New Approach: Next Generation Strategy

Starting in 2007, and based on conclusions from numerous evaluations and assessments (described below), the Manufacturing Extension Partnership (MEP) has worked to develop a new strategic approach. This approach is based on an expanded vision of its role in the manufacturing sector, in which MEP seeks to help firms grow by becoming more competitive and innovative.1 MEP calls this the Next Generation Strategy, and it is built on findings from a business model study sponsored by MEP and conducted by a longtime MEP consultant, Mike Stone.

Published in 2010, the Stone study stated that:

“MEP needs to provide a broader range of services, especially services that foster growth, innovation and sustainability.2 These include in particular those that focus more on innovation, beyond the process improvements that were a traditional MEP focus.” 3

Based on this view, MEP has recast its mission statement:

Vision: MEP is a catalyst for strengthening American manufacturing—accelerating its ongoing transformation into a more efficient and powerful engine of innovation driving economic growth and job creation.

Mission: To act as a strategic advisor to promote business growth and connect manufacturers to public and private

________________

1NIST, The Future of the Manufacturing Extension Partnership, October 2008, p. 5.

2Stone and Associates, “Re-examining the MEP Business Model,” October 2010, p. 7.

3Stone and Associates, op. cit. p. 4.

resources essential for increased competitiveness and profitability.4

A Change in Direction

This new strategy represents a massive and ambitious change of direction for MEP. It orients MEP to the difficult task of encouraging small- and medium-sized manufacturers to adopt and implement growth-oriented strategies, seeking to encourage continuous innovation instead of just continuous improvement. In doing so, it relegates the core of existing MEP business—lean manufacturing—to a supporting role at best.

Such a strategic shift will undoubtedly require time to implement, and will likely require the adoption of midcourse corrections. For now, though, MEP is focused on implementing its vision through the provision by MEP centers of new services, and the adoption of new metrics.

In its new strategy document, MEP translates the new vision into five service categories:5

- Technology acceleration.

- Supplier development.

- Sustainability.

- Workforce development.

- Continuous improvement.

This chapter describes each element of this strategy in turn. Given that the new strategy is focused on improving the competitiveness and innovative capacity of SMEs, this chapter also addresses how MEP is helping SMEs enter the global marketplace by exporting more effectively and discusses the role of MEP centers in the development of innovation clusters and networks. While we describe each of these elements separately for analytical clarity, all of these service categories can and do overlap to a greater or lesser degree in practice. Each of the new initiatives is discussed in the following sections.

TECHNOLOGY ACCELERATION

MEP’s Technology Acceleration strategy has four principal components:6

- Connecting manufacturer technology needs with technology sources.

________________

4MEP, “The Future of the Hollings Manufacturing Extension Partnership,” December 2008, pp. 7-8.

5MEP, 2008, op. cit.

6MEP “Technology Acceleration,”

<http://www.nist.gov/mep/manufacturers/tech-acceleration.cfm>. Accessed July 20, 2012.

- Technology scouting.

- Supplier scouting.

- Product development and commercialization assistance.

We describe each of these components in turn below:

Connecting Manufacturers to Technology Providers

MEP’s signature initiative in the area of technology acceleration has been the National Innovation Marketplace (NIM).7 This is an online tool that MEP anticipates will connect manufacturers to technology and business opportunities by facilitating connections between technology requestors and potential suppliers. NIM is expected to encourage technology translation and adoption, and provide estimates for the potential for business growth. It is also expected to facilitate the building of technology-based supplier networks.

Reaching Critical Mass

While NIM focuses attention on the need for networks to connect SMEs better to technology and to business opportunities, there are real challenges in building tools that can do so effectively. Most importantly, all online markets require that they contain a critical mass of buyers and sellers. Once beyond the beta or pilot stage, online markets have only a very limited time in which to attract this critical mass. Without that, visitors will come to the site, try a search, find few or zero relevant results, and never return. This has been true of online information markets since the earliest online communities.8

Effective Service Delivery

Moreover, online marketplaces must explicitly provide users with information and/or services that they cannot readily access elsewhere. To date, this does not appear to be the case with NIM. Currently, there are about 2,500 entries, with widely varied characteristics.9 For example, a search for a “magnetometer” vendor on the NIM website generated zero results, while on Google it generated 2.4 million hits and on eBay, 77 offers. While the concept of NIM appears to be sound, what matters is whether it works in practice. While this is only one example, this sample search suggests that NIM needs to mature further before it can serve as a unique and useful resource for manufacturers.

The point here is that building successful online marketplaces is difficult, and usually requires considerable investment in outreach to potential

________________

7See <http://www.usainnovation.org>.

8For several examples, see Tharon W. Howard, Design To Thrive: Creating Social Networks and Communities that Last, Elsevier, 2010.

9Accessed July 19, 2012.

participants and partners. It would be useful to determine whether the NIM website is attracting significant repeat business from vendors or customers.

Technology Scouting

In 2009-2010, MEP partnered with RTI International to pilot a technology scouting program. Unlike traditional ”push-based” technology transfer in which the initiative comes from the technology provider, technology scouting is pull based, finding solutions for a small manufacturing client’s unmet technology need.10

NIST-MEP has been researching potential tools and services that can provide technology scouting support for SMEs by pulling technologies from government laboratories, universities, and private-sector sources. MEP is also testing the efficacy of a “light” version of technology scouting that utilizes a “self-service” technology needs write-up approach with subsequent distribution to technology sources. “This effort is intended to provide another Technology Scouting opportunity for clients, and possible service offering for MEP Centers, requiring fewer resources from both MEP Centers and client manufacturing companies.”11

Partnering with RTI12

MEP’s engagement with RTI has been implemented in four phases starting in mid-2008. It focuses on two core efforts, with one additional recent initiative:

- Technology Scouting (TS): Helping clients find technologies they need.

- Technology Driven Market Intelligence (TDMI): Finding markets for client technologies and technology-related products.

- RTI is now introducing training in Lean Product Development (LPD).

RTI began work on technology scouting for MEP in 2008 with pilot projects leading to a full series of Technology Scouting Training Workshops in 2009.

The objective of the Technology Scouting Training Program is to train MEP center staff members to be able to acquire and undertake successful technology scouting mission assignments for MEP client companies. It is not yet

________________

10MEP, “Technology Scouting,”

<http://www.nist.gov/mep/upload/Technology-Scouting-One-Pager_v3.pdf>. Accessed July 10, 2012.

11NIST, “Next Generation Strategy,” April 2011. Access at

<http://www.nist.gov/mep/technology-acceleration.cfm>.

12This box is based on interviews with Tom Culver, RTI manager to MEP center clients, and Kirsten Reith, RTI manager NIST to MEP, October 24, 2012, and on an RTI presentation, RTI Technology Acceleration Services Development: Supporting business growth and innovation initiatives for NIST MEP, September 2012.

clear what benchmarks MEP and RTI have in place to gauge the success of this training program: While some intermediate metrics have been identified—e.g., number of center staff trained—we do not yet have a clear view of the outcome metrics.

Technology Driven Market Intelligence is a parallel effort focused on training center staff to provide enhanced marketing services to clients, focused on the sale of technology or technology-driven products.

RTI staff note that TS/TDMI assignments require an entirely different level and type of engagement with client companies. Existing lean manufacturing assignments are largely based on sales to project managers and line supervisors; TS/TDMI assignments require connections to C-level executives (e.g., chief executive officers [CEO], chief financial officers [CFO]) prepared to discuss strategic issues. This in turn requires a very different set of skills for center staff.

While RTI’s primary role is to train MEP center staff, RTI also provides more direct support for newly trained center staff, helping them to make sales and to implement projects. RTI staff indicates that to some extent at least, RTI’s role is evolving significantly beyond training to active support for centers. This may indicate that even where successful, training MEP staff is insufficient to support successful transition to the new services.

As of September 2012, RTI had delivered a total of 14 workshops on TS/TDMI, had trained more than 300 MEP center staff, and had more than 25 pilot projects running at different centers (21 pilot TS projects and 5 pilot TDMI projects).

Outcomes

Two sets of outcomes will define the success or otherwise of the TS/TDMI component of the new strategy:

- Can centers successfully train or acquire capacity to successfully engage client companies (and potential clients) at the C level?

- Can centers successfully find and attract an economically sustainable market for these services?

The first of these concerns the successful implementation of the program; the second relates to the successful development of a sustainable market for these services.

RTI notes that the program is still rolling out and that it takes time to make what is a substantial transition in center staff capabilities and orientation. As of September 2012, RTI claimed the following outcomes:

- 6 TS MEP client-funded pilot projects running.

- 13 TDMI MEP client-funded pilot projects running.

- Center success stories:

![]() The Manufacturing Resource Center, a Lehigh, Pennsylvania, based MEP center sold more than $300,000 in projects to clients in 2010-2011.

The Manufacturing Resource Center, a Lehigh, Pennsylvania, based MEP center sold more than $300,000 in projects to clients in 2010-2011.

![]() The Texas Manufacturing Assistance Center sold more than $85,000 in projects to clients in 2010-2012.

The Texas Manufacturing Assistance Center sold more than $85,000 in projects to clients in 2010-2012.

![]() Five other centers report selling a total of nine projects to clients in 2011-2012.

Five other centers report selling a total of nine projects to clients in 2011-2012.

RTI is also engaged in working on other aspects of Technology Acceleration with MEP. These include partnerships with Edison Nation, an online clearinghouse of innovative ideas,13 and with the U.S. Patent and Trademark Office on an IP Awareness Assessment Tool.14

Supplier Scouting

In line with the new strategic emphasis on connecting SMEs to supply chains and networks, MEP is developing approaches to leverage MEP center-based knowledge of local manufacturer capabilities and even prequalify supplier capabilities.15 Pilots were under way in 2009 with the Defense Logistics Agency Defense Supply Center Columbus, and with BAE Systems, Inc.

It is not entirely clear whether the objective of this strategic emphasis is to enhance the visibility of SMEs and other lower-tier suppliers to Original Equipment Manufacturers (OEMs) and tier 1 suppliers, or to engage OEMs and tier 1 suppliers to seek out SMEs with specific capabilities.16 Perhaps this will be clearer once the pilot projects are concluded and more documentation is available. The importance of supplier development in the new MEP strategy is discussed further in the section on supplier development below.

Lean Product Development and Commercialization Assistance

MEP is developing three sets of tools for supporting product development and commercialization related to the Technology Acceleration initiative:

- Lean Product Development uses existing lean manufacturing tools to focus on product development to support a waste-conscious, disciplined approach.

________________

13See <http://www.edisonnation.com>.

14See

<http://www.uspto.gov/inventors/assessment/index.html>.

15MEP, “Technology Acceleration,” op. cit.

16A tier 1 (or prime supplier) submits products and services and their invoices to the final customer, e.g., a major corporation or government agency. Lower-tier suppliers provide inputs to the prime supplier.

- MEP has partnered with the U.S. Patent and Trademark Office to offer basic training in intellectual property for MEP field staff.

- MEP is partnering with national organizations and other government agencies to help small companies identify financing options for product development and commercialization processes.

Finally, aside from these initiatives, technology acceleration may also be considered to include MEP’s innovation engineering initiative, which is discussed in the context of workplace training below.

SUPPLIER DEVELOPMENT

MEP argues that it is well positioned to understand the rapid changes in supply chains now under way, and to help small firms position themselves as suppliers by providing assessments of industry dynamics and market intelligence. In recent years, SMEs have faced relentless price pressure, both domestic and especially from abroad. But this pressure has also brought opportunities. After dealing for years with tier 1 suppliers that monopolized all contacts with the eventual purchaser (e.g., a major auto manufacturer such as Honda or Ford), some SMEs are now finding that larger firms are increasingly seeking to partner with companies that can add value, regardless of their location in the supply chain.17

Irene Petrick suggests, moreover, that as higher-tier suppliers OEM-led vertical supply chains are challenged or even replaced by networks of collaborating suppliers, there will be more opportunities for SMEs to engage at levels from which they would previously have been excluded.18 Not only is negotiating leverage more widely distributed across the network, firms are increasingly valued for the specialized capabilities that they bring. Petrick also stresses that increasingly, value is driven by the ability to innovate, which references other aspects of the MEP new strategy.19

Honda of America, for example, is seeking ways to reach out beyond tier 1 suppliers, especially in the Midwest, where its suppliers are heavily concentrated: Almost half of Honda’s U.S. suppliers (308) and about 60 percent of its procurement from suppliers ($11.8 billion in 2011) are in Ohio, Kentucky, Michigan, and Indiana.20

OEM concentration geographically is matched by the way that some centers focus on particular industries, perhaps especially within supplier development. For example, while Ohio MEP assigns specific industries to

________________

17Irene Petrick, “Supply Chain Globalization,” in Alliance for American Manufacturing, Manufacturing a Better Future for America, 2009.

18Petrick, op. cit. p. 291.

19Petrick, op. cit. p. 295.

20Fred Braun, Honda of America Manufacturing, The MEP in the MidWest, NAS Ohio workshop, “Diversity and Achievements: The Role of Manufacturing Extension Partnerships in the Midwest,” March 26, 2012.

individual centers, in Oklahoma supply chain activities are focused on three industries in particular across the state: wind energy, aerospace, and petrochemicals.21

MEP now has a supply chain initiative, led by MEP centers in Illinois, Virginia, South Carolina, and Texas. This initiative has drawn on extensive research undertaken by NIST MEP into the needs of customers at the top of the supply chain. 22 It identifies areas of potential weakness as well as improvement among tier 1 and even tier 2 suppliers, for connecting tier 1 with lower-order suppliers. This research has included a substantial mapping and planning exercise, involving questionnaire replies from 49 manufacturing companies at various levels of different supply chains.

The centers leading the study eventually proposed a series of possible activities that could address the needs identified in the course of the study. This approach is summarized in Table 6-1.

In May 2012, the working group of MEP centers presented a framework through which to implement the supply chain initiative to the MEP Advisory Board.

SUSTAINABILITY

MEP’s signature initiative in this area is E3: Economy, Energy, and the Environment initiative. This is a collaborative effort of five federal agencies, including MEP.23 The concept is that each agency will bring specific tools and expertise to support innovation, energy saving, and job growth in manufacturing to support improvement at the firm level.24 Typically, E3 begins with a one-day energy audit and a two- to three-day lean and green assessment, after which specific steps for improvement are recommended to the company and tracked.

Pilot projects were completed in Columbus, Ohio, and San Antonio, Texas, and about a dozen projects have now been completed. In Alabama, the E3 project is supported by a team comprising the Alabama Technology Network, Alabama Power, and the mayors of Montgomery, Huntsville, and Tuscaloosa. The projects have utilized more than $2 million in funding from multiple sources25 to focus on 40 automotive industry suppliers in the area that have committed to take part in the project. As of 2012, the project has identified $263,200 of potential energy savings and savings of more than 26,700 metric tons of greenhouse gases. The project has also lined up financing for

________________

21Oklahoma MEP, op. cit. Exhibit I-17—Key Products.

22NIST MEP Supply Chain Development Initiative: Improving the competitiveness of U.S. supply chains, May 9, 2012.

23The other agencies are Department of Commerce, Small Business Administration, Department of Labor, Department of Energy, and Environmental Protection Agency.

24NIST, “Economy, Energy and Environment: Going Green in the Black,” July 21, 2010.

25E3 “E3 Alabama,”

<http://www.e3.gov/accomplish/alabama.html>. Accessed July 26, 2012.”

TABLE 6-1 Supply Chains: SME Needs vs. Proposed MEP Offerings

| Supply Chain Opportunities | Supply Chain Needs | ||||||

| Supply Chain Strategy Workshop for Prime | Supply Chain Strategy Workshop for Supply Chain Partners | Total Cost of Ownership Support Workshop & Services | Demand Planning/Volatility Reduction | Failure Mode Effects Analysis (FMEA) Supply Chain Risk Mgmt | Collaborative New Product Development | Technology Scouting/Innovation Engineering | |

| Identify and Address Choke Points | X | X | |||||

| Increase ERP/MRP Effectiveness | X | ||||||

| Mitigate Global Risks | X | X | |||||

| Document Supply Chain Strategy | X | X | |||||

| Reduce/Manage Volatility | X | X | |||||

| Align Supply Chain Metrics with Long-term Business Focus | X | X | |||||

| Optimization of Supply Chain | X | X | X | ||||

| Recognize Emergent Needs for Future Supplier Capabilities | |||||||

| Expand Supplier Matching Capability | X | ||||||

| Better TCO Decision | X | ||||||

| Enhance Value Chain Collaboration Among Suppliers | X | ||||||

| Improve OEM/Supplier Product Development Collaboration | X | ||||||

SOURCE: NIST MEP op. cit.

improvements from Alabama Saves, a $60 million program to provide low interest loans to support energy initiatives in manufacturing.26

As E3 suggests, lean manufacturing may provide a foundation for improving the environmental impact of the company or factory. As the High Liner case described in Box 6-1 indicates, many energy-saving improvements

________________

26E3 “E3 Project Summaries,”

<http://www.e3.gov/ground/summaries.html>. Accessed July 25, 2012.

result from incremental changes in operations. These may be facilitated by the ways in which lean manufacturing empowers front-line workers to take the initiative in suggesting improvements. At the same time, lean manufacturing provides tools through which senior management can focus on the details of the production process, e.g., through the Six Sigma toolkits.

What is increasingly apparent is that there are overlaps between different elements of MEP’s new strategy, and with other aspects of individual center strategies. For example, Vadxx Inc., a Cleveland-based firm whose plants convert plastic and rubber scrap into synthetic crude oil, has implemented projects that address technology acceleration and green manufacturing, but also falls within the Ohio strategic focus on polymers. The company manufactures and sells crude oil made from polymer-based waste, such as scrap tires, scrap plastic, and medical waste.

As with any startup, finding product development and marketing partners is a huge challenge. Jim Garrett, the Vadxx CEO, explicitly credits Magnet MEP Ohio with enhancing the company’s credibility, helping it to partner successfully with Rockwell International.27

There is direct overlap as well. Lean manufacturing emphasizes the reduction and elimination of waste, which is in itself a step toward greener manufacturing. Efforts to reduce waste are in themselves green initiatives, whether or not they are labeled as such.

A recent study of companies that have implemented lean manufacturing practices suggests that there is substantial synergy between lean and green.28 Bergmiller and McCright found that there was a strong positive correlation between the introduction of green management practices and lean management outcomes. On reflection, this does not seem surprising. As the High Liner case, described in Box 6-1, suggests, many energy-related improvements are found through incremental improvements in production processes. The introduction of lean manufacturing also often has the effect of empowering workers on the factory floor to identify and recommend such improvements. At the same time, it encourages management to become much more vigilant in seeking out these opportunities.

Some of the findings from Bergmiller and McCright’s paper further illustrate the synergies between green management and lean management:

- “Substitution of less toxic, more recyclable, or more easily processed materials is significantly correlated to customer satisfaction, profitability, and improved cost performance.

- Extending the life of products correlates with improved customer satisfaction and profitability.

- Returnable packaging is highly related to improved cost performance.

________________

27Jim Garrett, Vadxx, NAS Ohio workshop, “Diversity and Achievements: The Role of Manufacturing Extension Partnerships in the Midwest,” March 26, 2012.

28Gary G. Bergmiller and Paul R. McCright, “Are Lean and Green Programs Synergistic?” Proceedings of the 2009 Industrial Engineering Research Conference.

- Waste segregation is significantly correlated to customer satisfaction and profitability and highly related to improved company cost performance.”29

The point here is that in some ways green manufacturing initiatives are a natural extension of—and complement to—existing lean manufacturing tools and programs.

Green manufacturing is also increasingly tied in to “green” courses offered by colleges and universities—overlapping with workforce development. For example, Purdue University now offers three levels of “Green Ed,” including a certification as an SME Green Specialist, as part of its green enterprise development program.30

WORKFORCE DEVELOPMENT

NIST MEP’s identification of workforce development as one of the five strategic dimensions signals an effort to reinforce and extend efforts already under way in some MEP centers. Under this strategy, MEP proposes to help firms take a more deliberate approach to developing their workforce as they adopt new technologies and new business models. This focus on workforce development also addresses a key challenge raised in recent studies, which show that manufacturing companies are behind those in other sectors on a range of workforce development criteria.31

MEP’s strategy for workforce development has focused on efforts to formalize and extend training programs for use within a company, as well as new efforts to partner with community colleges and other educational organizations—including professional organizations—to develop new certifications relevant to manufacturing and especially advanced manufacturing.

MEP’s attention to workforce development has traditionally included management training in lean manufacturing. These programs, as implemented by MEP centers, however, did not result in additional certifications. A number of universities and management training programs, however, offer a range of certifications in lean manufacturing to middle management and production workers.

In addressing this component of new strategy, MEP focuses on four core areas:32

- Layoff aversion.

- Skills standards and certification.

________________

29Ibid.

30Purdue University, Green Enterprise Development,

<http://www.greenmanufacturing.purdue.edu/>.

31Sloan Center on Aging and Work, Talent Management Survey 2009.

32MEP, “Creating an Innovation Practice Next Generation Strategies: Workforce,” briefing presented at MEP Advisory Board Meeting, May 6, 2012.

Box 6-1

Environment and Energy Case Study: High Liner Foods, a Pilot Project

with Maine, New Hampshire, and Massachusetts MEPs.

One of North America’s largest seafood processors with additional lines of business, High Liner Foods participated in a test pilot developed by the New Hampshire, Massachusetts, and Maine MEPs in collaboration with the U.S. Environmental Protection Agency (EPA), designed to field test EPA’s energy and environment toolkit and integrate it into the lean manufacturing techniques employed by the MEPs. After preliminary review, the team decided to focus on the company’s mozzarella cheese stick line because it utilizes more equipment than any other product line, and therefore seemed to offer the greatest potential for energy savings.

An initial walkthrough of the production facility quickly identified areas for initial savings. For example, in a 100-foot area, lighting far exceeded recommended levels, and the area was delamped for immediate energy savings.

Other issues that emerged from the value stream mapping exercise were tackled in a series of “kaizen” or rapid process improvement events. Four of the largest energy-saving proposals were:

* Changing the initial handling of the raw product, as cold storing mozzarella would be replaced by flash freezing to eliminate the energy required for 10 days of refrigeration.

* Minimizing the use of compressed air, used to blast each carton of mozzarella on the packaging line to ensure that it was full. This could be replaced by a less expensive alternative involving photo-sensor detection and a mechanical rejection system. The project also repaired leaks in the compressed air lines causing thousands of dollars of lost energy.

* Creating variable frequency drives for the hydraulic pumps, compressed air systems, and portable heater units. Previously, these systems had no way to incrementally increase their output. Additional demand required putting on another 50 hp compressed air unit or 70 hp hydraulic pump. Variable drive systems could instead dial up additional compressed air, heat, or hydraulic volume as needed.

* Recycling heat from the deep fryer. The project team devised a heat recycling system that utilized deep fryer energy to preheat the 30,000 gallons of water used daily in the production process to 100°F, leaving only an additional 40°F or 50°F of heating required, thereby creating substantial energy savings. A new water recovery system also reduced water consumption.

Overall, the pilot project identified more than $200,000 in energy savings opportunities for High Liner Foods, including electricity ($108,800),

compressed air ($48,000), water consumption ($21,500), hydraulic power ($13,000), and heat recovery ($26,600).

________________

SOURCE: Excerpted from New Hampshire MEP,

<http://www.nhmep.org/press/pr2010_jan11.pdf>. Accessed July 17, 2012.

- Innovation Engineering Leadership Institute.

- SMARTalent.

These four core areas are further described below.

Layoff Aversion

Layoff aversion refers to efforts to identify and assist manufacturers that are at risk before they are forced to suspend or dismiss their workers. According to MEP, layoff aversion programs have been operating in a number of states over the past decade—including California, Pennsylvania, South Carolina, Oklahoma, Missouri, Michigan, and New York. CMTC, a California MEP center, reports that its programs have had a range of positive results:

- 126 manufacturers engaged.

- 1,805 jobs retained.

- 349 jobs created.

- $59 million in sales increases.

- $49 million in sales retained.

- $8 million in cost savings.

- $17 million in investments created.

The CMTC layoff aversion effort is part of a partnership with the Los Angeles County Economic Development Corporation and the City of Los Angeles.33 Other centers have also had impressive results. In Mississippi, for example, the Mississippi Technology Alliance feared that Cooper Tires, a global tire manufacturer, might close its factory in Tupelo, which would have had a substantial negative impact on the Northeast Mississippi economy.

MTA implemented a lean production improvement program with management at the plant, focused on continuous improvement, which it believes led directly to Cooper’s decision to expand the Tupelo plant by 7,000 square feet

________________

33See Los Angeles County Economic Development Corporation, City of LA/LAWIB Monthly Layoff Aversion and Business Retention Initiative Progress Report,

<http://www.wiblacity.org/images/stories/PDF/laedc_report_may_2011.pdf>. Accessed July 19, 2012.

and add $16 million in investment in two phases. Overall, the project resulted in the addition of 150 jobs and further investment of $22 million.34

MEP appears now to be working to engage other centers in developing similar programs.35

Skills Standards

The development of skills standards is in part an effort to address skills gaps in the workplace, identified (among others) by the National Association of Manufacturers (NAM).36 A key aspect of MEP workforce development strategy is the development of widely recognized standards for certifying the skills and professional capacities of workers. Accordingly, MEP has adopted the widely used skills standards developed by the NAM.

The NAM standards provide for a range certification from what NAM calls “personal effectiveness competencies” to “industry-specific certification.” The Manufacturing Skills Certification System endorsed by NAM validates specific skills certified by its partners ACT (a nonprofit organization focused on career planning and workforce development),37 the American Welding Society, the Manufacturing Skill Standards Council, the National Institute of Metalworking Skills, and the Society of Manufacturing Engineers. This system of certification provides workers with “a system of stackable credentials applicable to all sectors in the manufacturing industry” that are nationally portable and recognized across industry.38

In June 2011, President Obama announced a major expansion of Skills for America’s Future, an industry-led initiative that aims to improve industry partnerships with community colleges for skills development.39

The expansion includes an expansion of the Manufacturing Skills Certification System, designed to give students access to manufacturing credentials valued by employers. The expansion should allow students and

________________

34MEP Success Stories, “Cooper Tires,”

<http://ws680.nist.gov/mepmeis/SearchSS.aspx?ID=3143>. Accessed July 23, 2012.

35It should also be noted that CMTC is among the largest MEP centers, and the data do not indicate how long a time period is covered. So in the context of a 10-year period in a huge region, these results might not been seen as quite so impressive.

36NAM “2011 Skills Gap Report,”

<http://www.nam.org/content/Institute/Research/Skills-Gap-in-Manufacturing/2011-Skills-Gap-Report/2011-Skills-Gap-Report.aspx>. Accessed July 19, 2012.

37Formerly known as American College Testing, but simply ACT since 1996.

38NAM, “NAM-Endorsed Manufacturing Sills Certification System—Executive Brief,” n.d.

<http://www.themanufacturinginstitute.org/~/media/E5A6A4DBCEBD4F579636DAFAA9952F18/Executive_Brief.pdf>. Accessed July 19, 2012.

39White House, Office of the Press Secretary, President Obama and Skills for America’s Future Partners Announce Initiatives Critical to Improving Manufacturing Workforce, June 8, 2011,

<http://www.whitehouse.gov/the-press-office/2011/06/08/president-obama-and-skills-americas-future-partners-announce-initiatives>. Accessed July 29, 2012.

workers to access programs for manufacturing credentials in community colleges in 30 states as a for-credit program of study.40

MEP is expected to play an important role in this initiative:

“The 60 Centers of the national MEP system will serve as the “boots on the ground” with local manufacturers to educate them about the value the NAM-endorsed skills certification system to their business so that they utilize the skills certification system in their recruitment and hiring efforts. In addition, the MEP will provide input to The Manufacturing Institute about aggregate skill needs of manufacturers by industry and geography so that certification systems can remain dynamic and evolving.”41

Innovation Engineering

The effort under the new strategy to enhance innovation among manufacturing SMEs represents, perhaps, the most radical departure from previous MEP practice. The name of the Innovation Engineering initiative is itself an important clue as to the driving vision: Just as lean manufacturing can be seen as the application of methodological tools to well-known problems—a kind of systemic engineering of the production process—innovation engineering anticipates the development of a toolset focused on stimulating more innovation. Indeed, it utilizes a similar engineering metaphor. However, unlike lean manufacturing which dates back to the 1990s in the United States and the 1960s in Japan, there is as yet limited evidence to show that this “innovation through engineering” approach is successful.

To date, the primary approach to innovation engineering at MEP revolves around a program presented by an organization called the Eureka Ranch, renamed the Innovation Engineering Leadership Institute (IELI). The program was initially called Eureka! Winning Ways (E!WW), and has been renamed by IELI as the Innovation Engineering Management System. Here, we use primarily E!WW as this nomenclature is more familiar to centers and other MEP stakeholders.42 MEP is strongly encouraging MEP centers to adopt this program as the core of their innovation engineering curriculum—utilization of

________________

40According to the MEP, “This program was designed by the Manufacturing Institute, an affiliated non-profit of the National Association of Manufacturers, in partnership with leading manufacturing firms, the Gates Foundation, and the Lumina Foundation, and key players in education and training including ACT, the Society of Manufacturing Engineers, the American Welding Society, the National Institute of Metalworking Skills, and the Manufacturing Skills Standards Council.”

41White House, June 8, 2012, op .cit.

42IELI,

<http://innovationengineering.info/>. Accessed July 28, 2012.

E!WW is one of the new measures of center performance under the new CORE metrics system.43

The E!WW website states that it provides “a proven system of tools developed through scientific inquiry—grounded in hard data and proven reliable in real world application” and that is now available to smaller companies where once it was reserved for large companies like Nike, HP, Proctor and Gamble, and Disney.44

The E!WW program is usually presented in conjunction with MEP centers by staff from IELI. The initial approach is through a one- to three-day seminar. This stresses tools for brainstorming and thinking new product ideas, as well as providing a considerable amount of encouragement for innovation itself. The program appears to provide much less guidance in implementing new ideas, although it is probably fair to say that this would be the place where the MEP center itself steps in to provide additional consulting services.45 Based on the published schedule for fall 2012, one to two workshops are held each month by IELI, usually in conjunction with MEP.46

As we have seen above, the methodologies for lean manufacturing are fairly well known. Numerous studies have addressed their effectiveness, and they are now a staple of every MBA course. This is not yet the case with the innovation program encouraged by NIST.

- The staff at the MEP centers are trained in lean manufacturing, not innovation. Discussions with center directors have indicated that many see the need to replace existing staff with new staff that have a different skill set.

- New curricula will need to be developed. There are some questions as to whether E!WW is as universally applicable as MEP appears to believe, and in particular whether it is sufficient to cover the entire product development cycle for innovative products, and whether there may be alternative programs that are in some respects superior, particularly in light of the diversity of the MEP client base.

- Innovation and product development can take much longer than the implementation of lean manufacturing. Thus metrics designed to capture the short-term outcomes from lean oriented projects will almost certainly not be sufficient to capture outcomes from innovation-related projects that often take years to reach fruition. The new core metrics are a good start in this direction.

It should be noted that not all MEP centers are using the E!WW toolset. For example, MEP of Nebraska is using the Gallup Corporation’s

________________

43MEP Private communication, July 23, 2012.

44IELI website,

<http://innovationengineering.info/>. Accessed July 28, 2012.

45The standard agenda covered by IELI is provided in Appendix C.

46IELI,

<http://innovationengineering.info/location.php>. Accessed July 28, 2012.

Entrepreneurial Acceleration System, which it is implementing through a partnership with the University of Nebraska Omaha and the Omaha Chamber of Commerce.47

SMARTalent

SMARTalent is a new set of tools (developed by MEP) which aims to integrate different aspects of workforce development into a coherent strategy for clients. It pulls together four elements of workforce development:

- Planning and strategic alignment.

- Recruitment.

- Development and management.

- Retention and succession planning.

In 2012, several MEP centers (Illinois, New York, Texas, Pennsylvania, Washington, and Ohio) are helping to pilot the functionality and value of the SMARTalent tool. At the same time, all centers are being encouraged to investigate how workforce development and talent management can support the growth of manufacturing businesses, and the integration of workforce components into strategic business planning.48

CONTINUOUS IMPROVEMENT

The new strategy calls on MEP to promote operational excellence within manufacturers by providing services that minimize expenses and reduce wasted activities. This strategic thrust reflects a continued focus on lean manufacturing.49 This component of MEP’s new strategy is discussed in detail in Chapter 3.

EXPORTING AND GLOBALIZATION

In addition to the five service categories identified by MEP and described above, this chapter also describes two additional activities—support for exporting and support for clustering—that also advance the MEP’s new strategic thrust.

At present, export-led growth is not identified as one of the five strategic thrusts of the Next Generation Strategy, although there is ample evidence that supply chains in manufacturing have globalized. This means that

________________

47MEP of Nebraska, op. cit. 1-12. More details can be found at

<http://www.gallup.com/se/152741/gallup-entrepreneur-acceleration-system.aspx>. Accessed July 20, 2012.

48MEP Advisory Board presentation, May 2012.

49Lean manufacturing is discussed in detail in Chapter 3.

efforts to improve supply chain integration for U.S. SMEs will involve more exports and even potentially direct investment abroad.50 MEP nonetheless appears to be paying considerable attention to the need for increased exporting from manufacturing SMEs. A recent report from the U.S. International Trade Commission (USITC) highlighted some comparative characteristics of exporting and nonexporting SMEs, as described in Table 6-2.

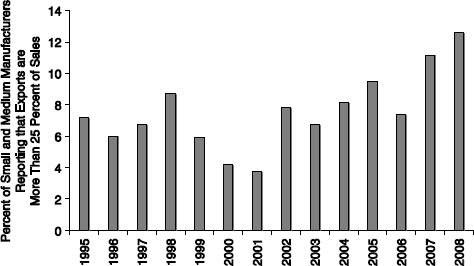

The table shows that exporting is strongly associated with positive economic outcomes in terms of higher revenue, growth, and more value added per employee. It is therefore not surprising that enterprising SMEs in manufacturing are increasingly seeking out additional markets, although the overall percentage of SMEs that export remains below 14 percent of all manufacturing SMEs, as shown in Figure 6-1.

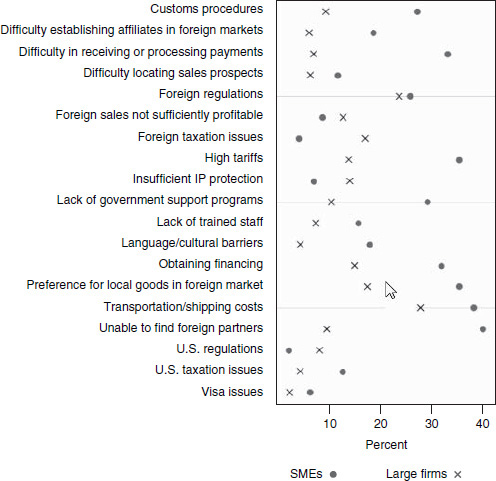

The USITC survey also addressed perceived barriers to exporting among SMEs and found that these firms had substantial concerns and that they were different from those of larger enterprises, as shown in Figure 6-2.

MEP, with its new innovation-focused strategy, seeks to help SMEs link up with a wider ecosystem of firms and research organizations and to promote the development and manufacture of innovative products and services, many of which could have potential markets overseas. The International Trade Administration (ITA) can offer specialized assistance at the final stages of this

TABLE 6-2 Comparing Exporting and Nonexporting SMEs in Manufacturing Sectors

| Indicator | Exporters | Non-exporters | Key Finding |

| Average Revenue per Firm (Millions of Dollars, 2009) | 3.9 | 1.5 | SME manufacturers that export earned more revenue than non-exporting SME manufacturers |

| Manufacturer Revenue Growth (Percent Change, 2005-2009) | 36.8 | -6.8 | Exporting SME manufacturers’ revenue grew faster than that of non-exporting SMEs |

| Average Revenue per Employee (Thousands of Dollars, 2009) | 281 | 163 | SME manufacturers that export are associated with higher labor productivity than non-exporting SME manufacturers |

SOURCE: U.S. International Trade Commission, Small and Medium Sized Enterprises: Characteristics and Performance, November 2010,

<http://www.usitc.gov/publications/332/pub4189.pdf>.

________________

50Bernard and Jensen have long noted the superior performance characteristics of exporting plants and firms relative to nonexporters. Andrew B. Bernard and J. Bradford Jensen, “Why Some Firms Export,” The Review of Economics and Statistics, 2004, MIT Press, vol. 86(2), pp. 561-569.

FIGURE 6-1 SMEs in manufacturing with >25 percent revenues from exports.

SOURCE: NAM Annual Survey of Manufacturers, 2009.

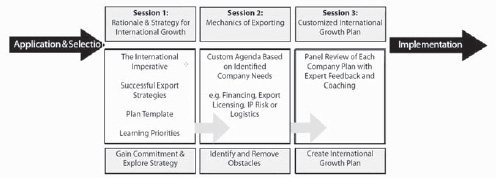

development. In particular, ITA’s ExportTech program runs a three-day workshop in which companies with interest in exporting their products are provided with information and expertise that will help them develop effective international growth plans and get into international markets.

According to MEP, “ExporTech is deployed nationally as a collaboration between the Manufacturing Extension Partnership, U.S. Export Assistance Centers, and other partners including District Export Councils, State Trade Offices, Ex-Im Bank and SBA. These partners help to recruit participants, line up speakers, and in many cases serve as speakers themselves in the ExporTech sessions.”51

Typically, it runs as three full-day sessions in which groups of eight companies (usually C-level executives) are provided with the tools and background needed to develop a customized international growth plan, which is the eventual result of the exercise (see Figure 6-3).

As operated in North Dakota, the first ExporTech session provides broad background on international transactions, including a review of successful export strategies. Content and expert speakers for the second session are customized to the specific needs and composition of the group of companies. In the final session, executives present each company’s international growth plan for feedback from a panel of experts.

Between sessions, executives gather information and develop plans with the aid of experts from the sessions who include government export

________________

51MEP, The ExporTech Program,

<http://www.nist.gov/mep/exportech.cfm>. Accessed July 19, 2012.

assistance providers and private-sector resources. North Dakota MEP estimates that a minimum of 40 hours of work outside the sessions will be needed to develop an effective international growth plan. 52

Evidence from other centers suggests that ExporTech has gained traction and is now a regular service offering (see Box 6-2 for a profile of ExporTech). For example, Oklahoma reports that since the program was first implemented in 2008, 6 programs have been delivered serving 28 companies.53

CLUSTERS AND NETWORKING

Given that, in many cases, MEP support for cluster development will require access to a wider range of resources and expertise than do traditional lean-focused projects, a number of MEP centers are developing new approaches. Some MEP centers have developed strategies that focus heavily on networking and the development of local clusters, while other remain primarily focused on identifying and serving individual clients. NorTech, “a regional nonprofit technology-based economic development organization serving 21 counties in Northeast Ohio,” represents the cluster end of this continuum.54 Its focus is on building regional clusters for selected manufacturing sectors, specifically flexible electronics and advanced energy products.

This reflects the dense set of regional networks that impact support for manufacturing in the region:

- JobsOhio Network partners.

- Edison Technology Centers.

- Ohio MEP center.

- TechSolve and MAGNET.

- Ohio’s Manufacturing and Technology Small Business Development Centers (MTSBDC).

- Community colleges.

- Local economic development organizations.55

In Ohio, a dense network of support programs encourage partnerships and networking. The state-led MEP program operates in conjunction with Edison Technology Centers.56 The market for support services has been

________________

52North Dakota MEP, op. cit. Once again, the precise mechanics are likely to differ between centers. The North Dakota program outlined above is an example; we cannot conclude that it is precisely typical.

53Oklahoma MEP, op. cit. p. 20.

54See

<http://www.nortech.org/>.

55Schmenk, op. cit.

56The Edison Technology Centers were founded in 1984 to provide a link between manufacturers and university resources. Berth Colbert, Ohio MEP, National Academy of Science MEP Workshop, November 14, 2012.

Box 6-2

ExporTech Case Study: Raloid Corporation, Reisterstown, Maryland

Company Profile

Raloid Corporation is a contract manufacturer of close tolerance components and assemblies for the defense industry. The company has 75 employees and approximately $10 million in annual sales, and competes with much larger companies. Prior to ExporTech, its customer base was 100 percent domestic. However, margins in the United States are under pressure, so international sales became more attractive.

International Potential

Raloid identified a specific international opportunity: The 51 percent Buy American requirement for the Department of Defense opens up supplier business to international companies who partner with American manufacturers to meet the 51 percent requirement.

Discovery of Opportunities through ExporTech

Raloid’s Carl Livesay participated with four other companies in the initial ExporTech class. “The program required a lot of homework from each of us, but the guidance and resources we received through it saved us tons of time and tens of thousands of dollars,” said Livesay.

“The program gave us access to every resource we could need—legal, exporting, financial, logistical, and more. At the end of the program, we presented our plans to a panel of experts, who poked and prodded us to refine our plan and expectations,” explained Livesay. “Now we have a detailed document—and the knowledge we needed—to guide our progress into these new markets.”

Results

A key ExporTech benefit for Raloid was accelerating the ITAR compliance.a After two years of failed efforts, personal introductions made through ExporTech provided approval within days. Raloid was then able to sell internationally. Starting from zero, the company achieved $250,000 in international sales last year and expect to hit $350-500,000 this year. Raloid is now developing more opportunities in the United Kingdom, Turkey, Italy, and Australia.

“The resources from ExporTech have far surpassed my expectations, and were not available anywhere else in such an efficient and cost-effective package. And the connections we’ve made—with the USEAC, MEP, DEC, and state Business and Economic Development staff—give us instant credibility in the international business community. They have introduced us directly to many of the same companies that may have never returned our calls previously.

Months after the program ended, we continue to receive referrals, ideas, and introductions that are incredibly valuable.” Bruce Livesay

a“International Traffic in Arms Regulations (ITAR) is a set of United States government regulations that control the export and import of defense-related articles and services on the United States Munitions List. … For practical purposes, ITAR regulations dictate that information and material pertaining to defense and military related technologies (for items listed on the U.S. Munitions List) may only be shared with U.S. Persons unless authorization from the Department of State is received or a special exemption is used.” Source: Wikipedia.

SOURCE:: Mtech, University of Maryland. <http://www.mtech.umd.edu/ummap/documents/Raloid_Client_Story.pdf>.

segmented by size and function, with small manufacturers who need general assistance being served by the state’s Manufacturing and Technology Small Business Development Centers to provide low-cost or free “business consulting, market and product development, workshops and seminars, defense transition and commercialization, and resource referrals.”57 Larger manufacturers are sent to Magnet in Northern Ohio and TechSolve in the southern part of the state,58 with the two centers also providing coordination and training for the MTSBDCs.

Both Magnet and TechSolve are also Edison Technology Centers with specific sector expertise: Magnet in automotive and TechSolve in aerospace and aviation.59 These are two of the industries targeted by Ohio. Edison funds are used to provide the state match for MEP, and are focused on three areas: (1) manufacturing assistance; (2) technology advancement, and (3) cluster development.60

At the same time the Ohio Edison Center/MEP system assigns specific functional expertise to selected sectors. For example, Magnet is the center focused on product development, and benefits from the Product Development Center created with Third Frontier funding in 2006.61

________________

57MAGNET, “The Incubator at MAGNET,” July 2011.

58Christiane Schmenk, Ohio’s Economic Development Strategy, NAS Ohio workshop, “Diversity and Achievements: The Role of Manufacturing Extension Partnerships. in the Midwest,” March 26, 2012.

59Schmenk, op. cit.

60Daniel E.Berry, Strengthening MAGNET as an Element of the Ohio MEP Center, NAS Ohio workshop, “Diversity and Achievements: The Role of Manufacturing Extension Partnership in the Midwest,” March 26, 2012.

61Berry, op. cit.

The PRISM Initiative:

Partnership for Regional Innovation Services to Manufacturers

On the ground, these initiatives and others will need to be integrated and tap into further resources—for example, sources of capital—if they are to have the effect of powering up innovation in local SMEs. One ambitious attempt to provide an integrated approach is provided by Magnet Ohio though its PRISM initiative.

The PRISM initiative can be seen as a means of focusing multiple resources on promising small companies, with the aim of moving the company into new markets, generating new growth and new jobs. It also has the powerful backing of one of the best innovative companies in the region, the Timken Company, whose CEO has been closely involved with Magnet for many years and strongly endorses the PRISM concept.62

PRISM aims to connect companies to the right resources in a faster and more systematic fashion by developing an engaged network of higher-education-based assets that link small- and medium-sized manufacturers (SMM) market knowledge and University research and development capabilities for the development of innovative new products, markets, and services. Magnet sees this as a having the following characteristics:63

- MAGNET-managed and facilitated.

- Curriculum and programs offering unique hands-on experience for associate, bachelor, and master’s degree students who want to “Make Things.”

- Active network with northeast Ohio SMMs and support resources.

- Mechanisms to apply university-sourced technologies, skills, facilities, and equipment in innovation.

- Infrastructure for skunkworks, spin-offs, internal development, and market-based research collaborations.

- Flexible capital pool tailored to projects.

The four- to five-year objectives for PRISM are outlined below.

PRISM is now well into the implementation phase. The first batch of eight companies are in the program, having paid PRISM $87,000 in fees and generated $314,000 in external funds. They are focusing on 8-10 products, which by 2014 they project to $233 million in revenue and 740 jobs. These are hugely ambitious goals. It remains to be seen whether PRISM can meet them.

However, Magnet says it is meeting carefully designed metrics, and feedback from companies is positive. For one company, Magnet found initial funding: “The first $50-100,000 seed capital was critical. We wouldn’t be here without it” (client CEO); for another, early design assistance means that “The

________________

62James W Griffith, private communication, NAS Ohio workshop, March 2013.

63Berry, op. cit.

CAD Models gave us credibility” (client manager). A further 25 projects are in the PRISM pipeline.

CONNECTING TO C-LEVEL CLIENTS

At the heart of the new strategy is a fundamental shift in the relationship of the center to its clients, along several dimensions:

- From a focus on lean production and improving the bottom line to an emphasis on growth and expanding the top line.

- From point solutions to continuous connection.

- From a single line of services to a strategy that provides multiple offerings covering all aspects of company performances.

- From connection to line supervisors and plant managers to continuing consultations with C-level executives (C level includes CEO, CFO, chief operating officer [COO] and other senior executives).

The latter is perhaps the single pivotal point that will determine the success or failure of new innovation-based strategies. Without effective ongoing access to C-level executives, the new focus on top-line growth and company strategy is essentially irrelevant, given that plant and line-level staff do not typically have those responsibilities. .Indeed, there is a concern that MEP’s growing focus on C-level interaction, which calls on providing services to larger companies that actually have C-level executives, may have the unintended consequence of directing centers away from smaller firms with fewer resources for innovation, but as of yet, we have no evidence.

This focus on the C level also created new challenges. As our interviews with center directors have made very clear, attracting and retaining the interest of C-level executives requires an entirely different type and level of marketing effort for MEP centers. In particular, it requires that MEP center staff gain competency in providing strategic advice to a firm’s leadership. This in turn requires either that existing center staff be heavily retrained, or that new senior staff with additional capabilities, especially in strategic marketing, be brought on board.

It also requires new marketing efforts. Some centers have developed extensive executive education programs to make the initial connection. For example, the Manufacturers Resource Center (MRC) in Pennsylvania offers what is in effect a mini-MBA program through which executives meet at the center regularly for six months.64 Others focus on semiformal networking: The Delaware Valley Industrial Resource Center (DVIRC) in Philadelphia runs executive forums tailored to the size of the company, which provide executives with a sounding board of peers, and are facilitated by senior center staff65

________________

64Interview with Jack Pfunder, director, MRC.

65Interview with Barry Miller, director, DVIRC.

Others have tried to develop low-cost introductory evaluations, and others still have adopted approaches from other organizations. For example, one center director said that “We follow a process we refer to as ‘Value-based relationships.’. It is a 10 step guide from first contact through project success and measurement.”66 A review of the information provided by center directors strongly suggests that most see this as a long-term project which requires painstaking efforts to connect and maintain the connection over time (see Appendix C).

Finally, it should be noted that both the sales cycle and the impact cycle for strategic services is much longer than it is in general for lean services. Strategic services require the development of trust by C-level executives, which takes time and is often based in positive word of mouth from peers (perhaps accelerated by the development of forums or other groupings of C-level executives who can act as champions and references for center services). And outcomes can take much longer: For example, development and implementation of a plan to enhance global marketing might take many months, and the positive impacts of implementing the plan may take years to fully emerge. These kinds of impacts are therefore difficult to capture in center metrics.

CHALLENGES IN IMPLEMENTING THE NEW STRATEGY

The new strategy is a very ambitious set of objectives, taking a well-known program with a 20-year track record and turning it in an almost entirely

Box 6-3

Attributes of leading MEP Centers

Many of the MEP centers that appear to be embracing the initiatives of the new strategy share similar attributes.

1. They have developed or acquired services and strategies to help clients think broadly about how they profitably grow their company: not just focus on operational and lean services.

2. They have leadership with some level of for-profit business acumen.

3. They build client relationships at the C level.

4. They develop relationships to more broadly promote understanding of the value of manufacturing to their state. The overall system can and should build upon these “better” centers and leaders.

________________

66Responses to NAS Information Request. See Appendix C-1.

new direction. This new mission, however, imposes a series of significant challenges.

Building the Required Capacity

Each of the strategic components listed above will require development of new tools and capabilities for the MEP centers and in some cases for NIST MEP. It is certainly worth noting that new services required by both NIST MEP and other center funding partners place a substantial burden on what may be a small center staff. In Nebraska for example, Table 6-3 describes the requirements imposed on the center by the various funding organizations involved, with each requirement being mandated in some form. The MEP of Nebraska has 10 administrative staff and 8 customer agents.67

Developing New Markets

Creating demand for the suite of new innovation-focused services is a key challenge for MEP. MEP centers face the need to provide services that clients are willing to pay for, in order to ensure that they meet matching funds requirements. At the same time, MEP performs a valuable public service in assisting companies to adopt new and often unfamiliar practices in order to improve their performance and, in the aggregate, the nation’s competitiveness. MEP thus faces an important challenge in encouraging the centers to be proactive given a largely risk-averse client base.

Coping with the Decline in State Funding

MEP centers require funding and/or revenue to stay in business. As state funding support has declined or vanished, centers need to offer services to larger companies and branch plants of large companies to pay their bills. This development, however, may be leading some centers away from fulfilling an important public role of serving those SMEs that private consultants do not cater to.

Funding New Strategy Implementation

The new strategy offers a substantial opportunity for centers to become much more important players in the economic life of their regions. But it also requires that they effectively build an entirely new business, providing new services to what will likely be new clients (or at least different staff at the same client companies). Typically, building a new business requires capital, and it is not at all clear in a world of shrinking state funding and limited NIST MEP

________________

67MEP of Nebraska, op. cit. 1-6.

TABLE 6-3 Funding Organization Requirements—MEP of Nebraska

| Funding Organizations′ Requirements |

Near-term Responses | Longer-term Responses |

| Ind. Cluster Development (DED) (NMEP) |

|

|

| Supplier Development (NGS/Growth) (NMEP) (DED) |

|

|

| Technology Acceleration (NGS/Growth) (NMEP) |

|

|

| Innovation (NMEP) (DED) |

|

|

| Export (NGS) (NMEP) |

|

|

| Sustainability (NGS/Growth) (NMEP) |

|

|

| Workforce (NGS/Growth) (DED) |

|

|

| services provided by Community College partners. | ||

| Continuous Improvement (NGS/Growth) (NMEP) |

|

|

| SOURCE: MEP of Nebraska. NOTE: Organization abbreviations are as follows: Nebraska Department of Economic Development (DED); HMEP Next Generation Strategy (NGS); Nebraska Manufacturing Extension Partnership (NMEP). |

||

resources where that capital will come from. As one center director observed, “Centers are going to have to develop additional funding sources for some of the new initiatives from banks, state EDA funding, partnerships, etc.” Another indicated that success would require additional MEP and federal funding: “MEP and other public funding will be needed to launch new strategy services until they become self-sufficient from client revenue. The initial seed capital for these new services will likely be from federal and state grants, but only until self-sufficiency is reached. This may take 2-4 years.” 68

This is a major challenge in part because almost all centers rely on existing revenue streams to meet the require 1:2 MEP federal funding match. They cannot afford to allow existing revenue streams to decline without risking a spiral of decline with revenue shortfalls driving the withdrawal of matching money, triggering further cuts in services.

Current revenues are tied to current consulting contracts. Most centers generate at least a third of their funding from consulting, which until recently has been almost all focused on lean. As no center has spare resources, it is difficult to see how centers can successfully perform the difficult tightrope act of shifting resources to generate new innovation- and growth-oriented consulting and hence funding, without reducing existing consulting revenue streams.

The inescapable conclusion is that centers must find additional grants and investments. It is very telling that the centers which appear furthest along in developing innovation and growth practices—notably in Pennsylvania—benefited from a substantial investment of state funding some years ago, which effectively funded the transition.

________________

68Responses to center directors information request. See Appendix C-2.

Developing C-level Relationships

Centers will have to make substantial steps in developing numerous relationships with senior staff at clients and potential client companies. This will require a new level of effort, new tools and strategies, and most likely new staff. Based on our interviews with center directors, we believe that developing these relationships is the single most critical aspect of implementing the new strategy successfully.

Again, it is important to stress just how big a jump is being asked of the centers. Organizations which have primarily been focused on day-to-day improvement, often in partnership with line supervisors, are now being asked to offer—and in fact sell—strategic advice services to C-level clients. This requires a fundamental shift in orientation, and likely a major shift in staffing. It is hard to see how the skill sets of existing lean consulting translate into innovation and growth strategy. Again, those centers furthest along have made substantial new hires with new skills, and have downgraded the resources focused on lean. It simply appears unlikely that most existing staff can effectively be retrained for the new strategy.

At the same time, it takes a major effort to develop a substantial number of C-level relationships. Both of the successful Pennsylvania centers have developed extensive outreach efforts for C-level staff, including development of an entire new training curriculum for CEOs. The successes and failures drawn from this massive effort could at a minimum be shared much more widely with other centers as they attempt to tread the same path.

Working with the Centers to Effect Organizational Change

The centers are operated by a wide range of institutions including both university and non-university organizations. .Not only are the centers careful to defend their autonomy from MEP, in some cases it appears that they are comfortable with traditional lean manufacturing focus and are neither prepared for nor committed to a wider mission. MEP is now working harder to reach out to advisory boards, and especially fiduciary boards, to expand the network of stakeholders committed to new strategy. However, interviews with center directors indicate that the transfer of expertise between peers is very limited, and that this imposes unnecessary costs and strains as centers seek to move forward. A more proactive approach from NIST MEP to enhance peer-to-peer communication through a variety of formats would be very welcome, and we believe would be welcomed by many center directors and staff.

Outreach and Expansion

While the centers and MEP have good data on companies with which they have worked closely, these account for only a small percentage of possible support recipients. Centers report to MEP that they “touch” about 10 percent of

possible target firms (i.e., small manufacturers in their regions), but are apparently not required to provide further support for this claim (e.g., a list of contacts made). One key challenge for MEP is to expand its reach while working with flat or potentially declining budgets.

Our analysis suggests that there are widely different outreach strategies in play, and that there does not appear to have been a systematic effort to identify and share best practice. This will be especially important as MEP centers seek to find not just new clients but new C-level clients.

It should also be noted that traditional metrics for penetration are in some respects misconceived. Indeed they may be driving centers to adopt ineffective outreach strategies in order to meet goals imposed via metrics. For any business—and centers are best understood as subsidized consulting businesses that reach hard-to-serve but important populations—it is critically important to identify the market segments that can best be served by the local MEP organization. NIST MEP itself argues that only a fraction of small manufacturers—maybe 15 percent—are “innovation-ready.” Centers freely acknowledge that their sweet spot is with firms ready for innovation and with the capacity to invest. Thus, measuring outreach as percentage of all manufacturing SMEs in a region may incentivize centers to waste resources chasing contacts with firms that may never become clients. We believe that NIST MEP could serve centers more effectively by developing a much more narrowly drawn set of penetration metrics. Given that the new CORE metrics provide a more comparative framework for assessment, this should still impose pressure on centers to expand outreach—but it would allow them to focus their efforts and resources more effectively.

NIST MEP Innovation and Growth Tools

NIST MEP has invested a very substantial amount of money (apparently at least $30 million) in developing tools which when adopted and fully implemented are designed to help centers transition to the new strategy. This ambitious effort follows to some degree on a previous successful initiative at NIST MEP to develop a suite of lean-oriented tools in the late 1990s.

However, there are some important differences between these initiatives. Lean consulting had emerged somewhat earlier with exhaustive analyses of changes in the automotive industry. Some of the core principles were well known and had been implemented at some companies (e.g., Toyota) for decades. That is not the case with the innovation and growth tools. In each case, these tools can at best be described as experimental: there is no track record of success, and early indications from the field suggest that gaining traction with them will be a long and difficult journey. Moreover, the inability of either NIST MEP or the most heavily funded contractor, the Innovation Engineering Leadership Institute, to provide any substantial analysis of program impacts is worrying. A center-piece program that has received substantial federal funding but provided no documented results indicates that, at best, the

continued heavy reliance of the innovation and growth strategy on sole-source contractors could be reconsidered. Similarly limited outcomes appear to result from other initiatives even when implemented by more established providers, such as the supplier scouting tools developed by RTI. Here too, despite extended efforts, results appear underwhelming

It is possible that there are problems with the tools and the consultants. However, it is also possible that the lack of results simply reflects lack of demand: There has been no study at NIST aimed at establishing the size and scope of the market for the new services. With regard to the new mantra of business in America of “fail fast, fail cheap,” NIST MEP should at a minimum be looking to develop benchmarks that will provide some objective information as to when experimental programs like those implemented in recent years are failing. All exciting initiatives carry the risk of failure: That is the case here. The issue is when and how NIST MEP will recognize it and make necessary adjustments.

Existing Metrics

MEP is considerably more advanced than agency Small Business Innovation Research (SBIR) programs were at the start of the National Academy assessment in terms of metrics.69 Each MEP center is required to report extensively on its activities, and undergoes an annual review and assessment. Each completed project is surveyed directly by MEP’s survey contractor. To date, the data collected are more extensive than the reports generated, so enhanced use of existing data would be appropriate and useful.

Adjusting the New CORE Metrics

While the CORE metrics describe in Chapter 4 are a substantial change and a real effort to capture the kinds of data needed to assess the new strategy, it is apparent that they will require close monitoring and ongoing adjustment as they are implemented. These may also require changes to the program’s data collection processes.

CONCLUSIONS

There is a need and opportunity to enhance and reshape the landscape of manufacturing support in the United States to address new competitive challenges and to take advantage of opportunities in emerging technologies. In general, the United States offers limited support for civilian manufacturing in comparison to many of its major trading partners. As described in the next chapter of this report, many advanced countries have significant programs to

________________

69National Research Council, An Assessment of the SBIR Program, C. Wessner, ed., Washington, DC: The National Academies Press, 2008.

support the development and commercialization of new technologies, including fostering innovation, scaling-up production, and the creation of related supply chains.

MEP is one important element of a national manufacturing strategy. MEP centers are widely dispersed geographically, covering the entire country. They are in general well connected to their local economies, and to the small manufacturing sectors within them. Many have developed a positive record of achievement in serving their clients. In addition to the federal contribution, many MEP centers also enjoy support from their state government, as well as from a variety of state and regional organizations.

MEP’s plan to enhance the innovation capacity and growth of small manufacturers under the new strategic orientation is in line with recent academic and policy analyses that call for U.S. manufacturers to become more innovative and more focused on growth and international competitiveness. At the same time, as this report documents, many MEP centers face significant risks as they seek to transition from a tight focus on lean production to a much wider range of services that require new clients, new contacts, new kinds of client conversations, new services, new toolsets and capabilities and, often, new staff as well. Some centers may also not realize sufficient demand for the new services.

MEP’s transition is therefore likely to be uneven. Some centers—with strong state support—have already moved forward and have approached sustainability with at least half their revenue coming from these new services. Other centers with fewer resources may face significant difficulties. They are seeking ways to adjust their reporting to meet the new CORE metrics without taking, what are in their view, extensive risks with their core businesses.

This differentiated take-up could, in the end, become an advantage for NIST MEP.70 If new modalities for sharing best practices—and failures—can be implemented effectively, the risks for adoption laggards can be reduced, and a catch-up phase can be encouraged. Thus, the inevitable spread between early adopters and late adopters can be used by the program to help smooth the path for late-moving centers. As NIST encourages the expansion of MEP centers into new growth and innovation services, it will be especially important to ensure that best practices from leading centers are widely adopted, and that center staff have more and improved capacities to share their experience and expertise.

Looking beyond the challenges of this transition, NIST and the wider community of stakeholders in manufacturing and innovation should also consider how MEP centers might contribute to the emerging landscape for manufacturing support and hence to the development of robust innovation and

________________

70MEP has not provided—and may not have—accurate data on the take-up of innovation services at the center level. In some cases, centers may have relabeled what they already do as “innovation services.” For example, one center with a large information technology consulting business now calls this “growth services.”

manufacturing ecosystems across the United States. For example, further consideration in national and state manufacturing support and innovation strategies is needed to address how MEP centers can fruitfully cooperate with other individual public and private organizations, including the institutes of the proposed National Network of Manufacturing Innovation, in translating research into commercial products, prototypes, and industrial production processes and in enhancing demand and capability among small- and medium-sized manufacturers for such engagements.