work will require overcoming the complexity of the power system’s unique ownership, management, and regulatory situation. The electric power system is regulated by a large number of local, state, regional, and federal entities. In most cases, the investors and owners of the transmission and distribution infrastructure are not the same as the investors and owners of the generating sources. Further, in some cases no benefits may accrue to some of those that have to make investments, such as states that have neither the loads nor the generation sources, but must support transmission lines between adjacent states that have loads and sources.

- Permitting and construction of new power system assets are very time consuming. Large power plant projects and large transmission and distribution system projects can take several years to over a decade to complete.

Finding: For electricity as a fuel for LDVs to be effective in reducing net GHG emissions, the entire U.S. electric power system has to shift largely to electricity production from sources that emit low GHG emissions (for example, nuclear, renewables, and natural gas with or without CCS).

3.4.1 The Attraction of Hydrogen

When hydrogen is used as a fuel in fuel cell electric vehicles (FCEVs), the only vehicle emission is water. When hydrogen is used in an internal combustion engine, the emissions are water, some nitrogen oxides, and some trace chemicals mostly as a result of using lubricants. Although CO2 emissions are absent from vehicle emissions when hydrogen is used as an LDV fuel, varying amounts of GHGs are emitted during hydrogen production. The amount depends on the primary fuel source and the technology used for hydrogen production. Most of the hydrogen on Earth is found in either water or hydrocarbons such as coal, oil, natural gas, and biomass. Because of the diverse primary sources for hydrogen, an amount of hydrogen large enough to fuel the entire LDV fleet could be made with only domestic sources. Different process technologies can be used with different primary sources to make a pathway for delivering hydrogen to consumers at different costs and with varying amounts of GHG emissions. The diversity of supply sources and production technologies is an advantage of hydrogen fuel.

For more than 10 years, there have been serious efforts in the United States, Europe, and Japan to develop FCEVs and the needed production and delivery technologies to supply hydrogen. As Chapter 2 indicates, there has been considerable success in developing FCEVs, but some challenges remain. There also has been considerable success in developing production, distribution, and dispensing technologies for making and delivering low-cost hydrogen, but major challenges still exist. The two major challenge areas are the following:

- Making low-cost hydrogen with low GHG emissions. At present, the lowest-cost methods for hydrogen production used by industry are based on fossil fuels and have associated GHG emissions of varying amounts. The low-GHG methods are currently more expensive and need further development to become competitive.

- Building the hydrogen infrastructure will be a large, complex, and expensive undertaking. Hydrogen-fueling stations would have to be available before FCEVs can be sold. Until a large number of FCEVs are in use, the cost of hydrogen as a fuel will be high. Because FCEVs are new and hydrogen as a consumer fuel is new, there are many practical concerns such as safety, codes and standards, permitting, and zoning issues that need to be addressed before growth can flourish.

3.4.3 Current Status of the Market

Hydrogen as an industrial commodity is produced in large quantities in the United States and in many other countries. The amount of hydrogen produced is over 50 million tons per year worldwide (Raman, 2004; IEA, 2007) and over 10 million tons per year in the United States (EIA, 2008b). Most of the hydrogen is used in the chemical processing industry and in refining crude oil, and most of it is produced in large facilities closely associated with the end use. Over 95 percent of U.S. hydrogen is made from natural gas, with other sources including refinery off-gases, coal, and water electrolysis. Several hydrogen pipeline systems (Houston, Los Angeles, and Chicago) exist to move large quantities of gaseous hydrogen between nearby industrial users with over 1,200 miles of hydrogen pipelines. Some established industrial gas companies produce, store, and distribute hydrogen as either a gas or a cryogenic liquid to smaller users by truck. The demand for hydrogen for industrial use has increased consistently for several decades.

Even as the infrastructure for producing, delivering, and using large amounts of hydrogen for this industrial market is well developed, the infrastructure for producing, delivering, and dispensing hydrogen for use as a transportation fuel has yet to be developed. For illustrative purposes, if hydrogen were to be used as a transportation fuel, then the current U.S. production level of 10 million tons per year would be enough to fuel about 45 million cars (at 60 mpgge and 12,000 mi/yr). There is, however, little spare capacity in the existing system for this new market. Therefore, a new hydrogen infrastructure is needed before large numbers of FCEVs are produced. This infrastructure will need to be much different from the existing one because it has to focus on wide distribution of small amounts if distributed through retail outlets, similar to what is done for gasoline today.

Academic, industrial, and government efforts over the past 10 years to define this retail-fuel-oriented infrastructure have mapped out the needed technology improvements, established performance criteria for different parts of the infrastructure, estimated the cost of hydrogen and the infrastructure over time, and suggested possible implementation methods. The NRC report Transitions to Alternative Transportation Technologies—A Focus on Hydrogen (NRC, 2008) contains an analysis of the technical needs, costs, petroleum savings and GHG emission savings possible by moving towards a hydrogen-fuel infrastructure.

3.4.4 Hydrogen Infrastructure Definition

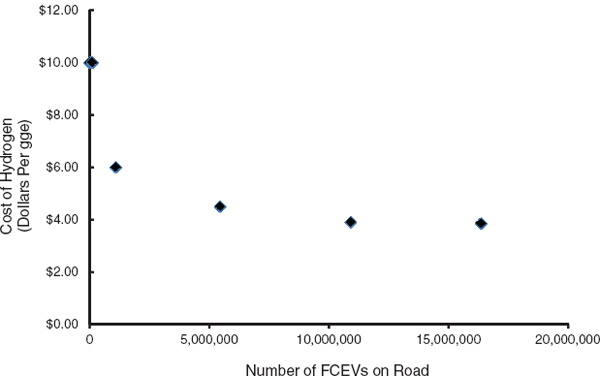

Rather than being built throughout the entire United States before FCEVs are available, a hydrogen infrastructure likely will first be started in a few markets. Then the infrastructure will be built up in conjunction with increasing local FCEV sales. The concentration of demand will result in a decrease in the high initial cost of hydrogen and the infrastructure as

equipment for commercial-scale production is installed and used at commercial rates. This process will then be repeated in additional markets until a critical mass of FCEVs and hydrogen stations is built to a market-sustainable level.

The first hydrogen stations are likely to be supplied by truck delivery from local hydrogen-distribution points. This is a high-cost method that may be largely replaced by hydrogen stations with on-site hydrogen generation capabilities where the hydrogen is made at the retail station rather than supplied from the large plants that now supply the bulk of hydrogen. This approach precludes the need to transport or deliver hydrogen, and the distributed hydrogen generation equipment can be sized for the demand. Several technologies are available for the small hydrogen generators, including natural-gas reforming, water electrolysis, and biofuel reforming.

- Small natural-gas reforming—The process is the same as that used in today’s large natural-gas reforming facilities. However, the reforming apparatus for fuel is small and packaged such that it looks like a large appliance. These reformers have been demonstrated at a number of hydrogen-fueling stations in the United States, Europe, and Japan. CO2 produced in the process is released to the atmosphere because capturing it is difficult.

- Small water electrolysis—Commercial alkaline water electrolysis units are available and have been demonstrated in small hydrogen stations. GHG releases are associated with the source of electricity and can be high or low depending on how the electricity is produced.

- Small biofuel reforming—Ethanol reforming and other biofuel reforming have been demonstrated in laboratories, but research and development (R&D) is still needed to increase hydrogen yields and lower costs to be competitive with small natural-gas reformers and small water-electrolysis methods. GHG releases can be low depending on the source of the biofuel.