4

Consumer Attitudes and Barriers

The preceding chapters demonstrate that there is great potential for new generations of advanced-technology vehicles, fuels, and fueling infrastructure to advance the nation toward the twin goals of significantly reducing greenhouse gas (GHG) emissions and petroleum use from the light-duty vehicle (LDV) fleet by 2050. But technological advances alone are insufficient to promote success. Consumers must embrace the new designs and new fueling systems discussed in Chapters 2 and 3, or LDVs and fuels will never achieve the market penetration rates necessary for successful achievement of the petroleum and GHG reduction goals of this study. While highly efficient internal combustion engine vehicles (ICEVs) and “drop-in” biofuels would differ little in most characteristics that consumers consider (other than cost), alternative-fuel vehicles (AFVs) operating on electricity or hydrogen will appear very different to consumers. Given that most of these vehicles will come with a so-called technology premium that, initially at least, will make them more expensive than the vehicles they will seek to replace, winning consumer acceptance will be challenging, likely requiring substantial policy intervention.

Consumer purchasing patterns have been studied for decades. Although many vehicle attributes influence car-purchasing decisions (Box 4.1), the common conclusion is that buyers’ economic concerns are one of the primary drivers of almost all transactions (Caulfield et al., 2010; Egbue and Long, 2012): money talks; most of the rest is window dressing. Thus, when dealing with the task of selling vehicles whose primary purpose is to help reduce petroleum consumption and the related environmental impacts, appeals to consumers’ environmental and social sensibilities are not likely to move much metal after the thirst of the relatively small groups of innovators and early adopters is satiated.

Attracting members of these two groups, part of a hierarchy established by Everett Rogers in his seminal Diffusions of Innovations (Rogers, 1962), is critical, however. Rogers (2003) estimated that they collectively make up just 16 percent of the consumer base, but their acceptance or rejection of innovations guides the remaining consumer groups. They set the stage by removing uncertainty about new products, policies, or technologies and by establishing a level of peer acceptability that makes more risk-adverse consumers comfortable with accepting them as well.

The initial group, the innovators, is the smallest, estimated by Rogers at just 2.5 percent of the consumer base. Their role is to launch new ideas, products, and technologies. They typically are younger and more financially sound than the general population and are characterized by a desire to be first to possess or use something new and different in the market. They are willing to take risks and can use their financial well-being to soften the impact of the occasional failed venture. Early adopters are the next group to adopt an innovation. They constitute approximately 13.5 percent of the consumer base. The group includes a high percentage of opinion leaders, but

BOX 4.1

Attributes that Could Affect Car-Purchasing Decisions

CO2emissions

Comfort

Ease of fueling

Fuel consumption

Initial and operating costs

Performance or power

Reliability

Safety

Size of car or internal and cargo space

Style or appearance or image

Travel range

_______________________

NOTE: The attributes are listed in alphabetical order.

its members are less risk-averse than the general population and more selective than innovators in their enthusiasm for innovations to adopt. Like innovators, they tend to be younger and have higher income levels and social status than other consumers. Early adopters tend to be opinion leaders in their communities and are in the group most looked-to by other consumers for validation of or information about new things. In the automotive arena, Deloitte Development LLC (2010) characterized early adopters for one combination of alternative vehicle and fuel technologies—the battery electric vehicle—as young individuals with annual household incomes of $200,000 or more who consider themselves to be environmentally sensitive and politically involved.

Not all innovators and early adopters will embrace the same products, ideas, or technologies, so technology and policy developers cannot count on the groups as a monolithic 16 percent of the market. Still policy makers and the private auto and fuel industry companies must work together in pursuit of the nation’s GHG and petroleum-use reduction goals. They must be able to attract the interest of a significant portion of these two groups to make inroads with the general consumer base, which Rogers further divided into the early and late majority adopters, each constituting an estimated 34 percent of the consumer base, and the laggards, or last to adopt, constituting the remaining 16 percent of consumers. Rogers determined that innovations achieve peak market penetration with the early majority adopters.

Each of the various groups can be further subdivided into smaller market categories defined by factors such as age, gender, geography, income, social status, and political leanings. Thus, the automotive innovator group might include dedicated environmentalists, older empty-nesters, and “first on the block” ego gratification seekers. The environmentalists would be willing to pay a premium and accept reduced travel range, cargo and passenger capacity, and limited refueling opportunities to acquire vehicles and/or use fuels that they believe would help reduce GHG emissions; the empty nesters might simply wish to free themselves of the expense of purchasing petroleum-based gasoline (and recognize that they no longer need a vehicle that can travel long distances); and the first-on-the-block innovators may simply be those whose egos are gratified by being seen as out in front of the pack in their vehicle choices and whose incomes can support their desires. The success of a new automotive and/or fuel technology or idea will require that the needs of such disparate subgroups be met.

Meeting the needs of all subgroups or selling these new automotive ideas to the early majority will not be easy. Increased utility and convenience cannot be counted on as selling points. The automobile became a successful new technology in the early 20th century because it demonstrated superiority to the horse- and ox-drawn vehicles it would replace. It offered greater speed, greater range, and greater utility than animal-drawn vehicles and promised the individual a new level of freedom of movement (Morris, 2007). With an engine that demanded combustible fuel, the auto also gave the oil industry a whole new market for its product.

If policy makers determine that AFVs are essential to meeting the nation’s oil and GHG reduction goals, then consumers will have to be asked to consider adopting another significant change in personal transportation, but it is one that—at least in the formative stages—means sacrifice, not improvement. The contemplated change is not replacing the horse-drawn buggy with a motorized carriage that can carry its own fuel for hundreds of miles and be refueled in minutes. Rather, it is the swapping of a sizeable portion of conventional, internal-combustion LDVs that run on liquid hydrocarbon fuels and the accompanying nationwide system of fueling stations for a variety of new vehicles and fuels that will require development of massive new production, distribution and retailing systems. In addition, many of these new AFVs use powertrains—such as plug-in hybrid electric (PHEV) systems—that typically cost more and offer no improvements other than increased fuel efficiency, reduced emissions, and, in the case of plug-in vehicles, cheaper fuel costs for the electricity used to charge the batteries. Battery electric vehicles (BEVs) offer less range, and along with PHEVs would require large GHG emissions reductions in the electricity production system to deliver meaningful net GHG reductions for the LDV sector. Some options, however, such as the drop-in biofuels described in Chapter 3, entail few if any customer acceptance challenges for the vehicles, which can still use internal combustion engines. In this case, the technology challenges are upstream in the fuel supply sector, with implications for the fuel costs experienced by LDV consumers.

This chapter examines demonstrated results and stated preference surveys, with stated preference surveys in the forefront because, as many of the vehicle and fuel types under consideration are not yet in the market, there has been little opportunity for researchers to conduct studies of demonstrated preferences. The preference surveys, particularly in environmental matters, have a certain level of bias engendered by respondents’ wish to appear environmentally responsible even if economic conditions rather than environmental beliefs ultimately determine their actions (Kotchen and Reiling, 2000), but the impact of such biases—which remains unquantifiable (Hensher, 2010)—does not materially affect their value in illustrating general trends over time.

There is no big mystery at work in the LDV-buying decision process. Consumers typically acquire things for a range of reasons. In the case of LDVs, research has shown that the bulk of purchases revolve around perceived need—to replace an aging vehicle, for instance. “Desires,” whether for a different color or body style, improved “infotainment” content, a more prestigious nameplate, or simply a newer model, still account for a significant minority of purchase decisions,

TABLE 4.1 Car-Buying Motivations, 2005 and 2011

| Motivation to Consider Buying New Car | April 2005 (%) | August 2011 (%) |

| Old car had high mileage | 34.3 | 25.7 |

| Old car needed frequent repairs | 17.3 | 14.3 |

| Needed additional vehicle for family | 18.0 | 11.9 |

| Needed vehicle with more room | 12.0 | 12.3 |

| Lease expired | 9.7 | 9.5 |

| Wanted new vehicle | 6.5 | 8.0 |

| Wanted better fuel economy | 21.9 | 16.7 |

| Not sure/other | 18.3 | 22.4 |

| Liked styling of new models | 16.3 | 12.3 |

| Wanted vehicle with better safety features | 14.6 | 11.5 |

| Financing deals/incentives too good to pass up | 13.8 | 11.7 |

| Significant other wanted new car | 17.6 | 16.1 |

| Wanted car with new infotainment equipment (navigation, DVD player, etc.) | 11.8 | 7.9 |

NOTE: Sum of totals exceeds 100 percent because respondents could provide multiple responses.

SOURCE: BIG Research, Consumer Intentions and Reactions, April 2005, August 2011, proprietary information prepared for the committee by request.

however. Table 4.1 shows surveys of retail consumers taken in two periods—2005 and 2011—representing different economic conditions.

A large number of LDVs are purchased each year for commercial and government fleets, and those purchases are not reflected in Table 4.1 or in Figure 4.1, both of which examine trends among retail consumers. Yet the fleet segment is one in which a substantial number of AFVs will be sold in the future per private and governmental policies encouraging greater use of highly fuel-efficient vehicles. It is too early to tell how those sales might affect the overall success of any particular AFV or alternative fuel.

As these surveys show, replacing a vehicle for reasons including high mileage (age), the frequency of repairs, expired leases, and/or the perceived need for a vehicle of a different size account for more than half the stated reasons for buying a new vehicle. Reasons stated as “wants” or desires rather than needs ran a close second. The need to acquire a new vehicle because the old one was wearing out remains a strong motivation but has diminished in importance among those who purchase their vehicles as vehicle reliability and quality have improved—providing for longer-lived cars and trucks in our garages. Lessees, of course, replace their vehicles more frequently, and typically for reasons other than age-related wear. But leasing accounts for just 20 percent of the new-vehicle market (Automotive News, 2012). The need or desire for a vehicle with better fuel economy, however, has concurrently increased in importance over the past few decades as primary motivation for new-car purchase. (Note: The decline in stated importance of fuel economy between 2005 and 2011 as shown in Table 4.1, is a result of the unusually high level of importance attached to fuel economy that was shown in the April 2005 BIG Research survey and was spurred by gasoline price increases at the time.) The trend of fuel efficiency rising in importance along with fuel prices

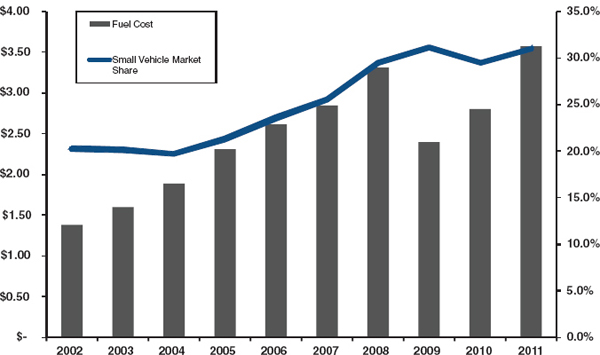

FIGURE 4.1 Small vehicle market share (retail sales only) and fuel cost (in 2011 dollars).

NOTE: Recession-driven sales of less-expensive models 4.1 helped Alt keep Vehicles. small-vehicle market share high despite fuel price declines in 2009 and 2010.

SOURCE: Data provided by Edmunds.com’s AutoObserver.com Data Center; chart prepared for committee by Edmunds.com.

continues: Consumer Reports magazine reported recently that in an April 2012 telephone survey of 1,702 adult consumers who were asked to state what they believed would be the most important factors in their next new-car purchase, 37 percent cited fuel economy as their top consideration (Consumer Reports, 2012). While altruistic reasons for purchasing a new vehicle—to help improve air quality, reduce oil use, cut GHG emissions, improve the environment—score highly in some special-interest group surveys (Consumer Reports, 2011b), in broader whole-market surveys that allow respondents to list their own reasons for purchase, they appear, at worst, to be not considered at all or, under the best of interpretations, to be secondary, hidden constituents of the more selfish, economics-driven stated reasons such as “wanted better fuel economy” or “wanted new vehicle.” A motivator not mentioned in the surveys cited but known to be a purchase driver of certain AFVs in the state of California is single-occupant access to high-occupancy vehicle (HOV) lanes, also called carpool lanes. Although most states that provide such lanes limit access to vehicles carrying at least two people, California currently permits drivers of most battery electric vehicles, some plug-in hybrids, and all fuel-cell electric vehicles to use the lanes even if there are no passengers in the vehicles when an authorized, state-issued access sticker is displayed. Access to HOV lanes in a state noted for its crowded rush-hour freeway traffic is believed to be an important selling point for those vehicles. Indeed, General Motors has released a television advertisement for its 2013 Volt PHEV that highlights the fact that a specially tuned version of the vehicle qualifies for HOV lane access in California.

Achieving a considerable reduction in LDV fleet GHG emissions and petroleum use through adoption of alternative fuels and powertrains is not likely to be accomplished by appealing to altruism. Once early adopters have made their choices, the remaining 84 percent of consumers are going to have to be persuaded either that the alternative fuels and vehicles offer them an improvement over their present preferences, or that there is a pretty immediate economic benefit to be had in making the switch. Environmental benefits simply do not appear to be a determinant for consumers in large purchases, such as motor vehicles. “Economic concerns are consumers’ priority,” researchers at the Mineta Transportation Institute have found (Nixon and Saphores, 2011, pp. 10-11).

Conventional wisdom holds that American consumers want big cars and trucks with large and powerful engines and that fuel economy just is not that important because gasoline and diesel prices in the United States are so much lower than in much of the rest of the world. Those attitudes certainly have shaped U.S. automakers’ marketing and product planning agendas for most of the time since World War II. As recently as April 2011, in an editorial in the influential trade journal Automotive News, publisher Keith Crain bluntly stated that while the auto industry has responded to rising gasoline prices and increased regulatory demand for better fuel economy with a number of cars that achieve an EPA highway-cycle rating of 40 mpg, “the trouble is, no one wants to buy them” (Crain, 2011). Gloria Bergquist, the Alliance for Automobile Manufacturers’ vice president for communications, repeatedly has pointed out that in 2010 a single pickup model—the Ford F150—outsold all 30 gas-electric hybrid cars and sport utility vehicles (SUV)s offered for sale in the United States by mainstream auto manufacturers (Harder, 2011). Those statements reflect consumer choices influenced at least in part by continued low pricing of gasoline. In the past year, however, sales of smaller cars with high fuel efficiency have increased as a percentage of the market, as have sales of larger cars, crossovers, and light-duty trucks that use smaller, more efficient engines to replace “gas guzzler” V6s and V8s (Drury, 2011). History, however, has shown that the march toward efficiency stops when fuel prices have stabilized or dropped after a run-up (see Figure 4.1).

Still, such attitudes may be generational. Most Americans under 40 have now been exposed to smaller vehicles, mainly from the import brands, and, as sales trends show, acceptance of compact cars in the U.S. market is growing. The recession of 2008-2009 and the continued economic slump that has followed certainly have influenced that growth, as have increasing fuel prices in recent years. However, there is evidence indicating that potential savings from fuel efficiency improvements is not a significant factor in consumers’ vehicle purchase choices, indicating that consumers are becoming inured to gasoline price increases because they inevitably have been followed by price decreases. (See details in Section 4.6 below.)

4.3 FACTORS IN CONSUMERS’ CHOICES

Numerous studies have attempted to quantify the needs and desires that drive LDV-purchase decision making. Their findings are fairly consistent and are exemplified by a recent stated-preference study by Capgemini (2010) that ranked the most important factors gathered from 2,600 online respondents in the United States, Europe, and Asia and found reliability, safety, vehicle price, fuel economy, and the variety and cost of options all in the top 10. Consumers who identified themselves as planning to purchase a new vehicle within the next 15 months were asked to rank the most important factors they would apply to their car-purchase decision making (see Table 4.2).

In addition,, respondents were asked about their interest in so-called green vehicles, and 72 percent of U.S. respondents (versus 57 percent overall) cited fuel economy as the number-one reason they would consider a fuel-efficient petroleum or alternative fuel car or truck. Only 13 percent

TABLE 4.2 Importance of Factors in Consumers’ Choice of Vehicle

| Factors in Consumer Choice | Percent Respondents Saying Important/Very Important | |

| Mature Markets | Developing Markets | |

| Brand reliability | 89 | 90 |

| Safety | 89 | 91 |

| Price | 86 | 85 |

| Fuel economy | 82 | 85 |

| Quality of exterior styling | 77 | 84 |

| Quality of interior styling | 77 | 85 |

| After-sales service | 71 | 83 |

| Vehicle availability (take it home versus wait for special order) | 71 | 82 |

| Extra options at no cost | 70 | 74 |

| Features and options | 66 | 79 |

| Low emissions | 64 | 75 |

| Financing at 0% or low % | 62 | 73 |

| Brand name | 55 | 80 |

| Cash-back incentive | 46 | 69 |

| Hybrid or other alternative fuel system | 36 | 66 |

SOURCE: Capgemini (2010).

Capgemini is not the only one finding that income tax credits, although currently the preferred federal policy for incentivizing AFV purchases via subsidies, may not be the best route to take. A number of studies prepared since hybrid-electric vehicles achieved sufficient market penetration to figure as a potentially valuable tool in the effort to reduce the nation’s GHG emissions and petroleum use have found that while subsidies work, those that directly place cash in the hands of the consumer are more effective than those—like income tax rebates—that require the consumer to pay the full price up front and wait until tax time for the subsidy payment (Gallagher et al., 2008; Diamond, 2008; Beresteanu et al., 2011).

In addition to providing immediate gratification, direct rebates, sales-tax credits, or other types of cash subsidies, including subsidies enabling the manufacturer to lower the retail price of the vehicle, would enable consumers to rationalize that the cost of the vehicle is less than its so-called sticker price. When applied to the amount being financed, such direct subsidies lower the monthly payment and can help a greater number of consumers qualify for loans to purchase new AFVs. Tax credits, in contrast, do not affect the qualifying terms or monthly payments for purchasers (although they may be used to lower monthly lease costs, as has been the case with the Chevrolet Volt PHEV and Nissan Leaf BEVs). One argument against tax credits such as the present “up to $7,500” federal credit on BEVS and some PHEVS (depending on battery size) is that they tend to reward higher-income consumers—who arguably are least needful of subsidies—and do not provide the full potential reward for consumers with lower incomes and thus lower tax liabilities.

Even in the aftermath of publicity about the possibility of future oil shortages and the need for increased national energy security, gasoline as a fuel is not seen by most car-buying consumers as a negative. Indeed, there is a consensus in consumer preference surveys that unless there is intervention through government policy, internal combustion engines powered by petroleum or a competitively priced drop-in biofuel (if such a fuel is commercialized) are likely to remain the predominant powertrain in LDVs in the United States for decades to come. A sampling of recent studies bears this out.

In its June 2011 report on AFV preferences, the Mineta Institute found that “in general, gasoline-fueled vehicles are still preferred over AFVs,” with 36 percent of the study’s respondents ranking conventional ICEVs as their first choice (Nixon and Saphores, 2011, p. 1). Hybrid-electric vehicles (HEVs) were second in popularity, with 26 percent of respondents identifying them as their first choice, followed by compressed natural gas vehicles (CNGs) at 13 percent, hydrogen fuel cell electric vehicles (FCEVs) at 18 percent, and BEVs at just 9 percent. The responses exceed 100 percent because each is the average of respondents’ choices in a variety of scenarios. A stated-preference survey of 3,000 consumers in the United States, Germany, and China, conducted in the first quarter of 2011 by Gartner, Inc. (Koslowski, 2011), presents similar findings, with 78 percent of respondents ranking gasoline-fueled vehicles as the type they “definitely” would consider for their next new-vehicle purchase, followed by HEVs, 40 percent; CNGVs, 22 percent; and BEVs, 21 percent. Respondents in the Gartner study were permitted to make more than one selection and FCEVs were not included in the choices. Although such surveys have value in indicating trends, they do not reflect present realities. Hybrid vehicles, for instance, still account for less than 3 percent of annual U.S. new-car sales more than 12 years after their introduction in the market. J.D. Power and Associates found in its most recent “green” vehicles study that its research into consumer attitudes over the years shows that “while

most consumers say they want to create a smaller personal carbon footprint … this consideration carries relatively low weight in the vehicle-purchase decision” (Humphries et al., 2010, p. 10).

Reasons for the strong preference for continued use of gasoline-powered vehicles appear to be based strongly on up-front cost—they are demonstrably less costly to purchase than alternatively fueled vehicles. The cost efficiencies realized by the tens of millions of internal combustion engines produced each year make petroleum-fueled cars and trucks far less expensive to purchase than any of the new crop of alternatively fueled/powered LDVs.

Convenience, especially the ready availability of fuel, is the second most-stated reason for preferring petroleum. The United States has a widespread gasoline service station network that serves even the smallest communities, and gasoline prices in the United States remain among the lowest in the world. Both factors make it incredibly convenient for consumers to continue purchasing and using gasoline-fueled vehicles. Perceived reliability of ICEVs versus alternative vehicles is another key factor, with some researchers finding that consumers believe conventional ICEVs are far more reliable than alternative vehicles (Synovate, 2011).

4.6 HOW CONSUMERS VALUE FUEL ECONOMY

Many consumers responding to attitudinal surveys say that they place fuel economy at or near the top of the list of factors they will consider when buying their next vehicle. But when it comes to applying potential fuel economy savings to the purchase decision, most research has shown that consumers just do not do it. So even though a case can be made for long-term fuel and maintenance savings making some AFVs less costly to own than gasoline vehicles over a period of years, a tendency by consumers to ignore such savings potential would make it more difficult for manufacturers and policy makers to persuade consumers to consider alternative fuels and vehicles with higher prices than conventional ICEVs. Researchers at the University of California, Davis, Institute for Transportation Studies, for instance, have found that consideration of a payback period for higher-priced AFVs “is not part of the vehicle purchase decision-making even in the most financially skilled households” (Turrentine and Kurani, 2007, p. 1220).

This tendency of consumers to fail to modify the up-front acquisition cost of AFVs by the long-term value of reduced fuel and other ownership costs (maintenance, repairs, and insurance chief among them) can be explained by applying behavioral economics’ principle of loss or risk aversion. In general, increasing a vehicle’s fuel economy through improved technology requires paying a higher initial cost. Future fuel savings, however, are uncertain due to the unpredictability of future fuel prices, the fact that the fuel economy consumers will achieve in actual use will differ from the government’s ratings, and potential variations in vehicle use, lifetime, and other factors. Given the uncertainty in future fuel savings it is reasonable for a consumer to be reluctant to pay more for higher fuel economy. One of the most well established findings of behavioral economics is that when faced with a risky bet, typical consumers count potential losses approximately twice as much as potential gains and exaggerate the probability of loss. This approach can result in an undervaluing of future fuel savings by half or more relative to what would otherwise be expected (Greene, 2010a). Other possible explanations have been proposed, including shortsightedness and the lack of information or the necessary skills to estimate future energy savings. There is not an established consensus on this subject, however, and the published literature contains evidence to support both views—that consumers accurately value and that they undervalue future fuel savings (Greene, 2010b). Anderson et al. (2011) found that consumers typically take no position and merely consider future fuel prices to be the same as today’s because they cannot accurately predict. Because the evidence for undervaluing appears to be stronger, the analyses and modeling in Chapter 5 assume that consumers behave as though they required a simple 3-year payback for an expenditure on higher fuel economy.

Overall, there is little doubt that a significant portion of consumers are interested in fuel efficiency. A variety of recent studies and surveys have shown that fuel economy is a top concern of 60 to 80 percent of prospective auto buyers (Consumer Reports, 2011a). Just how important, however, seems to depend on what it will cost the consumer to achieve a higher degree of efficiency. J.D. Power and Associates consumer research over the years has shown that “many may consider it, but when the time comes to put their money where their mouth is, very few follow up,” the research firm’s senior manager of global powertrain forecasting, Michael Omatoso, said in an interview (personal communication, M. Omatoso, Troy, Michigan, September30 2011). There have been a number of studies that include attempts to discern the premium consumers are willing to pay for AFVs, and they find it most typically is in the range of $1,600 to $2,000 (Boston Consulting Group, 2011; Deloitte Touche Tohmatsu Ltd. Global Manufacturing Industry Group, 2011). But as more AFVs come into the marketplace, the issue seems to remain a fertile field for future research.

There is interest in AFVs, but it is limited by a number of factors including a general unwillingness to abandon a fuel and powertrain combination that has shown itself to be quite effective in providing for consumers’ transportation needs over the decades, even if that effectiveness is not accompanied by the levels of environmental cleanliness necessary to achieve the nation’s present goals. In a 2010 survey of consumer adoption literature, researchers at the University of Wisconsin found broad agreement that there is consider-

able interest in AFVs if performance characteristics remain comparable to those of ICEVs (Guo et al., 2010). Now that there are some of these vehicles in the marketplace (most notably conventional hybrids, although at this writing there is one compressed natural gas passenger car, two BEVs, and one PHEV in the market, pricing for several more BEVs and PHEVs has been announced, and there are several test programs utilizing fuel-cell electric vehicles), it has become clear that initially these vehicles will cost more and in most cases provide a reduced user experience—based on range and fueling convenience issues—than conventional ICEVs. As a result, more recent studies have predicted relatively slow and low adoption rates for AFVs, typically—in the aggregate—below 20 percent of the U.S. market by 2025 (Humphries et al., 2010).

Although cost and convenience are the most-often cited reasons for anticipated low adoption rates, they are but are two of several significant barriers to AFV adoption cited when consumers are asked to list, or to pick from a prepared list, those things that most concern them about alternatively fueled vehicles (Table 4.3). All of these concerns must be addressed via public policy and/or manufacturers’ marketing efforts if the best fleet mixes necessary to meet the goals set out in the committee’s statement of task are determined—as indicated by the modeling results in Chapter 5—to be those requiring large numbers of AFVs. Such efforts will be needed to help overcome objections to vehicles that at least initially could offer less performance, range, utility, and fueling convenience and will cost consumers more to purchase than conventional ICEVs with advanced-technology gasoline powertrains that will not have the higher initial costs.

TABLE 4.3 Principal Barriers to Adoption of AFVs

| Reason That Could Influence Purchase Decision of an Alternative-fuel Vehicle | Percent Respondents in Each Study Citing Reason as a Concern | ||||||||

| Auto Techcast | Gauging Interesta | Green Autob | Minetac | ||||||

| Cost vs. comparable conventional vehicle | NA | 74 | 35 | 53 | |||||

| Fuel availability | NA | 75 | 32 | 55c | |||||

| Fuel cost | 30 | NA | 17 | 46 | |||||

| Payback period | 46 | 49 | 18 | NA | |||||

| Performance | 49 | 16 | |||||||

| Range (BEVs) | 43 | 75 | 12 | 49 | |||||

| Refueling/Recharging time/convenience | 38 | NA | NA | 55c | |||||

| Reliability | 26 | 57 | 17 | NAd | |||||

| Size/Seating capacity | 17 | 33 | NA | NA | |||||

aGauging Interest responses are from U.S. participants only.

bGreen Auto responses are only from consumers who said they would not purchase an AFV.

cMineta survey, by Nixon and Saphores, combines fuel availability and refueling time.

dNA = Not asked.

SOURCE: Data from Harris (2011); Ernst & Young (2010); J.D. Power (2011); Nixon and Saphores (2011).

In its recent “Drive Green” study (Humphries et al., 2010), J.D. Power and Associates set out to determine the perceived drawbacks to specific types of AFVs. Researchers found that while there are differences in degree and in rankings, the top reasons in all cases (HEVs, clean diesel, PHEVs, and BEVs [fuel-cell electric vehicles were not asked about]) were the so-called initial cost premium consumers attached to most AFVs and the perceived long-term cost of ownership (exclusive of the purchase price premium), which some respondents believed to be higher for an AFV than for a conventional ICEV.

In the case of BEVs and PHEVs, concerns about driving range on a single battery charge also ranked high. This should not be an issue with PHEVs because they can be driven using their gasoline engines or engine-generators and are not solely dependent on batteries, showing continuing consumer confusion about the differences among the advanced powertrain technologies.

Range also could be an issue with AFVs using compressed natural gas. The only factory-built model currently in the market is the Honda Civic Natural Gas. Its design retrofits the CNG fuel storage and delivery system into a vehicle designed for petroleum-based gasoline. The pressurized tanks needed for the CNG occupy much of the vehicle’s trunk area and even then hold only the usable equivalent of 7.5 gasoline gallons. While the CNG Civic attains almost the same EPA combined city-highway fuel economy rating as the gasoline model (32 mpg vs. 33 mpg), its smaller-capacity fuel tank limits its range to about 240 miles versus the gasoline Civic’s estimated range of 430 miles. However future CNGV are likely to be designed from the ground up and could better house larger fuel tanks, thus enabling them to deliver improved range.

The move to more efficient, lower-emission LDVs almost certainly means that cars and trucks, regardless of the fuel source or powertrains, will have to be lighter than they are today. Present and proposed federal Corporate Average Fuel Economy (CAFE) policy is devised to enable larger vehicles to continue to meet the standards and does not necessarily lead to downsizing of the fleet to go along with the lightweighting. But downsizing has occurred, principally for economic reasons stemming from the recession of 2008-2010 and subsequent slow economic recovery and prolonged period of high unemployment. While that raises concern among those who find that consumers today do not want to give up size for efficiency, it might not be as big an issue in the future. Sales of larger vehicles could begin climbing as the economy improves in the future. But as younger consumers who today are in the used-car market or still are too young to be car purchasers begin replacing Baby Boomers and Gen-Xers in the new-car market, there may be a generational shift toward a preference for smaller cars.

In the past decade, according to sales data from online automotive information provider Edmunds.com (see Figure 4.1), the U.S. market share for small cars—a category including compact and subcompact cars, vans, SUVs, and compact pickup trucks—has increased by 53 percent from 20.3 percent in 2002 to 31.1 percent in 2011 (Edmunds.com, 2011); at the same time, the average price of a gallon of regular-grade unleaded gasoline has increased by 88 percent when adjusted for inflation.

For decades, sales activity for small cars and trucks seemed to correspond closely to fluctuations in retail gasoline prices. But as Hughes et al. (2008) found in their study of gasoline price inelasticity, driver behavior triggered by increases in gasoline prices has changed considerably in the past decade. Price run-ups may no longer lead as rapidly as in the past to the behavior changes once commonly associated with periods of unusually high gas prices—driving less and buying smaller and more efficient vehicles are two examples. In addition, fleet fuel efficiency has increased in recent years, dampening the impact of rising gasoline prices. Small vehicles’ share of the LDV market keeps gradually increasing, but this could be a sign of increased general market acceptance as well as a reaction to several years of a weak national economy. It also could be related to the downsizing of aging Baby Boomers’ households and transportation needs.

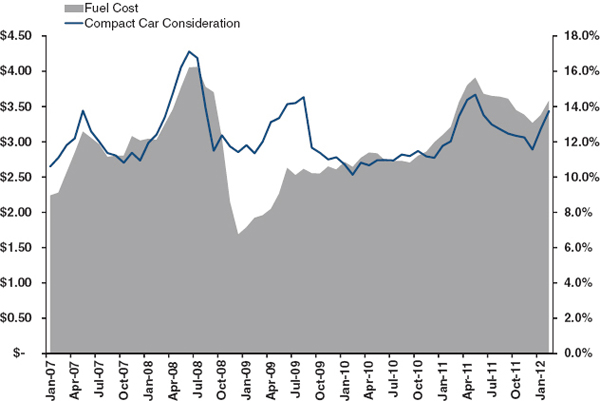

Both Edmunds.com and auto industry consulting firm AutoPacific, Inc. track consumer consideration of compact and subcompact vehicles. (Edmunds derives shopper consideration rates from details gleaned from consumer searches on its website—repeated, lengthy, and detailed research into a specific model equates to “consideration” of that specific vehicle type versus casual browsing; AutoPacific uses a bimonthly internal online consumer intent survey that asks approximately 1,000 respondents what types of LDVs they are considering for their next purchase.) Each recently compared small-car consideration rates to fluctuations in gasoline prices. Both indicate that while consideration rose sharply and in lockstep with price run-ups in the first half of 2007 and the last half of 2008, consumers may not be increasing their consideration of small cars at the same pace in the most recent series of gasoline price hikes, which began in September 2010 (Figure 4.2). That data and the previously mentioned small-vehicle sales versus fuel price data (see Figure 4.1) appear to further validate the results of Hughes et al. (2008), but also could mean that while fuel price still matters, price increases have to be very large in order to elicit significant movement toward smaller, more efficient vehicles. This would mean that policies based on only modest increases in fuel taxes or other fuel-efficiency related fees would be less likely to succeed than policies such as CAFE standards, or

FIGURE 4.2 Compact car consideration and fuel cost.

NOTE: “Normal” consideration level is in the range of 10 to 12 percent. Consideration spike in the period of February to September in 2009 corresponds to the U.S. “Cash for Clunkers” economic stimulus program in which consumers received funds to apply to the purchase of new, more efficient vehicles in return for junking older, less-efficient models.

SOURCE: Data provied by Edmunds.com Data Center; chart prepared for this report by Edmunds.com.

fee systems aimed at making the use of inefficient and/or high-emissions vehicles prohibitively expensive.

“People remember the gas (price) spike in 2008 and how a lot of people panicked and downsized their vehicles, only to see (gas) prices drop. So now they are taking a wait-and-see approach,” said market researcher George Peterson, president of AutoPacific (personal communication with G. Peterson, Troy, Michigan, August 25, 2011). He said the so-called tipping point at which consumers say they would change their new-vehicle buying goals and shop for more efficient vehicles has steadily increased and now is about $5.50 a gallon, up from $3 a gallon just a decade ago. Undoubtedly, the tipping point will continue to increase with economic recovery and improving fuel efficiency for ICEVs.

Advanced alternative fuels and powertrains are still rare and consumers have had very little real-world experience with them. Thus there’s little solid information available to help determine what consumers will accept in the way of alternatives to gasoline- and diesel-fueled vehicles.

In fact, there is some concern that this lack of knowledge has led to confusion in the marketplace about the characteristics, values, and drawbacks of the various types of AFVs and has caused some degree of consumer paralysis (Synovate, 2011). Researchers on both sides of the country, however, have found that word of mouth can be a powerfully influential tool, pointing to the potential value both of public demonstration and deployment programs and of public information campaigns. Axsen and Kurani argue that the mere presence of greater numbers of AFVs on the nation’s roads will increase both public awareness and public acceptance as the real-world experiences of many drivers are communicated to friends, neighbors, family members, and co-workers (Axsen, 2010; Axsen and Kurani, 2011). Zhang et al. (2011) found that positive word of mouth increases the perceived value of AFVs and leads to a higher willingness by consumers to pay a premium for them. Such studies show that getting AFVs into the market, even in small numbers, would generate word-of-mouth reports that could help put to rest (although there is also the possibility that some will reinforce) the negative concerns about barriers that appear to be limiting AFV acceptance at this point. Price disparity, however, still can be a strong disincentive, as has been shown by the slow market penetration of conventional hybrid vehicles, which still account for less than 3 percent of the U.S. LDV market more than a decade after introduction. Consumers do not have many negative attitudes about hybrids any longer. But because most HEVs still have a price premium when compared to comparably sized and equipped ICEVs, sales have risen and fallen with gasoline prices in recent years but overall have leveled off in the range of 2.5 to 3 percent.

It should be pointed out again that these early positive reports are coming from a unique and generally accepting group of AFV purchasers, the so-called early adopters whose interest in and desire to possess advanced technologies invariably make them prone to acceptance. Engineers at Nissan Motor Company, for example, told the committee that early Nissan Leaf owners were adapting to the Leaf’s characteristics in ways that mainstream buyers might not. For example, the heating system on a BEV is a significant drain on the battery charge, reducing range when in use. As a result, many early Leaf owners have developed the technique of using the car’s seat heaters—which draw much less charge from the battery—rather than the cabin heater. It is uncertain whether a potential mainstream buyer would see that as a plus or a minus.

4.10 INFRASTRUCTURE AVAILABILITY

The availability of fuel, including battery-charging facilities for BEVs, is also a major issue affecting consumer willingness to acquire AFVs. There are so few of the vehicles and so little infrastructure available at present that it is not possible to determine the necessary balance. One exception is E85 fuel (which is a blend of 85 percent ethanol and 15 percent gasoline) and the “flex-fuel” vehicles built to use either gasoline or E85. There often is no financial incentive for the owner of a flex-fuel vehicle to purchase E85. While a gallon of E85 may cost less than a gallon of gasoline, it delivers significantly fewer miles.

Earlier studies of consumer adoption in Canada and New Zealand of flex-fuel, or dual-fuel, vehicles using CNG as the alternate fuel found that the presence of refueling infrastructure was a significant factor in consumers’ decisions to acquire such vehicles. Greene (1990) concluded after reviewing a Canadian government survey of consumers in the provinces of Quebec, Ontario, and British Columbia that a “substantial refueling network is a pre-condition for the markets accepting alternative fuel vehicles and … essential if dual- or flexible-fuel vehicles are to use the new fuel a significant fraction of the time.” In their study of buyers of CNG vehicle conversions in New Zealand in the 1980s, Kurani and Sperling (1993) found that successful achievement of the government’s goal of pushing 150,000 converted vehicles into the market between 1979 and 1986 (that goal was not met; the total number of conversions by 1986 was 110,000) depended in large part on two types of government subsidies: those that helped consumers defray or earn back the cost of acquiring the converted vehicles, and those that helped underwrite new CNG fueling stations so that consumers would perceive that a fueling infrastructure was being installed and that they would have access to the fuel. The CNG conversion program ended—dropping from 2,400 a month in 1984 to 150 a month in 1987—following a 1985 change of administrations that saw significant curtailment of government subsidies for the program.

From these studies and from consumers’ stated concerns in the more recent studies cited earlier in this chapter, it is

clear that policies aimed at promoting increased use of AFVs will have to address adequate provision of infrastructure.

To painlessly achieve any necessary transition to alternative light-duty cars and trucks, the new-generation vehicles intended to replace petroleum-burning LDVs will have to provide utility, value, creature comforts, style, performance, and levels of convenience in fueling and repair and maintenance service that closely replicate those of the liquid-fueled vehicles being phased out. They are going to have to fulfill consumers’ needs and desires, or consumers will have to be presented with disincentives to continued purchase of conventional ICEVs or offered various incentives to make up for the things they perceive they would lose in a switch to an alternative vehicle or fuel. Most people do not want to pay more for a green vehicle, and of those who are willing, most would expect fuel and other savings to recoup the additional purchase expense over their period of ownership. Boston Consulting Group recently found in a survey of 6,593 consumers in the United States, Europe, and China that 40 percent of U.S. and European car buyers say they would be willing to pay up to $4,000 more for an AFV but would expect full “payback” over the first 3 years of ownership (Boston Consulting Group, 2011). Only 6 percent of U.S. respondents said they would be willing to pay a premium—the average was $4,600—without expecting to earn back the money during their full ownership period (Boston Consulting Group, 2011).

So although consumers overwhelmingly say that they want fuel efficiency and energy security, they have not demonstrated a willingness to pay much extra for it or to accept inconvenience in order to attain it. Vehicle purchase price, the long-term cost of ownership, the time it takes to refuel, the availability and cost of fuels, and the perceived need to downsize and to surrender performance attributes such as speedy acceleration and cargo and towing capacity all are cited in various studies as reasons people are not interested in AFVs. Some of this is due to lack of information, and studies such as those conducted by Axsen and Kurani (2011) and Zhang et al. (2011) have shown that word of mouth and demonstrated use by neighbors, friends, and relatives all have a positive impact on consumers’ willingness to consider AFVs. That, of course, requires getting the vehicles into people’s garages and onto the roads.

Some of these barriers, of course, are likely to change over time. As additional advanced-technology vehicles are placed into service, public familiarity with and knowledge of their advantages, and will improve, perhaps mitigating perceived disadvantages. AFVs also will develop a track record for resale value—a key component in determining overall cost of ownership and one that is missing now because few of the vehicles have been in the market long enough to develop a resale value history. Early estimates published by the manufacturers and a few ratings companies and analysts show that BEVs and PHEVs are thought to have lower lease residual values, an indicator of marketplace resale value. Pike Research analyst David Hurst estimated in 2011 that both the Nissan Leaf and the Chevrolet Volt would have residuals of around of 42 percent at 3 years—lower than either the popular Toyota Prius, which has a 60 percent residual value at 3 years, or corresponding conventional ICEVs such as the Nissan Versa (a Leaf counterpart) or the Chevrolet Cruze (a Chevrolet Volt counterpart), both at 52 percent (Hurst, 2011).

The relatively rapid rate of performance improvement and cost reduction that is characteristic of some new technologies can both help and harm rapid adoption of AFVs, fostering a larger market by lessening both cost and convenience barriers. Rising production volumes for biofuels could bring down their costs and make them more widely available, similarly addressing two barriers in ways that can accelerate expanding demand. Improved batteries and battery-charging rates could help reduce or even eliminate BEV range anxiety, fostering a larger market by lessening both cost and convenience barriers. Rising production volumes for biofuels could bring down their costs and make them more widely available, similarly addressing two barriers in ways that can accelerate expanding demand. Improvements in materials and engineering could make it possible to produce AFVs that are competitive with gasoline vehicles with respect to cargo capacity, towing ability, and other performance characteristics, and without the cost premiums that would inhibit widespread adoption. Conversely, rapid rates of technology advancements could inhibit diffusion beyond an early-adopter segment. Such progress would hasten the obsolescence of earlier generations of an advanced AFV technology and also suppress residual values. For example, if ongoing improvements in battery technology, such as steadily decreasing costs and rising performance, reduce the purchase price of a newer BEV relative to older BEVs still operating within their battery life expectancies (see Chapter 2), then early AFV models could depreciate more rapidly than is typical in the car market. This could lead to expectation among consumers of additional advances in the future, and a corresponding uncertainty about how well new generations of BEVs would hold their value if additional advances do indeed occur. This uncertainty could inhibit purchases by consumers concerned about resale value or could result in unfavorable lease terms.

However, because of the time it takes for automakers to bring new technologies into their fleets and for the national LDV fleet to turn over, these barrier modifications would have to be in place by or before 2030 to have a great impact on the fleet in 2050.

Absent a national emergency that requires consumers to abandon the gasoline or diesel ICEV, achieving the volumes needed to realize sufficient consumer acceptance in the early years of a planned transition to AFVs is unlikely without significant government policy intervention.

The simulations described in Chapter 5 suggest that the types of AFVs that might be needed to achieve the desired levels of petroleum and GHG reduction are those that initially will carry a large price premium because of their technology content. Once advanced vehicle technologies have become widely diffused, the vehicles in which they are incorporated will become much closer in cost to the advanced “conventional” vehicles that then would be available. In fact, the committee’s midrange case shows that both BEVs and FCEVs could cost less than advanced ICEVs by 2050. (See Figure 2.8 in Chapter 2.) In addition, the superior energy efficiency of those alternative vehicles would return more than enough benefit to consumers, in terms of reduced fuel consumption, to offset any cost premium that did exist. The trick will be to persuasively convey this information to consumers.

Accomplishing this is likely to require increased understanding of consumers’ attitudes about issues of sustainability, climate change, and environment and of how to motivate consumers in these arenas. The President’s Council of Advisors on Science and Technology has recently recommended that the Department of Energy incorporate societal research in its programs to gain an understanding of how energy programs succeed in the market (PCAST, 2010).

Broadening such research to include a focus on understanding consumer attitudes, expectations, and past behaviors relative to alternative automotive and fuel choices as well as to other technologies introduced to increase fuel efficiency and reduce emissions would seem essential to successful achievement of the petroleum use and GHG reduction goals set out for the 2030 and 2050 time periods in the committee’s statement of task.

Anderson, Soren, R. Kellogg, and J.M. Sallee. 2011. What Do Consumers Believe About Future Gasoline Prices? NBER Working Paper 16974. Cambridge, Mass.: National Bureau of Economic Research.

Automotive News. 2012. Leasing Boom? Not So Fast. March 7, 2012. Available at http://www.autonews.com/article/20120307/finance_and_insurance/12030990. Accessed April 3, 2012.

Axsen, J. 2010. Interpersonal Influence within Car Buyers’ Social Networks: Observing Consumer Assessment of Plug-in Hybrid Electric Vehicles (PHEVs) and the Spread of Pro-Societal Values. Davis, Calif.: University of California, Davis.

Axsen, J., and K.S. Kurani. 2011. Interpersonal Influence Within Car Buyers’ Social Networks: Developing Pro-Societal Values Through Sustainable Mobility Policy. Available at http://www.internationaltransportforum.org/2011/pdf/YRAAxsen.pdf.

Beresteanu, A., and S. Li. 2011. Gasoline prices, government support, and the demand for hybrid vehicles in the U.S. International Economics Review 52(1):161-182.

Boston Consulting Group. 2011. Powering Autos to 2020: The Era of the Electric Car? Boston, Mass.: Boston Consulting Group.

Capgemini. 2010. Cars Online 10/11. Listening to the Voice of the Consumer. Capgemini. Available at http://www.capgemini.com/m/en/tl/Cars_Online_2010_2011__Listening_to_the_Consumer_Voice.pdf.

Caulfield, B., S. Farrell, and B. McMahon. 2010. Examining individuals’ preferences for hybrid electric and alternatively fuelled vehicles. Transport Policy 17(6):381-387.

Consumer Reports. 2011a. Survey: Cost Savings Are Driving Shoppers to Better Fuel Economy. Available at http://news.consumerreports.org/cars/2011/05/survey-cost-savings-are-driving-shoppers-to-better-fueleconomy.html. Accessed on May 30, 2011.

———. 2011b. Survey: Car Buyers Want Better Fuel Economy and Are Willing to Pay for It. Available at http://news.consumerreports.org/cars/2011/05/survey-car-buyers-want-better-fuel-economy-and-are-willing-to-pay-for-it.html. Accessed on August 12, 2011.

———. 2012. High Gas Price Motivate Drivers to Change Direction. May. Consumer Reports.org. Available at http://www.consumerreports.org/cro/2012/05/high-gas-prices-motivate-drivers-to-change-direction/index.htm.

Crain, K., 2011. If you build it, they will come. Automotive News 85(April 4):12.

Deloitte Development LLC. 2010. Gaining Traction. A Customer View of Electric Vehicle Mass Adoption in the U.S. Automotive Market. New York: Deloitte Global Services, Ltd. Available at http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/us_automotive_Gaining%20Traction%20FINAL_061710.pdf.

Deloitte Touche Tohmatsu Ltd. Global Manufacturing Industry Group. 2011. Unplugged: Electric Vehicle Realities Versus Consumer Expectations. New York: Deloitte Global Services Ltd. Available at http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/us_auto_DTTGlobalAutoSurvey_ElectricVehicles_100411.pdf.

Diamond, D. 2008. Public Policies for Hybrid-Electric Vehicles: The Impact of Government Incentives on Consumer Adoption. Ph.D. Dissertation. Fairfax, Va.: George Mason University. Available at http://mars.gmu.edu:8080/dspace/bitstream/1920/2994/1/Diamond_David.pdf.

Drury, I. 2011. Four-Cylinder Engines, Mpg on the Rise. Available at http://www.autoobserver.com/2011/10/four-cylinder-engines-mpg-on-the-rise.html. Accessed on March 23, 2012.

Egbue, O., and S. Long. 2012. Barriers to widespread adoption of electric vehicles: An analysis of consumer attitudes and perceptions. Energy Policy 48:717-729.

Ernst & Young. 2010. Gauging Interest for PHEVs and EVs in Select Markets.

Gallagher, K.S., and Erich Muehlegger. 2008. Giving Green to Get Green: Incentives and Consumer Adoption of Hybrid Vehicle Technology. Harvard Kennedy School Faculty Research Working Paper RWP08-009.

Greene, D.L. 1990. Fuel choice for multifuel vehicles. Contemporary Policy Issues VIII(4):118-137.

Greene, David L. 2010a. Why the Market for New Passenger Cars Generally Undervalues Fuel Economy. Discussion Paper 2010-6. International Transportation Forum, OECD, Paris. Available at http://cta.ornl.gov/cta/Publications/Reports/Why_the_Market_for_New0001.pdf. Accessed May 23, 2012.

———. 2010b. How Consumers Value Fuel Economy: A Literature Review. EPA 40-R-10-008. Available at http://www.epa.gov/oms/climate/regulations/420r10008.pdf. Accessed May 23, 2012.

Guo, J.Y., G. Venkataramanan, B. Lesieutre, A. Smick, M. Mallette, and C. Getter. 2010. Consumer Adoption and Grid Impact Models for Plug-in Hybrid Electric Vehicles in Dane County, Wisconsin. Part A: Consumer Adoption Models. Madison, Wisc.: Public Service Commission of Wisconsin.

Harder, A. 2011. Obama Claims Connection Between Fuel Standards, Jobs, but Reality Is Complicated. Available at http://www.nationaljournal.com/energy/obama-claims-connection-between-fuel-standards-jobs-but-reality-is-complicated-20110811. Accessed on August 12, 2011.

Harris Interactive. 2011. Auto TECHCAST Study. June.

Hensher, D.A.H.B. 2010. Hypothetical bias, stated choice experiments and willingness to pay. Transportation Research Part B 44(6):735-752.

Hughes, J.E., C.R. Knittel, and D. Sperling. 2008. Evidence of a shift in short-run price elasticity of gasoline demand. The Energy Journal 29(1):93-114.

Humphries, J., D. Sargent, J. Schuster, M. Marshall, M. Omotoso, and T. Dunne. 2010. Drive Green 2020: More Hope Than Reality? Westlake Village, Calif.: J.D. Power and Associates.

Hurst, D. 2011. The Plug-In Vehicle Residual Value Conundrum. Available at http://www.pikeresearch.com/blog/articles/the-plug-in-vehicle-residual-value-conundrum. Accessed on May 4, 2012.

Koslowski, T. 2011. Strategic Market Considerations for Electric Vehicle Adoption in the U.S. Stamford, Conn.: Gartner, Inc.

Kotchen, M.J., and S.D. Reiling. 2000. Environmental attitudes, motivations and contingent valuation of nonuse values: A case study involving endangered species. Ecological Economics 32:93-107.

Kurani, K.S., and D. Sperling. 1993. Fuel Availability and Diesel Fuel Vehicles in New Zealand. TRB Reprint Paper No. 930992. Davis, Calif.: University of California, Davis.

Morris, E. 2007. From horse power to horsepower. Access 30(Spring):2-9.

Nixon, H., and J.-D. Saphores. 2011. Understanding Household Preferences for Alternative-Fuel Vehicle Technologies. Cambridge, Mass.: Massachusetts Institute of Technology. Available at http://transweb.sjsu.edu/PDFs/research/2809-Alternative-Fuel-Vehicle-Technologies.pdf.

PCAST (President’s Council of Advisors on Science and Technology). 2010. Report to the President on Accelerating the Pace of Change in Energy Technologies Through an Integrated Federal Energy Policy. Washington, D.C.: Executive Office of the President.

J.D. Power and Associates. 2011. 2011 U.S. Green Automotive Study. April.

Rogers, E.M. 1962. Diffusion of Innovations. New York: Free Press.

———. 2003. Diffusion of Innovations. 5th Edition. New York: Free Press.

Synovate. 2011. Synovate Survey Reveals Whether Consumers Will Stay Away from Electric Powertrain Vehicles Because They Don’t Understand How They Work. Available at http://www.ipsos-na.com/newspolls/pressrelease.aspx?id=5482. Accessed January 29, 2013.

Turrentine, T.S., and K.S. Kurani. 2007. Car buyers and fuel economy? Energy Policy 35:1213-1233.

Zhang, T., S. Gensler, and R. Garcia. 2011. A study of diffusion of alternative fuel vehicles: An agent-based modeling approach. Journal of Product Innovation Management 28:152-156.