The widespread adoption of solid-state lighting (SSL) will necessitate further technological and scientific advances to improve product quality and reduce costs and also require greater dissemination of product information to support consumer purchases. This chapter identifies the barriers faced by industry to the widespread deployment of SSL products and analyzes the role that governments and partnerships can play in bringing reliable and competitively priced SSL products1 to market. Consideration is also given to the time line and the quantifiable benefits for the commercialization of SSL products as replacements for current incandescent and halogen lamp (i.e., light bulb) technology.

Consumers need assurances that the SSL products they purchase will meet their lighting needs as advertised to avoid some of the early deployment problems associated with the introduction of compact fluorescent lamps (CFLs). Problems encountered during the introduction of CFLs are discussed in Chapter 2 and again later in this chapter, as are the lessons learned for the introduction of SSL products.

Also examined in this chapter is the role of support for consumer purchases in the form of financial incentives (or giveaways) by utilities and state energy efficiency programs and the establishment of more stringent lighting requirements in new construction and building retrofits to stimulate market demand to support SSL industry development in the United States. To avoid problems experienced with the introduction of CFLs, government and industry both have a role to play in helping achieve scientific breakthroughs, developing standards, supporting consumer purchases with financial incentives, and having a viable disposal plan in place to address safe disposal of end-of-life SSL products to support adoption, as discussed in more detail later in this chapter.

SSL costs must come down in all major cost categories, including materials use, yield, wafer processing, assembly, and packaging to reduce the cost of SSL products at the point of purchase. This chapter further discusses those categories of cost along the value chain that need to be addressed to improve the value proposition of higher quality light, longer product life, and overall lower life-cycle cost compared to current lighting products on the market.

SSL products to date have been successful in penetrating the vehicle and traffic signal lighting markets, retail and refrigerated displays, and electronic and entertainment markets. However, the performance of SSL products needs to improve, and costs need to come down to further penetrate the residential, commercial, and industrial lighting replacement market, which is the largest potential market for SSL. The cost of organic light-emitting diodes (OLEDs) must be substantially reduced before OLED lighting products penetrate the lighting market. The replacement markets also hold the most promise for the greatest energy savings and environmental benefits from SSL use, consistent with the Department of Energy’s (DOE’s) SSL program objective and funding priorities.

At this time, the United States is lagging behind other countries in SSL manufacturing volume, and most manufacturing is located in the Far East.2 The SSL lighting industry is intertwined with the electronics industry, and light-emitting diodes (LEDs) are used not only for general lighting but also in many other applications, including backlighting of liquid crystal display (LCD) TVs, laptop computers, and handheld devices. One analysis of the LED market revenues for all such applications approached $10 billion globally in 2010, and sales of packaged LEDs rose 55 percent in 2010 with sales of 81 billion units (Young, 2011). LEDs fabricated of gallium nitride (GaN) were principally responsible for this

________________

1 Including those based on light-emitting diodes (LEDs), organic LEDs (OLEDs), and, potentially in the future, semiconductor lasers.

2 Market shares are as follows: United States and Europe, 23%, Japan, Korea, Taiwan, and China, 72% (Young, 2011).

growth, rising 67 percent and now accounting for 79 percent of the LED market. LED backlighting for LCD television screens is now the leading market for LEDs, accounting for 27 percent of the inorganic LED sales, and is the fastest growing LED market today. Total revenues from sales of backlighting rose 84 percent in 2010 and accounted for 70 percent of inorganic LED sales (Young, 2011). Lighting, automotive, and signage applications of LEDs enjoyed a greater than 20 percent growth in the past year to slightly less than $2 billion (Young, 2011; Bhandarkar, 2011). IMS Research estimates that the North American lighting market has close to 4 billion incandescent lamps, 1.6 billion CFLs,3 1.65 billion fluorescent lamps, 200 million HID lamps, and just over 500 million halogen lamps (Young, 2011). McKinsey (2011) studied the global market for lighting in all applications and found that in 2010 LEDs for general illumination captured 7 percent (roughly €3 billion) of the market for new installations and 5 percent (€0.3 billion) of replacements.

U.S. participation in SSL research and development (R&D), manufacturing, and sales is currently well behind other developed countries. Japan is a leader in the LED industry in production and in public funding for R&D. Suppliers such as Nichia, Toyoda Gosei, Sharp, Rohm, Panasonic, Toshiba, and Citizen reside in Japan. More than 20 national universities in Japan have strong R&D efforts, which surpass the number in the United States. Currently, LED lighting is being subsidized by the Japanese government in order to reduce electricity use, in part in response to the devastation to the country’s electricity supply (25 percent reduction) caused by the Sendai earthquake and tsunami of 2011. LED lighting sales in Japan are estimated to top $1 billion in 2011, making Japan the largest market for LED lighting products. The LED adoption rate for new lamp purchases has already reached 40 percent and is projected to exceed 50 percent in Japan by 2012.

In June 2011, a new national energy-saving program was launched by the South Korean government aimed at achieving a 100 percent conversion rate to LED lighting in buildings owned by the South Korean government, as well as a 60 percent penetration of all lighting applications nationwide by 2020. To support this initiative, the Korean government will provide $185 million in funding support in 2012 and 2013 for LED point-of-purchase rebates. Samsung, LG, and Seoul Semiconductor are crucial players in helping reach these goals. These companies already offer a broad range of LED products for the domestic market. Samsung announced a 60 watt (W) equivalent LED lamp at less than $20 in 2011. Seoul Semiconductor was the fourth largest LED manufacturer in 2010 (Bhandarkar, 2011). China is currently a net importer of LED lighting for notebook backlights and automobile headlights. However, China intends to be a major producer of LEDs by 2015, and large capital investments by LED makers are now being heavily subsidized by the Chinese government (Young, 2011). Until July 2011, metal organic chemical vapor deposition (MOCVD) equipment was subsidized 50 percent by the Chinese government. More than 200 MOCVD systems were purchased under this subsidization program. However, it is now being discontinued until further demand for LED lighting is demonstrated. Motivated by the potential for large energy savings using SSL, LEDs are a targeted technology in China’s 5-year plan. Started in 2009, the plan is focused on the development of a sustainable LED industry. The Chinese central government’s objective is to consolidate the industry with five or six major players, all of which would be able to compete globally with the intention of becoming low-cost manufacturers by 2015; with China being the largest consumer of LEDs with a market reaching $74 billion by that same year. China has announced its intent to phase out incandescent lamps by 2016 starting with those over 100 watts in October 2012 (Reuters, 2011).

Mobile OLED displays are now being manufactured almost exclusively in Korea and the Far East for handheld electronic device applications such as smart phones. It is expected that display manufacturers in Japan, Korea, and China will move to larger displays, where OLEDs are very attractive alternatives to liquid crystal displays (LCDs). Although displays are a highly commoditized product, their relative price elasticity compared to general lighting makes displays the ideal first application for OLEDs. Larger companies like GE, Philips, Osram Sylvania, and Samsung are all developing OLED technology for lighting applications, with Moser-Baer, located in New York, being the first commercial entry into OLED lighting manufacturing.

Several large U.S.-based corporations and numerous medium-size lighting and start-up companies participate in the SSL market. These companies hold world-class positions and employ tens of thousands of people in the United States. In the LED chip market, Cree Inc., and Philips-Lumiled are among the top 10, based on worldwide revenue. Both companies still manufacture in the United States and produce revenues of the order of $1 billion annually. Some of the world’s leading LED manufacturing equipment suppliers reside in the United States, with VEECO and Applied Materials being leading MOCVD reactor suppliers. Numerous substrate equipment suppliers and fabrication and test companies play a critical role in the SSL supply chain. The LED lamp and luminaire markets have numerous medium and small companies providing LED lamps and luminaries.

OLEDs have also been the subject of a growing manufacturing base over the past decade in the commercialization of color mobile displays. Mobile display production in 2011 was estimated at approximately 3 million displays per month for Samsung alone (Wall Street Journal Asia, 2011). Leveraging this early manufacturing experience, several

________________

3 The term CFL applies to not only the twisted fluorescent replacement for incandescent A-lamps, but also “folded” fluorescent lamps, e.g., GE’s Biax lamp. These do not share the problems associated with the twisted CFL.

manufacturers are now developing OLEDs for general lighting applications because of their potential for high efficacy, large area coverage, and conformable configurations. At present, however, OLEDs have some shortcomings for general lighting applications, as discussed in Chapter 3, such as very high cost compared to LEDs and to other lighting technologies.

BARRIERS AND THE SSL VALUE CHAIN

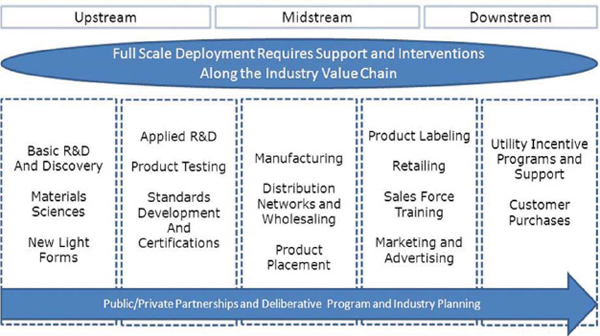

Despite the rapid increase in manufacturing and sales of SSL products based on LEDs, barriers remain to be overcome for them to dominate the lighting market. Efforts focused on materials research and overcoming manufacturing challenges to improve SSL products and reduce costs are essential. Barriers exist all along the SSL value chain, depicted graphically in Figure 6.1. The value chain identifies at a high level the market activities and participants comprising the lighting industry. Activities include, but are not limited to: R&D; patenting and licensing intellectual property; the making of specialty manufacturing tools required in commercial-scale SSL component and product manufacturing; manufacturing itself; product assembly; component and product distribution, wholesaling, and retailing; and various light form applications in the consumer market. Market participants include all those individuals, businesses, and organizations participating in some aspect of the lighting market just described, including the lighting design community and consumers.

The industry value chain shown in Figure 6.1 is depicted as consisting of three major categories of activities (upstream, midstream, and downstream) and is used to organize the discussion in this chapter around the barriers that need to be overcome for widespread SSL adoption. First are upstream market activities, including basic and applied R&D, performance standards setting, and determining the best ways to test products. Second are the midstream activities that focus on manufacturing and the movement of product to major wholesalers and retailers, also including associated sales force education and training on the benefits of SSL. Third are downstream activities that include decision-making on particular lighting applications and end-user purchases and the offering of any purchase support programs offered by utilities or other entities to support widespread adoption of SSL. There are barriers to full-scale deployment at each point along the value chain that will be discussed below.

UPSTREAM OPPORTUNITIES AND CHALLENGES

R&D challenges to improving the efficacy, reliability, and color quality of SSL products while reducing the cost are many, as noted in preceding chapters of this report. While challenges for improving SSL products to support widespread adoption can be generalized, some challenges are unique to specific end-use sectors and applications, including residential, commercial, industrial, and general illumination and niche applications. Upstream barriers include but are not limited to the following:

FIGURE 6.1 Solid-state lighting industry value chain.

1. Potential for inferior product quality compared to other illumination alternatives if sufficient scientific breakthroughs are delayed;

2. Bulky and heavy product designs due to SSL heat sink requirements;

3. Uncertain product lifetime, insufficient warranties, and lack of expedited testing procedures;

4. Costly product design and engineering, including choice of rare earths, wafer, and substrate design; and

5. Costly packaging and components and product manufacturing.

For uniform and consistent adoption of SSL, improvements need to occur upstream quickly to ensure that the market is not tainted early with inferior products and that SSL products continue to come down the cost curve.

Several upstream R&D needs must be addressed if widespread adoption is to occur. For example, LED R&D support is needed for improving the yield, efficiency, and operation at high power and high temperatures. One specific development, discussed in Chapter 3, is the development of low-cost, highquality substrates for GaN for the growth of lattice-matched LED structures. The removal of such defects as would occur due to lattice mismatch in LEDs should increase reliability, yield, and efficiency. Improving LED light output and color is also important because most LED lamps currently available do not have the same light output and color rendering properties as incandescent lamps, and those that do have lower efficacies.

New dimming switches (“dimmers”) will need to be developed. As is the case with some CFLs, existing dimmers used with incandescent luminaires may not work with LED replacement lamps because of perceptible flicker, no smooth dimming, radio interference, and insufficient loading (dimmers require a minimum load). Even though LED lamps are labeled “dimmable” they are not universally dimmable by the myriad of dimming systems currently available. Consumers accustomed to incandescent dimming might notice and be bothered by the fact that LED lights do not get warmer in color as they dim.

LED lamp heat management needs to be improved. Even though heat management requirements are much less for LEDs than for incandescent lighting, both the point heat source nature of LEDs and the thermal sensitivity of the device create a thermal management challenge. If LEDs and OLEDs are to compete with fluorescent lamps and other light forms, particularly in the commercial sector, efficacy must be improved. And because many applications require an omni-directional lamp, the unidirectional emission from the LED must be modified by lamp design to become more omni-directional.

MIDSTREAM OPPORTUNITIES AND CHALLENGES

Midstream market activities, as defined for the SSL industry and depicted in Figure 6.1, include all of the means and processes for moving products from R&D and smaller-scale manufacturing to full-scale manufacturing and, ultimately, to architects, engineers, lighting designers, contractors, and retailers for sale to and use by consumers. This definition is broader than what might typically be defined as midstream because of the heavy emphasis in the SSL industry value chain on continued R&D and smaller-scale manufacturing, which in this case is included as an upstream activity. Midstream activities are also defined to include product labeling for consumer information and for marketing and advertising, which includes ENERGY STAR® and related labeling systems, such as the Northeast Energy Efficiency Partnership’s DesignLights™ Consortium, established outside of the federal government.

Midstream market actors principally include distributors, designers, and contractors responsible for designing and installing lighting in commercial and industrial buildings, and lighting contractors and electricians serving the residential sector. Midstream labeling efforts help facilitate and inform decision-making by these market actors. The barriers and challenges to widespread adoption in residential, commercial, and industrial sectors, while generally similar, can also be quite different. The lighting systems design and product decision makers are different for each sector, and decision makers in each sector have a different level of knowledge and experience with SSL technology. Bringing information to all lighting decision makers uniformly and consistently through ENERGY STAR® or other labeling programs has proved valuable in deploying new lighting technologies, whether for CFLs in recent years or SSL today. Examples highlighting the success and value of labeling programs are discussed below and later in this chapter.

General midstream barriers include, but are not limited to, the following:

1. Risks associated with moving from demonstrations and niche market product manufacturing to full-scale standardized product manufacturing;

2. Availability of SSL products on the market in retail and other outlets with still uncertain product demand;

3. Lack of availability of some SSL products and light forms (not a full array of lighting solutions yet available);

4. Lack of awareness of applications and benefits of SSL by architects, design engineers, building professionals, and consumers; and

5. Lack of information and training of wholesalers and retailers on various SSL light forms, product applications, performance, and costs, which impede stocking decisions, product placements, and sales emphasis.

SSL manufacturing refers to the full range of activities and materials use, including intellectual property and labor to produce SSL products for sale, including for use in televisions, mobile devices, and signage, as well as end-use lighting products for general illumination in buildings. Each SSL product has its own set of manufacturing challenges, and LED and OLED technologies, in particular, as emphasized in previous chapters, present different challenges and opportunities for use in general illumination and specialty lighting and for lowering energy use and costs.

LED Manufacturing Yield

The low yield of high-efficiency LED devices with proper color and the fact that they are grown on relatively small substrates is what makes LEDs relatively expensive. The substrates (sapphire or silicon carbide) are typically 2 to 4 inches in diameter compared to 12 inches typically for silicon. The LED devices are sold to manufacturers for assembly into luminaires (i.e., SSL products). Some LED manufacturers, however, are vertically integrated and make the LED package and their own varied lighting devices and luminaires. All LED-based luminaires require optics to distribute the light, a large heat sink to remove the heat, and driver electronics to control the current input. The cost and assembly of these components is similar to other commonly used electronic devices, such as hand-held games and cell phones, where cost is dependent on manufacturing volumes and component size. As with other electronics, competition and progression along the learning curve associated with moving to highervolume manufacturing will bring down the cost and price to consumers.

Another important benefit of improving the crystal growth and substrates is the effect on greater yields. The yield of high-efficiency LEDs at the proper wavelengths is relatively low under current design and manufacturing processes. Low enough, in fact, that manufacturers are “binning” their product. After testing, manufacturers put the product in bins each with a range of wavelengths and efficiencies and sell them to consumers at different prices. Binning is used when the yield is low and manufacturing processes do not have sufficient quality controls in place to ensure a consistent and uniform product. For most all other semiconductor devices, manufacturers have detailed sampling and testing of devices from large lots. Device functionality is also sampled and tested. Devices are typically made and sold to a given specification. Improved epitaxial growth technology should eliminate binning and substantially improve yields and lower costs. Improvements in LED efficacy, and thus efficacy of luminaires, will also result in lower cost and as a result increased SSL adoption.

Early manufacturing challenges need to be overcome, particularly if the United States wants to be home to a successful SSL manufacturing base. The risk of not manufacturing SSL products in the United States is one of continuing to import technology, intellectual property, and product and, thus, export money and jobs overseas. The U.S. LED manufacturing base, although substantially smaller than that of Japan or Korea, is still a multibillion-dollar industry and will at some point produce higher yields and higher efficiencies. The very large industry efforts currently under way, coupled with legislation that requires higher lighting product efficacies, with time should allow attractively priced lighting products to be available in the marketplace that meet the mandated U.S. efficacy standards.

LED Efficacy

The relatively high cost of general illumination LED lamps and luminaires today is due to the recently established manufacturing base and not necessarily to suboptimal designs and low yield, both of which will improve with time and from the natural learning curve associated with manufacturing electronic products. In addition, current LED products suffer from relatively low efficacy compared to their potential efficacy. LED luminaires require large heat sinks to maintain temperature and large electronic components to carry high currents. Higher-efficiency LEDs will contribute to a lower heat load, which would in turn substantially reduce the cost of the luminaire by reducing the size and cost of the heat sink and supporting electronics. Improving LED efficiency can lower luminaire costs by an amount roughly equal to the efficiency improvement and allow for smaller, lighter designs that are more attractive to consumers. Improvements in efficiency will come with scientific research and breakthroughs.

FINDING: To make LED-based luminaires and lamps at high efficacies (notionally those exceeding 150 lumens per watt) at prices lower than fluorescents, technological and manufacturing breakthroughs will be needed.

RECOMMENDATION 6-1: The Department of Energy should concentrate its funding on light-emitting diode core technology and fundamental emitter research that have the potential to lower costs of solid-state lighting products.

OLEDs

SSL products based on LEDs and OLEDs can fill separate lighting niches. Based on current experience, there do not appear to be any fundamental reasons why OLED lighting cannot become cost competitive with LEDs as engineering, design, and manufacturing infrastructure and experience with OLEDs are improved. The multiyear learning curve and multibillion dollar manufacturing base in Asia for OLED displays should significantly reduce costs and make the manufacture of OLED-based general lighting devices more attractive.

The manufacturing experience gained as OLEDs have emerged as an increasingly important display technology provides manufacturers with the experience and confidence to move this technology, with its unique features, into the lighting market in the near future (Willner et al., 2012). OLED displays have a much higher selling price than do light sources, and OLED costs will have to be substantially reduced for OLED lighting products to be viable in the market place. In this context, Universal Display Corporation in Ewing, New Jersey, provides significant intellectual property to the industry with their holdings of more than 1,000 patents covering many of the key technologies that are required to make high-efficiency OLED displays and lighting sources. In addition, Novaled in Germany has important intellectual property in low-voltage, high-efficiency OLED technology that may prove significant for lighting applications. Other chemical companies, notably Idemitsu Kosan, PPG (in Pittsburgh, Pennsylvania), and BASF, also have a portfolio of materials that they provide to the display industry. Intellectual property and manufacturing development is currently emerging as a global industry whose center is in Asia, but significant market strengths and players are also located in the United States and Europe.

Equipment manufacturers, which provide the key infrastructures needed for sustained growth in manufacturing, are also starting to take notice of the possibilities for potentially large developing markets for OLED displays and lighting. Aixtron, AG, the largest producer of MOCVD equipment for LED lighting, also produces (on still a small scale) organic vapor phase deposition systems for OLEDs. Applied Materials is the world’s largest supplier of equipment for low-temperature polysilicon deposition on glass substrates used as OLED display drivers. Its division, Applied Films, supplies in-line deposition tools for “front-plane” OLED display materials deposition. ULVAC in Japan provides many OLED display manufacturers with evaporation systems, whereas Angstrom Engineering is a leading supplier of laboratory tools used in OLED device experimentation across North America. Most OLED display manufacturers have no single source for deposition tools, and work is continuing to engineer low-cost, scalable, and high-throughput methods to deposit and pattern organic thin films. It should be noted, however, that the current lack of a complete tool set for the manufacturing of OLEDs remains a limiting factor in their widespread and low-cost deployment as lighting sources. (See Chapter 3 for the committee’s recommendations on where DOE should invest to enable widespread deployment of OLED SSL.)

There should be no impediments to the deployment of LED and OLED lighting products due to availability of starting materials. Gallium, one of the two components in the material set of the most commonly used LEDs, is a byproduct of aluminum manufacturing and is abundantly available. LEDs are manufactured with very small amounts of phosphor containing rare earths to create the color balance needed for efficient white output, as described in Chapter 3. The rare earths in phosphors, however, are in short supply globally and are mainly sourced today from China. If other supplies are not developed or the rare earths become much more expensive, then other alternatives need to be found to make white-light LEDs. DOE and the lighting industry disagree on the severity of this problem, and the potential consequence is that product supply might be in jeopardy if the industry view proves correct.4,5 High-efficacy white-light LEDs can be manufactured with red, green, and blue LEDs, in which case phosphor is not required. In addition, quantum dots can be used to replace the phosphor, as discussed in Chapter 3. In the case of OLEDs, the materials are carbon-based and closely related to dyes used in paints and inks. Hence they are widely available, easy to synthesize, and typically inexpensive. Also, there do not appear to be toxicity issues in organic materials used in lighting that would impede their widespread commercial distribution.

Performance

As new and innovative products move to market, it becomes increasingly important that performance testing be standardized so as not to impede adoption. Currently the testing method for LED-based emitters—the so-called LM-80 standard (IES, 2008)—specifies data collection at various intervals over a 6,000-hour time period to evaluate lumen maintenance. Doing this requires 8 months of realtime testing to introduce a new product. The standard places a significant burden on new technology, for which new and improved product introductions face market pressure to occur at a faster pace.

The current standard for forecasting lumen maintenance, TM-21 (IES, 2011), which specifies no greater than 30 percent diminution in light output (the so-called “L70” point) in 25,000 hours of operation, appears to be more than adequate to meet market demand. In addition, efforts to increase efficiency should extend the LED lifetime even further by decreasing the operating temperature and removing processrelated defects. Currently, the lifetime of luminaires will be limited by the lifetime of the supporting electronics and not the LEDs themselves (Next Generation Lighting Alliance and DOE, 2010). The reduced electric current requirements for more efficient LEDs should also have a beneficial effect on extending the lifetime of the supporting electronics.

________________

4 DOE New Critical Materials Strategy, released December 15, 2010, see http://energy.gov/articles/energy-department-releases-new-critical-materials-strategy.

5 NEMA letter to DOE, November 28, 2011. Available at http://www.nema.org/policy/paegs/rulemaking-comments.aspx.

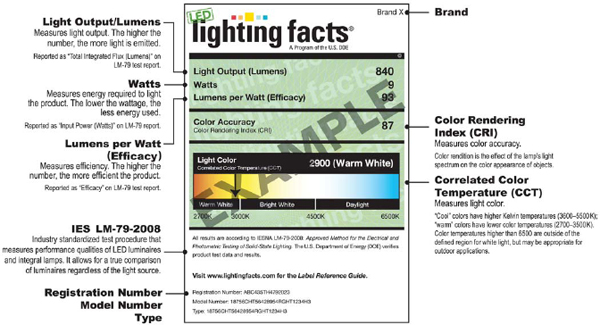

FIGURE 6.2 Lighting Facts Label. SOURCE: DOE and NGLIA.

FINDING: There are currently no industry-accepted accelerated life tests for SSL products, which slows the development and deployment of new reliable products.

RECOMMENDATION 6-2: The Department of Energy should continue efforts to help develop accelerated life tests for luminaires and LEDs.

Labeling of SSL Products

Several efforts are under way to standardize the information provided to consumers who purchase (or who consider the purchase) of SSL products. In December 2008, DOE, in collaboration with the Next Generation Lighting Industry Alliance (NGLIA), started a voluntary program known as SSL Quality Advocates. Members of this program pledge to use the “Lighting Facts Label” depicted in Figure 6.2, for SSL products in order to accurately communicate key performance characteristics of SSL devices to consumers and retailers.6 The Lighting Facts Label is designed to help retailers and utilities compare qualities and benefits of similar products. Although it is not designed to be affixed to product boxes, it could appear on the product that is purchased by consumers or in retail displays.

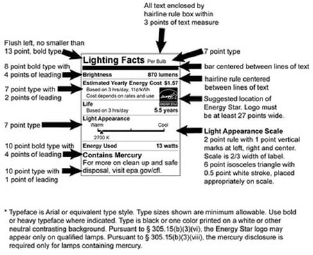

The Federal Trade Commission (FTC) published a final rule on July 19, 2010, that required all medium screw-base lamps, including incandescent, compact fluorescent, and LED lamps, to carry their version of a lighting facts label. This label is intended to give individual consumers more information about the lighting products they are purchasing and will be on each replacement lamp box. An example of this label is shown in Figure 6.3. This rule went into effect on January 1, 2012. The voluntary DOE label will not be used on products that require the FTC label, in order to avoid confusion. Both labels are limited in information content, for example, no information of dimming capability or expected lifetime is given, both of which are important features for the buyer to consider.

While labels help communicate to consumers the performance of lamps they are considering purchasing, they do little to help them understand the choices that they have after the phase-out of general service incandescent lamps, which began January 1, 2012. The FTC label, for example, does not show how a particular lamp compares with other lamps on the market and does not indicate whether the lamp is dimmable. Furthermore, while both the DOE and FTC labels provide information on color quality, there are few studies elucidating people’s preference across different attributes of lighting technologies (brightness, color, lifetime, and price, for example) to help guide how labels and communications could be more helpful to consumers purchasing decisions.

________________

6 For more information, see http://www1.eere.energy.gov/buildings/ssl/advocates.html.

FIGURE 6.3 Lighting Facts Label. SOURCE: Federal Trade Commission.

FINDING: The labels designed by DOE and FTC for lamp packages help consumers better understand the characteristics of the product they are purchasing, but important information is missing from the labels that would help consumers to better differentiate products and assign value to the products.

RECOMMENDATION 6-3: The Federal Trade Commission should conduct a study in 2014, 2 years after introduction of the label, to determine the effectiveness of the labeling and whether it could be improved by additions and/or changes.

The Energy Independence and Security Act of 2007 (EISA 2007) provided an authorization of $10 million for each of the fiscal years 2009 to 2012 for public awareness. It appears that this money has not been appropriated, however, to help the education process.

FINDING: The move to new lighting is changing the entire vernacular used for lighting. It is going to be critical to label products in a clear way and educate retailers, consumers, lighting designers, and contractors on the opportunities and challenges with these new lighting technologies. To this end, EISA 2007 authorized $10 million a year to advance public awareness, but this money has not been appropriated.

RECOMMENDATION 6-4: The Department of Energy and lamp manufacturers and retailers should work together to ensure that consumers are educated about the characteristics and metrics of the new technology options.

As discussed in the Chapter 2 section “Current Federal and State Programs,” the Environmental Protection Agency (EPA)-led ENERGY STAR® program is a voluntary labeling program designed to promote energy efficient appliances and other end-use products.

ENERGY STAR® labeling for lighting products applies to residential applications and, to the extent these are part of federal procurement activities, to commercial applications. Industrial applications do not currently fall within the scope of ENERGY STAR®. As a result, ENERGY STAR® does not provide the information and labeling that would enable lighting decision makers in the commercial sector (beyond federal procurements) and the industrial sector to make informed choices easily. This may significantly limit the impact of ENERGY STAR® overall in improving lighting efficiency in these sectors and impede widespread deployment of SSL technologies. Other programs, such as the Northeast Energy Efficiency Partnership DesignLights™ Consortium (DLC) initiated in 2009, partially fill this gap, but not as comprehensively or with as high a profile as the ENERGY STAR® program would (and does for residential sector applications).

The DLC is comprised of utility companies and energy efficiency program administrators throughout the United States interested in providing incentives for high-performing LED products that meet individual sponsor criteria. The DLC claims that its qualified products list includes only high-quality, high-performance, tested, and verified LED products. The qualified products list is used by program administrators to determine the products to include in their programs for consumer rebates.7

DOWNSTREAM OPPORTUNITIES AND CHALLENGES

Downstream market activities include all means and processes employed to support end-user purchases of lighting products, which can include some later-stage, midstream activities, such as training of retail sales staff, technical support for distributors, design professionals and contractors, and information dissemination to support consumer purchases. More typically, downstream activities are consumer focused and intended to encourage and support consumer purchases. Such support can be in the form of financial incentives to consumers or product “giveaways” or incentives to retailers to increase the percentage of SSL products available for purchase. The main downstream barriers include, but are not limited to, the following:

1. Higher first-cost of SSL products and systems, absent utility rebates or other government or manufacturer incentives, compared to conventional lighting;

2. Lack of consumer awareness and undervaluing the benefits of SSL;

3. Skepticism regarding SSL performance claims without sufficient field-testing;

________________

7 Further information is available at http://www.designlights.org/.

4. Lack of utility financial incentives or government support for consumer purchases;

5. Uncertainty about SSL product use and replacement opportunities; and

6. Uncertainty associated with handling and disposal of toxins contained in SSL products at their end of life and the potential for future government regulations regarding safe disposal.

Downstream barriers, while generally similar among sectors and building type, affect decisions differently across the residential, commercial, and industrial sectors. This is because the decision maker for lighting choices differs in each sector, and the barriers are more difficult to overcome in one sector than in another. For example, the residential sector is characterized by thousands of point-of-purchase outlets, including small local retail establishments, big box stores, department stores, lighting showrooms, hardware stores, grocery stores, and local convenience shops. Each carries a wide variety of lamps, and most do not have sales staff that are knowledgeable about the characteristics of particular lighting products to aid consumers with their purchase. Moreover, consumers generally do not concern themselves with lighting characteristics—cost is a primary driver of lighting purchase decisions.8 Providing information about lighting choices for residential purchases also differs. Utility bill stuffers and utility-sponsored in-store advertising, as well as collaborative labeling efforts like ENERGY STAR® and the DLC-qualified products list, aid utilities in determining for which products to provide incentives. Multifamily residential buildings have their own unique challenges, particularly where renters do not make lighting purchases but, rather, the building owner or a management company has this responsibility. In this case, cost is the primary driver for lamp purchases.

Commercial sector lighting decisions in new buildings are made by architects, engineers, and lighting designers working primarily with large building projects and by contractors and distributors whose primary focus is on smaller buildings. While final lighting decisions belong to the building owner, information and lighting systems options are provided by the lighting design community. Providing SSL information to architects, engineers, and lighting designers is therefore critical to widespread deployment of SSL in new construction.

The building retrofit market is different from the new construction market with respect to the activities and actors involved in lighting decisions. Major retrofit and renovation lighting decisions are most often made by contractors and energy services companies. Often, energy services companies (ESCOs) are also the primary contractors used by utilities for implementing lighting efficiency programs in building renovations and retrofits. Utility program activities and information targeted to ESCOs and contractors is important in the retrofit market.

Industrial sector lighting applications require large amounts of ambient light. Industrial buildings are less homogeneous than commercial buildings and often require specialty and task lighting. Such buildings and lighting systems are typically designed by facility designers specializing in industrial and facility applications, usually working in concert with manufacturers.

Utility-Administered Programs and Partnerships

Electric utilities have long played a role in incenting energy efficient product purchases by consumers—in part at the direction of their regulators or in response to state law and in part as a response to their customers’ vocal support for such incentives and programs. Several successful programs are currently being offered by utilities to encourage purchase of SSL. As found by GSD Associates in its review of the Small Commercial Lighting Program administered by the New York State Energy Research and Development Authority (NYSERDA) (GSD Associates, 2005), training activities, technical support, and incentives encourage contractors, distributors, designers, and other trade allies to design and install lighting projects that result in better lighted spaces, which allow people to see more easily and which cost less to operate.

The small commercial market segment, although difficult and costly to reach through such programs, has been persuaded by this program to install energy efficient lighting. Large projects tend to have design teams and architects involved in project design and implementation, while smaller projects are often installed by lighting contractors with products selected by the contractor, distributor, or manufacturer’s representative. By focusing outreach and information dissemination on these mid-market actors, program efforts can influence the practice of designing, specifying, and installing lighting for small commercial buildings—ultimately providing effective, energy efficient lighting to an increasing portion of the market.

Utility incentive programs working in concert with programs like the DLC help spur consumer demand for LED products and support manufacturers’ interest in providing market-ready retail products. As an example, each year the Long Island Power Authority’s (LIPA’s) Energy Efficient Products Program (Box 6.1) works with lighting manufacturers and retailers to coordinate incentive programs that promote specific ENERGY STAR®-qualified products. In October 2010, LIPA announced a campaign encouraging customers to switch to energy-saving lighting by offering

________________

8 While a high-performance lighting system typically has a payback of 4 to 8 years, a building owner’s expectation for payback is shorter—around 2 years. A common problem in commercial buildings is that the person responsible for the operating budget is not the same as the person responsible for the construction budget. The decision to go ahead with a more expensive but better performing system would have to be made at a higher level in the organization, where other priorities often preclude sufficient attention to the building energy performance. In residential construction, the limiting factor often is available capital for the construction of a highperformance home.

BOX 6.1

The Value of Partnership in Rebating LED Purchases—Long Island Power Authority

Because of the success of the Long Island Power Authority’s (LiPA’s) Initial LED fixture markdown, LlPA approved additional funding through 2011 The Energy Efficient Products Program in 2011 added LED bulbs to the product mix and established a sales goal of 25,000 ENERGY STAR®-qualified LED products. Through October 2011, a total of 31,326 products were sold through the LlPA markdown program of which more than 26,000 have been downlights—and sales through year-end 2011 were in excess of 37,000. Because of the early success of this program, both Cree, the manufacturer, and Home Depot, the retailer, provided rebates of their own, bringing the promotional retail price to just under $25. In 1 month following these added rebates, sales increased by more than 200 percent.

a discount on ENERGY STAR®-qualified LED recessed downlights. This promotion began as a pilot offering, when Home Depot began carrying one of the first ENERGY STAR®-qualified LED downlights. The retail price for this luminaire was $49.97, and with a $15 discount from LIPA, customers could purchase the luminaire for $34.97.

In addition to those sold at Home Depot, LIPA’s Energy Efficient Products Program has allocated funding for more than 77,000 ENERGY STAR®-qualified LED lamps and luminaires to be sold at Costco, Sam’s Club, and 15 independent electrical distributors across the Long Island service area. LIPA’s Energy Efficient Products Program provides site visits to enrolled retailer partners and place point of purchase materials that call out the product’s energy savings and promotional pricing provided by LIPA. Field representatives on LIPA’s behalf provide training to the sales force at each location that joins the program. The program also provides retailer in-store promotions complete with light displays to educate consumers on the ENERGY STAR®-qualified LED products and demonstrate the energy efficient lighting products and their dimming capabilities. LIPA also promotes LEDs with bill inserts, newsletters, and print ads in local newspapers.9

National Grid offers a similar rebate and support services program in its New England service area, which covers several states (Box 6.2). This cross-state program is helpful in stimulating industry interest in serving the broader regional market. The market potential for ENERGY STAR®-qualified LED products is high, with opportunities for lamps, retrofit kits, and luminaires. Recent technology additions by GE and Philips now have cost-effective general ambient lighting solutions on the market for table lamps, whereas previously the LED market had been focused more on downlighting.

BOX 6.2

The Value of Partnership in Rebating LED Purchases—National Grid

National Grid has been promoting emerging solid-state lighting (SSL) technologies through its residential and commercial energy efficiency programs since 2007. Like most efficiency programs the goals are energy savings facilitating the introduction and sustainability of emerging technologies in the marketplace. To that end, National Grid is an active participant in the ENERGY STAR®SSL lighting Program and Northeast Energy Efficiency Partnership DLC. National Grid has seen ItS program savings attributed to SSL increase over the past several years. Incentives are offered for a wide range of SSL products that are listed by ENERGY STAR® and the DLC. It is expected that up to 10 percent of the savings through its lighting programs could be attributed to SSL by the end of 2012. Most savings are derived through “downstream” Incentives provided directly to the end-u2Br for purchasing and installing solid-state lighting products. Starting in late 2010 for residential downlight retrofits and expanded to commercial reflector/directional lamps in 2011, National Grid has been offerl ng “upstream” I ncentlvesto retatlers and distributors for select solid-state lighting products. These upstream programs are targeting end-users that would otherwise purchase halogen-based incandescent products.

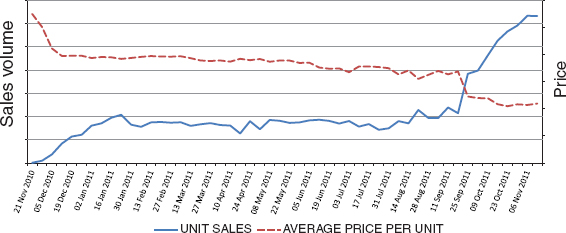

Reducing the price of SSLs for retail purchases has been shown to increase sales, as illustrated in Figure 6.4— showing monthly sales and price data compiled by Philips—which shows a significant increase in sales as LED prices fell.

One of the fundamental advantages of SSL is that the light-emitting structure does not contain materials that exceed existing U.S. regulatory toxicity levels. This is in contrast to other lighting systems that can contain highly toxic materials like mercury. However, other materials that are used in the white LED device packaging may have high levels of toxicity. Because these materials do not directly affect the fundamental light generation mechanisms, it is theoretically possible that substitution materials can be found and used to address toxicity issues. It is important to identify potential toxins in SSL and their role in the device’s operation and use.

________________

9 LIPA’s LED program is continuing in 2012 with a goal of 52,500 products (lamps and luminaires) and a budget of $787,500.

FIGURE 6.4 LED sales and price relationship. Courtesy Philips Lighting.

A recent study by researchers at the University of California, Davis (Lim et al., 2011), focused on the potential metallic toxins in LEDs. The study found that other than arsenic and some metals, the materials found in LEDs do not pose serious health risks. Among the LEDs tested, white LEDs appeared to be the safest for the environment because of the absence of toxic substances. LED lighting does not contain mercury, which is a miniscule component in all fluorescent lighting products.

Other potential toxicity issues can originate from the polymers used for the plastic lenses/encapsulate or from the phosphor used to generate white light. It is important to note that while this study found for blue/white LEDs that toxic levels for copper, silver, and nickel are exceeded, based on California’s Safe Drinking Water and Toxic Enforcement Act of 1986 (Proposition 65), currently no federal regulations are violated by the levels of any material in white light LEDs. Furthermore, in LED-based lighting components only lead was found to be in the European directive Restriction of Hazardous Substances, and lead levels for this standard were not exceeded. Current SSL products appear to be in compliance with current environmental regulations, thus disposal should not impede widespread deployment. As regulations and materials used in manufacturing change, there needs to be continued study and vigilance so that disposal does not become an issue.

RECOMMENDATION 6-5: The Environmental Protection Agency in conjunction with the Department of Energy should conduct a study to understand the environmental impacts of SSL and to determine potential disposal strategies, if necessary, that should be developed as SSL deployment develops.

SSL COST AND ENERGY SAVINGS POTENTIAL

The United States electricity consumption was 3,754 TWh in 2010, and lighting electricity consumption in all sectors accounted for roughly 19 percent of U.S. total electricity use.10 DOE’s estimates for lighting electricity use, by sector and technology type, in 2010 are shown in Table 6.1.

It is anticipated that the adoption of SSL will lead to large energy and attendant cost savings. Nonetheless, there is some uncertainty of just how large these savings might be. In this section, the committee reviews estimates prepared for DOE and also provides its own estimates.

A recent study performed for DOE by Navigant analyzed 12 markets for SSL, including four applications in general illumination; 11 four applications in outdoor lighting;12 and four applications in consumer electronic displays (Navigant Consulting, 2011).13 The study found the greatest savings potential to be in general illumination, where LEDs are estimated to have saved 0.38 TWh of electricity in 2010 alone because of the replacement of incumbent technologies with LEDs. The study estimates that if the four general illumination applications switched entirely to LEDs, savings could reach 133 TWh per year.

The Navigant study further estimates that the maximum theoretical energy estimated savings for all niche

________________

10 EIA, 2012, Electricity sales and revenue data, available at http://www.eia.gov/electricity/sales_revenue_price/index.cfm.

11 These applications were as follows: (1) PAR, BR, and R shaped; (2) MR16; (3) 2-ft by 2-ft Troffer luminaires; and (4) general service A-type.

12 These included roadway lighting, parking facilities, other area and flood lighting applications, as well as lighting outside residences.

13 These included television displays, desktop monitor displays, laptop displays, and mobile handset displays.

TABLE 6.1 Estimates for Lighting Electricity Consumption in 2010 by Sector and Technology Type (in terrawatt-hours (TWh) per year)

| Residential | Commercial | Industrial | Outdoor | All Sectors | |

| Incandescent | 136 | 15 | 0 | 4 | 156 |

| Halogen | 12 | 15 | 0 | 1 | 28 |

| Compacl fluorescent | 15 | 16 | 0 | 1 | 32 |

| Linear fluorescent | 10 | 250 | 23 | 10 | 294 |

| High intensity discharge | 0 | 49 | 35 | 98 | 183 |

| LED | 0 | 3 | 0 | 2 | 5 |

| Miscellaneous | 1 | 0 | 1 | 3 | |

| TOTAL | 175 | 349 | 58 | 118 | 700 |

SOURCE: DOE (2012).

TABLE 6.2 Average Efficacy, Power, Daily Usage, and Lamps Per Household in 2010

| Incandescent | Halogen | CFLs | Linear Fluorescents | HID | LED | Other | |

| Efficacy (lm/W) | 12.1 | 14.3 | 52.1 | 67.3 | 62.4 | 40.7 | 37.5 |

| Average wattage (W) | 56 | 65 | 16 | 24 | 126 | 11 | 54 |

| Average usage (h/day) | 1.8 | 1.9 | 1.8 | 1.9 | 2.5 | 2.1 | 1.4 |

| Average number of lainps per building | 31.8 | 2.3 | 11.7 | 5.1 | 0 | 0.1 | 0.4 |

SOURCE: DOE (2012).

market applications14 from 100 percent LED replacement is 263 TWh per year. A previous report (Navigant Consulting, 2006) projected that electricity savings from LED adoption by 2027 could be larger than the energy used to illuminate all homes in the United States today (NRC, 2010).

The committee developed its own estimates of energy savings potential that might result from different scenarios for the transition to LEDs for general illumination purposes in the U.S. residential and commercial sectors and outdoor applications. These estimates and their derivation are discussed in the following sections.

Potential Energy Savings for the Residential Sector

Today the residential sector accounts for 39 percent (1,446 terawatt-hours [TWh]) of U.S. electricity use.15 Approximately 12 percent of residential electricity use is to power lights (DOE, 2012). Approximately 78 percent of lighting electricity use is attributable to incandescent lamps. For the committee’s estimates, the baseline assumptions for lighting technology characterization and lighting energy use in the residential sector rely on the 2010 U.S. lighting market characterization from DOE. Estimates from DOE’s market characterization for average efficacy, power, daily usage, and lamps per house in 2010 are shown in Table 6.2 for each technology type.

For the residential sector, it was assumed that usage patterns (hours per day for each technology type) will remain the same during the 2012-2020 time period. This excludes any potential direct “rebound effects”16 associated with lighting energy use or other changes in consumer behavior. It is further assumed that the demand for illumination (measured in lumens) will be proportional to population growth. Using these assumptions, residential lighting use would grow from roughly 173 TWh in 2010 to 187 TWh in 2020 in the base case (Table 6.3), where the base case does not account for the impact of EISA 2007.

The first scenario estimates the impacts of EISA 2007 standards. Given the limits for rated lumen ranges and

________________

14 Niche-application lighting includes under-cabinet kitchen lighting, under-cabinet shelf-mounted task lighting, portable desk task lights, outdoor wall-mounted porch lights, outdoor step lights, outdoor pathway lights, and recessed downlights, as defined for ENERGY STAR® Program Requirements for Solid State Lighting Luminaires Eligibility Criteria.

15 EIA, 2012, Electricity sales and revenue data: http://www.eia.gov/electricity/sales_revenue_price/index.cfm.

16Rebound effects include the following consumer responses to an increase in energy efficiency. The direct rebound effect means that efficiency gains lead to a lower price of energy services, leading to an expanded or intensified use of the energy consuming products or services. For example, when consumers switch from incandescent lamps to compact fluorescents, they may leave their lights on for more hours than they did previously because their operation costs less. The indirect rebound effect reflects the case where an additional income that is freed up by saving energy costs can be used for other energy- or carbon-intensive consumption. For example, the income gained by installing an efficient furnace and insulating one’s house could be bundled into additional air travel, leading possibly to an overall increase in energy consumption and greenhouse gas emissions (adapted from the definitions in Sorrell, 2010).

TABLE 6.3 Residential Electricity Consumption, Due to Lighting, as Estimated by the Committee

| Year | BAU (TWh) | Scenario 1 (TWh) | Scenario 2 (TWh) |

| 2010 | 173 | 173 | 173 |

| 2011 | 174 | 174 | 174 |

| 2012 | 176 | 176 | 176 |

| 2013 | 177 | 177 | 177 |

| 2014 | 178 | 107 | 56 |

| 2015 | 180 | 108 | 53 |

| 2016 | 181 | 109 | 50 |

| 2017 | 183 | 110 | 48 |

| 2018 | 184 | 110 | 46 |

| 2019 | 186 | 111 | 45 |

| 2020 | 187 | 112 | 44 |

NOTE: BAU = business as usual; TWh = terawatt-hours.

maximum rated wattages (see Chapter 2), these standards are only expected to substantially impact general illumination in the residential sector starting in 2014 (see Chapter 2 for the detail on EISA standards for general illumination). It is assumed that residential illumination services will be provided with the maximum allowed wattage while providing the same level of illumination. As a result, this scenario provides an estimate of the technical potential energy savings that can be anticipated as a result of EISA implementation.17 Under this scenario, lighting technologies (whether CFLs or LEDs) would replace standard incandescent lighting starting in 2014, leading to residential electricity use of 112 TWh in 2020. Savings are estimated at 514 TWh between 2012 and 2020 (or an average of 57 TWh per year).

A more aggressive scenario was also developed in which LED lamp efficacy would continue to evolve according to projections in DOE’s Solid-State Lighting Research and Development: Manufacturing Roadmap (DOE, 2011), shown in Table 6.4. The values in the table were depreciated by 24 percent to take account of the higher operating temperature. DOE does not report projections for overall lamp efficacies—only packaged device efficacies. Thus, a package-to-lamp efficacy ratio of 42 percent is assumed— which reflects the ratio between 2010 package efficacies and the efficacy for LED lamps reported in the DOE 2010 market characterization. Under this aggressive scenario, cumulative savings from 2012 to 2020 could reach 939 TWh (an average of 103 TWh savings per year).

Potential Energy Savings for the Commercial Sector

Baseline assumptions for average efficacy, power, usage, and lamp counts in the commercial sector are shown in Table 6.5 for each technology.

TABLE 6.4 Projections for LED Package Efficacies Used in the Committee’s “Aggressive Scenario”

| Year | Efficacy |

| 2010 | 96 |

| 2012 | 141 |

| 2015 | 202 |

| 2020 | 253 |

NOTE: Projections are taken from DOE (2011, p. 24) and are for device temperatures of 25° C.

Using similar scenarios as those used to estimate residential sector savings, commercial lighting use would grow from roughly 347 TWh in 2010 to 406 TWh in 2020 in the base case. The base case does not account for the impact of EISA 2007. The committee estimates that the EISA 2007 standards will save 60 TWh between 2012 and 2020. A more aggressive scenario was also developed in which LED package efficacy would continue to improve according to the projections in Table 6.4, again depreciated to take account of the operating temperature. Under this aggressive scenario, widespread adoption of LEDs could lead to cumulative savings from 2012 to 2020 of 771 TWh (an average of 86 TWh savings annually) (see Table 6.6).

Residential and Commercial Energy Consumption Surveys

The Residential Energy Consumption Survey (RECS), the Commercial Energy Consumption Survey (CEBCS),18 and the Manufacturing Energy Consumption Survey (MECS) have been the primary sources of data for estimating the nation’s lighting energy use. These surveys were designed to be nationally representative of U.S. residential, commercial, and manufacturing building energy use and expenditures, and are administered by the Energy Information Administration (EIA). Since the late seventies, CBECS and RECS surveys have been conducted every 4 years. MECS was developed in the mid-1980s and has been conducted once every 4 years on average since its inception.

While RECS data are available for 2009, the most recent CBECS data available are from the 2003 edition of the Survey. EIA reports, “the 2007 data did not yield valid estimates of building counts, energy characteristics, consumption, and expenditures.”19,20 These data collection errors have since

________________

17 Technical potential does not take into account different rates of adoption to technology turnover; it assumes the baseline technology is replaced by the efficient one overnight.

18 CBECS includes all buildings in which at least half of the floor space is used for a purpose that is not residential, industrial, or agricultural. Thus, it includes also schools, correctional institutions, and buildings used for religious worship, in additional to “commercial” buildings.

19 Available at http://www.eia.gov/emeu/cbecs/. Accessed May 24, 2011.

20 EIA reports that because of the use of “a cheaper but experimental survey frame and sampling method by EIA’s prime contractor, design errors in the construction of the method and selection of common building types, and an inability to monitor and manage its use in a production survey environment.” Available at http://www.eia.gov/emeu/cbecs/. Accessed May 24, 2011.

TABLE 6.5 Average Efficacy, Power, Daily Usage, and Lamps Per Building in 2010

| Incandescent | Halogen | CFLs | Linear Fluoresceins | HID | LED | Other | |

| Efficacy (lm/W) | 11.7 | 16.3 | 55.2 | 76.6 | 75.2 | 55.8 | 66.2 |

| Average wattage (W) | 53 | 68 | 19 | 37 | 350 | 12 | 11 |

| Average usage (h/day) | 104 | 12.4 | 10.4 | 11.1 | 11.1 | 20.8 | 14.8 |

| Average number of lamps per building | 14.1 | 8.7 | 39.3 | 301 | 6.3 | 6.9 | 0.1 |

SOURCE: DOE (2012).

TABLE 6.6 Commercial Electricity Consumption, Due to Lighting, As Estimated by the Committee

| Year | BAU (TWh) | Scenario 1 (TWh) | Scenario 2 (TWh) |

| 2010 | 347 | 347 | 347 |

| 2011 | 377 | 377 | 377 |

| 2012 | 381 | 381 | 381 |

| 2013 | 384 | 380 | 384 |

| 2014 | 387 | 379 | 337 |

| 2015 | 390 | 382 | 312 |

| 2016 | 393 | 385 | 292 |

| 2017 | 397 | 389 | 278 |

| 2018 | 400 | 392 | 268 |

| 2019 | 403 | 395 | 261 |

| 2020 | 406 | 398 | 257 |

NOTE: TWh = terawatt-hours; BAU = business as usual.

been corrected for the 2011 edition of CBECS. Without further support for data collection, policy makers and the lighting industry generally are left to rely on a nearly decade old survey data. The results of the survey, in either case, because of data limitations and the frequency of collection, are of little use to energy modelers and policy makers. EIA could ask consumers to fill out tables similar to Table 6.7, which uses the room types from DOE’s 2010 Lighting Market Characterization study (DOE, 2012). The list of data and questions provided below is illustrative and not exhaustive.

Questions related to lighting use that EIA might consider asking CBECS survey respondents include the following:

1. The percentage of the square footage in buildings that are lighted when the building is operating under normal use conditions.

2. The best estimate of the percentage of square feet lighted for each room (space) identified in Table 6.7.

3. The percentage of room area in square footage, lighted during off hours—hours when the building is not in normal operating use, excluding the space lighted by emergency lighting.

4. The types of lighting used to light space in the building: fluorescent lighting other than CFLs; CFLs; incandescent lamps other than halogen lamps; halogen lamps; high-intensity discharge (HID) lights, such as high-pressure sodium, metal halide, or mercury vapor; and other types of lighting.

5. The type of lamp if “other” is identified in (4) above.

6. Questions about the percentage of floor space lighted by the types of lighting just identified, keeping in mind the following:

a. The lighted portion of the floor space, so these percentages must add up to at least 100, but because more than one type of lamp can light the same area, it is also possible for them to add up to more than 100; and

b. The percentage of the lighted area in the building lighted by each lighting technology, e.g., fluorescent lighting; compact fluorescent lighting; incandescent lamps; halogen lighting; HID; and other lighting types.

FINDING: Without appropriate data on consumer lighting use, it is difficult to establish an appropriate baseline of energy use in lighting and benchmark energy lighting efficiency.

RECOMMENDATION 6-6: The Energy Information Administration should collect data on energy demand for lighting through the Residential Energy Consumption Survey, the Commercial Energy Consumption Survey, and the Manufacturing Energy Consumption Survey. These efforts need to be pursued on a consistent basis and should consider adding questions that would increase the accuracy and usefulness of the data. In addition, detailed lighting market characterization based on nationally representative surveys, such as the 2001 Lighting Market Characterization from the Department of Energy, need to be pursued every 5 years. It would be helpful if these surveys are available before this study is updated in 2015.

Annualized Life-Cycle Cost of Lighting

The committee has developed a first-order comparison of the consumer life-cycle costs of light. The following assumptions are used: a retail electricity price of 0.11$/kWh and a 10 percent discount rate reflecting the implicit discount

TABLE 6.7 Suggested Design to Be Used in Future RECS to Assess Lighting Energy Consumption and Usage Patterns

| Number of lamps used less than Hi/day: | Incandescent | Halogen | Compact Fluorescent Lamps | Linear Fluorescent | HID | LED | Other |

| Basement(s) | |||||||

| Balhroom(s) | |||||||

| Bedroom(s) | |||||||

| Closet(s) | |||||||

| Dining Room(s) | |||||||

| Exterior(s) | |||||||

| Garage(s) | |||||||

| Hall(s) | |||||||

| Kitchen(s) | |||||||

| Laundry / Utility Room(s) | |||||||

| Living / Family Room(s) | |||||||

| Office(s) | |||||||

| Other |

NOTE: Similar tables using other usage intervals (1 to 4 h/days, 4 to 12 h/days, and more than 12h/day).

rate of the consumer. The latter is in general higher than the market rate and the social discount, both utilized in analyses of public investment (Azevedo et al., 2009; Frederick et al., 2002). The committee employed two scenarios for daily usage of lights: 3 h/day and 10 h/day. The committee selected these two usage scenarios for two reasons: first, because they are representative of average daily usages in the residential and commercial sectors, and second, the results are found to be very sensitive to the number of hours of use. For each scenario, it is assumed that a 60 W incandescent lamp would be replaced by another lighting technology while the same energy service is provided (850 lumen). The level of the energy service and the baseline power for the incandescent lamp does not change the overall results for this assessment.

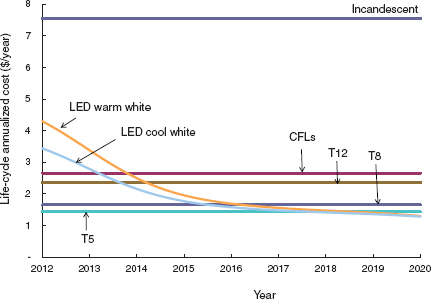

The committee assumed efficacies, lifetime, and cost per thousand lumen values shown in Table 6.8. The committee used the figures from DOE (2011) for efficacy and lifetime of warm and cool LEDs, and scaled them so that for year 2012 they are in reasonable alignment with the efficacies and lifetimes of LEDs that can currently be purchased by consumers in retail stores. These same scaling factors were used for years 2015 and 2020, resulting in the following weighting factors for cool and warm LEDs: lifetime factor of 0.5, efficacy factor of 0.51, and a markup factor for price of 3. This further translated into lifetimes and efficacies for LEDs that are half of the goals reported by the SSL roadmap, and capital expense costs per thousand lumen that are three times what is reported in the SSL roadmap.

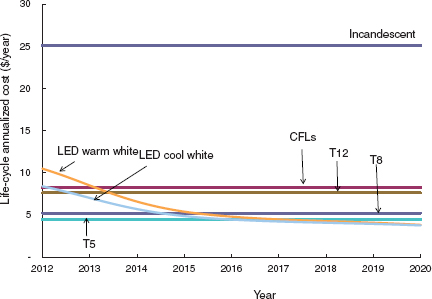

The results of the analysis in the 3 h/d usage scenario are shown in Figure 6.5 and for the 10 h/d scenario in Figure 6.6.

TABLE 6.8 Assumptions Used in Calculation of Cost in Figures 6.5 and 6.6

| Efficacy (lm/W) | Lifetime (h) | Lamp Cost ($/lamp) | Service Cost ($/thousand lm) | ||

| Incandescent | 14 | 2,000 | 0.5 | 0.5 | |

| Compact fluorescein lamp (CFL) | 69 | 8,000 | 4.4 | 4.3 | |

| Fluorescent tube (Tl 2) | 69 | 5,000 | 2.0 | 2.0 | |

| Fluorescent tube (T8) | 92 | 12,000 | 2.0 | 2.0 | |

| Fluorescent tube (T5) | 104 | 20,000 | 2.0 | 2.0 | |

| Solid-state lighting (system level, warm white) | 2012 | 72 | 25,000 | 23.0 | 22.5 |

| 2015 | 103 | 25,000 | 6.7 | 6.6 | |

| 2020 | 129 | 25,000 | 3.1 | 3.0 | |

| Solid-state lighting (system level, cool white) | 2012 | 90 | 25,000 | 18.4 | 18.0 |

| 2015 | 114 | 25,000 | 6.1 | 6.0 | |

| 2020 | 132 | 25,000 | 3.1 | 3.0 | |

FIGURE 6.5 Annualized life-cycle costs of lighting technologies for 3 h/day usage scenarios. A 10 percent discount rate and an electricity price of $0.11/kWh are assumed.

FIGURE 6.6 Annualized life-cycle costs of lighting technologies for 10 h/day usage scenarios. A 10 percent discount rate and an electricity price of $0.11/kWh are assumed.

FINDING: On a life-cycle basis, warm and cool white LEDs are already cheaper than incandescent lighting and will likely be comparable to that of fluorescent lighting technologies in the near future. For applications where the daily usage is larger than 10 h/d, cool white LEDs have now a similar consumer cost to CFLs or T12.

ROLE OF GOVERNMENT IN AIDING WIDESPREAD ADOPTION

Government can have a role to play in spurring technological innovations and development as well as new product introduction for products that offer economic, environmental, energy, and national security benefits to the nation.

SSL technology, when fully deployed, offers all of these benefits. The federal government and many state governments provide R&D support, manufacturing support, and information resources to market participants, including consumers, to advance the public good. Industry, health and safety, and environmental regulations also play a role in directing industry behavior as it conforms to meeting stated public policy goals.

Outreach and Communication on Implementing Standards

Chapter 2 reviewed targets and timetables set by various bodies around the globe for the implementation of more efficient lighting products for illumination. In many cases such targets and timetables are mandated by law, such as in EISA 2007. Some states were permitted to accelerate these timetables, and California issued a fact sheet discussing its early adoption.21 This section reviews the efforts made in communicating the implications of these standards to the consumer public.

The phase-out of incandescent lamps in the European Union began on September 1, 2009.22 At that time, the European Commission had not issued any guidance documents to consumers about the choices they would have after the transition date. There are no official estimates of the percentage of the European population in September 2009 that was aware of the changes in available products, but the European Lamp Companies Federation (ELC) estimates that more than half of the adult population was aware that changes were coming. This is largely the result of the media and retailers themselves in various European countries informing the consumers of the change. It should be noted, however, that some of the information provided was found by ELC to be inaccurate. Negative reactions were experienced in many countries, and it was not until a year later that the European Commission finally published its consumer guidance on its website where readers in Europe are now able to find it in their own language. ELC estimates that the total amount of money that the European Commission has spent on consumer awareness programs such as this is approximately half a million Euros. The member countries have not funded local language programs, at least not on a systematic scale. Much like in the United States, halogen incandescent lamps and LEDs are also available to consumers and meet the legislative requirement. Nonetheless, the European Union recognized the need for government intervention to aid in the lighting transition. The United States is the only country in the world where such significant changes in consumer choices of lamps has taken place without the government first making efforts to build awareness with the consumer.

An effective program for communicating to consumers about the incandescent lamp phase-out was launched by the Australian government. After Cuba instituted an import ban of filament lamps in 2005, Australia was the first country to announce, in February 2007, that incandescent lamps were going to be phased out in that country starting with an import ban in February 2009 and ultimately leading to a sales ban in November 2009. While the total amount of money that the Australian government has spent on consumer education is not publicly available, the federal and state governments in Australia collaborated with industry, retailers, and other stakeholders to produce in-store banners and other point-of-purchase materials intended to give guidance to the public about lamp choices. One such example is shown in Figure 6.7.

The Australian government also produced training manuals for electrical contractors to explain the new regulations and to teach the basics of lighting energy efficiency. The acceptance of these regulations has been high, and the over-whelming majority of media reports have been positive and in support of the regulations.23 In other examples around the world, New Zealand joined Australia in June 2008 by announcing its intention to phase out incandescent lamps. The government of New Zealand worked with Australia to develop a common minimum efficacy standard for these lamps.24 However, public opinion and a change in government in New Zealand led that country in March 2011 to repeal the ban. There is some speculation that the minimum standard may be re-introduced in New Zealand now that the election period is well over. The Canadian government announced in October 2011 that the phase-out in that country will be delayed by 2 years and will now begin in January 2014. Brazil is currently considering regulations similar to those in the United States and is watching developments in other countries closely. China recently announced that it will phase out 100 W incandescent lamps starting October 1, 2012 (Taylor, 2011).

On the other hand, the market share of incandescent lamps in Japan’s residential market has for a long time been much lower than in other countries, even without government regulation or intervention. The traditionally high electricity rates have contributed somewhat to Japanese consumers voluntarily using fluorescent lighting in their homes, and after the 2011 earthquake and tsunami, as a result of extensive news coverage and government outreach to the public, the adoption of even higher efficiency LED lamps has accelerated.

Discussion

These examples suggest that national governments can greatly help increase public acceptance of higher-efficiency products with positive and proactive messaging. And conversely, by remaining passive, government can turn the public against such efforts. The committee found that in

________________

21 See http://www.energy.ca.gov/lightbulbs/lightbulb_faqs.html.

22 European Commission Regulation 244/2009.

23 Email communication with Bryan Douglas, Chief Executive Officer, Lighting Council Australia.

24 AS/NZS 4934.2(Int):2008, which was later replaced by AS/NZS 4934.2:2011.

FIGURE 6.7 Australian lighting information brochure. SOURCE: Reproduced by permission of the Commonwealth Department of Climate Change and Energy Efficiency, Australia.

California, media coverage has been fair and balanced and informative as to what the new standards really mean for consumers. As described in greater detail in Chapter 2, the rollout of CFLs encountered many problems. Foremost among them was the lack of a robust public education campaign to prepare consumers for this new technology. Related to this problem was the failure to consider and give sufficient weight to consumer expectations and reactions to this new lighting technology in terms of lighting quality, reliability, costs, and durability. Finally, there was an absence of any serious effort to proactively anticipate and attempt to address foreseeable problems with the technology that may be important to consumers, such as the objectionable color temperature, the potential for mercury pollution, and the inability to dim many CFLs. The lessons of CFLs have played out in other types of technology introductions, such as the transition to digital TV (see Box 6.3).

FINDING: As discussed in this chapter and in previous chapters, demonstration, outreach, and public and industry education programs are important for widespread adoption of SSL products and can help to avoid the problems encountered during the introduction of CFLs.

RECOMMENDATION 6-7: The Department of Energy should take a leadership role, in partnership with the states and industry, to examine and clearly identify opportunities for demonstration, outreach, and education so that its activities in support of SSL deployment are most valuable.

BOX 6.3

Lessons to Avoid: The Digital TV Example

The transition to digital television (DTV) provides a relevant analogy and some potentially useful lessons for the transition to solid-state lighting (SSL). As is the case with SSL, DTV offers important benefits and advantages over existing technologies, but because of public unfamiliarity with the new technology, consumer dermnd was “latent” Another similarrty is that the successlul deployment of DTV required action by several different industries that are not linked or coordinated, as is the case with SSL.