5

Modeling the Transition to Alternative Vehicles and Fuels

Achieving the goals of reducing light-duty vehicle (LDV) petroleum use and greenhouse gas (GHG) emissions by 80 percent by 2050 and petroleum use by 50 percent by 2030 is likely to require a transition from internal combustion engines powered by fossil petroleum to alternative fuels or vehicles or both. There is also potential for significant technological advancement both in the LDV fleet and in the fuel and fueling infrastructure that will power vehicles over the next 40 years. Which of these technologies will actually enter the market depends on a range of factors, including the extent of progress in the different vehicle and fuel technologies, market conditions in gasoline and other fuels markets that will affect cost and competiveness, consumer preferences over vehicle and fuel characteristics, and government policies toward this sector. Government policies are likely to be particularly important because the benefits of both petroleum and greenhouse gas reductions accrue to the public as a whole, and so market forces alone cannot be relied on to provide sufficient reductions.1

Two different models were used by the committee to assess the potential and opportunities for achieving the goals of this study. The first was the VISION model developed by Argonne National Laboratory (Singh et al., 2003). This spreadsheet model was an ideal starting point for the committee’s analysis because it has been widely used in the past for light-duty vehicle (LDV) sector forecasts of energy use and GHG emissions. All inputs must be specified, including future rates of penetration of vehicle and fuel types and the costs of each. VISION does not, however, attempt to estimate how markets will react to alternative vehicles and fuels or to the policies that may be needed to successfully introduce them.

The second model, the Light-duty Alternative Vehicle Energy Transitions (LAVE-Trans) model, incorporates market decision making and reflects the most significant economic barriers to the adoption of new vehicles and fuels. It therefore allows for assessment of policies and possible transition paths to attain the goals. Penetration rates of different vehicle and fuel types are determined in this model in response to price, costs, and vehicle fueling characteristics; they are not simply assumed as they are in VISION. Moreover, LAVE-Trans includes a consistent and comprehensive assessment of the benefits and costs of different policy and technology pathways over time.

It is important to emphasize the nature and extent of the uncertainties that lie behind all of the analyses in this chapter. First, the analysis uses estimated improvements to fuel efficiency and fuel carbon content, and the associated costs, for vehicles up to the 2050 model year as provided by expert members of this committee, evidence from the literature, and consultation with experts outside the committee. (Detailed descriptions can be found in Chapters 2 and 3.) Both models use the same GHG emissions, fuel economy, and vehicle cost estimates. These estimates by necessity reflect numerous assumptions, most of which are highly uncertain, particularly when such forecasts are made far into the future. One way the committee represents this uncertainty is to include both “midrange” and “optimistic” estimates for important variables such as vehicle fuel efficiency and fuel carbon intensities. However, it is difficult to reflect the full range of uncertainty. Thus, a “pessimistic” case is not included here for vehicles in which either technology does not progress very rapidly or costs do not come down over time and with volume as expected.

There is, in addition, uncertainty in the assumptions about consumer preferences for different vehicle characteristics,

_______________________

1Both petroleum use reduction and GHG emissions reduction are types of public goods in that once they are reduced, all members of society benefit through greater security and reduced risk of global climate change. No one is excluded from these benefits. The private sector will tend to underprovide such goods because private individuals must pay the costs of reductions but do not get all of the benefits—the benefits are shared by all. When there are public goods, then, government action may be essential for attaining amounts of the public goods that are economically efficient for society (Boardman et al., 2011).

including range and limited fuel availability for alternatives such as hydrogen fuel cell vehicles.2 A sensitivity analysis illustrating uncertainties about the market’s response to alternative vehicles and fuels is described in Section 5.7. There is also controversy about the magnitude of the social cost of GHG emissions and the social cost of the United States’ reliance on oil and petroleum-based gasoline. The estimates used in this report are drawn from the most recent literature but do not reflect the full range of uncertainty. Finally, it is extremely difficult to model all of the feedback effects that will inevitably result over time as technology development and markets interact.

Despite the inherent uncertainties in attempting to forecast four decades into the future, the committee’s modeling effort here uses the best available evidence and information and makes plausible assumptions where sound data are missing. Analysis of the results from the two models then provides useful insights about what various vehicles and fuel combinations can achieve, the nature of the processes by which changes will occur, and the general magnitude of potential costs and benefits of different policy options.

5.2 MODELING APPROACH AND TOOLS

VISION is designed to extend the transportation sector-specific component of the National Energy Modeling System (NEMS) used by the Energy Information Administration (EIA). It provides longer-term forecasts of energy use and GHG emissions than does NEMS. While not as detailed or comprehensive as the NEMS model, VISION provides greater flexibility to analyze a series of projected usage scenarios over a much longer timeframe. It has been used extensively in the literature.

For the purposes of this study, VISION has been modified in a number of ways. The most up-to-date assumptions from the committee about vehicle efficiencies, fuel availability, and the GHG emissions impacts of using those fuels have been included. It is assumed that new-technology vehicle sales ramp up slowly and that new sales for a particular vehicle type never increase by more than about 5 percent of total new LDV sales in a given year. In addition, only one plug-in hybrid electric vehicle (PHEV), a PHEV-30 with a real-world all-electric driving range of 25 miles, is included. It is assumed that because of their limited range, battery electric vehicles are to be driven 1/3 fewer miles per year than other vehicles (Vyas et al., 2009) and that any decrease in miles driven by electric vehicles will be offset by increased mileage from other vehicles. Total new car sales and annual vehicle miles traveled (VMT) are assumed to be the same as in the projections from the Annual Energy Outlook 2011 (AEO; EIA, 2011a), and there is no assumption of a “rebound effect”3 if the cost of driving a mile declines. Adjustments to VMT can be included separately in any VISION run assessment.4 Finally, GHG estimates from biofuels include both emissions from production and from indirect land-use changes (see Chapter 3).

The committee uses the VISION model to explore how a focus on specific technologies or alternative vehicle and fuel types has the potential to reduce oil use and GHG emissions to achieve the study goals. The committee then turns to the LAVE-Trans model to shed light on how policies might be used to achieve the needed transitions.

The Light-duty Alternative Vehicle Energy Transitions (LAVE-Trans) model uses a nested, multinomial logit model5 of consumer demand to predict changes in the efficiency of vehicles and fuels over time, including a possible transition to alternatively fueled vehicles. Any transition to these advanced vehicles faces a number of barriers, including high costs due to the lack of scale economies and lack of learning, consumer uncertainty about safety or performance, and the lack of an energy supply infrastructure. Each of these barriers has been incorporated into the LAVE-Trans model so that the costs of overcoming them and, alternatively, the benefits of policies needed to do so can be measured (subject to the limits of current knowledge).

The model incorporates an array of factors that affect and are derived from consumer behavior, including the rebound effect; “range anxiety” and perceived loss of utility, particularly as it pertains to the availability of a fueling infrastructure; aversion to new technology and its reciprocal effect, early adoption; and the significant discounting of future fuel benefits over the lifetime of the vehicle. Nine variables influence the market shares of the alternative advanced technologies:

_______________________

2Thanks to recent research, such issues are better understood than they were a decade ago (e.g., UCD, 2011; Bastani et al., 2012), yet much remains to be learned.

3Improvements in the efficiency of energy consumption will result in an effective reduction in the price of energy services, leading to an increase of consumption that partially offsets the impact of the efficiency gain in fuel use. This is known as the “rebound effect.”

4If a 5 percent reduction in vehicle miles traveled is plausible under certain policies, then the estimates of GHG emissions and oil use can be reduced by 5 percent.

5A multinomial logit model is a standard model often used to represent consumer choice where there is a finite set of discrete options. The probability of choosing among the set of available options is governed by representative parameters for a particular class of consumer. A nested model refers to multiple layers of choice (see Daly and Zachary, 1979; McFadden, 1978; Williams, 1977). For example, the first level of choice in the LAVE-Trans model is between choosing whether or not to buy an LDV. If a consumer chooses to buy an LDV, the next level of choice is between purchasing a passenger car or a light truck. Then, within a particular class of vehicle there are multiple options, such as whether to purchase an ICEV, FCEV, or BEV. Further description of the LAVE-Trans nested multinominal logit model can be found in Section H.2 in Appendix H.

- Retail price equivalent (RPE),

- Energy cost per kilometer,

- Range (kilometers between refuel/recharge events),

- Maintenance cost (annual),

- Fuel availability,

- Range limitation for battery electric vehicles (BEVs),

- Public recharging availability,

- Risk aversion (innovator versus majority), and

- Diversity of make and model options available.

It also includes policy options that affect consumer choices, including new-vehicle rebates, incentivized infrastructure development, and fuel-specific taxation. Although both the LAVE-Trans and VISION models use the same committee-developed technology and cost assumption for different vehicles and fuels over time, the LAVE-Trans model represents a significant improvement over the VISION model in several ways. First, because it includes consumer behavior in the vehicle market, it is able to predict the shares of different vehicles that enter the market in response to policy and market changes, whereas VISION must assume these shares over time. Thus, LAVE-Trans is much better able to assess the types of policies that may be necessary to achieve the goals addressed in the present study. Second, LAVE-Trans can be used to assess the full range of benefits and costs of different policies. The committee’s approach to measuring benefits and costs is discussed more fully below.

5.3 RESULTS FROM RUNS OF VISION MODEL

Forecasts of the penetration rates of different types of vehicles using the VISION model must be compared to some alternative outcome in which there are no further policy actions and limited technological advances. In this analysis, two such cases are presented. One is the business as usual (BAU) case. It closely follows the AEO 2011 reference case projection to 2035 and from there is extrapolated to 2050. In this case, NHTSA CAFE and EPA GHG emission joint standards for LDVs are set out to 2016, with fuel economy continuing to increase to 2020 per the Energy Independence and Security Act of 2007. Renewable fuel production increases in response to RFS2 (the amended Renewable Fuel Standard), but it is assumed that financial and technological hurdles facing advanced biofuel projects will delay compliance. The other case is the Committee Reference Case. It adds to the BAU case the CAFE rules that have been set through the 2025 model year, and the levels of advanced biofuels production required under RFS2 are assumed to be fully met by 2030 through the production of thermochemical cellulosic biofuel.

5.3.1.1 Business as Usual (BAU)

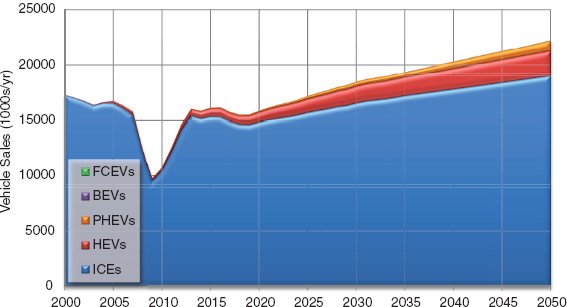

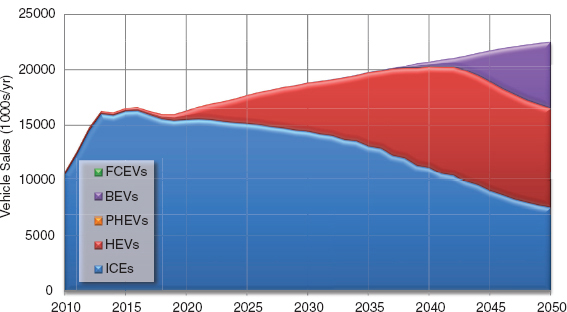

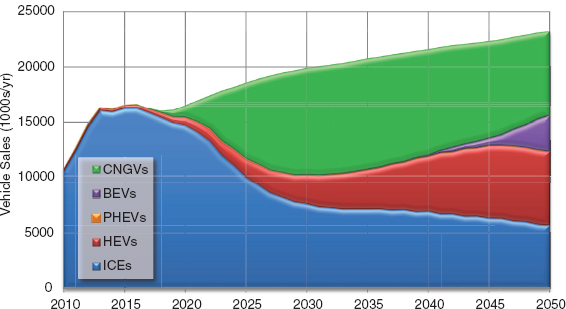

In the BAU case, new-vehicle sales increase to 22.2 million in 2050 from 10.8 million units in 2010 (a year in which sales were severely depressed due to the recession). Diesel, hybrid, and plug-in hybrid vehicles make modest gains in market share (Figure 5.1). The total stock of LDVs increases from about 220 million in 2010 to 365 million in 2050.

Fleet average on-road fuel economy improves from 20.9 miles per gallon gasoline equivalent (mpgge; equivalent to a consumption of 4.8 gge/100 mi) in 2005 to 34.7 mpgge (or 2.9 gge/100 mi) in 2050. This is consistent with the Energy Independence and Security Act of 2007, which requires a fleetwide fuel economy test value of at least 35.5 mpg in 2020 and includes modest improvements in vehicle efficiency thereafter. This is enough to offset most of the forecasted increase in vehicle travel from 2.7 trillion to 5.0 trillion miles. Energy use increases to 159 billion gallons gasoline equivalent (billion gge) from 130 billion gge. Com-

FIGURE 5.1 Vehicle sales by vehicle technology for the business as usual scenario.

pared to 2005 levels, petroleum use remains unchanged, the result of increased use of corn-based ethanol (to 12.0 billion gge/yr in 2050) and the addition of 8.9 billion gge/yr of cellulosic ethanol and 8.1 billion gallons of gasoline produced from coal. The net effect of increased overall energy use and the shift to a somewhat less carbon-intensive fuel mix is a 12 percent increase in 2050 GHG emissions.

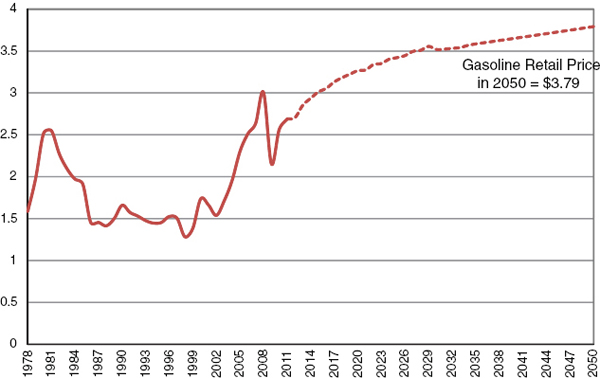

Oil prices in this scenario are expected to gradually increase to $123/bbl by 2035 (in 2009$) according to AEO 2011, resulting in a pre-tax gasoline price of $3.16 in 2035. Gasoline prices are then extrapolated out to 2050 assuming the compound rate of growth modeled in AEO 2011 from 2030 to 2035, yielding a pre-tax price of $3.37. The current gasoline tax of $0.42/gal is assumed to remain the same (in constant dollars) out to 2050. Gasoline prices in this scenario are shown in Figure 5.2. The pre-tax fraction of these gasoline prices is assumed in all modeling scenarios.

5.3.1.2 Committee Reference Case

The committee further defined its own reference case to include all of the midrange assumptions it developed about vehicle efficiencies, fuel availability, and GHG emission rates up to 2025 (summarized in Chapters 2 and 3). This Committee Reference Case assumes that the 2025 fuel efficiency and emissions standards for LDVs will be met. The committee interprets the standards to require that new vehicles in 2025 must have on-road fuel economy averaging around 40 mpg (given a fleetwide CAFE rating of 49.6 mpg for new vehicles, the difference between on-road and test values, and the likely application of various credits under the CAFE program). See Box 5.1 for an explanation of on-road fuel economy compared to tested fuel economy ratings.

This case also assumes that the RFS2 goals will be met by 2030. As a result, corn ethanol sales rise to almost 10 billion gge/yr by 2015 and then remain at that level. Based on the analysis in Chapter 3, it is also assumed that all cellulosic biofuels will be thermochemically derived gasoline. The RFS2 requirements result in annual production of 13.2 billion gallons of such biofuels by 2030 and roughly constant levels thereafter.

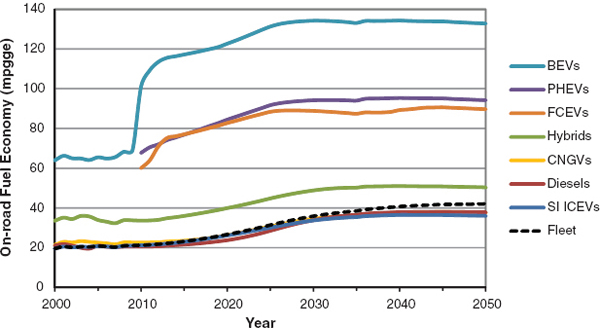

Under the assumptions of the Committee Reference Case, the fuel economy (fuel consumption) of the stock of LDVs in use improves to 35.5 mpgge (2.8 gge/100 mi) in 2030 and to 41.6 mpgge (2.4 gge/100 mi) in 2050, up from 20.8 mpgge (4.8 gge/100 mi) in 2005 (Figure 5.3). This improvement is largely due to efficiency improvements in internal combustion engine vehicles (ICEVs) as well as increasing sales of hybrid electric vehicles (HEVs). Hybrids are more successful in this scenario compared to the BAU case, increasing their share of new-vehicle sales to 33 percent (7.3 million units) by 2050.

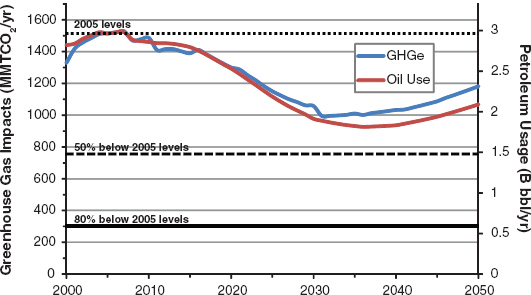

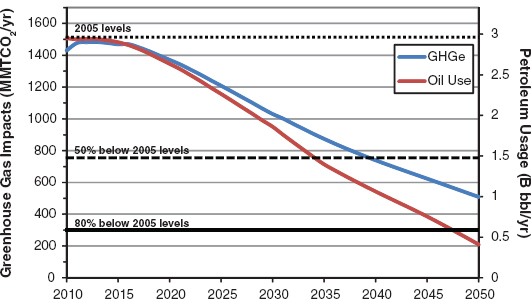

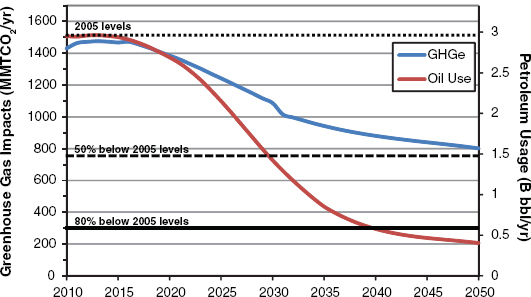

Greenhouse gas emissions are 30 percent below 2005 levels in 2030, at 1,057 million metric tons CO2 equivalent (MMTCO2e) per year, but rise again and are just 22 percent below in 2050 (1,121 MMTCO2e/yr) as VMT continues to rise while the efficiency of the on-road fleet remains approximately constant (Figure 5.4). Petroleum use is 36 percent below the 2005 level in 2030 (1.91 billion bbl/yr) and 30 percent below in 2050 (2.09 billion bbl/yr), also rising with

FIGURE 5.2 Retail gasoline fuel prices (1978-2050), including federal and state taxes. Projected values shown as dotted line. SOURCE: Data from Annual Energy Review 2010 [1978-2010] (EIA, 2011b), Annual Energy Outlook 2011 [2010-2035] (EIA, 2011a), and extrapolation by the committee using the compound annual growth rate for 2030-2035 (0.42%) [2035-2050].

BOX 5.1

The Distinction Between “As Tested” and “Actual In-Use” Fuel Consumption

A large difference exists between the fuel economy (miles per gallon, or mpg) figures used to certify compliance with fuel economy standards and those experienced by consumers who drive the vehicles on the road and purchase fuel for their vehicles. The numbers used to certify compliance with the Corporate Average Fuel Economy (CAFE) standards are based on two dynamometer tests. These test values are also the numbers discussed and presented in the tables and figures of this report. A different 5-cycle test procedure is used to compute the Environmental Protection Agency (EPA) “window-sticker” (label) fuel economy ratings that are used in automotive advertising, most car-buying guides, and car-shopping Websites. Neither procedure accurately reflects what any given individual will achieve in real-world driving. Motorists have different driving styles, experience different traffic conditions, and take trips of different lengths and frequencies. Realized fuel economy also varies with factors including climate, road surface conditions, hills, temperature, tire pressure, and wind resistance. The impacts of air conditioning, lighting, and other accessories on fuel consumption are not included in the two-cycle tests.

Both CAFE mpg and “window-sticker” mpg were based on the values determined via standardized city- and highway-cycle procedures that were codified by law in 1975. The divergence between test-cycle values and real-world experience was recognized and in 1985 the EPA revised calculation procedures for the window-sticker ratings in order to bring them more in line with the average performance motorists were reporting in real-world driving. From 1985 through 2007, the window sticker values averaged about 15 percent lower than the unadjusted values used for CAFE regulation. The label values were updated starting in model year 2008, and the update further increased the difference between CAFE and “window sticker” values by factoring in additional adjustments, so that the current window sticker values average about 20 percent lower than those used for regulation.

The results can be confusing. For example, the 2017-2025 CAFE rules envision a 49.6-mpg “fleet average new LDV fleet fuel economy” for the 2025 model year, but acknowledge that real-world fuel economy will be significantly lower—probably somewhere below 40 mpg. A further complication is that the “National Plan” (the joint rulemaking by NHTSA and EPA) regulates greenhouse gas (GHG) emissions in addition to fuel economy. Because some technologies for reducing LDV GHG emissions do not involve fuel economy, EPA now also reports a “mpg-equivalent” value representing the CAFE fuel economy that would be needed to achieve a similar degree of GHG emissions reduction. That type of number is the one given as the 54.5 mpg “equivalent” stated in many discussion of the 2025 target; it reflects special credits for various technologies that can help in achieving fleet average GHG emissions of 163 grams per mile by 2025.

The CAFE numbers represent a higher fuel economy than most consumers are likely to experience on the road. The estimates of actual fuel consumption and associated GHG emissions presented in this report, however, reflect a downward fuel economy adjustment for approximating real-world impacts. Although there is no universally agreed-upon method for converting test values to on-road values, the committee has determined that an appropriate estimate for analytic purposes can be obtained by adjusting the CAFE values downward by about 17 percent (i.e., multiplying by 0.833). That factor is used whenever the report discusses “average” on-road values.

VMT. Thus, the Committee Reference Case, which assumes current policies included in the AEO BAU case augmented by the proposed 2025 fuel economy and emissions standards and RFS2 compliance, does not come close to meeting the 2030 or 2050 goals.

To explore possible paths to attain the goals addressed in this study, VISION was run for a range of cases. The predominant characteristic of these runs is to focus on a market dominated by a particular vehicle type and alternative fuel (e.g., electric vehicles and grid with reduced GHG emissions, or fuel cell vehicles and hydrogen generated with CCS). To assess the range of possibilities, the committee looked at runs that used the midrange vehicle efficiencies as well as at runs that used the optimistic efficiencies representing technological progress proceeding more rapidly than expected, as described in Chapter 2. From the fuels side, the committee considered both present methods of producing a fuel as well as fuel supply technologies with reduced GHG impacts as described in Chapter 3. Each of the possible fuel types is shown in Table 5.1. A brief description below of each of the scenarios modeled with VISION identifies the important assumptions and variation in those assumptions. Section H.1 in Appendix H provides further detail.

- Emphasis on ICEV efficiency. These runs continue the reference case’s focus on LDV fuel efficiency improvements through the period to 2050. Shares of advanced ICEVs and HEVs increase to about 90 percent of new-vehicle sales by 2050. Two runs are included that differ only in their assumptions about the fuel efficiency improvements of vehicles over time. The first assumes the midrange assumptions for fuel efficiency for all technologies (Chapter 2, Table 2.12), and the second assumes optimistic fuel efficiency for ICEs and HEVs while maintaining midrange values for the small numbers of other types of vehicles in the fleet. It is assumed that the RFS2

FIGURE 5.3 Average on-road fuel economy for the Reference case light-duty vehicle stock. In most cases, the average efficiency plateaus as the fleet gradually turns over to vehicles that meet the 2025 model year CAFE standard. There are small reductions over time with rising use of advanced technologies in trucks.

FIGURE 5.4 Petroleum use and greenhouse gas emissions for the Committee Reference Case.

requirements described in the Committee Reference Case, above, are still in place. These increased vehicle efficiency cases require much less liquid fuel over time and assume that gasoline is the fuel reduced.

- Emphasis on ICEV efficiency and biofuels. These two runs are similar to the case described above. The difference is that more biofuels are brought into the market after 2030, as described in Table 5.1. The modeling runs assume this additional biofuel, largely in the form of drop-in gasoline that displaces petroleum, and the only difference in the two runs is the assumption of vehicle fuel efficiency. The first run assumes all vehicles are at the midrange efficiency, and in it the share of petroleum-based gasoline as a liquid fuel falls to about 25 percent by 2050. The second run assumes optimistic fuel efficiency for ICEVs and HEVs. In this case, bio-based ethanol, bio-based gasoline, and a small amount of coal-to-liquid (CTL) and gas-to-liquid (GTL) fuels make up all liquid fuel, with almost no petroleum-based gasoline.

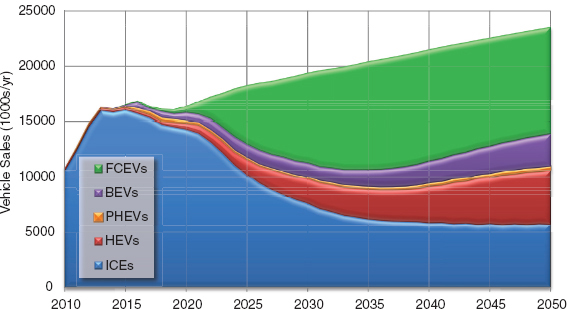

- Emphasis on fuel cell vehicles. This case comprises 4 different runs of VISION, to capture variation in both vehicle efficiency and fuel carbon content. In all of these runs, the share of fuel cell electric vehicles (FCEVs) increases to about 25 percent of new car sales by 2030 and then to 80 percent by 2050, modeled on the maximum practical deployment scenario from Transition to Alternative Transportation

TABLE 5.1 Description of Fuel Availabilities Considered in Modeling Light-Duty Vehicle Technology-Specific Scenarios

| Fuel Type | Description (values reflect annual production in 2050) |

| AEO 2011 | AEO 2011 projection extrapolated to 2050; 12.0 billion gge corn ethanol; 8.9 billion gge cellulosic ethanol; 8.1 billion gal CTL gasoline |

| Reference | RFS2 met by 2030: 10 billion gge corn ethanol; up to 13.2 billion gge cellulosic thermochemical gasoline; up to 3.1 billion gge CTL; up to 4.6 billion gge GTL |

| Biofuels | Includes Reference biofuel availability plus additional drop-in biofuels: Up to 45 billion gge cellulosic thermochemical gasoline; 10 billion gge corn ethanol |

| AEO 2011 | AEO 2011 Electricity Grid: 541 g CO2e/kWh; |

| Electricity Grid | 46% coal, 22% natural gas, 17% nuclear, and 12% renewable |

| Low-C | AEO 2011 Carbon Price Grid: 111 g CO2e/kWh; 6% |

| Electricity Grid | coal, 25% natural gas, 12% natural gas w/CCS, 30% nuclear, and 23% renewable |

| Low-Cost H2 | Lowest Cost: $3.85/gge H2; 12.2 kg CO2e/gge H2; |

| Production | 25% distributed natural-gas reforming, 25% coal gasification, 25% central natural-gas reforming, and 25% biomass gasification |

| CCS H2 | Added CSS: $4.10/gge H2; 5.1 kg CO2e/gge H2; 25% |

| Production | distributed natural-gas reforming, 25% coal gasification w/CCS, 25% central natural-gas reforming with CCS, and 25% biomass gasification |

| Low-C H2 | Low CO2 emissions: $4.50/gge H2; 2.6 kg CO2e/ |

| Production | gge H2; 10% distributed natural-gas reforming, 40% central natural-gas reforming w/CCS, 30% biomass gasification, and 20% electrolysis from clean electricity |

NOTE: CCS H2 case analyzed by LAVE model, not VISION.

Technologies: A Focus on Hydrogen (NRC, 2008). There are two runs with the midrange vehicle fuel efficiencies, the first with low-cost hydrogen production (Low-Cost H2 Production) and the second with low-GHG hydrogen production (Low-C H2 Production), described in Table 5.1. Finally, there are two additional runs with optimistic assumptions about the fuel efficiency of FCEVs, each with the different assumptions for the GHG emissions from hydrogen production.

- Emphasis on plug-in electric vehicles. There are 4 VISION runs emphasizing plug-in electric vehicles (PEVs) to account for differences in assumptions about vehicle efficiency as well as GHG emissions impacts of the fuel. In all runs, the share of BEVs and PHEVs increases to about 35 percent of new LDV sales by 2030 and 80 percent by 2050, in line with the rates put forth in Transitions to Alternative Transportation Technologies: Plug-In Hybrid Electric Vehicles (NRC, 2010a). Relatively greater sales of PHEVs than BEVs in all years are assumed (see Table H.3 in Appendix H for details). Each of the two runs in each pair of runs—midrange and optimistic—uses a different assumption about GHG emissions from the electricity grid (AEO 2011 Grid and Low-C Electric Grid, Table 5.1). The low-emissions grid is assumed to emit 25 percent of GHGs per unit of generation compared to the BAU grid by 2050.

- Emphasis on natural gas vehicles. These runs assume that sales of compressed natural gas vehicles (CNGVs) are 25 percent of the market by 2030 and 80 percent by 2050. In both midrange and optimistic cases, CNG fuel use rises over time, and so little liquid fuel is needed by 2050 that it is assumed that no CTL and GTL plants are ever built. It is further assumed that RFS2 must be met by 2030, and so the liquid fuel that is used is primarily biofuels in both of these runs.

5.3.3 Results of Initial VISION Runs

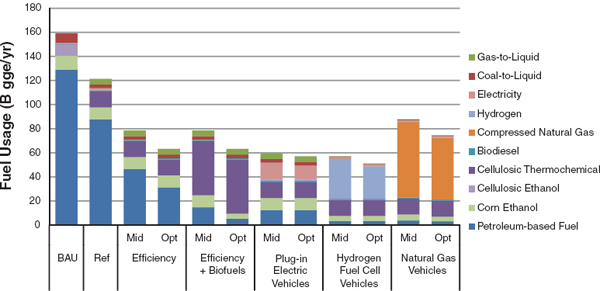

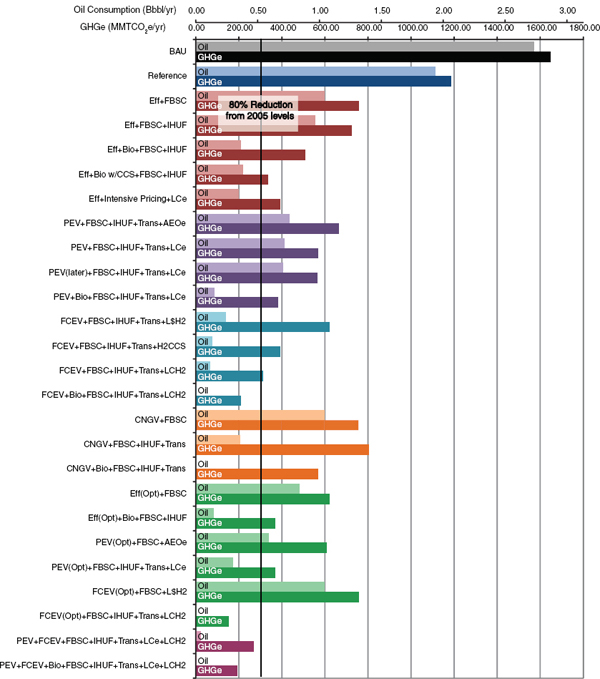

Figures 5.5 to 5.7 indicate the results of the VISION model runs described above. The total amount of each type of fuel used in each scenario is shown in terms of energy use (billions of gallons of gasoline-equivalent). For the hydrogen and electricity cases, the fuels are not broken down by carbon content. Figure 5.5 shows results of the assumptions about fuel use that were made for the different VISION runs. For example, the total amount of liquid fuels used is the same for the Efficiency and Efficiency + Biofuels scenarios—it is assumed that it is the fraction of that fuel generated from biomass that is different. Higher prices for biofuels are likely to drive liquid fuel prices up over time and could result in less total liquid fuel used, but that type of market feedback cannot be accounted for in the VISION model runs.

Some ethanol and cellulosic biofuels are used in all of the scenarios because of the assumptions that they will be required under regulations such as RFS2. Over all of the scenarios, fuel energy use is lowest for the Plug-in Electric Vehicle, Hydrogen Fuel Cell Vehicle, and Optimistic Efficiency for ICEV and HEV cases.

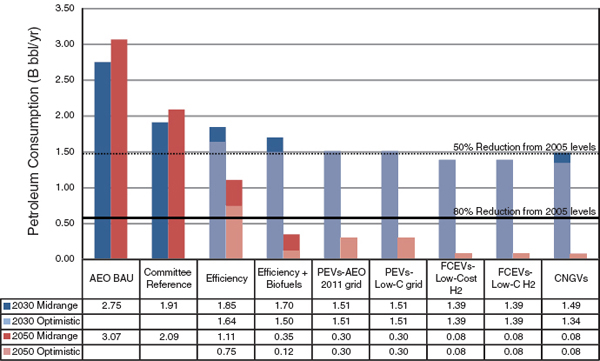

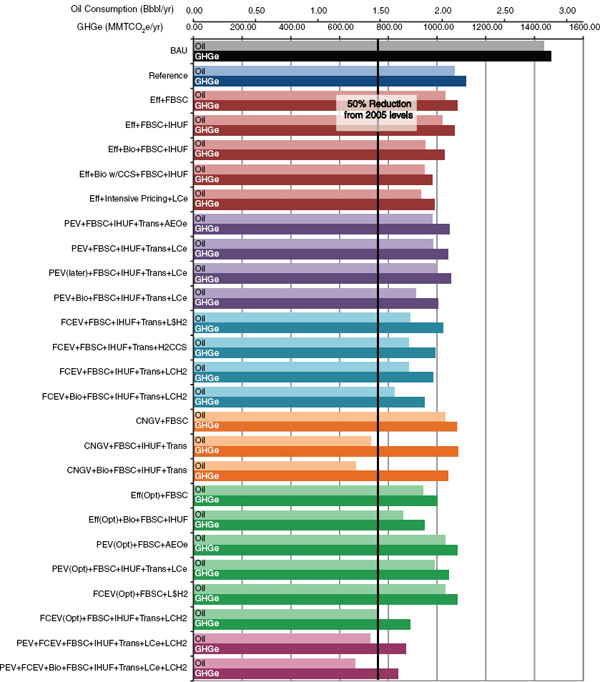

Figure 5.6 shows that the long-term petroleum reduction goal of 80 percent by 2050 could occur if there is either (1) a major increase in biofuel availability with high-efficiency ICEVs (including HEVs) or (2) a large increase in alternatively fueled vehicles. All of the cases involving a transition to alternatively fueled vehicles meet or nearly meet a midterm petroleum reduction goal of 50 percent by 2030; in addition, optimistic ICEV efficiencies and widespread availability and use of biofuels could meet this interim goal as well. It is important to note that all of these scenarios assume very aggressive deployment of the specific vehicles and fuels being emphasized. The VISION model cannot address how these vehicle shares would be achieved. The model tells us nothing about how market conditions or policies would produce such results in vehicle and fuel shares.

FIGURE 5.5 Fuel usage in 2050 for technology-specific scenarios outlined in Section 5.3.2. Midrange values are the committee’s best estimate of the progress of the vehicle technology if it is pursued vigorously. Optimistic values are still feasible but would require faster progress than seems likely. No GTL or CTL fuel is used in the fuel cell and natural gas scenarios.

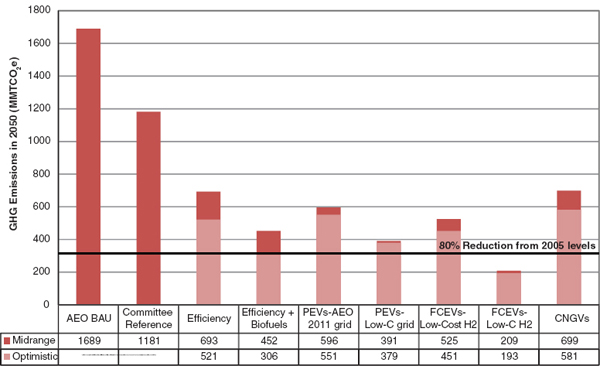

Figure 5.7 shows GHG emissions results for each scenario. It is noteworthy that all of the scenarios show substantial emissions reductions from the Committee Reference Case. However, meeting the 80 percent reduction goal is extremely difficult. Even given the aggressive deployment of advanced vehicle technologies and fuel supply technologies 2050 (by Technology) assumed in these runs, only two scenarios meet the 80 percent goal, the FCEV-dominated fleet powered by very low GHG-emitting hydrogen fuel and the optimistic case for vehicle efficiency plus biofuels. Several other scenarios come close to meeting the goal, and small reductions in VMT that could be expected with strict policies to reduce

FIGURE 5.6 U.S. light-duty vehicle petroleum consumption in 2030 and 2050 for technology-specific scenarios outlined in Section 5.3.2. Midrange values are the committee’s best estimate of the progress of the vehicle technology if it is pursued vigorously. Optimistic values are still feasible but would require faster progress than seems likely.

FIGURE 5.7 U.S. light-duty vehicle sector greenhouse gas emissions in 2050 for technology-specific scenarios outlined in Section 5.3.2. Midrange values are the committee’s best estimate of the progress of the vehicle technology if it is pursued vigorously. Optimistic values are still feasible but would require faster progress than seems likely.

GHGs might be sufficient to push them to the 80 percent goal as well.

Although these model results illustrate penetration levels of certain vehicles and fuels that may achieve the petroleum usage and/or greenhouse gas emissions reductions desired, the VISION model does not estimate the cost or the policy actions that would be necessary. For this, an alternative approach is needed.

The LAVE modeling builds on the VISION analyses, illustrating how market responses may influence the task of achieving the petroleum and greenhouse gas reduction goals as well as providing a sense of the intensity of policies that may be required and measuring, very approximately, the costs and benefits. The committee recognizes that such estimates will be neither certain nor precise. Both market and technological uncertainty are very substantial, as is illustrated in Section 5.7, a fact that requires an adaptable policy process. However, ignoring market responses and the costs of necessary policies would be a mistake. The policy options included in the LAVE model are briefly summarized in Box 5.2 and described in greater detail in Section 5.4.2.

The analyses using the LAVE-Trans model proceed as follows. First, the LAVE-Trans and VISION model projections of the BAU case are compared to establish the general consistency of the two models. The LAVE-Trans model is then used to approximately replicate the VISION model scenarios, which again shows broad consistency but also some differences between the two models. The strategy and approach to policy analysis using the LAVE-Trans model are described next, including how costs and benefits have been measured. All of the policy scenarios described below include strict CAFE standards that are tightened over time, and also some policy approach to bring alternative fuels into the market, such as RFS2. In addition all policy scenarios below also include the Indexed Highway User Fee (IHUF).

- The first set of policy analyses explore what might be achievable by means of continued improvement of energy efficiency beyond 2025 and introduction of large quantities of “drop-in” biofuels with reduced greenhouse gas impacts produced by thermochemical processes. To provide incentives for greater efficiency from ICEs and HEVs, the first feebate policy in Box 5.2, the Feebate Based on Social Cost (FBSC) is introduced.

- A second set explores the potential impacts of policies that change the prices of vehicles and fuels to reflect the goals of reducing GHG emissions and petroleum use. In these model runs, stronger feebates

BOX 5.2

Policies Considered in the LAVE-Trans Model

Feebates Based on Social Cost (FBSC)—An approximately revenue neutral feebate system that precisely reflects the assumed societal willingness to pay to reduce oil use and GHG emissions (see Boxes 5.3, 5.4, and 5.5 on feebates and the values of GHG and oil reduction).

Indexed Highway User Fee (IHUF)—A replacement for motor fuel taxes, the IHUF is a fee on energy indexed to the average energy efficiency of all vehicles on the road and is designed to preserve the current level of revenue for the Highway Trust Fund (see Chapter 6 for details).

Carbon/Oil Tax—A gradually rising tax levied on fuels to reflect the societal values of their carbon emissions and petroleum content (see Boxes 5.4 and 5.5).

Feebates Based on Fuel Savings—A feebate system that compensates for consumers’ undervaluing of future fuel savings. This feebate reflects the discounted present value of fuel costs (excluding the social cost fuel tax) from years 4 to 15, discounted to present value at 7 percent per year.

Transition Policies (Trans)—Polices that consist of subsidies to vehicles and fuel infrastructure designed to allow alternative technologies to break through the market barriers that “lock in” the incumbent petroleum-based internal combustion engine vehicle-fuel system. These could be either direct government subsidies or subsidies induced by governmental regulations, such as California’s Zero-Emissions Vehicle standards.

on vehicles, those based on fuel savings, are included, and carbon and petroleum taxes are added that reflect estimates of the full social cost of using those fuels.

- The third, fourth, and fifth sets explore transitions from ICEVs fueled by petroleum to plug-in electric vehicles, fuel cell vehicles powered by hydrogen, and compressed natural gas vehicles, respectively. These all include transition policies tailored to the particular vehicle and fuel type being considered.

- Two final groups of cases consider combinations of PEVs and FCEVs and the implications of more optimistic technological progress. These also include the appropriate transition policies.

- Finally, the implications of uncertainty about technological progress and the market’s response to advanced technologies and transition policies are considered. These cases include the IHUF, FBSC feebate, and transition policies while examining varied assumptions of technological progress and market behavior.

5.4.1 Comparing LAVE-Trans and VISION Estimates

As shown in Table 5.2, the BAU cases from the LAVE-Trans and VISION models confirm the general consistency of the two models. Each was calibrated to match in all years with respect to total vehicle miles of travel and total vehicle sales. There are differences in new-vehicle and vehicle stock fuel economies, the distributions of stock by age, and in the starting year GHG emissions rates due to the use of two different starting base years.6 These lead to differences between the models of about 5 percent in energy and GHG emissions estimates in 2010, with the differences declining in subsequent years. This decline reflects the fact that the differences are chiefly due to the starting-year data for vehicle stocks and LDV energy efficiency and usage.

LAVE-Trans models vehicle purchase decisions and vehicle use in ways that VISION does not, enabling it to include market responses to improvements in vehicle technologies. If vehicles have fuel economy gains that are more than paid for by their fuel savings, for example, consumers will purchase more vehicles and the size of the vehicle stock will increase. If vehicle efficiency improves but fuel prices do not increase proportionately, vehicle use will increase. Market shares of vehicle technologies are not assumed in LAVE-Trans as they are in VISION but are based on a model of consumer choice that accounts for the prices, energy costs, and other attributes of the different technologies. All of these factors change a great deal over time in all cases.

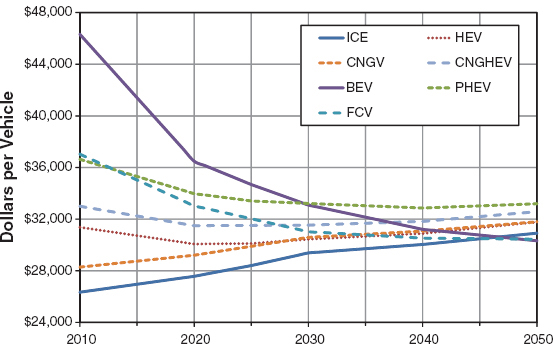

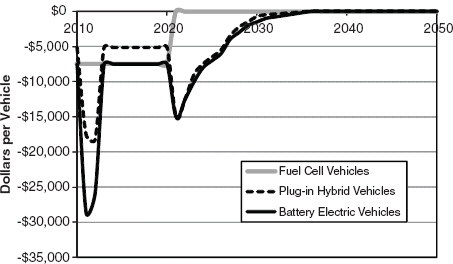

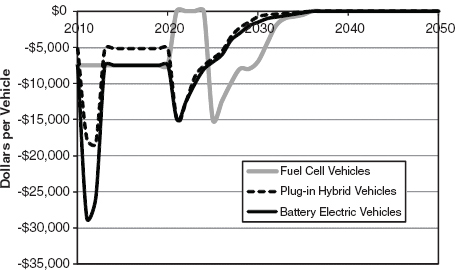

The purchase prices and energy efficiencies of future vehicles strongly affect their market acceptance. In the LAVE-Trans model, novel technologies start out at a significant disadvantage relative to ICEV and HEVs because millions of these latter vehicles have already been produced and can access a ubiquitous infrastructure of refueling stations. Novel technologies must progress down learning curves by accumulating production experience and acquire scale economies through high sales volumes. As a result, the initial costs of BEVs, PHEVs, CNGVs, and FCEVs are much higher than the long-run costs projected in the midrange and optimistic scenarios. The long-run costs for passenger cars in Figure 5.8 show what is estimated to be technologically achievable in a given year at fully learned, full-scale production. In the midrange assessment, these potential costs converge between 2030 and 2040, with FCEVs and BEVs becoming slightly less expensive than ICEVs but with PHEVs remaining several thousand dollars more expensive. The optimistic assessment trends are similar but the convergence occurs more rapidly and the advantages of FCEVs and

_______________________

6The LAVE-Trans model has a starting year of 2010, while VISION uses a base year of 2005. Instead of reprogramming or recalibrating the models, it was checked simply that their estimates were consistent.

TABLE 5.2 Comparison of Business as Usual Projections of the VISION and LAVE-Trans Models

| 2010 | 2030 | 2050 | |||||||

| LAVE | VISION | LAVE | VISION | LAVE | VISION | ||||

| Energy use | billion gge | 132 | 126 | 137 | 129 | 158 | 159 | ||

| Petroleum use | billion gge | 124 | 120 | 118 | 115 | 129 | 129 | ||

| Greenhouse gas emissions | MMTCO2e | 1,431 | 1,498 | 1,467 | 1,487 | 1,645 | 1,689 | ||

| Vehicle sales | thousands | 10,797 | 10,797 | 18,502 | 18,502 | 22,219 | 22,219 | ||

| Vehicle stock | thousands | 222,300 | 236,310 | 255,603 | 281,976 | 314,538 | 365,199 | ||

| Vehicle miles traveled | trillion miles | 2.73 | 2.73 | 3.75 | 3.75 | 5.05 | 5.05 | ||

| New light-duty vehicle fuel economy | mpg | 22.5 | 22.6 | 29.8 | 30.3 | 33.8 | 34.8 | ||

| Stock light-duty vehicle fuel economy | mpg | 20.6 | 21.2 | 27.4 | 27.8 | 32.0 | 31.7 | ||

BEVs are greater (see Figures 2.10 and 2.11 as compared with Figures 2.8 and 2.9).

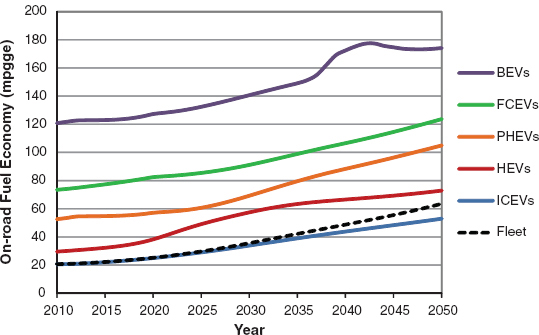

The energy efficiencies of new vehicles are shown in the midrange case to continue to improve at a rapid rate beyond 2025 (see Table 2.12 for details). The new-vehicle fuel economy numbers are inputs to the LAVE-Trans model and are taken from the estimates presented in Chapter 2 after accounting for the difference between on-road and test-cycle values. Internal combustion engine cars (both gasoline and CNG) increase to over 90 mpg by 2050, while HEVs exceed 120 mpg. PHEV fuel economy is the same as HEV mpg when operating in charge-sustaining mode and the same as BEVs when operating in charge-depleting mode. Such large increases in energy efficiency mitigate the effects of fuel prices over time.

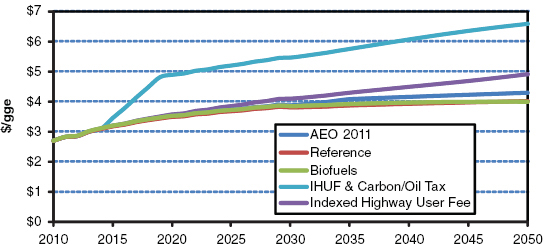

The prices of energy are also important and vary substantially among the cases examined below. Figure 5.9 shows the different assumptions about what influences the price of gasoline. The price depends not only on the level at which gasoline is taxed but also on the quantities of biofuel blended into it. Some included cases reflect the use of an IHUF on energy which increases very gradually over time as the average energy efficiency of all vehicles on the road increases. The greatest effect on pump prices, however, is with the introduction of a tax on the social value of carbon emissions and petroleum use, as described in Box 5.3, Box 5.4, and Box 5.5, assumed to be phased in over a period of 5 years. It is important to note that policies that greatly reduce the amount of oil used in the transportation sector, such as a number of those considered here, are likely to reduce both the demand for petroleum and its price. Less domestic use will mean fewer imports from insecure sources, which will likely reduce the magnitude of the social costs of using petroleum.

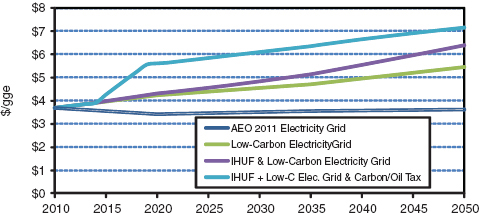

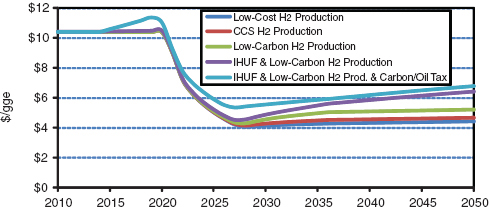

Figure 5.10 and Figure 5.11 show prices of other fuels under different assumptions. The price of electricity to consumers is affected by the de-carbonization of the grid, the IHUF, and the social value tax. Hydrogen prices start at more than $10/kg at low volumes and decrease as production approaches 6,000 tons/d. When and how quickly the decline occurs varies by scenario according to the level of hydrogen demand.

FIGURE 5.8 Fully learned, high-volume retail price equivalents (2009$) assuming midrange technology estimates.

FIGURE 5.9 Retail prices of gasoline (in 2009$) under various policy assumptions.

FIGURE 5.10 Retail prices of electricity (in 2009$) under various policy assumptions.

FIGURE 5.11 Retail prices of hydrogen (in 2009$) under various policy assumptions.

BOX 5.3

Feebates

Feebates are a fiscal policy aimed at influencing manufacturers to produce and consumers to purchase vehicles that are more energy efficient or produce fewer GHG emissions or both. A feebate system consists of a metric (e.g., g CO2/mi, gge/mi), a benchmark, and a rate. Each vehicle is compared to the benchmark and is assigned a fee or a rebate according to the difference between its performance on the metric and the benchmark, multiplied by the rate. For example, if the metric is g CO2/mi, the benchmark is 250 and the rate is $20/(g CO2/mi), a vehicle emitting 300 g CO2/mi would pay a fee of $1,000, whereas a vehicle emitting only 150 g CO2/mi would receive a rebate of $2,000. By carefully choosing the benchmark, the feebate system can be made approximately revenue neutral. Benchmarks can be defined in various ways, including as a function of a vehicle attribute, such as the footprint measure (wheelbase × track width) used in the current CAFE standards.

BOX 5.4

The Social Cost of Carbon Emissions

Twelve government agencies conducted a joint study of the social cost of carbon (SCC) to allow agencies to incorporate the social benefits of reducing carbon dioxide emissions into cost-benefit analyses (Interagency Working Group, 2010). The agencies used three well-known economic integrated assessment models (IAMs) to produce the estimates and considered a broad range of factors that affect the damage estimates. Their estimates for the years 2010 to 2050 (Table 5.4.1) represent the present value, in the year in question, of the discounted future damage resulting from a 1 metric ton increase in CO2 emissions. Estimates are given for three different discount rates (5%, 3%, and 2.5%), and for a 95th percentile (5% probability) estimate from the models at a 3 percent discount rate.

The group provided the higher 95th percentile estimate because of the following important limitations of the current state of knowledge concerning future damage due to climate change:

- Incomplete treatment of non-catastrophic damage

- Incomplete treatment of potential catastrophic damage

- Uncertainty in extrapolation of damage to high temperatures

- Incomplete treatment of adaptation and technological changes, and

- Assumption that society is risk neutral with respect to climate damage.

The interagency study strongly recommends using the full range of estimates in assessing the potential damage from climate change (p. 33). The range is an order of magnitude: from $4.70 to $64.90 per metric ton in 2010, rising to $15.70 to $136.20 per metric ton in 2050. In the committee’s judgment, the 80 percent greenhouse gas mitigation goal reflects a societal willingness to pay that is most consistent with the highest, 95th percentile estimates. This is the value the committee refers to as the social value of reducing greenhouse gas emissions.

TABLE 5.4.1 Social Cost of CO2, 2010-2050, in 2007 Dollars

| Discount | 5% | 3% | 2.5% | 3% | |||||

| Rate Year | Avg | Avg | Avg | 95th | |||||

| 2010 | 4.7 | 21.4 | 35.1 | 64.9 | |||||

| 2015 | 5.7 | 23.8 | 38.4 | 72.8 | |||||

| 2020 | 6.8 | 26.3 | 41.7 | 80.7 | |||||

| 2025 | 8.2 | 29.6 | 45.9 | 90.4 | |||||

| 2030 | 9.7 | 32.8 | 50.0 | 100.0 | |||||

| 2035 | 11.2 | 36.0 | 54.2 | 109.7 | |||||

| 2040 | 12.7 | 39.2 | 58.4 | 119.3 | |||||

| 2045 | 14.2 | 42.1 | 61.7 | 127.8 | |||||

| 2050 | 15.7 | 44.9 | 65.0 | 136.2 | |||||

SOURCE: Interagency Working Group (2010).

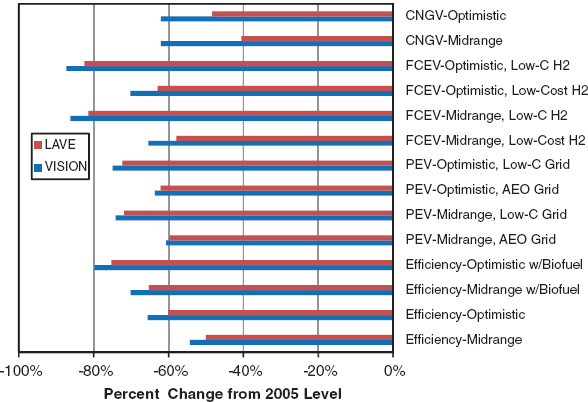

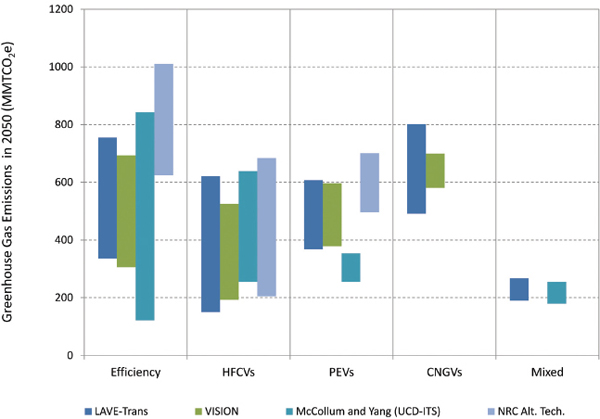

The market responses included in the LAVE model should make it somewhat more difficult to meet the GHG and oil reduction goals. To illustrate this, the LAVE model was used to approximately replicate the VISION model cases shown in Figures 5.6 and 5.7. The approach was to solve for the subsidies to alternative technologies that cause the LAVE model to predict the same market shares assumed in the corresponding VISION model run.7 This solution method results in a net subsidy to vehicle sales which over time will increase the size of the vehicle stock and thereby increase vehicle travel and energy use. In reality, the same market shares could be achieved by cross-subsidizing vehicles, which would reduce the impact on vehicle sales (e.g., via feebates; see Box 5.3). In that respect, the method will tend to exaggerate the greater difficulty of meeting the GHG and petroleum goals as a consequence of market responses.

In most cases the models produced very similar reductions in petroleum use and GHG emissions (Figure 5.12) with the LAVE-Trans model predicting somewhat smaller reductions, as expected. In most cases the differences are on the order of 5 percentage points. The VISION and LAVE-Trans CNGV

_______________________

7Only the key market shares were carefully matched. For example, in the PEV cases the market shares for battery electric and plug-in hybrid electric vehicles were matched; the remaining technologies’ market shares were as predicted by the LAVE model. In the FCEV cases only the market shares of fuel cell vehicles were closely matched.

BOX 5.5

Social Costs of Oil Dependence

The costs of oil dependence to the United States are caused by a combination of:

- The exercise of monopoly power by certain oil-producing states,

- The importance of petroleum to the U.S. economy, and

- The lack of ready, economical substitutes for petroleum.

Costs exceed those that would prevail in a competitive market due to the use of market power chiefly by nationalized oil exporters. The direct economic costs of oil dependence can be partitioned into the following three, mutually exclusive components (Greene and Leiby, 1993):

- Disruption costs, reductions in gross domestic (GDP) due to price shocks,

- Long-run GDP losses due to higher than competitive market oil prices,

- Transfer of wealth from U.S. oil consumers to non-US oil producers via monopoly rents.

When the U.S. takes actions to reduce its oil demand the world demand curve contracts resulting, other things equal, in lower world oil prices.1 Such use of monopsony power counteracts the use of monopoly power, increasing U.S. GDP and reducing the transfer of U.S. wealth to non-U.S. oil producers. Individuals will generally not consider the fact that reducing one’s own oil consumption produces benefits to others via lower oil prices. As a consequence the social benefits of reducing oil consumption exceed the private benefits. Although this appears to be similar to an externality, it is not an externality. The National Research Council (2009a) report Hidden Costs of Energy: Unpriced Consequences of Energy Production and Use considers only external costs and thus provides no relevant guidance on the value of reducing oil consumption.

Sudden, large movements in oil prices can temporarily reduce U.S. GDP by creating disequilibrium in the economy, leading to less than full employment of capital and labor (Jones et al., 2004). A substantial econometric literature on this subject has identified an important impact of price shocks on U.S. economic output (e.g., Huntington, 2007; Brown and Huntington, 2010). Reducing oil consumption reduces vulnerability to price shocks.

The Environmental Protection Agency and the National Highway Traffic Safety Administration (EPA and NHTSA, 2011) have published estimates of disruption costs as well as the monopsony effect. The estimates, based on Leiby (2008), recognize uncertainty about future oil market conditions and other parameters and are therefore specified as ranges that vary by year (Table 5.5.1). The range of total social costs per barrel is approximately $10 to $30, with the midpoint estimates lying close to $19 per barrel. If U.S. petroleum use decreases over time in accord with the reduction goals set for this study, the value of the monopsony benefit will also decrease. It is assumed that it will be halved by 2050.

cases differ a good deal, chiefly because the VISION model included both ICE and HEV CNGVs while the LAVE model was capable of including only ICE CNGVs. In both models BEVs are assumed to be used only 2/3 as much as other vehicles. The “missing miles” are allocated 60 percent to other existing vehicles, 30 percent to trips not taken (reduced VMT), and 10 percent to increased vehicle sales.

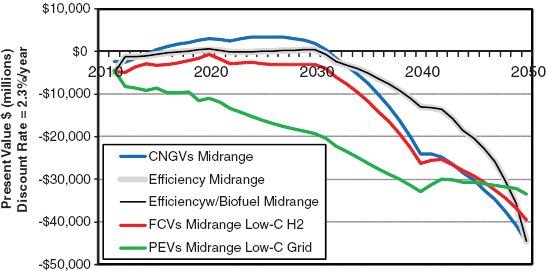

The vehicle and infrastructure subsidies estimated to be necessary to achieve the market shares assumed for the VISION model are very large (subsidies are shown in Figure 5.13 as negative values). The LAVE-Trans model was used to estimate the per-vehicle subsidies required to achieve the market shares for alternative technologies assumed in the VISION runs. No assumption was made about who would pay for the subsidies. For the CNGV and FCEV cases, it was assumed that 300 subsidized refueling stations would be deployed to support initial vehicle sales. Inferred subsidies for five runs using midrange technology assumptions are in the range of $35 billion to $45 billion annually by 2050 (values discounted to present value at 2.3 percent per year8). Cumulative subsidies run to hundreds of billions of dollars. Although per-vehicle subsidies are larger in the earlier years, fewer vehicles are being sold so that total subsidies are smaller. The VISION CNGV sales through 2030 are somewhat lower than the LAVE-Trans model would predict in the absence of subsidies, and so small taxes on CNGVs (positive values in Figure 5.13) are needed to match the VISION assumptions. For the most part, the very large subsidies are a consequence of assuming market shares for the 2030 to 2050 period that are substantially higher than the LAVE-Trans model estimates the market would sustain without continuing subsidies. The next section explores what might be possible with temporary subsidies that are sufficient to break down the transition barriers but can be quickly phased out once those barriers have been breached.

_______________________

8OMB Circular No. A-94 specifies discount rate for projects up to 30 years, whereas the time-frame for this analysis is 40 years. The recommended rate for 20-year projects is 1.7 percent and for 30-year projects is 2.0 percent (OMB, 2012).

TABLE 5.5.1 Oil Security Premiums, Midpoint, and (Range) by Year (2009 $/barrel)

| Year | Monopsony | Disruption Costs | Total | ||||||

| 2020 | $11.12 | $7.10 | $18.22 | ||||||

| ($3.78–$21.21) | ($3.40–$10.96) | ($9.53–$29.06) | |||||||

| 2025 | $11.26 | $7.77 | $19.03 | ||||||

| ($3.78–$21.48) | $3.84–$12.32) | ($9.93–$29.75) | |||||||

| 2030 | $10.91 | $8.32 | $19.23 | ||||||

| ($3.74–$20.47) | ($4.09–$13.34) | ($10.51–$29.02) | |||||||

| 2035 | $10.11 | $8.60 | $18.71 | ||||||

| ($3.51–$18.85) | ($4.41–$13.62) | ($10.30–$28.20 | |||||||

SOURCE: EPA and NHTSA (2011), Table 4-11.

The estimates in Table 5.5.1 do not include military costs (EPA, NHTSA, 2011, p. 4-32), yet access to stable and affordably priced energy has traditionally been considered a critical element of national security (e.g., McConnell, 2008, p. 41; Military Advisory Board, 2011, p. xi). Estimates of the national defense costs of oil dependence range from less than $5 billion per year (GAO, 2006; Parry and Darmstadter, 2004) to $50 billion per year or more (Moreland, 1985; Ravenal, 1991; Kaufmann and Steinbruner, 1991; Copoulos, 2003; Delucchi and Murphy, 2008). Assuming a range of $10 billion to $50 billion per year, and dividing by a projected consumption rate of approximately 6.4 billion barrels per year (EIA, 2012, Table 11) gives a range of average national defense cost per barrel of $1.50 to $8.00 per barrel (rounded to the nearest $0.50).

Adopting the EPA-NHTSA estimates indicates a range of about $9 to $30 per barrel, with a midpoint of $19. A reasonable range of national defense and foreign policy costs appears to be $1.50 to $8 per barrel, with a midpoint of about $5 per barrel. Adding these numbers produces a range of $10.50 to $38 per barrel with a midpoint of $24 in 2009$, or about $25 per barrel in current dollars. This is the value adopted by the committee to reflect the social value of reductions in petroleum usage.

_______________________

1Since OPEC is not a competitive supplier, there is no world oil supply function in the usual sense. The response of world oil prices to a reduction in U.S. demand will therefore depend on how OPEC reacts. OPEC’s options, however, are not unlimited. If OPEC does not reduce output, oil prices will fall. If OPEC does reduce output, it loses market share which diminishes its market power. Greene (2009) has shown that in terms of economic benefits to the U.S. there is very little difference between the two strategies.

5.4.2 Analysis of Transition Policy Cases with the LAVE-Trans Model

Given the committee’s fuel and vehicle technology scenarios, the LAVE model was used to estimate what might be accomplished by policies that reflect the social value of reducing GHG emissions and petroleum use combined with additional but temporary policies to induce transitions to alternative vehicles or fuels or both. Policies that reflect the value of reducing GHG emissions and petroleum use are initiated in 2015 or 2017 and remain in effect through 2050.9 The current subsidies for electric and fuel cell vehicles are assumed to end by 2020 and be replaced by the new policies. Policies to induce transitions to alternative vehicle and fuel combinations begin at various dates and are phased out once the alternative technologies achieve a sustainable market share. Their intended function is to overcome the barriers to a transition from the incumbent energy technology to an alternative. Transition policies consist of explicit or implicit vehicle and infrastructure subsidies. Implicit subsidies would result from policies such as California’s Zero Emission Vehicle (ZEV) mandates that require manufacturers to sell ZEVs regardless of market demand and therefore to cross-subsidize ZEVs. Or, requiring fuel providers to provide refueling outlets for alternative fuels would induce cross-subsidies from petroleum fuels to low-carbon alternatives. Similarly, policies such as RFS2 to require certain amounts of biofuels are an example of an implicit subsidy for alternative fuels.

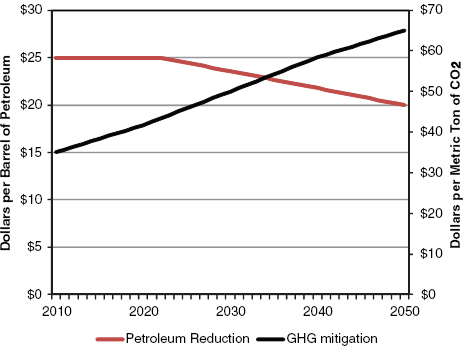

At present, there is both uncertainty and disagreement about the value of reducing petroleum consumption and the value of reducing greenhouse gas emissions. The committee’s approach is to value these reductions according to society’s willingness to pay, as reflected in the stringency of the reduction goals. For example, carbon emissions should be valued at a cost consistent with the cost of de-carbonizing the electric utility sector as discussed in Chapter 3 and described in greater detail in Box 5.4. For GHG mitigation, the commit-

_______________________

9The feebate system reflecting the social value of reductions in CO2 emissions and petroleum use begins in 2017 while all other fiscal policies, if used, begin in 2015.

FIGURE 5.12 Comparison of LAVE-Trans and VISION model-estimated GHG reductions in 2050 given matching deployment.

tee elected to adopt the highest estimates of the Interagency Working Group on the Social Cost of Carbon (2010), and for petroleum reduction the committee derived its own estimates based on research by Leiby (2008) and others (see Box 5.5). These assumed values are shown in Figure 5.14.

Policies consistent with a strong commitment to reduce oil use and GHG emissions are included in all the policy cases. Specifically, a steady tightening of CAFE/GHG emissions standards combined with associated policies is assumed to ensure that they are met and enforced, which would yield efficiency improvements of both the midrange and optimistic vehicle technology scenarios, as explained in Chapter 2. Because the fuel economy and emissions standards will almost certainly be a binding constraint on manufacturers’ technology and design decisions, they will induce manufacturers to price the different drive train technologies so as to reflect their contributions to meeting the standards. This is represented by an approximately revenue-neutral feebate system that precisely reflects the social value of reductions in petroleum use and GHG emissions (see Boxes 5.3, 5.4, and 5.5 on feebates and the values of GHG and oil reduction).

Policies such as the RFS2, Low Carbon Fuels standards, or equivalent will be needed to bring drop-in biofuels to market, and additional policies will be required to ensure that electricity or hydrogen is produced via methods with

FIGURE 5.13 Annual subsidies to alternative fuels vehicles required to match five VISION cases. Negative values represent a net cost. The two efficiency curves are overlapping but not identical because the vehicle costs are the same and fuel costs nearly the same.

FIGURE 5.14 Assumed social values of reductions in GHG emissions and petroleum usage (in 2009$).

reduced greenhouse gas impacts, as explained in Chapter 3. These policies are implicit in all model runs except the BAU and Reference Cases. Their costs are reflected in the prices of the fuels for those cases assuming fuels produced with reduced GHG impacts (e.g., “+ Low-C Grid”). In addition, the very large improvements in energy efficiency included in all the policy runs will severely reduce Highway Trust Fund revenues unless measures are taken to prevent it. All policy cases assume that motor fuel taxes will be replaced by a user fee on energy (IHUF), indexed to the average energy efficiency of all vehicles on the road (see Chapter 6 for details).

Two additional fiscal policies were considered. A tax can be levied on fuels reflecting the social costs of their carbon emissions and petroleum content. When this tax is used, the feebates reflecting the social value of carbon emissions reductions are reduced. Since the vehicle choice model includes the first 3 years of fuel costs, the fuel taxes paid in those years will be taken into account by consumers in their vehicle purchase decisions. Thus, the feebate rates are adjusted to include only the social values of reductions in carbon emissions and oil use in the remaining years of the vehicle’s life. The impact of the fuel tax is therefore on vehicle use rather than vehicle choice. The remaining fiscal policy is an additional feebate system that compensates for consumers’ undervaluing of future fuel savings. This feebate reflects the discounted present value of fuel costs (excluding the social-cost fuel tax) from years 4 to 15, discounted to present value at 7 percent per year.10

5.4.2.1 Transition Policies

A transition to an alternative vehicle and fuel combination such as fuel cells and hydrogen or plug-in electric vehicles may be necessary to meet the reduction goals. This section focuses on such a transition away from the incumbent petroleum-based, ICEV-fuel system. As seen in the VISION results and again below, it may also be possible that the goals can be met without a transition to hydrogen- or electricity-powered vehicles. A shift away from petroleum fuel toward drop-in biofuels, combined with much more efficient ICEV and HEV engines, also offers an opportunity for significant greenhouse gas and petroleum reductions by 2050, although the 2030 petroleum reduction target remains difficult to achieve in all cases. With the data and model available, the committee is not able to fully explore the transition to large-scale low-carbon biofuels production here but does examine this case with the available information below.

In the LAVE model, transition polices consist of subsidies to vehicles and fuel infrastructure. These could be either direct government subsidies or subsidies induced by governmental regulations, such as California’s ZEV standards. The function of these subsidies is to allow alternative technologies to break through the market barriers that “lock-in” the incumbent petroleum-ICEV vehicle-fuel system. The transition policies used in the policy cases have been constructed by following these rules:

- Annual sales in the first 3 to 5 years of a transition should number in the thousands to tens of thousands of units.

- The increase in sales in any year should not be more than 6 percent of total light-duty vehicle sales.

_______________________

10OMB Circular No. A-94 recommends a discount rate for private return on capital of 7 percent (OMB, 2012).

- The growth of sales should avoid abrupt increases or decreases.

- Subsidies should be phased out as sales approach the level the market will support without subsidies.

In reality, a transition policy would need to be more comprehensive. Transition policies could potentially offer a greater variety of incentives, such as access to high occupancy vehicle lanes, free parking in congested areas, and so on. In the LAVE model the vehicle and fuel subsidies are intended to measure the cost of inducing transitions rather than to describe the specific polices by which they should be accomplished.

5.4.2.2 Transition Costs and Benefits

The costs and benefits of each of the policy cases presented below are measured relative to a Base Case that includes identical assumptions about technological progress and all other factors but does not include new policies to induce a transition to alternative vehicles or fuels or both. This was done to better measure the incremental costs and benefits of accomplishing transitions to alternative vehicles and fuels, as distinguished from the obvious benefits of having better technology. In general, this means that if the midrange technology assumptions are used in a transition case, the transition case will be compared to a Base Case that also uses the midrange technology assumptions. If a transition case uses optimistic assumptions for some technologies and midrange assumptions for others, its Base Case will make identical assumptions about technological progress. The transition cases differ from their respective Base Case only in terms of the transition policies. Except for the BAU and Reference Cases, all Base Cases assume that fuel economy and emissions standards are continuously tightened through 2050.

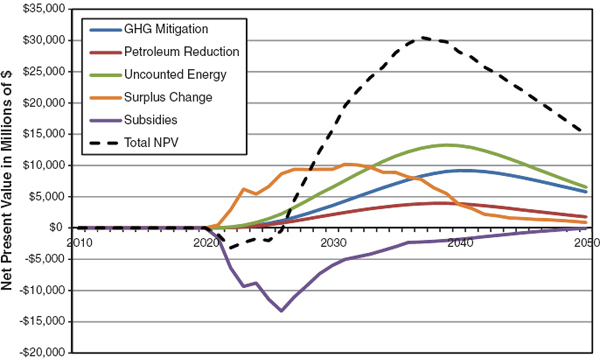

Costs and benefits are measured11 as changes from the respective Base Case in the following five quantities:

- Costs of subsidies,

- Additional fuel costs or savings,

- Changes in consumers’ surplus,

- The social value of GHG reductions, and

- The social value of reduced oil use.

- Subsidy costs include the implicit or explicit vehicle subsidies due to the higher costs of more efficient vehicles with lower greenhouse gas emissions, and they include the cost of subsidized infrastructure for public recharging of plug-in electric vehicles or refueling hydrogen or CNG vehicles.

- Additional fuel costs or savings. Since consumers are assumed to consider only the first 3 years of fuel savings in making their vehicles choices, it is necessary to account for the additional costs or savings over the remainder of each vehicle’s lifetime. Additional fuel costs or savings are private costs or benefits that accrue to the vehicle user that (by assumption) are not capitalized by the vehicle purchaser at the time of purchase.

- Consumers’ surplus is an economic concept that measures consumers’ welfare in dollars. Two changes in consumers’ surplus are measured: (1) satisfaction with vehicle purchases and (2) satisfaction with fuel purchases. The LAVE model includes a widely used method of modeling consumer choice that recognizes that not all consumers have the same tastes or preferences. Some may prefer the attributes of electric drive while others prefer internal combustion engines. If electric-drive vehicles become available at competitive prices as a result of successful transition policies, the satisfaction of those with a preference for electric drive will increase. Those who prefer ICEVs will still have that option and so will be no better or worse off than before the plug-in vehicles became available. Consumers’ surplus measures that increased value in dollars. Vehicle subsidies increase consumers’ surplus but by less than the gross amount of the subsidies. This results in a net economic cost, at least in the early years of a transition. Taxing the energy consumers must purchase to operate their vehicles creates a loss of consumers’ surplus, in addition to a transfer of wealth from consumers to the taxing entity. The surplus loss over and above what is counted in the vehicle purchase decision is also measured when changes in tax policies are considered.

- The social value of reducing greenhouse gas emissions and oil use. These values are measured by multiplying the changes in estimated annual quantities times the social cost of emissions per unit assumed by the committee consistent with the goals of the study (see Boxes 5.4 and 5.5). Hydrogen and fuel cell vehicles will also have zero tailpipe emissions of other pollutants, and may have lower full fuel cycle emissions, as well. The committee has not attempted to estimate those potential benefits, and they are not included in the cost and benefit estimates.

The net present value (NPV) of a policy case is the sum of all costs and benefits from 2010 to 2050, plus the fuel, GHG, and petroleum costs and benefits of vehicles sold through 2050 that will still be in use beyond that date. From an economic perspective, an optimal policy strategy would be one that maximized NPV. NPV depends strongly on the discount rate assumed, and there may be widely differing opinions about the appropriate discount rate. A 2.3 percent rate for

_______________________

11All costs and benefits are measured in constant dollars, discounted to present value using an annual discount rate of 2.3 percent.

all years is used, which is consistent with the most recent guidance of the U.S. government (OMB, 2012); however, the appropriate discount rate is yet another source of uncertainty.

Sections 5.4.3 to 5.4.9 present results from transition policy cases and compare them to their respective Base Cases. In general, all cases (except BAU and Reference) assume fuel economy/emissions standards to 2050. All cases (except BAU and Reference) include feebates and the IHUF. All transition cases assume vehicle subsidies or mandates and infrastructure subsidies or mandates. A few of the cases add special policies as noted in the text.

Rather than enabling us to reach definitive conclusions, the committee’s modeling suggests the extent of technological progress and the kinds and stringency of policy measures that are likely to be needed to bring about transitions. It provides useful insights about the interactions between policy, the market, and technological changes. It also provides a general indication of the costs and benefits of achieving the GHG and petroleum reduction goals conditional on the many assumptions that must be made. Uncertainty will be an inherent property of the process of energy transition: uncertainty about technological change, uncertainty about the market’s response to technologies and policies, and uncertainty about the future state of the world. The extent of uncertainty about both future technologies and the market’s response to them is illustrated by means of sensitivity analysis in Sections 5.6 and 5.7 below.

5.4.3 Energy Efficiency Improvement and Advanced Biofuels

The cases described in this section explore what may be possible given the midrange and optimistic technology projections, continued tightening of fuel economy and emissions standards, and large-scale production of thermo-chemically produced “drop-in” biofuels. These cases maintain the ICEVs with improved technology but involve a transition to large scale production and use of cellulosic biofuels. A final case also includes adoption of all the pricing policies described above. All cases include the IHUF, which increases from $0.42/gge in 2010 to $1.27/gge in 2050, and feebates that reflect the assumed societal willingness to pay for reductions in GHG emissions and oil use.

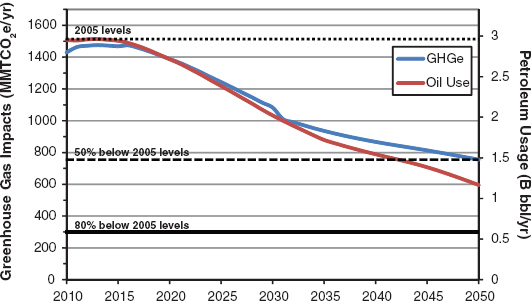

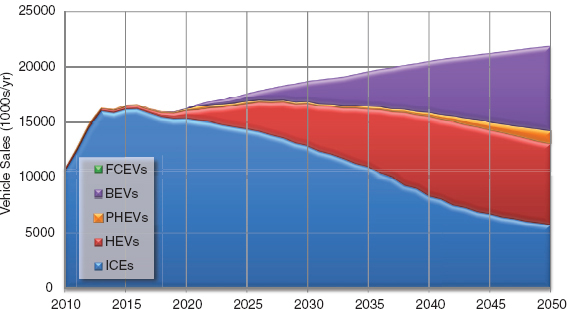

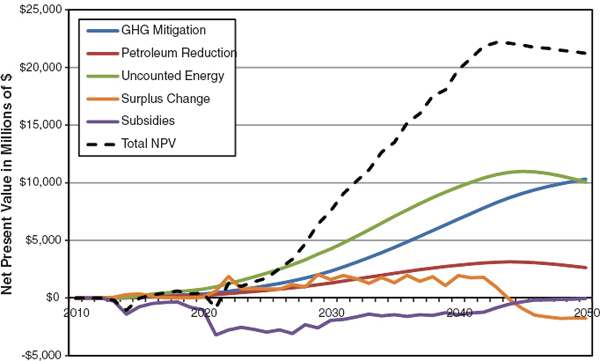

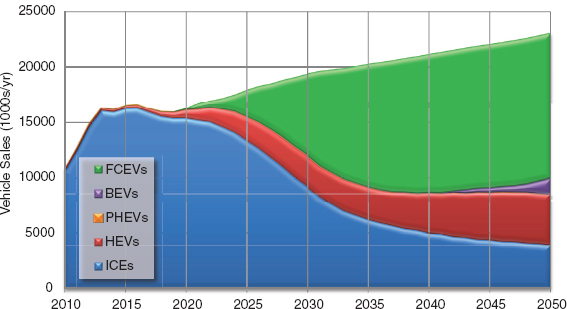

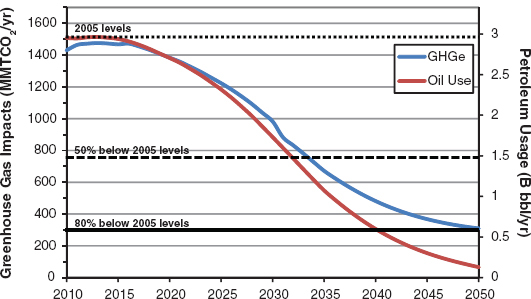

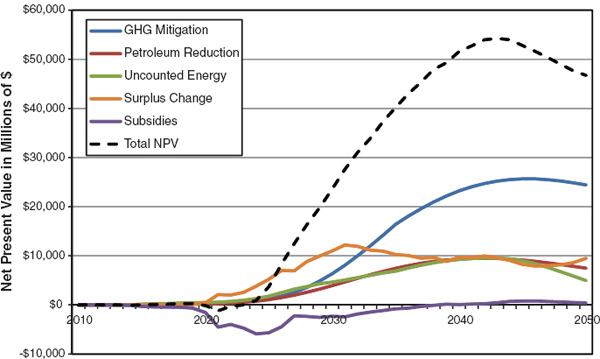

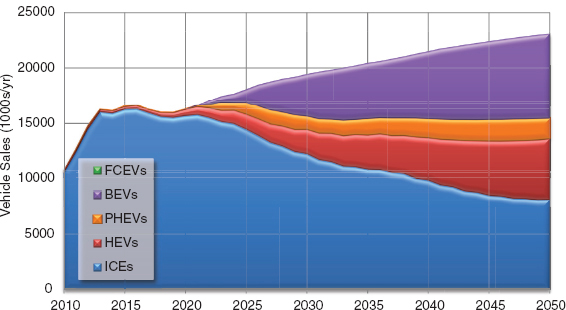

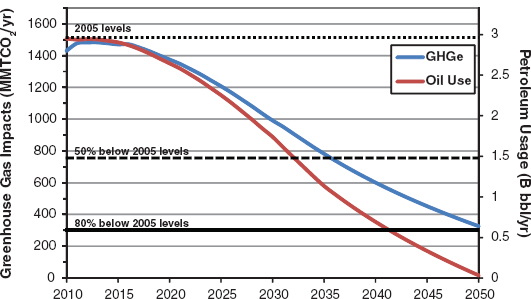

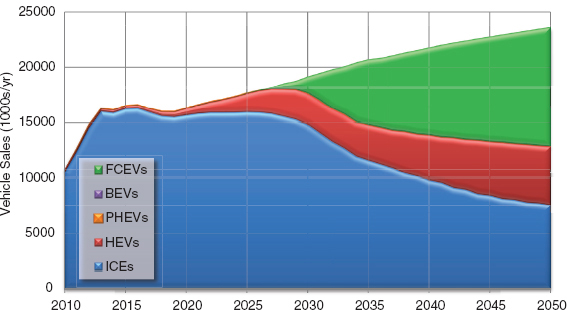

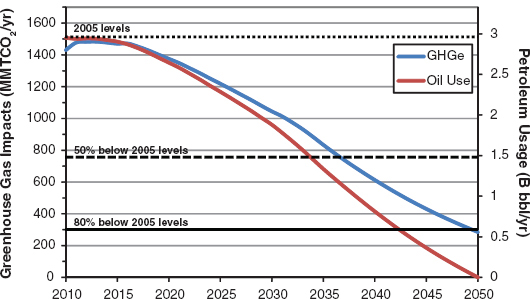

The technological progress enabling increased energy efficiency described in Chapter 2 (Table 2.11) will be devoted to improving vehicle fuel economy only if strong policies, such as increasingly stringent fuel economy and emissions standards, are put in place beyond 2025. The approximately revenue-neutral feebates, which are phased over 5 years beginning in 2017, amount to a tax of $60 per ICEV in 2021, with rebates of $770 per HEV, $1,650 per PHEV, $2,900 for each BEV, and $2,575 per FCEV. The feebates change over time as energy efficiencies, fuel properties, and the social willingness to pay for GHG and oil use reductions change. Assuming such standards are implemented, the midrange estimates of efficiency improvements and their costs result in estimated reductions in GHG emissions of 29 percent by 2030 and 52 percent by 2050 (Figure 5.15). For the same dates, petroleum consumption is estimated to be reduced by 33 and 64 percent, respectively. The reductions are due in part to the continued reduction in rates of fuel consumption for both ICEVs and HEVs (Figure 5.16) and by a steady shift from ICEVs to HEVs and BEVs (Figure 5.17).

If technology progresses as envisioned in the midrange scenario, the economic benefits of the efficiency improvements versus the Business as Usual case could be very large.

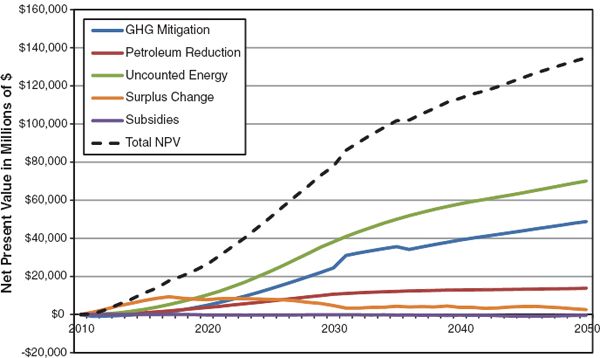

FIGURE 5.15 Changes in petroleum use and greenhouse gas (GHG) emissions for the Efficiency case with midrange technology estimates as compared to 2005 levels.

The key components of economic costs and benefits are shown in Figure 5.18 as annual costs, discounted to present value at the rate of 2.3 percent per year. The sum of the individual components grows to an estimated $130 billion per year by 2050. The largest component is “uncounted fuel savings,” the future fuel savings not considered by consumers at the time of purchasing a new car but realized later over the life of the vehicle. Consumers’ surplus, their net satisfaction with their vehicle purchases, decreases slightly after 2030 due to the increased cost of ICEVs over time. The net present social value of the transition to much higher efficiency vehicles is estimated to be on the order of $3.5 trillion.

Increasing the quantity of thermochemically produced, drop-in biofuels from 13.5 billion gge to 19.2 billion gge in 2030 increases the estimated reduction in petroleum use from 33 to 37 percent in that year. The 2030 reduction in GHG emissions is 32 percent versus 28 percent. In 2050, when the biofuels industry has expanded to produce 45 billion gge, the estimated impact is much greater: petroleum use is down 86 percent (compared with 64 percent) and GHG emissions are 66 percent lower than in 2005 (compared with 52 percent without advanced biofuels) (Figure 5.19).

If carbon emissions from the production of 20 percent of thermochemical biofuels were captured and stored, an estimated 78 percent reduction in GHG emissions versus

FIGURE 5.16 Average fuel economy of on-road vehicles for the Efficiency case with midrange technology estimates. The upturn in battery electric vehicle (BEV) fuel economy after 2040 reflects the rapidly increasing share of new BEVs on the road (and thus a larger fraction of the BEV fleet is the newest, most efficient BEVs). The downturn that follows is representative of an increasing number of battery electric trucks in the fleet.

FIGURE 5.17 Vehicles sales by vehicle technology for the Efficiency case with midrange technology estimates.

FIGURE 5.18 Estimated costs and benefits for the Efficiency case with midrange technology estimates.

2005 could be achieved by 2050. Given the uncertainty in the analysis, the 2050 goals would then be met for all practical purposes. The 2030 goal of a 50 percent reduction in petroleum use is still missed because of the low initial ramp-up in production, however; the estimated reduction is 37 percent. The cost of 20 percent CO2 removal for biofuels blended into gasoline adds about $0.20 per gallon to the average price of gasoline in 2050. If CCS is applied to all biofuels, then the net GHG emissions from the LDV fleet could be slightly negative.

5.4.4 Emphasis on Pricing Policies

A great deal can be accomplished by means of policies that change the prices of fuels and vehicles and harness market forces to reduce GHG emissions. This scenario, like the others based on the midrange technology scenario, assumes that fuel economy standards are inducing manufacturers to produce increasingly efficient vehicles. However, it also introduces stronger feebates and adds to the cost of fuels the social willingness to pay for GHG and oil reduction. The additional feebate system capitalizes in vehicles’ prices the uncounted energy savings due to consumers’ assumed under-

FIGURE 5.19 Changes in petroleum use and greenhouse gas (GHG) emissions for the Efficiency + Biofuels case as compared to 2005 levels.

valuing of future fuel savings.12 Production of electricity and hydrogen via processes with low-GHG impacts is assumed, but not intensive use of drop-in biofuels.

The fully taxed price of gasoline increases from $2.70 per gallon in 2010 to $4.90 per gallon in 2020 and $5.50 per gallon in 2030. Gasoline prices continue to increase, reaching $6.60 per gallon in 2050, as a result of $2.70 per gallon in combined taxes. The price of electricity in 2050 is roughly equal to that of gasoline on an energy basis, but BEVs are more than three times more energy efficient than comparable ICEVs in 2050. Feebates also strongly encourage purchases of BEVs. The rebate for a BEV in 2020 is almost $14,000, while ICEVs are taxed at $300 each. The difference decreases as vehicles and fuels improve so that by 2050, BEVs receive a $1,300 per vehicle rebate, whereas ICEVs are taxed at $2,500 per vehicle (the incidence also shifts to approximate revenue neutrality).

The result is a massive shift to battery electric and hybrid electric vehicles. By 2050, an estimated 59 percent of new-vehicle sales are BEVs and 33 percent are HEVs. In 2050 almost 40 percent of the vehicles on the road are BEVs. In the absence of policies to put a hydrogen refueling infrastructure in place, fuel cell vehicles never achieve any significant share of the market. Battery electric vehicles are far less dependent on early infrastructure development, which gives them a decisive advantage over FCEVs in this scenario.