Canada’s Industrial Research Assistance Program (IRAP)

The National Research Council of Canada’s Industrial Research Assistance Program (NRC-IRAP) currently supports over 8,500 Canadian SMEs in their R&D and innovation-related activities.1 IRAP has a growing international reputation, and has been identified as a best practice in providing a broad suite of innovation support services and funding to Canadian SMEs.2 This chapter examines the key features of the IRAP program: the origin and history of the program; its organization and governance; the resources dedicated to it; the services provided; the characteristics of its clients; the benefits derived from the program, the program’s strengths and weaknesses, and lastly suggestions on how IRAP might be improved.

HISTORY

The Industrial Research Assistance Program (IRAP) was initiated sixty years ago in 1962, under the management of the National Research Council. It was designed to provide industrial firms with assistance to support research and was a response to the post-war belief that Canadian industrial research, and government support for such research, was insufficient to maintain Canada as a major industrial nation.

Today, the program’s mandate is to stimulate wealth creation by supporting technological innovation. This mandate is achieved through two strategic objectives. The first is to provide support to small and medium-sized

________________

1John McDougall (President of NRC), “National Research Council Canada,” Presentation at the 10th Annual Re$earch Money Conference on May 11, 2011.

2Council of Canadian Academies, “The State of Science & Technology in Canada,” (2006).

<http://www.scienceadvice.ca/en/assessments/completed/science-technology.aspx>.

The original objective of IRAP was to “stimulate a build-up of competent research teams in industry” through the funding of “relatively long-term applied research projects in science and engineering.”

___________________

NRC 1969, Summary Report on IRAP for Study Group reviewing Federal Government R&D Incentives Program.)

enterprises (SMEs are defined as firms with 500 employees or less) for the development and commercialization of their technologies. As the current Director General of IRAP has recently stated, “IRAP assists SME firms to develop, adopt and adapt technologies and incorporate them into competitive products and services to be commercialized in the global marketplace.”3 The second is to collaborate with, and in some cases to fund regional and national organizations that support the development and commercialization of technologies.

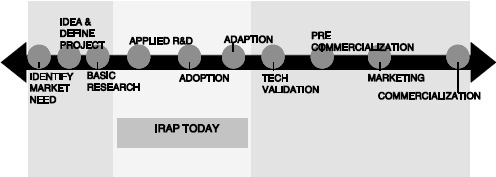

In summary, IRAP’s objectives and corresponding services are situated in a key space within the innovation continuum, as noted in Figure APP-A1-1.

This focus on SME firms is important since Canada is a nation of SMEs: for example of a total of 1.14 million business establishments in Canada that have employees only 2,708 are large businesses (defined as having 500 or more employees)—the remaining 1,136,053 are SMEs (99.8 percent) with an average size of 6 to 7 people. As a result, IRAP is challenged to deliver services to such a large client group dispersed across Canada’s wide geographic landscape.4

FIGURE APP-A1-1 The innovation continuum.

SOURCE: Modified from a Presentation by Dr. Tony Rahilly (Director General), “Our Program Overview,” on October 5, 2010.

________________

3Bogdan Ciobanu (Director General of IRAP), “Supporting SME Growth Through Innovation” on May 8, 2012 at the National Academies of Science conference in Toronto, Ontario: “Canadian Approaches in Promoting Innovation in Manufacturing.”

4Industry Canada, “Key Small Business Statistics,” July 2010.

<http://www.ic.gc.ca/eic/site/sbrp-rppe.nsf/vwapj/KSBS-PSRPE_July-Juillet2010_eng.pdf/$FILE/KSBS-PSRPE_July-Juillet2010_eng.pdf>.

How Has the Program Changed Over Time?

“Throughout its history, IRAP has gone through a complex evolution of expanding functions and coverage, as well as numerous reorganizations” of its administrative structure. Most of this evolution appears to reflect a need to respond to altered economic conditions.5 The timeline can be briefly summarized as follows:

![]() 1962-1978: (later known as IRAP-P) Contributions to Large Projects—IRAP began as a single program providing long-term technical and financial assistance, lasting up to five years per project.

1962-1978: (later known as IRAP-P) Contributions to Large Projects—IRAP began as a single program providing long-term technical and financial assistance, lasting up to five years per project.

![]() 1978-1984: The program expanded and diversified in response to a growing realization of the importance of SMEs. Three new program elements were added:

1978-1984: The program expanded and diversified in response to a growing realization of the importance of SMEs. Three new program elements were added:

1. IRAP-M: Contributions to Small Projects which increased assistance to small- and medium-sized enterprises (SMEs) having little or no in-house R&D capability and experience.

2. IRAP-L: Contributions to Laboratory Investigations covered up to 75 percent of total costs (not to exceed $6,000 in 1983) of small firms subcontracting to “laboratories, institutes, or consulting firms” with the task of solving specific technical problems or fulfilling ‘testing requirements with their products or processes.’6

3. IRAP-H: Contributions to Firms Employing Undergraduates.

![]() 1984-1988: IRAP placed a new emphasis on technology diffusion and decentralization through:

1984-1988: IRAP placed a new emphasis on technology diffusion and decentralization through:

4. IRAP-R: Contributions to Major Projects Involving Technology Transfer focused on complex collaborative R&D projects.

5. IRAP-S: International Technology Services were created to promote co-operative R&D between foreign owners of the technology and Canadian companies.

![]() 1991-1999: as outlined in the NRC’s Strategic Plan (1991), IRAP began to focus on “increased decentralization, increased selectivity with an emphasis on ‘more complex projects with greater technical impact,’ the consolidation of the program’s five elements into ‘two,

1991-1999: as outlined in the NRC’s Strategic Plan (1991), IRAP began to focus on “increased decentralization, increased selectivity with an emphasis on ‘more complex projects with greater technical impact,’ the consolidation of the program’s five elements into ‘two,

________________

5Richard G. Lipsey and Kenneth Carlaw, “A Structuralist Assessment of Technology Policies—Taking Schumpeter Seriously on Policy,” Industry Canada Research Publication: Working Paper Number 25, October 1998: pp. 87-108.

6Lipsey and Carlaw 1998, p. 88.

more flexible elements,’ and continued efforts to build and strengthen the IRAP network through ‘increased linkages with complementary programs and services.’”7 The two consolidated programs are noted below.

1. Technology Enhancement (TE) allowed support for small scale initiatives enabling SMEs to demonstrate and improve their technical competence as a basis for more substantive investments.

- Up to 75 percent of eligible project costs were covered under TE.

- This includes the salary costs of subcontractors and consultants, and travel-related expenses up to a maximum of $15,000.

2. Research, Development and Adaptation (RDA) focused on more complex projects involving applied R&D (unproven) as well as the adaptation of technology. RDA sought to meet the needs of firms that lacked specific technical expertise or a crucial technology to undertake a project.

- Funding of between $15,000 and $350,000 was provided covering up to 50 percent of project costs.

![]() 2000-2005: Throughout the first half of this decade, IRAP’s program scope expanded and diversified.

2000-2005: Throughout the first half of this decade, IRAP’s program scope expanded and diversified.

- IRAP organized 3 Technology Missions to Asian countries resulting in the signing of 20 MOUs between Canadian and Asian companies. Thus, there was an increased international focus on getting SMEs into the global marketplace.

- IRAP also fostered integration of sustainable development practices into the innovation processes of Canadian SMEs through a joint initiative (Eco-Efficiency Innovation initiative) with the Ontario Centre for Environmental Technology Advancement (OCETA).8

________________

7NRC (1991), Strategic Direction for NRC: A Council Discussion. Ottawa.

8NRC (2000-01), Performance Report. Ottawa.

<http://www.collectionscanada.gc.ca/webarchives/20060117225755/http://www.tbs-sct.gc.ca/rma/dpr/00-01/nrc00dpr/nrc00dpre.pdf>, NRC (2001-2002), Performance Report. Ottawa.

<http://www.collectionscanadagc.ca/webarchives/20060120051523/http://www.tbs-sct.gc.ca/rma/dpr/01-02/nrc/nrc0102dpr_e.pdf>, NRC (2002-2003), Performance Report. Ottawa.

<http://www.collectionscanadagc.ca/webarchives/20060120100152/http://www.tbs-sct.gc.ca/rma/dpr/02-03/nrc-cnrc/nrc-cnrc03d01_e.asp#S2_2>.

- The Canadian Technology Network (CTN) and IRAP collaborated to develop regional initiatives and a Technology Cluster Strategy focused on linking existing local skills and strengths and opportunities in emerging sectors to core NRC R&D priorities.9

- IRAP joined with Technology Partnership Canada (TPC) to support and fund SMEs with projects at the pre-commercialization stage.

![]() 2005-2009: IRAP developed a new strategic plan emphasizing the needs of medium-sized businesses and on helping more businesses grow from small to medium size.10 To achieve this objective, the total number of funded projects decreased but the size and number of larger projects increased. In addition, because of the success of the IRAP program, new roles and responsibilities were directed toward IRAP including:

2005-2009: IRAP developed a new strategic plan emphasizing the needs of medium-sized businesses and on helping more businesses grow from small to medium size.10 To achieve this objective, the total number of funded projects decreased but the size and number of larger projects increased. In addition, because of the success of the IRAP program, new roles and responsibilities were directed toward IRAP including:

- IRAP partnered with the NRC’s Canadian Institute for Scientific and Technical Information (CISTI) in a pilot program to provide Competitive Technology Intelligence (CTI) to firms through NRC-IRAP ITAs.

- IRAP provided Technology assessments for DFAIT’s International Science and Technology Partnership Program (ISTPP).

- IRAP provided application, technology, and commercialization validation for PWGSC’s Canada Innovation Commercialization Program (CICP).

- IRAP provided regular support for Department of Foreign Affairs and International Trade (DFAIT)’s Trade Missions.

- IRAP provided support for SMEs in communities in Southern Ontario through the disbursement of $45 million from the Federal Economic Development Agency for Southern Ontario (FedDev).

________________

9For more information on NRC Cluster Strategy, see

<http://www.nrc-cnrc.gc.ca/eng/clusters/index.html>.

10NRC (2003-2004), Performance Report. Ottawa. <http://www.collectionscanada.gc.ca/webarchives/20060120074932/http://www.tbs-sct.gc.ca/rma/dpr/03-04/nrc-cnrc/nrc-cnrcd3401_e.asp#_Toc81043592>, NRC (2004-2005), Performance Report. Ottawa. <http://www.collectionscanada.gc.ca/webarchives/20060120062945/http://www.tbs-sct.gc.ca/rma/dpr1/04-05/nrc-cnrc/nrc-cnrcd45_e.pdf>, NRC (2004-2005), Performance Report. Ottawa.

<http://www.collectionscanada.gc.ca/webarchives/20071207170610/http://www.tbs-sct.gc.ca/dpr-rmr/0506/nrc-cnrc/nrc-cnrc_e.pdf>.

![]() 2009-2011: In response to the 2008 global financial crisis and recession, the Government of Canada developed a comprehensive stimulus and economic recovery plan called “Canada’s Economic Action Plan”. As part of this plan, IRAP received a monumental investment in Budget 2009 of $200 million over two years. The funding included $170 million to double IRAP’s contributions to firms and $30 million to help hire more than 1,000 new post-secondary graduates via its Youth Employment Program.11 NRC-IRAP estimated that this would enable it to provide larger contributions to firms per project and allow it to support approximately 1,400 additional SMEs (beyond its annual base) over the two year period of the stimulus package, see Table APP-A1-1.12 This increased flow of resources is discussed further in section 3.

2009-2011: In response to the 2008 global financial crisis and recession, the Government of Canada developed a comprehensive stimulus and economic recovery plan called “Canada’s Economic Action Plan”. As part of this plan, IRAP received a monumental investment in Budget 2009 of $200 million over two years. The funding included $170 million to double IRAP’s contributions to firms and $30 million to help hire more than 1,000 new post-secondary graduates via its Youth Employment Program.11 NRC-IRAP estimated that this would enable it to provide larger contributions to firms per project and allow it to support approximately 1,400 additional SMEs (beyond its annual base) over the two year period of the stimulus package, see Table APP-A1-1.12 This increased flow of resources is discussed further in section 3.

IRAP was also given responsibility to deliver the Digital Technology Adoption Pilot Program (DTAPP is an $80 million pilot program that began in October 2011 and that will run until March 31, 2014).13 It is delivered by IRAP ITAs who offer SMEs advice on ICT systems and technologies, and provide funding to improve business performance. It is a component of the Government of Canada’s overall Digital Economy Strategy to accelerate digital technology adoption and investment in Canada in order to increase SME productivity.

![]() 2012: In the 2012 federal Budget (March 2012), IRAP received a $110 million increase in funding per year, effectively doubling its budget. It

2012: In the 2012 federal Budget (March 2012), IRAP received a $110 million increase in funding per year, effectively doubling its budget. It

TABLE APP-A1-1 The Impact of Budget 2009 Over Two Years

| Purpose | 2009-2011 | Projected Impact |

| Contributions to firms | $170 M | 1,400 firms |

| Graduates through YEP | $30 M | 1,000 post-secondary graduates |

| With existing organizational structures and existing operating dollars | ||

| NOTE: NRC, “NRC-Industrial Research Assistance Program (NRC-IRAP),” March 2010 <http://acamp.ca/alberta-micro-nano/images/docs-conventional-energy/Finance/Generic%20IRAP%20PPT_FINAL%20ENG_March-2-2010.pdf>. | ||

________________

11Government of Canada, “Canada Economic Action Plan: Budget 2009,” Tabled in the House of Commons by the Honorable James M. Flaherty, Minister of Finance on January 27, 2009

<http://www.budget.gc.ca/2009/pdf/budget-planbugetaire-eng.pdf>.

12NRC, “National Research Council Canada Backgrounder,”

<http://www.dehnel.com/images/D-Pace-IRAP_backgrounder_PCO_e.pdf> and Government of Canada, “Canada Economic Action Plan: Budget 2009,” Tabled in the House of Commons by the Honorable James M. Flaherty, Minister of Finance on January 27, 2009

<http://www.budget.gc.ca/2009/pdf/budget-planbugetaire-eng.pdf>.

13NRC, “Digital Technology Adoption Pilot Program (DTAPP),”

<http://www.nrc-cnrc.gc.ca/eng/ibp/irap/digital-technology-adoption/dtapp-index.html>.

was also asked to develop and deliver a new “concierge” service to SMEs across the country in order to provide SMEs with one-stop shopping to access the range of other federal innovation support programs. This influx of funding was in response to the Jenkins Report (a comprehensive review of support for business R&D in Canada with the objective of optimizing the contributions of the Government of Canada to improve business innovation and competitiveness). In particular, recommendation two of the Jenkins Report advised the Government to redeploy funds from “Indirect” tax credit programs like the Scientific Research and Experimental Development (SR&ED) program to a more complete set of “direct” support business through programs like IRAP.14

ORGANIZATION AND GOVERNANCE

The IRAP program is administered through the National Research Council of Canada (NRC). The NRC is Canada’s largest federal research and technology organization with a budget in 2010-11 of $749 million, employing over 4,000 staff in most areas of science and engineering research and includes 1,500 visiting workers.15 The NRC is a Government of Canada statutory organization with its mandate outlined in the National Research Council Act. NRC’s powers include:16

- Undertaking, assisting or promoting scientific and industrial research in different fields of importance to Canada;

- Investigating standards and methods of measurement;

- Working on the standardization and certification of scientific and technical apparatus and instruments and materials used or usable by Canadian industry;

- Administering NRC's research and development activities; and

- Providing vital scientific and technological services to the research and industrial communities (IRAP derives its authority from this statutory power).

The IRAP Program is overseen by the NRC’s Senior Executive Committee composed of a President, five (5) Vice Presidents, the Secretary General, the Director General of Human Resources Branch, the Director General of IRAP and the Chief Financial officer. Services are delivered on a

________________

14Review of Federal Support to Research and Development—Expert Panel Report, “Innovation Canada: A Call to Action”

<http://rd-review.ca/eic/site/033.nsf/vwapj/R-D_InnovationCanada_Final-eng.pdf/$FILE/R-D_InnovationCanada_Final-eng.pdf>.

15John McDougall (President of NRC), “National Research Council Canada,” Presentation at the 10th Annual Re$earch Money Conference on May 11, 2011.

16National Research Council Act, R.S.C., 1985, c. N-15,

<http://laws.justice.gc.ca/PDF/N-15.pdf>.

decentralized basis across Canada primarily by the ITAs. In addition, the NRC-IRAP program has an Advisory Board in place to provide an external perspective on the strategic direction and management of the program. The 10 to 12 advisors are appointed by the President of the NRC, and represent a cross-section of national industry associations, provincial organizations, universities and government.17

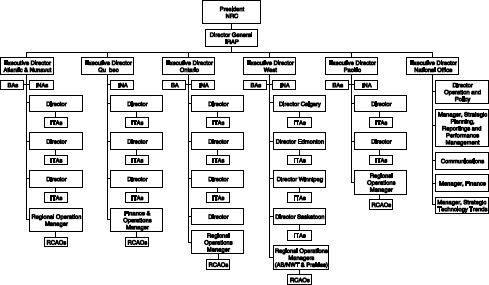

As shown in Figure APP-A1-2, the Director General of NRC-IRAP reports directly to NRC’s President and is responsible for managing the national delivery of the program and demonstrating the program’s alignment with its strategic objectives. The position is supported by six Executive Directors located at the National Office and in each of the five regions. The Executive Directors are supported by Directors who are responsible for directing the Industrial Technology Advisors (ITAs) in their responsibilities for providing technological and funding assistance to small and medium size firms.

Innovation Network Advisors (INAs) in the region, who report to the Executive Directors, focus on building effective regional innovation system relationships and, where warranted, work with innovation support organizations to provide expanded or new innovation assistance to SMEs. They also work closely with the Directors and the ITAs in each region and help identify gaps in regional innovation assistance available to respond to SME needs and work with organizations to provide resources to address these unmet needs.

FIGURE APP-A1-2 Detailed organization chart of NRC-IRAP18.

________________

17NRC, “NRC-IRAP Advisory Board,”

<http://www.nrc-cnrc.gc.ca/eng/ibp/irap/about/advisory-board.html>.

18NRC, “Internal Audit,” September 2007

<http://www.nrc-cnrc.gc.ca/obj/nrc-cnrc/doc/audit-nrc-irap.pdf>.

Business Analysts (BAs) who are located in all regions except Québec, manage a portfolio of clients in collaboration with ITAs, and conduct due diligence on client companies and their projects to ensure that the basic business functions are planned for and provide support and advice to clients throughout the process.

Each region has either a Regional Operations Manager (ROM) or a Finance and Operations Manager (FOM) reporting to the Executive Director, responsible for ensuring day-to-day operations of the program in the areas of resource management, quality assurance and performance management. Finally, Regional Contribution Agreement Officers (RCAOs) who work under the supervision of the ROM / FOM are responsible for a wide range of activities undertaken in support of the delivery of the program with regard to financial contributions. More specifically they administer contribution agreements with firms and organizations, including assisting the ITA with preparing and reviewing agreements and amendments, reviewing claims and processing payments in accordance with the terms of the contribution agreement, and advising ITAs, INAs, signing authorities and clients on appropriate modifications to agreement clauses.19

Regional Distribution

IRAP field staff is located in 147 offices in 100 communities across Canada in regional economic development organizations and networks, business associations, universities, and colleges. In a 2007 survey of ITAs, 80 ITAs (37 percent) indicated that they are co-located at NRC facilities.20 With the construction of new facilities in support of technology clusters, previously dispersed business lines of NRC (including IRAP ITAs) are now housed under a single roof in some cities. Examples include Chicoutimi, Québec’s Aluminum Technology Centre; Edmonton, Alberta’s National Institute for Nanotechnology and Fredericton, New Brunswick’s Institute for Information Technology.21

IRAP RESOURCES AND BUDGETS

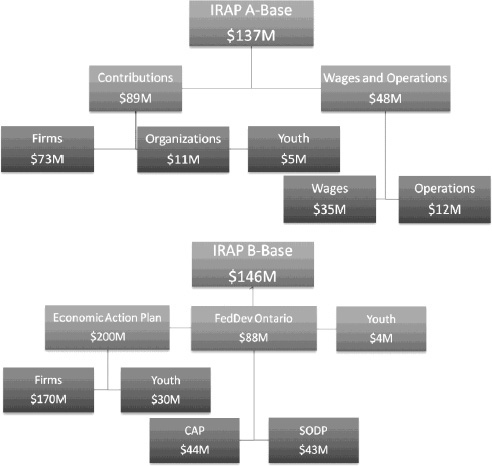

The NRC-IRAP budget allocations for FY2008-2009 to FY 2011-12 are shown in Table APP-A1-2. Over this period of time, IRAP’s A-Base budget (the normal amount it receives every year) has averaged about $89 million per year in contribution payments to SMEs, as well as $48 million per year in wages and operating costs—for a total IRAP budget of $137 million per year.

IRAP’s B-Base funding is also identified in Table APP-A1-2 (B-Base funding is one-off incremental funding for a limited time and for a specific

________________

19NRC, “NRC-IRAP Advisory Board,”

<http://www.nrc-cnrc.gc.ca/eng/ibp/irap/about/advisory-board.html>.

20Impact Evaluation 2007, p. 45.

21Impact Evaluation 2007, p. 45.

purpose). This B-Base funding is primarily the result of the Government of Canada’s comprehensive stimulus and economic recovery plan called “Canada’s Economic Action Plan” in response to the 2008 global financial crisis and economic recession. As part of this plan, IRAP received an investment in Budget 2009 of $200 million over two years. The funding included $170 million to double IRAP’s contributions to firms and $30 million to help hire more than 1,000 new post-secondary graduates via its Youth Employment Program. As a result, note then that contribution payments in FY 2009-2010 and 2010-2011 (at a level of $235 million) are unusually high for each year—and then in 2011-12 contribution funding reverts to the more normal level of $89 million.

TABLE APP-A1-2 NRC-IRAP Budget (FY2008-2009 to FY2011-2012)

| Programs ($000) | 2008-2009 | 2009-2010 | 2010-2011 budget as at October 1, 2010 | 2011-2012 |

| A-Base Contributions | ||||

| Contribution to firms | 71,002 | 73,601 | 72,384 | 72,714 |

| Contribution to Organizations |

11,518 | 11,371 | 11,763 | 11,380 |

| Youth Program | 5,000 | 5,000 | 5,000 | 5,000 |

| Total A-Base Contributions | 87,520 | 89,972 | 89,147 | 89,094 |

| B-Base Contributions | ||||

| Canada’s Economic Action Plan (CEAP—Firms) |

0 | 90,000 | 80,000 | |

| Canada’s Economic Action Plan (CEAP—Youth) |

0 | 10,000 | 20,000 | 0 |

| Youth Career Focus Program Funding |

0 | 262 | 3,624 | 0 |

| FedDev Ontario (CAF) | 0 | 17,500 | 26,600 | |

| FedDev Ontario (SODP) | 0 | 27,500 | 16,150 | 0 |

| Total B-Base Contributions | 0 | 145,262 | 146,374 | 0 |

| Total Contributions | 87,520 | 235,234 | 235,521 | 89,094 |

| Wages | 33,904 | 32,550 | 37,742 | 35,208 |

| Operating | 14,781 | 12,176 | 8,741 | 12,292 |

| FedDev Ontario (CAP and SODP) Operating Budget (Salary and Ops) |

0 | 2,118 | 2,001 | |

| Total Wages and Operating | 48,685 | 46,844 | 48,484 | 47,500 |

| Total Budget | 136 205 | 282 078 | 284 005 | 136 594 |

SOURCE: NRC-IRAP, “Program Overview,” January 2011.

This table clearly illustrates the one-off incremental funding that was provided to IRAP during 2008-2009 and 2010-2011. This B-Base funding in effect doubled the NRC-IRAP’s national budget and quadrupled NRC-IRAP Ontario’s budget.22 Note however that the amount spent on wages and operations remained constant at $48 million. Thus, while additional funding to the IRAP program for contribution to SMEs is beneficial, it also placed enormous pressure on IRAP staff to deliver the program with no new administrative or operating resources.

In addition, during this two year period as part of the Government’s stimulus and economic recovery plan, IRAP was asked to deliver two support programs (involving $88M in payments) for the Federal Economic Development Agency for Southern Ontario (FedDev Ontario). These programs were the Southern Ontario Development Program (SODP) aimed at stimulating local economies and enhancing the growth and competitiveness of local businesses and communities,23 and the Community Adjustment Fund (CAF) aimed at quickly minimizing the impacts of the global economic downturn by creating employment opportunities, and assisting communities with populations of less than 250,000 to adjust and restructure their economies.24

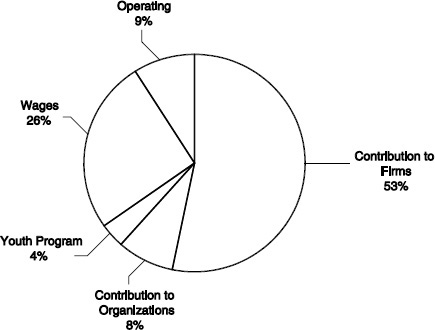

Figure APP-A1-4 shows the key components of IRAP’s budget for a normal year, in this case 2011-12. Note that just over half of IRAP’s 2011-2012 budget (53 percent) is allocated to payments to firms and another 8 percent to regional organizations that support business innovation. Note also that the portion of total IRAP funding spent on wages is high at 26 percent. This is a reflection of the quality and experience of the ITAs and the large number of ITAs across the country. It also reflects the fact that like the rural doctor, ITAs make house calls (i.e. they regularly visit each client SME at their location). Also note that the portion spent on the Youth Program (employing recent technology graduates) is small at 4 percent. Arguably, considering the high employment rate for youth in Canada at 13.9 percent in early 2012 (at nearly twice the overall unemployment rate of 7.3 percent), more funding could be allocated to this program.25

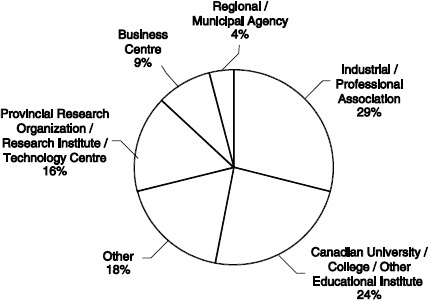

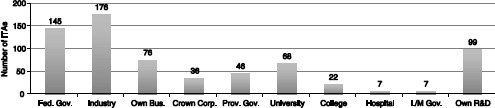

Figure APP-A1-5, identifies the types of organizations that receive funds to support private sector innovation (8 percent of the 2011-2012 budget).26 These recipients represent a broad cross section of innovation intermediaries

________________

22NRC (2009-2010), “Departmental Performance Report,” <http://www.tbs-sct.gc.ca/dpr-rmr/2009-2010/inst/nrc/nrc-eng.pdf>, p. 22.

23Canada’s Economic Action Plan, “Southern Ontario Development Program,”

<http://www.feddevontario.gc.ca/eic/site/723.nsf/eng/h_00097.html>.

24Canada’s Economic Action Plan, “Community Adjustment Fund (Budget 2009 and Budget 2010),”

<http://www.actionplan.gc.ca/initiatives/eng/index.asp?mode=7&initiativeID=126>.

25The Star, “Youth jobless rates remain high globally, report says,” on May 22, 2012 at

<http://www.thestar.com/business/article/1182249--youth-jobless-rates-remain-high-globally-report-says>.

26Impact Evaluation 2007, p. 33.

FIGURE APP-A1-3 A summary of NRC-IRAP’s A and B base funding during 2009-2010 and 2010-2011 stimulus (Millions of Dollars).

that offer innovation services to SMEs. For example, to pick one IRAP region, the types of organizations in Western Canada that receive funding include: Alberta Innovates, Arctic Energy Alliance, BioAccess Commercialization Centre, Biomedical Commercialization Canada, Calgary Technologies Inc., Canadian Environmental, Technology Advancement, Corporation (CETAC) WEST, Communities of Tomorrow, Composites Innovation Centre, Enterprise Saskatchewan, Entrepreneurial Foundation of Saskatchewan, Government of the Northwest Territories, Industrial Technology Centre, Manitoba Innovation, Energy and Mines, Springboard West Innovations, TEC Edmonton, Western Economic Diversification Canada, and local universities, colleges and technical institutes.

SERVICES

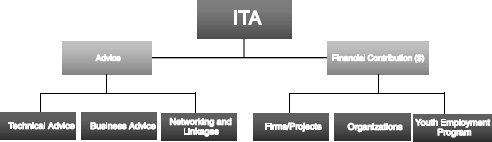

The NRC-IRAP program provides support to Canadian SMEs for the development and commercialization of their technologies through the following two main groups of services:

1. Technical and Business Advisory Services are provided by over 230 Industrial Technology Advisors (ITAs) to mentor clients’ projects through all stages of the innovation and commercialization process. ITAs are viewed as a trusted advisor, which often results in long-term relationships and partnerships formed between NRC-IRAP and Canadian SMEs. ITAs can also recommend project funding as noted below. They also provide Networking and Linkage Services through their extensive networks which can connect SMEs with industry experts, providers of risk capital, potential commercial partners and other investors. Access to the ITAs’ commercial networks opens up opportunities for SMEs to connect to knowledgeable individuals and organizations about local sources of financing, regional R&D initiatives, technology brokers and technology transfer centers.

2. Financial Assistance is provided to support innovation projects, graduates, and organizations. For example, in the 2009-2010 fiscal year, IRAP contributions supported 2,597 firms, 2,947 projects, and the creation of 11,921 jobs.

a. Financial contributions to firms to develop technologies provide up to 75 percent or $1,000,000 per year of the total eligible activities (e.g. eligible expenditures include up to 80 percent of labor costs and 50 percent of sub-contractor costs; but exclude material and capital expenditures). Note that an eligible firm must be an SME incorporated in Canada that is committed to growing its business and generating profits, through the development and commercialization of innovative, technology-driven new or improved products, services, or processes.

b. Financial contributions to third party innovation organizations that provide services for SMEs.

c. Financial assistance to hire new graduates under the Youth Employment Program. The program provides up to $30,000 in a non-repayable contribution to help clients hire graduates for an R&D project. This provides post-secondary graduates (aged 15 to 30) with tailored, career-related work experience. SMEs benefit from the knowledge of new graduates while graduates gain

FIGURE APP-A1-6 NRC-IRAP services.

valuable work experience that will assist their career choices. IRAP supported 781 recent graduates in 2009-2010.27

In summary as shown in Figure APP-A1-6, the ITA is the main delivery agent of the IRAP program. ITAs deliver either advice, or financial contributions. The advice can be technical or business advice, and also extends the network of the SME to include individuals and organizations knowledgeable about local sources of financing, research and development institutions, technology brokers, and technology transfer centers. ITAs can also provide financial assistance in the form of a grant to projects with merit, or funding to regional organizations that offer other innovation services to SMEs, or funding to hire post-secondary graduates.

The Key IRAP Resource: The Skills and Role of the ITA

IRAP employs over 230 Industrial Technology Advisors (ITAs) which account for approximately two thirds of IRAP staff. They deliver the core IRAP services to SME firms. Each work with about 42 clients per year and 11 of their clients will receive funding.28 They provide R&D project advice, technology and business advisory services, competitive technical intelligence, networking and linkages, funding, and investment readiness counseling.

The ITA’s goals are to help SME’s develop/improve new products and processes, improve efficiency and productivity, adopt and adapt technologies, and increase sales and add jobs.

In this regard, the experience of the ITA field staff sets them apart from most other federal and provincial government service providers. The profile of the ITA advisors is outlined below and in Figure APP-A1-7:29

- 75 percent have masters or PhD degrees.

- 80 percent have previous specialized industrial experience.

________________

27NRC (2009-2010), “Departmental Performance Report,”

<http://www.tbs-sct.gc.ca/dpr-rmr/2009-2010/inst/nrc/nrc-eng.pdf>.

28NRC-IRAP, “Program Overview,” January 2011.

29NRC-IRAP, “Program Overview,” January 2011.

FIGURE APP-A1-7 ITA experience.

SOURCE: NRC-IRAP, “Program Overview,” January 2011.

NOTE: ITAs can have more than one employment experience.

- 55 percent have worked in another Federal government laboratory or department.

- 41 percent have worked in a college, cégep or university.

- 45 percent have run their own R&D facility and/or been a leader within a R&D facility.

- 34 percent have been entrepreneurs.

- 16 percent have experience in some type of Crown corporation.

- 24 percent have some experience in working either in the provincial or municipal government level.

Also see Table APP-A1-3 for a summary of how ITAs spend their time on the job (and how they feel they should spend their time). In summary, the ITAs feel they should spend more time developing funded projects and managing contribution agreements and less time on administrative tasks.

Table APP-A1-4 identifies the top four advisory services (out of 22 services) requested by SME clients from ITAs. SME clients are not charged for this advice. The top four are: management advice, financial advice, technical advice and marketing advice. This summary illustrates the broad range of business advice offered by ITAs. However note that there are considerable differences in ranking between the advice actually requested and what clients might be willing to pay for. For example, of the top four ranked services, no client firms were particularly willing to pay for these services. Instead, the client firms indicated they were more willing to pay for: access to legal advice, partnering, competitive technical intelligence, and patent/literature searches.

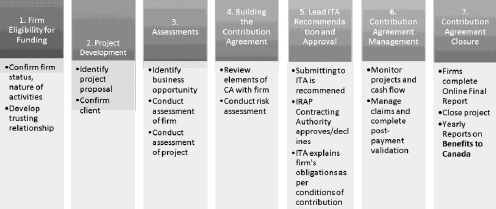

The Role of the ITA in Funding a Project

A good SME project proposal to IRAP will include clear commercial goals and objectives (identifying challenges, risks and opportunities), a work plan, and a budget estimating costs, and demonstrate a good business case to pursue the project. The proposal should identify potential applications and

TABLE APP-A1-3 Summary of How ITAs Spend their Time

| ITA Survey—How do ITAs spend their time? | Percent | ||

| 4 years ago | 2006-2007 | How ITAs feel they should spend their time | |

| Developing funded projects and monitoring/managing contribution agreements | 38.6 | 34.3 | 38.4 |

| Providing technology information and advice | 23.2 | 17.8 | 26.6 |

| Engaging in linkage and networking activities (e.g. presentations; building, maintaining and expanding contacts; attending seminars and courses) | 15.5 | 12.1 | 17.6 |

| Completing administrative tasks (e.g. information tracking, reporting, due diligence) | 17.1 | 29.5 | 11.8 |

| Other | 5.5 | 6.3 | 5.6 |

| TOTAL | 100 | 100 | 100 |

SOURCE: Impact Evaluation 2007, p. 58.

markets, potential impacts and benefits to the company and to Canada (in the form of growth, job creation, wealth generation and improved quality of life), and must advance the financial position of the company in increasing market share, profits and sustainability.

IRAP payments (see step 5 in Figure APP-A1-8) begin after the project is approved. The client will then start to implement and manage the project, submitting status reports and monthly claims according to the costs incurred and dispersed (note that good record keeping is mandatory and the potential for audits is high).

In Figure APP-A1-8, note that step 7 identifies the mandatory requirement to report yearly on Benefits to Canada. This includes reporting on the following tangible outcomes:

- New or improved products.

- New or improved processes.

- Increased capabilities and competitiveness.

- Improved efficiency and increased productivity.

- Introduction of new technologies.

- Acquiring new patents.

TABLE APP-A1-4 NRC-IRAP Advisory Services Accessed by Client Firms (2002 to 2007)

| Advisory Services Accessed by Clients | Percentage of Clients Accessing Service* | Ranking based on Access | Ranking Based on Willingness to Pay for Service |

| Management Advice | 24.2 | 1 | 5 |

| Financial Advice | 23.3 | 2 | 7 |

| Technical Advice | 22.7 | 3 | 6 |

| Marketing Advice | 21.8 | 4 | 10 |

| Patent Search and Literature Search | 17.5 | 5 | 4 |

| Mentoring and Coaching | 17.2 | 6 | 13 |

| Expertise Linkages | 16.9 | 7 | 18 |

| Technical Assessment | 16.9 | 8 | 11 |

| Referral to Other Organizations (including non-governmental) | 15.9 | 9 | 22 |

| Project Development | 15.7 | 10 | 12 |

| Market Assessment | 15.2 | 11 | 9 |

| Project Management | 15.0 | 12 | 15 |

| Market Linkages | 14.6 | 13 | 16 |

| Competitive Technical Intelligence | 12.0 | 14 | 3 |

| Business Strategies | 12.0 | 15 | 8 |

| Linkages and Referrals to Other Innovation Systems | 11.9 | 16 | 21 |

| Identified Business Opportunities | 10.5 | 17 | 14 |

| Promotion and Trade Shows | 9.9 | 18 | 20 |

| Partnering | 8.0 | 19 | 2 |

| Access to Legal Advice | 7.6 | 20 | 1 |

| Export Development | 5.9 | 21 | 17 |

| International Trade Missions SOURCE: Impact Evaluation 2007, p. 23. |

5.8 | 22 | 19 |

SOURCE: Impact Evaluation 2007, p. 23.

NOTE: (*) Percentages sum to more than 100 percent since clients can identify accessing more than one advisory service.

- Attracting and retaining the best technical employees.

- Increasing sales, revenue, productivity, market share, new markets and creating new jobs.

Regarding contribution funding, an important distinction should be made between funding “firms” and funding “projects.” Firms are eligible to receive funding for a project that will support the development of their innovative technology. (The project must lead to: increased skills, knowledge and technical competencies, improved management capabilities, or new or

FIGURE APP-A1-8 How does funding work?

improved products, processes and services). Note that firms may enter into several project agreements with IRAP over time. There is no limit on the number of projects, or any program graduation required. However an overall limit on the level of contributions that may be made to a given firm, in any single year, is set at $1,000,000.30

Not surprisingly as a result, there is a higher level of project activity than firm activity because of variability in project length as well as the potential for successive projects in a given fiscal year. For example, between 2002-03 and 2006-07, IRAP started and funded approximately 5,800 discrete projects, but only 4,100 firms were funded.

Note in Table APP-A1-5 that the number of funded client firms has decreased by 21 percent between 2002-03 and 2006-07 while the total contribution funding values have declined only very slightly (0.8 percent decline). As a result, the average payments to firms have increased by 24 percent.

TABLE APP-A1-5 Number of Firms Actively Funded by NRC-IRAP

| Firms/Fiscal Year | 2002-2003 | 2003-2004 | 2004-2005 | 2005-2006 | 2006-2007 | Percent Change |

| Total Firms Actively Funded | 1746 | 1745 | 1609 | 1498 | 1393 | -21 |

| Total Contribution Funding (in millions $s) | 62.2 | 62.4 | 60.6 | 68.3 | 61.7 | -0.8 |

| Average Contribution ($) | 35,624 | 35,759 | 37,663 | 45,594 | 44,293 | 24 |

SOURCE: Impact Evaluation 2007, p. 11.

________________

30Impact Evaluation 2007, p. 13.

IRAP’S CLIENTS

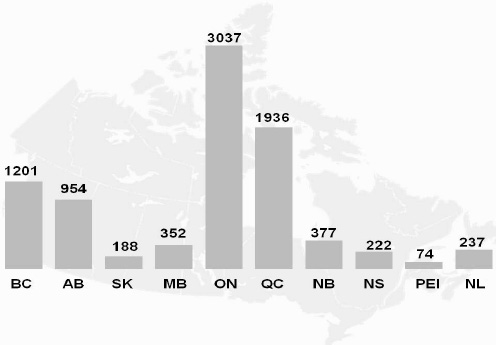

NRC-IRAP clients can be described as Canadian SME firms with under 500 employees with the potential to innovate. The most recent statistics from 2009-2010 indicates that NRC-IRAP worked with a total of 8,578 SMEs of which 2,871 (about 33 percent) received some form of funding.31 Note that 84 percent of clients have fewer than 50 employees, and 67 percent have fewer than 20 (recall that the average size of an SME in Canada is 6 to 7 people). These companies are not large enough to have extensive R&D departments—instead they are faced with technical, financial or managerial challenges that are obstacles to their advancement.32 Clients span all industry sectors and Canadian geography; see the detailed regional client breakdown and description in Table APP-A1-6.

FIGURE A1-9 National overview NRC-IRAP clients by location (2009-2010).

________________

31John McDougall (President of NRC), “National Research Council Canada,” Presentation at the 10th Annual Re$earch Money Conference on May 11, 2011.

32NRC-IRAP, “Program Overview,” January 2011.

A Snapshot of Client Firms

Various characteristics of client firms are discussed below, including:

- Size of Firm (employee size).

- Age of Firm.

- Industry Sector of Firm.

- Location of Firm.

- Goods and Services.

- Project Duration.

- Amount Funded.

Size of Firm. Between 2002-03 and 2006-07 the average number of employees in the firms that received funding was 32 employees.33 As mentioned earlier, over this five year period, about 67 percent of IRAP funded firms had fewer than 20 employees (23 percent had 1 to 4 employees, 25 percent had 5 to 9 employees and 19 percent had between 10 and 19 employees). More recently, again as of 2011, about 67 percent of IRAP funded firms had fewer than 20 employees. 34 While this suggests that IRAP is targeting smaller SMEs, it raises some issues about the adequacy of support for medium-sized SMEs.

Age of Firm. Note from Table APP-A1-7 that firms have been incorporated for about 11 years on average when they signed their first agreement with IRAP (with a median age of 7). This implies that most firms assisted by IRAP cannot be considered ‘startups.’

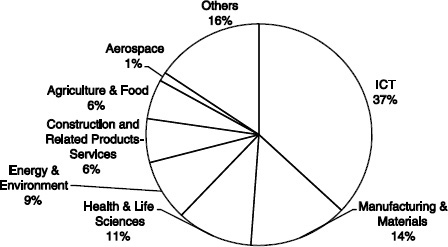

Firm Sector. The IRAP program does not target specific sectors. Funding and advice is available to any firm that meets eligibility criteria, regardless of sector. However, the most recent data indicates that the largest served sector is ICT at 37 percent of all clients funded, with Manufacturing and Materials clients following at 14 percent, Health and Life Sciences at 11 percent and Energy and Environmental firms at 9 percent (see Figure APP-A1-10).35

Location of Firms. The data sets provided in the Public Accounts of Canada show all the firms (614) that received over $100,000 of IRAP funding (totaling $216.3 million in 2010-2011) and plot them geographically. The average amount transferred to industry for these 614 firms was $199,839 with a median of $160,000. In addition, there were a total of 2,481 recipients of transfer payments under $100,000 totaling $93.4 million which were not listed in detail.36

________________

33Impact Evaluation 2007, p. 13.

34NRC-IRAP, “Program Overview,” January 2011.

35Impact Evaluation 2007, p. 12.

36The live maps (<http://batchgeo.com/map/42c2079a5ae7425be116dbd9f8d37dd2>) include a web link to the firm’s website, the location, and the amount of money received through the IRAP Program.

TABLE A1-6 IRAP Clients Across Canada

| Region | Clients in key sectors and technologies | Partners | Success Stories |

| Pacific Region: British Columbia and Yukon (33 ITAs) |

Forestry, mining, electronics, software and hardware, advanced materials, industrial engineering, food technology, biotechnology, construction, aerospace, fuel cells, electrochemistry, information technologies, engineering and physics | British Columbia Innovation Council, LifeSciences BC, BC Technology Industry Association, Okanagan Research and Innovation Centre, Victoria Advanced Technology Council, Western Economic Diversification Canada | e.g. Xenon-Pharmaceutical s, Ostara Nutrient Recovery Technologies Inc., Profile Composites Inc., Simon Fraser University, Green Steam Inc.37 |

| West Region: Alberta, Saskatchewan, Manitoba, Northwest Territories (47 ITAs) |

Advanced Chemistry and Materials, Advanced Manufacturing, Biotechnology and Bioprocessing, Construction, Energy, Environmental Technologies, Food and Agricultural sciences, Health-care and Pharmaceuticals, Information Technology, Electronics and Telecommunications, Transportation | Alberta Innovates, Arctic Energy Alliance, BioAccess Commercialization Centre, Biomedical Commercialization Canada, Calgary Technologies Inc., Canadian Environmental, Technology Advancement, Corporation (CETAC) WEST, Communities of Tomorrow, Composites Innovation Centre, Enterprise Saskatchewan, Entrepreneurial Foundation of Saskatchewan, Government of the Northwest Territories, Industrial Technology Centre, Manitoba Innovation, Energy | e.g. Boreal Laser Inc., Manitoba Harvest, Userful Corporation, Quantiam Technologies Inc., Quantum Technical Services.38 |

________________

37NRC, “NRC-IRAP—On the leading edge of the mighty Pacific,” <http://www.nrc-cnrc.gc.ca/eng/ibp/irap/about/bc-yukon.html>.

38NRC, “West: Alberta, Saskatchewan, Manitoba and the Northwest Territories,”

<http://www.nrc-cnrc.gc.ca/eng/ibp/irap/about/alberta-nwt.html>.

| and Mines, Springboard West Innovations, TEC Edmonton, Western Economic Diversification Canada, Local universities, colleges and technical institutes | |||

| Ontario Region (70 ITAs) | Electronica, software, photonics, cleantech, manufacturing, life sciences, medical devices, construction, and aerospace | Federal Government: FedDev Ontario, Business Development Bank of Canada, Natural Sciences and Engineering Research Council of Canada, Foreign Affairs and International Trade Canada, Export Development Canada; Provincial Agencies: Ministry of Research and Innovation, Ontario Centres of Excellence, Ministry of Economic Development and Trade; NFP: ventureLAB, MaRS, Communitech, Sault Ste. Marie Innovation Centre, Northern Centre for Advanced Technology Inc., Ottawa Centre for Research and Innovation |

e.g. Wolf Steel Inc., WinMagic Inc., Axiom Group Inc., Hendrick Seeds Inc.39 |

________________

39NRC, “Ontario So Much to Discover,” <http://www.nrc-cnrc.gc.ca/eng/ibp/irap/about/ontario.html>.

| Region | Clients in key sectors and technologies | Partners | Success Stories |

| Quebec Region (50 ITAs) | Communications, Environment, and Manufacturing | Business Development Bank of Canada, Canada Economic Development for Quebec Regions, Centres locaux de developpement, Reseau Trans-tech | e.g. Motion Composites Inc., Technologies HumanWare Inc. Developpement Effenco Inc., Medicago Inc., Muridal Incorporated |

| Atlantic Region: NB, New foundland and Labrador, PEI, NS Nunavut (Over 30 ITAs) |

Agriculture and aquaculture, wood products, advanced manufacturing, computer science and telecommunications, nutraceuticals, food products and biotechnology | Atlantic Canada Opportunities Agency, Fisheries and Marine Institute of Memorial University, Dalhousie University, New Brunswick Community College, PEI BioAlliance | e.g. Quark Engineering and Development Inc., Soricimed Biopaharma Inc., Acadian Seaplants Limited, Allens Fisheries |

Quebec is the location of the largest number of funded firms (over $100,000) by the NRC-IRAP program at 178 firms (29 percent of the total) with Ontario a close second at 143 firms (24 percent) and British Columbia coming in third with 84 firms (14 percent). Not surprisingly, in Western Canada the numbers of funded firms are clustered around more densely populated cities (i.e. Vancouver 76 firms, Calgary 40 firms, Edmonton 26 firms, Saskatoon 17 firms, and Winnipeg 21 firms). In Central Canada, Toronto and the surrounding area have the highest number of funded firms at 119, followed by Montreal at 70 firms and closely followed by Ottawa with 69 firms. Eastern Canada has significantly fewer funded firms, given the smaller population, with the largest number of recipients centered on the three key cities of Halifax with 23 firms, St. John’s with 22 firms, and Fredericton with 14 funded firms.

TABLE APP-A1-7 Age of Firms

| Percentage of Firms / Age of Firms | Age of Firm (Years) | |||||

| +/-1 to 2 | 3-5 | 6-10 | 11-15 | 16-20 | Over20 | |

| Percentage of NRC-IRAP Firms | 22 | 21 | 22 | 11 | 9 | 15 |

SOURCE: Impact Evaluation 2007, p. 13.

FIGURE APP-A1-10 IRAP Clients by industry sector, 2010-2011.

SOURCE: Bogdan Ciobanu, 2012.

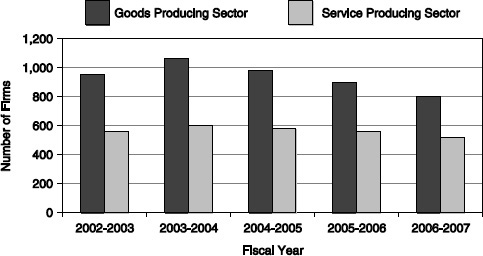

Goods and Services. Figure APP-A1-11 illustrates that a higher proportion of the funded firms have been in the “goods” producing sector with the remaining categorized as “services” producing. This is not surprising given the presence of the manufacturing industry in the goods producing sector. Note however that the number of firms in the goods producing sector has been declining steadily since 2003-04.

Project Duration. The duration of a typical IRAP funded project

FIGURE APP-A1-11 Distribution of the NRC-IRAP funded firms.

SOURCE: Impact Evaluation 2007, p. 16.

averaged 9.5 months, with the shortest project duration at 2 days, and the longest project lasting about 5 years. Again, this data suggests that IRAP funds relatively small projects that have shorter durations40

Number of Projects per Client Firm. As noted in Table APP-A1-8, a significant majority of IRAP clients (72 percent) receive funding for only one project. The remaining 28 percent receive funding for multiple projects with 18 percent receiving funding for two projects. This raises the issue of whether or not IRAP should be providing more sustainable funding to higher growth medium-sized SMEs in order to help them build critical mass to enter global markets and expand.

Amount Funded. The average total amount contributed to projects (i.e. dollars actually received by firms over the five years from 2002-03 to 2006-07) is approximately $56,000 per project.41 Note however that the median amount per project over the five years was $20,000. Furthermore, while the median contribution per project grew from $15,000 to $36,750 over the five year period (an increase of 145 percent) these are still relatively small project investments to develop technologies for global markets.

BENEFITS

The IRAP Impact Evaluation Report of 2007 (a mandatory evaluation of the IRAP program conducted every five years—with the next evaluation due later this year) concluded that NRC-IRAP produces significant economic impact, and generates a higher SME capacity for R&D, knowledge creation and commercialization. The total wealth creation benefits of the Program were identified in the range of $2.3 billion to $6.5 billion (and estimated to be about $4.2 billion) over the 5 year period (2002-03 to 2006-07)—i.e. benefits exceed the costs of the program by a factor of 4 to 12 (estimated at 8). In fact, according to the Impact Evaluation Report:

- There is a strong correlation between NRC-IRAP assistance and firm growth—for example, for each 1 percent increase in both contribution agreement funding and advisory services, firms show an 11 percent increase in sales and a 14 percent increase in employment.42

TABLE APP-A1-8 Number of NRC-IRAP Funded Projects per Firm (by Fiscal Year)

| Number of Projects per Funded Firm | Percentage of Total Funded Firms |

| 1 Project | 72.40 |

| 2 Projects | 18.48 |

| 3 Projects | 6.04 |

| 4 + Projects | 3.08 |

| SOURCE: Impact Evaluation 2007, p. 16. | |

________________

40Impact Evaluation 2007, p. 15.

41Impact Evaluation 2007, p. 14.

42Impact Evaluation 2007, p. 28.

TABLE APP-A1-9 Median Total Contribution Amount Received by Firms over the Life of NRC-IRAP Funded Projects (by fiscal year)

| Median CA / Fiscal Year | 2002-2003 | 2003-2004 | 2004-2005 | 2005-2006 | 2006-2007 | Median Total CA Across 5 Years |

| National Median Total CA ($s) | 15,000 | 15,000 | 20,000 | 25,500 | 36,750 | 20,001 |

- There is a strong correlation between NRC-IRAP assistance and firm growth—for example, for each 1 percent increase in both contribution agreement funding and advisory services, firms show an 11 percent increase in sales and a 14 percent increase in employment.42

- There is a positive and significant impact on productivity—a 1 percent increase in NRC-IRAP assistance (both funding and advisory) lead to a 12 percent increase in firm productivity, while a 1 percent increase in funding led to a 3 percent to 5 percent decrease in production costs.43

- There is a positive and significant relationship between NRC-IRAP assistance and R&D capacity and capabilities—a 1 percent increase in financial funding led to a 13 percent increase in R&D spending by the firm and a 3 percent increase in R&D staff.44

In addition, based on a review of the 437 final reports from NRC-IRAP clients, 94 percent of clients reported an increase in their technical knowledge and capabilities, 70 percent reported an increase in their ability to conduct R&D, and 93 percent reported that they anticipate commercial benefits to accrue as a result of IRAP assistance.45

Most recently, the Director General of IRAP, Bogdan Ciobanu, shared the following impact numbers in a presentation (May 2012). He stated that every $1 invested by IRAP generates an overall return on investment of $12 in socio-economic benefits to Canada in the form of:

![]() $10.44 in new sales.

$10.44 in new sales.

![]() Increased employment.

Increased employment.

![]() $2.5 invested by industry.

$2.5 invested by industry.

In short, he stated that the program continues to produce positive and significant benefits from its investments.

There are also a variety of third party sources who rate IRAP positively. For example, The State of Science and Technology in Canada report by the Canadian Council of Academies in September 2006 stated: “NRC-IRAP was rated the number one program in terms of support for commercialization of

________________

43Impact Evaluation 2007, p. 28.

44Impact Evaluation 2007, p. 28.

45NRC (2009-2010), “Departmental Performance Report,”

<http://www.tbs-sct.gc.ca/dpr-rmr/2009-2010/inst/nrc/nrc-eng.pdf>, p. 22.

science and technology.”46 From an international perspective, IRAP is also gaining a reputation as a best practice. Some recent references include:47

- Thailand-based ITAP program recognized as best practice program, modeled after NRC-IRAP.

- 2007 Australian Department of Industry, Tourism and Resources “Study of the Role of Intermediaries in Support of Innovation.”

- Columbia -- Bogotá’s emulation of NRC-IRAP in discussion.

- Chile adoption of NRC-IRAP’s Contribution to Organizations Program.

- IRAP highly regarded and referred to at a recent Technopolicy Conference on Creating World Class Regions in Germany (September 2010).

- ProInno Europe recently tabled IRAP as the “Good Practice Identification—Advice for transferability Innovation of Internationalization of SMEs Policies.”

From the firms’ perspective, the Program is also viewed very positively:

- For example, Ernie Davidson, an NRC-IRAP ITA, urged Mike Lazaridis (founder of RIM) to apply for NRC-IRAP funding to investigate Surface Mount Technology. As a result, sales to Sutherland-Schultz were so strong that RIM’s annual revenue went over the $1M mark in 1990 for the first time in the company’s history.

![]() “That was the breakthrough that got me the Sutherland-Schultz contract because we were probably the only company in town that even knew what surface mount technology was.”

“That was the breakthrough that got me the Sutherland-Schultz contract because we were probably the only company in town that even knew what surface mount technology was.”

Mike Lazaridis, Founder and co-CEO, Research In Motion (RIM)

- “There should be another billion dollars into IRAP because it is working.”

Terry Matthews, Chairman and CEO, March Networks; Chairman, Mitel; Chairman, Wesley Clover International

________________

46Council of Canadian Academies, “The State of Science & Technology in Canada,” (2006).

<http://www.scienceadvice.ca/en/assessments/completed/science-technology.aspx>.

47Program Overview Presentation by Dr. Tony Rahilly, Director General on October 5, 2010.

- “IRAP is critical to building Canada’s innovation economy… The popularity of the IRAP program is a testament to the strength of IRAP’s reputation as a valuable resource in the science and tech community.”

Avvey Peters, Executive Director, Government and Communications, Communitech

What Metrics are Used to Measure These Benefits?

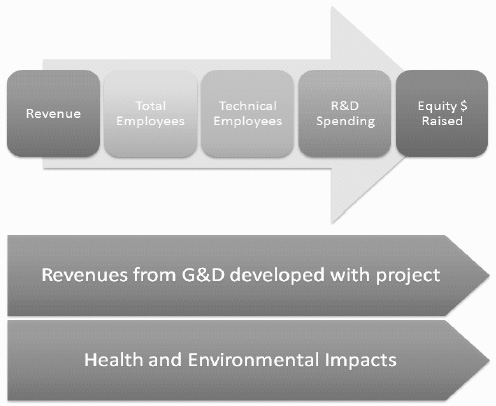

Director General Ciobanu articulated the following revised IRAP Metrics Framework (2012) in Figure APP-A1-12 to measure impact and benefits. This framework focuses on measuring five key outputs: increased revenues from goods and services developed by the project; total new employees; total new technical employees; new R&D spending; and equity raised as a result of the project.

FIGURE APP-A1-12 Metrics framework.

As a result, the desired impacts from IRAP investments are increased revenue, new and improved products and services, increased sales and high quality jobs. Client firms are responsible for most of this information tracking and input. This improves the line of sight between managing the project investment and ensuring the monitoring of the return on investment to Canada. In developing the metrics for SME funded projects, consideration is also given to:48

![]() Information collected by the Canadian Revenue Agency, Scientific Research and Experimental Development (SR&ED) Tax Incentive Program, and Statistics Canada to ensure alignment.

Information collected by the Canadian Revenue Agency, Scientific Research and Experimental Development (SR&ED) Tax Incentive Program, and Statistics Canada to ensure alignment.

![]() Information available from SME clients’ fiscal year end statements to facilitate ease of completion.

Information available from SME clients’ fiscal year end statements to facilitate ease of completion.

![]() IRAP’s reporting and accountability requirements, including those of formal evaluations.

IRAP’s reporting and accountability requirements, including those of formal evaluations.

Are There Particular Success Stories?

The Federal Budget is the government's most important annual policy statement reflecting through its announced spending, tax, and regulatory initiatives, the government's policy priorities for the year. Most recently, three brief success stories from the NRC-IRAP Program were highlighted in the Federal Budget 2012:

The National Research Council’s Industrial Research Assistance Program (NRC-IRAP) has a strong track record of providing innovative small and medium-sized companies with financial resources, customized services and access to highly skilled people. Recent success stories include:49

- Wolf Steel Inc. (Barrie, Ontario)—The firm has been able to design, manufacture and market a new high-efficiency furnace—the only gas furnace manufactured in Canada—with assistance and advisory services from NRC-IRAP.

- Quark Engineering and Development Inc. (Halifax, Nova Scotia)— The firm has transformed their TetherBerry networking technology into a multi-platform and Bluetooth-enabled device, leading to better market penetration, new business opportunities and increased revenues, with the assistance of NRC-IRAP.

- Motion Composites Inc. (Saint-Roch-de-l’Achigan, Quebec)—The company designed and produced a wheelchair that is lighter, more

________________

48Shannon Townsend, Margaret McKay, Julia Rylands, Melissa Littau, “Measuring Results: From Actions to Impact,” at the 15th Annual PPX Symposium on May 25-26, 2011.

49Government of Canada, “Jobs, Growth, and Long-Term Prosperity: Economic Action Plan 2012,” tabled in the House of Commons by the Honourable James M. Flaherty, P.C., M.P. Minister of Finance on March 29, 2012.

<http://www.budget.gc.ca/2012/plan/pdf/Plan2012-eng.pdf>.

durable and more affordable than a traditional wheelchair, with financial support from NRC-IRAP.

IRAP STRENGTHS AND CHALLENGES

There are many strong features of the IRAP Program. The following five give a sense of their diversity.

- The IRAP program operates in every major city and community and every Province and Territory across Canada, connected by a common culture and communications backbone. This permits it to serve SMEs wherever their location and bring the suite of IRAP advisory and financial services to them. It also permits an IRAP ITA in one part of Canada to use the common platform and bring in ITA expertise from other parts of the country to meet a specific SME’s needs, wherever they are located.

- The IRAP program is integrated into the research and technology expertise of the National Research Council and its 18 Institutes across Canada, and many ITAs are co-located at these Institutes. This permits the ITAs to obtain privileged and easy access to NRC researchers and knowledge in virtually all areas of science and technology, and to obtain their advice on specific SME research and technology challenges and opportunities.

- The background and experience of the ITAs is quite unique in the Canadian innovation program delivery system. As the Director General of IRAP characterized the ITA capability in a recent interview (June 2012), “the ITAs understand technology in a business context.” He explained that while the ITAs have strong backgrounds in technology, they have even stronger backgrounds and experience in building and managing small businesses. He believes it is this combined skill set that makes their advice so relevant for SMEs.

- The ITAs try to establish long term relationships with each SME client—reflecting the culture change that the program has gone through from funding “projects” per se—to funding “firms”. In this regard, the ITAs develop a personal sense of responsibility for the performance of their portfolio of SMEs and seek to advise each firm on its business growth over the longer term.

- The ITAs are “embedded” in the communities in which they operate and develop extensive knowledge of the regional innovation ecosystem in which their SMEs perform. In this regard, the ITAs can also fund 3rd party innovation service providers in the local area who may offer SMEs services not available through IRAP or the NRC. In this way the ITA can strengthen the entire regional innovation cluster and ecosystem.

As highlighted in the benefits section above, IRAP is generally commended and is a highly regarded program. Nevertheless, here are several key weaknesses:

- The Jenkins Report while generally very laudatory in its assessment of the program “IRAP was widely praised as an effective, well run program that provides industry with non-repayable contributions, mentorship and technical business advice,” also highlighted several weaknesses of the program, stating: “The main criticism is the exhaustion of funds very early in the fiscal year, but this is also one indication of the high level of demand for the program. Some believe that the amounts of IRAP funding awards are too small to be effective and that the application process is excessively difficult for first-time applicants.” Our assessment of IRAP’s performance suggests these weaknesses as areas for improvement.

- IRAP has not yet articulated a strategy to deal with the tension inside the program between focusing on assisting smaller SMEs and start-ups (these are riskier investments for an ITA) versus focusing on providing multiple rounds of investments for more mature SMEs who have demonstrated a capacity to perform (these are less risky investments for the ITA). In what proportions should funding be allocated between these two competing client groups?

- The inherent skill sets and background expertise that each ITA brings to the program to support the client is a potential concern. Specifically, many ITAs come to IRAP from Information and Communication Technology (ICT) backgrounds, and the impact on the program has been a somewhat unbalanced level of support being targeted towards ICT firms and projects. As IRAP expands how will it ensure its skill sets encompass most key areas of emerging science and technology? Alternatively, should IRAP fund only firms in a few priority areas of science and technology?

- How will IRAP managers cope with a rapid expansion of funding (an incremental $110M per year) and a rapid expansion in responsibility to deliver other federal programs (such as the Digital Technology Adoption Pilot Program) or to provide services to other federal program managers (such as performing technology and business assessments for the rapidly expanding Canada Innovation Commercialization Program)? The IRAP program has not yet demonstrated the capability to manage such extraordinary increases in both permanent resourcing and in expanded responsibility.

- In 2009-10 IRAP provided assistance to its portfolio of 8,578 firms, out of a total population of 1.14 million SMEs in Canada. Of the total of 1.14M SMEs, the Director General of IRAP has identified approximately 75,000 SMEs that are technology-based and could potentially require some form of IRAP advisory or financial assistance. From these he suggested that about 25,000 technology-based SMEs

would be currently eligible for some form of assistance. If these rough estimates are accurate, then he noted that IRAP in its current structure and business model may be reaching only 1/3rd to 1/10th of its potential market. This raises issues in a decentralized federation of how IRAP could collaborate more closely with other federal and provincial programs (there are over 250 federal and provincial innovation support programs) to deliver relevant innovation services to a larger market of eligible SMEs.