Moderator:

Ginger Lew

Three Oaks Investments

Dr. Lew, who was Senior Advisor to the White House National Economic Council and to the Administrator of the Small Business Administration until September 2011, is now CEO of Three Oaks Investments, a consulting firm that provides advice to emerging companies. She began by thanking Dr. Wessner and Dr. Kota for providing a framework for some of the administration’s initiatives, and said that this panel would attempt to explore a specific policy framework for the MEP. The subsequent speakers would then be invited to fill in gaps of opportunities and challenges. Dr. Kota’s remarks, she said, demonstrated that the administration does understand the importance of innovation, and of funding basic research.

THE NEED FOR MORE CLUSTERS AND INTERAGENCY COLLABORATION

“As a civilian,” she said, she would make some additional comments. First, she said, the nation continues to miss opportunities, such as the need for more public-private innovation clusters. It also needs more inter-agency collaboration in order to optimize its leveraging of existing agency dollars, initiatives, and programs. She suggested that the MEP study examine whether the program should in fact position itself as a hub for agency coordination. The MEP’s own budget is modest compared with the “giants,” such as DOD, but it “provides the critical function of translating the pre-commercial research that the government invests in, and taking it to the marketplace.”

Dr. Lew underlined the urgency of the panel’s task by reminding participants of how much ground the U.S. manufacturing sector has lost to foreign competition in recent years. In the 1950s, manufacturing’s share of the GDP peaked near 30 percent. Today its share is about 11 percent, a decline that accelerated after 2007. The United States is still the world’s largest manufacturer, with a global share of about 22 percent of global output, but “it faces more challenges from around the world.” There is a growing awareness in this country that thriving manufacturers are critical to America’s economic recovery. “As the president has said, we’ve got to go back to making things.” The United States cannot completely move into a knowledge- and services-based economy, she said; it also has to produce tangible assets.

THE ‘TREMENDOUS RISKS’ THAT FACE NEW TECHNOLOGY FIRMS

A challenge for many American businesses, she said, is to gain access not only to technology, but also to capital. “We keep saying the U.S. government will invest in high-risk technology, but translating that technology into marketable products that consumers will buy requires sustained financial support.” She cited the demise of the solar energy company Solyndra as an example of the “tremendous risks” that face new technologies. “We can invest all this capital in the early stages,” she said, “but if the private markets are not stepping in to fill the gap from there to the market, we can be throwing billions of dollars down a black hole.”

Dr. Lew said she spoke partly from her experience as a venture capitalist in Europe, where governments offered incentives to accelerate the development of promising technologies, including solar, wind, and bio-fuel products. When government subsidies and tax initiatives ended recently, she said, no private investors were willing to step in. The high risk had caused them to pull back, and she predicted that this lack of capital would become a greater problem in the future.

This raises the question,” she said, “of what type of assistance the MEP can and should provide to companies.” She described her recent visit to China, where she witnessed evidence of “its stunning economic growth,” increased GDP, and rising per capita income. She said she saw an “explosion” of universities and “unabashed government investment in R&D.” After touring some SMM facilities, she said that “clearly China is on a march to become a global giant in the manufacturing sector. That is a formidable competitor for the U.S. to face.” The United States must be equally aggressive, she said, and one contribution of the MEP evaluators could be to suggest ways to maximize the program’s benefits and enhance the SME client base.

Dr. Lew then introduced the next speaker, Roger Kilmer, director of the MEP, who had requested the Academies’ study. She expressed the committee’s thanks to Mr. Kilmer for “his visionary leadership” at MEP since 1993, and

applauded his commitment to make the MEP more “strategic and relevant in this shifting environment.”

THE MEP IN THE INNOVATION CHAIN

Roger Kilmer

Manufacturing Extension Partnership

National Institutes of Standards and Technology

Dr. Kilmer thanked Dr. Lew for her service, and said that he looked forward to the Academies’ study as a complement to the feedback already gathered by the MEP from its manufacturing centers across the country. It was also important to have the same kind of conversation from a policy perspective that the Academies could provide, and to educate the public on the mission and accomplishments of the MEP.

The MEP was created in 1988 specifically to make useful technologies more easily available SMMs.15 He noted a gap between the needs of these SMMs and the perceptions of those who invent or develop technology. For example, the kinds of technologies he had worked with at the National Institute of Standards and Technology (NIST), such as advanced manufacturing robotics, were not needed by small manufacturers—and this continues to be largely true today. “I think there’s a lack of understanding of what the SMMs need, what expertise they have, and what constraints they have. Many technologies are aimed at a different set of folks than those the MEP deals with.”

With that perspective, Dr. Kilmer said, the MEP created a system of centers around the country on a partnership model. By legislation, MEP centers can provide only a third the value of the services they provide, with the balance coming from industry and state partners in their region. The MEP must also work with larger manufactures, and once a project is identified, it charges a fee for its service.

The MEP Depends on Partnerships

The MEP is a relatively small program, Dr. Kilmer added, so that partnerships are necessary. The total headquarters staff numbers about 45 people who focus on setting strategy, evaluating the needs and demands of clients, helping facilitate the development of tools, and “gluing together the centers into a network that can share best practices.” More broadly, the MEP has about 1,300

_______________

15NIST defines a small or medium-sized manufacturer as one with fewer than 500 employees.

staff distributed among its 60 nationwide centers. This staff relies heavily on local partners to deliver services tailored to the needs of manufacturers. 16

“Part of our evolution,” he said, “was to change from offering a technology push, where we knew about which technologies work in a federal lab, to looking at what manufacturers really needed. It also meant learning to look at the entire manufacturing enterprise—not just the tech piece of it, but everything else: the financing, workforce development, marketing, and sales.”

Helping Both with Short-term Needs and Long-term Strategy

During this evolution, Dr. Kilmer said, the MEP began to rely more on local resources. While this is “a little confusing to us from a national level,” the key thing is that manufacturers recognize local entities as the source of manufacturing assistance. The MEP centers themselves may function as an advisor, consultant, and/or matchmaker, helping small manufacturers address their short-term needs in the context of a long-term business strategy. The center helps companies set priorities and make the incremental changes that a small manufacturer can afford in terms of both cost and time. To date, the centers have worked with some 30,000 SMMs on more than 9,000 projects.

He said he was proud of the degree to which the MEP understood its manufacturing clients and the features of the manufacturing world. In the first decade after MEP was founded, its task was to create the centers and begin operations. Then in 2000 it shifted into connecting and integrating individual centers into networks. The first decade of this century saw a revolution in productivity for the SMMs, but MEP leaders believed that productivity alone would not be sufficient; companies needed to think about strategy as well. Accordingly, the MEP began to advocate a focus on future priorities.

Moving from a One-on-one Approach to the Community Context

Today, Dr. Kilmer said, the program is moving from its traditional one-on-one approach to more collaborative activities, such as encouraging hubs, clusters, and community partnerships. The E3 Initiative specifically looks at the community context, including all the elements that affect a small business.17 These changes were stimulated by feedback from clients and reported to the

_______________

16MEP centers are structured in various ways. “Most MEP centers are not-for-profit corporations (501(c)(3)) affiliated with state governments, or affiliated with universities.” U.S. Government Accountability Office, NIST Manufacturing Extension Partnership Program Cost Share, GAO-11-437R, Washington, DC: U.S. Government Accountability Office, 2011.

17E3 provides the framework for government agencies to establish and collaborate on an Economy, Energy, and Environment Initiative. E3 projects are public-private partnerships that are driven by communities to assist manufacturers in becoming more sustainable, competitive and energy efficient.

headquarters by the centers. The E-3 program also takes into account the changes in manufacturing itself, including globalization, and its dual aspects of competitive challenges and export opportunities. Other changes included the greater attention to supply chains, technology innovation, and new ideas coming from outside manufacturing.

Innovation is a principal driver of manufacturing change and a key to profitability, he said, and MEP responds by helping small manufacturers to develop product/process and business model innovations. While technology itself directly improves manufacturing processes, it must be incorporated into products in ways that differentiate them from competitors’ products. Another key, he said, is sustainability—ways in which a company can benefit by using sustainable practices, including those that benefit the larger community and society.

The MEP Strategy

The overarching strategy of the MEP, Dr. Kilmer said, is to increase the capacity of manufacturers to be innovative so as to drive profitable sales growth. For more than a decade, the MEP has focused on promoting lean manufacturing, quality and cost effectiveness. While those are still key services delivered by the MEP centers, they are today considered not the end of the journey, but the beginning. The new challenge is to look at the other side of the business ledger, he said: “How do I grow the company? How do I get new sales with existing products? How do I get into new markets by exporting? Most important, how do I develop new products either by working with new supply chains or technologies built into other things I currently do?”

He said that these new concerns have been summarized under five key areas:

• Continuous improvement.

• Technology acceleration.

• Supply chain.

• Sustainability.

• Workforce.

An essential point, he said, is that all of these functions are interrelated and must be developed in an integrated fashion. “When we’re working with a company, it is not just about the supply chain piece or the workforce piece. All of those have to be built into a strategy the company can implement.”

A challenge for manufacturers today, Dr. Kilmer said, is to sort through the many programs available to manufacturers to find what is most useful. Most assistance programs are designed for large manufacturers, who already have the resources to make changes and benefit from them. “A lot of it has to do with how we get to a strategic level with SMMs rather than just fixing problems,” he

said. For a manufacturer, there are many steps to transferring a good idea into a saleable product or process. One step is to put the new technology to use not only in one market, but in multiple places. Another is to apply the incremental advances in technology in different circumstances and places. Finally, the MEP, as a national program, faces the challenge of sharing the lessons learned and best practices across the system to improve economies of scale and leverage its efforts. “The MEP’s role in this innovation chain is really to advise the manufacturer, helping it to assess different opportunities and challenges to make strategic decisions. It is also needs to be connectors that can help SMMs find the other resources and components it needs.”

Connecting Firms with Resources to Develop and Sell Their Product

Given the diversity of the MEP’s centers across the county, Dr. Kilmer asked, “how do I develop a system that can help all of them as they help manufacturers?” The centers need to help firms create new ideas, discover market opportunities, and find the right tools to drive the ideas into development and production. “That’s been our focus,” he said. “How do I help companies very quickly and very cheaply? We’re usually talking about small manufacturers that don’t even have an R&D budget, but they need to determine whether or not this is something that, one, will work, and, two, has a market. If the firm reaches that point and the answer is yes, how can I connect them with resources to do the development and commercialization, get it into production, and move out into the market?”

Some cutting-edge elements for success, he said, are access to modeling and simulation tools; a CEO of the company who leads and drives the process; continuous innovation to keep a pipeline flowing with ideas; and consistent incremental improvement, especially for the smaller firms. “Our centers can’t just hit the switch once and leave. You have to help them through this whole process as they continue to innovate and make changes.”

Services Developed by MEP

Dr. Kilmer listed some examples of the services and tools developed by MEP. For technology acceleration—to actually get technology into the hands of small manufacturers—there were many links, including places where an organization may perform basic research, applied research, technology transfer into a product or service, and then manufacturing. While this process is often called a chain, he said, the image is not strictly accurate; there are many branching components situated in many organizations. For MEP, he said, the challenge has been how to partner, translate, and communicate with all the organizations and elements on those branches. These partnerships are often based on what technology is doing to manufacturing, or on how the manufacturers can adjust to the technology.

One tool the MEP helped develop is the National Innovation Marketplace, an online resource of technology solutions identified in universities, federal labs, or institutes. It allows centers (and anyone else) to find and use technologies that can help them improve their products or processes. It can also be used by those in the market for a technology or a manufacturing capability. For example, the E3 tool mentioned earlier can help develop sustainability, a community-based approach involving utilities, local communities, manufacturers, and economic development groups.

“We really are the connector between the manufacturer and the technology source,” Dr. Kilmer concluded. However, the manufacturer needs to handle not only the technology, but also product development, commercialization, IT management, financing, and scale-up. “MEP is the partner that tries to help develop those tools and innovative approaches that keep that process alive and moving.”

REPOSITIONING THE MEP SYSTEM TO MEET THE GLOBAL MANUFACTURING CHALLENGE

Mark Rice

Maritime Applied Physics Corporation

and MEP Advisory Board

Mr. Rice began by describing the MEP advisory board, of which he is the chair. In 2007, the America Competes Act changed its makeup from primarily academic members to mostly manufacturing members. Today, the 10-member board has seven CEOs of manufacturing companies and three members from academia.

Mr. Rice said that he had been a board member for four years, and that it had taken him that long to understand the MEP system. “It’s a large, complex system,” he said, “that does some wonderful things that are truly hard to appreciate until you get into the depths of what each center does.”

The Link Between Manufacturing and Innovation

As a product of the 1960s and 1970s, “the Apollo generation,” Mr. Rice said that he had grown up with a strong understanding of the link between science and innovation. “But what that generation did not gain was a strong understanding of the link between manufacturing and innovation. It’s when I travel to Germany or South Korea that I am impressed with the engineers there and their understanding of that link.” He did not find that understanding in American universities, he said. One reason he had decided to join the MEP board was his conviction that the program could help build this understanding through better communication with the nation’s engineers and engineering students.

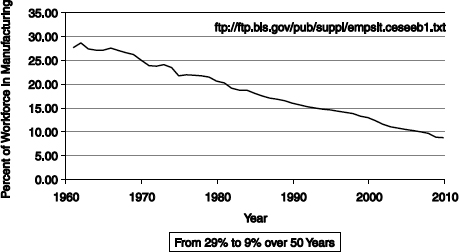

FIGURE 2 Decline of manufacturing jobs as a percentage of total U.S. workforce.

SOURCE: Bureau of Labor Statistics.

He began with a brief sketch of the context of manufacturing employment in the U.S. In the last 26 years, he said, U.S. manufacturing had lost eight million jobs.18 The manufacturing workers, with the percentage of the workforce in manufacturing population as a percentage of the total U.S. workforce had declined from 30 percent to about nine percent over the same period. Most of the loss came from companies with more than 500 employees. While about 99 percent of all manufacturing firms today have fewer than 500 employees, only 40 percent of manufacturing employees work for those small firms.

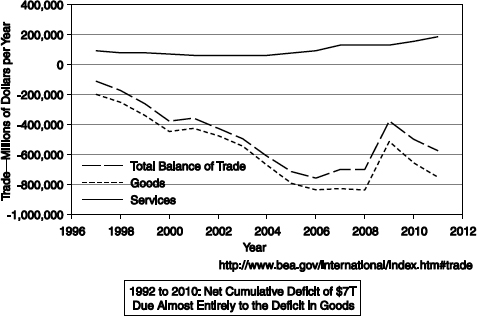

The balance of trade of goods and services has also deteriorated, with the balance shifting away from trade in goods and toward trade in services.19 This trade deficit has been associated with a loss of about $7 trillion dollars from 1992 to 2010. For manufacturing as a percentage of GDP, the U.S. portion of GDP from manufacturing has dropped from about 18 percent to about 13 percent. In the same period, the manufacturing portion of GDP has risen.

Other Countries Outspend the United States by Wide Margins

Similarly, an analysis of exports by company type and employment size shows that 82 percent of all manufactured exports came from companies that

_______________

18<http://www.ces.census.gov/index.php/bds/sector_line_charts>.

FIGURE 3 U.S. trade balance in goods.

SOURCE: Bureau of Labor Statistics.

had more than 500 employees. He noted that recent reports by the Information Technology & Innovation Foundation (ITIF) further characterized the crisis by showing that Japan, Germany, and Canada all outspend the United States on manufacturing programs by wide margins, although program differences make direct comparisons difficult.20

Mr. Rice offered a historical example of how the MEP may have the ability to strengthen manufacturing in the United States. He said that his company had attempted to open an export operation in South Korea, but “made a lot of mistakes” and had to halt the effort. Much chastened, he returned home and decided to meet with his local MEP center, the local export assistance center, and the Small Business Association. Out of that meeting came not only financial assistance, but also further discussions with the MEP center, which realized that many small firms trying to begin exporting would have similar problems. The MEP center, collaborating with SBA and the export assistance

_______________

20According to the ITIF, “…Germany’s and Japan’s experience belies the received wisdom that manufacturing as a share of GDP is falling in most advanced economies over time….Clearly, Germany and Japan’s SME manufacturing support programs have played an important role in sustaining the strength and vitality of their nations’ manufacturing sectors over the past forty years.” <http://www.itif.org>.

center in Baltimore, developed a course for potential exporters. “They saw a need,” he said, “they jumped in, and they paid for the course curriculum development. Our company took the course, piloted it, and introduced it through the MEP centers.”

The Public-private Partnership Model as the Future of MEP

By now, Mr. Rice said, about 400 CEOs have taken the course, written their own business plans—with federal help—and are engaging in trade missions and exporting around the world. This is the kind of project, he said, that the MEP system is good at—bringing several federal agencies together to meet a need. “This is very tough to do from Washington,” he said. “It’s easier to do from the field through an inter-agency solution that is delivered through a public/private partnership that has skin in the game. So the public/private partnership model represents the future and the strength of the MEP system.” Its strength, he added, was in its grass-roots nature, and its ability to “pull” the technology and the need out of the manufacturer, address it with state and federal help, and then distribute it through 60 centers.

He said that his “enthusiasm for public-private partnerships had grown immensely” through his exposure to the MEP system. The different perspectives of companies, state government, and federal government “inherently separate these functions,” so that a strong force is needed to “drive them back together.” That force, he added, needs to be based locally, not in Washington; “it can’t be a federal program that’s pushed down from the top. It has to be something that’s out listening to the clients, the state, the cluster, the manufacturing sector. We’re an extremely varied country, and this thing is not the same across the country.” He also said it was important that “no entity has full control.” Bringing all participants together is an “immense job,” he said, and the MEP performs it well.

Mr. Rice said that the MEP’s oversight role brings it into effective contact with both small and large companies. He recalled his own participation in a partnership that included Amtek, a large automotive supplier, as well as other large and small companies. “That marriage of small and large value chain thinking in the formulation of a program, and its delivery through a network of centers, is really the magic of this program.” He said it resembled the Fraunhofer program of Germany as adapted to U.S. customs, and encouraged the attendees to “think about what public/private partnerships can be, not just what they are.”

The Manufacturers Need to Have ‘Skin in the Game’

The disputes that arise within the centers, he added, “are part of the landscape,” and inherent to the public-private partnership process. He encouraged the audience not to focus on them, because “these are tough things to manage and disputes are part of the system. The beauty of the MEP centers is

the manufacturers having skin in the game. The needs of the clients and the pressure from the federal government meet in the middle, and that middle ground is where the magic and the chemistry takes place.”

Mr. Rice also praised the feedback mechanisms for the MEP. The use of the national advisory board by Mr. Kilmer’s office, he said, was paralleled at the local centers, each of which has a local advisory board. He said that for national issues, he had “felt completely comfortable” telling Mr. Kilmer when he thought a policy was wrong, and vice-versa.

A strong feature of the program, he said, was the diversity of the centers, and the way the program accommodates that diversity. “In a sense,” he said, “this mirrors the way this country works. It isn’t a really top-down system, it’s one that embraces all parts of this ‘living organism’ and tends to evolve as a result.”

Mr. Rice turned to “some repositioning recommendations.” He began with funding, which he said should be about four times as large as it is at present. This would allow expanding the interagency links, which at present don’t always work smoothly, and continue to increase the competency of the center staffs, including addition of more scientists and engineers. It would also allow rotation of the federal, state, and local staffs between positions, strengthening linkages by bringing in new perspectives. Another recommendation was for the program to continue the state match at current levels. This is difficult to do at a time of tight state budgets, “but state involvement in this is absolutely critical to the success of this program. The state brings a perspective that neither the federal government nor the local company can bring.”

Technology Transfer is ‘Where We’re Falling Down’

The program needs to improve its ability to facilitate technology transfer, he said, which is “where we’re falling down.” One model of effective technology transfer is the German version, but suggested that the Korean programs “may turn out to be closer to our business model than the German one.” What the Koreans have done is to link manufacturing to innovation, using science to support rather than drive the process. This approach can benefit from additional partnering of industry with federal labs, he said, adding that this model can overcome a major weakness in the U.S. system. “We do a great job of innovating, we do a great job at science, but we don’t do a good job at technology transfer.”

Mr. Rice urged more attention on consortia as bridges between federal labs and industry, but these consortia need to embrace the full range of the manufacturing sector, not just a few large firms. “Some of the novel thinking about the evolution of contracting is right where public/private partnerships operate. We don’t have the legal structures in place to regulate these partnerships as part of a procurement chain, but we ought to think about it. Because that’s where we’re getting beaten.” A centralized economy doesn’t

have that problem, he said, and is able to “just blow through it.” One U.S. advantage, he said, is that the MEP centers provide a brokerage function and can interface between agencies and governments, both large and small.

“I’m a big advocate for what the MEP is,” Mr. Rice said in closing, “but I’m a bigger advocate for what it could be. I sense that it is the essential missing piece for the evolution of this tech transfer process through public-private partnerships. It needs to be linked to a strategy—not a Fraunhofer strategy, or a Korean version per se, but an American strategy. The beauty of the American system is the diversity we bring to these problems. Let’s embrace that and figure out how to make it work on a local, state, and federal scale.”

DISCUSSION

Diane Palmintera of Innovation Associates said that when she talks to MEP directors around the country, they say that while they applaud the effort of MEP to move toward innovation and technology, their staffs are not always prepared to coach firms on tech transfer and innovative technologies. Mr. Kilmer agreed, and said that the MEP has been working on a training curriculum related to innovation. “Quite honestly,” he said, “it’s a difficult thing for the centers. Some staff will be able to make those changes and some won’t. We try to equip them, with training and professional development, but it is a challenge.”

Dr. Wessner followed up on that question, asking how much authority the federal MEP office had to revise programs or strategies in the centers, and whether any centers had been discontinued over the years. Mr. Kilmer said his first approach was to show centers how a new or revised program would benefit the manufacturing clients; this might be accompanied by a performance evaluation. There have been a few cases where the national office has had to close down centers, but it plans to reopen them. “It is very much is a process of leading, dragging, and in some cases, stronger action,” he said.