Important Points Made by the Speakers

• Working-age people with disabilities are more likely to be poor than others, despite high and rising federal expenditures for this group. (Stapleton)

• Bold innovations might slow the growth of expenditures while also improving the economic status of people with disabilities, but the evidence base to support such innovations is inadequate. (Stapleton)

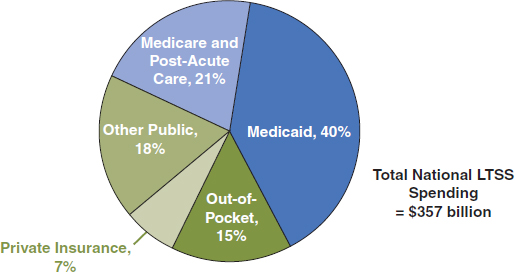

• Medicaid is the primary payer for long-term services and supports, with elderly beneficiaries and nonelderly beneficiaries with disabilities accounting for the majority of enrollment and expenditures for these supports and services. (Musumeci and Reaves)

• The United States lacks a universally available insurance-based approach that would spread the financial risk of aging and living with a chronic illness or disability. (Goldberg)

• A social insurance program could gain political support if it was self-financed, reduced Medicaid spending, and complemented private insurance. (Goldberg)

The third session at the workshop examined the government’s role in financing long-term services and supports. David Stapleton, a senior fellow at Mathematica who directs Mathematica’s Center for

Studying Disability Policy, spoke about public income support programs for working-age people with disabilities. MaryBeth Musumeci, associate director at the Kaiser Commission on Medicaid and the Uninsured for the Henry J. Kaiser Family Foundation, and Erica Reaves, policy analyst with the Kaiser Commission on Medicaid and the Uninsured, together discussed Medicaid as a funding source for long-term services and supports. Lee Goldberg, vice-president for health policy at the National Academy of Social Insurance, made a broad-based argument for the importance of social insurance as a practical and moral necessity.

PUBLIC INCOME SUPPORT PROGRAMS FOR WORKING-AGE PEOPLE WITH DISABILITIES

David Stapleton Mathematica

Working-age people with disabilities fare poorly in the workplace compared with workers without disabilities, Stapleton said. In 2012 only about 27 percent of workers with disabilities were employed, compared with 71 percent for those without disabilities, and their poverty rate was 31 percent in 2012 versus 12 percent for their peers.1 Among those who were beneficiaries of Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), 48 percent had household incomes below the poverty level (Wright et al., 2011). Two-thirds of people who have been in poverty for 3 or more years have a disability (She and Livermore, 2009). At equivalent income levels, people with disabilities are much more likely to experience various types of hardship than people without disabilities, and people with disabilities have been falling farther behind those without disabilities in income and employment for the past three decades (von Schrader et al., 2011).

Despite these indications of unmet needs, federal expenditures for working-age people with disabilities are high and rising rapidly, Stapleton said. When the more than 60 federal programs that provide support for this group are combined, federal support for this population was estimated to be $357 billion in fiscal year (FY) 2008, having increased by 30 percent in real terms over the previous 6 years (see Table 4-1). Income maintenance and health care account for 90 percent of the spending, which is split about equally between the two. The total spending on working-age people with disabilities represented 12 percent of all federal outlays in FY 2008,

________________

1 These statistics are from the Annual Disability Statistics Compendium, a Web-based tool available at http://disabilitycompendium.org (accessed October 17, 2013).

TABLE 4-1 Federal Expenditures for Working-Age People with Disabilities by Major Expenditure Category, Fiscal Year (FY) 2008

|

|

||

| Category | FY 2008 Expenditures (in billions of dollars) | Percentage Change, FY 2002–2008 (adjusted for inflation) |

|

|

||

| Income maintenance | 169.8 | 29.5 |

| Health care | 169.1 | 34.4 |

| Housing and food assistance | 11.6 | 17.9 |

|

Education, training, and employment |

4.3 | –2.6 |

| Other services | 2.5 | 2.3 |

| Total | 357.4 | 30.6 |

|

|

||

NOTE: Totals are rounded.

SOURCE: Livermore et al., 2011.

although the magnitude of these expenditures is not readily apparent because it is spread across so many different programs.

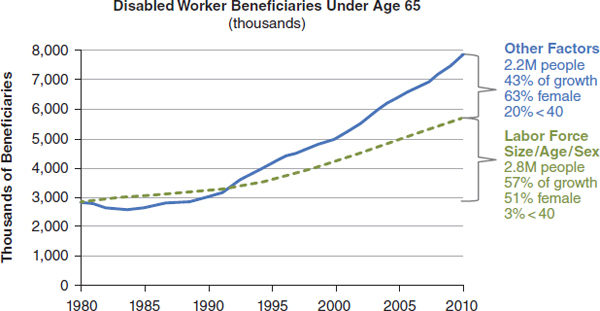

The number of people who rely on these benefits has been growing rapidly (see Figure 4-1). In 1980 about 2.8 million people under age 65 were receiving Social Security disabled worker benefits; by 2010 this number had risen to 7.8 million. Part of this increase can be accounted for by the growing size of the labor force, the aging of the baby boom, and the increased participation of women in the labor force. But 30 percent of the

FIGURE 4-1 Growth in the total number of working age Americans receiving SSDI benefits due to demography and other factors.

SOURCE: Reprinted with permission from David Stapleton, Mathematica.

increase—about 1.2 million people—was due to other reasons. One reason is that the disability prevalence rate for female workers is now close to what it is for men. The number of people with disabilities under age 40 also has increased disproportionately.

In response to a question, Stapleton pointed out that SSDI has changed somewhat since it began. Originally designed for older workers who experienced the onset of disability, it now provides benefits to workers of any age. More younger people are enrolled, and they are more likely to have psychiatric problems or developmental problems. It also has become more sensitive to the business cycle, suggesting that it is functioning in part as an unemployment insurance program for people with disabilities. During recessions, many more people apply for the program, and some are accepted, in which case they may stay on until retirement age. Stapleton labeled that trend a significant problem.

The Need for Bold Innovations

With the Social Security Disability Trust Fund projected to be exhausted in the year 2017, potential changes in the program have generated great interest. Stapleton offered several options for bold changes in the SSDI program. One option, he said, is to tighten eligibility standards and reduce benefits in order to limit the growth of expenditures. Another option would be to engage in bold innovations designed to slow the growth of expenditures while also improving the economic status of people with disabilities. According to Stapleton, this second option could potentially work because of the many inefficiencies in the current system. For example, Stapleton argued that the current system discourages people with disabilities from working. It also is extremely fragmented, he said, with many different agencies and funding streams directed at the same populations.

Stapleton briefly described three proposals he suggested could lead to large-scale change:

1. One would require that employers provide a mandatory 2-year private disability insurance program for their employees. Having employers pay for the first 2 years of SSDI benefits would give them more incentive to keep their employees on the job.

2. A second proposal would use an experience-rating approach to the SSDI payroll tax, which would give employers additional incentive to keep people off SSDI, and also to turn SSI into a program of block grants so that states would have more flexibility to improve the well-being of the SSI population.

3. A third proposal would convert almost all federal programs into block grants, including SSDI and SSI. This proposal would also

turn all means-tested programs into block grants, such as the Supplemental Nutrition Assistance Program.

Stapleton argued that it could be disastrous to go forward with any of these programs. They are all untested and extremely risky, he said. They may cost less or they may cost more—no one can be sure which—and they could do harm to vulnerable people.

Stapleton added that some evidence points in more productive directions. Private disability workers’ compensation insurers have been successful in keeping employees at work following the onset of medical conditions. The welfare reform for low-income families carried out in the 1990s offers numerous lessons—some positive, others cautionary. Other countries such as the Netherlands and United Kingdom have moved forward with reforms.

Stapleton judged the evidence available today as “clearly not adequate” to support major reform legislation in the United States. Rather, he said, a foundation for reform needs to be developed first in order to build trust within the disability community that vulnerable people will be protected and that transparency and accountability will be achieved.

A Reform Process

Stapleton described one possible reform process featuring a management structure that would address barriers to reform and build trust. It would have full and transparent financial accounting and would employ “super waivers” that cut across agency and federal–state boundaries. A federal disability policy board would be created with a charter to

• Lead a reform process with positive objectives.

• Grant super waivers to federal agencies, states, localities, and private entities for positive reforms.

• Coordinate cross-cutting activities under the waivers.

• Rigorously monitor disability population outcomes.

• Support continual improvement through evaluation, dissemination, and technical assistance.

• Make midcourse adjustments.

Under this proposal every state would have its own disability policy board, with consumers represented through an independent consumer review board. State and local chapters of the review board would monitor changes, and a federal appeals process could be in place for individuals who think they are being harmed by the waivers being granted. The policy board would develop a budget that encompasses all federal expenditures aimed at supporting the working-age population with disabilities. Annual

rolling 10-year budget projections would reflect fiscal reform objectives, encompass federal and state expenditures, and provide benchmarks for expenditure growth. State-level expenditures could also be projected and tracked, including state matching dollars. Responses to the waiver process and budget projections could vary. The default response would be no response and a continuation of current programs, while the preferred response would be for federal agencies, states, localities, and private entities to propose waivers designed to improve economic and other outcomes and reduce expenditures relative to budget projections.

These waivers could help accomplish various goals, Stapleton said. For example, they might allow for a single source for all their needs (e.g., income benefits, health benefits, social services) with integrated eligibility determination. They could also be structured to avoid individuals’ need to stop working in order to receive benefits, and also to encourage savings and support community living. These super waivers could address the integration of SSDI with workers’ compensation and private disability benefits, he added. Finally, Stapleton suggested these types of waivers could help build transition programs for youth and young adults with disabilities. The pace of reform could be accelerated by making the projected budgets binding, but that would need to be balanced against the risk that too rapid adjustment will harm those the reforms are intended to help, he said.

Stapleton concluded that establishing a target for a collection of programs could encourage those programs to meet that target through innovations designed to help people with disabilities. The benchmarks then could be lowered to reduce spending. Policy makers will likely refrain from reductions that are perceived to damage people with disabilities, he said. Many promising options cut across federal, state, local, and private jurisdictions, which implies that these sectors will need to work together to experiment with reforms. Benchmarks would encourage overall budgeting for programs and rational decisions rather than the piecemeal cuts that are being made today.

MaryBeth Musumeci and Erica Reaves Henry J. Kaiser Family Foundation

Medicaid is the primary payer for long-term services and supports (LTSS) such as nursing home care, home health services, and home- and community-based waiver services (see Figure 4-2). While LTSS users ac-

________________

2 The data presented in this section resulted from analyses carried out by the Kaiser Commission on Medicaid and the Uninsured.

FIGURE 4-2 Sources of expenditures for long-term services and supports (LTSS), 2011.

NOTE: Total long-term care expenditures include spending on residential care facilities, nursing homes, home health services, and home- and community-based waiver services. Long-term care expenditures also include spending on ambulance providers. All home- and community-based waiver services are attributed to Medicaid.

NOTE: Total in 2011 = $357 billion

SOURCE: KCMU, 2013a.

counted for almost one-half (46 percent) of Medicaid expenditures in 2009, they represented only 6 percent of total Medicaid enrollment. The Medicaid LTSS beneficiary population is diverse, with enrollment and spending that varies disproportionately across beneficiary subpopulations. Elderly beneficiaries (people of age 65 and older) account for 52 percent of Medicaid LTSS enrollment and about 45 percent of Medicaid LTSS expenditures, nonelderly beneficiaries with disabilities represent 40 percent of enrollment and 51 percent of expenditures, and nondisabled adults and children account for 8 percent and 4 percent of enrollment and expenditures, respectively.

Institution-based LTSS account for 45 percent of Medicaid LTSS expenditures, with home- and community-based LTSS accounting for 29 percent of all Medicaid LTSS expenditures.3 While 61 percent of elderly beneficiaries rely on institution-based services, only 21 percent of nonelderly beneficiaries with disabilities access institution-based LTSS. Total Medicaid long-term care per capita expenditures are highest for nonelderly

________________

3 The balance of Medicaid expenditures for LTSS attributable to mixed long-term care (4 percent); inpatient care (7 percent); drugs (4 percent); physician, lab, X-ray, outpatient/ clinic, and other acute services (9 percent); and rehabilitation therapy and other supportive services (3 percent).

beneficiaries with disabilities ($37,394), followed by the elderly ($34,007), and then by nondisabled adults and children ($14,918).

More than two-thirds (68 percent) of Medicaid beneficiaries who use LTSS qualify separately for Medicare. Medicaid LTSS expenditures for these “dually eligible” beneficiaries represent 65 percent of total Medicaid LTSS spending. Fifty-one percent of dually eligible beneficiaries use institution-based LTSS, and 33 percent access LTSS in the community.4

Expenditures for Medicaid long-term services grew from $54 billion in 1995 to $123 billion in 2011, with considerable growth in the share of Medicaid LTSS expenditures devoted to home- and community-based services (HCBS) over that time period. Spending for HCBS for elderly beneficiaries as a percentage of total Medicaid long-term care expenditures for the elderly varies dramatically across the states, from less than 10 percent in seven states to more than 40 percent in seven states and the District of Columbia. For nonelderly people with disabilities, Medicaid HCBS spending as a percentage of total Medicaid long-term care expenditures for nonelderly people with disabilities ranges from less than 50 percent in six states to greater than 80 percent in eight states.

Long-Term Services and Supports Offered by Medicaid

Medicaid covers a wide array of long-term medical and supportive services, with home health, personal care, and Section 1915(c) home- and community-based waiver services being the most widely used benefits. Every state that participates in Medicaid (currently, all 50 states choose to do so) must offer home health services, which accounted for 11 percent of the $50 billion spent on Medicaid HCBS in 2009. Expenditures for personal care services and home- and community-based waiver services, each provided at state option, accounted for 22 percent and 67 percent of total 2009 Medicaid HBCS spending, respectively.

Section 1915(c) waivers were developed to give states the flexibility to cover services and supports that people need in order to live independently in the community (e.g., case management, adult day health care) and to directly address the bias toward institutions that has been traditional in the Medicaid program.

In general, Medicaid benefits are an entitlement. If people meet the eligibility requirements, they are entitled to receive the services. However, as a cost-control measure, states can cap HCBS waiver enrollment “slots”; many states maintain “waiting” or “interest” lists, which serve as a proxy for the level of unmet need. Significant demand exists for home- and community-based waiver services, driven by beneficiary preferences to live in the com-

________________

4 The remaining dually eligible beneficiaries do not use LTSS.

munity. Pressure on states to reduce their HCBS waiver waiting lists has increased, especially after the U.S. Supreme Court’s Olmstead decision,5 which found that unjustified institutionalization of people with disabilities, when they are able to live in the community, is discrimination under the Americans with Disabilities Act. In 2009 individuals with intellectual or developmental disabilities accounted for 62 percent of individuals on waiver waiting lists nationwide, while older adults (with or without disabilities) represented 29 percent, with the remaining 8 percent consisting of children, people with physical disabilities, people with HIV/AIDS, people with mental health needs, and people with traumatic brain and spinal cord injuries.

Medicaid LTSS Options and the Affordable Care Act

In addition to home health services, personal care services, and HCBS waivers, the Affordable Care Act (ACA) offers six new or enhanced options for states to provide community-based Medicaid LTSS (KCMU, 2013b). To date, the most popular option is the Money Follows the Person (MFP) demonstration program, which was expanded by the ACA and now has 46 states participating. Under MFP, states receive enhanced federal Medicaid matching funds for qualified HCBS for people transitioning from an institutional setting to a community-based setting. The health homes state plan option, which 25 states are implementing or have planning grants for, is a new Medicaid benefit aimed at allowing states to coordinate care for individuals with chronic conditions; states electing this option receive 90 percent enhanced federal funding for the first 2 years. The new Balancing Incentive Program provides enhanced federal matching funds for states that spent less than 50 percent of their Medicaid long-term care dollars on HCBS in 2009; the goal is to increase the proportion of long-term care spending devoted to HCBS in these states, and 15 states are currently participating in the program. Fourteen states are pursuing the HCBS state plan option, expanded by the ACA, which allows states to offer HCBS as Medicaid state plan services instead of through waivers. Nine states are pursing the Community First Choice state plan option, established by the ACA, which allows states to provide home- and community-based attendant services and supports with 6 percent enhanced federal matching funds. Finally, 26 states submitted proposals to implement a demonstration, under new authority in the ACA, to align the administration and financing of acute and long-term care services for dually eligible beneficiaries; to date the Centers for Medicare & Medicaid Services has approved memoranda of understanding with six states.

In response to questions from the audience, Musumeci and Reaves

________________

5 Olmstead vs. L.C. 527 U.S. 581 (1999).

noted that state take-up of the six new or expanded ACA LTSS options varies, with three states not pursuing any option and numerous states pursing three or more options. Specifically, with regard to the financial alignment demonstrations for dually eligible beneficiaries, Musumeci said that states may face challenges in implementation given that these demonstrations are seeking to integrate two disparate complex programs that were not necessarily designed to work together, that dually eligible beneficiaries are among the most vulnerable, and that some states and health plans have limited experiences with managed LTSS to date. Many important details about the demonstrations in areas such as enrollment processes, continuity of care, and beneficiary protections remain to be specified.

States are still in the implementation stages of the ACA, so it is too early to determine the full impact of the various LTSS options. The Kaiser Commission on Medicaid and the Uninsured will continue to track states’ activities, given the potential of these options to lower the growth of long-term care spending and to increase beneficiary access to HCBS.

Lee Goldberg National Academy of Social Insurance

The demand for LTSS will rise in coming decades, but not much spare capacity exists in informal sources of long-term care. Most families continue to need two wage earners, said Goldberg. Record numbers of people are living alone—28 percent of households consist of a single person— which increases the demands on caregivers. And changes in state Medicaid programs are expected to put extra demands on informal care as people avoid going into institutions and opt for HCBS, where the absence of 24-hour care requires that family members make up the difference.

The government funds long-term services and supports for those with low incomes in addition to subsidizing LTSS indirectly through the tax code. But Medicaid, which is the de facto governmental system for long-term care, is a safety net program. The United States lacks a universally available insurance-based approach that would spread the financial risk of aging and living with a chronic illness or disability.

The Rationale for Social Insurance

Social insurance mimics private insurance, but it can also serve broader societal goals. According to Goldberg, social insurance is flexible in that it can change in order to address unforeseen developments, whereas private contracts tend to be overly specific and rigid. However, social insurance

needs to be universal in order to avoid adverse selection, the situation in which only those who will need the insurance are enrolled in the program. Either a governmental mandate or strong economic incentives, as in Medicare Part B, can compel participation, suggested Goldberg. With universal participation, he said, the government does not displace private insurance, and premiums are not tied to an individual’s risk.

Goldberg stated that social insurance is compatible with private insurance. With Social Security, the financial services industry has prospered as people have sought ways to supplement their income over the course of their lives. Medigap is another example of the compatibility between social insurance and private insurance, he said. France has one of the highest rates of private long-term care insurance despite a strong social insurance program with an HCBS benefit and a cash benefit. Many governments rely on mandatory social insurance not just for LTSS but also for pensions, Goldberg said, whereas the United States continues to rely on means-tested programs and tax expenditures.

According to Goldberg, pooling risk and spreading the cost of care over a large number of people is efficient and increases community resources because people can save for the average cost of LTSS rather than for the maximum potential cost. It also has a moral justification. The English philosopher John Rawls described a just society as one in which the rules are established before anyone knows where they will be in that society. When operating behind this “veil of ignorance,” a well-run insurance program is the most just system, Goldberg said.

Types of Benefits

Social insurance benefits fall into two categories. A defined set of benefits, as is provided by Medicare, can help ensure the availability of complex services that require clinical knowledge and advanced technology. This is the indemnity model familiar from health insurance. Such benefits can be monitored and controlled and are familiar to most Americans. If this model were pursued, expanding Medicare would be one possible way to provide LTSS, although Goldberg argued it would be politically difficult. The other category is cash benefits, as are provided by Social Security, which are designed to improve economic well-being rather than to provide a defined set of services. According to Goldberg, cash benefits are useful for supplementing services, and they provide consumer flexibility in selecting combinations of goods and services. However, cash benefits make it difficult to monitor how funds are spent or to ensure the quality of care. Goldberg argued that both models are needed for LTSS. The population needing this care is heterogeneous and needs both kinds of benefits, he said. The question then becomes whether expanding both is politically feasible.

Research has shown that mandatory social insurance programs with monetary benefits could provide significant Medicaid savings (Tumlinson et al., 2013). This research posited that benefits would be limited to just a few years, but even a 2-year benefit would cover almost half of people with disabilities for the duration of their need for long-term care, and a 1-year benefit would help about one-quarter of the people for the duration of their needs.

Experiences in Other Countries and in the United States

Goldberg asserted that most OECD6 countries other than the United States have replaced means-tested programs with insurance-based programs. In some cases, prices have been higher than expected, but the programs generally have been popular and manageable, Goldberg said.

In Britain the government is currently pushing for reforms in long-term care that would limit people’s lifetime out-of-pocket costs and raise income eligibility on means-tested HCBS, with financing through a freeze on the inheritance tax. Despite being proposed by a conservative government, the fate of this proposal was uncertain at the time of the workshop.

The United States does not address long-term care as part of its health system, as most other countries do, Goldberg said. But the states have a history of experimentation that continues today. For example, Hawaii is considering a social insurance program, and “quiet” discussions are going on elsewhere, Goldberg said. Pension reforms in California, where a new pension law has created an opt-out system that allows people to contribute part of their paycheck to a private-sector pension program, could provide a framework for legislation elsewhere.

The Need for Change

The current system needs to be changed, Goldberg concluded. It is a disease-dependent and income-based system. Support for social insurance among policy makers could be bipartisan, he said, if the system were self-financed, if it reduced Medicaid spending, and if it complemented private insurance. Such a program would not need to address all of the risks a person faces. In addition, social insurance lends itself to starting small, Goldberg argued. Some things could be done at the state or federal level that could have political appeal. According to Goldberg, a groundswell

________________

6 “The mission of the Organisation for Economic Co-operation and Development (OECD) it to promote policies that will improve the economic and social well-being of people around the world. The OECD provides a forum in which governments can work together to share experiences and seek solutions to common problems” (OECD, 2013).

of political support will be needed to achieve universal coverage for long-term care, but such support will need to be carefully built. Federalizing the program would lift a substantial burden from the states, he said, while also providing a greater uniformity to benefits. It also would enable even more far-reaching reforms, such as integrating the program with Medicare.

Given the political climate, incremental changes in LTSS where states are willing to move ahead in the face of federal paralysis may be the best approach. One thing is certain, said Goldberg: With long-term care costs projected to double by 2040, keeping the current system on autopilot is not a good option.