4

Merchandise Trade

Of all the data on U.S. international transactions, those on merchandise trade probably have improved most in recent years. Despite having to monitor a volume of merchandise trade that has dramatically increased in the 1980s and despite significant budgetary constraints, the Customs Service and the Bureau of the Census have made significant strides in improving the data. However, several areas warrant further attention: doing so will result in a more accurate picture of U.S. merchandise trade.

This chapter describes the key features of merchandise trade data; delineates the existing collection system for those data; discusses the shortcomings of the system; and makes recommendations for their improvement. The emphasis is on ways to improve the quality of the data through strengthened quality assessment and quality assurance procedures, greater automation, and wider use of sampling techniques.

DATA ON MERCHANDISE TRADE: KEY FEATURES

Unlike other U.S. international economic statistics, which are estimates based on sample surveys of firms or establishments and other entities, merchandise trade data are compiled on the basis of full tabulation of the official import and export documents required by the Customs Service for tariff collection and export administration. Since January 1989, U.S. imports have been clas-

sified into 14,000 categories derived from the international Harmonized Commodity Description and Coding System (HS); exports have been classified in terms of 8,000 HS-based codes.1 The Census Bureau enters these data into computers, tabulates them in various forms, and publishes them every month. Many data are collected at the request of various public and private organizations. Monthly merchandise data record the physical movement of U.S. imports and exports of goods by value, commodity, and country of origin or destination, as well as the dutiable status and tariff rates of imports. They also capture the quantity, shipping weight, Customs Service district of exit or entry, method of transportation, and data by state. These detailed monthly statistics comprise more than 200,000 data cells. Their monthly tabulations and publication are beyond the requirements of federal statutes: Public Law 96-39 only requires reporting of imports by commodity (about 14,000 data cells) and the total for exports (one data cell) on a monthly basis.

The Census Bureau releases to the public highlights of the nation 's merchandise imports, exports, and trade balance about 45 days after the end of the reference month. The monthly statistics include transactions of the reference month and transactions of earlier months that arrive too late for inclusion in previous reference months (that is, the carryovers). Data disaggregated at detailed commodity levels are often released later in various printed and machine-readable forms but with no regular publication schedules. Major monthly aggregate data series are seasonally adjusted. Aggregate data are also available on an annual basis. In addition, the Census Bureau tabulates various series of specific data at users' requests on a cost-reimbursable basis. The Census Bureau disseminates merchandise trade statistics in various forms, including printed reports, CD-ROMs (computer disk —read only memory), and magnetic tapes. The agency recently eliminated the production of microfiche reports. The Census Bureau's monthly merchandise trade statistics are also disseminated by the National Trade Data Bank, along with other economic data series. Figure 4-1 lists sets of data on merchandise trade prepared by the Census Bureau.

Merchandise trade statistics are the most widely used data on U.S. international transactions. Federal agencies that closely monitor U.S. international trade include the Federal Reserve Board, the

|

1 |

There are more commodity codes for imports than exports because imports are subject to tariffs, and they are classified in greater detail in conformance with U.S. tariff schedules. |

Department of Commerce, the Department of Agriculture, the International Trade Commission, and the Office of the U.S. Trade Representative. These agencies use the data to assess the U.S. trade outlook and trends in exchange and interest rates, to develop export promotion activities in international markets, and to formulate policy positions in bilateral and multilateral trade negotiations. Other major users of merchandise trade statistics include state and local government agencies, businesses, academic researchers, and private analysts. They use the data to assess trade patterns, evaluate foreign competition, and identify market opportunities at home and abroad. Also, increasingly, the transportation industry relies on shipment data to plan where and how much to invest in terminals and other facilities (U.S. General Accounting Office, 1989).

In addition to the Census Bureau's merchandise trade statistics, other specialized primary data on U.S. exports and imports of specific commodities—not covered in this study—are collected and compiled by other federal agencies and private organizations. These data include: establishment data on exports of U.S. manufactured products compiled in quinquennial economic censuses and the Annual Survey of Manufactures (ASM) by the Census Bureau; monthly (since 1989) and quarterly export and import price indexes produced by the Bureau of Labor Statistics (BLS), based on BLS surveys of importers and exporters of selected commodities; statistics on imports and exports of crude oil and petroleum products generated by the Energy Information Administration (EIA), based on EIA data collected directly from importers and exporters; information on imports and exports of major agricultural commodities (such as grains, cotton, and oilseeds), gathered directly from corporate entities by the Department of Agriculture; and detailed information on U.S. waterborne cargoes to and from foreign countries for 63 U.S. ports, compiled under the privately owned Piers Import/Export Reporting Service (PIERS) of the Journal of Commerce.

In addition, there are federal agencies, international organizations, and private businesses that take the Census Bureau data and add value to them by making them easier for users to get the specific information —for specific commodities and countries, on a time-series basis, seasonally adjusted, or using different classifications than those provided by the Census Bureau. These secondary sources include U.S. federal agencies like the International Trade Administration, which operates a foreign trade data bank, COMPRO, for government users; the International Trade Com-

FIGURE 4-1 Available Data on Merchandise Trade

|

Monthly Publications and Hard-Copy Reports |

|

|

FT900 |

U.S. Merchandise Trade |

|

FT920 |

U.S. Merchandise Trade: Selected Highlights |

|

FT925 |

Exports, General Imports, and Imports for Consumption, SITC-Rev.3 Commodity by Country |

|

TM985 |

U.S. Waterborne Exports and General Imports |

|

Monthly Computer Printouts of Selected Foreign Trade Commodities |

|

|

IM145 |

U.S. General Imports, by harmonized TSUSA commodity |

|

IM146 |

U.S. Imports for Consumption, by harmonized TSUSA commodity |

|

EM545 |

U.S. Exports of Domestic and Foreign Merchandise, by harmonized Schedule B commodity |

|

Annual Publications and Hard-Copy Reports |

|

|

FT247 |

Imports for Consumption, 10-Digit HTSUSA by Country |

|

FT447 |

Exports, 10-digit HS Schedule-B Commodity by Country |

|

FT895 |

U.S. Trade with Puerto Rico and U.S. Possessions |

|

FT927 |

Exports and General Imports, Country by 3-digit SITC-Rev.3 Commodity |

|

FT947 |

Exports and General Imports, 6-digit HS Commodity by Country |

|

TA987 |

Vessel Entrances and Clearances |

|

Microcomputer Compact Discs |

|

|

CDEX(yr-mo) |

U.S. Exports of Merchandise Detail Database Commodity Summary Database Country Summary Database District of Export Summary Database Harmonized Commodity Masters, Exports Concordance Database Harmonized Commodity Masters, Commodity Descriptions Harmonized Commodity Masters, SITC Descriptions Country Name Database District Database |

|

CDIM(yr-mo) |

U.S. Imports of Merchandise Detail Database Commodity Summary Database Country Summary Database District of Entry Summary Database District of Unlading Summary Database Harmonized Commodity Masters, Imports Concordance Database Harmonized Commodity Masters, Commodity Descriptions Harmonized Commodity Masters, SITC Descriptions Country Name Database District Database |

|

U.S. Merchandise Trade Magnetic Tape |

|

|

IM145 Data Bank |

U.S. General Imports and Imports for Consumption |

|

EM545 Data Bank |

U.S. General Exports of Domestic and Foreign Merchandise |

|

U.S. Merchandise Trade Magnetic Tape—Continued |

|

|

EM595 |

Shipments of Merchandise Between the United States and Puerto Rico and Shipments from the United States to the Virgin Islands |

|

Exports by State/Region/Port Magnetic Tapes |

|

|

EQ912 |

U.S. Exports of Domestic and Foreign Merchandise by State |

|

EQ932 |

U.S. Exports of Domestic and Foreign Merchandise by Region |

|

EQ952 |

Exports of Domestic and Foreign Merchandise by Port |

|

Transportation Magnetic Tapes |

|

|

TM380 |

U.S. Waterborne General Imports and Inbound Intransit Shipments |

|

TM780 |

U.S. Waterborne Exports and Outbound Intransit Shipments |

|

TM385 |

Monthly Vessel Entrances |

|

TM785 |

Monthly Vessel Clearances |

|

Microfiche |

|

|

IM175 |

U.S. General Imports and Imports for Consumption |

|

EM575 |

U.S. Exports by 4-digit SIC-Based Product Code |

|

EM595 |

Shipments of Merchandise Between the United States and Puerto Rico and Shipments from the United States to the Virgin Islands |

|

TM380 |

U.S. Waterborne General Imports and Inbound Intransit Shipments |

|

TM780 |

U.S. Waterborne Exports and Outbound Intransit Shipments |

|

TM385 |

Monthly Vessel Entrances |

|

TM785 |

Monthly Vessel Clearances |

|

TM980 |

Exports and General Imports by Vessel and Air |

|

Other Related Merchandise Trade Data Products and Sources |

|

|

CENDATA |

An on-line data service offering the most current and widely used facts, specializing in press releases and information on ordering the latest data products; includes entire monthly U.S. Merchandise Trade Press Release and Supplement. |

|

EBB |

The Economic Bulletin Board of the Department of Commerce provides information on economic growth, inflation, monetary and fiscal policy, and foreign trade subscribers. |

|

National Trade Data Bank |

Includes merchandise trade import and export data from the Census Bureau. |

|

Network Access to Compact Discs (CD-ROMs); HTSUSA and Schedule B Data |

|

|

IM145 |

U.S. General Imports |

|

IM146 |

U.S. Imports for Consumption |

|

IM545 |

U.S. Exports of Domestic and Foreign Merchandise |

|

Standard International Trade Classification (SITC) Databases |

|

|

U.S. Exports U.S. General Imports |

|

|

End-Use Commodity Category Classification Databases U.S. Exports by State Database U.S. Imports Databank Database (HTSUSA) International Trade Administration COMPRO System |

|

mission, which develops and maintains time-series data on U.S. foreign trade, now available to the public through the National Trade Data Bank operated by the Department of Commerce; the Bureau of Economic Analysis, which issues quarterly balance-of-payments data; and several others. International organizations, including the United Nations, the International Monetary Fund, the World Bank, the General Agreement on Tariffs and Trade, and the Organization for Economic Cooperation and Development (OECD), also receive and compile foreign trade data from member countries and produce numerous publications and other data products.

In the private sector, many trade associations, consulting and research firms, and other organizations also act as retailers of the Census Bureau merchandise trade data to their clients or members. Some specialize in particular groups of commodities; others process a wide range of data from many of the primary and secondary sources and offer on-line access, tailored reports, and other information services.

COLLECTION SYSTEM FOR MERCHANDISE TRADE DATA

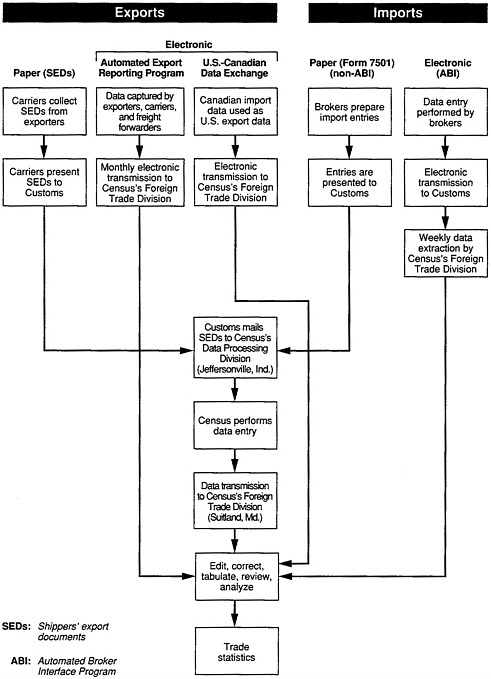

Under federal regulations (authorized under U.S. Code, Title XIII and its amendments), the Customs Service is responsible for collecting import and export documents, and the Census Bureau is charged to process them to compile merchandise trade statistics. The federal regulations stipulate that the Customs Service has overall responsibility for import documents (for example, the Customs Form 7501); the Census Bureau and the Bureau of Export Administration of the Department of Commerce are responsible for export documents (for example, the shippers' export declaration [SED]). Because of the bifurcation of responsibilities between Customs and Census, different federal regulations, methods, and procedures are applied to collect and process data on exports and imports. Figure 4-2 provides an overview of the collection and processing system for merchandise trade statistics.

Exporters, importers, and their agents can file export and import documents either in paper form or electronically. Filing is mandatory except under certain conditions. SEDs are not required for export shipments when the value of commodities classified under each individual export commodity code is $2,500 or less, but commodities that are covered under export control regulations are not exempted. Reporting requirements for imports apply to transactions valued at $250 or more for selected commodities for which there are import quotas, and for all transactions

valued at $1,250 or more for other commodities. To account for shipments below these cutoff levels in its monthly reports, the Census Bureau includes estimates for these shipments; however, the estimates are derived from outdated historical patterns of these shipments. According to Customs and Census officials, in 1991 about 86 percent of import transactions and about 48 percent of export transactions are being reported electronically. For 1990, a total of approximately 26 million import and export transactions were processed, an increase from about 18 million in 1980. The import and export documents are not protected by the confidentiality provision of Section 9 of Title XIII, U.S. Code. As a matter of policy, when individual companies object to the publication of data that reveal their own activities, Census has sometimes accommodated them by combining data for detailed commodities into larger groups.

EXPORTS

A carrier has 4 working days after the clearance date for departure of a shipment to submit to the Customs Service a manifest consisting of a batch of bills of lading and a summary sheet. The bills of lading contain information on quantities and destinations but not on values. The carrier must also present with each bill of lading a shippers ' export declaration (SED) showing the commodity shipped and its value or an explanation why no SED is required (for example, a low-value shipment). If a required SED is not forwarded by the carrier, Customs is supposed to pursue the matter. Small fines are sometimes imposed for failure to comply. The Customs Service ordinarily gives the SEDs little or no review for completeness or accuracy and forwards them daily to the Census Bureau's Data Processing Division at Jeffersonville, Indiana. According to Census, about 500,000 SEDs are currently received monthly by the Jeffersonville center. These account for about 52 percent of the export transactions (60 percent of the value of exports).

SEDs are not required of more than 100 companies participating in the Census Bureau's Automatic Export Reporting Program (AERP). These companies send the required information monthly by modem, computer tapes, floppy disks, or machine-prepared shipment summaries directly to Census's Foreign Trade Division in Suitland, Maryland; 15 percent of export transactions (about 20 percent of the value) is reported through AERP. In addition, since January 1990, under a merchandise data-exchange program between

the United States and Canada, SEDs are generally not required for U.S. exports to Canada.2 The United States uses the import data compiled by Canada to report on U.S. exports to Canada. (Similarly, Canada uses U.S. import data to report Canadian exports to the United States.) These data are electronically transmitted by Statistics Canada (the Canadian government 's main statistical agency) to the Census Bureau's Foreign Trade Division; they account for about 32.5 percent of the export transactions (about 20 percent of the value of total U.S. exports). SEDs are also not required for export shipments under U.S. military assistance program aid to foreign countries, which are reported directly to the Census Bureau by the Department of Defense.

IMPORTS

Import data are collected on Customs Form 7501. The forms must be submitted by importers or their brokers to Customs during a period beginning 4 days before and ending 10 days after the arrival of the goods and must be accompanied by commercial documents showing the required tariffs. Because of cash-flow considerations, brokers may delay filing the forms until near the end of the period.

According to Customs, in 1991 about 14 percent of the import transactions (22 percent of the value) were reported on Form 7501, which contains a (yellow) statistical copy. Until recently, Customs ordinarily mailed the statistical copy in daily batches to Jeffersonville without review. This “rip-and-strip” procedure was instituted in 1987 to improve timeliness of data processing. Because of problems with data accuracy, however, Customs started to phase out this procedure in December 1989 and to send the statistical copies to Customs import specialists for review and for necessary corrections before forwarding them by mail to Jeffersonville for processing. As a result, data have been received on a less timely basis, and Customs is working to reduce these delays. Currently, about 100,000 import documents are received by Jeffersonville monthly.

The other 86 percent of import transactions (78 percent of the value) are filed under the Customs Bureau's Automated Broker

|

2 |

This exemption applies for general license merchandise; SEDs are required for merchandise transshipped through Canada, for grain shipments exported to Canada (whether or not the country of destination is shown as Canada or a third country), and for shipments exported to Canada that require a validated export license. |

Interface (ABI) program, in which brokers transmit information by computer directly to the ABI. The ABI has a computer edit program, which includes statistical edits and parameters jointly developed by Customs and Census. Entries that fail the editing are sent back by computer to the brokers for corrections. Accepted entries are transmitted to the Customs mainframe in Franconia, Virginia. The Customs Service weekly extracts statistical data onto magnetic tapes, which are forwarded also on a weekly basis to Census's Foreign Trade Division at Suitland, Maryland, for further processing. Customs conducts a routine review of accepted entries. A complete review by an import specialist is made of a 2 percent random sample; a 100 percent review is made of certain categories of cases. When changes are needed in the ABI computer edit parameters, they are developed jointly by Customs and Census.

CENSUS BUREAU PROCESSING

When the shipping documents (7501s and SEDs) are received, staff members at Jeffersonville sort out all documents for high-value shipments (those worth more than $2 million for imports and $1 million for exports), which account for 1-2 percent of all documents but represent 40-50 percent of the total value of imports and exports filed manually. They are subjected to close scrutiny by higher level clerical staff. The remaining documents are subjected to various forms of clerical review, which include checking the completeness of the statistical data, identifying nonstatistical documents and separating them, and referring selected documents to higher level clerical staff. About 73 percent of the export documents are entered into the computer system, 24 percent are withdrawn because they are nonstatistical, and 3 percent are referred to higher level clerical staff for review because they contain high-value shipments or lack entries. For imports, the comparable figures are 72 percent entered, 11 percent rejected as nonstatistical, and 17 percent missing data, or, occasionally, of high value. More senior clerks impute missing data either by referring to manuals or, occasionally, by contacting importers or exporters.

After these cursory reviews, serial numbers are affixed to SEDs, and the SEDs are then microfilmed. To minimize processing costs, import documents are no longer microfilmed. (Both the export and import documents are retained in batches for 2-3 months.) The next step is data entry, during which data are subjected to

simple computer edits. Computer files of the keyed data are transmitted by telephone daily to the Foreign Trade Division in Suitland for further processing.

At Suitland the data undergo a more complex computer edit called the edit master. It contains commodity codes, permissible parameters and ranges for commodity prices, quantities, and other information. It checks the validity of commodity codes of all transactions. It also examines relationships between commodity value and quantity, commodity and country, and commodity and Customs Service's district. Data that fail this computer edit are either referred back to Jeffersonville for correction or reviewed and reconciled by the professional staff at Suitland. Data that pass are tabulated monthly.

QUALITY CONTROL

Although the Census staff subjects high-value shipments to close scrutiny, there are few formal procedures to ensure timely, accurate, and complete filing of documents (either manually or electronically) by importers and exporters. Computer edits currently represent the major quality-control tool of the data collection system.

As noted above, the Customs Service does not routinely examine export documents. In contrast, it does review import documents as part of the tariff-collection process. In an effort to promote U.S. exports, Customs seeks to avoid creating obstacles to exports. In addition, Census regulations allow a carrier 4 working days after the departure of a shipment to file an SED or an explanation of why none is required. These policies and procedures make export data more vulnerable to inaccurate reporting than import data.

Customs and Census do not systematically coordinate or communicate with importers, exporters, or their agents, except to resolve errors in some documents. Yet data filers directly determine the quality of trade statistics. Unless filers comply with reporting requirements, data will not be timely and accurate. Yet, neither Customs nor Census has systematic controls to ensure that all required 7501s and SEDs are filed and that they are received at the Jeffersonville data processing center. A Census supervisor recalled, for example, a case in which a mail pouch was received with a note from the post office that the pouch had broken in transit. The contents were in disarray. Whether any SED was lost could not be determined.

There is no statistical control in the Jeffersonville mail room where the SEDs and 7501s are sorted and nonstatistical forms are discarded. Whether forms are lost or discarded inadvertently cannot be ascertained. In the early 1980s, a decision was made for budgetary reasons not to institute formal statistical control at this stage in Jeffersonville. According to Census, although there have been no reported instances in which documents on high-value shipments have been accidentally destroyed, there have been cases in which such documents have inadvertently been sent directly to be key-punched rather than to a more intensive review. Similarly, documents on low-value shipments on occasion may not be removed and may be incorrectly routed for keying. These cases are usually identified at the keying or computer-edit stages.

Other vulnerabilities relate to clerical review and imputation procedures. One item most frequently omitted on SEDs is the commodity classification. 3 To impute the missing data, the clerical staff at Jeffersonville use a commodity classification book and edit manual developed by the Foreign Trade Division that contains commodity codes and related price/quantity ratios. The staff also have access to Dun and Bradstreet publications and the Thomas Register, and they can contact exporters to request missing information. Yet even after these clerical edits and imputations are made, computer edits at the data-entry stage reject about 6 percent of the key-punched entries, primarily because of erroneous commodity codes.

Formal quality-control measures are applied at the keying stage. A computer edit program is built in to detect keying and document errors. The edit program at this stage is a simplified version of the edit master used at Suitland. It deals primarily with ranges of acceptable entries within a specified field; it does not test for proper interrelationships or consistencies among fields. When an error is discovered, a green X is placed on the form, and the form is referred to higher level clerical staff for disposition. As noted above, this occurs in 6 percent of the keyed documents.

Another quality-control measure applied at Jeffersonville is the formal statistical sampling program used to control operators' keying errors and to ensure an “average outgoing quality limit” (AOQL) of less than 2 percent errors. The first stage of this effort requires

|

3 |

In contrast, according to Customs, this omission generally does not apply to 7501s: import documents are usually scrutinized, and the commodity classification is a required data element that must be reported. An import transaction, whether filed manually or electronically, cannot be processed without this information; an entry without the commodity classification will not be accepted by Customs. |

the key-punch operator to key one vessel batch (about 350 forms) and one air or other mode of transportation (MOT) batch with an error rate of under 1.2 percent. During this stage, 100 percent of the operator's work is verified. Operators who qualify by this standard enter the second stage, in which 10 percent of their work is sampled and verified. (Random number tables are used to select the sample, and appropriate tables of acceptance and rejection are provided to the reviewer.) Operators who do not meet the acceptable quality standards of the 10 percent level of review are returned to the first stage, 100 percent review. Operators who qualify move to the third stage, at which 2 percent of their work is sampled and verified. Operators who fail to maintain the required standard return to stage two, that is, 10 percent sample verification. Operators are considered fully qualified when they perform at the 2 percent verification level, stage three. Only fully qualified operators are allowed to key documents for high-value shipments, and all keying for those documents is completely verified.

Nonetheless, according to Census, of the data sent from Jeffersonville to Suitland, the Foreign Trade Division (FTD) rejects about 0.2 percent of the entries containing values of $200,000 or more and about 0.8 percent of the entries of lesser value. FTD sends these data back to Jeffersonville, where the microfilms or original documents are reviewed, and the data are corrected or imputed for reprocessing. At Suitland, FTD relies on its edit master to control data quality. Data forwarded from Jeffersonville, as well as those transmitted electronically under ABI and AERP, are subject to the edit master.

The FTD's commodity analysis branch contains five substantive sections and one classification-system section. The five substantive sections are food, animal and wood section; minerals and metals section; textiles section; chemical and sundries section; and machinery and vehicles section. There are generally four commodity specialists, economists, or statisticians in each section, or a total of about 20 professional staff. With the assistance of about five professionals from the methods research and quality assurance branch, they are primarily responsible for the establishment, conduct, monitoring, and modification of the edit master and imputation program. The systems and programming aspects of the edit and imputations are the responsibilities of system and programming personnel. The edit master recently was redesigned to reflect the new commodity classification system used in reporting the Harmonized Commodity Description and Coding Sys-

tem (HS). Each HS commodity classification has an edit master. The edit master contains approximately 100 fields of information that specify reporting requirements and dictate the applicable edits, edit criteria, and imputation factors.

To develop the edit master, the commodity specialists consider current reporting requirements and examine past shipments to determine price, quantity, and shipping weight parameters and imputations factors. They also consider countries, maximum acceptable reported or imputed quantities, shipping weights, and any known reporting problems. The edit master is used to validate the reported statistical information and to impute missing information and information that is determined to be erroneous.

Imputations on highly improbable or missing entries are made at Suitland for 22 percent of export shipments and about 5 percent of import entries. Most of the imputations involve quantities or shipping weights. The value amounts are accepted as stated. Occasionally, commodity classifications are also imputed. For example, if a value of $50 is attributed to an automobile, the commodity classification may be changed to automotive parts. There is no assurance that the 78 percent of the export transactions and 95 percent of import transactions that pass the edit master provide accurate data, however, because the accuracy of these transactions is not verified.

According to FTD, commodity specialists monitor the patterns of items rejected by the computer and of imputations (as well as the nature of errors pointed out by data users). To resolve problem cases, they may examine past records, and, in the case of high values, they may contact the exporters or importers. If rejects are more numerous than expected, the specialists may review recent price trends. If prices have increased, they may modify the upper limit of the edit parameter accordingly, but FTD staff note that they are more reluctant to modify the lower limits of commodity unit prices. The edit master also may not include current information for all commodities. When commodity prices are volatile—for example, those of oil and major agricultural commodities—they can fall below or rise above the edit ranges, and imputations based on the edit ranges can create errors.

FOREIGN TRADE DIVISION COMPUTER CAPABILITIES

Monthly FTD processing is performed on a UNISYS 1194 mainframe computer. The monthly export and import data are edited on a flow basis in batches, referred to as “cuts.” Generally, cuts

are made on a weekly basis. At a predetermined time each month, all of the edited data and corrected rejects are combined for tabulations on exports and imports. Various monthly reports, publications, and other special contract tabulations are produced after this monthly “closeout.” Currently, the Census Bureau is evaluating the use of microcomputers as potential replacements for selected mainframe activities.

FTD has made increasing use of microcomputers since 1983. According to FTD, as of early 1991 it had 150 microcomputers, 66 printers, on-line storage of 27 billion characters, 4 optical disk systems, 2 CD-ROM servers, 6 tape drives, 12 CD-ROM individual readers, and a 15-cassette backup system. FTD uses microcomputers for 18 statistical applications and 8 administrative functions. Included among statistical applications are maintaining the edit master, performing initial processing, correcting high-value rejects, carrying out analytic work as an interface to the ABI system, and providing access to prior-and current-month export and import databases. However, access to an entire year's data is still lacking due to limited storage capacity.

The FTD analysts need to review and analyze export and import data at the transaction level. More than 2,000,000 export and import transactions are processed each month. Although the storage capacity limits access to detailed data through the use of the microcomputer network to only the month being processed and the prior month, according to FTD, it is now storing data for the past 18 months on optical disks. Summary data for exports and imports by HS code, by country, and by Customs districts for several years are available on CD-ROM disks. FTD plans to install more optical disk systems in the future.

Recent improvements in FTD's computer processing capabilities have resulted in better access to past data by FTD analysts and FTD's ability to respond more quickly to ad hoc requests. Formerly, relying solely on UNISYS processing, FTD lacked the ability to generate special reports quickly and inexpensively. Virtually all historical data were stored on magnetic tape in the UNISYS tape library. It often took 6 months or more for FTD to retrieve the data and to write custom COBOL programs to prepare reports and cost thousands of dollars to process the large volume of data required for the reports. Some of the users' requests were met only through the use of the COMPRO system implemented on the National Institute of Health (NIH) computer network by the International Trade Administration. COMPRO, however, is accessible only to federal agency users and researchers supported by

the federal agencies. As a result, FTD could not accommodate all cost-reimbursable requests. Now, according to FTD, using CD-ROM technology, it services ad hoc requests in a few days or weeks at costs usually in the range of $50 to $200.

FTD has recently begun to issue monthly export and import data in compact disk format (CD-ROM). This format provides the most detailed level of summarized data releasable under disclosure rules. Each disk contains supporting files of alphabetical dictionaries and concordances linking one commodity classification to another. Although CD-ROM disks are primarily developed for improving data dissemination, there is an additional benefit for FTD: the disks can be used with standard microcomputers equipped with CD-ROM readers. This capability allows the FTD staff to prepare summary reports from the CD-ROM data, a capability until now available only on the UNISYS mainframe. The availability of data on CD-ROM virtually eliminates the need to print approximately 500,000 pages of tables each month for reference by FTD analysts.

FTD hopes to store an entire year of detailed transactions on the microcomputer network when additional storage is acquired. In order to accomplish this goal, about 6 billion additional characters of on-line storage are estimated to be needed, at a cost of approximately $50,000. Having a year's worth of data on line will provide the capability to revise an earlier month's data. In addition, some of the work using data files on the UNISYS will be shifted to the microcomputer network, resulting in a savings in mainframe computer costs.

FTD is also developing a database of exporters by matching an exporter 's employer identification numbers (EIN) reported on the SED to that obtained in the 1987 economic census. This database will provide a profile of exporters. FTD is studying ways to summarize the 9.7 million export shipments for 1987 into a file small enough for use in a microcomputer system. The export database will facilitate analysis of U.S. exports as accounted for by major producers and industries.

FTD has recently converted import and export transportation statistics from batch mainframe processing to an interactive microcomputer-based system. The mainframe systems consisted of 200 COBOL programs, which cost FTD $250,000 a year in computer charges to tabulate the transportation data. The microcomputer system is supported by FTD staff; it involves less than $10,000 a year in mainframe computer charges and shortens processing time. Using this system to tabulate transportation statistics, FTD

is able to transfer to Jeffersonville many functions previously performed in Suitland. The microcomputer-based system links the clerical review unit at Jeffersonville to FTD at Suitland. The system also provides on-line analysis and correction capabilities at both Jeffersonville and FTD in Suitland. Similarly, direct transmissions with Statistics Canada are now possible in conjunction with the bilateral data-exchange program.

FTD has outlined four alternatives concerning future development of the data processing system: to perform all work on the UNISYS mainframe, to perform all work on microcomputers, to use a combination of microcomputers and mainframe (the current situation), or to use minicomputers. Each alternative has various advantages and disadvantages in terms of such criteria as staff training, physical and system security, data storage, interactive capabilities, turn-around time, availability of software, and ability to take advantage of latest technology. Recent changes by FTD have moved it from full reliance on mainframe computers toward the mainframe-microcomputer combination.

SHORTCOMINGS OF THE DATA SYSTEM

UNDERREPORTING OF EXPORTS

Until recently there had not been much written about errors in foreign trade statistics. Ryten (1988) attributes the lack of interest in errors to the widespread perception that Customs monitors all merchandise transactions, that it has the power to enforce its writ, and that, as a result, there are few measurable errors left. Discrepancies in data between partner countries are often attributed to differences in definition, timing, and valuation. But with the growing importance of foreign trade to the domestic economy and rising demand for information on foreign trade, there has been increased concern about the quality of the data. Several recent studies show that there is a strong probability that U.S. exports have been underreported, possibly resulting in overstatements of the U.S. merchandise trade deficit (Ott, 1988; U.S. General Accounting Office, 1989).

The underreporting of U.S. exports to Canada prior to 1987 has been well documented. The Census Bureau and Statistics Canada have compared U.S. and Canadian merchandise trade statistics for 20 years. For 1986, the U.S.-Canada data reconciliation studies showed $11 billion in unrecorded U.S. exports to Canada based on Canadian import statistics. In 1987, in an effort to address this

undercount, the Census Bureau introduced a monthly summary level adjustment to the total U.S. export figure based on Canada's figure of its total imports from the United States. These adjustments, however, did not correct understatements in detailed product data. By 1989, the value of unreported U.S. exports to Canada rose to $16 billion, about 20 percent of the total value of U.S. exports to that country. Canada was encountering similar, although smaller, undercounts of its export statistics. (In 1990, under an agreement signed 3 years earlier, the United States and Canada dispensed with the collection of export statistics on trade between them. The two countries have since substituted counterpart import data as their own data on exports to each other.) The main factor contributing to the U.S.-Canada export undercounts is the lax enforcement of export reporting requirements along the 3,000-mile U.S.-Canadian border, through which most U.S.-Canadian truck traffic flows.

The same basic reporting system that led to the undercount of U.S. exports to Canada is still in use for U.S. exports to other countries, although the magnitudes of undercounts in vessel and air shipments to these countries may be lower because document controls (for example, manifests, entrance and clearance documents, etc.) exist for these cargoes. In 1988 and 1989, for example, with the aid of the Customs Service, FTD completed a series of audits at four international airports: Seattle-Tacoma, Miami, Los Angeles, and New York-Kennedy. On the basis of these audits, the Census Bureau estimated that undercoverage resulting from the failure of exporters or their agents to file the required information was 7.2 percent of the shipping weight of all air export shipments. Applying this percentage to the 1988 value of all air export shipments would yield $6.7 billion. Since the relationship between weight and value has not been determined, however, Census did not estimate the value of export underreporting. In the audit reports, Census stated that evidence was found, especially in Miami, of deliberate undervaluation of cargo (Puzzilla, 1988).

Comparisons of U.S. export data with data on imports from the United States reported by major trading partners also indicate probable underreporting of U.S. exports (see Appendix C). For example, for the period 1980-1989, such comparisons suggest an undercount of about 7 percent a year of U.S. exports to Japan, Germany, and the United Kingdom. Because of differences in definitions, concepts, and measurements, it is difficult to quantify the magnitudes of the undercounts. According to FTD, a recently completed data reconciliation study with Japan showed a possible 3 percent undercount

of U.S. exports to Japan in 1990. FTD is currently engaged in data reconciliation efforts with a number of major trading partners, including the European Community, Korea, and Mexico, to better estimate undercounts of U.S. exports to these countries.

Experts have attributed export underreporting to several factors. The first is that compliance with export reporting is not strictly enforced. Although import documents are reviewed in connection with the process of tariff collection, export documents are subject to minimum scrutiny. There are few incentives for exporters to file timely and accurately except their good will. Second, exporters have incentives to understate sales to reduce their taxable income and to pay lower import duties to importing countries, especially those in Latin America. Third, exporters almost certainly do not report transactions that are restricted or banned under U.S. law, and about 40 percent of all U.S. exports are subject to at least partial restrictions. Lax enforcement efforts obviously contribute to underreporting of exports.

Some of the understatement of exports can be attributed to nonvessel operating commercial carriers (NVOCCs), which are primarily freight consolidators. These carriers consolidate shipments from small exporters into one large shipment. Because of this consolidation, the NVOCCs have greater bargaining power than individual small exporters to negotiate lower freight rates from major carriers, and small exporters save time and effort and reduce shipping costs. The NVOCCs file SEDs for the exporters, and they try not to alienate clients by pressing for information. Their main purpose is to obtain the lowest freight rate for exporters from the major carriers. Thus, if the consolidated shipment consists of different items with different freight rates, the NVOCCs are inclined not to report the higher freight-rate items.

Still another cause of misreporting is that exporters fear that the information reported on the SEDs may be leaked by employees of carriers to competitors.

INADEQUATE REPORTING OF DATA QUALITY

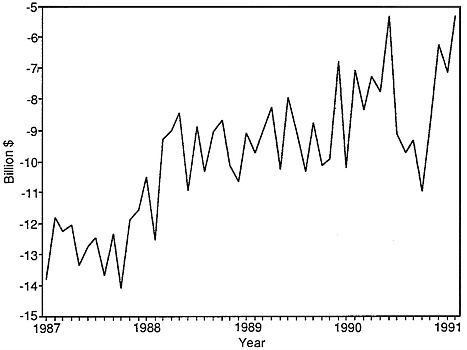

The quality of the merchandise trade data and their limitations are inadequately communicated to users. The published merchandise trade balance data routinely fluctuate widely from month to month; see Figure 4-3. Users at times have interpreted a large monthly change as indicative of shifts in the underlying trend or other basic properties of the data, which, in turn, has sent strong signals to financial and foreign exchange markets. Our analysis

FIGURE 4-3 Seasonally adjusted merchandise trade balance: January 1987-February 1991.

shows that, although the trade balance figures are indicative of underlying trends over time, large month-to-month changes can exist without any change in the trend. The Census Bureau currently provides no measures of uncertainty to the merchandise trade data. The statistics are reported as if they were perfect measures, and users often rely on them as if they are. Major misinterpretations at times can be made.

Appendix D and Appendix E address this issue in detail and interpret the data variability. Appendix D points out that the monthly changes in the trade balance over the period from February 1987 through February 1991, corrected for trend and for correlation across time, have a small mean value, $249 million, and a large standard error, $1.4 billion: that is, the standard error is about six times the mean. Thus, a monthly change in the trade balance of as much as ±$4.2 billion during this period, for example, would be within three standard errors of the mean (3 × $1.4 billion = $4.2 billion), a kind of band that is widely acceptable in quality-control charts. Moreover, monthly changes tend to alternate in sign,

from positive to negative to positive. These results suggest that large monthly changes can occur without any change in the underlying trend of the trade balance. Appendix E shows that fluctuations in the monthly changes in the trade balance can also be induced by the seasonal adjustment procedure used by the Census Bureau. Alternative methods of seasonal adjustment could model seasonal movements as well or better than current methods and reduce the volatility of the monthly trade balance data.

LACK OF FORMAL DATA MANAGEMENT PROCEDURES

The present processing procedures include several operations designed to detect and correct errors (such as sample verification of data entry, the application of several kinds of automated edit checks, and the imputation of missing and erroneous data) and to subject documents reporting large transactions to close scrutiny. However, there are few established formal data management procedures to guide the collection, processing, storage, and dissemination of merchandise trade data, making it difficult for the Customs Service and the Census Bureau to monitor and evaluate their own performance and pinpoint areas of vulnerability for improvement.

As noted above, there is at present no accounting of export and import documents before they arrive at Census's Jeffersonville data processing center. Imputation of one or more missing or suspect values or codes is required for about 22 percent of export transactions and about 5 percent of import transactions. There is no systematic evaluation of how well these imputations approximate truth or of how accurate the data are that pass the edit master. In addition, the two major quality-control measures applied by Customs and Census, edit checks and imputation procedures, are at times marred by outdated parameter values. Interaction between data filers and Customs and Census staffs is infrequent except when errors are detected in submitted documents.

As a statistical agency, the Census Bureau's mission is to collect, process, and disseminate monthly data on a timely basis. From this perspective, each batch of the monthly figures is largely considered a product itself, a “snapshot” of the current period, rather than an observation of an ongoing time series of which each month is one part in a sequence. Over time, there have been changes in definitions and commodity codes used by Census in compiling the data. As a result, a time series of observations that is consistent across time is lacking, making analysis of trends, seasonality, and other underlying changes difficult.

To gauge the quality of the existing data, we canvassed users' views on the adequacy of U.S. merchandise trade statistics. Appendix B reports in detail their assessments. Among shortcomings cited by users are lack of consistent time series and errors in disaggregated data. Users also point out that different figures of trade balance are reported in trade statistics, in the U.S. balance-of-payments accounts, and in the national income and product accounts. They find the different concepts and definitions of trade balance applied for the various purposes confusing, and it is difficult for them to gauge the accuracy of the different reported figures. Merchandise trade statistics are derived as by-products of administering tariff collection, export control regulations, and other laws governing international commerce. The concepts and definitions applied for several administrative purposes do not coincide with those for analytic objectives. To bring the data into conformity with balance-of-payments concepts, the Bureau of Economic Analysis (BEA) has to make adjustments to the monthly Census merchandise trade data. BEA also makes adjustments to the Census data to relate changes in merchandise trade to domestic production and income data as shown in the national income and product accounts.

The accuracy of foreign trade data clearly concerns many users. Two told us about instances in which data errors have led to incorrect applications of administrative rules developed under U.S. statutes that apply to international merchandise trade. A few others said that errors made specific data series unusable or of questionable value for their purposes. Some of them have informed Census about the errors they have detected and have met with mixed success in resolving specific reporting or processing problems. The quality of detailed data on specific commodities, of estimates of excluded low-value shipments, and of data on exports by state of origin came under particularly heavy attack.

Our interviews with brokers, forwarders, importers, and exporters disclosed that some filers do not understand questions they are required to answer. Under the circumstances, they may supply erroneous data, particularly with regard to the origins and destinations of shipments. In addition, importers and exporters frequently experience considerable personnel turnover; new staff members may lack sufficient training or motivation to provide accurate data. With regard to the origin of exports, the final product may have been manufactured in several stages at different locations. Under such circumstances, attributing the origin to a specific location may be arbitrary. Similarly, individuals who file the import documents may not know the destination of the im-

ports. It is not surprising, therefore, that a disproportionately large percentage of imports show New York as their destination or that Louisiana was shown in trade data to account for 44 percent of U.S. agricultural exports in 1987. In addition, only 75 percent of the SEDs reported the exporter's employer identification number (EIN) in 1987.

In view of the shortcomings of the monthly data and their influence on public and private decision makers, the panel deliberated about a recommendation to end the production of monthly merchandise trade statistics and move to a quarterly reporting basis so merchandise and services trade data could be released at the same time. The panel ultimately decided against the elimination of the monthly data for several reasons:

-

The savings of shifting from monthly to quarterly data are minimal, since monthly data are needed to produce quarterly data;

-

Significant improvements in existing data are possible with effective enforcement efforts and sound database management;

-

When data users are apprised of the data limitations, they will be disabused of many of their false assumptions about the accuracy of the data; and

-

When monthly data are made more accurate, they will be more timely and useful than quarterly data.

Instead, the panel considered ways to improve the quality of merchandise trade data.

IMPROVED DATA QUALITY

The need to improve the quality of merchandise trade statistics is well recognized by the Customs Service and the Census Bureau. Given the bifurcation of responsibilities between the two agencies, which can affect the operation of the program, Customs and Census have increased their coordination in recent years. Their efforts have significantly reduced processing delays and lowered the data adjustments for carryovers in recent years. As indicated above, other improvements in the system have included broadening the use of electronic reporting of imports by importers and their agents to Customs, enhancing computer processing capabilities at the Foreign Trade Division at Census, and exchanging data between the United States and Canada to improve the accuracy of U.S. export data. Additional quality measures currently under consideration by Census include: completing postponed sea and border audits; continuing to explore the feasibility of data recon-

ciliations with Japan, Mexico, South Korea, and the European Community; implementing an exporter education program; enhancing editing procedures and augmenting internal computer capacity to facilitate processing, analysis, and publication of data; and developing an integrated multi-agency automated system that would serve a variety of export control and commercial purposes, in addition to facilitating export reporting. In this section we consider these and other methods to improve quality control; the need for enhanced automation; and the feasibility of using sampling techniques to collect merchandise trade data.

IMPROVED QUALITY CONTROL

In determining the adequacy of existing quality-control procedures, one should make a distinction between quality assessment and quality assurance. Quality assessment refers to the use of measures to assess structures, processes, and outcomes and to measure levels of quality over time. Quality assurance refers to adoption of such measures as may be required to improve quality. Most of the proposals by the Census Bureau to improve merchandise data quality pertain to quality assurance rather than quality assessment. With the exception of the proposed data reconciliation efforts and the port audits, there are no new initiatives under consideration for quality assessment.

Below we consider several ways to improve operating procedures of the merchandise trade data system. They are not mutually exclusive. Undoubtedly limited resources will preclude adoption of some of them. They do stress the priority of quality assessment. All of the proposals would improve quality, but only the adoption of the first two—a continuous independent review system and a continual strategic port audit program —in combination with some of the other methods, will quickly achieve the greatest amount of quality improvement.

A Continuous Independent Review System

Under a continuous independent review system (CIRS), a sample of documents received at Jeffersonville would be photocopied and forwarded to the Census's professional staff in Suitland for coding. The sample documents would be replaced in the batch of mail from which they were taken so that they cannot be identified by the operating personnel. On a periodic basis, personnel detailed from Customs would participate in the coding. This

independent coding would be entered into a separate database established for CIRS. The results of the independent coding would be matched by computer with the results from the normal processing of the same documents (or transactions, depending on the sampling techniques), reconciliation made, if possible, and causes of differences analyzed. (A slightly different procedure would be required for automated filing.) The small database established for CIRS would thus contain the coding elements of both the independent and ongoing review systems as well as the results and analysis of errors and reconciliations. All of the cases in which reconciliation was not possible and a smaller sample of cases in which no apparent irreconcilable differences were detected would then be used for contacts with the importers or exporters, if possible, or with the brokers or forwarders, to determine what their basic records (not the Form 7501 or SED) show regarding the elements coded. The results of this contact would also be coded and entered into the CIRS database.

As this database built up, a wealth of reliable information would be obtained on the quality of the system, rates of error regarding individual coding and reporting elements, the circumstances under which these errors occur, who or what is responsible for them, and, most important, what changes are needed initially or at Jeffersonville or Suitland in editing or imputation procedures to improve data quality.

A somewhat similar system was introduced at the Social Security Administration, in part in response to a U.S. General Accounting Office (GAO) critique, to obtain unbiased measurements of the validity of policies and procedures for establishing entitlement to old age and survivors insurance benefits and, more important, to determine the necessary modifications to the policies and procedures. This system operated successfully for 15 years.

As an experimental adjunct to the CIRS, reviews could proceed from the other direction. That is, a sample of establishments could be selected and requested to examine their records to determine the value of their exports and imports, and other desired information, during a given period. The data would be coded and compared with the results of the normal system, as above. This approach, even if not fully implemented, would provide valuable information on the feasibility and nature of the data available and on accounting or other record-keeping modifications required to proceed with an establishment survey approach to the collection of some or all of the merchandise trade statistics (see section below, “Use of Sampling Techniques”).

The benefits from a CIRS, as indicated above, would be to yield some checks on whether Customs has obtained and forwarded the record, whether Jeffersonville has received and retained the record, and whether the clerical reviews, key punching, and data edits at Jeffersonville conform to established procedures. Most important, it would reveal whether the master edit and imputation procedures at Suitland are valid and what modifications are needed at all stages of the system. A CIRS would not only improve the process, but also provide a measure of the accuracy of the data (except in those cases in which exporters deliberately failed to report transactions or understated their values).

The cost of the system would depend on the scale adopted. Fortunately, a CIRS could be introduced on a small scale and expanded as problems were overcome and the value of the system was ascertained. Designing such a system would require considerable work by the manager of the system, a systems programmer, a clerical employee, and part-time efforts of a statistician and a commodity specialist from each of the five substantive commodity analyses sections. A 4-6 month start-up period would be required.

A Multipurpose Port Audit Program

Although a continuous independent review system would enhance data quality, it would not help for cases in which filers deliberately avoid reporting. In many instances, it also would not detect deliberate understatements of the values of transactions. For these situations, the port audit program should be continued. In addition to the four completed audits, six audits were originally planned but postponed for budgetary reasons. This program should become an integral part of the ongoing process, and the concept and strategy of the program should be expanded to incorporate features of the Internal Revenue Service audits, including parts of its Taxpayer Compliance Measurement Program (TCMP) (see Roth et al., 1989). If funds become available, the prime purpose of the port audit program, which is to measure underreporting, should be expanded also. If the audits are designed to obtain information on commodities, types of exporters, and circumstances contributing a disproportionate share of errors, the results should help to identify process improvements.

In addition, part of the audit should be designed not primarily to permit unbiased estimates, but rather to yield a high-visibility or demonstration effect. Under the leadership of Customs, a particular vessel or a particular forwarder or exporter could be tar-

geted for delay in approval for shipping because of a history of incomplete or inaccurate statistical reporting. Customs may actually select the target because of a drug or other control program but announce and display SED inaccuracy as the cause of such an action. The information from the trading community suggests that word travels fast and such delays would raise concerns about the effects on operating profit and provide an incentive for better compliance with statistical reporting requirements. This strategy is similar to that used by the IRS and other compliance enforcement agencies.

Producer- User Interface

The Foreign Trade Division provides statistical products much needed by federal government agencies, state and local governments, academia, and private industry. User needs are central to any consideration of data quality, and FTD would be better able to decide what to produce if it had more information on user needs. FTD has received some such feedback and has been responsive to some of the demands for data, but there are many users or prospective ones who remain less than completely satisfied with the data now available. Periodic surveys of both public and private current and prospective users should be undertaken.

The panel's survey of data users clearly revealed that different users attach different priorities to having merchandise trade statitsics that are accurate, timely, detailed, or as comprehensive in coverage as possible. In view of resource and other constraints, meeting one user's needs might not fulfill another's. Nonetheless, the panel believes that improvements in process productivity through enhanced data management should enable Customs and Census to improve data accuracy, timeliness, and coverage to better meet the needs of most users.

Producer-Filer Interface

The quality of merchandise trade data depends not only on Custom's and Census's resources, but also on the completeness and accuracy of the original data provided by exporters, importers, brokers, forwarders, and carriers.

Customs and Census should make additional efforts to cultivate and develop a symbiotic relationship with filers. Users should be encouraged to educate the public on the advantages of having reliable trade data and the need to support programs that generate

them. In addition, private industry, through its trade organizations, meetings, and publications, should be urged to take steps to ensure greater accuracy of the raw data provided to FTD. The accounting and financial management professions should be asked to assist in establishing standards for the basic record-keeping necessary to provide the required information to FTD.

Reporting Data Adjustments for Undercounts and Imputations

Before the commencement of the current U.S.-Canada data exchanges, Census adjusted export totals to account for the undercount of U.S. exports to Canada on the basis of results of reconciliation studies. If the completion of several more port audits and the establishment of a continuous independent review system produce evidence to permit quantification of the extent of undercount of U.S. merchandise exports to other countries, actual adjustment of published data to incorporate the undercount should be done. Relegating mention of undercounts to footnotes or technical publications, while perhaps sufficient for academicians, may not best serve policy interests. Public perceptions about the U.S. trade balance and the country's economic well-being, as well as the reaction of financial markets, may be highly conditioned by newspaper headlines and the 20 seconds of airtime on television and radio devoted monthly to the release of trade data. In addition, since little has been published on the methods used in the U.S.-Canada data reconciliations, such information on future data adjustments should be documented and made available to users.

Moreover, where more than a certain number or percent of the entries of a given cell are based upon imputations—the criteria should be statistically determined—data users should be alerted either by means of a footnote or by use of a different type or size of print for that cell.

Matrix Organization

Although top Census and Customs officials almost certainly are highly committed to fulfilling their joint responsibility to provide accurate import and export statistics, this may not always be the case at working levels. Management attention, incentives, resources, and rewards in any organizatoin are directed at the major functions of the organizations and their subcomponents: Customs is necessarily more concerned with collecting tariffs on

imports and controlling selected imports and exports; Census focuses on processing statistical data.

The preoccupation of organizations with their primary mission to the detriment of secondary or tertiary responsibilities has been addressed in the managerial literature, which is replete with suggestions on how to deal with it. One approach that might have merit for trade statistics would be to create a matrix organization, in which employees of different units or functions are temporarily placed in a unit working on a common problem. Some staff members from Customs and Census have expressed a desire for greater contact and “networking ” among employees of the two organizations. Port audits, difficult cases, commodity classification problems, and contact with trade sources are just a few areas for which joint efforts at the working level could be intensified.

Long-Range Planning

Because of the ever-increasing and evolving nature of international trade, fundamental changes in concepts, collection methods, processing procedures, and methods of dissemination will be required to respond adequately to changing data needs. Collecting, tabulating, and disseminating data are arduous tasks requiring attention to immediate problems; those who manage these operations seldom have time to address future concerns.

To permit more detached attention to longer range planning related to trade statistics, consideration should be given to the establishment of a small high-level unit at Census or Commerce. Its principal function would be to deal with long-range problems associated with concepts, computerization, new product development, and organizational adjustments that may be needed in the months and years ahead.

INCREASED AUTOMATION

Although there has recently been a substantial rise in electronic filing of import data under Customs' ABI program, Census has had little success in increasing electronic filing of export data. As a result, there remains a large volume of trade documents that have to be processed manually by Census each month (about 8 million in 1990, in comparison with 13 million in 1985). Indeed, the manual processing of import and export documents consumes about one-third of the $16 million annual budget of Census's Foreign Trade Division. More electronic filing of trade documents

by importers and exporters would significantly reduce collection costs. This change, accompanied by a substantial increase in FTD 's data processing capabilities, should enhance data accuracy and timeliness. Electronic reporting of imports has increased substantially in recent years, and the prospects are good that additional importers, exporters, brokers, and carriers will automate their operations in the future.

Accuracy

The undercount of exports and erroneous detailed product data are problems relating to accuracy. They result from a failure to file documents and from inaccuracies in information contained in the filed documents. As illustrated by the electronic reporting of imports, greater automation of export reporting could bring benefits. It could facilitate data capture and improve data processing capabilities. It might also reduce costs of implementing improved procedures to detect and correct anomalies in data reported, as well as of following up on missing data. Moreover, it would facilitate the reporting of the apparently growing volume of low-value shipments that are now too costly to capture and tabulate. Each of these changes could increase the accuracy of reported trade data.

Although merely increasing the fraction of documents filed electronically would not necessarily provide more accurate data, an improved database would make it less costly to conduct audits and cross-checks of trade data with other data sources, such as the in-house Census data on manufactured exports reported on the Annual Survey of Manufactures (ASM) questionnaires. Furthermore, a greatly improved data processing capability would enable Census to treat international trade data, domestic production data, and input data as part of a consistent, coherent body of economic information.

Revisions

FTD currently revises monthly import and export statistics in several ways. On a monthly basis, aggregate import, export, and trade balance figures for the prior month are adjusted for carryovers. On a quarterly basis, FTD publishes a list of errata for prior months' statistics. Recently, on an annual basis in May, FTD has been publishing revised merchandise trade statistics for the prior year. With an improved capability to manipulate data, it would be pos-

sible for FTD to undertake revisions at the detailed level for the calendar year at minimal costs and on a timely basis.

Timeliness

Increased automation could improve the timeliness not only of the initial trade data releases, which already take place fairly promptly (and which, with improved editing procedures, would be more accurate), but also of the later detailed data that presently have no preassigned schedule for regular release. With both greater processing flexibility and tabulation capability, it would be possible, at little incremental cost, to generate reports that otherwise might have to be delayed or discontinued because of their cost.

Automated Export Reporting

The capture of data can be automated in the paper-handling process by using various available imaging and character recognition or electronic note-pad technologies. It also can be automated by moving toward an all-electronic system of filing trade documents. Two considerations led us to give most attention to the second approach. The first is that many obstacles and disincentives to the electronic filing of export documents have been eliminated or reduced. Until recently, FTD's automated reporting program for exports was perceived to be limited to large exporters. Although the set-up costs had declined markedly since the program was initiated in the early 1970s, it was apparently still considered too costly to be worthwhile for small exporters to participate. The extension of the program to freight forwarders and carriers in recent years has removed a major obstacle, making it feasible for small exporters' shipments to be reported electronically. Our second consideration is that in the not-too-distant future there is likely to be a major effort to standardize international electronic trade and shipping documentation. Simplification and consolidation of export documentation through the development of a universal electronic shipping and trade document should provide an incentive to filers to participate in FTD's automated reported program for exports.

A better understanding is needed of why many exporters are reluctant to file electronically. Our discussions of the program with nonparticipant exporters and forwarders yielded explanations that ranged from “ I had not heard of it” to “What's in it for me?” Others noted there is no pressure to participate comparable to

that applied by Customs to get importers and brokers to participate in ABI. A forwarder participating in the automated export program for 3 years, who was the only exporter or forwarder in his port to participate, stated that his decision to participate was based on three considerations: his export operations had been computerized 5 or 6 years ago; the trend of all export operations was toward computerization; and steamship companies and exporters were starting to ask for, if not insist on, more computerized handling of data. He suggested that the participation of other forwarders would depend primarily on their current and future use of computers. He also noted that an obstacle to his beginning use of AERP had been that helpful commercial software was not available. As a result, his in-house programmer had to devise a system for his firm. These views may not be representative of the thousands of exporters and forwarders, but they clearly indicate the need for marketing and educational programs.

Customs and Census should consider other measures to advance use of automated reporting in the export clearance process. Such measures might include frequent imposition of penalties for failing to file SEDs or for filing incorrect SEDs and, perhaps, last-in-line handling of nonautomated reporting shipments. More generally, Customs might take more leadership in this area, which would convey the impression that it is Customs, and not Census, that is driving the program.

Customs and Census have developed a joint proposal to expand the Custom's existing Automated Commercial Systems linkage for electronic data interchange with brokers, importers, carriers, and port authorities, which would process data on exports as well as imports. The two agencies tentatively termed this proposal the automated export system (AES). A multiagency committee would be assembled to coordinate development of the system and provide operational guidelines. In addition to Customs and Census, export licensing agencies, including the Departments of Commerce, State, Defense, Agriculture, and Energy, as well as the Office of the U.S. Trade Representative, would be represented on the committee. The proposal anticipates funding largely by Customs. Census would finance its own increase in computer capacity to handle the additional workload. Other participating agencies would underwrite improvements in their own computer systems and the costs of linking to the Customs computer. Initial costs for Custom's share of the export system are projected to be $38 million over a 5-year period. FTD has requested $3 million ($600,000 per year for fiscal 1992-1996) for its portion of development costs.

These costs include capital expenditures as well as four additional full-time employees. It projects that the participating rates of the exporting community will be 10, 20, 40, 50, and 60 percent over the 5 years beginning in fiscal 1992.

FTD summarizes the benefits of AES as follows: reducing the distortions in the trade balance by substantially eliminating the nonreporting and undervaluation of exports; cutting the manual documentation costs to private industry; eliminating the manual data capture of 6 million SEDs annually; facilitating export trade; speeding the export process; assisting in curtailing illegal exports; and providing the potential to release trade statistics earlier. FTD estimates that under AES, it would achieve cost savings of $600,000 in 1994, $900,000 in 1995, and $1.2 million in 1996. In evaluating the proposed development of the AES, one must recognize that securing more accurate merchandise export statistics is only one element. Administration and congressional approval will also depend on the other objectives. Nevertheless, if the projected net benefits can be validated, the proposal should be supported as desirable.

A recent survey by the National Trade Facilitation Council, a large trade association, indicated many current manual reporters would voluntarily consider converting to electronic filing only if convinced that, despite the initial investment of money and time necessary for the conversion, the system would cut their overhead and personnel costs. Our interviews with foreign government officials suggest that importers and exporters have provided the impetus for the automated trade data reporting systems in their countries. Thus, to achieve the desired participation rate, emphasis should be placed on working with exporters and their agents in designing the system so that it is user friendly and economical and advantageous to them. An extensive educational effort should be conducted under the leadership of Customs. In addition, however, since there are incentives for underreporting and nonreporting, concerned agencies should also continue efforts in other areas, such as interchange of data, port audits, and a continuous independent review system.

USE OF SAMPLING TECHNIQUES

As described above, export data are currently based on the processing of official documents for all transactions valued at $2,500 or more, and import data are based on all transactions valued at $1,500 or more (plus those valued at $250 or more that are cov-